The Orange Housing Bubble – Orange County still largely in a housing bubble. 5 charts looking at income, employment, and housing costs. A $100,000 county wide price drop and prices are still inflated.

Orange County still carries the most expensive price tag in Southern California housing. Yet simply having a high price tag doesn’t mean prices are justified. Recent data shows that home sales in Orange County are now down over 10 percent on a year over year basis and the median price has collapsed from its peak. I wanted to dig deep into the county data to see whether a housing bubble is still present in Orange County. Using a variety of metrics including income, employment, and housing costs Orange County is still one of the most inflated areas in the country. We have shown million dollar homes taking million dollar price cuts. The correction no doubt is in full swing. Yet Orange County is a large area and we can only understand it better by looking at each data point and compiling it all together into a holistic overview. Let us examine 5 charts showing that Orange County overall has one of the most inflated real estate markets in the United States.

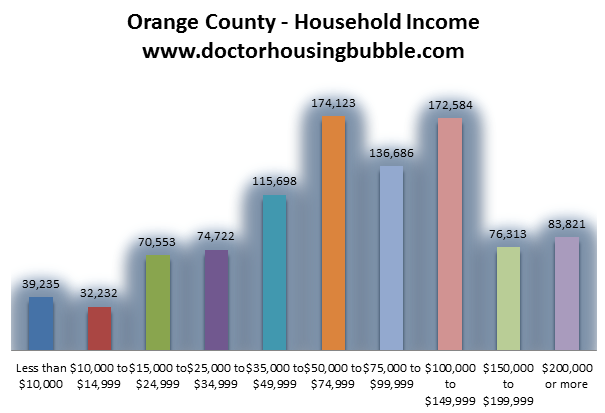

The amount people spend on housing in California is astronomical. Let us first look at how much households that own homes in Orange County spend each month:

Source:Â Census

41 percent of OC homeowners spend 35 percent or more of their household income on housing. Keep in mind that 35 percent of income is the upper-range if we are looking at entering a home in a more fiscally disciplined environment. The Census only goes up to 35 percent but it is likely you have many families spending 40, 50, or even 60 percent of their household income on making that mortgage payment. Especially with the current economy, you might have a dual income household that is now down to one earner or with one earner with a depressed salary. What this chart above shows is that even if a county can have a relatively high income distribution it does not justify high priced housing across the board.

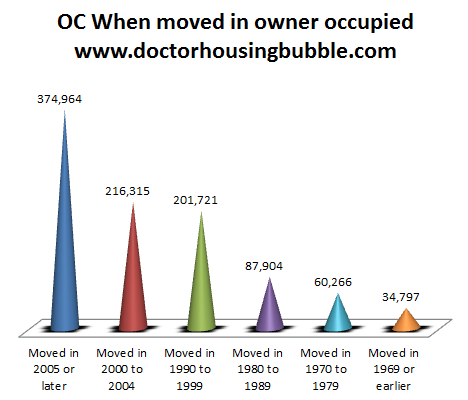

Let us examine the income distribution of households in Orange County:

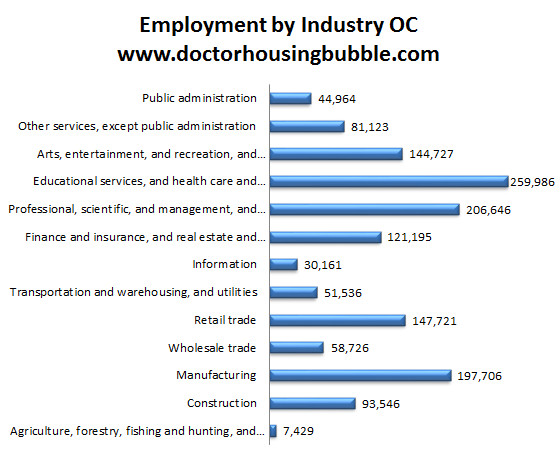

The vast majority of households in Orange County make between $50,000 and $149,999. This is a very wide distribution. The actual median household income for Orange County is $71,000. The $100,000 to $149,999 range doesn’t reflect the distribution all that well because you have the bulk of families hugging the $100,000 range (i.e., two income households). For Southern California Orange County is a wealthy county overall. Yet an interesting point to note is the massive number of two income households. For example OC has 975,000 households yet 1,445,000 people are actually fully employed:

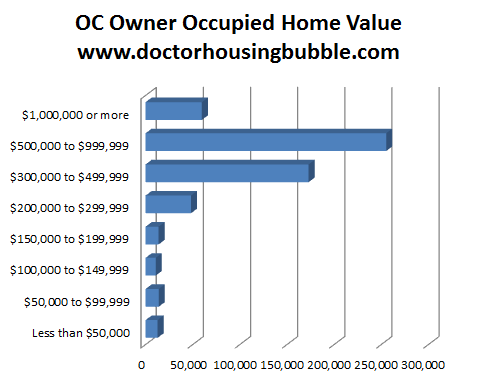

A large number of people are employed in education, health care, and manufacturing. These are good paying professional jobs but certainly not enough to put you in the $200,000 range which is what is necessary for buying many homes in Orange County (the above income chart reflects this). 8 percent of households in Orange County actually make $200,000 or more a year. Yet when we look at the cost of a median priced home we see why so many problems exist and will persist in the market:

Keep in mind the above is for 2009 and is averaged out for the year by the Census.  According to the latest figures from Data Quick the median Orange County home price is $435,000 (for the last month of home sales). This is nearly $100,000 lower than the Census figure for 2009. The bulk of housing in 2009 in the OC was valued between $500,000 to $999,000 yet the median household income was only $71,000! This is part of the SoCal housing bubble that is now bursting in a second round lower.

If we look at the actual household income one would need a household income of $150,000 or higher just to be in contention here. Only 15 percent of households have this in Orange County it is likely many already own given the homeownership rate for OC is 60 percent. 53 percent of all owner occupied housing was valued at $500,000 or higher yet only 15 percent of actual households can actually afford this payment. This disequilibrium is why with recent data we now see a county wide price decline of $100,000 in one year.

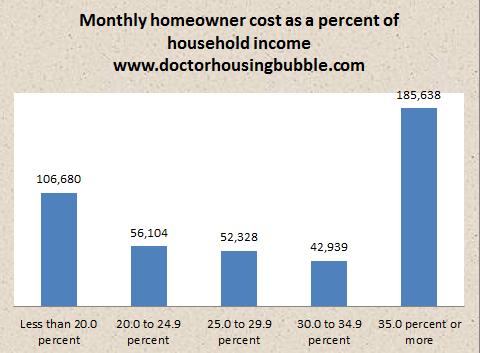

Many people bought during the housing bubble as well:

So what you have is many people living in homes spending a large amount of money on their mortgage yet were only able to buy in the go-go years of the housing bubble. What the data reflects is that many of the current owners would not be able to afford their home in today’s market where incomes now need to be documented more fully and standards have become more normal. I don’t like using the word stringent because standards are still flimsy with FHA insured loans and only needing 3.5 percent as a down payment. Are things tougher than a few years ago when anyone could get an option ARM and jump into a $700,000 McMansion without documenting income? Of course but that doesn’t make the current environment stringent. If anything, on a longer historical perspective it is a relatively easy market for money. Mortgage rates are still near their historical lows and down payment requirements are a joke with FHA insured loans. The problem of course is one of income and the Federal Reserve gimmicks are merely trying to wash over things with cheap debt and not addressing the weaker situation for middle class families.

It is abundantly clear why Orange County prices are falling and sales have collapsed. The county like many in Southern California is still largely in a giant bubble. If rates even go up by say 2 or 3 percent (still below historical norms) the market will take it directly on the chin. Why? Because people are already stretched thin at the moment even in a county with “high incomes.â€Â I know some will say “well this area has great schools …†and I get these comments even for areas in Los Angeles. The schools were good in 2000 as well. It wasn’t like they just realized schools were good there. And we have hundreds of counties around the country with good schools that have moderate priced housing. So this is just more emotional reasons to justify current prices. Emotions do play a big role in buying a house, that is a fact. Yet what we have now is an actual buffer (aka examining incomes) and this is showing that people just don’t have the money to support current prices. I’m sure everyone would like a $1 million home but that isn’t how the world works. Is there a premium for good schools and a good neighborhood? Of course! But this is like saying “since this is a BMW it needs to cost $70,000 more than a Chevy.â€Â Well okay, but do you have the income to back it up and not “own†it by merely going into massive debt?

