7 Housing Trends to Look for Going into 2013. Did the foreclosure pipeline increase last month?

There was an interesting trend that emerged last month. 2012 has seen a reversal in the housing market yet this topic has been largely absent from all debates. The piece of data that was released addressed the still formidable foreclosure pipeline. Foreclosure starts saw a 260,000 increase from the previous month. It is expected that actual foreclosures are decreasing as the pipeline is being sold and as the economy recovers, this figure will slowly move down. Yet to see the foreclosure starts pipeline increase goes counter to everything we are hearing. What gives? There are a few reasons for this increase. We also need to explore the building side of the equation and how rents have been picking up in 2012. The flood of investors and Wall Street swarming into the rental market is a new experience. What are the trends for housing going into 2013?

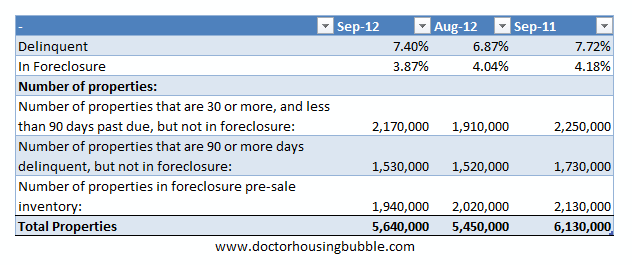

Trend #1 – Foreclosure pipeline

It was surprising for some to see the earliest distressed pipeline bucket increase by 260,000 last month. The reason this was surprising is that there has been a steady decline in foreclosure starts for over a year. What this means is that we will be seeing more of these foreclosure hit the market in the next few months. Why the sudden jump? Banks are being calculating and want to sell into a positive trend for the housing market. They see big investors over bidding and buying properties, many times without viewing the place in lots, and pushing prices higher. Yet at some point markets do get saturated.

Economics would tell you that more rental supply on the market will likely push rents lower. Yet many are now buying to flip thus removing property for sale (until ready for the flip) or rent. This is one reason why rents and prices have been pushed up this year as well including the ultra-low mortgage rate. Yet this trend is not being driven by solid economic fundamentals. Certainly not to the level we are seeing with price increases. The trend to look for into 2013 is how much momentum this can carry going forward.

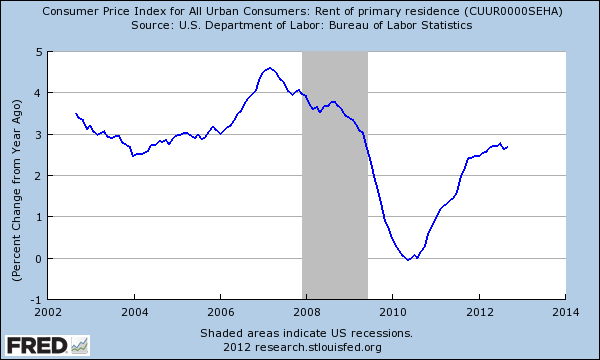

Trend #2 – Rental Market

Rental prices have seen a nice move up in 2012:

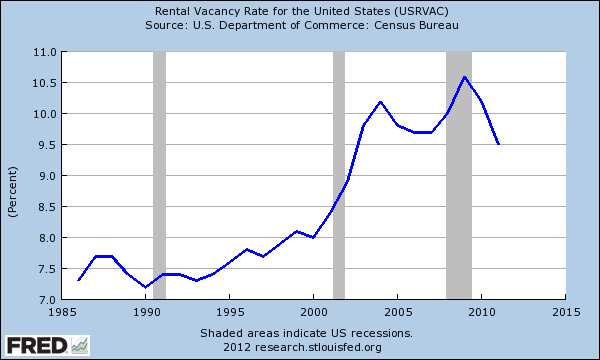

Too bad incomes have remained stagnant. That is the unfortunate reality with this push up in rentals. More household income is now being spent on rental housing. This usually impacts those least able to afford these price increases. The rental vacancy rate has also been falling:

Big pocket investors are diving into the market trying to chase yields. Yet being a landlord is an expensive business and probably will not scale well with single-family homes. The projections many of these investors have are too rosy and this usually is not seen until a few years of property ownership. We have to see if this trend continues going into the new year.

