Shadow Inventory in 10 Prime Southern California Cities. How Pent up Inventory and Option ARMs are the new Front for the California Housing Market.

For a state like California the real question in 2010 will be how exotic mortgages like Alt-A and option ARMs react to recast dates and a slumping economy. It may be the case that some other states may be finding bottoms quicker financially but California will be wrestling with another $21 billion budget deficit in a matter of months promising additional gridlock. California lived and fell by the housing sword. We have one of the highest unemployment and underemployment rates at 23 percent. This hasn’t changed even though the stock market has been raging. Some states have already washed out a large portion of subprime mortgages but California holds 58 percent of all option ARMs. This is a uniquely California problem.

People have so much blind faith in the notion that somehow the stock market leads the way before jobs even recover. If you want to plot this trend on a chart it would look like:

At this pace, we are going to see an unemployment rate of 12 percent and a Dow of 20,000. Clearly there is a disconnect in the current economy. If we dig deep into the balance sheets of many companies, many of the short-term gains have occurred because of eliminating one of your biggest line items, employees. Now this might be a problem given employees usually use their wages to pay for a thing called a mortgage. So a few cents in profits for shareholders might be good, but this trend cannot continue. At some point companies need to hire AND earn solid profits. We are not close to seeing that given that the recent GDP growth was purely based on government spending. It is also important to understand that anything looks up when you are floating in the abyss.

One of the major wildcards in California is how the shadow inventory is going to impact the housing market. On the surface, things might look to have stabilized but there is a growing backlog of homes that are in pre-foreclosure, set for auction, or are now bank owned that the public cannot readily see. This has been well documented. Initially, shills for the industry claimed that this was somehow a myth but that has been largely discredited because even banks have admitted to this! We know that many homes are being temporarily put into mortgage purgatory into programs like HAMP. If early re-default rates are any indicator, long-term success is not assured. In fact, many loan defaults that are now happening are based on job and income loss and no amount of modifications can help that unless the modification includes a W-2 job. Prime, near prime, and subprime are all seeing spikes in defaults. We have yet to see any trend reversing this.

But I want to focus on shadow inventory today because this really highlights the next battle in 2010. Many locations that are considered prime have yet to see any significant correction in California. I pause when people say, “ only the low end fell but the middle to high end will remain fine.â€Â I would agree with this if our economy wasn’t seeing unemployment that is the highest on record since the Great Depression and wages have been stagnant for a decade. Keep in mind that overall, the median price in California is still down by 50 percent. We have not seen prices increase. So far, what we have seen is the low end get obliterated while the mid to upper tier has fallen, but at a much slower pace. Couple of reasons for this. Higher end homes typically have higher incomes that provide a stronger buffer than say someone who stretched into a subprime loan. That doesn’t mean that distress won’t happen but they can hold out longer. The drop in sales at the higher end means current buyers are no longer able to afford homes because:

-Their income cannot afford the place

-They can’t buy the home with government financing

-They don’t have maximum leverage products like Alt-A and option ARMs anymore

This is the eye of the hurricane:

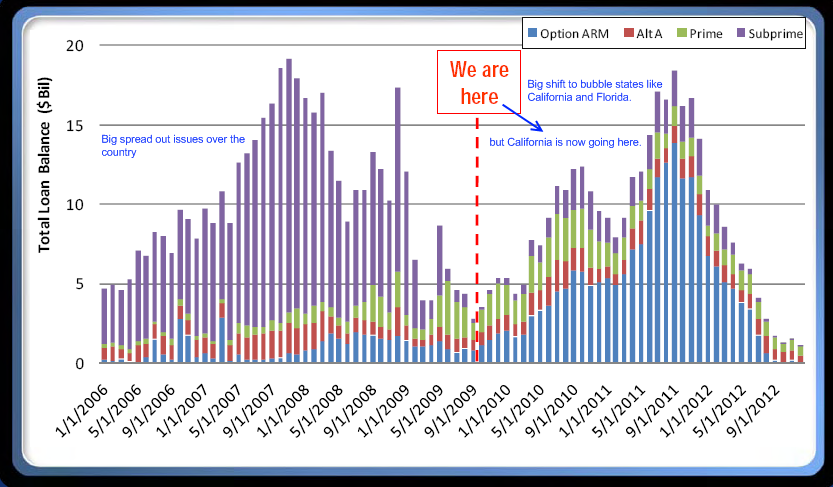

So while wave 1 was largely a nationwide issue, wave 2 is largely focused on bubble states like California, Florida, Nevada, and Arizona. It will now become a more concentrated and targeted problem. Contrary to popular belief, 78 percent of option ARMs have not recast and 350,000+ of these loans are still active with over 200,000 here in California.

