Smallest home in Los Angeles:Â 264 square foot studio selling for $550,000 highlights collective insanity.

People have once again lost their collective marbles when it comes to real estate. There is now a massive trend with momentum for non-stop housing appreciation. In other words, our housing bubble sins are now fully washed away making way for more aggressive risk taking. I’ve been traveling and seeing real estate from many different locations and thanks to ubiquitous sites like Zillow, virtually every large metro area is seeing massive housing appreciation detached from income growth and people are tracking real estate down like starving hyenas after an injured wildebeest. We are now in a market where potential buyers are in a panic to buy for no other reason beyond they feel they will miss the boat yet again. Today we highlight what is probably the smallest home we have ever featured on the site.

Smallest of the small

Los Angeles is in a big housing frenzy. Every area including those with high crime rates are seeing solid price gains. Who cares about crime when you can get a sweet taste of that housing equity nectar! Today we look at this 264 square foot gem:

10449 Scenario Ln, Los Angeles, CA 90077

Studio 1 bath 264 sqft

I love how they also use a nice perspective on these photos to give it bigger depth:

The ad is wonderfully worded:

“Zen-like retreat, perfect for a UCLA student or young professional. Secluded and private hideaway in nature. It is a 264 square foot studio with skylights and sliders leading out to the deck and backyard. Carport has storage cabinets and a washer and dryer. It is located near UCLA and Beverly Hills, it is the least expensive property in the highly desirable Beverly Canyon area.â€

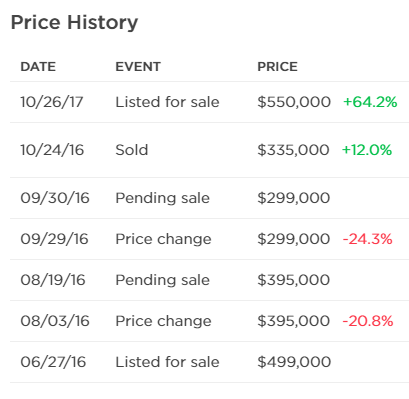

In a case like this, why not buy a larger RV and park it in a mobile lot? I mean seriously, this place is 264 square feet! And the asking price is $550,000. But you can see some wild pricing here:

This is where you realize something is off in the market. So in June 2016 the place was listed for $499,000. A big stretch. Little by little they dropped the price to $299,000. That got someone’s attention and it sold for $335,000. Now, one year after that sale date someone is asking for $550,000. What caused this place to be “worth†$215,000 (64% increase) in this short period? I mean why would you work when you can buy a 264 square foot property and profit $215,000 in one year?

Let us say a lot of work was done on this place. How much work can you do on a 264 square foot home?

The market is manic. People are in a deep state of delusion. Welcome to California housing my friends!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

325 Responses to “Smallest home in Los Angeles:Â 264 square foot studio selling for $550,000 highlights collective insanity.”

Hello Doc

That is a REAL HOMES OF GENIUS. Here are some more.

Sold for $820K, prior sale was $470K 4 yrs ago

https://www.trulia.com/homes/California/Los_Angeles/sold/22108865-2109-S-Redondo-Blvd-Los-Angeles-CA-90016

Sold for $950K, prior sale was $360K in 2013 then $820K in 2015

https://www.trulia.com/homes/California/Los_Angeles/sold/3899472-5025-W-21st-St-Los-Angeles-CA-90016

Sold for $850K prior sale was $450K in 2016

https://www.trulia.com/homes/California/Los_Angeles/sold/3894412-3038-Buckingham-Rd-Los-Angeles-CA-90016

As I have posted years ago, mid cities area was booming due to low prices (under $500K for a reasonably sized home) and proximity to the Westside. Mid ciities is also gentrifying bigly.

NO TANK IN SIGHT

But as Jim Taylor has been saying for 5 years ‘housing to tank hard soon’. But when it does tank, prices will still be higher than in 2012-2013 in the meantime, you have burned through 5 years of rent.

02/06/2013

$351,821 Sold

04/18/2006

$585,000 Sold

05/23/2003

$287,500 Sold

And not only that, while stocks have gone up 300% since the crash, they’ve all been earning 0.001% interest in their money market account. Cuz you know, Dow 1K was just around the corner. Some guy on some blog said so, therefore it had to be true!!

Greetings All. One thing we should keep in mind, if we’re being honest, is time-period bias (i.e., the idea that numbers can be manipulated to fit an argument based on the specific beginning and end points put into use). So of course Mr. Landlord points us to the (February) 2012 – (August) 2017 timeframe, when the Los Angeles S&P/Case-Shiller index increased from 159.53 to 267.19. That is a smoking ~5-year price appreciation. The picture is decidedly less attractive if you stretch the graph back to July 2006, when the index peaked at 273.85; so in a ~11-year timeframe, Mr. Landlord’s asset has still not reverted to its original value (although Mr. Landlord presumably generated rental dividends and benefitted from tax shields). But maybe Mr. Landlord has owned his properties since March 1996, when the index was at 73.07. I doubt we are all going to agree on what constitutes the “proper” timeframe (and in fairness that depends on one’s individual preferences and circumstances).

One thing I will say is that, in my humble opinion, housing prices in California reached a permanently new high base in the 1996-1998 period; much like oil will never trade at $15/barrel again, no one should hold their breath for a $200,000 house anywhere on the coast again. Isn’t it curious that this new base coincides with the Greenspan put? (I’ll always return to my basic argument that assets have been abnormally inflated by the Fed’s policies of monetary socialism of the last 20 years.)

I would also, respectfully, add some nuance to Mr. Landlord’s argument that so many folks have apparently foregone 300% returns in the equity markets. For starters, time-period bias is again important. If you owned the S&P 500 at its closing record peak in October 2007 at 1565, and for whatever reason did not sell through the record closing bottom of 676 in March 2009, your portfolio would have declined by 57% (all percentage numbers ex dividends). Now, enter the pain of negative convexity (in a nutshell, the downside is worse than the upside). Do you know how much the S&P had to increase to get your portfolio back to break even? 131 percent! Furthermore, the S&P closed today at 2591, which is a mere 65% higher than the October 2007 level. So, to simply say the perm-bears missed the 300% rally is somewhere between disingenuous and not fully appreciative of the math.

The last point I will make is that it is really hard (for me anyway) to think about real estate as a great investment vehicle versus equities or even fixed income (credit and MBS mainly). As I like to say, the best time to buy a place is when you need a place to live, and the best time to sell a place is when you need to move. Otherwise real estate investment characteristics — mediocre long-term returns, illiquidity, maintenance costs, management hassles, etc. — are just not attractive to me. But kudos to those who can make a good living at it.

Cheers

Hi, QE.

The houses you listed here are really not apt comparisons with the “Tiny House” dog that featured in the good Doctor’s post. The only real dog among the three is the last, the place on Buckingham Road.

The place at 2109 S. Redondo is a BEAUTIFUL moderate sized home that I’d be happy to have for, oh, $550K, if I lived in Los Angeles. It would be more like $375K to $450K in my north side Chicago neighborhood, which has a lot of comparable houses- really cute older “storybook” cottages with a lot of charm and cute architecture.

The house the Doc featured is a runty little dog with fleas. It’s definitely a Tiny House.

Agreed – put that house in La Jolla or Del Mar and I’ll take it.

The street view of the house located at 2109 S. Redondo has a high wall around it probably for a reason. The apartment building across the street has bars on the windows and most of the other houses on the street have chain link or iron fences around them like you see in Mexican barrios. The crime map shows areas of high crime not too far away.

I forgot to ask…. how is the neighborhood around the Redondo house?

Not a great neighborhood! Dirty streets, cars parked in the front yards. There are some nice fixed up houses but they are few and far between at this point. Also all those streets dead end into a street that runs along side the 10 freeway that is a normal parking lot for Angelenos who live in their RVs and vans. Also, terrible schools.

Redondo schools are not terrible at all they are actually pretty good. At least 8 or above on greatschools. Not sure where you got that info.

The house is not in Redondo Beach, where yes, the schools are among the best in the state. It is on Redondo Blvd in mid-city, where the schools are quite bad.

