Modified mortgages re-enter shadow inventory – By next month the housing crisis will have cost 5,000,000 Americans their homes via foreclosures. Distressed inventory still above 5,000,000.

If we were to take a count of how many people lost their homes to foreclosure since 2006, that figure will reach 5,000,000 by the end of the year. This is an enormous number and is rarely discussed as a historical case study in action. It is interesting how many seem to ignore this grim figure and pretend that it never happened. So keep in mind the turmoil those 5,000,000 completed foreclosures have had on the overall housing market. Will the current shadow inventory impact the current upward trend in housing? Banks are selling into some fierce momentum but things are still tepid with the overall economy. Most importantly, household income growth is nowhere to be found. Completed bank repossessions are still running at about 50,000 per month and foreclosure starts are still close to 100,000. This housing bounce as we have mentioned is coming from a trifecta of low interest rates, Wall Street investors, and foreign money. I think it is useful to take a look at where we were and where things are heading.

The impact of the housing crisis

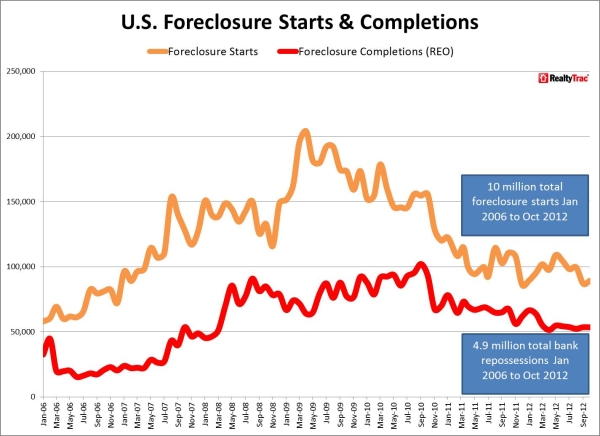

RealtyTrac put together an excellent chart highlighting the damage caused by this housing bubble bursting:

Source:Â RealtyTrac

If you want to take 2006 as a baseline, it appears that repossessions run at around 20,000 per month and foreclosure starts are around 50,000 in better times. Since 2006 the housing crisis has cost nearly 5,000,000 Americans their homes while another 10,000,000 have faced the prospect of foreclosure. This is an incredibly high figure considering that nationwide, roughly 50 million households carry a mortgage on their property. This context is important when we examine the following current data:

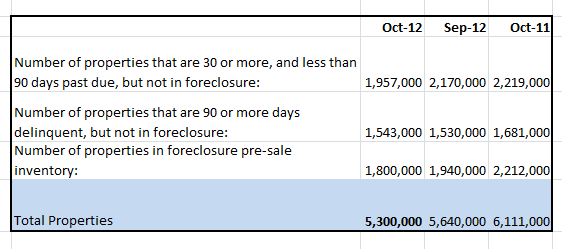

You still have over 5,300,000 mortgages in the foreclosure pipeline. Rising home values make it easier for banks to unload these properties via short sales and other mechanisms. Given that the entire market was turned upside down because of 5 million completed foreclosure, the 5,300,000 homes in the foreclosure pipeline is still a big concern and the fact that nearly 100,000 are being put back into this bucket each month is concerning. The current momentum is clearing out properties but as we had mentioned, prices in areas like Arizona are actually turning investors away.