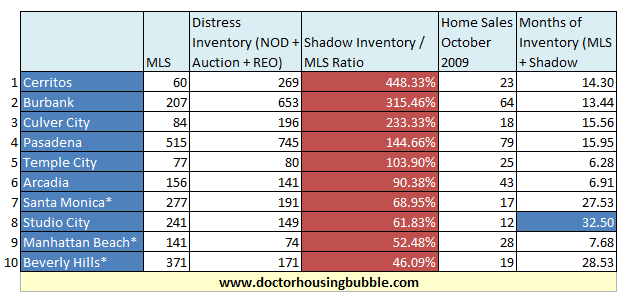

I spent some time gathering 10 hot spots in Southern California to highlight the shadow inventory. Some cities like Cerritos are geared to middle class families while areas like Beverly Hills are more targeted to the 90210 crowd. Let us look at the data:

The above data I believe is the next front in the housing war in California. If we are fighting the current battle looking at past data we are doomed to repeat additional mistakes. We need to recall why sales increased in California in 2009:

-Big drop in price

-Lower end sales

-First time buyers (cheaper homes)

-FHA loans (3 out of 10 loans)

-Investors

-Fence sitters

The last category I believe has kept price drops in mid to upper tier markets more moderate. I received many e-mails this year from people saying, “me and my partner can’t wait any longer. We’ve waited for years and don’t want to wait anymore. We are buying because we want to [start a family, establish roots, own a home, etc] and are moving now.â€Â Mix this in with the belief that the bottom is in and you can see why the market currently looks like it does. But the above data tells us another story.

The data in the chart tells us a growing number of homes are in distress. Take for example Cerritos. A good middle class area with good schools. 60 homes are listed on the MLS but 269 homes are in distress. The shadow inventory is nearly 5 times as large as the public data. Many of these are major defaults waiting to happen.  Take for example this home:

The above home is 3 bedrooms and 2 baths listed at 1,252 square feet. The most recent loan is listed as:

02/22/2006:Â Â Â Â Â Â Â $544,000

A notice of default was filed on:

08/27/2009:Â Â Â Â Â Â Â $20,043

Do you think people are going to be able to catch up to something like this? This isn’t like a $100,000 loan across the country where you go in arrears and you owe $3,000 or $4,000. You miss two or three payments in California and you are in the hole for tens of thousands. People won’t be able to catch up and many of these loans don’t qualify for HAMP because they are past the underwater requirements of the program.

This pre-foreclosure is one of many in the area. The buffer is getting weaker and this will align with wave 2 above. What will this do to prices? We’ll wait and see but clearly anyone betting on prices rising is out to lunch.

If you look at the 4 cities with the highest shadow inventory above, they all fall in the “middle class†range. Cerritos, Burbank, Culver City, and Pasadena. These are all areas where most housing blog readers are itching to jump into. You can also find some other unique dynamics above. For example, Manhattan Beach although high in price, doesn’t have an enormous shadow inventory number. But then again, there isn’t many low priced housing in the area. Including shadow inventory MB has one of the lowest inventory at current sales rates. But looking at Beverly Hills, you’ll notice that the public data is open yet sales have slowed down dramatically.

Studio City has off the chart inventory if we include the MLS + shadow inventory. And this is something that has no precedent. We don’t have any past trends where banks held off on so much inventory with such high levels of toxic mortgage waste. But at a certain point, home prices need to reflect local area dynamics. There is no avoiding the long-term trend. But looking at this data we still have a rough ride ahead.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Shadow Inventory in 10 Prime Southern California Cities. How Pent up Inventory and Option ARMs are the new Front for the California Housing Market.”

Great post Doc! Thanks for giving us a good overview of these 10 cities! This definitely helps put into perspective what the market truly looks like in these highly sought after cities. After seeing the numbers on Arcadia, it makes it a whole lot easier to hang out and wait for the next wave hit. Apparently the chinese aren’t buying up all the property there like so many of the chinese realtors lead people to believe.. LOL!!!

Wish you would do San Diego. No inventory here. At this point w/all the government intervention, should we even assume that any of the shadow inventory will ever come to market?

