What does empirical data and economists have to say about buying a home versus renting? The answer may surprise you.

There tends to be this myopic view in California regarding the housing market. People forget the relatively young history of the housing market and the trials and tribulations associated with owing a property. Many people also suffer a dramatic case of confirmation bias to justify their house lusting ways. It might make paying that mortgage on the $700,000 crap shack much more palatable. In expensive places like California, the market has spoken and people are largely shifting to renting properties. The numbers are abundantly clear despite the house humping rhetoric for those trying to jack up the housing cheerleading. The cheerleading is getting incredibly loud with zero down mortgage in the Bay Area and with the Super Bowl ad showing us that you can get a mortgage with the “click of a button†like buying a café latte at Starbucks. Sounds reasonable to me that you are making the biggest purchase of your life over your iPhone in one second. But this speaks to the financial amnesia where people just want to get into markets at their peaks and are fully driven by emotion. So let us look at the pros and cons of buying versus renting.

Housing is overrated as a financial investment

First, housing is overrated as a financial investment. The last median home price for a U.S. home is $288,900. The latest data on median US household income is $53,657. So the typical US home costs 5.3 times the annual US household income.

Run these numbers for Los Angeles County. The latest median price for a home in L.A. County is $516,000. The median income for a household in L.A. County is $61,094. So the typical L.A. County home costs 8.4 times the typical L.A. County household income.

This matters because it means a significant portion of your wealth is tied up in one asset. Economists are largely in favor of diversification. It is easier of course to diversify with stocks than it is with real estate. Also, homes don’t pay out a dividend.

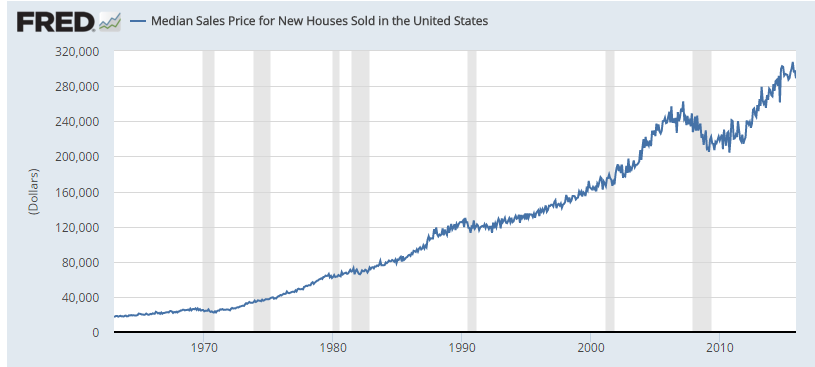

The U.S. homeownership rate is declining because home prices are up:

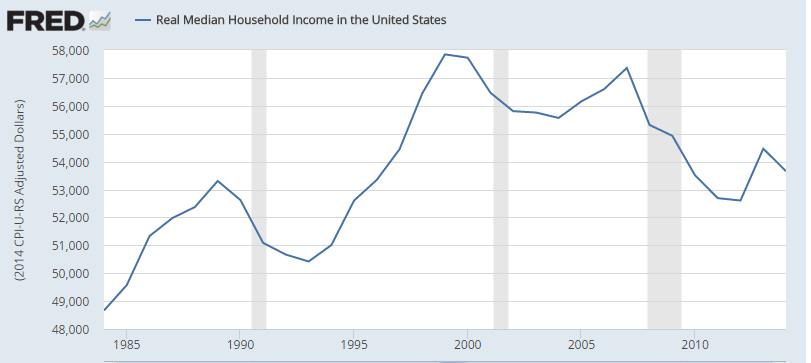

While household incomes are stagnant:

In California over the last decade we have a net loss of homeownership households while renter households are up dramatically. In general tying up most of your wealth in real estate is not smart. And in California, to save up for that 20 percent down payment to be competitive against all cash offers, is going to take a lot of money (in the Bay Area with the typical house costing $1.2 million it will require a down payment of $240,000).

Homeownership locks you into one location

We’ve provided evidence and data suggesting that Millennials don’t have the same housing needs as Taco Tuesday baby boomers. Many don’t crave the McMansion life and many won’t be at one job forever. The problem is that houses lock people into locations. Some will argue that you can sell but that is in an up market. Just ask the millions that sat underwater for a decade or so. If your job shifts you may need to do a brutal commute (as some do in the Inland Empire) or actually sell for a loss. People then lock in for the wrong reasons. When jobs disappear and home prices fall, people stay put for too long instead of moving for better opportunities. What is interesting is there is empirical evidence suggesting higher homeownership predicts higher unemployment. You can read “Does High Home-Ownership Impair the Labor Market.â€Â In this way, Los Angeles County being a renting majority county is a good thing. It is also interesting that in San Francisco with many high paying jobs, the homeownership rate is incredibly low.

Another issue is the housing market turning into a commodity and speculation being rampant. This essentially forces people to become speculators in an asset class that was once tame. Most of the arguments for buying look in the rearview mirror feeding into a confirmation bias. Yet today, even some of these people if they are reasonable will argue prices are overheated. Yet there are absolutely benefits to owning.

The positives of owning a home

People enjoy houses to decorate, have barbeques, and to stay put. One big topic that is rarely discussed is that homes now come with an ancillary asset, that of public schools (assuming there are good public schools in the area). This is where some economists argue for school vouchers – vouchers would break the deep connection between where you live and what school you attend. This would give working class people a better chance at attending schools if homes and schools weren’t bundled. You see this in certain areas with crappy and poorly built homes but excellent schools.

Another perk is the principal pay down. A home is like a forced savings account assuming you have no discipline, which many do not have as highlighted by the pathetic amount saved for retirement (if any) by most households. However in high priced areas, the delta between your total home cost and what you can make in other investments makes the decision tougher. You are betting on a diversification folder of one item versus a broader approach. Economists agree, being diversified is good. Also, there is no guarantee that in 30 years a home in a high priced market is going to outperform the market. In fact, data suggests that homes will lag the stock market in the long-term.

This leads into the dumb logic of “well the stock market is down†by say 20%. Stocks lead and real estate follows. Okay, you have a stock portfolio of say $140,000 and now it is down to $112,000 (a drop of $28,000). You still have $112,000. But say you bought that $700,000 crap shack with the $140,000 as a down payment and prices dropped 20 percent (now that home is worth $560,000, a loss of $140,000 and you still have a mortgage of $560,000 that needs to be paid back). You lost your down payment and with selling costs running between 5 and 6 percent, you may need to bring funds to the table to sell. Leverage works bought ways yet house humpers only see up.

Another benefit is the hardcore marketing behind the “American Dream†of owning a home. This is deeply psychological. I can sense the sadness and desperation in some emails when people ask me if buying is the “right†thing to do as if they were living in sin renting. Ultimately you are paying for a roof over your head. Do you feel better giving money to banks or a property owner? Many economist feel the tax code is heavily biased towards homeownership. The mortgage interest deduction is seen as “A Senseless Subsidy†by many economists since it subsidizes housing for the wealthy. Most Americans don’t even realize that with the standard deduction, they get relatively little back for owning a home after all expenses are factored in. Regardless, the tax code tilts in favor of owning, especially owning rental property (this gives you the tax benefits of owning property and also the monthly rents – serving as a dividend). Wall Street ate this up since the Great Recession hit and has become the biggest landlord in the country.

It is also interesting to note that behavioral economics shows that people get used to owning a new home very quickly.  But you never get used to commuting. So if you have this as a choice always live closer to work. This might be worth listening to for those living in the Inland Empire and commuting into L.A. or O.C.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

212 Responses to “What does empirical data and economists have to say about buying a home versus renting? The answer may surprise you.”

I know that you are right… But it feels strange to bouce around from rental to rental in your thirities waiting for a crash that might not happen. When you grow up with parents and grandparents that have always owned you feel like a loser. It seems like the dream of owning a home moves further away every year as your downpayment money grows at 1% and year and houses go up $100,000 a year.

