Back to the California housing future -Low priced housing areas in California in for a real estate double dip? New buyers and investors jumped in too soon. Massive sales and speculation in lowest priced zip codes.

Fool me once, shame on me. Fool me twice, and I must be buying real estate in Southern California. It is amazing what a little tax credit and hype can do for a housing market. Yet the juice that seemed to get people buying again is now losing momentum. In the last year we’ve been covering the mid-tier market with areas like Culver City and Pasadena because this is where the next price correction will occur. However, during this time we have also seen a flood of buyers and investors buying in depressed market areas. In Southern California, this has been seen in areas like the Inland Empire where prices have been crushed with extraordinary amounts of foreclosures. Today I want to focus on Los Angeles County and take a look at the top selling zip codes. Get ready for a back to the future experience.

Antelope Valley Style

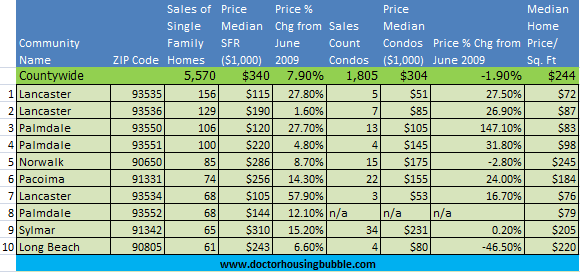

I wanted to sort out all the zip codes in Los Angeles County (over 270) and sort them by top selling locations. The list shouldn’t surprise you for the latest month of data:

All these areas are priced under $300,000 except for one with many priced in the $100,000 range. The amount of sales is near the amount of peak sales months found back in 2006 as you will see, but the big change is price. Look at the yearly changes in prices. Do you think a 57 percent price increase looks healthy? Or what about a 27 percent increase? Keep in mind we are looking at a good number of sales so this does provide a solid sample set. What has happened in this time? Has the economy recovered in these areas? Not exactly but you have many investors pouring into these markets. It is fascinating that this area is seeing a large number of sales but for different reasons from 2006.

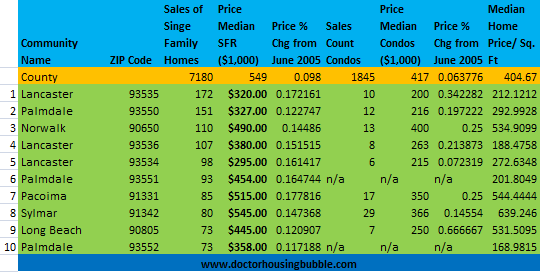

Let us look at the top selling zip codes in 2006:

The first obvious thing that should jump out to you is the same zip codes appear again and we are looking at data from four years ago. The next big trend you should see is the actual price tag back then. Today you see each area selling off of its peak by $200,000 to $300,000 (this is a big chunk given some areas are now selling for slightly above $100,000). What was the push for buying out here in 2006?

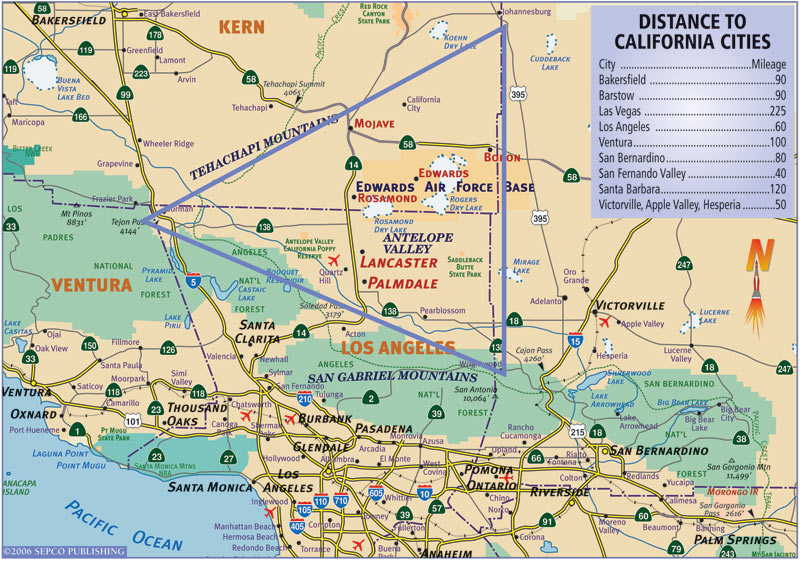

The large amount of homes purchased in these areas had to do with many people being pushed out of Los Angeles. Even though Palmdale and Lancaster are officially part of Los Angeles County they are pushed way out to the north:

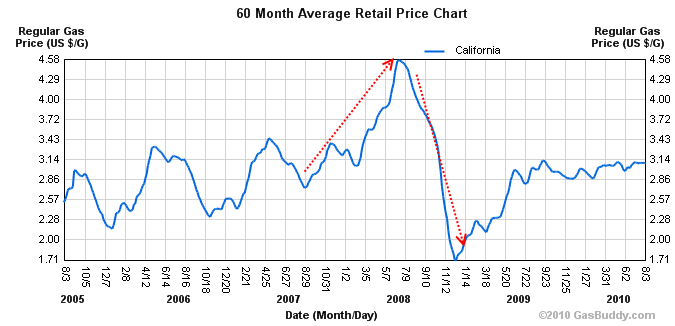

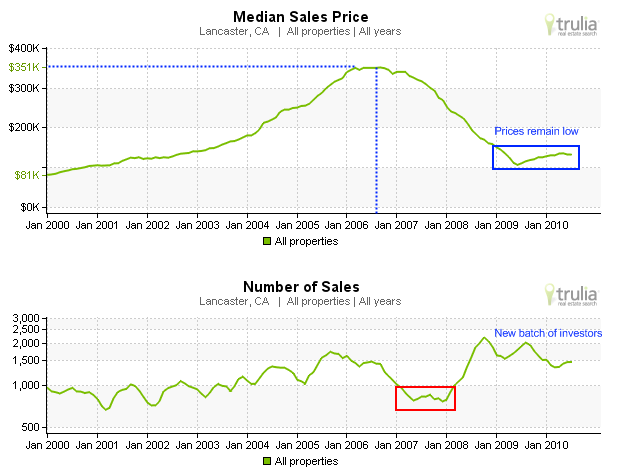

For well over a decade people unable to buy in ever more expensive cities of Los Angeles started moving further out to purchase homes. The allure was strong and the price was right for many years. What caused the boom in the 2000s was largely the access to subprime financing. These areas were littered with poor underwriting (aka no underwriting) and were the first to come crashing down when the first signs of weakness appeared. The above charts show the incredible price collapse that was witnessed here. What imploded the area was of course bubble like housing prices but what completely punctured the bubble in the Antelope Valley was when gasoline prices spiked. Employment in Palmdale and Lancaster took an even bigger hit and many people do a grueling commute into the Los Angeles area. With the spike in fuel, it pushed the housing market over the edge:

The crash came immediate and the housing market came tipping over like a neatly lined up row of dominoes. Yet the market in Lancaster and Palmdale is still weak when it comes to employment. Similar trends exist in the Inland Empire. Yet home buying in terms of sales is approaching peak month volume. Do investors and first time buyers see something that is different from the actual employment and overall demographic trends? From speaking to people, it appears that many have waited for so long, that like a starving dog that gets a first meal in days, many are devouring anything with a low price tag. That seems to be the guiding force in these markets:

Let us list the different trends:

2000 – 2006

-Bubble in L.A. cities pushed lower income families further out

-The desire to own plus subprime lending made it possible

-Fuel costs were still relatively cheap

2007 – 2009

-Market crashes because bubble bursts

-A flood of homes go into default with subprime collapse

-Prices enter a free fall

2009 – Present

-Investors smell good deals and jump in

-First time buyer incentives and price make buying an option for many

But are the deals good? As an investor you want to look for markets that are stable and provide adequate cash flow with a minimum amount of headaches. The amount of exotic financing combined with the economic collapse has pushed a flood of homes onto the market in this area. Let us take a look at a dramatic example (although extremely common for this area):

43405 STANCLIFF AVE, Lancaster, CA 93535

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2005

Square feet:Â Â Â Â Â Â 2,662

Listing Price:Â Â Â Â Â Â $172,900

Previous sale price:Â Â Â Â Â Â Â Â $405,000Â Â (August 2005)

Now is this a good price? Clearly the 2005 price wasn’t because it is now selling for $232,100 less. In fact, the five year price decline is enough to purchase this home outright. So is it cheap? Given recent sales trends it would appear that some do believe this. Yet I think some are misguided because the current price jump from last year signifies a creeping mentality of flipping again. Call it the HGTV syndrome. To buy and hold, you need to have a suitable employment base. From talking with some investors buying out here you know many are getting into something they have little idea about. They see consistent monthly rent checks yet it is anything put.

These areas are hard for property managers especially with the transitioning economy. I’ll let a few people say it in their own words:

“(BestPlaces – 2/2/2009) I’ve lived here for two decades, which is about 19-1/2 years too long. When the ink is dry on our retirement papers we are out of here. Why? Over run with gangs and section 8 housing. Arrogant Mayor and City Council passing laws as if this was their own personal kingdom. New business construction as the strip malls sit empty. I doubt they will ever finish tearing up the main roads over and over and over again. Don’t even think about owning a Rottweiler or “pit bull” in this town. If the crime continues, and it most like will, don’t plan to own any dog that the city council doesn’t like (pretty much anything over 40 pounds is on their radar).

The constant wind, at least that will save you the cost of a patio because you will almost never be able to use it – ditto on your BBQ. Big box stores selling only the cheapest nastiest goods. Even the department stores feel like seconds. Everything is the color of dirt. No architectural standards committee which assures a horrible mish mash of fake Grecian temple strip malls next to modern office buildings, across the street from fake south western adobe. No airport and it’s 2+ hours to the next closest one. Nightmarish traffic on the freeway and off. Some of the worst schools in Southern California.â€

Now this is merely one perspective. Each area has good and bad so take it for what it is worth. But many are making the mistake by looking at a nice picture and a cheap price and assuming that it being “close†to L.A. is somehow reason enough to make it a solid investment. Many are buying without even going to the area (giant mistake). If that is enough to buy, then buy this place in Detroit:

Is that the monthly rent? Nope. That is the final sales price. You can find literally hundreds of places like this. Sometimes places are cheap for a reason.

Many are now realizing that a home is really only as good as what surrounds it. This includes schools, neighbors, climate, and access to work. The idea that a giant McMansion is simply good enough is a flawed idea that is now going away. Just take a look at Nevada and Arizona and you can see the same dynamic take place as what is happening in the Antelope Valley. But we have the halo effect hitting here because of its “proximity†to Los Angeles. 450,000+ people live out in the Antelope Valley. Investors buying up for easy cash flow properties may be in for a surprise if people start moving out. Flippers better hope we have more tax credits and easy access to loans for the foreseeable future to keep sales brisk (or more would be investors to unload to). Do we need to talk about Detroit to show what happens when people leave for better economic opportunities?

To give you an even better sense of the problems still in the market, let us look at some data:

Lancaster

MLS Listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,229

MLS REOs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 54

Non-public distressed data

NODs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 749

Scheduled for auction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,056

REOs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 519

Does that even look remotely healthy or normal?

Fool me once, shame on me. Fool me twice, well we’ve been down this road before haven’t we?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

48 Responses to “Back to the California housing future -Low priced housing areas in California in for a real estate double dip? New buyers and investors jumped in too soon. Massive sales and speculation in lowest priced zip codes.”

What the hype can do, even to very intelligent, otherwise rational people, continues to amaze me. I am currently living in Australia where, if you believe in housing prices eventually being tied to incomes, is near the top of a gargantuan housing bubble. I feel like I am living a rerun of life in the US for the early naughts.

