Southern California is only $32,500 Away from Seeing Housing Prices Fall by 50 Percent from the Peak: The Precipitous fall from $505,000 to $285,000.

The Southern California housing market still shows significant signs of distress. It is rather obvious that the Federal Reserve is going to do everything it can to weaken the dollar and try to strong-arm interest rates until they scream uncle. During this same historic week that we are now in zero interest rate policy Ben Bernanke helicopter (ZIRP) world, another milestone occurred in Southern California. The median price for an area with more than 20 million people has now breached the $300,000 mark. This is significant because the peak of $505,000 was reached only last summer.

The market has deteriorated so quickly and with such devastation, it gives me pause to think what is going to happen when the $300 billion in pay option ARMS (POA) recast in 2009 through 2012. For many long time readers you know that my “crash scenario” meant prices falling 40 percent from their peak. The median price for the region is now off by 43.6 percent. Keep in mind that last month 55 percent of buyers exercised their bargain shopping right to purchase repossessed homes. You have to take that into context when looking at the median price. However, let us go through our monthly analysis of one of the most expensive and diverse housing regions in the country:

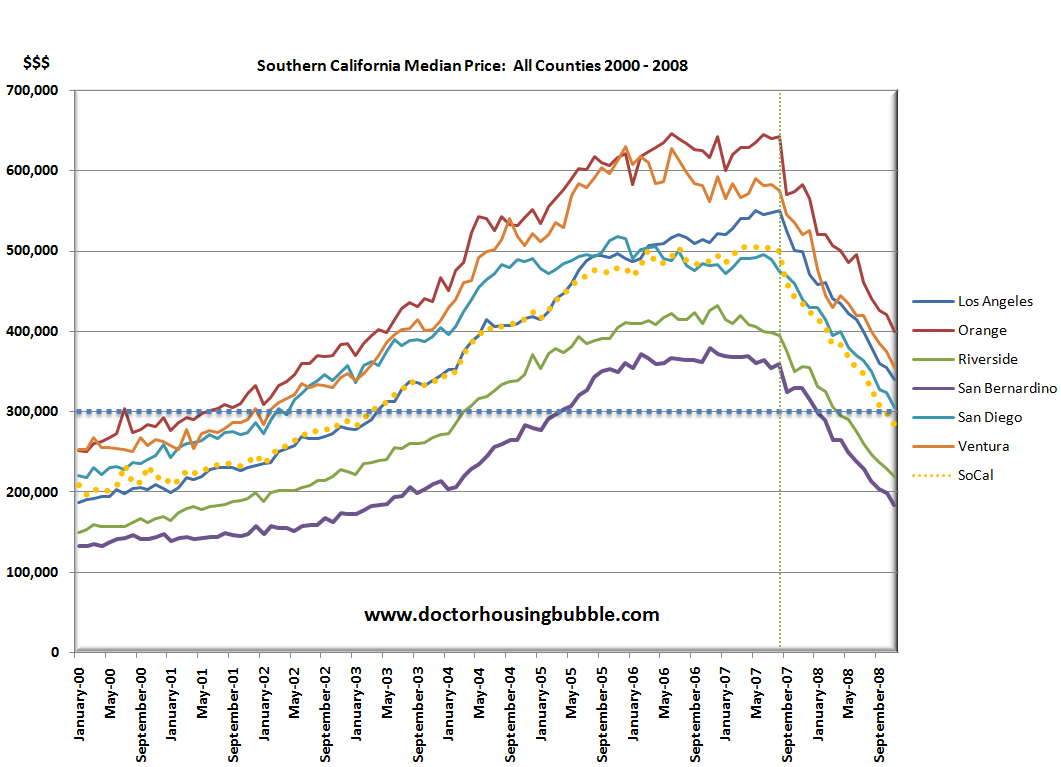

*Click for sharper image

This chart gives a very clear picture of what has occurred in Southern California. You’ll notice that most counties reached their peak in the summer of 2007 only to fall precipitously over the next year. Southern California is a micro view of what has occurred in many metro areas across the country. You have your prime locations in Laguna Beach, Santa Monica, and La Jolla that will remain resistant simply because of their locations. Yet you have areas like the Inland Empire that have seen unrelenting price drops similar to those in Florida or Arizona. Aside from the Southern California median price dropping below $300,000 we have our first county dropping below $200,000 since 2003. The median price for a home in San Bernardino is now $185,250. San Bernardino hit a peak of $380,000 in November of 2006. Guess what? We’ve just had our first county drop by 50 percent from the peak.