Yeah- I feel you on that. My wife and I keep saving for (maybe) a condo/apartment down payment in the Bay, but NO WAY are we buying right now. Either prices are going to plateau- or crash. But waiting for a massive crash is no way to try and build/plan for a life together. If a real estate crash happens again, it will probably be tied to a regional economic crash, and we may just be unemployed.

My Boomer parents are just incredulous that I can’t seem to get ahead (or anyone else in my generation). To them, careers and cheap housing was like fruit on a tree- all you had to do was reach out and pluck it…

My grandparents (both 95 & 96 respectively!)who lived through the Great Depression are far more sympathetic. Even their now aging minds remember what times were like before WWII and how hard things really were. “Get a job- ANY job, do what you have to do. Just Survive!”, my grandpa told me when during the last collapse and my subsequent bout of unemployment.

But hey, they survived, and the hard times became only a small part of their long, and eventually stable, middle-class lives. I try to keep it in perspective… Things could be better, but they could be A LOT worse!

Hell yeah my Great Aunt Mary was like that. I had a (literally) shitty job at an animal hospital and she was all like, “Don’t go to college. People will always need someone to take care of their animals.” It was the shittiest animal hospital in town and I even got bit by a Dobe. But if I’d hung in there (vet was always urging me to take classes in accounting, I think he wanted to put me at the front desk) I’d have done far better than I’d have done with this foolish college thing. I’d have been able to transfer to a nicer animal hospital, or go somewhere with the accounting skills. Maybe a people hospital.

Some wisdom in that post for sure but the global economy we live in now I would argue is way scarier and much more challenging than even in the Great Depression. There are certain costs involved in modern life that just didn’t exist back then. Car/health insurance. A cellphone/computer, no these are not necessarily a luxury and are required just to even apply for jobs and be somewhat competitive in the job market. Some form of reliable transportation unless you live in an urban environment. Back in the 20’s and 30’s you could grow your own food, work odd jobs, live with just the clothes on your back etc. You could still travel by horse!!!! Cheap land was everywhere and hell you could move into the middle of nowhere and squat out a pretty decent life living in the woods. People at least had freedom back then.

The baby boomers though definitely had the low hanging fruit opportunities. Hell they didnt even have to pick it, it pretty much fell into their lap. RE is going to crash just like the rest of the economy. How much is anyone’s guess. Just look at the Nikkei today. Hammered! Dow since Jan? Hammered! Everything that should have been left to crash in 2008 never was, so the bubble got bigger and the govt is out of ammo. Neg rates will usher in the demise of an already struggling middle class on life support.

Nick I agree. Hell even back in the 80s, where I lived there were cheap rooming houses, you didn’t need a phone so much, certainly not a cell phone, or a car, and basically the “overhead costs” of living were far lower than they are now.

Nick,

Very accurate description! Good observation!

How are you feeling now Nick? Your Nikkei comment about the market plummeting downward as now turned to all-time new highs and moving skyward. You cannot wait forever for a crash that will never happen. You must buy at high prices before you die.

Emotions.

Ego

There is no shame in renting. Some of the richest smartest people rent. Pick a place you really like and stay there as long as it makes sense. You can be very stable and rent. Only splash out the huge cash when you’re settled and have a place that you love. Why else would you put all your money into something and tie yourself to it if you didn’t love it. The way I always saw it, even if it’s a roughly even financial wash between renting and buying, to me it’s a no brainer…rent. You’re flexible, liquid, and able to move on any other great opportunities that show up.

Remember, 99.9% of the general public don’t even understand the most basic principles of rent vs. buy. All they think is that if you rent you’re throwing money away while if you buy you’re building equity. It’s obvious nonsense as even the most basic rent vs. buy calculator like the one from the NY demonstrates. Tell them, you can either rent a house or rent money. I like in a luxury 3 bed 3 bath about 50 steps from the sand. I rent it and can walk away from it at any time I want and it’s a fraction of the cost were I to buy it something right now. At some point I’ll buy, but only when it makes sense and when I love the place.

Amen. I like to remind pretentious “homeowners” that unless they paid cash, they are basically renting from the bank.

And its not just the mortgage, its the maintenance, the taxes, the insurance – and the TIME it takes to handle those things, like spending time doing the work yourself or scheduling it, weekends in home depot, etc.

Houses in most areas aren’t going up at all. In bubble areas they’re going insane, outside of those places its way cheaper to rent. Much is driven by foreign money, which is dead, and social apps, the funding of which is in the process of dying. Job visibility is limited for most unless you’re a government drone, but those jobs crush your soul, its like they have an iq ceiling or something.

I rent for 1K/mo – been the same now for 6 years. Buying the equivalent house would run me probably 300-350K. I wouldn’t want to buy the place, due to its age and accumulated termite damage. Thats another thing, old houses are OLD. Some were built well, most are a mess. New homes can have shoddy workmanship. You must both love the area and the property and figure you’ll be happy there for the next 10-15 years with a steady job, then pulling the trigger might be worth it.

Agreed. The President and owner of a software company I worked for (who was worth millions) rented houses in rich areas. He would rather spend a few thousand per month on rent than millions to buy a place in the same location.

When you rent you get a valuable benefit that most homeowners have lost. Time. Your time is your own. You don’t mow, paint, fix, deal with repairman and contractors, or even worry about that stuff. You just call the landlord and he handles it. In today’s world that demands too much time for work and commuting, This is a precious commodity.

And also. Even if a homeowner gets lippy about how superior he is to a renter, remind him that he is renting from the government. If he doesn’t pay his property taxes, the government won’t let him stay in the house. Rental properties, usually multis in a building, have a much lower tax burden per unit than single family homes.

We moved to Hawaii in 1968. Our place on Portlock Road was $40k, somehow I know this although we left it when I was about 11. It shows up on Zillow etc for a couple-few mil. Besides, the place was huge – 5 bedrooms 3 baths, huge “lanai” (hawaiian for patio) roofed over, front side and back yards …. If we’d worked together and kept the place, we’d all have a place to live, and a pretty nice one too. Zero housing costs other than utils, property tax which I don’t think is that high in Hawaii.

So I think buying makes a hell of a lot of sense even if it seems overpriced, if you play the long long game.

“So I think buying makes a hell of a lot of sense even if it seems overpriced, if you play the long long game.”

Agreed ONLY if the buyer has 20% down and low or no outstanding debt. I guess there lies the problem.

I don’t know what the required down payment was then, in 1967-1968. The house was a big spread out thing, but it needed work so my dad went over alone for about 4 months and worked on it, then came back and we all packed up and moved.

Maintenance, repairs, replacements, improvements, insurance are expenses beyond taxes… FFS how many people commenting here have obviously never owned a house or haven’t owned a house for any significant length of time?

Hotel – Dad was very handy with tools and did all the repairs on our Portlock place. I don’t remember a plumber, carpenter, etc ever coming in. Dad worked in computers but would have been much better off, financially for sure, and probably psychologically, if he’d just been a carpenter.

But for the average person, yeah maintenance costs are a real factor.

My kid is 5 and has lived in 4 houses. It takes a special breed to not follow the crowd.

You’re not alone but it is a lonely place, math is hard for the lemmings.

Humans suffer from persistance bias. Math can’t lie to you, but someone working on commission has to choose to be honest with you.

I was born in Pasadena, so I know we were there, then Balboa Island, then Costa Mesa so that’s 3 houses by the age of 5, since we moved to Hawaii right around my 6th birthday, that might make 4 houses by the age of 6 ….

My dad was certainly not a lemming. Could have done quite well working for IBM or something but opted to move to Hawaii and even as things went downhill, stayed there.

