Flippers cutting it close in Paramount and high prices in Bell: A slowdown in sales and aggressive pricing as the summer enters the final stretch.

The summer selling season is drawing to a close and flippers are out in droves trying to squeeze out maximum profits before the fall hits. I know some of you are obsessed with Santa Monica or Beverly Hills but your budget might only give you room for a tiny bright blue 400 square foot place in Pasadena. Expectations people! This is SoCal, land where the notion of property ladder was invented. What would you say to buying in Paramount or Bell for example? You certainly would get more house than you would in Pasadena or Culver City and you are close to city centers. Bell is closer to downtown L.A. than Culver City. After all, everything is gentrifying so better buy now before Compton becomes the next Paris. Even though prices fell in SoCal from June to July and sales have been weak for most of 2014, eager sellers are still trying to get the most out of the current market. Today we’ll take a look at a flip in Paramount and some gentrified prices in Bell.

Flipping in Paramount

One of the key aspects of a frothy market is asking for manic like prices for simple upgrades. This was common in housing bubble 1.0 and is common once again. Sure, flippers with renovations will add value but people drink too much of the cable housing Kool-Aid when it comes to how much they should profit from their “work†which amounts to ordering around contractors and acting like a reality star on your cell phone. You will get what the last sucker is willing to pay. Nothing more.

It should tell you something when you point to a city and people suddenly come up with excuses as to why not to buy there. Yet their budget certainly doesn’t point to a crap shack in a target city. Take a look at this flip in Paramount:

15344 San Jose Ave, Paramount, CA 90723

3 beds, 1 bath, 1,202 square feet

Let us look at the descriptive ad:

“WOW, WOW, WOW!!!***STANDARD SALE*********AWESOME OPEN FLOOR PLAN! 3 BEDROOMS! 1 BATHROOMS LARGE KITCHEN! PROPERTY HAS BEEN COMPLETELY REMODELED INSIDE AND OUT,EXTERIOR HAS NEW STUCCO,INTERIOR HAS WOOD FLOORING THROUGHOUT THE HOUSE,KITCHEN HAS BEEN COMPLETELY REMODELED WITH GRANITE COUNTER TOPS AND NEW CABINETS,THE BATHROOM HAVE BEEN REMODELED WITH CERAMIC TILES AND SEPARATE SHOWER STALL,LAUNDRY AREA, BACKYARD IS GREAT FOR ENTERTAINING,PROPERTY IS LOCATED IN A GREAT FAMILY NEIGHBORHOOD,SO MANY UPGRADES, MUST SEE TO APPRECIATE…â€

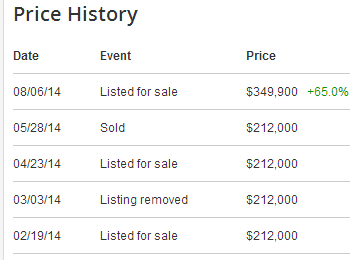

Wow indeed. The place has been remodeled with all the typical buzzwords: granite countertops, new cabinets, and of course wood flooring. This place last sold in late May for $212,000. So what is the current list price?

So the work suddenly added $137,900 in value? Why work when all you need to do is add granite countertops, wood floors, and cabinets and you can turn six-figures in a matter of a couple of months. Of course the schools in this area aren’t exactly the highest rated but with gentrification being all the rage, I’m sure you will have no issue sending your kids there!

The next place takes us to Bell:

6219 Flora Ave, Bell, CA 90201

3 beds, 2 baths, 1,206 square feet

Bars on the windows are always a sign of a neighborhood that is up and coming. This place last sold for $180,000 back in 1994 (after being sold in 1993 for $85,954). Ignore that foreclosure there in the sales history or the 1,000,000 foreclosures that hit in California over the last decade. You can only win in real estate no matter the price, remember? The current list price? $345,000.

The schools in this area are rated even lower than those in Paramount. People do realize that $345,000 is still a hefty price tag for this quality of a home, do they? Sure, you can doctor up loan docs and squeeze people into places but I guess that is the point. With investors pulling back, the market has slowed down dramatically because people in these immediate areas have a tough time getting mortgages with these current prices. So either prices will adjust, incomes will go up, or deus ex machina investors are going to swoop in and convert these into rentals.

Keep an eye on these two places because sellers in these markets are following the same pattern as folks in Pasadena. It is a SoCal kind of thing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “Flippers cutting it close in Paramount and high prices in Bell: A slowdown in sales and aggressive pricing as the summer enters the final stretch.”

“Even though prices fell in SoCal from June to July and sales have been weak for most of 2014, eager sellers are still trying to get the most out of the current market.”

BTFD!!!

On a serious note; we should all be careful what we wish for because your income will be at jeopardy if this giant bubble even twitches in a funny way and greed turns to fear.

I’d love to see these flippers have to pay real workers and not use cash and illegals in order to keep their bottom line low. I’m not against illegals or cash being paid to help individuals that own a home and need help with things. But when it comes to using this help in financial gain these flippers are no better off than wall street hucksters.

“I’m not against illegals” – You should be. Remittances suck money out of our economy, allow Mexico to remain the political sewer it is instead of forcing change and they drive down wages.

“we should all be careful what we wish for because your income will be at jeopardy if this giant bubble even twitches in a funny way and greed turns to fear.”

That’s what morons who gorge themselves at the trough of cheap credit have to worry about. Pigs follow each other through the corral and get slaughtered together – the folks who proclaim “this place is different” and “this time is different” won’t be there to save anyone else when the time comes.

I don’t believe that the stock market or the housing market or the bond market or the commodities market or the derivatives market will collapse in a vacuum. I am concerned that the few crumbs that drop down to the 99.9% will dry up and we will see worker participation rates (real employment) fall fast… The few crumbs cycling in the current “economy” is all there really is at this point. That plus the .1% ever increasing spending on hookers and cocaine… I may not have a seat at the trough but I still have a daily ration of rice and fish sauce…

@ TiredofBS I am curious who are all these people you refer to who have said: ‘this place is different’ and/or ‘this time is different’. Does the fact that there are 12 zip codes in SoCal where prices are higher than they were during the bubble (search archives) not convey a place is ‘different in terms of price rises’. That does not mean those 12 zip codes are somehow impervious to a drop in prices.

‘This time is different’ I cant recall anyone on this blog ever saying that nor have I ever seen a post where someone proclaimed ‘buy now or be priced out forever’.

What some posters on this site (who said they would never buy in LA or Cali) have done is create these repeated posts of things that nobody has ever actually said. What people have said is that they purchased a home in 2010 or 2011 or 2012 and felt they got a good deal. Without knowing the buyers personal factors (income, family, intention to live in 1 home long term, etc.) yet they are being called ‘shills’ for purchasing a home. for the record I bought a house in 2012, but I would not recommend someone buy a home now nor do I think the future prospects for renters is exciting either. Capiche?!

It’s not piggish to gorge at the trough of cheap credit…it’s smart. Look at homes and look at the S&P. The only ones getting slaughtered are the meek who earn 0% on their savings and forever cry that the sky is falling.

QE Abyss, where in my comment did I claim that those phrases were from this comment section? That’s right, I didn’t, although plenty of said mantra is espoused here often, it might not be verbatim but it’s the insinuation or leading conclusion.

Do you understand the use of paraphrasing with quote marks?

I’ve never labeled anyone on here as a schill. I do think it’s rather peculiar that anyone who claims to be completly content with their purchase decision would even pay attention to a housing bubble blog, much less make a post about it. Seems to me that they probably harbor some doubt and are seeking confirmation bias.

And the whole thing about the 12 zip codes at higher price levels than in 2008… I wasn’t aware that the final chapter had been written. Good to know.

Sure Dfresh, fatties are the smart ones in this world. Good luck with that savers straw man.

@DFresh, What? makes you believe that people are getting 0% interest. Most people I know buy PMs. And you know What?, when the markets are rigged like they are now, not everyone has a nerve to participate in the casino. I personally never play casinos, ever. Am I a bad investor now if I despite malinvestment? Or am I just conservative? I would repeat myself just in case you have a short memory, the priced didn’t fall further in 2009-2010 because of the ONLY one resin, the fed funny money aka MBS and QE infinity. Unprecedented event in the US history, indeed, who could’ve predicted that. Now you tell me who is smart here. Enjoy your gains while it lasts…

I see the issue, everyone has an opinion…I say more power to the people whom bought at the bottom, enjoy it, things always go up and down. Catching it right is a good thing. I had a property and just kept paying because that’s what I do. Now it’s worth more, who cares. I wouldn’t buy it at these lofty levels. I say great timing to all those who bought at right time. I was close to pulling trigger on some properties in Sacramento but didn’t.

Let’s talk about the real issue, how many are considering water in their purchase decisions? I doubt many at all, people don’t think of water, they think of garages, kitchens, bathrooms, nice living rooms, a pool and backyard. The issue of water trumps that fake bs all day. If we don’t get it, good luck with any house you purchase but California allows you to walk away, so no harm no foul.

The fed has done something that had never been done in the history of mankind….

Give it sometime to see if it works, so far the rich are richer, the poor are poorer. The fed’s experiment failed and now you have failure on top of a declining GDP across the world…..I say the fed didn’t take the power of higher rates on the fixed income senior and banks. That is a huge chunk of money that they didn’t get to count against GDP. And all the risk priced today is mispriced, as a credit office I can say that without blinking an eye.

We are coming into some hard times…the hot money fix is over….what are u doing for people today ms. Yellen for the people on the street, one without a bull in front of it?

RE: What?

We may see a downturn in housing while the FED uses back channel means to keep the stock market levitated as long as possible and mitigate the effects of an S&P downturn for the sake of pensions and other interests. Everyone knows stocks are overvalued, but I think there will be an enormous effort put into softening the downturn there. We might see a situation like in Housing Post Bubble where the bottom/bounce back is more rapid than logic would dictate. At this point I think the macro economic effects of Housing Bubble 2.0 busting are far less worrisome to the FED than a stock implosion. If this is the case I could see hot money fleeing to the “safety” of stocks once housing goes negative. I could see a situation comparable to the mid to late 90’s where housing bottomed out and was flat for a while while the stock market raged. We know all this stuff is cyclical so whatever comes I;m sure it’ll be a variation on something we’ve seen before.

Maybe the idea is to make homes affordable while making the stock market go higher so that future gainers can buy these homes? Inflate away this mess seems to be the only way to fix the debacle the FED is in now.

all in my opinion

I agree with What?, we should be careful What? we wish for because when SHTF, it won’t be just housing crash, this time is indeed different… it will be the entire debt bubble collapse and it will hurt 99% really bad…

You mean Compton is affordable? Compton’s Dr. Dre just became a billionaire. I want a vacation home there, to build my hip-hop cred for 2016.Bars on the windows would be great. How cool! I already feel gangsta.

Racism is alive and well. Thanks Hillary!

As a foreigner I’ve no idea what kind of people (colour, ethnicity or language) live in there, but I can say that if you have to have bars on the windows, it’s not a place I’d want to live.

Is that racism too? As far as I know, there could be little green martians there.

Uuuuuuuhhh………yeah. Thomas, you probably missed the “Dr. Dre”, “Hip Hop Cred”, and “Gangsta” bits too. You can head back to the EU anytime. Class Dismissed.

Interested to know why you think the comment is racist?

The shallow-minded mantra these days is that anything culturally insensitive is “racist.” Apparently it’s just too much hard work to think these things through.

Because if you don’t like Obama, you are a racist, right… right?

I’ve been looking at a flip in Eastern Ventura County lately. In a neighborhood where similar homes sold for as much as the low 600s in the froth of 2013 these folks picked up this home as a trashed short sale for around $400K a year earlier. They put it on the market at 2013 prices this spring and it just sat. After a couple of price reductions I finally took a look inside and found something peculiar, hilarious and a bit sad.

The flippers-to-be apparently remodeled from front to back and ran out of money midway through. The entryway and front room are nicely done – fresh everything, high grade lipstick on the pig. At the back of the house the kitchen has a couple of new appliances, but original aging tile and cabinetry… and then we get to the unmitigated disaster that is the backyard – a bare dirt junkyard. Think somebody’s desperate to get out while the getting’s good?

Anyway the sad thing is that, even with the partially complete remodel the house is probably still worth about $500ish in today’s market – a price that would still offer the flippers a tidy profit. By trying to milk the market and slowly chase it down with incremental price reductions they may not sell until their profit is eroded to nothing. Sometimes when you get greedy nobody wins.

I saw one of those halfway completed flips this past spring in Pasadena. Brand new bathroom and shower “stall” — except that the stall had no glass walls. If you were to use it, water would splash all over the bathroom.

There was an elderly couple looking over the house. They were the only other ones at the open house.

The husband was friendly and talkative. He told me he was a next door neighbor. Said he had worked in the film industry, as a stagehand. Seemed proud about it.

He was as perplexed about the shower stall as I was. He agreed that his neighbor had likely run out of money.

He was clearly uninterested in the house. Was he there only out of curiosity? Or had the neighbor cajoled him into pretending to be a buyer? If so, he wasn’t playing his part very well. Very talkative, and readily admitting that he was only a neighbor.

Perhaps he resented being cajoled into playing a buyer, by a neighbor who hadn’t lived in that house all that long, if at all.

Oh yes, and the realtor wasn’t very informed. I asked if the house had an attic space. Its slanted roof indicated that it might.

The realtor said she was pretty sure there was an attic, that she’d seen the access door in the ceiling … somewhere or other. She went looking into all the closets, searching for the access door, but couldn’t find it.

Housing IS Tanking Hard in 2014!

I am seeing big price cuts in my market. Once sellers realize they have to cut even more to make the sales all the sellers on the sidelines will rush in to panic sell as their goldmine starts to sink.

what market may that be Jim Taylor? just curious.

Do you guys have any idea of where to read a good blog about getting into the apartment rental business?

SF Bay Area

Jim, keep telling yourself that and you’ll feel better when you end up buying soon. You are house horny and getting impatient. The chances of you buying in 2014 are much greater than housing tanking in 2014…who would have ever imagined. 🙂

Would you mind sharing what market is seeing these massive price reductions. I am seeing the opposite here in the South Bay. Anything priced accordingly sells very fast at market price. There is very little inventory and much demand.

Before any of the resident bears accuse me of proclaiming “housing will go up forever”, I have never claimed that once. Would I buy today given the chance? Probably not, but it depends on one’s situation. For those that can save considerable amounts of money (very few people), it makes sense to keep renting and saving. Housing prices will stay flat or decline, you will be rewarded for your patience. For those who can’t save any money (the vast majority), it might be in your best interest to buy. Rents are probably consuming a large portion of your take home pay and there is no guarantee of huge future price reductions for housing.

As we are witnessing first hand, the allure of the forbidden fruit is just too tempting for most to ignore…

“Jim, keep telling yourself that and you’ll feel better when you end up buying soon. You are house horny and getting impatient. The chances of you buying in 2014 are much greater than housing tanking in 2014…who would have ever imagined. :)”

Yes, we found out, not so long ago, that Jim is a youngster. They do tend to be less patient. I am not sure how Jim’s youth changes mathematics but hey who knows at this point…

“Would you mind sharing what market is seeing these massive price reductions. I am seeing the opposite here in the South Bay. Anything priced accordingly sells very fast at market price. There is very little inventory and much demand.”

Yes we KNOW!!! You live in the South Bay! WE GET IT!!! Your a genius!!! Okay is that what you want to hear?

“Before any of the resident bears accuse me of proclaiming “housing will go up foreverâ€, I have never claimed that once.”

We never said that you said that. You are known as the Rental Parody Parrot. Rental parity, rental parity bawk!!

“Would I buy today given the chance? Probably not, but it depends on one’s situation. For those that can save considerable amounts of money (very few people), it makes sense to keep renting and saving.”

Come on just say it!!! You are dying to say it. Rental parity, bawk…

“Housing prices will stay flat or decline, you will be rewarded for your patience. For those who can’t save any money (the vast majority), it might be in your best interest to buy.”

What about rental parity?

“Rents are probably consuming a large portion of your take home pay and there is no guarantee of huge future price reductions for housing.”

Come on are you telling me that like our current commander in chief can’t use the “R” word anymore you can’t use the “RP” bawk word anymore?

“As we are witnessing first hand, the allure of the forbidden fruit is just too tempting for most to ignore…”

Bawk!!!

Way to keep it real, What? Good stuff!

“it might be in your best interest to buy. Rents are probably consuming a large portion of your take home pay”

not here in southern California, there’s a house for sale by my office (looks like a flip) for $630K and the area is nothing special by a long shot, assume a 10% D.P. you’re looking at about a ~$3500 mortgage payment, income to qualify ~$180K (how is it that on the internet everyone seems to earn about $200K or greater and yet I’ve never meet anyone in my life at that income level, weird, but i digress) but i can rent a house one street over for $2200.

never mind that i can’t even afford the $2200 rent the disconnect between what people earn and what houses costs is startling.

my .02

Happy – how do you get to a $3500 mortgage? Last week I pointed out that a 4.002% 30 yr fixed mortgage is available. That’s $2406. (assuming 20% down and thus the loan is 504k – a jumbo) Estimate that taxes would be just shy of 600/mo.

I would think that a lot of folks would choose $3k/mo for ownership vs $2.2k/mo to rent the same property. I guess all that I can say is that I would, assuming no other extenuating circumstances, like the fear of the market collapsing, or needing to move, losing my job, etc.

By buying of course you lose the opportunity to invest the down payment elsewhere, but in terms of monthly expenses you’re going to come out very close after the income tax savings are factored in. Sure, there are many other factors to consider as well, but financially, if somebody has the down payment, owning is compelling even at that price IMO.

I have put my money where my mouth is. With the exception of one job stint from 2010-2011, I have always been an owner rather than a renter, even when that meant the mortgage payment was a bit of a stretch for me.

Jeff – the tax savings talking point often overlooks how dynamic tax situations can be. Folks are paying a lot less in interest these days due to the low rates. This makes the play against the standard deduction for most people less attractive because there’s less interest to add up at the end of the year.

At least you admit being biased toward the ownership perspective since a one year rental stint really doesn’t afford much experience.

@jeff wrote: “…assuming 20% down and thus the loan is 504k…”

A $126K down payment? Real estate shills are deeply amusing.

The average American saves less than $100 per month. The top 15% manage to save at least $500 per month. For those in the top 15% of savers, it will take a mere 20 years to scrounge together that $125K down payment you suggest.

Market is still hot around here… It slowed down a bit, but multiple offers as well as a couple of days on the market is still commonplace for homes that are “priced right”, though I start to see more homes sitting with no offers even with price reductions…

Right you are, Jimmy.

July home prices down 2.4%, sales down 3.1%

http://dsnews.com/news/08-15-2014/home-sales-decline-first-time-five-months

發生了什麼事,以所有的ä¸åœ‹å¯Œäºº

FÄshÄ“ngle shénme shì, yÇ suÇ’yÇ’u de zhÅngguó fù rén

I don’t know what that means

Our friend Google Translate claims it’s: “What happened to all of China’s wealthy”

I’m curious if that is close to what What? was trying to convey…

The target of the message understands…

Leave it to an apocalyptic scientist to decipher the hidden message. Of course it lost a little in translation but that is part of the fun…

Watts will be the new Paris before Compton don’t cha think?

Dr hb you are hilarious ! Luv it!

“WOW, WOW, WOW!!!***STANDARD SALE*********AWESOME OPEN FLOOR PLAN!”

Great opening sales line, all in caps. So glad they used the word ‘awesome’ in their description for 3 beds, 1 bath, 1,202 square feet in Paramount.

It’s a bittersweet move but I’m throwing in the towel and moving to the Southeast next month. We have a 2000 sqft home under contract with great public schools for $200K. I’m looking forward to having discretionary income again. The Chinese can have Torrance.

I do think the Socal market will eventually decline but can’t afford to wait around to find out.

The economy will most likely decline before the housing market so probably no real value in waiting around…

I’m really enjoying the SE. I never thought I would find an a place that I thought was better than CA but its actually really nice here. My property taxes on a 3BR come out to about 50 bucks a month and includes trash. Don’t tell the rest of them, we don’t want to ruin it. (actually I’ve been surprised at how many CA refugees I’ve met here.)

@IPFreely ….West of Boise, Idaho is booming with residential construction in anticipation of more Cali refugees. Meridian was the 10th fastest growing city in the USA last year. Moving to Idaho from Cali is like a half price sale on energy costs, insurance , taxes and housing. Irrigation cost for water is FREE .

The only caveat : Liberals are encouraged NOT to apply for Idaho citizenship.

When I was a kid I went down to Bell Gardens to visit my Uncle at his Wife’s Brother’s place in Bell Gardens. It was an apartment opening up onto the street. (My Uncle came out to see all of us from NYC. He referred to our hill in Highland Park as a mountain.) I remember thinking how glad I was that I didn’t live around there. So if Highland Park was more desirable than Bell Gardens back in the ’50s, just think about it today! Why Highland Park ACTUALLY borders Pasadena! That home of the hip.

https://www.redfin.com/CA/Compton/2409-E-124th-St-90222/home/7347504

Crack Shack or Compton Mansion?

Did you know that hoe cakes are really a pan cake cooked on a hoe over a fire? I thought they were cakes that ho’s ate…

Nearly half an acre. Worth every penny in the land of milk and honey.

I looked up maps of neighborhoods in northeast LA, and now there are several conflicting ones out there. Four neighborhoods have appeared on some of them that were never listed as neighborhoods back when I was there. on one map there were the following:

Montecito Heights, Monterey Hills, Sycamore Grove and Hermon. The last one is where I grew up.

When I was a kid, there was a street named Hermon Ave. It no longer exists, having been renamed Via Marisol at the request of Councilman Art Snyder. The area served by the Hermon Ave freeway exit was sometimes known as the Hermon District, but was always considered a subdistrict of Highland Park. Monterey Hills was the name of the (mostly) empty space above the Hermon district, stretching east of Monterey Road down to El Sereno. Depending on which elementary school you went to, it would either be in Highland Park (Hermon District) or El Sereno. Sycamore Grove was a park along N. Figueroa, in between Cypress Park and Highland Park. Again, I assume elementary school boundaries would make a difference which you were called. Loreto St School would’ve been Cypress Park. That school was where they sent kids that were a problem for the district. I don’t recall the name Montecito being used back then, but most of it would’ve been either the unbuilt parts of the Hermon District of Highland Park west of Monterey Road, El Sereno or Lincoln Heights. The name may have been used in Lincoln Heights and El Sereno, but as I never lived in those places, I wouldn’t know.

A recent article in the LA Times on line was listing a lot of neighborhood complaints about an LA Times neighborhood map that screwed up a lot of neighborhoods, e.g. putting part of Koreatown in Hancock Park, and assigning Highland Park houses south of Ave 50 to Mt Washington (which only starts where the hill rises from the flatter areas).

There is a street in Highland Park that is the steepest one in LA. It starts at the bottom and goes straight up the side of the hill but never connects to the street winding around Mt Washington. So community-wise, it really is more a part of Highland Park, since that is where it starts, and it is not a through street. People may wish to live in the “nicer” neighborhood” of Mt Washington, but that doesn’t make it so.

Ah Eldred street. A few years ago my wife and I did a lame “steepest streets in LA” impromptu driving tour (slow afternoon, OK?). Anyway, this street was genuinely impressive – scary to turn around on for fear of rolling, I think we had to back down until we found an open driveway. Fun times in LALA land.

Another example to support doc’s observations:

Not the best neighborhood, and not in the worst neighborhood in Lawndale. It’s on extremely busy street during peak time. Not a bad size house.

Bought for $475k

Listing after upgrades for $675K

Not bad after the recent $24k reduction.

http://www.redfin.com/CA/Lawndale/15611-Prairie-Ave-90260/home/23042920

I find the first paragraph of the “Flipping in Paramount” section very entertaining. Well done DHB!

Is it racist or good judgement to fear dangerous neighborhoods?

Living near South Pasadena I see newer Highland park homes that appear to be a good deal. But when watching the local news Highland Park always has shootings and an awful LAUSD school system. There are even parts of NW Pasadena that are crime ridden.

I personally don’t care what nationality my neighbors are. I do care about noise, crime, graffiti, general upkeep of homes and buildings, parks, schools, etc.

“I do care about noise, crime, graffiti, general upkeep of homes and buildings, parks, schools, etc.” In shopping for a home it is common sense to consider the above, racism plays no part.

If you as a buyer consider only a white neighborhood even though the development is not maintained and dismiss a neighborhood well maintained but is by-racial, I fell sorry for you.

Landlord…”Oh yes, and the realtor wasn’t very informed.” Sounds like par for the course?

Sat. made my weekend trek fro resale’s and new homes. Sat. was resale day, 5 open house told by agents very little traffic, all 5 homes on market avg 119 days, none had price reductions.

New homes today, but I have to keep going further out and even then sales appear stagnate. Many options now standard some price reductions for quick closing, I have been finding, no question qualifying is the huge issue.

Buyers meet some elements, but in general the whole package of credit, down payment, cash reserve, minimum salary requirement is the death for sales new or resale.

here’s a novel way to stay afloat and make property values rise as well.

“Studies show that bulldozing distressed properties reduces foreclosure rates in the surrounding neighborhoods and can improve the values of nearby homes. An analysis conducted for the Western Reserve Land Conservancy found that demolishing 6,000 homes in and around Cleveland between 2009 and 2013 helped slow the fall in property values, generating a net benefit in retained property values of $1.40 for every dollar spent on demolition.”

http://www.nytimes.com/2014/08/17/business/in-a-bank-settlement-dont-forget-the-bulldozers.html?_r=0

So, how about to bulldoze half of the existing home, it should increase the value of the remaining homes by 100%. Plus, we will increase rent demand by 100%. Win-win to everyone… Or better off, lets demolish all of the existing housing… even better

But the rich Chinese will save us! Whoops, never mind… http://www.marketwatch.com/story/china-officials-dump-luxury-homes-amid-crackdown-2014-08-17?link=MW_latest_news

ç¾Žåœ‹å®£å‚³ã€‚æˆ‘å€‘æœ‰è¶³å¤ çš„ç¾Žåœ“ã€‚

MÄ›iguó xuÄnchuán. WÇ’men yÇ’u zúgòu dì mÄ›iyuán.

What?, would you mind to post the translation along, too lazy to use G Translator…

Surely this won’t have any knock-on effects in other markets. I’m sure the Chinese home buyers’ buckets of money will continue to overfloweth in SoCal.

That’s sarcasm by the way.

For a fantastic free education on the Chinese economy, visit http://blog.mpettis.com/

That’s a reasonable interpretation, KR…rich Chinese governmental officials are worried about conspicuous consumption at home might lead to corruption charges. Why not bring those funds here to the states instead?

這是一個å‰å¤§çš„想法

Zhè shì yīgè wěidà de xiǎngfǎ

Oh common, I cannot read Chinese…

“Oh common, I cannot read Chinese…”

時間å¸ç¿’

ShÃjiÄn xuéxÃ

Although California home prices dipped from June to July, I just heard a radio commercial on KFI-AM in which Tim Conway burbled, “Home prices continue to rise!”

Conway then announced the advantages of upgrading your home, and promoted a company that will upgrade it for you, and that financing is available.

So despite the information on this blog, the mainstream media continues to trumpet a housing rebound.

真的

Zhēn de

I remember the same type of advertisements on talk radio leading up to 2008. I also remember similar advertisement hyping for the IT industry leading up to the dot com crash. Not claiming that the same thing will happen in this case but the correlation is difficult to ignore. It’s as if talk radio pundits hocking the hype du jour are a good barometer for what’s to come.

After visiting new and resale’s over the weekend, it is very evident that the Fed will probably move to creative loan programs to maybe kick start housing this fall, probably won’t make a difference.

Very few folks looking and even fewer expressing a desire to buy even if they can afford it, seems nobody trust the economy and this administration to do the right move to change it around.

So I’m just wondering what happens to home prices when demand for 30 year mortgage’s drop?

Which they did 38% to date do to cash and Institutional buyers!

Leave a Reply to a guy from Seattle