GOP tax plan will be a bad hombre for the California housing market:Â National Association of Realtors warns that prices can fall by 8 to 12 percent if tax plan is approved.

It seems like a lot of people are tripping over themselves regarding the GOP tax plan. For California, the housing cheerleaders always trumpeted the massive amount of tax deductions you got when buying a ridiculous crap shack. I always found this to be absurd. You usually got “free market†thinkers on the economy but then suddenly, wanted massive government support when they bought their expensive home. In the Bay Area a crap shack will cost you $1.5 million if you even want to have a parking spot within walkable distance. So it is no surprise that the GOP tax plan doesn’t give two seconds of thought as to what is good for California. And good just means on what side of the dinner table you are sitting at. Frankly, the rest of the country subsidizes the crazy housing market in California and other expensive states so it never made sense to have a mortgage interest deduction of up to $1,000,000 when the typical house in the U.S. costs $200,000. In regards to housing, the GOP tax plan will not help California housing values.

Subsidizing expensive California

There is some irony that San Francisco, a city that touts to be progressive and open to all is so incredibly expensive that only the elite can afford to live there. Surely you can see the cognitive dissonance in that? We want to help you so long as you stay far and away from our expensive NIMBYism enclave. An area where making $100,000 a year will confine you to living with roommates and eating Ramen from your tech cubicle.

Here is why capping the mortgage interest deduction makes total sense from an equitable perspective. First, most people don’t live in expensive California crap shacks:

They typical home costs $203,400. So assume a 10 percent down payment and you have an $183,060 mortgage. Assume that mortgage is at 4 percent interest. You are paying roughly $7,200 a year in mortgage interest. Now let us assume you buy a $1,000,000 California crap shack. Say you put down 20 percent. You are paying over $32,000 a year in mortgage interest. So why in the world is the person buying that California crap shack getting such a big mortgage deduction when by definition the typical home in the US costs $203,400?

Of course, the National Association of Realtors (NAR) is upset by this:

“(Mercury News) The tax incentives to own a home are baked into the overall value of homes in every state and territory across the country,†association president Elizabeth Mendenhall wrote in a news release over the weekend condeming the proposed tax overhaul. “When those incentives are nullified in the way this bill provides, our estimates show that home values stand to fall by an average of more than 10 percent, and even greater in high-cost areas.â€

I love how this is phrased. So basically socialism is baked into the home price. Okay you free market wannabes. You can’t have it both ways (okay, you can). The reason the NAR is upset by this is that they make money when people are churning real estate – meaning more buying and selling. They want volume. Like the McDonald’s of housing. So if this stalls home sales they lose.

Another fun item for California is the following:

“Another controversial housing-related item in the tax proposals is the capital gains provision. Under current law, homeowners can exclude up to $250,000 (or $500,000 for married couples) in capital gains on the profit from the sale of a home — if they have lived in the house for two of the last five years. Both the House and Senate proposals would change that — homeowners must have lived in the house for five of the past eight years to qualify for the savings.

Last year, 13 percent of homeowners in California had lived in their home for between two and four years, meaning they won’t be eligible for that tax exclusion, according to the National Association of Realtors. Some housing experts worry the GOP tax plans will encourage Bay Area homeowners to stay put instead of selling, exacerbating the region’s housing shortage.â€

Bwahaha! So much for the home equity train. I’ve talked about this before but housing cheerleaders like to paint this quaint vision of getting old in a home, painting the walls of your kids bedroom, and acting as if you live in a place for 30 years. No, in reality most are house humpers that lust after those HGTV shows and can’t wait to sell into a bigger property. Well now, you have to wait five to eight years before working on those cap gains. Can you tolerate a crap shack for two years? Sure. Can you tolerate it for 5 to 8 years? Hmmm.

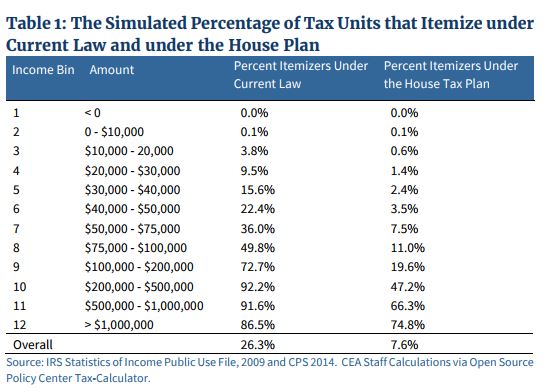

And most Americans don’t itemize:

This bill does not help your typical California house humper. It will help the majority of renters. Why? Because of the above. The standard deduction going from $6,350 to $12,000 for single filing households and from $12,700 to $24,000 for married filing households actually helps out the typical American household.

I hesitate to get into the tribal mentality of “blue†team and “red†team because ultimately it divides people from actually doing a deeper analysis. There are good ideas and bad ideas coming out from both parties. In the above case regarding housing, a place like Los Angeles County with the majority of households being renters, it will help at least with their tax bill. This won’t help your future crap shack buyers in the Golden State.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

299 Responses to “GOP tax plan will be a bad hombre for the California housing market:Â National Association of Realtors warns that prices can fall by 8 to 12 percent if tax plan is approved.”

Many of the rich will pay more under new tax plan, contrary to what the liberal MSM try to portray the new tax plan as a giveaway for the rich.

If we take the example of a high-net-worth individual living in California and making $1 million a year, that person’s state taxes amount to $102,000. If that person owns a $1.5 million home, property taxes would be around $27,000. As the new plan eliminates mortgage interest deduction above $500,000, this person would lose the ability to deduct roughly $20,000 in interest expenses.

In total, this person would lose roughly $150,000 in deductions. At a 40 percent tax rate, this person would end up paying around $60,000 more in taxes under the GOP plan.

The idea that this is a tax giveaway to the rich just doesn’t hold true. It may help somebody that lives in Florida, who doesn’t have to worry about state tax deductions, because there’s no state income tax. And it does help out corporations by lowering their tax rate… but as far as individuals who lose their itemized deductions, this is going to, in effect, be a tax increase.

That rich people will lose the SALT is a state issue, not a federal government issue. The rich people from CA were subsidized for too long. There were the rich people in CA (politicians) who decided to steal from their citizens to support all the millions of illegals and sanctuary cities. Since they wanted this, let them pay for it out of their pocket. Let’s see how fast they restructure the state taxes; Ha!…

Although I completely agree that the MSM is a joke the “rich” they are referring to is the ultra rich (like the D Trumps etc.). It’s pretty obvious that this is a gigantic wealth transference scheme that has the potential to blow up the entire economy. Besides that, millionaires who live in California do so because there is nowhere else in America with the combination of weather, great natural beauty & cultural opportunities as this state provides. On top of it all this bill is designed to jack up equity & asset valuations as corporate tax rates go down and…the lower tax rate on sole proprietorships partnerships LLCs etc. will put more money in the pockets of the non W-2 types. It’ll probably just make housing less affordable for the working stiffs.

You are right in some respects, but those ultra rich like Warren Buffet and Soros had plenty of loopholes ALWAYS. Otherwise, why did they scream during 8 years of Obama that they pay “less taxes than the secretary” (percentage wise)?!!??…

The central piece of the legislation was to lower the corporate tax rate of small business owners from 35-39% to 20% (the highest in the industrialized world). I paid them in many years. The small business owners were the most affected because they actually paid those rates since they could not afford the overhead of an army of lawyers and tax experts like the big corporations. In most cases they paid more in taxes than GM or GE. They are the number one job creators in this country not the big corporations developed around the politicians. The government can “create” jobs only in the measure they can tax. Tax who and for what? To install a bath fan at a cost of $22,000 per fan?

Natural beauty? Is that what you call the black smoke billowing out of burning houses?

