Flipping in Pasadena: Inventory increasing in Southern California while housing mania runs rampant across the state.

The housing market is now fully out of control in California like a rising Hollywood actress. People are stomping over one another with cashier’s checks falling out of their back pockets to purchase a home and the psychology has shifted to “I should have bought a few years ago to cash into this party! I’m not missing this real estate Metro bus!â€Â Of course, and the case remains, you do not lock into property gains until you sell. So unless you plan on buying and selling on a routine basis, the fast rise is really nothing to scream home about especially when underlying fundamentals are so out of sync with a normal market. You can also get a pulse on the mania by looking at how aggressive flippers have become. I’m starting to see some incredibly epic flips and many are sitting for a good amount of time on the market. Inventory is also increasing including in sought after neighborhoods. Today we’ll look at a home in Pasadena that demonstrates what is truly happening in the housing market in Southern California.

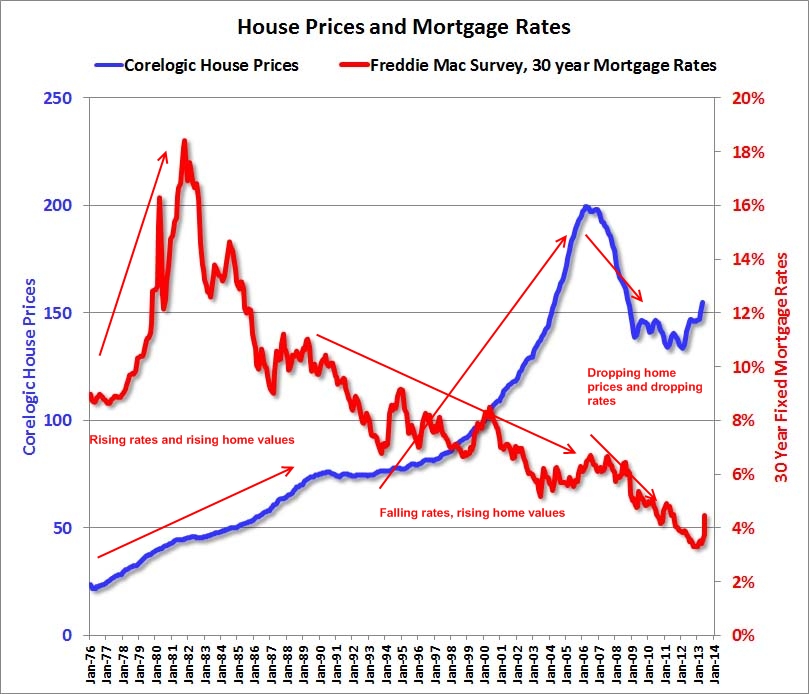

Home prices and interest rates

Before we look at the home, let us examine the relationship between home prices and mortgage interest rates:

Source:Â Calculated Risk, my annotations

During the 1970s, home prices went up at a very healthy pace in spite of major spikes in interest rates. Why? Because higher rates were a reflection of overall inflation which included inflationary pressures on wages. So in this case, we had higher rates (ridiculously high rates) and higher home prices. Next, you have the 1980s through the 1990s where rates fell dramatically and home prices rose. Incomes were going up in real terms during this time as well. The 2000s show a market where home prices fell but rates were falling. For the 2000s however, the real kicker is that it was the first decade where households actually saw inflation adjusted wages fall in this generation plus the added benefit of juiced up steroid ridden mortgages like option ARMs and Alt-A products courtesy of Wall Street.

Today, with no real wage growth, low rates are being used as the catalyst to boost home prices. As we saw with rates only going from 3.5 to 4.5 in the last month, the market went nutty just on this little change. But look at the red line above! Even 4.5 percent is a ridiculous rate thanks to the Fed’s aggressive policies. We’ve papered over a weak decade of wage growth with financial gimmicks. The history of mortgages rates demonstrates that yes, incomes absolutely matter.

