Where the renters live. San Francisco and the big jump in rents and home prices. The least affordable place in California just got more expensive. San Francisco median rent now at $3,100.

It is hard to believe that there is a market more constrained than the one in Southern California but there is. San Francisco is really in a world of its own and makes the SoCal housing market appear calm. But comparing crazy and crazier might not help those looking to buy. A few colleagues e-mailed me about the massive jump in rents up north. San Francisco has been a very expensive market for a long time. The homeownership rate in San Francisco is very low. In expensive Los Angeles County about 50 percent of households own their home. In San Francisco County it is closer to 36 percent. San Francisco rents have gone up dramatically in the last year or so with the median rent in San Francisco hitting $3,100. Keep in mind this isn’t for a typical home and more likely for your standard apartment. The rise in rents obviously hits the bulk of the city given that most rent. Let us look at what is going on up in Northern California.

San Francisco and rents

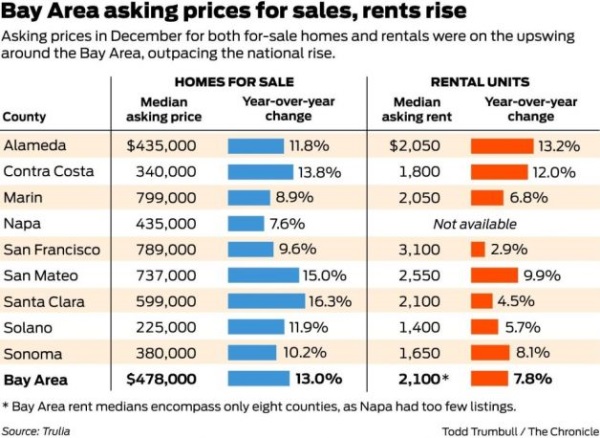

Both home prices and rents have gone up dramatically in the last year. Take a look at data for Northern California:

Source:Â SF Chronicle

The median rent in San Francisco is now $3,100. The median home price is $789,000. The median home in San Francisco County went up by 9.6 percent. Most areas saw double-digit increases in rents and home prices in the last year. San Mateo County saw home prices go up by 15 percent and rents go up by 9.9 percent.

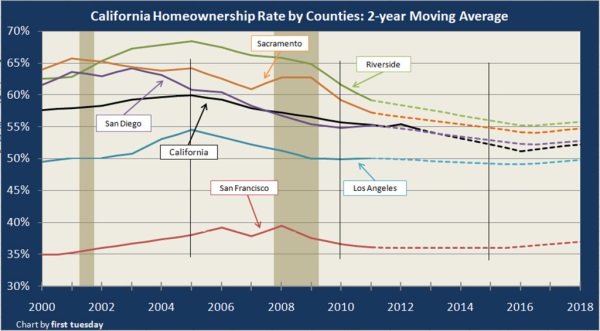

This is why the homeownership rate in San Francisco is so extremely low:

Even at the peak of the mania where California saw record homeownership, San Francisco never touched the 40 percent mark. Since that point, it has steadily declined. If you look at the chart above, homeownership is correlated with the price of housing. The cheaper the area, the more likely you are to have homeowners. Makes sense. A place like Riverside County with more affordable housing has a homeownership rate of 60 percent, closer to that of the nation. Overall however the bursting of the housing bubble has pushed homeownership in California much lower.     Â

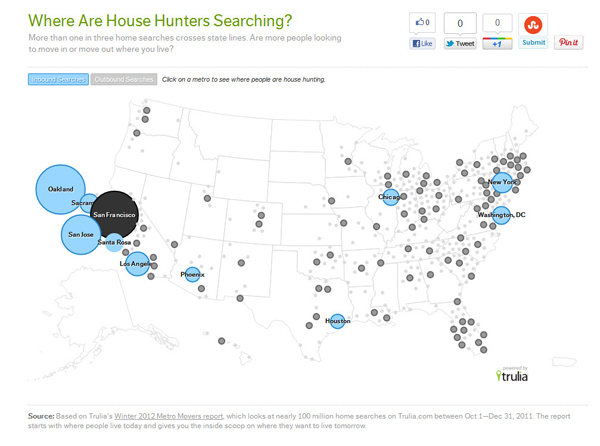

Then you look at San Francisco above and see how detached it is from the rest of all the other areas. Homeownership in San Francisco is extremely rare at 36 percent. What is interesting, is that an area with many more people like Los Angeles does not have the home search activity that you see up north:

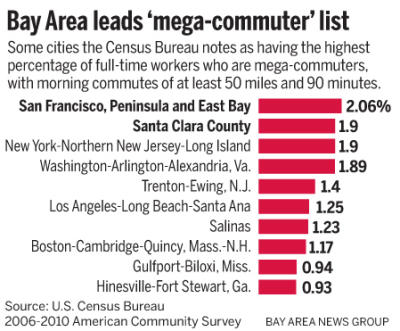

The above is an interesting graphic, what you find is that many people in San Francisco are looking for housing outside of the area (most notably counties close to the area). This is why you see Oakland, Sacramento, San Jose, and Santa Rosa light up while San Francisco shows high outbound activity. Does this mean people will act? Unlikely given that many people are willing to go the route of super commuters. I’m sure many of you saw a study regarding “mega-commuters†where people spent at least 90 minutes (each way) in traffic and travel 50 miles each way. The area with the highest percentage of mega-commuters? You guessed it, the San Francisco area:

A couple of things I will add here. While there appears to be interest in moving out (outbound housing searches from those in San Francisco) people are unlikely to make big leaps. Hence the real figure of mega-commuters in San Francisco. Many just went more inland and purchased a home to deal with the long commute. Ironically San Francisco has some of the strongest rent control laws in the country covering most apartment rental units.

One of the biggest reasons for this is this exemption:

“You live in a building constructed after June of 1979. This “new construction exemption” is the biggest exemption in SF and can not be changed Click here for link to Assessor’s database, where you can usually find out the date your building was constructed.â€

Well of course in California’s older areas, most of the building took place prior to 1979 with very little new construction since that period. Of course San Francisco is plagued by the same massive drop in inventory that we are seeing throughout the state. Year over year inventory fell to the tune of 68 percent. And what you see is that a large percent of inventory in San Francisco is already rented. Given the hot rental market, you probably have fewer landlords tempted to sell and they are already used to the business.

It is hard to believe that there is a region in California that makes Southern California seem a bit more calm. If you are in San Francisco as a buyer or a renter, good luck.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

48 Responses to “Where the renters live. San Francisco and the big jump in rents and home prices. The least affordable place in California just got more expensive. San Francisco median rent now at $3,100.”

San Francisco-certainly no place for a modern day Hippie!

One additional factor here may be the expiring options for employees in companies like Facebook, Twitter, etc. While not a huge influx of newly – minted millionaires, given the perpetually low supply of available homes to buy in SF these new entrants may be making an impact at this point. If they can’t find the right home, I would think that anything they wind up renting will only increase the overall rental costs in the immediate area, due to competition.

San Francisco has rent control, which distorts the market. My old roomate lives in an OCEAN VIEW apt. on La Playa Ave. in S.F., for $750. a month.

He has been there for over 20 years, and will not move until he is taken out feet first.

There are many renters with similar stories. Rent control freezes tenants in place, and offsets any desire to move.

I was a 19 year old hippie in 1966 living up on Frederick St., just a few blocks from Haight and Ashbury. I don’t remember the exact rent, a lot of things are fuzzy from that period, but it was around $200 for a house. That same house is worth an easy two million today. I also went to college at UT Austin, another hot place today, and paid $75 a month for a great apt. half way between the campus and the downtown bars. Did graduate work at the U. of Miami and lived in Coconut Grove, two blocks from the marina in a house for $150 a month. The Grove was mainly Bahamian then with conch fritter push carts. My generation had it great. Today, if you are 20 years old and want to hang out in SF for a year, better be a Rothschild.

Oh, I also lived in Santa Fe. Well sort of, it was too expensive even then for my construction job in the summer of 1967, so I lived out on the Santa Clara Indian Reservation in a trailer for $35 a week.