Markin, you are 100% correct. Northern Idaho is butt ugly, the waters are all polluted, and the people are all illiterate rubes without teeth. Our unemployment rate is through the roof, taxes are astronomical, and our 4 seasons are without charm. There is no future in this state with it’s high cost of living. We are not attractive to the super rich. Stay in California at all costs.

I think this new plan is saying to the typical house humper….”You idiots be realistic on what you buy. We are not being forgiving this time around.”

I think more high end workers are likely going to be downsizing or likely rent. They may even take less on their home sales just to leave Dodge.

I think smaller homes or less priced homes will likely see a surge with this plan in my opinion.

Anybody else notice the timing on this thing? I’m sure it’s simply coincidence that nobody is going to have time to sell out of their real estate positions before the new rules take effect.

The point here is that there’s no time left to exit the theater. Current CA homeowners will be grandfathered on the MID and CA RE taxes are already low relative to a lot of other states.

This whole thing is going to tighten supply because potential sellers will be even more disincentivized to sell. That means the increasing number of owners who move out of state will be more likely to hold and lease out their homes instead of selling. The increased supply and the doubling of the standard deduction is good news for renters.

Yep, this lays that out nicely: https://www.linkedin.com/pulse/watch-out-effects-tax-reform-migration-fiscal-conditions-ray-dalio/

Flight out of California is likely to be epic. Reno may end up being too close for comfort.

The billionaires and millionaires who live in California primarily live in lavish gated estates near the coast. They generally do venture inland where the weather is more extreme and which increasingly looks like a dirty impoverished third world country thanks to decades of Democrat mismanagement.

I am in love with Flyover.

Well no one is losing SALT but a cap at $10k shared between property tax and state income tax makes sense. Since states typically chose income or property tax as their income vehicale.

$750k deduction is still crazy high as only rich people or expensive cities borrow these amounts. Still think they should either kill the mortgage deduction all together or make it a tax credit that kicks in wqually for the US median home sale price.

I would not get to peppy about the well off getting a tax hike from the the loss of the high end mortgage deduction. The also made the AMT calculation more generous and most at the half a million mark were probably losing that deduction to AMT anyway. It remains increadibly difficult to generalize about taxes because two people making the same income can have very different tax situations.

California is already losing almost 100,000 taxpayers per year.… If this tax bill goes through, this is really going to force a lot of people out. This is going to have a major impact on the high-tax states like CA, and this is going to be a revenue drain.

Yes, long term the population in CA is increasing but the big question is this – Is the population increasing with taxpayers or with leaches and dreamers???!!!… What is the impact going to be on state pensions and sanctuaries???!!!!…..The history shows that as a state you get more of what you encourage and less of what you discourage. You discourage the businesses and taxpayers through a myriad of taxes (under different labels), you will get less of them because of migration. As an example, Apple, the staple company of CA also restructured their taxes through Ireland. More businesses and wealthy individuals will decide that enough is enough. It is not going to happen overnight, but what is the long term effect? 5 or 10 years from now? How will the finances of the state look like if they encourage illegals and discourage the businesses and taxpayers?

CA is losing mostly productive working class people. As time goes on, more higher skilled white collar exits are joining the ranks of those leaving.

The big lie some people promote is that it’s the poor who are mostly leaving. It takes initiative and drive to leave. Those aren’t traits common to unproductive moochers.

Many of those ‘moochers’ are your cleaners, nanny’s, gardener’s, and the cheap labor for almost all construction and remodeling! It is the hypocrisy of California’s elitist form of socialism, hire all this help for ridiculously low wages, then smile at the media cameras and act all bent out of shape over social injustice and equality!

Payday loans to seniors tripled in CA last year…. APR 372 % !!

There are more payday loan centers in the USA than McDonald’s restaurants !!

http://www.dbo.ca.gov/Press/press_releases/2017/Release%20-%202016%20payday%20loans%20report%207-5-17%20-%20final.1.asp

It’s funny how people in Red states want CA to fail. We pay in 300 billion and take back 288 billion in federal tax money. The Chinese are the ones buying up the high end real estate here. They usually pay cash and then take out a HELOC to either buy other properties or remodel. If we lose 10-12% of our value the Chinese and other foreigners will just buy up more real estate.

I would love to know where you get your numbers as far as CA losing taxpayers. As far as the rich saying enough is enough they’ve benefited the most over the last 6 years. They’ll find CA as a bargain, and since most of them are foreigners do you think they would want to live in a backwards state that preaches hate and intolerance as a way of life? Or do you think they’ll want to live in communities were they are accepted? A lot of the cities that have seen the most growth over the last 6 years are communities with foreign born tight knit groups.

I know I work in one, and as far as the foreign investment my wife works for a bank that makes those loans all day long. When she started they were lending about $100,000,000 a month now they’re loaning our close to $500,000,000 a month.

We pay in 300 billion and take back 288 billion in federal tax money.

Stupid argument. You think a state should get back the same amount that it pays in? That is not possible.

Think about it.

Some tax dollars must pay for the federal employees in Washington DC who then return money to the states. Other tax dollars pay for overseas military bases, and embassies, and foreign aid.

Every state should be getting back less than it pays in, because some of what it pays in is spent in Washington or overseas.

AJ -Astute analysis; I concur that the rhetoric here – often an extension of GOP and alt-right talking points – rails against any type of equitable distribution and roots against California, in general. Not all red states are intolerant, but to generalize is not entirely incorrect because the racial and ideological elitism is quite pervasive. Listening to perverts like Rush Limbaugh and O’Reilly for hours on end is bad for an ethos. But, the heyday for unchecked WASP domination is almost over and we all will have to evolve or go extinct. California gets it mostly right in looking forward instead of trying to preserve a mythological past – which is conservatism in essence.

There are not the people in red states who want CA to fail; they have zero influence on CA politics.

There are the politicians in Sacramento and the CA governor who want CA to fail despite the climate, natural coastal beauty and all natural resources. Like the liberal/socialist Maduro in Venezuela (so much praised by the socialists in CA) who manage to fail one of the richest countries in South America (full of oil). Then he blame others for his lack of intelligence and common sense.

You, like a typical liberal, blame the red states for the failing of the liberal idiotic policies of your “smart” politicians. Like Hillary blaming everyone and everything instead of looking in the mirror. You can never improve as long as you blame others for your shortcomings.

What’s lost in all the socialist screaming about the tax plan is the fact that rates are getting lowered. You guys are focusing only on the lost deductions, completely ignoring the fact that rates will be lower.

So the standard deduction doubles AND rates are lowered for everyone. And you socialist fools are screaming about a tax giveaway for the rich. LOL.

The reason Nancy is calling this a disaster is because she knows it will be disaster for her in 2018. When everyone’s paycheck increases in January, they will know it was Trump and the GOP who made that possible.

eckspat: But, the heyday for unchecked WASP domination is almost over

Almost over? WASPs long ago lost their “dominant” position in the American establishment.

Although Jews make up only 2% of the U.S. population, there are more Jewish students in the Ivy League (prep schools for America’s ruling class) than non-Jewish whites (WASPs included): http://www.theamericanconservative.com/articles/the-myth-of-american-meritocracy/

the extreme irony that the WASP demographic group which had once so completely dominated America’s elite universities and “virtually all the major institutions of American life†had by 2000 become “a small and beleaguered minority at Harvard,†being actually fewer in number than the Jews whose presence they had once sought to restrict. …

Harvard reported that 45.0 percent of its undergraduates in 2011 were white Americans, but since Jews were 25 percent of the student body, the enrollment of non-Jewish whites might have been as low as 20 percent,

Likewise, there’s only one WASP on the Supreme Court.

Finance, law, media, entertainment, academia — which of these do the WASPs dominate?

What about the states that get back over 2X what they put in? In the case of Mississippi and New Mexico, they receive over $2 for every buck they put in the pot.

