The Southwest housing mania is overheating: California, Arizona, and Nevada leading the way once again with unaffordable housing markets.

There is a great book called Willpower that examines the ability of people to actually exercise self-control and how these character traits impact life. Those that can delay gratification typically end up doing better in life throughout marriages, work, and their financial decisions. Why this matters for housing especially here in California is most people look at their left and right and are trying to keep up with their neighbors. It is fascinating to see many people trying to cash in on their current equity so they can leverage up to a bigger home because they can. Forget about paying down the mortgage for retirement. Time to press reset and leverage into a bigger home. Since home ownership in California is largely in the domain of older home owners many are simply diving into this property ladder game once again. Retirement figures show that many older Americans are horribly underprepared for retirement. Yet the advice is always to buy as much house as you can get your hands on. Think about the $700,000 starter crap shack here in SoCal. For a 20 percent down payment, a household will need to save up $140,000. Most are into instant gratification and that is why car leases reign supreme in the land of all hat and no cattle. This is the land of Purnia Dog Chow eating baby boomers living in million dollar homes and welcoming back their heavily indebted offspring. The Southwest once again is paving the way to this new recent housing mania. If we look at California, Nevada, and Arizona we find that home values have quickly outpaced underlying economic activity.

Where you least can afford to live

People fail to underestimate how much it costs to own a home. Beyond the mortgage and interest, there is a litany of other costs associated to buying a property including: taxes, insurance, maintenance, and other costs including utilities that may be higher from owning. This isn’t to say that buying a home is a bad decision. In fact, in many parts of the country it is a wise decision. It is also dramatically clear that many people use housing as the panacea for all financial success. They might view stocks as overvalued but find real estate reasonably priced just because they know of a neighbor that did well. It should be abundantly clear that it doesn’t take a Phi Beta Kappa mindset to do well in real estate. You have some that can barely string together two words yet did well in the industry. I remember during the last bust former waiters and tellers that suddenly were raking in six-figures. Did they invest it wisely and stash it away for a rainy day? No. It was squandered on bigger homes, cars, and a lifestyle that is now gone. Willpower is more than simply keeping up with the Joneses and paying $700,000 for a piece of crap stucco box built during FDRs first term.

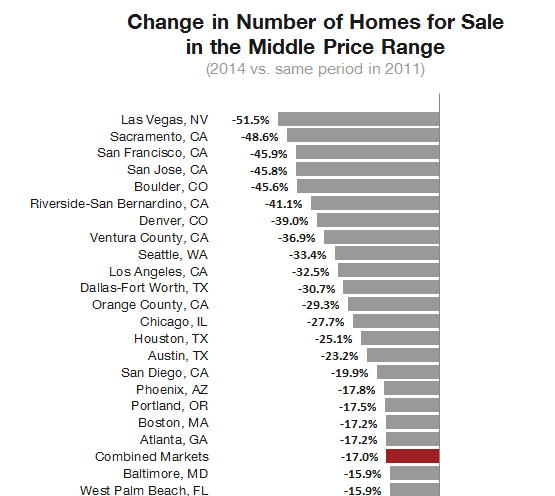

No one operates in a vacuum however. We do live in a society after all. The Southwest has something in the air that simply makes people go into mania every so often. I think delayed gratification is a rare trait and plays into the boom and bust culture. For example, take a look at this chart:

Source: Redfin

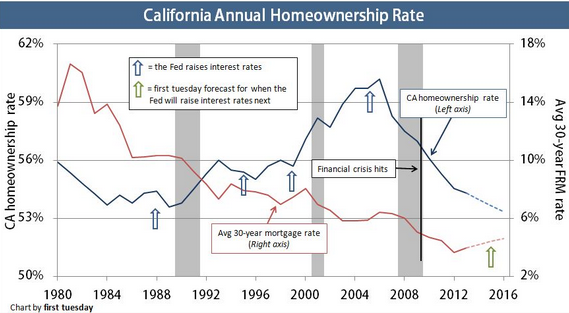

This is a very telling chart. In essence, there is little affordable property out in the market compared to what was available in 2011. So you have two choices today and one includes simply puckering up and buying or renting. What I find more interesting is that people are unable to buy today not because of lack of desire but because they are financially strapped. The market is forcing willpower on them. If idiot mortgages were out again, they would be running to their nearest charlatan for a giant mortgage. You have 2.3 million adults living with their parents in California. These people can’t even afford a rental let alone a home. And the numbers get reflected in a continuing drop in the home ownership rate:

You’ll also notice that Colorado, Seattle, and parts of Texas make the list. But it is clear the Southwest dominates the club. Why is that? There is something to be said about the sunshine tax. The weather is great but if you look at the Inland Empire, you are basically living in Arizona or Nevada when it comes to the weather but paying twice the price. We’ve analyzed the area and found that over 40 percent of those living in the Inland Empire actually leave their counties for work. This is the land of the epic commuter.

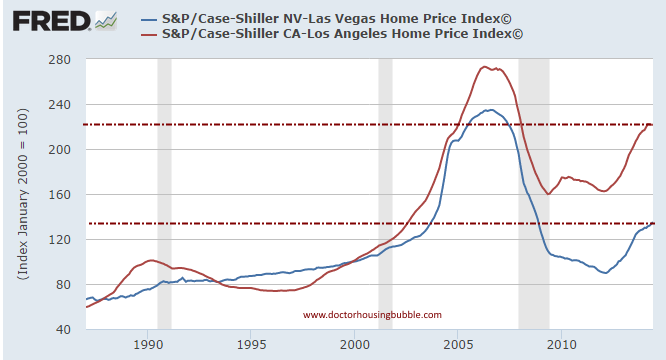

You see the same nonsense from hipster neighborhoods and how some are trying to justify current prices. Yet ironically, some of these same people are not willing to make the purchase. If this is such a stellar deal, why not buy the place to rent, flip, or sell at a later date? Their assumption of course is that more suckers are lining up to buy these places. Well as we’ve noted, the summer selling season was a dud and sales volume is pathetic. It was interesting to see Nevada boom in the last bubble too because of California equity run-off. The toxic mortgage pushers with their headquarters in L.A. or Orange County allowed their mentality to permeate the Southwest. Sell the easy money sizzle throughout the nation. Why wait to save for a down payment when you can own TODAY! Forget about delayed gratification or willpower, time to buy right now.

