Shadow inventory projections for 2013 – Modified loans re-default and new foreclosures. The overall household formation equation.

Shadow inventory is still very much a part of the housing market. This inventory is slowly making its way through the system. Once the home is on the market for sale, it is no longer in the shadows. With constrained inventory and interest rates providing a boost to the leverage a buyer can take on, banks are slowly leaking out more of these properties for your viewing consumption. People have asked how is it that so many people can be living in homes without making a payment. Shadow inventory is simply a modern day oddity of this housing market. In any other typical housing market you would see inventory increasing either through new building or people putting homes for sale given the uptick in home values. Yet millions of Americans, over 10 million cannot sell because they are underwater. Over 4 million are deep in distress. Speculation about the shadow inventory draw down for 2013 is already coming out.

Shadow inventory draw down for 2013

According to LPS and their latest Mortgage Monitor Report 5,300,000 are in some stage of distress:

-1,957,000 late 30 days or more, but less than 90 days

-1,543,000 90 or more days late, but not in foreclosure

-1,800,000 in foreclosure process

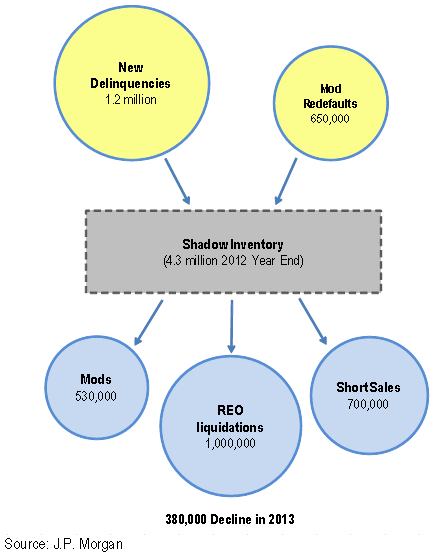

Depending on the definition of shadow inventory, the number can be lower. Typically the number is based on the number of properties not on the MLS but are in some stage of distress. According to JP Morgan this number is up to 4,300,000 at the end of this year. Their projections for 2013 shadow inventory is telling:

The above is an interesting breakdown. JP Morgan is expecting 1.2 million new foreclosures and 650,000 loan modifications that will re-default. Given the horrible loans in FHA products this should come as no surprise. The numbers then include another 530,000 new mods, 1 million foreclosure sales, and 700,000 short sales. By the end of 2013 we should see the shadow inventory decline by 380,000 leaving us still with about 4 million properties. So much for the non-existent shadow inventory.

I would also like to point out the incredibly high number of new delinquencies. These tell more of the story. Why are we still seeing an incredibly high number of foreclosures in a recovering economy? The problem of course is that household incomes are not going up and households are still being strained on the income front. Having 1.2 million foreclosures in 2013 isn’t exactly an optimistic forecast. And take a look at those 650,000 mod re-defaults. This is simply more prolonging the inevitable for many home owners but someone is paying for this. Those paying for this are those currently buying at inflated prices and also those seeing their buying power decrease via Federal Reserve actions. Ironically the hike in rents is hitting those least likely in our society to afford it. The CPI isn’t really a good measure because many of the hidden cost are being passed on via debt based products like higher education and purchasing homes that gain a boost with lower rates.

Household formation

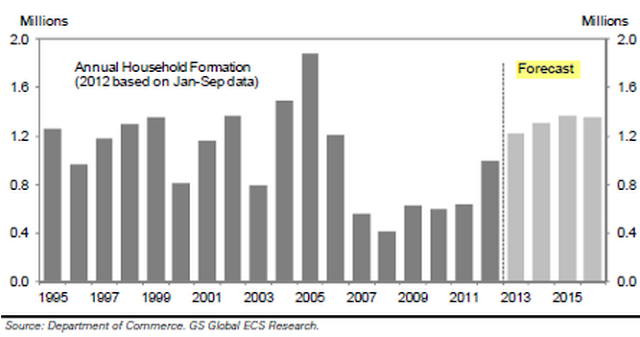

Household formation has been weak since the recession hit. In more typical years the US adds about 1.2 million new households. This can come in the form of renters or buyers:

Source:Â GS

The projections are for 1.2 million new households. There are a couple of reasons why we will have to wait and see if this will play out. First, younger Americans are typically the first to go out and form households. There are very little indications that they are doing well. Many are saddled with enormous amounts of student debt already. A large portion are working in jobs that pay very little plus many are underemployed. Household formation will occur when this group undergoes a strong growth in their earnings potential.