This post hinted at it, and you also suggest it, but the truth is, a condo is WAY better than living in an apartment and a single family home is WAY better than living in a condo, as you get older that is. I have lived in West LA for over 15 years now and I rented for 10 years, even with roommates sometimes, so I’ve seen it all. I finally bought my first home at the end of 2011 at the bottom of housing market crash. It was completely by chance, one of my housemates wanted to move out and so I went to look at apartments, and for those of you who live in West LA, you have two choices, ratty old housing stock that is expensive or brand new buildings that are ridiculously expensive, it’s just always been that way. So since I had a lot of savings, I ended up buying one of the last condo units in a new condo building and got a great price. Honestly, there is a real, palpable difference living in your own home versus living in an apartment. You will maintain it better, you will make improvements to it, and in an environment where prices are rising, you capture the upside and you don’t have the threat of getting kicked out or having your rent go up. There are both economic and psychic benefits from homeownership. Of course if you can’t afford to own then you can’t afford to own. I recently got married and we bought a single family detached home in Playa Vista last year, we signed our contract just before the Google land sale was announced all the prices went up. I would like to say I planned it, but again it was just pure luck. The only reason I was looking for a bigger place and the only reason I could afford it was because of another income stream. And we really love the place. So I say just live you life and if you find something you like that you can afford, then buy and don’t worry about it. If you can’t afford it, just keep saving money and keep your eyes open. People have this idea that buying a home is like making sort of investment, it’s not, it’s an expense. The sooner you dispel the notion that you can speculate with your primary residence, the happier you will be.

“You will maintain it better, you will make improvements to it”

That’s not entirely a good thing. During the last bubble — 2000 to 2008 — living in my condo was like living in a construction zone. So much flipping going on. People buying units, remodeling, then flipping. Things quieted down when the bubble popped. But this last year was noisy again.

and in an environment where prices are rising, you capture the upside and you don’t have the threat of getting kicked out or having your rent go up.

Maintenance fees do go up. Every other year or so, they go up. Last January my monthly fees went up from $733 a month to $762 a month. Then there are all the special assessments for things you don’t want.

One reason my maintenance fees rose from about $700 to $733 a couple of years ago was because the building bought an upgraded cable/internet contract from Verizon. I didn’t want it. I don’t watch TV, and I already have an ISP. But I have to pay for it, though I don’t use it.

I don’t know why the maintenance went up again this year. Higher water bills, perhaps.

And yeah, you can get kicked out. If you don’t pay your monthly maintenance fees — and the periodic “special assessments” — HOAs can place a lien on your unit. If you don’t pay, they can eventually foreclose on your unit.

It’s just like property taxes. Yeah, you own the house or condo. But if you don’t pay your property taxes, the government can take away your property.

It’s been said that condos combine the worst aspects of renting and owning a house, with the benefits of neither. There’s much truth to that. Thin walls. Noisy neighbors. You are NOT the master of your own home. Tons of rules, often arbitrarily enforced.

John Dave raises an important point. Many younger people are priced out due to over-priced homes. Yes, and it is a shambles. What is more interesting is that they should feel like ‘losers’. While that may be true, it certainly doesn’t have to be. The losers are those that bought into, and therefore helped create, the situation that has priced out their children. Good on ya’ baby-boomers. A financially savvy bunch if ever there was one. But that equity is useless unless you realize the gains. Just how many do that? How many will have to use that equity to pay their kids huge down payments. So where’s the gain? Probably sitting in a mortgage brokers bank account, or an investment bankers wine portfolio, or a hedge fund, or a REIT. Is there a difference then, between an illusion, and a delusion?

I don’t see any layoffs in the Bay Area so Rents are still going up and houses are still low supply and overvalued, despite the stock market issues from the last 6 months.

the stock market has gone down, Oil is at $30, china and Russia problems, strong dollar and YET. Rents still up… houses still selling a stoopid redunkulious prices..

I don’t know how some of you have faith that they’ll be a crash…

In the last bubble I believe California major city houses were at 10X median income. We can do it!

I sold a home in So. Cal. in 2014. Based on those traditional rules of thumb for fairly priced real estate, 3 times income, and less than 15 times annual rent, things were already in the stratosphere! My home sold at roughly 10 times average incomes for that zip code, and at 30 times its rental value! Things have only gotten worse since! However, I’m glad I sold … I think this all catches up at some point, and I wouldn’t want to try to sell once the market has turned!

“I don’t know how some of you have faith that they’ll be a crash…â€

Please refer to the circa-1990 peak followed by the mid-1990s crash, and to the circa-2006 peak followed by the late 2000s crash. It might not be possible to predict when or why the next crash will occur, but you can be almost certain that one will occur.

The question and gamble here is: how long will it be until the next crash, and how long should you spin your wheels renting while waiting to buy? In terms of making a mathematically prudent decision, it really depends on each person’s individual situation, and when and how severe the next crash is.

In summary, it’s not really possible to make the perfect decision, since you don’t know the future. But given the currently high real estate prices and other economic uncertainty here and throughout the world, I’m choosing to gamble that there will be a crash within the next few years, and am waiting at least a few years to buy (unless a crash happens sooner).

Here’s some historical housing data for L.A. for reference:

http://www.jparsons.net/housingbubble/los_angeles.html

And the other big dynamic that I’m sure you’re aware of – when the crash happens, how will the new potential buyer fare? I’ve been on the short end of the stick, I still very clearly remember getting laid off in ’09.

It will crash again…. so did you buy in 2010? Are you going to time it right next time?

Holo stated “…so did you buy in 2010?â€

Not sure who this is directed to, but I bought in late early 2009. Close enough.

Didn’t Yahoo just announce a lay off of 15% of its staff?

YAHOO is Not by any means a way to measure the layoffs situations. Yahoo have been a sitting duck for a while. They tried to turn Yahoo into a fashionable tech company that caters to women with lots of lame projects.

wake me up, when Cisco, Applied materials, Oracle, Samsung lay off people.

Though I read HP, IBM and Intel will have layoffs soon.

P.S. I don’t want to people to lose they’re Job… that sucks and hurts a lot of families. But this bubble needs to pop and correct the course. You gotta build from the ground up and not patch up….

Yahoo has been laying off people for years

That’s not the right indicator

If Samsung lays off people, we *are* in trouble.

I’m with you Teqilini, I don’t see a crash anytime soon . People still buying homes at stupid, more rediculous prices than last year. Specially here in the west side of LA. As much as I would like for Jim’s famous line about the housing market to tank hard, I’m giving up and will focus on something else .

It’s not easy to see the cliff ahead when one is staring at the asses of the herd.

Hotel, it was also impossible for you guys to see the bottom…

Except that it was never bottom as we are stuck in the same bubble from 8 years ago. Who here knew that the government and Fed were going to levitate prices with the same cheap debt that led to the original downturn?

BTW, prices across the world are falling. The high end market in New York is falling. Are conditions any different now than they were back then that So Cal will be spared?

holo, not sure who “you guys” are, but claiming something isn’t there due to obscured vision is different from admitting to not being sure due to the same.

Stock prices tend to be a leading economic indicator whereas job growth is a trailing indicator.

Why would more layoffs be reported then if things are going so well:

http://www.usatoday.com/story/tech/2016/01/16/party-over-soaring-tech-valuations-big-funding-rounds/78028176/

I clearly understand what you are saying — that the rent and buying price shoots up and there is no symptom for both prices to come down. Bay area and So Cal are totally not comparable. Bay area is similar to an island, where land is limited and precious whereas industries are prosperous. So Cal is open land to make you live 15 miles away as long as you can get on 405, 5, 605 you may get to your office in half an hour. So Cal definitely has more land than bay area but less intensive IT industry.

LinkedIn fell 44%. Twitter is laying off coders — the most overpaid profession in the world. What do Twitter, Microsoft, and Snapchat all have in common? They have all had layoffs in recent months. The tech industry giants Hewlett-Packard and Microsoft slashed thousands of jobs last year. Yahoo — layoffs. Theranos — dead in the water. Marc Beniof predicts “blood in the streets.” WTF are you taking about? Have I misunderstood?

That’s also true… however those people twitter layoff are able to find another 120K job in a split second at another start up. Same with Yahoo the good people will probably be snatched quick… so unless there is an avalanche that hits all companies…??

Truth!

