The Modern Banking System is Like a Broken Dam: At 8% Annual Compounded Growth it would take us 11 years to reach the Peak of the S&P 500. Old Ideas and Prophets Falling Hard.

Before reading this article, I would like you to take a deep breath. Okay? If you feel like candy bursting out of this broken economic piñata, you are not alone. Things are dire and virtually every piece of news we read reinforces this premise. On Wednesday, we had a nice technical rally and you should have seen the glimmer of hope in the eyes of those on the cable financial shows. We all want a recovery but a recovery based on hard work and getting back to what is financially prudent. Not the talking heads. They could care less about the ADP employment report that showed 697,000 jobs lost in the month of February. All they cared about was whether a handful of gluttonous financial stocks moved one or two points because the U.S. Treasury and Federal Reserve are intravenously pumping capital into the veins of these flailing institutions while allowing the American taxpayer to flounder like a carp yanked out of the stream.

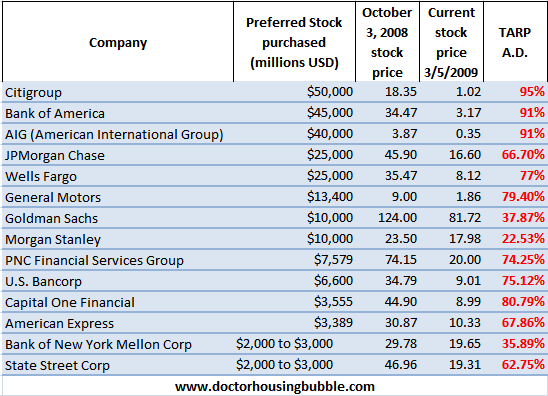

The poorly planned Troubled Asset Relief Program (TARP) of 2008 has been a complete boondoggle.  How have things gone in the stock market since the TARP came about? Well let us take a look:

Since TARP version 1.0 was signed into law on October 3rd, 2008 the S&P 500 is down approximately 38%. Think about this for a bit. We are talking about 5 months ago and the market has shed nearly 40% of its value. From the 2007 peak, we are now off by a mind boggling 56.4% putting us back to levels not seen since 1996. Can you even remember what you were doing back in 1996? In 1996 here in Santa Monica the civil tiral of O.J. Simpson was beginning. We are now past the lost decade estimate at least in terms of equities and this puts us in the realm of witnessing our own lost decade similar to Japan. The unfortunate thing is we followed many of the policies that Japan did with their failed banks yet expected a different result. People are now claiming that stocks are a bargain. These people were cheering the market on Wednesday only to get reamed on Thursday after Citigroup went into the penny stock territory and the survivability of GM is now in question. If you haven’t figured it out yet, the mainstream financial pundits really have very little knowledge regarding economics. What they are good at is hyperventilating like a hypochrondiac entering a hospital when the market is up or down.

Our Banking System is a Broken Dam

The reason capital injections are failing is rather simple. Imagine a dam. A gigantic dam constructed with the best material and concrete found in America. Initially engineers find out that there is a tiny crack starting to form but choose to ignore it.

“Don’t worry! This dam is so big a tiny crack will be no problem.”

Yet as time goes by, the crack splits wide open. The engineers ignore the water pouring out of the system because storm after storm has replenished the supply and the gaping hole is simply replenished by new water coming in. That is, until the storms stop coming.

Suddenly, the big hole explodes and water is gushing out. The engineers call upon locals and dip into their water reserves trying to replenish the dam but keep on ignoring the massive damage caused by that tiny crack. Water is poured in but simply flows out just as quickly. The hole is now too big to repair. They never constructed any mechanism or safeguards because they believed no crack would ever occur and even if it did, rain would come. At this point, all they can do is wait for the water to rush out and construct a better dam for the future.

This I believe is what is happening with our current banking system. We can keep injecting capital but the gates of financial hell are now open and any money we throw into the system will be burned in a fiery end. If you need any evidence of this just examine AIG and what a colossal mess that has become.

I’ve constructed a chart showing some of the biggest TARP recipients. I’ve also included their stock price as of the day when the TARP was signed into law:

What a sigh of relief! If it weren’t for that wonderfully planned TARP, we might actually need 3 shiny quarters to buy one share of Citigroup but thanks to trillions of taxpayer bailouts, we can with a smile buy one share for one whole dollar! Just take a look at the above chart carefully. We have absolutely flushed money away into the broken dam known as our banking system and the plan isn’t to reform the system and root out the corrupt crony capitalist; no, instead our plan is to give these same institutions more money and believe that they will do well. What an absurdidty! We are giving banks money so they can then, not give it back to us!