We rent a house for ~1/6th of what the landlord must pay every month, yet everyone seems to think this is ok. Granted, there are some differences, especially some serious tax advantages for rental losses, but still the prices seem completely unsupportable. Half a million gets you a miserable bungalow with a long commute into the city. Yet when I talk with highly educated, financially successful people, all I hear are rationalizations as to why Australia is different.

Housing costs are currently in the 8x range for household income and the large city we live in looks amazingly like SoCal pre bubble burst. However, for the most part, Australians seem convinced that Australia is different, there is no bubble. Real estate TV shows are still popular and the office coffee talk centers more around types of granite than repayment issues….

We’ll see. I hope not to see the ugly devastation again after escaping halfway around the globe!

Some further analysis shows that it’s even worse than the median numbers indicate.

While the decrease in median home price has fallen between 41% and 64% in these ten areas, in eight of the ten, the median price per square foot fell by an even greater amount. Some examples:

93550: median price decline: 63.3%, median price/sf decline: 71.7%

90650: median price decline: 41.6%, median price/sf decline: 54.2%

93534: median price decline: 64.4%, median price/sf decline: 72.1%

91331: median price decline: 50.3%, median price/sf decline: 66.2%

91342: median price decline: 43.1%, median price/sf decline: 67.9%

Across all ten zip codes, the unweighted average decline in price was 53.4%, while the price/sf fell by 61.5%.

What does this mean? The type of homes that sold in 2006 are not the same kind being bought today. The only way to get a larger decline in the price per square foot than in the total price is for the denominator to be larger now than it was then. In other words: bigger homes are selling and smaller homes aren’t.

The decline in the median price per square foot, therefore, is the more accurate indicator in the real price decline. Across these ten zip codes that ranges from a 53% to a 72% decline since 2006.

And if you’re the owner of a smaller home in these neighborhoods, expect to take a loss of at least that amount. After all, if someone wants to live in one of these depressed markets, why should he have to settle for less than a McMansion?

Many people are making the same mistake over on the Central Coast of CA.

House prices in Santa Maria are falling like a rock. But because it is “near” Santa Barbara, some think it is a good deal. Gangs, crime rate above average, and dead grass in front of repo. homes.

“Santa Maria, the Lancaster of the coast”.

Working on doing a short sale in my low-priced area and the banks are being stupid. I don’t know if they are still holding my loan at 400k on their books so they don’t want to accept a short sale or what. I’ve had investor cash offers at go up to 170k and I see plenty of sales prices in the past year of the same floor plan in the 160k’s. The bank keeps refusing offers after telling me they want to do a short sale. Everyone knows prices are going to go down this year so I bet they get way less than 170k if they take it to foreclosure. Not to mention the other associated foreclosure costs. Rent free 20 months and counting. I’ve actually already moved to my new place for all that want to flame me for squatting… I probably should have stayed at the much nicer place. I’m sure the bank will push this thing past 2 years at this rate.

A great deal of knowledge, ideas, and deals, come from years of being involved (and not scared or pessimistic) listening to those that have contacts in the property exchange process. Since the crash, as of late, things are evolving. Those that are pissed off because there are driving forces to rebuild the housing market in SoCal, will just have to be those that will wonder what happened and die bitter angry old people. Yes, I can see, read, decipher the data of what is posted here as a basis for why things should not have happened, and I can even say, there are certain changes necessary in loan origination, property taxing, and so forth. But just because you or I “feel” that something should, or shouldn’t happen, doesn’t mean it will. I can sense the anger and frustration all over, including here on this blog. Part of that though, is a raw sense that some people feel they are entitled to own property in SoCal and can’t because their own sense of superiority over things that is much larger than themselves. Having the right contacts, listening to others without prejudice and taking action, are some of what I see investors (speculators) are doing today. There is this mindset that speculation is an evil mix of ideas and makes everyone suffer at that hands of a few. My sense is that some here want to believe there is going to be some major reset again in SoCal… there might be in some areas, but I personally don’t think it’s major. I think the damage is as low as it’s going to get and what you see on the MLS is what can’t sell for a variety of reasons. Let me give you an example; I can pickup a fairly decent house off the books in OC for 20%-30% less than peak. But I won’t find it on the MLS. However, there is a property, same area, only 15% less thank peak, and it’s been on the MLS for 6 months. Why? Because the house backs up to a heavily traveled street and it’s noisy. Therefore, the sellers (the flipper who bought it) screwed up and now he has no choice but to heavily market the property using all means to do so. What I’m trying to say is the “good” properties are moving. There is still a demand for housing, the difference is buyers are a lot more picky and have learned a bit more from reading the news the last 2 years. There is also this notion that nobody has any money… this is so very wrong for people to assume. All of the data we see, in my opinion, is part of the resetting of a multitude of activities. People are moving out, people are moving in. I know there are nay sayers that there isn’t money coming in from other areas. There is.. plenty of it. If you, the potential home-buyers wants to wait everything out, ok… nobody is telling you any different. But I see people who have a totally different idea about that. The idea that just because people feel property values are too high, I recommmend you step out of SoCal and do a lilttle traveling. The SoCal real estate market is actually a World-Wide market, that is getting more publicity than ever in the history that I have ever seen. The idea that people will sit there, cross their arms, and refuse to buy something, is laughable. No problem, someone else is going to buy though, whether you like it or not. Take all this resetting process, and in the next (say 24 months) the pain is mostly over, the healing begins, although slowly at first… by say 2013-2015, it’s game on again, stronger than before. I’ve spent some time in Hong Kong not long ago. I met a group of investors just itching to stick there gains, from decades of exports for years, into something (SoCal style). Ever priced real estate in Hong Kong? They could sell ONE CONDO there and buy beach front in Newport Beach with it. This angers people no doubt, but the reality is, SoCal property is, and always will be, in demad, not only locally, but world-wide. This demand will stay steady, although lower than at peak, because the buyers are different now, and that is part of the resetting process. The basic reason is simple; those that could not, or did not buy during the surge in property values, are now diving in and those selling are relocating, retiring… whatever, their leaving. The point is this, properties are changing hands into those that have the means to pay prices that others can’t.

