The future of California will be with rentals: California’s homeownership rate will remain stagnant for the next decade.

While indicators of the economy seem to be doing well, the homeownership rate in California is telling a different story. The unemployment rate looks healthy, the stock market is still very high even with the recent correction, and people seem to be spending beyond their means once again with credit card debt solidly above $1 trillion. Euphoria is oozing out of Taco Tuesday baby boomer beer guts and the saliva is dripping when they pull up their Zestimates on Zillow. Yet somehow, the homeownership rate remains stagnant. Millennials are living at home in record numbers especially in California. The recovery started in 2009 almost a decade ago yet people aren’t out buying homes in droves (yet inventory is pathetically low). The future of California will be with rentals.

Rentals will dominate the future

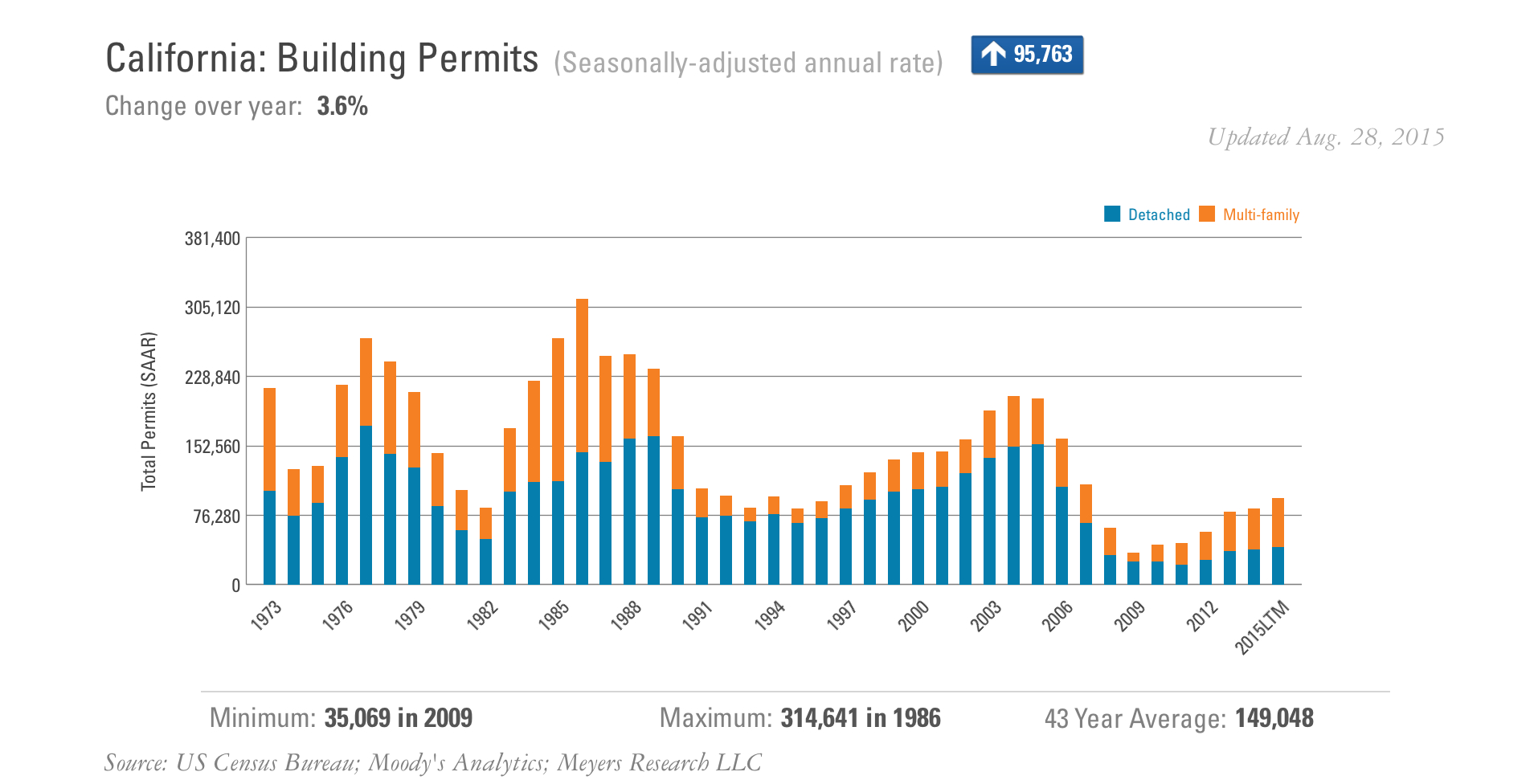

I know it is hard to believe but rentals will dominate the future of California. Many of the larger construction projects coming online today cater to multi-family units. In other words, apartments. You have older home owners selling properties in a very low supply market. So of course, even a turd of a house will look desirable to house lusting buyers. The crap shacks that come across my email box are laughable. At this point with such low inventory, home buyers have beer goggles when looking at properties and are willing to buy anything just so they can get in. Yet the future is with rentals:

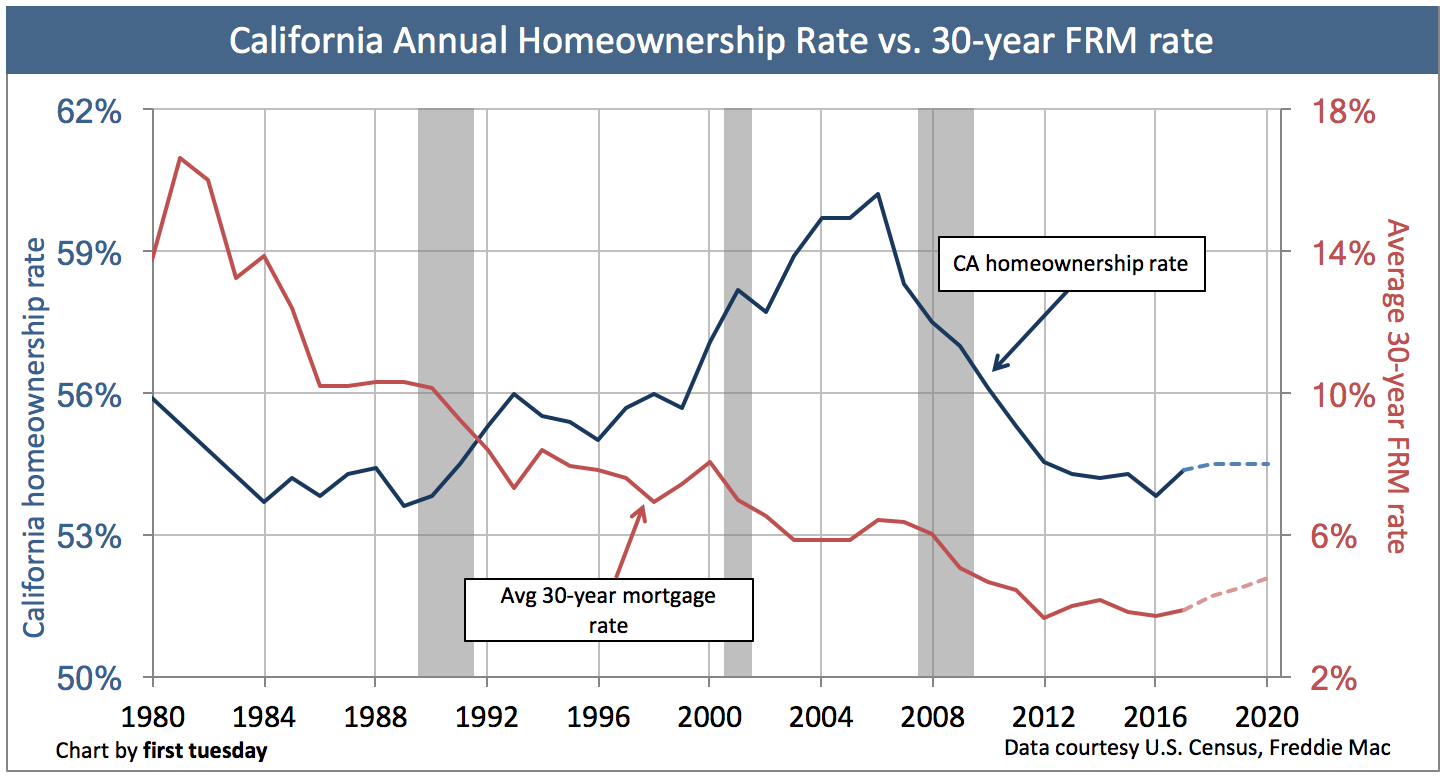

The homeownership rate in California remains near generational lows. Take a look at the following chart:

Between 1991 and 2009 most building permits were for detached homes. This was your single family building craze. But starting from 2009, most of the building permits taken out have come in the form of multi-family units largely for apartments. Builders realize that future demand is going to be in the form of renting.

