Real Homes of Genius: Santa Monica 735 square foot home for $649,000. And they say the housing bubble is over? Figuring out real estate values by looking at comparable lease rates.

The housing bubble is alive and well in certain Westside cities. Even as the state in other areas like the Inland Empire has found a more reasonable price level, some areas seem to remain in a state of denial. Prices remain elevated in some markets even though the overall trend is pushing to lower prices. Santa Monica is one of those locations. Definitely a prime Southern California niche but current prices are disconnected from market fundamentals. In all this talk about the bubble and finding a bottom, never do we hear the mainstream media give any actual method for home buyers to measure a reasonable price for a home. Basically a good price is whatever your mortgage lender will allow you to borrow. This is actually one of the reasons we got into this housing mess in the first place. Buyers were empowered with unbelievable amounts of debt and many had no idea how to value a real estate deal besides a few inflated appraisals which somehow conveyed accurate values.

Today I want to provide you with some tangible methods of valuing real estate in your own area. This should give you some tools to cut through the propaganda and help you arrive at a more fair assessment of home prices. Today we salute you Santa Monica with our Real Homes of Genius Award.      Â

Santa Monica home and rental comparison

Santa Monica is a highly desirable city in the Westside of Los Angeles. As of 2008 87,000 residents call Santa Monica home. The median income for a household is $71,796. A large reason for this lower income level is that out of 45,000 households 32,000+ are renters (70%). The median housing payment for homeowners is $3,744 per month.

That should put the city into context. If we want to arrive at a reasonable price, we should look at a rental and home for sale that closely resemble one another. Let us look at our home for sale:

Details

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 735

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1947

On MLS for 86 days

Zestimate:Â Â Â Â Â Â Â Â Â $574,500

List Price:Â Â Â Â Â Â Â Â Â Â Â Â $649,000

Believe it or not, this is one of the cheaper homes for sale in Santa Monica. The home is listed at 735 square feet and with the current list price, will cost you $883 per square foot. Let us examine the listing details:

“2 bedroom + den/1 bath home with a warm heart and wood burning fireplace. Great starter or condo alternative. Numerous possibilities or move right in. Completely gated, lush landscaping as well as the santa monica schools. A value packed, comfortable home you should see right now!â€

$649,000 for a “starter†home. This is Southern California for you. I dug deeper to find some sales history on this home:

3/17/1995:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $190,000

6/19/2002:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $433,000

If you believe in the current list price, this would mean the home increased in value by $216,000 over 8 years while the majority of Californians saw stagnant wages. Let us look at a comparable rental in Santa Monica:

Details

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 939

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1940

On MLS for 86 days

Zestimate:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $764,500

Believe it or not, the rental has a Zestimate that is $200,000+ higher than the same comparable home. What is the current lease price for this bigger home with a higher estimated value? $2,900 per month.

Let us run the numbers of the home for sale assuming we are putting a 10% down payment:

Purchase price: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $649,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $64,900

PITI @ 5.5%:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,992

That is a big payment for a 735 square foot home. Before running an analysis, let us look at 3 income scenarios:

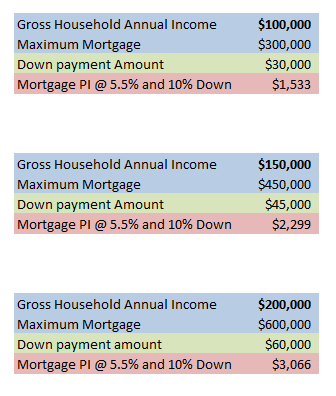

For this home, a household will need to bring in at least $200,000 per year. I find it hard to believe that a family making $200,000 will want to live in a 735 square foot home but I could be wrong. The above rules apply to any location. You should not take on a mortgage that is 3 times larger than your annual household income. I know in California with Alt-A and option ARMs this might seem ultra conservative. The first thing anyone should ask before buying a home is how much they can afford. The above should give you a quick guideline.

Next, we should run an analysis between the rental and home sale. I purposely selected a bigger rental with a higher estimated value to drive this point home. Someone buying this home will be paying $4,000 out of their net income each month. Let us forget about tax deductions for the moment because you are on the hook for $4,000 each month here.

In terms of the rental property, we can run a few investment property scenarios to see whether it is a “good buyâ€:

$2,900 x 12 = $34,800

$34,800 x 12 =Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $417,600

$34,800 x 15 =Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $522,000

When we value rental properties, we can use a 12 to 15 time annual rent figure to arrive at an estimated value. So for the rental property with a much higher estimate, we get a range between $417,000 and $522,000. The $649,000 for a much smaller place is much too high by this valuation method.