There’s a sucker born every minute, so we will do the same thing over again. Since so many like gangster music and poking holes in themselves, I don’t see the downside. Going outside is soo overrated. Oh that’s right, we rationalized SoCal because of the weather. Two hours to airport? Don’t have to worry about all that airplane noise drowing out the gansta rap going up and down the streets. Traffic jam? More time to listen to the jams on my deluxe car surround system with subwoofers that rattle the doors of the Big Lots when you drive by. Big dogs eat too much. Just get a ferret or one of the P Hilton dogs. Kids don’t like school much anyway. It’s all good.

Interesting Patrick about Australia. From all accounts, Canada is going through the same thing and they say the same thing-they are different.

I think the world has some very “interesting” times ahead. I think we swung so far into free trade, we may swing back into the other direction before moderating.

The Great depression redux? Something about history repeating itself?

Very interesting and well researched and documented article. I live in the Antelope Valley and the description (while not entirely untrue) was written by someone with an incredibly bad attitude.

There are a lot of people buying homes as an investment, but the majority of buyers are people buying homes for their family to live in. I’ll admit that this might not be the best time to invest, but it is a great time to buy a house to live in. The prices are very low and they aren’t gong to get much lower and the mortgage rates are excellent.

palmdirt

That’s what us Drag Racers called LACR. You’d click top gear, and the afternoon wind would blow your car to the left as you passed the end of the grandstands. When the 14 fwy was brand new, we’d ride up to wrightwood in the 40 ford, but that was in winter time to play in the snow. The high desert is a misearble place most of the time…OK to visit, ride dirtbikes, or watch races at willow springs, but only a fool would choose to spend any significant time there unless you have to.

SoCal-Native,

You are absolutely correct about pocket areas in California that are exposed to a world-wide market. I think if some folks that comment on this blog would travel to other parts of the world, they might learn a different perspective of the cash flow situation pertaining to real estate. One has to travel to China to actually see how much properties sell for where the economy is exceedingly more productive. Folks in Shanghai easily pay over one million dollars for a 1100 sq. ft. condo close to work. When they travel over here and find a property with land for almost half the price, they jump on it. A 1550 sq.ft. property in Diamond Bar recently sold for 560K in a few days. It was a clean property, but nothing too special. The school district is sought after.

@So-Cal Native: You’ve mentioned these great “off the books” deals in several posts. Where do we find these deals? Or do we need to be “in the industry” to find these?

SoCal does have an international draw for big money, but I have to question the big price tags in some of these outlying areas. It would be a poor investment for someone of means to purchase and hold a place that will appreciate slowly. And if they have millions in cash and high compensation, they would not want to buy those places to live in.

I imagine places like Newport Beach or Santa Monica would draw international money, but not the inland areas.

SoCal, you are right about the good properties moving, but for the most part the “good” properties are actually on the MLS in order to get maximum exposure. The cash investors buying bundles of homes, much like previous downturns, are getting the bank/lender’s mixed bag of REO crap. They’re not getting a thing in truly prime areas, that’s for damn sure, because the banks are holding on to those properties and milking them for top dollar. I took a look at a couple prime zip codes via title recording and compared to MLS, very few properties are changing hands without being on the MLS, and those that are don’t have any substantial discounts.

Those 50% (or more) off from peak, off the books deals are certainly out there – out there in the worst and farthest reaches of LA County, Riverside and San Bernadino counties, etc.

As for the Chinese and others coming in and buying everything because it’s “cheap” to them, well I’m sure they’ll do just as well as the Japanese who came in before them. One group of Japanese investors overpaid for 2 Rodeo Drive and sold it for $.65 on the dollar, if I remember correctly.

http://articles.latimes.com/2007/sep/18/business/fi-rodeo18

No doubt many will lose their shirts catching a falling knife, and more power to them. I will agree though, that in times like these assets will move from weak hands to strong hands…but IMHO we haven’t seen anything yet…

Tangentially, my wife had on HGTV the other night and some SoCal couple was buying property in El Salvador as a vacation house. I kid you not, from memory they paid around $600K for a non-ocean front (ocean view though) house that had maybe 3500 squ ft and was (get this) 20 minutes into town and looked pretty damn isolated down a long dirt road without any sign of neighbors nearby. Insanity – reasonably nice house but come on here the only market for stuff like that at that price is other Californians who might come down thinking this is remotely acceptable based on their crazy frame of reference and eternal optimism over housing. I’ll also throw in that they had 2 grade school kids (limiting away time at said vacation home) and were talking about still needing to save for their kids’ educations. That whole area of the country needs to stop buying real estate both locally and internationally, join a support group, and get a grip on life.

I believe we are in the midst of a radical change in societal values. The values of frugality and the overall shunning of debt are on the brink of a “tipping point”, as Malcom Gladwell might say.

–

Contrary to the thoughts of SoCal-Native, I think housing prices are destined to decline for two main reasons. First, people with current equity (or money) can’t keep prices rising, or even where they are, by trading with one another. It takes new money, new people, new job creation and new wealth to drive prices up. This is not happening (globally).

–

Second, the sweeping societal change we are on the brink of. As people the world over pay down debt, the trend will accellerate. People will not find value in taking on hundreds of thousands of dollars in debt, especially when the intent becomes to actually pay it down, instead taking ever-rising paper “equity” and moving up.

To the realtor: “SoCal-Native”. I guess life is good as a realtor in S.C. Enjoy screwing up buyer like you did in the last 5 years.

@Eric – I consider Corona, Murrietta, Riverside, San Bernardino, Las Vegas, etc., to be Inland areas. There are foreign investors buying in these areas at a growing rate as markets stay low, or move lower. Again, I know it is hard for some to wrap their mind around why, but I keep saying, it’s cheap for them because they do not rely on the US ecomomy for their financial support. Newport and Santa Monica, too expensive, and not a good deal in the eyes of foreign investors. They will wait out any potential crash and be right on top of it scoop them up.

