Getting out of San Francisco:Â 83 percent of Bay Area renters plan to leave the area before settling down.

San Francisco real estate continues to operate in a land of full on self-indulged delusion and pseudo-tech worship. I travel to the Bay Area and San Francisco often and the amount of self-delusion when it comes to real estate is amazing. You will find all of these convoluted justifications as to why a crap shack should sell for $1.5 million and when some other chump takes the jump, they use this as some sort of reinforcement of their real estate buying acumen. You are the amazing market timer and they are the fool (at least that is the thought process). I’ve seen this with couples in the area where two professionals have sound financial judgment but then a kid is thrown into the mix and all hell breaks loose. “Well I don’t want my kid living in a rental!†or “I want them to have a piece of real estate when I turn over and pass on†as if your kid wants to chase the same Full House rat race. People are mistaking luck with skill but that is part of human nature. And a recent survey found that 83 percent of Bay Area renters are planning on getting out of the area to settle down.

Getting out of San Francisco

You are seeing people paying ridiculous amounts for San Francisco real estate and in some cases paying rental multiples that only a Pets.com investor would find appealing. The only justification is that property values will continue to move up in an unrelenting fashion. So I was up in the area recently and almost every other person was talking about the next tech related boom or about real estate value while pulling up random housing apps. It was as if you were walking around in a giant cult city. “Just look at this property†with a fancy chart looking like a Bugs Bunny prop. You then ask, “you live in the bath tub of a studio for $2,000 a month right?†– something just seems off.

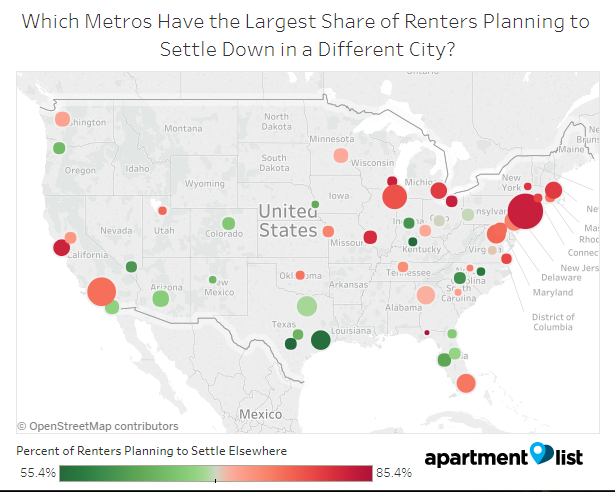

As we’ve talked about there has been a massive trend to renting since the housing market took it in the shorts a decade ago. There are many large metro areas where renters are planning on getting out before settling down:

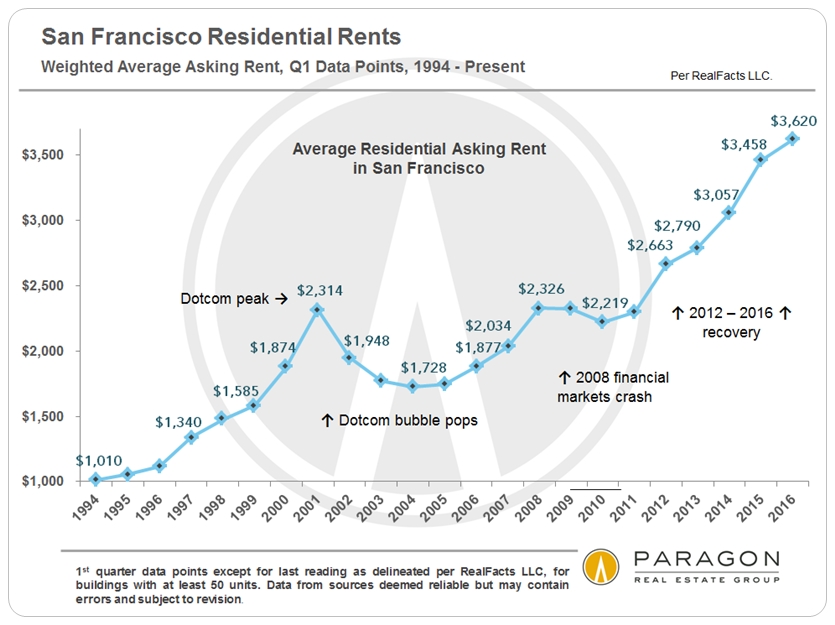

New York and Los Angeles also have a high percentage of renters saying they will get out before settling down. Of course part of the desire to get out is affordability. Crap shacks are solidly over $1 million in San Francisco and rents are astronomical as well:

If you think economic changes don’t impact real estate you are out to lunch. Just look at what happened to rents when the dotcom bubble burst. Rents fell by 25% and rents are notoriously sticky on the way down. So of course the economy will impact home values and rents as well.

Do you think there might be frothy valuations in some of the tech companies in the Bay Area?

“(NY Times) Seven of the world’s 10 most valuable companies are in the tech sector, matching the late 1999 peak. As the American stock market keeps marching to new highs — the Dow hit 22,000 this week — the gains are increasingly concentrated in the big tech stocks. The bulls say it is inevitable that Apple will become the first trillion-dollar company.â€

So this justifies four programmers to squeeze into a crappy San Francisco rental and to pay absurd levels on rent thus negating any true benefit from their large incomes (assuming they are not socking it away and buying avocado toast, Teslas, or any Apple product that is being pushed out).

The reality is, there is a large amount of delusion in the market and the fact that 83 percent of Bay Area renters plan on setting roots outside of the Bay Area should tell you something.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

220 Responses to “Getting out of San Francisco:Â 83 percent of Bay Area renters plan to leave the area before settling down.”

Come to Moscow. Daddy and Vlad have a great deal for everyone.

That’s just stupid. How does anyone believe this Russian collusion shit?

And that Morgan Freeman video is beyond embarrassing, I used to respect that man ….this whole Russian meme is making america look like a laughing stock.

There is a village idiot for any narrative the democrats come up with. You have to be brainless and live in a virtual reality to vote democrat to start with.

I’ll let you play golf with Vlad.

“That’s just stupid. How does anyone believe this Russian collusion shit?”

Democrats believe all sorts of fairly tales. For example they think if the govt ran health care it would be free. They’re just not very smart.

Democrats also believe that our puny species can affect the climate. That although the climate has changed continuously over billions of years, the climate would have suddenly stopped changing at this point in time, were it not for Man.

SOL,

Some democrat leaders are just plain evil (see carbon tax to extract more wealth from serfs); then there are also the brainwashed hoards who vote for those leaders by reflex (not too much thinking but plenty of emotions).

I think that Gore is in the first category. That is why he has a carbon footprint 1000 times mine or yours or any of his followers. When Gore will sell his waterfront house and moves to the mile high city maybe is time to read more again – not about human impact but sun impact.

Have you heard of 50 cents from China? Similarity, Russian has Web brigades

https://en.wikipedia.org/wiki/Web_brigades

Its because its true. I still wake up every day wondering how in the fuck we wound up with such a feckless,miserable piece of shit like Trump as the President. I knew there were some stupid people in this country but after the election its clear there are A WHOLE LOT of really, really dumb people and every single one of them voted for Trump. The election results were effectively the end of the United State’s era of being a global leader. We can never hold our heads up high nor ever make any kind of valid claim to anyone else or any other country because they will all know that yeah… America… the country that chose a big orange troll.

“America… the country that chose a big orange troll.”

I’ll agree on that but I can see a logical explanation to the process. I’m not saying it’s correct, but it is logical (but not new by any means).

The People(TM) is fed up with presidents who won’t do a single thing to make ordinary worker life easier, regardless of the party, so there’s really only one party in the elections, the Money Party. Ordinary people have been getting poorer and poorer since early 90s and they know it. Even I can see it: Drop from “well-to-do” to “survives” is visible and real.

So, given a bunch of clones who definitely will continue the current policy and a troll, The People chooses the troll as it’s not yet known to be the worst possible option.

“When you have to choose between a known evil and unknown, always choose the unknown”.

It may end up badly, but at least it’s not already known The Money Party puppet.

Also I’ve funny ideas of democracy: Technically, in democracy, the majority is always right, no matter what they do, regardlessa of how stupid it looks to the minority. That’s the definition of democracy, essentially.

