Real Homes of Genius: Pasadena Home Back to 1996 Price Levels? The Pasadena Housing Market Food Chain – 4 Homes from Low Price to High Price all in Distress. Foreclosures and Short Sales in Prime City. Almost 4 out of 10 Homes in California Underwater.

There was an interesting study out of Arizona showing that many underwater homeowners don’t walk away from their mortgage because of moral reasons. Well they have yet to get a taste of the Alt-A and option ARM problems that will hit California in the next few years. Another study showed that many in California and Florida had no qualms walking away from their obligations. We now know that being underwater is the biggest risk factor in predicting a foreclosure. This should go without saying because if you had some equity you would merely sell the home and exit the game. I can understand the moral argument if say someone had a $120,000 mortgage and the home is now worth $100,000. In that case, walking away isn’t a big deal. But in California with a $500,000 option ARM on a home that is worth $250,000 walking away is the right economic move.

The big question will be whether homeowners in California respond to the Wells Fargo and Chase interest only home owner renter program for example. You haven’t heard? The plan is to basically convert option ARMs into interest only payments for six to 10 years. In other words, you will be betting home prices speed up in this time to recoup your massive losses. The bank of course is the big winner here. If you can find a cheaper rental chances are you would be better off letting the place go unless you are happy keeping an albatross around your neck just so the banks can claim inflated values so they can please each other on crony Wall Street.

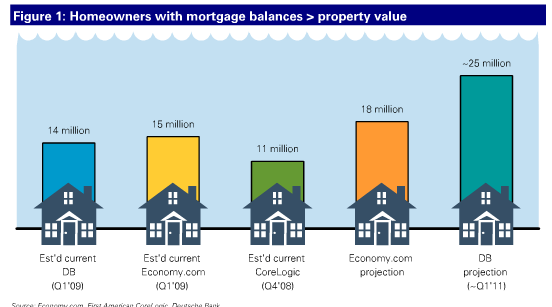

How underwater is California? Roughly 7 million mortgages with 2.4 million underwater. Throw in another 300,000 of “near negative equity†and you have yourself approximately 40% of all mortgages with negative equity. Forced renters for the moment, but more like real estate speculators. This isn’t only a California problem. Let us pull a report from Deutsch Bank that was released in July:

1 out of every 4 homes is underwater. The number of homes underwater as of the end of Q3 is approximately 11 million. DB is projecting that when all is said and done, 25 million mortgage holders will be underwater in 2011. That is a bit pessimistic but when it comes to housing, it is hard to say where the bottom is given current programs like HAMP. By the way, preliminary figures were released on HAMP this week and an abysmal number of permanent loan modifications were made. As it turns out, people don’t want/can subsidize the banks’ zombie desires on eating the financial brains of homeowners with no job or negative equity. With job losses in many areas, people may need to relocate and may need to sell their home. Do you think many will let a good job pass in this economy because they are underwater? So far the data says no.

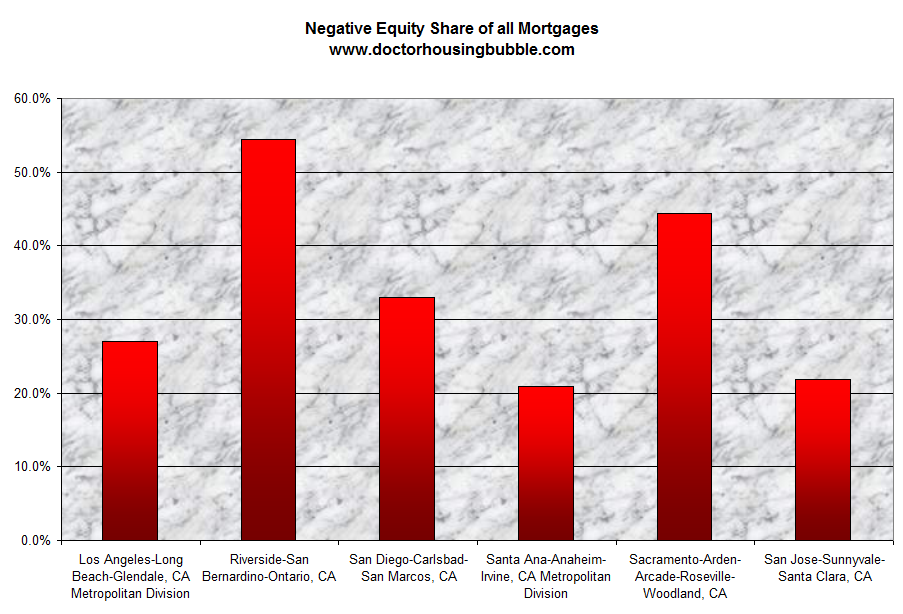

Let us look at some of the larger California metro areas:

The Inland Empire and the Central Valley have been devastated. With over 50 percent of mortgages underwater, there will be pain in these areas. This is part of California and this will add major burdens on central state governments. Upkeep on empty homes, rising crime, and surging unemployment. How is this good for housing? I have yet to hear a good argument showing how the economy in California will pull up housing prices. The only argument the housing cheerleaders have is, “well just look at those price drops! This has to be the bottom!â€

As I have discussed for years, the housing price decline will happen in stages like tipping dominoes. First the lower cost areas like Compton and the Inland Empire will get slammed because of their concentration of subprime loans and lack of income support. This stage has already happened and will continue to happen.  The next phase was more middle class areas would take a hit. This is already happening as well if you look at areas like La Mirada or Lakewood. Prices have fallen but are still in the process. The next phase is the higher mid tier and the upper tier. Today’s homes look at lower priced properties in a prime city. It is funny how the caveats get narrower as time goes along.

-It will never happen in L.A. County! Prices will only fall in the Inland Empire

-It will never happen in Pasadena! Prices will only fall in L.A. County overall

-It will never happen in prime Pasadena! It will only happen in 00000 zip code of Pasadena

Today we salute you Pasadena with our Real Home of Genius Award.

Pasadena Non-Prime to Prime

As it turns out, the name of city is not enough to keep prices high. The above home is listed as a 3 bedrooms and 2 baths property. Listed at 1,303 square feet it was built in 1905. In California this is considered a modern home. The property has been listed for 104 days. Let us look at the sales history first:

08/27/1996: Â Â Â Â Â Â $148,000

03/23/2007: Â Â Â Â Â Â $510,000

This home is now a foreclosure. Let us look at the recent pricing action:

Price Reduced: 10/01/09 — $199,900 to $159,900

Price Reduced: 11/04/09 — $199,900 to $153,504

Price Reduced: 12/07/09 — $153,504 to $147,364

We are now back to the 1996 price point. Lost decade? Indeed. A 71 percent price drop in Pasadena. Price drops are happening everywhere. But let us pick another home just to show that there is more than one property that fits these criteria.

The above home is a 2 bedrooms and 1 bath home. It is a smaller place at 888 square feet. Let us look at some sales history here:

Sold 02/17/2006: Â Â Â Â Â Â Â Â Â Â Â Â $370,000

This home is now listed as a short sale at $280,000. Nearly a $100,000 price cut in 3 years. You want to keep moving up the Pasadena food chain? Let us go on then.

This home is a 3 bedroom and 2 baths home. It is listed at 1,728 square feet and has been on the market for 84 days. This home is bank owned. At one point in 2005 this place had $750,000 in loans. Today it is listed as follows:

Price Reduced: 10/16/09 — $557,750 to $541,018

Price Reduced: 11/13/09 — $541,018 to $524,787

A drop of $226,000 from the 2005 price. I don’t know about you but losing $226,000 in 4 years is a pretty big deal. Not prime enough for you? Let us continue on then.

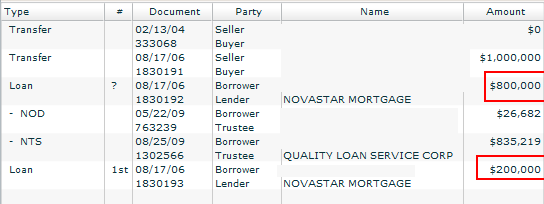

This home is a 3 bedrooms and 2 baths home. It is listed at 1,978 square feet. This is a current short sale or pre-foreclosure (depending on how you see it). Let us look at what got this home in trouble:

Good old Novastar (poster child of toxic mortgage lending) made $1,000,000 in loans on a 3 bedroom home. The notice of default was only filed in May of 2009 and the original Novastar loans were made in 2006. So it took about 3 years for payments to be missed. The current short sale price is $949,000. Even an FHA insured loan won’t help you here. Anybody have a $200,000 down payment and looking to spend nearly a million dollars for a 3 bedroom home? From $147,000 to $1 million all in one city. That covers much of the food chain.