And let us be generous here. Imagine you are buying this home not to live in, but to rent out as an investor. Let us be generous and say that this place will also rent for $2,900:

Annual rents:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $34,800

Property management:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,784Â (8% rate)

Vacancy:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,740

Maintenance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,610

Insurance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,000

Taxes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,000

Net operating income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $18,666

Once we get the net operating income, we can try and arrive at our capitalization rate:

$18,666 / (price of home $649,000) = 2%

This is a horrible rate by the way. The average cap rate for rentals is roughly 6 to 8 percent. And if you think the above expenses are high, think again. Anyone that has owned investment property will go with the more cautious side because expensive things have a way of coming up. A roof replacement in California can eat up $10,000.

If you want to get a value by the cap rate you can solve for the price:

($18,666) / (x) = 6%

X Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â $311,000

Now this is a much lower price obviously. But this is why when you talk to real estate investors, they will always have fast rules for valuing places like multiplying 10 to the annual rent (i.e., $12,000 x 10 = $120,000) for the price of the home.

But this is Southern California and the Westside is still using bubble metrics for home prices. Today we salute you Santa Monica with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

34 Responses to “Real Homes of Genius: Santa Monica 735 square foot home for $649,000. And they say the housing bubble is over? Figuring out real estate values by looking at comparable lease rates.”

“find it hard to believe that a family making $200,000 will want to live in a 735 square foot home but I could be wrong. ”

If you know that the place can be rented out for $2,900/month, what does that tell you about incomes of prospective residents?

As a rule of thumb, rent should not exceed 1/3 of net pay, so 2,900/month rent means that prospective residents net 104k/year after income taxes, social security, medicare, etc.; and that puts their gross incomes above 160-180k.

If you make 170k and you have enough savings for 20% down, you can find a mortgage at 5% interest, your monthly payment (PITI) would be $3,480, and you would be saving around $900/month on federal & state taxes, bringing your net pay to $9,800. PITI is 35.5% of net, which is still comfortable, and the true cost of the house is 3480-900=2580: less than renting.

Property taxes and maintenance will erase that “savings” real fast. Also, assuming someone has 130K cash to put down on a house just because their annual income is 170k is ridiculous. Most of their income is probably being eaten by the enormous rent they are paying to live somewhere nice before trying to buy.

“find it hard to believe that a family making $200,000 will want to live in a 735 square foot home but I could be wrong. â€

This begs the bigger question….how many perspective renters, and buyers, are in this income catagory?

Nameless, what you are talking about? Check your math against this statistic for Santa Monica http://www.city-data.com/income/income-Santa-Monica-California.html

In short less than top 25% of Santa Monica households make more than $150K. Where you are going to find that abundance of households with $170K income? (There are not many of them in Beverly Hills even, median income – $93K. Got it?) And you think this top 25% Santa Monica earners are about to create bidding war for this 700 sqr feet shack? Are you serious? Wake up!

As I said before on this blog rents are bad bubble also, many renters are stretched thin, that is why no money for down payments is left when is time to buy (where do you think 20% down of the hypothetical buyers is coming? In this case $130K – saving more than 20% for 10 years on income of $60K!? And this after rent 50% and food…) You know the big picture without the pink glasses.

As I said many renters are stretched badly and this conclusion is easy to make looking at the average rent in SM my estimate around $2500 and the respective median income of renting households, which should coincide with 33-percentile of the whole income lather, so let’s estimate $60K, that is the number I used above. $60K income and $2500 ($30K/year) rent is walking on thin ice. Disaster waiting to happen.

When I estimate that lower 33-percentile is the median of the expected renters income, maybe is fair to use 67-percentile to be the median buyers income for particular city. Which in MHO distorts the DHB formula of affordability x3 little. But It is only a little because the income of the 67-percentile is very close to 50% and the income lather is stretched to infinity at the high end without any real effect on the markets and prices of any type and median statistic numbers.

This is my math, how do you like it?

Scenarios that assume 10% down miss the fraction of the market that supports higher costs via higher down payments (movers-up, heirs, savers, stock market winners, etc.)

Statistics on median net worth, not just household incomes, in a given area would be very useful. In Southern California, there remains a perception that one’s house is a reasonable long-term place to park a large fraction of net worth. That’s why a comparison with rents is insufficient to describe today’s market.