Very cool chart, Doc. I was wondering if there is a link to this sort of data by city or even zip? I was happy to see Burbank & Studio City in the top 10 as the Valley is my home and where I’ve been anxiously awaiting. Unfortunately Burb & SC are a bit out of my league and having grown up in Burb and lived in the Valley my entire life, I much prefer NoHo (duh, right?) so was wondering about shadows in that area.

thanks again for everything you do to edumicate us!

I love your materials, data and level of thinking.

I want to bring up the fact that although there is a disconnect between unemployment, the overall health of the economy and the Dow, the issue for investors with plenty of cash where to shelter their money. Gold is at historical highs, 12 month CD’s paying less than inflation rates, and US currency relative to foreign currencies at a low. That said, companies have previously hedged their earnings to constant currency, and large cap firms such as GE and JNJ who produce daily items the world needs with constant foreign currency can easily ride the housing based credit crunch out. Just one point to consider since I love the column and want others to understand the current dilemma of investors with plenty of cash and no where to place it. Forget the hedge funds, derivatives and others, and look for good old fashioned american companies that pay a dividend and invest in american workers.

Hey Doc,

I like the information and enjoy reading it. I was wondering if you could offer some opinion on why the banks did not pass on any of the bailout money they received from Fed Reserve programs such as “TAFT”. After all wasn’t the point of TAFT to free up money to borrow?

Why won’t the government/lending institutions just debt forgive such has been done in China and earlier years in the states?

Most sub-prime areas have already hit bottom. The prices there are so low they cannot go much lower. The middle class areas such as Pasadena and Burbank should be next. The rich areas like Beverly Hills can hold out much longer because people in those areas do not depend completely on earned income. They have savings, inheritances, etc. Time will tell if I am right or wrong.

OK, just more food for thought…. I’m not denying downward pricing pressure but again, just more food for thought:

The graph that DHB uses shows total value of the loans. What I think is more important is the total number of homes involved. The avg. size of ALT A loans is much higher than the avg. subprime loan so the graph is misleading in showing that the new wave will be similar in size to the old wave. The inflated value of the loan isn’t as important as the number of homeowners effected.

Some % of these will purposely default to initiate loan defaults. Many will redefault but SOME percentage will be fine once they get a loan work out. This will slightly lower the wave of coming inventory.

How current is his data? How many of these people have already refi’ed or sold their home? I know of several that had ARMs that have refinanced into very low rates. This may not be a significant percentage but certainly would reduce the wave that the graph shows to SOME degree.

Given how slowly banks are processing these foreclosures, the “wave” may be spread out over a time horizon that’s 2 – 3 times longer than what’s show on the graph effectively cutting it down by 50% or more.

Is regular supply WAY down? Many people with equity that may otherwise sell and upgrade are NOT selling dragging down regular inventory and increasing the % of sales that are distressed sales.

Housing starts have been down so new home inventory is down also contributing to reduced supply.

So given all of the above, the coming crash may not end up being more than continued downward pressure that keeps prices low or slightly reduces them but doesn’t result in the double digit drops that some are hoping for.

Again, just some thoughts on why the wave will have an impact but perhaps not the significant impact that we all hoped for.

I just walked away from closing on a $535k, 1500 sq ft house here in San Jose. The macro and micro economics just looked too unsettled and risky. I passed up on the 3.5% down FHA loan at 5.375% too.

Tough call and my wife hates me – her house hunger is burning but sometimes the government cheese is not worth the chewing. My monthly cash flow would have gone from $1850 for rent to $3850 before tax savings or about $1400 more a month net cash.

Let’s see what the future holds.

At this pace, we are going to see an unemployment rate of 12 percent and a Dow of 20,000.

I think that you are overly optimistic. Dow 20,000 would likely require a U3 of 18%. However; on the bright side, we will probably see U3 of 15% within 6 years.

BTW nice sleuthing on the shadow inventories.

Excellent article! It would be great if you could do the same data crunch for San Diego County. We just moved from Texas and are renting and frustrated that home prices have not fallen enough in the 92129 (PQ), or 92127 area. We know there is a lot of shadow inventory, and we have tried contacting owners directly for short sales but folks just are not being forced to sell. The agents are insane and all sound exactly the same (there are multiple offers, minimum offer is $700k even though the home needs some work..etc. the home needs work really means it is trashed). And these homes are shoe boxes. It would sure be nice if someone made the banks list their inventory, as well as made the banks actually default on homeowners that are not paying their mortgage. sorry for sounding heartless but home prices need to return to values that people can actually afford.