SoCal Guy,

In the case of Mississippi with a large percentage of blacks and New Mexico with a large percentage of hispanics, I’m sure the unemployment rate among these two demographics do not have anything to do with the expenditure of the federal government. In the case of New Mexico, add for a good measure a large percentage of native indians without employment to better understand the situation. It does not have anything to do with the red state politics but demographics and history.

Son of Landlord,

The jews want diversity but not in high places. When Obama had to nominate for a FED governor he had a “choice” to “chose” between 4 jews. It really did not matter which one have been selected. He just had to give his blessing to make the FED look legit. It just happen that it was Yellen. The other governors before her were also jews.

You mentioned also the lack of diversity at the Supreme Court and Ivy League Universities. At the Supreme Court they don’t want to have the same % of whites (WASPs) like in the rest of the society. They discriminate, but it is OK for them to discriminate. That 45% whites you mentioned includes also whites from Europe (15% plus 25% US jews). However, if you look at the demographics of those whites from EU (15%), most of them are jews from Europe.

Above I just stated facts, even if someone is tempted to call me antisemitic. I don’t have anything against jews in general and I don’t like to discriminate. But those at the top surely practice discrimination and that shows on statistics and facts. That discrimination is practiced in academia everywhere. I have friends jews and they agree that some of those from the top are hypocrites. If they are really for diversity and against discrimination like they claim, then they should not occupy more than 2% of the top positions. Many times they nominate a minority person as a front and they still control that position.

Like you said, the WASPs lost power long time ago (decades ago). The beginning of the end was 1913. Ekspat speaks from his own imagination about WASPs power. My children and I were discriminated everywhere for being whites – in employment and prestigious university applications. That is why I had to make my own company (sick and tired of liberal politics associated with employment) and my son had to go to a private medical school. Looking back, it was a blessing in disguise. However, going through those times it was not fair at all.

These how much is paid in and received back comparisons are simple minded. The devil is in the details and the effect of multiple orders are almost never a part of the equation. For example, how much are California state policies costing residents of other states? Things such as crime laws which allow those who should be locked up get out early can go commit crimes in other states and CA emissions regulations which drive up the cost of vehicles sold in other states immediately come to mind. It’s nearly impossible to calculate the true balance of payments.

I don’t necessarily buy the spin, but who cares? Really? As a person who owned in California, sold, and moved out of state, part of my rationale for leaving was prudent awareness that things don’t stay ‘golden’ (pardon the pun) forever! Everyone makes choices. Mine was to listen to my gut, pocket a ridiculous windfall, and get out! That cash has provided infinitely more flexibility! It is inevitable that something will trigger a pullback in California’s pricey real estate, and homes can quickly go from ‘gold mine’ to ‘boat anchor’! Of course, this can happen with any asset class, but I am one-click away from unloading stocks, unlike a more involved process for real estate!

In the Bay Area, this hasn’t really hit people yet. House prices can only go up here. Of course, trump tax bill will lead to rising prices because people are staying put and foreigners don’t have mortgages and blue purple people are cute! Especially the last reason of course.

Bahaha…can’t wait for the stock market to crash, SALT to go away and tech funding to disappear. 1.7 million for a 1200 square foot crapshack in a good school district…of course you can buy that with your 50% off RSUs and your 130k salary.

This is a great move and a one-two punch, hammers frothy RE prices AND poorly run states – which just happen to be run by libs. So much of their budgets are dependent on ponzi economic schemes and they’ve run up absurd tabs to pay (off) govt pensions that are completely unsustainable. A side benefit is the producers will leave for greener pastures and along with them jobs and prosperity will be more distributed throughout the country.

Thank you Rent Control!

Rent control really is the key here… because any additional disposal income that renters get is going straight to rent. Huge boon for landlords here all around. Landlords get to continue to deduct interest while competing renters for new homes won’t be able to…. Also landlords benefit from the resulting inflated rents. Huge win for landlords, unless you have rent control.

I really can’t stress this enough… landlords get to continue to deduct mortgage interest. Plus rents go up…. Home-ownership rate will continue to go down.

Let the good times roll.

Yawn. We have heard for the last 4 years rents are going up. My rent has not increased a dime. Keep dreaming.

Millennial is of the ME generation.

I have received double digit % pay increases for five year now.. By your logic everyone has received those pay increases.

Rent hasn’t increased in SoCal since 2012???? You must live in a fantasy land where you can buy a car for the same price as 2012 (used or new) and your health care cost the same as 2012.

bawaahahahaha double digit % salary increases? Yeah, yeah sure, keep dreaming. Salaries have not been increasing for most Americans….. in decades!

http://www.pewresearch.org/fact-tank/2014/10/09/for-most-workers-real-wages-have-barely-budged-for-decades/

It’s a bit pathetic that you have to make up lies in order to push your agenda. Luckily, most people see right through your BS.

-Why are you denying something that is an empirical fact?

-Visit Craigslist to see that a one bedroom now goes for $2000.

“-Why are you denying something that is an empirical fact?”

I don’t deny empirical evidence. Economic cycles show that nothing goes up forever.

The housing history of California shows that there are boom and bust cycles. Many people have been saying that for a long time here on this blog.

“-Visit Craigslist to see that a one bedroom now goes for $2000.”

Sure, I can visit Craigslist or call up for rent signs. You can rent a room for almost the same amount as in 2009 here in this area. Rents/Salaries have not increased by much.

There are area’s were even rents are too high. In those area’s its best to live with roomates or move back to your parents. Or, you can buy a tiny house.

My rent has not gone up. Ever. My advice: don’t rent from a professional managed company. Find a private landlord and when he increases rent, move away to a cheaper place.

Millenial — you are making the rest of us millenials look bad. You can’t use a single data point to refute a trend. For the record, my rent went up last year!

Like NoTankInSight says, this is a huge win for landlords. I would get behind the cap if it applied to everyone, even real estate businesses, and did not grandfather in those with existing huge mortgage deductions. Otherwise it’s just screwing over millenials.

Molo, in a desperate attempt to pass the plan the republicans just increased the mortgage deduction to $750,000 mortgages. Looks like you should be OK versus the landlords, other than the fact that they have been around the monopoly board more and have cash.

Molo, rents in this area have not moved at all. If your rent increased just move back to your parents or in-laws. Most Americans are broke and in debt. The landlords are only as liquid as their tenants. RE cheerleaders have to make up this lie that rents are sky high…they think that the sheeple will buy overpriced housing if the rent is high lie is preached daily. The truth is, renting is a bargain compared to the overpriced houses.

Since rents cant go up (salaries have not moved at all) the only variable is house prices crashing down (by 50-70%). Just wait and see.

“Move in with your parents or in laws.” What if they don’t live close by. And what if you have a family, what then?

Salaries for the top 15 to 20% of earners have continuously gone up. These are the people buying in decent parts of socal. If your rent has never gone up, good for you…you are in the minority!

stagnant rents are very common. Most Americans are broke. Salaries are down (adjusted for inflation). If your parents or in-laws dont live close live with friends, roommates. Or, buy a tiny house or rent another cheap apartment from a private landlord. There are dozens of options to not participate in the housing bubble and win at the end. All you need to do is save and wait until the ship goes down.

As a fully qualified 20% buyer who has resisted the urge to drink the cool aid the last 3 years and at times questioned and regretted my stance…I hope this awful tax plan causes something…anything to help correct the prices in SoCal. I wonder if the wildfires will do anything as well.

I am in the exact same position. Live in a nice rea in LA. Fully qualified. 20% + downpayment in the bank. Seriously house shopped for over a year and got more and more discouraged before making a firm decision this fall to stay put in my admiitedly pricey rental for a year or so and wait for a correction. Really hope this is the beginning of that.

Be patient. It may seem like the worm will never turn but it will, and when it does you’ll both be in a position to pounce. It is so laughable that everyone thinks this time is different – it’s not. Hang in there.