Along these lines, it would be very interesting if Dr. Housing Bubble looked at the correlation between S&P500 value and median house sales price per sq. ft. in different local markets. I think the house/stock correlation is not a coincidence. During the credit party, some fraction of home equity was moved via refinancing into other investments. This liquidity has helped the higher net worth areas to slow their price declines.

I submit that’s one reason some areas like the Inland Empire have fallen while others have not. Local markets wherein homeowners have higher net worth are more flexible moving equity around, including into down payments. In the IE, the housing market has been strongly corrected to levels supported only by incomes, due to comparatively lower net worth. (As we know, even there a new artificial floor has been put it by external investors, who again skew prices away from the rental comparisons.)

As stock markets rise and housing values drift lower, more capital will move into housing, even though incomes remain stagnant. The ‘continuing bubble mentality’ is therefore in part based on alternative investment classes which hold up certain housing markets. These, in turn, are very intentionally held up by low Fed rates, manipulated bank earnings, and gov’t policies, and there is no reason to suspect this manipulations will abate.

Foreclosures may accelerate in 2010 and 11, but as long as investors see SoCal housing as a good investment vehicle, the capital will be there to prop up prices. It will be very interesting when state and municipal budget crises bring on higher property and state income taxes. These will reduce the relative appeal of SoCal real estate investment, and might finally bring about greater pricing consistency with local incomes and rents.

Until and unless these factors are taken into consideration, comparisons of prices and rents like this one in Santa Monica will remain interesting, but mostly inappropriate to fully describing the situation.

The property has been on the market for three months and hasn’t sold, so it looks like the market won’t bare that price. There are also other considerations. Perhaps the listing agent is using 735 square feet because of county records. Whatever the specifics, an able buyer and a willing seller will determine the market value. That doesn’t have any bearing on how good of a long term investment the property is.

da-di-da

If I could follow your math I might like it. Your shorthand style is too much for me.

That noted I am writing this from the almost new SFR my son is renting in Carlsbad. It is a gated community, pleasantville clean, so quiet the kids can literally play in the street. But there is a park right next to the house my granddaughter and her neighborhood kids play in with a basketball and volleyball/tennis court (minus the net) and just beyond the picnic tables a key protected pool that looks like a resort – and is of course heated softwater. The house? In excess of 2100 square feet. The rent? $3000.00. Yes it’s easy to thumb my nose at a $2900.00 963 sq ft rental in Santa Monica from here but I can go beyond that. I am here looking to buy a house the majority of which I will put down in cash. How do I have the cash? I searched till I found a decent landlord in South Pasadena. I rented a 960 sq ft 2 bedroom apt for $1100.00 for the last four years. Meanwhile I put my savings into deferred compensation and saved everything I could above that. I would never throw my money away renting or buying a place like either of those way over priced properties in Santa Monica. Any reasonable person willing and able to pay $2900 in rent will find a way better property to rent on the west side. Why? What da-di-da pointed out about the income ratios in that area. Not a glut of people with that kind of money. When you charge Mercedes prices for a Pinto you don’t get a stampede of buyers. 86 days on the market tells you that. Inland Empire homes at 3 times income are selling in days to weeks. So perhaps Santa Monica needs to be renamed Tulipville.

To add to this, I can say for certain that the $2900/mo price is just an asking rent figure that will never be achieved in a market with 1200 sf 2/2 houses for rent for the same price. My estimate for true rent on a property like this is about 2300-2400 dollars. My neighbor is renting a 1400 sf 2/2 on a good street in Sunset Park for $2800/mo. That’s a new lease and reflective of current conditions as the owner was asking $3100/mo and the home sat vacant for 5 months. Basically, the spread is larger than you are showing above.

You have to keep in mind, Soviet Monica has long attracted insane people with a belief that the local cultural attractions outweighed any economic and regulatory burden imposed on the residents.

This is a place where businesses post hours during which the homeless are asked not to block the entrance by sleeping there. That level of capitulation tells you almost everything you need to know about the town.

After 2 + years sitting around waiting for the right time to buy. We finally decided to Rent. In our area the San Fernando Valley seems like the monthly payments for Rent vs Buy are about equal. We are paying 2500 for a house that would probably sell for 425K or so. Also keep in mind that the owner pays for yard maintenance and pool service and trash collection about 150 a month. All considered monthly we may not be doing so much better. However the large amount of money we would have put down stays in our account any repairs maintenance, plumbing etc, somebody else’s problem. We are free to move, change neighborhoods and not worry about watching our equity vanish. Believe me I wanted to buy a house more than anybody and it took me quite a while to come around to the idea of renting, however right now i feel so relaxed and happy I think I want to rent forever!!!