Today, you have a different sort of acceleration in prices. In Nevada and Arizona, the massive push was from big money investors. They are now pulling back. When you hear people say things like “you missed the boat†it sounds as if they are speaking about missing a critical time to buy Google, Twitter, Facebook, or Microsoft stock. If you are truly buying for the long-run and prices make sense in the context of many factors including opportunity costs, then missing one or two years doesn’t matter. In other words, whether they acknowledge it or not, they are speculators just like a day trader. Nothing more. And many are itching to buy but they are flat broke or unable to pay current prices. Since 2000, housing has become a speculative arena. Just look at the booms and busts since then:

Now we enter into the typically slower fall and winter seasons. Buying a home is no longer a simple decision. Just like you have analyst, brokers, and Wall Street firms to analyze stocks you now have an entire industry built around investing in housing (hence the big firms eating up single family homes since 2008). We love our sun, manias, and housing here in the Southwest.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

118 Responses to “The Southwest housing mania is overheating: California, Arizona, and Nevada leading the way once again with unaffordable housing markets.”

@ Doc: ‘It is fascinating to see many people trying to cash in on their current equity so they can leverage up to a bigger home because they can. Forget about paying down the mortgage for retirement. Time to press reset and leverage into a bigger home. … Most are into instant gratification and that is why car leases reign supreme in the land of all hat and no cattle.’

_____

I can only hope the smarter money has already begun exiting the Southwest housing market. There is a lot of complacency and entitlement around; it a coarseness.

Some of it reminds me of the Grimm Brothers short tale, ‘The Fisherman And His Wife.’ Except for many who’ve been protected in this economy, only known long wave house price inflation and boom… there is no hesitation at all in desiring and expecting ever more, and ‘irrelevant’ savings + ever more debt is the magic wish-giver for even more instant gratification magnificence – perhaps with future consequences.

The Fisherman And His Wife. http://www.pitt.edu/~dash/grimm019.html

(2,812 words)

Forgive me for glimpsing at a foreign market, but I suspect it’s a feature of all prime markets at the moment. In London, I’ve recently seen a couple in their 50s buy a 5 bed house at £2.4 million ($3.9 million), using their savings (“It’s not earning anything in the bank”) and also a new mortgage from a private-wealth bank. The house was being sold by 2 older people.. (70/80 years). 30 days later the new buyers in their 50s put the house on the market as a rental, without even modernising it (they’ve simply removed old furniture) and it’s now had nearly 2 full months of voids (no tenants paying rent). Oh and the yield on rent (vs price paid) is a sliver 1.8%. And this is the best bit… the new owners/landlords, already own a very similar 5 bed house themselves ON THE SAME ROAD. A new house has just come to market on same road asking substantially less. I can only hope some people find out leverage works 2 ways, when prices begin falling faster and harder. However I really believe these buyers/investors think they are special, and that it’s only ever reward for owners/buyers/property-investors. There must be many such buyers out there, and I can’t wait to see what occurs when the market turns properly.

but suzanne researched this (the fisherman and his wife)

Ahh, that tripped me up, for it’s partly a lesson about not overreaching, not being greedy, and finding personal happiness within your means.. until I remembered that total cringe television commercial for a realtor/mortgage.

https://www.youtube.com/watch?v=20n-cD8ERgs

Suzanne is only interested in her sales commission (imo), and that couple have surely split up by now… her so pushy, him so soft. Every house / area is ‘special’ according to Vested Interests. One lesson drilled into me.. ‘Debt is not wealth’ and, ‘If you’ve got no money, you’ve got few friends.’

Yoo-hoo (only detail I was it’s a 3-bed, not 5 bed – I sourced the other info from premium charge websites, including UK Land Registry and Companies House, to put the story together.)

http://www.rightmove.co.uk/house-prices/detailMatching.html?prop=43557127&sale=51627398&country=england

Click and check the Sales Date, check Sold price, and click the link ‘Currently on the market’ to see open the new listing, a rental listing, with furniture removed, but still old carpets, wallpapering etc.

It seems to me there is a lot of hardened conviction in housing wealth from older owners who have rode the long wave property boom, and all the reflation, with some doubling down at such very high prices.. in all prime markets. Whereas younger people, including my family (top flight litigation solicitors/ IT managers with degree in Comp Science with AI) are totally priced out even a starter home… well they refuse to meet crazy asking prices anyway, vs all the stimulus to help recovery vs such reflated house prices. It’s like older owners have known nothing but housing opportunity, wage inflation, stock market growth, ever higher living standards, and wealth… and younger people in their 30s have known nothing but having opportunity denied and taken ever further out of reach….. home ownership just some impossible dream.

brain said ‘If you’ve got no money, you’ve got few friends.’

money talks and bullshit walks, if you’ve got no money you’re full of bullshit

That youtube video of the pushy wife and colluding agent makes me cringe. And I’m female. What a wimp of a man.

That being said, I’ve known a few couples like this in my time. My old neighbors – he was a cop, she a SAHM. 3 kids. That poor bast#$d worked $80,000 of overtime per year to pay for his wife’s lifestyle.

They had the McMansion. Mercedes SUV’s. The house was furnished in Pottery Barn, the best of everything. $100,000 back yard with pool and spa. The husband worked overtime to pay for his wife’s designer clothes, Coach purses, fake tits and $200 hairstyles. It was PAINFUL to watch that family.

That poor guy was never home to enjoy any of it, he worked literally every single day. They are still together….

If you get a new car every 3 years, leasing is a better use of your money. If you keep a car a long time, not so much.

This is what my contact – who in 2008 bought a home in San Bernaghetto (he calls it that) – told me about cars/SoCal.

_____

April 2014: As for cars, there is a snob value about them here that I don’t think is quite as bad in the UK. Last month I was advised by a friend of my wife’s that driving a 2004 Civic was a liability, and that showing up to a job interview in it would have me ruled out before I even walked into the building (even though the vehicle in question is scrupulously maintained and looks almost like new).