Same here. 20% saved. Not willing to buy into a bubble market and be left holding the bag when the market collapses (which it will). I am lucky – I lease a nice house in a great area and my landlord increases rent only 3% every year. I’m staying put. Cheap rent 🙂

Smart move Calgirl.

I agree you’re all doing the right thing, hang in there and keep saving past 20% DP if you can, see what happens down the road. Unfortunately So Cal will never drop to affordable levels ever again. When the next recession hits and prices do drop, it’ll be minor, just to last years levels. It’s Manhattan, NY here now, demand will ALWAYS strip supply, all you can hope for is a little 5-10% drop every 10 years before it goes right back up. If you don’t buy on one of those little dips, at least you will have enough saved to outright buy a house cash in another state.

I live in Menlo Park, CA and have been here my entire life. As a full time Realtor since 2003, I’ve seen the ups and downs of the market. Personally, we purchased multiple properties in 2009,2010, 2011 and 2012. We have sold 2 of our duplexes in the past 6 months. There is no disputing (in my view) that we are in a massive asset bubble. I preach this to clients of mine who approach me with the desire to purchase. This new tax plan will not effect us, personally I want prices and expect them to come back to earth. I’m estimating a correction of 30%-35% in the next 12-18 months.

You are the second realtor who predicts a 30-35% reduction in prices within just a week.

How quickly things can change! Love it.

The tax plan is unlikely to cause a crash. Going forward it is likely to slow the rate of appreciation and halt the insane mcmansion projects.

I hope BA Realtor is correct about a 30-35% decline. The top of the real estate market will probably come in the spring of 2018, but the decline will probably not start until late 2018 so the bottom will probably not come before 2020. Trump’s chances for re-election don’t look good.

hey Gary, for this tax plan which will result in lower CA house prices I will thank Trump….for lower prices the moron deserves the votes!

Actually, if prices go down enough there will be plenty of people happy about that.

I appreciate you sharing your experience and view in the peninsula, since I live out here too and patiently waiting 🙂

Agree!

I think it will impact LA, OC and San Diego which is good. This is why I supported Romney over Obama. Romney too wanted to reduce the mortgage deduction but lost the election. Think if Romney was elected OC housing would have been about 150,000 dollars cheaper and LA about 100,000

I don’t think that Romney would have been any different than Obama. They were both puppets of the same globalist interests of Trilateral Commission and CFR. One was the puppet on the left hand and one on the right hand. Same like the Bushes (Jeb and George) Bernie and Clintons.

With Trump the situation is far more complex. There are still lots of players and the outcome still hard to detect at this point. I reserve my right to assess him at the end of his presidency. He is led to some extent but he also fights back when he is pushed. He is unpredictable so I can’t assess at this point the outcome of this dynamic and nobody can. One thing is for sure – he is not a pushed over.

I kind of agree with you on the unpredictability of trump in the beginning I thought it was just a rehash of bush and Goldman people but lots of his decisions have gone against standard establishment neocon or neoliberals.

He certainly is unpredictable and will make his own decision

I have enjoyed your writing and points of view!

This legislation will not affect existing housing in California.There is a massive shortage because of insane regulation and fees to build new housing.

If everyone is under the assumption housing will tank with this plan what if in a hypothetical situation you have no one buying and selling. Everyone that bought property has the intent to live in it for a while. Is that a justification for housing to be worth less or to make it worth less? Why would a speculator try to lower the value if everyone who bought sees no need to sell and buyers are not needing a new place?

Make America Great Again

California will be alright, so what if we have to pay a few dollars more in taxes, not everyone is overextended.

I recently did another road trip across Flyover country, nothing wrong with living there, especially if you have an average education, and average skill set, and want an average job where you ONLY have to work 40 hours a week to afford a nice house in a good school district. If this is what you want, go for it, it’s waiting for you.

However, if you are ambitious, if you are at the top of your game, if you want to compete with equally ambitious folks, if you strive for success, if you want to reach for the golden ring, then you need to be in a world class city. The world’s best, brightest, and most successful people are drawn to these cities, if you are one of them, you want to be here also.

The weather has nothing to do with this, NYC and London have crappy weather, and are still world class cities.

Unless you’re rich enough to live in a gated compound with security, it’s hell living in a third world sanctuary city like LA. Once the next devastating earthquake hits, even living in a living in a gated compound with security is not likely to save you from the hordes on the loose taking whatever you’ve got.

Unless you’re rich enough to live in a gated compound with security, it’s hell living in a third world sanctuary city like LA. Once the next devastating earthquake hits, even living in a gated compound with security is not likely to save you from the hordes on the loose taking whatever you’ve got.

What you’re saying is if you strive to be a classist snob, Los Angeles is the place to be!

Do you mean that only the brightest Slumlords are attracted to LA (the slum capital of the world)?

Or you meant that in the Flyover country there are no ambitious people who started their own businesses and become millionaires or people who go to medical schools and become surgeons or engineers who start their own companies and make over a million per year. I know enough of these who enjoy Flyover country far more than the slum capital of the world LA. They can not even understand why would so many millions live one on top of each other for a miserable quality of life for most of them!!!….I took my children to CA to visit relatives since they were young and they can not understand why so many millions chose to live in those miserable conditions and traffic and astronomical prices and taxes. I told them that is something I can not answer because there is no logical explanation.

I live in LA and ask myself that same question every day. All it takes is a brief visit outside the city to remember why I live here.

Flyover, if you don’t live in CA, why is it so important for you to prove that it sucks so much here?

Why do you care?

Surge, I used to live in SoCal. I am an investor and SoCal is one of the markets I’m following. That doesn’t mean I want to live in SoCal. I’m always looking just at ROI, regardless if it is residential or commercial RE.

As an investor, I’m looking at the facts and trends.

I hope that now you have the answer.

Apparently you can deduct 10k of property tax, at the one percent tax rate, that is a million dollar home, to go with the related mortgage interest deduction.

Landlords get to deduct unlimited amounts.

Don’t forget the AMT adjustment.

Don’t mind paying more federal income tax, small price compared to the big increase in my stock holdings.

Landlords can deduct any expenses as a rental is treated like a business (which it is).

But the weather is great!

“- An unrelenting wildfire fanned by hot, dry Santa Ana winds threatened more than 12,000 homes in and around Ventura, California, on Wednesday, forcing thousands of people to race for safety.â€

https://www.reuters.com/article/us-usa-wildfires/unrelenting-california-wildfire-threatens-thousands-of-homes-idUSKBN1E011H

The weather in CA is so good that Murdoch lost to flames his $28 mil. mansion 5 miles from the ocean! Very good, indeed!!!…

no, he just loss some small utility buildings, not the main 7,500 sf house. 16 acre property with a number of buildings, it is an old vineyard operation. Murdoch released a statement Wednesday saying television footage showed there may be damage to some buildings in the upper vineyard area, but the house and the winery appear to be intact.

If you can afford to surround your house with acres of well irrigated vineyards, your house is probably OK.

John, the news changed after I posted. I did not make it up. When you posted I read the news and what you say now is correct.

Still, which house burned is irrelevant. The total damage is in billions. It was/is a bad fire.

Much of Cali has a major fire issue going forward if we continue to see extend dry spells and record heat waves. A good parallel to the risk many communities take here are flood zones in other states. In general its seems everyone sucks ass at building to mitigate exposure to common natural disaster risk.

So as usual you have to look into your own risk factor when you purchase a property because the government and local realtors are unlikely to steer you clear of a likely disaster zone…

Tonight, about 8:30 p.m., it was 70 degrees in Santa Monica. I suppose the Santa Ana winds, and the nearby fires, had something to do with the heat. I could even smell the fires.

Nothing says Christmas like a hot December night.