Tha’ts too much to pay to rent or own for so little space. And is that one of those stinky trees in the yard? Nice.

@ kelmag

Thats exactly what i went through. People make it seem like you are not worth anything if you dont buy a house. I rather keep building my savings and if there comes a time when its too good to pass, then ill take the plunge. Until then, ill pass on buying and just rent.

In Santa Barbara, a significant number of people live in shared housing. I make over $120K a year as an individual, and until recently, shared rental housing with people. The majority of my colleagues do as well, unless their parents or grandparents took home equity out to give them a DP on a house that’s now worth about 30% less than it was a few years ago.

Speaking of sq footages and crazy prices, I live in SM, have been for about 16yrs – strictly as a renter. However, clearly we have outgrown the space we are in and the prices have no way of coming down from its bubble point on the westside. We are eyeballing a short sale in Philips Ranch (91766) about 2900 sq ft, large lot for around $640K – which still feels a bit bubbly but I am just tired of sitting around for the banks to open the foreclosure inventory flood gates…also higher interest rates maybe just around the corner…housing credit is great but not a critical factor…it’s like saying if you buy the rolls royce and we will throw in the CD player for free! Thoughts?

Prices are not coming down much in Santa Monica. It’s a very desirable place to live with a good quality of life, and the school district is good so one has to take into account that they don’t have to spend money on a high priced private school education.

Wydeeyed,

very similar here. I am renting for the last 6 years 2bd apartment in Torrance now 1200/month. (It is beyond me why there is any rental market exist for more than 2000/month!?) On the taxes my household income shows 135K for 2009. I am EE my wife midsize bank clerk. We are saving 40-50K a year. (Not to sound spoiled but it is 40K if we go to Hawaii or put 10K down on new Lexus.) The point is that smart people do not buy RE because they “can afford” they do it when it is good time for it. And this is even more important now, exactly because with the lack of opportunity for economic prosperity for the average Joy the RE is turned into alpha and omega of wealth building. If so making such decision buy/rent should be done with even more responsibility and consideration. All your finances depend on this good or bad decision… Getting to here buying in Westside, South Bay and Orange coast does not make sense since 2004 and is still true. If somebody does not get it please buy that condo next to me for $400K and let me know how much equity you will build for next 10 years, meanwhile I will have real savings of at least 1500/month, add HOA, maintenance and it goes to 2000 (about 25K a year). Would you build 250K equity meanwhile on now 400K condo? If answer is not (or not certain) then I will be at the place where you are heading (with your purchase now) sooner and more certain about it. (If answer is “Yes I will certainly build that equity†just show me how this fit the big picture and I will laugh my arse to the bank. Ha-ha-ha) Would it be worth 650K in 10 years? Where then SFR prices in same area would be? Not a single house less than 1 million (in Torrance, 2 millions in SM)? On that stagnated income? Chinese investors to wipe our arses? Wake up, guys! (If prices do not come down soon they have no way up. If they do not correct soon it is even more certain they are not going anywhere next 5-10 years…) On the way up for RE is concrete wall of stagnant wages and long term dire economics of aging empire. Buy now and you are drained financially, 10 years for now when it is time for colleges’ tuitions what do you do if you have put all your eggs in the “owning†basket? I, the renter will have liquid solution… In 20 years when I retire I have solution also and your condo may have the same price tag on redfin for 120 days, just ask the Japanese how it worked out, how much equity they have build since their 1990 bubble started to leek…

Only 78,000 people live in Santa Monica? Holy housing hogs, Batman! The Army Corps of Engineers should plow an earthmover down Montana Avenue and then put up some condominiums.

It all gets down to supply and demand. If you have 50 people after 5 or 6 houses, the price unfortunately won’t drop even if the economy is sliding. If one is not happy about that, just rent and stop the snickering and be happy renting in the area you wish to live. Wasn’t a couple of months ago that some nut purchased a superman comic book #1 for 1 million dollars? (Simple supply and demand) The only thing that will change the situation is if we have a global insurrection on banker occupation so the middle class can thrive again.