On the other hand when majority really is the majority and how much they were fooled before elections?

I don’t have answer to those and yet, from democracy point of view, those are essential issues.

IMHO most governments, even in western countries, aren’t democratically elected.

See Commission in EU, The Top Tier of Power: Every one of them is nominated by the local Cabinet ministers (not EU Parliament), who aren’t necessarily even member of local Parliaments, i.e. not voted but Party puppets and Commission is that squared: Party people choosing other Party people to power and The People have no say about it at all.

That’s as far as you can get from democracy, while still calling it a democracy, of course.

Just a little anecdote before the free flowing hatefest begins…

Many years ago in my first year at that snobby school in the heart of the Bay Area I rented a house in Palo Alto with a couple of other dirt bag grad students – oh to be 21 again. Anyway the place was you typical 3/2 crapshack on a small lot, very similar to my house in SoCal. I think it’s pretty ridiculous that my personal crapshack is supposedly valued at $600K these days, but on a whim Zillowed my old grad school rental the other day. $2.6 MILLION. Yikes! I’d sooner move to Chernobyl.

“Sooner move to Chernobyl”…

LMAO, and it’s posts like these that make this blog so great! Oh, and another great article! I look forward to it every week…and I’m in Texas!

Dear, we are blessed. I live in Kerrville, Kinky lives here as well. Life is truly a paradise in the Hill Country.

No need to worry if you are a renter here as we have seen “peak rent” in the bay area. There are too numerous multifamily rentals that have been completed or are in the process of being completed. Many of these are offering move in specials that essential are a rent discount in disguise.

As someone from the bay area, specifically the peninsula, I’m definitely part of the “83 percent of Bay Area renters plan on setting roots outside of the Bay Area”

Prices are ridiculous.

And 83% of people swear they floss every night too, LOL.

These surveys are meaningless.

“So this justifies four programmers to squeeze into a crappy San Francisco rental and to pay absurd levels on rent thus negating any true benefit from their large incomes (assuming they are not socking it away and buying avocado toast, Teslas, or any Apple product that is being pushed out).”

I can tell the Dr has never worked in tech. It’s not the salary that matters. It’s the stock options. And yeah, people will squeeze 4 to an apartment to work for a start up with the potential of walking away with $2M if/when the company goes public or is bought.

I went through this twice, worked at 2 start ups. One of them paid off very nicely. One of them paid off, OK. But in both cases, what drew me to the place wasn’t a salary. Salary was good, but what I really cared about was the stock options. I was lucky in that both times, I worked remotely so I had the best of both worlds….SV money without the SV cost of living. But that’s a rare thing.

Point is a 25 year old who is making $100K a year and has 20K stock options at 20 cents strike price will gladly live in squalor for a year or two at the chance of an IPO of $15/share happening. And that doesn’t happen in Flyover Country.

100% correct. None of these people would be living in shipping containers, vans or bunking up with a bunch of dudes unless there was a chance at getting rich quick with stock options. That 100K salary is laughable. Nobody is forcing these people to do this, it’s all self inflicted pain.

For every stock option that becomes worth something, there are 100 others that become worth jack shit. Your mocking of “Flyover” says a lot about how dissatisfied you are with living on the coast.

“For every stock option that becomes worth something, there are 100 others that become worth jack shit. Your mocking of “Flyover†says a lot about how dissatisfied you are with living on the coast.”

LOL. Dude I live in Flyover Land myself. I’m not mocking anything. Simply stating that IPOs for tech startups don’t happen in flyover land. Sheesh.

My apologies for misinterpreting your flyover comment, although it is a bit difficult to believe someone who doesn’t live on the coast without direct experience can fully understand what is motivating people who do.

And 99% of the people I’ve meet that got that 1 in 100 payout (it’s probably more like 1-10,000) have this elevated opinion of themselves as being the smartest person in the room.

Never mind that in essence they won the fucking lottery and got ‘lucky’ but to themselves they are just that smart.

Avi, I live in flyover country and I understand perfectly the motivation of people on the coast. I used to live there – San Diego, OC, Seattle and I know those markets very well. I know other markets very well, too. I am an investor, and if I want to preserve my capital, I better know the markets I’m investing in very well. I’m sure it is the same with Mr. Landlord.

“My apologies for misinterpreting your flyover comment, although it is a bit difficult to believe someone who doesn’t live on the coast without direct experience can fully understand what is motivating people who do.”

No worries.

I’ve lived on both coasts. I know what it’s like. But several years ago I decided I’d had enough of the madness and moved to flyover country.

Given high tech startup failure rates, I would assume your experience is due to luck than anything else. And this is during a tech boom, rather than a bust. That said, with the Fed holding interest rates still near zero, the stock market and real estate are the only two areas one can invest; thus I don’t expect them to drop any time soon, no matter how ridiculous they seem.

Oh sure, luck played a role. Although with both companies I knew there was something there. It was a real company with a real product, not a dancing cat emoji.

And yes not every tech startup makes it. But that’s not what I said. What I said is people will live in squalor for the chance to hit it big. Doesn’t mean they will all make it. But the success rate is a lot higher than some here think it is. I was 2/2 myself. And I know several people who have gone through 3 or 4 startups, each of them paying off. These people aren’t gazillionaires but they have enough to live a comfortable life in the Bay Area.

Unless you’ve spent time in SV, you can’t imagine how much money there is being made. And remember you don’t have to be the next Amazon to “make it”. There are hundreds of companies bought by Amazon or Microsoft or Salesforce or Facebook or Orackle that we never hear about. Small deals for $1M or $2M. That’s change found in the couch for Oracle or Facebook. But $2M for a company with 8 employees is a lot of money for those 8 employees. And then those 8 employees use that that $2M and go start another company and the cycle starts all over again.

As other people have pointed out, your chance of making huge $$$ on your options is quite low. Even if the company is successful, often the owners will try to screw you out of your money somehow. Dollar shave club made the news when their employees made good money because of the rarity.

Also they are thinking about changing options grants to count against a company’s profits. That could reduce issuing the options in the first place.

However, I will agree that the chance of participating in one of these fortune making exits is higher in coastal California than most of the interior of the country.

Youth is optimistic and they will crowd themselves to have that small chance of the big time.

Freakonomics did a study on why people go into drug dealing. The pay is initially crap and it is extremely dangerous. The answer is that once you make it past, you have a shot at making into some seriously lucrative positions.

I can only imagine when the markets correct and IPO’s disappear for a while. It will be interesting to observe the fate of all the lottery dreamers when the doors shut on their hopes of making a quick buck. I do recall the news that came out after the dotcom boom went belly up and you could see the tears in some peoples eyes that it was all over.

Rents will likely plummet all because of the IPOs going away. If no new incentives why live in silicon valley or anywhere near the coasts?

Day of reckoning will come when we least expect it.

“..Getting out of San Francisco..”

Would think the timing on this one couldn’t be better.

A lot has been discussed on this blog and elsewhere as to when the real estate bubble final collapses under its own weight. (Not a “if” but a “when”).

Could the proposed Fed “great unwind” of bond assets finally be the coup-de-gras?

The way I understand it, as the Fed unwinds it’s asset balance sheet, interest rates *will* go up.

Will then 10YR treasuries drop in price and by extension mortgage interest rates go up?

I live in Irvine, and follow various areas very closely. I have noticed over this summer that asking prices (>>$1mm) are getting soft with daily MLS price reductions.

I get the sense in talking with people that the party this time is really over.

A very large earthquake of the financial kind in San Francisco and elsewhere is a very real possibility.

People, including my family, are moving out to a better life. But the question is: will most of the people moving out just be replaced by people moving in from other states thinking the Bay area and southern CA are the greatest places ever?! People sometimes move to CA without realizing just how high the cost of living is here and then they find out their high salary isn’t worth much when everything is so expensive here.

Yeah, probably but that’s their problem now!

With redfin and other tools it is easy for them to see how much a home costs in LA so I doubt they will come here if the cost of living is a serious concern.