Pasadena Flip

1836 Peterson Ave, South Pasadena, CA 91030

Bedrooms:3 beds

Bathrooms:2 baths

Single Family:1,363 sq ft

Lot:8,973 sq ft

Year Built:1927

The aggressiveness of flips in the current market is reminiscent of the peak days of the bubble. There is truly no difference and the attitude is definitely permeating into the streets. The above place has a large lot but the property itself is only 3 bedrooms and 2 baths. Some work has clearly been done:

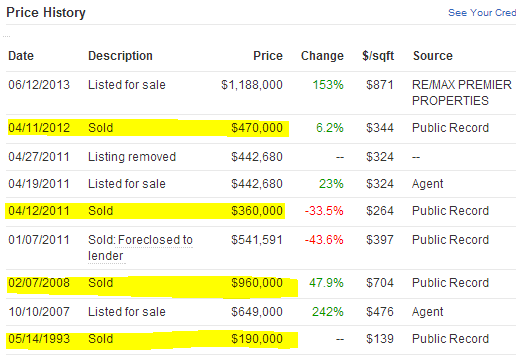

But you will be blown away when you see the sales history here:

This place sold for $190,000 in 1993.  It then sold for $960,000 in 2008 which was insane. Someone got a good deal in 2011 for $360,000 but we didn’t see the condition of the place (although at $960,000 – who in the world made that loan?). It sold last April for $470,000 and is now listed at $1,188,000. Bwahaha! Yes, there is no mania in Southern California.

This is merely one example of many in the loony market where supply is constrained, banks ignore non-payment on mortgages, rates are artificially low, and people like sheep line up for round two of the California housing bubble.

Los Angeles Inventory

Of course, higher rates this time will pop this bubble because many of the large investors are focusing on real estate for flips/rentals because the market is providing negative rates courtesy of the Fed. So people are chasing yields like cats after mice wherever they can but the market is now overbought and people are trying to get their hands on whatever chair remains as the music speeds up. For the first time in a few years, inventory is starting to increase:

Source:Â Movoto

I’m seeing more of the aggressive flips linger for months now. From colleagues in the industry, the recent interest rate spike spooked some from buying (and pushed some from actually being able to afford the place since they were stretching to get in). The Fed is hoping for a Japan like market. So far it is QE into infinity but we might have hit a lower bound threshold. Low rates or high rates, some of the homes for sale in this market reek of manic behavior. If you are buying this summer in SoCal, good luck to you.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Flipping in Pasadena: Inventory increasing in Southern California while housing mania runs rampant across the state.”

Seeing very similar conditions in No. Cal. People are camping out for days, to get in line, at some new subdivisions.

SOME of this is justified. When interest rates go back to normal (whatever that is), the same payments will buy a lot less house.

For young buyers, this may indeed be the opportunity of a lifetime.

But you won’t be able to tell for sure, for a least a decade.

How is it the opportunity of a lifetime to overpay for something?

It’s the opportunity of a lifetime for real estate agents and the hedge funds that are slowly selling off their inventory!

When interest rates go up in an environment with no wage growth, home prices go down. So contrary to your advice, prospective homeowners should sit out this rate transition and wait for the better deal. And there will be a ton on new inventory on the market as the rental investment trade unwinds, further suppressing prices. You don’t want to buy while both these dynamics are underway.

It is EXACTLY this sort of thinking that is getting people into trouble.

If this blog has done nothing else, it has certainly made clear the INVERSE relationship between housing prices and mortgage rates. As the current article mentions, there are explanations for the rare cases where the market deviated from this.

Generally it is true that when rates go up, prices go down. So how people think it is an advantage to give the money to one party vs the other is beyond me.

In fact, I would prefer to have higher rates and LOWER home prices so my property taxes are lower, my mortgage tax write-off is higher, and I have the opportunity to pay the loan off faster thus avoiding the interest rates altogether.

no no no! Your town will jack up tax rate when home price went down hill. It is all about how much the town needs to run, and expensed it out on each one of you suckers.

The only good thing about buying in high interest rate environment is, if you were lucky enough to hold on to your home longe enough, to meet another rate deep dive, you could refi and get the lower rate. But if the wait is longer then 10 years, the damage of over paying in interest has been done then.