Today we salute you Pasadena with our Real Homes of Genius.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Real Homes of Genius: Pasadena Home Back to 1996 Price Levels? The Pasadena Housing Market Food Chain – 4 Homes from Low Price to High Price all in Distress. Foreclosures and Short Sales in Prime City. Almost 4 out of 10 Homes in California Underwater.”

I got myself a nice rent control apt in a GREAT location and plan on staying here for a long while. The place would cost me 3 to 4 times as much per month to buy. The rent vs buy is so far out of whack I don’t know why anyone would buy.

Dear Doc please don’t throw me off with any Global Warming a hoax post like mish and I can hang with this totally. Dead on and well researched that’s you

This information is beyond stunning….and its happening to other locales. Ohio is being hit hard, by the same effect. Whole areas of McMansions in “well to do” areas are vacant or in foreclosure. The only thing that is really good about this is that the real estate taxes will HAVE to be revised downwards by all these properties turning over for hundreds of thousands of dollars less. Otherwise homeowners will sue.

And it will force downwards the taxes on existing homes who’s buyers have chosen to sit tight. The bad thing is that the tax revenue is going to fall through the floor for the school systems – the first casualty of the domino effect.

Seems almost like the RESET button is being hit in the L.A. area…my sympathies to you all.

This is a great website although everytime I read it I get angry with myself and sick to my stomach. I lost $350K on my house in SD. No – it wasn’t a short sale. But I was competing against irresponsible short sellers. I bought in 2005 and had to sell in 2008 (classic buy high and sell low). I lost half of my equity. Now I live in a much nicer home in a different part of the country. I managed to buy without a mortgage. I have nothing but contempt for people and institutions that try to game the system. Be very carful not to get sucked into their game.

Good Luck to all

i think we are all going to be living in trees in 5 years, throwing our feces at one another and.—————- it will be government mandated and controled.

Bernake Comments on Mortgage Defaults and Subprime Abuse

17 May 07

While speaking at a conference sponsored by the Federal Reserve Bank of Chicago, Bernake fielded questions about the increase in mortgage defaults nationwide, noting that defaults and foreclosures would likely rise throughout the year but probably won’t significantly impair the economy.

He also felt that the emphasis should be on tackling bad lending practices that led to the meltdown, such as mortgage fraud and predatory lending.

At the same, Bernake felt that there were many good borrowers who were facing an underwriting backlash as lenders nationwide tightened guidelines and denied more new loan applications because of the losses in subprime lending.

He further added that the United States economy would be able to absorb the massive losses related to the subprime mortgage crisis and that the majority of home loans would continue to perform just fine.

Bernake feels that strong job growth and income, coupled with past housing appreciation that has kept house values near record levels should allow the majority of homeowners to manage their mortgage, and avoid further financial difficulties.

“We are now back to the 1996 price point.” Only in NOMINAL dollars which don’t count. In REAL dollars we are back 1980s pricing. Lost 2 decades.

Interesting perspective on the bubble mania decade:

http://www.bigbuilderonline.com/industry-news.asp?sectionID=363&articleID=1140416

Our lost decade already arrived and we didn’t realize it. Welcome to the United States of Delusion!

I wonder what is the address of the last home, the one purchased for a $1 million It looks like in my neighborhood, I bought in 2003, but still too high. Will be upside down soon.

I’m guessing that areas such as Upland and Rancho Cucamonga are behaving much like La Mirada and Lakewood are. I have noticed that prices have fallen but not to the same extent that I have seen just a bit further to east in Fontana and Rialto or up north in the Victor Valley area. There was listing over the weekend for around $409k in Rancho Cucamonga that caught my eye. The asking price for these houses in 1990 were in the mid $400k range so that particular lising is back to the 1990 level. Most other listings in the area appear to be drops back to the 2001-2003 range although some have the nerve to ask a lot more than what was paid in 2005 or 2006. Prices are all over the place.

I went to an open house in northeast part of pasadena,The asking price for a 2 bedroom 1 den and 2 bath house is $868K. Total livng area is 1,748 square feet. It also is availabe for rent $3K per month. Does it make sense to buy? Do the math. Yes, you will break even only if you stay put for 30+ years provided the house appreciates 3% for 30 years.

I live in South bay, 90503. Doc is dead on right about shadow inventory. There were few houses in my block foreclosed, banks tried to sell them for the prices of 2007 it did not work and they are not making a second attempt. No open houses, no “for sale†sign… just dark houses with weeds coming up… One townhome is empty for almost a year and no activity. I don’t understand how is this possible to end well!? I don’t. I generally the rule is in every downturn prices overshoot on the way down with good reason to remove the glut of houses on the market. But now banks are not lowering the prices in the prime areas, market is not clearing the inventory, potential sellers are holding not put more houses on the market, because in their delusional mind “now prices are depressed, we’ll wait…â€, so natural sales are not happening, ( but life goes on – divorces, deaths …) which all are factors for increased inventory down the road. I just don’t understand how is possible for this to end well!? I don’t.