Trickle-Down Theory Existed by 1896

Perhaps, the most famous speech in American political history was delivered by William Jennings Bryan on July 9, 1896, at the Democratic National Convention in Chicago. In part, he said:

“There are two ideas of government. There are those who believe that if you just legislate to make the well-to-do prosperous, that their prosperity will leak through on those below. The Democratic idea has been that if you legislate to make the masses prosperous their prosperity will find its way up and through every class that rests upon it.â€

This is an example of why one should study history. There is nothing new under the sun–including the Trickle-Down Theory. It has never worked, and it will not work this time either

Exactly! Why do Americans believe that giving corporations more money with result in higher wages and more hiring. The same corporations who have extra money during the last decade spent it on stock buybacks to raise thee price of their stock and to raise CEO compensation. Flyover argues that CEOs who follow this obvious plan are worth 1000X the median employee. Hey, I could do that. Make me CEO and pay me 1000X more. I don’t have enough cronies to support me yet.

Sorry Bob! I can’t make you a CEO. You either make yourself a CEO, of your own company, or sell yourself to the board of one companies looking for a CEO. There are companies specialized in head hunting for the best CEO they can afford. It is not enough to be good but you have to know how to network and sell yourself.

I think that those on the board know how to buy stocks. They don’t have to hire a CEO for that. They are looking for a little bit more than that. Since I know the demands for a job like that and I don’t have the stamina and patience for a job like that, I prefer to be the CEO of my own small company (LLC). Since I know what the CEO job of a large company means, I don’t envy those people. That stress level does not appeal to me at all.

Ha! I should have said my network of ultra-wealthy cronies is not good enough to get me hired as a CEO yet. It is purely crony capitalism to make 1000X your median employee. This did not happen when America was Great.

I could start a company and if it is successful could theoretically pay myself 1000X my median employee. The great capitalists who cared like Henry Ford and all of the CEOs when America was great, did not do this.

I don’t see Trump trying to make America Great Again.

Seen it all before Bob,

I told you many times and you refuse to believe that Ford did not raised wages because of the goodness of his heart. That is a well established myth with the left. Ford was first and foremost a business man. He never mixed business with philanthropy. He did philanthropy with some of his profits.

Read more about him. He raised the wages because he was forced by the market like any CEO. If you would care about middle class, you would support the politicians who are against globalism and immigration. Only then you can have the workers again in the driver seat. Come on, is common sense. I am sure you can understand something as basic as supply and demand from ECON 101. Less workers, means higher wages. Harder for companies to move because of higher tariffs for bringing back their goods, means higher production here.

Trump was right about curbing immigration by enforcing the laws already passed by democrats and right about tariffs and to scrap NAFTA and a slew of other “free” trade agreements. Free markets do not need “free” trade agreements, they need government out of the way. Crony capitalism need “free” trade agreements like air. It dies without them. “Free” trade is code word for government to pick winners and losers and is typical of a socialist country. If Trump is going to do that or not remain to be seen. As much as you hate him, at least give him credit for what he is saying even if it is anathema to a liberal.

The face of US corporations is not the stock exchange. The liberals would have you believe corporations are the fortune 500 but nothing could be further from the truth. There are almost 30 million small business but only 18k have over 500 employees. Most corporations have less than 20 employees and those are the entities Trump is targeting with the tax plan. He is attempting to encourage entrepreneurship and an increase in the total number of businesses which has been in decline since the 80s.

And this is a very good thing. I work for a big fortune 100 company, and its level of derp at times is painful. I would love to start my own company and eat their (and other former employers) lunch. They get money shoveled to them not by earning it, but by employing an army of lobbyists that probably have pictures of the pols in compromising positions or promise them a job after theyre out of office – I’ve seen this personally, gov guy writes a contract, sole source to a company and then goes to work for that company making big $$$ while working on his golf swing. Time to MAGA these clowns outta there!

William Jennings Bryan???

You mean the guy Ambrose Bierce wrote this poetic parody about?:

http://www.quotationspage.com/quote/12762.html

Trickle-Down Theory Existed by 1896

Perhaps, the most famous speech in American political history was delivered by William Jennings Bryan on July 9, 1896, at the Democratic National Convention in Chicago. In part, he said:

“There are two ideas of government. There are those who believe that if you just legislate to make the well-to-do prosperous, that their prosperity will leak through on those below. The Democratic idea has been that if you legislate to make the masses prosperous their prosperity will find its way up and through every class that rests upon it.â€

This is an example of why one should study history. There is nothing new under the sun–including the Trickle-Down Theory.

The Personal Exemption in the Senate’s version is eliminated, which is scheduled to be $4150.00 in 2018. The Standard Deduction is $13000.00 filing jointly, $9550.00 head of household, and $6500.00 filing single. A family of 3 or more will have less deductions, under this bill, even if they have not itemized in the past.

Calif. regulations already add $100,000 to the cost of new housing. The insane property values are directly connected to California’s Democrat-Marxists policies on numerous overlapping cost impacts.

1. Open borders and 25 billion spent on illegals medical, housing, education, LAW ENFORCEMENT.

2. extreme confiscatory taxation due to over spending and over promise of Retirements which are never going to be paid as promised, (Democrat payoffs to unions)

3. unsound BONDS requiring the public to pay back in more taxes than the original cost of borrowing. A raise in interest rates will be catastrophic.

I like this part of the tax plan. The corporate give away is a joke as trickle down economics has been proven to be bs (I have lived through the 80s). I think the deductions were a joke and to reward higher home prices was a bigger joke. As soon as this passes I cant wait to see the panic in every bay area home owner bragging about their huge net worth (in home value of course). This will also prevent home flippers and the home bailers who sell and relocate to cheaper parts of the state. Its been a joke for a while and I expect to see prices dip everywere.

“I like this part of the tax plan. The corporate give away is a joke as trickle down economics has been proven to be bs (I have lived through the 80s).”

You must have been asleep if you don’t think the 80s was anything other than an economic boom.

There is no tax giveaway. This is typical socialist thinking, where 100% of the money is the govt’s and they “give it away” back to those who earn it. You are a disgrace.

I think the renters will be disappointed. The requirement of 5 years of principal residence to get the 500K cap gains give will result in much lower inventory. This will push prices even higher with a big drop in sales. Basic supply and demand analysis.

I also think NAR is worried about the big drop in sales. Less homes being sold is a real problem for them. So, they are trying too scare the public with stories telling them their home price will drop. Not true. Don’t fall for that. Prices will rise from reduced inventory. Watch

lol….yeah, we will watch. If the NAR predicts 10% price drops the reality is it will be more like 20-30%. add interest rate hikes and the upcoming recession and you have a crash! Cant wait!

“…it will be more like 20-30%.”

Ha! For the past few years you’ve been predicting a 50-70% drop.

Which is it?

yeah, I am happy to clarify. Prices will collapse by 50-70% from today’s prices when the crash happens. We will see a dramatic pull back in California coming from the tax plan alone. Add interest hikes and the upcoming recession and you have your crash.

Millennial so when exactly do we see the first 20-30% drop, after all the tax plan was already approved and announced.

Keep in mind home affordability for loans does not include any tax deduction.

There has never been a decrease in house prices in CA without a recession.

“Millennial so when exactly do we see the first 20-30% drop, after all the tax plan was already approved and announced.”

Yes, the tax plan was a pleasant surprise. For the decreasing house prices the moron deserves to get my vote.

I would not ask for an exact date if I were you. That’s not how markets work. You have to be patient. But patience pays big time. Buying a house in California is all about timing.

Sounds like you might be renting for a while longer.. lol

“Sounds like you might be renting for a while longer.. lolâ€

Hell yea! What else what I do? Buy an overpriced crapshack during the biggest asset bubble in history? That’d be financial suicide. Why buy and overpay if you get a massiv discount on housing by renting?

