Orange County home prices near all-time high levels: Inventory rising and looking at inflection points.

I’ve been tracking data throughout the Southland for well over a decade. The most expensive county in SoCal is Orange County. Home to the Real Housewives of Orange County and regular guest on flip this house shows. Inventory has been rising strongly in Orange County for the last year. It is hard to tell when inflection points hit but the same capitulation and language I’m hearing today is similar to what was being said in 2006 and 2007. Keep in mind everything looked great on paper in 2007: low unemployment rate, record house prices, and a peaking stock market. People were buying saying “it seems like we reached a new plateau.â€Â The same trend is hitting the market today. The median price of a home in Orange County is only 7 percent off the all-time high reached in 2007. The peak price was reached in June of 2007 and we are inching closer to that point. Sure we don’t have those insane toxic loans but we do have maximum leverage courtesy of low rates. We also have foreign money in the market at levels never seen. Once again, this is uncharted territory. It might be worth looking at some history.

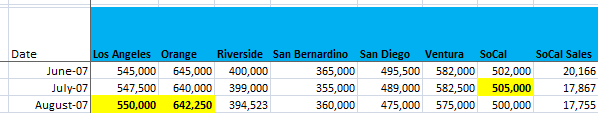

Peak OCÂ Â

The headlines continue to trend well for housing:

“Home values continue to go upâ€

“Sales are upâ€

“Price near all-time highsâ€

What is problematic is that the homeownership rate continues to fall and is near a generational low. A lot of the current momentum is simply built on the back of years of investor buying and now that they got their fill, the late party arrivers are trying to get a piece of the action.  It was also built in a market with suppressed inventory. Let us first look at the previous all-time high:

The previous peak was reached in June of 2007 when the median home price in Orange County hit $645,000. At the time this figure seemed insane to some because of what households were earning but for the most part, the status quo was that prices made sense (headlines in the media always get it right). Well guess what? Local household incomes haven’t increased all that much since 2007, certainly not to justify some of the prices we are seeing. In places like Irvine, you have massive sales volume going to foreign investors.

There are a couple of leading indicators as to a changing housing market:

-Rising inventories

-Slowing price gains

-And sales dropping

The first two items are happening. Inventory is up sharply:

Source: Â Redfin

This is the biggest leap since the housing bubble first burst. Price gains are moderating. Yet sales are up year-over-year meaning this still has momentum. We still have momentum because of the frothy six-year bull run in stocks. It is no surprise that having a weak stock market year is already showing that real estate relies on hot money, especially in this current market. Keep in mind the stock market is merely moving sideways – we have yet to even experience a moderate correction. Since 2009 the S&P 500 is up 207 percent.

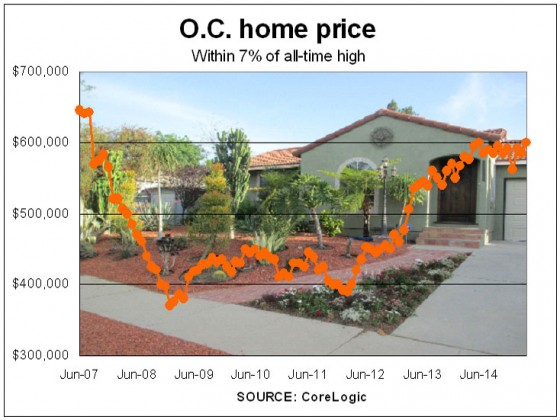

Look at the price history for Orange County:

Source: Â OC Register

After hitting the peak in June of 2007, prices reversed quickly. By January of 2009 the median price in Orange County was at $370,000. Of course people blame toxic mortgages but it is worth nothing that the majority of foreclosures happened on traditional 30-year fixed rate mortgages where people simply couldn’t make their monthly payments. There is a foreclosure graveyard that people are easily forgetting and some think that buying a home absolves you of that 30-year mortgage requiring monthly cash flow.

Just look at the latest Census data:

Median household income for Orange County

2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $75,422

2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $71,601

So while OC home prices made the climb from $370,000 from early 2009 to $629,500 (it dipped last month to $615,000) the typical OC household income saw their income go up by $3,821 over a longer stretch between 2007 and 2013. And this is for the most expensive county in SoCal. And then you wonder why we have rental Armageddon, adult kids moving back home, and people living with roommates well into their 30s and 40s.

Sales are being driven by investors, foreign buyers, flippers, and now capitulating households stretching their budgets to the max and leveraging everything they can with low interest rates. People are chasing the headlines and are forgetting that SoCal does things big – we boom and bust big. There is no moderation here.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “Orange County home prices near all-time high levels: Inventory rising and looking at inflection points.”

