Empire in the California Sun – Home prices in California rose 109 percent from 2001 to 2006 and have fallen 37 percent since then reaching post bubble lows. California following Tokyo housing correction trend. 50 year trend between fixed mortgage rates and new home sales broken.

The California housing market is mired in problems. Listening to pundits and those fixated on the arguments used during the bubble, you would think that California never faced any sort of correction. In fact, you would think that the biggest housing bubble bursting would have only minute ramifications on the long-term trends of the market. California was at the heart of the toxic mortgage craze and many odd mortgages like the option ARMs were founded right here in Southern California. There is absolutely no reason to buy in today’s market especially in areas that are still inflated. But as we have learned buying for many is emotional rather than economic. Only this time, people have to document their income to enter into a foolish bet. Even last year, with tax credits and other gimmicks people started betting that it was a solid bottom instead of a sophisticated head fake. Our argument was that the Federal Reserve and other juicy coupons like tax credits suckered enough people off the fence to give the market a little breather. The data is now out and it is clear that the market was simply operating on fumes from these fence sitters.

Did the bounce of 2010 hold?

The summer of 2010 seemed to be a bottom if you followed the pundits. Prices only stabilized because of a few factors:

-1. Federal Reserve pushing mortgage rates lower

-2. Enough people on the fence decided to jump back in

-3. Tax gimmicks

Even with all this rocket fuel the market has burned out:

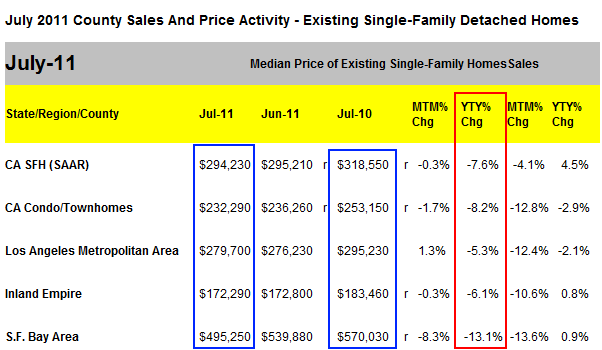

Source:Â CAR

Overall California home prices based on the California Association of Realtors data are now down over 7 percent from last summer. Condos and townhomes are down over 8 percent. In more inflated markets like the Bay Area home prices are down 13 percent from last year. What this means is that for the tens of thousands who bought last summer with FHA insured loans they are now part of the ever growing class of underwater homeowners. Many of these people bought saying, “I don’t mind if home prices drop because I want to setup roots for my family.â€Â But deep down many of these people were itching to see bubble prices come again! I had a couple of people like this e-mail me a few months later in the summer of 2010 talking about the “appreciation†their home gathered in a few short months. Of course, that kind of discussion is now over in the summer of 2011 as that “equity†has evaporated into thin air. Just because toxic mortgages are now a sideshow doesn’t mean people won’t overpay for a home.

I understand the psychology behind buying a home. But what I don’t understand is that there is little evidence for buying right now based on economic fundamentals. If you want to buy because you are being pressured or need the status of being a homeowner, go for it. Yet trying to argue that prices are a bargain right now is wishful thinking. I’ve argued that if household incomes were rising and the California underemployment rate weren’t over 23 percent then we can make a reasonable argument to purchase. Yet over this time incomes have shrank and unemployment is sky high. What the unemployment stats don’t show is the number of people who left high paying jobs in the bubble housing market making six-figures, for example pushing toxic mortgages, are now working full-time in jobs paying much less. Either way, the trend in home prices is rather clear:

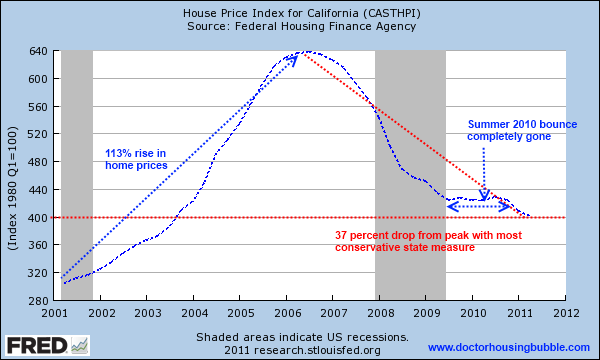

The conservative HPI measure registered a stunning 109 percent rise in home prices for California from 2001 to 2006. In five years home prices soared by a whopping 109 percent with no correlation in rising household incomes. There is absolutely no other explanation than it being a bubble. Yet some want to justify this rise and purchase today even with residual bubble prices permeating many markets in California. According to the data in the chart above California home prices are now down 37 percent from the peak in 2006 taking home prices back to levels last seen in 2003. Keep in mind in 2003 the unemployment rate was in the six percent range and the state budget was not experiencing the trauma it is facing today. What justification is there today for buying a home in inflated markets? That mortgage rates are at historical lows? We had lower rates with 1.25 percent teaser mortgages but how long can that last? Not long because it is unsustainable. Even if we look at new home sales with historical mortgage rates we realize we are in a different market today:

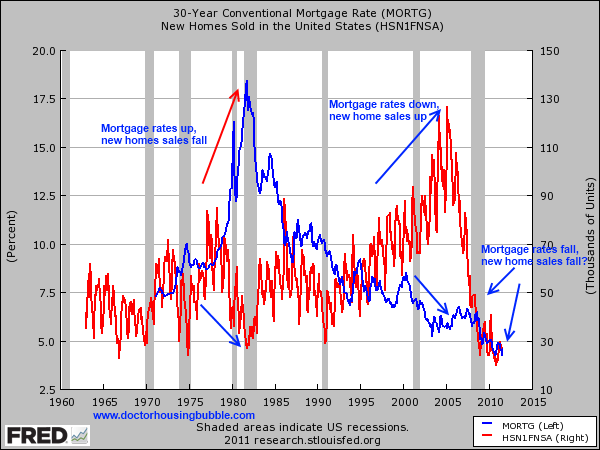

The pattern is typical in that you see mortgage rates rise and new home sales fall or vice versa. This pattern has held up since the 1960s. Of course, this pattern has been broken today. What you see is 30 year fixed rate mortgages hitting record lows yet new home sales are also at record lows. Why? Because people are broke or have become poorer than even a decade ago! Home prices should be a function largely of the household income of Americans. We are in new territory and given the big events around the global markets buying today is a big bet. You also have the seasonal factors that fall and winter are typically the slower selling months.

Japan revisited

There are many differences and similarities with the Japanese post-real estate bust market. What no one can mistake is the price changes after both bubbles burst:

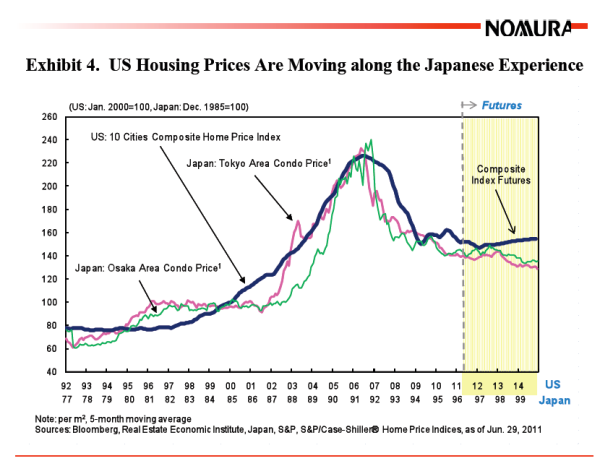

Source:Â Richard Koo, Nomura

We are looking at Japanese home prices from 1977 to 1999 versus U.S. home prices between 1992 up to 2014 with futures included. Those who deny this pattern are flat out delusional and are simply choosing to see what they want. The data does not back up a miracle rise in home prices. Keep in mind this is data for the 10 cities of the Case-Shiller Index and if we look at some metro areas in California the bubble is still going on and will pop like it did in Tokyo. There is little reason to buy in California just like there was little reason to buy in the summer of 2010. Many of those who bought only one year ago are now fully underwater. They should be comfortable in the home they purchased because it is unlikely that home prices will be moving up for years to come.

Those that argue that inflation will make home prices more expensive forget the fact that unless we see wage inflation this is not going to happen. Where is the evidence that households in California are getting richer? P.T. Barnum, the American showman, once said “there’s a sucker born every minute†and this was said over a century ago. Some things rarely change. What many also fail to realize is that interest rates can only remain this low as long as the world has faith in U.S. Treasuries and is willing to accept incredibly low rates. This can go on for a few years but we are already scraping the bottom of the barrel here.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Empire in the California Sun – Home prices in California rose 109 percent from 2001 to 2006 and have fallen 37 percent since then reaching post bubble lows. California following Tokyo housing correction trend. 50 year trend between fixed mortgage rates and new home sales broken.”

Those that argue that inflation will make home prices more expensive forget the fact that unless we see wage inflation this is not going to happen.

Chairsatan Bernank and his puppets in DC have tried and tried to put Humpty back together again (inflation of wages), but that dog just don’t hunt anymore.

And the electorate think ol’ Guv Moonbeam is gonna help things along out there on the Left Coast? ROFLMAO

The left OR the right will not correct things. Both are sold out, it’s just to WHAT interests. The right just happens to harbor hate and loss of God given freedoms. The left just wants to raid everyone’s pocket book.

I’d rather be broke and free, then have 10,000 billionaires, 320,000,000 indebted corporate slaves, and conservative ideals mandated into law. These are the same people who fear Sharia law, but want to make “christian” laws. LOL!

The choice in 2012 is probably going to be between a completely ineffective leader and a guy who thinks science is a lie. Maybe 2012 really is going to be the end of civilization. Everyone should just stop paying their mortgages now and go on a spending spree since it takes 2 years to foreclose you won’t have to worry about it.

Right, because history has shown that hyperinflation never happened unless there were wage increases. Full of shit much?

“Right, because history has shown that hyperinflation never happened unless there were wage increases. Full of shit much?”

I don’t see any mention of hyperinflation here, and it looks like the bankster/politeers inability to inflate wages is a given at this point – Pushing on a string indeed!

http://news.yahoo.com/census-us-poverty-rate-swells-nearly-1-6-142639972.html

“The ranks of America’s poor swelled to almost 1 in 6 people last year, reaching a new high as long-term unemployment left millions of Americans struggling and out of work. ”

“The median — or midpoint — household income was $49,445, down 2.3 percent from 2009.”

Should be pretty obvious who is full of it here…lol!

I don’t blame the left or the right for California’s problems. I don’t even blame our elected officials or the bureaucrats or the unions. I think the blame falls squarely at the feet of the 1978 electorate, California’s absurdly easy constitutional amendment process and of course to no small degree, Howard Jarvis. We get to live la vida loca due to a bunch of idiots who are mostly not here anymore, or are dead. Thanks guys!

Uninformed bashing from the east is not helpful.

Yes, definitely tragic that California homeowners did not have to face a tax bubble to go along with the fed-orchestrated housing bubble. And now that prices are falling, the state could have just jacked up the rates to keep up the revenue. Bad news all around.

The shortfall on property taxes is made up for by higher state income taxes today. Are you enjoying those? I’m not. The problem with income tax from a public policy standpoint is that tax receipts rocket up and down with the stock market. The government essentially owns something like a call on all stock held. In good times, it is worth a lot and in bad times, it is worth nothing. Income taxes aren’t a good stable way to raise revenue. Property taxes are. Government needs to be a stabilizing force for the economy not something that flings it wildly from one extreme to another.

I’m sorry you seem to feel that it would be terrible if California had had huge property tax runup in the property bubble. However it would have done some good. A bunch of people would have sold their homes, which would have helped keep the bubble from overheating. However, I don’t think it would have come to that. Tax rates probably would have been lowered to fend off the imminent tax revolt. The ratchet effect of prop 13 means that nether can tax rates be raised or lowered to adjust for economic reality.

Keep in mind that the real estate bubble was FAR from normal. It was a once in a century event.

Real estate is in a perfect storm now. Shadow inventory will grow as the prices head further south. More people will stop paying their mortgages. Unemployment is growing as the population is aging. There’s not one thing about this market that’s positive.

Regarding wage inflation, did you all catch this in President Obama’s jobs speech?

“Pass this jobs bill, and starting tomorrow, small businesses will get a tax cut if they hire new workers or raise workers’ wages.”

So let me get this straight. He wants taxpayers to subsidize small businesses so that employees (i.e. taxpayers) can get higher wages? I doubt that this type of wage inflation will be enough to justify the bubble prices we are still seeing in prime areas of So Cal.

He’s just trying to kick some employers sitting on the fence into action. I’m sure greed will sway a few. Alas, it is probably a while before anyone who has been out of work for a while will be contemplating buying a home. Signing up for a large mortgage requires a certain complacency about employment risk, that these folks will have rightly shed. So, we’d be looking at secondary effects as perhaps business owners see an uptick in their business due to these revived consumers and decide to buy a house.

Home prices also reflect purchases by counterfeiters and their ‘associates’. Money is no object for them as there is no effort involved. If you are talking about prices based on purchases by actual working people producing real goods and services, then yes, they will drop.

I have always been a renter, but came into a little money a few years ago and have been looking for a house in the La Crescenta/Montrose area since then. Everything in our price range (we’re approved up to $450K, but trying to stay under $350- $375K) is a fixer-upper or tiny. All our friends keep pushing us to buy, but common sense told me it was a bad idea – and this blog has helped keep me focused – thanks!!

Just curious, though, since that area has excellent schools, will prices become more realistic in the next few years? And if they do, how can we compete as first-time homebuyers (hope to have 15% – 20% down) with these cash buyers? I just can’t see how we’ll EVER be able to buy a home here – and we would like to, since we’re never planning on moving – we have kids, and like the schools and the area… Sorry if any of this question is ignorant, but real estate has always been confusing to me…

Don’t buy a house that doesn’t work for you just to buy a house. It’s not worth it. I know many people who bought in last 10 years. Overpriced, tiny, oddly shaped houses. None of them are happy. Don’t let people pressure you into buying. Prices are still way too high. Think about it like this: You really want an ice cream cone, so you go to the store and all they have is the one flavor you don’t like, half the normal size and twice the normal price. Do you buy or say f-it?

You’re right of course – I’ve been saying “f-it” to the CA housing prices for years! 🙂

It doesn’t sound like you’re too ignorant. I’d say take your time to buy, and during that time learn everything you can about real estate. There’s plenty of people out there who would love to take advantage of your low real estate IQ, and gladly help you part with that 20% down as quick as possible.

I’m a bit confused as to why that area has home prices like it does (Trees? Mountain side?). The location is a bit out there, and the surrounding areas aren’t appealing at all. Due to it’s location I would have to think home prices are going to be coming down in the upcoming years.

Thanks, pBamma! The only reasons I can think of for the high prices in La Crescenta & Montrose is: safe neighborhoods and excellent schools. The architecture is nothing to write home about – it’s the typical suburban L.A. poor urban planning. But it’s an appealing are to raise kids, and the only place I can think of where all the public schools are blue ribbon quality.

Ah yes. Well my wife and I are DINKs (and intend to stay that way) so we don’t really take schools into consideration. A nice neighborhood on the other had is sometimes hard to come by here in LA… especially in our budget which is currently a bit lower, but similar to yours.

When we first started looking in December, we had nothing in the bank, but an ideal rent free living situation. We had made a low ball emotional bid on a stubborn regular sale. What was nice is that we lost the bid and had gone through the emotional process which helped us not get too attached to the next place.

What’s nice about this blog is it helps point out basic trends and helps you to keep a lid on your emotions. We’ve probably seen around 30 homes with our agent, and 50 open houses. Learning a ton about homes, what we like, what we hate. I’ve been tracking the asking prices and sales of all of these homes and can see the downward trend live. We’ve put in 4 offers, and I’m glad to have lost them all to gain the learning experience.

We’ve since stopped looking at homes because it is really easy for a home to get mixed up in your emotions. Plus, plain and simple, we should wait as prices will at best very likely stay flat., and more importantly our savings are growing at 3k per month with our living situation. What is really nice is that our more desirable areas are coming down into our budget as our savings go up.

Take your time, learn as much as you can, get the emotions in check, see a ton of homes, get a good pulse of your market. This economy isn’t getting better for awhile, the U.S. is still in two wars. The banks have a ton of inventory, and the baby boomers are retiring.

@Katy: Ignore the all cash buyers; housing is due for another leg downwards. Jobs and income aren’t coming back any time soon, and the Feds aren’t able to turn things around (as we’ve well seen). The important thing is to stay out of debt right now, and make certain that your savings are safe.

You may have noticed what Europe is going through right now. That will eventually be repeated here; there is no other alternative.

Time is on your side; use it wisely.

Don’t worry about that Katy. As a first time homebuyer, you don’t have a house to sell, which means you won’t have to place any contingencies on your offer. Sellers will like that. They will also like the cute pictures of your kids and will like imagining they the home where they raised their family will have children again. (Think Woody and Buzz in Toy Story 3 looking for a new child to love them all over again.)

Just get your finances in order so you can really afford to buy the house you want, rather than the shack you can afford. That may mean you have to save another few years. Be patient. In the mean time, the carrying cost of rent is lower than owning most likely. If you have to move, you won’t have a house to sell. Enjoy it!

Outstanding post; now we can be knowledgeably genuinely spooked on our prospects, remember California is one of the world’s largest economies. One adjustment never made–ok, rarely–by housing optimists making up charts on housing wealth, is that to sell those houses covered by a certain statistic, there is usually about a 7% cost of sale, taxes, and in this market, probably fix-up for non-distressed owners which can be sizeable for many houses. Thus the losses of equity and profit on homes extend much deeper net. The value of an asset is its net fair market value, not its gross value.

That said, remember that there are twenty million second homes in the US and many of those are in California; the cooling of the speculative market in resort or country second homes and the lack of buyers who want to buy in the marginal areas v. sellers who want out of what is now a depreciating and expensive asset, is not a small factor in California. The charts seem to focus on first home buyers, since everyone has to live somewhere. Second home buyers don’t need that second home and many second homes were bought, built, and maintained due to their astronomical bubbling price leaps. In fact, the construction industry’s loss of just the second home new market has been a major force downward to the economy in this recession. Without a lot of wealth in the first home as equity to be borrowed and leveraged as a second home down payment, selling many of those millions of second homes is now hard and getting much worse fast, and second home buyers are very allergic to buying in a sinking market.

“with tax credits and other gimmicks people started betting that it was a solid bottom instead of a sophisticated head fake…with no correlation in rising household incomes…Those who deny this pattern are flat out delusional and are simply choosing to see what they want…There is little reason to buy in California just like there was little reason to buy in the summer of 2010. Many of those who bought only one year ago are now fully underwater. They should be comfortable in the home they purchased because it is unlikely that home prices will be moving up for years to come.

Those that argue that inflation will make home prices more expensive forget the fact that unless we see wage inflation this is not going to happen.”

Thank you Dr. HB for keeping the story straight all these years. HEAD FAKE AND A SUCKER PUNCH BANKSTER RETURD CRONY STYLE.

Unless you are all cash and connected, I don’t know you can get into a residential property without it becoming a falling knife. Any cash buyers out there dealing with distressed property managers at banks? Or are the banks all outsourcing the management and trickle sales of their balance sheet pigs?

Exhibit 4: US Housing Prices Are Moving Along the Japanese Experience….

I like that title. So what does that mean for the US housing market? Is it going to be a massive tsunami, or a meltdown like Fukushima? I’ll bet on a Fukushima.

By the way – I don’t agree with your main title which states that housing prices have reached “post bubble lows.” Sure, maybe in some Inland Empire town in the middle of the desert, but not in most California towns. I live in a town on the coast, and houses are still way, way, way, way, way too high. Post bubble lows? Give me a break!

miso sorry-“Post bubble lows? Give me a break!”

I think what he meant by that is that home prices fell after putting in a bubble top in 2007. Then, after falling for three years, they bounced a tad in 2010 due to gimmicks like the tax credit.

Now, home prices are dropping again, and have taken out the 2010 lows, and are printing fresh lows for the post-2007 period.

If you look at the biggest stock market bubble in American history, the NASDAQ tech stock bubble that peaked in March 2000, you will see that is mirroring the multi-decade collapse of the Japanese Nikkei index. The Nikkei peaked on the last business day of 1989, at about 39,000 points, and now, 22 years later, is trading at 8,535, about 22% of peak value, BEFORE figuring in losses due to 22 years of inflation.

It is too soon to tell, but our housing price collapse would figure to track the Japanese housing price collapse.

The fed is going to have its hands full generating enough inflation to inflate away credit card debt. But I doubt they have the political cover to create a Weimar type inflationary tsunami needed to inflate housing again.

When I see car prices dropping, fine cuisine establishments trimming and sports merchandising decreasing then maybe, only maybe, will I give up temporarily on real estate. I don’t presently see this happening. What I do see happening is safe haven investing, or dare I say hiding, in gold, bonds and real estate. Government has a hard time of depreciating land.

Further to the above, there is an editorial today at 321gold.com, by Steve Saville, that discusses the manner in which the NASDAQ Index is tracking the Nikkei, in terms of post bubble collapse.

http://www.321gold.com/editorials/saville/saville091311.html

Miso – When the Dr. says “Post Bubble Lows”, he means to this point in time, not that he believes the market has hit bottom. From the Dr.’sarticles it’s obvious he doesn’t believe the market is anywhere close to the bottom in many locations.

Main question is: How much more prices will decline in So. Cal. ?

My guess is that we will see 15-20% drop.

Since 2000, I’ve been saying 50% from Peak. We aint there YET!!

sounds about right

“Those that argue that inflation will make home prices more expensive forget the fact that unless we see wage inflation this is not going to happen.”

Regardless of inflation, credit is contracting, and therefore credit-based markets (like real estate) will struggle to maintain prices

I don’t see how credit is really “contracting” in the mortgage market. If you can show the income your good to go FHA. That’s why I think CA is half in/half out of the bubble. IE and lower income/non-prime areas it’s cheaper to own than rent even with a pittance of a down payment. Most of LA County and other primes (The OC, Bay Area) still out of whack with incomes.

If a person has stable income buying in the sub-prime areas isn’t a bad deal now. You get the tax credits and at worst you see another 5-10% drop off of already cratered prices. An ensuing rise in interest rates may not even out with further price declines. The poorest areas are extremely close to bottom.

@Charlie:

If you had seen the recent reports on consumer credit, you would notice that general Credit is decreasing, not increasing. While the MSM headlines said it was increasing, the only real increases were in Student loans and Auto loans. The latter being due to the return of subprime financing for cars.

We discussed this in the comments section a couple of articles ago, and the Doctor has had articles about Student loans in the past.

If you could back up your impression with actual numbers, that would be one thing. But you can’t; and I welcome you to prove me wrong.

Oh, and no, we’re not close to the bottom yet. We haven’t solved the debt crisis; and one can’t solve a debt problem with more debt.

the outlying “poorer” areas have no jobs, and banking on keeping one out there if you do happen to have one is a crapshoot, that’s why sales have halted out there too.

I would argue that credit will almost instantly contract on Oct 1st, when jumbo loans drop from 729K to 625K, and that’s just for the larger markets. The jumbo loan limit in areas like Ventura will drop from 729K to just below 600K. That’s over 100K in credit lost for the high end markets.

Also, So Cal had the worst July sales month for homes in 4 years, where FHA loans took up around 31~32% of all loans, down from 34~35% in the past 2 years (ref: http://dqnews.com/Articles/2011/News/California/Southern-CA/RRSCA110815.aspx ). When there are less homes sold, and a smaller portion of those loans originating from the FHA, it’s reasonable to say that simply qualifying for FHA is poor evidence of credit expansion.

You could also look up the general credit stats on the fed website: http://www.federalreserve.gov/releases/g19/Current/

You’ll notice overall credit has gone up very slightly since 06, but government credit (via student loans) has quadrupled since then to the tune of almost +300B USD. In technical terms, you could say that credit has expanded, but in practical terms, it’s pretty much the opposite.

We’re close to an education peak (if not there already) as more students are defaulting on their payments as well. Given that, these same students will probably not be able to qualify for other types of non-revolving debt (i.e. cars, homes, etc), and as home prices keep slipping, there’s no home equity to support further economic activity (loans to support small business expenses/start-ups, 2nd homes, etc). As a result, whether or not the banks are well capitalized (which I’m convinced they’re not), there’s just too little breathing room for most American’s to acquire greater access to debt.

Case in point, credit is still contracting and affecting home prices

“I don’t see how credit is really “contracting†in the mortgage market.”

C’mon Charlie! How short our memories really are. Access to mortgage credit in ’11 versus ’06, is there really a comparison? The American government is the only true source of easy credit via FHA left so I agree it doesnt take MUCH more than a pulse to qualify for an FHA loan but as we can see with the ceiling dropping to the $600k’s for FHA the cracks in the system are showing and I don’t see how the feds can continue to provide credit at the rate they have. And remember it is a thousand times harder to qualify for a loan these days than it did in ’06 when you didn’t even need documents proving who you were to get a loan. Ofcourse mortgage credit is contracting and I believe will continue to do so until we get back to 20 percent down for sound, creditworthy buyers.

“Number of defaults on student loans jumps”

http://www.msnbc.msn.com/id/44488514/ns/business-stocks_and_economy/

This won’t be helping.

The “Native Californian” speaks through his “wrong orifice” again:

Newsboy:

“And the electorate think ol’ Guv Moonbeam is gonna help things along out there on the Left Coast? ROFLMAO”

Yeah, those suckers…they still recall balanced budgets and tax rebates from excess revenue…the idiots..hahahahahah ROFLMAO!!!!!”

And Swiller:

“The left just wants to raid everyone’s pocket book.”

Yeah, sure they do. Because “the Right” has demonstrated such a deft handling of the economy, right?? And yes, Californians with experience recall Reagan, that “Leftist” tripling our states taxes before moving to D.C. and quadrupling our Payroll taxes. While running up more national debt that all the presidents before him…all of them.

Meanwhile, Obama and Bush go golfing and laugh their asses off at fools like you two.

The chart isn’t lying, but I wonder exactly what the Futures market is seeing when they see a rise in housing prices in early 2012? Their crystal ball is seeing something mine isn’t seeing.

A lot of GOPhers and DemoRATs in the USofA these days, bought almost -0- AMERICANS…

Then again, I don’t expect you to have a clue about what I’m saying, even though I know Newsboy knows EXACTLY about which I speak.

IMHO, the best use of Klownifornia would be to sell it to the PRC, at least then it would have a positive contribution to make!

Then why are you wasting your time on a CA housing blog? Do you really have nothing better to do ?

DHB wrote:

> The summer of 2010 seemed to be a bottom if you followed the pundits.

>Â Prices only stabilized because of a few factors:

When I see the plot, what I am seeing is the end of option ARM resets, not these other things. Recall the infamous Credit Suisse plot of when option ARMs come due. That is expected to Peter out in 2011. However many came due prematurely because of negative amortization limits in the contract.

Have my banking and checking at BofA. Wondering if it’s safe, even with FDIC. BofA is in a boatload of trouble with dog assets like the acquisition of Countrywide and Merrill. Stock price down 48%, dumping workers. how is BofA gonna manage it,s foreclosures? Are squatters going to get an extra year or two on top of the two they got now? Should I run to the local credit union with my cash?

I hope you do online banking cause those BoA lines aren’t going to be fun. I’m currently working on a bank switch now (real tired of the Wells Fargo constant sales pitches). I’ve sort of got a chip on my shoulder with the bailout deal. If I can’t vote and stop my taxes being given to the banks, I can sure as hell vote with my money and pull it out.

If their too big to fail, then lets make them smaller. Credit Unions!!!

@CC:

No BofA isn’t solvent. It hasn’t been for the past 2+ years. Neither have the other TBTF Banks. This is not news. Yes, your money is at risk if it’s over the FDIC limit. And the FDIC doesn’t have the funds to cover the TBTF bank deposits. The taxpayer may cover the FDIC insurance. Or not. It really depends on the timing.

Anyone not using a local Bank or Credit Union is just shooting themselves in the foot, and costing themselves money. Sort of like buying at Walmart, where its screw your community so that you can save yourself a few pennies.

So yes, you should move your money out of BofA IMO; and a local Credit Union is best. But not all CUs are the same. Here’s the best resource on how to find a good one:

http://banktracker.investigativereportingworkshop.org/credit-unions/

What you want is a CU with a Troubled Asset Ration well below the median. Those with high TAR values will probably be in trouble and should be avoided, IMO.

Good luck.

Don’t Local CU’s just deposit their money at TBTF banks? Even when only pulling $3K out of mine, i have to give them 24Hr notice, and then I was given a check to go across town to a bigger bank to make my withdrawl.

@Surfaddict: I believe it depends. They hold it either at the Fed, or in accounts that can be passed along to the Fed. And in vault cash of course. In the case of a Bank failure, those deposits should still be there, and not have been gambled with. For example, during the Great Depression, about 35% of the Banks failed, while very, very few CUs did.

I would expect most of the deposits to have been loaned out though, as with Banks. The question is how good the loans are; and the CUs tend to be more in touch with the better loans to its members and community. The Banks, and especially the big Banks, have been gambling wildly and irresponsibly, knowing full well that the US Government will bail them out.

These are generalizations though. Some CUs felt that they had to give out risky loans in order to compete with the Banks. Their concern is very valid, as the big Banks want to eliminate all competition and own it all. They have been very successful at this, and the U.S. Government has been actively helping them drive out the competition, in exchange for the funding of Congressional campaigns.

Crony Capitalism at its worst, and is one of the reasons why the big Banks really all need to be eliminated, as they have well demonstrated that they are a threat to the well being of a functioning democratic society. There’s really no need whatsoever for a bank with over $100 Billion in assets. Normally a business gains due to efficiency in size. But it’s been demonstrated that financial institutions do not.

In any case, keep an eye on the Troubled Asset Ratio of your financial institution. It’s no guarantee, but it will stack the odds in your favour.

You guys are awesome thanks. I’m going to a Credit Union ASAP!

We got out of BofA last year. Crazy fees for using your debit cards were being discussed and sent out to customers giving them a heads up. So, my wife and I took all of our “cheese” and joined a credit union. I will never deal with the Too Big to Fail banks for the rest of my life. Then there is good ole Uncle Warren Buffett who gave BofA 5 billion and he’s getting a guaranteed 7% return yearly on his investment. With that said, it is clearly evident that the Fed Govt, Banks, and Heavy Hitters like Buffett et al are running the show. Expect further corrections in the So Cal markets and Nor Cal markets, there’s no other way around it. Jobs are scarce and money is tight right now and will be into the future for probably the next decade at the very least.

The State will tinker with property tax rates, especially when/if Jerry gets a second term. Jerry would like nothing more than to kill or modify Prop 13, which he opposed from the outset. And the odds are good that the Feds will tinker with the mortgage interest deduction, probably through means limitations, regardless of who wins the election in ’12. It’s just whispers now, but watch out in ’13 as the politicians come to these conclusions in their ‘ revenue enhancement ‘ search.

Neither event would be good for CA real estate…for reasons obvious to everyone but our government masters.

Since when do our government masters have any obligation to prop up CA real estate? I know they choose to do so in order to benefit the banks but …

They will only tweak the mortgage interest deduction for the RICH.. unless you want to see rioting like in GREECE…. Anyone making under $250K a year will not get their MID touched unless the sitting president never wants to work in Govt again for the rest of their lives.

> Anyone making under $250K a year will not get their MID touched unless the sitting

> president never wants to work in Govt again for the rest of their lives.

Usually sitting presidents don’t ever work in government again for the rest of their lives. They make millions on the lecture circuit and go to work for a charity or something else to keep themselves busy. There have been a few exceptions like John Quincey Adams.

I think the mortgage interest deduction could be gotten rid of if you nix it for all new mortgages and phase the older ones out slowly over the next 10-15 years. You aren’t paying much interest in the latter part of the loan term, so the deduction isn’t worth as much.

Besides, the MID is a trap. You only get to take the deduction if you have income. If you lose your job, you are paying the full interest.

Too many people believe that there is something that the state could do that would turn this whole thing around today. The fact of the matter is that there is nothing to do but stop being afraid to spend our money because of the economic state. If anything we should be spending more than we were before the crash. Also these are the people that the majority voted into office, if that many of you are upset with them exercise your constitutional rights and petition to have them removed.

Sorry, I have to disagree with you about spending. Spend more money? You might want to take a look at how well that’s worked out for Greece.

It’s pretty simple. You can’t solve a debt problem by piling on more debt.

The only thing that the Feds can do to get things moving again is to clear out the bad debt. Which means letting the big Banks fail. Spending more money just isn’t going to solve it, which anyone who has had to pay off a credit card can understand.

This will come. The markets are omnipotent, and not the Central Bankers. But it can go on for a while.

Jeff, most of these people would gladly vote for the same bozos again if there was an election today. This state is getting a well deserved, painful financial lesson. Things need to crash and burn before any meaninful recovery takes place.

The last graph showing the composite US housing prices against Japan is very interesting, but given that many areas of the country are down a lot more than California, does anyone know of a comparable graph which shows the cities themselves against the Japanese curve? I ( and I am sure others ) would be interested to see how far behind the curve California cities are since prices here are inching down at a much slower pace than other cities across the US.

“But what I don’t understand is that there is little evidence for buying right now based on economic fundamentals.”

I am trying to decide myself right now. I am fortunate to earn a high income in this economy, but am single and in the 33% tax bracket. My accountant advised me to buy a house so I have some tax deductions since I have very little deductions right now. I have to pay rent regardless, and soon it will have to be renting a house for personal reasons. So rent will not be cheap and could amount to $20K a year or more in the San Fernando Valley (right now I pay $10K/yr). I don’t know if I should wait longer or try to get a decent deal in the area I want? I figure if I don’t buy, I’ll still pay rent and more money to uncle Sam, and with lower interest rates it may be a wash in my case.

Leave a Reply