People, w/o the “extend and pretent” from the govt/banks, inventory levels would be enormous as the good doctor has pointed out, and price drops in 2009 would be in double digits across all tiers like they were in 2007 & 2008. We all know there will be another crisis due to the govt/central bank’s market manipulation and QE, once this happens the govts/central banks will no longer be able to backstop the markets and another crash will occur. Just think where prices would be right now if banks had to mark-to-market and were not able to hold on to shadow inventory. There is no happy ending in this story, just hold onto cash and wait for the REAL crash.

@ Whitehall –

I sympathize with your situation. I walked away from closing on a home in Granada Hills in Sept. ’08 and my wife hated me for it. She continued to hate me for about two months – until the prices began dropping again and she saw that we would have immediately been $25K underwater in the mortgage. It’s been a year now, and she looks back on it and says that even though she didn’t agree with it at the time, it’s was definitely the smartest decision.

The housing market will eventually settle – until then, patience is key.

Quick Commenter, I don’t see your point. The value of the loan IS important, regardless of the rate at which it amortizes or implodes. For just one example, banks make earnings estimations based on projected interest income, and leverage against that (inasmuch as leverage is done against anything these days). If they are expecting a million dollars in interest on a loan, and end up with nothing, how is this better or good news? If this is multiplied by 200,000, what difference does it make whether it happens over one year or five? We know what will happen: they will pass their poor lending choices on to us, either in the form of a demand for more bailouts, or a refusal to lend. We sure as hell aren’t going to pay back the already accomplished bailouts in our lifetimes, so whether the implosion happens in one year or five is kind of moot, except I track with DHB that, as with all healing pain, it’s best to get it over with quickly.

~

Spreading the wave out and keeping house prices from going down may be a great thing if you’re a RealTor accustomed to taking your six percent off the top for doing not much of anything.

~

But if you are, say, an elder who needs to downsize, or a fiftysomething couple with elders who need extended care and you need equity to pay for it, or a younger couple starting out and not in the California Dreamin’ salary ranges, or any couple or individual facing unemployment…how on earth is any of this good news? Especially if any of these people were lured into the market on bad fundamentals.

~

DHB is trying to get EVERYONE to think about the WHOLE PICTURE of housing inflation, not just their own limited self-interest, which has already gotten all of us into such trouble. His intended audience for as long as I’ve read him (since 2006) has been primarily just regular people who jump on the Gotta Have House bandwagon, without thinking it through. However such systematic thinking is sorely lacking in many sectors, especially those that have built up a system for concentrating profits and socializing costs playing Housing Monopoly.

~

But I’m pretty cynical about all this. I didn’t buy till I was in my 40s, had a 50 percent down payment and the ability to finance the rest at effectively 3% over 15 years, and found exactly the house that fit my life and budget, and offered both productive capacity and other significant savings (in this case, zero cost commuting to earn a living), at under 50 percent of similar rental. For 25 years that set of fundamentals felt like a straitjacket; now it feels like a kevlar vest. I never expected to get rich, just housed, and that’s better than hosed.

~

My sense is that all this government intervention (which despite being a kneejerk liberal myself, I oppose) is intended in part to send a strong signal: if you built your entire lifestyle around inflated housing and flipping, get out while you can by any means necessary. If you are and always were in it for the long haul based on well thought out fundamentals, make your choice now but be prepared to stick to it for a good ten or 20 years.

~

But this in no way indicates a healthy housing market. This is going to be an expensive, protracted, all absorbing battle, and while there may be a handful of “winners” here and there as there are in any war, profiteers being a fact of life like tapeworm, the whole thing will be a mess for most and a cataclysm for many. The fact that we don’t even know how many houses are out there is horrendous in my mind in part because there ARE people who would buy if the prices came down, and we could get this frakkin’ Model T restarted, instead of shoving it broke down the highway.

~

rose

Regarding strategic defaults, if you want to listen to Brent T. White, the University of Arizona law school professor who promotes walking away; he wrote “Underwater and Not Walking Away: Shame, Fear and the Social Management of the Housing Crisis.” Click the link below:

http://www.kfi640.com/common/podcast/single_page.html?podcast=TheBillHandelShow

Download the 12/01 Podcast, titled “Tiger Woods”, and the interview begins on minute 39:10. It lasts about 17 minutes. Interesting stuff.

Quick Commenter–

You’re holding on too tight–housing in this state is too expensive, period. California is in economic shambles, and will remain so until it accepts that, like its residents, an inflated housing market has rendered its debt unserviceable. That the Government, Fed, Treasury, Banks, and Wall Street would have us believe otherwise is irrelevant. Talk is cheap; neither they, you, nor I can stop what’s coming.