Yes, incomes are higher than other areas but that does not mean home prices reflect value in home prices. Run the numbers with a ratio:

2010

$435,000 (median price) / $71,000 (household income)Â Â Â Â Â Â Â =Â Â Â Â Â Â 6.1

2000

$250,000 (median price) / $58,820 Â Â Â Â Â Â Â Â Â Â = Â Â Â Â Â Â Â Â Â 4.3

This is just one way to measure cost relative to income and even after the $100,000 price drop and many more tens of thousands from the peak home values are still in a bubble in Orange County. In other words, prices will drop or incomes need to go up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

48 Responses to “The Orange Housing Bubble – Orange County still largely in a housing bubble. 5 charts looking at income, employment, and housing costs. A $100,000 county wide price drop and prices are still inflated.”

Testify! I have been waiting here in Foothill Ranch for 5 years! Finally, we are seeing homes in the 450K range. Still about 35% too high, UNLESS you have 2 incomes and both people make 150-200K/year, which based on this study shows me that is very unlikely. You may have 1 income in that range, but 2 is very, very rare for a family. Even then, what is the true cost to the family? I can guarantee that the rare family with 2 incomes earning 400-500K does not have both parents at home 24/7. You may have one that stays home and earns that kind of money, but the other is going to be traveling, at the office 16 hours a day, working weekends, etc. I know a couple of these types, who are lawyers. Let me say, working weekends, esp. Sunday for twice what I make is not worth my life or time or freedom.

I realize this is all about choices, but the point I am making is that Docs numbers bear out what I am seeing. I also notice that there are quite a few people living in these homes, usually mom/dad/grandparents. How much are the grandparents kickin’ in for the mortgage?

In the end, this bubble must burst too. When you compound everything I have mentioned with maxed out CC’s, student loans, car loans, HELOCs, etc. you have a recipe for financial armageddon. I know, I know, not everyone has all the debt. The reality is many do and this bubble will only end in pain!!!

What? Prices are still way too high, true. But you don’t need a $300K – $400K household income to buy a $450K house. Let’s not get carried away.

We spent over $400K for our new house 10 years ago. During the stupid days, it was valued at $900K. 250K would be just about right.

This blog is always so spot-on, and one of the ONLY sources of sane assessments of the OC housing market, which is– yes!– *still* in a huge bubble. Thank you for confirming that I’m not totally out of my mind when I go to view some stucco tract house that looks exactly like every other stucco box on the street, and I choke on the close-to-$300/sq.ft. price. I have about 30 properties on a watch list in specific neighborhoods that I like, and just in the past two weeks, I’ve seen so many price decreases of $50k, $75k, $100k. I told my husband, “I think the upper end is *finally* starting to come down.”

I hate it with every bone in my body, because I really miss being a homeowner, but after reading this, we’ve decided that we’re just going to find a nice rental home and lock in a 2-year lease and keep our money in the bank.

Trapped homeowners can come up with a million reasons why “this time” the market is different.. but in the end when bubbles pop they always overshoots to the downside, then eventually reverts to fair market value (about 1999 prices when adjusted for inflation, or 3 – 3.5 times household income).

Along the way there are usually “bull traps” that occur which give false hope that the market is returning, or at least basing for a while, but these are just temporary pauses in the larger downward leg back to pre-bubble prices.

Homeowners don’t want to hear such things, just like they wanted to believe their Nasdaq weighted portfolio from late 99 onward was just in a “temporary pullback” You can’t fight history, and history (the market cycle) is on the side of renters/cash reserves for the time being.

For demographic reasons, the trend line even in 1999 was already a multi-decade-long bubble. The fundamentals of that year will never exist again in our lifetimes.

If you look at the trends over the last couple centuries, we’ve been in a long-term bubble for at least 65-70 years. There is no such thing as a “new normal”. Today (and continuing for at least another couple decades), every fundamental that created this situation is unwinding. We haven’t seen a fundamental-based bottom in nearly a lifetime.

