Short sale dynamics – short sales recorded the highest number of transactions in three years during the first part of 2012. What data do we have on short sales with second mortgages?

Short sales have played a big part in the current housing market. In the first quarter of 2012 there were over 133,000 short sales, the highest number in three years. This is an important alternative to foreclosure and a good portion of the distressed inventory pipeline is being washed out via this mechanism. Short sales in California are making up roughly 20 percent of the sales pool. An interesting point though is that 39 percent of homes that enter foreclosure have a second lien yet only 4 percent of short sales completed in the second quarter had a second mortgage according to RealtyTrac. Part of this has to do with the legal barriers of selling a home if there are two or more liens placed on the property. Short sales also contribute to the fall in foreclosure sales since many properties are exiting the market via the short sale mechanism.

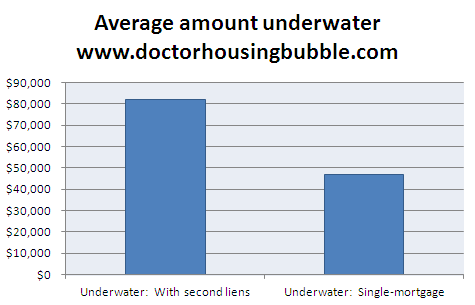

How deep are underwater homes with second mortgage?

Most of the 11 million underwater homeowners continue to pay their mortgage as agreed. Yet there is a big difference between someone that bought a home for $100,000 and is now valued at $90,000 and someone that bought a $500,000 home now valued at $200,000.  Markets like Las Vegas include homeowners that are incredibly underwater.

Let us take a look at the data on underwater homes between single-mortgage homes and those with second-liens:

The average negative equity for single-mortgage homes is $47,000 while that of homes with second-mortgages is up to $82,000. This is a significant figure. So what has occurred as the distressed pipeline moves lower, short sales with single-mortgages have been making up the bulk of the short sale action which as previously noted, is no small figure. Yet action on homes with second-liens continues to drag out. The more likely event for many of these homes is going to be through the foreclosure process which is roughly 15 percent more costly than via the short sale route.

Short sales in prime areas

Short sales are occurring in many areas including mid-tier locations like Irvine:

4 bedroom, 2 bathroom, 1,644 square feet, Single Family

This is a good example of what is going on with the mid-tier market. Here you have a home in a desirable mid-tier area but it is listed as a short sale. The ad reads:

“**Short Sale Subject to Lender Approval.** Single Story 4 Bedroom/2 Bath in the coveted area of College Park in Irvine. This is a fabulous location with a low HOA. This is a great opportunity to invest or live in Irvine. On quiet street within walking distance to Community Pool/Spa and Elementary School.â€

Yet if we look at sales history, we realize that some second lien activity is likely to have taken place:

The last recorded sale occurred in 2001 for $330,000 and it is currently listed at $575,000 as a short sale? Since tacking on second liens doesn’t pop up in sales data we don’t know how much debt is tagged onto this home but we can guess it is around $575,000 or higher since even at this current sales price it is listed as a short sale.

What is interesting is this home doesn’t seem to have a foreclosure filing. So you can probably see that banks are now more willing for homes to be sold via short sale even before the foreclosure process takes place. The interesting thing is just a few houses away you have a scheduled auction yet no where does the home appear outside of the foreclosure filing data.

Short sales are a much more common route to sell homes in this hot spring and summer:

Irvine:Â 638 MLS listings with 139 listed as short sales

Since JP Morgan, BofA, Citi-group, and Wells Fargo hold 48 percent of the $849 billion in second mortgages I’m sure we’ll continue to see short sales as a very popular method of selling underwater homes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

54 Responses to “Short sale dynamics – short sales recorded the highest number of transactions in three years during the first part of 2012. What data do we have on short sales with second mortgages?”

DHB – Great article and timing. In May (2012) we got discouraged and didn’t go the highest and best round on a short sale we loved, but boy it need work. We only needed to go up $5K and we would have won the bidding war as it turns out. The buyer walked and it is back on the market.We resubmitted the original price offer and wil go up more to get the house. At just has a 1st, but boy, i’ts a whopper.

Has anyone had experience with a short sale?

How far back of comps do they use?

How much did the price jump?

Will the crappy condition make them less greedy?

Is a good cash & 20 day escrow deal what the banks wants?

We bought an REO just over a year ago – not the same as a short, but there are some similarities. My advice – get a good real estate attorney to review all contracts, have your own seperate title work done (you’ll be asking them for a ‘Litigation Opinion’), and find your own inspector (and make sure he has experience, ask for sample reports).

Concerning the title work – do some research on the ‘clouded title’ problems out there.

While you may be dealing primarily with the owner, if our situation is indicative, once the bank gets involved it can get ugly.

Do not get over excited, you could get screwed really bad. We almost bought a home with a $275K unreconveyed mortgage on the books that the bank and title company colluded to hide. Our private title work uncovered this.

Find out why the other buyer walked.

Keilanders, you are soooo correct! We bought a place a couple of years ago that both the realtor AND title company said was “fine, no problems.” Unfortunately, we did not get their opinions in writing and we did not hire n attorney at that time. Huge mistake!