Are the majority of foreigners Canadian and Chinese or maybe Russian.Well,the commodity complex has had an increase of 100%since 2014 in their CDSs,suggesting bankruptcy-so making life difficult for the commodity producing countries.China has a visible problem with exports,the cost of shipping a container is down,suggesting the boom of China may be over for now.So will these new cash buyers or worse mortgagees fail and default?If nor then go short the CDSs of the commodity complex although you will need lots of luck.

Homes in OC may be overvalued but not like homes in Toronto, Canada. Now that oil prices have been decimated, with lots of job losses in Western and less energy business for the finance sector in Toronto, let’s see what happens to Toronto real estate. I think it is safe to say that it has stopped going up. But will it go down and by how much is the question.

That’s a 5% increase in the median income, but during that time inflation has been at least 15% using official figures (and more than that if you don’t trust the official figures). So hardly any raise in incomes, but everything people are buying is costing more.

As of right now…Dow is close to dipping below 17k, Nasdaq is below 5k, and S&P is almost below 2k.

The math is the math is the math is the math. No thing for the FED to buy if they try more QE. No new mortgages and government spending is relatively tame and a GOP congress is not going to enable a Democratic Presidents largesse in an election year. FED has to raise rates to tank the markets and pop Housing Bubble 2.0 so they have something to buy. Lower home prices will equal more mortgage debt (volume trumps price) and another recession will open up Washington to more stimulative spending. This is the reason I’d be suprised if we don’t have liftoff in September. It’s purely to try and front run the next downturn and open up the opportunity for more easing later.

I can tell you this from my own view

2015 was the biggest median down payment home buyer profile I have had in 16 years in the O.C.

Sellers aren’t really bugging as much as their own equity model doesn’t allow them to. What I mean is that they need to sell at a certain price to make it worth it to them.

My Parents in Nellie Gail Ranch is one of those people as they have been trying to sell their 2,000,000 home for 6 months now but their next door neighbors sold for 2.5 and 2.45 million

Read the internal story with housing and you can see that there is story line of demand trouble

For example, all this talk about how new home sales are great this year.

We have had 3 straight lower revisions for new homes and if we get another soft new home sale report

That will be this is the 3rd straight year where new home sales have missed their sales estimate

Charts I have here are very telling and the report from Wells Fargo as well

http://loganmohtashami.com/2015/08/19/new-home-sales-need-a-strong-total-report/

Hi Logan, how can someone find out what new buyers are putting down as a down payment? Does the Fed or any other federal agency keep track of that data? How can I find out that data for my home city of Chicago? It would be interesting to see what buyers are putting down this time around compared to the bubble years from 2002 to 2006.

Yes, there is data out there and I believe the avg down payment is much lower now than it was 3 years ago, and getting lower each year.

There is a chart & data line out there for that.

My clients median down payment this year has been 41.6% which was a big difference from last year where it was a clear range of 5% -10%

Move up buyers, investors, gift down down-payment.

It is amusing to see all those that claim that the game is rigged somehow presume to know what TPTB are thinking. More to the point, why in the world would these people care about some piece of shit house in the South Bay or some other junk house across the USA? If you look at the data, most of THEIR money is tied up in financial wealth – stocks, bonds, and businesses and not some cardboard house. This is the power base.

I do agree that emotion is a big part of buying. It would be a good assumption to say many that have bought even knowing prices were high were emasculated men trying to appease the wife. Just look at the Canadian house flipper shows. Most of the men seemed less enthusiastic for buying yet the wife has some serious nesting syndrome going around. It would appear there is a large amount of that sentiment going around. In some Chinese cities women won’t even date men if they don’t own property.

But guess what? This shit happened last time and the TPTB couldn’t control home prices falling. You even see massive market intervention in China failing and you have no larger economy where the central powers have more of a say.

Since 2009, O.C. median home price increased 70%, but median income only increases by 5%. Nope, no problem here…

Expecting to see a lot of high-end garage sales after this market cools off.

Sometimes the simplest data is the best. People are trying to justify these prices any which way they can, but the prices just don’t make sense. Some of the fundamentals are different between the last bubble and this one…but in both cases, wage growth didn’t justify the insane price increases.

Just because you’re afraid of being priced out forever, so you spend all of your savings on a down payment, and squeeze into the most expensive thing you can, leaving you no savings, and no ability to save in the future. You’re one economic downturn from disaster.

Agreed. At the end of the day, wages don’t justify the real estate prices in these West Coast cities. Sure, one can go out and spend all of their savings a squeak in with a loan for some of these overpriced places, but that doesn’t mean it’s smart.

It is market distortion through intervention that is propping up these housing prices. They did this to rescue the banks that made risky bets on mortgages. They should have just let the banks fail so that better managed businesses could flourish. Instead, they have propped up the prices with ZIRP instead of letting the market take care of things.

