Southern California and the MLS Myth: Why the MLS does not Provide an Accurate Picture of Housing Inventory. Shadow Inventory, Foreclosures, and Fantasy Housing Numbers.

Many of you that search or browse housing listings know what the MLS is. This is the Multiple Listing Service provided to realtors and those affiliated with real estate branches. In the past, the MLS might have been an excellent snapshot of market inventory. Many sites like Redfin and ZipRealty provide consumers excellent data for browsing inventory but they do not cover every city in the country. For the most part, home buyers and sellers have never been so educated on market dynamics. Then how in the world did this housing bubble happen with so much information? How was it possible to inflate the California market with Alt-A and option ARM products when so much data was available?

It is important to note that MLS data comes from listings that are represented by brokers who are both members of the MLS system and NAR. The list also expands to Canada. But with the massive amount of foreclosures many banks are dealing with bulk buyers directly. In Southern California last month 20 percent of all buyers went with all cash. Each MLS is geared to local markets but again many argue that the MLS forces membership into the real estate circles. To that I would agree. That is why companies like Zillow had to fight hard to break into this game. The Department of Justice did break some of this up in 2008 and many online brokerages now have better access to data. But how can you track something that isn’t reported?

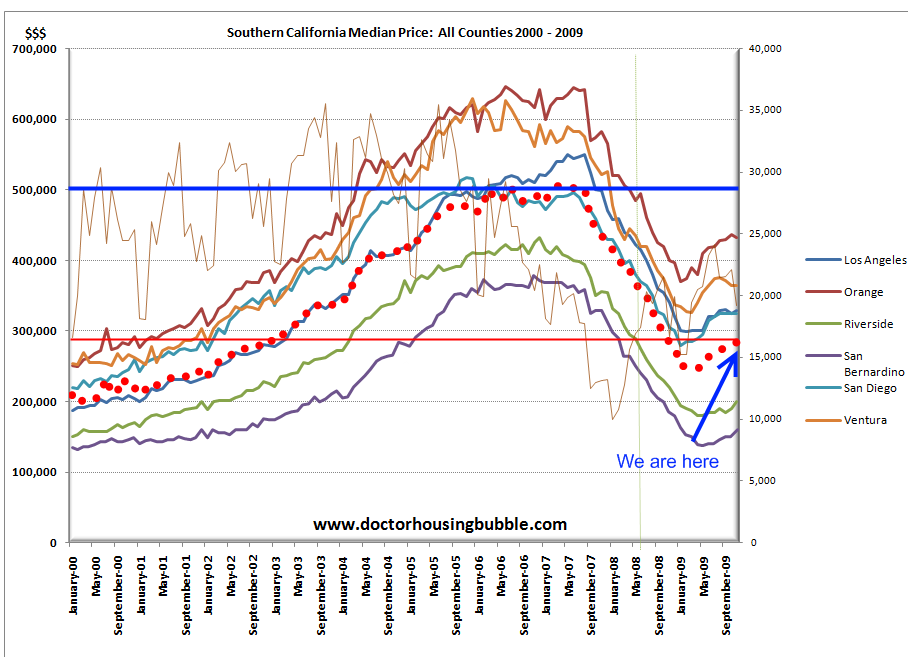

I would argue that during the bubble access to information actually fueled the mania. For every one article talking about housing being over priced, you had 10 articles telling you how cheap homes were and how home prices never went down. And for a decade checking your estimated home price would have justified your own belief. In today’s market there is an underworld of information that isn’t easily accessible. Part of this is the shadow inventory. And this is a real issue as banks have admitted to holding homes off the market. The one argument against this data point is a narrow focus on REO data. Yet to get to REO (bank owned) you must go through various other steps. More on that later but let us first look at Southern California as our case study:

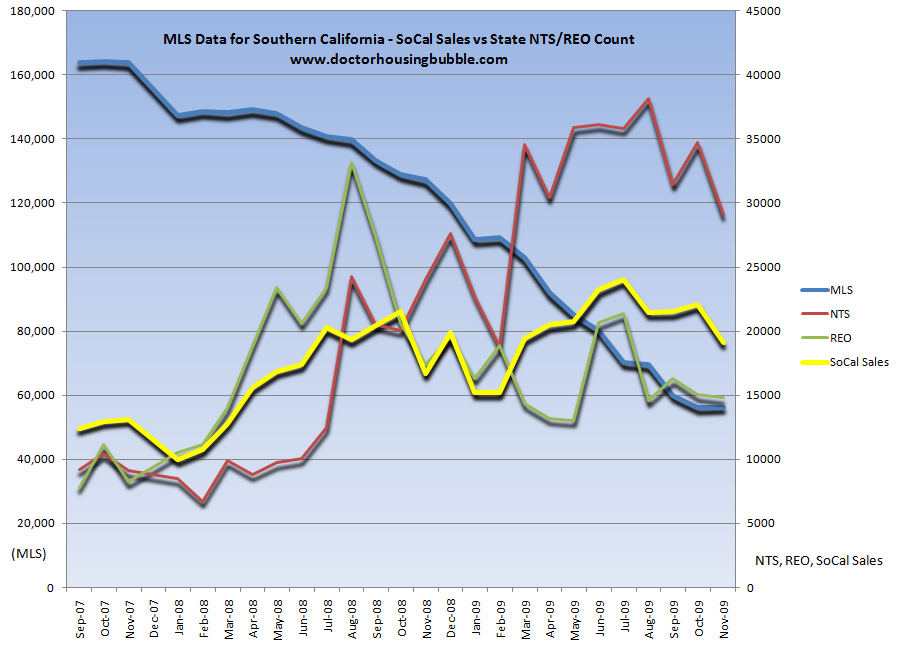

Now I want to spend a bit of time on the above chart. I pulled data from a variety of sources including the MLS, foreclosure records, and Southern California home sales data. What you’ll notice with the blue line is that MLS inventory for SoCal has fallen from over 160,000 homes to below 60,000. This you would think would be because of massive amounts of sales. If you look at home sales it is the case that this has increased but not anywhere close to the bubble heyday where we were seeing 35,000+ homes sold in a month. The big drop has more to do with sales occurring in the foreclosure market.

This is interesting because I was looking at homes that weren’t listed on the MLS and was dealing with a bank directly only a few months ago. This is happening many times over. You can see on the chart above REOs with the green line. It might look like this number has fallen drastically but this has more to do with programs like HAMP that are already proving to be inefficient. What these programs do is simply shift housing inventory into the shadows and hope that prices somehow go up in the next few months or year. Yet that isn’t working out.

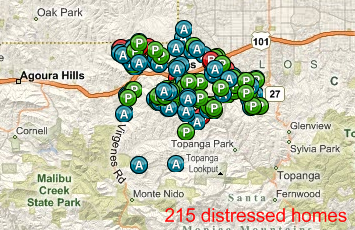

Let us run a case study on a new area. Let us look at home of toxic mortgage superstar Countrywide Financial, Calabasas:

We find that 215 homes are listed in distress. The MLS has 228 listings and only shows 30 of these. In other words 185 properties out of a sample size of 413 are hidden to the public. This is nearly as big as the actual MLS data. We see this two world scenario occurring in many places. In some areas it is even worse. Let us look at Agoura Hills for example.

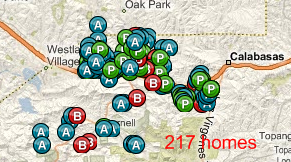

The MLS has 140 listings and the shadow data is at:

The neighbor of Calabasas and the same trend is spotted. In this case, the shadow inventory is larger than the MLS data. In some cities in Southern California the shadow data is enormous and doesn’t resemble anything that is shown on the MLS. Let us look at Cerritos for example:

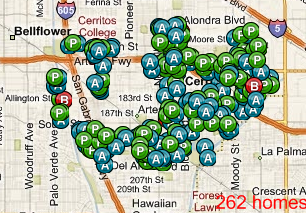

Cerritos has 262 homes listed in distress. The MLS has 70 homes listed. Last month Cerritos had 23 home sales. So you either have:

Public perception:Â 3 months of inventory

Real data:Â Â Â Â Â Â Â Â Â Â Â 14 months of inventory (big difference)

It is hard to quantify shadow inventory because many in the industry are too optimistic regarding bailouts. Unfortunately the industry was so corrupt and polluted for years in the state that Alt-A and option ARM products are going to be trickling out into the market for years. The only reason we are not seeing defaults hitting the MLS in mass is because of programs like HAMP and suspension of mark to market. This doesn’t mean there isn’t any problems of course. It just means that the issues will take longer and be more painful.