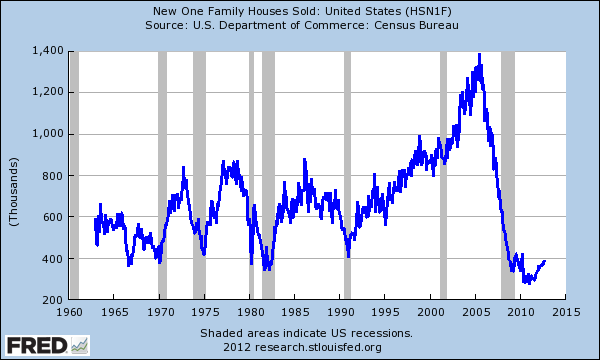

Trend #3 – New home sales?

New home sales are a better indicator of a real rebound in housing since this trend is likely to put people back to work in new home construction and shows demand exceeding current supply. This trend is barely visible:

There is a modest pickup in new home sales but it hardly registers on the chart above. The real demand from Wall Street and many funds is for cheaper properties. So far, we have yet to see this trend impact the new home sales market. We are well below the annual trends going back to 1960. All the activity at the moment is at the lower end plus a major part of the market (above 30 percent) is being dominated by investors.

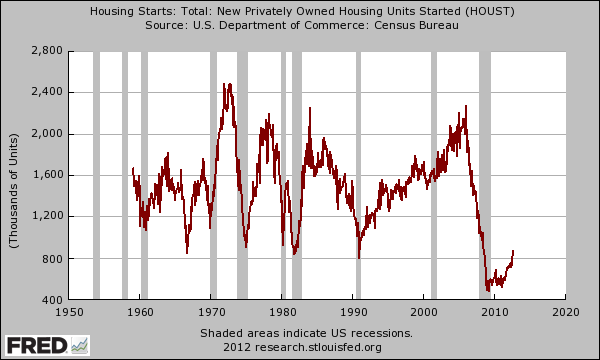

Housing starts are picking up but the trend is small:

This is another trend to keep our eyes on going into 2013.

Trend #4 – Expensive state housing

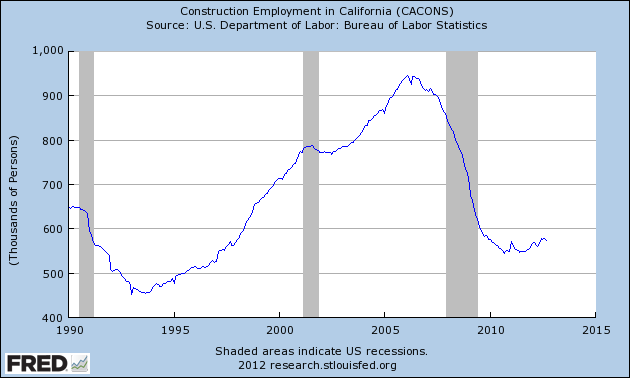

Some areas in California have seen no correction since the bubble burst. In fact, many homes are selling for prices above the previous peak price. Construction employment in California is still stuck in the 1990s:

And given the sales volume and the reality that all loans are government back, you can forget about the hundreds of thousands of jobs that were dependent on housing bubble 1.0. If housing is in such a good trend, why are we not seeing construction jobs pickup? The reason again is investor demand is for existing lower priced homes while flippers are targeting high priced markets for used homes. Construction employment would also see a boom if people were remodeling their homes but short-term investors are looking more for an in and out strategy.