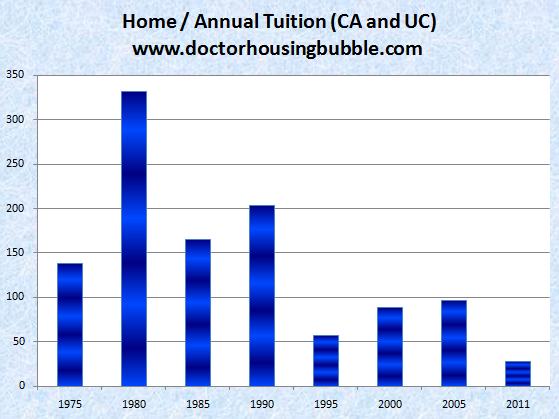

In California, we did a comparison between the University of California tuition and home prices in the state:

“This is an interesting perspective. The cost of an UC degree was cheapest in 1980 in relation to housing prices. For example, for the cost of the median home in California in 1980 you would have been able to purchase over 330 years of education at the UC. Today the cost of a median priced California home will only get you 22 years of college education.â€

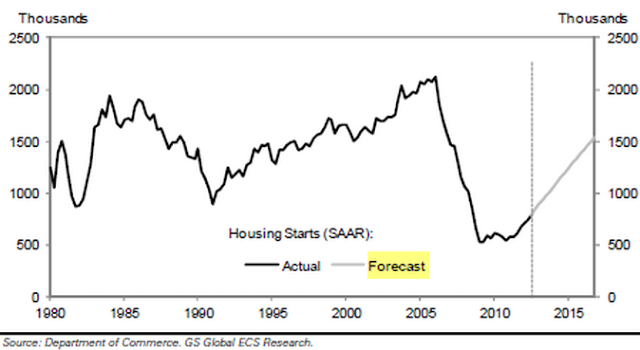

This goes back to the point that younger Americans are paying a much higher cost for education than the previous generation. The draw down in shadow inventory will largely depend on how well the economy recovers for this group. Housing starts are still low but did move up this year and projections are pushing this figure much higher next year:

With the fiscal issues hitting the country next year we will have to keep an eye on the underlying household income growth and employment prospects for many to determine whether the housing market will improve. This year the big boost has come from the Fed and constrained housing inventory. Investors have also jumped in to eat up a large portion of supply (about 1 out of every 3 purchases). Builders have not gone out in full force because they fully understand that cash strapped Americans are looking for cheaper properties (that is based on the monthly payment) and not more expensive newer homes. The shadow inventory is going to be part of this housing market for years to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “Shadow inventory projections for 2013 – Modified loans re-default and new foreclosures. The overall household formation equation.”

The college debt problem (as you’ve clearly outlined today and in prior postings) is really the under – reported financial bubble that’s about to explode in our faces. Much discussion in DC now about some kind of fiscal debt deal allowing students to discharge their college debts via bankruptcy – but of course that won’t happen, since the banks are the ones who’ll take it in the shorts the most. But in a saner world that’s exactly what should happen – make it an even split among the three players here; the student, the college and the bank. Everyone pays out a portion for their errors in judgement and/or being part of the corrupt system of higher education. I went to a community college and then a state school to finish my degree back in the early 80’s, and the costs I see today are so whacked – out it beggars belief.

Too right. It’s going to be bloody and the banksters will again walk away with ill-gotten booty.

Why in the world should those of us who scraped up the $ to help our children attend schools, keeping them at less expensive schools and commuting, and those children worked while going to college to help pay, While on borrowed $, students lived in dorms, apts, used the $ for personal luxuries, went on “spring vacations”. Not to mention the advantage of “connected expensive universities.

These families can repay what they took. Tough. A college degree used to mean you might have a brain and were responsible. Now, it appears most are just greedy and/or stupid. If they can’t figure out what interest and principal means, they should get an encyclopedia or dictionary, or search the internet for free and study that deep concept.

I agree. My brothers friend got hit by the car as he was riding a bicycle to university while renting off campus to save money.