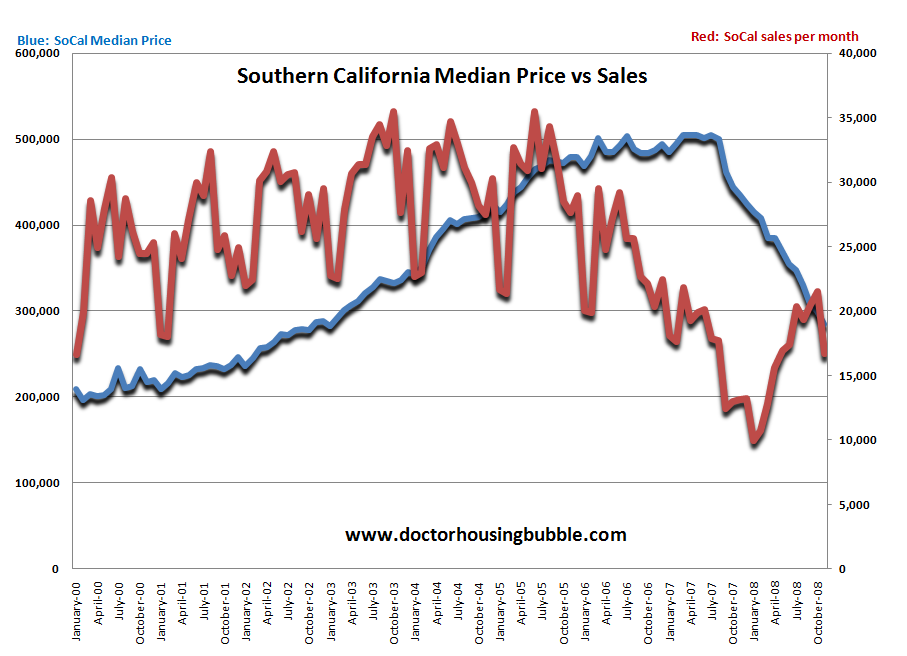

Now there are many things pushing prices lower. Market confidence is shattered and it doesn’t help the public to hear that a Ponzi scheme run by Bernard Madoff has been going on for probably a decade and has put at risk nearly $50 billion. That isn’t the boost in the arm we need right now. First, to simply think that the housing market collapsed out of nowhere is a mistake. Let us look at the sales pattern in conjunction with median price for Southern California over this decade:

The first warning sign we had came with the major pattern dislocation in the summer of 2006. The normally robust bounce in sales did not occur. Yet prices kept going up for another year. This is where the bubble stepped it up to another level. This graph from a technical perspective gives you a better understanding why looking at price alone is not a good predictor of future trends. What you’ll also notice is the steady sales increase from January of 2008. Normally, winter is the weak selling season and you’ll notice the seasonal dips in the chart followed by the healthier summer selling seasons. Keep in mind that our recent ascent upwards was fueled by these strong price drops.

The recent sales increases should be taken in context. If you look at the decade, we are still well under even the weakest winter trough from 2000 to summer of 2007. You’ll also notice that last months sales are now reflecting the typical fall and winter weakness.

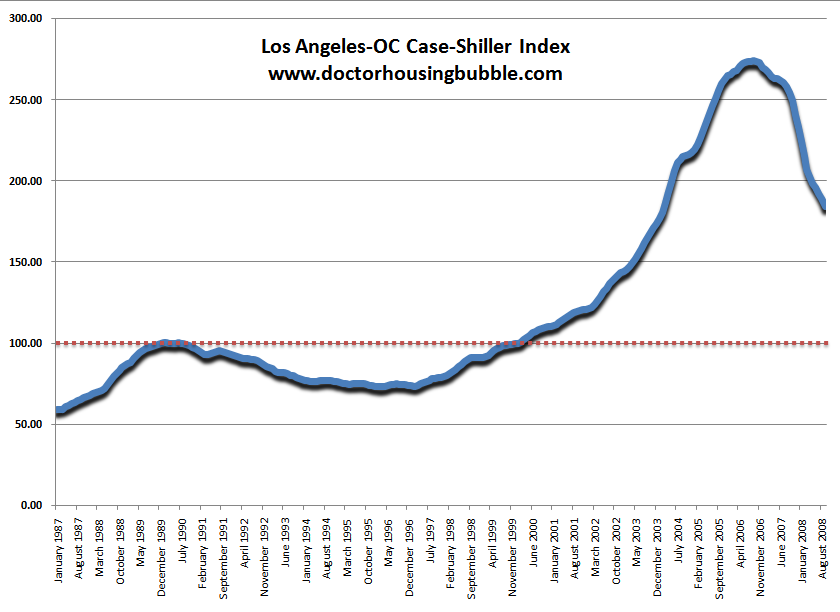

Some argue that the median price is a poor indicator. Yet this is what the average family on the street is most likely in tune to. It is also the average family that will be buying homes so yes, it is important. It is fascinating that during the boom, those in the real estate industry kept championing robust median price numbers and now that the numbers don’t suit their purpose, they choose to knock them down. Okay, let us look at the Case-Shiller Index for the Los Angeles and Orange County area:

The Case-Shiller Index measures repeat sales on the same home. So this is arguably a more accurate reflection. The index doesn’t give us a price per se but gives us an overall measure of price increase from a baseline point. For example, the baseline year is 2000 and has a number of 100. At the peak, the LA/OC measure jumped to 273.94. That is nearly a tripling of price in less than a decade. This measure is now converging with the median price. How so? Let us look at the median price of a home in L.A.

