Pasadena and the art of marketing old homes: Los Angeles has many areas with very old homes and unsuspecting buyers purchasing into future cash outflows.

People are desperately trying to find great deals on crap shacks. In California, most buyers have no clue about foundations, termites, or even basic roofing yet buy homes that are nearing 100 years in age. Issues will arise that will cost a good amount of money. It is simply part of owning a home. But the desire to “own†overpowers any common sense. In retirement it is easy to find shelter. What isn’t easy to find once you reach into old age is additional streams of income. For this reason, you have many people locked into their homes in California with little in retirement savings. These are your Wal-Mart shoppers living in homes worth close to $1 million but basically unable to leverage their lotto ticket. Plus, many have their adult kids moving back home with them thanks to rental Armageddon. Pasadena has some old homes. I mean old. Today we’ll take a look at a couple of properties that can be your next home!

The old home market

Our first home was built in 1923, six years prior to the Great Crash of 1929. This home is quickly nearing a 100 year anniversary. The property seems to be a court sale. When you look at this place and many like them, you realize that Pasadena has some massively old and outdated properties. Even with that said, people still will buy because the goal is to own a crap shack at all costs. Of course sales are wickedly low because you still have to have an income stream to service any mortgage attached to the property for 30 years.

Take a look at this property:

560 Macdonald St, Pasadena, CA 91103

2 beds 1 bath 1,170 sqft

This place will need a ton of work. Let us look at the ad:

“The Court Date is 4-28-2015. The accepted offer is $365,000 and the first overbid will be $383,750. Great potential home on a large lot.California Bungalow on quiet street. As is sale with no contingencies. 10% deposit payable to the estate to accompany the offer. Cashier check to be given to the attorney for deposit into estate account. Subject to court approval. 2.5% commission of court approved purchase price paid to listing agent and 2.5% paid to succesful selling agent only.â€

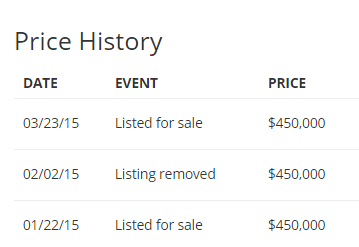

So you’ll need at least $45,000 in cash since the current list price is $450,000:

But maybe the inside is super nice? Let us look:

Unless you like zombie apocalypse décor, you might need to spend some sweet cash to make this place livable. It looks like the last time they updated the inside of this place was back in the Great Depression. And they are still asking for nearly half-a-million dollars.

Let us look at a more traditional home for sale now:

844 N Catalina Ave, Pasadena, CA 91104

2 beds, 1 bath, 768 square feet

The tiny home market is booming in Pasadena! I love how this ad actually turns the age of the home into a big plus and gives us a blow by blow history on the property:

“Offered to the market for the first time in 90 years, this cozy residence occupies a special place in Pasadena history. Originally commissioned by the Drawbaugh family, who moved to Pasadena in the late 1800’s, the home was completed in 1921, then purchased by the Wallace family in 1925. Representative of the crop of sturdy and practical bungalows that figured significantly into the growth of Pasadena in the early 1900’s, it was determined by the City of Pasadena to be a contributor to the Bungalow Heaven Landmark District. In addition to two bedrooms and one bath, there is a sweeping screen veranda at the rear of the home, from which the view of the wonderful rear yard can be enjoyed. A welcoming front porch, wisteria covered arbor, original built-ins, exposed wood floors and a usable basement are just a few of the many features of this inviting home. Truly a unique opportunity, this home will handsomely reward the love and care given it by its next owner.â€

Yes, for the first time in 90 years this home is on the market! I know you missed your chance to buy this place at the 80 year mark. The 2014 tax assessment came in at $35,696. The current asking price is $465,000. So the new buyers have the luxury of paying 13 times more in property taxes for the exact same benefits! Now you know why counties and states love property bubbles! But I love the story on this place. I mean who are we kidding here? This is a freaking old house that had many people living in it. Many are likely gone. But “Bungalow heaven?â€Â I mean we might be pouring it on heavy here. The same can be said for rundown mansions in Detroit selling for $1,000. You can picture it: “In 1800, John Smith III moved into this place with his 10 kids. After the Civil War, it was then handed over to John Smith IV who held onto the place for 50 years…â€Â You can buy awesome stories on Amazon for your Kindle or iPad for $4.99 and I assure you they will be more interesting than the story of a beat down crap shack.