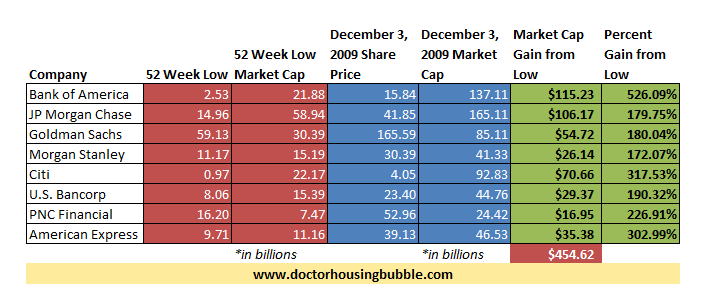

This is something we need to wrestle with. Do we pull the Band-Aid off quickly and deal with it once and for all or do we allow this to become a massive decade long disaster like Japan experienced? It seems like the bankers and real estate industry would rather prolong the misery for as long as possible. Because what is the worst case scenario? The market is flooded and homes sell for market prices. Banks fail as they should. But instead, banks become zombies and little by little their toxic balance sheet eats away at the productive sector of the economy. Just look at how well banks are doing:

Some are going to argue that notice of defaults should not be included in the above. In most normal markets I would agree. Yet with only 3 to 4 percent of notice of defaults curing this means much of the inventory will reach market. Could be in six months or as long as 24 months. But it will hit because home prices are massively underwater and prices haven’t gone up even close to bubble peaks:

And that boost comes at the cost of:

-FHA insured loans requiring only a 3.5% down payment

-Fed buying mortgage backed securities holding rates artificially low

-Moratorium programs like HAMP

-Banks holding inventory off the public view

Yet at a certain point people realize that the MLS is not a reflection of reality. It is the ideal dream world scenario. The fact of the matter is each day hundreds of people are unable to make their housing payments. You don’t need a crystal ball to make that prediction. You’ll know things are recovering when the shadow data starts thinning out. Until then don’t believe everything the MLS is telling you.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

46 Responses to “Southern California and the MLS Myth: Why the MLS does not Provide an Accurate Picture of Housing Inventory. Shadow Inventory, Foreclosures, and Fantasy Housing Numbers.”

As long as the banks keep the houses added to the MLS to a trickle, prices are not going to drop that much. There are plently of people with a high school education, who make a ton of money-

Firefighters- City of Davis, CA – Salary & Benefits- $125,000. a year

Firefighters- City of Long Beach, Ca – Salary & Benefits – $175,000.

College degree-Teachers- Hayward,CA- Top Salary $105,000.& benefits

Retired State of Ca. Workers making over $100,000. in cash- 12,000.people

Lots of money in the Golden State!

“Some are going to argue that notice of defaults should not be included in the above.”

I would argue that since for every notice of default there are about 3 mortgages that are late on payments and the mortgage servers in some cases seem to be maximizing their returns by NOT sending out notices of default, that the long term number of houses in the market is grossly understimated here.

Just how big is the elephant in the room?

As for firefighters, the WSJ wrote an article about the firefighter in Palmdale making 8,000 a month who walked from his 4,000 a month mortgage. …

Another shoe dropping is the renters who are stiffing their landlords in California.

With CA real unemployment hovering in the 22% range, the number of homes being released to the market will have to remain at a trickle pace. This is the tight rope that the real estate market is now walking on.

File BK and banks get nothing…!

Robert,

You are such a despicable shill. Why do you bother to speak at all? Nothing but bullshit flows from your lips.

You’re a rat bastard.

Robert Cramer, Im going to call you out. Dont publish false statistics and attack the same people that are protecting and educating you and your children. Claiming that Hayward’s teachers make $105,000…check this out:

http://husd.k12.ca.us/previous/HUSD/PDF/Salary/186Days.pdf

The top teachers, after 18 years of service and a Master’s Degree, get $88K, not $105K. If you are going to quote statistics, get them right and do your research, not spout Republican talking points.

I have no connection to Hayward, have never been there, but I am an elected official and know enough to know that no public school K-12 teacher in CA is making that kind of money.

Using past data correlations such as MLS inventory to price movements become mute when the financial landscape changes. This is occurring across a broad spectrum of financial data points which makes the predication business based on past models suspect or useless depending on your point of view. The BLS birth/death model is a good example along with most if not all the financial reporting on the stock market price movements. The idea that growth during the past 30 years has been dependent upon excessive credit expansion gets no play in today’s highly leveraged world. The grim reaper of debt service is expanding and no amount of highly leverage consumers or financial firms can out run this financial shark.

According to the Irvine Housing Blog and financemoney.com, most of the Option ARM problem has been resolved.

“What I find interesting is how much of the Option ARM problem has already been resolved (probably through foreclosure). If $750B was issued, and only $200B remains, only 20%-25% of the Option ARM problem remains — at least in the form of Option ARMs.”

http://www.irvinehousingblog.com/blog/comments/Lenders-Can-Hold-Real-Estate-Indefinitely/

According to the Irvine Housing Blog, http://www.irvinehousingblog.com/blog/comments/Lenders-Can-Hold-Real-Estate-Indefinitely/ , “What I find interesting is how much of the Option ARM problem has already been resolved (probably through foreclosure). If $750B was issued, and only $200B remains, only 20%-25% of the Option ARM problem remains — at least in the form of Option ARMs. Many of these original borrowers already went through short sale, foreclosure or walked away.”