Even my wife doesn’t really believe me when I claim that it’s perfectly safe and reliable. Since we were married last summer, her 2012 Lexus has broken down twice (complete battery failure the first time, radiator cap burst open the second), and my Civic not at all, despite doing over three times the mileage during that period! Nevertheless, she believes the breakdowns to indicate that her 2012 car is now “worn out”, and has her eyes on a brand new one. Sigh.

Not only do the cars here not rust, but they tend not to do short journeys from cold, either (distances, even local ones, are just too great), and so with the basic maintenance as prescribed by the Haynes manual, they’ll go for 150k miles before requiring any significant TLC. About the only environmental challenge they face is that the road quality is absolutely atrocious – even worse than in Britain – with monster potholes, rough surfaces and a generally bone-rattling ride on virtually every road in the state. CalTrans simply doesn’t do resurfacing: it appears to be against their religion. I’ve had to replace all the wheel bearings on the ’04 Civic and a couple of wishbone joints as a result. But a couple of hundred dollars on parts and a couple of Sundays fitting them is a damn sight cheaper than a new car.

_____

BTW:

Consumer Debt Hits an All-Time High

By Allison Schrager September 30, 2014

[..]For many American households, the recession was a time to pay off debt and get their finances in order—whether they wanted to or not. But according to the latest data from the Federal Reserve’s Flow of Funds (PDF), Americans are taking on debt once again. The difference is that this time we’re borrowing to finance new cars, college tuition, and other consumer goods.

http://www.businessweek.com/articles/2014-09-30/consumer-debt-hits-an-all-time-high

That is very sad. You know what will happen the prices will fall they will be underwater but since they own it they can ride it out I suppose if they paid cash perhaps eventually they can ride it out till the next bubble and sell at that time…?

In arizona there is a troubling sign…on MLS now the builders (meritage, toll, etc) are listing new builds with freebies..like guest houses ….not granite tops…seems the over building is catching up with demand..quickly..and the fall is usually the slow period..also a note here..they just closed 5 applebees bar and grills…and the brand new intel plant in chandler isnt installing any equipment…seems the new high dollar chips they make there arent selling that well…I heard you can buy a new tablet wholsale in china for $45..who the hell needs a tower these days with a $500 chip from intel…and intel has like 10% of the tablet market..kinda missed the boat….City of phoenix just missed the income projections for tax base ……where is the housing recovery…about to go the other way

Here is an article by Reuters on September 29th titled “Americans Step Up Spending in August but Home Market Weakens” —

http://news.yahoo.com/u-consumer-spending-accelerates-august-124410273–business.html

The LA Times says prices are flat in July according to Case Schiller index —

http://www.latimes.com/business/realestate/la-fi-case-shiller-home-prices-20140930-story.html

That means if you buy a house today and put down 20% for a down payment, as soon as you sign the papers you’ve lost 30% of your principal because it will cost 6% to sell your house.

What if you don’t sell. How much principal have you lost then?

@Lord Blankfein, that’s a touchy subject. Technically, until one sells their house nothing has changed. However, since many people both love the concept of equity (but only when equity is in their favor), and hate real estate equity when their home is underwater, it’s one of those “your mileage may vary (YMMV)” notions. It depends on which side of the trade a person is on.

Will depend on the specific market, but in some places the issue isn’t “overbuilding” so much as chasing margins by building for price ranges where demand is absent.

In the city adjacent to mine (northwest) there was a major development announced, but they’re building at the target price that’s about 40% above local median sales, and 6x median household income. This despite the fact there’s existing stock in that range that’s not moving particularly fast (gap between median asking price and median sales price is up to 50%).

There’s clearly demand for housing, builders just seem to be focusing on building for a price point where demand is slackest because the people who most want to buy can’t afford the asking price. The thinking seems to be that if they can sell, that’s where they’ll make the biggest profit. Which is probably true but it’s reliant on a pretty big ‘if.’

Housing To Tank Hard in 2014!

I Hope you right Jim, I am trying to find a place for my family when the market tanks

Real estate takes years to tank…do not hold your breath. The average time from bubble top to market bottom is 6 years. Save your money, hold tight, if you see a bargain move otherwise patience is your best friend.

6 years? So we should be hitting market bottom on pricing from the 2008 crash right about….now.

@Jim Tank 2014, we just got the GDP numbers, 4.6%… waaaawww…. No tanks 100,000 miles ahead!!! we are in full REKAVEREE

Recently, I have seen many flips listed, with price reductions. Are flippers exiting? SoCal real estate was down for most of the 90’s, but most of the decrease in prices occured 90-92 (about 2 1/2 years). From 93-97 prices were mostly flat. The “Tanking” has apparantly begun. 2015 should be interesting.

Your down to the 4th quarter to see if your constant statement becomes reality

Ok, lets say “Tank hard in 2015”

Beware the ideas of March … 2016…

Ides of March.

Home Prices Unexpectedly Fall

http://www.businessinsider.com/sp-case-shiller-home-price-index-sept-30-2014-9

The Housing Recovery Won’t Be Over For Years

Read more: http://www.businessinsider.com/housing-recovery-wont-be-over-for-years-2014-9#ixzz3EqeiUnUh

I’m glad you mentioned the IE being like a more expensive Arizona or Nevada. The only reason I could see someone wanting to live in the IE over those other areas would be family or a niche job situation. Otherwise, why put yourself through the additional headaches and higher prices? In other words the only real desirable part is the coastal area and where’s the rental parity there? It doesn’t exist and reading comments about someone’s deal in 2011/2012 doesn’t do anything for anyone looking to buy today or tomorrow.

Doc says, “It is fascinating to see many people trying to cash in on their current equity so they can leverage up to a bigger home because they can. Forget about paying down the mortgage for retirement.”

Is this conjecture or factual? I’d like to see a statistical breakdown — how many SFH sales today are trade ups, sideways, trade downs, and first time buyers.

You’ll like this; front page Sunday, Albuquerque Journal

http://www.abqjournal.com/469700/news/ghost-houses.html

I fully intend to continue renting until I can buy at rental parity. Right now that is a $650 a month difference for me.

That being said, things are definitely starting to change in the housing market in my area. The comp up the street dropped $65,000 from its original list price of $399,000. Took 4 months to sell. Right now its pending, who knows if it will actually close. Still see a lot more new listings with deluded top of the market listing prices. They sit and sit, some start price reductions, others just disappear from the MLS. They’ve missed the boat..