Millennials and Generation Y also have an increasing tendency towards renting rather than owning. Of course older generations think that everyone is like them and that at some point, they are going to get the McMansion bug. But guess what? Generations are different. Smaller families, later marriages, and less job security are creating a very different generation. And the rental trend is showing this as well.

So it actually comes as no surprise that those that want to walk in the shoes of the older generations now have to compete for single family homes in a very low supply market. Here is what $500,000 gets you in Santa Ana:

2518 W Stanford St,

Santa Ana, CA 92704

4 beds 2 baths 1,024 sqft

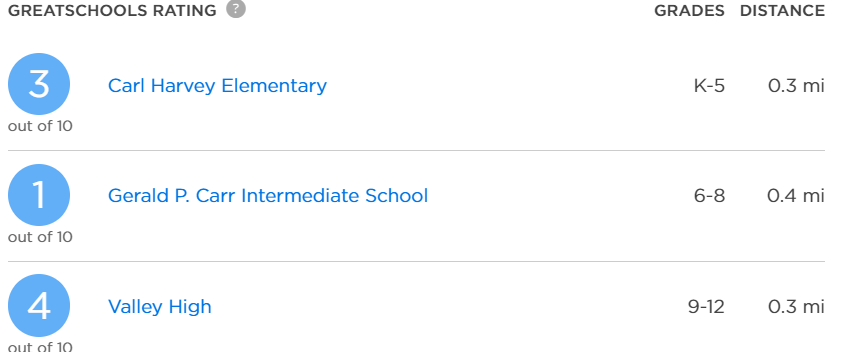

How are the schools in the area?

And this is for $490,000 and you get bars on your windows. And Millennials in California are more prone to living at home:

“(OC Register) Brown’s father, Greg, understands the economic forces keeping his daughter and his 25-year-old son under his roof. He also says it’s different, today, than what he experienced at the same age. After Greg Brown graduated high school, in 1980, he moved briskly through the typical young-adult milestones — finishing college and earning a master’s degree and marrying his wife by his mid-20s. Today, he’s a real estate contract manager.

The elder Brown said he’d like to see his kids move out, but doesn’t want to rush them out the door without a career and proper financial footing.

“Our expectations for our kids are probably in line with what we were expected to do,†Greg Brown said. “But we understand, for several reasons, for some millennials, it’s gonna take a bit longer. In some cases maybe a lot longer.â€

This time it is different. The fact that the homeownership rate is stagnant speaks volumes and builders are catering to the demand of renters. The future of California and new household creation looks to lean to renters.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

385 Responses to “The future of California will be with rentals: California’s homeownership rate will remain stagnant for the next decade.”

Doctor, you wrote “Millennials and Generation Y …”

Millennials are Gen Y. You should have written “Millennials and Generation Z …”

Hmm 25 and still under his daddy’s roof? Sounds like his son is still in school, lazy, or just a snowflake. Even with a decent job, he could get roommates so that he doesn’t have to suck on moms milk at 25, pathetic! He should of got one of those STEM degrees and moved to midwest! I’m just a silly business major but I already have a career, diff generation.

I hardly see how moving in with stranger roommates is an advance in independence and achieving adulthood, than living with parents until you have some savings, and a solid job. In fact, multi-generational living was the norm in most societies until after WW1, when this country became extraordinarily affluent, and it became possible to make a good living not only without college, but without having passed 8th grade.

It could be that the Age of Affluence is drawing to a close, and it looks to me like it truly ended a couple of decades ago as most people could only maintain the lavish lifestyles of the 60s & 70s by piling on personal debt. In other words, by faking it. It could be that multi-generational living will again become the norm, especially in expensive coastal metros where the average income does not even pay the rent on a one bed apt, let alone buy even a shacky house in a neighborhood like Santa Ana.

Living with your parents as an adult is a very smart thing to do. You save a ton of money. Save that money, put some in crypto and stocks and wait for a real estate crash or until prop13 gets repealed. When prop 13 falls house prices will crash. Once prices crash you can move out and afford a nice home.

With all due respect, and speaking as a Cali native, there is no way Prop 13 will be repealed in a way that causes a crash in house prices. A revision to Prop13 which will incrementally bring taxes up to fairer value, yes, but a sudden or sweeping change… not a chance, even MoonBeam Jerry would not do such a thing.

You have it all figured out Millennial !!!

Ivy League arrogance with a community college education

Banking on the repeal of prop 13 is like watching paint dry hoping the paint will stay wet.

$17-$18 billion is a lot of money? You’ve got to be joking, right? The governor’s proposed budget for the next fiscal year is $131 billion.

No tank in sight, how am I arrogant?

I am not banking on a repeal of prop 13 but I certainly promote it whenever I get a chance. This law is just in place to benefit older generations and screw younger ones who are already having to pay for overpriced crapshacks. It should be the other way around. Older generations should pay way more property taxes and younger ones should get a pass.

There’s a strong argument that the older generation has benefited the most from the ongoing unprecedented economic welfare. The artificial inflation of asset (real estate and stocks) prices by Fed and government policies have shut younger generations, those with less capital, out of value investment opportunities. High housing, education, and health costs make it hard for recent graduates to save for a meaningful down payment or to buy into an expensive stock market. Even current home owners couldn’t afford their own bubbly-priced houses. Amazon with a P/E ratio over 500 is enough to make any investor queasy.

Our parents:

* Had it better than any generation in history

* Were raised on home-cooked meals

* Mom stayed home and gave them attention

* College was cheap. A fraction of what we pay

* A degree (in anything) would land you a good job

* Corporations kept you for decades

* Stock portfolios and homes increased 4x in value

* Retirement was a human right

And they..

* presided over the outsourcing of jobs…

* …leading to the underclass’s opiate-drenched collapse

* paid illegal immigrants to tend to their homes

* fed us frozen pizza and fruit juice, no cooking

* hyper-industrialized prison, healthcare, education, housing

* bought plastic junk and used toxic cleaning supplies

* triloscan soap, olestra chips, phthalate shampoo

* prescribed antibiotics liberally, nuking our gut flora

* gave children Ritalin, Prozac, Wellbutrin, Klonopin…

* …pink slime, lead fillings, accutane, Snapple, Percocet

* got divorces and bought sports cars

Thanks boomers!

What a simplistic (simpleton) way of thinking this Barnie Panders!….. Is that all our public education system able to produce??!!!!….That tells a lot about teacher’s union and the future of this nation!!!…

Compare that to the titans in critical thinking of the founding fathers!!! Where we started and where we are today!!!!…Sad….

Well Doctor, I never thought Id see it but you have finally admitted defeat. This time IS different, but you know its not bc the Mellennial’s want to rent. Its because the fundamentals are strong and prices are JUSTIFIED based on SUPPLY and DEMAND. Poof goes the bubble.

Lol berti, you forgot to take your pills old man. Crash is around the corner is what you meant to say.

Indeed. Things are different if you choose to take the blue pill (read only mainstream headlines). I remember such occurrence prior to the last downturn.

Bert,

I was thinking the exact same thing, that the good Dr. is throwing in the towel. This is a good sign of a market top, capitulation. This very well be the “jump the shark” moment for California real estate.

which I’ve been saying ofr 4 years….or more.

1st

We are in the everything bubble, caused by a decade long central bank experiment. Interest rates are moving up and so is core inflation. I’m guessing we are close to the peak on house prices.

We are in the everything bubble, caused by a decade long central bank experiment. Interest rates are moving up and so is core inflation. I’m guessing we are close to the peak on home prices.

Thank you doctor for stating the obvious for people with blinders on. This is what I stated many times here – the quality of life for most people in SoCal will go down in more ways than just crammed in multigenerational housing.

The fact that Prop 13 is maintained just exacerbates this condition. No, it doesn’t have to go to 3% but nothing or max 1% would be better than what it is now. That would increase mobility and all the cards will reshuffle. It would be a much better use of existing resources. An old couple does not need 4 bedrooms from the time they raised their children. Under the present situation the government pick winners and losers. This is not a free market but a feature found in communist countries.

TOtally agree flyover! Prop 13 must go

Proposition 13 locks in a property tax that’s 1 percent the purchase price of a home. After the first year, the tax cannot increase more than 2 percent of that original bill.

Blaming affordability problems on Proposition 13 ignores the complexity of the housing issue, and the decades’ worth of policies that deter development and lead to demand that exceeds current supply.

Proposition 13 makes home ownership much less costly than it would be if property taxes were still doubling from year to year, as they were prior to Proposition 13 in some parts of the state.

If property taxes go up, housing prices may drop some, but you’re still going to have not enough homes from too many people and it’s still going to be a problem.

If anything is to blame for the lack of affordable housing, it’s onerous building fees on development and overly stringent environmental laws like the California Environmental Quality Act (CEQA) which requires a detailed review on how it could affect the nearby environment.