Does that sound right to you?

The nature of the MLS members cooperating to keep distressed inventory off of the MLS to affect market prices seem like price fixing to me. If so, then the federal gov’t would be required, under the Sherman Antitrust Act, to prosecute MLS members or the MLS itself for antitrust violations. Seems like the data is there to show cause. Maybe just too much of a political hot potato to take on when on one hand your political party favors the results of the price fixing and the other hand ignores the duty to enforce law.

Dr. HB. Are you joining the need more fiber crowd…

Everywhere I look now a days I see ads for “more fiber”. Pills, snacks, even H2o. What “more fiber” really means is move the crap on through the system.

Thanks DHB for your insight into the constipated world of RE and their need for more fiber.

Hey…cut Robert some slack. The fact is that people do get paid more in CA than in most other places ( especially when cities use less firefighters and pay overtime since it is cheaper than having more hired staff), so it stands to reason the homes will always be more expensive here than most other states. However, even for those at $150K a year, that translates to to a $450K-500K house and not the $750K and above which is where housing has been, so there will still be room for house prices to fall from where they were. As the good Doctor has been saying, it was the easy access to credit and larger pool of buyers ( due to zero down and no doc loans) which stoked the frenzy, not just a few extra thousand dollars of salary.

BCumbers, the public job wages will have to come down in CA if the housing corrects. The grotesque inflation of public and state gov’t salaries over the last decade was made possible by tax revenues from inflated property values. It is one of the reasons CA is in such bad shape. We’ve already seen the state furloughing workers left and right. Public employees making obscene salaries are being exposed by many newspapers and will probably be dealt with under the new Govenor. Nevertheless, as state tax revenue goes down, so should state spending and thus firefighter salaries. Since state revenue is closely tied to property values, then firefighters shouldn’t be making what they’re making. Here is the thing: if firefighters were making that much money when I was growing up, then I would have become one. Who doesn’t want to be looked upon as a real hero?

I was really impressed with this blog entry and ran similar reports to the ones you show for an area that would be assumed to be free of trouble. Would you believe that in La Jolla there are 219 properties that are either currently owned by a lender, going to auciton, or in preforeclosure status?! That is incredible. You are talking about one of the nations premier luxury communities and one of the most desirable places to live in the world. Now imagine what is going on in other parts of the country! The real inventory is a very well kept secret, which is surprising for an age in which information is so easily available. Thanks for bringing this to light.

This whole debacle will slowly trickle on for many years to come. If only they had of allowed the natural system to work, they’d be a quick correction and then you’d have a natural stimulus that really was specific. These government interventions just are targeted at big corporations and industries. It’s not spread across the board. Anyway…. I don’t see anything changing at least for two years. It’s 2012 before anything meaningful happens in prices!

I couldn’t help but laugh after having read this tripe:

“IHS Global Insight’s quarterly housing valuation survey showed prices were up 0.2 percent from the second quarter, led by a 2.1 percent rise in home prices in California.

A separate Federal Housing Finance Agency showed house prices rose 0.9 percent year-over-year in the July-September period. That was the first advance since the second quarter of 2007 when the housing market slide started.

The surveys are the latest evidence that the housing market, the main trigger of the worst U.S. recession in 70 years, is stabilizing. Home sales have been trending higher, boosted by low mortgage rates and prices, as well as a popular tax credit for first-time buyers.

The IHS Global Insight survey, which covered 330 metropolitan areas, showed prices rose in 169 markets and fell in the remaining 161. For the first time since the survey started in 2005, there were no metropolitan areas where prices were deemed to be “extremely” overvalued.

“For the nation as a whole, the housing market is now slightly undervalued, 8.6 percent when weighted by market value and 10.1 percent when weighted by housing units,” IHS Global Insight said.”

-http://www.reuters.com/article/idUSTRE5BG56P20091218

That chart does not include benefits.

BCumbers, I think if Robert is going to make accusations such as this, he needs to be held accountable. Im pretty tired of people blaming some of the hardest working members of society for the state’s issues.

We do have a problem with high retirement packages in this state, and they need to be fixed. However, it is very expensive to live in this state and if someone spends hours and hours every day educating my kids, or is ready to put out the fire in the neighboring canyon in 110 degree heat, then they deserve my credit, not my blame. I dont think it is unreasonable for someone with a master’s degree and 18+ yrs of service with a school district teaching making $88K in the Bay Area.