I wonder if some of the price increases are from boomerang buyers. These are the people whose homes were foreclosed on in 2006 through 2010. Starting in 2013 many now have the credit event wiped off of their FICO score calculator. Just in time to buy at another peak?

https://finance.yahoo.com/news/boomerang-home-buyers-poised-return-market-roar-084957915–finance.html

And they’ve since saved up a down payment?

Nathan….the article about the boomberang buyer says they qualified for a FHA loan with only 3.5% down. FHA has been very lenient on qualifying people who have bad credit but are working on improving their credit score.

The article says…

“About 700,000 of the 7.3 million homeowners who went through foreclosure or short sales like Cooley-Guys’ during the bust have the potential to get a mortgage again this year, said Daren Blomquist, vice president of Realty Trac. That compares to the 3 million people overall who got a mortgage between October 2013 and September 2014.”

Have the POTENTIAL to get a mortgage. The article is about a single person. It tells us nothing about the impact boomerang buyers are causing.

I wonder the same thing. Also, I don’t think lending standards are that stringent. I was approved for a home price more than six times my annual income. I was shocked to be approved for that much. Granted I have no debt in my name – car is paid for, no student debt anymore – but still…six times my income?

I also have a friend who got an ARM on her first home, and no, she’s not a savvy investor with a strategy.

Keep dreaming my friend, keep dreaming. I used to think like you. I read all of the data, did fundamental analysis like a Warren Buffet wannabe. Then made the same conclusions like you and Doctor Housing Bubble’s minions. Then one day the light bulb went on and I realized the banks, hedge funds, the federal government, The Fed, etc. all play by a different set of rules. The game is rigged. We live in a 1984 type of world.

The dynamic has changed quite a bit between 2007 and 2015.

2007: No down liar loans are the norm. Interest rates near 6%.

2015: Large downs/all cash is the norm. Interest rates under 4%.

Add to the fact we’ve had plenty of inflation during the last 8 years and almost NO new construction. You guys are smart enough to realize the median 75K OC income stands no chance to buy a median priced 600K + OC home. 75K is truly low/middle class for OC. The low/middle class has gotten utterly destroyed over the past 8 years. The real question is what is the median income for people buying OC homes…I would guess it is much greater than 75K. The divide grows every day in this country. To think places like Orange County, CA will be affordable for the middle class in the near future is a pipe dream!

There is some ways to still get in on the cheap. I know a family that makes $75k a year and are buying a new $300k home for 3.5% down ($10k). They did have a bad FICO score and could not qualify for a house loan because of some credit card delinquencies 5 or 6 years ago. They hired a lawyer to fix this issues a few months ago and now they have a good credit score again or at least good enough to qualify for a 3.5% down payment loan from FHA. 🙂

@ Lord Blankfein:

O.C. has many, many crappy areas and a few nice areas, not so dissimilar to L.A. Granted, the crappy areas in O.C. are often nicer than crappy areas in L.A., but they’re crappy nonetheless. Houses in nicer areas such as Yorba Linda, Anaheim Hills, some areas of Brea, Newport Beach (and other coastal areas), and south county might hold their value better than houses in Stanton or La Habra. But all houses will lose value in the event of an economic downturn, as was demonstrated in 2009-2012. I’ve seen more than one single family home in Newport Beach in 2011 that sold for around $600k-$700k, now selling for $1.2M+. Although there has obviously been inflation since 2011, there hasn’t been 50% inflation!

I just don’t see the logic that just because people bought houses with large down payments or “cash†(cash being probably just another loan type), that house prices can’t or won’t collapse. House prices are probably just as prone to collapse as last time around. I really don’t think it matters to a significant extent how people financed the house, or how much of a down payment they had.

There have historically been so many boom and bust cycles in CA real estate that it’s hard to argue this time is different. It’s probably not different this time.

What’s funny is, some of those houses in Newport Beach, on the Peninsula, are tiny narrow shotgun type houses with no yard, probably originally just summer houses. I call ’em dog houses.

“Although there has obviously been inflation since 2011, there hasn’t been 50% inflation”

I meant 100%, not 50%.

at some point what people earn is going to matter again……i dunno when that will be but it will happen, eventually

Responder, all the no down liar loans stopping paying their mortgage or walked as soon as it hit the fan back in 2007. Renting was a much cheaper option than being tied to a sinking boat anchor house. I highly doubt that anybody who put 20% or more down recently is going to just walk away if prices go down. These people will likely hold on until the bitter end. And what is the alternative, renting? Rents have gone through the roof in the past 8 years.

I’m not saying prices won’t come down. I just don’t think we’ll have a repeat of 2007. Things are very different this time.

“To think places like Orange County, CA will be affordable for the middle class in the near future is a pipe dream!”