We were moving so we put the place up on the market only to find their were serious title problems that blocked the sale. The title company denied everything, the realtor “forgot” and after $89,000 in legal fees we were finally able to get the matter cleaned up. (BTW, title insurance told us they don;t cover those problems—-sounds like an HMO, eh?). We took a major loss. I would not buy at all right now until all the dust settles in the housing market. Good luck to any risk takers out there who want to gamble in this housing casino game.

Kielanders

Can’t thank you enough. Great advice and insight, as we thought if we went retail (MLS) clean title was a guarantee. Opps!

We found a home with the same unreconveyed mortgage issue going to auction last Tuesday. (We’re a cash & close, so we can go where the parasite filippers go.) I called our own title rep and she said caveat emptor on the home, which was a beauty. My heart shrink, but we passed. She said run, don’t walk.

On Monday, I’ll call her again and run this short sale house by her. She’s been spot on and even taught us about the nuances of Abstract Of Judgements and other “got ya” liens. We were planning on buying a Trustee Sale Guarantee policy. Talk about carveouts, but it is better than nothing.It’s 3X’s the amt of a normal policy, btw.

Thanks again. DHB and all you lovely smart people, you’re the best!

Last thing:

Make sure any real estate attorney understands the present clouded title problem as it exists today, and how it relates to MERS. This means that you need to educate yourself about it as well. Many RE attorneys don’t, and some quick questioning will uncover that. If you do find a home that you absolutely must have, you also need to educate yourself on ‘Quiet Title’ actions.

Even though we got the bank to ‘clear’ the title with the proper reconveyance paperwork. The quickness of their response indicates to us that it was a robosigning action. We have no proof, but we are suspicious. Therefore, we are probably going to do a Quiet Title in the next couple of years.

I hear you. Same thing here except I’m seeing prices go up $10,000 more per week lately in desirable locations.

They use comps going back to last year I think

crappy conditions still get as much as not crappy. People are HUNGRY as there is no inventory and people are driving the prices higher but over bidding by 20,000 dollars and the snow ball effect is triggered. Banks or any seller now wants lots of cash, good credit, highest offer!

Has anyone had experience with a short sale? – I’ve bought and sold over 50+ SS since 2008.

How far back of comps do they use? – How far back? The shorting lender run it’s own internal price. This pricing can be an AVM (automation valution model – think zillow or BPO – Broker price opinion or an appraisal). From that point the shorting lender will figure out what the “NET” amount they need.

How much did the price jump? Not sure what you’re asking

Will the crappy condition make them less greedy? Make who greedy? If you’re the CEO of the bank you would do everything to stop the bleeding – that’s why short sale dept is called “loss mitigation” – the banks are trying to mitigate loss.

Is a good cash & 20 day escrow deal what the banks wants? Cash/financing really doesn’t matter… especially if the property qualifies for conventional and/or FHA financing. If the property does not qualify for financing then YES cash will help.

There are a lot of nuts and bolts to a short sale. First, the offer must be accepted by the owner before it is presented to the bank and only one offer is submitted. The listing agents motivation is to find the offer that is most likely to close because the sellers only motivation is to remove their debt. If you are the one offer that is accepted (remember, you are buying the property from the seller, not the bank), then the bank will usually come back with appraised value from comps less than 90 days.

The ammunition you have to negotiate the banks approved price, is recent solds (90 days or less) and condition. But if you come in with an offer too low from the start, you probably will not be accepted by the seller.

The key is to be educated to values of your maketplace. The short sale marketplace is a wild west and properties are priced across the board. A successful short sale is priced at comps from the start. Many agents price them below market to generate many offers but then it just becomes a bidding war.

Do your homework on market value

Thank you BILL. The house has a knock out backyard, but the condition of the house is pretty sad. There is even dry rot in the beans from the roof. I mean, although the house looks like a beauty, the neglect is visible and that’s before the inspection. One would think absolute beauty, and then walk it with a keen and aware eye of neglect issues, and the BPO changes. The house down the street is a flip that sold a few months back at $459K, with no pool, but the inners are perfect. This house is the reverse. Great yard, but the house is a mess, and mean $50K+ minimum.

We are going to subtract $29K for fixing up the must do’s, and hope the bank takes it. We let this house get by us last time, because our agent told us we would not get it. The winner was $5K over our bid. From now on, we will do our own thing.

WE”RE CASH, 20 days to COE, and 10 day inspection.

Does cash mean anything to the bank?

For all you warning us about title issues, THANK YOU. I will start my due diligence the moment we get word we’re the ones they pick.

Hi Mad As Hell,

If you are in California, all of our contingencies are removed in writing. And with a short sale, timelines do not start until the approval is delivered to you. On this house, have your own termite inspection and if you have dryrot in structural beams, also have it inspected by a structural engineer.