As for the blame of the state’s condition, you can lay this at the feet of several groups. Start with some bad priorities set by the Assembly, as well as overspending. Why are we spending so much on prisons, yet we have overcrowding there? Why do our roads blow in this state? Why are we 47th in the US in per pupil funding? Also, the finger has to be pointed at Prop 13. People living in homes with values of $1 million + valuation paying $1800/yr in property taxes, when their neighbor has the same valued home and is paying $12K, starving the state of adequate tax revenue, yet we pay nearly 10% sales and income tax. Crazy.

Of course, the really big blame for our mess goes to Wall Street cooking the books with fraud, real estate salespumpers, and people that were irresponsible in getting over their head financially who used their homes as ATMs. That’s the reason for 14 months of shadow inventory, not a firefighter.

“starving the state of adequate tax revenue”

BZ, you’re quite simply either a stone cold crook or certifiably insane. California’s tax revenues have grown in leaps and bounds over the past 20 years. The problem was that the Cal pols, elected by Cal idiot voters, never understood that you can’t spend more than you make forever. Adequate tax revenue? Your pols had far more than that, but they chose to blow it on giving gifts to state workers and noncontributors to the economy. Why did you let them get away with it?

Cal is one messed up sack of crap, no doubt about it, but Cal people griping about it need to go straight to the source of their problems and complain. They can find that source by looking in the nearest mirror. Your state will, however, serve one last useful purpose before financial collapse: serving as a cautionary tale to other states not quite so far down the road to economic suicide.

Don’t expect much sympathy from the rest of us, especially those in conservative states. Having known your state to be the land of fruits, nuts and flakes for three decades, we’re now seeing you living through what we always knew would be the result of your damned stupid lib policies. You made the choices; now you can live with the consequences.

We don’t need sympathy from the Red states. We just need your most talented people to keep moving to the Blue states. Keep the Red states poor and racist.

mac- thinks for telling it like it is.. I grew up here and came back a few years ago. Everything you say is true to me. Let’s all look at the state objectively- it WAS a kind of paradise: incredible agricultural bounty; fantastic universities; strong technology, defense, and aerospace industries; manufacturing, etc. What now? A huge gulf between rich and poor, an exploited underclass of “undocumented” workers (don’t say illegal, and mr. policeman- DON’T ask for papers in LA). Hell, we aren’t that far away from the poor Appalachian states statistically (poverty rates, spending per student, etc). Now we’re even starving the backbone of the state (agriculture in the valley) of water over some little fish in the delta despite all of the myriad leaps and bounds we have made as a state and a country with some sound environmental policies, but it’s never enough for the left- they want some bizarre paradise where all borders are open, everything is free, everyone has some great paying state job, and they can still have their lifestyles which are the result of what they malign. They destroyed paradise here in my opinion. If it wasn’t for the entertainment industry my fiance and I would be in another state with some fiscal sanity. I sure will miss the land when the day comes that we do leave. But the people- what has become of us? The nation seems to have woken up after one year of the freaks running DC, but I don’t have a lot of hope for CA- the leftism is much too deeply entrenched now in the populated areas. Hell- they’ve even completely taken over the rural area where I grew up. Get some popcorn, mac, and enjoy the disaster movie. In twenty years I’ll probably join you. 6th richest economy in the world if it were a country and it’s bankrupt- what a joke. Gotta get me one of those state jobs man!! Get on the tit!

jk2001- what a caricature you create… Look at net migration out of ca, specifically for middle and upper-middle class folks (the backbone of every state financially). sure they come to SF area, LA and NYC, and then they leave. My cousin and his wife lived in CA their whole lives until five years ago when they moved to a beautiful house in CO. They both work the same jobs they had before except they telecommute now. Ask yourself- where are they spending their money- here or in CO? Look at the booming population in places like the Nashville area- why do you think Nissan moved its US operations to Franklin, TN from here? Answer: they aren’t taxed to death to pay for an overly expansive state gov and their employees can afford to live there. TN wants them- CA doesn’t.

not to be a total cali-bashing freak, but check this:

http://www.seattlepi.com/national/1501ap_us_sci_whos_happy_list.html

lots of ‘racist’ red states high up on that list and CA, NY waayy at the bottom. Hmmm (scratches head)..