Good point on the capital gains angle and also for anybody looking to sell and then buy and stay in California they will lose their mortgage interest deduction because they were grandfathered in so that will cause people to want to sell less and create more of a supply problem in my view (assuming loan is greater than 500k)

My opinion is that is you buy a house at any time. High or low. If you stay in the house for at least 10 years you will be OK. For so many reasons.

I never really understood the resilience of the Mortgage Interest Deduction (MID). When a expense becomes a deduction, that expense is basically being subsidized by the federal government. So why would the federal government subsidize mortgages from private banks? Using this line of thinking it makes more sense to subsidize the states under the SALT deductions than subsidize private banks under the MID. That being said I have taken advantage of both the MID and SALT deductions in the past, but if one had to be eliminated or reduced it’s an easy choice of the MID.

The MID may not make sense to you but it evens the playing field when competing to buy homes, Investors can still claim every deduction under the sun as a business expense–including MID. If individuals can’t claim any of those expenses, investors will be able to outbid individuals and eventually all homes will be owned by the investor class.

Also, if corporations can deduct state income taxes, why shouldn’t individuals also be able to deduct them? What’s the real difference between an individual’s living expense and a business expense? Why should student loan interest be deductible and home loan interest not be deductible? The whole Republican tax plan is NUTS!

Poor Gary doesn’t understand the difference between a for profit corporation and an individual. LOL

Mr. Landlord, most real estate investors are not corporations. They are just average Joe’s who own a few rentals. Half my neighbors own rentals–usually just one.

Pretty sure if this exact tax plan was passed under Obama you would be in full support! Ranting that Repubs who do not want to support it; want grandma to eat cat food.

C’mon……be honest!!!

You GOP dopes, please keep leaving CA. Jerry wants you out. Only the wise are welcome.

“Only the wise are welcome.”

Are those leaving Mexico or So. America for CA wise?!!…Then you’ll fill CA with wise people and the taxpayers “dopes” are leaving in droves for greener pastures. In ten years the CA population increased 10 millions and Sacramento is showing 150,000 more tax payers. Very “wise” dynamic. Yes, there will be lots of taxpayers left to pay for those huge pensions from government unions. Good luck with that! You’ll need it.

I notice that the income from rentals will now be taxed at a lower rate (more like dividend income). That’s a huge bone for the commercial real estate industry. I’d guess then that would push more money into the purchasing of rentals, since the returns will be even higher, maybe offsetting the decline the Doctor is predicting? Either way, this surely is the gold age of the landlord.

Yep, and don’t forget landlords still get to deduct interest and any disposable income increase for renters leads to increased rent.

This is a HUGE boon for landlords.

Everybody knows that renter will be the big winners from these tax plan. More money to save and house prices will drop significantly in California.

Nobody in their right mind thinks either:

A. Rents have not increased dramatically since 2012

B. Renters have been huge winners the past 5 years

And then there is Millenial

small correction:

Nobody in their right mind thinks:

That is it a good idea to buy an overpriced crapshack during this insane bubble.

“Rents have not increased dramatically since 2012” Actually, they have not increased by much since 2009. Most people are still in a recession (financially). The buyer who purchases during this bubble is stuck with an overpriced crap shack. In a job-loss recession he cannot rent it out without losing a ton of money. Also, he cannot sell without losing money. Its better to wait until prices are down 50-70% and enjoy cheap rents until then.

“nobody in their right mind “…

Thank you for declaring the politicians for the past 8 years as not being in their right mind.

Every year they told us there is no inflation and no entitlements adjustment needed.

Personally I know that the real inflation is over 10% year if everything is accounted for: food, electricity, gas, education, health care, housing, etc. I also know that some few people they’ve got the rent staying the same. In reality it is a decrease, because of the loss of purchasing power. The same landlord will have to pay higher prices when maintenance is needed. If they don’t increase rent, they will pay out of their pocket because they do not build enough reserves for future higher prices.

Of course Steven Terner Mnuchin is waiting for the tax plan to go through and then he and his allies will make sure regulations disappear. Wall Street will start up the “make believe we have money” machine again and the market will soar. Wall Street, financial companies, banks, and others will hand out loans like candy, securitize them as soon as they can, and use the money to make more loans that people can’t afford.

When the market crashes next time, it will likely be a total collapse.

Its hilarious and very entertaining to see how worried the housing cheerleaders are because of Trumps tax plan!!! I remember how many Trump fans were telling us how housing will go up due to Trump……and here comes his tax plan which will crush house prices in CA! Too funny!

My wife and I will wait until this ship sinks. Make this housing market great again!

Securitized rent will probably have a boom in the coming years.

I had heard from someone that the change from 2 of 5 to 5 of 8 (primary res. tax exemption) has some loophole for those that need to relocate fora job or medical reasons etc.

IE. Someone can capture the exemption ($250k single, $500k married as before) if they aren’t living in the primary for the full 5 years but move for the above reasons.

Does anyone know if this is true or not? I haven’t been able to find info. on it.

I 100% agree with posters above that it will make inventory even tighter in CA and with less Greenfield and brownfield to build on I think it will have the opposite effect and drive prices here. Just my two cents.

You heard right and you’re looking for IRS Publication 523.

It’s a partial exclusion that gives you credit for whatever percentage of the required time you do have in the house.

The new job also has to be 50 or more miles away.

Though I guess it’s possible that the extension of the exclusion will also effect the partial exclusions.

I’ve already got a job-related out-of-state move planned for next year so I’m hoping this exclusion still applies. 3 years in the house and potentially around $75k in gains if optimistic valuations hold.

Thanks Sam. I hope they either grandfather us folks in or that exclusion still applies. We don’t have any plans of moving but it was always nice having that flexibility if the desire arises.

All the doom and gloom pundits are out in full force. As was said before, the proposed tax plan’s effect on CA RE will be a nothing burger. It actually may cut limited supply even further. The only things that will tank CA RE is either a massive job loss recession or a natural disaster of unprecedented proportions.

I’m still blown away that joe middle class thinks they will soon get bargains on decent CA RE. The rich may say otherwise!

I don’t see how this won’t ultimately result in more upward pressure on low to mid ranged priced housing. It will incentive downsizing by the weather and staying under a certain price point for other buyers. And obviously people will be selling less with a 5 year limit on a tax exempt sale now.

This is about to have the opposite affect that Millennial is praying for IMO. Even tighter inventory coming, higher prices, and an intensification of the market problems we are having right now. In summary, I consider his tax bill to be a total disaster.

I agree. I think prices will rise from the big drop in inventory, and many fewer homes will be sold. NAR makes their money from the number of sales, so realtors will panic.

Agreed. Sorry for all my typos above, I type too fast and don’t proof read it. I’m not as dumb as I appear from my messages. Dumb, but not that dumb.

I think it will further exacerbate this housing shortage and push prices in the old bubbly direction. Millennial I would not celebrate yet, I don’t think this tax bill is going to do what you want it to. You may have to put your recently purchased MAGA hat away now.

MAGA=make america great again by crashing the housing market and economy? I am all in on that. It all points in that direction. my favorite line: Wait, save and see :))

The super moron trump gets my vote if he accomplishes that (of course it will be unintentional on his part. lol)

How is it that tax payers in big tax states like California get to deduct state taxes from their Federal returns? What is the justification for this? Essentially the rest of the country is subsidizing states with high taxes. Again, how is this fair or justified?

Not true, California gets around 50 cents from the Federal Government for every $1 it pays to the Federal Government in taxes. By contrast South Carolina gets $8 for every $1 it pays in taxes. How is that fair?

Here is a chart of who are the biggest leaches:

https://www.theatlantic.com/business/archive/2014/05/which-states-are-givers-and-which-are-takers/361668/

California also releases felons early who can easily go on to commit crimes in the rest of the country, thereby exerting a cost burden on other states. How about that for what’s fair?