When in the world are we going to see major trials and putting some of these criminals away? We are starting to see some seeds of this anger boil over with the inquiries into UBS and American tax evaders. It is estimated that $18 billion is off the books. These banks including foreign institutions are walking zombies and you can ask Japan how that worked out for them after 8 major stimulus plans and countless capital injections. It is understandable that many people have forgotten about the Great Depression but there is no excuse for not paying attention to the lessons from Japan. The hubris on Wall Street is incredible.

If you think things are bad, you’ll know we are starting to reach a bottom when we can construct a book on all the horrible calls made during this bubble collapse. Let us take a lesson from the Great Depression:

“The autumn of 1931 brought also an outburst of laughter. When old certainties topple, when old prophets are discredited, one can at least enjoy their downfall. By this time people had reached the point of laughing at Oh, Yeah, a small book in which were collected the glib prophecies made by bankers and statesmen at the onset of the Depression; of relishing the gossipy irreverence of Washington Merry-Go-Round, which deflated the reputations of dignified statesmen of Washington; of getting belly-laughs from a new magazine, Ballyhoo, whose circulation rocketed to more than a million as it ridiculed everything in business and politics, even the sacred cow of advertising; and of applauding wildly the new musical comedy, “Of Thee I Sing,” which made a farce of the political scene, represented the vice-president of the United States, Alexander Throttlebottom, as getting lost in a sight-seeing party in the White House, represented a presidential candidate as campaigning with Love as his platform, and garbled the favorite business slogan of 1930 into a slogan for newly-weds: “Posterity is just around the corner.”

We may actually be arriving at a point where we can laugh at the absurd hypocrisy of it all and this is highlighted buy the nightly take down of our business “leaders” and so-called expert financial channels:

*Hat-tip Calculated Risk

I ran a quick calculation to see how long it would take the S&P 500 to reach its high of 1,576 from its current 682.55. Assuming a nice rate of 8% each year (heck, this is close to the Bernard Madoff rate) it would take us 11 years before we see those 2007 highs again! Do you really see 8% yearly gains for 11 straight years after the trillions we have dumped into bailing out failing banks and poorly managed institutions? Forget about a lost decade, we are now getting close to having two lost decades. Now tell me, what will you be doing in 2027?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “The Modern Banking System is Like a Broken Dam: At 8% Annual Compounded Growth it would take us 11 years to reach the Peak of the S&P 500. Old Ideas and Prophets Falling Hard.”

In 2027, I will be one year from “retirement.” I don’t care how much I have, I will be finished. If I have it ($$$) fine, if I don’t so what. There is more to life than the almighty (dollar). Retirement for me is no longer participating in the rat race. I’ll be 57 and more than ready to be done with the rr.

The United States currently allows 1,200,000. legal immigrants into the country every year.

Due to the recession and unemployment rate, how about a 5 year moratorium on immigration?

The acceleration of this Depression is incredible. Throwing good money after bad only magnifies the problem. Unfortunately, we are all Global now and the U.S. could bring down the entire house of cards. Assets like real estate (Especially in California) are just about Dead in the Water. Even, the Regional Fed made that statement today about the West.

But no, not on the Westside! High-end properties get will see a 50% reduction at least, from their peaks in 2007. Throw in moonwalking, and the Westside is in for an astonishing real estate collapse.

http://www.westsideremeltdown.blogspot.com

http://santamonicameltdownthe90402.blogspot.com

Sorry, I haven’t show up here for a while, even I am 100% with you.

I heard enough bad news and actions nowadays. Even I was enlightened by so many articles here in DHB, still it makes me feel so bad since, as I expressed before, there is a good doctor to point out the symptoms of disease. However, Dr. HB seems to me never giving us a medicine to cure and no hope to a end-cancer patient.

As I said I am an incurable optimist, I always try to find a solution, effective to rescue the current economic mess produced by GWB or Obama’s boyscots.

My major is political science and I have been in real estate business for 20 years. When I look at the downturn, tell you the truth, I really don’t believe what I have seen recently, let alone my disappointment at Obama.

Talking is easy. Do I have any verifiable experiment report to confirm what I thought as a practical approach should be?

Here we go. Please read may artices at AR:

1) Go Out to Govern, Not Stay In to Manage, Please!