To comply with CEQA, a builder must make a report detailing the environmental impact of their proposed project which could take nine months to a year, and that’s not including any litigation that might happen. Stakeholders can also have their say in the process who are typically locals or community groups. The law was also written so that anyone can weigh in on a project, she says, no matter where they are. That means people in L.A. could comment on a project miles away in the Bay Area.

You’re misrepresenting the complaint. Nobody is saying that Prop 13 is 100% responsible for the CA housing affordability problem, although it certainly is a key component. People can stick their heads in sand all they want but it doesn’t change the fact that when you push back in one area, other areas are going to have to take up the slack. It’s not sustainable.

Samantha’s complaint regarding CEQA is the same critique we always hear. But let’s be real, very few environmental documents are ever sued, leading to the delays purported here. CEQA is critical in examining a project’s potential environmental impacts, requiring feasible mitigation, and ultimately disclosing the reasoning behind a public agency’s decision making. Yes, this process takes time and money, but we’re talking 6-9 months for the typical IS/MND and under 100k. CEQA is a false scapegoat

Samantha,

First, I’m one of the most fiscal conservative guy you can find on this forum. I’m not for increasing the prop. taxes, I am for eliminating them completely or no more than 0.5%. That being said, I don’t think it is fair or constitutional to charge a guy 10 times more for the same services; that is communism where the government picks winners and losers.

Second, while you are right in everything you said, my point was not that Prop. 13 is THE cause. My point was that Prop. 13 exacerbates the housing situation in CA. I agree with the intention and the spirit of the law but not with the wording. I agree with the cap on tax increases, but a house next door, of the same value, should enjoy the same low tax. Even better, cap all the prop taxes at $1,500/year like in Switzerland. After all, all citizens benefit the same from services provided by the local government. I did not see the schools, fire stations or roads in Switzerland suffering in any shape or form from the cap in property tax. I can argue that all of them are in better shape than ours.

In conclusion, I am not for higher taxes – I am for no taxes or fair taxes (low taxes). There is nothing fair for somebody buying a house today to pay ten times more in property taxes than Waren Buffet on his 22 million dollar house. I understand your point of view of being frustrated with the liberals in Sacramento, but supporting Prop 13 in the current form is not fair for any property owner.

If you don’t want to throw grandma to the curb, cap the taxes for all at $1,500. Why should some benefit more than others?

I love leftist logic. Increase property taxes and that will make housing cheaper. Cuz the money to pay for the higher taxes will be provided by the unicorn every homeowner in CA has access to, right? LOL

What’s leftist is as Flyover said a communist style approach of giving one guy a giveaway on the backs of other taxpayers.

I agree that Prop 13 has a small effect on housing prices. The difference between grandma paying $2000 per year on a house she bought in the early 1980’s and her neighbor with the same tract house they bought for $!M with a high paying 6 figure job who can afford the 10K per year in property taxes and a $48K mortgage is minor. Grandma on SS pays 2K and new home owner pays 10K. A difference of 8K per year matters a lot to grandma and she should be protected.

However the inheritance rollover of tax to grandma’s six figure salary son is ridiculous. Why should heirs inherit the same tax as the parent? I can see if it only if it is based on need. Also, if grandma sold the house before she died, she might pay up to 140K in taxes to CA and 200K in US taxes. After she dies, RIP, the six figure son inherits the property with the tax basis on the house at the date when grandma dies???? Why is that even close to being fair? CA and the US government now have to go up to 340K in debt for this. We all are paying for this.

As far as environment impact reports, I think water, traffic and schools should be considered.

1) Why is the government telling me I need dirt and rocks for a yard, rebuy my washing machine, toilets, dishwasher, shower heads, etc, when they are approving massive developments that are using all of this (my) water? Water availability must be fixed before new developments happen.

2) Why would anyone approve a development when the roads and parking cannot sustain it? Why? Developer greed but we all have to suffer with no parking and 30 minute traffic jams. Put in buses or light rail to fix it and charge everyone in the neighborhood if they approve.

4) Schools Again, don’t approve a large development without sufficient schools.

5) Drainage and infrastructure. I live next to a neighborhood that wasn’t studied for drainage. 30% of the houses flooded and your tax dollars paid the bill at 10X after the fact to fix it.

I’m not a NIMBY but when problems like those above happen, my tax dollars will be used at 10X the price to fix them without a reasonable study.

Samantha,

There are a case in the 1980’s before Environmental Impact Reports in Santa Maria CA where a developer built an entire subdivision of higher priced houses on top of an old oil refinery site. People who bought homes there got sick and some children died. The developer pulled a Trump-move and declared bankruptcy and retired with millions into one of the newer gated communities out of state. I look at Trump and see this same greedy screw everyone for the bucks developer based on all of the Trump bankruptcies. I actually know someone who didn’t get paid by Trump for the work he did. A hardworking American who was robbed by our President. That’s why I didn’t vote for him. Political rant- off.

You know who got stuck with the bill for these houses that had to be demolished? We all did. You can state “Buyer Beware” but a community will never leave an entire subdivision boarded up and vacant if it wants to survive.

A little up front study to determine things like this benefits us all.

Your comments make me think you are one of those naive young people. You can take that as a compliment.

What? Sean claims that very few projects subject to CEQA are ever litigated? Please, almost every project in LA is litigated under CEQA!

http://www.latimes.com/opinion/editorials/la-ed-ceqa-lax-20170714-story.html

Sean also claims that CEQA is critical in examining a project’s potential environmental impacts? No doubt Sean makes a lucrative living abusing CEQA as an environmental lawyer?

How true, places like Lassen and Modoc benefited from prop 13 and kept people in those places that are middle age. The coastal counties are the problem and the tech industry which refuses to set up shop in uncool places like Riverside County and stay in LA. Both LA and Riverside have less than the US average on college graduates but LA is cooler to the hipster tech people . The Democrats that run California support more population density housing which favors urban areas in economic development over rural ones. This is a great caused of the high rent, just looked at New York City which is based upon that model of high density it New York City has high rents.

Eliminating prop. 13 might bring down the cost of houses just a little bit but then the person buying that house will be hurting to pay property taxes….will have to somehow come up with the money for insane unconstitutional property taxes ON TOP of mortgage and other bills.

As a millennial, it hurt to pay property taxes. Almost one whole month of pay went to property taxes for a year.

Also, it doesn’t just stay the same, even with prop 13. Don’t forget that local projects can be put on homeowners to pay for thru property taxes. Why was I paying $50 per year for “Project water well #2” or something I don’t even understand??!!

Prop 13 may not directly affect the cost of the home but it does in other ways.. You HAVE to pay for government services. I grew up in the South Suburbs of Chicago and I saw my suburb prosperous, till a neighboring burb built a much better mall. It eroded the town’s tax base, because the only way to provide for all the town’s service was now property tax as the mall in my town went south.

Over the next 20 years, the population fell by half because of the necessary increase in property tax. The declining population means those left pay EVEN MORE, because the services need don’t go down.

Now 40 years later, my burb is a mess and the mall in the neighboring suburb is closed and that town is also a big mess.

You have to pay for services, you do this through sales taxes or property taxes. Prop 13 is essentially rent control for mortgages which any Econ 101 class tells you, rent control is only good if you get in at the beginning and it cause all sorts of problems later on in the chain.

California has the highest poverty in the country, when taking cost of living into account. Poor people rent, CA has the most poor people per capita of any state, so it makes sense.

As for the 18-34 living at home….this is what happens when you spend $200K for a Gender Studies degree kids. Don’t be that guy/girl. Get a degree in something useful like comp sci or finance and you’ll be just fine.

Live with you parents until 40, vote against prop13, put money in stocks, crypto and bank account and wait for the crash. Easy way to survive the bubble and buy a house on the cheap side!

Don’t forget praying to the tooth fairy.

Speaking as a tail end Boomer, born in the early 1960s … I don’t trust crypto. The kids might like it, but it’s not real money. It isn’t anything. It’s prey to hackers. It’s prey to manipulation. It’s uninsured and unprotected.

The Jerusalem Post says “Israel is shaping up to be a hub for cryptocurrency swindling.” http://www.jpost.com/Israel-News/Bitcoin-fraud-could-be-the-next-big-thing-for-swindlers-in-Israel-519755

So crypto “swindling” is doable. In which case, it will be done.

I expect crypto to collapse as a worthless, ponzi style, massive financial fraud.

At least with real estate, you get a house. With stocks, you get equity. With CDs, you get FDIC insurance. What do you get with crypto?

Translation: Put off all milestones of life to (maybe) buy a home a nominal discount after taking into account further appreciation and inflation, if you’re lucky… Pretending you can time the market, much less KNOW how significant any correction might be is nothing more than arrogance. Nothing wrong with renting but don’t pretend you know more than any other armchair analyst here.