The problem is that the kind of house that you would want to own in fly over country in an area that is some what desirable that you would be willing to trade California for is not that much cheaper than inland California. For some reason Real estate is nuts everywhere compared to salaries and if you think you are getting a cheap McMansion in Austin or Denver, think again; sure if you are the first or second guy that made the trade years ago then you made out, but ever idiot with a TV is also moving to these places and driving up prices. I know people in Colorado, Idaho, Oregon, and they are pissed off at the idiot Californians that cash out and overspend on houses in Portland, Denver, Boise and drive prices up for the locals. Californians are no different than the Chinese when it comes to ruining the local real estate market in other states.

When my family moved from California to rural Oregon back in 1970, my Dad who hated overpaying for anything drove a really hard bargain with the people selling the property we bought, which was a vacant 6 acre lot and a second 3/4 acre lot with a framed but not finished cabin on it. I wonder if that plus camping in the yard while we finished the place were a factor in nobody saying those kinds of things about us? We’re still very friendly with the relatives of the people that sold us our property.

Difference is in Denver or Boise you can live in the best part of town for the price you’d pay in Riverside, for the same home. And property tax is lower, sales tax is lower, income tax is lower, utility costs are lower, car registration is lower, gas is cheaper.

It’s not just a straight up how much will my house cost equation. It’s the entire cost of living. And when you look at it as a whole, it’s cheaper, any way to look at it.

I just visited Idaho Falls for the eclipse and it was really nice! I think people are crazy to choose Riverside over Idaho. I lived in Riverside for 2 years in grad school and it was so miserable. The summer heat was unbearable, the traffic was awful, and the crime had me looking over my shoulder constantly. My friends car wouldn’t start one night and dozens of homeless crawled out of the darkness and swarmed the car like the walking dead. It reminded me of MJ’s Thriller video.

I love Idaho, because the people I know there are right-leaning and absolutely hate the liberal ideology that has decimated places like California.

That being said, Boise has insane traffic. We like Boise but the traffic is always nuts there. Too much growth around Ada and Canyon Co. etc. with ugly track homes everywhere and traffic to access them.

I love Idaho, but sorry that is always my experience with Boise area. I think I would have loved Boise 25 years ago when it was a little more quaint.

@Molo

“…dozens of homeless crawled out of the darkness and swarmed the car like the walking dead. It reminded me of MJ’s Thriller video.”

Oh God, I was trying so hard not to laugh at work reading this!

The problem is that living in inland California isn’t any better than living in Arizona or Texas. In fact, it is worse. It is super hot in the summer and somewhat cold in the winter. You are very far from good restaurants and cultural amenities. And, you still have to pay California’s high income taxes.

If one moved to, say, Dallas, you probably have less “culture” than LA or SF. But more than living in Riverside.

Oceanbreeze,

That word “culture” is very, very subjective. Just 2 people can argue over it forever. Throw millions into the mix and you can get an idea how much that “culture” is worth. It is not like I go everyday to opera or museums. Once in a while, yes, but once in a while I am in different cities or different countries.

Same for restaurants. Any decent size town has plenty of restaurants and lots of different things on the menu. Again, what is a good meal is at the very least “debatable”.

The dominant “culture” in SoCal is from Mexico given the % hispanics.

Flyover,

Agreed that defining “culture” is tricky. Maybe for the sake of simplicity when discussing real estate prices we can call it things which are attractive to (most) rich people. Museums, shows, diversity of cuisine, and non physical entertainment options. Some areas in what could be classified as flyover certainly have good regional cuisine as well and probably much better outdoor recreational activities.

What about the Palm Springs or Palm Desert area of Riverside? There are good restaurants and plenty to do. Although median home price I’m sure is a bit higher.

Sorry, quit hiding your greed behind some comparison of real estate in other locations. I have places in Denver and the inland northwest. Certainly Denver is now expensive. But, don’t try to con people. First, who would want to live in Riverside and who would want to spend 90 minutes on the freeway? Second, yea you will spend at least $500k on a decent house in Denver, but will get a pretty nice house as opposed to a crap shack! And folks, just stay away from the nice parts of the northwest. We like it without all you Californians. Just because you ruined your state, doesn’t mean you have to infect everyone else!

If this San Francisco rents chart isn’t the best proof of why you should own real estate I don’t know what is. Rents fell 25% after dot com burst? Wow big deal. I’m sure the landlords that held these properties until now are really sad for buying in 2001. People with regular jobs lose 100% of their income if fired while landlords lose 25% of theirs in worst case scenario! Not to mention rents literally fell to what they were a year ago in the year 2000. And what happened in 2008? Rents fell by $100? Woah. That’s financial ruin right there… NOT!

your moniker makes sense.

You’re absolutely right- I have lived in San Francisco most of my life, I now live in Oakland. As long as you don’t buy at the top of the market (i.e. NOW), Real Estate has been and probably always will be a huge cash cow for those lucky enough to get in on it. Landlords have been killing it here since the late 90s through both good and bad economies. Unless a huge earthquake hits, it’s always going to be an owners market…

“Getting out of San Francisco: 83 percent of Bay Area renters plan to leave the area before settling down.â€

What’s stopping these people from leaving TODAY? Let me take a few guesses: get rich quick scheme tech job, culture, diversity, progressive thought, weather, CA lifestyle, family, etc. There are simply some areas in this world where it makes zero sense to live unless you are extremely wealthy…the bay area is one of them. Move on, nothing to see here!

Progressive thought? Like there are 64 genders, schools should not grade students, addicts should be given free needles, cleaning poop off sidewalks is racist and health care and education are rights and consequently should be Fuhreeee! Those progressive thoughts?

I’ll pass. Progs are fools and simpletons, children in adult sized bodies.

64 genders? It’s at least 121. H8ER!

I always love how progressives will scream about “Science Deniers” with respect to GloBull Warming and then turn around with a straight face and say yeah, sure a person with a penis can be a girl, how dare you question that? The progressive mind is fascinating to observe. Like a horrible car crash on the freeway. You know you shouldn’t slow down and look, but you just can’t help yourself.

As a true liberal.

1) 64 genders? It doesn’t bother me what you want to call yourself. Everyone should mind their own business. It is none of anyone else’s business but your own.

2) Schools should grade. That is life. They grade in the most liberal school districts in the US.

3. Addicts should be given free needles and a recovery program. Free needles so they don’t “accidentally” give the mayor, a congressman, or anyone else some horrible incurable disease when they get lonely one night.

4. Cleaning poop off the sidewalk? Everyone should be responsible for their own dog and the Mad Pooper should be cited for neglecting to clean up her poop.

5. Healthcare should be a right. It is in most civilized countries. We don’t want to become third world.

6. Free education. It is free in most countries that are competing with the US. Good companies provide free training to keep their employees productive. This just makes sense so we don’t lose and become a failed third world country. I love the US and hope it becomes successful. Education will make it successful. You can’t argue with that and the people who do argue are just selfish and are traitors who want the US to fail.

Seen this all before, Bob: 64 genders? It doesn’t bother me what you want to call yourself. Everyone should mind their own business. It is none of anyone else’s business but your own.

Unfortunately, trannies disagree with you. They want to force everyone else to know and celebrate whatever they call themselves.

I say if you were born with a penis, you’re a man. If you sever your penis you’re a self-mutilated man. If you think you’re a woman, you’re mentally ill.

Trannies call this “hate speech” and want it outlawed. They want schools to brainwash small children to accept trannies’ mental delusions. They bully politicians and everyone in public life to support their mental delusions.

Sorry, Bob, but this is not merely about “calling yourself what you want.”

Free education. It is free in most countries that are competing with the US.

France (and I assume most of Western Europe) does not have free universal education. There are only so many free college seats available, and they go only to the top scorers in the national entrance exams. You don’t score high, no free education for you.

Try that in the U.S., where low scorers tend to be blacks and Latinos, and await the lawsuits.

Israel has free universal college education, but for such a small country, Israel receives disproportionately massive financial subsidies from the U.S. and German governments, and from private Jewish and Christian evangelical donors.

Because much of Israel’s military is paid for by the U.S. and Germany, Israel can divert its spending to free universal college education.

When some foreign nation pays for the U.S. military, then the U.S. can afford free universal college education as well.

Healthcare should be a right. It is in most civilized countries. We don’t want to become third world.

Israel has free universal heathcare, but see above.