December 1999 median price:Â Â Â Â Â Â Â Â Â Â $192,000

August 2007 median peak price: Â Â Â Â Â Â $550,000

550,000 / 192,000 = 2.86 times

Nuts. The median price of Los Angeles is now $340,000. Let us run the numbers again:

December 1999 median price:Â Â Â Â Â Â Â Â Â Â $192,000

November 2008 median price:Â Â Â Â Â Â Â Â Â Â Â $340,000

340,000 / 192,000 = 1.77 times

What is the current Case-Shiller number? 184.54. Keep in mind that the Case-Shiller Index looks at L.A. and Orange County. The 184.54 number takes us back to where we were in February of 2004. The median price in Los Angeles county in August of 2003 was $338,000. The index and the median price are converging with a trend and are only separated by 6 months in Los Angeles. Bottom line? You can choose to look at the Case-Shiller Index or the median price and the story remains the same.

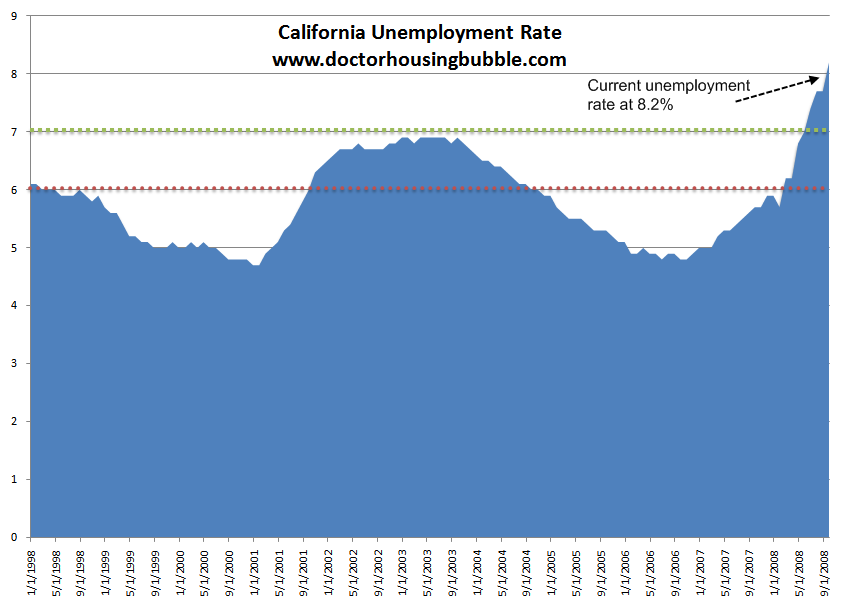

Yet California is facing challenges beyond just the housing market. Some people forget that you actually need good employment to buy a home. They have become so laser focused on interest rates or monetary policy that they forgot one thing. A large number of Californians were employed in the real estate industry! I talked in great detail about the rise and the fall of the Southern California housing empire in a previous article. We benefited the most from the housing bubble and are paying the price during the bust.

Have you noticed that the bailouts have gone into the black hole of crony capitalistic banking wonderland? Wasn’t the main purpose of the bailout to keep the market from collapsing as it currently is? The truth of the matter is the bailout was never for you. The bailout was to keep the world of the bankers and those on Wall Street from collapsing. Even floor brokers now realize that they aren’t part of the private club as we have seen the many pictures of entry level workers walking out with their boxes from Lehman Brothers. It is the Titanic and only a few lifeboats are available. Who will get a piece of the bailout lifesaver?

California is also in a budgetary mess. While our politicians get paid to literally do nothing, our employment base is getting shattered to pieces:

It is stunning how little focus has gone into sustainable job growth. Here we are, nearing the end of 2008 and having committed over $2.2 trillion and what can we say we have accomplished with all this? My main question is how can we as a public simply not care where this $2.2 trillion went? Think if we only dedicated half the time from the bread and circus theater of the auto industry to asking the Fed to open up their books. $15 billion for the auto industry. $2.2 trillion for the banking industry. Hmmmm. You know how many jobs that $2.2 trillion could have created? I’m not for government meddling as long time readers know but I would rather have that $2.2 trillion go to rebuilding roads, schools, focusing on healthcare, and maybe getting our budget in order. If it is a choice between banks, hedge funds, and our buddy Madoff I’d rather see the money go to the average American taxpayer who is already being taken to task while watching the Fed and U.S. Treasury destroy their currency.

I still stand by my prediction that the bottom for California housing will not be reached until 2011. I know in our nano-second driven world, it is hard to imagine 2 or 3 more years of this. But we only have 2 roads we will follow. One road takes us down our current path. Price destruction and massive market corrections to fix the misallocation of a bubble decade. Otherwise known as deflation. Or if the Fed and U.S. Treasury have their way hyper-inflation. Their actions hope for a 1970s style inflation were they can prime things up and then get it under control. Anyone that looks at data from that time realizes that bringing down high inflation is no easy task.