Nope. Probably far more poor than wealthy in OC. Anaheim, GG, Stanton, SA, etc. People doubling, tripling up. Working poor/welfare aren’t going anywhere. Their numbers are growing much faster than any “wealthy elite”. Homeless population exploding. Crime exploding. House fires, 10+ people in one apt displaced, people living in garages, etc. Let me guess…this will never come to “desirable hoods, they are insulated bubbles? The high prices will keep the “undesirables” out? My guess is it’s already happening. Grandma’s beach bungalow housing three generations, six roommates renting a 3 bedroom 700k OC suburban rancher. Five cars in the driveway, eight on the weekend. Landlord doesn’t care; house a complete gut remodel w/90’s era carpet, appliances. Tenants can trash it, as long as top $ rent is collected, who cares who sleeps there.

Maybe $15/hr minimum wage will help? Went into a SoCal branch of a bank recently; teller stations boarded up, only two huge silver machines with an employee who told me there are no more tellers. Businesses will lay off more people replaced by ‘bots, tech to save $. So much for $ that was going to help “working poor”, give them the means to buy a $400K pre-war stucco starter home in “gentrifying” South LA. Upside, more free time for shopping, dining out and trips to the beach/park to hang!

Perhaps global elite/celebrities/trust fund babies will buy, status quo maintained in your neck of the woods. Hope so because move up middle class buyers are evaporating. I think there might be interesting changes down the road for residents in “desirable” Teflon communities.

“No man is an island” – John Donne

You got it nailed. There’s a book called “Slum Planet” or “Planet Of Slums” or something …. imagine huge favalas, everywhere.

Of course the average mobil home park in Huntington Beach, Newport Beach, Corona del Mar, Laguna, etc if they’re close to the beach at all, flush directly into the ocean. I remember shitty old oil-worker shacks in Huntington Beach before it was Disneyfied.

The rise in crime is evident almost anywhere I go. Shootings seem to have made a comeback – it seems like the early 90’s once again in California. I thought the gang problem was solved, but it is coming back in a big way. A kid got stabbed to death by other students in a high school near my house. 4 fatal shootings in my town within the last 6 months. Saw a guy dealing drugs to cars passing on his street in an ok middle class neighborhood. I saw all this as a kid in the 90’s, it’s starts out small and seems contained until it explodes everywhere.

Those “all cash” purchases were made through low-interest loans taken out by hedge funds to set up REITs. When the value of their portfolios fall or a better investment opportunity arrives, their investors and creditors won’t idly stand by. Bad debt by any other name is just the same.

Sure, mortgage rates are lower now, but they’re most likely going up, especially if and when the Fed decides to tighten.

Orange County being affordable for the middle class in the near future is a pipe dream? I can understand a few select enclaves in OC being overpriced, but the entire county? I heard the same rationale back before the last bust in 2009.

2000: this time it’s different.

2007: it’s not a bubble because people (as opposed to investors) are buying RE to live in. This time it’s truly different.

2015: it’s not a bubble because investors are buying RE with cash (low interest loans). People are not getting toxic loans any more (if you ignore FHA loans).

Note how the rationales for bubble prices flip flopped between 2007 and 2015 to fit the agenda. The bubble has and always will be in the prices and not in the quality of the loans. In the end, people and corporations, can and will walk away from their underwater investments. As much as the media blamed subprime, plenty of prime mortgage loans went bad during the last bust.

“As much as the media blamed subprime, plenty of prime mortgage loans went bad during the last bust.”

This sounds very likely. I have a buddy who bought a $300k condo in 2007 with (I believe) $60k down, which was a lot of money for him at the time. There were various issues involved (including a jobless period), but the end result is that he short-sold the condo in 2009 or 2010 because there didn’t appear to be any hope that the price would recover and he could rent for less.

There is at least some anecdotal evidence that people will walk away from their investments in the event of a significant price decline, despite a (relatively) big down payment investment.

2007: it’s not a bubble because people (as opposed to investors) are buying RE to live in. This time it’s truly different.

2015: it’s not a bubble because investors are buying RE with cash (low interest loans). People are not getting toxic loans any more (if you ignore FHA loans).

Note how the rationales for bubble prices flip flopped between 2007 and 2015 to fit the agenda.

NO, I do not note that.

I note how YOU flipped the rationales. But I am not aware that YOUR 2007 rationale was ever voiced by others at the time. I certainly never heard anyone say it.

@Responder

It’s a very real phenomenon. Known as strategic defaulting, many decide to walk away form underwater loans when servicing the debt is no longer worth it. Here’s an article on Morgan Stanley, among many, walking away from their loans during the last bust: http://www.slate.com/articles/business/moneybox/2009/12/everyones_defaulting_why_dont_you.html

Those who think this time is different are either in denial or ignorant of the past.

Furthermore, unless real estate in Bubble area are rising, the holding costs compared to renting doesn’t make sense. Who will buy after 5, 7 years of stagnation for double what they can rent for?