I was indoctrinated to believe the rates reflected the inheirent risks…a loan with collateral and less risk vs one with no collateral, should carry lower interst rate>>>that is how the real world works doesnt it?? That is how odds-makers operate in vegas isnt it?? Should i blame fed intervention for the distortions? Politicains offering to forgive loans to buy votes?? I am saddened and disgusted, tryng to find my way through the jungle of corruption…

Combine this with the inevitable austerity the Republicans will extract in exchange for millionaires to pay a little more in taxes with the current Fed trickery running it’s course and we might have the perfect storm for a major housing crash within the next 18 months. We are in uncharted territory.

Forget just a little more in taxes, lets take all their wealth! That should cover the spending for at least a couple more months.

“Combine this with the inevitable austerity the Republicans will extract ”

Is this really austerity or attempting to restore some semblance of sanity to federal spending? We either increase taxes to pay for the $4 Trillion that we spend (on $2.6 Trillion in tax receipts) or we cut spending by the same amount. That’s just to balance current spending. We still have to find $16.4 Trillion to pay what we owe. The fiscal cliff is really no cliff at all, compared to the remedies needed to tame out of control spending.

@johnt

“Is this really austerity or attempting to restore some semblance of sanity to federal spending? We either increase taxes to pay for the $4 Trillion that we spend (on $2.6 Trillion in tax receipts) or we cut spending by the same amount. That’s just to balance current spending. We still have to find $16.4 Trillion to pay what we owe. The fiscal cliff is really no cliff at all, compared to the remedies needed to tame out of control spending.”

You are confusing federal debt with private debt, they are not the same at all. The US went off the gold standard a long time ago.

This post from Marshall Auerback is pretty good:

It simply means that the government does not “need†money to “fund†its operations. It seems counter-intuitive, but the public actually needs the government’s money to pay its taxes rather than the government needing taxes to pay for highways, bridge repairs, schools, national defense, etc. For the household, paying back debt means they have to sacrifice current consumption (spending). For the government, no such financial constraint is imposed. Its ability to spend now is independent of how much debt it holds and what is spending was yesterday. That situation can never apply to a household or business firm.

Because the government is the only entity that gets to create money, it can “buy†whatever is for sale in terms of its money merely by providing that money to the public, which opens up a huge range of policy options. Putting this in concrete terms, the government–‘buys’ a new highway or a new aircraft carrier, as long as the construction materials and workers’ wages can be paid for in its own currency.

Where does the government get the money? The government creates this money by crediting bank accounts. It creates money with the stroke of a computer keyboard. New money is an entry on a spreadsheet, nothing more.

To put this in everyday terms, the dollars the government creates function something like tickets to the Super Bowl. As you go into the stadium, you hand the man a ticket worth $1000, and then he tears it up and throws it away. Why? Because the ticket has served its function: it has enabled you to gain entry to the event in question; similarly, a tax is paid to extinguish a state liability, but as soon as the tax is paid, it has no further value to the government. The tax receipt can be sent to the shredder. Tax payments (which discharge a liability to the state) then “drain†the money we call legal tender (otherwise known as “fiat currencyâ€), which can be pictured as a movement of funds away from the private sector and “down the drain†as the money is literally burned, or simply wiped off the liability side of the Federal Reserve’s balance sheet.

How does the government taking your tax money and throwing it in a shredder pay for anything? The answer is that it doesn’t.

Taxes function to reduce aggregate demand, also known as spending power, and not to collect what the government needs to spend on something else.

As a matter of conceptual clarity, it makes no sense to say that a government ever “builds up a store of savings†that allows for higher spending capacity in the future. The government neither has or doesn’t have any dollars; it simply makes computer entries on a bank’s balance sheet, as Federal Reserve Chairman Bernanke described in the “60 Minutes†interview above.

It spends by changing numbers upwards in our bank accounts. Think of this like a football game. Awarding 6 points for a touchdown doesn’t “use up†some stock of points held by the stadium. It is “electronically credited†via the scoreboard. Nobody asks that the 6 points be “repaid†somehow.

You don’t “save†what you have the option of creating or not creating (i.e. fiat currency). Not spending, not “creating currency†via crediting bank accounts, simply means less present day economic output.

We all learned this as the paradox of thrift.

There is nothing to “saveâ€. The government is never revenue constrained.