The Southern California housing market operates with all these multiple forces pulling at it. Before you start looking at a bottom ask yourself the following questions:

(a)Â Is the employment situation good for the state?

(b)Â Are wages increasing?

(c)Â Is there a lack of inventory on the market?

(d)Â Are prices going back up?

I would answer no to all the above and if someone asked me whether Southern California has hit a bottom, my answer would be no.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

31 Responses to “Southern California is only $32,500 Away from Seeing Housing Prices Fall by 50 Percent from the Peak: The Precipitous fall from $505,000 to $285,000.”

Nice post, as usual. One thing I was reading is that in the last 8 years, about 40% of GDP was due to the FIRE (finance, insurance, and real estate) economy. Imagine our economic growth numbers 40% lower. Real estate reminds me of the Nasdaq crash – it will go much lower than people think, and it will not come back. Amazon will be back at 400$ a share…in 2155. The median house price will get back to half a million at about the same time. In the mean time, expect stories about how people are replacing their worn, chipped, discolored granite countertops with their Grandma’s technological inovation – formica.

I am writing to you since the State of California has been hit hard by the Subprime and Toxic Mortgage Crisis. I have done research into this topic and it is clear that small business owners in California have been hit hard and are suffering especially since self-employed micro-business owners may have used their homes to have access to cash. These small business owners are now at risk of foreclosure in the upcoming “resets” in 2009. As you will see from the NASE survey which I developed for NASE, the failure of these small businesses will lead to catastrophic job loss.

I am a Professor at Kean University in Union, NJ, and I would like to share the results of a National Association for the Self-Employed (NASE) survey, 2,400 responded, that indicates that self-employed business owners have Alt-A, Option ARMs, Interest-Only, Subprime mortgages. Estimates are that:

· 22.9 % (3,709,800* At-Risk) of all self-employed business owners used risky or “toxic†mortgages or refinancing that are scheduled to “Resetâ€.

· 19.2 % (3,110,400* At-Risk) of all self-employed business owners are at-risk of “payment shockâ€. They do not know the monthly mortgage payment that they will be required to pay at “Resetâ€.

· 18.4 % (2,980,800* At-Risk) of all self-employed business owners are very worried about the monthly mortgage payment due at “Resetâ€.

· 7.9 % (1,279,800* Immediate Risk of Default) of all self-employed business owners have already missed one to three or more monthly mortgage payments at this date before the expected resets in 2009 to 2012.

* Based on 16.2 million self-employed business owners per SBA Advocacy

Since the average number of employees for each self-employed business is 1-10 employees, this level of involvement in foreclosures and failure at reset may cause potentially millions to lose their jobs.

The NASE Surevy sheds light on this mortgage foreclosure crisis. The survey highlights the fact that self-employed and micro-business owners bear the largest share of the “toxic” mortgages that are out there. These Alt-A, Option ARMs, Interest-Only mortgages will “reset” in 2009 and will result in the next wave of foreclosures.

It is suggested that loan modifications will help lower foreclosures. I agree, however, whereas loan mods will lower the monthly mortgage payments and may lower default, there is another concern. “Re-default” rates on modified loans are very high. In order to lower the rate of “re-default” we should include “immediate and specific financial guidance” to enhance the borrower’s ability to make the revised monthly payments.

The NASE survey Press Release was issue on November 21, 2008. Small Business is the “key” to the solution of this crisis. I have been researching Small Business Failure since year 2000 and concluded that the main cause of failure was the lack of understanding financial management. Individuals have the same problem.

The survey discloses that micro-businesses had the vast majority of these mortgages that are expected to “reset” and cause the next “tsunami” wave of foreclosures. The findings reveal an interesting fact that may offer a key to mitigating the losses on “toxic” mortgages that have plagued the banking community.

The survey results will have great implications because it relates to the foreclosure crisis. It also offers a path to a “solution” to this crisis that will mitigate the losses that are currently being generated by the “toxic” mortgages held by banks and investors worldwide.

I have researched the Credit Crisis and testified on April 16, 2008, before Senator John F. Kerry’s US Senate Committee on Small Business and Entrepreneurship. During the course of my research, I discovered that there was a connection between small business and the “toxic” mortgages that are now being downgraded and are causing havoc and bank failures. Proving this would be difficult. Fortunately, I was able to gain the support of NASE (National Association for the Self-Employed) to run a survey to see if my theory was correct.

Working with NASE we created a survey which was published as a Press Release dated Nov. 21, 2008. The survey was intended to confirm my research that small business owners held these “toxic” mortgages that are expected to “reset” and cause further havoc to our already fragile economy.

The survey revealed stunning results that confirmed my research. My research indicated that small business comprised a significant portion of the “toxic” mortgages such as Alt-A, Option ARMs, Interest-Only, etc. These mortgages are prime and near-prime and are expected to fail in the upcoming resets that are expected to begin in 4th Quarter 2008 and continue through 2012.