The schools in the immediate area of the house located 2109 S. Redondo score poorly. For example, Alta Loma Elementary School scored a 2 of out 10. Look at the Trulia schools map.

Ah yes… it seems I was mistaken.

What do the quality of schools matter when millennial are not getting married or having children? Plus, the house is so expensive per square foot no bank is going to put a loan on that thing

I haven’t heard about RE cycles yet? Why the hell would I be shorting the market if I was that clueless?

You’re making this stupid assumption about me that I’m an “RE cheerleader” because I state the obvious, which is that housing in much of America is still affordable. That causes you to apparently believe that I’m in denial there is a bubble, and that I am blissfully unaware of real estate cycles. Are you even paying attention? Have you looked at prices anywhere besides LA and the bay area?

Cedar Rapis, IA:

https://www.zillow.com/homedetails/703-G-Ave-NW-Cedar-Rapids-IA-52405/121542432_zpid/

https://www.zillow.com/homedetails/2175-Sugar-Creek-Dr-NW-Cedar-Rapids-IA-52405/2110539150_zpid/

The median household income there is $63k. That’s enough to easily qualify for (and be able to easily afford) a $200k mortgage. You’ll notice those homes cost significantly less than that.

Orlando, FL:

https://www.zillow.com/homedetails/16423-Cedar-Run-Dr-Orlando-FL-32828/84650499_zpid/

https://www.zillow.com/homedetails/14265-Sapphire-Bay-Cir-Orlando-FL-32828/82105385_zpid/

Notice the schools. A 10, 9, and 9. That rivals the best private schools on the west coast.

Should I continue? Because you can pretty much throw a dart at a map of the U.S. and nine times out of ten land on affordable housing.

“You would probably not be able to afford the home you live in if you had to buy it now.”

I’ve posted numerous times about my situation, which is that I bought in 2009, sold in 2016 for a large profit, bought again in January of this year. Have I ever once stated that now is a good time to INVEST in the southland? NO. I only bought because it was a house with a floorplan that literally never comes on the market unless it’s new construction, and it will be my family’s home for the next 20 years. I put a crapload down, which I am fully aware will (temporarily) disappear in the next few years. Due to the built-in rental unit, my housing expense is effectively $1,000/month for the 3,200sf of the main house. The tax benefits cancel out two-thirds of that, so really, for a while at least, I’m paying more like $300/month. And yes, I gloat about that while I’m lounging in the pool with an IPA. How much do you pay in rent again?

Ugh, wrong thread…

John,

“bought in 2009”

Exactly what I assumend/said. You bought it cheap after the crash. Exactly what i am planning on doing. Why do you want millennials to lose their shirt and buy during the biggest asset bubble in history (now)?

I never, not once, said that I want millennials to buy in bubble areas now. I’m merely encouraging truth and logic over straight doom and gloom. Which means:

1) It’s okay to buy in a bubble area if it’s your dream home, not an investment, you can easily afford it, and you plan on staying for 15-20 years.

2) The entire country is not in a bubble, and in fact I believe that regardless of age, it’s wiser to put your money in a flyover rental (where positive cash flow is easy to find) than it is to keep it in the stock market right now.

“But when it does tank, prices will still be higher than in 2012-2013 in the meantime, you have burned through 5 years of rent.”

AH, that is completely wrong. Prices will be like in 2009-2012 or even 2002.

If you have rented the last few years you are way ahead of the homeowner when the crash happens. You saved tons of money and built equity while the owner will see his “book value” vaporize during the next crash. You need to do your homework when it comes to California real estate cycles…..its all about timing.

“AH, that is completely wrong. Prices will be like in 2009-2012 or even 2002.”

You’re the one who isn’t doing his homework. Look at the median sales price for the last 50 years (google image search is your friend) and then enlighten us as to why this downturn will be different. Because it’s a bigger bubble? No, it isn’t – not in 90+% of the state. And for the U.S. as a whole, the last few years are barely a blip on the charts – prices are on the long-term trend line.

Hi Millenial

Let’s play this out a little. A crash wont happen in 2017. Doubtful Trump would allow a crash on his watch, That being said, IF a crash starts in 2018, it will bottom in 2020, right? It is happens in 2019 then prices will still increase some between now and then. Then the bottom would be in 2021.

And so it just matter of to what extent a crash, in terms of % drop. For prices in 2018 to go back to prices in 2010, that would mean nearly 50% reduction in prices, right?

I am not saying you are wrong, but I am doubting prices will go lower than 2012 no matter what happens.

When the crash happens the investors will swoop in again, rent out the homes and turn this country further into a renter-nation.

For those of you who werent following housing – investors overwhelmingly bought homes either in bark-room deals at the banks or in house-by-house purchases.

Right?

“When the crash happens the investors will swoop in again, rent out the homes and turn this country further into a renter-nation.”

Investors swooped in only after a 30+% reduction in many markets AND with the help of ZIRP and easy credit. If the crash came again, how many of them would still be liquid or credit-worthy considering that corporate debt is at an all time high? And will the Fed be able to rescue the market when rates are already historically low? In other words, how many bullets left in the Fed gun chamber?

Bailing out TBTF banks is one thing, but would the public stand for bailing out private investors or Wall Street for a second time?

John,

“Because it’s a bigger bubble?” Exactly.

https://www.cbsnews.com/news/most-americans-cant-afford-a-500-emergency-expense/

from the article:

“typical American household still earning 2.4 percent below what they brought home in 1999â€

Also, most Americans can’t afford a 500 dollar emergency surprise. Meanwhile the median house prices are artificially inflated.

Nothing is different, the market always reverts back to where it should be. Bigger bubble, bigger crash. Until the market is aligned with fundamentals.

You can’t cheat your way out of it.

QE Abyss,

“That being said, IF a crash starts in 2018, it will bottom in 2020, right? It is happens in 2019 then prices will still increase some between now and then. Then the bottom would be in 2021.”

>>Yes

“For prices in 2018 to go back to prices in 2010, that would mean nearly 50% reduction in prices, right?”

>>>Absolutely, 50-70% IMO.

“When the crash happens the investors will swoop in again, rent out the homes and turn this country further into a renter-nation.

For those of you who werent following housing – investors overwhelmingly bought homes either in bark-room deals at the banks or in house-by-house purchases.”

>>>Whats stopping me from being like an investor and buying in all cash?

Even if its not all cash, many people I know bought between 2009-2012 on a conventional mortgage. You make it sound like its rocket science.

Millennial:

In other words, you didn’t actually check. Most Americans not being able to afford a $500 emergency expense, or earning 2.4% below what they did in 1999, has nothing to do with whether we’re in a bigger bubble than the last one (which we are not). You sound like an evangelical arguing against evolution by putting on a blindfold and earplugs.

“Where’s your proof?”

“It’s literally inside you and all around you. In your DNA. We watch it happen in living creatures in real time. There are countless fossil records which show evolution step-by-step.”

“That’s your opinion.”

Sigh.

John,

“Proof”

I understand were your confusion is coming from. For some reason you think I am supposed to prove something to you. Lol.

Let me tell you a secret. I couldn’t care less if you deny that this is the mother of all bubbles.

In a few years when I buy at 50-70% less from today’s prices I will gladly share that info with you. But I doubt you or other RE cheerleaders will still be here.

Millennial:

I see the analogy went right over your head. I don’t need proof from you, because unlike you, I look at the data.

One of your problems is that you never qualify your statements. “…this is the mother of all bubbles.” Where exactly? The bay area? Yes. LA? Yes. California? No. The U.S.? No.

You can believe whatever you like, but you’re just making yourself look foolish by making statements that are demonstrably false, and for the benefit of readers who may not know any better, if I happen to be around I’ll call you out on it.

If prices keep rising, this will eventually become the bigger bubble, which is fine with me, because I hold real estate. When it drops, I’m all-in shorting the market. I’m a realist, you’re a perma-bear, and as a result of wearing blinders, you have no idea what a long-term trend line is, or why it and inflation make this bubble a non-event for the U.S. as a whole.