When decisions made in Sacramento no longer have knock on effects for other states – especially those which are neighboring – then you can start whining about what’s fair. Until then, watch out for fires.

LOL. The NAR’s stated mission is to help families buy homes. So wouldn’t a 10% price drop, you know, help families buy homes?

I don’t think they are actually concerned about a price drop or a price increase for that matter.

All they care about is transaction volumes.

Transaction volumes will go down. There will be less inventory and less transaction and more landlord owned real estate.

I concur. Less inventory for sure and lower transaction volume. Bubble continues.

True – a professional RE agent can do well in a buyers market or sellers market. During the last RE market collapse, California lost tons of RE agents, probably most of the ones who were just ‘weekend warriors’ (the ones for whom it was a part time job on the weekends). Brokers who are excellent at getting listings always do well.

Yep..

A 1% price increase or reduction only impacts realtor commissions by about 0.025%

A 1% change in volume changes commissions by the full 1%

This is why you can’t trust realtors… well at least 95-98% of realtors

Is there some kind of genetic defect that causes Californians to forget how much their economy is based on bubbles? Remember how bad it was when the last housing bubble popped? Those days are going to return soon enough, tax bill or not. When it does, the people who saved their money will be in the drivers seat. If you can read this site every day and still believe that housing is an “investment,” you deserve what happens to you.

Liberalism is a mental disease.

While I don’t disagree, I do believe that believing in money is also a mental disease.

“Is there some kind of genetic defect that causes Californians to forget how much their economy is based on bubbles”

Californians? You mean whole US do you? And dollar as a currency.

Whole US economy, including the money, is based on huge bubble and the actual value it has, is about 1% or less what it is now. A big Ponzi-scheme if you want, run by FED.

I won’t say it doesn’t have actual value, it is a big economy, but the current value is totally absurd.

California subsidizes the rest of the nation – not the other way around. No state gives more money to the Federal Government than California – $406 billion in 2015 (latest figures I can find), compared to second place Texas at $280 billion. California gets around 50 cents for each dollar they pay to the Federal Government. By contrast South Carolina gets almost $8 for every $1 they pay to the Federal Government. California is not a leech by any standards that are mathematically accurate in spite of what is stated in the first paragraph. California subsidizes the rest of the USA, not the other way around.

What’s not in your numbers is what California costs the rest of the nation in terms of the effects its policies has beyond the state line. It’s simply lazy and convenient to only look at a top line number.

Enough with this nonsense. CA is a 3rd world state where you have a few ultra rich people, a small and shrinking middle class the masses are in poverty.

34%

Of the nation’s welfare recipients live in California but only …

12%

… of the U.S. population resides here.

http://www.sandiegouniontribune.com/news/politics/sdut-welfare-capital-of-the-us-2012jul28-htmlstory.html

How we compare

California is third among states in per-capita spending on welfare:

$179

New York leads the nation:

$256

Idaho is at the bottom:

$17

Tim:

Can you cite your sources, please?

CA is enormously wealthy and headquarters some of the biggest companies in the world.

But I think those tax numbers are inflated. Apple may pay all those taxes as a CA company, but just because the books are completed in CA doesn’t mean all the money’s there.

Maybe Apple should put “Accounted in California. Booked in China.†on the back side of their financial statements.

I agree with comments on this board that the tax law will increase the number of renters relative to homeowners. All those renters had better invest well or they will never retire.

Exactly, buy a house at a peak or low, and hold for at least 10 years, and you will have a fixed expense both in mortgage and property taxes in CA. Buying at a low is preferable but the key is to hold for at least 10 years. At that point you will have the option to sell at a profit, or stay with a fixed housing expense until you are old or dead.

My mother is in a house she bought in 1976 at a local peak (The midwest relatives said mom and dad were crazy at the time.).

Today, Mom has paid off the mortgage and has a $2000/year, yes per year, housing expense.

True, she still has 1980’s flooring and kitchen, but it is home to her.

Her neighbor who is renting, is paying $3500/month. Yes, per month.

The moral of the story is buy a house now and stay. You can stay forever in CA.

As an add-on, that 2000/year is 1300 in Prop 13 property taxes and 600 in insurance.

Her midwest neighbors who did the same in WI without Prop 13 are now paying much more per year.

Prop 13 is a firiend d to anyone who buys a house.

Bob, it’s been over 40 years since 1976. The variables and values have changed dramatically since then. Your mother simply got lucky on timing her birth year and should be thankful younger people are subsidizing her lifestyle. Prop 13 is going to be toast long before another 40 years passes.

I should have also added that along with Prop 13, high inflation is your friend when you buy a house.

Inflation was very high in the 1970’s and 1980’s.

Most predict that inflation with become officially very high again in the next few years.

My mom had a 6.5% mortgage, inflation was at 10% and savings accounts were paying 9%. They had no reason to pay off their loan.

Buying a house with a loan at the lowest rates in US history (4% is an obvious decision.

Prop 13 will likely be hard to overturn.

Bob

Here’s the thing, Bob. Your mother is already paying for it in the form of increased crime, congestion, cost of living, homeless people knock on effects, decreased quality of services to property tax paid ratio, and so on. Prop 13 is already being technically overturned, just not on its face, that’s all. Productive and reasonable people are getting the fuck out of the area, leaving your momma to be increasingly surrounded by a bifurcation of despair and decadence. The smell of urine and money. Overturn that.

That sounds grim.

However, in Mom’s neighborhood, the Millenial couple renting for 3500/month seem nice and are successful. The other neighbor just sold their house for $700K and seem nice and successful also.

I don’t know where they get the money. Maybe Bitcoin?

CA has the highest wages and greatest job growth in the US.

It must be the liberals causing so much success.

It’s duly noted how nice people overpaying for basic houses has nothing to do with a decreasing quality of services and living to price ratio.

CA also has the highest number of poor people on welfare along with a bunch of other less than desirable rankings. Other states rank lower on unemployment. Other rankings completely debunk your job growth claim. Oh well. Not sure why you’re bringing the liberals non sequitur into the discussion.

But Avi1985, people paying 1% property taxes on an overpriced $1M house are now paying 10K/year in taxes. The same house in Flyover Country may be 100K with 1K per year in taxes. CA should be collecting nearly 10X in taxes for better services. I see this with better bike lanes, trails, recycling, etc in CA.

We will likely one day swing away from prop 13 since all things tend to fall into a tic-toc progression. But there are down sides to both extremes.

There original reason for prop 13 remains valid today. Its keeps the elderly from being priced out of a home do simply to inflation in their home value. Which was historically a real problem from my grandfathers generation.

Clearly as California home prices and income taxes demonstrate though, there are some downsides to giving up the property tax cash cow.

“CA has the highest wages and greatest job growth in the US. ”

Yes. True by itself but not even near of whole truth.

“Highest wages” for very small elite (<1%) for compensating highest cost of living, resulting no more than mediocre purchasing power and "greatest job growth" in low-income and part time jobs for poor and illegals.

None of those jobs pays enough for living, of course. That's the whole idea.

Telling partial truths is standard method in propaganda and here we have a glorious example of that.

Not only can pay be a little to a lot higher in major cities of California. California is almost too big a state to look at as just one big mess. Our major cities can be attractive if you have the right occupation though because our pay scales for those people are in general higher than competing cities.

The problems Californian cities are facing with housing bubbles are similar in many major cities which are seeing tech booms. Dallas and Austin are in the midst of massive housing price increases with a totally different philosophy on business and taxation. One major common reason is an explosion of good tech jobs outside of just coastal regions and San Francisco.

Though its clear some of Cali’s unique policies are making this problem much worse and more difficult to solve than in other states.

On a previous thread, I posted a beautiful Brentwood house on Gretna Green, which was offered for $2,795,000 (along with plans & permits for a new house).