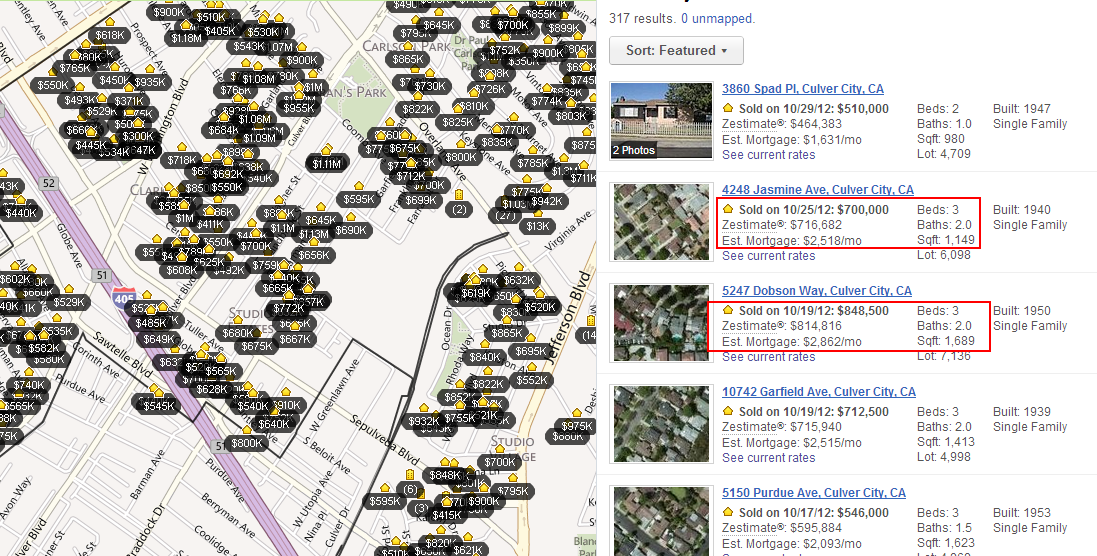

Take a look at some recent Culver City home sales:

$700,000 for a 1,100 square foot home? $848,000 for a 3 bedroom and 2 baths home? You be the judge and ask whether these are realistic prices. These prices are completely dependent on low interest rates.

Trend #5 – Prices going up

The Case Shiller Index turned positive in 2012. Will this trend continue into 2013? The large boost came about because of low interest rates. Ben Bernanke has already hinted that he will be leaving in 2014. We are already seeing the impact of low rates on the standard of living for many. As more and more seniors become dependent on fixed incomes (the majority rely on Social Security as their primary source of retirement income) how are they going to feel about their income being stuck while food and energy prices soar?

There is always a cost to taking actions like this. This was not organic growth. The Fed with QE3 is buying $40 billion in MBS each month and already has a balance sheet of over $2.8 trillion. This engineered growth will need to continue to keep the trend in housing going. The market is already addicted to sub-4% mortgage rates. The market is all government backed loans or big pocket investors.

The trend for prices moving up will depend largely on mortgage rates but also on how investors treat the rental market. Will many try to sell into the current market? We are already seeing this with flipping rates increasing.