Millennial:

I see the analogy went right over your head. I don’t need proof from you, because unlike you, I look at the data. One of your problems is that you never qualify your statements. “…this is the mother of all bubbles.” Where exactly? The bay area? Yes. LA? Yes. California? No. The U.S.? No.

You can believe whatever you like, but you’re just making yourself look foolish by making statements that are demonstrably false, and for the benefit of readers who may not know any better, if I happen to be around I’ll call you out on it.

If prices keep rising, this will eventually become the bigger bubble, which is fine with me, because I hold real estate. When it drops, I’m all-in shorting the market. I’m a realist, you’re a perma-bear, and as a result of wearing those perma-bear blinders, you apparently have no idea what a long-term trend line is, or why it and inflation make this bubble a minor bump for the U.S. as a whole.

John,

You probably haven’t heard about RE cycles yet. Bubbles always pop. These are just facts and have nothing to do with being a perma-bear. Just google it.

Its very simple to see that this is the mother of all bubbles. Prices have never been that disconnected from fundamentals. Americans are broke and most cant even cover a 500 dollar emergency expense.

Yes, you own a home and therefore you think everything is fine. What people like you forget is that when you bought the home it was a steal compared to today’s prices. You would probably not be able to afford the home you live in if you had to buy it now.

If you think this housing bubble can just go on forever, why waste your time here? Go out and buy!

Greetings All. One thing we should keep in mind, if we’re being honest, is time-period bias (i.e., the idea that numbers can be manipulated to fit an argument based on the specific beginning and end points put into use). So of course Mr. Landlord points us to the (February) 2012 – (August) 2017 timeframe, when the Los Angeles S&P/Case-Shiller index increased from 159.53 to 267.19. That is a smoking ~5-year price appreciation. The picture is decidedly less attractive if you stretch the graph back to July 2006, when the index peaked at 273.85; so in a ~11-year timeframe, Mr. Landlord’s asset has still not reverted to its original value (although Mr. Landlord presumably generated rental dividends and benefitted from tax shields). But maybe Mr. Landlord has owned his properties since March 1996, when the index was at 73.07. I doubt we are all going to agree on what constitutes the “proper” timeframe (and in fairness that depends on one’s individual preferences and circumstances).

One thing I will say is that, in my humble opinion, housing prices in California reached a permanently new high base in the 1996-1998 period; much like oil will never trade at $15/barrel again, no one should hold their breath for a $200,000 house anywhere on the coast again. Isn’t it curious that this new base coincides with the Greenspan put? (I’ll always return to my basic argument that assets have been abnormally inflated by the Fed’s policies of monetary socialism of the last 20 years.)

I would also, respectfully, add some nuance to Mr. Landlord’s argument that so many folks have apparently foregone 300% returns in the equity markets. For starters, time-period bias is again important. If you owned the S&P 500 at its closing record peak in October 2007 at 1565, and for whatever reason did not sell through the record closing bottom of 676 in March 2009, your portfolio would have declined by 57% (all percentage numbers ex dividends). Now, enter the pain of negative convexity (in a nutshell, the downside is worse than the upside). Do you know how much the S&P had to increase to get your portfolio back to break even? 131 percent! Furthermore, the S&P closed today at 2591, which is a mere 65% higher than the October 2007 level. So, to simply say the perm-bears missed the 300% rally is somewhere between disingenuous and not fully appreciative of the math.

The last point I will make is that it is really hard (for me anyway) to think about real estate as a great investment vehicle versus equities or even fixed income (credit and MBS mainly). As I like to say, the best time to buy a place is when you need a place to live, and the best time to sell a place is when you need to move. Otherwise real estate investment characteristics — mediocre long-term returns, illiquidity, maintenance costs, management hassles, etc. — are just not attractive to me. But kudos to those who can make a good living at it.

Cheers

Great article Doc. 264 sq.ft. for 550k? America is almost great again! Meanwhile the homeownership rates plunged to a 50 year low. The RE cheerleaders must be right this time: this is the year when millennials go out and buy in droves!

Nah, just another year with more landlord ownership and more renters.

Expect more of the same, rinse and repeat.

Gotcha! So this is not the year! Just like 2016 and 2015….so just wait until January to hear it again. 2018: the year when millennials go out and buy in droves!

Yeah, the new economic paradigm: renting out to each other. Rentiers will never compete against each other for renters during this time of high rents. This time is truly different.

Well, day-um. Can you post the listing for this ? It may make me move back to Kali !!

In case you missed it:A $500 surprise expense would put most Americans into debt

https://www.cbsnews.com/news/most-americans-cant-afford-a-500-emergency-expense/

Here a conversation I overheard between a Millie and a RE Cheerleader regarding the article:

Millie: Mhm, the article states that student debt is one of the reasons why people cant cover a 500 bucks emergency.

RE Cheerleader: When we were young we worked AND went to college. We had to pay for everything. Kids are spoiled and lazy nowadays.

Millie: Ah ok. Well, another reason is that incomes are down: “typical American household still earning 2.4 percent below what they brought home in 1999”

RE Cheerleader: It does not matter. That’s not the issue. Americans and especially Millie’s are lousy savers. They keep buying Bavarian cars (BMW’s and Audi’s) and spend a fortune at Starbucks!

Millie: But, but, but, I drive a beater car and I don’t drink coffee.

RE Cheerleader: Quiet! Don’t try to kill my argument you spoiled brat. Millie’s are lousy savers! That’s the whole problem.

Millie: Ah ok. So what should we do?

RE Cheerleader: For the umpteen’s time. Buy a house!

Millie: Huh?? But as I said, I have student debt and salaries are not enough to pay for these insane prices?

RE Cheerleader: Do I really have to spell it out for the umpteen’s time? Buy a house! Its a path to being financially independent. Also, its like a forced saving account!

Millie: Ah ok! I get it now. Buy a house! Thank you for the advice (with C).

Re Cheerleader: Finally there is still hope. Just make sure you buy this house very, very soon. Like almost now. Because otherwise you will be priced out. Forever!

Millie: Ah okay, okay. Please advise (with S) which realtor to use? There are so many and I heard some are dishonest?

RE Cheerleader: They all lie, so it doesn’t matter!

Millie: Ah ok. One more question. I don’t have a down payment?!

RE Cheerleader: Zero down is back. Just go now, your lender and realtor will get you into a house. Soon you will be one of the many millionaires on Dr. Housing bubble.

You could enter that as exhibit A for the definition of Straw Man Argument.

Millie, there is some truth in what the RE cheerleader and millie are saying. That is the puzzle part.

Like I said before, life is full of obstacle for those determined to win. It is like in football – you need a strong offense and a strong defense at the same time. Then you have to fight. And most of the time you can not run in a straight line due to many fighting against you to take your ball (in this case money). It is not easy and it is not for the faint of heart. There are always obstacle. Otherwise all will be winners and that is impossible. You can make them all losers by kicking them out from the field but you can not make them all winners.

I used to live in SoCal; I went to college there. At that time I realized that fighting in a straight line does not work. Now I live in flyover country. I scored big but not in a strait line. I lived in Seattle, too. When I moved to Seattle, that was pretty much flyover country comparative to SoCal where all the action was. Microsoft was just beginning to grow.

In socialism and communism all are losers; they can’t even play. In capitalism or something close to it, at least you have a chance to play – some will win and some will lose. This opportunity does not exist in a central planned economy like we used to have in Eastern Europe.

Try to find a growing city, where the balance between RE prices and incomes is reasonably good and where you can find employment. However, in this global economy if you really want to get ahead, use a job ONLY as a stepping stone and always aim for your own business. That is when you really get rewarded. My landscaper who is from Mexico does not have a year under six figure (not even in recession). He has many employees. His English is OK to communicate but poor. However, the service he provides, reliability and cheerful attitude are second to none. Everyone wants to hire him even if he is not the cheapest. Six figure where I live, based on cost of living is like half a million in SF. If he would have continued to live in CA and compete with millions from his previous country and pay for the cost of living in LA, he would still live in poverty.