In regards to people of retirement age “upsizing” – I see it all the time. My boss quit and moved back to the Midwest. He’s 64 yo. His wife is 5 yrs younger. They were renting here after losing their house in a short sale 6 yrs ago. They closed on a McMansion back in their hometown 2 mths ago, with NO JOB or income except a small pension. I thought he was NUTS to do this. I said why don’t you rent for a while and wait to see how housing prices go? He, like 98% of other credit addicted Americans, looked at me like I was insane. Guess what… he’s still unemployed and his new house has taken a nosedive in value already. What a huge mistake.

I save/put away a ton of money living my in rental house. And if the plumbing/hot water/hvac goes out, all I do is pick up the phone 🙂

I do not suffer from the instant gratification disease, thankfully. I will not overpay for my own home, in fact I won’t even budge off the fence until I can get it dirt cheap!

I am in the same boat… keep renting until I can buy. I can find a decent home in the area at …. $700K, but no, thanks you… I will wait until the price drops to $500K, and then I move.

I enjoy your market insights Calgirl. I wouldn’t go a million klicks near any low/mid/prime housing market, in the frenzy of the last few years. Instead my plan changed to wait until the housing deals begin coming to me… searching me out. If and when low-to-mid-to-high prime markets turn, it’s going to shake older VI’s world. There is hardened belief in housing wealth or housing always being a safe bet, and many reckless risks being taken.

Much of the older Vested Interests here haven’t been touched by the global financial crisis – they still count the value of their homes, and expect more future house price inflation, not caring a thing for younger generations, who they think will have no choice but to pay “what it is worth” to lock in greedy entitled view of their permanent housing wealth.

“Much of the older Vested Interests … not caring a thing for younger generations,”

Do younger generations “care a thing” about the well-being of older generations? Doesn’t just about everyone put their own interests first? Aren’t most appeals for self-sacrifice really an appeal for others to sacrifice their interests for yours?

I’m hoping a market tank because it’s in my own interest. If I were a seller, I’d be hoping for a bigger bubble.

So older folk don’t care about you. Well, I doubt you care about them, so it evens out.

son of a landlord – that username… did you inherit a lot of rental houses? I gather from your post you plan to expand your portfolio if we have correction? If you have rental properties now, do you ever consider selling, to lock in a high price?

Some of the points you make are valid. It’s a market – we should operate and compete within it. However my own view is policy (including global policy to the financial crisis) has already unfairly forced too much ‘sacrifice’ onto younger generations, to protect the positions of Vested Interests.

I want some rebalancing and market normality to be restored. I treat all people as individuals whatever their age, although there is some truth that I have lost respect for a lot of older owners with their proud attitude to how smart they’ve been with housing investment, and expectations of even more wealth gains. A couple of years ago I suffered an elderly man saying how he bought his home in the 50s for $7,500 and how it was worth $600,000 today. He then bought a small place on the coast for cash, to see out his final days by the sea, and left his house on the market for a full year until someone paid him what it was worth. During that time, neighbors had to take to getting gardener in themselves, to keep his overgrown lawn tidy. A young couple eventually bought it, but had to move their mom in, to live with them, as she had contributed towards the very expensive purchase price.

It would be good if more older owners actually wanted lower prices, in low-mid-high prime markets, for the sake of future generations – and that is not asking them to sacrifice a lot, when in prime markets their homes have often gone up in value x50-x100. For many older homeowners, they still have the home, in which to sleep, rest and play… without having to constantly tally up how much it’s worth, and how much more they want from their projections of even more future housing wealth.

“In fact, according to Clear Capital, as shown on the red line, U.S. nominal housing prices are just back to 2005 levels, completely ignoring inflation. This means that many homeowners today have no more equity in their homes than they did when they bought a decade ago. Even two and a half years of real estate market recovery has not brought an end to the lost decade for many markets and the nation as a whole.”

http://viableopposition.blogspot.ca/2014/09/the-housing-markets-lost-decade-looking.html

http://www.businessweek.com/articles/2014-09-25/for-sale-85-million-beverly-hills-mansion-built-on-spec

no comment necessary

…

Rubbish. LA isn’t a world-class city. Just ask anon/Tired BS and his BFF E-blo.

“In addition to U.S. tech, energy, and entertainment money, Los Angeles has lured investors from China, Indonesia, Russia, Latin America, and the Middle East who use U.S. real estate as a haven from political and economic uncertainty back home, says Alessandro Cajrati Crivelli, the builder of a spec home listed for $45 million in the Holmby Hills area of Los Angeles. “If you buy a house for $50 million, $60 million, and it falls to $40 million, it’s still better than having your money under a dictator who decides that money doesn’t belong to you anymore,†says Cajrati Crivelli. “It’s the return of capital rather than the return on capital.â€

Oh I get so excited at the thought of all that money trickling down so that I can afford a 1MM property with my slice of the trickle down.

I’m setting my sights a bit lower.

Would be happy to scarf just a few jelly beans from that $130,000 candy wall.

BTW, What the hell is a “candy wall”?

Dr. HBB scholar quiz question #1): How many maids does it take to clean a Italian lizard skin door?

Dr. HBB scholar quiz question #2): What’s so special about Italian lizards? Wouldn’t the ones from the IE or Arizona work? Just ‘askin.

L.A. is one of the best places to live in the world…. If you have a lot of money. If you’re not wealthy it’s a miserable place to live.

MonkeyMafia….That about sums it up!

No one argues that L.A. shares no significance on the world stage, it’s that the attribute alone is not enough to support the premise that it is less immune to a downturn than other areas, globally significant or not. You’re being mocked because the suggestion is too simplistic to be taken seriously. That you keep bringing it up out of context of the conversation doesn’t help your case either. Do you want us all to think you can pee further as well?

“…If you buy a house for $50 million, $60 million, and it falls to $40 million, it’s still better than having your money under a dictator who decides that money doesn’t belong to you anymore,†says Cajrati Crivelli….”

Maybe I have been watching too many re-runs of “Mr. Ed”, but horse sense would indicate to me if that you have that kind of loot to p*ss away on a house, you *are* the dictator!