This is in contradistinction to the way users of the currency, versus the issuer of a currency, such as a household functions.

For them, spending is constrained by income. Their checks will bounce if there is no money in their accounts. And for users of the currency monetary savings can be stored to permit higher consumption in the future. And households don’t have an electronic printing press in their basements which would eliminate that constraint. As Rob Parenteau has already noted, this is called “counterfeiting†and it’s a jailable offence.

True, if a government spends too much after getting us to a state of full employment and higher economic growth, excessive government spending can create inflationary pressures. So to that extent, there is a limit. But acknowledging that unconstrained government spending can create inflation is not the same as arguing that it is in any way operationally constrained. Contrary to conventional “gold standard†thinking, where it is said that every DOLLAR SPENT HAS TO BE ‘FINANCED’ BY AN OUNCE OF GOLD ALREADY IN EXISTENCE, our government can afford anything that it is for sale in its own currency.

The debate therefore should not be focussed on “affordability†but on what our the national priorities of our government? The political process, not a non-existent gold standard, determines that if we want more killing toys then the national government can always meet those expectations in a fiscal sense, unless we run out of real resources. Likewise if we desire universal health care, in a manner where the government provides this as a national right, rather than foisting it on business as a marginal cost of production (remember, businesses are constrained in a way that governments are not).

Further, if there is a problem with excessive private indebtedness and overspending, then the mirror image of that has been the excessive fiscal drag that the national government inflicted on the USA between 1996 and 2007. If you want the economy to grow and produce the saving capacity (via income growth) to allow the private sector to repair their precarious balance sheets then the last thing you would want to do is run “tight Budgets … for a long time into the futureâ€.

What is needed when the economy has been driven by private spending funded by ever-increasing levels of debt (and a contracting public sector as a proportion of total output) then what is required is a change in the composition of final expenditure – from private to public – unless you want to “scorch the earth†and deliberately contract the economy.

The consequences of overspending might be inflation or a falling currency, but never bounced checks a government creating its own currency can never go broke. Government spending limits ought to be set by our policy makers by considering what we, as a society, want, like universal healthcare, full employment, a well-functioning economy and our ability to accomplish this—not out of some preconceived notion of what is “affordableâ€.

About @rumble’s post. It’s that kind of magical thinking that guarantees the full destruction of a currency and the economy that is forced to use it by the only entity with the legal monopoly on the use of physical force.

Two things are going on with the tuition sky rocket. One, the state’s funding to higher education has gone down and two, a lot of today’s reduced tax money goes for fat pensions, not operating expenses. And, with current demographics, the pension payouts will be blowing out the system into oblivion. Make that in spades for the rest of the state system. In short, the state of California is triple …. Housing prices are the least of California’s problems.

what are the California figures? what are the L.A. county figures?

Well, what happens if the state can’t pay pensions anymore?? What if they simply declare bankruptcy like the cities??

This is the trillion dollar question.

States can’t declare bankruptcy because they are technically sovereign. Arnold actively looked in to the possibility back in 2005/6. He even looked in to reverting to territorial status for California. Problem was that California was never legally a territory.

FHA versus Conventional. I am interested to hear comments from informed people on this website as I am close to opening escrow on a home and will enter the loan process. (I am already approved for FHA or Conventional) and a first time buyer.

From what I can gather here are the differences between FHA and Conventional.

FHA down payment can be 3.5%, 5% or 10% down. The interest rate will be 1/10 or 2/10 of a percent lower than conventional. If I sell the home in the future before pay-off, then the new buyer can assume the loan (if they qualify of course). Further, if I refinance in the future, I dont need to show proof of income with FHA. FHA loan (on a $450K) loan will require about $500 – $550 per month PMI. The PMI will continue for 5 yrs minimum even if LTV is 78%. But with minimum mortgage payments, attaining LTV could take longer. Or if home prices sink then it could take even longer to attain 78% LTV.

Conventional loan is 10% down minimum and I will pay approx. 2/10 of a percent higher interest rate, however, the PMI will only be approx. $150 per month and will disappear when the LTV is 78% but could be as short as 2 years (versus 5 yr minimum with FHA).

More about me: I plan to live in the house the rest of my life (self employed and wont need to consider relocation). therefore, I doesnt seem to me I should care about the assumability aspect of an FHA loan. Also with interest rates today being so low, should I care about refinancing options in the future (could interest rates ever go lower?)