It’s so sad that you don’t know what’s going on. VC money is drying up. We will soon be a ZIRP society. Twitter crashed again. That’s truth! Nobody needs programmers. They need audience. They need revenue. They need to show profits. Bye to all the programmers pulling down 120K a year out of college to improve an app that makes no money at all. Truth! Tesla whiffs again. You really haven’t a clue about what’s going on in the Valley and SF, do you?

Tech bubble is popping people

http://www.usatoday.com/story/tech/columnist/shinal/2016/02/05/bye-bye-internet-bubble-20/79887644/

Overpaid!!?? Have u ever written code before? Extremely difficult. In my opinion software engineers and engineers in general are totally underpaid. This why this country is so non-competitive. The majority of the smartest and brightest high school students in this country go into Medicine, law, and Wall Street. This is because that is where the money is. Plus engineers have the continuous risk of all is being laid off. I call it internal brain drain

Tech is tanking. I AGREE with tolucatom!

I seriously never got on Linkln because the name bugs me, I can’t tell if it’s Linkln or LinkLn.

Everyone I know who got layed off at Twitter at a very high paying job in the bay area in a few weeks

I have been trying to tell people since ’08 that it will be at least 15-20 years before the next sell-off and it won’t be a crash. Everybody on the internet has this dream that they will see the crash before it hits and guess what……… wait for it…….. There won’t be another crash!!! Ever!!! I am an economist and I promise that there will not be another crash until at least 2020 and it will be a minor sell off. The FED has to maintain inflation to pay the interest on the deficit and the only way to pay the interest is to keep the markets inflated. They will stop for nothing and will only raise rates once or twice a year, which will in turn possibly produce a 5% selloff at the most. The last 9% sell-off has been bought back up to it’s previous starting position, which is 4% from all-time new highs. The market and VC money is actually booming now more than it has since the crisis (which by the way everybody knows and blogs about 10x as much as the bullish rally we have seen in the last 8 years producing all time new highs.) Think about it, while you dream and beg for a crash and inflation keeps moving upward forever. You grandchildren will make more in a year than you will earn your entire lifetime and your house you live in now will be worth tens of millions more in 10-20 years. Inflation is something that is guaranteed and there is no avoiding inflation, no matter what! Inflation is impossible to avoid! You can read these comments and feel sorry for all the people commenting. There comments hold no validity now that the market has stormed all the way back to all-time new highs. They can keep yelling “bubble” but they will only hear echoes and do nothing to stop the bubble. If it happens to pop, then it will start again the year after only growing to numbers larger than the first bubble. Inflation is all but written in the constitution of America and it is our culture. Do you hear any politicians in the presidential debate trying to curb inflation? Didn’t think so, they are lying to the people and other citizens beside us economic readers have no clue that they are being deceived. Inflation is both the Angel and the devil on our shoulders. It must be balanced properly.

“Feds tell banks to prepare for negative interest rates.” CNBC

“In Europe, [NIRP] might even be killing banks. Amazing as it may seem, free money is not keeping the over-leveraged banks of Europe fundamentally sound. Some may be facing their own Lehman Brothers moment…The ECB has limited influence now to increase inflation. Deflation is going to to wallop European markets…” — Forbes

Do not believe what you read on FORBES!!! Especially when they promote crash or deflation talk.

F- False

O- Over

R- Read

B – Bullsh*t

E – eventually

S – Set a side

I’m glad my parents had the foresight to buy a commercial/residential bldg back in 1963. We’ve held on to it and it provides with housing AND income for us.

“I’m glad my parents had the foresight to buy a commercial/residential bldg back in 1963. We’ve held on to it and it provides with housing AND income for us.â€

That’s great if you enjoy the continual hassle of being a landlord.

If you invested $50,000 in 1963 in an S&P 500 index fund, and left it alone to grow (reinvesting the dividends; annualized rate of 9.795%), you would have over $6.4 million today, mostly hassle free. This, of course, excludes taxes on the gains, but you get the idea. Just sayin’.

Source: http://dqydj.net/sp-500-return-calculator/

They didn’t have index funds in the 1960s

And as they say, an index fund never gets a clogged toilet.

Apparently, most landlords have to deal with some really shitty tenants. I’m the opposite of that. I’ve cleaned carpets, replaced all wall sockets, repainted, etc. I always pay rent on time, basically are exactly what you want in a tenant.

I do enjoy being a landlord. I have great tenants, always have. My father had his business in the bldg, a pharmacy. There’s more to life than just money. If I had $6M, I’d give most of it away 🙂

Some people love cleaning toilets, there’s always some level of exception. By and large, land lording is not enjoyable. This especially holds true when it’s not a primary income stream.

If instead of putting $50,000 into the S&p IN 1963 ONE PUT $5000 INTO A HOUSE WHERE $50000 WAS THE 20% downpayment, then at 3.5% appreciation rate the house would be worth about $5234000.

In addition, had one taken out another $50000 when the value reached $1,000,000 the investor would have nearly 2X $5234000. You get the picture. And hopefully there would be some rental income somewhere along the way……

Karen Lee: Problem is, rentals are a hassle. And I dislike hassles. S&P 500 is reliable (insofar as is possible with the market), and is not a hassle. It won’t call me up on a weeknight to report a slab leak that will take many, many hours of my otherwise free time over the course of a month to resolve (like what I had the pleasure of dealing with recently). If it weren’t for my significant other insisting that we keep it, I would have been done with it a long time ago. I’ll take a few $$ less with the S&P 500 (or a few $$ more, you never know) and not deal with any hassles.

Karen Lee: And if you were referring to a primary residence (and not a rental), I would have a primary residence anyway. So a primary residence that appreciates is really a moot point in this instance.

Responder,

You are completely forgetting that the returns on the 1960s property were levered at least 4 X 1… it’s not even close… that was a far better investment than the S&P

Holo: can you provide an example? I’m not asserting that you’re wrong, but it’s pretty easy to state “…it’s not even close… that was a far better investment than the S&P†without having to prove it.

Even if you’re right, being a landlord is not fun. I’d take less money in exchange for a hassle-free life of not being a landlord.

Devin Fryland stated: “They didn’t have index funds in the 1960s”

The S&P 500 index has been around since 1957. A 1-second Google search would have informed you of this.

Source: https://en.wikipedia.org/wiki/S%26P_500_Index

Of course, the fallacy being presented here is that the circumstances of 1963 to 2016 are applicable to 2016 to 2069.

And if they had invested in the stock market or technology instead you’d be fabulously wealthy 🙂

In other words, you and your parents won one of the many genetic lotteries. What about your children, or your children’s children? Inherited wealth tends to dissipate with each passing generation.

There’s a good discussion (a while back) on Reddit about that. Apparently riches to rags is really common. I actually thought it normally went the other way and my family were just a bunch of screwups.

The ones of us doing best, stayed on our little parochial island, got to know people over decades, and didn’t go fleeing to the big Mainland where supposedly there are good paying jobs galore etc. I have *some* connections here but if I’d stayed home I’d probably own a house, and I dunno, golf or something.

I didn’t have kids, neither did my brother or departed sister.

@Rhiannon

Consider yourselves the exception. Parents should be worried about how their children will be able to afford housing if the economy continues to be susceptible to speculative forces.

I think one aspect left off the positives of owning a home is the transfer of “wealth” from parent to child. If you stay put for 30 years and pay off the mortgage, when you pass away your child can inherit the home and basically live rent free besides paying the taxes. Without rent, your child can easily diversify into other ventures. You can not do this at all with renting. If you are just thinking about yourself and the short term then yes renting can be better, but if you are looking long term and multigenerational owning a home is probably better.

That is very naive perspective. Houses cost money to maintain and protect their value, “rent free” isn’t free of expense.

though I didn’t type that part, I understand the maintenance costs. But if you don’t have to pay rent, maintenance costs is not the huge of a burden.

It’s more than just maintenance. Repairs, improvements, replacements, and insurance costs immediately come to mind.

Maintenance isn’t quite as bad as you think it is.

