Median home price in San Francisco hits $1.42 million:Â A standard condo in San Francisco is now selling for $1.15 million.

San Francisco housing has entered into a new reality. Tech money and foreign cash continues to flood the market and pushing prices to astronomical levels. The typical San Francisco crap shack now will cost you $1.42 million, a new record high with condos going for $1.15 million. The city is entering into escape velocity of gentrification. You have older Taco Tuesday baby boomers with rudimentary tech knowledge that bought decades ago living next to a new generation of wealth and tech savvy professionals. You see this as well in Los Angeles. Some real estate “experts†barely have a working understanding of tech but definitely know how to navigate to Zillow to view their inflated prices. San Francisco is such an odd case study. A city that outwardly states it supports the poor but when you look at prices even making $100,000 a year makes you part of a new high income poor – at that income level a sizable amount of your net income is going to go to simply paying for housing unless you want to be part of the mega commuting culture that is now emerging in California. What is going on in San Francisco?

The new ultra rich in San Francisco

It is hard for people to wrap their minds around the cost of housing in a place like California. Not so much that it is expensive, but once you look at the property and price you realize people are paying high prices for crap shacks.

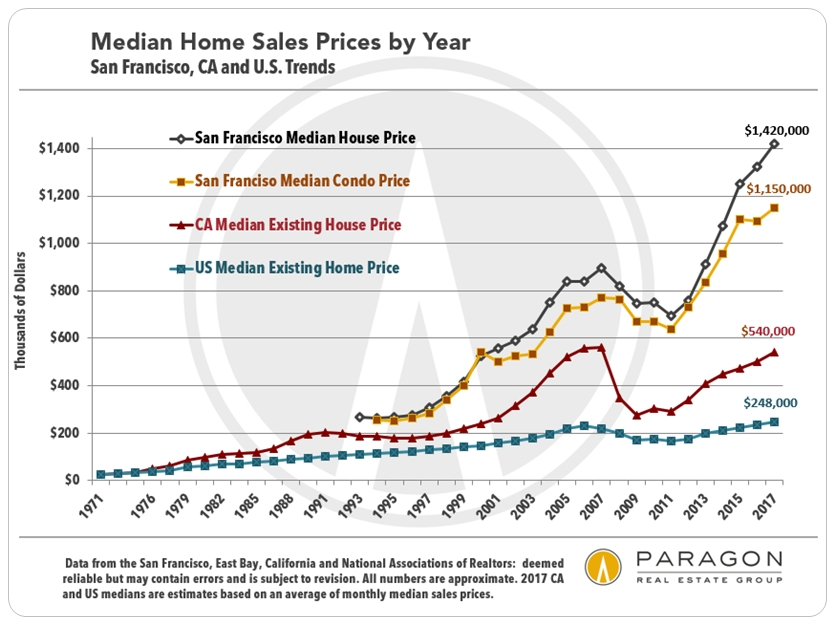

Take a look at prices in San Francisco:

And people are still active and buying. You’ll notice that prices for the U.S. and California overall are merely back to their previous peak price points. Adjusting for inflation, things are moving along more carefully. In San Francisco, we are in a different dimension.

You have foreign money flooding the market and you also have dual income high tech households trying to buy up what little inventory exists. This new class of wealth would rather live in a million dollar dump than spend horrendous hours in a commute. The new sign of status is living near your work, not a McMansion out in the middle of nowhere.

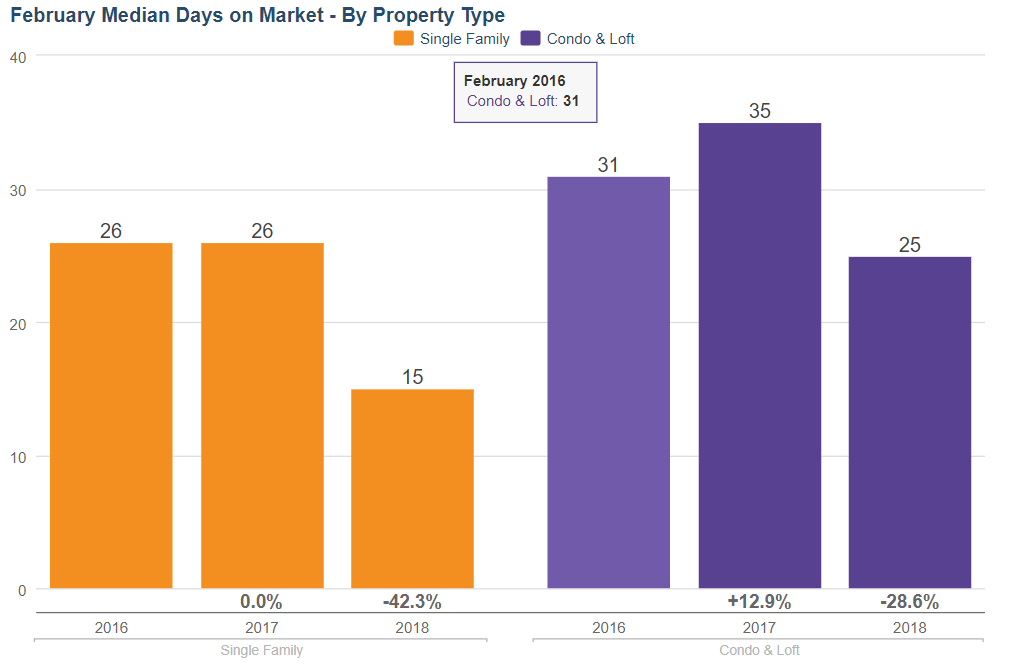

And properties are moving along nicely in San Francisco even at a median price of $1.42 million:

What is telling is that the media is now in unison championing why real estate is a great buy, even at these prices. Forget about the multitude of factors that now face our economy including jobs that don’t last for a lifetime or the necessity for mobility with the new workforce. You have the Taco Tuesday baby boomer mentality where people want to stay put forever and assume everyone is going to follow in their same footsteps. Apple wasn’t built following the old. Facebook wasn’t built by following the old. Tesla wasn’t built by following the old. This generation is different and their need in housing are reflecting a changing tone.

Beyond the obvious, even at $1.42 million most are not going to have the money to buy these properties. So what does this do to the current market? What does it do to neighborhoods? Or how about the local school systems?

I think people just assume that high prices are always going to be part of the equation in California. But recent history shows that we go in booms and busts. For those that seem to think the market can only go up they should be out in the market buying real estate. That is their position. For those renting, you are already taking a position. And many parts of the state are becoming renting majority counties.

San Francisco real estate continues to go up. Who is buying right now? Funny how those buying real estate at these levels don’t see it as speculation but think stocks or crypto are “crazy†– everyone picks their “investment†product and the market seems frothy across all areas.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

456 Responses to “Median home price in San Francisco hits $1.42 million:Â A standard condo in San Francisco is now selling for $1.15 million.”

Given LA and SF are 60-70% rental markets..

The vast majority of people in both locations have no choice but to rent

Home ownership rate is in the 30-40% and has been for a long time

Renting is def a smart way of saving money. Less liabilities, don’t have to put 200k down and you are saving monthly. If you are really smart you live with your parents until 40 or so and invest in crypto. You might pull in a 10x and be a millionaire. Someone who bought an overpriced crapshack and tied up all his money cannot profit from crypto gains and will never catch up with the renter. Unless he somehow finds drug money in the parking lot.

If you are really wanting to do better financially, leave California. My husband makes less than half what he made in LA and now we are in a beautiful huge house, paid cash, in a very nice area. In LA we rented. Living in CA is for lifestyle, not to save money.

Spoken like a true Millennial! You must be popular with the ladies.

Kolob,

I am doing great financially. Why should I leave? All I need to do is wait for a nice recession and housing crash.

Dean, yea I

I Am married. We have lots of cash and no debt. We have no financial stress, can travel anytime we want etc. So I guess you are right I must be popular and have been successful with my strategy so far.

Living with your parents until you’re 40 is ludicrous. I hope you’re trying to be funny to make a point. Otherwise it would be like saying, “Sure the guy got put in prison for thirty years for something he didn’t due, but now he’s out and they gave him 10 million dollars compo. Well no amount of money makes up for that time lost and no amount of money, even a billion dollars would make up for what you missed by living with your parents, instead of experiencing life.

After all if I were to tell you you had 24 hours left to live, you wouldn’t say “Gee if only saved more money,” no you’d cry over things you missed out on and now will never do.