There are always those who must sell, no matter what the market. Those who bought near the peak and put 20 percent might hang on but the majority of real estate was purchased much cheaper .

Son of landlord………

I remember very well that rationale from 2007.

@Martin

I recall a lunch time news story about the red hot southland RE market in 2005. It wasn’t a bubble because people bought houses to “live in”.

@Son of a Landlord

Brush up on your history before launching baseless accusations.

There are ebbs and flows to everything and real estate is no exception. With China and much of Europe soft right now I’m sure a lot of California real estate horny foreign nationals have hit the pause button.

The combination of comparative stability and nice weather will get a lot of mobile people looking to see if they can make it work.

The correct comparison is other cosmopolitan cities around the world not Des Moines or Atlanta. Those with money and mobility will vote with their feet and more and more we will become a State with the wealthy and the poor and not much of a Middle Class. I’ve seen several demographics charts that have shown how the middle has been withering. The last two administrations in Washington have been great for the wealthy and the poor. The Middle Class? Not so much.

If you like it here, it’s not going to get easier except on the margins. Stop praying for Great Recession II with your pious offering that “this time you won’t blow it”

Buy what you can afford and take on roommates, sell the BMW, and you might be eating Ramen and Mac ‘n Cheese for a few years, but we’ve all had to do that.

There’s no “silver platter” and no your not entitled.

If you think buying a home is So Cal is crazy, just try renting. I have been trying to find a place for 5 months. I am always told I came in second (as if that matters) to people who either, offer more than asking rent, give giant deposits, or offer multi year lease commitments with increases.

It is as if everyone came to the realization that owning is a stupid idea and will do anything to avoid it.

I pay my sister $500 a month in rent. I’ve got a roof over my head and food in the fridge. I travel anywhere in the world. My investments and bank accounts are fat. Sellers can keep their overpriced homes. I am comfortable never owning.

How’s the saying goes, something about how a stock portfolio never gets a busted toilet or a leaky roof, or an assessment for a new sidewalk out front?

I hope your investments pay enough to cover your housing expenses when you retire. The challenge is that we need to save enough to cover the last 20 years of your life, factoring in rent.

Unless, of course, you can stay with your sister until you’re 80. I don’t have that option, so I need to find something that will work for me later in life. 🙁 What if rents are really high in 2030? 2035? 2040? Move to the fly over country? Inland to the desert? No good options. 🙁

I’ve been in San Diego two months, getting a read on the RE market here. Of the 10-20 houses I’m looking at in the $800K-$1M range, several have had price drops in the last two weeks. One 2/1 Del Mar TH with ocean view, listed at $1.2M few months ago, just dropped price again from $950 to $919K, probably overpriced to begin with. Several others in Carmel Valley in the $850K range have had price drops of $10-25K. One in Del Mar Heights sold at $925K, $25K under asking. Although these are modest price drops, it appears the SD market is softening in this range. Probably going to wait 6 months or so before considering buying to see what’s happening with the US economy. I see deflation as a real threat as China devalues and oil sinks below $40/bbl- a pickup in Asian sellers who bought as investments, and a stock market correction beginning in the energy sector as corporate defaults rise, and spreading to the finance sector as mortgage defaults rise. Anyone taking on LT debt now, paying fixed payments on depreciating assets, is going to take a bath in the near future.

Seeing similar stuff in the OC in the same price range. A few people are biting…but for each house that sells, there are 10 sitting.

There’s something in the air that feels like it did back in 2006-2007, when the market was topping. Numbers can be spun every which way depending on who is reporting them. But, remember the market is all about perception and it changes fast. There are too many negatives pushing against home prices now Chinese stock meltdown, US stock market meltdown, Worldwide stock market meltdown, Home price resistance, Job layoffs, Race to the bottom for the devaluation of currencies, and the Fedspeak is getting long in the tooth.

I too believe we have arrived at the tipping point.

http://www.westsideremeltdown.blogspot.com

http://www.westsideremeltdown.blogspot.com

There will be job losses, stock market will head down for sure. NO way this La-la-la can go on forever.. and once again main street gets screwed.

If you think that the collapsed in oil will have no repercussions in jobs and stocks you are dreaming.

Add china, and Europe… This economic trend that on the up up is not sustainable.

Looks like a trickle down on the listings, inventory for lower end is still very low, while the higher end has larger supply and price decreases. I’m seeing numerous year over 10% increases throughout a majority of San Diego neighborhoods.

In my old beach hood, vast majority of the pop over 55, bought their houses/rental properties before Clinton was President. Also a never ending churn of renters. Very few seemed to actually buy. No world class elite; a few new money types, RE hustlers, a few firefighters. One neighbor loved to tell anyone he could corner how he bought his place from a 70’s era TV actor. Few under 50 knew who he was talking about, would politely nod until they could get away, but the guy just loved his “celebrity connection”.