I don’t view it as pure downward pressure as lack of ability to support current price levels. I am putting my money where my mouth is as I am in the process of selling my San Diego house because I don’t believe prices can be sustained and i think am better off investing elsewhere for the time being. If we can believe the zilow zestimate as just an indicator of trend, my house was zestimated at $560k at the beginning of the summer and peaked at $632K in Sept…and it is already back to $599K as of today. I accepted an offer a few weeks ago for $609K and am waiting to close. Its only going to keep going down, especially as the government stimulus starts to disappear. I think its the perfect storm of high unemployment, record number of foreclosures and the lack of exotic loans which jacked up prices that will make home prices continue to fall in mid and high areas over the next couple of years.

And lets not forget about the big problems with commercial real estate and how it will affect banks and their cash flow. That is totally going to drag on the financial system’s ability to loan money for real estate or anything else; which will make it harder to buy a home and thus put even more pressure on lowering prices.

Whitehall and Steve. At the risk of sounding sexist, I think women have the nesting instinct and like to start their nests as soon as possible, even if it is not financially optimal. Unfortunately, I have to agree with Dr. HB. A long time ago he predicted that housing prices will not bottom till 2011. I think that prediction is still the most likely to be true. If you can hold out till prices bottom, or are at least near bottom, you will save enough money to take your wives out for dinner, get them flowers, take them on vacations, and you will still have money left over. Good luck.

yes, PLEASE research and feature san diego county!

It seems like the best bet for investors is housing that has hit bottom. Areas like Riverside or areas OUTSIDE of California, Arizona, Nevada, and Florida. Areas that will give a positive cash flow. I think that all of these bubble areas will be at the bottom whenever there is a positive cash flow opportunity.

What about interest rates? Where do you see interest rates going?

Legend has it the band on the Titanic played right up until the end. As long as the ship was still floating and not listing too badly, you could make a case that everything was OK–but it wasn’t. Ironically, wasn’t it the SS California that picked up the wealthy in the lifeboats while the steerage (yes, most of us) were condemned to two miles of liquid death? Folks that haven’t, wake up. SoCal is going down. You’ve made some great movies, but this is reality. Planet of the Alt Apes is just getting to the scary part, while the Alt-Apes of Wrath will be coming to a theatre near you. Pour me another brandy, my good man.

I got a letter from my morgage company (BOA) few days ago stating couple of things. First they attached a “Debt Collector Notice” stating that as the servicer of my loan they are considered a “debt collector under various state and federal laws”. Then they proceeded stating the name of my “creditor” The creditor was listed under a 12 alphanumeric code. So, I called the number listed to inquire who my “new” creditor is??? It happens to be no other than Freddie Mac. I have to tell you folks that they made ever harder for you to reach a live person. The automated response machine have not had a ” live person” option unitl I litteraly screamed into a receiver “account rep”. Lo and behold, it was then that I was connected to account rep. My first question posed was to find out who the creditor was. A lady on the phone responded how she wouldn’t know. I asked politely to have her manager or supervisor come to the phone. She put me on hold for about 2 minutes and finally she came back and said” Sir,your creditor is Freddie Mac, is that all”. I have to tell you I was bit shocked by all this secretness. My point is this: even though I am paying interest only on my loan thru 2017 and I have a second which by the way I’m paying interest only too my house is about 200K under water. To add insult to injury the same bank approved short sale on the house accross the street for 215K which was sold in Dec 2004 for 410K. Now, how does this play out is anyones guess, given the fact that on one end they let some people to short it and suck others dry who are current on theirs. They dump my morgage onto a tax payer and makes me wonder about one thing which is stop paying the first and try to have the bank lower my first note. I would like to hear from all of you out there if you have any thoughts to share in terms of how to proceed in this type of situation.

If companies want to maintain their profit margins, they’re going to need to fire a bunch more people. And this is the downward spiral. The federal govt needs to start financing $1M home loans. Why not, they make the money.

Interesting macro economic fact I just read – Roubini was being gloomy (of course, but he’s a cool dude), and, at the end of a long paragraph, reminded us that 20% of EXISTING jobs will be outsourced in at least the next decade to other countries. I slapped my forehead, and said, Of Course! This has been going on for some time, and the recession will probably accelerate outsourcing as companies cut costs. How we make up for the 7 million jobs lost is quite a mystery.