Trulia Price Reduction Report December 2009

http://matrix.millersamuel.com/?p=6604

(Price Reductions by County: maps for Dec, Nov, Oct, Sep 2009)

Thank You DH for great info all the time!

I live in Chicago and we too had this real estate bubble. However, Doc, I must disagree with you that upside down home debtors (they are not “owners” if they owe a mortgage on it!) will walk away.

I had dinner with a bunch of people Saturday night. Some people bought houses from 700K to 1 million dollars. Now they are upside down and yet they believe that prices will come back up because; “they have to, real estate doesn’t go down all the time”, “prices always go up and not down”, “no one has ever lost a dime investing in real estate” and of course the grand daddy of them all “in the long term….”.

Bottom line, people are still delusional. The only question is how when will they wake up?

Latest report……………………….San Diego house hunter.

Looking at the stats, prices are still down about 20% (officially) in the areas within 15 miles of the coast yet unofficially they are at peak bubble pricing. The “official” stats are being affected by all the foreclosures and short sales. As it turns out, foreclosures and short sales are not available to the general public, only to those who “know someone” and has the proper connections. Those of us who do not have those connections are faced with inventory that is at or near peak pricing.

I was hoping that this Spring more inventory would change things but I know of a lot of pent up demand that will eat up any inventory increase, at least initially.

It is looking like the Feds are succeeding in reigniting the bubble in some areas and I think it could get even more bubbly before it all blows up again. The problem is it is looking like years before this all plays out.

Trust me, I am in no way suggesting anyone purchase at these levels. Only a fool would fork over 600K for a dump that needs 200K work and then you still have to live next to 3rd world immigrants.

Meanwhile, being that I just moved back to S.D. from Phoenix, I am constantly checking what is going on there. Currently I don’t think there has EVER been a point in time where there has been such a discrepancy in prices between “prime areas” in Ca. and “prime areas” in Phoenix. The downside in Phoenix has to be no more than 20%, and more likely 5 to 10%

Below are two examples for 600K. They are probably “over the top” for some people but they are just for educational purposes. You could get something just as nice but not quite so grandiose for 375 to 400K.

http://ca.realtor.com/realestateandhomes-detail/7339-N-2Nd-Drive_Phoenix_AZ_85021_1113966530?gate=cln

http://ca.realtor.com/realestateandhomes-detail/4631-N-Royal-Palm-Circle_Phoenix_AZ_85018_1109036105?gate=cln

The way things are looking here in S.D. I will probably be forced back to Phoenix and live the life of Reilly, not the worst fate. And yes, I will buy that house with as little down as possible so that I can walk should my “bet” go the wrong way………thank you Taxpayer. I am tired of being the Screwee, I want to be the Screwer for awhile.

The trickle of houses is pathetic. There’s an LLC called “Marbury Park Group LLC” based in El Segundo that has bought up 100’s (I’m being modest because the figure is much higher) of distressed properties. They deal directly with the banks because the properties that they have bought don’t seem to have been auctioned. They do a cheap fix, same paint colors on all the houses, same Home Depot crappy fittings, same “GRANITE” countertops, cheap sod (no sprinkler system) and then flip these houses in under two months. It seems inherently wrong that this LLC and others like it are the only ones invited to reap the profits. They trickle these crap houses back onto the market and people swoop in! I don’t get it.

Anyway the area that I’m talking about is Woodland Hills.

just goes to show there is no fool like an old fool. I say take a wait and see attitude, bankers are trying really hard to start a another housing bubble. In the area were I live, (orange county) I see a lot of house flipping especially in neighborhoods full of third world populations, or rednecks with less than a high school diploma. buyer beware. I say it’s safer to rent for now, save your money and buy, once prices and property taxes are stable, preferably in a neighborhood with a future.

My friend just sold his house in Glendale in 3 days for 695K. He is getting a divorce. The house was a nice 1920’s spanish style with 1600 sq. ft. sitting on a 7,000 sq. ft. lot. Not a spectacular view house, but just a clean old house. If a divorce was not pending, the house would have sold for more. Go figure?