C’mon guys (& gals :)), the GDP is 4.6%, we are in rekaveree… what could possibly go wrong… Can someone explain me how the FED can keep interest rates at 0% if it doesn’t pour bils of $$$ into the system. Do they have a magic wand?

*** The big “middle class†rip-off: How a short sale taught me rich people’s ethics

http://www.salon.com/2014/09/29/the_big_middle_class_rip_off_how_a_short_sale_taught_me_rich_peoples_ethics/

Living in the IE is nothing like living in Vegas or Arizona.

#1. The weather is cooler than those desert cities by at least 10 degrees or more depending on the area.

#2. Vegas has the strip, world class food and entertainment. Now the IE does not exactly have that, but it’s apples to oranges. In Vegas, yes it’s Vegas but other than the strip what is there? That can get boring on a repeated basis yet L.A. is a one hour drive from the IE. Also, the Fox Arts center in Riverside pulls in some cheap B list acts, and Ontario’s Citizens Business Bank arena is the 16th busiest venue in America. They have had Metallica, the Lakers, and countless other A list shows.

#3. San Manuel Ampitheater has the best sound system I’ve ever heard. And if you’re a rocker, it’s the place to be to see top acts. I’d rather go there than Irvine or Staples any day. And I wont set food in Inglehood’s Forum.

#4. Phoenix. A fine city and between Tempe and Scottsdale, you pretty much have it all. But it’s hotter than the IE and you can’t drive to the ocean or L.A. in one hour. I do like that they are a red state though and you don’t have all the CARB or firearm restrictions. California can be so restrictive on anything, I’m surprised they don’t tax passing gas.

The quality of life in Rancho Cucamonga, Upland, Claremont, Chino Hills, Corona, and a lot of Riverside especially along Victoria Ave or south is very high. Christmas at the Mission Inn is beautiful and made Travel Channel’s top 10 places. And if you really want to go extreme you can do Temecula (90 miles) but the trophy wives, exploding wine country, low crime and top schools can not be beat.

You pay a lot to live in SoCal but the lifestyle is absolutely unparalled and every kid east of the Rockies dreams of growing up in California.

Nailed it all right on the head. Keeping it real, The Realist. Let’s be honest. Vegas and AZ are hellholes that are great to visit for a day or two but only a fool would live there.

Vegas is suspect but Phoenix -Scottsdale very nice freeway system, very nice sports venues, very nice restaurants, lovely tuscan and Spanish colonial homes, weather Oct thru May excellent.

So many nice cars also… Telsa, exotic cars are routinely on the roads, if this town is a hellhole wonder where you live Mr Yo?

in other words, it’s a slightly less hotter hell and it’s got the same stuff every other place does. So impressed.

I have been plotting SFR prices from 1945 to today for So. California. The basic price cycle is 7-12 years up and 7-12 years down. A 360 degree cycle is 14 to 24 years! Same cycle since WW2! If the bottom was 2011 in So. California then the top is 7-12 years away. AKA 2018 to 2023. I was buying from 2009 to today and on to 2016. From 2017 to 2024 is sell window. How can I say this? Well when you sold 198 properties from 1999 to 2007 with an Average Gross profit of 1176% per deal/escrow/198 and average IRR NNN of 27%/mo. that batting average stands as #1 in USA! I bought back almost 100% of what I sold for about 2.7c/dollar from 2009 to 2014. This cost of goods will give me a return of: 3100% to 6600% if the normal cycle occurs! Trust me! I had 4 semesters of Calculus and read over 500 business books since getting my Degree in Finance & Real Estate (Double Major). Oh, in general the Southern California Real Estate market has a Personality of doubling every top to top and bottom to bottom! AKA the tops are about 200% of past tops & bottoms are about 200% of previous bottoms…. not to hard to do the math on the prices….

WOW! 4 semesters of Calculus – You MUST be a genius. I’ll go out and tear up my Caltech math degree right now…

You wouldn’t happen to have the stats for las Vegas now would you? 🙂 Much obliged.

Did You Take A Typing Class As Well?

Wait a minute, if 2011 was the bottom then by your calculation, prices started dropping in 1999-2004?

you got em good my friend. The index never fell 1999-2004. What say you IRR-genius?

@IRR-GENIUS,

Home prices in SoCal typically fall in the aftermath recessions. As long as California GDP is positive, home prices will not fall. However, home prices in SoCal tend to peak right before recessions kick in.

IRR-GENIUS: You stated, “AKA the tops are about 200% of past tops & bottoms are about 200% of previous bottoms…. not to hard to do the math on the prices….”

Given that house prices are approaching their 2005-2006 highs currently (aka past “tops”), you’re assertion is that the current prices will be roughly doubled before we’ll start to see price decreases. Although anything can happen obviously, for you to make this outlandish assertion, as well as your other assertions, leads one to wonder if you wasted your time and money obtaining your degree(s).

Not only is past performance is not indicative of future performance, but it appears you likely incorrectly evaluated past performance, making your prediction of future performance even more ridiculous (if that is at all possible)!

“it’s hotter than the IE and you can’t drive to the ocean or L.A. in one hour. ”

Can you really drive from the IE to the ocean in only one hour? Or even to L.A.? I imagine the traffic must be brutal, especially the farther east you live.

Do people who live in IE really care about going to the beach? First of all, it is not a 1 hour drive. When I lived in Pasadena is was 30-40 minutes on a Sunday morning with NO traffic, but how often is there NO traffic in LA. Given that is is quite rare that there is NO traffic in LA, from IE to the beach is more like 1 1/2 hour drive.

Lastly, I grew up near the beach and for me to live in Pasadena (or IE) the rest of my adult life was unthinkable. I bought a house in Baldwin Hills (15 min. to the beach with NO traffic on 10 fwy) and yet I only end up going to the beach 4 or 5 times a month in summer. (20 minutes driving time if driving down Jefferson or Venice Blvd).

So, anyone who moves to IE thinking they will go to the beach is probably dreaming. If you live in IE, wont you go to a lake or the desert?