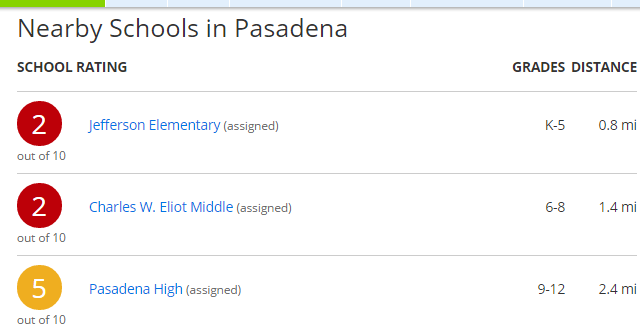

Plus you get some “awesome†schools in the area that will likely skim over the history of this place:

$465,000 for 768 square feet. Are you the lemming lucky buyer to buy this place for the first time in 90 years? Maybe your name will be in the next listing 50 years from now.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

90 Responses to “Pasadena and the art of marketing old homes: Los Angeles has many areas with very old homes and unsuspecting buyers purchasing into future cash outflows.”

844 N Catalina Ave, Pasadena, CA 91104 is within easy walking distance of Pasadena’s classic “Rick’s Burritos”. Says it all.

The small house fetish is pretty funny. Those Pasadena houses are bargains compared to the tiny shit boxes selling in Manhattan Beach. Check this out for giggles:

596 sq ft. SOLD for 1.05 M

https://www.redfin.com/CA/Manhattan-Beach/440-35th-St-90266/home/6709621

864 sq ft. SOLD for 1.2 M

https://www.redfin.com/CA/Manhattan-Beach/464-Rosecrans-Ave-90266/home/6709590

965 sq ft. SOLD for 985 K

https://www.redfin.com/CA/Manhattan-Beach/2801-N-Valley-Dr-90266/home/6708313

908 sq ft. SOLD for 1.349 M

https://www.redfin.com/CA/Manhattan-Beach/532-5th-Pl-90266/home/6712164

984 sq ft. SOLD for 1.1 M

https://www.redfin.com/CA/Manhattan-Beach/2113-Chestnut-Ave-90266/home/6704111

973 sq ft. SOLD for 1.2 M

https://www.redfin.com/CA/Manhattan-Beach/1822-8th-St-90266/home/6702416

These old crap boxes will all be bulldozed and replaced by a McMansion if the lot is big enough. This is happening at an alarming rate in MB.

Nothing to see here, move along. Call me when the DOW hits $15K… this is when gets interesting…

This Manhattan Beach crap shack is a bargain compared to the ones you listed: https://www.redfin.com/CA/Manhattan-Beach/2701-Oak-Ave-90266/home/6708526. However, the $799K is just the listed price. It will probably sell for over $1M.

That could be easily mistaken for a shack in Appalachia where a bunch of hillbillies live. I think you are right, it will easily go for over 1M. West of Sepulveda and 4000 sq ft lot. Land value pure and simple.

I think this also tells us about how resilient the LA economy really is. Remember when all the aerospace/aviation companies migrated out of South Bay – now 1 to 2 decades later and you would think that all the aerospace/aviation companies were moving back to South Bay with these prices in Manhattan, Redondo, Hermosa…

I think it is simply the rich keep getting richer and want homes in SoCal near the beach.

Aside from a major job-loss recession, can anyone give me 1 foreseeable/likely scenario that would cause a crash in home prices again in LA?

another bad snow year…

QE Abyss: “Aside from a major job-loss recession, can anyone give me 1 foreseeable/likely scenario that would cause a crash in home prices again in LA?”

A MAJOR EARTHQUAKE and or a SERIOUS DROUGHT.

Casino club tactic # 24, Los Angeles edition:

– When all else fails, divert attention to Manhattan Beach

It’s different this time. Really, really different. 🙂

There’s what’s different this time…

– New rationalizations to dispute what isn’t different this time.

And what isn’t…

– For every action, there is an equal and opposite reaction.

The first one is hilarious…

Which is closer, the Chevron refinery or the ocean.. Both are pretty close

I imagine both of these crap shacks come with plenty of hidden asbestos too.

“…hidden asbestos…”

Don’t forget the asbestos eating termites. After all, they have had 100 years to evolve.

Oh – nice schools too (not) – so sad – I hate it in here in Illinois, especially after another long winter. I guess that says something about one of the reasons for this crap shack insanity. 😛

The new normal…

Obama’s America…. and California still votes for the Progressives…. Please think of the rest of us when you vote. America will need to bail out California one of these days, and I for one, will object to taxpayer funds going towards any California bailout…. let Hollywood write the checks….