D1, where exactly the supply of 170K households is coming from (where this decision to buy a shack in SM for $650K is economically justifiable)? Give us a hint. China? And what benchmark for affordability is used for this x 4? 170K x 4, so 650K makes sense. This is good laugh. I will keep renting you let me know, i will stick around. Decisions are made easy in moronic heads and this category extend even into 170K income, but this does not make this moronic economic decision less so. Sorry to use the right words.

Speaking of China, there’s a big housing boom going on there, which has apparently spilled over into Australia. Any evidence that the latest China boom is contributing to the uptick in SoCal home prices?

Gov is doing everything to keep housing bubble from crashing too quickly, so the big picture is still being missed. Prices are hugely distorted–not a little–hugely. At some point the gov stops intervening and the crash returns. They’re trying to inflate (perhaps you forgot that we are in a two-year emergency fed zero-interest rate target, that will not last) state is broke, unemployment rivals depression. Actually, because of larger population and vast welfare state, there are far more unemployed than in the depression, just a smaller percent of the population. Buy now? We are still in a state of emergency–the Treasury has been drained, but nothing was fixed. Nothing. No one went to jail, had to return bonuses. Republicans will defeat banking reform or Dems will de-tooth it. Dump your life savings in a home costing 3 times the intrinsic value? Go ahead. The debt society has lasted 40 years, maybe all you need is another five…

unless wages rise/stabilize/or simply exist we are seeing repeat of japan and going nowhere the model of annual income x 10-12 works well hmmm 600 take home =7200 x12 =86400 ,,,thats after expenses on new home at 600 mind you ,, tells me that i did ok at 85000 not sure whose math it is ,,,,,oh my other is pre bubble 30yr fixed,,,,, do i get a home ownership diploma? lol (looking for way out of here) good luck guys

@ Epobirs

Soviet Monica? Cute but missplaced. What does a liberal bent and empathy have to do with communism? I don’t recall reading in my history books that USSR sufferred from terrific schools, great restaurants and shopping, high value houses, vibrant tourism, wonderful climate, etc. Oh, the SM pier has no admission…must be some grand communist plot!!

da-di-da,

My observation, not opinion………

The GDP in China is about 10 times what we have here (ours is basically 0 in real terms) which means they have lots of extra cash. Sure there are plenty of poor folks, but just by sheer numbers, they have more up and coming millionaires than us. Their economy is like ours was in the mid ’60’s. In a big city like Shanghai, you will easily pay over a million dollars for a 1,100 sq. ft. condo close to work. Homes with land are unheard of there. The minimum down payment on a property used to be 20%. Since the beginning of the year, the government mandated a 40-50% down payment to slow down their bubble (unlike our banksters) and property is still hot there. With so much positive productivity there, it is not hard to believe. When they see houses over here with land and a good schools for 500-600K, they snap them up. They are not waiting for the economy here to improve to buy something, for their economy is booming, at least for now. And when they pay cash or almost cash, they’ll never foreclose on anything here even if the local economy falters along. Even if you are a millionaire in China, the living standards still suck; the air is dirty and it is always crowded wherever you go and property with land is virtually impossible to obtain close to work. It’s very rare to see a Chinese name on a foreclosure list here. You might occasionally see a Korean or Japanese name on a list, for they sometimes adopt the idiotic credit crunch American lifestyle.

So that leaves us locals waiting around for the sky to fall, which it surely will on the majority of California properties like the Dr. states. I wish it was easier to obtain one of those properties in Cerritos, Arcadia, or Walnut, etc., but it appears that won’t be so, at least for now. Who knows. You can rabble on about income vs payment, etc., but concerning these areas, it makes no difference with cash or mostly cash buyers. Our local economy makes little difference to these people. We have been sold out long ago and the money we used to make is in the hands of others now who have strong purchasing power.

Duh. Both of these houses are being offered at “lot values” so someone can tear it down & build something 3 to 4X as big.

Also many houses are being listed at price 30 to 50% more than the price they can sell at.

Santa Monica is an 8 square mile premium housing area surrounded by LA. House here sell for 2X what they do a few miles away in Mar Vista. The School & police security are much better than nearby LA. The people who buy houses here are usually in the upper 10-20% of wage earners in the area.