This housing bubble is the biggest scam in human history, I think the home price needs to drop another 80% from this level before the market returning to normal

Obama mortgage relief program only helps 31,000 borrowers so far…

WASHINGTON (AP) – Just over 31,000 homeowners have received permanent loan modifications under the Obama administration’s mortgage relief plan, a big setback for the government’s embattled effort to stem the foreclosure crisis.

Lenders say they are having a hard time getting borrowers through the trial period, which can last up to five months. Many homeowners who were given verbal approval for the program have not returned the necessary documents.

American Foreclosures Set To Break The 4 Million Mark

http://www.businessinsider.com/american-foreclosures-ready-to-break-the-4-million-mark-2009-12 (excerpts):

One in every 417 U.S. housing units received a foreclosure filing in November

Default notices nationwide were down 8 percent from the previous month but still up 22 percent from November 2008.

Nevada, Florida, California post top state foreclosure rates.

Nevada foreclosure activity – one in every 119 housing units receiving a foreclosure filing in November — 3.5 times the national average.

Four states account for more than 50 percent of national total: For the second month in a row, the same four states accounted for 52 percent of the nation’s total foreclosure activity: California, Florida, Illinois and Michigan.

Las Vegas drops out of top spot among 10 highest metro foreclosure rates. After four straight months with the nation’s top foreclosure rate among metropolitan areas with a population of at least 200,000, Las Vegas dropped to No. 5 thanks to a 33 percent decrease in foreclosure activity from the previous month. One in every 102 Las Vegas housing units received a foreclosure filing in November — still more than four times the national average.

I want to know about home prices in the GLendale, Burbank, and la Crescenta area right here in southern california. For some reason the house prices in these areas have fallen slightly, however not enough for my family to purchase a house. Is it due to ALT A loans or that is where house prices are ogin to be. SOME INFO WOULD BE HELPFUL… THANKS KEEP UP THE GOOD WORK

@Garen, I have the exact question. Home prices seem to be way out of line with rents and incomes in Glendale and Burbank.

Garen Reyhanian & Geoff:

Wait until Sept of 2011, you will see 15% to 20% drop in Glendale & Burbank Area. Alt loan will crush the housing market!

“I just don’t understand how is possible for this to end well!? I don’t.”

It’s not possible. May take a few years to see it play out in certain areas. In other areas(Las Vegas), it already did….$120K new build houses, $30-40K condos.

“Home prices seem to be way out of line with rents and incomes in Glendale and Burbank.”

Yup, same thing in nearly all once middle class but now high end neighborhoods in LA County….rents at 1/3 of what a mortgage would be in Sherman Oaks, Culver City, Burbankian, etc. Prices will continue to drop I think….a modest 3 bed/1 bath south of Victory/west of the 5 in Burbank sold at $225-275K in 1999. I think those places currently at $450-600K have a very long way to fall.

“Anyway the area that I’m talking about is Woodland Hills.”

There is decent stuff at an ok price in Woodland Hills, but you have to be willing to put in some work. Everyone out there wants a move in ready place so you can get a decent price on a run down place that is short sale or FSBO as long as you know what you are doing on renovations. I’m guessing this Marbury Group sees the same thing. Why the sheeple keep buying at $450-700K, I can’t figure out.

Larry, why didn’t you just walk away? You obviously did not need your credit score to buy your new mortgage-less house. 350k is quite a chunk of change.

“Burbankian” Lol very true.

The only argument the housing cheerleaders have is, “well just look at those price drops! This has to be the bottom!â€

The only cheerleaders I know point to the rising Case Shiller index.

I showed the first house on the list. It would cost at least $20,000 just to de-uglify it enough so you could stand to keep your cookies inside you, to say nothing about making it livable. That is if you don’t mind the crappy neighborhood with the crack house down the street. It is no longer on the market, it is going to auction.

How do you come up with the report that shows the mortgage and HELOC balances? I have always wanted to do that. Property shark seems like it might give some of this information. Does anyone have a clue on how this is done?

Great insights on Pasadena. There are several condo projects that aren’t selling. I wonder how much those prices will come down. Currently they are asking $400 – $500 or so per square foot…but not selling a thing. Wonder where the prices will go to get sales to start up again.

To LA Architect. The Marbury Group you speak of – Have you been to visit any of these homes? Do you recall the address(es) of the home you saw in Woodland Hills? I am curious as I live there and we recently saw a home that we were told was owned by an investment group with a similar name. The thing is the home was bought in April 2009 and recently fell out of escrow, and is back on the market. Thoughts?

Leave a Reply to Dan