The reason I mentioned the contingency removal is to give you a strategy. The short sale approval is buyer specific so if your offer is accepted by the owner and the bank has approved the short sale, here is what you do. Once the approval is delivered, start your inspections and request all of the underlying documents from the title company. If the inspections take longer than your ten days, so be it. Because until you remove them in writing, they are still in effect. The agent will not want to cancell the escrow because the approval is specific to you. So, really inspect the property well and if it is a dog, run from it

As far as the title company. If it is not on schedule B of the prelim and it comes up after close of escrow, then the title company is liable for it. The underlying documents are all of the documents that go with the schedule B exceptions on the title report. When you start reading the documents, you might see something else.

I am a realtor as this is how I guide my buyers through a short sale

MADASSHELL – Bill is “some what right”. Many agent’s as Bill said will think “highest offer is the best offer” and use terms like fiduciary responsibility to the seller and some even say to the bank (which is total BS – when the owner is NOT the bank).

Now… How the heck do you get a short sale approved? I’m going to tell you something that most realtors and/or other won’t talk about… short sales suck, and still to this day most realtors have NO idea on how to do them. They will get acronyms and call them selves certified short sale expert when they only dealt with like handful of deals… I’m goinging to give it to you straight… and I’ve done over 50+ ss since 2008 and have managed over 50+ short sales in 2009. I’m a developer/investor and seen craaaaazy stuff. So here it goes…

You want offer accepted?

– Simply put – if you want to buy houses… let the listing agent double end it. No need to have a buyers agent ( I can go into this details but just let them get the commission – why? because ss takes time and most SS listing agents will block everyone else offer.) **Is that fair? NO but is life fair? NO… just learn to play the game better

– CONTROL the BPO/Appraisal. – In a SS situation the BPO/appraisal that is ordered is the #1 important part of the transaction. Many times BPO agents only get paid $50 to $75 per pop. Meaning they don’t even show up to the property. They will send a “photo taker” who knowns NOTHING about real estate and/or a broke realtor who looking to get “REO listing”. You as the buyer MUST meet them at the property and/or the listing agent and give the BPO agent/appraiser your “justification package”.

– What’s in the “justification package” – put everything from comps, inspection reports, termite reports, crime reports, megan law report, etc

The name of the game is to have the BPO agent/ appraiser use “TRUSTEE SALES” in CA – the 3rd party trustee sales are what investors are buying the exact home at auction…. you want those to be in the comps because if a SS is NOT successful the property will be sold at the trustee steps and that’s is the message you must convey.

Doing that alone will get you deals…

Side note

I buy defaulted notes in the secondary market. Meaning more and more notes are becoming avaliable for sale. When 1 year ago only big wall street investors where able to buy them. Now I’m seeing companies like Carrington etc buying these non-performing notes and looking to foreclose rather then SS.

Ok I went off on a tangent. Good luck

Bill and Jeff,

That is emensely helpful, to have to experienced brains feed me a data point that is useful. THANK YOU

And Jeff, we are also looking into the Trustee Sale angle, and this short sale has been postponed once (maybe even twice) and is scheduled for Aug 13th again. Our Broker said we might even pick it up as a TS home. Being cash has an advantage.

The open house looked like a carnival yesterday, and the agent left early. It will have 20+ offers no doubt, mostly first time buyers. I assume bottom of the pile for them. The “bottom up” pricing was food for a bidding war. One 1st time buyer thought she could go below list. I had to explain the crazy market to her. (I have a commercial background) and she seemed surprised the REIC works that way right now.

Thanks again. We have reconsidered our offer and are going up $25K and that’s it.

May the better offer win, and yes we will do a good inspection. Our money tree “ain’t” producing nectar. LOL

Hello!

Has your new offer been accepted by listing agent and submitted to bank making this an Short Sale Contingent? If this home came back on the market after buyer walked, you may find yourself in the same situation…. a bidding war.

I work in Northern California, but with this multi offer stuff, it is best to go in with your highest and best offer, get your offer accepted and negotiate from that point. Good Luck.

How about do not make an offer and wait out the bidding wars that this faux inventory and faux monotary policy supported demand cause?

Sandy

We put in a fair offer to get a highest and best, and then we are going to pump it during final & best. We know how this agent works.

We also wrote a short letter to the seller stating we want the home, and will do a H&B round this time. We also did a 10 day inspection and a 20 day escrow, stating she’ll get her short sale incentive money quicker with us, and we will have patience to close the short sale (if it has a chance to close). With people needing up to 45 days to get a loan, we will be a hassle free cash & close. Did we do the smart thing?

Here in the SF Bay Area there’s not much supply on the market and the interest rates on mortgages are very low. The ending result is that homes are getting bid up. The cost of rent is high enough now that equivalent mortgage costs will buy you a house in the $500K-$600K range, easily.

I guess many of these buyers feel their employment is fairly secure.

I think it’s pretty simple. Inventory, or, homes on the market, is low because so many are just stuck, and can’t even think of selling, because it would cost them a ridiculous amount of cash to bring to the closing table to settle affairs. I live in a very expensive market (Upper Westchester, NYC metro), and, I’m pretty sure there are literally millions who must have borrowed big time on their homes since the 90s (when home equity lines were basically invented for the modern yuppie/boomer. My parents would have considered it an embarrassment to do such a thing). Homes have tripled and quadrupled in value in some neighborhoods since then. Salaries haven’t. We’re talking a half million for junk. Why can’t they sell? Gotta be the HELOCs.