Modifying out of the shadows

There was an interesting angle taken over at SoberLook regarding the shadow inventory figures:

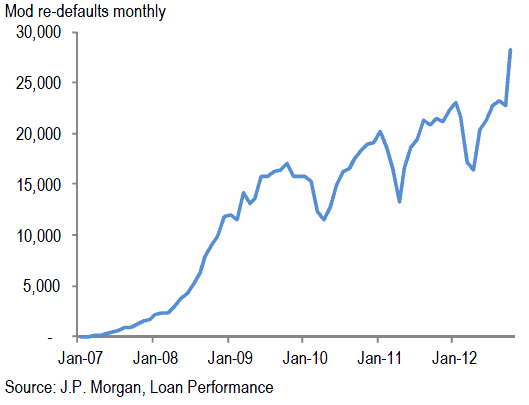

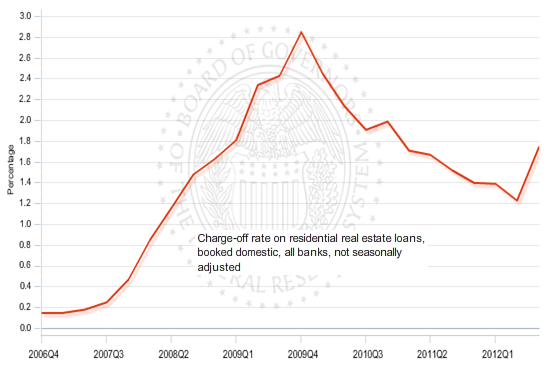

“This could be a cause for concern. However, banks have some leeway in when they actually take charge-offs during the year, so it is worth taking a look at a more up to date delinquency data. JPMorgan recently published the October delinquency results. Indeed there was an increase in delinquencies, mostly in October (there seems to be some delay in reporting delinquencies that the Fed picked up in Q3, particularly by Bank of America). But delinquencies seem to the heaviest in sub-prime mortgages. Is this another wave of subprime defaults?â€

A modified mortgage is yanked out of the shadow inventory pipeline. From data from the OCC and other figures from HAMP, re-defaults on modified loans are very high. It might take one or two years to re-default but the success rate is poor. In other words, was the shadow inventory figure temporarily depressed because of these weak modifications?

From looking at the figures, this does seem to be the case. What is interesting however, is the massive jump in short sales being approved by banks. The shell game allowed these homeowners to tread water until the Fed went into QE3 and now, banks are “working†with these homeowners to unload the properties at higher prices to new buyers and in many cases, investors. I’m not sure if this is really the core function of helping homeowners out.

Something is definitely going on recently because charge-off rates have spiked recently and the housing market is moving up:

Source:Â FRB

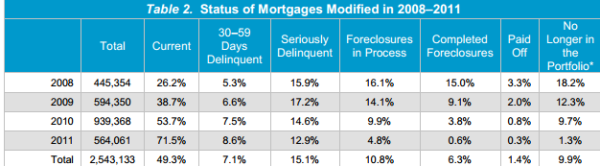

So how many mortgages have been modified? Since 2008 it looks like over 2.5 million:

In other words, you have a solid number of modified homes re-entering the shadow inventory figures. With investor demand and short sales, the figure is moving lower. But it is important to always keep things in perspective especially when moving buckets around.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

54 Responses to “Modified mortgages re-enter shadow inventory – By next month the housing crisis will have cost 5,000,000 Americans their homes via foreclosures. Distressed inventory still above 5,000,000.”

Additionally, we now have “revised” figures that show new home sales stagnating (again) – http://www.reuters.com/article/2012/11/28/us-usa-homesales-idUSBRE8AR0RP20121128.

September and now October new home sales have been revised sharply lower – so add that to the bucket of other unreliable gov’t figures that are forever being massaged in order to assuage whomever’s in charge at the moment.

Sore loser. Mr. “Corporations are people, my friend,” got crushed. Get over it. And, thanks for introducing conspiracy theories about gov’t numbers being revised (“massaged”)….further lessens your credibility on this board and reveals your blind partisanship. Hey, guess what, the monthly gauge of pending home sales from the National Association of Realtors was revised HIGHER in September and is now up 13.2 percent from October of 2011. Private and public economic numbers get revised higher and lower all the time; they always have and they always will.

Maybe you have Benghazi-gate dreams that will still come true. Looking more and more like there’s nothing to see there, either.