Hopefully wealthy Chinese with money suitcases/global elite will buy these places when they eventually do hit the market, because I’ll bet many offspring of these owners can’t afford to keep these homes with their own salaries/savings. And the pool of people in SoCal who can qualify to buy them is very, very small.

For all of you folks dreaming of another housing bubble popping- KEEP DREAMING. Folks, where have you guys and gals been in the last nine years? Right in front of your eyes you saw what happened. First, the banks and investment houses got bailed out with your money. Second, the federal government and The Fed took unprecedented actions to prevent housing prices from falling any further. In other words, just like in chess, you thought The Fed, federal government, big banks, etc. are cornered. But then they just make up more chess spaces out of thin air to play with. God only knows what else they will come up with if we do have a second economic downturn.

In other words, the game is rigged. Get used to it.

And all the unprecedented actions are USED UP. There’s nothing else than can do now to prevent prices from crashing. This time WILL be different. It will be ugly…maybe even uglier than the last one.

People are paying more and more for housing, and when the economy REALLY starts sliding…a lot of people who are in up to the ears in mortgages and other debt…they’re going to be screwed.

It’s not THAT different than last time.

In a democracy, even in many dictatorships, majority rules. Democratic oligarchies and dictators can maintain dominance only until popular discontent reaches critical mass. Then they must give in to survive.

If a coming real estate crash is big enough, tens of millions of people might refuse to leave their houses without a fight. The powers that be might feel compelled to grant mortgage forgiveness, resulting in free houses for those who over-extended. Toss in student loan forgiveness while they’re at it.

Then they’ll bail out the banks with free money, and inflate the govt out of debt. The savers and the frugal will be left paying for everyone.

Look at all the people who defaulted on their mortgages, then lived rent-free for several years. Look at all the squatters and people on rent control.

In our system, it’s the responsible people — the savers and the frugal — who end up subsidizing the rich, the poor, and the deadbeats.

I agree. If ZIRP was the end all and be all of economic policies, the Fed would have not waited until the greatest recession since the Great Depression hit to enact it. On the contrary, ZIRP has encouraged record mal-investments in the forms of tech bubble, stock market, and real estate bubbles.

The Fed wants to tighten becomes it fears that they won’t have any resources left to deal with the inevitable downturn. Even now, crashing commodity prices are signs of market forces exerting themselves against the Fed’s efforts to artificially create inflation.

** Reply to Nathan 118**

Nathan 118 you said all available options are used up. Do you honestly believe that if we have a serious downturn that they will just sit on the sidelines and allow the vicious vagaries of free markets to take their course? Of course not. They will step in and do whatever it takes, both conventional and non-conventional to stem the tide of a deflationary collapse. The Federal Reserve and their band of crony capitalist can make up the rules, laws and regulations depending on what benefits them. The random vagaries of the free market on the other hand, is for us little peons to experience, not for them. The profits are private and if any losses occur, they will be socialized, just like during the last financial downturn in 2008.

They’ll be dragged out and slapped about imo.

Younger people are pissed off. Very pissed off.

SOAL, cling on to your fantasies.

I agree, I don’t think the Fed or USGov has the ammunition to do anything. If a rise in interest rates to .35% is scaring the shit out of the stock market, there isn’t really much room to lower further. If $4 trillion in bonds didn’t create a huge boom, then I don’t know what could.

Deflation is just what we need and we might just get it this time. Imagine going into a recession and commodity prices actually falling rather than shooting through the roof like the last go around! Imagine things you need to spend money on getting LESS expensive!

I think most intelligent people are aware that the game is rigged (it undoubtedly always has been). However, that doesn’t mean there aren’t opportunities here and there, such as the previous housing bubble. Who’s to say that housing wont tank again before the government and banks have a chance to collude to “fix” the problem?

Also, maybe the government and big banks might decide one day that lower real estate prices might boost retail sales, thereby yielding bigger profits to the banks and yielding more tax revenue.

It all seems like a big game; we just have to figure out how to play it, along with all the rule changes along the way. As for me, I’m just waiting around with my big down payment hoping that prices will deflate at least 20%. Maybe I’ll be waiting forever, who knows… But I really don’t think the current charade can be kept up forever, even with significant collusion between government and big business.

Will the current charade last forever? Definitely not.

Will the current charade last longer than most are willing to wait? Absolutely.

As I have said many times, you only get so many years on this planet. The number of years you are capable of buying a house is even less. Most people are not willing to wait for a decade or more in hopes of a correction. Home buying is much too emotional. I do not see this changing and will base my decisions on that.

Congratulations you chose the red pill

This is exactly what the powers that be want you to do…. step up to the table and play the game

You both have valid points (Responder and Lord B), even though you’re slightly disagreeing. You can wait it out and make a decision to buy low, AND you have to keep as much emotion out of it as you can. It’s a fine line.

I was basically resolved to rent for a few more years until I retired and then rent in various places or buy a house in a much less expensive place, but while I was waiting (and saving like a mofo, uh mofa), I started looking for a bargain in 2009. I found one in 2011 (bargains are very hard to find), and as late as the morning my offer was accepted, I was still willing to step back and continue renting if I didn’t get it.

I currently have a 40% equity cushion, but I’m not counting on that appreciation anyway — I’ve assumed for years that my retirement had to be funded from my 401K and after-tax investments, and have no particular need nor desire to sell. Actually, while doing my house hunting, I took great pains to ignore any thoughts about the house appreciating in value, as I didn’t want it to distract my decision-making process.

It’ll pop. Feds can’t control everything. And yes it’s rigged and there are bankers who will profit no matter what.

Look at the stocks. It just took a huge crap the other day. And it will continue to fall. The Real Estate Pop will follow.

Today I was listening to Ric Edelman’s financial advice radio show. He was promoting the economy, real estate, the stock market. Everything.

He said the recent downturn in stocks is no biggie. “What happens when stocks go up? They go back down! When happens when stocks go down? They go back up!”

Edelman was saying the stock market has had double digit increases these last few years — 10% to 18% up per year. In that context, this recent downturn is no big deal. Stocks will go right back up again.

Edelman was also saying that home builders are more enthusiastic than ever. New home starts are up. Real estate sales are up.

He said people are wrongly focusing on Puerto Rico, and the Yuan, and some other trivia that won’t much harm the U.S. economy. The stock market is psychological, and this incorrect focus caused people to doubt the market. But the market will rise again.

Edelman was extremely bullish on the economy.

I have no idea if he’s right or wrong.

Prices MUST be declining all over SoCal, if the listing I’m linking here is any indication. How is it that this spectacular house is listed for $1.6M while horrid little 800 sq ft shanties in less desirable areas are selling for $700,000?

Or did the L.A. Times make a mistake, and the price is really $11.6M? Or has the Hollywood Hill area suddenly become undesirable?

http://www.latimes.com/business/realestate/hot-property/la-fi-hotprop-fred-durst-20150820-story.html

You can cherry-pick all you want to show prices are decreasing – perhaps it is a lousy floorplan. And when a realtor says ‘jewel box’ I take that to mean it sits on a small lot… or some other undesirable aspects. The article says he purchased it last year for $1.5M. So, he is asking MORE than what he paid for it a year ago. Does that mean prices MUST be declining?

A recent LAT article from last week says LA home prices increased 5.5% year over year.

http://www.latimes.com/business/realestate/la-fi-july-home-prices-20150819-story.html

It is Fred Durst, that would knock off at least 25% for me.

I was looking at real estate in LA this past week and couldn’t believe my eyes at prices. Crappy areas and crappy houses in need of major renovations asking higher prices than SF Bay Area prices. $700K seemed to be a popular price for some reason. Mortgages in the $4K range for a 2 bed around 1000 sq. feet. Ouch.

If there is another housing decline it really should be more local than wide spread. Other cities that did not feel the boom should not suffer for a just a few cities big drops. the way the market appears to work is that everything goes up together and down together. I think that rational has to change to save other towns from being pillaged.

Here in Florida, I know of at least three people who have not paid their mortgage’s in years. They are not facing any sort of imminent foreclosure action and the only one’s hounding them for money are the local condo boards and HOAs who want their money. (FL law however makes it very hard for Condo’s or HOAs to do much)

Is the same thing happening in LA/OC? How aggressive or not are the banks being in kicking out delinquent note holders?

I’m single, self-employed and make close to six figures. But take deductions for tax reason and don’t qualify for a 600k loan.

So I can’t afford a house even with a $200k down payment.

@Andrew: I’m not sure where you live, but there are a lot of nice condos under 10 years old that you could buy for well under $500k in O.C. Many have crap school districts, but I’m assuming that doesn’t really matter to you. I would not buy now because I think the market is ridiculous, but that’s just me. So actually, I think you probably could afford a nice place to live if you wanted to. No reason to max yourself out at $600k, even if you could do it.

And I agree, various self employment-related tax deductions are a double-edged sword when it comes to qualifying for a loan. Otherwise, they are pretty nice.

For some reason, I don’t find condos attractive. Looking for a house with a nice yard and backyard. HOA fees don’t make it any easier.

The Stock Market just took a huge sh*t this money. Maybe, the pop is next?

#crossingmyfingers

My only regret is not taking more deductions. I would have more money saved up.

I think it’s a blessing in disguise. In a few years, those same mortgage lenders will be begging for your business.

I agree.

And if he keeps saving money, maybe HE can tell the begging lenders to stuff it, and get a great cash deal from a desperate seller.

That’s because it’s a hyperbubble. Wait for the crash.

Time to take a walk down Memory Lane:

https://www.youtube.com/watch?v=20n-cD8ERgs

Somebody even made rave dance video from clips from the commercial, it’s fantastic:

https://www.youtube.com/watch?v=mHs40zpN20o

i have that clip in my youtube favorites to remind myself to never let a fleamale tell me what to do. i wear the pants. happily single and MGTOW all the way

You say that now, but you haven’t met Suzanne

SUZANNE RESEARCHED THIS

WHAT?

THIS LISTING IS SPECIAL JOHN

Spent the greater part of my night trying to help my aging parents lower the zillow value of their home because it’s 40% higher than all their neighbors’ homes. It’s drawing unwanted attention and they don’t like it. prices have been increasing a lot recently and I don’t know if there are any buyers out there willing to jump at the opportunity to overpay this time around, vs 2005. Does anyone else have this issue with zillow or notice this trend?

I just took a look at Zillow estimate for my home.

I paid $470K in 2012, Zillow estimates $532K. But that is not accurate, similar homes to mine are selling for $600K these days. I thin Zillow is not over-estimating across the board, I think it is a house to house matter.

Here’s an insane listing for a duplex:

Aug 14, 2015 Listed (Active) $1,975,000

May 11, 2015 Sold (Public Records) $1,500,000

Jun 30, 2011 Sold (Public Records) $600,000

https://www.redfin.com/CA/Los-Angeles/840-S-Orange-Grove-Ave-90036/home/6914234

Someone bought a near 100% increase in 4 years….will anyone be stupid enough to buy a 300%+ increase in 4 years?

Or 200%….but pretty sure anything increasing hundreds of percents in a few years is not good….for the last fool anyways.

The listing has this line:

Drive by only, inside with accepted offer.

What does that mean? You can’t see the inside unless your offer is accepted? Wow.

The former secretary of labor examines California’s Proposition 13 and how it’s robbed the state of billions

http://www.salon.com/2015/08/22/reich_leveling_the_playing_field_for_all_businesses_will_make_the_california_economy_more_efficient_partner/

Meanwhile home prices are at all time highs and so are property tax collections.

Even if the housing market gave up 10-20% there are so many people sitting on the sidelines waiting to buy, they would jump in and bid prices right back up. Demand still outweighs supply, at least in LA. With the federal government insuring 90%+ of home mortgages and CA making a killing on reassessed property taxes, I find it hard to believe that anyone will let the music stop. Someone has to pay for that bullet train and Ipads for inner city youths.

If that was the case, then why did prices fall more than 20% during the last downturn? It wasn’t until the government and Fed stepped in that prices stopped falling. Even then, investors had gobble up a huge chunk of the inventory. I doubt that those investors want to be the last to sell or that buyers want to catch a falling knife. What other measures can the Fed and government enact should the current interventions fail? A healthy recovery requires qualified, income-based demand. As home ownership is at the lowest level in decades, not too many people jumped off the sidelines during this “recovery”.

Prince of Heck, they housing VI always see inexhaustible supply of buyers willing to snap up on slightest fall. Only thing you can do is wait for them to be proven wrong.

—

Real Estate Bubbles:

The manic phase of the boom lasts for several years. In the classic assets mania, markets outrun any rational valuation based on yield or cash return. Properties come to sell at absurd prices on the expectation they will appreciate to still more absurd prices. And they do. They defy gravity, moving from one lofty new high to another, month after month, year after year…. long enough to lure in otherwise prudent people to mortgaging their gains to reinvest in the inflated assets on margin.

Before the market can top, everyone who could conceivably be drawn in must have already become a buyer. And debt levels supporting the asset prices must be many times higher than any that could conceivably be serviced out of the cash flow yielded by the asset itself.

Then comes the bust. Just as everyone has come to count on the idea that the lofty asset valuations are permanent, there is a crash.

—

Markets are driven at the margin. They’re driven by people who have to buy or people who have to sell. So when you get to the point when there are people who must sell, and that will come, then prices fall across the board because not many people have to be forced to sell at a low price to push values down.

@GB

I believe that we are currently experiencing the very echo bubble that you are referring to. Prices fell as much as 30% in some areas but there was no capitulation before the government and Fed intervened. Instead of organic buyers, the institutional and international investors swept in and picked up the buying slack.

Nobody has mentioned Trump…..Obama is gone and we have someone in the WH that knows RE. You think its gonna get worse for housing? Not gonna happen. Want a house in the OC in a good neighborhood that is affordable? Check out 90620. California is nice and it will not be affordable to everyone in 20 years so get ur properties now because no more popping is coming.

Leave a Reply to Responder