Nearly 2,400 responded. The results are dramatically stunning because it is now clear that these “Troubled Assets” (TARP) that are held by banks and Fannie and Freddie, will be the cause of the next “tsunami” wave of foreclosures which will begin at the resetting of these mortgages.

See the Press Release and my Commentary on the NASE survey at http://www.nase.org .

I’m a big believer in bell-shaped curves, a.k.a. “what goes up must come down”.

The Case Schiller index, along with unemployment stats, certainly point to an ‘over-correction” of the index below the 100 baseline. It appears that home prices have a LONG way to go down, more than the 15% I keep hearing thrown around the media. Were taling median price of around 185K, which equates to another 40% from where we are now, and thus nearly 70% from peak!!

Bottom line: HOARD your cash, do not waste a cent – and prepare for the ultimate fire sale. I do believe, however, that the fire sale window will be very short, because hyperinflation will be trying to blast through that window before you can…

Great summary as usual, Doctor.

Here is a tidbit of news for CA:

The state’s top three financial officials voted unanimously today to freeze $3.8 billion in financing on road, levee, school and housing construction projects throughout California in the most drastic fallout yet from the state’s cash crisis.

The Best Article I Have Ever Read (edit/delete)

The Root, The Mother Branch? (Draft) (edit/delete)

Dr. Housing Bubble

The Four Horsemen of the Economic Apocalypse: Lessons from the Great Depression: Part XX. Housing Distress, Stock Market Tanking, Commodities Collapsing, and Unemployment Surging.

The Southern California housing market still shows significant signs of distress. It is rather obvious that the Federal Reserve is going to do everything it can to weaken the dollar and try to strong-arm interest rates until they scream uncle. During this same historic week that we are now in zero interest rate policy Ben Bernanke helicopter (ZIRP) world, another milestone occurred in Southern California. The median price for an area with more than 20 million people has now breached the $300,000 mark. This is significant because the peak of $505,000 was reached only last summer.

****

DHB wrote the best article I have ever read recently in 6 months.

I post a link to the article in other topics many times.

Even I am not satisfied with DHB’s right diagnosis without a feasible solution, I spend so much time to write a comment on it in the above title. But unfortunately I lost my content when I tried to upload it and AR computer ate it so that I lost my patience to do it again and placed it in my “Draft”.

If you would like to understand the current economic development much better than Ben Bernanke or Hank Paulson, I would like to recommend the article to you.

If you understand what DHB said, and read what Jude Wanniski reckoned those wrongful events in the history in his book “The way the world works,” I believe you would see what the GWB’s boys did and went wrong, to discern the future trend and benefit yourself from this man-made “recession” as those errors Presidents Hoover and Roosevelt made in creating the historical “great depression” in 1930′.

Mind you “Be patient it is a long article.” If you are unable to have a peace of mind, don’t click the web-link.

Thank you for your efforts DHB. Without you, and a few others like you on the net, I would be woefully unaware of what was REALLY going on with the housing/economy collapse, how we got to this point, and what the future holds.

I am one of those who bought at the peak and whose value is now down by 45% currently. I concur that the bottom will not be seen for 2-3 years, and even then prices will probably stay flat for years afterward. I also fully expect values to drop another 15-20% in those 2-3 years, and I suspect my property will take decades to return to the value it was appraised at when I purchased it, if it ever does.

To top it off, I now need to move for employment and am pretty much screwed. It still seems soo many people aren’t aware of what’s happening and don’t understand how everybody who bought between 2003-2007 was the victim of fraud. Yes, I said EVERYBODY, because during 2003-2007, we all paid a greatly inflated price based on contrived competition between disparagingly different buyers utilizing fantasy loans engineered and pushed by the mortgage industry.

Everybody qualified and brokers and banks all got paid their fees ( the larger the sale price, the larger the fee ), which is apparently all they cared about or had to care about, because they would simply resell the loan immediately anyway and move on to the next schmuck.

There is so much anger and blame out there towards people like me, most often from people who are not in the same position ( angry renters, people who bought 10 years ago, etc. ) and will NEVER understand how it feels to be in this situation. Those of us who bought during the bubble weren’t all flippers. Some of us were just families who wanted to buy our own home, after renting our entire lives. We took out conventional loans, we put a down payment down, and now we have no options and a rapidly depreciating asset that will never rebound, or as it’s otherwise known, an albatross around our necks.

I’m in Nor-Cal, and I think the first 1/2 of 2009 is going to be a harsh wake up call for soo many people, as far as unemployment, increasing foreclosures, and general despair. Once the holiday season is over, any last remnants of the fantasy world we’ve all been living in will dissolve entirely.

Tyrone: maybe the state is quite consciously waiting for a federal bailout. I’ve heard the new president might have plans to spend a lot of money on infrastructure.