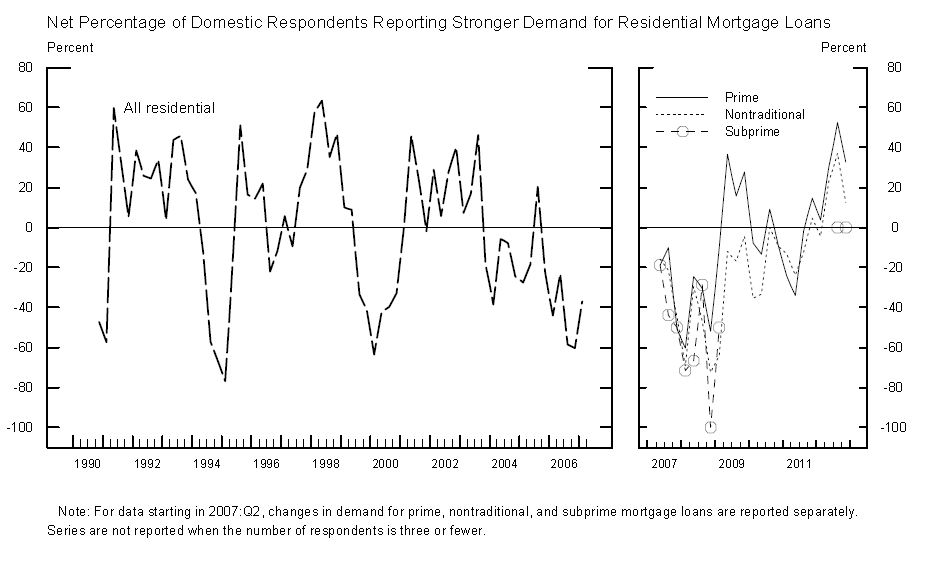

Trend #6 – Demand for loans

Demand for loans is high:

This push was driven by lower and lower rates. It is hard to envision rates moving any lower from here. Rates are already in a negative scenario courtesy of the Federal Reserve. At this point, we are simply conditioning the market to these low rates and the Fed will need to purchase $40 billion a month in MBS to maintain this path. The Fed has never gone this deep into their balance sheet expansion so those saying they know how this will play out have no historical reference point. The only other country that has gone this deep into quantitative easing is Japan and their economy isn’t so hot. They also entered these agreements to save their zombie banking sector.

Trend #7 – Remember history

There are some interesting stories in the news that are worth examining:

“ From Cincinnati.com. “The costs of the housing crisis remain steep in Greater Cincinnati and across the nation, yet the presidential candidates barely touch on the topic. ‘I find it absolutely remarkable,’ said Bill Faith, executive director of the Coalition on Homelessness and Housing in Ohio. ‘If you look at what triggered this whole financial market seize-up, it was housing.’â€

This was an interesting trend. The entire election largely stayed away from housing even though it was at the core of our current financial crisis. Why? It is a losing proposition to discuss even while prices are going up. The big winners are large money investors and flippers. For the typical home owner, as we know many are still underwater so bringing this up in the debate might bring to surface some unwanted feelings. Plus, who is going to address the mortgage interest deduction for wealthy households?

“Since 2006, Greater Cincinnati homeowners have joined families nationwide who’ve lost $7 trillion in home equity. One in four local families – 111,397 in all – are ‘under water’ on their mortgages. That cripples their ability to refinance at today’s historically low rates or sell their homes, leaving them vulnerable to foreclosure if their finances take a downturn.â€

This speaks to my previous point. Talking about housing brings back memories of the financial crisis. Many across the nation, especially in crucial swing states like Ohio or Florida are deep underwater.

“Roger Davis of Fairfield, a retired police officer, is one of millions of Americans looking for answers. He has pinched pennies to keep up payments on the house he and his wife bought five years ago. Their home has lost so much value in the years since that the family is now underwater. Davis is disgusted that his bank hasn’t met him halfway by allowing him to refinance. ‘People are walking away from their homes – we’re not doing that, and we’re getting penalized,’ Davis said. ‘We’re trying to be good Americans.’â€

This is another important point. I keep hearing about well off households in California refinancing giant loans while in many other states, banks simply choose to ignore those homeowners. This kind of selective assistance is a reason why longer-term I see the mortgage interest deduction being cut back significantly for wealthier households and this will have a major impact on a state like California. By the way, the majority of homeowners in the US don’t even itemize so the deduction doesn’t even help but of course the lobbying arm of the industry will try to complicate the facts.

The trends in 2012 largely came from the low rate interest environment and massive investor buying. Will this keep up into 2013? For the investor portion, we are already seeing many turn away from places like Arizona where the market is saturated.  Time will tell but those trying to apply open market economic theory here are contending with a deux ex machina with the Fed and government policy. This is a command control housing market being driven by policy, banking intervention, and the government.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

26 Responses to “7 Housing Trends to Look for Going into 2013. Did the foreclosure pipeline increase last month?”

http://www.zerohedge.com/news/feds-balance-end-2013-4-trillion

09/13/2012

The Fed’s Balance At The End Of 2013: $4 Trillion

“Imminently, the Fed’s Open Markets Operations desk will commence buying $40 billion in MBS per month, or about $10 billion each week. Concurrently, the Fed which is continuing Operation Twist, will still purchase $45 billion in “longer-term” Treasurys, sterilized by the $45 billion or so in 1-3 years Bonds it will sell until the end of the year at which point it runs out of short-term paper to sell.