AntiCoyte,

Trying to follow…..what has experiencing life to do with living with your parents? Think about it, if you buy an overpriced crapshack and are deep in debt you have financial stress and might lose that house during the next recession (7 mio lost their house during the last bubble). If you live with your parents you are probably debt free and can actually do stuff in your life (travel, nice cars, vacation, go out, invest in crypto and stocks). You are also flexible and if the RE market crashes by 55-75% you can buy a normal priced house. If you already bought high you are out of options.

Maybe we have a diff. Definition of experiencing life. Being a debt slave is not experiencing life. I feel very sorry for you. Somehow you had really bad mentors in life and haven’t gotten a chance tonexperience living a debt free life? Maybe it’s just normal for you to always be in lots of debt?

Millennial is doing great financially but is desperate to “own†a house. That’s why he should leave. There is no guarantee prices will drop as low as he expects.

Leave?? Where should I leave to? I like California. There are beautiful parts in this state. LA and the Bay Area are arm pits but there are other nicer areas that are less crowded.

Desperate to own? Not at all. I would buy if it crashes but if not, renting is much cheaper. I am on this blog because I want to continue to learn about the market, manipulations and scams. The entertainment is the icing on the cake.

Of course you’re desperate to own and the excuse that you’re here for the entertainment is the big lie told by both those desperate to own and those desperately hoping CA housing prices stay inflated.

Okay. Quick story. In 2014 I almost bought. The realtard (supposed to be a family friend) was the biggest liar under the sun. The lender he suggested was no different. We ended up not buying and I started researching online. I also tried other realtards. The point of the story. It opened my eyes. If buying made any sense or would benefit me, how come everyone had to lie in order to get you to sign? I found this blog and other websites, read books, blogs etc. I am forever grateful I did not buy and found this website. Yes, my goal is to buy, but not until the market crashes. Call it desperate or whatever you want. It doesn’t matter I am Not buying until we see a severe crash. Rest assure I will share it the minute I sign that deal.

Millie, so what is the story?

You only said you did not buy and everyone was a liar.

Did not say the reason you did not buy or what was the lie told to you

Often times when you have to make a stressful decision you fell like everyone is lying/witholding info from you – while in reality you are just crumbling under the weight of the decision. Same thing if something goes wrong with credit score,final payment, etc…calling everyone around a liar is typically a flag about your own approach to life

Agents and loan officers are there to get things done. They should not advise you about directions of the prices, etc…

I am glad you ask. Put yourself in my shoes for a moment: I was just a few years into my career, good job, good money, a promotion later, wife has a decent job, had money saved for a down payment, 800+ credit score. We thought, okay let’s buy a house. Back than I was not thinking about rental parity, prop13, etc. I was very much pro buying. My parents bought early in their marriage and have several rental properties.

the realtard, supposed to be a long time friend of my family, figured out quickly that I ask questions and do my homework. That’s just how I function. Anyways, I guess everything took too long for him. In my mind, if you make the biggest purchase in your life so far you want to learn and compare as much as you can. I am happy to elaborate on his lies if you want. But the point of the story is, it opened my eyes. If realtards, especially if they are friends of your family have to make up so much shit and lie in your face multiple times than you ask yourself why? The answer is simple. Buying makes zero financial sense. If it would make sense, why lie? To get thinks done you say? Nothing got done in the end, and them making up these lies resulted in me getting suspicious about everything they said. Thank goodness this happened. If I would have bought, I would have had to pay 700 dollars more a month than what I pay now as a renter for basically the same place. Plus a significant down payment. Without this guy and his lender I would have never researched so much online. I found blogs like this and websites explaining how renting makes way more sense because during s bubble you have no rental parity. You yourself proved it as well. (Pay 200k down plus 1500 more a month than a renter).

Than I thought, well, I will still keep looking, tried different realtards and they were all similar. The only real estate agent I found that seemed good was a young kid. She said because the buying experience was so horrible she decided she can do a better job than that so she became an agent. Unfortunately, she gave up

Two years later. I guess in this market you can only be an agent if you lie like there is no tomorrow and hope to find a stupid buyer that does not do basic research. The funny thing is, if the guy would not have lied that much I would have probably bought (I could have afforded it). So I am forever grateful, that it went down that road. Now I understand the game. You only buy during a recession when prices are down 55%-75%. Until then renting is a smokin deal.

“…when prices are down 55%-75%”

LOL

I’d suggest you buy when everyone is not buying, you sell when everyone is not selling. Ignore whoever you think they are lying to you. Do your research and think about your affordability. There is no time that is not a good time to buy. It depends on your purpose of owning a property. Like us, we have big dogs so there is no option that we can sell at high price, move to a rental, and wait for next crash.

123,

Dude…

“ There is no time that is not a good time to buy.â€

I could not disagree more, it’s all about timing. Right now is the worst time in history to buy a home. It’s massively overpriced. Wait for the next recession and buy half off. Buy now and you will never recover from this mistake.

Also, it’s not about affordability. I can afford to buy now. It’s about patience, buying opportunity and opportunity costs.

I like that you have dogs. Take em for a walk and post less financial advice-maybe?

Not a great idea to build real estate over a big earthquake fault. Doubly not a good idea to make that real estate the most expensive in the country. I wonder how many people have insurance? Even the shitty government earthquake authority insurance?

It’d be so sweet if we get a severe earthquake. That would help to correct the market. But we might not need it. A recession will come soon, interest rates are going up and millennials are not buying. All signs point to crash.

Millie, wait til the wife gets pregnant. That renting shit gets old real fast when you have kids. Most crave a big yard, neighborhood play dates and sidewalks to learn to ride bikes. The wife will want to decorate and well ya know…nest! Others on this blog will agree.

Grandma,

Why would a renter have no access to playgrounds, parks or a backyard? You can have all of this for less money. Renting from s private landlord is much cheaper than renting from the bank. I don’t expect you to follow this, crunch the numbers or have any clue of what opportunity costs mean. You are spoiled since when you bought it was dirt cheap Compared to now plus you don’t pay your fair share when it comes to property taxes. You are a beneficiary of the housing bubble and think you are entitled to participate in this discussion. Wait until we raise your property taxes to what millennials have to pay then you have room to talk.

No matter where you build there is the risk of a natural disaster. Tornadoes in Oklahoma, Hurricanes in Florida. Earthquakes in CA. Tsuunamis in Oregon. And on and on.

Yes, we are also due for a huge asteroid strike, not a good idea to build anywhere right now

@surge

Asteriod strike! Hahahahaha, sorry but that was hilarious. Needed a good laugh this morning. Thx

You laugh but I grew up in a small town in south suburban Chicago, Park Forest and a meteor actually crashed through the house not far from where I grew up and injured the occupants.

Not really. Some areas are more or less prone to natural disasters than others. A quick search on google will reveal there is a lot of analysis showing CA and LA to be more prone than some other parts of the country and world.

What goes up will go down and the other way around. Always did, always will. Nothing new under the sun. Everyone knows that. The only debate is on the timing and amplitude. Both of these depend on so many variables that not even the people from the FED can predict. I don’t know that either.

I’m just saving steadily and I’m patient like always. I can afford to do this because I have a house I like and live in it. All I’m looking for are investments with good ROI.

100% agreed

The private Fed is the reason for the crashes. It’s illegal.

How come cities run exclusively by socialist Democrats – who claim to be for the little guy – are always the worst places for “the little guy”?

Things that make you go…Hmmmmmmm……

Just keep voting Democrat y’all and everything will be just fine. I hear Cuckerberg has a super cool idea of Universal Basic Income for everyone in California. You get $1K and you get $1K and you get $1K. What could go wrong?

Yes, How come cities run exclusively by socialist Democrats are so desirable and have so many jobs that so many people want to move there and pay any price to live there?

Do go on….. LOL

“In fact, in some parts of the Bay Area — including Santa Clara, San Mateo and Marin counties — already more people are leaving than arriving, according to the estimates released Thursday, which cover the period from July 1, 2015, to June 30, 2016. The same would be true in San Francisco if it weren’t for the high number moving in from abroad. ”

Illegals are moving in, American middle class is moving out.

3rd World Status: confirmed.

After the lecture I gave you on the previous thread you still did not get it. The word is not “desirable”, it is “demand”. Something can have demand without being desirable and something can be desirable without much demand or with a lot of demand. Calcutta in India and Mexico City, both have lots of demand and are far cry from being desirable.