So, what we have right now are the minority of the financially secure, the smart and the lucky, or, both, who own free and clear, and can trade within the market. Everyone else is stuck, underwater, or unable to meet today’s credit standards. Unfortunately, the low interest rates and low down payment FHA loans are preventing true price discovery. When will this ever end? When will we ever not have people making $80-100,000 gross living in $500-900,000 houses?

That is what I used to think too. Now that prices are bumping up and in some cases exceeding prices 2005/06, I have been waiting for inventory to flood but nothing.

It would appear that most people think their house is indeed their ticket to riches so are holding on tight and then of course you have the group who don’t want to give up the prop 13 bonanza and it seems their grip gets tighter the higer prices go.

Hey, I am the last one who would have ever thought they would successfully reignite the bubble but it is happening before my eyes and kind of in a state of shock about it.

Yes, yes, this too will collapse but will it be later this year or in a few years when prices are 100% higher? When the next collapse does happen, what crazy stuff will the FED do the next time? Will prices be lower today or at the bottom of the next collapse? How old will I be then?

My house in 92104 that I sold for 669K (with a tax basis of 289k) is worth around 850K today and rising.

I was so thrilled to cash in the housing bubble money in 2004 and now know more than ever I realize the housing bubble money is not REAL. Yes, I have 550Kish I can spend on Chinese junk, but if I want to buy a house like I had I now need to cough up an additional 200K from my sales price.

I am pretty deprssed, if you can’t tell. The FED has pretty much ruined my life.

I could have purchased a better house in 1988 as a factory worker (on my own without my future wife) paying 10% interest than I can today with a second pay check, 3.5% interest and a 550K down payment!

Anyone know the Party affiliation Greenspan and Bernanke have and which Presidents initially appointed them? Those are the two guys hell bent on making a million nothing, unless you have to work for it.

“I am pretty deprssed, if you can’t tell. The FED has pretty much ruined my life.”

Martin, you are not alone. We sold around the time you did, and we’ve been living a nightmare ourselves. We can’t believe this is still going on. We had a perfect home.

We regret our decision to sell it.,ut it wasn’t a home to get old in.

We can relate.

“I was so thrilled to cash in the housing bubble money in 2004”

“Yes, I have 550Kish I can spend”

“I am pretty deprssed, if you can’t tell.”

Cry me a freaking river, Martin. You were thrilled in 2004 because those were FED-juiced ill-gotten “bubble money” gains, too. Just because you tried to outsmart everyone and it didn’t work out EXACTLY how you schemed it doesn’t mean that anyone should give a rip about your half million dollar “plight.” Will you listen to yourself?

Martin, we sold in 2007 back East, pocketed the $$, and have yet to buy in CA…simply b/c in the areas we have been looking, we can’t afford a house we’d like to live in. We can either 1) live in a crappier house in the area we want to live, or 2) live where we would rather not in a nice enough house. It’s still quite surprising that the market here hasn’t collapsed, given all of the negative economic conditions (high unemployment, underwater mortgagees, declining wages, demographic shift of boomers retiring, adult kids living at home, state government deficits and debts, declining tax receipts, etc.). Not to mention the world and national economies tanking. Yet, the propping up (hiding of housing inventories by banks) continues and we still can’t buy the house we’d want comfortably on a pretty high income. So we continue to wait until it makes sense (i.e., not paying over 50 percent of income for shelter).

Man, you people really have to consider moving from California, if possible. Crazy stuff. I live where the bankers breed, so I see big money every day, but your market is absurd.

DFRESH,

Let’s get this straight. What I am upset about is the destruction of money and what money means, not my personal decision.

I made decisions based upon hundreds of years of economic history and then out of the blue the FED decides it has the power to create 3 trillion dollars. It was unprecedented and is no less than economic robbery from everyone who has worked and saved. Throughout history bubbles pop, the dust settles, the world moves on. Not this time.

And, as a matter of fact, my decisions were the correct ones since the bubble did pop. What went wrong was the creation of 3 trillion dollars (and growing) of money out of thin air! Anyone who thinks that is okay needs some sort of help.

By the way, not all that was bubble money, some was the return of my equity.

I take it you think the housing market is based upon sound economics?

Martin, what the hell are you talking about. First of all you should thank the Fed for that huge bubble sale where you probably accumulated most of your wealth. A lot of people have NOTHING, ZERO, ZILCH, NADA…and you are sitting on half a million plus pouting. You can buy in many desirable parts of southern California with your giant downpayment and mortgage the rest with 3% money. You’ll likely be living in a very nice area, very nice house with payments less than people pay in rent for 1 bedroom apartment.

How would you feel if you bought in 2006 with 20% down and now have a net worth of zero or less? Then you have every right to be mad at the Fed. No sympathy from me…

BayAreaRenter

We can relate to your journey as well. It is insane as you stated. I cannot believe this engineered controlled collapse is going so well, and is now in a micro bubble in So Ca as well. Marginal neighborhoods are going for bubblicious prices, and we refuse to buy one of those overpriced dumps. You’re not alone.