I have one friend left in my friend group (ages 25-32) that still lives with mommy/daddy. Needless to say he hasn’t had a girlfriend in YEARS because lets be honest here, if you are still at home after 21 or so, you don’t have your life together. There is a point at which frugality becomes a detriment to your personal life. I’ll take a mortgage over being a laughing stock of society any day of the week.

No matter what you think about the crypto stuff it’s a FACT that the returns have absolutely CRUSHED real estate appreciation. Someone who took a decent sized bet just a couple of years ago could still sell those assets and buy many houses. Sounds like a lot of you missed out and have sour grapes.

What do you get with crypto?

For starters a shit ton of return. Also, it pisses of older farts who don’t profit from the crypto bubble. These people want younger generations to further inflate the real estate bubble and the stock bubble. kids are fascinated with crypto because it’s a big fuck you to those people and because the returns are astronomically. It’s cute when you cheer about a 2% day for the Dow. Litecoin and ethereum made over 5000% last year.

Millennial, I keep hearing that the current real estate and stock appreciation are “not sustainable.” But do you think that an annual 5,000% appreciation of crypto is sustainable?

People inventing ever more new crypto currencies is crazier than house flipping.

The people behind crypt might make money. Most of the end users will be fleeced.

Son of a rent seeker says “I don’t trust crypto.” but what he really means is “I don’t understand crypto.”

“it’s not real money” Money is whatever people decide to use as money.

“It isn’t anything.” It’s a network of participants utilizing a platform for value exchange.

“It’s prey to hackers.” It is not. Each participant is prey to hackers getting their passwords as is the same with accessing other financial accounts.

“It’s prey to manipulation.” Degree depends on the crypto asset in question just like all other financial assets.

“It’s uninsured and unprotected.” Generally uninsured like most financial assets yet anything is insurable for the right premium. Protection is as simple as using a strong password and not letting anyone else have it. Even an old fart can do that.

“So crypto “swindling†is doable.” Why not? Swindling is already an established risk in all other financial assets.

“What do you get with crypto?” An asset that someone is willing to give you something else for in exchange.

Excellent answers Soal glo!

Absolutely son of a landlord. The crypto bubble is still a baby. We have not even hit a trillion dollar market cap. Once we hit 10 trillion market cap or so I would start to unload and cash out. The masses have not even started investing in crypto. The institutional money is slowly moving in. Once your Uber driver starts telling you about the next hot coin you will know it’s no longer sustainable. That’s long ways from now. We are at the beginning with crypto.

With real estate it’s very different. Everyone knows it’s way overpriced. The kids have no interest in buying a home and spending most of their money on an overpriced mortgage. They rather live with their parents and live a debt free life. Nobody Believes anymore that buying an overpriced crapshack is the American Dream. The younger generations don’t follow the old BS their parents believed in. So who are your future buyers that are supposed to support the bubble? Some mysterious Asian cash buyer who does not exist?

As a last year gen x by some and a first year millennial by others (1978) , saving for a house was extremely difficult. i bought my first home in las vegas in 2010 for 100k and saved saved saved until 2013 to purchase one in socal. I then purchased another in 2016 and i def know that I will not be purchasing anymore. my prop taxes in my first home in las vegas is 1000 dollars per year with a value of 275k. my home i purchased in 2014 has a prop tax rate of 5600 and my 3rd home has a prop tax rate of 10000. i spoke to the neighbor of my 2nd home whom he bought in 1981 and he pays 1200 per year. i also spoke to my 3rd home neighbor who bought in 2010 who pays 6000 per year on a prop now valued at 1.2 millions. prop 13 is ruthless for younger generations. if we are to be honest with ourselves, real estate in socal will not decrease ever by more than 40% again as that was once in a life time opportunity in 2008. since my parents own 3 houses and the prop tax on each home is less than 3k , there is no incentive for them to sell. why sell when rents are high , prop tax is low and social security draw is low. when the do pass (god bless their souls) and i inherit those 3 properties why would i ever want to sell. i can see selling my high prop tax properties but never the prop 13 inheritance. this is the rat trap of “high middle income to wealthy” preserving wealth and inequality among californians. if we were to repeal prop 13 , we might see a homeless population increase of the elderly who are stubborn and will not move. Some have no choice, where would they go? Some only have family in socal and will never leave. repealing prop 13 will drain the elderly savings on prop tax and because of that we would have to take care of the elderly, either it be your/ our parents or the states responsibility. Either way it is not easy to undo prop 13 without seeing heavy pushback and great consequences. dont get me wrong im not complaining about prop 13 but why would someone like me want to repeal prop 13 so that we can have equality for all. if you cant afford a home now, millennial is right, index funds, bonds, cash reserves and renting. does owning property make you feel better than renting. 30 years of debt is high stress but also high reward. just a point of view from someone on the other end.

Millennial: “Once your Uber driver starts telling you about the next hot coin you will know it’s no longer sustainable. That’s long ways from now.”

Ah, no, we’re already at that point: http://www.latimes.com/business/la-fi-bitcoin-mainstream-20171207-story.html

Nah, we are far away from this point.

Coin Market Cap has the total network value of cryptocurrency at ~$480B. This is a long way from the nearly $3 trillion peak that the dot.com bubble hit. It was much easier for the lay person to buy stocks in the 90’s than it is for people to purchase cryptocurrency today. Additionally, issues such as storing private keys and the volatility of the asset class means many people are still staying on the sidelines.

Just mark my words, crypto has not even really started yet. Watch the market cap over the next years. Stock market gains and real estate appreciation is a joke compared to what crypto will do.

Joe Schmo, why would people laugh about someone staying at their parents in his/her 40’s. Maybe older people think that’s odd but they never experienced a housing bubble like today when they were young. When they bought real estate was very cheap compared to now. I think it’s very smart to stay with your parents as long as you can and save a ton of money. Just wait until the market crashes. I never met anybody who laughed about millennials staying at home. It’s just what you do in California during a housing bubble. It just seems some old people are disconnected from reality and are somehow stuck in their 70’s mindset.

I sort of agree with Millennial.

I have a cousin-in-law who lived with mom through the 90’s, 2000’s, and 2010”s in LA.

He never worked a day in his life and now is a house-multi-millionaire after his mom passed away.

I fear for our society, but he has no heirs, but he found a way to make millions with the least effort. He currently lives frugally on mom’s stock 10-30% gains (about 30K per year which is more than he would ever make on Social Security) with no mortgage and mom’s 1300/year Prop 13 taxes. His effective rent is $100/month in LA.

He wasn’t born with a silver spoon, but he isn’t a drain on society. He is just a practical unambitious only child person who was born into a family that was lucky and smart enough to buy a house in the 1960’s for 12K.

Is this fair? If someone wins the 1M lottery, is that fair?

Luck is luck and isn’t all of our goals to live comfortably for the rest of our lives?

Someone who dies with 50M is no better off than someone who dies with 1M.

Sorry Bob, but your cousin-in-law sounds like a lazy, pathetic bum who grifted off the family for decades and has done nothing in his life. Zero accomplishments. Pretty shameful.

Did you get a degree in gender studies, rayz studies, or social justice? There is a void in teaching logic (void in safe spaces), math (it’s too “rayzizt”) or science (ignore X and Y chromosomes)?

We need to have liberals art colleges accountable for destroying the intellect of a generation, they need to teach conservative arts to Generation Z. The Millennials are wasted.

Got my degree in Agricultural Science with a major in avocados. The classes were packed with millennials and the tuition cost about 160k for 4 year degree but includes practical training in how to grow them and process them into a delicious toast. Included in the tuition costs were avocado toasts for lunch. Now I have to pay 14 dollars for avocado toasts!

If avocado toasts were free millennials could easily save for a 200k downpayment. Unfortunately, there is no free lunch.

Housing To Tank Hard Soon!

I recently become 1 of 3 inheritors of a 3bed 1 bath home in Santa Monica, North of Montana Avenue. The home was purchased by my grandparents in 1955 for $16K. My parents inherited the home in 1975 and it was appraised at $75K. Back then we could barely afford to pay the taxes until Howard Jarvis rolled into town with his Prop 13. This actually made living a little easier. My mother has passed and now me and my sister and brother have inherited the home. We called Westside Rentals and they said it will rent for $7K – $7.5K per month!!!!! Prop 13 taxes are only $3.5K per year. It would sell today for land value at $3M.

Given that me and my siblings are not in any desperate need for money, why would we sell?

With baby boomers acquiring properties through inheritance, it is easy to rationalize to just sit back and collect rent….. rental rates will rise,,,, home prices will rise on the Westside (or at least be least prone to crashes when the next crash does happen).

You just won the lottery and you’re taking the payments over the lump sum.

Dear QE Abyss,

Congratulations on winning the CA Housing lottery.

I am sorry for your loss.

I know a few others who won millions in the Housing lottery.

Their decision on whether take the lump sum was:

Take the Lump Sum if:

1) If you don’t live near the property to check on it, it is hard to rent it remotely without paying a property management firm to manage it with their fees.