Thus far, my plan is for a Conventional loan with 15% down payment and a 30 yr term with payments every 2 weeks. That being said, I welcome any comments from people well versed in these matters as I may have missed something in all this, because many of my peers are telling me to go with FHA?

Compare the monthly payments at this point. Assume any down payment will be lost in a 20% market correction and that you will be stuck with the PMI over the life of the loan. Now which one is looking better ? Probably a 10% conventional if you are never going to move. If both are comparable, then do the 3.5% FHA so you have the option to walk away if things go too far south without losing that 10-15% down. Save that money for an emergency.

Re FHA or Conv. home loan. The FHA has it’s fee’s to insure the loan did you account for that?

If you truly are going to never move I would consider the conventional. The reason. You can drastically shorten the life of the loan to the neighborhood of 16 or 17 years. You do this not by your planned biweekly payments. They really only gain minimally on your outstanding principal. Instead, be clear that you have no pre-payment penalty on your loan and double down on the principal every month. In effect by payment three you are already ahead to the amortized payment due on month 5. While the initial decrease in outstanding principal is modest you in effect are creating a compounding growth in your favor saving tens of thousands or possibly solid six figures over the life of the loan. If in fact while the principal amount of each payment is low in the first few years, you are able to pay triple in principal you will accelerate yourself out of mortgage insurance rapidly earning back what you would have paid just for insurance (notwithstanding Maximus’ warning regarding market downturn). By the way I see the .2% interest premium on the conventional loan as minimal especially when looked at against the high rate of FHA mortgage insurance and it’s 5 year term. Good luck.

Maximus, Wyeedyed;

thanks for the sage advice on my home purchase and mortgage loan. BTW: something that is not talked about much here is the tax savings aspect. My CPA cranked out some numbers for me: my federal withholding as a homeowner (versus renter) will decrease approx $775 per month ($9.3K per yr). If Bush tax cuts roll back it will be about $500 per month. The tax credit at the end of the year if I pay PMI will be approx. $1800 per year ($150/month but not saved till year end). Of course, I will need to consider that not only would I get hit if home prices decrease but some of these tax deductions may disappear through uncle sam fiscal gyrations.

Tuition payments are nothing. Now that payments are adjusted by income ratios, students will simply pay the minimums. So, even if they owe $400,000 for that bachelors in basket weaving, they’ll only pay $40 a month until the day they die working at Wendy’s. More cash to free up for Iphones, spinners on the wheels, and those $300 Nike’s! Whoo hoo!!!!

I personally never plan on paying my student loans off. They can’t get me when I’m dead!

To which I say amen brother. I suspect before long a tidal wave of similar thinking will quickly sweep the nation, & nobody will pay. Then they can drive a stake through this well intentioned but thoroughly failed student loan industry.

Replace traditional higher ed with 100% online training that will be free with the only fee involving testing to certify basic levels of knowledge (i.e. – CPA exam, Bar exam, etc).

Hey John, thanks for the reply.

There are actually a lot of ideas out there that are new and some that are as old as time itself.

An apprenticeship could work. Have kids around 18 years old work along side people in a trade for minimum wage in order to gain experience.

Online stuff could work too depending on what you want to do. I don’t think brick and mortar school are going to go away, but that is an option a lot of people are taking these days.

It’s unfortunate that we look down upon trade jobs like plumbing, electical, and welding. Those people can make a lot of money on their own. I know people who do dry wall and can pick and choose which jobs they want to do. I only wish I had options like that!

If I was really smart back in the day, I would have banked all of those student loans and gambled it in the stock market or just saved it. I know kids right out of college that owe $100,000 for a bachelors degree. They are all terrified of having to pay it back now, but never bothered to worry about it while they were taking out those loans! The government will get their money back one way or another. You can’t dischage those loans like you can a credit card. They will simply make “minimum” payments until the end of time.

Over time through inflation those payments will be nothing. Think about people who bought homes in the 70’s and 80’s. Their mortgages are so low they could work at McDonald’s to pay it! The problem is their tastes and habits are so expensive that they can’t live with out cable, starbucks, and yoga classes.

It’s all about priorities!