J – same situation, in Norcal wife and I bought in ’06, paid what we thought we had to with intention to live in home and raise family, value now off 1/2 and comp rental is half of our mortgage. We too have a fixed mortgage but it just doesn’t make sense based on today’s value to stay, so we have likely made our last payment and will walk. Don’t have any other debt and good jobs/income (for now) so are hopeful to save some extra cash for down the road and get into a safe rental. I see lots of posts from ANGRY people who are not in this situation that want to blame folks like my wife and I, and I agree they just don’t know how it feels. It’s defintely been a hit to our pride but it’s not the end of the world. Thaks DHB, I look forward to reading your future posts. Do have family in Socal but they still don’t get it.

I hate to respond to posters, but I need to comment on the bell shaped curve fan. Bell curves are not “i.e. what goes up must come down.” You appear to be likening the curve to some sort of quadratic equation rather than a normal distribution of data points. The “bell curve” always seems to get misused like that. What you may be thinking of is mean reversion, which basically means that that home prices will rise and fall over time, but ultimately will be the same over the long run. This “same” would probably be inflation adjusted. Whether the home sales that occur in order to determine your mean value and standard deviations for calculating your potential mean reversion form a normal distribtion, or bell curve, remains to be seen.

Well, here it is:

http://ace.mu.nu/archives/279812.php

…and our new President-elect wants to spend another TRILLION dollars we don’t have… hard to be a victim when you vote for these kinds of antics.

Remember 28% of our GDP goes to service the national debt.

Our country is ADDICTED to consumption on credit.

Our children and grandchildren are SO screwed. By us. And we’re not stopping or even slowing down.

The carcass of America is currently being picked clean.

I am SO glad so many of the WW2 combat vets I knew aren’t around any more to see what we’ve done with the wonderful blessings they provided us-

To J:

Don’t feel sorry, we understand.

Darwin said “the fittest survive.” By making a mistake, treat it as a fee paid to learn. But, please don’t make the same mistake next time.

Now, it is the good time to get even with those big fat cats. While our politicians won’t bail you out, you have to do it by yourself, right? That’s why I created a blog “American Poor Folk’s E-gold” and a series “Bank Hug Club” (sort of DHB’s “we salute the house genius”) in which I am talking about good steals, a legal bank robbery for those like you to get even.

If you want to be smart, please go to my blog to know how to dig out your “gold” out of other’s trash. They are everywhere in USA so that you may lose something in California ponzi house game and win some somewhere by using my technique.

Huh. My friends in Huntington beach swear their 600,000 home has appreciated. they’ve recently put it up for sale. And in Long Beach their home has gone down a little but bottomed out. Are some neighborhoods immune from these price declines?

Great post DHB as usual

and great info Fresno Dan. I might add to your imaginings of our economic growth numbers 40% lower some imaginings of how many people FIRE employed…in high-paying jobs…especially in California. And I’m sure that those numbers don’t include all the people who work at the Home Depots, furniture stores, stainless-stell appliance stores, landscaping businesses, plasma screen stores, Mercedes and Hummer dealerships…should I go on. I’m thinking that this is all going to be a lot worse than it looks even now. And I’m thinking it will be a looong time before housing turns around. We may see the bottom in 2011 if it continues its rapid decline, but it will be a looong time before we see any real gains (hyper-inflation aside.)

Gael,

I cannot accept you post about the friend’s appreciated house in Huntington Beach unless I assume big dose of irony on your side. I am watching HB for a long time. In 2006 the cheapest houses (even in 92647) on the market were around $650K (some exceptions because of condition for $620K). Now everybody can check prices start from $450K, some exceptions at $400K. If we were to talk about Torrance/South bay, where I live this appreciation talk is more adequate. Not really appreciation but at least not crash like in HB…

Bwa-ha-ha!

Tyrone: maybe the state is quite consciously waiting for a federal bailout. I’ve heard the new president might have plans to spend a lot of money on infrastructure.

js: Where the f*** do you think they’re getting that “money”? The country is BANKRUPT. And if they do find some “money”, who do you think is going to pay for it?

I got out of the stock market ONE YEAR AGO because I saw the risk; my next move is to get away from total US Dollar dependency because I see risk there. How about you?

It is getting ugly out there… I have lost 1/3 of my morning business, simply due to the fact that people that don’t have a job anymore don ‘t stop to buy a cup of coffee and fill up their tank at 6 a.m. in the morning.

We are expecting even more lay offs once Christmas is over. The large retailers and grocery stores are barely hanging in there until January.

Car lot after car lot is closing up…

Where are the people supposed to come from that can afford to buy a house?

I have 10 applicants for one measly minimum wage job. People that last year barely acknowledged my employees, waving their AmericanExpress cards to pay for snacks and gas on their way to Reno are now asking for an application.

The restaurants are empty… the grocery stores deserted. You can tell when it is a common payday for most people by your sales figures. You have a small surge on Fridays and then sales drop again.

Even sound businesses can’t get financing for upgrades and fixtures. The banks are shutting down on loans. Without the financing businesses can’t operate.