And, it’s “whoever’s” in charge.

ah, yes – the always – predictable trollbait brings them out in full force. Thanks for playing, but as per usual, we’ll never see you again on this board. Funny how that works.

Hey Dude, I’m one of the 47% and I’m waiting for my entitlements, food stamps, gifts and other goodies to make up for hte destruciton of the economy of your GEO W. Bush. It takes time to get over Mr. Turd Finger and his side kick Turd Blosum, remember that crowd? Unfortunately, I voted for the republican, the right wingo extremeist was just too much for me.

‘lost their homes’

No, not THEIR homes.

EXACTLY – WTF DHB?

“Their” homes?

How do you say “their” when the avg person had ZERO equity at the time of loss!?!

Technically it is their ‘HOME’. Home is just where you live. Your apartment can be your home. A tent can be your home. A car can be your home. The HOUSE wasn’t theirs.

Entitlement Village the new suburb, welfare moms, obamaphones coming to a neighborhood near you just wait and see

I think it’s located right next to Corporate Welfare Metropolis; which has been around for decades.

Exactly, thank you!

If the equity market would get around to crashing, I’d grab up some Lockheed Martin shares so I could get my quarterly dividend/welfare check too. I don’t know anything about ’em fundamentally, but i know the game is rigged to give away taxpayer money to these type of corps so that they don’t have to see the same level of (market) risk as other entities do. And given the U.S. policy to rule the world by force, I think LMT is a pretty safe long term bet. Already get my IBM welfare dividend check every quarter.

It wasn’t their house, it was the banks. It would be their houses when they’d finished renting the money from the bank they used to buy it.

Remember land inflation is bad for the economy, so every foreclosure is another opportunity for someone to pick up a residence for a more affordable price. i.e. a net gain for the economy.

The Doctor’s articles are insightful and analytic. Kudos!! We still see zero down houses being handed out + joblessness (underemployment) is rising. Shiller predicts a further 20% drop in house prices and these facts support his prediction.

Ok, there are tiny pockets of RE here and there where prices have bounces a little but these are so tiny and temporary based on a short flare of what the Doctor describes as foreigner money, investment companies and a handful of wealthy using leverage to buy a $1.4 million (and up) LA houses. With Wall Street bonuses dropping and financial-related jobs plunging, there will be far fewer of these ‘high dollar people’ who can afford those multimillion dollar houses. When state and federal governments get serious about the massive multi-trillion $$$$ deficits, property taxes must increase as well as abolishing the mortgage interest deduction on houses > $500,000. The government needs to get serious about increasing revenue and RE is a golden goose ready to milk.

I welcome anyone drive around Dallas or Houston suburbs and you’ll see these formerly $120 psf houses now on the market for less then $50 psf as well as how deteriorated those neighborhoods have become as occupants no longer ‘take pride of ownership.’

It’s sad and even sadder to see no solution to falling house prices for years to come.

What parts of Houston are you referring to? I don’t really see anything like that, unless you are talking about the KB and other lower builders that planted tract homes on the fringe of bad areas. It should not have been a shock that pride of ownership would only last a few payments for those builds.

You have a little problem in the Lone Star State. It is not uncommon for inexpensive houses to have a tax and insurance payment greater than half the mortgage. This is true for almost all $100 a sq. ft. houses. This is true even in the exquisite Woodlands. And, this will get worse as a state income tax will never pass and oil is going to $65. Better short the Permian again just like 1980’s. Think how crazy it is for a house that has $431 mortgage payment with a real estate tax of $225. See below. By the way, this is on its way to sunny California. Every time a Republican dies or moves out of state, three latinos are born.

http://www.zillow.com/homes/woodlands,-texas_rb/#/homedetails/21-Dellforest-Ct-Spring-TX-77381/28771880_zpid/

All you Calies here is a real mansion. Eat your hear out, 6,000 sq ft for 790,000 in top neighborhood that would cost you minimum of 3 million in a Cali. But, wait, look at the taxes, only $1,200 a month plus insurance on a mortgage payment of $2,700 thanks to BEN. But, here comes the kicker, how about those electric bills to cool this sucker. Try at least another grand and a half for 8 months out of the year. Better be packing for Ecuador.

http://www.zillow.com/homes/77380_rb/#/homedetails/34-Firefall-Ct-Spring-TX-77380/28777803_zpid/

Pre-election numbers revised down?