There is a not so Black Swan event that will happen early in 2010: Saudi, Kuwait, and others will decouple oil contracts from the dollar, as Iran already has and Iraq got occupied for trying. Everything will change. Planet of the Alt-Apes will still be playing, but everyone will run to the other theatre to see Ali Babba and the 40 Theives. Everyone thought the last depression was over when the stock market rallied and Roosevelt had his liar-guy chats and make-work schemes. Have you read about how well all that worked? DHB has whole doctoral thesis on it here. If only FDR had a hellicopter. In six months lets see if that housing bubble is getting pumped up again, or if it’s 1932 all over again…

This is what I love about these types of boards. It truly brings out amateur hour when people like Mac that think they know what they are talking about. He/she probably has never been an elected official, likely having never run a company, and he/she calls the shots from afar, maybe never stepping foot in CA and calling everyone a crook, sacks of crap, and idiots.

Im on the front lines here, chief; how about you?. Im an elected official, having sliced 20% out of very well run school district’s budget over the past year. I also am very pro-business, having run several successful companies myself. Let me explain by what “adequate tax revenues” means in California.

California collects $323 billion taxes/yr, with only 16% coming from property taxes, a stable source, even with the bubble bursting. Most people dont move in a nationwide recession. The great majority of the rest comes from sales, income, and capital gains taxes. With a 12% unemployment figure, and U6 being 20+%, guess what happens? The state goes bankrupt because of huge drops in sales, income, and capital gains taxes.

Im not suggesting raising taxes; this should appeal to you and your knee jerk reaction, mac. Im suggesting restructuring taxes, so that property taxes play a bigger, more stable role like they did before Prop 13 passed, and LOWERING sales and income taxes to generate jobs. As for old cali’s claims that everything used to be better, I agree–we used to adequately fund tech, education, roads, etc here. That changed starting in 1978.

As for red state vs blue state, Ive lived all over…there isnt a comparison on where I would want to live. The red states claim financial conservatism, yet they receive a much higher percentage of government funding back living off the government teat. Notice a trend here?

http://www.taxfoundation.org/research/show/266.html

Nearly all the top states are red. So much for your myth of self sufficiency (aka “pull yourself up by your own bootstraps”)

Rollups are about $27000 for a teacher earning $88000. Get a grip B2….that is a handsome salary and if you think that is OK try finding out what the armies school administrators earn…they’re cleaning our clocks guy. This gravy train HAS to end. Hell, the head of the athletic dept at UC berkeley makes $2.3 MILLION!!!! Aren’t you even a little sick of this yet?

Yes, CA needs to raise property tax rates. Repeal Prop 13, the govt needs the money. Watch real estate really slump. But this is how most govt’s think. They want their money and if they cant get enough from transactional events, they’ll start increasing ownership taxes. Oh joy.

What are rollups? Benefits and taxes? Ive never heard the term. Mr Cramer said $105,000 + benefits, not $88K, which is from the Hayware website. My original contention had to do with misquoting stats. As for the $88K, I would have killed for that out of school, but not after 18 yrs with a masters degree. Considering the average priced house in not so nice areas in SF is $270K, this sounds about right to me for pay.

I would be impressed to see a K-12 teacher with just a college degree making this. The closest you could find is in my neck of the woods…Laguna Beach pays its teachers with 24 yrs of service $108K for a masters degree,graduate work, and professional development, and they are a basic aid school district in an extremely affluent area.

As for the UC system, no arguments here. Everyone from the AD to the President of the system is way overpaid, along with most professors. Now that’s a joke. But dont conflate the K-12 system with the poorly run UC system.

if the MLS only shows a small portion of the houses for sale, where do you look for the real “hidden” REO’s, delinquencies, foreclosuers, etc…?

Oh “BZ” you are such a know it all. You are all knowing while those that disagree with you are all know-nothings. If you are so big and wonderful then why are you working for the government?

The government always needs more and more revenue. Yet the solution of spending less and being more productive is never employed. Oh silly me, I forgot, it is all for the children.

BZ, I agree with you on one thing, i.e. Prop 13 is a disaster for California. The national trend in the last few decades has been to screw future generation, and Prop 13 magnified that trend here in CA.

There are too many public employees. The Police State of California has many employees of America’s Largest Street Gang. Stop the War on Drugs, fire about 50% of the police, and you can save a whole lot of money. I hope California legalizes marijuana so we can tax/collect money from the dope smokers as well. No use putting them behind bars.

BZ ..better start praying its not our type or class or opinion that they decide to make the people who are turned into lamp shades this time…

Eli, first of all, I dont work for the government. I am an elected official that gives my time to the local schools. Im an entrepreneur and businessman at heart, having worked in corporate America and now running my own company. I have and will continue to create value for my investors, myself, and my family, and yes,I contribute, not take away, from CA’s revenues for schools and roads. Can you say the same? Are you both producing and giving back? If not, then why not?