@Average Joe – You have made an assumption that everyone, everywhere has debt to pile out of. Further, you have assumed that everyone, everywhere sees this as a risk. When in fact, they plan to buy and hold indefinately. Lastly, read my response to Eric above.

@Duboiz – Supply and Demand (and I’m not a realtor). Market Capitialism 101.

“Contrary to the thoughts of SoCal-Native, I think housing prices are destined to decline for two main reasons.”

~

They are already. The ones being sold are in two price regimes: short sales and FHA lending. The short sales are going for half off to people from other countries with $300k in cash, which is what the homes are worth. PAYING 50% OF A HOME VALUE IN A SHORT SALE REPRESENTS A PRICE DECLINE. The FHA-lending homes are going for absurd, unsustainable sums. FHA lending standards are supposedly tightening. Supposedly. For an end to that, we’ll have to see how our government insolvency pans out.

~

@SoCal Native: China’s and India’s GDP are about a tenth of what ours is. I’m not sure where you’re getting the idea that they have more wealth because they’re not dependent on our economy. China is having a huge property bubble right now so they may be playing the same game you played the last decade. You informed us how that ended. The Chinese have high savings rates and typically have no problems pooling cash with extended family. That may be where they’re getting the money also. But there’s a lot of speculation going on over there, a lot of inflation, and a huge housing bubble. Dem boyz are inveterate gamblers so I’m not laying awake at night worrying about what they’re doing to this housing market.

@PRCalDude- Forgive me, should have said “continue to decline”, in most areas at least, even the ever so wonderful coastal towns throughout orange county. Average home prices will eventually correlate to average incomes.

–

@SoCal-Native- I was referring to the total amount of debt out there (not at all about everyone having it), and that deleveraging will be tough on all assets that have been dependent on debt. You are right, however, about one assumption I did make. That debt will once again be seen as a risk, especially in large denominations, regardless of interest rates. Trends change, and its my opinion that the borrowing trend seen over the last 10-20 years is about to change.

DHB is showing us colorful graphs for last 2 years. I was living in a 998 Sq feet appartment in Cerritos for last 15 months paying $1900 and hoping something will change but I was wrong. Next week I am moving to rental house 1500 sq feet for 2200/month. My point is DHB’s charts tells us only one thing “THIS IS NOT THE RIGHT TIME TO BUY” but at the same time his perdictions are becoming like earthquake perdictions. Is it possible that bad guys are looking at DHB’s charts and changing thier game plan so that this can go on for a long time.

Thanks,

@PRCalDude – There are more wealthy Chinese, than there are maybe you’re aware. The Chinese have access to more money than ever before in History.

http://www.bbc.co.uk/news/10760368

Just because the article mentions Canada and the UK, don’t think the influx hasn’t started in the USA.

Short term declines in the housing market, I can buy that, which will only entice buyers of another variety to step in, as well as continue with current investors. the Chinese are some of the strongest savers on the planet, and are determined people. A decline to us, is a bagain to them. The pooling of family money is one way, if you consider 300m of Americans unable to, a mere 600m Chinese is a good start. I was told, on more that one occasion, that getting a 40 year, low interest loan, for US Real Estate, was available through Bank of China for Chinese Nationals.

The Chinese may be a factor and to a certain smaller extant the Indians. Apparantely prices for commercial property in some areas of Mumbai are now higher than downtown Manhattan.

But they can’t gobble up everything. Take me, I can easily qualify for 500-800k house . But today’s market has changed. Jobs are not a permanent thing anymore. I rent and am actually getting used to it and am happy. I don’t have to worry about maintainance and can move at the drop of a hat. We need a market that goes up for a few years to lure people in-especially in today’s job markets.

China is possibly having the biggest credit fueled real estate bust -some say it is way bigger than what we had. That has to burst sometime and if it did-those investors will wan’t to sell here-which it isn’t going to sell very quick.

I think prices are cheap-but there are a lot of fundamental factors that have changed. For one people are a lot more mobile-or at least have to be. So they do need a good market to ge tin-it is kind of a self reinfocing cycle. Plus with all the offhsoring, high paying jobs are not that easy to come by.

With the shadow inventory and the new dynamics-I think it will be a few years before we reach a bottom and then a few more of anemic growth. not that different from the great Depression.

SoCal-Native- sure maybe there is tons of foreign money out there just itching to get into Southern Cal, but it’s enormous- there are tons of houses, and these real estate cycles have all happened before and for similar reasons. I think there has been a ton of wealth created in our country and internationally since the ’80s and a lot of things have changed, but there’s not an omnipresent steam roller of world capital all over the place. Have specific areas gone through huge changes since the 80’s? Yes. I grew up in Sonoma County- it will never be the sleepy inexpensive place I grew up in. As soon as all of the wealth was created in the Bay Area in the 90’s Sonoma County was forever altered- it’s super beautiful and very close to SF. Orange County is I think similar- it will never be the sleepy place it once was. Most of it is so close to some really stellar beaches, many super nice neighborhoods, gorgeous houses- it’s going to continue to be a wealthy expensive place in many areas… but what’s happened that’s so significant in LA? Sure it has a gigantic economy, but it’s always had a pretty gigantic economy. Has its DNA been fundamentally altered? Has it been “discovered” and thus developed or turned into a place with fancy this or that? I don’t really see that. Sure some places have gentrified, but really significant stuff? I dunno, and folks with money- middle class on up are not coming in as much as leaving. Just because there are Chinese folks buying properties doesn’t necessarily imply that foreigners are coming in with bags of cash- a lot of those folks have probably lived in the LA area for years and years and have a lot of cash saved. Anyone can look at the direction of the state and get cold feet about it all- massive unemployment, broke governments, etc etc. Those are real things, not just stuff some of us are imagining because we’re wishing for cheaper properties. We’re simply analyzing a situation. Money can really be made in real estate- I’ve done well with it myself. I think a lot of people buying now are going to lose money. Are there deals for folks with connects? Sure, and go for if you get a deal, but in my neighborhood I think people are totally nuts. I’ll continue to rent without the shackles for now.