It looks alright now, but reality will start setting in soon. The 70s-80s crises and recession was an effect of demographics, the 90s and 00s were also an effect of demographics, and the very recession we’re in now is the leading edge of the exact same demographic wave. This progression will leave us in recession for decades and will cause continuing housing value drops, which will slowly accelerate until it surpasses current fundamentals and overshoots by a large margin.

It’s either this or a Weimar Republic style hyper-inflationary collapse that’ll have similar ultimate results. The stickiness of incomes in our society that is so disconnected from production causes a strong resistance to this kind of inflation. Only direct payments to

Eric, I agree, “Wei mar Republic style hyper-inflationary collapse that’ll have similar ultimate results. “. (As a side bar, remember what happened in Germany after Wei mar.) The reason for the hyper inflation is to save the banks. We sheep will be sacrificed to save the banks.

Christmas Wish List:

#1 – The addition of a comments section for individual properties on Redfin and Zillow where I we can heckle insane, pie in the sky sellers and realtors with posts like: “Why would I by this piece of junk when I can get the Granite Kitchen with another half a bath and 100 more square ft. one block away for $50,000 less … MAYBE YOU SHOULD LOWER YOUR PRICE!”

2nd this!

~Misstrial

Thanks for this one DOC… OC locals are “true believers” and think I’m a nutball when I say the OC housing market is unsustainable. I’ve had to find my own way to live your masthead “Love SoCal/OC and Forget the housing Bubble” or I’d go insane. Heck, I left for 2 years and moved back. Maybe someday soon, I’ll be able to afford a house here!

Well Said OCD Dan! Very well said! There currently is a recipe for financial Armageddon. Housing prices are in the stratosphere, and the economy is in the dumps. Jobs are scarce. Houses are way-overpriced in places like California.

You know what will absolutely crash housing prices? Rising interest rates (as in 6, 7, 8% or more). Housing will get slaughtered with rising interest rates!

Banksters and Governmentsters have artificially propped up housing prices. This will end up exploding in their faces.

Great info. I live in Santa Monica (renter), and we are currently looking in Laguna Niguel. In the past two weeks, we have looked at 11 homes. 7 were vacant, 2 more were still occupied but short sales.

9 out of 11 (82%) were distressed sales! We aren’t necessarily looking for a short sale/foreclosure. Its just what is going on down there. Even our Realtors say that something very baaaaaad is going to happen. they suggest lowball offers, or waiting.

There are several “real home of genius” locations around the OC. Especially in areas of Orange, Yorba Linda, Anaheim Hills, and Costa Mesa. I’ve been waiting for the Doc to post about the OC for quite a while. I’ve lived here for the better part of my life and would like to own a home here moving forward, however I can’t justify it as a responsible purchase until there is at least another 15-20% correction.

we live in ventura, and have been waiting housing to drop for 6 years in apartment..how much longer should we wait? sign

I suggest at least one year – give it time for the economy to do its work on stubborn homeowners.

Whether or not a Republican Congressional House can do much in the way of repair remains to be seen. You do not want to be caught in a mortgage should things go further south.

~Misstrial

Nothing is free. A safe assumtion is it costs $200 per square foot to build / construct a house. 2000 sq feet = $400,000. Today i owe $400K on my 2000sq ft house. so I think I am not over-paying, nor under-paying, but I am just staying put, waiting for hyperinflation to kick-in over the next decade, when $400,000 will be chump-change.

I’m not sure $200/sqft is a safe assumption. (Acutally I don’t particulary thing any assumption is safe, but that’s another argument.) Areas of Corona bordering the OC are hovering around $130-$150/sqft. In areas of Anaheim, Orange, and Santa Ana the after is also below $200/sqft. Given, the beach areas are substantially more, but these are fringe properities that don’t represent the county as a whole. Also take into account houses that were built decades ago. . . . .they sure as hell didn’t cost $200/sqft to build. There isn’t a magic number for $/sqft. Even new homes are priced largely on current market trends. Simply put, the $/sqft of a home is related to what the market can afford. Based on the Doc’s numbers, in 2000 the multiplier was 4.3, therefore a 2000 sqft home should only be worth $152/sqft on average in the OC. So $200/sqft might be a good assessment if you live in a good area, but $125/sqft might also be a good assessment if you live ina crappy area.