I dont claim to know it all, but I have a good feeling for business and local government. I also want to call out people that are misguided on how bad the situation is for local governments. There are spending problems in this state, yes, but for the very well-run city governments and school districts (and there are more than you know), to group them with everyone and to say starve the beast is cutting off your nose to spite your face. If we continue these huge cutbacks, your property values, children’s education, and public safety will all suffer big time.

BZ,

Thanks for the Hayward teachers pay stats link. Note, that that is for about 8 months work. Teachers also can opt for summer pay if they need or want. And that does not include pension and health benefits that are the envy of all in the private sector. Guaranteed pension on the backs of taxpayers? I wish I had that.

I’m a democrat. So don’t give me that “Republican Talking Point” BS.

I don’t mean to single out teacher in particular. They are hardly the most overpaid of public employees. The abuses elsewhere are much worse.

“Considering the average priced house in not so nice areas in SF is $270K, this sounds about right to me for pay.”

Your logic is backwards. You’re assuming property values are justified, even though only 10% in bay area can afford the median home price. It’s simply the availability of interest only ARMs, or worse OPTION ARMs, plus a bubble mentality over the last decade or so that has allows property values to go so absurdly high. And then you justify public employee wages based on property bubble valuations? I guess you think public employees must automatically be part of the top 10% of wager earners.

I’m not sure what you are referring to when you say the MLS should show a higher number of “homes in distress”. There are three bubbles in each map you show. The red “B” which are bank owned homes and may or may not show in the MLS depending on where they are at in the REO cycle. The green “P” ones are homes with a notice of default filed, these are in the beginning stages of foreclosure and are months away from being banked owned. Then there are the blue “A” which are in the notice of trustee sale phase or auction phase and although these are much close to being banked owned they are still not foreclosed on and will not reach the MLS.

The MLS only reflects homes that have been actually listed for sale and never has reflected homes “in distress”.

Mark, it’s more like 10 months of work. Most school districts in CA go until the third week in June since we have to have 180 days of schools. The teachers get 1 week of spring break and the holidays off (like the rest of us). Considering many people get 2-3 weeks of vacation off/yr, then they really are working until early July. School starts up again early Sept. Of course, I wish I had this much time off myself/yr, but I wont get into that. I also am glad I dont make $45K as a starting salary in the Bay Area.

I agree with most of you that many public employees are overpaid. The ones that are most egregious to me are the prison guards bc of their powerful union. I also think that California’s public employees get overcompensated in their retirements. People game the system all the time with retiring early and then being hired back at consultant wages. Is this the main issue with CA’s budget? IMHO, no.

I bring up property values because that is the subject of this blog. I also think that teacher salaries have to be competitive in order to attract good talent. If someone says I cant go into teaching because I will never be able to afford a home, then that is a big obstacle. People complain alot about failing schools. The two best ways to fix this are to hire excellent administrators and to pay well enough that bright, motivated people choose teaching as their profession. Private schools give tuition breaks to teachers’ kids. Public schools need something to motivate people. (the third way is to elect competent people to local school boards, but that is another subject).

Im suggesting a restructuring of CA’s tax system and cutting of certain taxes. Most of us that bought recently get shafted by paying too high property, income, and sales taxes bc of Prop 13 (I propose a .7% level on today’s market value for EVERYONE except seniors over 65 instead of 1.2% for recent market values for new buyers and 1980s rates for those who bought 25+ yrs ago). We have to pay nearly 10% sales and income taxes to make up for revenue shortfalls, which kills jobs too. Cut those to 7.5% like other states. Property taxes are more stable since people dont move as much in a downturn when sales and incomes taxes get crushed.

OK, BZ, thanks for sharing your thoughts. I agree with you 100% on Prop 13. Just because the government spends too much (IMO) does not justify lousy tax policy.

I love this blog, but dammit, post like these are freaking depressing. I don’t think people have really registered just how effed up the state of California really is right now – and not just for the current generation of 18 to 65 year olds. I’m talking about the state of California that today’s Kindergarteners will soon inherit. It’s pretty freaking scary when you think about it. I really don’t want the US to go through what Japan did, but it sure seems like that’s the trajectory of our fiscal and economic policies.