2) Take the lump sum if you think housing is in a bubble and will drop by 50% imminently.

3) Take the lump sum if you will be arguing continuously with your co-inheritors about rent, improvements, rental management companies, tenants, and on and on. My wife and I have a small rental and we are always “discussing” what to charge and what to improve. I don’t think I could do that with my brothers and sisters.

Rent it if:

1) You have done an analysis and you see a better ROI in housing.

2) You think housing prices will continue to rise.

2) Management fees are reasonable.

3) You love your co-owners dearly and never argue. Please see a lawyer about a contract in case one of the co-owners wants to sell in the future.

Thinking about it a little more.

1) Renting: Your share of the 7K/month would likely be approximately 2K/month after management fees and maintenance. You would be taxed on this at your income rate.

That is 24K/year.

2) Selling: Your share would be 1M tax-free since Trump abolished the death tax.

Actually, if you sell immediately and pay a RE agent 5%, you will likely personally have a 50K capital loss on the house since the new basis is calculated at the time of your parents death. Strange laws that if your parents sold the day before they died, they would have paid 600K in Federal 20% Capital gains tax. Now Uncle Sam pays you for cost of selling. and never collects the 600K. If you think Prop 13 doesn’t make sense, the upgrade of the basis is even crazier.

Can you take that $1M and invest it and make a hassle-free 2.4%?

Sure, you can invest in the “safest investment in the world” 10 year Treasury Notes at 2.87%. Or wait until the end of the year and likely make nearly 4%.

Of course, if housing appreciates at the same rate it has been, you would make much more in appreciation of the house.

My Crystal Ball is broken, but being the crusty old barn owl who has seen it all before, I would expect a 10-20% drop in housing sale prices that may not recover for 8-10 years.

Either way, you can’t lose.

Sorry again for your loss and congratulations.

Lots of points for me and siblings to consider THANK YOU

CAN YOU PLEASE HELP ME DECIDE? I own a condo with $100k equity. I’m thinking of selling it now to buy a NEW construction home selling for $650k. My problem is the new home is only 1500 sq ft. so I don’t know if its even smart to buy that (i do not have a problem with a small house as that is what I prefer but $650?). The old houses they’re showing me are around the same price, some of the lots are huge but all of the houses need so much work. I’m thinking of just cashing out and then renting an apartment or just staying put, but I’m afraid to lose the equity. I read somewhere that home values might drop down 10-20%. What would you do?

I like a lot of what Bob has to say here. I was in a similar (yet different) situation at the bottom of the crash when my Mother died, leaving an unoccupied house in the Northwest that my Wife and I had loaned her for her housing, and a smaller house that she used for rent money that I inherited with my Brother. With 20/20 hindsight, we should’ve sold both at a huge loss over peak price, and brought our share down here. In QEA’s case, he has inherited a house here in a choice area that is in an area with rapid appreciation and may or may not be at the peak. I think that beach areas in SoCal aren’t a candidate for loss of appeal with the public. Prices may change with the economy, but the choice of the top dogs won’t change. What should have been obvious to me (that the rural inland areas were undergoing decline and that there would be no recovery) wasn’t at the time. Too much RE Kool Aid imbibed?

Help,

My humble opinion is that if it is the right house size and neighborhood, you should buy but only if you are planning on living there for at least 10 years.

If you see lifestyle changes that will happen before 10 years that will require you to move, don’t buy. You will likely take a loss for either tax purposes, or with rental parity (ie you could have rented cheaper).

I think a house should always be a long term investment.

I’d sell. People in your situation (non-occupant owners) are going to be first in line for the dismantling of Prop 13. By then it’ll be too late as everyone will be rushing for the exit.

Me too. The profit would buy numerous rentals in flyover country with a FAR higher total cash flow.

so is there no more state tax when u sell that n.montana house..after trump 2018 new bills…..

I buy none of the hype! ‘Cash in hand’ is winning the housing lottery … don’t be fooled! I’ve owned rentals, had good tenants, horrible tenants, had to sink lot’s of money back in, have had to weather declining markets, and am acutely aware of what happens when pocketbooks get stretched like they are all over the coastal urban areas of California! Clearing 7 figures off of people who have more money than sense is far better than risking a housing market set back, or dealing with having to deal with one horrible tenant!

QE, just like you I inherited a house but location location location. My Pop bought it after retirement, he was the third owner in 125 years, for $75k in ’99. Italianate mini-mansion, carriage house garage & shop, curb stunner, main drag of a quaint walkable town, with blue ribbon trout fishing ten minutes away. Stone foundation, solid beams, pristine woodwork throughout, tin ceilings, marble fireplaces, plus he put in insulation, modern mechanicals, and a quality metal roof.

Hasn’t appreciated a dime. Taxes are >$4k/yr including Property, Village, and School. After two 100-year floods in a decade in some local towns, FEMA redrew flood maps and his house is now half on and half off the flood zone. So another $70/mo in mandatory flood insurance, which eroded all appreciation off the market value, even though the house has never been wet. Won’t rent for more than 50% of costs, and the renter population is sketchy at best.

Pray daily to your wise ancestors.

More renters are good since modern careers and work require more mobility, plus young people living longer at home builds family unity and with our aging demographics, the elderly are better taken care of. And, maintenance is easier and usually done better by professional companies like Blackstone.

Plus, because of technology, if one wants a home or RE for investment, cheaper and easier through stocks, 401k’s, etc.

And, with still a shortage of low priced homes, still a robust housing market…..at a perfect time for retail bricks and mortar disruption……like some malls and retail space being converted to apartments, etc….more walkable communities, etc.

Maybe sometime more people will understand quantum physics, and how finally the world is a living organism, a new paradigm, where even one thing in one part of the world affects everything…..like the invention of the smartphone in 2007.

Spoken like a true landlord!

Great article Dr. Housing bubble. Housing (especially in socal) has turned into more than just a place to live. Demographics, supply and demand, NIMBYism, Prop 13, etc all point to a rental future in socal. And you want to be on the collecting rent end, not on the paying rent end.

Is low inventory still a myth? Just read the dam article, facts are hard to argue with.

Total myth. They are building everywhere you look. Meanwhile, adults stay with their parents to save money=less rental demand. Rents will soon fall. What we need is to repeal prop13. Also we need to reveal publicly how much each household pays in property taxes. If younger generations find out how they are screwed by this law it it will be history soon!

Millennial, the younger generations aren’t going to change it. The state of California is going to find itself in a financial bind so severe that “drastic” measures will have be taken. That’s how Prop 13 will meet its fate.

Milie, having a conversation with people like you is useless. You would tell me the sky is not blue and the sun does not rise in the east because of blah, blah, blah. Current low inventory relative to historic norms is a FACT, it does not matter what you call it or how you interpret it. Finding out what every residence pays in property taxes is not some deep dark secret, it is available to the public…just google.

“Just googleâ€

I rather see the media turn peoples attention on how prop13 is screwing younger generations and shift the voters focus on how prop13 needs to be repealed because older people in million dollar shacks pay less property taxes than a young couple buying an overpriced condo. I don’t see news articles showing how your neighbor pays a fraction of taxes compared to you for a similar home. The prop13 fraud needs to be exposed and explained the right way so people understand and demand it to be repealed.

Shhhhhh. Don’t give all the secrets away to Millie. As far as we are concerned how much everyone pays is private and no one I repeat no one should be allowed to find out how much someone else pays in property taxes. Imagine how horrible it would be if you could just put the address into the county treasurer’s website and see, or if Zillow and Redfin told you. That would be terrible. No, no, no, we must keep it a secret. We can’t let the Millenials find out how much we pay in property taxes. It would ruin everything if they knew.

Millennial, I’d be careful what you wish for if you have living parents that own houses.

There are easier loopholes that CA could target.

These are more drastic ways CA could raise tax money.

1) Like PA, they could charge a 4% inheritance tax on assets. ie if your parent’s house sells for $1M, you may owe CA $40, 000 when they pass on.

2) They could also get rid of the biggest, most unfair loophole of them all in my humble opinion. When you inherit a house in the US, the basis is automatically stepped up to the value of the house at the time of your parent’s death. ie if your parents own a house valued at $1M house, you only pay cap gains tax in CA (14% for the highest bracket) on any sale over $1M. If CA eliminated this loophole, the entire 14% of $1M could be passed on to the heirs as a tax. $140K in taxes could be owed to CA if this loophole was closed. Currently, the tax on the entire $1M is lost to both the Federal and CA governments if the parent dies. Uncle Sam misses out on 200K and CA misses out on 140K.

The extremes in differences between Prop 13 taxes from someone who bought in the 80’s compared to the neighbor who just purchased averages 8K per year. Pretty minor compared to the inheritance loopholes.

In this world nothing can be said to be certain, except death and taxes. _ Benjamin Franklin

If you knew what you were talking about you would know this is public information. Look up on the Los Angeles County Assessor’s website, search the address, then it is also on the Treasurer’s website for the county. Learn what you need before making a stupid comment.