Like Chicago? Detroit? Baltimore?

I read that there’s a shit map of for San Francisco showing people where not to go cause the homeless are shitting on the side walk…..did a google search….here’s “A” link, it’s just the first one so don’t go off about the link….

http://dailycaller.com/2018/01/15/san-francisco-defecation-map/

What a lovely place to spend $1,400,000 to live …….for ~$6K a month you too can live in a toilet.

San Fransicko is not desirable, unless you enjoy stepping on human feces and seeing them defecate and spraying you.

I should have said:

Yes, How come cities run exclusively by socialist Democrats are in such demand that so many people want to move there and pay any price to live there?

Demand: willingness and ability to purchase a commodity or service

San Francisco is not a prison. All of those people could move to the conservative bastion of Kansas but conservatives don’t create that kind demand for their cities.

Why?

I asked an engineer awhile back why he stays in the Bay Area.

1) Family – He grew up there.

2) Jobs. Conservative cities just can’t seem to offer the variety of jobs and high wages that the Bay Area or LA offer. Socialist Democrats seem to do a better job at this. His point was that if he makes 200K per year, 5K, per month in rent or mortgage (30%) is affordable.

3) Weather. Many people living in CA hate snow. Even though many drive up I80 to Tahoe to ski and pay thousands to rent there.

4) Activities, arts, theater, sports, clubs, are all available in the city

Many are commuting an hour to their high paying jobs, and some have the willingness and desire to pay 2M to move closer and walk to work.

Toilets are also desirable.

Guys, you can discuss it all day long about whether SF is desirable or not…reality is: money and statistics speak and they say that people are willing to pay the current rent prices. If you think it is undesirable, it is undesirable to YOU and obviously desirable enough to others. Your only power is to judge what others consider desirable (they do not give a shit what you think).

Yeah there are no good paying jobs in Dallas Atlanta. All those Fortune 500 companies based in Texas and Georgia and N. Carolina pay like $10.50/hr.

You people live in a separate world, both figuratively and literally.

Spending $5k a month on housing on $200,000 salary is only affordable if you don’t care to do anything else or save money. That’s roughly half your take home pay and the money you have left over will be used to buy things that have an increased cost because you are living in such an expensive area.

My girlfriend and I make over $200,000. If we had to pay $5,000 a month just for housing it would seriously cut into our ability to save, travel, and do the other things we enjoy. Could we do it? Yes. Do we want to do it? No. We actually want to retire some day.

After taxes, $200,000 only nets you roughly $127,000. Is it doable to pay $5,000 a month? Sure. Is it financially healthy? Probably not.

Surge is right in the way a child’s brain works. There are a lot of people in India and China and a lot of dumb money changes hands over there so always demand = desire.

Yup, give everyone $1k and rents go up $1k across the board. That’s how severely constrained housing markets work. Renters have little bargaining power.

The James Henry Law: In certain kinds of constrained real estate markets, most new wealth creation goes to landlords.

It does not work like this. $1k is one time deal, rent hike would be for every month. That $1 will be blown on short term consumption and that’s it. Redistribution within system. No change.

Now, if hypothetically taxes are lower, then rents/stuff will increase in prices (because this is sustained extra cash on hands)

Sean’s point is accurate though.

If you give renters disposable income it goes directly into landlords pockets with rent increases.

With the Trump tax plan I expect rent YOY increases in SoCal to be Yuge in 2018.

That made me laugh out loud. Don’t you wish notankinsight, weird that that hasn’t happened for me at all. Since I started my career I had massive salary increases. Received several promotions but my rent has not increased a penny. Well, i certainly don’t show how much money I have. I drive an older Honda and whenever I get a chance to speak to my old landlord lady I tell her how hard life is and how I can get barely by, lol. I rent in an area where many struggle financially. If you live below your means for a decade or so you can buy a house in all cash during the next crash. That’s what I am doing and I don’t charge you for giving out my secrets. Over the years I learned just how dumb people really are. They spend less research on buying a house than on researching their next vacation. They believe anything their realtard tells them, buy with 3% down, switch employers almost annually and will be the first once to get laid off during the next crash. it ends with foreclosure or short sale. That’s when I come in and swoop it up for 55% below today’s “priceâ€.

The funny thing is the city that went bankrupt, Stockton, is the first one to roll this out. I say lock up the supervisors and mayor.. If you have to file for bankruptcy you clearly don’t know how to manage the finances of the city.

https://www.npr.org/2018/01/29/581674763/in-california-stockton-experiments-with-guaranteed-basic-income

I don’t see many Democrats moving to republican areas, but I do see alot of Texas plates in Ca. Funny thing about hypocrites is that they always make a judgement. Why not stay in the place they made crappy? How is that Texas and Oklahoma fraqqing going? Why not put up a house on top of that natural disaster? Also when a republican house goes down don’t think they are not near the front of the Fema line. They will take aid, but not offer it. Garbage.

“How is that Texas and Oklahoma fraqqing going?”

How’s that car running?

This is a direct result of Fed funny money and artificially low interest rates. The inflation happened, in asset prices. As bad as it is, it’s still better than inflation in consumer prices.

This real estate is also being paid for by people working in highly overvalued companies, due to the same funny money phenomenon. So if you’re a Tesla engineer, you’re getting a paycheck from a company worth more than GM, but will never make a dime, and spending it on a condo in SF. It’s not real money anyway, you may as well blow it on a crap shack with a toilet wedged in what used to be a broom closet in 1940.

Such is the perverted environment that the central bankers have created.

+1

Excellent explanation!

This line is pretty funny-

“It’s not real money anyway, you may as well blow it on a crap shack with a toilet wedged in what used to be a broom closet in 1940.”

I think it’s more than just “cheap and easy credit” as POH likes to describe. The credit may be cheap but it’s certainly not easy. Everything is income based underwriting and POH’s “exotic products” line is way over hyped.

Definitely a combination of many circumstances:

Low rates

Foreign money looking to escape the east and SF seems to be a straight shot with climate that is preferrable

Major tech money

Building restrictions strangulating inventory

Prop 13 keeping properties within the family for generations

Boomers not retiring and leaving in mass

So, it’s not just 1 major event; it’s a combination of different components which all lead to insanely high prices. Not really sure what can change it at this point.

Fed mortgage rate support is everywhere. The insane prices are only in a few, albeit large and important, metropolitan areas – something like SD, LA, SF, Portland, Seattle, Houston, Austin, Miami, Orlando, DC, NYC, and Boston. In most of the country rents and prices are well-aligned, indicating the current Fed activities are pretty spot-on for them.

What we are seeing is a huge gap between a number of booming metropolitan areas and the majority of the country, which is still experiencing a weak recovery 10 years out from the crash. Fed policy can’t accommodate both and they are choosing to tune policy for the majority of the country and allow booms in the big, well-educated metropolitan areas. They can only have one policy so somebody is going to see a mismatch. Even if in the long term a more restrictive policy would be better (and that’s not clear) this is a democracy and you can’t tell the 200 million not in the boom areas they have to be unemployed to keep house prices down for the 100 million in the boom areas.

Thank you!

A rare good post with an interesting idea.

I wonder why lenders would not be able to do what FED can’t…adjust actual mortgage rates based on location (risk). This would be an interesting idea.

“Fed policy can’t accommodate both and they are choosing to tune policy for the majority of the country and allow booms in the big, well-educated metropolitan areas. ”

Nice idea but I’ve much more cynical view to anything FED does: It exists solely to make owning banks (and other ‘too big to fail’ -banks as a side effect) even richer they already are.

Nothing else matters.

To that policy 1,6M average mortgage fits like a glove: It makes lenders filthy rich.

So far I haven’t seen FED doing anything which would cause loss of profits to banks. Loss of property of people? A lot, they don’t care an iota of that.

‘Fed policy can’t accommodate both and they are choosing to tune policy for the majority of the country and allow booms in the big, well-educated metropolitan areas. ‘

Nice idea but I’ve much more cynical view to anything FED does: It exists solely to make owning banks (and other ‘too big to fail’ -banks as a side effect) even richer they already are.

Nothing else matters.

To that policy 1,6M average mortgage fits like a glove: It makes lenders filthy rich.

So far I haven’t seen FED doing anything which would cause loss of profits to banks. Loss of property of people? A lot, they don’t care an iota of that.