What are you talking about? Aren’t those white collar IT guys and gals (layers, doctors, etc) with $250K+ annual incomes and the “rich Chinese” with suit cases full of cash are supposed to pay the bill? All I hear on this blog is that the SoCal is for the “chosen” ones, so let’em pay the bill when the bill is due!

Housing NOT to tank hard in 2015…

I actually sold the family home built in the 50’s in So. Cal. in 2014, after my Mother passed away. I thought long and hard about keeping it due to its close proximity to the ocean. But since I had been involved in the homes upkeep for the last several years, due to my Mom’s frail health, I also knew that this home was a money pit waiting to happen, so sold it! While not always true, personal experience and in talking to others, I have found that older homes are often occupied by elderly people who have stopped caring for the house due to age and often finances, and that any remodeling, means expensive updates just to meet local building codes. If you are flipping houses for a living or plan on a tear down and rebuild, fine. But, if you plan on living in an old home, you had better know what it is you are getting yourself into! The purchase price may be just the beginning of significant expenses to upgrade, remodel, and renovate!

“You can buy awesome stories on Amazon for your Kindle or iPad for $4.99 and I assure you they will be more interesting than the story of a beat down crap shack.”

Hilarious, doc!

Sad thing is the realtor probably shed a tear when crafting his/her Burns-esque ode.

Both properties look like bulldozer fodder as it would be cheaper to build new than to try and upgrade these ‘structures’ into modern homes. I have no idea though how difficult or easy that would be in Pasadena or what the building setbacks would be but if you can’t put more than 1170 and 768 sq. ft of house on these properties they should be worthless to a modern buyer. Go get a new condo. At least you’ll have a modern kitchen, bath and amenities.

I’m with you on condo vs house, when there is such a massive disparity between the fallen-down, tiny old tear-down shack vs a glossy, new, large and low-maintenance condo for the same price. If there were only a small price disparity, or none, you might be better served financially to buy the house, no matter how shabby, because of the land value. But is it really worth the extra appreciation, to put up with living conditions that would be considered downright slummy by any reasonable standard?

When living in a house means putting up with slum living conditions when you could have a high-end lifestyle for the same money, plus relatively low HOAs and much lower taxes (because you own far less land) in a beautiful condo, there is really no choice. Even though you might be “making money” on the land appreciation, you will eat your heart out thinking of the glossy, beautiful condo I saw listed in Old Town Pasadena, with more space, for $300K less money.

I hate living in a condo.

* Thin walls mean you hear your neighbors’ barking dogs, crying babies, music, flushing toilets, showers, shoes clacking on hardwood floors, and noisy exercising.

* Fighting for time to use the shared washer/dryer. Yes, many condos have “community” W/D’s rather than W/D’s in the units.

* Paying HOA dues for things you don’t want. My HOA dues include cable TV and internet. Well, I ALREADY have my own ISP, but since last year I must pay for TWO ISP’s. And I DON’T want cable TV. Never watch it.

My building also has a pool and sauna that I never use.

And they’re constantly reinstalling new carpets, new paint, and redoing the lobby and elevators (two cosmetic upgrades so far), even though the old lobby and elevators were fine by me. More wasted money.

* Tons of rules & regulations on what you can and can’t do. PAGES and PAGES of rules and regulations.

I want to buy my own window air conditioner, because the building’s central cooling is only turned on a few months a year. But window air conditioners are forbidden because they’re considered “unsightly” and might decrease property values.

That’s another thing. No central cooling until the board determines that the temperature is hot enough to justify the cost of turning it on. Usually from June through September.

Sure, my condo is in a great location. On Ocean Ave in Santa Monica. I can see the beach from my balcony. But I’m considering a move inland, to possibly Pasadena or Woodland Hills, because I hate this noisy, regimented lifestyle.

I was happy when I bought my condo and was even happier when I sold it.

Shoddy construction throughout. Thin walls and ceiling and floors. Even though I lived on the top floor, the whole unit shook when people walked on the roof. The roof had a shallow pool and jacuzzi. Only saving grace was my W/D in the unit. Underground parking so the whole building would collapse in an earthquake. The whole plumbing system was replaced after only 20 years of original because the builder used minimum standards

Probably, you should’ve read the rules before you bought your condo…

@son of a landlord:

*No all condos have thin walls. We own one that has thin walls, built in the 1970s. We rent one that has pretty good walls (you might hear only an occasional subdued thump from next door), built in the 1990s. It varies from place to place.

*I would only ever live in or buy a condo that has its own washer/dryer. Thankfully, that seems to be the norm in OC.

*Most condos (at least in OC) don’t have shared services like ISP and cable TV. Therefore, that’s not an issue for many condo dwellers.

*I agree, a pool is a waste of money (at least for me). And frivolous spending by the HOA is annoying.

*I like the rules, as long as they’re enforced. It keeps the neighbors’ dogs quiet (sometimes).

*You can get a portable A/C unit to circumvent the “no window unit†policy. It just has an exhaust hose that goes to the window. I doubt anyone would even notice. Only having A/C through Sept is ridiculous. October is frequently very hot.

All in all, I don’t mind condos much as long as they meet a few of my basic requirements. Ironically, my parents, who live in a nice neighborhood in a single family, have more noise issues than us who live in a condo.

Hi Laura. What is this nice sized newer condo in Old Town Pasadena for 200k? That seems pretty optomistic.

@ sleepless,

It does little good to read the rules & regulations, because rules and regulations are always changing. A HOA board is like a legislature, always drafting new laws.

For example …

@ Responder,

My condo didn’t have shared ISP when I moved in, and that was so for many years. Then last year the HOA chose Verizon ISP for the entire building.

Most likely someone on the HOA board already had Verizon, and figured he’d pay a lower, group discount rate, if the entire building signed on. So he pushed the matter through.

That’s how HOA’s work. People with agenda form cliques, get themselves elected, then shove their agendas down everyone’s throats. Until they’re overthrown in a later election, and a new agenda gets shoved through.

HOA’s are tiny, banana republic-style oligarchies. I’ll never again buy anything — condo, townhouse, or a house in a gated community — which is subject to a HOA.

Nice piece. Just want to point out that Bungalow Heaven is a legitimate historical landmark district with a large number of Greene & Greene style craftsman homes that are legitimate historical landmarks. Stating that the home is a part of Bungalow Heaven is not hyperbole. Your other points are well made, though.

It is similar to the Ross-Moyne district of Glendale. Cute historic homes that sell for a lot of money

Yet some on this blog have said that older houses can be better than younger ones. Specifically, that pre-WW2 houses are often better than post-WW2 houses (built ca. 1945-1965), because the earlier houses were built with care, and have solid plaster walls, while the latter houses are mass-produced, with weak drywall walls.

How about not building with trees at all? What is wrong with building concrete homes? ICF for that matter. Super sturdy and earthquake / high wind resistant, more sound and water proof, have better RV value? cost about same as the conventional construction.

I read about ICF after seeing your post. It doesn’t seem to have many disadvantages as long as it’s waterproof foam and you never want to remodel. Works for me. I’d be ok with CMU, too!

Sleepless,

My house is ICF construction, R-50 value for walls, floors and ceiling. It lasts forever, has zero draft and it feels like an icebox. Energy bills are minuscules. You can’t even compare the quality with a house stick built. It is a totally different class of construction.

The reasons it is not popular are:

1. It cost way more to built than regular frame regardless of what the manufacturer of ICF says. I built it myself for me and I know. I agree that it is worthed.

2. If I would build it for others I wouldn’t get the money back, forget about profit.

3. People when they shop for a house perceive that value in terms of price per SF. The fact that the price per SF is meaningless is irrelevant. What counts is the buyer’s perception. Therefore, builders respond to market demand in kind.

4. Most buyers don’t know anything about construction. If they do, they usually build themselves. Consequently, they can not tell the difference between ICF built and regular frame. Inside it looks the same.

For people who can afford to pay extra, ICF is definitely the way to go for any location, hot or cold.

Concrete homes earthquake resistant? I’d read that concrete and brick are especially vulnerable in an earthquake, because they’re brittle and don’t bend. Whereas wood or steel bend and sway, and so are less likely to break.

Or are you talking about steel-reinforced concrete?

SOL,

I thought you know about ICF – my mistake. It is very good for earthquakes. It has lots of steel in all directions and it is mono pour. In case of an earthquake it works like a piece of wood in the waves, like one unit. Again it is very well reinforced with strong rebar. It is also very good against water if it is installed properly. If used for a basement in area with moisture it works very good. I would use it again in any type of climate.

This is going to annoy some folks here but my relative bought a 1000sf house on a large lot in South Pasadena for a grand total of 181k back in 96′. Built in the 30’s….basic home…not fancy at all. Up on a foundation….it’s been nothing but a great, low maintenance home. No real unexpected repairs in almost 20 years.

Part of that perhaps may be: I don’t think it had ever really been a rental. In the car world: you “buy” the owner, not the car.

Chemtrails, Here is your PROOF 100% Real “MUST WATCH” https://www.youtube.com/watch?v=L5is16A8pfw Don’t Have Time – Click Watch Later Button – Clock

What do chemtrails have to do with housing?

Chemtrails gotta live somewhere…

A much better (and funnier) short film about chemtrails: https://www.youtube.com/watch?v=avTunGhbzFM

Chem trails are banned from SoCal. They could bring down property values. Those unsightly lines we make destroy the paradise image real estate agents are trying to perpetuate. Guess I’ll have to fly at 40,000 feet from now on. They’ll never catch me up there…air is too thin.

I was going to respond with a comment about that hellish bungalow gothic, but realized you nailed with with “zombie apocalypse decor.”

Where is the cryptkeeper with a pitchfork? In the closet?

Yikes. You say there askin’ over $100k? We’ll for every seller…

After a long day, reading this comment made me laugh out loud. That place is a scary crypt. Lol

Great Article ! thank you for taking the time to write such detail article. I enjoy each one of them. You must be one of the few people trying to let everybody know how disgusting this real state market is. Too bad that there are too many stupid idiots letting the vultures destroy economies.

If the author’s intention was to bring home the fact that Southern California real estate, using Pasadena as its model, is relatively overpriced to most of the rest of the country, then that’s already a given, from Compton to Beverly Hills. The Market is what the Market is. Were he the owner, would the author himself not sell them at market rate (or more), which both of these seemingly are? Moreover, many of these older homes were built with much greater care in their day than later ones and really do have a “charm” about them that later, more cookie-cutter ones don’t. Indeed, Bungalow Haven is a wonderful neighborhood and not the misnomer that the author makes out. Yes, prices are outrageously high in Southern California, but bottom line, is the author saying anyone who hasn’t bought by now has missed the real estate boat and should stay a perpetual renter, paying off another’s mortgage?

I believe the author is stating ‘buyer beware’ as he or she has for a number of years. Far more responsible than the main stream messages of apathy, ambivalence, and going in cahoots with the status quo real estate industry cartels. Note that the author routinely points out the same insidious nature of the rental situation.

3Wade: “Yes, prices are outrageously high in Southern California, but bottom line, is the author saying anyone who hasn’t bought by now has missed the real estate boat and should stay a perpetual renter, paying off another’s mortgage?”

~Sigh. This comment might have got my stress levels up, were it not for the fact that one of the houses I’m following in my market (not in SoCal) has had it’s asking price cut by $105,000 in the last 6 months alone, and likely will eventually sell for way under what it’s currently asking.

Why the smeg would I wanted a $105,000 bigger mortgage just to own 6 months ago, seeing asking price is now $105,000 less today, and still not sold? To satisfy the bulls forever HPI fetish? Renting has just saved me $95,000 past 6 months versus that house (eg my rent = $20,000 a year).

Renting may be paying off someone else’s mortgage, but unlike others, I’m in no rush to get neck deep into a jumbo mortgage (which I would have to pay off with 25-30 years of work) for an overvalued property that can easily fall back in value.

News Flash, smarter folks prefer an old house – better built, more character. Many of us prefer a smaller home – less maintenance, less heating/cooling, smaller carbon footprint. I would take my two houses (one built in 1958, the other built in 1913) before I would take any NEW McMansion crap shack.

Not all old houses are well built and not all new houses are bad. That is a real dumb generalization which does not have anything to do with the reality.

If you want to buy something cheaply built (minimum building code) that’s what you are going to get. If you are cheap or can’t afford a well built home, then you get a piece of junk. It was the same in the past and it is the same today. No change.

I build custom homes to the highest and best building practices for people who can afford them. The rest go to builders who mass produce houses at minimum building code and then they complain for the quality.

For all to know: there is a huge gap between minimum building code and best building practices. Why would a builder build something high quality (behind the walls), to sell below his cost, when all the buyer sees and cares is the granite countertop, the SS appliances and the price???!!!…

@builder: I know a construction defect attorney. I’m sure you do, too (lol). Custom homes and custom additions etc., built by any builder to any standard, can and do have problems. People shouldn’t fool themselves into thinking otherwise.

I completely agree with you, though, that old houses can be built just as crappy as newer ones, and sometimes worse.

@ builder,

Any tips on how the home buyer can tell if a house is well-built? Other than by hiring an inspector?

For that matter, how do you hire an inspector you can trust?

There’s a conflict of interest when a realtor recommends an inspector. Realtors want the sale to go through. Inspectors want future referrals from the realtor.

Good question SOL.

The first step is to hire an inspector reffered by others who worked with him in the past. It is true that using your RE agent for inspector referal can be a conflict of interest.

Then, like in every type of investment try to educate yourself as much as you can. You spend hours analyzing a stock and you may invest $20,000, but you don’t educate yourself when ivesting hundreds of thousands? Try to talk to various builders of high end homes how is their house different than a house built based on minimum building code. You learn something from one, some other things from another and over months of learning you get a pretty good understanding of why a house keeps the quality over time and another doesn’t. Not all frames are the same, not all HVAC is the same, and on and on there is a long list of things you have to look for.

It is too much to give a lecture in a brief post.

I also like the idea of a smaller home. Perhaps building more efficient yet small homes is the best of both worlds. I shudder to think how much it costs to heat a McMansion in winter with such vaulted ceilings. I can barely Heat my 800 square foot apartment without going broke.

What’s a house worth if there is not water coming out of the fixtures?

time will tell but why take that risk right now..market rounded tops work out in your favor if you have patience….price gains will be nil or negative next year…praying for snow in northern california might be more prudent for angelenos than worrying about a 800K bloated shack…

Since the Greenspan 2000 bubble, now housing market is = stock market. Who are the “all cash†buyers, they are not the regular Joe buying a new home with a mortgage. The home ownership rate is at the generational lows, where are the rental occupancy is at the historic highs. So, the Joe is renting now, not buying. Who is buying the stock market? It is not Joe either. The regular Joe is too poor to buy stocks, he lives check-to-check it payday loans, which are at the historic highs, or credit cards debt, same as the payday loans. Now, the FAKO score is loosening it standards, so Joe can get even more debt since he cannot repay the old debt. Now, you call it what it is – the asset bubble. The same “force†that drives the stock markets, does the same thing with the housing market. You can tell this time is different, how exactly is it? Same old sh!t, different ass!

Thanks for nailing it…SoCal real estate isn’t for the “Joe’s” anymore, who are being pushed farther out of the beach areas and city center.

The incomes of the bottom 90% in the U.S. have been stagnant to down for 30 years. The 10% are doing a little better than inflation, the 1% is growing nicely and the 0.1% is exploding in income and wealth.

Further, America more than ever is a refuge for the gains of the global nouveau riche.

What’s the point of bemoaning this fact of life of the “regular Joe”? Why not just accept it?

Acceptance of untenable circumstances is for the doom and gloom crowd. Nothing changes for the better through apathy.

It’s not a top 10% or top 1% closed-club-membership. I’ve seen it myself; when markets turn they turn on each other, even taking pleasure in downfalls – it creates opportunities.

The 0.1%, and the gains you speak of for them is also wider deflationary, (unless they’re spending like fury, “Brewsters Billions” style back into the economy, but more likely sat on their gains).

Population growth is a depressor on values if that population is not in position to borrow/pay house prices in a vibrant economy, with capital productivity etc. Forgive me for not wanting to pony up $300,000+ to live next to a house where there’s 6 people sharing. Some may be desperate to pay such sums in this manic real-estate market, but it’s a temporary phenomenon imo.

Rising debt levels create economic feedback that forces a deflationary reaction. Debt cannot indefinitely compound faster than income. Central banks can create liquidity by creating debt, but only markets can create capital by valuing assets above liabilities.

…and forget about that “same day skiing and surfing” thing… Not going to happen any time soon http://abcnews.go.com/US/californias-drought-worsens-governor-announces-water-restrictions/story?id=30047515

yeah, what happened to those clowns who ignore the WORST traffic on the PLANET yet claim they can play in the snow and the surf on the same day (as if anyone actually would want to do that). Throw in a drought and they might want to claim you can surf and dirt bike in the same day, except you can do that pretty much anywhere you have surf.

With the drought likely to get worse any homes near the coast will probably be saved due to close proximity to the ocean for a desal plant. Not sure how we will be able to pump water inland to the farms but i bet it will look something like the oil pipeline in Alaska or maybe the keystone pipeline. Either way farms will likely be saved and probably if you have a larger farm with adequate funding to support a desal fee.

On the other note this state recovered?

http://www.gpb.org/news/2013/02/08/northeast-georgia-out-of-drought

Might need a Rain Dance to get out of this one.

I still don’t understand the allure of California. During the Northeast winter months a trip to CA is a welcome break from the snow and ice, but to actually live there? As a consultant I spent a year in CA and you couldn’t pay me enough to live in this hell hole. The air is full of smog, the salaries suck, the summers are brutally hot, everything is overpriced, traffic sucks at all hours of the day (stuck in a backup at 3am, really?), areas of the city are run by gangs, and then there are the people. For the most part you have either nice and clueless or mean and smart. I understand the backlash against the educated transplants as a whole they are mean SOBs. That said, I love visiting California but not enough to move into a MUCH smaller home and take a massive cut in salary.

Good. We won’t miss you.

A bit sensitive, aren’t we?

No water = No California

Truer words never spoken, unless you get your water from elsewhere.

I’m pretty angry and bummed about the real estate market in California like many of you. That being said I’m confused why population expectation numbers aren’t discussed as the main counter point to most (if not all) arguments made on this forum. Am I missing something?

Bloomberg projected that the city of Los Angeles is to have 15.7 million residents by the year 2025, an increase in population of 38.4% over the most recent census.

Reuters projected the number of people in California, already the most populous U.S. state, will rise to 60 million by 2050 from 36 million now.

Desalinization plants have already been built in other parts of the world and the technology is improving every year. When it comes time, California will build what plants it needs to, people will pay more for water, and the whole process will most likely be subsidized (whether we like it or not). California will keep on – keepin’ on.

With all that being said I would love the real estate market to crash; I just don’t see it happening with the incoming population boom that we are expected to have. It seems like a simple supply / demand issue coupled with people from all classes wanting to live here. (I’m in LA).

@Drew

From 2007 through 2009, RE crashed by 30% even though population growth continued. Since then, prices have recovered despite some of the lowest sales volume for any “recovery”. Hence, population-driven demand had little to do with it. Despite the population boom, there just aren’t enough qualified organic buyers at current prices.

I wish that were the case but every single decent property I look at with my agent ends up having multiple offers (sometimes more than 5 even). It’s terrible.

Reuters projections are simply that: projections. They can compile as much data as they want but there’s no real way of predicting population growth in any location because the parameters that are fueling growth now may change drastically down the road. Believe or not, most of the world populace doesn’t have ambition to move to California. If they did, we’d we’d probably have over a billion people here now. As a whole, we tend to think of ourselves as being special and more important than everybody else simply because we live here. That is just not reality.

Reuters isn’t the only one predicting it. Multiple agencies including non bipartisan groups are predicting the same thing. Most of the gains are natural births within the local population. So while I agree that no one can truly predict the future, I’ll side with the experts on this one. It doesn’t take billions to increase the population in a city to uncontrollable demand levels, only a couple million out of the 7 billion on the planet.

Good entry Doc; I’ve read through it a few times and had a giggle – also pulling up the listings for each and having a look around the neighborhoods on streetview.

Here’s a funny (archived) listing from around my way – surreal but actually real and serious – (They sold it in 2013 for £2m dead on in the end… but that’s way down from what they were patting themselves on the back when they smugly thought it was worth over £5million). There’s been general reflation since, but top end houses like this still weakening in my market.

http://www.rightmove.co.uk/property-for-sale/property-33717502.html

Hopefully to be repeated, with similar listings, for SoCal prime in Liquidity-Crunch/Buyer-Slippage/Crash 2.0.

Real estate is a command economy! If you don’t believe it, just read The Communist Manifesto by Karl Marx and whose the other guy??? Oh yeah…Joseph Engels.

I was talking to my husband last night about this blog, and others like it. One year ago, I was so adamant about buying a home and my husband kept saying NO, we need to wait this out and see what happens because it felt too risky. Our realtor kept pressuring us to overbid and we put an escalation clause in one of the contracts we wrote. When every deal fell through, I started reading this blog and others like it — and I stopped listening to the mainstream media.

I think this blog in particular has kept me from making the biggest mistake of my life, and for that I am very grateful. All of our friends are buying homes and I feel left out, but I also feel like delaying gratification might give us an opportunity to save more for what we really want in the future. The fear I once had that I’d never own a home is dissipating because I feel like I understand many of the downsides of home ownership that are discussed here.

Thanks for writing this blog and for saving me from making what was probably a BIG mistake.

Ditto on this…

My wife has been wanting to purchase a home for the past year now to keep up with friends and not burn money on rent but I’ve slowly edged her into” team patiently waiting” b/c of all the good posts and comments on this blog.

At the moment it feels good to have relatively low rent, not worry about housing upkeep expenses, and have $$ in the bank for vacations or saving for when the time is right to buy. And IF that time never comes, we can live with that as this means living has gotten too expensive and we’ll uproot.

I love this blog. There are a couple of other good ones out there, too. Check this one out. http://wolfstreet.com/2015/03/26/wage-growth-vs-home-price-appreciation/

Good for you…

I own in San Francisco and it is absolutely insane to be buying right now in this state, I’m not familiar with the Colorado market but everything works in cycles and patience is the key to investing, when people are crowding into an overbought stock, you see, the easy trade is over, those whom bought in 2010-11 are alright today, the people buying right now are not..odds are not in your favor, wait for a better trade….

I would never buy my home at today’s price….its rediculous…

Are you ever tempted to sell?

In the market-theory I was taught, ever higher highly generous achievable prices, should tempt out ever more sellers (even when they love their homes/areas).

I can only presume, with it going was past that generous stage , many hold (low inventory in low-mid-high prime markets) on expectation HPI on HPI on HPI won’t ever stop.

Manic phase: Properties come to sell at absurd prices on the expectation they will appreciate to still more absurd prices. And they do. They defy gravity, moving from one lofty new high to another, month after month, year after year, long enough to lure otherwise prudent people to mortgaging their gains to reinvest in the inflated assets on margin. Before the market can top, just about everyone who could conceivably be drawn in must have already become a buyer. And debt levels supporting the asset prices must be many times higher than any that could conceivably be services out of the cash flow yielded by the investments themselves. Then comes the bust. Just as everyone has come to count on the idea that the lofty asset valuations are permanent, there is a crash.

Good call ma’am. Now is not the time to be pursuing a “lifestyle” and chasing shiny glossy things. Living your life [and not a “lifestyle”] will prepare you for making a move when you’re ready, not because all your friends are doing it.

Remaining calm while the mob does it’s thing is not only sensible, but far more rewarding when it all comes crashing down. Sort of like not seeing a house as an ATM machine to fund a standard of living one can’t afford: your prudent actions will keep you from disaster.

Stay the course.

Thanks for the encouragement. My parents always told me to look at what everyone else is doing, and then try to do the exact opposite. I try to keep that in mind all the time — even though it’s very hard to do sometimes in the “consume more” culture in which we live.

I dont understand if that crack shack is half a million why is not any ole good shape good neighborhood not 10 million dollars.

I mean that is not even worth 10,000. I would pass at 5,000.

You’re buying the land, not the house. It’s still overpriced, though, at least IMO.

Same here….this blog saved me from buying an overpriced crap shack. Thank you all for the insight and valuable information. I hope this bubble bursts soon. And if it doesn’t we will keep renting.

The operative assumption for all such bargains is that one is buying the lot… that the shack will be scraped flat.

It’s impossible to re-hab properties that old. (on the economics)

One can scrap them down in one day and get to building something decent.

Of note is the terrible decline in the local schools. This is entirely due to the change in demographics.

When any society imports vast, vast, numbers of aliens — de facto creating a two-tier caste society — ( aka soft slavery/ serfdom) the public school has to be dumbed down to the alien language and culture.

Unlike America a century ago, it is now cultural policy to NOT blend in Latinos.

Instead, a dual track education system has been initiated — ethnic politics — to such a degree that the ‘system’ is even trying to get native Americans to be bi-lingual.

As one can imagine, dual language cultures don’t really fly — just on the economics.

The only society that has really — somewhat — pulled it of is Quebec. Of course, Quebec is the exception that proves the rule. Dual languages leads to caste economics and enmity across all of society.

For those interested in how crass ethnic politics can get: study up on Honolulu — Hawaii generally. There all politics is ‘ethnic.’

Is it not so that Switzerland has three “official” languages — German, French, and Italian? That each canton is authorized to chose its official language. Most cantons have chosen German, a few French, and one Italian.

At least that’s how it was, many years ago, when I last heard about it. (I’ve not been to Switzerland since the 1970s, when I was very young.)

Actually they’re up to four, those strange Swiss.

Again, not the extreme outlier.

In both cases, there is no second-class language.

Whereas, in modern America, Mexican and other dialects of Spanish ARE second-class languages.

You can’t get through to a PhD speaking Mexican.

(Mexican is NOT Spanish. I’ve had shocked, native Spanairds regale me with just how L O N G it took them to understand Mexican.) (three months is typical)

The REALITY is that our MSM is talking right past the initiation of a caste economy.

The other strange thing — politically — is how unlimited immigration is destined to permanently displace Black Americans at THE picked-upon, discriminated minority.

Black political representation in Congress is destined to collapse. Rangle and Waters, both, are hold over Blacks. Their districts are sure to flip to Latino politicians — soon.

My house was built in 1926 in Burbank and the lath is maple wood. The outside has redwood planks that have the tar paper and chicken wire and then the thick stucco. The lath and plaster wall and the planks and stucco are about a foot thick and would stop a bullet(unlike the new cheap homes). The modern drywall homes don’t last long and are cheap in so many ways. Lath and plaster will last centuries. Don’t knock the old homes; they will be standing long after the drywall from China homes that can make you sick are torn down.

Leave a Reply to Imfromcolorado