Your Detroit example is an excellent sample of what is ahead for housing not only in Calif but nationally and aligns with the process of asset deflation in Japan which we now understand is longterm. The other issue is that most homeowners have little or nothing invested into these properties as equity levels are now at there lowest levels since the Great Depression. These equity less properties in various stages of distress or holding on for better days will eventually become part of another down price wave.

Most housing prices are strongly correlated to employment. Because it’s a leveraged purchase for most everyone. All cash transactions account for way under 5% of all purchases.

I still remember looking at newly constructed 2/2 beach condo’s in Newport for $100K in 1994. The local economy was so slack that these condo’s were not selling. To think that foriegners with money will support an economy and housing prices….one should look for similar situations around the world. I really dont see any. CA real estate is pretty expensive by most comparisons and unemployment is really in the teens. This is a situation that still has to correct.

What a great article, Doc! We are experiencing Bubble 2.0 due to tax credit and low down payment loans from FHA, although it pales in comparison to the first Bubble.

Everything comes down to jobs. With high unemployment, house prices will resume their dramatic decline and bottom in 2015.

The blacks have moved into the Antelope Valley. No one wants to live around the black (and Mexicans) which depresses prices significantly. If it was at least a White neighborhood people could pay high dollars. But with ghetto trash & criminal street gangs in the “hood” prices are falling more & more lower.

Section-8 attracts dark people. If you are dark or like living around dark people it’s a great place, but for those of us who have blue eyes we are victims of their violent criminal tendencies.

So Cal Native wrote”

“I think the damage is as low as it’s going to get and what you see on the MLS is what can’t sell for a variety of reasons. Let me give you an example; I can pickup a fairly decent house off the books in OC for 20%-30% less than peak. But I won’t find it on the MLS. However, there is a property, same area, only 15% less thank peak, and it’s been on the MLS for 6 months. Why?”

Perhaps your 20-30% off house is sold on the court house steps. This is one place that investors (flippers) get their deals. The bottom line of why the flipper can’t sell his MLS property likely includes the noisy street but that is simply a factor not the cause. An awful lot of houses in So Cal are on busy streets. Your anecdote supports that the market is in decline. If A can buy a better property for 5-15% less he will surely do that. Your flipper is a knife catcher.

“I was told, on more that one occasion, that getting a 40 year, low interest loan, for US Real Estate, was available through Bank of China for Chinese Nationals.”

I was told that if Viet Nam fell there would be a domino effect and Communism would possibly enslave us. Don’t believe everything you here. Please clarify and site a source. Are you saying a mainland Chinese can go into the bank and take a loan for real estate in a foreign country without setting foot in the U.S.?

By the by almost anyone can get a low interest loan in today’s economy and I’ve read that banks will mod loans by extending the mortgage to 40 years no principal reduction allowed. I would not want to take on that debt.

SoCal-Native, I agree in the real world it helps to have connections and real estate is no different. At the same time just because someone is from a Hong Kong, China, India, Switzerland does not make them a savvy investor. Buying an investment property because you think it is “cheap” is not a good reason or idea. An experienced real estate investor will create a cash flow analysis of the property and will want to get paid a risk premium for taking that risk. I’m not saying there aren’t any good deals out there. What I’m saying is that the average property in O.C. will not attract or compensate an investor for taking that risk specially in this market.

–

In my opinion prices are not going to continue increasing in O.C. Real estate prices are going to be pressured down by various factors (employment, interest rates, etc). Currently prices in O.C. have been slowly increasing, but have you looked at the inventory lately? And I’m not talking shadow inventory. It has been creeping up since the start of 2010 and it is already up to levels from September of 2008. Check out the redfin webpage below and only graph the # of houses for sale.

–

http://www.redfin.com/county/332/CA/Orange-County

–

D1, I agree that there a certain areas that are more desirable and have people living in them with higher means. Regardless of where in the world you are. If you are investing from a purely investment perspective you will want to be compensated for the risk. You will therefore need to buy at a much lower price point than someone that is looking for their primary residence who in turn has other considerations.

The person paying a million for a condo in Shanghai is a rich person, not the typical Chinese person. This millionaire owns a company that employs tens of thousands of people making product for the American consumer. So, of course he can buy whatever he wants.

Their factory workers employed by this millionaire make something like $3 a day. That’s roughly on par with what prison labor in America is paid.

The only situation worse is in a city like Detroit, where there are houses and no jobs. It didn’t happen overnight either – it took 20 years.

I don’t forsee the Detroit situation happening in CA – we have unemployment, but it’s due largely to this economic collapse, not a long-term restructring in the economy. We went through a restructuring in the 1990s due to the end of the cold war, but bounced back becaue of our economic diversity.

What we should do is focus on our strengths. We passed a bond a few years back to give away money to biotech research. We should do that again. We should also focus on tech, trying to meld it even more tightly with media. We should restructure the UC and expand its research capacity. Undergrad education should be made “free” (tax supported). We need to fix up education from grades 6 to 12, so it isn’t a total piece of shit.

We also need immigration reform: we have to suck in as many immigrants as possible. Deprive other countries and even other states of talented people.

There’s one thing that the classical economists had right: human labor is the source of all wealth.

Property prices in Detroit are caused by a population that has dropped by half in the last 30 years.

Calif. property prices benefit from immigrants . The U.S. allows about 1,000,000 legal immigrants a year. From one third to one half go to one state- CALIF.

Yay. I love the internet where racist scumbags like Homer can post their ignorant hateful trash proudly for everyone to see.