>Fed policy can’t accommodate both and they are choosing to tune policy for the majority of the country and allow booms in the big, well-educated metropolitan areas.

Nice idea but I’ve much more cynical view to anything FED does: It exists solely to make owning banks (and other ‘too big to fail’ -banks as a side effect) even richer they already are.

Nothing else matters.

To that policy 1,6M average mortgage fits like a glove: It makes lenders filthy rich.

So far I haven’t seen FED doing anything which would cause loss of profits to banks. Loss of property of people? A lot, they don’t care an iota of that.

@surge

That’s illegal. It’s called redlining

Someone to listen to? Bad news for the bears

https://www.cnbc.com/2018/03/16/steve-eisman-who-called-the-big-short-during-last-financial-crisis-says-hes-sleeping-easy-now.html

Almost two years ago, a relative was a renter who had a saved a decent amount of money. He told me prices were too high and he was going to wait for them to come down. I changed his mind and he bought a very nice little cottage with a backyard in Dana Point in the low 600s. Now, that same cottage is in the mid 800s. Now, he tells me he is glad he bought because even if prices fall he has a 250K equity cushion. That equity cushion continues to increase each day. I was able to save one lost sole. He now gets it. It is all about inflation. The FED does its best to make sure there is a small inflation. So, why not just buy then sit back and enjoy the ride. Even if you screw up and buy the top, after a few years, the FED will fix it for you.

how much can he rent out that dana point bunghole for? Will the rent cover his mortgage? If so, he’s sitting OK…if not, that equity bubble means nothing unless he sells now.

Actually, if he rented it out, the rent would not be enough to pay for the mortgage and taxes. It will be some time before the rent covers the payment.

Lol JT, another fake story

My bet is you are a 50 something guy trolling for fun.

You lost that bet bro

Nope. I am right on the money.

Dang he got me. I am like 57 years old

well I for one am glad you’re basically admitting that what we have isn’t capitalism. BUT there’s a bust coming, just like last time and the time before that. Is his $250K cushion enough? I don’t know…….If the economy was allowed to function he could be upside down for a decade or more……like I was in the 1990’s.

You never know when you are at the top until after it has passed. When you buy, with some luck, after a few years you may have enough equity to survive a downturn. It is risky. You could get unlucky and be down hundreds of thousands several years later. But, the odds are in your favor since the government and private debt levels are so high that the entire system would collapse if deflation takes hold. So, the Fed desperately engineers inflation and that is how the system works.

@JT The QE unwind is well under way and the Fed will continue to raise the FFR, so what is that going to do to your hypothesis that debt levels are just going to keep going up?

Sunnyvale 850sqft home listed at $1.45M recently sold for $2M in 2 days, broke record for price/sqft (thats over $2K per sqft).

https://sf.curbed.com/2018/3/2/17073100/silicon-valley-house-home-sunnyvale-record-price-crisis

LOL, thats insane! I bought a bigger, nicer house ~20 years ago with ocean view down in San Diego for less than 180K! Lots of funny money chasing stupid nowadays. No doubt lots of broken families and broken bank accounts in the future.

That Sunnyvale house gives me a headache- $2M for everything I ever wanted to escape from, which is life in a fugly little 50s-stye subdivision house that reeks of cheapness.

Laura, agree… the crazy thing is that it doesn’t even look like a nice tear down.

I would expect you buy that place for the lot and spend a million dollars cash building your dream home.

… but the lot does not feel like a $2M-$3M home

I sold my home in the Bay Area recently to cash out from that madness.

You’d have to build a house that cost $2M to justify the price of that “tear down”.. meaning you’d have to spend $4M at least.

But I’ll bet that most of the people looking to buy this thing can’t afford to tear down and replace. $2M is a LOT of money, even for most well-paid techies in Sunnyvale. Figuring on a 20% down payment, you’re financing $1.6M, which means you have to make about $400K a year to afford this distinctly lower-middle-class house. And you’d still be just a little stretched, because you also have house taxes and cars to run.. and you’d like to enjoy a few of the luxuries that you work so hard to have. What sucks the most, though, is that, as a techie, you know that you have only so many prime earning years before you become “legacy” IT, and you can no longer command anything like the kind of money you could a decade earlier, but you haven’t saved much because basic, half-decent working-class housing is so expensive that you tear through your paycheck just paying for a substandard little house that many blue-collar types out in Flyover Country would sniff at. Hopefully, you have gobs of stock options and the start up you work for is successful, but that doesn’t always happen. It has to occur to some of these people that they could live 3X as well on a quarter the paycheck somewhere else-and still have money left over to put towards savings.

Laura, it sounds crazy but many of these Silicon Valley purchases end up as tear downs

I would expect the lot to be nicer than this one though, but you would be amazed at the cash floating around in the Bay Area both from Tech and from Asia.

+1

Laura, lots of common sense in your post, which is not so common these days. Lots of lemmings in the SF area these days!… They have knowledge but they lack wisdom.

So according to the stories this house was bought by a young, single techie for all cash. Looks like he only has to pay taxes.

If you have that much cash money, why are you buying this crap. He has enough brains to earn and save, but bought crap.

Kaboom. My mind is blown

If bums urinating on you and $3500 1 bedroom studios isn’t enough reason to live in San Fran, how about this….

SAN FRANCISCO (KPIX) — Car break-ins are on the rise across the Bay Area. In fact, 2017 was a record-breaking year for our three largest cities.San Francisco leads the pack with 31,120 break-ins last year. In the same period, San Jose reported 6,476 car burglaries. That number is the highest the city has ever seen and a 17 percent increase compared to 2016. It was also a record year in Oakland with 10,007 reported cases in 2017, up 32% compared to the previous year.”

CA’s slide to 3rd World status continues unabated.

That is what liberals call “desirable” – a poop city with burglaries everywhere; sanctuary city on top of that. Statistics and maps speak for themselves. No further comment needed.

Even with so many problems, people still want/need to live in SF. This means there is something more to life than number of break-ins. If someone is fed up, they move. Yes, SF city proper is not very family oriented, but it is what it is

Nobody can argue that the demand to live in the Bay Area is going up. Prices prove it.

The poop web page has a disclaimer that it is not run by the government or verified. Yet conservatives like Rush Limbaugh spread it as the truth. That just annoys me. Making stuff up to prove a point. There is a sucker born every minute who will take it as the truth.

I probably couldn’t tell the difference between a rude dog owners who don’t clean up their dog poop and human poop. That has given me an idea to post a site for our conservative neighborhood showing a neighborhood map of where the dog poop is piling up.

Also if conservatives show tens of thousands of people fleeing the Bay Area, they must be getting replaced by even wealthier successful people to keep the house prices rising.

If so many people are leaving, why hasn’t supply increased? Either rent or home prices or both would fall if you would believe the conservative biased media. That is Capitalism 101.

Again, the home prices in the Bay Area keep going up. That means the demand keeps going up. More wealthier people are moving in than moving out so supply remains low.

“Seen it all before Bob” says: Nobody can argue that the demand to live in the Bay Area is going up. Prices prove it.

That is complete bull. Fact is prices are moving up nearly everywhere in the country because of inflation. Prices are moving up strongly in Detroit. That does not mean demand to live in Detroit is going up. When prices are going up everywhere, that just means there is inflation.

Fact is males who like women hate the bay area because the bay area does not have enough quality women. I would never live there. What straight male would??

http://www.areavibes.com/spokane-wa/crime/

Yeah, and Spokane is the Garden of Eden.

I am hours away from Spokane. I don’t live there, although Spokane is a livable affordable city with some nice neighborhoods, especially the South Hill and Liberty Lake area. I wouldn’t mind living there, but I live in a nice place and I can not live everywhere at the same time.

I would move to Spokane anytime before I would consider SF. SF has exactly zero attraction to me. I wouldn’t move there not even if I would be a billionaire.

Flyover, SF has no attraction to you? This is fine. What are your argument? That SF is going down because people are leaving? Or because you do not like it. What is your point? If it is overpriced, but you don’t like it/have to live in here – what is this to you?

I live in California but would never ever want to live in San francisco or close to it. Way to crowded and way to overpriced. I don’t know much about Spokane other than mr landlord lives there and that you have rental parity there. I would buy there.

Flyover,

My comment was directed towards Landlord who slams CA but lives in crime ridden Spokane. Statistically (specifically property crimes which he quotes) are higher per capita in Spokane than SF. Double for the state of WA. It’s amazing given the lack of liberal democrats and “bad hombres†(and no Somali restaurants). Must be the meth or oxy.