You guys misunderstood what I mean. It’s needs to published in articles, newsfeeds, studies etc how much more younger generations pay in property taxes and how the major tax burden is on us young buyers. We are being screwed so that older people pay next to nothing in property taxes. This needs to be addressed in social media. If millennials would understand how prop13 is a big scam to benefit those who don’t need it, the law would change. It needs to be marketed the right way to make a difference and spark outrage.

Millenial,

When the older generation was paying high taxes their kids were in school, they were young and using all the resources. They paid 2% per year inflation since then.

Now they are using practically zero resources, they paid there fair share.

What property tax do you pay? Your $700 per month in your crap shack rental with 8 millennials living in 5 bedrooms.. in POS huntington beach?

Millennials pay very little property tax.

We all can agree that prices in Cali are a rollercoaster.

As an aspiring homeowner, why would you want prop13 repealled and increase volatility of your own cash flow?

Most people are fully aware of prop 13. Some were even alive when it passed. If you raise grandma’s taxes, then you yourself might be displaced later on in life. People are reluctant to see their own taxes go up given how high they are already.

Stupor man,

I agree with you that taxes are super high especially in CA. Although I am against Prop. 13, I never advocated higher taxes for elderly. What I advocate is to cap all property taxes, for everyone, at $1,500/year. Based on the assessed value of RE in CA, plus the sales tax, plus the income tax, if the government would be run efficiently with the taxpayers in mind, there should be plenty of money. Also, the cap of increases per year in prop. 13 can stay. CA does not have a problem of not enough money, it has a problem of too much spending. That too much spending is a burden on the younger generation.

Cry me a river. The entire “these poor elderly people with fixed incomes†is total bull crap. When these people bought a home they did not pay ten times their annual salaries for a crapshack. Back than you could easily buy a home with one income. Their homes are long paid off and They love to brag about how good the housing bubble has been to them as if they had accomplished something. If you can brag about your one million dollar home you need to pay your fair share of 1.2% property taxes. We let these people stay in their homes and transferred the tax burden to new buyers who are already screwed by highly inflated property prices.

If you want to stay in California but can’t afford a heavy increase in property taxes go out and work. You can be a greeter at Walmart while you sit in your wheelchair.

“You can be a greeter at Walmart while you sit in your wheelchair.”

You are an ignorant, selfish, childish douche.

In many cases, the house is all they have. It is not possible to live on social security by itself anywhere in southern California without a paid-off home and low property taxes. That equity is for the $4-5k/month assisted living facility they know they’ll need in the last 10 years of their lives. And here you are getting all jealous because you think they have some huge advantage. You’ve got youth, and they would gladly give it ALL up for that. How would you like to be completely out of money in your 90’s? Because that’s what many of them are faced with. That Walmart greeter in his wheelchair couldn’t afford an apartment, let alone a nursing home, and meanwhile your future is set thanks to your parents. So have some goddamned human decency.

The question isn’t whether or not property tax laws need to be revisited. Of course they do. The problem will be in the transition. You can’t expect hundreds of thousands possibly millions) who own in expensive areas to suddenly sell and move to a house hours away that is “cheap” by today’s standards, with taxes they cannot afford. It isn’t their fault they got a good deal 40 years ago, their neighborhood turned wealthy, the economy turned against the young, and prop 13 enabled them to stay so long. In states with taxes based on current value, they see increases coming well in advance and have years to prepare. Doing it virtually overnight is out of the question and simply won’t happen, as much as you would love to see them suffer, even though their advantage doesn’t affect your taxes AT ALL. So get over it.

Their catching a break also isn’t affecting home prices in any meaningful way. Look at the northeast. Those states have much higher taxes based on current value (well over 2% in some cases), and their housing prices are outrageous.

Millennial,

You have the wrong target for Prop 13. Most states protect grandmas by freezing their property taxes.

You should target the people who paid half-off in 2009-2010 for their houses. They are now paying half of the taxes of their neighbors who purchased a house this year.

Of course, when your prediction of a half-off sale happens this year, you will be in the same situation and will have to double your taxes during the next cycle.

Oh dear Millennial, there are so many things wrong with your argument over Prop 13. You are aware that it was instituted to protect seniors with limited incomes from losing their homes due to the high property taxes. So you think that once the younger generations know how the seniors are ripping off the younger generation via Prop 13, that things will change? They will not and let me tell you why. Seniors are exactly that. Older than you, retired, with a lot of time on their hands. They are a large population and they have a lot of political influence – they have time to write to their government representatives, attend hearings in droves and make their needs known. The AARP is also not without influence. They’re a tough crowd to beat as they’ve lived through a lot worse than this. You start threatening to repeal Prop 13 and put a large number of them out on the street, you will be facing a battle the likes of which you have never seen.

Secondly, it’s very clear that you’ve never met a senior on a fixed income. Someone who put in their 40 years only to see their pension get reduced or eliminated due to corporate takeovers. They’re on medication that costs them hundreds of dollars a month that is not covered by Medicare – something they’ve paid into their whole lives. Yes, many of them own homes they cannot afford to buy now – a lot of folks are in that situation, shoot, I have years until retirement and I’m in the same situation.

What disappoints me the most is that I won’t be around to see what your life looks like when you are 75. One thing that time teaches us is that nothing lasts forever and that your financial situation can drastically change in a flash into a truly desperate situation. I hope it doesn’t happen to you, or anyone, but it might, and all your investments could be gone in an instant. Think that can’t happen to you? Talk to the people who lost EVERYTHING in the Thomas Fire and even though they were adequately insured, it still isn’t enough to rebuild. Talk to someone whose child gets cancer and the medical bills bankrupt them because of all the expenses that medical insurance doesn’t pay. People who invested well and thought they had a sufficient nest egg. You may very well become one of those seniors who you believe should GTFO, be a greeter at WalMart in their wheelchair or just become homeless. Ahhh, the tunnel vision of youth. In spades.

The cry fest has hypocrisy written all over it. Shocker, the people who benefit the most from the prop13 cry the loudest. You guys don’t want YOUR taxes to go up but wouldn’t admit it and hide behind the “poor grandma†argument. Good thing we have lots of renters ready to vote against this scam.

Millie, aren’t you going to inherit several houses from your parents? Guess you’ll be getting that sweet Prop 13 tax basis that goes with it. As much as I don’t agree with Prop 13, it’s not going anywhere. You honestly think renters will gain more power than corporations, wealthy people, lobbyists, the vast majority of middle/upper class, etc.

Nothing to see here folks, just keep making that money in crypto and use it for down payment.

This was inevitable and was predicted years ago. With a sanctuary state policy welcoming more low-skilled laborers with open arms, some of the highest housing costs in the country, excessive taxes, and a outward migration of the middle-class, you have all the makings of a predominantly rental state. Add to that the new tax reform which further affirms full tax deductions for rental properties while capping and/or limiting the deductions for a primary residence. It’s a good time to be a landlord.

That is a clear picture of democrats in Sacramento creating a feudal state. Open borders, H1 visas and sanctuary state to create a race to the bottom in wages – that way you have feudal lords and serfs (the serfs are too dumb to understand that what the liberal lords are doing is not out of compassion for the poor but with a specific purpose to keep them poor). Comparative with housing prices in safe areas, what the serfs are earning after taxes, are slave wages with no hope of ever being in a better position. I have to give credit to the teachers union in CA for doing a good job of brainwashing/indoctrinating the new generation not only to accept their slave status (to the banks) but to accept their feudal lords with gladness and elect them at every chance they have to vote. That is an accomplishment those feudal lords from dark ages would envy.

“Add to that the new tax reform which further affirms full tax deductions for rental properties while capping and/or limiting the deductions for a primary residence.”

Ironically this will be one of the talking points for selling to the public the dismantling of Prop 13 for landlords.

Yes Avi, eliminating prop 13 for rental property would be a good way to double rents overnight and literally blow up any affordable housing. Good idea.

Wheeling,

That is not how rents are set. Any landlord in a free market will set the rent as high as the market will bear based on the type of renters he is targeting. That is regardless of his cost, rate of return or capital invested. The later determines if he makes a profit or looses money; however, a landlord who bought today is charging the same as a landlord who bough 40 years ago for a similar place in a similar area, regardless of their cost.

The rent charged, unlike the RE prices juiced up by the FED, depends on the ability of the population to pay rent – actual wages in real life. I am a landlord and I have been a landlord for over 25 years, in all kinds of markets. Eventually, if the landlords have a very low rate of return or loose money, you will have a shortage, and you can raise the rents (there will be fewer properties for rent and fewer renters able to pay). However, that takes time; it does not happen overnight.

Getting rid of prop 13 would not cause rents to double. Landlords already price rents at the market rate so they could not increase. The value of the underlying asset will fall to match rental flow.