It’s perhaps true that going to Havasu or Glamis is the destination of choice. However I can assure you getting on the 10 at where it meets the 15, you hit the 605 then the 105 and take it to the end, you are at the beach in exactly one hour. You can take the 57 down to Newport in about the same time.

Having lived in Glendale, how did it take you 40 minutes to go down the 210 to the 10 from Pasadena to Santa Monica in no traffic? That’s a 25 minute drive. Are you taking stoplights, parking lots, et all into account? Maybe then.

The IE is a great place to live.

I live in temecula, and I go to the beach quite often actually. It’s only 30 miles and I go at least 2 x per month all through the year. During the summer there’s a bus that also will take you there non stop ~40 min each way. And of course I only go when there’s no traffic which is usually weekends. Seriously I go to the beach now more than when I used to live on the strand in Hermosa. When you’re that close, you take it for granted. Lakes aren’t very usable in the IE. They’re for the most part dirty and not swimmable and doesn’t have large crowds which is part of the fun.

@ Realist;

yes I am including time in street traffic in Pasadena getting to or from the 110, parking, etc.

QE abyss brings up a good point. It’s laughable that anyone would attempt to make it seem like driving from the IE to the beach is quick and easy. SoCal traffic is unpredictable and notice that nothing was mentioned about the return trip. There’s sugarcoating and then there’s sugarcoated covered in chocolate deep fried crack being sold to school children.

Let’s be honest, parking alone will take 10-15 minutes if you’re going on a day when other people want to visit the beach. Door to beach, living in Costa Mesa, will be 30 minutes at least. Inland cannot be 1 hour unless you’re flying in on a helicopter to land in your private helipad in Corona del Mar.

OCMan, you have a point. It sometimes takes me about 5 minutes to take a dump on the toilet, about 15 minutes to stop for coffee and then there’s about 5 minutes to brush my teeth and 15 minutes to take a shower. I did not account for any of those things, so please accept my apologies.

Thought I would chime in. I live in corona, and I go to the beach almost every weekend. I usually leave around 8 and it takes forty min to Huntington. I actually love the flexibility of living here. Would I rather live ocean front? Sure. But I don’t have a spare five million around. Live steps from a golf course, short drive to snowboarding, San Diego, Temecula, Palm springs and hit Vegas five times a year just because!

You got that right. I used to think like the people from OC who are struggling to make it in the middle class. Looking down on others but barely able to enjoy life while struggling to make ends meet just to have the bragging rights. BUT, I got tired of the rat race, sold my house in Rancho Palos Verdes, used it to buy a 4k sq ft home strategically situated in Temecula 5 min from the freeway, and paid ~$30k for solar panels and since the house is so huge it has enough space to carry 95% of electricity so I have near zero electric bill every month and zero vehicle fuel since I have a Tesla and a Leaf but since I work from home anyway fuel wasn’t even an issue. With all the money I make monthly goes into retirement and or lots and lots of traveling.

@ABiggerRealist, it’s really easy to argue with emotions but if you are interested in facts, I’d suggest you use Google’s traffic system to look up how long it would take to get from Temecula to Oceanside Pier. It’s ~38 minutes no matter which time of day any day of the week except those golden commute hours of 6-8am and 4-6pm. It sucks to argue with facts doesn’t it?

We’re looking at over an hour of total travel time for your particular example which is likely not the A to B scenario which applies to over 98% the rest of SoCal.

Are you suggesting that the facts show spending over an hour in the car for your scenario is something to write home about? Is Temecula considered the IE? Care to share some “facts” that reach beyond your bubble?

YoSig: “if you are interested in facts, I’d suggest you use Google’s traffic system to look up how long it would take to get from Temecula to Oceanside Pier.”

Google’s traffic system provides guesstimates, not facts. I’ve used Google traffic system, and in my experience, they often underestimate traffic and travel time.

YoSig: “It sucks to argue with facts doesn’t it?”

It would if you had some facts, rather than mere guesstimates.

If the Doc has any insights into this drought, I’d welcome an article on the subject from him. Will this be a longterm drought? Over a decade or more? How severe? How widespread? SoCal? The entire southwestern U.S.?

I learned a lot starting a business in the middle of the housing boom (last one). We were scraping by investing everything into our gym while a remarkable number of clients were “killing it” in real estate and peripheral industries. These folks spent ungodly amounts of money on cars, houses and toys. All well and good I guess, but I remember as far back as 2005 getting a sense of Das Bubble. I did not follow things as closely as I do now, but I started wondering how many of our clients had any type of a “rainy day” plan. By 2007/2008 the delayed gratification we’d shown in building our business had paid off pretty well and we had a solid, nicely established business. Most of our clients who had surfed the wave of Das Bubble were in financial chaos.

I learned a lot from that.

We eventually decided to leave Chico, CA and ended up in Reno. Based off of not paying state income tax it’s as if we live here for “free” (mortgage (on a really luckily acquired foreclosure) food, etc are all what we formerly paid in state income tax in CA. Reno has witnessed a decent re-bubbling with mainly institutional buyers and a large % of cash only buyers looking to do something/anything with their money. The institutional buyers pulled back, prices are slowly settling, but there is a significant lag. I like the house we are in but it was built during Das Bubble and I have this sneaky feeling none of these “good looking” houses are actually all that well made. We are looking for something older with a decent chunk of acreage to update and stay in for the long haul. I suspect it will be 203 years before all of this last re-bubbling finally settles and we can get something that makes sense.

Interesting times.

Add some GNARLY pension gaps to all of this picture and we have the makings for some epic fun: http://www.reuters.com/article/2014/09/25/usa-pensions-moodys-idUSL2N0RQ2RY20140925

I always get a big kick out of reading the Chicken Little comments on here. The sky is falling! The sky is falling! Truth is, the market’s great! With low interest rates and rising demand for housing and price appreciation, there’s never been a better time to buy or sell your home! Ask me about getting full list price for your home… and Get Rich! Hurry, these great market conditions won’t last forever!

@GetRetard, “Ask me about getting full list price for your home… and Get Retarded!â€

here, fixed it for ya 🙂

dude, don’t feed trolls

God let’s hope not

GetRich^ard, now that it is such a good time for real estate, where and what are you purchasing?

GetRich^ard..As most know I’m always full bore on real estate but I have to tell you the numbers don’t lie, the past 9 months have been anything but rosy.