The short sale dance we’re in is in a high earthquake damage area, so we’ll be paying for CEA insurance for sure. 1994 was a skate for us. Small putty cracks in a few walls, and that was it. We lived in a sweet spot in the hills. This short sale isn’t the same thing. If we had choices, we might pass on this beauty and find a sweet spot beauty.

This govt is treasonous, and tptb are evil sob’s.

Lord Blankfein

Did you not read my post? I could have bought in less desirable places prior to the bubble, how am I further ahead today? I could have bought in the best of areas prior to the bubble, how am I further ahead today?

I thought this forum was about the bubble and how unsustainable it is if not for the absurd efforts of the FED (in collusion with the banks) whose interests are in direct conflict with the Prudent and common sense.

I was able to buy the house of my choice in the location of my choice with a 100K down payment and 7% interest rates in 1999. Today, with 5 times the down payment I am unable to buy a similar house with 3.5% interest.

Just tell me, how should I be thankful?

Housing is the largest financial burden in a persons life and the fact that the fed is propagating another bubble ought to be of serious concern…….. but to each his own.

Some people may think this housing market has a strong foundation and is built upon sound economics and anyone stupid enough to have sold 5 years ago was purely an idiot, but I am not one of those. In hindsight, what made my decision the wrong decision was a FED gone mad.

BAY AREA RENTER.

Hopefully I can respond to you before the Rabid group does.

It doesn’t matter the reason you sold, the fact is, during any other time in history had you sold a house on one side of town to move to another area, you would be able to look at a house, think about it for awhile then buy it. An additional 10 or 20K would get you a much much different house.

Today, thanks to the FED, you sell a house and you risk being shut out of the area that you feel is safe for your kids. Today, an additional 50K on a house might get you better flooring over a house down the street. Today, having a plan of moving a few blocks away could end up in economic ruin for you and your family.

Perspective comes from living life. From my perspective, the current situation is unsustainable, crazy and nothing short of a living nightmare. At the same time, I know I may be blinded by my perspective so who knows how this will all play out?

Martin, I agree the Fed is completely insane…but that’s not going to change the facts of where we are today. You bet against the Fed and you lost. When trying to predict modern Fed behavior, you can forget about words like “rational, prudent, safe, based on historical standards, etc.” The Fed rewards speculation, risk taking and taking on massive debt load. Their current mission to save their bankster overlords is maintain nominal housing prices. They do this by reducing the monthly payment with super low interest rates. And the banksters chip in by sitting on their massive stockpile of distressed inventory.

Are we heading for another bubble if things keep up? Probably, but what are you going to do about it. You can join in or wait until things return to normal…whenever that might be. Seems like the area you are interested in defies economic gravity. This has been another sign of the times that people will literally overpay by vast amounts to live in certain zip codes due to location, schools, safety, employment, etc. I wished I had bought a house in 1999 in some of the rarified air areas too. It’s all about supply and demand (throw in ultra cheap money, Prop 13, etc), and you are seeing the end results of this.

I’m still not crying about your financial situation. Sounds like you need to look in a different area with a better entry price. I’m seeing several members on this board get extremely desperate becasue they need to buy right now for whatever reason. I would advise waiting until things return a little more to the normal side (more inventory and hopefully less competition). You’ve waited 8 years, what’s another year?

LORD…..

Sorry, folks, I just can’t let this go.

I think my exact words were ” I was thrilled to cash out bubble money”, so I am glad you do not feel sorry for me, as I do not feel sorry for my self because THRILLED does mean thrilled!

If you have been a reader of this blog you will know that I have recently been in bidding wars recently in much less desirable neighborhoods, going up to 30K above ask, but still lost out (4 times). I am trying to adapt to the situation by being proactive.

Most of my post was how the bubble is still here and seems to be coming back and how it is a complete unknown how it will play out. It is true that I made the mistake of saying the FEDS actions have had a serious effect on my life and I was depressed about that, forgive me. I know the FED has screwed others and others were not as fortunate, so that is why I am “THRILLED”. At the same time I don’t think we should all just not complain and accept without complaint whatever crap they fling at us.

Martin, my showing no sympathy for your situation had to do with your statement “the Fed pretty much ruined my life.” Your words, not mine.

I agree we are in uncharted waters here and another bubble is forming in front of our eyes. At this point, I wouldn’t be surprised by anything the Fed or TPTB do. I have little doubt we will eventually see 30 year mortgages with a 2.X rate or lower. Massive principal reductions will probably be granted and banks will likely be allowed to sit on their distressed inventory since this seems to work quite well. For renters and savers, better luck next time!

Mike M:

Here in Oakland, CA (across the Bay from San Francisco), the number of off-market bank-owned SFRs is more than FOUR TIMES the total number of active listings:

SFRs for sale: 379 (per Redfin ‘trends’ stats, July 30); only 34 of these are REOs (Redfin search, Aug 1)

Off-market REOs: 1,583 (realtytrac, Aug 4 number was 1,617, less the 34 on the market)

So the low inventory is not just because of underwater loan-owners stuck in their houses, though that’s probably a factor.