The long and the short of today is that the younger generation is totally screwed by the Fed’s free money and low salaries to blow asset bubbles. Throw in safers like myself and you have both ends of the demographics destroyed. The middle is not doing all that well either. That is I why I am now retired in Mexico. I guess I am fated to just keeep moving ahead of the Fed… If I live long enough, might end up in Bangladesh, lots of waterfront property cheap.

Observations from the Bay Area:

Rents went up massively over the past 3 years in every county led by SF County. The trend starts when a tech company gives a kid out of college a $90k/year + $15K signing bonus – kid sees his after tax income at around $5,500 and thinks, “Yeah, I can afford $3100 rent,” and so it goes. Landlords see the prices that are being paid and jack up rent accordingly – not even in SF but in all the surrounding areas. Lately I have been seeing rent reductions and landlords willing to bargain since outside of programmers, there is little wage growth here. I also see a lot of people doing the FHA thing then renting out their houses to cover mortgage and have cash flow. I don’t think it’s working since you could just buy a similar house through FHA and save around $800-$1000/month.

In reference to Herb’s comment: There are a ton of rent controlees living out their lives in apartments rented prior to the late 90’s. AND there are a ton of people who bought condos in the bubble who are unable to sell. Not a lot of turnover in the market. Also a lot of houses passed down through generations. This is how you see middle-income folks with houses in San Francisco.

@Jeff Beck – I am younger than you but I also remember when San Francisco has a counterculture vibe with young people living their lives here. Those days are gone due to gentrification.

http://american.com/archive/2013/march/a-better-way-for-young-families-to-build-a-future-social-security-taxes-vs-down-payments

This RE shill wants money destined for Social Security funneled in savings accounts for house down payments. These charlatans should all be flogged with wet noodles LOL

San Francisco has two huge factors you did not mention.

1. most of the “homes” are apartments for rent in multi-unit buildings. Never to be sold as homes to anyone.

2. It is a rent control town and has been for decades. There are many apartments that have not had a change in tenants for well over ten years. I know. I was one of them. Nothing like paying $1100/month for a a 2/2 near the park when the market rate is $2,500. That was 15 years ago.

So, if you consider that out of the 850K people living in San Francisco at least half are in apartments that will always be rentals and many never move out… it stands to reason that home ownership is very low and static. Has been for many years. It has been a built-out urban city since the 1960’s. The only recent change has been some huge condo towers south of the financial district.

Who wants to live in the bay area? When do you ever see the sun? People in the City do not look happy. Give me the SoCal beaches anyday.

Obviously a lot of people do. Some parts of the city are sunnier than others. Not everyone wants hot sunny weather, either.

The beaches north of Santa Barbara are too cold for health. Frisco people are so white. Unhealthy look, they don’t get enough vit D. A new study in the Journal of Alzheimer’s Disease claims low blood levels of vitamin D may heighten the risk of Alzheimer’s disease and dementia. Always thought that Frisco was a crazy town. Ventura is great for wind surfing and kites.

SuferBob, we love our city, despite the fog, but whatever you do, please just don’t call it Frisco. That’s awful.

Rent control front loads the rent prices since a landlord knows he may never get much more out of a tenant if they stay long term. A similiar thing happens in the Hollywood neighborhood.

SF proper is also a very small city, land mass wise. What is the desiarble downtown district, about 3 miles square? It’s the New York of the west coast. Plus it’s good public transportation means no car, payment, or insurance. That can free up hundreds a month right there.

It all adds up, as others have said, to a very distorted market. But if I won the lotto, that’s where I would choose to live.

Over here in Marin, it is very pricey and it was a bear to find a house to rent last spring/summer. So little to choose from, and much of it crappy (with ridiculous prices to boot). So. Cal. has so many better options for people who want to rent a house – we moved here from there and I could pick from lots of great houses in awesome places (beach communities, OC), no rush to decide…high prices, yes, but up here the availability all over the Bay Area is very small, mostly run down, and even more expensive. Not pretty!