Also, free universal healthcare is more doable if you have a homogeneous, non-Third World population. Sweden had such a population, but its healthcare services are being strained by the influx of Third World migrants. Ditto Germany.

As for the U.S., unlike Israel, nobody is subsidizing our nation.

Furthermore, the constant influx of Third World immigrants makes free universal healthcare impossible. We can’t afford to care for the entire world. Were we to attempt free universal healthcare, the flood of Third World immigrants would rise. We would become more Third World, not less.

SOL, what you say is plain Common Sense which in our “progressive” America is no longer so common. Thank you though for stating the obvious for some of our brainwashed youth. Maybe some of them will come to their senses and understand that what they call “progressive” in real life should be called “regressive”.

I’m not wealthy and have a place here….great dining, public transportation, arts, GG park etc..

would leave in a SF minute but wife is a lifer….city girl thru and thru..

will leave in the next 7 years no matter, keep it as rental, head to a valley and mountains

Just curious, what year did you buy your place?

If you buy TODAY, you need to be making several hundred K with a monster down payment.

LB-2004 with big down, mos. nut is $1600 where mos. rents are $4200…

will pay it off in next 3 years and move to quieter life….

the city is for the young, fast, fun and wild…too old for that, our view will get us that rental price, I mean where else can you look at downtown, GG Park and the Ocean, I can watch ships come in from my kitchen….

but all is not well under the sun-fog…violence and crime is getting bad. Racial divide hitting hard with the Chinese now viewed by the black people as enemies also….

sad days when muggers are targeting chinese folks because they are easy….just once I would like to be there and beat them to a dead pulp….scum needs to be scrubbed hard to find a shine…

People stay due to momentum. They are familiar with the area and afraid of how things would be elsewhere. They have friends and family in the area and would have to start over with a move.

When you have a family and one person leaves, it’s hard for that person. But it is easier for the rest of the family to follow them.

So you can see that leaving CA could start out as a trickle but become a flood.

Son of a Landlord, I need a short response.

1) If you want to hate someone and call them mentally ill for what they believe, it is your choice. The only gay people I know want to be left alone with with same freedoms that you enjoy. If you agree with that, I agree with you.

2) Education is free in Germany (we compete), it is $50/year in India (We compete), It is $300/year in China(We compete). It is $15,000 per year in the US. Why do you want the US to lose this race? Are you a traitor to our great country who wants us to lose? I do agree that a policy where people who attend public universities must earn that position with a level of grades from a secondary school or community college. Students should have to work hard to want the privilege of a college education. I also believe it should not be free. That was a disaster in CA during the 80’s back when America was Great and when it was free. Costs should be limited to what someone can afford on a half-time minimum wage job.

3) Healthcare is free in most first world countries. We don’t want to see dead people laying by the side of rivers with bloated bodies for days like they do in 3rd world countries. Have some respect.

Seen this all before, Bob

What you and the liberals want is not possible with open borders. As I said before, you have to chose – open borders or freebees.

The US taxpayers (aka middle class) can not pay for all of that to millions of third worlders flowing into US every year (legal and illegal), or the middle class will disappear in poverty. They are already taxed to the max on all fronts. The 0.0001% who make the tax law feed on the same middle class. Trump, hate him or not, was just stating the obvious (I’m not saying he is doing enough).

If you don’t want the US looking like a third world country, stop importing millions and millions coming from those countries (with that level of education and bacward culture). While some RINOs are at fault with that to benefit from it, ALL the liberals and MSM promote that (in US, Germany, France and Sweeden, too). The same problems we have here now they will have in EU in few decades due to the same suicidal policies. The globalists promote that everywhere in the name of Multiculturalism. Just by coincidence they do not promote that in Israel where they have the free health care and free college education. I wonder why???!!!!….

Can you explain to us? There is something about these bankers (from central banks) always thinking that something they promote is only good for others but not for themselves; the liberal/progressive/collectivists are notorious for that. They always like to “do good” when somebody else pays for it and someone else suffers the consequences for their actions.

Amigo,

NOTHING is free in life – someone has to pay. You haven’t figured that out yet?

Those countries with free healthcare – people pay (through the nose with their taxes). Canada has nationalized healthcare, and the citizens have to wait months for medical procedures.

In Ireland, the colleges are free, but again, the citizens are taxed heavily. The foreigners pay a huge tuition rate.

Seen this all before, Bob: If you want to hate someone and call them mentally ill …

Why do you conflate the two? I said mentally ill, but never said anything about “hate.” I That’s your smear.

It’s possible to believe that someone is sick — even mentally ill — and not hate them.

I never even said anything about gays. I was discussing trannies. You do like putting words into people’s mouths, don’t you?

Are you a traitor to our great country who wants us to lose?

Traitor, because I don’t believe in socialism? More smears. And a leading question to boot.

Because you argue by smearing and putting words into people’s mouths, you’re dishonest. It’s not possible to have a discussion with a dishonest person, so I won’t answer your leading questions.

What really confuses me is the info I’m hearing out of the tech world. A friend of mine deals with a ton of tech recruiters, and the word is that software job salaries are going down the toilet. So tech companies are peaking, the stock market is at all time highs, but popular tech jobs are getting salary-squeezed? How in the world are tech workers affording to live anywhere near their jobs?

We live with roomates/partners.

Where was this? In LA tech salaries and demand are still fairly strong.

A commenter on Wolfstreet dot com (in the HP Layoff article) wrote of Santa Clara county: “The tech job market in California is far worse than we are lead to believe. When our company, which is a small company, posts a tech job, we get huge number of resumes. I remember in the past when we posted jobs, we would get at best a dozen good resumes. Now, we are getting hundreds for each job. On top of that we getting spammed daily by hundreds of Indian recruiters to provide us candidates.”

Of course that’s anecdotal… but if true, clearly too much supply of tech workers looking for employment will have the effect of suppressing wages.

Housing to Tank Hard Soon!

Hello Jim !

See ya same time next year with the same slogan

Count on it 🙂

Landlords to tank hard soon!

Frat boys and football fans to get tanked hard soon!

Cost of living/affordability become a larger problem for families … it isn’t as easy or desirable to have roommates in order to afford the rent or mortgage! Places like S.F. or L.A. are less complicated for the single professional or childless professional couple. As soon as it transitions to ‘family’, I’m sure all the questions begin … ‘is this really a good environment to raise kids’, ‘the public schools are awful’, ‘I can’t afford private schools’, ‘where’s the nearest park’. And, I’m no longer spending my time at the gym, coffee house, or having lunch with friends at that new restaurant. Instead, my life now is my kid’s which changes perspective and priorities!

Yup, that’s exactly what I’m going through right now. I just don’t want to spend $700k to raise a family in an area with homeless overdosing on my front porch (already happened) and the house-poor neighbors cramming 6 adults into 600 sq ft because they need Airbnb money to afford mortgage.

Molo, nice vivid description and very real. Sad but true.

Jim we cannot be too far now.

For every 1 that leaves the Bay Area, 5 foreign born, college educated will fill the gap.

Most all are young, starting families, and need a place to live.

Yeah. All those illegals from the mountains of Mexico and Guatemala, replacing middle class Californians have PhDs in math. LOL.

He’s obviously referring to tech talent from India, China, etc. Which is happening here in the Bay Area big time. As for the Mexicans, etc. there are more moving back to Mexico than coming into this country. It’s perfect really, as manufacturing shifts to the south, displaced workers here in the US will now have the opportunity to toil in the slaughterhouses, work the fields…and perform all the other menial jobs we take for granted.

There’s lots of money to be made in tech and automation. Any company that is growing rapidly has manual processes that simply do not keep up. Young kids hate tedious tasks and having the skills to automate is almost priceless in the job market.

Interesting, if you take the bay area asking rental chart as presented and multiply the rents by 60%, the asking history is very similar to the historic asking rental rates in the inland Empire proportionately. I agree with Polish P, and add….

This is a historic chart of asking rent not paid rent. Most rentals are on annual leases, so I assert if you look back one year to two years back from the peak asking rate, you would find the average rate paid by tenants. I venture to say that the average rate paid is a much smoother line. I have been a landlord for over 30 years, and have never given a tenant at 25% discount to extend a lease. In fact I don’t recall ever reducing an existing tenants rent because of recession. I have agreed to move tenants to lower cost units during hard times, or allowing rent to be late (with late fee) under certain circumstances. My experience during recessionary times is that the rental market stays relatively strong as people rent instead of purchase. In addition some people lose their homes and are forced to rent.