Well, not necessarily. CA is s perfect example — not allowed to raise rates due to prop 13.

showgunz,

historically, it’s much smarter to buy high rates lower priced home, than low rates higher priced home…They will raise taxes on homes no matter high or low…its the socialism part of the govt. Buying now is stupid…Fed collusion and price fixing will end…

Aimeel, I thought the SAME thing for so long about low intertest rates. Why pay the buyer more when you can’t deduct the pricipal? If you wait for higher interest rates you pay the same payments, just more write offs on your taxes, easier to pay it off, and if you ever file BK or short sale it (god forbid) you have less to walk out from. My husband and I argued about it for the longest time. Do we buy now at interest low rates, or wait for the real bubble bust and pay less for the price and higher interest? This controversy kept me out of the market for ten years post grad school. Luckily my husband forced me to buy in 2012 and I chose a short sale and I underbid it. Somehow we got it and now I am just holding on. This bubble cannot last. It will pop and then everyone who can wait should do well.

It is nice to see comments with common sense and prudence. With so many around climbing over each other for scraps, there are times when it seems like I’m the lone spectator of the sheep being corralled for slaughter.

I sold my San Diego home in October 2012 at a 15% loss from its 2005 price, and now I’m sitting in (tax-free) Florida waiting for the California housing market to truly bottom–no more FHA, no more extended conforming loan limits, no more tax deductions for mortgage interest or state income tax–then I’ll buy. It might take a while, but the writing’s on the wall that all of our tools to “assist” the market are unsustainable. I only hope, at that time, that there’s still some form of Prop. 13 still around, but I kind doubt it, since raising taxes seems to be the solution to all problems.

KR, I’m confused at your post. You want to get rid tax deductions for mortgage interest but you hope Prop 13 stays. These are both forms of housing welfare, why not get rid of both of them. Many people are still under the false belief that Prop 13 is a good thing…keep granny from getting taxed out of the house. If anything, Prop 13 has helped inflate values of real estate in desirable California areas and people will not sell their house strictly because of the Prop 13 tax basis. This creates supply and demand issues and jacks prices up.

The driving force behind Prop 13 was corporations and it was sold as the granny sob story to voters. If anything, Prop 13 should be limited to a primary residence when the owner hits retirement age (nothing more). It’s comical that investment properties and the prop 13 tax basis can be passed onto heirs for generations. Why should I pay 5x the yearly property tax than the deadbeat adult child who inherited mommy and daddy’s house next door to me? Pay your fair share!

Prop 13 Redux

My grandparents purchased a 3 bd 1 ba home in Santa Monica, near San Vicente Blvd. Purchase price in 1955 was $17K and was a fixer upper. My parents inherited the house in the late 1980’s. Last year the taxes on the home were $2,200 total. The house is currently worth $2M. Hence if the property was sold today, the taxes would increase nearly 10 times. While I do think that Prop 13 is somewhat of a welfare scheme, I think of the wonders it has brought to my ancestors, ie. my mother who is retired, living off of soc. sec. and some investments… she would have had to sell the house a long time ago if Prop 13 were not in effect. Honestly, I can tell you, me and my siblings plan to rent out the house if and when we inherit it. It will rent for $6K per month with only $200/month in taxes. If we had to pay current tax base, we too would have to sell it…

Florida too gets lots of housing welfare in the form of lower-than-market premiums for flood insurance, courtesy of the Federal Flood Insurance Program. I keep hearing sea level has risen 9 inches in the last 100 years around S. Florida and I also keep hearing that sea level around the Atlantic coast rises faster than the global average.

QE Abyss, you made my point perfectly regarding Prop 13. It drastically distorts prices in certain desirable areas. As long as Prop 13 is around, people will NOT sell no matter what. If Prop 13 didn’t exist, there is no way in hell small shitboxes in Santa Monica sell for 2M period. This is no different than the times of serfs and land barons, if you came out of the right birth canal…your lot in life was set.

Lord Blankfein:

“The driving force behind Prop 13 was corporations and it was sold as the granny sob story to voters. If anything, Prop 13 should be limited to a primary residence when the owner hits retirement age (nothing more). It’s comical that investment properties and the prop 13 tax basis can be passed onto heirs for generations. Why should I pay 5x the yearly property tax than the deadbeat adult child who inherited mommy and daddy’s house next door to me? Pay your fair share!”