Surge,

Why so triggered Bro?…The whole purpose of this blog is for people to express opinions. Isn’t that obvious?!

I post my opinions the same way you post yours. Some learn from my posts and I learn from others.

What? Do you want to be the only one posting? Or you would accept just JT to give one each other high five?!!!….From my point of view, there is nothing wrong to be challenged in the way you think; that is how you develop a greater perspective.

Yes, my opinion is mine. You can accept it or reject it. You don’t have to become triggered. In the eighties there were lots of rich Japanese paying exorbitant amounts for RE in USA. That doesn’t mean that they were wise, most lots all their money. Heard mentality just leads you to the shearers.

Flyover, dude, yes I am triggered so what (Triggering is a cheap psychology 101 trick anyways). Opinion is dirt chip, yes you are entitled to it but who cares unless it brings value to the table. Talking about very very high level social issues on RE blogs is useless – in the end, the discussion will end up in the realm of “who really owns this land” – and then everyone will get triggered. Stating the obvious (that SF has a lot of specific problems) is also useless.

Surge, if my comments/opinions are useless why do you read them?

Are you on this blog the purveyor of what is useful and what is not?

Are your comments/opinions useful? If yes, why?

If I posted anything political it was ONLY in connection with RE which is influenced by politics as much as by the FED. I did not mentioned any other social issues which are not related to RE. While the main focus is on SoCal RE, even the Doc is talking about other areas like SF. As far as I know, all blogs are for posting comments/opinions – for some people they are useful and they learn from them, and for some without critical thinking you can hit them with a brick and they still don’t get them. Also, for me, your comments are just waste of virtual space. However, I recognize your right to post and freedom of speech. I don’t know what is the matter with these liberals who get triggered all the time and all the time are ready to take the freedom of speech from others. Those liberals from SF who control Twitter, YouTube, Facebook and Google practice censorship all the time for any conservative view and then they say “don’t be evil”. Hypocrites!…

Censorship of speech is un-american and against 1A. But the liberals have no respect for the law of the land – the Constitution. They change it as it is convenient to them at the moment.

Flyover, once you start throwing words like “liberals”, “freedom of speech”, etc.. – discussion spirals into pointless drivel, and then you are 1-2 sentences away from calling someone a Hitler. I do not want this on this blog, I want to see numbers/specific ideas, and I do not really care for the freshman-level non-actionable discussions. If you want political change, this is not the forum.

Surge, I’m sorry for you! I know that truth hurts, and liberal’s heads explode when they hear it. And they explodes especially when they hear about “freedom of speech” – their communist/collectivist minds can not stand it. “Freshman-level non-actionable discussions” is all I hear from you and MSM. Also, where are the numbers in your posts???!!!!….

Solutions, ideas? Vote out all democrats/socialists/collectivists for a start. If you can’t vote them out, move out.

“If you want political change, this is not the forum.” Ha!!!…this is all you hear at liberal universities. They don’t want to hear any view opposite of theirs. They like to live in their own bubble – “safe space”.

Guess what?!…I’m going to stay here and post everything I like if you like it or not. If you don’t like my posts, just skip my posts and move on! You don’t have any monopoly and wisdom and you are not going to take it with you in the grave.

Flyover, to add more fairness to my post:

<<<once you start throwing words like “liberalsâ€, “freedom of speechâ€, "republicans", "conservatives", "avocado toast", "realtard"… then discussion is going down the drain towards mindless drivel. Somehow you assumed that I am liberal.

I prefer when democrats changed by republicans and then democrats every 6-10years. This is the healthiest modulation. You seem to like just single party.

I provided plenty of numbers, but useless politically-charged drivel like yours seems to draw more responses. Fine.

Of course you can post here whatever you like, but then expect occasional feather-ruffing thrashing from me if you post political drivel.

Bbbbut the weather!! And the culture!! And the Chinese food!!! And the progressiveness!!! And those oh so awesome high tech paying jobs that don’t exist anywhere else in the world!!!

LOL

“San Francisco lost more residents than any other city in the US in the last quarter of 2017, according to data from real-estate site Redfin, which sampled a million users. The data factored in the number of residents that cities gained, meaning San Francisco lost a net 15,489 residents; about 24% more than the next-highest loser on the list, New York City. This is expected to continue into 2018, considering that, as of February, 49% of Bay Area residents were looking to move out of San Francisco, according to a survey by public-relations firm Edelman.”

maybe SF lost some residents, but they just went across the bay to live in Oakland/East Bay.

Bay area is growing.

You are wrong.

“SAN FRANCISCO (KRON) — The San Francisco Bay Area is losing more residents than any other United States metro area, according to real-estate site Redfin. In 2017, 19.4 percent of Bay Area residents were searching for housing elsewhere, the report said.

Of the 15,489 people who moved out of the area, most of them settled in the Sacramento area in-state, Redfin said. The top out-of-state destination for former Bay Area residents was the Seattle area.”

http://kron4.com/2018/03/07/study-san-francisco-bay-area-losing-more-residents-than-any-other-us-metro-area/

So, so, so wrong!!

“OAKLAND, Calif. (KTVU) – In the last year, California grew by .85 percent, bringing the total of people living in the Golden State to 39.5 million, according to the Department of Finance. But also in 2016, 30,000 people fled cities such as San Francisco, San Jose and Oakland to other parts of the country, according to an analysis by Jed Kolko, chief economist of Indeed.com of net domestic migration gleaned from the census. “

Timing is everything. I got it right in 2012 and bought at s low. Now I am waiting for the crash so I can sell on the way down and buy again at the low.

Plus buying at the low locks in a better tax rate.

Patiently waiting….,

why not just refi instead of sell?

Fundamental Question:

Why are tech companies so tethered to San Francisco?

One reason is historical accident. (Sun Micro, Stanford spinoffs, Cisco, Google, Apple, Intel, and hundreds of smaller enterprises).

But is there some gravity force from a black hole forcing these companies to stay put?

Suppose someone starts XYZ Crypto company and decides that Arizona is the place to be and will pay $150K entry level salaries?

Then what San Francisco?

What is also truly ironic is that all this technology is suppose to bring mobility along with it.

The reality is that (at least in my high tech company) that tech isn’t being used.

Why? Tradition (we have always done it this way), power, control, all of hot women in the front lobby, etc.

Of course none of this makes any logical sense, but neither does absurdly insane SF real estate prices either.

Yeah, the companies stay because that’s where the talent and support industries are, and the talent and support industries stay because that’s where the companies are. It’s an old phenomenon but it’s especially acute in the tech field because so often the #1 company gets almost everything and everybody else just gets crumbs. Tech companies have tried to move out of the Bay Area for decades and for the most part they fail.

Silicon Valley was farmland up until the late 50s. Shockley started it all in 1957, then that begat Fairchild, which begat Intel. All that happened in about a 10 year span. And from the late 60s, Silicon Valley as we know it took off. Add in Stanford to that mix and you have a self fulfilling circle.

What a lot of people don’t get is that the tech industry isn’t so much about tech, but also about money and connections. All the tech money is in SV. If you want to start a new company, you need money. And to get money, you need to be in SV to access it.

Now of course there is investor money outside of SV and plenty of start ups exist outside of SV. There’s Austin and NYC and RTC in North Carolina. But generally speaking those are more exceptions to the rule. And those companies are often 2nd or 3rd gen companies, ie the founders of those companies move there after running companies in SV.

It’s like movies in LA or finance in NYC. A movie can be made anywhere, and stocks can be traded anywhere, with cheaper rents and lower taxes, etc. But still, NYC and LA are the epicenters of those industries.

There’s something about Californians that makes them stay. I know plenty of people who live in the BA who hate everything about the area…the cost of living, the taxes, the progressive politics, the traffic, all of it. But still they won’t move. They have this mentality that somehow they’ll miss out on something if they go to Phoenix or Boise or Denver. It’s weird talking to them since on paper they know their lives would be so much better somewhere else, but still they don’t leave. It’s bizarre, in a way, but I also understand it. There is something unique about living in N. California, especially if your life revolves around the tech industry.

surprise, but life is not all about optimizing ones finances or real estate.

Mr Landlord.

I agree with this.

Other than family reasons, the engineers I work with like the peace of mind of earning an extremely large salary for a variety of jobs. If they grow tired of a job, there is an even better paying job across the street. That is security.

