2012 the year of the short sale – Short sales over 50 percent of all MLS inventory in Southern California. Beware of costs like PMI, HOAs, and Mello-Roos.

The lost decade in housing values was cemented by the Case-Shiller report today. Nationwide home prices have reached a post-bubble low. A large part of this is being driven by lower priced distressed homes and the reality that people are focused on affordability. This includes investors who are price conscious to make sure numbers work as an investment but also first time home buyers stretching their purchasing power with low down payment FHA insured loans and record breaking low interest rates. The Case-Shiller LA/OC numbers now show a 40.8 percent decline from the peak. What is definitely a recent trend is the quality of short sales hitting the MLS in mid-tier markets. Short sales now make up a sizeable portion of total current inventory for sale. We know that half of current sales come from the distressed pipeline but looking at current inventory we see that this pattern is continuing to hold. At least for Southern California, 2012 does look like the year of a short sale surge.

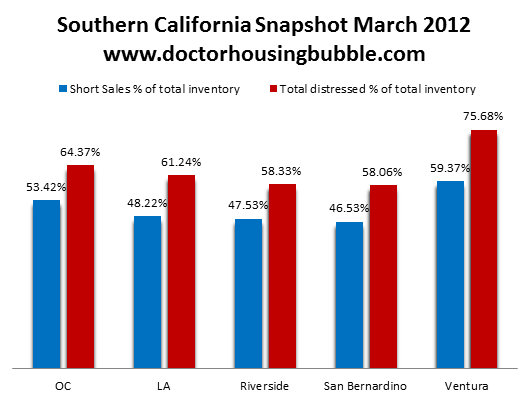

Short sales dominate MLS inventory

Short sales are definitely making their presence felt as a percent of total visible MLS inventory. More significant however, is the pricing these short sales are taking. Back in Q1 of 2010 for example, short sales made up roughly 25 percent of visible inventory but the pricing by banks did not show an interest in moving properties out quickly. The quality was also on the weaker side. Today short sales dominate the visible inventory but also the quality and the pricing is much more aggressive in the sense of moving properties.

It would be useful to look at the current MLS data and the categories each property would fall under:

The vast majority of properties on the MLS are distressed properties. If we dig deeper, we will find that most of the distressed inventory comes in the shape of short sales. In fact, over 50 percent of all visible MLS inventory comes from short sales. This trend has been growing since the crisis began but even in 2010 when the market was already troubled, banks were still reluctant to price properties aggressively when it came to short sales.

It appears that the shadow inventory is now starting to move at a brisker pace. This is positive news and the continuing drop in prices only makes sense. If most of the sales are coming from distressed properties then it is expected that home sales would continue to edge lower. You have to remember that a short sale is a sign of underlying economic issues. A bank needs to agree with a current owner that they would be willing to accept a lower price, below the initial mortgage balance, to move a property. By definition each short sale is a price reduction sale and over half of the current SoCal inventory on the MLS is listed as a short sale!

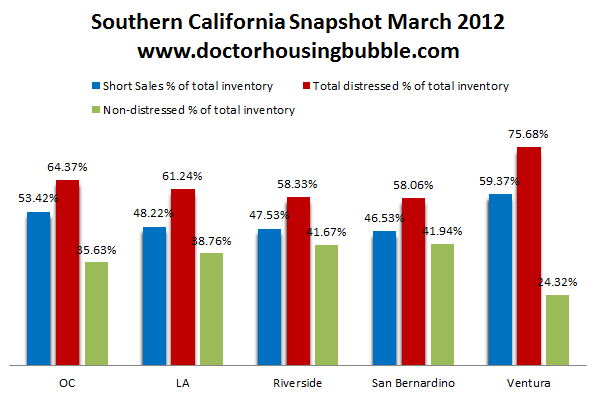

Take a look at the full inventory picture. Keep in mind that the total distressed column below is made up by short sales plus foreclosures:

Banks definitely seem more eager to move properties and this is likely due to the mortgage settlement that was reached recently. The above charts do not reflect a healthy market. I’ve also noticed that some people fail to account the full cost of owning a property and this is common for someone that has never owned real estate. Take for example FHA insured loans that are now the main entry point for buyers in California. On the surface a 3.5 percent down payment seems fantastic. But then you have the additional costs of:

FHA mortgage insurance:Â Â Â Â Â Â Â Â Â Â Â Â roughly 1% and higher (paid up-front)

PMI (annual):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â roughly .67% depending on the LTV

A commenter brought up a good point regarding “hidden†costs like Mello-Roos in Orange County and this reminded me of hearing a few people talking about “how they wished they would have known earlier the full cost of ownership.â€

Let us use a case for example. Someone bought a condo last year for $415,000 in Orange County that had once sold for over $650,000. A nice condo and certainly lower than the peak price. This person is now shocked how high their total cost of ownership is. Why? Let us run the surface analysis:

Purchase price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $415,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $14,525 (@ 3.5 percent down FHA)

Up-front cost:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,000 (1% of total paid upfront for loan MI)

Total mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $400,475 @ 4.25%

Principal and Interest:Â Â $1,970/per month

Many first time home buyers, the bulk target for FHA insured loans will only go by the above figure as their monthly cost. This person bought the condo in Orange County with high HOAs plus Mello-Roos and also PMI. These were all additional costs that come out of monthly net income and you cannot deduct Mello-Roos from your taxes and this is a big benefit of home ownership.