Flyover and Woody, your assuming that the property values will go down if prop 13 were repealed. That’s not 100% definite though. I don’t see it slowing down purchasers today who have to pay current market value on their new properties. Nor do I see any slowdown in states like Texas with some of the highest property tax percentages in the country, where properties are reassessed for market value every year and where they have one of the hottest property markets in the country and have been for years with continual double digit growth. I have been a landlord for almost 20 years in S. Cali and will say that in my experience inflation, over-population, and increased overhead equals rent increases and repealing prop 13 will not solve anything but will increase the costs of living. Sure there will be a short term increase of inventory as those that can’t afford it leave or downsize and they will be quickly replaced by those that can afford it. Basically repealing prop 13 will drive out the middle-class homeowners who are hanging on by a thread and replace them with more elites meanwhile increasing costs for everybody including renters all the while the state of CA can spend the increased revenue on programs to attract more low-income laborers to the state to keep wages down and rents up. Be careful what you wish for because you just might get it.

Wheeler dealer what’s going to go down is your profit margin. Good luck betting on things always staying the same!

The way I see it is from m Mom’s perspective.

He bought in 1975 and her current property taxes are about 1300 per year.

No mortgage and 900 per year in insurance. That is about $200/month in expenses.

If she moved to a senior living facility and rented her home to cover expenses,

1) Her neighbor with a !M comparable home is paying $4500 per month in rent, or about 54K per year in rent

2) If Prop 13 were revoked mom would pay 10K/year in property taxes or about 1K per month in taxes and insurance.

If she decided to rent it, she would either have to take the hit on the extra 800 per month in the increase in taxes and her yearly income would decrease by 9600 to from 54K to 45K or she would raise the rent if possible to cover it.

My points are.

1) Buy a home early and pay it off.

2) Prop 13 would be a burden, especially to the elderly if they wanted to stay in their homes. To someone who wanted to sell or rent it out, it would still provide a good income.

I just heard a stat that 30% of Orange County is foreign born. No wonder housing prices are going nuts with all that added demand.

Thank the liberals for promoting massive immigration legal and illegal, open borders and sanctuary cities/state. That is the reason for 30% foreign born. Repeat after me – liberals democrats are not your friends. They want race to the bottom in wages and sky high house prices and rents. That is the most obvious conclusion for anyone with 2 functioning cells. You don’t even need ECON101 to see the obvious.

The pinnacle of this insanity is to see the people most affected by this – young people and minorities voting democrat ALWAYS. The rich democratic donors stand just to benefit from this stupidity. I’m glad I am not affected. This idiotic policy actually benefits me tremendously. However, that does not change the truth of what I stated.

So depressing. I hate California, loathe Los Angeles and am kicking myself daily for agreeing with my delusional wife to move here in my late 40s two years ago. Owning a home will never happen as long as we stay here. I never in my wildest dreams thought I would be renting at this stage in my life. And don’t even get me started on what we are paying for our outdated 1300 square foot 3 bedroom 1.5 bath home. $3,600!!!! Should have stayed in North Carolina. I feel so stupid!

Dude, you need to take charge here. Sounds like your wife is calling the shots. If you have no hope of ever buying in socal, why the hell would you move here in your late 40s from a cheap cost of living/high quality of life area. You don’t want to be one of those people who are eternal renters in socal. That is a recipe for disaster!

North Carolina is a beautiful state. Not only that but their economy is doing better and better and the housing cost in a safe area is a fraction than what the same house would cost in a CA ghetto.

Yes, no place is perfect, but for any budget, the overall quality of life in North Carolina is way higher than CA.

Geez, 3600 a month! I pay way less. I live my landlord for the gift. The good news Mark, if you would buy you would pay way more! Why throw your money away if you can rent? Just invest some savings in crypto, make a killing and wait for the collapse! Also make sure you read up on prop13 and how it’s screwing younger generations!

Prop 13 is not “screwing younger generations.” It is benefiting long-term owners, which YOU will eventually be. If it does get repealed, in 30 years when you’re paying $2,000/month instead of $500, you’ll realize how short-sighted 30-something Millie was.

Crypto is not an “investment” in any sense of the word. It is a gamble, period. I have five figures in it myself, but it’s a small fraction of my portfolio, and at least I recognize that it’s a gamble.

And please don’t say “buy the dip” again. That could be the single dumbest thing I’ve ever read on this site.

Of course it’s screwing younger generations. The tax burden is solely on them. Older generations pay next to nothing in property taxes but they are the ones that can afford higher taxes. When they bought a house it was dirt cheap compared to today. Back in the 70,80 and 90s a house did not cost more than 3-4 tines annual incomes. Nowadays it’s like 10 tines annual household incomes. Not only did boomers profit from the housing bubble they also benefit from low property taxes. That’s why prop13 needs to go and property taxes for older people need to be heavily raised. At least to what a young couple would have to pay (1.2% of current market value)

As far as crypto goes. Of course it’s an investment and of course you should always buy the dips. You will probably soon regret you did not put more money in 😉

John D describes a ponzi scheme for the rest of us.

“Of course it’s screwing younger generations. The tax burden is solely on them.”

The government collects other taxes, you know. Sales and income.

“Older generations pay next to nothing in property taxes but they are the ones that can afford higher taxes.”

With that gigantic social security check, I presume?

“That’s why prop13 needs to go and property taxes for older people need to be heavily raised. At least to what a young couple would have to pay (1.2% of current market value)”

Need to address the spending problem in Sacramento before we increase taxes by that much (like the $100b train from nowhere to nowhere). And then there’s the problem of hundreds of thousands of seniors losing their homes. Sounds cliche, but it will happen. What do we do? Give just those people a UBI?

I would sooner meet halfway. Charge .06-07% (or whatever) for all. NO WAY do we automatically give the government more money when they already burn a good portion of what they get.

“As far as crypto goes. Of course it’s an investment and of course you should always buy the dips.”

If something has value, it’s an investment. We do not yet know what, if any, value crypto will have. Most variations will probably go away. One might end up on top and actually become a common payment method. I personally doubt it, but I’m betting (gambling) that it’s still got legs in spite of that.

“Buying the dip” only works if you know where the upside is, which you don’t unless you can see the future. You can try to guess where the bottom of the dip is, then average down when you’re wrong, which works great when the long-term trend is up, but eventually it’s going to stop working. Unfortunately, you won’t know when it’s stopped working until that portion of your portfolio has been thoroughly pummeled.

John,

“The government collects other taxes, you know. Sales and income.â€

And your point is?

What’s up with all these older people (mainly boomers) bragging how they sit on million dollar homes but as soon as you mention higher taxes /prop13 repeal they whine like little babies and hide behind the argument “poor seniors on fixed incomesâ€.

They love to blame the government for inefficiencies, illegal Mexicans and millennials but don’t own up to anything. On the other hand these people loooove government subsidies as long they benefit from it (prop13). They couldn’t care less if young buyers are screwed by highly inflated home prices and sky high property taxes as long nothing changes for them and as long as their home values keep going up on our expense. But as soon as their property taxes might go up to what millennials have to pay they cry you a river! Pathetic. Bunch of hypocrites. But that’s what they did their entire lifes, create the biggest debt burden in history, voted for these laws/politicians that benefit them….why not. As long as younger generations pay the price.

Millennial: But that’s what they did their entire lifes, create the biggest debt burden in history,

A lot of that debt burden was to subsidize your fat ass.

Didn’t you receive 12 years of free education? With free school lunches, breakfasts, and after school events? Followed by subsidized student loans, to attend subsidized colleges? Didn’t you benefit from any of government provided police, fire, sanitation, roads, and libraries?

Or are you saying that you’ve been on your own since an infant? Pulling yourself up by your own baby shoe strings?

Conversation between a millennial (Millie) and a boomer regarding the 20Trillion debt burden.

Millie: thanks for all the debt, don’t worry we got it covered and will pay it all back with interest!

Boomer: ungrateful Millie! This benefited you as well!

Millie: oh and I thought we are the ones being screwed here. How does it benefit me?

Boomer: free Education!

Millie: wait, you mean that useless high school degree that allows me to go to college where they charge me an arm and a leg for tuition? We exit college with a debt burden of 40k-100k. Have you not read about millennials and their struggles with student loans?

Boomer: ungrateful! The tuition is subsidized!

Millie: wait, weren’t California colleges tuition free until the 70’s. Somehow that changed to sky high tuitions that increase almost yearly. But….thanks for the subsidies!

Boomer: ungrateful! Libraries!

Millie: speaking of books….can you tell me why I could not rent the economics book for a handful of bucks? Why did I have to purchase version 367 for $250 to complete the homework and assignments? I thought I would be smart to buy version 366 for a lower price (I mean what can dramatically change within one year?).

Boomer: ungrateful! The police!! Would you rather have no debt and be unsafe on the streets?