While I think prop 13 is a good thing I think this only in that I agree with what you wrote here 100%. My mom is in an assisted living home (thanks to step Dad’s VA benefit) with people who have a lot of money. At dinner a neighbor of hers was telling me his tax rate on a multimillion dollar (today’s market) home are a little over 2,000.00 a year.

I also recall reading an LA Times article back in the 90’s on how Disney Land still pays 1950’s tax rates on Disney Land. But look at how they raise the price of admission every year.

It’s now nearly 2,700 square feet and beautifully redone. Still overpriced though.

http://www.redfin.com/CA/South-Pasadena/1836-Peterson-Ave-91030/home/7001994

Indeed mania is the primary behavior in the socal market.

I really appreciate your work here. Over the years I have gained solid knowledge and for that I am grateful.

Affordibility a relic of the past, in a centrally planned society.

From somewhere near the end of The Road to Serfdom.

Inventory is rising along with prices….what percentage is now processed foreclosures?

This is my backyard market.

I know it very well. First, off South Pasadena very different than Pasadena. South Pas has much lower turn over and went through less of a boom and bust.

As for the market here, I think people are getting much less excited about buying and much more excited about selling. The shift is palpable. I think that the “pent-up demand” is not an endless pool and will run out pretty soon.

For sale signs are staying out much longer now and I think the seasonal peak has passed.

One thing that is concerning, however, is one would infer a very large amount of new construction in the area. This isn’t the case and new construction, while noticable, remains constrained. This, unfortunately, will mitigate any comming correction.

For maybe 80% of Americans, real wages have been stagnant for 40 years or more.

I agree, my son doing the same job I did in 1980 makes the same wage as in 1980!, yet gas has went fron $ 1.19 gal to $4.10 etc. no young people will fill the expensive homes,( anything over $ 200 k). All those who think they have a $ 700 k house are in for a huge surprise!

Jim, the only thing I can say is, you did very well back in 1980. And you son is not smart.

This post is bordering on an ad-hominem attack — the assertion that the son is not smart is a bit insulting and certainly baseless.

How did this pass the moderator?

Don’t worry Aim,

Showgunx has no idea what he is talking about, Real Estate shill with no idea what PTI or DTI is…just think of him as meathead

Why Are California’s Businesses Disappearing?

July 03, 2013

http://www.businessweek.com/articles/2013-07-03/why-are-californias-businesses-disappearing#r=rss

Maybe it’s something to do with the soaring HPI, taking incomes out of workers pockets, to service rents and mortgages. Better business friendly conditions elsewhere?

In my experience the California FTB is far, far, FAR worse than the IRS in terms of fines, penalties, nit picking, and not being lenient. They will get you good if you blink and it is illegal to blink. Every year it’s something and in the latest episode, they dinged me interest and penalties for not withholding enough taxes from my W2 paycheck. I never hear from the IRS.

Agree completely. The CA FTB makes the IRS look like Boy Scouts.

The Fed has distorted pricing in all asset categories. The only question now is how long the discounting mechanism will remain broken. At least the Fed now knows that just a whisper about the possibility of tapering their money printing sends the fixed income and equity markets into a tailspin.

Mortgage applications reached a 3 year low last week on just a moderate uptick in 10-yr. Treasury yields. I guess this means the Fed can NEVER stop printing. Every decision they make now is a BAD one !

It does look as though the Fed has painted themselves into a corner. The fact that they are monetizing debt and the interest rates are rising anyway is enough to throw a fair amount of doubt on their ability to actually control things.

If big money has decided that they are no longer going to buy debt, we’ll get rising prices and rising interest rates. As the USD is on the rise due to global capital coming into the US. Very interesting trends are developing.

Well I guess all that USD coming home to pay for overpriced housing is one way to adjust the flow of foreign money. Make the yield pointless relative to inflation where they are saving it and it drives that money into action. But we have prices rising even when the USD is stable, I don’t know enough to understand all the dynamics. CA is one of the places a lot of that money seems to be distorting the market too.

I think the Fed is totally out of control of things…the Bernank tried to get a handle on things when he announced an exit from asset purchases, and Wall Street pulled a conniption.