Good point.

If they can build a house for 80.00 a square foot including the land AND sell it for a profit in Phoenix, it is very much about what the market can bare.

I know the costs of building are much higher in CA. but Phoenix proves they could go lower.

200 per sqft is still relative number. It would include cost of land + cost of building.

Cost of land must be very high in OC area which is based on hype. It can come down once hype meats reality.

Cost of construction would not be very high. Otherwise how would you get houses less than 100 per sqft in texas and many other part of US???

Dude – $400,000 to construct a 2000 square foot house???? Sorry! No way. That is a gross overstatement (overestimate). You’re thinking housing bubble RIP OFF PRICE, Mister. That’s the “take ’em to the cleaners” price. Try $200,000, max. MAX! But you may be right – hyperinflation may make your house be a $1 million or $2 million house.

I think his point was including land too. You can’t get a postage stamp for less than $200k if you want to buy raw land. Plus you have to include building costs, permits, grading… many GC’s will tell you the cheapest you can build in CA is $125/sq ft. Building costs in CA are MUCH more expensive than the middle of the country due to environmental, code, and worker’s comp regulations.

tl;dr – building a home is more expensive than buying a used one

Call a contractor. They were charging up to $400 per sq feet during the boom for new construction/remodel work. Yes/true their cost was around $110/ft, so the $90 is their margin. I KNOW, I managed my project myself and it cost me almost exactly $110/ft. to build. Permits alone were nearly $10,000. Engineering, archetecture i all did myslef, but that costs $100 and hr easy. $80 / ft is a reasonable floor, assuming illegal labor, low-end materials, and fixtures, no extras.

From what I understand hyperinflation, which generally occurs during a currency collapse, would not cause your house to rise in value. In fact, because resources needed to survive, i.e., fuel, food, will be rising rapidly, you would need to allocate a disproportionate amount of your income merely to survive, meaning house prices would decline further. Not to mention that people in survival mode aren’t going to be spending a lot of time at open house (unless there’s free food).

The price you pay is not bad but your estimation on ‘building’ is completely wrong. The price per square fee has nothing to do with the act of building a house. Square footage is an estimation for what a place will be in a certain city. A realtor tool. Most houses are old, that alone tosses your theory out the window. Construction 10 years ago is not even close to today. And why would a house from 1960 be expensive based on your theory? Should it not be dirt cheap since labor and construction was far less back then?

I am clear on price per square foot to build, versus price/sq foot sale price are 2 different things. Will you build me anything for less than $100 per square foot? If so, I want your number and will hire you tomorrow!!

Splendid analysis Dr. HB, you always have such a deep understanding and honest approach to this subject. I wish, media will consult you, but you are bruttly honest and march to your own (much appreciated) drumbeat, that’s why they will always avoid you, which is most unfortunate. Keep it up Dr. HB, always look forward to your analysis.

I’m about 90% sure most affluent areas in OC will not fall much further. I have been renting in Yorba Linda for 3 years and have seen the value of the condo I’m renting stay the same and go up a little over that time. Unemployment here is low at 6%, and there’s lots of people here with a lot of money.

an accepted very low-ball now would be great…but frankly, I’m perfectly willing to wait for the coming interest rate rises 1 to 2 years from now. Provided that lending practices remain tight and there isn;t a magical jump in incomes, we’ll see housing prices really deflate. Higher interest rate/Lower Purchase Price = Future Equity (for the patient)

That’s not true historically speaking. There is no obvious correlation between interest rates and the price of housing.

http://www.calculatedriskblog.com/2010/09/mortgage-rates-and-home-prices.html

“The historical data clearly demonstrates that there is no such correlation [between interest rates and price].

I’ve tried to explain this several times in several different ways. Price is what you pay for something. Interest rates are related to how the item is financed. Some people pay cash for a house. Would they pay more because interest rates are low? Nope.