Millie: mhm, you got a point here. And now that I think about it! Yes, the police kept me safe! I remember specifically how they set a trap to pull a bunch of cars over and gave them high dollar tickets! But they explained very well how this is to protect and serve!

I guess the only time you would disagree with the police on this is if you are a black, unarmed teenager who gets shot 17 times.

Boomer: ungrateful! The officer was fearing for his life!!

Millie: mhm, somehiw I still don’t think we got a good deal here!

Boomer: ungrateful! The trillions of debt keep you safe in this great country! The safest and greatest country in the world!

Millie: Ah military spending! I agree! I specifically remember in 2003 how Colin Powell showed the UN Security Council specifics of the WMD in IRAK. Boy, imagine these terrorists would have used WMD on us. Puh, that was close and thank goodness we spend trillions on fighting that security threat! Wait, but they did not find any?

Boomer: ungrateful! Do you really dispute our military is fighting and risking their life’s overseas to keep us safe in our country?

Millie: I do agree! I mean imagine we would have terrorists in this great country mowing down students in schools or killing dozens with assault rifles at country concerts!

I changed my mind! Now I do think we are well taken care off and all of what we have is just not possible without having 20trillion in debt! Thanks for the explanations and the subsidies!

Millennial: Boomer: ungrateful! The trillions of debt keep you safe in this great country! The safest and greatest country in the world!

Who said anything about being grateful for the military? I know it’s easy to argue when you put words into your opponents’ mouths, but it’s more honest to argue against what an opponent actually said.

I said nothing about being grateful for the military.

Perhaps you forget that Boomers helped end the Vietnam War. And those 1960s antiwar protests are one reason the Deep State ended the draft, and remains wary of any conflict that might bring high American casualties.

As for myself, I participated in the February 2003 antiwar march, a month before the Deep State invaded Iraq. What were you doing back then?

Why not move again?

NC is about as perfect a state as you can have. While not quite flyover level cheap, it’s relatively low cost and low tax. Pretty good weather. It can get muggy in the summer but it’s in the 50s in January, with 4 distinct seasons in most of the state. Beautiful beaches in Wilmington and the Outer Banks, mountains on the eastern side of the state. Duke and UNC are some of the best colleges in the country in the Raleigh-Durham area and have spurred a booming tech industry in RDU. Charlotte is the #2 city, after NY in finance. And within a 2 hr flight, you’re anywhere up and down the east coast from Miami to Boston.

Why on God’s green earth would you leave that for the cesspool of California?

mountains on the western side that is.

Mark, no marriage will survive a situation that is making one half of it so miserable, even if financial considerations did not weigh so heavily. But not only are you miserable, you are correct- it makes no sense for someone to remain in a high-cost comfortable life and buy a fine home an area he much prefers. You really do have to put your foot down at this point, and make your wife understand that the kind of lifestyle you had in NC is far beyond your joint means in LA and always will be. Most of all, though, you need to make her understand that she is making you utterly miserable, and endangering both of you financially; and that your relationship might not survive the stress. And it won’t.

Good luck to you in this.

Mark: “our outdated 1300 square foot 3 bedroom 1.5 bath home.”

That’s a decent sized house, unless you have many kids. It’s about what a house’s size should be.

I live alone in a 690 sq ft, 1 bath, condo. Your house would feel very to me.

I meant to write that “It would feel very roomy to me.”

My daughter is in NC and loves it. Plenty of jobs and other than a little more humidity in the summer and a little snow in the winter, comparable to CA for weather.

She only wishes Raleigh was closer to the beach. It is a 2 hour drive.

If you can find a job, Bakersfield or Temecula are less crowded and comparable cost to Raleigh while less than 2 hours to the beach.

Unless it’s family or a very specific job there’s no point in living way out in Bakersfield or Temecula and paying California taxes when you could just live in a similar clime in another state with a better cost of living.

LordBt, property taxes in NC average .9% and in CA, thanks to Prop 13, are 1%.

Not much difference unlike Texas which averages 2-4 %

NC and TX have much less expensive houses similar too Bakersfield and Temecula,

Both Raleigh and TX are much further from the beach.

TX has no income tax and NC has a flat 5.75% income tax. Compared to CA, TX residents are happy depending on the value of their hosue, but NC residents can pay more tax depending on income compared to CA.

There is more to Cali than just LA and SF. There are beautiful rural and semi-rural parts of S. California which have not been spoiled by over population and have more reasonable costs of living, problem is there are no jobs there.

Well would you look at that? The Doc finally came around! I’ve been commenting on this blog for a few years now and I’ve been preaching this years ago but hey, better late than never! The fact is that the US dollar is experiencing inflation at a much faster rate than usual and we can pretend that it doesn’t exist but that doesn’t make it go away. The only areas that it’s not accounted for is wages and food/consumer goods so to the average Joe, it SEEMS that this is a bubble when in reality, it’s the fair market value. Sure a rise in interest rates will negatively affect prices but it will stagnate them AT BEST until wages catch up which is right around the corner. You know what else is right around the corner? Automation! While this means that it would banish a great deal of people to rental land, it would introduce a great deal of new players to homebuying, namely the working professionals with jobs that can’t be automated. Those guys will be getting a hefty payday for their skills which means they will easily be able to buy into these prices. And last, an internet revolution is also right around the corner. If I could transfer hundreds of gigabytes of data a second why do I need to be physically present at my job? Can’t I move out of expensive silicon valley and work remotely from affordable Indiana? In the near future, you sure can!

Let’s stimulate dialogue that goes beyond the indicators of past recessions and let’s look at the market for what it is which is a changing market in a changing world. I’m not saying “this time is different” but let me ask you this: do we live in the same world today as we did back in 2000? My new Chinese neighbors say “no, no we don’t.”

A true contrarian may take Doc’s capitulation as a sell signal.

If this blog was a microcosm of homebuying sentiment (which I suspect it is) then you’re absolutely right. When prices were reasonable a few years ago, barely anyone was active (an indication of low demand in home buying) and everyone that was, was crying bubble. As the years went on, more people participated and people were accepting rising prices as the new norm. Now the Doc averages 300+ comments on his blog posts and even he himself is beginning to indicate that “this time it’s different” a sign of massive demand buying into massive hysteria all over again. Buckle up, cause you ain’t seen nothing yet. Bubble starting in 3, 2, 1…

Keep dreaming new age. We heard this time is different and buy now or be priced out forever for the last few years! You got to be a bit more creative. Meanwhile we have historic low sales and interest rates are going up! We all know how that ends. Ship is going down.

New Age,

I second your sentiment here…about this blog reflecting level of people’s desire to buy. It is getting very hard to buy, yet sentiment to buy is very high for a number of reason.

I also think that desire to own RE is driving some people mad. Here is what I see:

1) Comparison RE to crypto – well, crypto is different type of asset. There are also individual stocks that performed similar to crypto. Ideally, you want to have RE and crypto.

2) prop13 repeal – as if this is going to help prices. Loser shit.

3) All this talk about how california stinks and there are other places – why keep talking about, just move or stay where you are. Stop with this provincial cries about prime areas.

Yes we do. Shoveling cheap and easy credit into the economic system causes the same economic distortions (artificial inflation) now as it did 10, 20, or 30 years ago. The difference is that it’s now practiced on a global scale. Will the end result be different this time? Unless you believe that economic fundamentals have been permanently repealed, then no.

Yep. Once the credit bubble pops the inflation New Age describes will become all too obvious and then what? And that internet revolution? if a person doesn’t have to work at the site then why not hire from countries or areas where wages are not contingent on inflationary dollars. Lot of holes in this narrative.

The cheap credit is not so cheap lately……..

Looks like a long term trend has formed and Powell is not worried 1 bit (so far).

I left Cali in 2015 after 31 years. I would rather saw off all my limbs than return.

I work for Uncle Sam and hope to take one more overseas assignment (to Canada) and then retire and move to Indiana where my daughter lives. Not sure if the housing market will tank or not. Been hearing that for the past 7-8 years now. Glad I bought when I came back to California in 2013. I always wondered why so many people never bought during the last crash in 08 or 09? By 2010-2011 they were already talking about the next crash. That always made me scratch my head. Anyhow, if a correction is coming, I hope it does not happen before I sell and move in the next year or so. I’m hoping to cash out 130K and save more while in Canada since old Uncle will be paying for housing while I am there…..

“I always wondered why so many people never bought during the last crash in 08 or 09? By 2010-2011 they were already talking about the next crash. That always made me scratch my head. ”

These are left wing perma bears. Their goal is to destroy capitalism and agitate year after year – so far unsuccessfully luckily. But their propaganda is having some effects. Lazy millenials have bought into it. Hey why work, when I can vote for Bernie instead. It sounds nice doesn’t it? Sit at home playing video games all day, while Bernie taxes evil rich people to pay for your housing, food, transportation and health care.

What could possibly go wrong?

Mr Landlord,