So, the velocity of money is still really low, which is why we don’t see runaway inflation despite the Fed’s actions. If anything, we’re on the verge of deflation, which would be REALLY interesting to the housing market. I think the Fed planned on the “unintended” consequence of rising core inflation re-inflating housing prices, but it just hasn’t happened. So, now you have an economy dependent on the Fed and low interest rates, and any effort to return to the “old” normal is swiftly rebuked .

Surely anyone with that amount of money to spend would want a much better house.

You’re not from around here, are you?

I agree with Paula. I lived in South Pas. I would, if I had the money never ever ever pay that kind of money for that house – all else being equal. It seems your not from around here. The damn house is priced higher than the bubble peak. Rebuilding and increasing the size does not make up for the full flight of exterior stairs from your carport (!) to your front door.

Go check the income needed to buy a house like that. We’re talking high dollar professionals. OK, new thought. A flipper would buy it as his residence in South Pas. Yup high school educated high earner.

It is amazing how people are affected by group behavior and totally forget fundamentals in a real estate boom. They always seem to forget it is ALWAYS followed by a real estate bust. People beginning to buy and flip now will be burned, unfortunately there seems to be no penalty for a losing real estate bet now. Just more financial trickery to recapitalize the banks and Wall Street. Home buying is now officially a casino and everyone thinks they can win as long as they get a chance to play. Unfortunately the stakes get higher and higher as the bets get bigger and bigger. Derivatives are a prime example but on a grander scale. There is no real housing market anymore, just manipulation at the federal level to keep the game going.

The smart players who got in early are taking their chips off the table now as the real estate game is getting long in the tooth.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

Well in nicer parts of Sacramento the market has come to a grinding halt. Just the past few weeks – since the FHA PMI increase, and the recent rates rise.

I am also seeing an insane amount of new listings hit the market in the past month. My zip code alone I’m getting on average 6 new listings a day.

Now I’m seeing MULTIPLE price reductions.

Rate rise + FHA PMI increase = grinding halt.

Exactly.

The montly nut for buying a cruddy house in a cruddy part of Pasadena for $650,000 with 5% down is $3,800 a month using an FHA loan! Just for mortgage, no tax, maintenance or insurance.

C’mon, that’s $45,000 a year just on mortgage and figuring “affordability” coming in at 27% of total income, a family would have to make $180,000 a year to afford such a place.

Same thing here in Reno. Price reductions all over the place. Mortgage applications dropped to a new low. Houses not moving like they were before.

Fingers still crossed….

We will have major inflation with no wage growth. Thanks to NAFTA the global workforce will keep workers in the US from increased wages. Housing prices will continue to fall. unemployment will increase , States will increase Taxes to keep up their spending. Even if your home is paid off the State will tax you soo much that you will loose your house to the tax man. don’t buy a condo , the homeowners fees and taxes will leave you nothing but servitude to your debt. I wish us all the best!.

Nice place, nice neighborhood, but tiny lot and almost 90 years old. Up 200% in one year? Are the walls painted with cocaine?

Another listing that made me laugh! Check out the history…COMING SOON for only $765, but please put in an offer now HA

http://www.redfin.com/CA/Altadena/268-E-Altadena-Dr-91001/home/7255957

The listings are popping up a bit more, all of the sellers trying to find a greater fool. But there are so few buters waiting to buy – -the few buyers seem very desperate to not buy that chair before the music stops…what they will find out a few years from now when they want to sell is that they bought at a peak, and with agent commissions, transfer taxes, etc. they will be selling and bringing a checkbook to the closing, or alternatively, letting it go to foreclosure. The bust will be following this bubble, make no mistake about it. Long term, no matter how high rates go (doublful they will go as high as the late 70s, near 18-19 percent, but who can know?), if wages stay suppressed, housing prices will be tumbling and tumbling. The days of buying super cheap and waiting 5-10 years to double one’s money are long gone for a long time. But they mythology is alive and well, it seems. And Vegas continues to get gamblers, even though the casinos wouldn’t be in business if they weren’t “winning.” Like Warren Buffet once said about poker, “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.â€

In one lower end hood I have been watching, 92123, some 3 months ago I threw up my hands and said, “this is ridiculous, this makes not sense, I am out!”. Prices at the peak in 2006 were about 530K for a decent 3 bed 2 bath garage 1600 square or so feet. Recently, during the frenzy of 3 months ago, all time highs were made for that low end hood.