Is that possible?

That crowd is already in the neighborhoods…

No work or low pay, the crowd is now all of us!!!

I don’t understand how it is possible that the banksters have been able to keep air in this faux bubble. It makes me sick. Thinking about moving to Texas.

don’t – you’ll regret it

Bankers are able to do this due to: Federal law 12 U.S.C. §29, which allows them to hold on to foreclosure properties for 5 years, 10 years if they show “good faith”, and the Federal Reserve’s ZIRP (zero interest rate policy). The combination of the two allows banks to selectively leak inventory, especially here in SoCal.

Next up: the Federal Reserves $40 billion per month purchases of mortgage backed securities, aka QE3

Do the math: Dr. HB said that 50,000 bank repossessions per month are occurring. Let’s pretend the average mortgage balance on each foreclosure is $400K. QE3 will allow the Federal Reserve to transfer 100,000 foreclosures off the balance sheets of banks and on to the Fed’s balance sheet every month. In other words, one month of QE3 will suck up two months worth of foreclosures.

Typical mind of a defaulter is saving to the extreme by spending zero on maintenance since they know one day will come when the house is no longer theirs. Imagine what a house will look like in 10 years with no proper care…

Ernst – What you’re saying is how I see it too. What exactly that means for housing prices, I’m not sure. I tend to think overinflated prices for many years to come. But I also I think that even QE3 is not enough to cover the losses, in any reasonable period of time (i.e. <5 years), so something's gotta give. When and what – that is the question.

Solution to falling house prices is falling house prices. Don’t tell Bernanke

Here’s my take as a working Realtor – I’ve sold 8 short sales this year. All but one had had a modification. A couple even had 2 mods and were going to try for a third when I talked them out of it.

I’ve done several mods for clients over the last few years and currently am working on 5 of them now. Also have gotten the $25K reinstatement assistance for a couple others from the Hardest Hit Fund.

That’s several more properties put into the “shadow inventory”. Why? Because I expect some of these to redefault. Even if they get denied for modification, these sales are effectively off the market for several months while the mod is reviewed, then appealed, etc.

The US treasury publishes the statistics for loan mods every month, and the trend is clear. Easily, 50 percent of these modifications are either in default, foreclosed, or short-sold within 2 years.

California’s new law that prevents dual-tracking, (i.e., continuing the foreclosure process while in loan mod review) goes into effect Jan 1. This will further slow down the rate properties come to market.

I’m seeing loan mods computed with 2% interest & 40 year terms on the balance AFTER the lender first subtracts hundreds of thousand of dollars from the total with combinations of principle forebearance and outright forgiveness.

You know what? Many of these borrowers still can’t make the payment after the modification. They just don’t have the income. And in many cases, they never did. These were loans made to people that never should have gotten them and no amount of modification will fix that.

Right now there is a “shortage”. Properties in the under 300K range are getting 8-10 offers, with the sale going to asian cash buyers. Your first-time FHA buyer is out of luck again – on top of having to pay a higher insurance premimum for all the past FHA loans now going bad.

So is it safe to buy a house yet??

The best thing would have been to just stay out of the way and let the foreclosure process work its way through. People would have moved to areas with jobs and rented. In many cases they would not have even lost much money because they “bought” their homes with <3% down anyway.

The wasted trillions of dollars, but they reinflated the bubble It’s an insult, it’s thievery on a scale unmatched in history. I’m stunnned the dollar has survived thus far.