Some of the comments and posts here are actually sort of comical 🙂 You’re assuming I really have an interest in whether or not anyone believes what I post. I comment on this blog to provide accounts of events that I really see and observe. Posters that suggest that I am going to provide “proof” or site a source is exactly like placing someones address, bank account info, etc. just so a narrow minded fool has something to say. For the last few days, I believe many of the nay sayers don’t actually get out in the streets and talk to people. They must be stuck in front of a computer having some sort of fantasy about all of this. Because if they did, we would here other types of things. Frankly, I was hoping for more insightful folks, with real life examples of events of the last 24 months. Rather than argumentative torts of late. Wrong blog for me apparently. The truth of the matter is, as long as there are people like me (and many others I work with that have a strong sense or responsibility, love for my SoCal and Country, make things happen in face of extreme diversity and challenge, and don’t sit back and whine about things I don’t know anything about. Wishful thinking is just that without action. The negaivity and bantering is stifling and is definately not condusive of any productive activities. Splitting hairs over data, ignoring things right in front of your face, choosing to avoid (or not consider) street-level events, which is where deals are made, is a fools-paradise. Further, nobody cares if you can qualify for jack-poop mortgage – go ahead and rent… statements like that are of no value. I want to hear from those who bought, sold, have rental property, or has input into something they did, saw, observed, studied, or has something that is just plain cool to here about. I also don’t care if you think immigrants are buying or not. Argue all you want and spit on the computer screen. So they are not buying in Santa Monica… that place is an over-priced swamp anyway. For 35 years, I work east of the 605 and south of the 405/22 area. I know investors that are there and regret most of it. Further north in LA County, was considered bad news well before any boom-bust. Not news to investors…newbies, probably. The term “real estate market is local” is probably the best example of what I see today. Everyone has some type of visability into their local area and try to spin that like it will crush the SoCal market. Hate to break it to you… but, won’t happen. There are already pockets of areas that are stabilizing in the last 24 months. I will restate again, there might be some destabilization in areas, but I don’t see any major crash over-all in SoCal that hasn’t alreay happened. One must consider other factors. Not everyone is unemployed. In fact, somewhere between 80-90% of people are employed, give or take. Many of these are college kids that are not home-buyers anyway. I get the feeling sometimes, and that is the part that makes me laugh, is that take all the negative comments and sentiments, lets all sit together, sing kum ba yah, hold hands and force the real estate values right down the toliet and live like it’s thunderdome. At that point everyone can live happily ever after in their wonderful little white picket fence house in Brentwood that they bought for $150k. Leave it to Beaver was a great show, for it’s time, but far from reality today. I jalso ust love it when people compare places lilke Detroit to SoCal. I strongly believe if property areas in SoCal, particulary certains areas were to lose considerable value, from where we are today, there will be civil unrest. Places like the Inland Empire have lost value exceeding 50% from the peak. Many of the properties are being sold AT or BELOW today’s building costs. Doubtful that will last indefinately. Demand will outlast supply within 24 months for all the good properties. Once all the REO’s, short sales, blah, blah, blah, has passed through the processes… then what? Use this formula for your “local market.” All I’m trying to say is, the market looks grim for places like Lancaster.. but yet, people are buying there. Just read the Dr’s post. The fact that we argue why and maybe even laugh at that, is what will keep many of you wondering what happened 36 months from now.

@RedfinSurfer – Good stuff.. I’m totally on-board with your post.

I have no problem with these house flippers taking a loss – every little bit of money they overspend on a house is that much less tax money we have to give to the Wall Street welfare queens. If they want to take these plummetting assests off the hands of the banks, and thus my wallet, more power to them.

As to your other point, it’s hardly fair to compare Detroit to the areas of California you referred to. You could spend a couple of thousand dollars on a house in a “bad part of town” in Detroit, and you would probably lose that money. But if you buy a house in California now, you are likely to lose alot more money than that. Californians are still living in that dream world where they think their state is “desireable” to the rest of the country; that is one reason prices are still too high.

It’s only when people open their eyes to see the truth behind the equity colored glasses that prices will hit bottom.

@Gael: Go away.

~

@SoCal Native:

There were some numbers in that article you posted. About a couple thousand Chinese taking about $700 million to Canada. Shall we assume the same for the US? Shall we assume they’re taking it exclusively to SoCal? If so, what is the total size of the SoCal housing market in raw dollars and what will $700 million do to it?

~

You talked about 600m Chinese and their savings, but you ignored my other point about their GDP. Their GDP is a tenth of ours, therefore their per capita GDP is a tenth of what ours is on average. So those 600 million chinese really only represent 60 million Americans financially.

~

That’s a significant amount of people and money if concentrated in SoCal exclusively, which is about 20 million people all-told.

@SoCal Native,

You also ignored this part of the article:

“”But now, with the increases in property prices in cities like Shanghai, people don’t think it’s that hard to achieve.

“That’s why you’ve seen the numbers granted permanent residency have doubled.”

~

So this confirms my point above that a lot of the Chinese “wealth” is just based on their own property bubble and easy credit – paper appreciation, not actual appreciation. They’re just doing what you did over the past 10 years and are heavily leveraged.

No need to flame DG.

Posts like yours give us the true picture of what is going on. If we were to scare you off by flaming you we would see less of the truth. Thanks for posting.

I agree with Gael, maybe this site should be moderated or something..

Why are white people constantly terrorized by other white people for complaining about foreign nationals and section 8ers taking over their neighborhoods and making them uninhabitable?

Try to show a little compassion. It won’t kill you.

@PRCalDude – If I may, I would like to reduce our immigration purchasers and buyers, discussion, to a mere, I see what I see, and absolutely no factual numbers to support what I see. What I see though, and what I have experienced, an unusually high-traffic of “potential” buyers of other than American Nationality. Appears to be, mostly Asian. I hear other investors seeing similar activity, but, and I will say, I have no numbers that I can give you. I don’t “exactly” know how many I see, nor do I know, “exactly” how many there are, nor do I know “exactly, what and where they are buying. Data is a funny thing. I see it, I can feel it, I hear it, but…. don’t know. I will take a bow and surrender that you must be right, because I just can’t give you the numbers to support an argument.

“Frankly, I was hoping for more insightful folks, with real life examples of events of the last 24 months.”