Imagine just one buyer gets a special interest rate. Would that lucky buyer be willing to pay more than all other buyers for the same property? Nope.”

Dude, with all due respect, you are so full of it that I don’t know where to start. Go back an LOOK AT THE GRAPH, especially where the housing bubble exploded (when home prices went into the Stratosphere). What caused it? VERY LOW INTEREST RATES, along with free credit (home loans) to any donkey who walked into a bank.

http://economix.blogs.nytimes.com/2010/09/07/mortgage-rates-and-home-prices/

Go check out my favorite mortgage calculator (below) and crunch some numbers. Enter $500,000 as a loan amount, and enter 5% as an interest rate. Then change the interest rate to 8%, then 12% then 18%. See how much the mortgage payment increases. Is anyone naive enough to think that higher interest rates will not hurt housing prices? Of course they will, especially with housing prices still in the hangover phase (housing prices still artifically high in many places) of the housing bubble. I imiplore you to enter a home price into the mortgage calculator with increasing interest rates to see how drastically mortgage payment rise with increased rates. Does it matter? – of course it does! See if you can afford a $400,000 or $500,000 dollar house at 8% (or 12%).

http://www.drcalculator.com/mortgage/

As I noted in another comment in this article, interest rates were as high as 17% to 18% in 1981 and 1982.

http://www.freddiemac.com/pmms/pmms30.htm

Data can be read so many ways, which is why half the economists are wrong every time.

Maybe people were getting less house for their money as interest rates rose. If you have $2000 to spend on a mortgage, and more of that money must go to pay taxes, housing prices have actually dropped. Instead of granite counters people get tile, or single vanities vs double.

Or maybe those numbers stayed constant because as suburbs developed in cheap areas, it kept the average down, for every sale in West Hollywood or Manhattan. Who knows?

What we need to see is per zip code effects (or lack thereof) from rising interest rates over time.

I do think that using all cash buyers in the discussion is a bit misleading, because the last I heard, the vast majority of people buying a house have a mortgage.

Surfer, Yea and Santa Claus will come to your house this Christmas.

DOC: Which Source are you using to find median household incomes?

All: Is it just me or has anyone else noticed that 30 yr fixed mortgages jumped from 4.2% all the way to 5% in a really short time??? I think it was a few weeks, maybe less than 1 month.

You definitely aren’t the only one that noticed. If I were a buyer in this scenario, I would discount any offer by 10% just to take the interest rate rise into account. I would make sure the seller is aware of this also since most sellers are still in fantasy land.

Regarding the OC, I still see a 10 to 15% decline in premium areas. The doctor’s article pretty much summed up the many reasons for that. Every city is different, some prices will be more sticky than others. Rent, save money and go have fun in 2011, check back in during 2012 when things could get interesting.

I rent a house in Corona del Mar, built in 1969, with beautiful 180 degrees ocean view, 3 bedroom, 1800 sf, 3 car garage, 7000 sf lot, very well maintained (new kitchen, dual pain windows)… for 4000 Dollars a month. Same age homes with same lots, but without ocean view are selling for 1.4 Million, and those with view like the one I am renting for 2 Million. There are either still insanely rich people out there or insanely mislead people…. go figure…

Thanks for the great assessment of the situation in OC. I’ve been house hunting & following you for about 2 yrs now. I think we are finally jumping into the market. Found a house in an area selling for $300/sf that we are getting for $200/sf. I figure we’re a pretty safe bet against an additional 30% drop. Also, while it is true that as interest rates rise, you lose equity, with FHA you have a transferable loan, so you should be protected against rate increases (though transfers are bound to be difficult to put together).

–

I do believe we should see 15% – 30% further reductions, but the wildcard is government support for their crony bankers. These bankers aren’t dumb (crooked, yes, but not dumb). They will find a way to extend and pretend as long as their gov cronies play along, which as far as I can tell is indefinitely. With this external influence, prices could stay right where they are for the next ten years until inflation catches up (just look at Japan). As long as banks have enough cash to survive, why foreclose & sell a house at a lose that is carried at full bubble value on their books?