Sentiment of buyers is scared to buy let alone look at property. I find the folks who can afford these prices are also numb to real estate buying at the present, it seems 08′ ’09 is still deeply imbedded.

This is troublesome for the market to move forward even with solid price reductions. Take care

Good point about instant gratification…I think this article hit it right on the nail about our problem today and how this mentality translate to house buying mentality in US, especially in SoCal…

http://theamericanscholar.org/instant-gratification/#.VByWt_ldXNx

Maybe it would be more correct to say that there is little affordable property in desirable areas in certain markets compared to what was available in 2011? There are many lower income neighborhoods in Sacramento where house prices are only a slightly higher than they were in 2011. Unfortunately crime is often higher in those neighborhoods and the majority of the houses are poorly maintained rentals with absentee landlords.

Realtors still smoking hopium here in Phoenix and Scottsdale, Market is just getting softer.

Tempe Beach Bum …You are so right, it is as soft as a baby’s bottom. The agents just keep listing overpriced property and tell the sellers all is well in real estate.

Spring and summer were terrible, now it is all about fall-winter, what has changed nothing really.

Listings climbing again in high end zip codes especially, and so are new listings prices.

Spring and summer were basically dead, looks like the sellers are being told there is a pent up demand this fall, all I see is falling temps, and most likely falling pending sales again.

Lumber Liquidators stock down about 60% from last November.

Just saying.

Mr Yo….I see you live in Temecula, as a former 33 year resident iof So Cal- Ventura county, I feel sorry for you that you live in that town, traffic ,illegal crime I can go on, you have a nerve calling Vegas- Phoenix hellholes living there?

It’s ok, we’re all entitled to our own opinions. You can stay in your hellhole and i’ll stay in mine.

Is it just me or are there suddenly tons more foreclosures popping up when I search the listings???

It is just you 😉

Kdubbs …Don’t know about tons, but yes pre-foreclosure seems to being creeping back in

I love you, yeah yeah yeah, I love you… below was a suggested story at the FT, when I was reading up about Greece’s current position.

_____

The Associated Press

Sep 30th 2014 9:14AM

[..]The number of homes for sale has jumped 46 percent in Nevada, according to Michelle Meyer, an economist at Bank of America Merrill Lynch. It has risen 38 percent in California and 33 percent in Arizona. That has helped slow price gains in those markets. Meyer forecasts annual price increases will decelerate to 3.9 percent by the end of the year.

http://www.dailyfinance.com/2014/09/30/case-shiller-home-price-rise-july/

Redfin shows inventory in OC up 10% in Aug vs July. Sales dropped 6% for the same month.

Mortgage applications are down 10% YoY.

The percentage of listings with a price cut in OC just passed 41%, the highest level since 2010.

More homes, more price cuts, less buyers. What happens next?

We are not “over there yet”… Prices are still higher on Y-o-Y regardless to the cuts. When the prices start to fall on Y-o-Y, then the trend can quickly reverse. Wee are still in “home price rising” environment. We need to switch to all home price falling environment. Then we can start seeing tanks on the horizon. And keep in mind, the FED is always here to give a hand, so even if we switch to the “home price falling” trend, the FED can quickly turn it around.

Uhh, your YoY price gains are evaporating, quickly. Lets see if you can spot the trend:

http://2.bp.blogspot.com/-iVOA5bHkoUI/VCqsQ6BPPII/AAAAAAAAgu0/lvIIK_8nQ5w/s1600/CSYoYJuly2014.PNG

YoY price increases are deceiving. It’s the mix. Less lower priced homes for sale drive up median prices. It doesn’t mean a specific property has gone up in value during that period.

Dom, your data is pointless. Wake me when closed sale prices show a decrease. YOY CA is still up something like 8 or 9% in closed price.

The rest of that same data you post (and have been posting) is just noise. Said it before, I’ll say it again: the only reason you see price cuts is because greedy sellers are listing way too high. If it’s priced right, it sells.

Yes Cab, the chart I linked is pointless. There is no way to use this information to determine which way the market is heading. Laughing. 🙂

So far looking for a new place has been interesting. (I’m in the same position as CalGirl with a landlord looking to sell… for too much)

I went to the credit union to get pre-approved as I am approaching this move looking at rentals, buying, maybe buying my rental, or buying out of state. I have very high credit, a steady small business and healthy savings. I was a little shocked at how low the amount of loan they would give me was. I had gotten pre-approved two years ago for almost 300k more with very little changing over these two years. So basically back then I couldn’t find anything decent and now I can’t look at anything decent.

I just think the sellers are out of touch with reality at this point. The banks won’t even let me gamble on their shacks if I wanted to. The Chinese money is done. Investors are done. I think RE in 2015 is setting up to be ugly in SoCal. Even robert has soured on his beloved RE bull market.

@ The Observer: ‘I was a little shocked at how low the amount of loan they would give me was. I had gotten pre-approved two years ago for almost 300k more with very little changing over these two years. [..] I just think the sellers are out of touch with reality at this point. The banks won’t even let me gamble on their shacks if I wanted to.

_____

Ah that pesky tightening credit criteria… 🙂

That’s going to be a real source of correction, in my opinion, perhaps followed by sentiment change and a few more sellers willing to accept lower prices.

_____

‘Scared’ lenders, declining affordability making mortgages tough to obtain

September 16, 2014

Throw higher interest rates on top of it… if we ever see them, of course 🙂

@The Observer… that is quite some insight with the bank cutting way back on the amount of mortgage debt it would advance you in this market… much less than it would previously when house prices were lower…. vs now prices higher bubbled.

Even the would-be borrowing applicants with impeccable credit-history are finding that the banks are saying NO. To prime home-owners congratulating themselves on their bubbled house prices…. be afraid… be very very very afraid.