I have lost all the love i once had for this country. The game is rigged, and it’s enough to turn good men bad.

Actually the Dollar is getting destroyed and it will get only worse as the days go on. One ounce of Gold is over $1700. Food prices are skyrocketing. Also some of the inflation is being hidden with products getting reduced in size. Printing trillions of dollars to buy your own bad debt is a recipe for disaster.

The game IS rigged. And frankly, the outcome scares me. No matter how you slice it, the average citizen loses. No good investments, worthless dollar, inflated prices, and taxes, taxes, taxes.

Why ‘artificially induced’ higher home prices hurt:

If my house went up 100k and the rate goes up to 5%=$890 or 6% $1255 more a month also prop tax is higher etc…are they prepared to finance and too who. Going from $2220 a month to $3475 plus prop tax increase is huge.

How much higher do they want prices to rise, without the fundamentals to support it, looks like another big failure.

None of those five million owned their homes. The vast majority had no equity at all in the houses they bought. The foreclosures aren’t the problem. The government interferences that delayed the foreclosures are the problem. This mess could have ended, for the most part, two years ago. The delays hurt both the mortgage holders and the home buyers (who made reduced payments for additional months or years but still were hit with foreclosures).

The real question is, exactly how long do the banks have to keep zombie houses on their books with extend and pretend, before they “MUST” sell them? I had heard 5 years. If that is so, 2013 could be when many banks would have to get them off their books. If someone has the answer to this question, it would solve the question of how big the shadow inventory is and might be later. Perhaps, that might explain the increase in short sales on the Westside of LA.

http://www.westsideremeltdown.blogspot.com

How long do banks have to keep zombie houses on their books? Ernest Blofield’s comment (above) sheds light on the answer: Federal law 12 U.S.C. §29, which allows them to hold on to foreclosure properties for 5 years, 10 years if they show “good faith.” And I believe another commenter made the observation that once that 10 year period is up, you can bet your bottom dollar that the big banking industry is going straight back to Congress and lobby hard for another extension. I believe this is entirely likely; analogously, Disney kept going back to congress to lobby for copyright extensions when the disney copyrights were about to expire. And they won every time—we went from a regime where copyrights lasted 20 years, at maximum — to what we have now– not 30 years, not 40 years, not 60 years, but the entire lifetime of the copyright holder, plus seventy (70) years… Point is: We might be in this artifical stasis for a long, long time.

Here is my question. What would happen if we, as a society, just let these big banks fail? (assuming we had the power to). Would there be this gigantic parade of horribles, a chain reaction of economic ruination affecting every sector of the American (or even worldwide) economies? Or would the world just keep spinning?

Would the US Government need to bailout all those millions of bank custormers who had money tied up in these big banks, for example, with FDIC insurance payouts? Ben Stein, a famous conservative economist said that Obama “had” to bailout the banks with quantitative easing, “any student of history” would discover, if they looked at the Great Depression–that the alternative would have been way worse. Is that really true?

Jim Sinclair has often made a similar assessment of this situation. What the powers that be have been doing is most probably the least horrible solution to a dilemma that will eventually run its course with absolutely gigantic levels of money creation….leading to a “monetary reform”.

Somehow that’s the “least terrible”?

That’s the problem.

I agree with Patrick Lavender (and Ernst’s) assessment. I also think the answer is simple. It will go on until nearly all the loss is transfered from the financiers of this world to the rest of the populace.

Some interesting news from Sacramento… Housing Bubble 2.0??