We own a modest 4/3, 2,000sf in a great area. Even way overestimating the cost (including completely replacing the HVAC, water heater, carpet, and paint every 15 years, the fence every 10, the roof and all tile every 30, maintenance of wood floor, tile, and pavers, etc.), I can’t get the number to average higher than about $280/month. Wifey doesn’t like to count the tax deduction in budgeting, so I don’t. Current PITI plus maintenance is around $1,600 for a house that would rent for $2k. It will be paid off in 7 years, at which point our total cost of living including maintenance will be something like $700/month in today’s dollars. That’s half the cost of a 2-bedroom apartment in our city.

Let’s take a wild stab and say inflation makes that maintenance number $500/month in 20 years when we retire, and the insurance costs and taxes double as well. Still more than acceptable compared to what rent prices will probably be at that time.

If the neighborhood eventually goes to hell, we sell it. No biggie. But long term, if you buy at a low like we did, the math says that owning is better than renting. I’m not against renting and have done so for most of my life – if the math turned out otherwise, I’d be happy to rent again, but it doesn’t. And knowing that no landlord will ever tell us to vacate brings peace of mind that’s priceless.

John, your anecdotal scenario is a bit disingenuous without also having provided the term for which that $280/mo is calculated. Also noted is no mention of improvement costs.

I used a 30-year term for ease of calculating maintenance. Whether we’re still living there or not at that point, we will likely still own it and be reaping the rental income.

We have upgraded some – $30k-ish spent and it’s done – and it still comes in at around 1,600/month averaged out over 30 years. In today’s dollars, of course, because I have no way of knowing how inflation will affect us, for good and bad. That’s the total spent on the house, interest paid for 15 years, insurance, taxes, upgrades, maintenance, HOA, everything. I also include the replacement of much of the upgraded items in the $100k maintenance overestimate, such as tile.

It’s significantly cheaper than renting an equivalent house, period – by well into six figures. Of course it’s anecdotal – I didn’t say that owning is always better. Only that it can be. People need to choose which works best for their situation.

“Of course it’s anecdotal – I didn’t say that owning is always better. Only that it can be. People need to choose which works best for their situation.”

Clearly it’s an anecdote which does not apply to the scenario of rent vs buy today in any decent part of SoCal.

I’m sure you’re aware that was never my point. Regardless, in my neck of the woods (frequently cited by various publications as among the top 20 places to live in the U.S., where I send my kids to public schools with a 9 Great Schools rating), rent vs. buy is CURRENTLY a break-even proposition over 30 years with a 15-year loan. Obviously it wouldn’t be smart to buy there now, but it wouldn’t exactly be stupid either, if the buyers planned on spending their retirement in the house. And as they relax and travel, their retired renter friend next door will probably feel like a genius for paying triple the housing expenses of his neighbors, with decades to go until it’s time for the old folks home.

I’m sure you’re aware that not only is this a SoCal based blog with an additional focus on high cost California, the post for this thread is specifically about SoCal. The anecdote doesn’t specify which region the example relates to (which still remains unknown, top 20 places to live in the U.S. isn’t helpful in that regard), so it remains unclear what your point is.

“their retired renter friend next door will probably feel like a genius for paying triple the housing expenses of his neighbors, with decades to go until it’s time for the old folks home”

If they invested their savings from the difference due to renting in their productive years and earned a good return, presumably it makes up for the difference.

My home is in SoCal.

“…so it remains unclear what your point is.”

That’s because you’re choosing not to see it. CallSignViper stated, “If you are just thinking about yourself and the short term then yes renting can be better, but if you are looking long term and multigenerational owning a home is probably better.”

He neglected to include the maintenance part, but that didn’t make his point any less correct – in many cases owning is better, especially for multiple generations – but you felt the need to start an argument where one didn’t exist (for the desire to “win” on the internet? Or just trolling?), so you replied “That is very naive perspective. Houses cost money to maintain and protect their value, “rent free†isn’t free of expense.”

I’m simply stating that owning CAN be better for some people, including in many desirable areas. Not crazy bubblescious areas like SF and LA, but those are a small fraction of the total housing stock. Whether it’s a better deal than renting frequently depends on the individual, their financial situation, and their long term goals/plans. A home that is a good buy for one person would be a mistake for another.

I’m sure you can dig up an insult to counter that, but one thing you can’t do is show me math that says renting is always better.

John, it’s no skin off my back if you want to sneak in ad hominem, but I won’t follow you down that path.

I continue to suspect the value of this example as to its relevancy for the typical scenario of someone looking to buy today in high cost SoCal. There are always exceptions stemming from the past, but it’s of limited use to the immediate and future concern at hand. Keeping a house for 30 years is an outdated model.

By the way, challenging this anecdote is not the same as claiming renting is always better, so there’s no need to create that fork in the discussion. My claim from the beginning has been that houses are expensive to “maintain and protect†and therefore, “rent free†doesn’t mean cheap.

Wrong. If you are concerned about future generations, you could make more money just putting in an index fund. That would be much more money than a home. Then you could give them the money, which they could use to buy a house or to invest in any location you wish.

of course that is an option. However you do need a place to live. but the issue being raised is renting vs. owning not other places to invest money.

CallSignViper: I think many people here are comparing the savings you realize early on by renting and investing those savings, versus the eventual financial benefit of buying a house.

If you say so (slight sarcasm). Although I’m not disagreeing with your assertion that passing a home on to an heir(s) is likely a huge boost to the heir(s) future net worth, there is more than one way to accomplish this. Another way might be to rent, invest the savings wisely, and pass on the cash/investments to your heir(s). That, too, would likely be a huge boost to the heir’s(s) future net worth.

I respect your reply more than some of these other lames out here

What’s lame is the implied probability of an already outdated circumstance being applicable 30 years out from today’s environment.

“If you stay put for 30 years and pay off the mortgage”. Really?

Who does that? What color is the sky in your world?

My parents did that and my grandparents before them did that. That’s who. My parents and grandparents house are both paid for with no mortgage at all. Just because you don’t do it, don’t make it like no one does it.

My parents bought a house in New York City (in the borough of Queens) in 1975. They stayed put until they died 37 years later.

It used to be common for Americans to live a generation or more in the same house. And to pay off the mortgage, and then never borrow against the house. Once the mortgage was paid off, it stayed paid off.

I recall an episode of All in the Family when Archie Bunker had a Mortgage Burning Party.

Before houses were seen as an investment, Mortgage Burning Parties were commonplace: http://www.npr.org/templates/story/story.php?storyId=106242731

What’s bad is; I’ve seen a ton of this, you get these hard-working salt of the earth types who buy a house and leave it to the kids and the kids are just average, or worse. So you have your local meth or crack head living in a nice house – nice for a while anyway.

“have your local meth head living in a nice house”

i know that guy too. You should see that fucking house that every cop in the city knows all about. And think about this, imaging you bought that house without knowing it’s “history” for years after the meth head finally dies off you will be getting knocks on the door at all hours of the day and night.

many people just walk right in as if they own the place.

there are places like this all over socal.

That means they probably didn’t raise their kids right.

I find this interesting coming from you that always seems to be between a rock and a hard place. Are you telling me right now your life would not be a little easier if you were living in a place that is already paid for by a family member? You would rather be living pillar to post huh. Cool.

the only people i mow in their 30’s and 40’s that are new home owners are that way because they got the inheritance house…..there is no other possible way they could afford it.

one guy drives for a living and makes $10 an hour……his property taxes are $1200 a year on what he estimates to be a $600K house……Dad took care of him but sadly dad is gone now so lets see how long he can manage that property.

It’s won’t be easy for children to stay in a generational home either. What if they have to move away for a job? Or want to start their own family? Or what if the current neighborhood is no longer desirable due to economic conditions?

Why would renting prevent someone from diversifying their economic venues? In many cases, the money saved from renting can be used to invest in assets more liquid than real estate.