Where did all the money go that was pumped into the banks?

@gael

Your friends are sniffing glue and drinking the jones-aid – HB has been decreasing steadily since last year. Putting a house on the market and selling are two different things. There are a ton of HB houses that are still at overinflated 2006 levels, however they are also not closing escrow for 100, 200 + days…

I would rate this as one of your best articles Dr Housing Bubble. The graphs are superb, Congraulations. The comments too are excellent.

The sad reality is that most people never realized the sheer desrtructiveness of the artificially created housing bubbles – and sadly are now having to learn the hard way. Its important too that people realize that there is nothing of significance Governments can do about these painful “readjustments to reality”.

There certainly needs to be significantly more public debate and discussion regarding the bailouts – which are not cost free. It is likely most will prove completely ineffective and probably worsen the problems by prolonging them.

We can be sure that as the costs in social, political and economic terms become more apparent to people and policymakers – that the necessary regulatory changes will be put in place, to ensure that these artificial housing bubbles do not get traction again.

Hugh Pavletich

Performance Urban Planning

http://www.performanceurbanplanning.org

Christchurch

New Zealand

The fantasy world we lived in (as a poster stated) will not come back. I think people seem to forget the same demons that are behind the economic crisis also want to see the world population reduced to nothing but them and their inbred families. Get ready for blood.

Folks are spending a lot their energy telling us how it’s not deflation (disinflation?), but that’s not the truth. It very much is demand-exhausted deflation). If it weren’t for the fantastic amount of inflationary actions (0% interest, virtual cash going everywhere, two wars) prices would avalanche:

1) Housing prices collapsing (not an exaggeration) Huge inventory overhang.

2) Car sales off a cliff (obviously)

3) Unemployment horrible–unemployed tend to spend less, obviously.

4) Commodities speculation in general unwinding

5) Stock wealth has evaporated from price collapse.

6) Stock dividends also being suspended or reduced.

7) Debt,lending being curtailed reducing potential for demand-pull inflation.

8) Population aging–people get a little wiser as they get older and don’t waste quite as much money generally (except medical and bailing out their kids).

9) Those that do get jobs don’t earn as much, and with all this debt and inevitable tax increases they will likely have less disposable income.

10) Bankruptcy–folks don’t get paid or settle for pennies on the dollar.

*** I’m not an economist–there are a lot more reasons for deflation and only one for inflation–government. History shows that the markets eventually overwhelm government intervention. We can’t fix problems if we keep denying them.

J,

Nobody with half a brain blames FB’s for the bubble. The Wall St. banksters are to blame, and the shithead politicians who enabled the fraud. Now we are witnessing the fleecing of America by Wall St. for the second stage. Dr.HB is absolutely correct to notice the silliness of the “controversy” over a relatively TINY auto bailout as compared to an ASTRONOMICAL bailout for the Wall St. scum.

If things get bad and people figure out what actually went down…I believe that it could get very ugly. I mean, rather than waving signs on Wall St. that say,”Jump you bastards,” the crowds will more than likely THROW the bastards out the windows and then stomp their carcasses.

My statement about what the state of CA is doing was a statement of what I believe they are doing, not what I think they should do. Yes, the risk to the dollar is correct as far as it goes, but we’re not the only country doing massive bailouts. It’s the whole world that’s done massive bailouts to their banks etc.. Maybe all the currencies go bust.

Hi! Love your site! Your 12/18/08 article was extremely informative and well-written. I do wonder if this particular portion would deserve a little more fleshing out: “You have your prime locations in Laguna Beach, Santa Monica, and La Jolla that will remain resistant simply because of their locations.” While I realize that a small minority of readers would be in a position to afford a house in those locations, perhaps they would benefit from an education in direction of the “prime markets”? Are these areas really resistant, or just the last to fall?

Dear DHB,

I was wondering whether you can draw an “affordability curve” of the housing market for the past 30-50 years?

As you know, the current interest rate is at historical low, which will definitely increase the affordability of house. Given the same household income, at 11% rate, if you can afford a 200 k house; at 5.5%, could be 300 k. Also the household income also grows after adjusted by inflation.

So during the last 20-40 years, the house price has rocketed up, but taken interest rate into account, the affordability might not grow that dramatic.

Thanks

My California folks,

Still more bad news on the way after GWB’s automaker’s bailout. It is an ugly one for California (Don’t blame me; I am just a messenger):

Florida, North Carolina Had Record Job Losses in November By Timothy R. Homan

Dec. 19, 2008 (Bloomberg) — Florida and North Carolina alone accounted for a quarter of all the jobs lost in November

California’s rate was 8.4 percent, up 2.7 percentage points from November 2007. Mickey Levy, chief economist at Bank of America Corp. in New York, said yesterday “In areas like California you have the unemployment rate rising fast at the same time housing prices are falling fast, so it’s a bad combination.”

In the 12 months ended in November, Florida led all states with a 206,900 drop in payroll employment, followed by a decrease of 136,000 in California and a loss of 112,800 jobs in Michigan.