In football you don’t say that I can not win because I can not go in a straight line and there are too many who tackle you – you just fight and every second watch for what works.

Yeah, the sensible solution is to leave CA and buy elsewhere. I guess this blog tnen is for those of us who are staying for other reasons.

People hanging out here hoping for a huge crash in prices in the near future would be far better served by leaving honestly.

No no the real reason that millenials can’t buy is avocado toast. That $10 toast once a week adds up to $520 which over 5 years is 2500 which is a sizable downpayment on a home.

Oceanbreeze,

That’s a good one! I forgot about the $10 avocado toast that is mentioned so many times…lol.

Keep cheering it on! But, when it goes bad, it will go bad fast!

A couple of interesting points …

If you follow the USGS, earthquake activity appears to be increasing all along the San Andreas, at oil drilling/pumping operations, and at most of the ancient volcanic sites in the State, yet less than 20% of Californians carry earthquake insurance!

According to a recent article the State and all of its local jurisdictions have surpassed $1.3 trillion in debt and liabilities, and the condition of streets, utility infrastructure, and services continue to decline!

Fully 1/3 of all welfare recipients in the U.S. live in California, while realtors and you homeowners gloat over those values!

And, a recent survey indicated that 1/3 of those visiting a Doctor in California are considered diabetic or pre-diabetic, so you own a home but aren’t healthy!

Progressives here should be happy. Think of all the energy saved!! No more global warming!!

Corp tax rate is going to 20% immediately. That is bigly yuugely big! Did I mention it’s yuuge?

Hang on tight boyz and girlz, this Trumpian economy is about to take off lie we haven’t seen since the Reagan days.

I’ve been in business for decades and never ever meet a corporation that paid over 20% in incomes taxes. The rate is fucking meaningless.

oh and over 50% of US corporation pay zero income taxes…….but you knew that.

And here in my neck of the woods in socal for sale signs are everywhere, I think the market has turned.

While you are right, no company actually pays 35%, more like 20-25% after all the deductions, the same will be true with the new rate. No company will pay 20%, more like 5-10% after all the deductions. Point is there will be less money being stolen by the federal govt. And that is a good thing.

Too funny. The insanity of trickle down economics continues. It didn’t work 30 years ago when Reagan politicized it. The country is worse off than it’s ever been even as effective tax rates have fallen for the top .0001%. The tax burden will once again fall on future generations.

The Republicans didn’t have anything new to offer as part of their economic platform. The Democrats, most recently with Obama, adopted the same supply side ideas without advertising it for fear of angering their base.

For the government to truly not want to steal from taxpayers, it would first and foremost cut spending drastically. Have we seen any such effective efforts from either sides of the political aisles?

“Too funny. The insanity of trickle down economics continues. It didn’t work 30 years ago when Reagan politicized it.”

Yeah 22M new jobs created under Reagan. GDP growth averaging 3.5% during his 8 years (compare that to under 2% for Obama). Only a lunatic leftists would call that insanity. No wonder nobody takes you people seriously anymore.

Yeah 22M new jobs created under Reagan. GDP growth averaging 3.5% during his 8 years (compare that to under 2% for Obama). Only a lunatic leftists would call that insanity. No wonder nobody takes you people seriously anymore.

Reagan added $1.86 trillion, or 186%, more in debt from Carter. Based on your job numbers, that’s $84.5K/ job. Wow, great ROI.

My research says that 16M, not 22M, new jobs were added under Reagan. Under Clinton, 21.5M jobs were added, and GDP growth averaged 3.8% (despite higher taxes). Of course, both achievements were based on cheap debt.

Conclusions:

Trickle down economics is still voodoo economics

The market is still based on organic demand, not supply, over the long term.

Ditto head Neanderthals like you can’t help but wallow in your own delusions of political grandeur.

Well,…it looks like tiny homes are all the rage these days!!!…LOL

It shows that there is no limit to insanity…That is the reason prices in CA fluctuate widely. They go to stratosphere and then they crash; rinse and repeat. Who’s next for the cleaners????….In flyover country the ups and downs are way smaller.

This time around your neck of the woods is pretty darn frothed out IMO. If I recall you are somewhere in NID? If my memory serves me right, otherwise disregard everything I say below haha.

I track NID pretty closely and it is waayyyy overpriced given local incomes. It could be said that many retirees and RE investors don’t pay taxes and therefor isn’t reflected in your local income stats–but even so NID is super rich right now and will head south fast when the tide goes out. NID has no clothes. Don’t get me wrong, I love it there, I’m speaking only in terms of valuations.

NID (kootenai, benewah, some parts of bonner co.) is handily more expensive than where I live in Northern CA and I’m about 1hr20min from Commiefornia’s state capitol. Even though it is a liberal toilet bowl here there are robust demand drivers in terms of money swirling around (compared to anywhere in NID.) NID is rich right now. I see a bigly correction there when things mean revert.

All of you RE whiners can buy super cheap nice rural property around the Sacramento region (Sierra Nevada foothills) and buy dirt cheap rentals when the market gets hammered here. Happens like clockwork. You can’t do that in many places but can here.

To be clear, not calling you Flyover a RE whiner, I’m referring to the Millennial and Alex in San Jose type creatures.

nor cal fella,

RE whiner, huh? Let’s see if you can bring a little bit more to the table than accusations.

Can you provide an example? Are you calling Warren Buffet a whiner too? Probably not, but he is saying the same thing: Buy low and sell high.

I am saying in a heavily overpriced market its better to save money and build a war chest. Wait for the collapse and buy when prices are down by 50-70%. IMO the odds are 99% that we get another big crash. I also said, in case the market will never crash I would simply own RE at point of inheritance. This is to address the ridiculous claim of RE cheerleaders “If you dont buy now, you will never own”. “You will be priced out forever”. You are probably confusing whining with smart investing.

The def. of a whiner is to “complain in a feeble or petulant way.”

Isn’t that exactly what most RE cheerleaders are doing? They want millennials to rush into buying overpriced houses to keep the highly inflated house prices alive. Since millennials don’t buy, RE cheerleaders complain in a feeble and petulant way about these “loser” millennials. Maybe the RE cheerleaders are frustrated because first-time-home buyers are supposed to listen to older, “wiser” generations and chose not to? We had 7 MIO foreclosures during the last bubble. Maybe the older generation cant believe that millennials are not following the same mistakes that devastated millions before?

So the rhetorical question is, who is the RE whiner?

I do understand why this is frustrating to RE cheerleaders. And to me this is prime entertainment.

I’m not in NID, but I agree with you. I bought property there in 2011 and sold recently to cash in those valuation. That market has a spill over effect from SoCal and Seattle with about 6 months lag time. Watch the other 2 markets and get an idea where NID is heading.

Long term I’m a RE cheerleader but I watch valuations for short term moves. I go in and out based on the market conditions (like in stocks). I prefer to leave some money on the table to let someone else to be trampled in the rush for the exit. I’m not greedy. I go in and out in a civilized way happy that I got the direction right. That way I have peace of mind and don’t have to suffer complications from stress or use Tums pills. There are still some deals once in a blue moon but at this point I am a seller.

NID is one of many markets I’m watching.

This about sums it up: “Perfect for a UCLA student.” How many college students have 100K to put down on a house and then be able to afford a 450K mortgage? This is insanity. Prices will tank to 2002 levels. Meanwhile, I will continue to pay my cheap rent that hasn’t been raised in 10 years and wait for the RE carnage.

Mommy and Daddy, buying a place for their perfect little UCLA student is fairly common.

“Prices will tank to 2002 levels.”

No, they won’t. Take a look at the median history.

It could be much worse than 2002. At some point incomes will be the driving force in RE pricing contrary to what many here think. And when, not if, that day arrives prices will fall to the level where the average person can afford a home. so I would say 1999 values.

So now we have people predicting a crash that takes us back to 1999 and 2002 RE prices. Wait for these prices at your own peril. Just like the screaming buying opportunity in 2010-12, many people didn’t pull the trigger because they wanted another 25% discount. Prices back then (monthly payment wise) were the lowest in decades. We will have a pullback, but WISHING for 99/02 prices is insanity.