I think the main advantage we have seen with owning a house is the result of the drop in interest rates during the last 3 decades. I don’t know if it is possible for that to be repeated. We bought our house in the early 90’s when interest rates were at 8%. Over the years they have dropped to nearly 3%. We have seen a reduction in our mortgage ever since we moved in. If we had rented, we would be paying 2X the cost of our current mortgage for the same house. I also know that my mortgage will never go up. When I’m 80-90 years old, I will have no payment other than taxes and insurance. We have upgraded the house over the years so it isn’t quite that dramatic but it was still a better deal to own a house long-term. My observation is to buy when interest rates are high causing housing prices to be driven lower. When interest rates drop, you can ride the refi down.

Yes, drop in rates has allowed many to re-extend terms and reduce borrowing cost net of refinance cost, possibly many times over. Eventually the jig is up as zero bound is approached.

I bet you haven’t seen a reduction in taxes, insurance, replacement, repair, and maintenance costs which are subject to inflation.

I bet you haven’t seen a reduction in taxes, insurance, replacement, repair, and maintenance costs which are subject to inflation.

This is definitely true. However landlords have the same increase in costs so rent will increase to cover them.

It doesn’t quite work that way. Landlords can increase rent to the extent that the market will bear. Expenses don’t inform revenues.

I’m not disagreeing with you. Rents follow the same markets as housing.

A landlord won’t be a landlord for very long if they are losing money on their rentals long-term. Right? If every landlord has the same expenses, rents will go up. I could also add that if expenses go up and your tenants income does not, you will have more people adding to the wear and tear on the property which will require more maintenance.

Both landlord and homeowner have the same expenses. It’s up to both to decide whether the landlord wants to become a slumlord and whether the homeowner wants to live in a dump.

“A landlord won’t be a landlord for very long if they are losing money on their rentals long-term. Right?”

I’m not sure we could universally define “long-term” and we don’t know exactly how many leveraged landlords are upside down or for how long, nor the amount of low performing cap rates of the non-levered landlords. I have a haunch that there could be a surprising amount of upside down ‘accidental’ types since 2008 that are hanging in for various reasons. Then there is the yield seeking crowd ushered in the past few years that could find their cap rates sinking soon enough.

“If every landlord has the same expenses, rents will go up.”

They don’t all have the same expenses, and where they do have the same expenses there are a fair number of variables in play which makes it difficult to find parity.

“I could also add that if expenses go up and your tenants income does not, you will have more people adding to the wear and tear on the property which will require more maintenance.”

I’m not sure what you mean by this.

“Both landlord and homeowner have the same expenses.”

Not really. Some expenses are the same or similar, again with varying degrees of comparability. Then there are expenses that don’t overlap, for example the owner occupant doesn’t have property management, certain compliancies, different taxes/insurance, advertising/acquisition, to name a few.

“It’s up to both to decide whether the landlord wants to become a slumlord and whether the homeowner wants to live in a dump.”

That’s not very helpful because as we move away from the nominal scenario of comparing slum conditions, the differences increase exponentially.

“When I’m 80-90 years old, I will have no payment other than taxes and insurance.â€

And upkeep/maintenance expenses, gardener expense, etc. My guess is that you’re probably still saving a bit of money versus renting, but the savings might not be as dramatic as you initially think. Even less so when you consider that the savings early on could have been invested and grown over the years.

Your taxes and insurance might be as high as a rent today. Local governments have a lot of unfunded liabilities, especially pensions. Their only source of income is property tax. They might have to double taxes to keep from going bankrupt. Rental properties, mostly many units in one building, have a much smaller tax burden than single family homes.

We paid cash for our “cottage” in the 4th qtr of 2012. Nine offers and we won the bid, even though we were a lower bid. Our realtor used the inspection to lower the price even more.

I feel for all of you. We were trapped in a rental, after selling our luxury home, and the years clicked away. It was awful. Everything was in storage and my vehicle got trashed in the carport. This housing bubble (started late 2002) has been a freak’in nightmare. We should have paid $250K-$300K for this 1964 modest home, and we overpaid by $100K, plus $80K so far in deferred maintenance. Our accruals are $550 mo. We’re older and hubby’s eyes took a turn for the worse.

I am conversing on the same topic above. Landlords have these same expenses as homeowners so rents will likely increase for tenants as expenses increase to cover these costs.

No, Bob, they don’t have the same exact set of expenses and expenses don’t inform revenues. If only it were that simple.

“We bought our house in the early 90’s when interest rates were at 8%”

so did i at 9%, and i was upside down until 2000, that mid 90’s crash totally killed the neighborhood it was sad that by 2000 i lived in a hood best described as a foreign country.

the housing bubble that ended in 2006 saved my ass, and by 2010 the homes were going for less than i paid in 1991. I feel sorry for the people that bought that home, i’m sure they walked but I’ve never done the research to prove that.

“My observation is to buy when interest rates are high causing housing prices to be driven lower. When interest rates drop, you can ride the refi down.” – Right on the money. It makes no sense to buy in an environment where house prices were fueled by speculation, low mortgate interest rates / ZIRP, and QE. The economy hasn’t been on solid ground for so long, people under 30 never saw a time when we weren’t going from one bubble to the next.

For now I continue to rent, and horde cash. I am long on commodities now that most are at their 10-12 year lows.

I was trying to compare expense differences between a renter and a homeowner for the same property. I agree that a landlord with 100 units has an advantage per unit over a single family home. Being a former landlord, I know that for the same house:

Minimum costs for both landlord and homeowner.

1) Property taxes and insurance are identical

2) The cost of major repairs like roofs are identical.

3) Any outstanding mortgage on the property.

Extra costs for a landlord:

1) There is more wear and tear on a rental property since there are likely more people living in a property to cover the rent and it is less likely a renter will care for the property as well as a homeowner. Carpet, painting, etc must be done more frequently

2) In order to be solvent long-term, the landlord has to charge high enough rent to cover these expenses and likely make a profit with rent.

The minimum costs for a landlord and homeowner are identical for the same property.

The extra costs are driven by the extra expenses above and the profit for the landlord.

If I have paid off my house after 30 years, I don’t have to pay for the extra’s that a landlord will charge me(If the market will allow it).

In many areas of the country, due to lower home prices and low interest rates, initial mortgages+prop taxes+insurance are LESS than paying rent for the same property. I don’t know if that is true for CA. I suspect the higher rent covers maintenance, roof, updates, etc.

Rents will typically also increase with at least the rate of inflation. 2%?

A fixed rate mortgage will always be the same until it is paid off and there has been the advantage of falling interest rates. My mortgage payment has fallen 30% in 20 years while my neighbor’s rent in an equivalent house has increased 200%.

A good point was brought up that the down payment on a house could be invested in the stock market and the increase used to pay rent. That is a valid point for the stock market the last 8 years but lacks the security of paying off your mortgage. Stocks have increased nearly 200% in 8 years but have fallen nearly 20% in the last month. If I was retired and relied on the stock market today to pay my rent, I’d be panicking. If I was retired and had paid off my house, I’d have less worries.

I see you have never owned income property. You leave out “depreciation”. It is an imaginary expense that landlords write off against rental income. It is to cover the value of the property going down as it “wears out”. Also, if you make improvements like new appliances or a new roof, you can write off these against rental income. All the time the property is gaining in value, not depreciating. This is called tax-sheltered income.

Income properties are bought with leverage. If you put 20% down on a $500,000 property, that’s $100,000. After doing all your taxes, the net income is divided by the down payment, not the price of the house. This multiplies the yield 5X. It’s easy to make double digit returns safely.

After a few years of increasing property values and rising rents, the owner can refinance or get a second mortgage which the tenants pay. The property is now an ATM, but you don’t have to pay it back like you would if you did this with your primary residence. There are a lot of good reasons to own income property. Keeping up with inflation is a good one.

roddy, I was just thinking about that, although the rub is having to recapture depreciation when disposing of the asset.

I think Bob means well, and I agree with him that in many parts of the country there is a better argument to be made for owning over renting in most scenarios, but it’s a far different set of circumstances in most parts of Los Angeles, OC, SF, SD… which this blog has a focus on.

I’ll also add that just like rents move in two directions, profits in equities can be made in two directions. A tanking market also provides profit making opportunity, unless one is all tied up in a 401k with nowhere else to go.