2) Happy to See It happen. I Told You So Simple, Didn’t I?

at http://activerain.com/blogsview/969229/Go-Out-to-Govern-Not-Stay-In-to-Manage-Please

Ed Tse wrote: “However, Dr. HB seems to me never giving us a medicine to cure and no hope to a end-cancer patient.”

There was a post not to long ago where Dr. HB outright admitted he didn’t know what the solution was.

There is no way for us to fix this problem. This problem is going to fix us.

Hi, Dr.

The new Homeowner Affordability and Stability Plan has just come our? What’s your comments? Will this really save the house market? Why?

Thanks

Norman

oh, and the tarp helicopter could be manned by the previous administration, and we could have Clinton riding a surfboard labeled “mortgages for all” and/or “Gramm-Leach-Bliley” down the waves running out of the dam.

–

man, this could awesome.

Finding a solution for the current economic meltdown is like finding a solution for a hangover after having drank yourself unconscious. The time to take action was after the first few drinks, not after you take a nose dive onto the couch.

I enjoy reading your blog, after reading it I feel more informed, and depressed.

Not sure what anyone can do at this point, seems like the train is already off rails and about to crash.

Long time readers know that I have talked about the solution but it is so simple and direct, that people tend to look at more complicated issues. If it is simple why not do it? Because too many people are fed from the real estate industry so they tend to plug their ears with their fingers and ignore the obvious.

1. Home prices must fall back in line with historical trends. We are still overpriced. Solution? Let prices fall until they reach this point.

2. Stop bailing out insolvent banks. Solution? Don’t give them any more money.

3. Temporary nationalization of a few banks. If we take say the top 5 banks, we already have over 50% of all banking in the U.S. Focus on the few with the best balance sheet, take them over, gut them out. Separate the good, the bad, and the ugly. Painful but better than this Japanese style drip drip solution.

4. Focus on sustainable industries. Flipping homes to one another was never a solution. We need to let the finance and real estate industries contract to a minimum.

Long time readers know this. Yet no one wants to listen.

Not until we remove the “we are what we owe not what you own” backward mentality..

Can you say “Second world” status.

PHIL wrote: “The United States currently allows 1,200,000. legal immigrants into the country every year.Due to the recession and unemployment rate, how about a 5 year moratorium on immigration?”

I think it will be the other way around – think more immigration. China will start buying us up. Why? Simple: They have 2 billion people who save their money instead of buying cheaply made in China products.

I am a firm believer in bringing in the China man by the airplane loads to buy our foreclosured homes here is Socal. Also I would invite the Mexican drug lords from Mexico and Central America…

Think about it? They would be first generation immigrates , with a fully paid off house in the USA…

Money talks.

I agree with DrHB about letting housing prices fall back to historical prices. And like everything else in history that has been in a bubble will over shoot on the downside. So there is still a long way to go yet. There are meetings behind the scenes in gov that know this. They cannot 1.) say it 2.)let it run its course without showing some compassion for those yelling for help. It would create chaos, civil unrest, riots etc

Same goes for the banks. They are trying to do one thing — manage the system down. Avoid runs on banks cause they are insolvent. The losses from all the shenanigans are in the high 10’s of trillions and they can’t tell you this. Same as housing, would create chaos, civil unrest, riots etc

They will be successful if the s&p 500 can reach its bottom at around 250 (2009 earnings $32, low p/e on every other bear in history around 8) and they will have avoided an over throw of the government, riots, mass murders, a revolution.

My bet is they will, the complacency in america is amazing. If not, it will be interesting to see what the tipping point is. Venture to guess?

Dr HB, loved the way Jon Stewart skewered CNBC for the fools (naked short selling criminals, really) that they are. Where did your parallel quote from the Great Depression (“The autumn of 1931 brought also an outburst of laughter…”) come from? I know you’ve been highlighting a work from that time.

I view this kind of humor not so much as a signal that the bottom is here, but as an indication of how radically the social mood has flipped 180 degrees. From being heroes and geniuses only a couple of years ago, CEOs and billionaires are now regarded as bottom-feeders, down there with lawyers and liars (and my apologies to the good attorneys and good CEOs etc who are out there). Stewart and Colbert are the bellwether for this kind of thing – they were the first to ridicule GWB back when nobody dared to do so in public.

Thank you, DDM:

I know it looks not easy, but it is not as difficult as it looks.

From all the materials written by Dr. HB, I know he did have the right answer. But he is too kind to speak out to let someone die as a kind doctor.