Well, we live in the area of the listed house but just over the venice border. Our HH income is $275/annual. We RENT a 1100 sq ft house for $2800. We thought we could move to a larger rental since rents had supposedly gone down. But, we could not find anything larger or better for less than $3200/month. And I’ve looked hard for 6 months. We refuse to buy into these prices like the house you mention – ANY of our many friends who own bought their houses 10 years ago at an average of around $400,000 for the nice houses. WHY should i pay $750,000 for a shitty even smaller house? I don’t get it. But our area is not dropping substantially like all these blogs claim they will. (and have claimed for 4 years now.) but everytime we look at a starter home and wonder if it’s worth it, it’s been purchased before we even can write an offer. Michael Landon’s daughter just paid cash for a new construction down the street. it never even went on the market. THIS IS THE REALITY OF THE WESTSIDE. I’m in it, living it. tired of hearing that it’s an inflated bubble that will drop, because it’s not!!

Even is “stable” value areas like houston, tx there is still distress selling, especially in the large homes. There are many 4000-6000 sq ft homes in major distress.

Where I like the 8000 sq ft mansions on golf courses that cost around $1M all go up for sale in major market corrections… 2000 and 2008. I think the people in those upper markets here are buying big but have no reserves so when they lose that $250K a year job they cannot afford their $1M house anymore.

That is what it seems.

D1–

Are you kidding? Supply and demand? The same argument that flourished during the bubble years, praised as gospel by both real estate agent and speculator alike? Do you have so much as a simple understanding of Keynesian economics?

The principle of supply and demand exists solely within a natural economy, or a direct bartering system. Once an economy is monetized, supply and demand are commonly manipulated, yielding valuations that have no basis in reality. That prices remain unhinged from historic averages is not a product of supply and demand, but instead its continued manipulation by those whose livelihood is bound utterly to usury. Tulpengekte!

How cares how big the house is. How big is the lot and where is it located? That is what determines the value of this property not the shack that sits on it but rather what could be built on it.

No offense to all of you native Californians but at these insane house prices, rent prices, and all of the taxes you have to be nuts to continue to stay there. But then again this is coming from a prospective of a Midwesterner.

I do have relatives to lived in New Jersey where they were being overtaxed and prices for real estate, property taxes, income taxes, and business related costs were just too much to bare and little by little they left for greener pastures in low cost states. Low cost states like Texas, North Carolina, Georgia and Florida.

“I don’t recall reading in my history books that USSR sufferred from terrific schools, great restaurants and shopping, high value houses, vibrant tourism, wonderful climate, etc. ”

On the other hand at least the USSR might have been affordable …

Thanks D1

@nicole – I feel your pain. I lived on the WS for years and not only saw purchase prices but also rents going up incredibly. Here’s my take on it – trustfunders and kept men and women buy up properties irrespective of price. Most property owners in LA have owned for decades and can since their properties are paid off, can price at whatever they want to price at since they don’t feel they are losing anything. I moved away from LA and last year tried to move back, only to find that even with 12% unemployment, purchase AND rental prices were still sky-high, even higher than classic bubble eras 2007 and 2008 (it was still a massive bubble in 08 in LA).

I really don’t know how these prices can continue down there. Overall housing inventory is way up do to unused buildings being converted to condos and smaller apartment buildings torn down and replaced with huge multiunit buildings.

I also know people who bought before 2002 in nice areas of LA and they all bought for $250K – $500K (the $500K was Bev Hills). Nice houses, not brand new but with that old LA Spanish-style charm.

SInce central LA prices were higher to begin with, most properties were probably done with ARM and Alt-A’s. You will see those foreclosing this year and into the next two or three years. Coupled with high unemployment in LA and with many businesses leaving LA, you will start to see prices coming down in that timeframe.

If you find you are not able to buy in Santa Monica, there are a lot of other really nice parts of LA that you could consider. I know a lot of people on these boards have some snobbery about non-Santa Monica parts of LA, but in reality, almost everything from the beach to downtown and between the hills and the 10 is gentrified to the hilt – nice areas abound! Hell, even the Valley has some nice tree-lined suburbia if that’s what you’re looking for. I just hope you don’t get caught up in “Ineedahousenow” syndrome. I know plenty of couples who did that and are paying $5000/month mortgage to live in a 2/2 in a marginal neighborhood. Be good to yourself and just don’t do what they did.

One more thing, Santa Monica might have some well-heeled Asian buyers but I really doubt it’s a driving force in the market. My family is from Asia and when they think of buying “prestige properties” in the USA they tend toward the McMansiony Newport Beach type and not the quaint Santa Monica small lot, charming house type.

We are seeking a three bed room one and a half bath home with around 6,500 sq ft of lot and at least 1600 sq ft house. Preferrably in the sunset district. Any suggestions? Anywhere between cloverfield and 27th. Pico and ocean park.

Leave a Reply to Nameless is wrong