Lord,

My wife just alerted me that the home we sold in 2005 was on the market again.

We sold it for $455K…….a ridiculous amount at the time but here in 2017 it’s listed at ……$450K….RE only goes up.

“It could be much worse than 2002. At some point incomes will be the driving force in RE pricing contrary to what many here think. And when, not if, that day arrives prices will fall to the level where the average person can afford a home. so I would say 1999 values.”

It could be much worse, but probably won’t. A drop of a couple of percent in incomes doesn’t equal a 70% drop in home prices. I know people want prices to fall to a point where the average person can afford them, but in reality they’ll only drop to the point where a LOT of people start getting interested in investing when they see a nice discount. Momentum and low rates do the rest, and you’re back on the upswing. In 2008 you had two types of people – those who were waiting for another 20% drop, and the smarter ones who were putting in offers.

I really hope it tanks 70%. I stand to make a lot of money if it does. But it most likely won’t.

Yeah my buddy used to say all the time, “I got it so good, cheap rent in a good neighborhood with no maintenance headaches, why would I buy or move.”, until his building sold and his rent went to market rate. Now he whines nonstop about the additional $500 monthly rent increase.

500 dollar monthly rent increase seems very unlikely. I think you are exaggerating. For a landlord its much more lucrative to keep the good renters happy. Its not worth the hassle to increase the rent and lose a good renter for a worse one. Not to mention the loss for vacancies in between old renters leaving and waiting for a new one. Be good to your landlord, pay on time and don’t cause trouble. The favor will be returned. I pride myself with being an excellent renter. This behavior lets me save a ton of money and as a bonus my landlord has kept the rate stable.

Millennial,

He said the “building sold.”

The previous owners probably inherited a building purchased in 1965 by their grandparents. No payments, next to no taxes.

The new owner just bought the building for millions of dollars. Big payments. Big taxes.

I’m guessing the rent will go up another 300 in a year. Remember it had been a cheap price in a good neighborhood.

The Bank’s gotta get paid.

Lowly Teacher

Exactly teacher. Rental properties get sold all the time for various reasons. You can not predict when someone is going to die, get ill, retire, get divorced, relocate, go bankrupt, etc. The new owners end up paying a premium and rents go up to market rate overnight. This can and is happening everywhere in S. Cali where they don’t have rent control. Not just apartments buildings, but rental condos and rental SFH as well.

When my sister went to college, my parents bought her a condo as well. They didn’t buy it for her, as in she owned it, but they bought it for her to live in. She went to college in a very expensive city, where renting an was insanely expensive as was living in dorms. So they figured, buy a 2 bedroom condo, get a roommate to pay 1/2 the carrying costs, get a tax deduction on it as well. Worked out pretty well. They ended up renting it out for a few years after she graduated as well and when it was sold, they ended up making about $100K profit on it, which more or less was the cost of her tuition.

so what you are saying is kids today can not afford to buy a house…..which means they are over valued.

They are targeting foreign buyers most likely.

THEY ARE TARGETING CHINESE BUYER

Been there, done that. For those out there struggling to afford a house in CA, why not move to where housing is affordable? To those of you who probably can find work elsewhere, but can’t give up the California lifestyle and weather, is it worth the 30-year mortgage? For those who may have difficulty finding a job in another state, here’s an idea: Borrow $100k and get your Master’s or Doctor’s Degree, so you can get work anywhere in the country where the jobs pay well, housing is affordable and live a comfortable, potentially debt-free life. That $100k investment reaps far greater rewards than the $500k home loan.

We sold our home in CA and moved to Texas two years ago and haven’t looked back. There’s nothing like having zero mortgage. (You can’t escape property tax, though.) Near my work place there’s a little cottage on sale that’s built around the same time, comparable condition and twice the size, for 14% of the cost of that shack in California. https://www.redfin.com/TX/Stephenville/359-S-Columbia-St-76401/home/101379856

Yeah, at some point we need to put a banner at the top of this blog saying:

NOTE: The sensible solution to CA prices is to LEAVE. HOWEVER, if you want to stay, we can discuss housing prices on this forum.

And if you must have a grand house, here’s one at $450k asking price–and an hour away from Fort Worth Area, which is booming: https://www.redfin.com/TX/Stephenville/1484-Highland-View-Rd-76401/home/55027627

Cracking me up. Been in Long Beach for a month, searching for rental property for my buyer. Haha, back to ‘05. All overpriced, all just sitting, agents so-trying to create anxiety – “lotsa calls, gonna fly off the shelf soonâ€. In reality, the RE tires are stuck in tar and the Millennials are NOT buying houses; their parents are paying to rent them apts; even the 50-somethings are using mom and pop’s money to rent. 5,000 apts being built “downtown†Long Beach. Couple hundred condos. Street sweeping has been replaced by street sleeping…..EVERYWHERE!!

I follow the market and see lots of house just sitting on the market and several price reductions over time. It looks like these greedy sellers missed the boat. We will have fun once the panic comes.

Dispite all the “quaintness”, what would really concern me about a property such as this one would be fire, homeowners insurance rates.

Insurance for this dog can’t possibly be cheap.

Do a Google street view.. Road frontage is so narrow, that it must of started as some sort of horse trail in the 1800′.s

Good ‘f’ing luck if you have to get out in a hurry.

2006 = bubble.

2017 = not a bubble.

even though the median income finally passed the all time high from 1999……how does this math work?

The math works like this.

Roughly 2006: 509k Median Price @ 6.5 percent mortgage rates = $3,217 per month

Roughly Today: 580k Median Price @ 3.5 percent Mortgage rates = $2,604 per month

Median price of homes today would have to be around 725k to get the equivalent monthly payment of 2006.

99 percent of Americans ask “How much per month?” vs “How much does it cost?”

Thank the Federal Reserve.

McDuck,

That’s a good example for the math challenged. Not to mention you are paying much more towards principal with the super low rates. And people still wonder why 2010-2012 prices were screaming bargains.

@LB

Huh…I think McDuck is pointing out the lunacy of buyers who base their decisions on monthly payments rather than total cost. The Fed’s slight of hand tactics are all too evident in his remarks.

@POH,

Whatever point McDuck was trying to make, the numbers clearly show it is significantly cheaper to buy TODAY even though prices are higher. And as I mentioned, you are paying significantly more in principal today due to the super low rates. And as McDuck said, 99% people only look at monthly payments. Trying to wait these people out looking for the perfect opportunity to buy is an exercise in futility. And here we are almost in 2018 and rates are right around 4%. And they will be LOW for years to come.

Back in 2010-2012, McDucks same example would have been a giant buy signal. And people still couldn’t do the math or wanted another 25% discount..

@POH,

“Whatever point McDuck was trying to make, the numbers clearly show it is significantly cheaper to buy TODAY even though prices are higher. And as I mentioned, you are paying significantly more in principal today due to the super low rates. And as McDuck said, 99% people only look at monthly payments. Trying to wait these people out looking for the perfect opportunity to buy is an exercise in futility. And here we are almost in 2018 and rates are right around 4%. And they will be LOW for years to come.”

Using 2006, the biggest bubble back up till then, as a barometer simply masks the horrendous economics behind today’s market. Two similar scenarios stick out: 1. based on the afore-mentioned numbers, the price/income ratio is similar and 2. looking strictly at monthly payments often leads to financial distress if not ruin. So yes, you want to wait out the lemmings. If you depend your idea of financial stability is dependent on perpetually low rates and easy credit, then you sure can’t see the big picture.

“Back in 2010-2012, McDucks same example would have been a giant buy signal. And people still couldn’t do the math or wanted another 25% discount.”

Hindsight is indeed 20/20. Must be nice to be aware of the Fed and government financial put after the fact. As I said before, the economics did not make sense for many potential organic buyers back then.

By the way, try taking a look around the world outside of Orange County/L.A. Housing in many overpriced markets isn’t doing too well DESPITE ongoing the cheap and easy credit. Think we’re insulated from this?