This is a helpful discussion for me. Thank you!

When I was a landlord, depreciation taken over 30 years was a help with taxes but the amortization over 27/30 years didn’t give much leeway in lowering rent.

What is a good rule of thumb with rent vs buy in CA? If your mortgage, property taxes, insurance are less or close to rent in the same house, what would you choose? How far off would they have to be?

I realize that this is an instant type decision. Rents could go up or down as well as property values in the short term. However, in the long term, rent and property values have increased at least the rate of inflation. In my case, my house could rent for 200% of my initial mortgage after 20 years. 20 year old owners had the advantage of steadily falling interest rates so that has helped lower mortgages by 30%. This would be hard to repeat (Unless we go negative which is scary). Though Japan has had mortgage rates at 1-1.5% for the last 20 years which means the banks could become leaner and lower rates. Apparently Japanese backs don’t need to make 4% off of government free money.

Another comment. I was a coastal CA homeowner from 1988-1994. I bought for around 200K in 1988 and sold for 260K in 1993. A small profit. In retrospect (famous words), I could have sold 13 years later for 1M in 2006 if I would have kept it and rented it. Today it is worth about $700K. Still a good ROI, if I had kept it. Housing would have still beat the stock market from 1988 to now for that house.

“In retrospect (famous words), I could have sold 13 years later for 1M in 2006 if I would have kept it and rented it. Today it is worth about $700K. Still a good ROI, if I had kept it. Housing would have still beat the stock market from 1988 to now for that house.”

In 1993, you could have purchased Apple for $60 (pre-split) or Microsoft for $89.50 (pre multiple splits). ROI on those would dwarf those of many such properties.

Article on ‘affordable housing’ in Venice and median cost of home in Venice went from $350K to $1.6M in 20 years.

http://laist.com/2016/02/09/proposed_affordable_housing_in_veni.php

Excellent Article!!! I have come to these conclusiosn myself. I would like to add that a house is a depreciating assett. The Dirt is what appreciates. The problem is people are buying small awful homes with small lots. If you are going to buy into a bubble market and plan to stick it out hell or high water for 30 years at least get the bigger lot in the best area possible.

Either way HOUSING TO TANK HARD SOON!

Interesting Woodland Hills house: https://www.redfin.com/CA/Los-Angeles/21627-Mulholland-Dr-91364/home/4307092/crmls-PW16017733

No photos of the house’s interior.

I spoke with the listing agent. He said the house is occupied. Rented out. And so there is no access to see the inside.

This house is being offered without access to the inside! No photos. Nor can the buyer enter the house, much less do inspections.

I don’t know what weird agreement there is with the tenant, but this house is being offered sight unseen.

It’s not that terribly uncommon, especially as of late. Basically there is no agreement with the tenant, hence not available to show.

Let’s see, a tenant occupied property where the occupants are more than likely uncooperative with the current owner and no way to get in to inspect the property prior to bid. Seller not willing or unable to wait until after tenant is out to sell.

When nonsense like this results in bidding wars, it’s a huge topping signal. It could be too late at this point, though.

I’ve seen this before. Basically you have a foreclosure with a non-cooperative tenant, possibly the previous owner. Banks are horrible landlords and rarely even collect the rent nor make any repairs. Often they don’t even bother to evict and pass the problem on to the next owner. The tenant is probably looking for a handout in order to vacate. It’s a gamble and a possible headache of monumental proportions for someone who does not know what they are getting into. They may have a lease, may not, either way they will claim they do and that they have legal occupancy rights. Evictions can take months and can cost not just money but time and headaches. Like I said before, it’s a gamble. I have heard of people attempting to contact the tenant without the banks knowledge to see what the deal is.

That is really bizarre and ridiculous. You generally only need to give 24 hours written notice to enter. Unless you’re bulldozing the place, who would plunk down that much money to buy a house sight unseen? Crazy.

Tenant law-related stuff: http://www.dca.ca.gov/publications/landlordbook/living-in.shtml

Yeah but you may not want prospective buyers entering if you think the tenant is going to create problems as a result, so it could be better to stipulate no entry prior to bid.

If it looks good against comps, it’ll sell.

Just got transferred to a job in a high priced area of West L.A. The prices to buy a place to live there are sky high, even for condos.

But so are rents.

Now I have enough cash wherein I could put a very large amount down on a purchase, even at these high prices. In fact I could buy a condo, with enough down to keep my total monthly payment (mortgage, HOA, and taxes) down to less than what I would pay per month to rent a comparable place. Moreover, I also would get a mortgage interest and property tax deduction on my income taxes, which would result in a moderately sized refund to me at the end of the year.

Finally, I know the areas I’m looking at buying are and have always been high demand areas . . . and therefore always more expensive than other parts of Southern California. And short of a major earthquake, a complete meltdown in all the things that make West L.A. real estate HIGHLY desirable (UCLA and all its spinoffs, Silicon beach and the burgeoning tech presence, the proximity to the ocean, all the cultural/entertainment amenities of the west side, and the wealth generated by the Hollywood film and TV industry), or a major drought that keeps L.A out of water, there’s no sign that the west side will, in the near future at least, ever become a place that is NOT desirable to live. Thus, it’s a pretty safe bet that these west side neighborhoods will hold their value at the very least, if not appreciate significantly over the next 10 years.

So, should I rent in this area? Or should I buy? Or should I wait in the hope that prices might come down a bit sometime in the near future due to some kind of correction conditions in the market?

Thoughts anyone??

If you can afford it, you plan on staying out for the long term, and buying is cheaper then renting, then I would buy. It’s plain and simple.

It all depends on how long you plan to be there. If there is any chance at all that you could be transferred out of the area any time soon rent. If you love West LA and are determined to make it your forever home go ahead and buy.

Just don’t buy with the attitude that you can always sell.

Here’s some food for thought as you make your decision:

I moved around for work and rented for many years. While I enjoyed the foot loose and fancy free freedom, I also realize that I missed real estate buying opportunities that could have substantially increased my net worth. Whatever rent I paid is long gone.

When my husband and I purchased our house a few years back, one of our criteria was that the monthly expenses had to cash flow, if we ever decided to relocate and rent it out. With that achieved, we are more relaxed, enjoy having our own home and aren’t concerned about market trends.

With the markets rigged as they have been, it is hard to predict future trends. Common sense doesn’t seem to apply anymore….in terms of “what should happen”, versus “what does happen”.

That being said, as many have said on this blog, any financial move is a subjective decision based on a given person’s circumstances. If the pros of owning outweigh the cons, you might decide to go for it. Or vice versa.

Good luck remaining “more relaxed” if indeed you do “rent it out.”

“I also would get a mortgage interest and property tax deduction on my income taxes, which would result in a moderately sized refund to me at the end of the year.”

You didn’t give any numbers, so it’s difficult to know for sure, but it’s not a given that itemization of those two items net of the standard deduction in a low interest rate environment brings costs in parity with a comparable rent scenario in the areas mentioned.

“it’s a pretty safe bet that these west side neighborhoods will hold their value at the very least, if not appreciate significantly over the next 10 years.”

If you’re convinced of this, why even ask the question?

Another day in L.A. with miserable, HOT weather. Here in Santa Monica, by the beach, it’s in the 70s at night. In the 80s during the day. I hear it was in the 90s in the Valley.

It’s February. I’d like some winter. It’s just not normal, much less desirable, to bake and broil during the winter. Just how HOT will this summer be?

Of course, I have no air conditioning. My condo building only turns on the central air conditioning during the summer/early fall months. And the HOA rules do not permit private window AC units.

You live in a condo and the HOA says when you can run the AC? Never heard of such a thing.

The condo HOA runs the central AC, naturally. The central AC is such that it can only generate heat or cool air for the entire building. Right now it’s switched to heat, because it’s winter. So everyone gets heat. Of course, I can turn it off and get nothing.

The HOA had the option of buying a central AC unit that could generate both heat and cool air, year round, giving each condo a choice. But that cost more. So the HOA went with the cheaper central AC that could only generate temp at a time. (This was when they bought the new chiller, a decade ago.)