Exactly. College “pays” 20k a year for living expenses (as long as you go to a cheap public university). If you are working and go back for a Masters in whatever, all of the graduate level loans are not need based (so the EFC doesn’t matter) but they fall under the income based repayment program. Even folks who cap the Stafford at 138k, can get unlimited GradPlus loans. If you are at the IBR cap already for what you expect to make in the future, then you have no dis-incentive not to continue borrowing; taking 1 grad class at a time apparently is “part time” as long as you are degree seeking and many working adults can find time for that.

That is a 20k a year untaxed “income subsidy” for poor/unemployed people, and a limited payment “mortgage” for people who are better off and can save it. No wonder people are going back to school (which also halts all payments). Even at $1 trillion, it’s an order of magnitude smaller than the real estate bubble and it will be some time before anything is done, in fact 20-25 years on IBR before it is “forgiven” is built-in but the socialized cost will be enormous by then.

Now the “morality” question. Would you drag out an MS degree for 4 years in order to get 80k to buy a house ? Maybe a couple of degrees ? What if the degrees were possibly useful to your career ? Remember there are no credit requirements like a mortgage so you are guaranteed these loans and your payments are limited by your income (possibly zero if unemployed). Would that help you keep your house if you lost your job ? Is this just a sideways injection of money into the economy ? If you are following the rules and making your payments, it becomes a gray area for a lot of desperate people.

There are tons of kids who get a job right after school and realize they don’t even like what they went to school for! No internships…..nothing. They just think they are going to get that dream job right outta school. Nope! So, they just go back and get more schooling. The trouble is they don’t make any more money versus people who just got their bachelors in most fields. Overeducation isn’t the way to go.

A lot of it is who you know and who’s ass you kiss. It has nothing to do with how well you do anything anymore. Oh well, that’s why were at this current situation today.

What about the possibility of tax foregiveness for short sellers expiring in two weeks? That would kill a large part of what sales are ocurring now. There were 50 of those in the last 3 weeks alone on The Westside Of LA.

http://Www.westsideremeltdown.blogspot.com

I have been paying close attention to sales numbers lately and CA is looking like another bubble is in action. Anything that has rent parity for its given area is under lots of buying pressure. And I’ve now heard that there are some mortgage deals that have rates below 3%!

Given the way human nature works, as the prices rise the average retail buyer will start to think they need to buy a house before the prices get too high. And there you have it.

You want some numbers, here you go.

http://www.bloomberg.com/news/2012-12-17/highest-paid-california-trooper-is-chief-banking-484-000.html

We might not see much of this ‘shadow inventory’ as HUD is selling in bulk huge offerings of NPNs. Looks like the rule is – whatever is foreclosed on by the investors, only 50% can go back on the market. The other 50% needs to be held as rental property for 3 years.

One thing I’ve mentioned to my clients lately is to be cautious during multiple offer environments (as we’re seeing now). I started selling real estate in 1986 in South Orange County where we had a multiple offer environment from the late 80’s into 1991. From 1992-1998 many price points in our area regressed approx. 30-40%. From 2004-2006 multiple offers were again the norm. We all know how that turned out. In the spring/summer of 2010 we had a multiple offer environment due to the government tax credit programs. After those were removed, there was a subsequent regression of home values. That brings us to today. Are things different this time? They obviously are from the standpoint of extreme government intervention into what used to be a free market enterprise. I can’t say where things will go from here but I do think it’s important to recognize history and how it relates to real estate manias.

Thanks again Doc for your continued in-depth analysis.

I have to agree with that. Multiple offers are not the last sign ,but a pretty good indicator that things are getting too hot to be sustained. But if rates are going sub 3%, we could see this thing last at least another year.

Marty

This time is different. With the deep pockets buying bulk REO’s for rentals at deep discounts, inventory is ridiculously tight, and with the cheap money inticing fools,

I think we’ll see a rigged market for a decade, if not longer. We bought (cash and close) in late Sept and now there is 50+% less homes in our criteria. Prices have crept up. Last check 10 homes vs. our 22 homes search. One-stories will be at a premium as Boomers (78M) downsize. Glad we’re in, but I don’t like seeing all this govt interference. So Ca is FUBAR. FHA is the titanic, but so is the macro economy.

“This time is different”… Now, where have I heard that before….

What?