–

That’s why I’m jumping in now that we have found a deal that should be ok whether prices drop further or not. My recommendation, learn the market in the area you like, look for deals, make low ball offers, also use gimmicks that help the bank out like higher pricing, in return for a 3% kickback toward close (they like this as it keeps pricing higher).

Yes, there are plenty of folks with lots of Mula in Yorba Linda, but that can be said about any city in Southern California and that is not enough to justify high real estate prices. Historical prices in Yorba Linda have always been higher than bordering Riverside, Corona by about 20%; currently they are higher by about 30-40%. Result=Yorba is overpriced by about 15%. An average asking $600,000 home should only be about $510,000 then in order to sell buyer should always be able to offer 5 to 10% less which brings the $510,000 to $475,000. In Riverside Corona, same home can be bought for about $350-$370,000 which is approx 20% lower than Yorba Linda. Some areas have dropped faster than others, but most likely they will all drop in due time.

Yes, something very bad is gonna happen (in real estate). Prices are going to come crashing down like a locomotive falling from heaven. Mark my words. We are in an absolute, unsustainable real estate bubble. The real estate market is like a heart attack patient in the ICU. It’s deathly ill. Heart is still beating. Blood pressure is present, but SOON ENOUGH, it’s GOING TO FLATLINE. And when it does, the patient – the housing market – is going to DIE/KEEL OVER/KICK-THE-BUCKET/BITE-THE-DUST.

More california dreamers here than realists.

OC prices will always be high, it’s an excellent place to live for the already rich or upper middle class.

Averages and income only tell a portion of the story. Why don’t you consider the many people who earn 100K and have 500K to 5MM in assets? The rich move to the nice areas if you are middle class you can live in north OC where the most teen girls are pregnant.

So keep waiting dreamers, california writes songs about you. And the song ends where ca ruins you.

If you think I am wrong then it’s very likely you have no clue about the people who desire and live in the nicer areas of OC. Most don’t pine on the internet about home prices, they are out starting businesses and earning more money. That’s why it’s a republican area in a state full of very liberal democrats.

Excuse Me Sean – I am quite the realist and I study economics and business every single day. Housing prices in places like California are WAY TOO HIGH. WAY TOO HIGH. As an example, please see the article below on Dr. Housing Bubble.Com which shows an 800 square foot house in SoCal for $469,000 !!! This is ABSOLUTE INSANITY.

http://www.doctorhousingbubble.com/culver-city-condo-prices-fall-leading-indicators-show-culver-city-correction/

But I don’t get all my info from this website – not at all. I have been around and have seen first hand the “hangover effect” of the housing bubble in California, plus I live in a California coastal town which is way overpriced as well. Yes, I realize that the rich will always pay a good price for a home in a nice area, however, California real estate is too overpriced for most middle class families. I am well prepared to buy a home, but I REFUSE TO GET RIPPED OFF AND TO BE TAKEN FOR A FOOL.

Our country is on the verge of a DEPRESSION. Just the other day a woman at my work said so. I was amazed because I have been thinking this for some time now, but to hear it coming out of another person’s mouth was confirmation of how poor the economy actually is. So don’t be a ding dong and say “there are more dreamers here than realists.” IF YOU WANT TO GO OUT AND PAY DOUBLE THE FAIR PRICE OF A HOME, GO RIGHT AHEAD SEAN. GO RIGHT AHEAD.

Oh, and guess what Sean? I don’t know how old you are, but I remember in the early 80’s when interest rates were around 16 to 18% !!!! Don’t believe me? Look at this link below: (especially note the years 1981 and 1982).

http://www.freddiemac.com/pmms/pmms30.htm

If you are wondering why I bring this up, here’s why – higher interest rates WILL DEVASTATE HOUSING PRICES. DEVASTATE THEM! Even a historically average rate (I believe around 8%) would crush home prices. Not only that, but many trends are in place now that will bring about lower home prices (ageing population, poor economy, lack of good paying jobs, baby boomers who have little saved for retirement, oversupply of homes, higher taxes, and more).

Our country was “on the verge” of a depression for the first half of the past decade. It has been *in* one since about 2007.