_____

Ben Bernanke: I tried to remortgage but was turned down

Former Federal Reserve chairman Ben Bernanke admits that he failed to remortgage his home recently, and suggests that banks aren’t lending enough

2 October 2014

Ben Bernanke: I tried to remortgage but was turned down Former Federal Reserve chairman Ben Bernanke admits that he failed to remortgage his home recently, and suggests that banks aren’t lending enough

Speaking at a conference in Chicago on Thursday, Mr Bernanke told Mark Zandi of Moody’s Analytics: “Just between the two of us, I recently tried to refinance my mortgage and I was unsuccessful in doing so.â€

When the audience laughed, he added: “I’m not making that up.â€

http://www.telegraph.co.uk/finance/economics/11137589/Ben-Bernanke-I-tried-to-remortgage-but-was-turned-down.html

Not sure I buy this one:

Millennial home buyers making a comeback?

http://www.marketwatch.com/story/are-millennial-home-buyers-making-a-comeback-2014-09-30

My favorite house for sale recently…check out the price history…

https://www.redfin.com/CA/San-Pedro/668-Rapallo-Ave-90732/home/7735102

Buaha-ha-ha-ha-h-ah-a :). So… no buyers and the price keeps rising?

“Rear patio/yard is sliding down the hill towards Western Avenue. ”

Buaha-ha-h-aha-h-ahah-ah-ah-aha 🙂 🙂 🙂 🙂 What a joke… I wonder if you can actually obtain a building permit on this thing…

a guy from Seattle wrote: “no buyers and the price keeps rising?”

Why yes!! According to some of the real estate geniuses who post on this blog, Southern California is WORLD CLASS!!!!!! So it makes sense for a WORLD CLASS dump like that to have no buyers and the price to keep exploding HIGHER and HIGHER. By January that crap shack will be listing for $2 MILLION dollars because SoCal is WORLD CLASS!!!! Buy that pile of crap now before you are priced out of the WORLD CLASS SoCal housing market by hot money foreigners. This time is different…

Wow… gotta give the RE agent credit for the full disclosure. LOL at photo 31, the extension cord used as support to keep the wrought iron fence from falling down. Also LOL at the photographer in flip-flops: no way would I walk around that vermin-infested pile with exposed feet. $550k? Hmm, more like $100k BYOD… that’s Bring Your Own Dozer.

I know right….maybe rats are the new granite….hahahahaha

The housing market is funnier than going to stand up comedy. If I want a good laugh, I just head over to Redfin and see the pricing of these nasty homes going for sale at insane prices. I feel so sorry for the poor idiot that end up buying these homes. Sellers pricing whatever price they want hoping for a greater fool to come along. It’s really comical to see. I keep seeing rise in inventory. There is only so many fools that would buy, housing to price correct in early 2015

That dump looks like a crime scene.

Love the Home Depot ceiling ! Nice decorator’s touch there. Who would be stupid enough to pay over $100k for this place. Land value aside, how much would it cost to demo that dump, then have the lot stabilized? Before you could even think about getting permits to build.

The crack in the foundation – looks familiar. I had one in a near-new house I bought once. Found it when I had the carpet torn up to put in new flooring. I found out then why the drywall was cracked and outside stucco started to crack. Went at least 30 ft through 3 rooms. Got the builder out, was told it was totally normal and no big deal, that “concrete is designed to crack”. Doesn’t look totally normal to me! Got a cousin out who is a structural engineer, he said no way this is bad. Sent his report to the builder with a threat to sue, they fixed it to the tune of $18,000 (their expense).

Update: Looks like my landlord’s el-cheapo (aka free) FSBO ads on Craigslist expired. 2 days later they put in on Zillow (free listing). Still $70,000 over appraised value, but now they are offering 3% to buyer’s agents, whereas before they didn’t want to pay any agents fees. 1st step in the desperation ladder. Again no mention of it being a rental or currently tenanted.

Today I’m home sick with the flu, and some creep pulls up outside and stares at my house. The he gets out of his Lexus and moves my trash cans (its trash day) and starts taking pics. Next he’s gone round to the side gate and is trying to access the back yard (I have a padlock on it), then the dude rings my doorbell.

If I wasn’t sick as a dog and in my pyjamas at 11am I would have confronted him and told him to f@ck off. I should have let the dog go after him 🙂 How’s that for bold? Looked like an agent.. fancy car and had that useless, sleazy used car salesman look about him.

After this happy encounter, I called on a new rental that’s just hit the market today. Right around the corner, same floorplan, more upgrades and $30 a month cheaper. I’ll go check it out… these greedy owners can shove it. I was willing to co-operate to a point, with 24 hrs notice, but if today’s exhibition of invasion of privacy is going to continue, I’m moving now. The owners will crap their pants. They can’t afford to have it empty and sure as heck no new tenant is going to want to rent it while its “for sale”.

I’m stunned that anyone would even want to come check out the exterior. $70k overpriced in a declining market? And needs at least $30k worth of repairs? Maybe it was THE GREATER FOOL!

I say, let the fool eat his (her 🙂 ) cake :). Nobody is forcing you to buy. Nobody was forcing them to buy during the last bubble. If people are too stupid to figure it out, then they deserve what they get :).

I’m seeing pending sales and some sales for houses in Downey for $700,000/800,000. Who’s buying these houses??

According to a 2012 estimate, the median income for a household in Bellevue, WA was $88,073 (couldn’t find fresh data). The current median home price is $600K according to Zillow. So, how is that for affordability? It is 6.8 of the median HH income. Now I wonder who is buying all those $600K+ homes?

Just for comparison, the last peak was in Jul, 2007, the median home price was $585K (same Zillow), so we already surpassed the last bubble as I suggested on many occasions. The bottom was mid 2012, the median Bellevue home price was $485K, but it took almost 5 years to bottom… I expect the next bottom at least several years from now… Sorry, no tanks on the horizon 🙂 🙂 🙂

While I empathize with your 6.8 x median HH statistic for Bellevue, this is a SoCal housing blog.

6.8 x median HH income is nothing to write home about down here.

If you’ve done any research whatsoever about comparable markets, you’d realize how foolish you sound.

So… the “Great Recession” started in December 2007 and ended in June 2009, which makes it 1.5 years, but with constant QE and ZIRP the housing “bottomed” in 2012. So, say the next “Grand Depression” (or whatever the name we will come up with) starts sometime next year (we just had GDP 4.6%, so obviously no recession in 2014), so, potentially, it may take another 5 years (see 2007 – 2012) for housing to bottom… right? Can we now agree on housing to tank hard in 2020?

Leave a Reply