Then add in other distressed properties (again, per realtytrac, Aug 4)

Preforeclosures: 1,149

Scheduled fo auction: 833

It’s often said that many of these won’t actually get to auction, much less be repurchased by the banks – they’ll either cure, refi, or sell in a short sale. I’m a bit skeptical of that, simply because of how few short sales I see coming up in the listings. But then again, maybe lots of those are above the price range I’m watching (under $500k).

It sure seems to me the bubble is being reinflated here, though it’s not on the scale of the early and mid 2000s. It might not be quite as bad as Westchester: for $500k you can get slightly higher-grade junk. 😉

I’ve seen half-decent houses, including fixers, in the $350-500k range bid up $50k, $70k, and $100k over asking price (and I didn’t think the asking prices were intentionally set low to begin with….).

Seems to me the market around here reflects the changes to the USA at large – there’s very little middle ground. You can get houses under $300k in rough neighborhoods, and then there’s very little until you get to the mid $500s, and then there are even more in the $600-800k range.

In last weekend’s list of open houses, which has about 24 properties per page:

the first page is all houses over $1.2 million

there are no listings below $700k till page 4

there are no listings below $500k till the middle of page 6

“Since JP Morgan, BofA, Citi-group, and Wells Fargo hold 48 percent of the $849 billion in second mortgages I’m sure we’ll continue to see short sales as a very popular method of selling underwater homes.”

Does anyone know how DHB arrived at the estimated 48% of $849B of 2nd mortgages belongs to JP Morgan, BofA, Citi-group, and Wells Fargo?

what is up with Zillow.com

the site will not load..

that site IS a load

also what it the best site to look for condo’s in Houston

Realtor.com

House prices keep dropping in most of the neighborhoods in Houston, Dallas and Central Texas. Amazingly, I am seeing more houses in pre-foreclosure on the market for less then $50 psf with no takers. They sit there for months, some at $42 psf. In the meantime, builders are adding thousand of new houses not far way to these neighborhoods. Many of these new houses are near zero deals also so I expect they will add to the problem.

Watch out for the straw buyer scam wich has been pointed out here several times.

Always do your homework & watch out for 1. overinflated apraizals, 2. bad home inspections & 3. unclear tital reccords.

A very simple solution when purchasing any home is stipulate that buyer receive the recorded wet ink mortgage & wet ink promissory note at closing. Watch what happens when the seller reads this stip. Sorry,we can’t find them?

Has Congress extended the debt forgiveness as taxable income moratorium? I thought it was due to expire at the end of the year. If so, kiss short sales good-bye. Who is going to sell their home for $200,000 if they owe $300,000 on it and get a bill for unpaid income tax on $100,000 from the IRS?

What I can’t understand is why banks don’t offer property swaps. Two homeowners bought, e.g. $300,000 homes and they can’t afford them. They can afford $200,000 homes however. Rather than ruin people’s credit and have to foreclose or pay transaction costs for a short sale wouldn’t it be better to just have the homeowners swap houses? The bank would have to eat $200,000 in loan loss but there would be no impact on market prices because two unqualified buyers would take two ( perhaps) unsaleable homes off the market.

I might add that, due to the fall in interest rates, a property swap, might not cost the banks anything if the reduction in nominal principle were made up through lower financing costs, property taxes, insurance etc. This would be true financial ‘innovation’ that would allow the bank to keep, as in my example, both loans on the books at $300,000, but at a monthly payment the two previously underwater and distressed homeowners could afford. Basically you would just be allowing underwater homeowner with problems to refinance at current rates as if they had high FICO scores and 20% down.

I nearly burst into tears with sorrow reading of about the hardship and of the person who did not sell quite at the peak of the bubble and only netted $550k from the sale of their property. How can they possibly explain this to their friends? I also heard the sad story of a Squatter on the water in CA who bought a beach front property in ’95 for $950k and then stripped $1m from the first on a refi and another $1m from a Heloc on the same refi in 2005. They made one payment on the Heloc and as far as I know are still in the home today, claiming to be living solely on Social Security. Stories like these would make a great reality show…

I guess it boils down to jelousy. I am sorry you are jelous I made money on my house sale, that is your problem.

If you read my post, it was all about how the bubble, in my opinion, has reignited and prices are approaching the peak and in some cases exceeding the peak and how most people looking to buy are screwed. And how a factory worker on one income could buy a house that two incomes today can’t afford.

I guess your jealousy blinded you to everything except the 550K part. Jealousy will eat you away, get some help.

Ant:

You may want to pay close attention to what Martin is saying in his “rant”, particularly this:

My house in 92104 that I sold for 669K (with a tax basis of 289k) is worth around 850K today and rising.

I was so thrilled to cash in the housing bubble money in 2004 and now know more than ever I realize the housing bubble money is not REAL. Yes, I have 550Kish I can spend on Chinese junk, but if I want to buy a house like I had I now need to cough up an additional 200K from my sales price.