Sorry, it is a good news for someone: Texas gained 221,200 jobs in the last year, the most of any state.

Dahlings: I love my friends. They do believe their home in HB has gone up in value. G, they just fixed up the bathrooms. And my friends in Long Beach believe their home is still worth more than when they bought. Zillow tells them it costs a little more than when they bought in 2005. Zillow wouldn’t lie would it?

Do I believe in Zillow and home appreciation? No.

I think Dr. HB is great and am thankful for this site as it has convinced me to wait and not rush out to buy something outrageously overpriced. I used to think one needed a home if they were going to raise a family. I’ve been happily cured of that misconception.

Looks like the panic over future option ARM resets is exaggerated. Right now LIBOR adjusted loans are going to about 1.75%.

Maybe Greenspan was right, that we should all be in adjustable loans. Maybe this depression will last 30 years. That would save the housing and finance industries from collapse?

@Ed Tse

Indeed Unemployment is surely one of the four horsemen of the financial apocalypse:

(1) Major housing distress,

(2) Global stock markets crashing,

(3) Commodities collapsing,

(4) Unemployment surging.

Texas only gained jobs as oil prices surged. Where do you suppose the collapse of oil prices will take Texas now? Remember 1983?

1983 01 8.5%

1983 02 8.5%

1983 03 8.5%

1983 04 8.5%

1983 05 8.3%

Texas will be in as bad a shape as anyone soon.

I think Switzerland may have some trouble for being a safe haven for vast criminal fortunes being harbored in their banking system. Transparency is one of the demands of a population in Depression II.

@printfaster

Did you read the article? Did you see see the 60 minutes program? Do you have any idea what you are suggesting? Are you being sarcastic or did the lobotomy not go well? This is going to be the mother of all financial disasters. If these resets had occurred without all the other stuff, this would be a nightmare. First 1.75% + 2.75% = 4.50% if the centrals can artificially depress libor and the other index rates, but the big problem is that the Opt arm’s were largely negative amortization and the principal is larger now than at the time of origination. In addition, the values of these homes have dropped 30-50% so they are virtually all underwater. Third, huge second mortgages have been bled from these homes. Most no equity. Fourth, Unemployment. Turn on Kudlow. Listen to what you want to hear.

@printfaster

Sorry, I see you were being sarcastic…trouble is, if it’s 30 years, I’m 80+ and if I’m around then it’s a little too late. I guess people think the past is like a movie but the future is going to be as they expect it to be. The future might be a movie too–Grapes of Wrath, Of Mice and Men, Great Gatsby, Mad Max, Planet of the Alt-Apes… There have been quite a few recessions in the past, and there would probably be more except that the figures are skewed. Took a year to figure out what everyone except a few psycho-bulls new last spring. Depression is a tough call, but we’ve been putting fingers in the dike for 20 years we might be running out of fingers while the rain just keeps coming.

I have read so many of these blogs and yet still find it difficult to predict what lies ahead. From my finance background, I know that the liquidity being pumped into the market, (that is if it leaves the hands of the Wall St. cronys) MUST cause inflation. Yet there are forces working against it, like unemployment.

I also know that once foreign investors decide our currency is too risky, they may flee to the gold-backed euro, and perhaps the yuan. Getting those dollars back will mean large and rapid increases in interest rates, coinciding with a weakend dollar which also is inflationary. I remember the days of “stagflation” at the end of the 70’s. I parked my car because I couldn’t afford the gas. Housing was high but no one was buying as mortgages were 16% here in Tucson.

My best, dumbfounded guess is, continued housing crisis until late this year, where the number of foreclosures will decline. Call me crazy, but I predict a “mini-bubble” after that, where median home prices increase 5-10% year over year in 2010, then interest rates increase, bringing that little gift to a ceasing halt. Obama’s free spending on infrastructure will reduce unemployment, but it is borrowed money and will further fuel this nation’s ultimate demise.

I watched Nixon devalue the dollar in the 60’s ( I remember it though I was a child) and I expect Obama – or Biden if Obama leaves due to scandal- might take that route also. But will it happen before or after the next pres. election? Depends on how bad the eschewal of our debt by foreigners becomes, and when. Clearly, the major creditors of the world have much to lose from a weak dollar – for now.

I like the posts where the writers mentioned rents were half what the mortgages are from 2007 home prices. This is critical and enables us to predict a bottom for a certain area based on current and historical rents. In Tucson, rents seldom drop very much, and this fact attracts inumerable buyers during markets like this one, as there is little risk that the buyer won’t be able to make the payments via renters. For many homes here, rental rates are far above the monthly mortgages for the corresponding home prices, yielding huge positive cash flow, and so one could safely say they have overcorrected. Other home price categories still have to fall before one can acheive breakeven by renting. Those home prices are still at risk.

In any event, this is an exciting, yet terrifying time to be alive. Let us hope, and pray, and remain diligent.

Leave a Reply to St Alphonzo