Hi Sean,

Is Coto De Caza one of one of the areas that is considered nice? Check out the price drops for the area .http://www.zillow.com/homedetails/9-Cherry-Hills-Dr-Coto-De-Caza-CA-92679/25618932_zpid/ Also, based on the comments here I believe there are some pretty bright people with good incomes that see further price drops coming in all areas. This includes areas where the teenage girls don’t get pregnant and the women can afford breast jobs to try and fight the aging process. Also, don’t forget the dads that donate money to the high school sports programs in order to help their kids can make the team.

I have been watching with curiosity the sudden rise in bond yields. It did rise by quite a bit in just a few weeks. Perhaps the markets have lost beleif in QE2?? Perhaps just a speculative blip.

But if yields continue to rise, maybe that may be the one to finally prick the bubble?

The treasury notes are rising to counteract the continuing rise in commodity prices. Problem is that it will make the cost of borrowing more expensive and further deflate house prices.

What about in places like San Diego? In nice areas I see things selling at fairly high prices. San Diego is one of the only cities in the past year where prices have gone up. I’ve been watching the market closely there on nicer homes that are renovated and they are selling. Do you experts predict prices will fall further in San Diego?

Earl-Lee (lol)… primo areas of SD will be the last to fall, but fall they will. The high % of gov’t/military jobs and retirees with $$ coming from outside Cali helps delay the reckoning.

Real Life: family member has a classic 4/2 “Craftsman jewel” there, in the heart of Mission Hills. How classic? The house has a “Historic Designation” that results in a significant reduction in prop taxes (sweet!)… but even with that, bought in 2004, rented 2006-mid 2010, the rent was $1,000/mo. below owner’s PITI, D’OH!

OTOH, turnover in that ‘hood is VERY low (i.e. lots of 2nd and 3rd gen inherited owners), and homes that sold this year were still fetching, not peak, but 2004-early 2005 level prices… go figure. Owners say “they’re not making any more classic 100 year old houses in sweet neighborhoods, yada-yada…”… far be it from me to burst their comforting beliefs. ;’)

Let’s face it, male or female, if you “LOVE IT!”, then the premium is worth it. Me, I love VISITING Cali, but after 10-14 days, I’ve had my fill. It’s obvious that almost everyone there is stressed about $$… same in Manhattan. Profound personal choices, with far reaching consequences.

Any of you folks “comfortable” buying a 500K+ So Cal house ever worry about job loss? If you/spouse make 60K+, likely you’re gonna have a tough time finding a comparable job/pay. If you own a business, living wage jobs are leaving Southern California. Ever worry that California is tipping, people needing government assistance/services will outnumber those paying into the system? Just a thought.

About real estate and hyperinflation: Weimar Germany issued a currency called the rentenmark, which was backed by real estate. It effectively ended the hyperinflation. During a hyperinflation, you’d be crazy to sell real estate; only exchanges for goods or other real estate would take place.

T-bill interest is going up now. Look at what has happened to the ETF TBT in the last couple of months. We don’t have high inflation, but the bond bubble seems to be winding down just like the housing bubble before it. With QE going on, the big players want more interest for holding US debt. The Government cannot set the rate on a T-bill. They can loan out money to others at any rate they choose, and if the rate is below the market rate, they will have PLENTY of takers. But they have to take what the auction price is for their own debt.

The N vs S OC argument seems to forget that there are plenty of nice N OC areas like Villa Park. And they’re a lot closer to LA County where there are JOBS. S OC is full of service jobs, but what else?

The bloggers who point out that income alone doesn’t predict ability to buy are absolutely correct. Plenty of late middle agers have had parents die and leave them a lot of cash or property. And many of us have been saving quite a bit, too. If there is any whiff of high inflation, getting out of cash and into real estate will make a lot of sense. (Remember the rentenmark?)

I think that when interest rates rise, the market will have another correction. That will be the time for people with cash to start looking again at real estate. Don’t even think about RE as long as fixed rates are around 5% or less. Even though there are a lot of cash buyers, they are greatly outnumbered by non-cash buyers. This applies to working class and middle class areas (including upper middle class). Truly rich areas are different, because the cash buyer is much more common at that level. But if foreign interest in premium real estate in Socal wanes, there will be bargains to be had there too.

Leave a Reply to Lionel