No homeowner is permitted a private window AC unit. They’re considered unsightly. It’s thought that unsightly window AC units would decrease property values.

There are TONS of rules. All sorts of “unsightly” objects are banned from being kept on balconies, including bicycles.

I think I might have mentioned this before, but if you can’t get a window AC unit, just get a portable AC unit! These are able to be rolled around and they just have an exhaust hose extending to the window that’s generally pretty unobtrusive- I doubt anyone would even know you had one unless you pointed it out. They don’t work quite as well as window units [because outside (hot) air seeps in to the living space to replace the air that the unit exhausts], but they work decently, especially in smaller spaces.

Latest realtor LIE.

If you look at this home on the map, you’ll see that it’s in PORTER RANCH: https://www.redfin.com/CA/Los-Angeles/11762-Seminole-Cir-91326/home/5984949

Yet the listing address says NORTHRIDGE.

In fact, on Redfin, ALL the Porter Ranch houses are listed as Northridge.

Shame on Redfin. Is this even legal? The sellers will have to make full disclosure of the gas leak, and that the house sits atop a gas field with potential future leaks — so why lie now? Sellers will fess up before the closing, yes?

Technically it is the city of “Los Angeles”. Porter Ranch is not a city. One would not write “Porter Ranch” on their mailing address. I believe that Porter Ranch is a housing community that is considered part of the Northridge neighborhood. So the listing agent would be correct.

Yes, but Redfin puts Woodland Hills, Sherman Oaks, etc. in their listing address, despite those being neighborhoods of L.A. And they used to put Porter Ranch in their listing address. (I’ve been following PR RE since the leak, out of curiosity.)

Now the agents have switched tactics, and put Northridge rather than Porter Ranch.

Wow, what a change. The house we rented last year was near the line between Northridge and Porter Ranch, but definitely in Northridge, and the listings in that area often claimed Porter Ranch. I’m glad to be out of there.

I got hammered in the real estate crash that started in 1988 in CT. It is hard to explain to somebody how it feels to have your home drop 30% or more in value. At first, you lose your down payment. then you owe more than you can sell the place for. You look at homes for sale. You see that you can own a much bigger house in a nicer neighborhood for the mortgage you are now paying. Or you can buy a house just like yours for a lot less. It sucks.

Usually these downturns in real estate accompany a failing economy. You may be required to transfer to another state to stay on track in your career or to just keep a job. Being upside down in your mortgage prevents this. Now you are a double loser. It double sucks. Your neighbor that was renting a house just like yours called the movers and went on with his life. Your life sucks because you bought into the Realtor’s sales pitch.

In central CT back then house prices too TEN YEARS to come back, and CT is no financial backwater. To make matters worse, I was a Realtor. It triple sucked.

As a counter point, I bought in Seattle in Feb 2005 with an 80-20 split and 0% down. At the bottom in 2011, the market was down ~30%. At the end of 2011, I accepted a job offer in another country. We weren’t stuck, we simply hired a professional property manager and rented it out while renting a place in the new location. I suppose I could’ve driven myself mad by looking at what other people possess and how they live and bemoaning that I didn’t make the same choices they did.

You should probably sell that rental now, if you still have it.

Seriously, sell if you can now before Microsoft, Amazon, Starbucks, and everything that has fueled an insane bubble in Seattle for the past 20 years crash. I don’t track Washington RE but down here in Irvine it’s interesting to see the people that bought in 2005 finally able to sell their house for what they bought it for. I assume there is a lot of property that is still either underwater from the first mortgage, or the home owner pulled phantom equity out along time ago.

Still remember when I first came to Irvine / Newport for some tech training back in the summer of 2007 and had to ask the instructor WTF? How does everyone seem to have a new luxury car, is everyone down here making $200k+ a year here? That’s when I was introduced to the socal housing bubble

We sold it in 2014 when we moved up.

my X just sold here home she bought in 2005 when we sold our house. She sold for $30K less after “renting from the bank” for 11 years.

from what i’ve seen, housing in socal is a crap shoot.

See my comment above. I am seeing lots of recent sales on the MLS showing the same trend. 2005-2016 and they probably aren’t cutting a check to the bank, but if they took out a HELOC and just blew the money they are screwed. It will be interesting to see if the 10 year balloon payments due soon for some people that have been underwater / unable to refi force them into foreclosure

In the Eighties I bought and sold two houses and did well. In the Nineties I lost it all. In 2010 I bought my present home and doubled my money so far. That was because my wife wants it. We paid cash. I live in China now. It’s mostly luck. There are ratios to look at when buying a home. Average household income to house price is one. Rental price to mortgage price is another. Prices are way too high by all measurements now. It may go up a little more, but they will revert to the mean They always do. Do some research and make some graphs. It’s an eye opener. Don’t be kicking yourself for buying at the peak. Reversion to the mean is as sure as gravity.

I have a different viewpoint about home ownership. I bought my first home in 1979 when the prime rate was 18%, and it was a stretch for me. But being a single mom, I wanted a home for my son. Eventually I moved up to a better property, and I worked hard to pay off the mortgage before retiring. I’m thankful we don’t have a mortgage payment now, since there are so many other costs that eat up a limited income. To me, that’s the real benefit of home ownership. Many people don’t realize how much income is needed for retirement, and I advise anyone who is thinking of retiring to pay off their mortgage first. For renters, I don’t know how they’ll be able to manage a moving target when they retire.

This. The article does not address two of the big roles home ownership plays in financial planning: 1) minimization of living expenses during retirement and 2) it’s an inflation put in which you can live.

It’s not truly an inflation put. Outside of the cost basis, every expense involved with owning a house is subject to inflation.

had i stayed in the home i bought in ’91 i’d be dodging bullets in retirement.

location, location, location.

All of the circumstances of your experience cannot be reproduced today, not to mention that the incentive to pay off a mortgage is quite different at 18% vs 3%.

As HC said, times were different back then.

Buying at today’s prices can render owners virtually house poor now and the future. Price to income ratios are so skewed that a greater percentage of incomes are spent servicing mortgages. Those “owners” have less disposable income and little saved for retirement.

I bought a house in the late 80’s in CA when prices were considered high when compared to the middle of the country. We moved to the middle in the early 90’s and that is the first time I ever heard the term “House Poor”. The first time I heard that term was in the middle of the country. It was never brought up in CA.

I’m in the same situation but bought in the 90’s rather that the 70’s. At some point, the mortgage will be gone and I will be left with taxes, insurance, and maintenance. These are the same costs landlords have but they will also likely add in a profit for themselves.

Other than a severe rental market crash where landlords are being driven into bankruptcy (Could happen, I admit). the profit motivation for landlords to keep rents as high as possible to make the most profit will always mean rents will be higher than a paid-off house. Expenses will be the same for both as a minimum. When I am 80, I am conservative enough to want stable and minimum expenses. I pick homeownership for the long term.

Bob, you keep claiming the expenses of a homeowner occupant and an income property owner are the same, they are not, it’s patently false.

Of course rent is higher than a comparable paid for house, but that’s not really ever in dispute because there is no parity in that comparison. The question is, what’s the differential over a period of time between two options of like-kind with the least possible total cost?

Hotel California stated: “Bob, you keep claiming the expenses of a homeowner occupant and an income property owner are the same, they are not, it’s patently false.â€

I agree with this. In some (probably rare) circumstances, the costs might be the same. Example: I only have one rental, so my costs are pretty much the same as any homeowner. However, I suspect that “landlords†like me are in the minority, and that most landlords have many units. For example, if you have 100+ units, you’re probably going to have a full-time handyman who effectively works at a substantial discount because of the volume of work; same deal with gardeners, major repairs (such as roofing), etc).

I still think that, at face value, it’s definitely cheaper to live in a paid-off house than it is to rent. However, that difference starts to diminish (maybe substantially) when you consider investment options available to a renter in the early years, versus a home buyer who is paying much more money every month in the early years.