I am pretty deprssed, if you can’t tell. The FED has pretty much ruined my life.

I could have purchased a better house in 1988 as a factory worker (on my own without my future wife) paying 10% interest than I can today with a second pay check, 3.5% interest and a 550K down payment!

Here’s the key points “house is now worth 850K and rising” “I realize the housing bubble is not real” and quite tellingly “I could have purchased a better house in 1988 as a factory worker (on my own without my future wife) paying 10% interest than I can today with a second pay check, 3.5% interest and a 550K down payment!”

Martin is describing rampant inflation in housing beyond economic fundamentals. This is quite similar to the end of WWI in Germany when people had to bring a wheelbarrow of money to the market for groceries. His points are echoed throughout these postings to DHB’s articles where many say that they cannot buy a decent home at or even near the principal of % of income. My son cannot buy a decent house despite being in the top 8% of earners. Martin can with his equity bonus from prior house but he is aware that most are not in his position and cannot do so. Essentially he has to give up all the cash and become a mortgage slave again to buy a good house. His comment about buying in the 80s as a working man is spot on. My folks could not afford to retire to San Diego today as they did in the 70s. I could have bought a decent home there then but cannot afford to now (I’m a boomer).

The monopoly game is broken and is not at this time being fixed. The middle and lower middle class is getting hammered. That’s the point.

“The monopoly game is broken and is not at this time being fixed. The middle and lower middle class is getting hammered. That’s the point.”

Absolutely a true statement. Thank you. They are masking the GDII.

Update: The listing agent on the short sale wanted our highest and best, and he expects another 10 offers from the weekend and has 6 already. We gave it our best shot. If this doesn’t work, we are moving to a more affordable area.

I get what Martin is saying, HOWEVER, to say that his life is ruined and he is depressed while sitting on over 1/2 million is quite laughable. We are in a global depression. People are losing their jobs, homes, family, everything.

I think this is the reason Martin is receiving blowback for his comments. 550k in the bank is nothing to sneeze at, so stop being so dramatic and look around. You should feel very thankful/lucky you have that type of security right now.

BTW, our broker thought we should offer $25K less than we did. We have our limit on how much BS we’ll take, and evidently our broker’s is lower. He thought with $50K to bring up the house minimum, it is now an almost $500K home. Insane!

Update: Short Sale Offers We lost BIDDING WAR by $10k. We put in a reasonable offer(and still overpaying) on a fixer home/great yard- pool & spa combo. Went for back-up offer w/ other losers. howmuchamonth club vs. our cash. On to the next…

What we hate is some idiot overpays, and then the comps start to perk and boil, and bubble. I can’t take this anymore.

I’m feeding the ducks at the golf couse pond nearby this weekend. I need to chill. Duck feeding (puffed rice) is great therapy.

What are the chances that they let the Mortgage Debt Forgiveness Act expire? IMO, the chances are small, BUT, if that occurs, what will pre-foreclosure distressed borrowers do?

Thoughts????

Dan

A renewal is baked in the cake.They’ll renew it before it expires Dec 31st. Hooray for the Liar In Chief and his 535 Merry Thugs. (Romney is a LIC as well.) It is an election year.Elect-Tile Dysfunction is alive and well. Add the low interest rates will prevail for a long time. TPTB are trapped.

With all these foreclosure prevention programs, and punishment to the banks if they dare proceed with a foreclosure on a deadbeat or strategic defaulter, all bets are off for any law and order.

First off, Big Thanks to Bill and Jeff and the others with on topic and useful info.

I just started a SS in the IE. I don’t suffer the desperation necessary to latch onto the listing agent so I am not at all concerned about the outcome. I am betting a Euro induced liquidity crunch unleashes a MEMO at every Bankster branch to close all open Short Sales and REOs ASAP. Daddy needs cash flow to get through to the next quarter and Berny’s helo is in a holding pattern until Nov 19. (this is a black swan guess, not financial advice, enter the shark tank at your own risk) I just want to be on the other end of the call when they ask what will it take to get me to sign. I am not angry about waiting. I enjoy my family and my time more that way. If you are not part of the 1%, you better come up with a way to cope with disappointment.

My Rules:

Rule #1 is let the listing leech suck from both ends of the teet. It is all a scam anyway. Saw 4 SS’s in a month, 3 of the listers helpfully mentioning how much more successful a close happens when 1 Realtard reps both sides.

Rule #2 if the 1% currently only do business with massive QE with leverage, why on earth would anyone in the 99% put cash money in now. 3.5% is all this market deserves and guess what? It is all it is expecting.

Second, can everyone else leave the rants and raves to the HousingBubbleBlog daily sections. That place used to be “always” useful and informative, uggghhh what a chore it is to find a tiny bit of useful info nowadays. Now rants are threatening this blog also.

Now for some Hypocrisy:

FYI:

No extension in the cards at all. That was just another can to kick to keep the ponzi running past the election.

Angell:

You have a better chance of Romeny enacting a Wife Swap Act before anyone in the gov decides to help out the peons in the lower 99% with a Debt Swap/House Keys by Christmas Act.