Mello-Roos:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $225/per month

HOAs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $300/per month

PMI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $231/per month

Taxes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $345/per month

Add all this up for the newly initiated home buyer that assumed they would be paying a little bit higher than $1,970 per month:

PI ($1,970) + Mello-Roos ($225) + HOAs ($300) + PMI ($231) + Taxes ($345) = $3,071

This is why FHA insured loans are now seeing record default rates.  I think many are stretching to buy without taking the full picture into consideration only to be shocked of the true cost of ownership. Here in SoCal, I think many are seeing some good quality short sales and jumped in without doing the full analysis. The good news is that more quality short sales are being priced to move and the shadow inventory is moving out. Of course this means prices will be moving lower throughout the year.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “2012 the year of the short sale – Short sales over 50 percent of all MLS inventory in Southern California. Beware of costs like PMI, HOAs, and Mello-Roos.”

Mello-Roos = another good reason to never consider buying a home in California.

We’re looking in a neighborhood where standard sales are priced at $200k to $220k, and the shorts are sticker priced around $180k. Of course we would prefer to save the $20k and buy a short.

Does anyone have any recent experience with buying a short? As in the last few months? How long did the process take, was it a bidding war, and was is stressful?

We wonder if we should begin the process now. Our current apt. lease is up July 31st

I would extend my lease if I were you. We are in the process of buying a short sale, and it is extremely stressful. We were told it would take about 60 days, and so far it’s been four months, with no end in sight. This is the third short sale we have tried to buy, and we found the only way to get an offer submitted is to go directly to the listing agent.

IMO, saving $20k is nothing in the long run. If you were going to save at least 60k-100k, I would consider it. Unless of course, the short sale house had over 60k+ of upgrades that might be worthwhile.

Why stop there, Doc? How about the cost to repair appliances? An apartment manager may have a handy man he can trust, and he’s getting an economy of scale. Either the guy is on the payroll, or he’s a contractor and gets a huge chunk of his business from the property management company. He[contractor] is definitely giving the property management company his best price, to keep that steady business.

The individual must try to fix it themselves, ask around for references, or take their chance with the Yellow Pages or similar. Alternatively, they can purchase ‘insurance’ from the appliance vendor, but this usually comes at extortionist prices.

Then, repeat that exercise for painting, drywall repair, driveway problems, gardening, etc. In my own particular case, I love to garden, and grow a substantial portion of my own food in the Summer, and have the nicest flower garden on my block (not to brag, lol). But most people don’t like doing this. It is a bothersome chore to do, or they must pay someone to do it.

That’s pretty awesome you have a garden, I can’t wait to have one.

Papa–If you’re looking to buy, you must have a green thumb, otherwise, what’s the point? You can admire the shrubbery from the apartment window.

Also, you really need to be a handyman. You can go to places like Harbor Freight Tools (or equivalent) and buy the cheap tools you will need, even on a relatively new house. Lots of classes out there too.

The reason there are so many foreclosures and short sales is because of the stuff Dr. Housing mentioned, PLUS all the little stuff the property manager can buy in bulk at half price.

In addition, there is the stagnation of real incomes, the likely increase in interest rates and the ever-increasing taxation of property for a buyer to consider. Prices are unlkely to rise in the intermeiate term on any aggregate basis.

I think the list of costs is missing home owners insurance, no?

What in the world is Mello-Roos? I mean I know what Prop 13 is, but Mello-Roos is a new one on me. I thaught it was a cousin of a New York Knick. LOL

Mello-Roos is a special property tax for a specific area created by two CA congressmen, Mello and Roos. It effectively takes care of the ‘holes’ left by Prop 13. IMHO there would be no holes if tax money were spent properly.

april 1 fha upfront fee rises to 1.75% from1% and rise monthly from 1.15% to 1.25%

Wrong…developers will float bonds to pay the(ir) costs of infrastructure I.e. streets, curbs, gutters, street lights, landscaping, local area improvements including schools, parks and fire stations, etc..repayment of the bond is left to the homeowners over the life of the bond. Payments are collected by the tax assessor.

Google is your friend 😉

I’m w/Sean. What in the world is a ‘mello-roo’? Also, here in Chicagoland, my annual HOA charge is $425. Do you guys get extra garbage/landscaping/yard clean up services?

Here you go: http://bit.ly/H0esuH

In layman’s terms, Mello-Roos is a special tax assessment that is added to the standard property tax. It is generally for new communities where the infrastructure is not yet built (roads, sewers, schools, etc). The Mello-Roos special tax will eventually go away over time and it is NOT tax deductible. However, many Californians have deducted Mello-Roos taxes (just lumping them with the standard property tax). Sacramento has finally caught on to this and is doing something that will automatically raise a red flag (I remember reading this) if someone is cheating on their taxes. Mello-Roos taxes can add several thousand dollars to your property tax bill every year, the state wants this money!

On a side note, I remember talking to an old co-worker who would deduct his HOA dues also by lumping them into his property taxes on his tax return. That is illegal also but many people do it here. Californians get pretty creatitive when it comes to finding real estate related “loopholes” come tax time.

Lord Blankfein is correct. With an $8 billion deficit, Sacramento is finally going after Mello-Roos/Community Facilities District taxes…and maybe Assessment District and other land secured financing districts.

In short, a CFD/Mello-Roos district (“CFD”) is a financing mechanism for the developer who issues bonds in which the debt service for those bonds will be paid by the future home owner (pass-through). It is governed by the Mello-Roos act (1982) and typically is found in communities built several years after that.

The mistake people make regarding CFD is making blanket statements about whether to buy a property with or without a CFD. Bonds mature about 30 years after they are issued and in many cases the new owner may only have to pay 7-10 years after he closes on the house. So here’s what you have to do:

Obtain tax disclosure for the CFD. Find the maturity of the bonds. Do a present value calculation at say (4-5% over the amount of years remaining on the bonds). Subtract that amount by the listing price. Now you can compare apples to apples with a property without a CFD.

I am surprised people would be doing this as the 1099 one gets for interest paid on their mortgage is very exact and straight forward. HOA and MR would not be on there. Pretty easy to catch in a computer audit.

CAE, the Mello-Roos is included on the property tax bill. People would just play dumb and deduct the entire bill. This is similar to deducting your car registration, you can only deduct a portion of it…but I’m sure many people deduct the entire bill. Sounds like Sacramento will start enforcing this since they need the money. Back in the old days, unless you got audited you likely got away with it.

I think 2012 might be the year of the Asian buyer in OC.

http://www.bloomberg.com/news/2012-03-13/asian-buyers-buoy-new-homes-in-california-s-orange-county.html

From the article…

“Connie Wang paid about $960,000 last June for a new four-bedroom, four-bath house in a sprawling swath of Southern California that’s home to Disneyland and Pimco. Now she may buy a second as an investment.”

“Andrew Vu, who moved to Orange County from Vietnam with his parents 33 years ago, bought a two-story, four-bedroom house in Garden Grove, in June for $530,000. Vu — who also owns two other homes, in Corona and Victorville, as investments — said he appreciates the proximity to shopping areas and freeways offered by his new home, in Brandywine Homes’ Pomelo development.

“I like the area and, over the long run, it’s an investment,†he said. “I think we reached the bottom, and it can only go up from here.â€

SFR’s as “investments”…”it can only go up from here”. Hmmmm…..

That’s what they said about Japan in the 80’s…

That’s what they said about US real estate in 00 01 02 03 04 05 06 07 and now apparently again in 12. Any takers?

I got a good chuckle at reading that. Houses can only go up from here, circa 2005. I wonder if Ms. Wang read Dr. HBs article today regarding all the micsellaneous “costs” of “owning” a house…especially a 960K house. I’m sure in 5 years she can sell it for a handsome profit since they’ll be plenty of qualified move up buyers who will be clamoring for a 1M plus tract house in OC. Bwahahaha!

Is Andrew Tom’s brother???

Make sure your time frame is at least 6 months if you are going after short sales. I would guess about half of the listed short sale inventory is really just peole trying to stay in their homes for free longer. Just look at the number of short sales that have been on the market 100+ days. Standard sales in SouthWest Riverside that are priced competitively don’t last 2 weeks on the market. I’ve put offers on 15 different homes in SW Riverside so far and EVERY single one has had multiple offers and gone above the list price and we have lost out. I wish I had time to go for a short sale, but I need to buy in the next couple months as I close on the one I’m selling in a couple weeks. If this is a depressed market… it sure doens’t feel that way for buyers. Also a lot of fraud is still going on with short sales and you might see that you put an offer above list for a short sale and they never get back to you and the home sells for less than the offer you put.

Short Sales are a nightmare, almost as bad as getting into a bidding war on a foreclosure from the bank. Want to waste a lot of time???

These short sale people are gaming the system. It’s as crooked as it ever was. Thank god for government reform! Thank god we fixed the system huh?

Thank you DG and CC. I heard shorts were nightmares and now more confirmation. There is enough stress in our house right now, I won’t even try to buy a short.

Yep, there is definitely a lot of frauds with short sale & listing agents. They don’t even bother to return calls and the final sale are much lower than my offer too. In 91790 area codes plus 15 miles surrounding areas.

I am Ca licensed for my REIT career, and although I am no expert,

I see what you guys see. I see SS’s priced below market, with the

hopes of getting a bids to submit to the bank to hold off a

foreclosure, knowing damn well the process could take months and months,

and they can live free.

We were getting ready to put in an offer on a SS and in a day or two the seller delisted. Our broker called to tell us the house was delisted because the bank finally started to get serious about a modification. They used the SS orocess to game the system, and if things don’t work, they will just become defaulters in a foreclosure.When I saw the price I knew it wasn’t kosher.The exterior was great, but the interior was beautiful. It was $50K-$65K below comps.

This type of BS should be illegal. .

Worse, according to a lender here in Arizona, FHA rate are increasing effective April Fool’s Day (no really) from 1% to 1.75% upfront, plus from 1.15%/mo. to 1.25%/month. All the gotchas are adding up, and with rates inching up again, prices are likely to fall further.

What in the world is Mello-Roos?

Its another word for “special tax assessment”. Prop 13 is a 1.06% tax that everyone has to pay, but because of prop 13 a lot of areas have what they call melaroos/special asssessments that can be even higher than prop 13. You could easily have a couple of houses that are $200,000 and one pays $2000 /yr for taxes and the other pays $6000 per year because of special assessments. The newer the home the more mela-roos taxes you will see. Zip code 92593 is a pretty good example of this. If you look at the Southern Homes built prior to 2004 the taxes are generally $2000-$3000 depending on the house, but if you look at anything built 2004 and after the taxes suddenly jump to $6000 /year. You will find this pattern almost anywhere and I’m finding that there is more competition on homes with lower tax rates. You can look up the taxes on the home by going to zillow(scroll down and it shows the taxes paid). If you know the exact address you can also go the the county tax web site and usually find out exactly what mela-roos taxes the house is paying. What I haven’t been able to find out is where you find out when the mela-roos tax expires. Usually they are paying for some kind of bond/infastructure improvement that eventually goes away.

Realtors are DESTROYING this market with undervalued/under listed homes.

They have ZERO CLUE, i repeat ZERO CLUE how to determine WORTH

Many short sales ARE NOT UNDERWATER TODAY.

Borrowers would rather lose 150k than make next month’s payment.

STUPID

Excuse me angry appraiser but you and your kind are the most useless profession of them all. A house is worth what someone will pay. You opinion is irelevent. Get a real job that actually produces something. Opinions are like buttholes. Everyone has one

Yeah, well, the very premise of a supply/demand curve is all but thrown out the window without real price discovery in the marketplace. It completely distorts the curve as to be a quaint relic.

Better to say that the COST of a house depends on the level of debt facilitated by a lending institution.

Mr. Angry, mathematics do not lie. Homes are STILL overvalued by as much as 20%. We lived off a 30 year credit bubble that is coming home for its payment due. Yes there are rich folks, and some good jobs, etc etc…but they are nowhere near as prevalent as they used to be. Currently, America’s good ol days are over.

I’m not saying they will never come back…who knows what the future, and tech breakthroughs hold…but I’m saying short to mid-term, until the Chinese labor factor, American taxation factor, and all these other problems get sorted out, there is and will be no genuine economic recovery. No recovery means less good paying jobs, and less jobs means lower valued homes. The faster banks DEVALUE property and get it sold, as they should, the faster a consumer recovery can take place. Homes need to be as close to 2.5X per capita income as possible.

No one “loses” 150k, especially in non-recourse CA. It’s all paper and the FICO consequences eventually pass.

Mr. Angry, how do you yourself determine ‘worth’? Are you speaking worth as value? The definition of value is ‘what someone is willing to pay for something’. And also in the case of housing, what another party will lend someone to buy something. I’m sure 90+% of the general public does not have six figures in cash to buy a home.

I think neither do appraisers have any CLUE. We raised our bid by 50k to win the bidding war and got into contract. The offer price is in 700k range. An appraiser came in and magically appraised the price to be just $500 above our offer price, how convenient! He went through all the troubles of manipulating tons of factors in a dazzling way to make ‘adjustments’ with ‘comparable sales’, just to reach that number. Quite a few of those initial inputs are not right – I know all those comparable sales well, and a few of them are not even comparable sales in my opinion, while he omitted many actual comparable sales that have much lower price. All these are subjective anyway, so I shouldn’t complain about this too much.

To show how object he is, a ‘cost based approach’ model is included, in which the lot size is mistakenly put as 5000sft(the actual size is 2500sqft). And guess what, based on the utterly wrong lot size, he came up with almost the same number, lower by a few thousands this time.

This added to our mixed feeling about the deal. We eventually cancelled the contract.

Our agent is definitely more trustworthy than this appraiser dude.

Gerry! If you’ve got 50K to toss around like bellybutton lint, then perhaps you deserve to be fleeced by your appraiser and your agent both. I believe it’s called a skewering.

2,500 square foot lot? Really? What fits on a 2,500 square foot lot that justifies paying $700k?

What these graphs aren’t reflecting is the high number of “short-sales-to-be”. In Socal coastal cities you will find countless examples of homes priced way too high, including some who bought at the very peak (2006). These people are all praying to find some idiot who will pay their wish-price. But in reality they owe more than their house is worth, they are just still in denial about it… I especially love it when those listings emphasize how it’s “NOT A SHORT SALE” 🙂

Here’s my absolute favorite:

http://www.redfin.com/CA/Dana-Point/12-Ritz-Cove-Dr-92629/home/4960804

Anyone interested in paying 35% above the 2006 sale price??? Prices on the beach never go down, you know? In all fairness, this one may never turn into a shortsale because they probably put 50% down…

The banks are taking nominal write downs as RealTurds pump up the values in the eyes of buyers who are worried about missing the bottom or just don’t care.

Nice to hear that the shadow inventory is starting to flush…but back to household incomes being inline with sale prices at around a 3x multiple maximum – $150K annual for a $450 MAX homeprice with 20% down. How is that going work itself out in some of the shadier parts of OC – Garbage Grove, Costa Mesa, Lake Forest, etc? Are we going to get there Dr? How far out is the HEALTHY SFR home market in SoCal – Land of the commuters and the bedroom communities?

Banks still dragging their feet only selling what they have to. With no “mark to market” why should they? Nothing more than window dressing by leaking out a property here and there. But, the huge overhang of properties in the foreclosure pipeline still exists. Those with weak hands and tired of waiting are jumping in, fearing they are seeing the bottom. Mid to high end tiers still have another chunk to go, in order to clear their shadow inventory.

http://www.westsideremeltdown.blogspot.com

If a short sale doesn’t mean that your home is under water – What does it mean??

If you owe more than your home is worth-You’re underwater and a short sale would be required!! Short sales are still a joke! The only thing that has changed is that now you get to talk to one person who doesn’t know what they are doing. And that one person isn’t the person that I really need to talk to. From an Appraisal standpoint, the lender is setting the price that the Realtor lists it for. My comps, although required in a short sale package, have yet to be acceptable to the lender. If you are going to make an offer on a short sale, make sure it’s a pre-approved listing and that you the buyer have cash in hand. It will close in 60days or less.

If I understand the Case Shiller chart for California Cities, and the

FHA penetration of that market, EVERY person who bought FHA in

the last five years is now underwater if they sell (and 90% underwater

even if they don’t sell). People don’t learn, do they? Note: there is

a second bubble forming through bank “investment home” financing and

when that turns bad, the foolish banks will stop providing unlimited

easy money to investors who think home prices will only go up. Of

course, this will bankrupt even more banks, it appears. Anyone who

doesn’t understand this “second bubble by the banks” will

likely soon see, and the reason is EXACTLY what DHB shows here: the

cost of owning condos and single family homes when full cost is applied

greatly exceeds potential investor rental cash flow 90% of the time.

Even with the doom and gloom talk I just don’t see the inland market going down anymore. Its half the price to buy that it is to rent and properties are getting gobbled up like crazy right now. The prime markets are another story as it is still more expensive to buy then rent in these markets.

I’m on the same page as you, but I am still very skeptical. I see some pros, such as prices in many zips down to the recommended 3X per capita income range. I see many cons though, mainly gas prices and the jobs picture. Future property tax hikes are a scary thought too, all those billions needed to fund CA employee pensions. It would be nice to see a court void those pensions. IE people with money are mostly commuters, there are some good jobs out there but most are in LA/OC.

According to stats, (DQ news, trulia graphs, etc) prices are still flat to falling in most IE cities. Very confusing times for a cost conscious, savvy buyer.

You are correct about the rents. They are getting higher monthly as more choose to rent. 3BR homes in livable areas for $1700? How is a family supposed to afford that. A mortgage can be had for $1500 or less, and you get the tax break.

The other thing to consider is that the Inland Empire is a big place. It can include Moreno Valley, Riverside, and Hemet, but it can also mean Upland, Chino, and Chino Hills. All three of the latter cities may be in San Bernardino County, but they’re not as far to the east as they would seem. Chino Hills is actually SOUTH of the San Dimas-Pomona area and adjacent to Diamond Bar. A lot of coastal snobs think anything east of Pasadena is the Inland Empire but as far as I’m concerned, this is still the eastern rim of the San Gabriel Valley. It makes a difference, because if you live in Riverside and you commute to LA, you’re looking at generally a 2 hour commute each way. From Chino Hills, it may only be 45 minutes to 1 hour. This may seem like a lot, but I’ve spent that time commuting to Downtown from Monrovia because of how backed up the 210 can get.

I’d like to see a court void your pension.

There are some in the public sector, mostly high-level administrators, cops and firemen, who receive really generous pensions, but most of us don’t. I earn 25% less salary than I could in the private sector, but that’s a trade-off I consciously made for better and more stable benefits.

tech98 –

I call BULLSHIT on your claim of making 25% less than the private sector. In fact, government employees not only make more than their private sector counterparts, the LESS educated the government employee, the LARGER the income gap. Not to mention the lavish bennies you receive that the private sector DOES NOT, as proven by your ignorant comment to have the courts take away a private sector worker’s pension. GO AHEAD! WE DON’T HAVE ONE! WE HAVE SAVE FOR IT! Not to mention that private sector workers have much more stress and pressure on them to perform than the large numbers of useless sacks that occupy government jobs and wouldn’t last a day in the private sector.

http://reason.org/news/show/public-sector-private-sector-salary

“Its half the price to buy that it is to rent and properties are getting gobbled up like crazy right now.” I, in no way, disagree with that statement. But I know people that are buying those homes and they usually fall into one of two categories (there may be more but these are the examples that I know of).

Category 1 – Someone that does not have money to put down and does not mind driving an hour one way to work. I know of multiple instances where a person working for the same employer bought out that way because they did not have to put any money down.

When I ask a category 1 buyer why on earth they would want to live in Moreno Valley (et. al.), the response is generally the same. And it is that they cannot afford a house in the area they work. They are never exactly happy about having to move there. They just want their piece of the ‘American Dream’.

Category 2 – The cash buyer that wants to rent out the properties. If you don’t live out that way, then you are not familiar with the neighbors you will be getting if you choose to live in the heart of the I.E. IMO, (and it is just that) the I.E. will eventually become saturated with rental properties such as Nevada (although not at the same magnitude.) where the rents will have to be so low that the ‘investors’ will eventually get the shaft.

DG is right on. The inland markets are bouncing up. I just wish an area I want to live in would hurry up and bottom out. I don’t care how cheap Riverside/Corona/Indio is, I don’t want to live there.

Well I have a good paying job in the in SW Riverside County. Personally I think Temecula and Murrieta area are easily as nice as a lot of the prime markets(good schools and low crime). Yes the weather is a lot better in the prime markets, but I’d rather live with decent down to earth people than all the arrogant pricks in the coastal markets anyway. Not to mention I can get a 3000 sq foot place for under 300k which would cost a million+ in any coastal market.

shoulda let those houses and the banks fail. Too bad because now slow death waits or a quick collapse. Gotta keep printing or the gold boys will take over. Now gold is subject to confiscation because of inept educators basically running your schools. Depression first then war, that is what your facing. Internal violence will happen once the money disappears. (Assetts transferred out of country) Not a good sign do i see anywhere. YOU?

>>It would be nice to see a court void those pensions.

Dude, your compassion is overwhelming. Btw, retired state workers collecting a pension aren’t the problem.

They are a HUGE part of the problem.

What about retired public employees who spent their entire lives paying into the pension system? Are you going to void their pensions too? If so, I’m sure they’d like all that money back (about 30-35 years’ worth) with interest. And I’d think they’d have every right to it.

Receiving benefits that they were promised and what played a large part of their decision to work for the state is a huge part of tHe problem? If you want to advocate we need to restructure new state employee compensation for new hires moving forward that’s a different deal. But taking away benefits after someone has worked for them just isn’t right. Besides, without that compensation they’d likely become a drain on relief funds.

If you want to address the problem in all of it’s hugeness then advocate making the weathy elite and the big corporations they run pay their fair share. Roll back tax rates to Clinton or better yet Ike admins. We’d be solvent. Quick.

Goldhoarder – you do realize that this is reality on the private pension side. Company fails and the pension gets taken over by the PBGC. Everyone is guaranteed a pension but for the more highly compensated employees they may find it far below the level originally promised. A pension is regulated to make sure things don’t get too out of hand and fiduciaries have personal liability but at the end of the day a pension is an unsecured creditor of a private entity.

This is reality and although it’s sad not to get what was promised, it’s equally sad that our state/local governments have made unrealistic promises that they can’t keep. Also, resolution is not black/white – scale it back by age/time and it gets much better i.e. 100% to current pensioners and those >60, a bit less at various tiers below that until you get to something sustainable. Same thing can be done with Social Security. Yes, it’s still ripping off the youth but at least we are biting the bullet and sharing in this mess rather than rolling it forward and making it worse. Obviously new employees need something sustainable.

Bite the bullet and deal with it along with other difficult issues now. Procrastination has never made anything better and it has been obvious for a long-time that entitlement benefits in this country are the 800lbs gorilla that can’t be paid. Deal with it now and it’s easier on everyone.

I have been looking in the 650K range but happened upon a nice house in a nearby neighborhood that would work for me. The homes in 92123 go for 190 to 300 a sq. foot dependingon all the normal stuff, condition,location and so on and so forth.

Anyway, I bid on a house where according to comps for the exact type of house, it should sell for 450K if it had been completely redone. This house was not redone, it needed bathrooms, windows and the kitchen. The house was about 2000 sq. feet, and had about 1300sq feet of hardwood. The seller did a few things to spruce the house up but as usual made what they did do worse.

Anyway, the house got 11 offers! It turns out two were for all cash, mine and another person. To make a long story short, I was beat out by an offer that was 21K above ask (11K more than mine) and they accepted the house AS IS, no inspections! I had been given a chance to make my best offer, which I did but at the same time I am not nuts.

If buying a house during a housing crash is like this, then I can’t wait for the recovery!

Martin- We’re a cash and close as well.Thanks you for sharing your journey, as it is a good data point for us.There sure are a lot of stupid buyers out there ruining it for the rest of us.

I love this analysis as far as it goes, but there is one CRUCIAL step missing. The individual contemplating home purchase must take the grand total monthly nut, in the doctor’s case $3071, and determine(1) exactly how much of that is tax deductable for them, and (2) what isthe net, bottomline effect of that deductability.

Maybe this is an obvious point but the actual damage to a family budget from a 3071 monthly payment heavily depends on (1) and (2), which are obviously unique to each state and unique to the annual incomes of each family. I have been trying to convince my wife about this point for a long time but she just keeps saying “buy something becasue we are getting killed on taxes” and get angry. I keep getting quiter and sweeter and just say “absolutely, lets buy, but first let’s run the numbers to see whether we are getting a net savings from buying or not.” Personally, and all other things being equal (that is, not needing a bigger or better house than the one we are renting), I dont care whether I spend more in taxes or not; my concern is how to have the most money in my pocket each year after my taxes are paid in full and my expenses are covered.

Tax deduction saving is around $4,500 annually based on 25% tax rate.

http://www.bankrate.com/calculators/mortgages/loan-tax-deduction-calculator.aspx

That’s about what I get back for deducting 1 child, including the $1k child credit.

So if I get a home, will the interest deduction net me another $4k?

Wrong loan amount. Should be around $6,500 instead of $4,500.

As everyone knows, it is hard to get a loan to buy a home. So, right now, there is a town home, in Los Angeles County for 75k. It is near the freeways, and in a gated communities. So it does not make sense to buy it? I know, that the condo could easily rent for 1300 a month. The HOA’s are 199 a month. I do not know about the rest.

Maybe there are so many short sales b/c CA Attorney General Kamala Harris told Fannie & Freddie to stop all foreclosures last month. One recent study revealed that 84% of San Francisco’s mortgages had major paperwork errors (i.e. “robo-signing”). So banks are probably going around this little roadblock via “bank approved SS’s”. Remember, SF RE is one of the most expensive in all of CA, and the banks need their money one way or another.

Doctor didn’t include mandated flood insurance policies on FHA loans residing in known federal flood zone areas. (BTW, “Homeowner’s Policies” DO NOT cover hurricane floods, rain, tsunami, sewer, etc.. water damage.) The national average flood claim is about $26k. And the avg. premium is about $600/year, so add at least $50/month to that ever growing nut. And remember, typical flood policy limits are $250k for the structure & $100k for the contents. So think about all the “rebuilding costs” before you buy that “dream home”.

Also, 88% of CA homeowners do not have earthquake insurance. Mainly b/c they think the deductible is too high. Typical policies cost b/w $400 – $1200 /yr with a 10% deductible. So add another $34 – $100 per month to the cancerous homeownership nut as well. Because just remember, with no earthquake insurance policy, your deductible will be 100%, and you are still required to pay your mortgage, ouch!

Where is this supposed recovery in housing? We live on a TPC golf course in NC which is supposedly a top 5 area to live in the whole country. We bought 10 years ago and probably could only sell for what we paid a decade ago. Who is buying all these new homes being built by Toll Brothers and Lennar?

Bo, I don’t think NC has the magical hopium in the water that is standard here in CA. As you are reading on this blog: small, old shitboxes in average areas are still going for 500K sometimes with 10 offers bidding up the price. Housing should track inflation in a normal world and it should be a seen as a place to live in. Here in CA, that decaying pile of lumber and drywall called a house has made many people wealthy beyond their wildest dreams. I guess there are shortage of people who want to keep that dream alive. I’ll give myself two more years here and if things don’t straighten out, I’m heading for greener (or should I say browner) pastures. There is just no point of fighting all these people who all want the same thing and many of these people will end up in complete and total financial ruin!

Overpaid innumerate and wholly credulous doofuses.

AKA Boobus Americanus.

Dr Bubble or any helper,

Anyone know why the Bankers, or Bill Gross would be so kind pushing to Mortgage Debt Forgiveness than Forbearance? The former is to reduce the mortgage principal to match current home value, while the latter is just reduce monthly payment but the loan amount remain the same.

I don’t think bankers and Obama are soooo loving that they decide to screw the rest of prudent citizens by just helping a few reckless. Wonder if there were strings attached behind principal reduction. Thanks.

Because it will boost the value of the Freddie/Fannie bonds PIMCO and everyone else hold, plus it just makes Obummer look all warm and fuzzy to the entitlement crowd that elects him…

Papa you actually sound like a nice guy but can you please drop the faux news emotional talking points and just talk common sense. It really gets old.

Egads!

http://www.redfin.com/CA/South-Pasadena/1618-Camden-Pkwy-91030/home/7008685

They wont get that for it. According to the stats that say that area is getting 98% of list prices around $500/sq ft, I put this one at $1.4 million (small bonus for a slightly larger lot)

According to redfin, sold for 542K in 1997. I’m sure there was some updating since then, CMON MAN THIS ISN’T 2005 ANYMORE!

Here’s another one in town. Crazytown prices still.

http://www.redfin.com/CA/South-Pasadena/1909-Oxley-St-91030/home/7006423

Anyone have experience with buying TLC-needing homes and fixing them up?

Only I ask is that I came across a house that sold as a foreclosure in September 2011 for 256k and now it’s selling for 469k.

http://www.redfin.com/CA/Los-Angeles/2414-S-Corning-St-90034/home/6786126

Did the seller really put 150k into the house to fix it up?

From the pictures, it looks like a recent remodel so they probably did put some money into it. Did you happen to see where the house is located, literally a stone’s throw from the 10 Freeway. Not only NO, HELL NO!

I doubt that. They (the seasoned ones) normally don’t pay no more than 1/4 the difference between the asking price and the buying price to remodel any home. Most of the time less because they also have connections to having remodel at price that you can only beat if you do it yourself. I would guess in this case around 25K-30K max and the furniture is there only for the show.

This is a non-emotional statement, it is based purely on a business and taxpayer benefit…

I understand the state pension system. I also understand people can’t fathom not getting it, regardless of a “promise” or not. But the bottom line is that the Gov made promises they can’t keep, and Greece is what happens when you do that. They told the citizens of Greece “sorry” and it’s coming to CA too whether you like it or not.

No it’s not the nicest thing in the world to do, but if I were in charge I would send out notices saying “Look, we’re sorry, we screwed up and now the money simply doesn’t exist. There is no money to pay you, we can not borrow it either, it is simply null and void. It was a great idea but we failed.”

This is a free country and people forget freedom also means free to fail. They want a nanny state. On top of the pensions, I would cut all benefits to any illegal, including food stamps, ridiculous in-state tuition benefits, and access to health care even in an emergency. This country and state need serious shaping up and it’s time to toughen up the herd, like people were after WW2. Todays citizens are a disgrace. Don’t like it? Don’t come here. It would also make for good population control.

If I were able to do this, I guarantee you the economy in 5 years would have a boom bigger than the world has ever seen. A new, tougher, slimmer, more ingenuous population forced to live right and succeed. No more bleeding hearts. Don’t you want a strong America again???

Sounds to me that you would create a world with a lot of starving and sick and homeless elders and immiigrants.

what would be wrong with that. They would stop coming!

The problem with your prediction is CA can’t file bankruptcy like Greece could.

And you are about to have kids? Scary.

Why not? Do you honestly think the Gov is going to find a solution to fund all it’s promises? You’re talking over $100 Trillion, for the states and Fed combined. The worlds entire GDP is not that high.

Anybody, and I mean anybody that is under 40 years of age today is insane if they think life is going to continue this status quo until we are in our 70’s (or later) and die.

In the last 6 months alone Obama seized control of the food with the NDRPA and all law enforcement including now using our own military on the streets with the NDAA. Clearly they think or know something is brewing. More taxation, socialism, and decreased standard of living is now inevitable. The most likely way out is continued massive money printing and inflation. That $4k/mo pension ain’t gonna go as far with $10 bread loaves. If a corporation can file BK, and the Gov takes it over with a much smaller amount, why can’t the Gov admit it can’t pay what it promised, and make it a smaller amount. Same thing.

Our neighbor bought his townhome in Brentwood for $1.295k, stopped paying his mortgage about two years ago (though he takes exotic trips and bought a new BMW).

The property was listed on the MLS as a short sale with an unknown real estate agent(probably a relative) who has tied this property up in escrow for two years, we called to inquire, she said it was not available The owner just moved out, his fathers company just happened to buy it for $595k. This is our real estate market in Sourthern California, corrupt.

Ive been looking at thousands of less than 25,000 dollar houses, and thinking that when things turn around, having 500,000 in a baqnk account earning 45,000 a year, makes more sense than gambling on another sucker willing to pay my keep and house profit….!!!!!!!!!!!!

I’m in escrow in Belmont Shore area of Long Beach on a short sale. My wait time was just about 6 weeks, that due to the bank in this case was a small credit union. My total nut on this one bedroom condo with private detached garage will be 1050.00 per month. This is 200 less than rent for a similar unit in the area. It makes sense for me, after a year I have options to run it as a rental and buy again if prices decline.

I will say that in my mind SS’s are a nasty beast for the buyer. You have no power of negotiation and cant go at the seller after inspections for repair or price adjustments. I tried for a SS house just before this one, as was stated, the listing agent was the only way to get the ball rolling, he had talked the bank into listing the house low than played good cop to get my offer increased, then played the fool when illegal, non permitted additions were noted by appraisal and cross checked to city records. It was months, I pulled out and then sued for my cost, inspections and appraisal, surprised and astonished owner writes a fast check to stay out of court. Note, Putting 40k down payment gets the monthly payment, but in this economy I cant get a return on my savings past 1% right, so inflation is eating my savings alive and I will enjoy living there,

I would say buy conventional, have negotiating power and recourse/peace of mind.

Leave a Reply to Latesummer2009