I use to laugh at that term too, but So Ca is FUBAR for a long time. Before the housing market was allowed to find equalibrium, but his time is different. Way too much “sugar” from the candy man. This time is different. Savings and Loan RTC was a different business model.

This past year my business partner bought two foreclosed homes as an investment. He put some money into them and is renting them out now. One of these homes was designed by an architect who was a protege of Frank Lloyd Wright. He bought it for $31,000. (This is in Racine, WI.) My car cost more that. So this abundance of foreclosed homes does create a business opportunity for some.

3/2 Homes in the $250K and under range are flying off the shelves and hedge funds are snapping them up anywhere they rent for over a 7 times capitalization. This is having an effect on owner occupied buyers that are getting frustrated with constantly being out-bid for homes. They will drive up the prices as they bid higher to get a house. If animal spirits kick in, they will likely bid well over whatever their rent parity was just to get the house. How long can this go on? Always longer than most people think. So, I’d say at least another couple of years.

Thanks Bernanke. You did it. We have another housing bubble in the making. Every law was changed and rule broken, but you did it.

CAE

Well said. It is way to surreal and depressing. A REO was redone and in a $390K neighborhood (or less) this lipstick on a pig home has a $519K price tag. It’s in my neighborhood. Spray painted white kitchen cabinets and a needs work pool, and they are asking that? Some idiot will pay it to live across from a K-6 playground and a park. Way too much noise and traffic even at $390K Insane sh*t …here we go again!

Mortgage rates at these levels are getting everyone off the fence that had any desire to buy a house. And I hear the rates are headed lower. For those that don’t know, these are the lowest rates recorded in US history!!

It seems to be the game these days– the “investors” (rich rentiers*) snatch the starter homes out of the hands of would-be first-time buyers, and then turn around and rent them out to those same people. The first tier of the housing market is thus being stepped on like bugs and many otherwise-buyers are being forced into the rent ranks instead. With few starter buyers there will be few move-up buyers in future years.

Then the rentiers will charge the absolute max rent the market will bear, meaning most of these poor rent-serfs will have virtually nothing left over each month to save up. If they leverage to get into something, they just bomb out and get foreclosed on in a few years.

It’s so not a free market, it’s not even funny.

(* “rentier” with an ‘i’ means “someone who makes their income off rents that other people pay to them.”)

CAE,

Unfortunately, you are correct… Bernanke and gang have a very extreme agenda. The same agenda by Central Banks around the globe. However, history teaches us that in time these agendas will have very unexpected results. Black Swan events are inevitable….

Well, with college, the alternatives ,online, tv, or independent study, expand the offers at the community college and then transfer. Study to be an accountant, two years at JC and take a bookeeper job and take night classes at 4 year. Expand the night offerings for undergrad degrees at Cal State or UC.

let the banks keep them, they can pay the future calif prop tax coming, if its not a deal dont buy, they are pumping the market dont be a sucker this one will blow fast

“Watchdogs warn 1.7 million homeowners risk foreclosing, feds unprepared†By Andrew Phillips and John Solomon – WTop.com Monday – 6/3/2013, at: http://www.wtop.com/1289/3347704/Watchdogs-warn-17-million-homeowners-risk-foreclosing-feds-unprepared

Excerpt:

The government is already struggling to manage the more than 195,000 foreclosed homes it now possesses and is ill-prepared as a new wave of foreclosures looms on the horizon, according to federal watchdogs who paint a less rosy picture of the housing market than politicians.

In fact, the inspectors general at the Federal Housing Finance Agency (FHFA) and the Department of Housing and Urban Development (HUD) warn that a stunning 1.7 million mortgages are 90 days or more delinquent, putting them in danger of foreclosure. Such homes are considered “shadow inventory” in danger of being assumed by the government if the loans default.

More: http://www.washingtonguardian.com/sites/default/files/may_2013_housing_igs_report.revised.v2.pdf

And:

Testimony Before the United States Senate Committee on Appropriations Subcommittee on Transportation, Housing and Urban Development and Related Agencies An Overview of the Federal Housing Administration Testimony of The Honorable David A. Montoya Inspector General Office of Inspector General U.S. Department of Housing and Urban Development, June 4, 2013 – at: http://www.hudoig.gov/pdf/testimony/FHA%20Testimony%206-4-13%20Final.pdf

Leave a Reply