End result: every month through the end of 2012, the Fed’s balance sheet expands by $40 billion in MBS.

Beginning January 1, 2013 the Fed will continue monetizing $40 billion in MBS each month, and will continue Operation Twist, however it will adjust the program so that it continues to increase its long-term holdings at $85 billion per month, without sterilization as it will no longer have short-term bonds to sell. It will also need to extend its ZIRP language “through the end of 2016″ so all bonds 1-3 years are essentially risk free, as they are now, in effect eliminating the need to sell them.

End result: every month in 2013 the Fed will increase its balance sheet by $85 billion, consisting of $40 billion in MBS, and $45 billion in 10-30 year Treasurys, or the natural monthly supply of longer-dated issuance. The Fed will therefore monetize roughly half of the US budget deficit in 2013.

Putting it all together, the Fed’s balance sheet will increase from just over $2.8 trillion currently, to $4 trillion on December 25, 2013. A total increase of $1.17 trillion…

Another way of visualizing this is how many assets as a percentage of US GDP the Fed will hold on its books. Currently, this number is 18%. By the end of 2013, the Fed’s historical flow operations will be accountable for 24% of US GDP…

Why is this important? Simple: when the time comes for the Fed to unwind its balance sheet, if ever, the reverse Flow process will be responsible for deducting at least 24% of US GDP at the time when said tightening happens. If ever.

What is scariest, is that as of this moment, all of this is priced in. Any incremental gains in the stock market will have to come from additional easing over and above what Bernanke just announced.

And finally: Fed’s DV01 at December 31, 2013: ~$4 billion.”

The Federal Reserve is printing money when it buys trillions of dollars of debt from the government(at the end of the year it gives back the interest income to the government) . Notice that over the last four years, everything you buy(except housing) has gone up so much. Inflation of prices is a hidden tax that the voters do not hold the politicians responsible for.

Do not forget at the same time the Fed giveth it taketh away. Their zero interest rate policy is a brutal, not so hidden, tax on the prudent, mainly retired, savers. This also goes to bail out the oligarchy and keep them rich. If people only had the most minimal understanding of how this all works, maybe something could be done. Just like the middle-ages and you are the serf.

You are wrong (and right) on inflation. Its more complicated that just proclaiming “everything” you buy besides housing has gone up.

Yes – we are seeing inflation on non-durable goods and services.

No – durable goods get cheaper and cheaper every year.

Think about how people lived 20-30 years ago. All the crap we have now and how cheap it is relative to incomes?

http://scottgrannis.blogspot.com/2012/10/inflation-deflation-and-ipad-mini.html

@WS

Here is the key quote from the link you provided: “Memo to Romney and Obama: China has done us a great service by producing products so cheaply.”

If there ever was a more glib and ignorant quote in the history of trade, I do not know what it would be. First, the Chinese slave labor production takes the industrial base away in the US and all the traditionally well paid jobs. I know, now all these former manufacturing sector workers are to become computer programmers or nurses. A country that moves it industrial base and high wage sector off-shore will always end up just like Flint, Michigan. This is the same concept as currency devaluation that equals standard of living devaluation. A cheap “durable good” is no substitute for a good job.

China is quite often the place of final assembly before being shipped out as a finished product. But off-shoring is all over Asian. The APPL products are a good example. Chip set from S Korea, Screen from Toshiba, …assembled in China at Foxconn and shipped out.

Your article is confusing two very different groups that are participating in the housing sector–the real estate investors-speculators and regular individuals and families pursuing the American Dream for housing.

The speculators are participating to make a profit. If they win in the market place they add to their wealth; if they lose they don’t lose the home they live in.

The retired police officer mentioned above (as with many other American) may have become greedy and purchased his house with less than 20 percent down and mortgage payments too large a percent of his retirement income–all with the hope of “turning over” his house in a short ( very greedy) period of time for a profit.