I posted on this blog several years ago, I always tell young people that are interested in real estate to try and acquire at least four rental properties as a young adult. Monthly payment should be close to current rents If you do this, !hen when you are ready to retire you will have four times your housing expense in rental income. Lock in low fixed 30 year interest-rate today and a tenant will make your payment, even if rents stay exactly where they are today, you will be ahead. Even in the unlikely event that 30 years from now property values stays exactly where they are today, you will still be ahead. You will have four free and clear homes in Southern California. 30 years goes by in the blink of an eye.

Dealing with tenants and upkeep is a pain in the ass, most people don’t want the hassle.

And most property managers do a terrible job, suck all your profits, or both so that’s not a good answer.

Being a landlord isnt for everyone, but not as bad as you think. Condo’s take away most maintenance hassle, roof, landscape, structure ect. and built-in reserves for the most expensive items. You are left with interior, paint and carpet mostly. In my 35 year experience, average turnover is 3 years, but still have tenants for over 10 years.

Condos are a special kind of pain in the ass for landlords. HOA rules and fee increases for starters.

LeBuilder,

“I always tell young people that are interested in real estate to try and acquire at least four rental properties as a young adult.”

The only issue is timing. I’d agree with this strategy when we get a nice crash and you pick up these rentals at a normal price. But in today’s market at these hyper inflated prices you would be cash flow negative when buying and renting them out.

I understand why many older people make statements like yours. Back in the days when housing was affordable it cost like 4-5 times the annual salary in California. Nowadays, it more like 10-12 times. So, its easy to make statement like yours if you bought when it was cheap. That’s why I cant wait for an economic downfall in the US (specially in California).

Downturns can be deal time as long as you don’t get laid off. Happened to me in 2009. Takes forever to get back into the workforce and you make less.

There are RE deals today; just not in CA.

Look over in flyover country. You can pick up a decent house in a solid blue collar neighborhood for 75-80k and rent it for 900-1k/mo.

Granted these properties used to be 50-55k a couple years ago; but, there are still deals available.

Yea, for deals or normal prices you need to wait for an economic collapse. We should see that within the next few years. keep saving and wait for it.

End the Fed. That is all.

Nuf said.

In medieval times it was illegal to borrow money for profit. Too much at stake in the US now. Anyone who tries will be assassinated.

I don’t understand the California mindset that you have to spend $3500 for an average rent, or 1.5 Mil for a home. Having visited San Fran, I just don’t understand it. There are many places in the USA that offer great lifestyles, plenty of employment opportunities (yes good tech jobs – with stock options – exist outside of Silicon valley), top schools and very reasonable cost of living. In an upper middle class neighborhood near me, you can own for $2600 / month with 4700 sqft of space. I can’t even imagine how much a place like this would run you in San Fran but I’m sure it would be obscene.

https://www.zillow.com/homes/for_sale/1014-Westbury-Drive,-Matthews-NC-28104_rb

Sure there are start ups in the RTP, in Austin, in NYC, Boston. All over the country. But it’s not the same thing. There’s a vibe in SV that doesn’t exist anywhere else in the world. Most of the VC money is there too. And like any other industry, who you know is as important as what you know. There’s a reason why all the big names are there and not in Silicon Beach or Silicon Prairie or whatever other stupid nickname play on Silicon Valley is out there.

It’s like being an actor. You can go to NY and try to make it big on Broadway while living in poverty. Or you can go to, I dunno, Pittsburg and make a decent living doing local theater. (I’m just using Pittsburg as an example, I have no idea what the theater scene is like there). In both cases you’re acting, but it’s not even remotely close to being on the same level.

Living in poverty for the purpose of status just I guess isn’t my style. I don’t buy the latest gadgets or the fanciest house or the nicest car.

In my 30s, yes I tried to keep up with the Joneses but by my 40s I thankfully realized it just wasn’t worth the stress. I like it simple, a nice comfortable life without feeling that my worth is measured by material things.

We make life so much more complicated than it needs to be by aspiring for status. Life doesn’t have to be so hard y’all.

In the day to day, working on the bay area is not much different than working in other parts of the US. In the end a tech job is an office job. You can often make more money there and might be able to participate in some truly lucrative opportunities. Acting on broadway is much more visible due to the high profile clients of broadway.

I live in Orange County which has a similar mindset to SF particularly if your in tech.

Short answer: It’s all about status.

Hard t believe that someone would p;ss away money just to impress someone they don’t even know, but that’s the nonsense world we live in now.

Presently CA is overpriced for the quality of life it offers. Perhaps it will change in the future.

@LT-I live in what’s called and considered the North Bay of the Bay Area in Ca. About 40 miles from San Francisco. People live in Solano County where I live and commute to the Bay for work. Here’s a house with Sq footage comparable to the gorgeous home you posted.IMO, the homes out here are big boxes with no character. New homes in this city are being built starting at over $900k, so I can’t even fathom what it would be in the real Bay. https://www.trulia.com/property/1043627266-2025-Zinfandel-Ct-Vacaville-CA-95688

My old college buddy bought his and his wife’s first property in Vacaville back in ’06 and had their first kids there. By 2009, that house was worth 50% less of it’s original value. They didn’t even like Vacaville that much, just thought it would be a starter home that they could sell in a few years and move closer to the core of the Bay where he worked. Took them 10 years to even recover the value of that purchase. Ouch…

It has to do with:

1. Laws created to strangle growth

2. Local Salaries

3. Generally irresponsible behavior

Yes we are in a bubble again, this merry-go-round will soon stop. There will be winners and losers. Then the music will start again and people will start hoping back on. Welcome to the Future.

Housing to correct soon in line with expected market correction. Jim Taylors advice to tank hard soo… oh wait, that tanked years ago.

BTW- I agree w/ ending the Fed!

Brexit’s not happening. You heard it here first.

The globalists “love” the brits too much to let them go. They keep them in a hug like a boa constrictor.

I think they love all the EU, AUS, US and Canada just as much for our own good. Trump said he will fight these globalists, but they have him in strings already – another puppet. They made a web around him like a spider till they annihilated him.

Well its interesting you say that. Im a remainer. However we lost and should respect the decision. It doesnt matter if the Tony Blairs of the UK thinks leaving will be a disaster. I actually agree with them. However the only way to learn is the hard way. We could have taken the hit to the economy and finally silenced the leavers. Rejoining the EU in ten years.

Free trade is good as long as you retrain the displaced. We don’t do that unfortunately.

Oceanbreeze,

This word “globalist” is so misused! Free markets imply free trade. Another world for “globalist”, better understood, is “cronysm”. Globalists don’t want free markets. They want a one world central bank with one currency because that means TOTAL control (political, too). That is Communism/fascism on steroids with no place to run. A big totalitarian government is hell on earth for the average guy. It is very good for the 0.0001% who promote it. I am talking from experience of decades lived under communism.

Cromwelluk, why would there be a hit to the economy? Why do they always say that about countries who don’t want to join or be part of the EU. Being part of EU means you are under the power of the European Central Bank. Just like here in the US, being under the FED’s control. It’s terrible for the middle class and the currency.

Flyover, I agree with you. I’m from a country that was part of the communism (Soviet union) too when I was a kid. We lived through a war, when they were dropping bombs in our area. I’m never going to fall for politicians saying they are only wanting the good for the people or for the government wanting to centrally plan everything. I know it doesn’t work. At the same time, I’m not going to fall for people like Trump, who doesn’t understand history or foreign policy and is just beating the war drums!

We need true free markets and liberty for people to do what is best for the economy: self interest.

Glaba,

Let’s be honest! Trump does not have any say in foreign politics, same as Obama. Whatever the globalists around him tell him that is what he is doing. What he said on the campaign trail, was back then. What he is doing today is what the CFR (the den of vipers), TC (Trilateral Commission/ globalists) and AIPAC tell him – he is on strings.