Nothing’s perfect, including government policy. When the big ship Titanic is sinking, we have to cut the tie with it to make a survial by a small live boat. Look at the amount of $40 Trillions those big guys such as AIG owed in CDS and the bubble effects of $200 Trillions, please understand we are unable to SAVE the financial Titanics when all the advanced countries in the whole can only have GDP of about $50 Trillion. It is just like Hurricane Katrina is hitting hard on New Orlean.

When Katrina is over there, we can’t do nothing even we know someone are in a dying situation. We are able send helicopter to rescue only after Katrina was gone. It is the death toll we can NOT avoid. So, let those big institutions bankrupted if we have to keep most the people on board a chance to be alive and prosper again on their new-birth.

Don’t be blind as Bernanke, Paulson and Gaithner pretend themselves as the all-mighty God and tie to it by giving/ printing money through TARP as the Titanic’s Capitan believes that’s his honorable fate or mission.

How about going to my website to read my above articles or others to study my simple solution very hardly? After that, please give me a very hard time to defend my position. Your dissent opinion will be much appreciated.

Thanks,

ET

The point is that there are painful, frightening steps to take, but we’re not even going there. The boat is sinking and the orders are to row harder and feed the guys that ran the boat aground the rower’s rations. A rising tide may raise all boats that have enough line, but a Tsunami will wash all boats away. Then we start over. As Churchill noted, America will always do the right thing after all other options have been exhausted.

It is plain and simple, the likes of AIG and Citi are already on the bottom under a 1000 ft of water. Time to STOP bailing with our money. They seem to be on a course to print enough money to kill the dollar! Then what do you do….start another war , have another terrorist attack?

There are plenty of well-run banks in this country. We need to support THEM, not sink the whole system for the sake of the TOO-BIG-TO-FAIL crony friends of government. The problem is that we will all loose big-time as the pension funds, retirement accounts and 401Ks are decimated as a result of the fallout.

I converted my IRA/401K money to hard assets periodically as I went along. I had a feeling that something like this would happen. I also set up a disciplined approach to PAY OFF the mortgage EARLY. Home equity loans seemed fairly foolish to me. Why should I risk my home for a vacation ?!!? I can now walk around on, farm, cut firewood and when the time comes, sell off lots from my retirement fund. I won’t loose much in the market. However, we all could loose everything if the system collapses.

Dr HB.

Thanks again.

I don’t know if this is true, and I don’t understand it. I just heard that NAR in CA are fighting the stimulus plan to help the home owners from foreclosures.

Do you understand this? Is this true? I got this info from realtor.

I know this is off the topic, but I couldn’t help but post this.

Are they insane?

http://sgv.yahoo.prucalonline.com/details/start.aspx?

propid=008I012120243&puid=67eee51b-4637-4493-a982-b74a852e977b

$825,000, block and half from train tracks. Those trains gets loud out here.

At that price, one can find a better and bigger home at a nicer area.

I’ve been waiting for awhile for prices to drop here in Glendale, but I don’t see it happening. I know that I can wait. Because we waited, we saved enough for down payment, 20% at least. We still have money to spend on other things without having to worry about how we’re going to pay for it.

It just seems that being frugal is still a way to go.

Thanks again.

Crazed

In my opinion, high house prices are holding the global economy hostage similar to how high gasoline prices seriously taxed the economy in 2007 and 2008, but on a much greater scale. Now that easy money atm-style mortgage equity withdrawls are history, over-stated house prices serve absolutely no practical purpose for anyone, whatsoever, anywhere in the country, for any reason imaginable, except to a minority contingent of people who make money based on the financing and transaction costs involved in real estate. It’s sucking all the money away from every sector of the economy, like a giant friction brake. I can’t believe more people don’t see this situation for what it really is. The gov’t needs to pop what’s left of the bubble; not support it. A big part of the solution is easy: raise the federal funds rates a little. This is the time-tested way to pop a bubble. Raising interest rates would also help recapitalize banks as conventional savers would embrace the relative safety and improved return on CDs and money market accounts instead of flocking to treasuries, etc. The current bailout strategies are the medical equivalent of administering tranquilizers for a broken leg (or should that be tranquilizers for a broken ARM.) Popping the bubble will hurt its most blatant participants, but this country also has the capacity to pop it with a reasonable level of compassion and amnesty for the innocent. Prove me wrong!

And another thing: the “Making Home Affordable Plan” should have been named the “Real-estate Assistance Program for Everyone but Renters,” or RAPER for short. That’s what it does to responsible people who did not over-reach.

Doc,

Thanks for creating and maintaining this blog. Long time reader new poster. It looks like you agree with much of what Roubini prescribes and cures to the cancer.