Also, as you have mentioned before, the thought of becoming a billionaire with an exciting new startup that is funded by Bay Area VCs is extremely exciting and attractive.

It’s like buying a lottery ticket in Flyover Country but having a much better chance of winning.

If you are in the tech industry, the Bay Area really is unique. But the other thing that stands out about the Bay Area is that it is one of, if not the, best-educated major metropolitan area. Only Boston is comparable. Any other place with a similar percentage of doctorate holders is a college town. If you like smart, well-educated people as friends and co-workers, the Bay Area is really hard to beat.

In order to start your crypto company and be able to pay $150k salaries -> you need to be able to raise good capital. Need to be close to VCs. Need to attract top talent. And top talent typically does not want to live in Arizona (sorry, this is just a reality, good or bad).

Its like having a mall -> more shops clustered together better for everyone involved.

Silicon Valley is organic conglomeration of the large industry.

Like it or not, it is just more vibrant and dynamic there in that regard

Stanford, UC Berkeley and cooler weather (compared to inland or socal) – cuz nerds hate to sweat. They couldnt roll in the country (Whats that smell? neeeerrrrddsss!) or the desert and no way they make it on the beaches so they needed a place where the weather was good but not so good that you’d be expected to have an “outdoor bod”. Thats why it took so long for tech to make it down to socal in a big way – its like theyre allergic to anything slightly jock-ish

Plus more than a few are probably

I bought my home for 162k in 1998 and its’ never been below that. In 2009 it still hovered at the 400k mark. Now it’s over700k. We are adding an ADU that will raise the valve at least 200k. When I retire in 7to 9 years we will rent it all out if the market is down, or sell it if the market is high. I do wish they would slowly correct the prop. 13 inequity that makes the millennials suffer a higher tax due to the climbing market.

Let’s say prices drop 30% on the coast in 2019, and hit bottom in early 2020. That sort of drop will happen whether or not prop 13 is repealed.

So the smart millennial then buys a $500k property, at a typical 1.1% rate.

That year he’ll pay $5,500 in taxes, with or without prop 13.

If prop 13 is then repealed, it would have virtually no effect on housing prices. Housing prices are primarily affected by location (demand), the economy, and speculation, not taxes.

In 2030, let’s say the house is now worth $700k.

With prop 13, he’ll pay somewhere around $6,700 for that year.

Without prop 13, he would pay closer to $7,700.

But wait – I thought prop 13 was unfair to millennials??

There are unfair aspects to prop 13 (commercial property and inheritances), but the way millennials are treated is not one of them. They benefit from it, period. Once they actually own and can see past the next Xbox game release, they’ll realize that.

What millenial misses since he never owned a home here or anywhere else… is that without Prop 13 there is no limit to what your taxes could be. I have owned homes in areas like this, you really don’t want this trust me.

John, thanks for providing the example of how much millennials have to pay in property taxes.

That’s exactly why it’s a scam to screw young buyers by transferring the tax burden to them.

The boomer next door has the same house, receives the same services but pays a fraction of what the millennial has to pay. Why? Simply because the old fart is greedy and does not want to pay his fair share. The boomer did not have to pay ten times his annual household incomes for the house he bought. Back than houses were dirt cheap compared to now. Yet, he brags how good the housing bubble treated him and he is totally fine with new buyers paying way above value plus paying 1.1% of that overpriced house in property taxes. I don’t care if the inflated property taxes are locked in or not. They are too high to begin with and a scam because boomers get a pass. That’s why renters and millennials will vote against prop13. You need to lower taxes for new buyers and increase drastically for people who owned for a while. And don’t give me the pathetic poor grandma BS.

“That year he’ll pay $5,500 in taxes, with or without prop 13.”

Yes, but the people who own it now, pay $550 because of Prop. 13.

That’s the difference.

Claiming that $5k per year in taxes doesn’t affect selling/buying is just laughable, basically it’s a blocker for selling to anyone who can count and it’s not absolutely necessary to sell.

So No Taking In Sight you would also approve of rent control, which is what Prop 13 is for homeowners.

“Claiming that $5k per year in taxes doesn’t affect selling/buying is just laughable, basically it’s a blocker for selling to anyone who can count and it’s not absolutely necessary to sell.”

Point to the post where I said prop 13 beneficiaries don’t hold on to their homes because of the low taxes. Good luck with that.

If it was repealed overnight (which won’t happen), you would get a temporary surge in inventory, as happens every summer anyway. The affect on prices would be insignificant compared to other fundamentals.

John D failed to mention the resultant higher taxes and fees levied for everything else by the state in order to pay for subsidizing earlier property owners. Apparently he thinks Sacramento pays for government handouts with dollars grown on money farms in the Central Valley.

“John D failed to mention the resultant higher taxes and fees levied for everything else by the state in order to pay for subsidizing earlier property owners. Apparently he thinks Sacramento pays for government handouts with dollars grown on money farms in the Central Valley.”

The damage from prop 13 is already done. If they repeal it, do you honestly think county taxes and fees would go DOWN?

Before prop 13, property taxes set by counties were 2 to 3 percent of assessed value. Translation – first time buyers suffered right along with grandma.

Now the burden is slightly shifted to everyone – first time buyers, long term owners, and renters. Some owners benefit more than others, obviously, and renters get the shaft.

Prop 13 is bad. It’s also good. Definitely gives an incentive to own, unless you’re Millie.

“Fixing” it is not as simple as repealing it.

Prop13 is a bastardized way of trying to “solve” value-based assessment of property taxes. It’s like Affirmative Action…giving to one race at the expense of another. The real solution is to make property taxes assessed as a fee based on the size and type of the parcel of land, NOT THE VALUE. If the government wishes to increase that fee, the public has to vote on it. Period.

Thro,

I agree. Prop 13 is just helping the already bad property taxes. They shouldn’t even exist….we should be able to own a house without paying rent, prop taxes, to the government.

As a millennial, it really hurt to pay property taxes….about $4800 a year…a little less than take-home pay for a whole month!

The way I see it: 5 years of property taxes here is equal to a down payment on a rental house in another state!

$1+million? There are ranches here in lovely Roseburg OR for less than that. And they are little larger than a condo, say 500+ acres. Of course you wouldn’t have the struggle to commute every morning, getting out of town wouldn’t be filled with existential dread, and you wouldn’t be surrounded by sociopaths. I moved here from Portland. I hated it at first but was just in Portland last week for a night. COULDN’T WAIT TO GET OUT OF TOWN. Living in a small city/town has made me a friendlier person. It really truly improved the quality of life. The culture here is a little rednecky, so just wear some Carharts and you blend right in. Plus, anymore the flow of information is swift so wherever you are, the conversations aren’t all that different. Okay, so the restaurants are pitiful… but you can get any ingredient you want locally… and then order some super slick culinary items off Amazon and you are slicing/dicing/preparing some tasty dishes the next day! Less time on the road and less ENERGY wasted being ANGRY at the other drivers EQUALS more time for hobbies like golf-meditation-painting-skiing-hiking-etc.

An anecdote… I met up with a friend a couple years back and she said that so-and-so was coming into town from SF to spend the night. My eyes perked up because so-and-so is a HOTTIE. I couldn’t wait to see her again. She was more of an acquaintance to me in earlier times but she didn’t go unnoticed. WOW… she looked TIRED and not at all like the bright eyed 20yo I met 9 years earlier. She had been mugged and experienced many unpleasant situations in SF. I am pretty sure/perceived something even more sinister had happened to her but she decided to “keep it off the books”. It had definitely taken it’s toll on her looks. Yet she had the idea that she needed to ride it out as if that made her a champion of sorts in someone’s eyes. Her eye’s got wide when we talked about Portland and how cool the place was getting at the time (2010) plus the complete lack of crime that was Portland at the time.

Something else: you don’t need to move to fly-over land to find a good deal. Oregon has plenty of spots to live in that are relatively cheap. I lived in fly-over IOWA for 22 years. There is NOTHING appealing about those places in a natural sense. Sure, the people are fine but the visual/climatic/cultural aspects of fly-over land are what makes it only worth flying over unless it is that or PRISON assuming you can afford to stay somewhere on the west coast. The winters and summers in most fly-over areas are awful whether it is snow or super hot/humid. What natural splendors did I miss the 22 years I spent in FO land? Not to mention crime is being exported from Omaha, St. Louis, Kansas City, Chicago, Milwaukie and Minneapolis into smaller towns in that region. The PAC NW isn’t going to get much migration from many violent cities as they further implode under their current stresses. Portland and Seattle have GOOD problems. Midwest cities… NOT SO MUCH.