So were we, SoCal Native, yet we see no real life examples of events of the last 24 months from you, only unverified anecdotals from some whoopdedoo “RE investor” of crap areas who’s admitted to losing almost a million dollars over the past 5 years. Yeah, that’s someone worth listening to, FLOL. “east of the 605 and south of the 405/22”? So Garbage Grove? Westminster, Santa Ana? Yeah, you stick to the illegal alien clownhouses and the 909/951. 80-90% of people are employed? You mean 80-90% of EMPLOYABLE people are employed…well, how many of those are working retail, service industry, and extremely low pay? For every one of your talking points professing a positive future, there are half a dozen concrete reasons for substantially more pain in the RE landscape.

“The truth of the matter is, as long as there are people like me” – what, you mean real estate speculators who, along with virtually all of their peers, family, buddies etc. (as you yourself have indicated) have lost their shorts? Or “people like you” that don’t know the difference between “hear” and “here”. Sorry, but your awful grammar and lack of fundamental knowledge of the English language really do detract from your credibility. But hey, more power to you if you really are some rich RE speculator…keep on buying we need suckers to catch those falling knives…we need more people who *think* they are strong hands but really weak, turning those properties over to the *REAL* smart money in a few years.

Maybe the Mexicans and Chinese will fight over what used to be California in the future. Should be interesting. These people above aren’t paying attention to who/whom are being born in this state’s hospitals – and who isn’t.

Pleasant dreams all.

Yes Foolio but don’t forget to pay attention to the undercurrent in his postulations. The bottom line I hear is: “you folks on the side lines are blind and real estate is being snapped up by the Chinese geniuses with millions”. (enlightening that he validated the lack of validation in his last post). Somehow that mantra reminds me of the Realtor (spell check opted for the caps not me) bubble line “you have to buy now before your locked out of owning property forever”. Damn, fear is so powerful.

LOL, I love that old realtor (pronounced REAL TURD) line of “buy now or be priced out forever”. Of course, now it’s the delusional sellers being told “sell now or be priced in forever…or at least until the bank takes it off your hands”

his is the best time as it is a buyers market. You call the shots. The bay area prices have dropped slightly but not much. There’s not much of a declining market in most cities like Santa Clara and Cupertino. These are still highly sought after areas. Go out and shop, what can it hurt?

SoCalNative, you are right about the Chinese with the money. There are a number of foreigners from overseas that are investing in SoCal real estate. Right now it is the Chinese. Look at our imbalace in trade. Those dollars have to go someplace. What do you hear about the Burbank(media capital of the world) housing market?

Can anyone name some cities where there is actually a recovery happening? I live in the Laguna Niguel \ Dana Point area and things here are still declining, although not as fast. I looked at Fountain Valley which has always had a very heavy Asian draw and see the same thing. Additionally in these areas if I do a search on Trulia for all foreclosures and compare to all non foreclosures, it’s a 50\50 split…so even in these nicer areas that do draw a foreign investment crowd stuff’s still dropping.

From the perspective of an Antelope Valley resident, the review of the AV in the article was very one sided. Yes it is the desert, yes there is wind but it’s not always windy, not always hot and, all in all, the AV is a very nice place to live.

Finding beauty in the desert is not at all difficult once one opens one’s eyes to it and yes, this is a racially mixed community, diverse, creative, safe and friendly.

A price increase in the AV, after a 70% value loss was predictable; especially with the banks in nearly complete control of the supply of properties for sale. Bottom line in the AV, however, is that the houses are affordable enough so that people can buy a home that is within their means.

The real truth is that geographic areas with higher dollar homes are the ones most at risk. The issue is loan availability and underwriting; the higher the loan amount, the higher the risk to the lender and the tougher the underwriting. Geitner is now making noises about doing away with Fannie and Freddie and limiting FHA transactions… the resulting rise in interest rates would have a huge effect on values. Interest rates are currently subsidized by the Fed. How long can they offer free money at the window? who knows… The Chinese? These are highly uncertain times.

So in the AV at 4.5% interest, an average Californian can actually qualify for a mortgage and afford a nice home. Why are people buying here? It’s not because they are being stupid or starved to own property, it’s because in this market, they’re in a position to stop renting and thereby place their cost of living under their own control; It’s because this is a full documentation world now and here is where working people can still qualify (especially at 4.5%).

The AV has taken it’s hit and is now adjusting to the reality of reduced values and of mortgage loans with tighter underwriting standards. A national double dip may move the market more in favor of buyers (and will probably result in the banks releasing more inventory for sale) but the AV is much less vulnerable to decline because of the depth of it’s initial crash and the downside here is now limited.

The 57% growth figure in this article is somewhat misleading. The $40,000 / $50,000 houses were snapped up by investors and there were lots of cash deals selling over asking price. Those purchase prices are gone but keep in mind that it was common for a $325,000 home drop to $50,000 (no kidding). The 50k wonder deals that happened at the bottom may be selling now for a hundred or so now but compared to prices at the peak, prices are still comparatively low. A 50% increase on a $50,000 property changes the price from $325,000 at the peak to $75,000 (note that principal and interest on a $75,000 loan amount is $380.00 a month…).

Is our current real estate price base sustainable by the available employment? At this point the answer is yes. There are local jobs, Metrolink serves the area and the mayor mentioned in the comments on the AV is currently working to bring even more jobs. There is very little speculation going on at this point, save the investors; and beyond a certain price point relative to rents, investors simply no longer participate. Most buyers up here are looking for a home to live in, buying it responsibly and as long as their paycheck keeps coming, they’ll be able to afford it.

My belief is that things in this country will get worse before they get better. The AV has been to a real estate bottom that much of this country can’t even imagine. We are rebuilding at a time when certain geographical areas of America are still in decline; or are soon to be.

Think before you buy but realize that this economy is a slow moving train wreck, impacted by government action and political whim. We were at ground zero when the bubble burst but even here, it was a neighborhood to neighborhood decline.

The Antelope Valley is a community in recovery. We have seen what a 70% value drop looks like and we are climbing out. A 25% to 50% price increase might seem like a lot when presented as a raw statistic; but when one does the numbers factoring in an initial 65% to 75% market crash, a different truth emerges.

Leave a Reply to OldCali