IMO we need a Dr. Kevorkian for these insolvent institutions and we need it as soon as possible or else we languish like Japan. Its funny that we had a prime example of this type of bubble and how government intervention failed and yet we still go down the same path. AND it was within 10 years – can’t the people in our govenrment and especially the FED learn anything these days? FFS Bernanke is a supposed guru of the Great Depression, does he want us to replay it so he can practice his useless theories?

Thanks to you I’ve ratcheted up my savings and will be in a good position to buy something in 2010 or 2011.

What happened to the real-dur that wrote in a couple of weeks ago explaining how we are at the bottom and the simu-loss package would fire up those house sales? Maybe next month.

@Rent

You make valid points, but we’re in uncharted territory. There are numerous bubbles, all inter-related. The entire global house of cards financial system may collapse if things unravel too fast. Still, until the junk is flushed and a new paradigm created, it will just keep descending. This country traded most of it’s capacity, and is a melting pot of dissimilar cultures that do not care about one another. The bubble is now too big. Bank of America has derivatives of at least $100 Trillion–one bank. The whole financial system of the world is at risk. We need a rational plan–not grandstanding and emotional, knee-jerk reactions (which is what we have gotten so far).

Citi going down next Friday? Looks like the next big unwinding. AIG probably next. Fannie, Freddy? Wells just swallowed arsenic. BOA got a double-dose of Cyanide-wide and Merrill-koolaid.

There is no easy plan, but depressions have always led to war. We just want to avoid WW3 and the next Dark Ages. Neither is a given at this point.

I just found this terrific blog a couple days ago and love it. Great job DrHB! Nice to see there are similar sane people out there regarding the housing bubble. I think the only solution to the economic problem is to let housing market fall to fall back in line with incomes and become affordable again. In socal, I remember in the mid to late 1990’s a nice upper middle class house used to cost around $200-250k. Its currently 550k still. We still have a long ways to go. Hopefully the govts efforts doesnt prolong the bubble deflation for more than 3 years. Our sons are 4 and 1 years old so we can wait 2 more years but I hope the bubble won’t be too inflated by then. We could do something now, but I am afraid of being upside down in a few years like so many other homeowners. I think to fix our economy, the govt and people should focus on saving rather than focusing on consumption. Buying things with money you have saved rather than on credit. And for corporations to focus on reclaiming jobs for american workers rather than shipping them off to places like india, china, etc. for the sake of profit. A big part of the problem is other than housing, retail services and restaurants, there doesnt appear to be much industry left in the usa. It might take several painful years to accomplish but it could be done. I think a better economic stimulus would have been to give the bailout to responsible renters with income documentation to show we’ve been saving and are ready to buy houses…then again I’m a biased renter 😛

Tom

@fatherpain

Welcome. Most of us got here because we knew the crap we were hearing and reading just didn’t add up. DHB has done his homework and called it like he sees it after evaluating the information, rather than mis-reporting the symptoms to protect a failed prognosis. Sort of the anti-CNBC (Criminally Negligent Bullshit Creators) if you will…

Tom,

I am with you 100%, but unfortunately Americans saving money is not in the business plan for the Federal Gov’t at the moment. We’ll have to endure some pain before they change their minds I think.

Amerika,

YOU WANT THE TRUTH? YOU CAN’T HANDLE THE TRUTH! That way when the Feds come swooping down on banks under the cover or darkness on some Friday night when nobody is watching (probably during March Madness) to take them over, nobody will have suspected. It will feel like the invasion of Iraq- shock and awe from the left flank. We didn’t tell Sadam we were taking over his country and we certainly aren’t going to tell shareholders, bondholders and scumdog management we’re coming. The government will be our liberators (and not a minute too soon). Get it?

Be brave Comrades!

401K’s are eating their seed corn. You have one? Teachers Union? Corporate account? Maybe in CD’s? Mom and Pop living off that retirement from the airlines? Better get that spare room ready!

~

What about revenues from FIT this year? Toast. No money coming in there either.

~

Have an Annuity? Too bad; annuity’s don’t work at 0 percent interest.

~

Sorry folks, this money our fed is spending has gotta come from somewhere!

You are wrong Dr. A penny saved is a penny inflated away by the Fed.

Look at a monthly chart of the nasdaq and then the dow from the 20’s. Its all you need to see. It took the dow 25 years to get back to the highs from the crash of ’29. we’re looking at many years of pain

the book describing 1931 is “only yesterday” by frederick allen.

Leave a Reply to DDM