I like to be optimistic and I was hoping for a change when Trump won the same way the liberals had hope for change when Obama won. All we’ve got was the “change” and the bankers got everything. While I’m glad Hilary lost, I like to be realist in terms of what Trump can deliver – everything for AIPAC and nothing for the 99%, same as Obama. I think that Bannon was a good adviser, but even him was kicked out by the swamp.

The swamp are basically the globalists/collectivists/communists and they will make the life of 99% of the US population to resemble the life under communism. Bernie will not change anything; he will just accelerate the process. All Trump did was to delay the inevitable with less than a year. I was hoping for at least 4 if not 8 years.

@flyover,

You may be right about Trump and foreign policy via CFR bilderburger,etc…… However, I was also thinking Trump does whatever Trump wants and if these globalists really had his ear we already would’ve bombed NK and give in to Sha after the supposed chemical attack.

Neither has happened, which leads me to believe he is not solely influenced/controlled by these globalists/imperialists.

I know not a lot of campaign promises haven’t come to fruition (a lot of that is due to Congress) however, he did campaign on not getting into long wars and so far so good.

Hi Glaba,

Thanks for the comment.

Im not saying I’m right and your wrong. However for me the bigger deal is democracy. After ten years one side would be proven correct. If Im correct we could rejoin the EU or stay out if I’m wrong.

Nothing to see here, just another day another new normal apparently..I wonder when the professional real estate market will ever tell you it’s not the new normal..

https://www.yahoo.com/news/bay-area-home-sales-continue-000353439.html

Californians leaving CA for cheaper housing elsewhere are chasing a siren song.

There is a bubble everywhere. You can leave here and buy into massively overpriced Idaho, Texas, WA, OR, you name it.

I am the first to admit that California is a hellhole which was ruined by Bolsheviks, escaping is a great idea. But it isn’t a value play elsewhere that’s for sure. Timing is still everything.

NorCal fella,

I can’t talk about other states, but WA has 2 markets: Seattle area resembling a lot SF market (lots and lots of high tech jobs and high density and rainy) and Eastern WA, with very dry climate where prices go up a bit when SoCal prices doubles and decrease a little bit (5%??!!!) when the SoCal prices slash 50%. Timing definitely plays a role – if you sell at double price in SoCal and “overpay” 5% in eastern WA, you are still ahead, relatively speaking. Selling in CA at half price and saving 5% in Easter WA is not a smart move.

Also, there is a lag time from SoCal movements in price to affect Eastern WA – about 6 mos to a year to affect the markets here. These are “spill over” markets. Same for Eastern OR.

I read your posts a lot and normally agree with much of what you say. From my research and trips to Spokane looking at real estate, it is way more than 5% overvalued. I’ve seen prices double and triple there during this last market cycle.

I’m not saying I know more than you about the market there, I know you live in the area and respect your local market expertise, but I have seen exponential price growth there and it is actually not priced much different than the nor cal markets I invest in. I’d say it is almost identical in terms of current pricing and where it has catapulted from in say 09/10.

So, in my humble opinion, I think selling in CA and moving to that region is a total lateral move at best. Well perhaps worse because when the recession hits I’ve always watched E. WA and N. Idaho get decimated. Not because they are bad areas, they are great areas with solid people. It’s just that the demand drivers and microeconomics are not comparable to CA (love it or hate it.)

My two cents. As an investor myself I would not advise anyone to “cash out” of CA and buy into a massively inflated market. We can disagree on how inflated it is there, I guess that is the million dollar question.

My suggestion for anyone (and my own strategy as well) who wishes to bail on CA? Wait until CA softens then buy into a super depressed “flyover” area which will be massively discounted in comparison to the CA markets given the stronger fundamentals here. To be clear, I am not saying CA is better than WA/NID, (in my opinion CA is a sinking ship,) I’m just speaking in terms of valuations and market strength.

Anyhow, my two cents, appreciate your posts. Cheers.

I know more about SE WA than Spokane. Also, I compared Eastern WA to SoCal or SF not with areas like Redding, Oroville, Chico or Cottonwood. I agree that those areas behave more like Eastern WA than SoCal. Also, some of the NoCal areas have lots of riff raff which can make some of those places unsafe. Anyway, I probably generalize too much. You know that area better than me since I was never interested in NoCal – I never lived there.

I forgot to mention that you might be right at the low end of the market because the low interest rate made the houses cheaper than rent. Everyone needs a roof over their head.

Also, price of materials, labor cost and land prices increased making it impossible for builders to have a profit at the entry level market segment. Low supply plus high demand means higher increases in price.

However, once you go to mid range or high end market segment, what I said becomes the reality – not too much variation in price.

I live in Spokane. Prices here, and in neighboring Coeur D’Alene, ID have increased quite a bit the last 5 years. But they are still a bargain compared to Seattle. You can still get a nice 4 bedroom home, 2500-3000 st ft home in a great neighborhood, with a big yard for under $300K. For 200- 250K you get 2K sq ft in a good (not the best) neighborhood.

However even here traffic has become crappy. Coming out of downtown between 4-6pm is now a stop and go crawl. 10 years ago it was 60 MPH. That’s ho fast this area has grown.

Weather: Summers are hot and dry and beautiful. Around mid November it gets gray and you don’t see the sun again until around March. It doesn’t get very cold, temp in winter is always hovering around freezing so it’s a continual mix of rain/sleet/snow with freeze/melt cycle. But you will get the occasional cold snap where it’s 5 degrees for a weekm usually followed by a week of 45. It’s messy. But the summers make up for it.

Thanks for the reply, Spokane and CDA are cheaper than Seattle of course because they are not even comparable locations. The relationship is almost exactly the same as San Francisco to the great semi-rural Sacramento region where I live. In other words, it will always be cheaper in Spokane than Seattle for a myriad of economic demand drivers. (Like you’d I still take Spokane any day over commi Seattle.)

Spokane and Sacramento area like sister sisters. I’ve always found them to be so similar. Although you guys are more marijuana centric than us in terms of retail shops etc. which gives it a different vibe (we will look like you in 2018 when our lovely rollout happens.)

So many times I’ve been in Spokane and felt as if I am in Sacramento and vice versa. The prices are very similar too, even now in multi-family valuations are pretty much identical.

I just looked at a complex in Spokane and its deliverable at the same GRM and cap on actuals as a MF projects here in the Sacramento area.

Even though they are very similar, let me be clear, I think Spokane has a much brighter future and Sacramento is a post apacolyptic wasteland in many areas. Although I think Spokane’s homeless visibility on the streets is way higher than Sacramento. We have the wonderful diverse gangbangers but your transient population is really bad.

Also those areas east of your downtown along 90 are pretty sketchy (west central and east central I think?) Lots of methed out white guys there with backwards hats and saggy pants. Also walked a places around E. Sinto and saw some real creatures there living in some dilapidated places.

The parallels are pretty striking though, investing in Spokane and living ‘away from it all’ an hour away in rural Idaho is very very similar to investing in Sacramento and living an hour away in the rural Sierra Nevada foothills here where you an get a house on acreage for the same price as Kootenai or Bonner County. Buying in Cataldo/Priest River, St. Maries ID is the same price or more as the Sierra Nevada Foothills right now where I live. People forget how cheap it is here. Of course there is no local economy here really but there isn’t either in Kootenai Co. outside of CDA. You gotta make your money somewhere else right?

A plus to living in the Sierra Nevada foothills is that you get to drive down the hill to Sacramento and hangout with Nortenos or government workers! Or you can stay local and get a rifle pointed you by a cartel member in a tree if you walk down the wrong hiking trail in October during trimming season. Oh joy.

Spokane has been growing pretty fast with the influx of new renters and owners from California. As for the renters there are lots of apartment complexes being built around the area and the developers don’t seem to care where they build as long as it is up quick. However, I hear the city allows these new apartment complexes to avoid property taxes for ten years just to get settled in with getting their rentals filled up. Nice incentive.

Overall it is not too bad but the cities aging roads and bridges need a lot of work.

Now I hear Amazon is looking to expand. I wonder if they will pick Spokane as the new growth area? That would certainly elevate wages in the area since home prices and wages have not kept up with the West side of Washington. We’ll see. However, Spokane is an overall nice area.