A nearly $1.1 million markup from its previous sale in 2013.

Several people confidently predicted that the house would sell at that price, or close to.

NOT!

The house failed to sell: https://www.redfin.com/CA/Los-Angeles/853-S-Gretna-Green-Way-90049/home/6760373

Maybe there is a limit to what house humpers are willing to pay.

Here is one that took some time and a few price cuts … in Manhattan Beach. Several years ago, this would have been snapped up in a week.

https://www.redfin.com/CA/Manhattan-Beach/229-8th-St-90266/home/6711791

Looks like the house was taken off the market. That’s not a bad move on the seller’s part. Nobody in their right mind would want to jump through all the hoops of buying/selling a home during the holidays…this is why sales volume takes a nosedive from Nov-Feb. List the house in March or April is a much better proposition.

They may not get their exact price, but I bet they will get close to it!

Even though renters will see an increase in the standard deduction, everyone is losing the $4,100(2017) personal exemption deduction, so the average family who uses the standard deduction could see taxable income rise as a result.

States with no personal income taxes (Texas, Florida for example) have very high property tax rates in the 2.5-3% range. As a result, they may be more affected by the limit on property tax deductions to $10,000 than the high tax state like California.

I live in WA that has no state income tax. And my tax bill is well under $10K, for a house worth about $700K.

Regarding housing values in California, mortgage loans are based on your adjusted gross income, not taxable income or income tax deductions for mortgage interest or property taxes. Factors like interest rates, housing supply, and location have a larger effect on price stability.

True, but part of the buyer’s calculation (and the seller’s pitch) is that your taxes will be reduced. This factor is now partly removed from that calculation.

Most people have no clue to how to preprly calculate tax advantage of owning a home

Wasn’t there just an article not long ago on this blog about how Los Angeles is now predominantly a rental urban area? And, hasn’t there been ongoing articles about how California’s coastal cites are unaffordable to most? So, who’s complaining about a potential decline in housing prices? Is it those who took a big risk and bought at these insane prices? Or, is it the little retiree who didn’t have enough sense to capitalize on that equity while they had a chance? Or is it the landlord afraid if housing prices retreat, he will also have to lower the rent? I’ll bet all the ‘under-the-table’ low wage help who cleans you home, washes your clothes, does your gardening, or does all those repairs around you property would love a little break in their rent! Californian’s appear to be hypocritical! A realistic downward adjustment in real estate would be a good thing for those just hanging on, might put a few dollars more in the pocketbooks of those just hanging on! Oh, but what happened to your bleeding hearts …

The big secret is that even coastal California leftists don’t want to pay more than the next guy, including taxes.

Just returned after mandatory evacuation. It’s absolutely nightmarish here in SD county. Never experienced anything like this in my life. Could see a horizon of orange flames, power and street lights out, roadblocks, closed freeways, animals running free, it’s almost apocalyptic. My home is fine but others not far are burned to the ground. Many people still can’t return to their homes. Firefighters are doing a great job protecting homes and getting this huge fire under control.

I was just in Santa Barbara and its a nightmare. I think people are underestimating the damage – psychologically – these fires have on the housing market. Theres been so many of them in the past few years (all under libtard control, btw) that people must be starting to question the sanity of living in a desert with 10s of millions of mostly idiots.

And dont forget, Mel Watt is still in charge of housing and is doing everything he can to expand the bubble. You dont think when it bursts (and it already is leaking) that Trump wont use that opportunity to get the govt out of making home loans and hammer prices down to where people can actually afford a reasonable home – and not in a flood or fire prone area?

Millenial and others will be able to build a life and the parasitic (mostly) boomers will have to come up with other ways to make money. Too bad too many have little intellect and work ethic in that cesspool state.

I’ve seen many monstrous California brush fires over the decades, but this spate of conflagrations is like nothing I’ve ever seen. . Someone very near and dear to me lives way too close to the 405 and the Santa Monica mountains, and almost had to evacuate.

I can’t imagine that these fires will do anything to ease the inventory shortage, to say the least. So many people rendered suddenly homeless. My sympathy to everyone affected. Stay safe.

Its much more fun and way more profitable to buy Cryptocurrency than overpriced houses.

Invest in the IOTA….check it out. It’s gonna skyrocket.

Republicans are so clueless. They are sociopaths. Hillary was absolutely correct to call these idiots deplorables. What make America great again is to vote for these pro-Putin Trump useless Republicans out of office. They are wasting taxpayers money. That traitor Flynn should not be collecting retirement pay. He belongs in prison just like Trump and his crime family.

Did you drink too much last night?

Still dreaming of having a felon in the WH? One part of the Klinton Kriminal Klan? Did she share with you from her uranium dealings? What about Rich Seth and a list of a dozen “suicides”?

Go back to your booze!

“Still dreaming of having a felon in the WH?”

A good one, this. But unfortunately Mr. T. and GOP isn’t any/much better.

Remember GOP blocking any judge nomination in later Obama-era and now huge hurry to fill those vacant places with corporate shills who have no idea of how court operates?

That’s a long term con if anything: These judges will sit until they retire.

Clinton is a short term stupidity, this will harm citizens tens of years, much, much more dangerous.

What is up with the Democrats. Typically, power switches back and forth between Republicans and Democrats. That is only fair as everyone in the country gets what they want some of the time. Now, we have Democrats who think they should be in power 100% of the time. What the heck is wrong with you? You have seven more years to get a Democrat back in the white house … so just calm down and wait your turn.

“Typically, power switches back and forth between Republicans and Democrats. ”

That was the old way: The current way is that GOP freezes judge nominations at all levels when a Democrat is in precidency and then fill all of the vacant places when they get the power, fixing the power inbalance for tens of years in the future.

Very convinient permanent power grab from GOP.

Thomas is either delusional or he got his political parties mixed up.

Since the Clinton and Obama regimes, Democrats implant their leftist deep state cronies into all branches of government. Democrats in Congress then freeze or block ALL of President Trump’s nominees to the judiciary and agency departments. Democrats then they fill the vacant places when they get back into power.

Very convenient power grab by leftist totalitarian Democrats.

You mad bro?

These pro life freaks only care about the fetus. Once the child is out, they can careless. Conservatives are control freaks. They claim that they are for smaller government. In reality, they want to control our private matters from sexuality to privacy.

How much does the Soros organization pay you to troll, Pro America ?

Check, or automatic deposit? By the post, word, paragraph or sentence ?

Or could you not “careless” ?

Try posting something substantive next time.

The butt hurt. It burnsssss.

Food for thought:

https://www.cato.org/publications/commentary/great-18year-real-estate-cycle

I don’t believe an 18-year cycle is the norm any longer, as the table seems to indicate the cycles are becoming more irregular. But what if the average really is 18 years peak-to-peak? It brings up a question for our resident perma-bears:

What happens if it continues the upward trend by going up another 70% over the next 7 years (a very conservative estimate for a bubble area, considering the increase in LA in the last 5 years), and then takes another 2 years before you finally get your 50% drop? You will have waited 9 years for a savings of 15% off today’s prices. Sure, 15% is better than nothing. But is the TIME worth it, when you factor in what would have been 9 years of principal payments, or 9 years of rent increases? (I mean rent increases that happen in the real world, not M’s magic land.)

No, I’m not advising anyone to buy today in a bubble area. It’s purely hypothetical, considering there is no way to solve the equation except in hindsight.

Big Crash is coming. Every bubble pops. RE bubbles in California move in 10 year cycles. Pretty simple.

The tone on this website has really gotten nasty. Can we disagree without calling names?

Agree with you – very hostile, often horrid atttitudes – anti-Semitic, racist – how is this a discussion of housing prices? The theories are absurd 90% of the time – too many specious arguments and rants from the “I hate California†club. I’ve followed this blog since before the last bubble burst and it’s shocking how cruel it’s become.