“…An investment firm that owns the Waldorf Astoria hotel and the Weather Channel has bought more than 500 houses in Sacramento in the past few months, betting upward of $60 million that home prices will rise….” “…Starting in May, the firm bought about 900 homes in Riverside and San Bernardino counties, Southern California’s Inland Empire, which saw a boom-and-bust cycle last decade similar to Sacramento’s…”

http://www.sacbee.com/2012/11/25/5008543/big-investment-firm-buys-hundreds.html

We can only hope that the previous owners of those houses now rent them from their new owner and stop paying the rent. That would be funny…

Investment groups like hedge funds are buying houses based on their return yield from renting them out. This actually makes many homes “worth” more than the asking prices. So, they’re buying them in big tranches. Then they bundle them in a REIT and go public. Usually, the public is happy with a 5% yield….and the hedge fund bought them closer to 10%….so guess what the price will be once the homes are in the REIT? Yup, about double as a REIT asset. Interesting to see it all unfold.

There are REITs paying out 10% to 13% all over the stock market. Why not buy them? Be my guest. But, don’t come crying when there is a flash crash of 30% of your capital. There is a reason the REITs yield is so high and its not because of excess cash flow. It is something called risk.

An interesting take of how higher home prices should negatively impact rental investment returns, which will slow down investor purchases due to lower yields, which will slow down price appreciation. Real local incomes and sane economics do matter at some point:

http://finance.yahoo.com/news/rising-home-prices-may-actually-173023075.html

ya mean foreign “investors”, zero money down “owners”, and “hot money” isn’t the characteristics of a housing “recovery”?

“And, thanks for introducing conspiracy theories about gov’t numbers being revised…”

Thanks for contradicting your earlier statement. Awesome.

Yeah

DFresh “thinking” “sane economics”.

What a country.

Just think….some think “banksters” are our real problem!!!!!!!!!!!!

I’d like for you to point out the contradiction. But you won’t because there isn’t any. Funny how that works.

The contradiction is that after ignoring my earlier post that contained actual and objective data, you chose instead to comment on an opinion that I shared at the end. Then you post a “news” article that contains no information at all to support the author’s purely subjective opinion. You suffer from a bad case of projection, but then that’s been apparent from the beginning. Try harder next time.

The shadow will stay in place as long as it takes to bleed-off all the inventory. 10 more years? Quite possible. The banks and Fed run this country and they only stand to gain if things are kept on this same vector for a long while.

What is amazing to me is the the stock market continues to grow in the face of all these harsh economic realities. When Alan Greenspan called it “irrational exuberance” back in 1996, what should we call this?

It’s not irrational. The stock market continues to grow in the face of harsh economic realities because corporations are less and less reliant on American consumers for their revenues and profits. American corporations may be “people” but they are only beholden to a global base of equity investors, not to real American people.

Plus, most of the developed world is in worse fiscal shape than America, so where else are you going to put money?

So in other words, we take the money from the fire and put it into the frying pan.

Hey major hypocrites, if your house isn’t 100% paid for, that damn house ain’t yours either Look at all you, eating each other based on the LIES from the media controlled by the elite wealth.

47% of americans do not pay taxes. This is so freaking FALSE.

Everyone who buys anything pays taxes, or drives, or registers anything, or owns property, good God the list goes on forever, but hey, the rich say you all is lazy no good freeloaders, of course the business they own and control pays you just enough to be at the poverty level.

Social Security is an entitlement…FALSE.

Last I checked, each of us working are paying into S.S. That is called a BENEFIT.

Americans are so buried in their entertainment, they cannot think clearly or logically. Most just vomit out “facts” from MSNBC or worse, FOX. Wake-up people, stop quarreling and fighting each other while the elite buy our politicians and laws. You ALL deserve everything you get for voting these corrupt psychopaths into office. If you vote, you are at fault, accept your responsibility and that will be the first step to recovery for this nation. On second thought, nah, just turn on the TV, take a pill and a long drink, then go back to sleep. No worries, the revolution will not be televised to disturb you.

“47% of americans do not pay taxes. This is so freaking FALSE.”

Hey Swiller, nice straw man argument on your part. The actual statement is “47% of Americans do not pay FEDERAL INCOME taxes”

Why don’t you go educate yourself and learn the difference between FIT and the other taxes you mentioned?

Leave a Reply