Martin:

Dude… take the money and run. Go buy a multi acre ranch in fly-over country for $200k take the rest of the cash and buy pallets of nickels and some PM’s. Go out at night with Deere tractor a GPS unit and bury everything during vacations. I am guessing you can still enjoy these in your tax bracket. (send me a backup copy of the bury locations for safe keeping 😉

Any money still residing in 1’s and 0’s is not yours. You need understand that electrons are the property of the FED. If you want to hold on to your “misbegotten” (in the eyes of some here) gains, leaving it in digital promises is crazy. I dont’ care how much FDIC says it is safe. The only way you will get at it is by doing the 1%’s bidding. If you have an actual note, guess what you have? Something few people will have, usable and fungible cash. Fiat money is only a promise that when you wake up tomorrow, it will have utility. Digits don’t make the cut if they ration the ATM.

WTSHTF dig it up and buy half of Pasadena for all I care. Just don’t type there and expect the powers that be to listen to reason. Never gonna happen. Enjoy it. Go watch In Time with Justin Timberlake if you want an example of what will happen to the FED if they continue on this path. Your rant is strikingly similar to the 2 male protagonist.

Enjoy what you can, save up the depression for when you will really need it in a few years. Use up all the fun you can now. Fun is going the way of the dodo bird soon enough. You need a tour guide for fun, I can be a muse.

Finish your bucket list. Rent an RV and see what is left of America to be proud of. You won’t need all of 500K as a down once they strip mine all of it to pay the monthly nut at Treasury. Just don’t waste my time watching your cash rot waiting for the sanity train to pull up Union Station in LA. Nero is in charge, get around before you choke on the ashes in our mouths.

I think it is out of my system now.

End of Rants for me here. I pledge to submit facts from now on. Join me.

First off, Big Thanks to Bill and Jeff and the others with on topic and useful info.

I just started a SS in the IE. I don’t suffer the desperation necessary to latch onto the listing agent so I am not at all concerned about the outcome. I am betting a Euro induced liquidity crunch unleashes a MEMO at every Bankster branch to close all open Short Sales and REOs ASAP. Daddy needs cash flow to get through to the next quarter and Berny’s helo is in a holding pattern until Nov 19. (this is a black swan guess, not financial advice, enter the shark tank at your own risk) I just want to be on the other end of the call when they ask what will it take to get me to sign. I am not angry about waiting. I enjoy my family and my time more that way. If you are not part of the 1%, you better come up with a way to cope with disappointment.

My Rules:

Rule #1 is let the listing leech suck from both ends of the teet. It is all a scam anyway. Saw 4 SS’s in a month, 3 of the listers helpfully mentioning how much more successful a close happens when 1 Realtard reps both sides.

#2, can everyone else leave the rants and raves to the HousingBubbleBlog daily sections. That place used to be “always” useful and informative, uggghhh what a chore it is to find a tiny bit of useful info nowadays. Now rants are threatening this blog also.

Now for some Hypocrisy:

FYI:

No extension in the cards at all. That was just another can to kick to keep the ponzi running past the election.

Angell:

You have a better chance of Romeny enacting a Wife Swap Act before anyone in the gov decides to help out the peons in the lower 99% with a Debt Swap/House Keys by Christmas Act.

Martin:

Dude… take the money and run. Go buy a multi acre ranch in fly-over country for $200k take the rest of the cash and buy pallets of nickels and some PM’s. Go out at night with Deere tractor a GPS unit and bury everything during vacations. I am guessing you can still enjoy these in your tax bracket. (send me a backup copy of the bury locations for safe keeping 😉

Any money still residing in 1’s and 0’s is not yours. You need understand that electrons are the property of the FED. If you want to hold on to your “misbegotten” (in the eyes of some here) gains, leaving it in digital promises is crazy. I dont’ care how much FDIC says it is safe. The only way you will get at it is by doing the 1%’s bidding. If you have an actual note, guess what you have? Something few people will have, usable and fungible cash. Fiat money is only a promise that when you wake up tomorrow, it will have utility. Digits don’t make the cut if they ration the ATM.

WTSHTF dig it up and buy half of Pasadena for all I care. Just don’t type there and expect the powers that be to listen to reason. Never gonna happen. Enjoy it. Go watch In Time with Justin Timberlake if you want an example of what will happen to the FED if they continue on this path. Your rant is strikingly similar to the 2 male protagonist.

Enjoy what you can, save up the depression for when you will really need it in a few years. Use up all the fun you can now. Fun is going the way of the dodo bird soon enough. You need a tour guide for fun, I can be a muse.

Finish your bucket list. Rent an RV and see what is left of America to be proud of. You won’t need all of 500K as a down once they strip mine all of it to pay the monthly nut at Treasury. Just don’t waste my time watching your cash rot waiting for the sanity train to pull up Union Station in LA. Nero is in charge, get around before you choke on the ashes in our mouths.

I think it is out of my system now.

End of Rants for me here. I pledge to submit facts from now on. Join me.

Martin’s nutshell: Housing did crash, but so did the dollar, so the unaffordability remains.

Leave a Reply to surfaddict