Same experience. Was looking for a house to rent this past month and was considering Marin. Hardly anything available, and what was was either ridiculously priced or trash. Ended up choosing the East Bay in a month-to-month until things loosened up a bit. IMO, landlords want their cake and eat it too – rents are well above costs to carry + profit margin. My favorite to see are the ones almost going into foreclosure renting for $15K/month – enough to cover mortgage and rent on another property. In Marin you also have to consider gas prices and bridge tolls. Was spending around $100/week in gas and tolls a few years ago. Driving up and down those hills on the 101 everyday burns up a lot of fuel.

The productive people have to drive 50 plus miles while the unproductive people get rent subsidies , welfare etc…. Why not push the unproductive away from the city and subsidize them in a cheaper area. The politicians survive on voters who are dependent upon govt subsidies so logic will never apply.

“The politicians survive on voters who are dependent upon govt subsidies so logic will never apply.”

True, but not only at voter level: Majority of the money parties and congressman receive for their campaigns are from companies who sell goods or services for the states. Basically these companies pay a little for a campaign (“invest”) and then receive huge amount of company welfare from states (“profits”).

Even worse is FED: It’s wholly owned by too big to fail banks and it serves directly the banks profits. Damage to national economy or inviduals is totally irrelevant, as long as the owners get more profit.

Neither of these is something voting can change.

“The politicians survive on voters who are dependent upon govt subsidies so logic will never apply.”

EDIT:

The politicians survive on (lobbyist money from businesses whose profits are largely based on keeping compensation too low for their employees to survive, who employ) voters who are dependent upon govt subsidies so logic will never apply.

Don’t lose sight of the fact that most welfare and subsidies to the common citizen are immediately cycled into the economy. Social Security, Medicare, Section 8, EBT, etc, all get spent the moment they are distributed to the recipients. So, in reality, these are payments made to the economic system by the govt. The only one you can spend outside of the US is Social Security and what do you bet they make it harder to spend outside of the US as more people start receiving SS payments?!

Sorry to see the Landlords turn the screw on those people. A good earthquake can clear all that mess and start over there. The good news is where I live outside of Houston they are actually reducing rents there are so many empty houses. The family down the street just told the landlord reduce rent or their are moving and they got a 10% reduction. Incredibly, builders are adding over 8,000 more to the already massive oversupply here and that’s just in the north of Houston. The building is fiercely fast West and East of here (I don’t know about south). I don’t see house prices or rents rising any time soon.

At what point is it not worth the sacrifice, expense for people to live in such places? Long hours at work to pay for basic necessities, horrible commutes; is there much time left in a day to enjoy surroundings, spend time with loved ones, foster new relationships, even sleep? A human hamster wheel. Is it worth it for new blood trying to move in that doesn’t have a rent controlled apartment, inherited house/parents to live with? It wouldn’t matter to me if the weather could be computer programmed to ones liking daily and beaches had diamond sand. There’s something to be said for enjoying life, because honestly, there’s no guarantee anyone will be here tomorrow.

Awesome comment. I couldn’t agree more. After living in Atlanta, DC, and Orlando, I love the small town country life. I could careless for all of the non sense of having to sit in traffic for hours for a job that might not be there next month. No thanks!

My familiy had lived in the Bay Area since the 1800’s. Each successive generation lived LESS well than the previous one. My dad bought a new house in PALO ALTO for $11k after WWII with just a HS education. I struggled through 3 college degrees and lived in a shack in San Jose that consumed half my gross income. I finally gave up in 2006 and sold at the peak, retiring in much improved comfort in Boise.

SF, a great place to blow Mommie and Daddies money….

I’ll bet the Peninsula around Palo Alto is even worse than the City. 30 years ago while I was a grad student in the area I managed to find a rent controlled studio apartment in the East Palo Alto ghetto (Whiskey Gulch). I still remember that it started out at $350/mo and by the time I graduated 3 years later it had been regulated down to $325 – gave my landlady fits. I’m sure it’s all been torn down and gentrified now into million dollar digs for the Silicon Valley elite.