NorCal,

I didn’t mean to suggest Seattle and Spokane were equal cities, just saying relative to Seattle, it’s a bargain here. So while prices have gone up somewhat, it’s actually cheaper here today relative to Seattle than it was 10 years ago.

I’ve never really been to Sacramento – driven through but that’s about it – so I can’t comment on the similarities, but it makes sense. Although with it being the capital, SAC is somewhat recession proof isn’t it?

And yeah there are definitely shady parts of Spokane. It’s weird in a way too that the best part of town (or at least one of the best parts), South Hill is surrounded by ghetto. I like South Hill, but it’s too close for comfort for me. So I live out in the ‘burbs.

And homelessness is there, downtown, but I’ve never really thought it’s out of control or anything. Maybe I’m just used to it. And again, compared to “big cities”, it’s really nothing. CDA is generally OK everywhere, as is Post Falls. There are some no so great parts, but nothing close to a ghetto.

Median income for Kootenai county is $50K. So there is industry somewhere. As a comparison, median income for LA county is $55K. And that $50K goes a long way when you can rent a nice 2 bedroom apartment for $700 or buy a decent 3 bedroom home for $200K. Shit is just cheap here. For example skiing is a bargain. I have a season’s pass at 2 resorts every year. What I pay for 2 passes is 50% of what I’d pay for 1 pass in Tahoe. Costs $40 to register a car. Sales tax is only 6%. Gas right now is about $2.50. Electricity is among the cheapest in the country in N. ID and E. WA. And so on. People focus so much on “high income” jobs in CA. People always focus on how much jobs pay, they forget about what it costs. And when you do the pay/cost calculation, it’s pretty good in these parts.

And even that is somewhat deceptive. There are a ton of retirees here who on paper don’t earn a lot of money. But they have a ton of assets and money in the bank, affording them a comfortable lifestyle. Go to any golf course at 10am on a Wednesday and it’s packed with retired dudes. They’re the best types of residents for a city. They pay property taxes, but they don’t have kids in schools and they don’t cause traffic during rush hour. And that is a large part of the economy, centered on the geezers (I say that lovingly).

“Now I hear Amazon is looking to expand. I wonder if they will pick Spokane as the new growth area? That would certainly elevate wages in the area since home prices and wages have not kept up with the West side of Washington. We’ll see. However, Spokane is an overall nice area.”

AMZN already has a presence in Spokane, in its AWS division. Not huge, but decent sized. As far as expanding, if you mean the 2nd HQ, Amazon said it is looking at cities with at least 1M people, so Spokane is about 400K short. Total population of the metro area including CDA is around 600K.

And besides it would make no sense to have a 2nd HQ so close. It will be somewhere in the midwest I think. The obvious choice is Austin.

Mr. Landlord, sometimes you make too good of a case for moving to your region, my concern is that you will convince a lot of bozos to come and ruin your nice area.

Conversely, I can make a pretty compelling case for why California is a roach motel, but when I escape someday I will probably move to an area then inhabited by the wastrels of CA who read my posts and were compelled by my rhetoric to move away before me.

See, liberal minded people create poverty and homeless and crime but after they’ve blighted an area, the limousine liberals just move on to the next hamlet to destroy, leaving the wreckage behind them.

I don’t care what people do or what your beliefs are, let your freak flag fly! But don’t foist your liberal beliefs on me or my family, that is where I draw the line. I feel that is where a lot of Americans have drawn the line. Leave us our areas to be who we want to be, don’t turn every area into San Francisco please.

That is my concern for E. WA. and NID…what has kept your areas so wonderful is directly correlated to the dearth of liberal Californians and third worlders (I have no ill will for these people it’s just that they drag areas into the 3rd world with them–without exception.)

It should be noted that I am born and largely raised CA and not simply an arbitrary CA hater, I have legitimate reasons! 🙂

“Mr. Landlord, sometimes you make too good of a case for moving to your region, my concern is that you will convince a lot of bozos to come and ruin your nice area.”

Hmmm good point.

What I meant to say is, it’s hell on earth here. Stay away!!

It’s not a siren song. How many times have we went over the mismatch of incomes vs home prices in CA…a lot of these places still have a massively more favorable ratio than CA.

This is correct.

We bought our house in Grapevine TX in 2014 and sold and moved back to California in 2016 and cleared enough for a decent down payment on a house in Solano county.

And with the high property taxes in TX, our payment would be very similar to what houses now go for out in DFW.

Calexan, very curious to hear why you left CA, went to TX and then returned after such a short period of time. Did you miss aspects of California? I’m intrigued.

We had our first baby and were living in SF in a one bedroom apartment and once he started walking, it was just time to find more room. My wife’s company let her transfer to their Dallas office and keep her SF salary and her brother lived out there, so it was a no brainer to attempt the Texas life.

It wasn’t terrible, but we like outdoors stuff and it was either too damn hot or too damn cold. Then my wife quit work after she had our second and the week after she quit, my company filed for Chapter 11 and while that was all going on, my old company in the East Bay contacted me about coming back. So everything just kind of fell into place to make the move back (everyone said when we left, “Nobody moves BACK to California”).

We are very happy with how everything worked out. We actually love living in the more agricultural area of Fairfield, still close to SF/beach/Tahoe/camping and where my wife’s parents live up in Auburn area.

Cheers

For Home of Genius, I nominate this pile of rust: https://www.redfin.com/CA/Altadena/2162-N-Grand-Oaks-Ave-91001/home/7265951

Located in Altadena. Priced at $835,000.

From the description: “represents an exceptionally rare opportunity to restore an amazing piece of bespoke architecture.”

Okay, this is a historic pile of rust.

I love the description. A pile of rust is “an exceptionally rare opportunity to restore.”

Most of us want to buy a nice house. Not an expensive pile of rust, only to spend another small fortune to restoring it.

All I see is a lot priced at $900,000 (835k plus $65k in demolition cost plus hauling the debris). Is that worth that much?

Most people have no idea, good post nor cal fella, Case in point, friends sold home in Atlanta took about a 150k hit sold their home at $480k. They retire in Arizona, buy 3,100 FT house. closed at 793k and still need to put in about 40k to call it a home. Taxes close to 7k and HOA dues at $250 a month. This is not Scottsdale or Paradise Valley but way out 55 and older development. Where is the deal?

Before you cash out check out where the heck you are buying, it could be a whole lot worse, anybody moving to DENVER listening?

793k in Arizona for a 3100sqft house? Maybe the problem is the buyer in this case. There are many wealthy neighborhoods across Arizona but they are beautiful and worth the top dollar, so if they paid this much it must be an amazing home and neighborhood.

I never understand the need for people to buy such a luxurious house for retirement. My goal is to spend as much time as possible at home when I retire. I want to travel and see the world, not take care of a 3100 sq ft house.

Oh but we need room for when the kids/grandkids visit, LOL. Yeah they 1 time a year they visit. You’re better off paying for a hotel room for 3 days at Christmas than having 3100 st feet that get used 2% of the time.

The South California real estate market shows no signs of “tanking.” Yet I have found several homes for sale in Orange Co. lately at bargain prices–even some close to the beach. Are prices silently beginning to decline? Are investors starting to unload real estate at sane prices while most sellers remain greedy? All I know is that I am now being tempted to buy! For example, I noticed one nice OC home which just had its asking price slashed from $550,000 to $475,000.

Gary, which city are you searching in? 500k does not get anything decent in South OC.

I don’t know if the price reductions are attractive because of psychologically adjusting to the price increases for 6/7 years has been stressful for a potential buyer, but it may be that you are still overpaying.

You are not getting a “nice OC home” for under 750k, let alone 475k. You are mis-reading something somewhere.

Maybe a condo; but, certainly not a single family home.

Maybe you are mistaking lake Elsinore for the pacific ocean?

Gary, you don’t know what you’re talking about. I’ve lived and owned in South OC since 1999. There is no way you can buy a SFR for $550k let along $475k. Decent priced SFR homes priced in the $700-$800k range are in escrow within a couples typically. No price drops in this area unless the home was priced incorrectly to begin with. $550k can only get you a condo in South OC.

Gary, those deals were hard to find in 2011. You can forget about it in 2017!

If I were to buy a $750K home in Los Angeles today. I would be using $750K in debt notes and if I did not have that many debt notes I would have to take out debt so that someone else could fund the debt notes for my property.