Since this comments section has diverted to much discussion of govt revenue, I would like to propose an idea. There seems to be much agreement that allocation of assets is the major problem in CA. Why not establish an a la carte tax system? Assume 50% of total state income pays for general services such as education, roads, police, firefighters, etc., and 50% goes to special programs. The discretionary 50% could be somewhat directed by individuals to the programs they support. So just like people claim the number of withholding when they get a job, they could set the percentages of thier income tax to be directed to programs they want to see get funded. This would clearly be the most democratic way to dispurse tax revenue. People who have children could opt to direct their taxes to K-12 schools. People who think that gay/lesbian causes should receive more money can direct their taxes in that way. This way, individuals don’t have to watch their hard earned money go to support programs/issues they disagree with. Additionally, by allowing the public to determine where income taxes are directed, much of the corruption in government/private sector lobbying would go away. I think that in the end, programs which are deemed by the contributing public to be wasteful would die off due to lack of funding and programs which are important to the working class would flourish. Someone posted above that residents of CA should look in a mirror to find someone to blame as they elected the decision makers who have gotten us into this mess. To some degree that is true. But in a lot of cases, citizens are forced to vote for the lesser of two evils and don’t really have a candidate who will carry out their wishes when it comes to resource allotment. It seems fair to me that those who contribute the most, have the most say as to how their income taxes are used. Perhaps it would not have much of an effect as I have no idea what percentage of state revenue comes from individual income taxes but it seems like a fairer way of doing business to me. BZ, as an elected official, perhaps you can provide some insight as to what kind of effect something like this would have.

I like what BZ is writing and I agree with most of it.

What I find the most distasteful is people attacking people here. It sure seems people are waiting for *ANYONE* to place the blame on in their community instead of focusing on the real problem which is a corrupt political system, and corrupt crony capitalism. The politicians should be hounded out, tarred and feathered, but people here on this site would rather bash each other and blame each other while the politicians laugh in glee with the banksters who bought them off.

There will be blood in the future, mark my words.

“It seems fair to me that those who contribute the most, have the most say as to how their income taxes are used.”

What do you think is happening with the system now? Do you think YOU are a contributor? I’m thinking the scum on Wall St. thinks you are NOT. THEY are the contributors, and more oft than not, they contribute to the pockets of the corrupt republicans AND democrats.

Under your idea the indigent who cannot provide for the system get ZERO say. Poor, retarded, handicapped…..yea, just lock them up in concentration camps, they don’t produce anyhow. This is a very dangerous line of thinking and one that was used in Europe in the 1930-40’s.

“We don’t need sympathy from the Red states. We just need your most talented people to keep moving to the Blue states. Keep the Red states poor and racist.”

I think we’re butchering most of our chances to have talented people coming here. What have we got anyway? Sunshine? Heck Florida has that and gators!

We used to at least have a top tier public higher education system (the k-12 education is and has been absolutely horrendous for around 4 decades, but we used to have great higher education). And that attracted AND produced top talent in CA.

Well higher education, the UC and Cal State systems are both being cut to the bone (and I don’t mean just teachers salaries, I mean admissions!).

But you think sunbeams alone will attract talent, despite lack of affordable housing, aweful k-12 schooling, gutted increasingly unaffordable higher education, high and extremely unfair taxations etc. etc. etc.

I applaud Partyboy for thinking out of the box. Anyone that has creative solutions, good or bad, deserves credit. Unfortunately, I dont think your system is workable. As Swiller points out, the people in most need of government assistance, the indigent, the physically and mentally handicapped, even the working poor and middle class are underrepresented in Sacramento and DC–that is our problem today. Most people are decent-hearted enough to take care of people that truly need help. It is the people that need help the least that are getting the most out of their elected officials at the state level and pissing away money. I also agree that the system is way too corrupt. Beyond the improper campaign contributions, I think that lobbyists have their way with pols because they are better informed than the pols themselves and can make strong arguments for their cause without counterbalancing from consumers/voters. Those two forces alone, money and ignorance, are what are killing the system.

I dont like paying taxes. I cant name anyone who does. Im tired of my money going to big pharma, insurance companies, banks, oil companies, defense contractors (for non-necessary projects), dumb wars, stupid government pork projects, etc just like everyone. But I also want the kid I hand my money to at the store to be able to make proper change and answer questions about their product/service, I want to drive on freeways that are not pothole ridden, and I want my streets and parks safe just like everyone else. Even if I didnt have kids, didnt drive, and never ventured out my front door, I still would want those things.I take the good along with the bad. That’s the way it has always been in America and that is the way it always will be. It’s a compromise. If I starve government, then I wouldnt get those things I want, yet I still think pols would find a way to send money to causes that I didnt like, and to do it on the government’s credit card.

Our best path right now is education. Uneducated voters elect bad, uninformed, and ethically challenged pols. The faster we get our education system right, the faster we get a better informed electorate and the faster we get better representatives in local, state, and federal government that know what they are doing.

What the hell. I thought this was a real estate site not a government site. Those who want to fix the government, go to work for the government or shut up. For those of us not interested in working on government issues, please post thoughts about real estate.

It appears the shadow inventory could be a factor. Who has a way to find more data on the shadow?

Leave a Reply to torabora