I do not see the point in waiting anymore. The next “crash” will spur lower rates which would benefit previous buyers to refinance at lower rates. The term low rates is all relative. What if we get negative 10 percent interest rates? It distorts pricing, yes, but it is out of your control.

Waiting for rates to go back up is foolish. The only reason rates would go higher is if we had massive inflation. If we have massive inflation, then you would be rewarded for locking in at today’s prices and rates.

Try to be neutral in the marketplace. Buy something small. If it crashes then walk away since California is a non-recourse state. I was waiting for stocks and housing to crash further in 2010/2011. The only thing that crashed was the value of the dollar I put into my savings account.

http://www.sec.marketwatch.com/story/millennials-communism-sounds-pretty-chill-2017-11-01

1 out of 3 millennials would rather live in a socialist country. Of course! If you are fed up with this bullcrap you want something else. we need a dramatic change! Socialism will take over!!!!!!!

100/100 children would eat chocolate for dinner every night too. This just proves that millenials are children, who can’t think rationally.

The millennials in that article are lying through their teeth. If they REALLY wanted communism, they would all ask for political asylum in Cuba, N. Korea or Venezuela, wherever they will accept them. If they don’t, that means they are lying the same way they were lying when they said that if Trump wins they will all move to other socialist countries. Guess what? None of them moved.

When I lived in a communist country, everyone was willing to ask for political asylum to any free country where they would accept them, but not everyone was willing to risk their lives to escape that “paradise”. Many who dared to ask for a passport were killed. That kept away the pretenders from contenders. I risked my life and I am here. I asked for a visa from any country willing to give me one. Only the US accepted me. Many other millions of young people left wherever they were willing to accept them. The situation was the same in ALL communist countries. How many millennials are willing to risk their lives to get to live in a communist country? NONE.

What they mean in that survey is that they are willing for the government to use force to steal from the producers and share with them while they have fun and pretend to work (for a government job). There is a word for that – LEECHES.

Yap!

That’s the reality. No matter how much anyone farts, in the end the word Leeches describes these carnivores perfectly.

He said that students said they would rather live in a socialist country, not communist. They are not the same thing. I don’t know why you changed the word… it’s something politicians do. Think U.K., Canada, Ireland….

Family units are socialist in nature, everyone does what is expected of them and in a perfect world, everyone’s basic needs are met. In a middle-class family, the kiddos do their chores, they are fed, dressed and receive medical care. What’s not to like?

I love my country, I love my home state. I do not want to move. I know we can do better. Smile, put yourself in someone else’s shoes, feel empathy, know that if you lift up your neighbor, you are lifting up yourself.

Crousehouse,

I forgot to mention that none of the countries in Eastern block were called “communist”. ALL of them, without exception were called “Socialists”.

In those countries you mentioned, all the producers are angry at government policies stealing from the fruits of their labor. Only the leaches living in the “government projects” are happy to do nothing and be compensated for it.

Like I said, a big centralized government always picks the winners and losers. The winners are the leaches and the well connected (oligarchs). The losers are those who actually produce wealth for the country. If you reward the leaches, you will get more of them. If you punish the wealth creators you will get less of them. Long term, being concerned with the size of the slice each gets will lead to no cake to slice. That is what you see in all communist socialist countries. I used them interchangeably because the ideology is the same. The only thing which varies is the speed of implementation and how far they went. It is a bankrupt ideology regardless of how you look at it. I studied it in school and in real life. If you live long enough under it, you will understand it too.

It is easy for you to dream of socialism with a full belly and comfort brought to you by a capitalistic economic system (more so than other nations). In practice it never worked and never will. Initially you feel a high like in taking drugs. When you’ll run out of other peoples money and wealth creators you will feel very depressed, poor and destitute. Everything is great when you just start charging a new credit card. The pain comes later when you suffer the effects of having to pay it back. One way or another, you will pay.

Where I live, the state government decided to improve the housing condition of the poor by installing new bathroom fans in mobile homes. The cost based on the local manager in charge is more than $20,000 per fan, including all the administrative overhead. A non-profit can do that easily for under $1,000 labor and material, including power and overhead. That is just a small example of government inefficiencies at a small scale. The more the government grows, the more that type of inefficiency expands at the whole economy till everything collapses. All those taxes and printing of money leaves all families poorer and more dependent on government.

Also, because this action is not market driven, do you know what those poor people do? They cover the fans because the heat escape in the process and they don’t have enough money to heat the place. So, something well meaning ends with no benefit to the poor or the middle class paying for it in taxes – everyone gets poorer. Government misallocates funds. It is the size of misallocation and the extent of it which collapses the economy sooner or later. Government can never eliminate poverty regardless how much it tries. The unintended consequence of government intervention is widespread poverty.

There is a limited role for the government: to preserve the market system, fight corruption,administer justice and enforce laws, defense and foreign affairs. Of course, given human nature, the government is where you’ll find the most corruption. The smaller the government, the smaller the corruption.

Look at all the policies the government enacts in the name of “helping people buy houses”. What you see, is all prices going through the roof and the only beneficiaries are the banks.

Crousehaus,

All socialists eventually grow up to be communists. Their end goal is govt control of everything and everyone. Open your eyes man.

Of course I am not going to move to a communist country. I’ll stay with my parents but I want to make America more like a socialist country. Like in Germany. They have a government pension system, government healthcare, free tuition, labor unions, heavily regulated housing market. Do they have homeless people all over like we have?

Do we have 30 days of paid vacation? But dont be mistaken. Germany is also a capitalist country because you can own property and assets.

This is the form of government we need.

The US is controlled by the rich who just pay everybody off. Nothing that will benefit the masses will ever get done here. The rich will own it all and the middle class will be their servants. Modern day slavery!

We need to act now. Vote for the most leftist guy out there. It will never be like soviet union….but it will go towards a social democracy like Germany, Switzerland, Austria, France, Norway, Sweden etc. Dont listen to these fear-monger who tell you there is only what we have here in the US or communism. Its BS! Open your eyes and research!

Richard Star,

You can’t live like in Norway because Norway has 4 million people and an ocean of oil (relative to population). When prices for oil were high they built reserves for a rainy day. Before they discovered oil, they built a civilized country based on high level of education, hard work and financial discipline. That culture does not change overnight. Also, they don’t allow too much immigration. Their economic model will fail in US in few months.

Germany, the same way, build a solid economy based on a culture where hard work, high level of education and financial discipline where highly valued. In all their history, they had a homogenous population with a uniform culture conducive to national unity. All that started to change since they have Merkel. The more they will embrace multiculturalism, the more poor they will become. Watch and see – it is not going to take too long. Socialism will fail in Germany and all european nations the more foreign cultures will be introduced there. Those cultures mix like iron and clay. That is a fact. I already know lots of germans leaving the country of their grandparents. The Germany in the future will no longer resemble the Germany from the past so you can no longer bring that example (same with Sweeden).

Switzerland, I agree with you. It is better than most countries and financially/economically they are more to the right than US. They have a VERY decentralized political and economic system (like the founding fathers in US proposed), which is not the case in US now. How many times do you hear about president/PM of Switzerland?!…I have relatives living there. Swiss people and government don’t want any immigration, they have good work ethics, high level of education and they don’t have too many leaches to seep wealth from the producers. Therefore, the vast majority are wealthy. You can have a a waterfront palace in Switzerland and pay $1,500/yr in prop. taxes without Prop 13. They embrace the wealthy not tax them to death (to punish them for being successful). Even with those low taxes, they have better schools, roads, fire stations than in US. Why? Because they don’t have open borders like in US where millions and millions come every year legal and illegal.

You CAN NOT have open borders and socialism at the same time; very soon, everyone will be equally poor, contrary to what the democrats say. We know that, and very soon, the Germans, Swedes and those in other socialist countries will find out the hard way and they will be unable to right the ship.