Since that time single family listings have gone from 9 to 29, selection is much improved and from what I see sitting there, I can get an equivalent for a bout 50K less compared to just 3 months ago.

I wonder what an interest rate move from 4.3 to 5.3 move will do to houses and selection?

If you are curious,

A move from 3.3 to 4.3 does a lot more than 4.3 to 5.3. The curve for a one point increase is steepest at the lower interest rates.

You are dangerously wrong – Readers be careful!

Try the calculator yourself, and you’ll see:

http://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

Amount Rate (30yr) Payment (rounded to nearest $)

165k 0 pct 458

165k 0.1 pct 465

165k 1 pct 538

165k 2 pct 610

165k 3 pct 696

165k 4 pct 787

165k 5 pct 885

Calculator will not accept zero interest rate

Etherist,

I am not sure what you are referring to about being wrong. A jump from 3% to 4% interest rate does more harm to buying power than a jump from 4% to 5% interest rate. A jump from 5% to 6% does even less relative harm. Simple math. The curves are all out there, please review.

Here is the math, if you must know specifically, what $1000 a month of mortgage payments gets you and how much percentage in buying power you lose for each 1% increase in interest:

$1000 a month payment gets you:

3% $238,000 This is baseline purchasing power.

4% $210,000 12% loss in purchasing power from 3%

5% $187,000 11% loss in purchasing power from 4%

6% $167,000 11% loss in purchasing power from 5%

7% $151,000 10% loss in purchasing power from 6%

8% $137,000 09% loss in purchasing power from 7%

My point is a 1% move right now would result in a greater reduction in purchasing power than a 1% move from something like 7% to 8% would do, i.e., a 1% jump in rates is even a bigger deal than historically.

Plug these into the same bank rate calculator.

Thanks,

AK

There’s a certain point where the interest rate becomes unaffordable. People may be able to afford 3% or 4% and maybe even 5% but not 6%+.

I think you are looking at it with rose colored glasses. Most buyers have a fixed amount of income.

So a rise from 3.5 to 4.5 may be a higher percentage increase than 4.5 to 5.5, but for the buyer out there, it is cumulative! Since it is cumulative the impact on the market may be worse than you think from 4.5 to 5.5.

From your logic a rate increase from 1% to 2% is more costly to the borrower than a move from 5% to 9%.

Have to agree with Etherist as your “point” is a bit pointless. You are not seeing how a 6% interest rate affects someone who was hoping to buy with 3% interest. No one looks at it the way you are breaking it down.

Guys,

What I am saying is not a matter of opinion. It is quantitative fact. It’s easier to see in graph form.

http://www.theatlantic.com/business/archive/2011/06/chart-of-the-day-how-rising-rates-kill-mortgage-affordability/241309/

I don’t think anyone is disputing your point, it is the conclusion you infer. You are absolutely correct in your math but…….

Your saying 4.5 to 5.5 is less of an effect than 3.5 to 4.5. That may be but…..for Joe Six Pack or your average home buyer the move to 5.5 will not have been from 4.5 to 5.5 it will be from3.5 to 5.5. or 3.5 to 6.5.

By your own math a move from 3% to 6% would have a cumulative loss of purchasing power of 44%!

In many markets where an average house is 200K the rising interest rates might not matter as much as many people think, as your chart illustrates. It is a completely different animal in high cost areas such as California. Each percentage increase will be another blow, maybe less powerful but once something weakens you don’t need as much of a blow to break it.

That home is in the city of South Pasadena, Doc, not Pasadena.

http://mhanson.com/archives/1324. I’m not sure how much credit to give to this. How accurate has Mark Hanson been in the past?

mark hanson knows his shit.

Home prices didn’t rise in the 80’s and thru the 90’s. In OC started dropping in 89. I bought then and was underwater till mid/late 90’s

Leave a Reply