How you will sustain yourself on a ranch home in Roseburg, OR if there are no decent jobs around?

“plus the complete lack of crime that was Portland at the time.”

Complete lack of crime is a bit much, but yeah 10 years ago Portland was relatively safe. Not anymore. Thanks for sanctuary city policies and a lax policy on drugs, Portland of 2018 is a worlds apart compared to 2010. And thanks to the BLM, nobody in their right mind wants to be a cop anymore, especially in a progressive city like Portland. The end result, a shortage of cops and a green light for criminals to do as they wish. But at least you have like 1738 craft beers to choose from before getting assaulted or raped by a Mexican gang banger. So it’s all good.

“PORTLAND, Ore. (KOIN) – Someone who is assaulted in Portland only has a 3.5% chance of an investigation, according to a letter from the president of the Portland Police Association. Officer Daryl Turner wrote that detectives and investigators are “continuously crippled by catastrophic staffing shortages.

In Portland last year, the number of reported person and property crimes increased 7%, reported assault offenses went from 7,525 in 2016 to 8,042 in 2017 and 282 assaults were assigned to the 5 detectives in the Portland Police Bureau’s Assault Detail for investigation and follow up.”

Apparently you have a higher chance of getting raped or robbed in your lovely hometown of Spokane. Of course Portland has a larger population so there are more overall incidents however… per capita your town is akin to Detroit.

No BLM, no Mexican gang members, no sanctuary policies, just 85% conservative white people. The stats don’t support your bigoted comments.

http://www.areavibes.com/portland-or/crime/

http://www.areavibes.com/spokane-wa/crime/

SoCalGuy, CA policies of encouraging illegals and frustrating the federal LEO to enforce the laws of the land allowed many of the mexican gangs to go all the way to Canada. I would be curious if all the incidents would be stats based on ethnicity. I wouldn’t be surprised if the majority of culprits in Spokane would be the same like in CA.

The metro area of Spokane with all neighboring cities is close to a million. Lots of the liberals moved from CA and Seattle like locusts destroying everything in sight. There are not the conservative families increasing those % of burglaries but the same “nice” people moving from large liberal cities into conservative cities.

That is one reason I like small conservative towns and I am not going to say where I live (too nice to be spoiled by liberals). The conservative families are nice family oriented and civilized. Yes, few in town are mexicans, but conservative ones, hard working and disciplined. In the last 13 years since I moved here, I know all my neighbors and I never locked the doors on the house or cars. I leave even the key in the cars. Nothing ever went missing. Try that where you live before blaming the conservatives.

One time I was with family in Hawaii and the neighbors called me that someone they don’t know entered into my garage. It was my brother in law because I sent him there to take something. That is what I call a true neighborhood – better than any security camera.

That is not bigotry – those are facts. You don’t believe me? Go to East LA and let me know – is it bigotry or what I am saying is the truth? Liberals live in a parallel universe!

Flyover,

http://www.waspc.org/assets/CJIS/2016%20crime%20in%20washington.small.pdf

Uniform crime report for Washington. It’s from 2016 but they make one every year. Breaks down every stat you could imagine.

The majority of crimes are committed by good old white folk in your state. Unless you are trying to convince me that white people have joined MS-13.

I’m glad you have found a nice community. But this right wing bigotry from you and especially Landlord is annoying. I don’t live in East L.A. But since it’s majority Hispanic, I’d expect a lot of them to be involved in crimes simply because they are the majority demographic.

Now when crimes occur in WA, well it must be those Mexican/Canadian MS-13 gang members again. Give me a break.

I live in a nice OC beach community. Our demographics are similar to Spokane (80% +\- white) but a third of the crime rate of Spokane. You can even look at Santa Ana, which is probably the MS-13 HQ and it looks safer than Spokane.

SoCalGuy,

First, you gave the stats for WA state as a whole. WA state is a liberal democrat state so I’m not surprised to see the same results like in any other liberal democrat state. The whole political class is made up by liberals like you. Eastern WA has many enclaves of conservatives.

Second, it looks like you agree with me – you prefer to live in areas which are not “enriched” like in East LA (80% white). You could have bought in East LA if you really believe in that “enrichment and multiculturalism”. Based on your actions you are more racist and bigot than those you accuse them of, and hypocrite on top of that, same like all the liberal democrats.

Third, the line I always hear from liberals that this nation was formed by immigrants does not hold any water – 100 years ago there was no welfare, free medical, free housing and free food. Socialism with open borders does not work; the middle class will break under the taxes to support it while facing a race to the bottom to enrich the 0.0001% globalists.

Please revise your arguments because there are full of holes. I can point out more of them in your post, but I will stop here.

Flyover,

It’s amusing you think I’m some kind of die-hard liberal because I can assure you I’m not. Trust me, I’m married to a millennial bleeding heart #metoo liberal. She considers me a moderate. Honestly, I’m not much for titles. I believe what I believe. Fiscally, I’m conservative. But socially, I’m admittingly liberal. I believe in the 2nd amendment and never once preached open borders. I’m not for full blown socialism but I believe in basic rights. If you contribute to society, work a full time honest job you should be able to provide for your family including a roof over their head and basic health care. Kids should have access to higher education despite their economic background without graduating with soul-crushing debt.

My parents were Eastern European immigrants as well. I am a dual citizen myself. I understand their struggles. My father came over on a boat. He had to have a sponsor (my uncle) and had to sign paperwork that he’d receive zero public assistance for years. And this wasn’t 100 years ago, it was 1956. He was also bitter like you (and I understand why) but the veiled racism you spew is blatant. You seem too intelligent to not know better.

I grew up in Long Beach and my parents decided to move to OC when I was 12. I live where I live because it’s home. If East LA had the most consistent surf on the west coast maybe I’d live there.

I stand corrected my town is now 76% white. It was a seedy town when I grew up (mainly white gangs/Neo nazi skinheads). It’s become more diverse and crime has gone down. Does diversity make society better? If introduced too quickly then of course not. It weakens society especially if the immigrants come from drastically different social, religious and moral backgrounds. This is what is going on in Europe right now.

So just to clarify the “culprits†causing all the crime in WA are dirty CA liberals and not MS-13 members. Fair enough. It’s interesting- my wife hails from Kentucky (the educated part) but the state is primarily full of right wing, god-fearing, gun-toting, conservatives. Eastern KY, along with VA and most of Appalachia is the same. The whole area is referred to as the “white ghetto†(see when you put things in quotes it’s not racist). Drugs/crime is rampant. There is poverty everywhere and welfare fraud. There is no shortage of methadone clinics. There are also no Mexicans abusing the system. Just good ‘ole ‘merican conservatives with their pickups and guns (oh and Oxy pills).

These globalist you speak of are all on the same team. Liberal, democrat, Republican, it doesn’t matter. It just further divides people and distracts them from the truth. Some nutjob shoots up a school and now we need to ban guns. More people are dying each year from opioid overdoses than the height of the AIDS epidemic (in WA it’s meth but the heroin is coming). We blame the Mexican drug cartels and now Donny wants the death penalty for drug dealers. Why don’t we start with the CEO of Purdue Pharma and the Sackler family. Look them up.

If you want to blame someone then look at your peers. Your generation caused this mess. You guys were at the helm. When I flip through C-Span, I see a bunch of crusty old white guys. Something is seriously wrong with this country and you can’t blame today’s generation or recent immigrants on issues that started long ago.

Build a wall, moat, whatever you want around your conservative enclave. The reality is you have far more years behind you than lie ahead. Fuck the future generations, seems to me your generation’s mantra. Times are changing whether you like it or not.

We must, indeed, all hang together or, most assuredly, we shall all hang separately.

-Benjamin Franklin (the original globalist)

SoCal Guy, I am familiar with what happens in Kentucky and Appalachia in general. It is all the result of globalism and raising a generation with no hope. The causes are far more deep and divers for a post here and I can write a book to cover all bases – they all go directly or indirectly to liberal democrats and their agenda. Yes, there are republicans, too – RINOs, which are just democrats with and R after their name – McCain is a prime example.