In order to graciously pay back my debt on the debt notes i need to work. If i work i need to pay taxes on any property or income i receive.

Where do my taxes go? Mainly to pay back the central bank for the debt notes the federal reserve initially borrowed.

We are told that America is the land of the free, whoever told you that is your enemy?

The $ means absolutely nothing, why do we see other countries with hyper inflation? Any day $5 could have the purchase power of $1. That $750k house is now $3.8M. Our $ is backed by nothing, it is meaningless.

Any sort of debt is slavery. But to take out debt to receive debt? Man that’s just messed up.

Wrong. Our money is backed by thousands of nuclear warheads, a military machine with an unlimited budget and a shadow govt / central bank with tentacles reaching across the globe into many other govts/central banks.

That is what backs the $

If you are planning on leaving your state and are researching other states, do not make the same mistake as me and do your research on CITY-DATA.com. Who owns that site, a resurrected Joseph Goebbles???

I thought it would be an open forum to learn about other areas and get insight from locals. Well, it is an extreme leftist site moderated by fascists that ban you or give you ‘infractions’ for even mentioning illegal immigration for example and its affects on a region.

Really? That is banned? YES. Amen for this site where you don’t have that sort of content control, it is a sad day when you cannot discuss the future of a state in your country if you mention ‘illegal immigration’ or ‘homelessness’ etc.

Banned speech has worked really great throughout the course of history, according to CITY-DATA.com.

How far will prices decline in the next real estate decline? Will it be 10%, 20% or more. It all dependents upon what the powers that be (TPTB) want to be. Everything is controlled by the Fed, the bankers and the investor class. My guess is that they will want a large decline of at least 30% or more so that investors can again buy real estate at bargain prices. There is much more money to be make in a yo-yo real estate market than in a gradually increasing or stable one.

If this is so, the investors should start selling a lot of homes soon in order to raise money to buy homes later at bargain prices. Small investors will probably joint the smart money and also start selling once they see home prices declining. Eventually, the average homeowners will joint in and sell their homes in panic at the bottom. That is how the down cycle is controlled by TPTB. It all seems like a fixed game to me.

There is more than just 2 directions: up and down. There is also ‘sideways’. That’s a direction too, and who’s to say that housing doesn’t continue in that direction for the next few years? Waiting for your brilliant comment, Mr. Landlord.

Understand that sideways in nominal terms is down. The stock market peak this year was in March in dollar terms. Think outside the box. Or drown

“investors should start selling a lot of homes soon ” – it’s already started in the Sacramento region. Rentals galore hitting the market. Investors know we’re at the peak of the bubble.

Same old roundabout as last time. Inflate the market and build PANIC among regular folk (suckers) “prices are going to continue to go up – get in now”. Then dump the overpriced rentals investors bought cheap on said suckers. Wait for suckers to realize they were suckers, then can’t afford the mortgage, buy up yet again when it all comes crashing down. Wash, rinse, repeat.

Bingo! Here is a girl who learned the rules of the game! You are on the right track. Some people reach retirement age and they never learn this game or they never get ready to play it. The time to get ready for play is when the economy is good. Once the recession comes, it is too late if you don’t have the war chest ready. There is a time for everything – for offense and for defense. Both are important.

This game is so simple, I am surprised there are not more winners – buy low and sell high. The only “logical” explanation for those losing is that emotions get in the way and people become impatient.

I’m not seeing that at all in Sacramento, I’ve heard you say that for a while on this forum right? I thought it was you that posted about seeing all of these homes in your neighborhood for sale etc like 8 months ago if I recall.

I think you’re right that certainly WILL happen but in all honesty I’m seeing a different marketplace right now. I’m seeing more frenzy than even a few months ago. To each their own I guess 🙂

In looking a Movoto trends for Sacramento I am seeing prices down and inventory rising which supports your suggestion.

50-70% will be the decrease in prices (easily). If it only crashes by about 20-30% its still overpriced and not worth buying. Renting will save you a ton of money.

Most boomer parents own homes. This will all be handed down to millennials.

There is no reason to buy overpriced crapshacks.

If your premise holds true and boomers hand the properties to Millennials, then that will continue the supply strangulation and prices will not”crash”.

Contradicting yourself

Dan, the millennials who inherit the property will likely have to sell the property, esp. if there are multiple persons involved. Also, as the baby boomers age they may to forced to sell because of health reasons or just decide to move to a more reasonably priced area to make their retirement more comfortable.

Dan,

of course prices will crash. They always do after a run up based on speculation and manipulation. As soon as you are disconnected from fundamentals prices will correct at some point.

“supply strangulation”? There is no shortage in supply at all. I see houses on the market for 100+ days and hefty price reductions.

All you need to do is go on realtor.com, enter any zip code and click on map. You will see tons of dots on the map. Does that look like no supply?

The RE cheerleaders will always come up with reasons and creativity to sucker you into buying overpriced crapshacks. That’s their business model. As the bubble progresses the reasons get dumber and dumber. Trump is a real estate guy, housing to skyrocket!

Their will be an upcoming pot boom, housing will skyrocket. No supply, no supply! Housing will skyrocket! And on and on it goes but that has little to do with reality.

Multiple inheritors will likely sell any property in coastal S. CA. My brother-in-law who was raised in rural IL just gave his parent’s 80K house to one of his sisters since she had taken care of his Mom for many years while living with her. In CA, with a 1M dollar house, there won’t be any giving away. It will be sold (tax-free with likely losses due to selling costs). The dollar amount prohibits any of the siblings from buying the others out.

Gary,

Ya, maybe some will sell and maybe some will retain the property. But, with today’s life expectancy rates and boomers just hitting retirement age; many people will not be waiting around 10-20 yrs for this maybe.

http://www.latimes.com/local/lanow/la-me-newhall-ranch-20170925-story.html

Interesting article about a “new city” potential for northern Los Angeles county.

Nice read. If you hate your money you want to put it in RE now.

http://www.zerohedge.com/news/2017-09-26/sam-zell-calls-retail-real-estate-market-falling-knife-says-not-time-buy-anything

That article warns against buying RETAIL real estate. What has that to do with RESIDENTIAL real estate?

Agreed Landlord, the retail sector has zero connectivity to residential valuations currently.

Retail always gets hammered in recessions obviously but other than that it has never been a harbinger of the residential market.

PS Landlord, you asked above if Sac is recession proof because of the government base, you’d think so but Sac gets annihilated during downturns. We are like the “Ohio” of California. Sacramento has no Fortune 500 companies, no major universities (people will say UC Davis but that is not even in Sac County and is regarded as being disconnected from Sacramento,) and when our crappy state hemorrhages the state workers always get slashed or ‘furloughed’ which happened last time. You aren’t missing anything by never coming to Sacramento. The surrounding foothills are beautiful though. Cheers mate.

Yes, retail RE. Nobody said anything about residential RE.

The point here is, you don’t want to invest in retail RE at this time. Same goes for residential RE by the way.

tbh there were these same interviews and articles with Zell a couple years ago, now look where we’re at. Doesn’t mean he’s wrong, but after awhile it’s like how many times do we have to see this sort of thing? Isn’t he referring mainly to retail RE anyway?

Former Enron consultant and current NY Slines employee, Paul Krugman predicted a recession every year from 2002 to 2008. Eventually he was right. If you predict something bad will happen in the economy you will be right eventually. But you have zero credibility if you predict the same thing every year for 6 years and then in year 7 your prediction comes true.

That’s what housing bears have been doing for 20 years. Yeah, every now and then you will be right and there will be a housing correction. But had you bought 20 years ago, you’d be much better off than not having bought.

“But had you bought 20 years ago, you’d be much better off than not having bought.”

Landlord,

Millennials like me just started their career just a few years ago. We could not have bought 20 years ago. It’s bad timing for us in regards to RE. We did not cause this bubble nor do we profit from it.

The great news is there will always be RE crashes. Just like 08, 2001 (dot com bubble), 91-97 (flat housing prices). Nowadays, the market is so manipulated that the boom and bust cycles are more dramatic. All you need is patience and a frugal life style.

Mr Landlord, you are correct as you often are. The early prophets of disaster are often wrong. Jim Taylor included. The prophets are eventually right so: