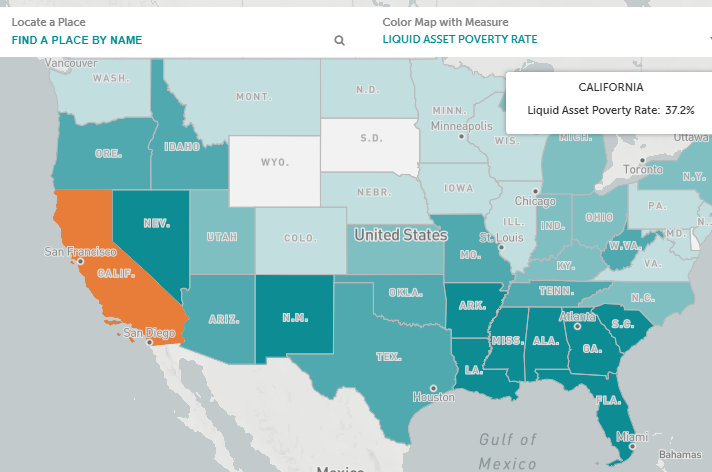

California Dreaming – More than a third of California households have virtually no savings.

A lot of people do not equate California with poverty. You certainly don’t think of poverty when you look at real estate values in places like San Francisco even though the homeless issue is right in your face.  The reality is that most people do not live lavish lifestyles. In fact, a new report highlights that more than one-third of California households have virtually no savings. These households would not have the ability to live at the poverty level for three months if one paycheck in the household was lost due to a job loss. You also have more than 2 million young adults living at home with their parents since the rent is too high. This isn’t the California that is presented in Hollywood movies.

California and the evaporation of the middle class

The reality is, the middle class is slowly disappearing in California. There was a time not long ago when a blue collar worker was able to purchase a home in many California locations. But there has been an aggressive gentrification. Now many people feel it is necessary to go into big debt simply to purchase a crap shack.

Here is the map of the study:

“(Pasadena Star News) Lars Perner, an assistant professor of clinical marketing at the USC Marshall School of Business, said California’s high housing costs have put many households on shaky financial ground.

“The cost of housing in California is exorbitant,†he said. “That’s a big part of the problem. People pay a disproportionate amount of their income toward housing.â€

In places like Los Angeles close to half of renting households send close to half of their paycheck off to rent. And for the majority that own they spend over 40 percent of their net income on housing costs. This provides very little buffer for any emergencies. And of course, people live day to day and the economy has been on a massive bull run since 2009. A small recession is going to cause major ripples. And the way California is structured supports a boom and bust economic cycle. Tax revenues are flush in good times thanks to high taxes across the board but when things contract, the money dries out very quickly.

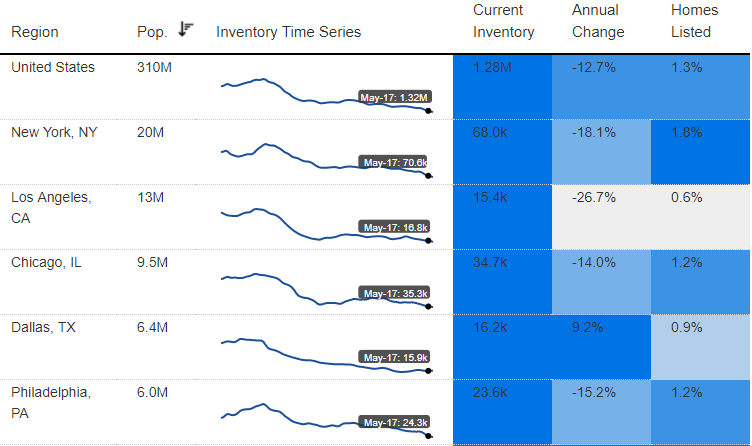

And inventory is down across the United States:

Housing inventory across the US is down 12 percent year-over-year but in Los Angeles, it is down 26 percent from an already low level. So for those crap shack hunting house lusting couples, they are simply biting the bullet and buying. Of course they are buying when everything is rosy and assume there is no correction on the horizon.

It is interesting that this shrinking of the middle class is happening virtually in all major metro areas. My view on this is that this is being accelerated by technology. People all want the same things across all areas: Amazon Prime, Netflix, Gyms, Whole Foods, Uber, etc. So what happens is that lifestyle choices are more standardized across cities because of technology so people push real estate values up in similar herd like trends.

But it is troubling to know that 37 percent of California households are living on the financial edge. And this is a figure that comes when the economy at least on paper looks good. What happens when you get your inevitable pullback in the stock market and real estate?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

232 Responses to “California Dreaming – More than a third of California households have virtually no savings.”

There are no good deals out there to be had. It’s best to wait for the end of this cycle and get something at a discount. No one knows when the economy will slow down, but it is inevitable.

Most of the country has no savings. Further, ZIRP decimated any savers left.

I was going to say the same thing. The average Joe with no savings isn’t just a CA thing. Most Americans can’t save money even if their life depended on it…it’s that bad. And if you are not a saver, the odds of owning in any decent part of socal are slim and none.

See my comments posted separately, and the link below.

https://www.gobankingrates.com/saving-money/americans-savings-state/

It occurred to me that on reading the definition they gave for zero savings, that it only includes savings accounts in banking institutions (e.g. banks, credit unions). It probably doesn’t include checking accounts and 401k plans or other retirement accounts. It would be interesting to see data on how savings accounts have declined since the Fed’s financial repression came to be. I think Cheddar is right about ZURP being partly to blame. A lot of people use tapping the 401k as their emergency money.

Joe R,

I am one of those. Apparently I don’t save, but I have million in assets producing cash flow every month. Keeping money in the bank when the FED doubles the money printing every few years in trillions does not make any financial sense. That is SURE STEALING of money via inflation – the most regressive form of taxation.

Yes, I put money in IRA to save in taxes and I can access those in case of an emergency. I never had to do it so far and soon I can access them without penalty. Even now there are loopholes to avoid both taxes and fees, but I don’t have to use it.

Apologies for using the term “money” loosely. We no longer have money, but currencies, bitcoin and dollar being some of them. The transition from money to currency was done from 1913 to 1971. Since 1971, we no longer have money. One attribute of money is a “store of value”. That can not be said about most currencies today under the control of central banks (equivalent of “Central Committee” in communist countries).

Like me, I don’t put my money in savings either. I’m not going to go through the hassles and report my savings with such a little of interest earned.

ZIRP didn’t “decimate” savers. The most important part of saving is denying yourself immediate gratification and putting money aside for the future. The interest rate is not important. This is just an excuse.

Have a helping of bullshit.

Because people’s mind set are “government should bail me out”.

“The interest rate is not important. ”

Really? Especially when the rate is zero and essentially, inflation corrected, negative.

It’s not ‘saving’ when you lose money all the time, it’s just losing money.

Pretty much. Worse than that, if you grab all these cash poor households living paycheck to paycheck spending 30%-50% of their take home on rent, how many of them still think they are justified in having 1-2 $300+ per month car payments…

A good chunk of Americans suck ass at saving.

Filter out all the people in that 37% with new iPhones and cars and then we can see who is being made house poor by high rents.

@RangerOne-Recently I was driving the 12 miles home from dropping my son off at work in the next town over. To avoid Road Rage from all the dang traffic on a 2 lane road, I decided to count the cars passing me that looked older than 5-7 years, just to see how many cars more than likely had a car payment. I believe I counted upward of 60 cars, and less than 10 fell into the range of no car payment, BUT I also factored in the cars older than 5-7 years could also have been purchased used and indeed have a car payment. It was eye opening. There was not 1 “jalopy” that passed by me in that stream of cars.

That is an interesting observation. New cars don’t require much maintenance and poor people tend to lease. My friends who are mechanics are struggling because used cars just aren’t being bought that much anymore. No one wants to afford the maintenance, can’t pay for it.

Los Angeles has been 60-70% renters for a long time.

I only see more landlords and more renters in the future.

Much like mature markets in Europe.

In order for this to work like in Europe we need Rent Control. Prices need to be controlled by Govt intervention. The market will not adjust “by invisible hand” until damage is done. Too late at that time.

Price controls ALWAYS (no exception regardless of country or what is controlled) leads to zero inventory (for grocery stores empty shelves and for RE, multigenerational cramped together in few sq. yd.). The government will NEVER use the money better than a private person.

If you want to help people have more money to spend, tax them less. In the end, everyone has to work or there will be nothing to share – general poverty.

If it is over your head study ECON 101 – basic common sense if you can understand what you read. I know this not only from school (MBA) but I saw it in reality for decades living in a communist country where the government practiced price control on everything. Look at N. Korea and Venezuela and you can understand ECON 101 in real life. Also don’t sell me the nonsense explanation that the US interferes in those markets (I heard this explanation before) because it doesn’t hold any water. In Soviet Russia, at the peak of their military power and empire building, stealing everything in sight, due to price control, the shelves where empty and none of the newly weds could find even a studio to rent or buy at any price – zero inventory.

What you see today in US is not free market. It is a TOTALLY controlled market by the government and FED – another form of globalist/collectivist “market”. The more the government controls, the worse it gets; just ask those living in Venezuela today. They had a lesson in socialism to last them a century. Some learn by reading and from other countries experience; others learn only from their own experience, and others are so dumb, that they never learn anything.

Flyover – I love you my friend. Every time I read one of your comments (without looking at the author) I can’t help but think I wrote that comment. I think I’ve also seen you over on JtR’s blog. Anyway, good stuff and I wish other’s would take to heart what you write because it’s right on the money. The government is not here to take care of us cradle to grave. Bernie Sanders would have taken us over the cliff and then we’d really feel the burn!

I kind of agree with Flyover the comment “The government will NEVER use the money better than a private person.” because I work for government. You don’t know until you see it. Everyday is workplace politics and who cares about others as long as they look like they care.

” The more the government controls, the worse it gets; just ask those living in Venezuela today”

False, see Nordic countries … cost of living is very high so the people are much poorer (=purchasing power) than the numbers actually show, but they aren’t really bad considering all things.

From US point of view all of them are socialisms. Not similar to Venezuela (and that’s a bad example anyway because of massive corruption).

Counterexample: Nigeria. But how about China?

It’s still a communist country led by Central Commitee and I see they are doing quite well lately. Huge bubble of course but that’s global: There’s much more loose money in the world than good places to put it.

IMHO we shouldn’t mix ideology to finances and to me it looks like financial success (or lack of it) is not related to government model, but the actual government.

Big government make big mistakes but (with small government) the market does the same so neither is better than the other. Governments are just slower to make (or fix) those.

The difference is that the market is just for the rich: Ordinary people have no saying at all and basically have it worse than slaves: Slaves had housing and food.

The market doesn’t provide either as there’s no profit in it. That’s the problem with small (or minimal) government.

Or bribed big government, which manages to combine all of the bad sides and losing most of the good sides.

Here in North we currently have one (I’m not from not US, if it wasn’t clear earlier, sorry)

Good article! This should cause people to pause! There is a huge discrepancy between the hype of real estate, sky-high prices, and the capability of the vast majority of people to actually afford a home in coastal California. The reality is that there is a small number of people with the means to compete for an even smaller number of properties for sale! That would seem like a very fragile market and fragile rationale to think your home is really worth anything close to what Zillow currently says!

California has always had a large number of poor working class people.

The majority of people who buy coast CA real estate aren’t even from CA. They are the wealthy elite from all over.

The working class has the inland empire, riverside, etc etc. The middle class has areas like diamond bar, garden grove, or south orange county.

Just because you want to live somewhere doesn’t mean you can.

Mexicanization.

GENTE-ficantion

It is getting a little crazy … and I am a real estate bull ( over the very long term only ). I don’t believe id short therm real estate investments. Regardless, check out this east side Costa Mesa listing … about 4 years ago, this would have been priced in the 700s. I do not think this is a good deal, as 15th street is very busy, this is getting crazy …

https://www.redfin.com/CA/Costa-Mesa/206-E-15th-St-92627/home/4591541

Crap shack bonanza!

This deal is similar. A TOWNHOUSE in Santa Monica: https://www.redfin.com/CA/Santa-Monica/1820-Montana-Ave-90403/unit-1/home/6768731

Sold in 2015 for $750,000.

Offered in 2017 for nearly $1.5 million.

A doubling of the price in only two years. (Yes, there as a remodel. But still…)

Ahhh. The fashionable bowling alley concept

The way the listing is worded, It’s all about the land, and not the house. A tear down to build 2 houses. I think it is overpriced too, but maybe not for the offshore foreigner to hide some money. I can’t see a builder paying that kind of money, but here in the bay area,

mansions are being built by individuals who buy old SFR’s and build their own custom castles.

It is more than that. If yo loo at west side Costa Mesa, which has a significant latino population, this same property would be worth about 750K. But, on the east side, where the white population is almost universal, prices are nearly double. This same story plays out over and over again all over SoCal. Twenty years ago, the difference in price between the latino side of Costa Mesa and the white side of Costa Mesa was not that different. Now, it is incredible … almost like the world has gone backwards in diversity … a large portion of whites are willing to pay through the nose for no diversity.

$7,308 per month

30 Year Fixed, 3.740% Interest

$300K down payment…..which is pocket change for most here from what I’ve read.

I didn’t see what the income to qualify was but assuming 33% for a mortgage payment means one would need $250K a year to qualify for that loan…..for costa fucking mesa.

I realize i’m the only one here that isn’t even close to that income…..but imagine writing that fucking check every month

Lol nice read. If you want honesty, I’ll give it to you. We used to be over that income, a Lawyer 180k plus a Finance career another 95k but we are no where near that now. Had kids, Lawyer went PT and Finance is about 105k now. Guess where most of the money goes though? Taxes… Sure the checks were about $7,600 biweekly but taxes took about 2300 off the top. At the end of the day, we live under our means so yes we get to save a decent amount and can buy most things we want but that’s also because our mortgage is under 2500 and car payments under 350, daycare another 1500. So even when people make good incomes they need to learn how to save and keep debt low.

Who can afford $7300/month? I just don’t get it. I have a great job and the monthly payment is more than my take home salary.

Housing To Tank Hard Soon!

The most reliable one note singer in the industry…lol

based on that costa mesa home I would need housing to more than tank, it would take a drop of 80% before I could EVER hope of owning a home.

Been saying that since 2014. Ain’t gonna tank anyone soon.

I guess that’s your theory

Jim Taylor,

Housing is going to tank the day you think housing prices can only go up.

When the biggest bear turns bullish that’s when it starts.

House prices will increase 50% per year indefinitely. Everyone buy now or be priced out forever.

I am the biggest housing bear.

And conversely when everyone thinks prices can’t go anywhere but down, you buy like you’ve never bought before. Not just in real estate, but any market.

For the record the 9:01 PM response was not the real me. But I will answer the question. i actually have had some thoughts that what if I am wrong and housing will just go up forever. So as you said I think these strange thoughts mean we are especially close to the top now. Housing to tank hard soon!

Housing to tank hard soon! Sell now and become a millionaire or buy now and become a schlup(or buy and hold for 10 years for your reward.)

I agree with lower case jim taylor. Housing is teetering and people like Upper Case Jim Taylor are trying to lie to cover it up.

you are saying based on……? low supply of homes, good economy, high rents which makes you think if you should pay 3k rent or pay 3k mortgage. At the end it comes down to how much monthly mortgage you can afford. Last crisis occurred due to bad loan practices. Now loans are harder to get and are fixed rate so unless someone goes through some really rough time no one is going under. I bought a house in 2015 and that mortgage is already much cheaper than what I would pay for rent. You think I am gonna sell cheap if market crashes? No…. which means when or if the crash happens you will not see a sea of homes listed for sale. The lack of supply will drive the prices right back up. There is no bubble, there is a shortage of single family homes because we are running out of space. Notice builders are focused on apartment buildings. If you think you are going to see price drop similar to 2008 you are dreaming. That was once in a life time opportunity to those who had money. If it drops it will be a modest 10-15% drop but your interest rate will go up and you will not qualify because your income will not be enough for the payments.

With the dollar losing value and assets such as stocks and real estate at record levels, what options does somebody with a savings account have to store their money in? Real estate still makes sense because at these interest rates, you could still buy and rent out at or above the monthly mortgage and not worry about losing your home. I’ve championed real estate for the last few years and to some extent I still do because given these interest rates and the few options that people with liquid capital have. It’s one of the best options available today for investors that don’t want to watch their dollars decay in the bank. Real estate takes a dive? You still have a renter to get you through even if the asset value is temporarily in the negative. I’m just not getting it because to me, it seems that the US is going the way of the rest of the world where real estate is sky high and doesn’t budge. Sydney? Tokyo? Hong Kong? Cities like those among a few more make US real estate look like a bargain even if it’s relatively more expensive than where it was a few years back. I’m not saying “it’s different this time” I’m saying the world is different as we’re getting more and more globalized and attractive to foreign investors and that’s not something to ignore.

New Age,

maybe change your name to New Real Estate Agent?

I totally agree with you. Right now is the best time to buy….because interest rates are low! My advice to you: Don’t waste your time here convincing the bears to buy. Don’t let them stop you. Go out and buy now!

You always have a renter available. But at what price? Are mortgages a steal right now? Of course they are. Will your real estate investment pan out in 10 to 15 years? Highly likely. But the big question is, if you dive into the market today, will you be in the red in 3-5 years? I definitely think so. Your capital will be tied up until the Fed inflates its way out of the next bubble, which won’t be tomorrow. It’s a global market and a global bubble.

As long as your renter(s) can cover PITI+maintenance, who cares what happens short term? I invest long term and really don’t worry about short term. Last house I bought was this spring. And I did that knowing there’s a chance that the price could fall in the next couple of years. But I am very cash flow positive on the property and that’s what matters. That should be the only thing that ever matters when investing in real estate.

Let’s say the price goes up 10% next year. Will I sell? No. Just like if it goes down 10%, I won’t sell. My horizon is 5+ years, so what happens between years 0-5 – whether on the upside or downside – doesn’t really matter.

“Are mortgages a steal right now?”

You must be high….mortgages are overpriced by 50-70%. Have you not heard of buy low sell high? The other way around does not work so well….unless you hate your money.

You’re absolutely right. I’ve been saying that here on the Doctor’s site for 5 years at least.

Buy or don’t buy. The market doesn’t care that you think it’s high. Try finding this bargain in London, never mind St John’s Wood, Paris or Hong Kong. You won’t get far.

try Tokyo after it experience 20 years of deflation…

same thing… joe 6 pack ain’t affording tokyo

New Age, you are right up to a point. For those who have debt, pay it off. For those with money in the bank, I agree, that it loses value every year. There are still some deals outside the big cities where you can get 12% return per year, net, after all expenses. I would go for those. However, I would never borrow for these price levels, or I would borrow small amounts and try to pay them back really fast. If you don’t have the title, you don’t have too much. Something can happen with the economy worldwide and you lose everything. Keeping money in the banks is also a losing proposition due to inflation – the most regressive form of taxation.

In the money game is not enough to have a good offense. The defense is equally important and many people miss this and they lose everything and work all their lives for nothing. At the current price levels, I strengthen my defense as much I can.

thank you for sound advice again.

So pay off all debt, but how should I invest my money for retirement. It seems everyone has “the best way” to do it.

Government employees in Santa Monica do very well: http://www.surfsantamonica.com/ssm_site/the_lookout/news/News-2016/November-2016/11_16_2016_Santa_Monica_Municipal_Budget_Among_Highest_Per_Capita_in_California.html

Police Chief Jacqueline Seabrook’s total compensation of $478,120 for 2015 was the highest among police chiefs in California. …

Santa Monica also was home to California’s highest paid assistant City Attorney. In 2015, Joseph Lawrence earned a total compensation of $442,414. …

The City’s “farmer’s market supervisor†received $140,000 in total compensation, …

the assistant city librarian received a pay and benefits package totaling $220,000 …

City bus drivers averaged $109,000 in total compensation.

City Manager Rick Cole, hired in 2015, was not yet in the group’s database but Fellner said he is expected to be among the top-paid city managers in California in three years. He was hired at $329,424 a year, plus health benefits and 21 days of immediate vacation.

And the city will be broke in 10 years and expect the State or Feds to bail them out.

I agree with the first part but I don’t believe that the fed will bail them out – not in the current form. If Obama or Hilary would be in power, yes, I would expect so; they are very generous when they use other people money taken by force in order to bail out friends.

Gee, now those extremely high downtown hourly parking meters and parking violation fines makes sense to me – paying all those salaries.

Yup. The Santa Monica City Council thinks that they can afford big spending, because Santa Monica is a popular tourists destination. Lots of rich foreign tourists, and poorer Angelinos, come here to shop and spend.

That’s why Santa Monicans voted to raise the sales tax another half a percent recently. A woman wrote a letter to the editor, saying she was glad of the sales tax increase because it meant that all those outsiders clogging the roads would “finally” be paying their “fair share.”

Of course, Santa Monica also has exorbitant hotel taxes. The city squeezes hard on visitors.

The city believes that it can continue big spending, because Angelinos will always want to come to the beach. Foreigners will always want to visit.

Yes, many Californians cannot afford coastal home prices. But the usual response is that coastal California is an international market.

So the question is not how many Californians can afford coastal California. It’s how many Chinese, Russians, Israelis, Brits, Germans, French, Italians, Japanese, Arabs, Indians, Canadians, etc. can afford coastal California.

Inequality follows population density. Land is the ultimate wealth, and as the population increases, competition insures that a minority will end up owning the land.

LMAO, why would anyone buy in CA at this time, crazy over inflated prices that will creator 2018 or latest 2019. We have seen this before, its not like its anythig new. Well, a sukker is born every minute, and that whats buying into this market.

Teeter, I am with you.

The reasons why people buy during the biggest asset bubble in history from my perspective:

People are not very smart

People are very impatient (I call it drive-thru mentality)

People believe the lies of those who profit from RE bubbles

People don’t invest the time to research

People follow the herd (Buy high, lose it later)

the real list looks more like this:

rental parity

Tankinsight,

Not sure if you fully understand what rental parity means. But, if you think you do, why don’t you provide an example? My bet is you won’t….

I agree there are a lot of sheep in the world, but most aren’t in danger of losing a home unless they walk away. The people who will get in trouble after buying at the current peak will do so after job loss, not because they couldn’t afford the house to begin with, as was the case with the last bubble.

On the face of it, it’s obvious what rental parity means, and you should take the tax benefits and maintenance into account when calculating it, but maybe what you’re getting at is that it can take an enormous down payment to reach that parity? However, in most of the country it doesn’t take more than 20% down, even today. And even if it does take a huge down, once you’ve reached parity, you don’t have to worry about losing the house, which is the most important consideration for people buying a primary at the peak – it isn’t about ROI. Is it a good investment? Not as good as it could be, but it’s still better than never buying at all. Many first-time buyers don’t have an inheritance or a lot of working years left before retirement.

If I was in my 50’s and didn’t own property, I wouldn’t wait even one more day to buy an Orlando rental.

John D and tank in sight,

see you prove my point. You CANT provide an example of rental parity in california….you are just talk and no evidence.

Millennial,

There are tons of home that rent for $3200 per month and sell for $700K.

Similarly there are tons of home that rent for $4000 per month and sell for $900K.

That is absolutely rental parity.

Sure it’s due to low interest rates, but those are the facts.

That’s why homes sell. 20% down payments and low interest rates product rental parity.

Millennial, I think maybe you’re the one who doesn’t know what rental parity means. There are at the very least hundreds of thousands of properties, very likely millions, in California which meet the criteria. My previous property in Temecula is a good example. A great area with excellent schools, sold for $410,000 in November 2016 (prices have increased very little there since then), and with 20% down the PITI is $1,934. It is currently rented at $2,300. Even including long-term maintenance, and NOT INCLUDING THE TAX BENEFITS, it has positive cash flow.

$420-450k is a typical price for a 2,000ish square feet 4-bedroom there now, and rents for that size place are $2,200-2,300. Look at properties in any city that isn’t within 10-15 miles of the coast or a tech hub, look at Craigslist rentals in that same area, then do the math. I’m not going to do it for you – it’s like you’re asking me to prove that clouds exist. Look around you.

tank in sight and John,

you guys are confirming there is no rental parity!

I am going to help you out:

“Rental Parity is a mathematical relationship between rental rates and property values where rent is equal to the monthly cost of ownership.”

In your own example rent is not equal to the monthly cost of ownership! No renter has to put down 20% of the house price + plus closing costs. If you put that much money down you would want to have your PITI much less then the rental rate. The renter who has the cash available is able to invest it and generate income. You are putting all that money into an inflated asset just to come close to what the renter is paying and you call this rental parity…

By your funny definition you will always have rental parity…..if the house prices continue to rise you just increase the down payment. In a few years you are going to tell me, of course there is rental parity, if you put 30% down!

Thank you again for your replies and the entertainment!

Rental parity means your PITI is equal to what the property would rent for, period. By definition it does not show the whole picture. You can redefine it if you like, but the whole point in the term “rental parity” is comparing payment to rent rates – to determine if it will cash flow and/or be a safe investment in that there is no risk of losing it due to job loss. It has nothing to do with down payments or ROI.

But since you mention it, yes, there are plenty of California properties that meet YOUR definition of rental parity, which is apparently zero down. Here’s one I picked from at least a dozen I found in less than a minute in one area (I know, 30 seconds of math and a 10-second web search are too much for you to bother with):

https://www.zillow.com/homedetails/29360-Coral-Island-Ct-Menifee-CA-92585/2093168300_zpid/

Assuming you could get a loan with zero down, this would rent for the amount you pay for PITI, HOA, and long-term maintenance. Again, not including the tax benefits, which would be huge. Enough, in fact, to invest more than the renter could.

You were saying?

John, we are not done yet 🙂

“Rental parity means your PITI is equal to what the property would rent for, period.”

No, it means COST of ownership equals rent. You are not including annual maintenance , HOA and PMI in your PITI. That’s the reason RE cheerleaders who claim that there is rental parity bring up “20% down and no HOA”. Otherwise they never get even close to the rental rate.

“You can redefine it if you like, but the whole point in the term “rental parity†is comparing payment to rent rates – to determine if it will cash flow and/or be a safe investment in that there is no risk of losing it due to job loss.”

Yes, i agree with that statement.

“But since you mention it, yes, there are plenty of California properties that meet YOUR definition of rental parity, which is apparently zero down. Here’s one I picked from at least a dozen I found in less than a minute in one area (I know, 30 seconds of math and a 10-second web search are too much for you to bother with):

https://www.zillow.com/homedetails/29360-Coral-Island-Ct-Menifee-CA-92585/2093168300_zpid/

Assuming you could get a loan with zero down, this would rent for the amount you pay for PITI, HOA, and long-term maintenance. Again, not including the tax benefits, which would be huge. Enough, in fact, to invest more than the renter could.”

Why not include the tax benefits? You absolutely need to include that.

Okay, help me understand how you see rental parity in your example.

Here is what i got:

30 year conventional loan at 4%. no downpayment, HOA of 80 per month, property tax of 1,25%, Annual maintenance 1,5% of purchase price ($5,248.5), Annual insurance = homeowner insurance (1225) + PMI (1% of purchase price) = 4,724 annually. assumed marginal income tax rate is 25%. Cost of renting a similar home 3b/3b, 2100 SQF = 1,800 in Mennifee?

Monthly cost of ownership:

Interest on debt – 1,166

Mortgage payment – 1,663

Paid principal (equity) – 496

Insurance payments (homeowner and PMI) – 394

HOA’s – 80

Maintenance – 437

Property tax – 364

Income tax savings – (383)

Total cash outflow= 2,555

Rent – 1,800

Monthly savings for renter = 755.36

Lets see what happens after ten years renting versus owning.

The owner built equity of 73,066

Now he sells it after ten years – transaction costs of 20,994

Net cash after ten years (assuming no capital gains) – 52,072

Savings after ten years of renting – 94,023

Present value benefit of owning vs. renting for 10 years >>>>>> (41,951)

Let me know which parameters you disagree with. I would like to have it as realistic as possible.

The vast majority of rental parity equations use a down payment of 20%. That has and always will be the gold standard. Anything less and you are paying PMI. What the renter does with that hypothetical 20% down is a giant assumption on everybody’s part, you may buy the next Amazon or you could buy the next pets.com.

Tax savings and paying off principle need to be included for this equation to be valid. Maintenance and upkeep of $200 per month should also be included. I don’t include HOA since I would recommend NOT to buy a property with an HOA…waste of money in my opinion.

As I have said umpteen times, show me just one property that was bought at rental parity and later lost. That’s all you need to know.

Lordi,

“The vast majority of rental parity equations use a down payment of 20%. That has and always will be the gold standard.”

What a bunch of horsesh***. Reference one source that says that. Gold standard? laughable! Nobody has every claimed that. You are just making stuff up. The only people who claim that are RE cheerleaders who want OTHERS to buy now. These hypocrites (like you) are not in the market to buy now but want others to pick up the slack.

“As I have said umpteen times, show me just one property that was bought at rental parity and later lost. That’s all you need to know.”

Nobody has said that buying at rental parity is not a good thing. But you RE cheerleaders want to make us believe that putting down 20% + closing costs means rental parity which total bogus. This is the def. of rental parity: “Rental Parity is a mathematical relationship between rental rates and property values where rent is equal to the monthly cost of ownership”

A renter does not put 20% down. It’s pathetic to put that much money down just to get to the rental price. If you do that or think that, you admit that the cost of ownership is way to high.

Millennial, your bias is causing you to fictionalize some of the figures – including homeowner’s insurance, property tax, rent (that property would rent for $2,200 – check the comps), and you’re way off on the maintenance. It doesn’t involve subtracting a random percentage from the payment, rent, or purchase price, which is a laughably inaccurate way to do it. Why would a $2m coastal property have four times the maintenance costs of a $500k inland property? Overestimating is fine, but it’s also important to know the details. It’s based on square footage, lot size, climate, contractor rates in the area, inflation, condition of existing maintenance items, and the quality/price/longevity of the big-ticket items you purchase. Maintenance costs are unique for every property and owner, but typically come to around $1,500-2,000/year (today’s dollars) for a 2,000sf house in a mild climate. I lol’d at $5,248.

I get it, you don’t want to buy. So don’t.

John,

thanks for your response! That is finally helpful/constructive.

“Millennial, your bias is causing you to fictionalize some of the figures – including homeowner’s insurance, property tax, rent (that property would rent for $2,200 – check the comps), and you’re way off on the maintenance.”

I am okay with the maintenance you suggest (2k). When you research online the rule of thumb of maintenance i see often the 1% rule. From my own experience I know my dad deferred a lot of big ticket items at our house. At some point the outside was remolded, the roof re-renewed, new front door, solar etc. We are talking 200k in total. Most crapshacks I see are way outdated. But okay, I go with your 2k per year. 2k is spent in a heartbeat if something breaks.

But whats wrong with the insurance and property tax? Regarding the insurance, you need to include PMI when buying with less than 20% down.

Regarding rent. In Menifee, there are many 3 bedroom 1,7k and 2,2k. So, 2k seems like a fair price.

People seem to forget that there’s no inherent right to be able to purchase a house. Prices are high but I wouldn’t bet on another 2009 style crash anytime soon. The underlying fundamentals in play then are not here now.

If you have a stable income and are mildly flexible I would look for the neighborhood and house size and type you can afford and plan for the long haul.

With online real estate you are competing with buyers everywhere. We see high prices but many see values they can’t resist. If you’re looking for an arbitrage opportunity you might be waiting a while.

The next crash is going to make 2009 look like a kids birthday party. Sure, you need a little bit of patience which most people don’t have. Let the impatient ones buy now. These buy-high people are needed and part of the cycle.

Realtor mantra.

“I wouldn’t bet on another 2009 style crash anytime soon”

I would, it’s what California RE does and always has. This is the 4th bubble I’ve witnessed in California RE since the early 80’s. BUT the one thing that is DIFFERENT this time is we never got to a true clearing price due to massive market manipulation……properties held off the market and allowing dead beats to live mortgage free for up to 48 months.

Those deadbeats are long gone. They enjoyed their few years mortgage free and have long since replaced with qualified buyers. We have likely seen the most qualified buyers EVER during the past 5 or 7 years. Has this will lead to price declines between 50 and 70% is a mystery? If that ever happens, I will be buying multiple properties with the war chest that is overflowing.

Again, how do qualifications have much weight in mitigating because of sky high prices? As stated over and over and over again, the last downturn was largely comprised of prime buyers. Recent developments in NYC’s billionaire row showed that strategic defaults are alive and well.

POH, I think you have made your point with the last downturn being mostly prime buyers. The VAST majority of these “prime” buyers had little to no skin in the game. The same is NOT true today. It’s been proven time and again (on this site) that today’s buyers are comprised of cash and large downs. This can’t be refuted!

@LOB

As noted several times, today’s big cash buyers (i.e. hedge funds) are using hard loans. How much collateral is backing those loans? There have been instances of Chinese “all cash” buyers defaulting on those loans. By the way, I know personally of a prime buyer who bought his property with a 5% down FHA loan in the current cycle. What about the property on billionaire’s row in NYC going into foreclosure after its billionaire buyer defaulted?

The world’s awash in debt, but you’re one of the few who believes that little of it has found its way into real estate.

Lordi,

“The same is NOT true today. It’s been proven time and again (on this site) that today’s buyers are comprised of cash and large downs. This can’t be refuted!”

I have been on this site for a while and think you are just making this up.

People are in more debt than ever. At the same time crapshacks have never been that overpriced. Wages have not increased in a decade.

If anything, that proves this bubble is much bigger than last time. To me this is the mother of all bubbles. When it pops prices will easily crash by 50-70%.

To follow up Millenial’s post,

Prices grew much faster in the current cycle than they did in the previous one. Very doubtful that this could have happen if much of these transactions were trully all cash.

https://mhanson.com/9-4-hanson-house-bubble-1-0-vs-now-never-different-time/

Bottom line: This great working paper on what really blew Housing Bubble 1.0 debunks the popular narrative blaming ‘a bunch of low-quality subprime borrowers and loans, and ACORN’. This conclusion is especially troubling to overly-long end-users, speculators, and institutions leaning on the “weak subprime loans blew Bubble 1.0, they are gone, so it’s different this time†rationalization, as a foundation for their investment.

Yep. Sky high prices growing exponentially higher than what traditional incomes can support lead to bubbles and their inevitable popping. The ideal circumstances for such event are alive and well today as they were a decade ago.

I made most of my money in RE. Long term, I am the biggest RE bull due to the regressive taxation we call inflation. However, I made my money by always going against the heard. It is simple like that – buy when everyone wants to sell, and sell when everyone want to buy. I did not make my money in SoCal. If I would have stayed there, I would still be poor and a slave to the bank; slaves never get rich.

My strategy ALWAYS work and I mean ALWAYS and EVERYWHERE for EVERYONE. It can be stocks or RE. I made my wealth in RE, but ask Buffet who made his wealth in stock – he employed the same strategy. To use his words – “buy when it is blood in the streets”. Emotional people call them vultures. Logical people call them level headed who have a common sense approach to investing.

The foreigners don’t eliminate the market forces; they just make the increase and decrease bigger – the sinusoid curve has bigger fluctuations. That is all there is to it. Those are markets where you invest for appreciation/speculation. They are not good for ROI/cash flow.

I agree. Being in southern California, I know that if we don’t leave here, we’ll end up poor as slaves. Taxes will keep going higher and higher and the middle class is disappearing, as the doctor says. Why would we stay here and slave away.

I don’t believe investing in stocks is any good, so we want to invest in RE. Investing in stocks is like gambling when the house knows your cards and has control over so much more than you do. I never understood why people put their hard-earned money in 401k. Do people really think the vultures on Wall St. are gonna make sure you are taken care of during your retirement?

I predict that a Northridge-style earthquake might be the “black swan” that pops the SoCal real estate bubble…

And watch the social unrest that will accompany such an event as the demographics and social support expectations are way different now than they were 23 years ago…

@ Jose – have earthquakes in LA or catastrophic gas leaks in Porter Ranch made much of a difference in home prices? Not in the long run.

I think most people in this country have little or no savings. I have relatives living in other parts of the country that own moderately priced homes in relation to their income and can’t save a dime. It’s definitely harder here but not impossible. Most people don’t want to do what it takes.

I keep a large liquid emergency fund that I watch eroding every year due to inflation. However, I couldn’t sleep at night without it. It’s amazing though how many new cars are sold (leased) each year. Excuse me while I go wash my $2K beater.

It always amazes me when I visit any place outside of Southern California, or the SF Bay Area too. Most people elsewhere just don’t drive new cars and don’t care. I was enjoying my old yet extremely clean beater until I got T-boned by a distracted driver, and I decided to rent (lease) a Honda this time around. It’s just a hair over $200 a month including tax, and I’m very happy because I don’t have to worry about repairs or maintenance as it’s all covered, however when thinking of what I’m paying over the duration of the lease I realized I could get a nice reliable beater for much less. When the lease is up, I’m most likely going the $2500 beater route, maybe an old BMW with a manual transmission.

Earlier in the summer I have been tracking a few news sites and blogs reporting about automobile loans and how outstanding balances are at record highs, however delinquencies are also on the rise, signaling a possible car bubble. I even read somewhere that the average new car price is around $35K which blows my mind. All fueled by debt of course. There are some links to those articles here – https://www.daydreameconomics.com/2017/07/11/average-fico-score-hits-record/

When every other commercial on the radio is “Come get a brand new car, even if you went through a repo yesterday!” then you know there is a car bubble.

I wonder if there will be another “Cash for Clunkers” program this time around.

There is a car bubble happening right now. I want to take advantage of all the repo cars by getting some capitol together and reselling these cars. I think you could make some decent returns especially with how bad these loans are and how quickly they are losing their value.

Houses still selling fast and at double what they sold for in 2011, in my neck of the woods – Sacramento suburbs. The fools buying them can’t afford to fix anything and they are turning to slums within a few months. A workmate just bought a tiny brand new house, 1 hour north east of Sacramento for half a million. He said he thinks prices will continue to rise and if he doesn’t buy now, he’ll be priced out. He’s an average income earner. These people are nuts.

Considering the weather patterns in the San Joaquin Valley it will be rather expensive to keep running your air conditioning. Also what if the power were to go out on a hot day? How would that look to someone thinking of avoiding high prices. On the central coast I hear from hotels that they get a lot of people from Sacramento and other inland cities getting out of the heat. This does not bode well in the long run. More uses consuming energy at peak times with longer than normal periods of high temperatures could mean serious infrastructure problems down the road.

I live in sac too. I think there are still good bargains to be had by people from the bay area who sell their overpriced homes and buy less overpriced homes here. Once the prices start to even out here then the market will stall until inventory increases and salaries catches up. The next housing bust wont be seen until after it starts just like all the other ones except this one will start with a slumping economy. Once job losses start and companies tighten up people wont be able to afford normal fixed loans due to their higher costs and less income. As people panic to unload these homes it will force a drop in prices. It wont be as dramatic as 2008 but it will be similar to 2000.

They are also buying “less” overpriced homes in Denver and elsewhere. When you sell your CA home for millions, the rest of the US looks extremely cheap. That is causing angst in Denver but this angst historically oscillates between Californians now and Texans during oil booms. As a word of warning, we sold our CA home in 1994 and could have purchased it back in 2010 for the same price. Boom/Bust/Boom/(when is the next Bust?)

I wonder if the millions who were hit hardest by Harvey and Irma wouldn’t give anything to be here in earthquake territory. I have to believe somehow the prices of land and homes will be even higher, bringing in refugees, rich and poor, to sunny California. How many million/billionaires in Miami will simply call it quits, and move here? So the question is, will these natural disasters have any affect at all on home prices here?

Where are the converted Texans who were asking us to come join them?

Billionaires with homes in Miami likely already have second homes in Los Angeles — and additional homes in New York and London, and maybe in Tokyo, Sydney, Vancouver and San Francisco too.

okay so there is tons and tons of supply if these people just sell half their holdings…..and I bet they are boomers…….maybe the boomers can live forever.

This is just panic thinking. Since prices have moved up so much, we know they should come down, but find it hard to believe the momentum can switch. Any rational we can use to say they won’t we hold onto for FOMO. Agreed lower supply around the nation, the people have to go somewhere. But I think there are plenty of places much closer to Florida, with more affordable prices than coming all the way to expensive as heck Cali. But I share your frustrations. I believed prices would tank years ago. I still know it in my heart that they will, its just taking longer to play out than anticipated.

Sooooo, what’s your best timetables?

Here’s a pretty good description of how this plays out

https://qz.com/1064061/house-flippers-triggered-the-us-housing-market-crash-not-poor-subprime-borrowers-a-new-study-shows/

Incorrect. I lived in Florida and went through Hurricane Andrew and others.ANY HOUSE built correctly had no problem I lived in such an apt complex and worked in a resort built to withstand such Cat 5 hurricanes. You had some fallen branches and maybe, MAYBE, a shingle or two, but only in those horrible homes not upgraded did you find any damage.

Millionaires in Miami and other places aren’t living in those kind of homes. They won’t be leaving any time soon.

“My view on this is that this is being accelerated by technology. People all want the same things across all areas: Amazon Prime, Netflix, Gyms, Whole Foods, Uber, etc. So what happens is that lifestyle choices are more standardized across cities because of technology so people push real estate values up in similar herd like trends.”

Interesting. In the 90’s everyone wanted a Barnes and Nobles, a GAP, a Z Gallery, and an Italian restaurant.

Either way… if this is popping up in more communities, and the middle class are disappearing, why are the well-to-do packed so thickly? If there are more cities providing the desires of wealthy …. why doesn’t the fact of wealthy people spreading out leave room for others?

Are there more wealthy than before? So many more wealthy people that the cities are clogged with them? Help me understand. I know there are the Chinese nationals, and there are more techie millionaires, and a bunch of kids who grew up in Scottsdale and Mission Viejo….. plus the people who bought a long time ago and their kids.

So everywhere, in every city, we are drowning in wealth? In Los Angeles, the sprawling metropolis that until a couple years ago everyone loved to hate, how have so many rich people in so many cities, in so many countries, suddenly EMERGED?

Genuinely Curious

Wealth disparity and the destruction of the middle class. You also have insane concentration of industries. Silicon Valley is doing pretty well but other major American industries are dead. And even within tech, it is really just a few huge players that eat up all the rest.

So we looked at the stats of our desired neighborhood with our realtor. I believe average (or was it median?) price for a SFH was $725,000. Average downpayment was 7%! On the one hand, it was weirdly validating and reassuring to know that yes, homes are so overvalued that so many “regular people” cannot put down 20%. And yet, we were horrified that SO MANY PEOPLE are putting down so little on such an expensive house. What in the world does this mean for the future?

We toured a middle class neighborhood where homes are touted as “starter” and priced between $650-$750k. Every third house was run down with rickety fences and dead, weedy lawns. The neighborhood seemed to be retirees who bought in the 80s and their adult children (and grandchildren) who cannot afford to buy their own property. Then you’d see a recent, beautiful flip sold at a huge markup to families like mine.

Meri,

the mentality is just buy and if the price/value falls just walk away.

AND when the next 2009 style crash arrives you very well might be able to live in that home for 4 years and not make a payment. I’m not like that but I know many who are AND ARE DOING IT.

Seems like the plan that is being geared up here…

First: You inflate properties to make it difficult for Joe 6 Pack to buy a house.

Second: Joe 6 Pack then is $%@!# about the price of rent going up while he is confined to his Gig jobs.

Third: Prices start to stumble. However, Joe 6 Pack’s Gig jobs start to dry up as well.

Fourth: Prices continue to decline and have flatten to a point where Joe 6 Pack could actually leave rental Armageddon.

Fifth: Joe 6 Pack realizes his Gig jobs are not likely enough to get him out of Armageddon while it appears now he is in a recession again.

Sixth: Joe 6 pack is clearly stuck in rental Armageddon as homes are now being bought up by new investors again.

Seventh: The cycle starts over.

Exactly

Joe 6 Pack, the average dude gets slaughtered in downturns in the cycle.

Investors pay all cash at auction bargain basement prices.

More landlords… more renters…

Rinse and repeat

Yeah your right, but you make it sound like a bad thing.

Remember, someday Jim Taylor is going to be right, make sure that you are ready.

Housing, healthcare, and taxes. Those embody the inflation that the FED cannot find.

You forgot higher education cost which also went up through the roof.

don’t forget education

also premium food

everything you need is expensive

Don’t worry CA, cuz here comes the bullet train….

https://ibb.co/nBJ5KF

F’n hillarious, maybe those are the workers who’ll buiild the next quarter mile ?? lmao

According to this website:

https://www.gobankingrates.com/saving-money/americans-savings-state/

the states with the worst zero savings percentage are Louisiana and Mississippi (48%). The best states are Vermont, New Hampshire and North Dakota, all 20% or less. Alabama is at 25% (so much for pinning it on the deep South!). California is in the middle of the pack. Cheddar Man is right that it is all over, not just in high cost states.

Any way, if there is a shortage of housing for sale, it doesn’t matter if most people can’t afford it. It just means that those who can afford it (who are still pretty numerous, say 5 or 6 million plus foreigners and out of state interests) can fight it out over the limited number of units for sale.

What do Vermont, NH and N. Dakota have very few of? Illegals. But I’m sure that has nothing to do with it right?

I was talking to a realtor last week (I should say arguing with) who said, “I know things are pretty high, but there are still great deals to be had out there.” I begged to differ. Even a former meth lab shack with bars on the windows is grossly overvalued in this environment.

She then went on to say (after I brought up 2008 of course) that it’s not going to happen again because that was a banking crisis and the mortgage market isn’t as screwed up. Even if that was the case, in 2008 you were playing with the bank’s money and could just leave the keys in the door, take a hit on your credit record, and move on. Today, yes, a lot of people are putting big money down. That only means that you’re going to lose your own skin before the bank takes a hit.

At the end of the day, if the big banks take enough of a loss, they get a bailout. You don’t. But let’s not forget that the entire asset market is overvalued. Stocks, bonds, real estate, etc. It’s one last juiced up mega-bubble. When it pops the baby boomers pull a Jonestown at the Mexican restaurant and lace each other’s margaritas with cyanide.

RE should track income levels over the long term. If 40-50% of your income goes to your crappy little roof, and this is average for your area, it’s going to crash. Period. No one likes the 1/3 rule. It’s no fun. You may have to live on the wrong side of Stabba Anna.

“She then went on to say (after I brought up 2008 of course) that it’s not going to happen again ”

I agree with her. 2008 it is not going to happen again. 2008 was just the walk in the park, warm up time for what it is to come. This is the mother of all bubbles and the FED is out of amo. That 1% raised over a decade is not going to offer too much stimulus.

Once again, arrogance reigns supreme among those on this website who simply dig up all and any rationale to justify their support for real estate prices, who think real estate is everything, and who are convinced that ‘this time is different’ … that coastal real estate will never tank! You can’t possibly know what will happen! There is only one sure winner … the one who takes advantage of this craziness, sells, pockets a handsome profit, and walks away!

You just described me. I always act like that when the market reaches peak “crazy” like today. It is just common sense to act like that. Sell when everyone wants to buy – that is how you make the money. The fool and his money are soon separated.

“There is only one sure winner … the one who takes advantage of this craziness, sells, pockets a handsome profit, and walks away!”

I sell and walk away. Where do I go then? Cheap ghetto rental, move to flyover country? Timing the market is impossible. You would literally need the stars to line up for this to work in your favor if you live in any desirable part of socal.

Timing the RE market is very easy. Timing the stock market is harder. The stock market can move like a fighter jet. The RE market moves like a cruise ship. Its very clear the top has been reached for RE. From now on it can only go down. Wait and see or buy now and be screwed.

Here in our little corner of the world, homes are selling fast. But we are also noticing multiple age groups living under the same roof. Grand-parents social security checks combined with parents minimum wage paychecks will qualify for the purchase of a home for the ” new ” first time homebuyers. These are the folks who gave their homes back to the bank seven or more years ago. Now their credit is clean and they qualify for the subsidized home loans for low income families , but they can’t afford to maintain the homes and landscaping , and then they lease a new car because leasing is cheaper than purchasing.( My 18 year old vehicle is still running good ) Mommy and daddy working , latch-key kids roaming the streets , visiting guests sleeping in the garage and curbside parking is at a premium.

As a landlord , it is becoming increasingly more difficult to maintain my properties because the tenants ( God love-em because they usually pay the rent on time ) need me to glance away at times and overlook some small violations of our rental agreements. But once that grass grows to 6 inches tall , they will get a telephone call from me to maintain the landscaping or I will hire a gardener and bill them for the work. If we have an open line of communication , we can work together , but if they continue to duck me , I will give them ” the look “. As in life and politics , compromise can make our lives go a little easier.

Fyi:. 3yrs post foreclosure you can buy with fha

2yrs for a VA loan

7 yrs conventional (shorter with certain caviots)

re: leasing

You can get some incredibly cheap leases out there. Of course the dullard you’re talking about don’t do that. But if you do some homework you’d be surprised. There are some cars going for under $100/mo for 3 year leases.

But I digress….

Yeah I totally agree, you have to have good communication with tenants. But the best way to avoid problems is to screen, screen, screen and then screen some more. Good quality tenants tend to be problem free tenants.

I’ve been hearing this forever, how nobody in America saves any money and we’re all going to live on cat food (which is actually not that cheap) after retirement. Just like how global warming was supposed to put Florida under water by 2010 or whatever. The MSM makes its money off scaring people. You’ll die from heat! You’ll be starving and homeless when you retire! Everything around you might kill you! Cops will shoot you on the street for no reason whatsoever! Trump is about to start WW3! See a pattern?

Except they were correct about the Silent Spring/DDT thing(the birds have come back), the river burning in Cleveland helped fix some major problems, and the smog in LA is much better now compared to the 70’s…….

My big worry is the removal of private pensions. There are many more people who will be dependent on SS in the next decade. Without it, they will not be eating expensive cat food, but they will be living in tents on the White House lawn eating Soylent Green.

Oops, hit return too soon.

Don’t forget the sardine industry in Monterey.

In the 70’s and early 80’s I could walk up a S. Ca beach and find starfish and sea urchins in most tide pools. I haven’t seen one since then.

The abalone are also gone.

Too many people with too much impact.

“Too many people with too much impact.”

But, but, but…isn’t that the immigration policy of the democrats and RINOs????!!!!…allowing, encouraging as many illegals to come here???? Aren’t Trump and Session the mean/fascists/bigots for trying to implement the laws passed by Congress before they came on board????

Yes, but the coastal elites surely benefit from the slave labor – the more slaves, the bigger the plantation. Who cares that the plantation gets ruined by too many people and the middle class gets decimated in this race to the bottom. What matters is to embrace all the millions of illegals, pay for their school, food and health and the elites to have cheap gardeners; after all it is the middle class paying for them directly or indirectly. But who cares about the deplorables?!!!…

I really have no idea what yuo’re talking about. Sardines? WTF?

Hah! Landlord, You must be one of those young inexperienced newbie people to not know about the sardine economic and environmental disaster in Monterey.

The MSM was really good about predicting these in the 70’s and we did something about it to avoid catastrophe ( The Monterey catastrophe happened in the 60;s_)

The MSM is warning now but even after 2 major hurricanes, Trump has buried his head in the sand at Mar Lago.

From another perspective, God is punishing us for voting in Trump after 8 years of no major disasters under Obama. After 2 major disasters like this, I am puzzled by the silence of people like Pat Robertson.

You decide, if you believe in God, or you believe in science, the evidence is there on Global Warming

I see steady environmental degradation on the S. CA coast compared to what I saw in the 70’s. That was my point.

My main point regarding housing is that:

1) Private Pensions are mostly non-existent now. That will affect housing in the next decade.

2) Public pensions are seriously underfunded. What will happen in the next decade?

3) Trump and the Repugnicants are constantly trying to kill SS.

What is left for the retirees in 10 years given that they have no savings?

It will be a wild ride.

And Flyover, the people benefiting from cheap illegal gardeners, childcare, butlers, drywallers, framers, etc are not paying enough for these illegals. They are the top 5%.

Watch closely. Trump relies on these people to build his empire. He won;t deport them as promised BUT will shift more of the burden for paying for them onto the middle class and cut taxes for himself and claim a victory on cutting taxes. Smoke and mirrors. Watch. Victory! I cut taxes!

Seen it all before B.,

If your democrats are any better, why didn’t Hilary campaign to do something legal for once and deport all the illegals based on the existing laws? Why? Because she was even more full of illegalities than the illegals. At least Trump said the right thing, that laws are meant to be implemented or we are a banana republic.

The fact is that both democrats and republicans are two sides of the same coin serving the globalists bankers. However, you are stuck in the democrat mode.

Flyover, I voted for Bernie, since he was the most honest of all of them.

Irony: people who treat global warming as a religion bashing people who believe in God.

For the record, I believe in neither. Well at least no the man made part. The earth has been warming and cooling for 4 billion years. But somehow my SUV is causing it to happen in 2017. Sure, why not?

Seen it all before Bob,

Bernie is always concerned with how equal the slice of the pie is till there is nothing to slice (no more pie) and everyone is equal poor.

Bernie is a communist/collectivist/big government supporter (totalitarian). He is just a puppet for the globalists. The DNC is as crooked as RNC. DNC slapped the hands of Bernie or he would have been the nominee based on popular vote instead of Hilary. RNC

(RINOs) slaps the hands of Trump everyday, because they are not there to represent the electorate. They represent the same globalists like DNC (Bernie).

Trump is there to represent himself, I agree with that. However, being attacked everyday from both the left and the right he helps with the gridlock. The less the politicians do, the more the average guy has room to breath.

Mr Landlord, though Pat Robertson has been unusually silent these days, I feel safe to comment for him. God has just punished Trump and 2 major Republican States with major hurricanes. Huh, no major hurricanes under the Obama Presidency. Or maybe it is just Global Warming

Flyover, Bernie was forced out by the Globalists during the DNC. Trump was allowed under the RNC. Case closed.

Bernie was close to FDR. The next election will elect an FDR candidate.

That is if we are lucky. Otherwise, with tent cities, it may be more extreme. That is my fear.

Trump was attacked from day one by MSM, owned 90% by 6 individuals, all globalists. Obama and Hillary were their darlings. They were sure that based on their propaganda she will win. Trump is attacked even today, viciously. Obama did not experiment not even 1% of the attack from MSM vs. Trump. Obama was a Wall Street puppet and he was rewarded by Wall Street handsomely. RNC always opposed Trump and they still oppose him. Trump, unlike any other candidate was not PC, represented himself and told the people what they wanted to hear. The other candidates had to say what RNC approved and they had zero chance against Trump. What, you think that the globalist shill Jeb Bush had a chance against Trump? He could have spent 100 times what Trump spent and he would not have gotten 1% of Trump votes.

I agree that the next candidate will be a populist based on the social mood. I just don’t know if it is going to be a populist from D or R. Congress is opposing Trump at every turn. If he is not doing anything of what he said he will do, I agree that he is toast. If he is doing at least 25% of what he said he will do, he will win the second term.

We both agree, that a populist will win. Remain to be seen which one. It is too early to say. Trump performance so far is poor and he alienated most of his base. If DNC would not have been as crooked as they come, Bernie would have won the nomination because he is a populist and he would have won against Trump for sure. Hillary had no chance against Trump. DNC was blinded by their own propaganda and did not feel the social mood. The only guilty person for Hillary loss was Hillary.

Check this one. Home is purchased for 1.6M. It closes, then instantly resold for 1.8M. Not a single bit of work was done to this fixer. And, at 1.8M, it had multiple offers. This is a high airport noise location … so not the best.

https://www.redfin.com/CA/Newport-Beach/1227-Sussex-Ln-92660/home/4584864

They even used the same pictures LOL.

@ JT something doesnt seem right. The commission paid to the broker on a $1.8M sale is about $100K…. someone flipped hoping for a tiny profit?

Realtor bought it, and is reselling it. So, the profit after commission is around 150K

Buyers remorse?

Dont assume all listing agents get the listing at 6%. Often times it can be 4-5%.

Also; many flippers are agents; so they only pay 2-2.5% out to the buyers agent.

a realtor maybe deserves 0.3 – 0.4 percent commission. Especially in a totally overpriced environment like California. You are better off negotiating for yourself. A realtor always pretends to negotiate but in reality he tries to screw you big time to get more money. Realtards are the lowest of the low.

@Millenial “A realtor always pretends to negotiate but in reality he tries to screw you big time to get more money. Realtards are the lowest of the low.”

As a realtard myself, the lowest of the low, I typically find that people that make statements like this fall into one or more of a few categories:

1. If they’ve purchased a home before, they chose unwisely and rather than realizing their own mistake its easier for them to place the blame elsewhere. Their realtard is a likely candidate.

2. If they’ve never purchased a home before, then they simply have no clue what they are talking about. Sitting down with an actual realtard and having a “discussion” rather than basing their views on anecdotal information found on the internet is a good start.

3. I start every interaction with people expecting to trust them. If they immediately question my integrity or trustworthiness, then that is a red flag to me because I have learned over the years that they are projecting their own character as to how they handle their affairs. I don’t want any client that feels that they cannot trust me because that ultimately means that I cannot trust them. PS: That one little tidbit of information is a life lesson, learn it.

I do not work in the CA market, thankfully. Where I live and work, homes are a normal 250ish median. Let’s say you represent a buyer for a 250k house, maybe the buy side commission is 3%, that’s 7500k which you split with your firm. Is that enough to compensate you for the last 1000 miles you’ve driven for your client and God knows how many hours you worked evenings and weekends missing time with your own family to show your client that perfect home that just came on the market and that you know is going to have 20 offers before you even get there? Yeah, lowest of the low, Mr. Millenial.

Then after all those weeks/months/maybe even years of work with one client and you finally get paid after splitting with your firm, think of all the money that’s left over after you pay for your state licensing fees, your required training, your MLS dues, your realtor association dues, your gas, your taxes and your government mandated unaffordable healthcare. Oh and we didn’t even get into marketing costs. Yeah, realtards are the lowest of the low Mr. Millenial.

Good luck with your home purchase whenever that may be. And if you choose to use a realtard, God bless him/her because I’m sure you’ll be a pleasure to work with.

@realtard,

I don’t fall in any of your categories. But I like how you blame the victim in your first point.

“1. If they’ve purchased a home before, they chose unwisely and rather than realizing their own mistake its easier for them to place the blame elsewhere. Their realtard is a likely candidate.”

Proves my point….the realtard is supposed to help the first time buyer, instead he lies, plays tricks and scams the buyer into an overpriced house. At some point when the buyer wakes up and realizes what happened the realtard just says: your fault, you signed, you were unwise. Blaming the victim is a typical attribute of realtards.

Regarding the rest of your post…I have little interest in your sob story.

I have had my experience with many realtards. The eye-opening event was with a realtard who claimed to be a family friend for over 25 years. I went through the process and almost bought through him but saw some red flags which made me research and be alert. As soon as he realized that I do my homework he got all nervous and lied as there were no tomorrow. I know now why he said so many times how much he loves first-time-homebuyers. He expected me to be clueless and to just march along without researching.

After dealing with about 10 realtards I only found one who seemed to be different. On her website she stated that she actually hates real estate agents and that a very bad experience made her want to do a better job than most of these agents. Unfortunately, she is no longer in the business of selling RE. My guess is you can only survive if you have no spine, lie and scam as much as possible.

“Good luck with your home purchase whenever that may be. And if you choose to use a realtard, God bless him/her because I’m sure you’ll be a pleasure to work with.”

I will buy when we see a nice collapse in prices. 50-70% lower than what the asking prices are today. Yes, I did not want to be the realtard having to deal with someone like me. I have zero respect for them. Until they prove they can do business without lying they are nothing but worthless pieces of sh*** to me.

JT,

How do you explain this one?

https://www.redfin.com/CA/Burbank/815-E-Valencia-Ave-91501/home/7146513

This is a fantastic way to launder money. Buy a house, sell it right away for $200K more. Presto, you just make $200K “clean” profit. I’d bet that if you did some digging you’d find a relationship between the buyer and seller.

you all come on over to Kerrville, where the prices are reasonable and we have a slower pace. We even have Kinky here. It is 84 degrees here now in the hill country, wind over 10mph so it is comfortable. BBQ this weekend, regular place.

Kerrville holds a special place in my heart. It’s where my plane was built 😉

Here’s how it played out last time. If you’re of the opinion that a nation’s wealth should be predicated on what it actually produces its’ not hard to deduce that the US (outside of weapons manufacturing and sales) offers little value to the outside world. Thank God for the US dollar’s preeminence as the premier reserve currency and prime petro exchange vehicle. I guess looking at this from this perspective real estate is virtually our only “product”. And everyone on the inside knows it. That’s why prices cannot be allowed to fall. But, as history has shown repeatedly, it’s just an illusion.

https://qz.com/1064061/house-flippers-triggered-the-us-housing-market-crash-not-poor-subprime-borrowers-a-new-study-shows/

If the housing market tanks bigly before the next election, I’m betting he prezzer will pull out stops that make the last bailouts look like nothing.

Yes, but the bailouts, like always, will be for the cronies at the top of the financial sector (TBTF), the 0.0001% who pay for the political campaign, not for the Joe six pack. Head, they win, tail you lose – don’t you love this casino game?!!!… The more you play, the more you lose. If you don’t have a very strong financial defense, don’t cry in the soon coming reset. Don’t count on Trump or any of the politicians to have your back – defend yourself. Learn the rule of this game and practice self defense.

Nah, that’s just typical American pessimism keeping you from seeing the forest. It could be argued that the last bailouts benefitted many Joe Sixpacks. Regardless, if he wants to get re-elected there will have to be direct benefits, unless the reckoning comes after the election which would mean three more years of waiting at least. And this has nothing to do with expecting him to have our backs, it’s about expecting him to have his own.

And by the way, lib states like California will not be at the forefront of his plan. It’s delicious!

Besides allowing them to live mortgage free for many years without fear of eviction, how did the organic buyer benefit from the bailouts? Many who took advantage of government loan modifications fell behind in their payments again.

I have no idea how many people never got caught back up, but imagine there were some who did and some who are still in their home today thanks to the bailouts. Whatever the case may be, that doesn’t mean the next bailout will end up with the exact same results.

“Nearly 70 percent of the homeowners who applied for the [TARP] program were rejected, according to government data.”

https://www.washingtonpost.com/news/business/wp/2016/12/30/after-helping-a-fraction-of-homeowners-expected-obamas-foreclosure-prevention-program-is-finally-ending/?utm_term=.01643caf076f

Even one of its authors, former Secretary of Treasury Geithner, admitted that the government programs were meant to foam the runway for lenders rather than to help troubled homeowners. The programs allowed mortgages to be refinanced at a lower rate. However, only principal reductions could truly make a real difference. But that would have meant that lenders would have to write down the value of their loans — the powers to be certainly wouldn’t have liked that.

Okay, so to repeat, whatever the case may be, that doesn’t mean the next bailout will end up with the exact same results.