My wife and I are one of the working poor in Silicon Valley, making joint income of $250K, just put an unsuccessful offer on a $850K 3/2 TH in Palo Alto that was bid up to $950K by cash buyers (likely Google or Facebook). This is another housing bubble in the making, and cash buyers are putting a ceiling over normal income buyers, squeezing them out. We rent a 1 BR for $2400, and new units are going for $2700. I think we’ll just rent and save until we decide to leave.

If you want to be taken seriously don’t refer to yourself as “poor” when you make 250K. It’s an insult to the REAL working poor who can’t afford a night out or any other luxuries.

A little overboard no? He is trying to buy a home for his family and keeps getting priced out – it can get frustrating. That level of income is working poor in that area, $2500 for a 1 br and all other monthly costs eat up a good portion of 1 income. The other is saved for that down payment, that 100k bid over is 3 years of diligent saving for that quarter million a year family. Tax liabilities are 50% when considering federal and state – pay that liability, those rents costs and you will be upset when you can’t even buy a house.

“…you will be upset when you can’t even buy a house.”

That still doesn’t make him poor. After taxes and $3000 in rent he’s still got $7000 a month to play with. Working poor is the janitor at wherever he enjoys on weekends. How’s about this, save 60% of your after tax income for 3 years and then move somewhere you can buy a house outright. The entitlement mentality is even uglier amongst the 1%…

You couldn’t pay me a million dollars a year to live out there. What’s the point?

It’s just as bad in Boston, the wannabe Silicon Valley II.

lol, 250k working poor. We’d love to make 25k again. I know, I know, it’s crazy out there 🙂

First, Go Bruins!

My friends and family always ask me if I’ll ever move back to New England. No thanks. I can watch all the Sox/Bruins games anywhere on the planet.

No thanks!

$1400/mo for 2/2 in Fremont, but living on a single income. That’s about 40-45% of my take home pay since my wife was laid off. All I can think about is “downsize”, but it turns out that is among the lowest rents for 1200 sq. ft. The only cheaper areas are 1.5-2 hours commute! I thought about Los Banos but the prices are inflated 30% over what I think is fair value due to low inventory. So we’re stuck here living paycheck to paycheck and I don’t really even like the area. If I could find a 40k desk job in Reno, I’d move – I’d still be better off.

Rent in the vallys an hills north of Sacramento is cheap. $600 for a one bedroom.

Melody dear, I am sure that you like living north of Sacramento, but the people who like to live in the City, well, they would not like to live north of Sacramento for so many non climate reasons, as you can well imagine dear. The high prices in the City, keep out the undesirable people. That is why we have all these “environmental,growth restrictions, and land use laws”(to increase the price of housing), otherwise we would be just as common as Texas with all their guns and stuff.

My my, the long knives of class/wealth envy are getting particularly sharp in this thread. I’ll grant that the overpaid Silicon Valley tech elite are almost as easy a target as the “hipsters” so frequently maligned here, but won’t it be ever so much more helpful to focus on emerging housing trends and how we might take advantage of them than on the lucky 1 percenters and how much we despise them.

Not sure if you’re being ironic or just honest in this post? If you’re being honest, yikes.

Well, there’s some truth in what City woman wrote even it it wasn’t PC.

Not only is there very little land left to build on, the plots of land that could support additional units are suppressed. The formula for affordable housing is little zoning +

empty plots of land (which gives you Houston).

You might think renters would welcome additional buildings and density since it would (in the long-term) bring down rents, but just like many land/homeowners they still discourage additional development.

‘One of the things that makes San Francisco special is that it has air and room to breathe. I don’t want to see high-rises,” he says. “Because even though the rent would go down, I wouldn’t want to live here anymore.”‘

http://www.sfgate.com/realestate/article/Startup-dreams-meet-pop-up-rentals-4226675.php#ixzz2NMYNRrKR

Hey Melody,

Feel free to drive over this lady’s pretencious Prius in your Ford – 150. We’ll all have a good laugh over yonder. Take er easy cowgirl. ;0

How Google’s Buses Are Ruining San Francisco

It’s become common practice for Silicon Valley-based tech firms, like Google, Apple, and Facebook, to shuttle its employees to and from work on Wi-Fi equipped private buses with cushy, leather seats.