@frustrated, wincompetent, et al – if you’re interested in the San Diego market, you could do no better that going to Rich Toscano’s Piggington’s:

http://piggington.com/

Its primarily based in SD and has a lot of very knowledgeable people on it.

(Dr HB – hope you don’t mind me pimping another blogger? Please feel free to delete this post if you want).

The deeper meaning of all of this is that the moneychangers have done an equity extraction on our entire country, and they have fled with the loot. I think that most of their investment is in asia and other places where the labor is cheap. They’ve decided to hell with this country, and to hell with the citizens of this country. The Roubini quote sounds correct; the globalists plan to keep twisting the screws and outsourcing to make greater profits. The disaster capitalists have turned their guns on us….I wonder when Americans will wake up and shove those guns up their asses?

Mike M.

I wonder how these companies will actually make money at the profit margins they enjoy, if they lay off enough people and outsource the work to the 3rd world.

Not the 3rd world workers and don’t count on China. Good article in NYTimes yesterday about China going down.

http://www.nytimes.com/2009/11/29/business/economy/29view.html?_r=1&scp=8&sq=China&st=cse

There’s been rumbling of outsourcing a portion of our company, interestingly enough it’s not IT!

Stojan, I may be able to offer my interrupted opinion of the information I digest out of this current economy along with some personal twist. Don’t pay any of your payments, live and enjoy your life on your income/monthly cash flow, don’t be a slave to anything, debt free is care free, learn to live more simple people. Be liquid and smart with cash, pay your necessities. Gas, light, insurances and eat well, because why?!?!

Well, if “we” as a country want to really get back at the Federal Government, lending institutions and money sharks at Wall Street for creating this mess,…… “dontcha†think they should pay it back?

Start over, get a clean bill of “credit” , after all, weren’t they bailed out…… I’m tired of paying for their mistakes.

Piggington has become a realtor forum. If you want to hear a bunch of realtors oppinions then head on over. Once and a while a non-realtor chimes in over there but is quickly ganged up on by the realtors infesting the once great site.

Stojan,

I agree completely with Tbag. I was underwater on my house by ~ $250k in Aug of 08 and tried to modify or convert to a fixed rate on the loan. I was given the runaround (as I’m sure everyone else who has tried to talk to their mortgage company has) and eventually decided enough was enough. I stopped paying on Sept 1 of 2008 and the house sold at auction on June 12 of 2009. We have been renting a house about a half mile from the old one since mid-May and could not be happier with our decision. We pay less than half of our previous mortgage on rent and have paid off all credit card debt. We now have ~ $4000 a month in savings after paying all necessary living expenses. Honestly, I think that I could buy a home on our old street for cash in about 4-5 years if we wanted to, but we are so happy watching our checking account increase each month I feel confident that we will remain renters for the unforeseeable future. It is truly amazing to live a cash-only lifestyle and not have any debt hanging over your head. I know that our credit is trashed for a while, but who cares? It’s like losing your driver’s license when you have no need whatsoever for a car. Does it really matter? Follow your heart but don’t let it interfere with your head. Best of luck in your decision.

Partyboy

I don’t know how old you are but I remember a time when a good credit rating meant something. It was an asset that had great value and gave you a chance to move up the economic latter.

Starting in the late 80’s credit standards have declined to the point that working hard to have a good credit report means a lot less than it did. Sure, anyone would prefer 800 FICO to 650 but what that difference meant was far greater 30 years ago. In addition, if you did screw up you were REALLY punished credit wise for 10 years. Today, it is more like “Oh, you have a foreclosure? No worries, it is happening to everyone, we can over look it.”

Today I would toss my 800 FICO score in the garbage in a heartbeat if it meant helping out #1.

The law of diminishing returns applies to everything, including FICO scores.

Good for you and I would do the same, especially since it is crystal clear that is what our Government is encouraging everyone to do.

I would think the banks will continue to slowly release shadow inventory in highly desirable areas. Those homes are worth holding onto and not flooding the market because the banks can make the most money in those areas. Beverly Hills, Manhattan Beach and Santa Monica shadow inventory is valuable property as long as they don’t flood those cities with inventory.

Banks may decide to flood Culver City since that area has little upside over the short or long term. Its a cut-your-losses city. But Beverly Hills, SM, MB are still desirable places to live by most people in LA. Holding & slowly leaking shadow inventory will give the banks the most profit in these areas.

Dr HB, any thoughts on the banks handling shadow inventory differently based on the city, its desirability, inventory levels & the banks ability to boost their bottom line over the next few years by not flooding certain desirable areas?

Leave a Reply to speedingpullet