Trump is making some attempts to enforce the existing immigration laws and the whole MSM and liberals scream “racist” and “Fuhrer”. He didn’t even make the laws; just trying to enforce laws made by Congress. All the liberal judges start legislating from the bench against him. If all poverty from the south is moved to US, you CAN NOT have socialism in this country EVER. The only way the government can pay for it is to “print money” which means very high prices and inflation (which is the most regressive form of taxation). High prices means low quality of life; simple like that. US already spend one Trillion dollar more per year, increasing the debt exponentially. How much more do you want them to spend? Higher taxes mean less disposable income, which means recession and lower quality of life for everyone. Do you think the high prices in SoCal developed in a vacuum? Just imagine the prices in SoCal without the immigration in the last 30 years!!!….Do you see the correlation??!!!….

Those countries in Europe don’t build empires, therefore they don’t have to spend a lot on military. The problem in US is that both Democrats and Republicans spend to much to police and control the whole world.

You know what Germany doesn’t have? Google, Amazon, Microsoft, Twitter, Facebook, Apple etc…

None of your darling socialist countries have any of that.

Now think to yourself why is that?

Tick tock….

Just make sure you don’t get cancer in Germany. It’s “free” but you’ll die.

Among the most common cancers, age-specific survival differences were particularly pronounced for older patients with breast, colorectal and prostate cancer. Survival advantages of breast cancer patients in the US were mainly due to more favorable stage distributions. This comprehensive survival comparison between Germany and the US suggests that although survival was similar for the majority of the compared cancer sites, long-term prognosis of patients continues to be better in the US for many of the most common forms of cancer. Among these, differences between patients with breast and prostate cancer are probably due to more intensive screening activities.

More of that awesome “FREE” health care in Europe. Won’t it be great when a DMV-like govt bureaucrat decided who lives and who dies?

https://www.forbes.com/sites/tomasphilipson/2016/09/06/eu-vs-us-cancer-care-you-get-what-you-pay-for/#5ddfe17f6ba5

A recent report suggests that cancer patients in England are suffering from serious lack of access to vital treatments due, in part, to problems with the drug assessment and approval process. The UK and other European health systems use central health technology assessment (HTA) to decide whether to cover a given treatment, but these processes are ultimately designed to help manage healthcare budgets – not get the best outcomes for patients. In cancer care, however, you get what you pay for.

Germany as a socialist democracy is extremely wealthy.

Out of 10 top manufacturing companies in Europe, 7 are German!

https://en.wikipedia.org/wiki/List_of_largest_European_manufacturing_companies_by_revenue

Volkswagen, Daimler (Mercedes Benz), BASF, SIEMENS, BMW, Bosch & Airbus.

Uneducated/brainwashed Americans don’t know that. They only want to believe America is the greatest country. The truth is, its great for the 1%. Every other American is suffering under this Aristocracy.

Poor Gary. Wow!! 7 of the top 10 in Europe. So Germany is the tallest midget.

Where is Germany’s Google? Or Amazon? Or Facebook? or Microsoft? Or Salesforce? Or Twitter? Or Apple?

They don’t exist in Germany. Or anywhere else in France. All those things are in the US. Gee, I wonder why that is…..I’ll let you think about it for a while Gary.

My bad Landlord. I assumed these German company names mean something to you. You only know twitter and facebook. Maybe this will help you:

German’s debt burden per GDP is 68%.

The US debt burden per GDP is 106%.

Total debt in the US is about 20 Trillion? Germany’s debt is 2,3 Trillion (in USD).

How can that be? Germany is such a bad, bad social democracy!! Nobody works! Everyone wants hand outs!!!! Everybody knows that in social democracies you only find lazy people!!!!!!!!

He’s a troll – and not a very bright one. Notice how he never responds to the replies his comments get.

That is true. However, those who are bright on a blog, read and understand, will get smarter. The stupid are always hopeless – you can’t fix stupid.

It’s actually 51% and climbing. The majority of millenials polled believe that the current economic system works against them. They’re right.

It’s always hilarious when communists (or pardon me, I mean Democrat Socialists) like Gary and Richard Star use their Apple made/designed/engineered laptops/iPads to bash capitalism. They truly are that unaware of their surroundings. LOL

Los Angeles is still a lot cheaper than The City, that is because it is still the land of the philistines.

Be vocal and tell your congressman or women to work towards banning foreigners from purchasing American real estate. Until you do that, don’t complain because your complaints mean nothing.

First of all I think any law like that would be thrown out by courts. If Trump can’t ban radical muslims from entering the country, good luck banning rich Chinese from buying homes.

Second, it is ridiculous to tell foreign people who want to bring money and invest it here “sorry we don’t want your money”. Actually ridiculous isn’t the right word….down right insane is a better description.

Now having said that, I think it would be reasonable for municipalities to enact rules against people buying homes and leaving them empty. Zoning laws can do that and possibly tax properties at a higher rate that are not occupied full time. Or things like that.

But a blanket “no foreigners are allowed to buy real estate” law….no way.

New Zealand has a no foreigner law on real estate purchases and our intellectual superiors, Vancouver BC has a similar law, that is why the Chinese money came to California.

Do you know how easy it would be to get around a “no foreign ownership” rule? There are already booming businesses acting as nominees and fronts for people in their property purchases. How many layers of companies/trusts would you have to look through in order to find out that the ultimate beneficial owner is a foreign person if your search didn’t instead lead to a nominee and you never find out that it’s actually owned by a foreign person?

@ JR and Landlord: I don’t know, I think Vancouver has already done that in Canada and Australia has, or is working on passing just that sort of thing. Mexico didn’t allow foreigners to purchase RE for many years.

Good idea or bad, it’s not a new concept.

And you’re both right: not likely to happen in the US

Very true. Governments are cracking down on this in general regarding financial accounts (FATCA, CRS), it won’t be too long before the government knows about all money moving in an out of the country. Now whether they are able to enforce and take action is a different story.

I don’t really care what Canada and Australia do. And I absolutely don’t give a shit what Mexico does. We believe in capitalism (or we used to any way), not bullshit socialist/protectionism like they practice in Canada and Mexico.

And besides Canada didn’t ban foreign ownership, they just slapped an extra tax on them. Not quite the same thing. And you really want to follow Mexico’s lead on economic policy? Jeeezuz.

A mania is a mania. The greater the mania, the greater the eventual crash. However, this endless rise in prices is getting boring to watch. Maybe we should just stop following the real estate market for a few years and do something else.

So what should first time home buyers that can not move 2000 miles away do? Even a solid income of around 200k annually can’t afford you a nice home in a good school district to raise a family.

Cry me a river, $200K can easily buy a nice homes with good schools in beautiful south OC. Plenty of jobs in OC, traffic comes into Irvine not the other way.

+1

200K income and can’t buy a starter home in a decent neighborhood? Either you have massive debt, major spending problems or your idea of decent neighborhood is Manhattan Beach. Not buying this one bit.

You only have to move 50-100 miles away, not 2,000. $200k will get you an amazing house in a great school district. Just not in LA.

If you can not move 2000 miles away, you move 1000 miles away. If prices are still prohibitive, you stay where you are and rent. If rent is prohibitive, you sleep under a bridge or you move. It is a free country. It doesn’t matter how much you make; what counts is what can you buy after all the taxes. In Zimbabwe even the poorest person is a billionaire. After the taxes, it is not too much he can buy with a billion. It is the same everywhere. Try to find the best balance between income and cost of living – that changes all the time depending on location. But if you insist that SoCal offers the best balance, then live there and don’t complain. Nobody keeps you there by force. It is your own decision and you can blame only yourself.

With the assumption that you are living in the Golden State, if you are making $200k in salary and want to own a house, you should be able to find a job anywhere outside of California for even half that amount and be able to afford to buy a very nice house in a good school district. Why rule out moving to another state? Family? Weather? But, with a $200k salary, you can rent a nice house in CA and still have a lot of money leftover. Let’s see, a comfortable rental would put you back maybe $3000-$4000 a month in a good school district in CA. That still leaves you at least $150k in annual salary. So my advice is to decide how important home ownership is to you, with all its benefits and negatives, versus staying in California.

So what should first time home buyers that can not move 2000 miles away do?

—

You mean doesn’t WANT to move. Anybody can move. Stop making excuses and either move, or learn to live in your situation. Option 3 is whining about it, which is what you’re doing.

I can understand not moving for a variety of reasons. Namely, in the case of teachers in California, they will lose their pensions.

The posters on this board constantly express their disgust with anyone of the Latino persuasion. So the responses here are much nastier than they would otherwise be.

Alejandra, why can’t you and your fam bam live off of $100,000 for a few years and save the rest? Sounds like a great problem to have!!!!

Those are excuses for not moving. It is a CHOICE not to move. That is my point.

Tax bill cuts mortgage interest deduction in half. Its a start.

The Tax Plan: One bug F. U. to upper middle class peeps in blue states. BWA HA HA HA HA HA. I love it. All those progressive assholes in Silicon Valley making $200K a year are about to be reamed. No more state income tax deduction, no more deduction on $1M mortgages, no more deduction of $25K property tax bills.

Mr. Landlord, what the GOP tax plan does is simply transfer wealth from Blue states to Red states just because the Dem states have a higher cost of living and higher salaries. It is simply a Robin Hood plan pretending to be a middle class tax cut. Why are Congressmen from Blue states selling out their own Rep. voters? I don’t get the logic of taxing the same income twice (by ending the SALT deductions) while giving huge standard deductions to people in Rep. states who simply live in lower cost of living states and, therefore, have little or nothing to really deduct.

Gary,

Please explain to me why someone making $50K, with a $200K home in Kansas, should subsidize someone making $200K with a $1M house in California.

I’ll wait.

Why reward states for having obscenely overpriced housing that drives out the next generation of society? States like CA care more about foreign nationals that Americans.

The state of california taxes you on taxes you pay to the federal government.

Mr. Landlord, you don’t seem to mind having those living in low cost of living areas subsidizing real estate investors in high cost of living states with a ton of tax deductions for real estate taxes and interest expenses. What makes landlords so much more deserving of the same tax breaks which you don’t believe individuals deserve? Also, why should someone in a low income state, with no major deductions, be given a $12,000 gift for imaginary deductions. The GOP tax plan is a sort of modified flat tax plan which favors those in low cost of living states. The only good thing about the tax plan is that hits upper middle class and lower upper class people who usually gain big in Republican tax cuts.

Finally, the high cost of living states always receive less from the Federal govt. in benefits than they pay in Fed. taxes. This change just makes that income transfer from the high cost of living states to the lower cost of living states much greater.

If this plan passes, I will consider moving out of California to one of the low cost of living states where you apparently living. Do you have a suggestion about which state would be the best one to move to for someone who is retired like me? My itemized deductions are not significantly more than the new $12,000 standard deduction so I personally would only pay a little more in income taxes under the Republican plan.

“Finally, the high cost of living states always receive less from the Federal govt. in benefits than they pay in Fed. taxes. ”

That’s because of the military for the most part. Red states have more military installations than blue states. Take away the military and that imbalance pretty much goes away.

I’m not a progressive asshole nor do I live in Silicon Valley. This will hurt me and many people I know if it passes. Corporate profits will go up but I don’t think it’s going to equal huuuuuge pay raises for everyone.

If by everyone, you mean the corporate executives then I agree. Corporate cash is up 9.2% since the end of 2015, yet wages have stagnated. They have the money, they just are not spending it, especially on wages.

https://www.moodys.com/research/Moodys-US-corporate-cash-pile-grows-to-184-trillion-led–PR_369922

I wouldn’t have thought the both of us would like the plan. Maybe its for different reasons but we both like it.

Millie,

Politics makes strange bedfellows. I think the two of us agree on a lot of more than you think.

I like the tax plan and I also like the reduction of the MID to $500K. Median home price in the country is $250K or something like that. Which means the vast, vast, vast majority of people won’t be affected by the cap coming down from $1M to $500K.

The people affected will be a small number in places like LA, SF, Seattle and NYC. And to them I say boo fucking hoo. Same with the elimination of state income tax deductions. If residents of CA and NY keep voting in Dems who raise taxes to 10% and more, that’s your problem not mine. I shouldn’t have to subsidize your tax and spend policies. If you want to pay less tax, move to a low tax state or start voting in people who will lower your state/local taxes.

Agree 100%. Even though I live in California I believe the plan goes in the right direction. I hope it goes through.

It is nice medicine I agree, just hope they don’t all come up your way 😉 The regressives love to ruin nice areas. They can’t help themselves.

I sure hope E. WA and NID never go purple. The only thing that will save you is making it too hostile for leftist scum to feel comfortable there. If you can succeed in that you will save your communities. Otherwise you will become California’s with crappier weather.

Probably add fuel to the Prop 13 resistance movement as well, Landlord

The GOP tax bill lowers the mortgage tax deduction to $500,000. If you look at housing stocks today, they are down. To me, this is going to put pressure on housing prices since lowering the deductibility of mortgages will eliminate some of the artificial demand for housing. When you subsidize something less, the demand should decrease (or the pricing power will decrease), which will allow for prices to go down.

If you are an investor and buy to then rent out the house, this is a business like Trump owns. You can fully deduct your mortgage if you are a landlord because it is a business. Trump wouldn’t screw himself. He only appears to be targeting Blue State homeowners.

If the property is a rental you can fully deduct the property taxes, mortgage interest, and any other expenses/overhead since it is considered a business. The proposed limits on mortgage interest deductions and property tax deductions would apply to primary and secondary residences.

I highly doubt that the proposed tax plan will go through as it stands right now. In fact I highly doubt ANY tax reform gets done. So far Trump is batting a big fat zero as far as passing any meaningful legislation out of congress.These people are so out of touch from the everyday American and furthermore can’t agree on the color of the sky let alone meaningful tax reform.

I agree that so far Trump has been unsuccessful in passing anything. However I feel an energy and enthusiasm for this plan from the Republicans that lead me to believe it will pass.

The part that you guys don’t get is that Landlords get to deduct interest regardless, so if this happens… (and it won’t, nothing will get done as per usual)… renters and landlords are no longer at even playing field. There will simply continue to be more landlords since they have an economic advantage to being with and now can deduct interest while renters can not.

Also, don’t forget $1,000,000 is grandfathered in to the plan… but nothing and I mean nothing will pass the next 4 years so it’s all a waste of time.

I dont care if my landlord can deduct taxes or not. My landlord is giving me a huge gift for letting me rent at a rate that is way below the cost of ownership. That allows me so save money and purchase with a large downpayment when the market tanks.

This tax bill will pass. It may get tinkered a little here and there but it’s passing.

“When you subsidize something less, the demand should decrease (or the pricing power will decrease), which will allow for prices to go down.”

That’s spot on. The tax plan is going in the right direction. Which is very surprising giving its coming from Trump.

I recently moved to DTLA. My apartment building gave me 1 month free! Considering my rent is $2,200 that is a huge bonus. And no, my building is not one to do that “1 month free” scam year round. A few weeks after I moved in that promo was done.

Moving from Hollyhood DTLA is great. There is so much building going on, the closest thing to a free market i have ever seen in CA. Someone call the press. There is some real competition.

Unfortunately this means i lost all my Hollywood friends since no one leaves their bubbles in LA. Anyone in DTLA want to go out and get drunk?

You’d have to be drunk to want to live in DTLA which is the homeless and thug capital of the US.

http://www.dailymail.co.uk/news/article-2468014/Life-Skid-Row-Where-homeless-fight-demons-drug-addiction-alcoholism-downtown-Los-Angeles.html

Man, Trumps Tax plan is fantastic news and I cant believe I am saying it…..

What got me convinced is the what I read on the devils website:

https://www.nar.realtor/nar-statement-on-tax-reform

From NAR President William E. Brown:

“We are currently reviewing the details of the tax proposal released today, but at first glance it appears to confirm many of our biggest concerns about the Unified Framework. Eliminating or nullifying the tax incentives for homeownership puts home values and middle class homeowners at risk, and from a cursory examination this legislation appears to do just that. We will have additional details upon a more thorough reading of the bill.”

That is music to my ears…..”Eliminating or nullifying the tax incentives for homeownership puts home values and middle class homeowners at risk”

Doesn’t it sound so beautiful? That this comes from the NAR makes it so much better!