I am not a racist and bigot. Those are words used by liberals to close a conversation with no logic. I have plenty of friends blacks and hispanics. Their skin color does not bother me a bit. I always look at the character. I would have preferred Ben Carson as a president instead of Trump. Does it mean I am racists??!!!….Now, I learn to live with Trump. Some of the things he is saying and doing are very dump (he is shooting himself in the foot) and some a very good. I know there are plenty of whites mentally gone. But like you said, bringing too many, too fast from a foreign culture is not good.

This is all the result of the spoiled boomer generation putting all importance on their personal economic prosperity ahead of anything else. This is the rootless entitled boomer cosmopolitan. Whose ego is defined by his stock portfolio and the value of his home. Nothing else matters. His nation is being invaded with mass immigration. Foreigners buy up all the property and price out the youth of his own nation. He relies on cheap labor to do his gardening, cleaning and the work for his landscaping or contracting business.

Now look at California. A wonderland built by white Americans that was handed to boomers on a silver platter. What have they done with their endowment? They’ve given it away to foreign hordes. Now only a quarter of California school kids are white. Whites are already a minority and will be a tiny minority in a few decades. There is very little of anything American remaining in California.

But who cares? The property values are up and the sun is shining. The boomers will go to their grave not caring one bit that they surrendered the West and allowed whites to become minorities in their own nations.

Last gasp, I think you use a too wide of a brush in painting the boomers. Some boomers are liberal/progressives and some are conservatives (some just RINOs). I don’t think the conservatives encouraged the immigration. The liberals and the progressives came up with sanctuary cities and “undocumented workers” instead of using the term “aliens” or “illegals” to avoid the correct conversation.

The globalists represented by democrats and some RINOs are the ones encouraging the mass immigration not the conservatives. I am a boomer and I said it for years on this blog that the massive illegal immigration is part of the feudal mindset of the liberal democrats in Sacramento to encourage a race to the bottom in wages and the massive inequality you see in the liberal sanctuary cities.

Therefore, be careful in putting all the boomers in the same basket. I could argue that there are more young millennials (not all but higher percentage than boomers) who vote for liberal democrats who are responsible of what you accuse the boomers. All the indoctrination they suffered in the public indoctrination centers takes a toll.

That’s true. I don’t even blame boomers so much. They are just products of the culture they live in. A culture that is largely directed by a certain tribe that dominates media, entertainment, politics, finance and academia. This is the reason so many Westerners are completely rootless and are not up in arms over the invasion of foreign hordes into their lands. There are a few that speak out but they are suppressed by the peer pressure of the conditioned masses.

Here we go with the tribe. Are you bringing that anti semitic nonsense spewed about over on ZH. That used to be a pretty good financial analysis news site yet all the commentary these days is about the tribe and Jews and anti-semitism.

+1

Excellent. You nailed it.

The U.S.government allowed massive illegal immigration to occur. Both Republican and Democratic politicians supported an open border with Mexico through their actions. It was a national decision–not one made by the white baby boomers living in California. Now the political power of those illegals has grown so that California and many other parts of the country are turning into sanctuary areas. Any whites who objects are called a racists even as they become a smaller and smaller portion of the population.

The same thing is happening to Europe and Australia–those areas are just decade or two behind California.

Ok. Next

Democrats want millions of votes. Republicans want millions of near slave employees. Illegal immigration is the one area where we have bipartisanship.

CA is for all intents and purposes a 3rd World nation now. It’s basically Brazil, where you have a small white aristocracy, Hollywood moguls and Silicon Valley titans. Then there is a small upper middle class, comprised of white people who work in tech and provide services for tech, like lawyers, investment advisors, etc. And the rest is a non-white serf population living in abject poverty.

Ok, what does it have to do with RE blog? You just want to discuss stuff you have zero control over?

Mr. Landlord: Then there is a small upper middle class, comprised of white people who work in tech and provide services for tech, like lawyers, investment advisors, etc.

You forgot the upper middle class composed of government employees — police, fire, teachers, DWP, UC professors, etc.

As in any Third World nation, government employees do very nicely. Secure jobs, good salaries, great benefits, and bribes on the side.

“Ok, what does it have to do with RE blog? You just want to discuss stuff you have zero control over?”

Surge, like I said before, it has EVERYTHING to do with RE. Too bad you can not connect the dots on such black and white picture. Not enforcing the laws on immigration resulted in crowded cities with high rents and high RE prices. If rents are higher, based on ROI, the RE prices will be higher. The quality of life of the existing residents is affected in a negative way in every aspect – traffic bumper to bumper, bad air pollution, homelessness, overcrowded hospitals supported by taxpayers’ money, budget deficits to pay for a myriad liberal programs, higher taxes, all to enrich even more the 0.0001% (globalists) who are the ONLY beneficiaries. Massive immigration, legal and illegal decimates the middle class in a race to the bottom in wages for unskilled and high tech workers. That is the reason for massive income inequality and the reason for CA looking more and more like a third world country – the aristocracy and the 99% dirt poor. Maybe few more years and this picture will become more vivid to you.

Yes, you can help change that. If all voters will cry in a bipartisanship way to their elected officials (letters, emails and phone calls), they will get the point if they want to get re-elected. Right now, only the conservatives voice their opinions against it, while the liberals cheer and support the Soros and MSM led groups for more immigration.

When Trump opened the public discourse on this issue, he was attacked merciless by the liberal MSM (the voice of globalists) and his RINOs. He may be a goof ball on other issues, but on that one he was straight on target. If he is a true populist or not, remain to be seen. However, on that issue he is a populist, at least in voicing the concern of the many.

Flyover – I understand Cali (and the US in general) inequality is growing. But this is RE blog. Yes, inequality impacts RE significantly. But this is RE blog – RE discussion under PRESENT conditions. If you want to discuss how to change conditions, you can contribute in political/social blogs. From your comments, I do not understand your opinion about which way will Cali RE move and your vision to how approach investment (in current climate).

“….a national decision–not one made by the white baby boomers ”

I hope you realize Congress and Senate consists of white baby boomers?

Most of who are millionaires too.

“National” has nothing to do with that, The People wasn’t asked at any point.

Actually in most of the West, America was built by immigrants from Mexico who arrived in Santa Barbara CA, Sante Fe NM, Pueblo CO and built businesses in the 1600’s. My family arrived poor and desperate from Sweden and Russia in the late 1800’s and were called “Dirty Russians” by the locals like you. The local business owners at the time gave them jobs and a chance.

The West was mostly built by Mexican immigrants since 1600.

It wasn’t until the late 1800’s when white immigrants moved in.

seen this all before, Bob: in most of the West, America was built by immigrants from Mexico who arrived in Santa Barbara CA, Sante Fe NM, Pueblo CO and built businesses in the 1600’s. … It wasn’t until the late 1800’s when white immigrants moved in.

Uh, those immigrants from Mexico in the 1600s, they were white. They were Spaniards. They were as white as your ancestors.

Yes, the white Spaniards built up both Mexico and the American southwest. And much of Latin America. But their ancestors are not the ones illegally immigrating into the U.S., so why drag them into the picture?

The line I always hear from liberals that this nation was formed by immigrants does not hold any water – 100 years ago there was no welfare, free medical, free college education while the local students pay astronomical fees to make up for losses, free housing and free food. Back then, there was no IRS, no FED and no income taxes. You worked hard or you die. Socialism with open borders does not work; the middle class will break under the taxes to support it while facing a race to the bottom to enrich the 0.0001% globalists.

Come on, Son of a Landlord.

1) Mexico declared Independence in 1810. They were Mexicans 50 years before the whiteys moved West.

2) Spaniards mostly assimilated and inter-married (or killed off) with the Natives of Mexico. Unlike the US which forced them into reservations and killed them off.

3) After 1700 it would be hard to find a pure whitey Spaniard in Mexico.

The US West settled by Mexicans who were Mexican for over 50 years before a Whitey showed up.

The US Whiteys showed up after 1860 looking for gold.

There, that is my racist rant to answer your racist rant.

It is true, there wasn’t Welfare back then but my Whitey brother tried to get Welfare a few years ago and was denied. All of the Mexican immigrants were working hard in the vineyards picking grapes to make a living and the welfare person told my able-bodied brother he would have to do the same. I think the sanctuary states are protecting their cheap workers and not giving away anything for free.

Seen This All Before, Bob: Mexico declared Independence in 1810. … The US West settled by Mexicans who were Mexican for over 50 years before a Whitey showed up.

Over 50 years?