Now he is stuck with his decision and should just let go of seeing his decision as an ongoing loss and accept that he has a place to live (that he owns) and continue to live the American Dream.

The moral of the story is pursue the American Dream for a place to live that you own not for profit (greed).

Retired police officers in Fairfield, OH, don’t buy houses in order to flip them.

retarded to enter retirement with fresh mortgage isnt it? Maybe he needs to get a job and be productive?

Yup, pretty dumb move, buying a house at that point in your life. Well, taking on a mortgage that you are having so much difficulty paying that you are whining for a lower interest rate is, too. But, hey, he’s probably fairly young, and has health insurance for him and his wife for the rest of their lives, so, they’ll do a whole lot better than us civilians.

My guess is that too many donuts clouded his decision making.

In many countries, you can’t get a mortgage if you’re over 60.

A stable and lasting real estate market is about employment. So what we’re seeing right now is all contrived by the banking system. Small inventory and cheap mortgages are all their doing. How long can it last? Who knows. But interest rates at 3.4% are pretty darned tantalizing.

The battle of two real estate mantras: 1) real estate is about local incomes; 2) all real estate is local. Right now mantra #2 is winning and extreme price:income ratios’s rule the day in good So Cal areas.

Check out the price on this. And it’s gone pending!

http://www.redfin.com/CA/South-Pasadena/2024-Ashbourne-Dr-91030/home/7008423

Bernhardt why should that surprise you? Houses in that area have historically been high and command high prices in such a gold-plated school system location. I predict that area will become even more expensive compared to other areas in the future.

From what I understand Pasadena, esp S. Pasadena has horrific public school systems. Everyone that is worth anything in Pasadena sends their children to private schools. I work in Glendale, and the information I receive are from sources who live in Pasadena.

Pasadena and South Pasadena are completely different independent cities. Pasadena is a large city perhaps close to the order of Sacramento. As such it has a large lower class population on it’s north and east sides. South Pasadena is more like a mid-west college town without the college. It has a lower income component in that it has sections that are made up of apt buildings. For the rest it has neighborhoods that range from lower middle class to upper class. The home in the link is in the latter of course and borders San Marino the Beverly Hills of the San Gabriel Valley. I am not saying the prices are not inflated however the schools in South Pasadena are I understand rated well above the average school in Pasadena. I’d hazard they are better than Glendale.

Someone, Do you mean the Southern area of Pasadena has bad schools or do you mean the city of South Pasadena has bad schools. Because the city of South Pasadena has excellent performing schools.

City of So. Pasadena has great schools.

Ah, thanks for clearing that up. I must’ve mis-understood.

Not *that* disproportionately high. You need to look at sales histories a little closer.

And what do you think will be the driver behind a graduation in prices in that area? The next bubble-generated windfall that the Fed is trying so hard to create?

Sout Pasadena’s schools are good by local and national standards. Pasadena, however, is just slightly above L.A. Unified, with all the same problems. I live in Glendale, and the schools there are not good at all, however, the city council will try to convince you otherwise.

I think if Romney would have gotten elected we would have had a major depression towards 3rd quarter of next year. I am not saying that I agree with what Obama stands for but it is going to buy us more time to figure out what to do about all the debt and the lack of jobs. http://thebasicsofliving.com/?p=252&preview=true

Aw, looks like you creeps can continue to cry for another 4 years. People are moving on with life and so should ya’ll. There’s still plenty of time to buy!

Obama win = Bernanke status quo = low interest rates stay and nominal home prices kept high.

Bernake was appointed during the Bush years. So interest rates are left low and are allowing first time home buyers and others to get back into the market. Why is this a problem? You’ve said it yourself, “I was tired of waiting so I bought.” What a hipocrite! So, some dumb ass wants to spend a ton on a house. What is it your business? How would you like it if someone kept looking over your shoulder pestering you about every single purchase you make. “Oh boy, he’s paying 99 cents a pound for apples! Better blog about it and blame Bernake.” What a joke!!!

Leave a Reply