There are more than 1,700 tech companies in San Francisco, which employ about 44,000 people.

Not everyone rides these buses, but those that do are making the housing hunt in San Francisco increasingly more difficult.

“At the actual open houses, dozens of people who looked like students would show up with chequebooks and sheaves of resumés and other documents and pack the house, literally: it was like a cross between being at a rock concert without a band and the Hotel Rwanda,” Solnit writes. “There were rumours that these young people were starting bidding wars, offering a year’s rent in advance, offering far more than was being asked. These rumours were confirmed.”

In several neighborhoods throughout San Francisco, rent has gone up between 10 and 135 percent over the past year, Solnit writes.

Here’s A Map To Silicon Valley’s Cushy Private Buses

In 1966, my wife to be was renting a place in Sausalito w/a beautiful view of the Bay for 105 dolllars!

This was jacked all the way up to $125/mo when she left.

Man, I remember the good ole days of 1998 when gas was $1 a gallon and value menu items at Wendy’s was $3 for a burger, coke, and fries.

Damn, those were the days baby! whooo hooo!

Don’t forget that oil was about $20/bbl in 1999. Around $100/bbl now. How’s that working out??

The digital revolution is the real “next big thing” in global economics, and the Bay Area is the undisputed engine for this form innovation in the country if not in the world. The workers and stakeholders who are part of this revolution deserve their just rewards in terms of salaries, bonuses, etc.

This is EXACTLY what DHB has been speaking of in terms of real price for real estate coming down to real incomes of the real inhabitants of these areas.

God bless them and God’s speed.

I would tend to agree, except many of those tech companies have distorted the stock market in ways unforseen just a few years ago. Facebook was a huge bust for anyone not working on the inside, the common investor took it in the shorts while the insiders made millions before the IPO. Same goes for Zynga and so many others – granted, the stock market is truly caveat emptor, but too many of these deals are becoming giant Ponzi schemes for those who have access to inside information, leaving the institutional investor in the dark. The SEC is still out to lunch in most of these cases, which is exactly what Silicon Valley prefers – and their intensive lobbying efforts in Congress and the WH have lead to privacy laws being flouted and in many cases outright ignored.

To cite just one recent example:

http://www.csmonitor.com/Business/Latest-News-Wires/2012/0809/Google-pays-record-fine-to-settle-federal-suit

Google’s already acting like a monopoly in most respects, and this kind of fine is literally peanuts in comparison to their humongous cash hoard. This does not lead to increased competition, but instead tends to kill it off in it’s early gestation.

Facebook, for example, does nothing for global economics. It is just a glorified digital scrap book. This is what is called an malinvestment, just like over paying for real estate. In the long run, it does nothing for the US economy. Apple is another example of your Bay Area buffoonery. A very expensive gadget with tremendous margins, produced by slave labor with most profits kept outside the US to avoid taxes. Samsung will be around way past the death of Apple. By the way, the new smart phones will be selling for under $100 made in India. Apple cannot handle that kind of competition. Unless, like GM, they get hundreds of billions of dollars in bailout money.

Melody dear, I am sure that you like living north of Sacramento, but the people who like to live in the City, well, they would not like to live north of Sacramento for so many non climate reasons, as you can well imagine dear. The high prices in the City, keep out the undesirable people. That is why we have all these “environmental,growth restrictions, and land use lawsâ€(to increase the price of housing), otherwise we would be just as common as Texas with all their guns and stuff. Well rent isn’t cheap in Anaheim or Santa Ana and most people would prefer burbs in Texas unless its the larger cities like Houston or Dallas and El Paso and so forth. In fact I think both Anaheim and Santa Ana have higher rents than Sac do and Anaheim is ovewr 50 percent Hispanic and Santa Ana is 80 percent.

Um, San Francisco’s rents don’t completely keep out the “undesirables” as the Inner Mission, the Tenderloin, and South of Market are still teeming with what most computer-literate yuppie white people seem to think of as “undesirables.” Brown people. Some of whom have college degrees and TEACH in the City.

Leave a Reply to Sunny SoCal