Option ARM Borrower Psychology: The Dirty Truth behind the Worst Mortgage Product and Those that Abuse Them. My Name is Bob and I use Option ARMs.

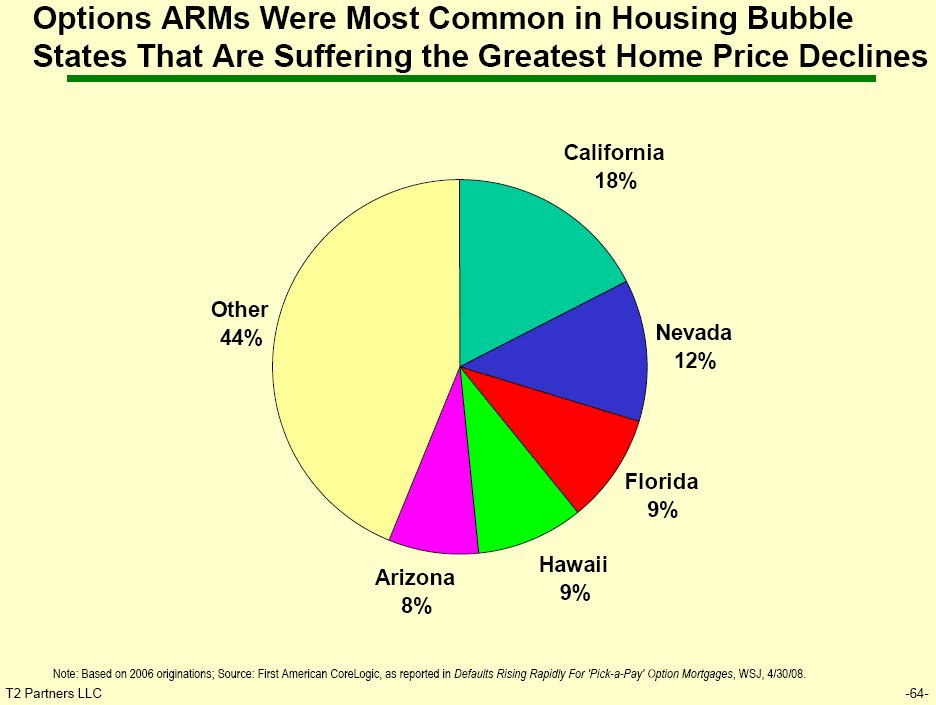

As we will soon painfully realize, Americans in all corners of the country will soon become extremely acquainted with the Alt-A and Option ARM terminology. These loans initially were thought to be much safer than those pesky subprime mortgages. You know, the loans that were made to low income families that supposedly set off financial Armageddon? Option ARMs are simply ticking financial time bombs. These loans are heavily concentrated in California and Florida. Other states have these useless and putrid mortgage products but the aftermath and damage will be deeply felt in both coastal states. If the country decides to create a “bad bank” (as if current banks were any good), then other states are going to get a delicious buffet of these exotic scorpions on a stick, otherwise known as Option ARMs.

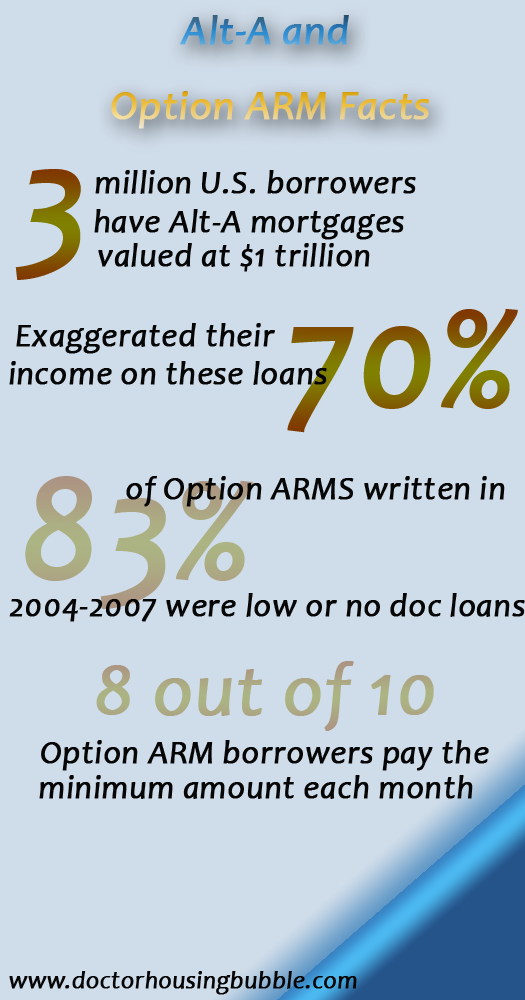

As the housing market bubble expanded like financial Jiffy Pop, lenders spurred by an insatiable appetite on Wall Street for mortgage securitizations (read the super Mortgage Birth Story) started pushing these once arcane and relatively unknown products. First, let us assess what we will be dealing with:

An Option ARM is simply an adjustable rate mortgage made to a “prime” borrower with various payment options. You need to remember that most subprime loans had high interest rates but most of the damage in that area has already passed. The borrower with an Option ARM can choose to pay the fully amortizing interest and principal, the full interest, or an incredibly low teaser rate in which the loan negatively amortizes. Guess which option the vast majority of borrowers opted for? With negative amortization, the incredible thing is the actual balance of the mortgage increased while the home price decreased! These loans were spawned in the delusional world where real estate prices never went down and gold flowed from the toilets installed in 3,000 square foot McMansions.

So now, not only are people with these loans massively underwater they now have a mortgage that has grown like a Chia Pet. How in the world did this mortgage garner so much fanfare? As I have been saying for a very long time, Option ARMs were simply a speculator product only viable in a real estate mania. That is, many of the borrowers never expected to live in their home forever and they would simply sell the home off to a greater fool before R-Day came along.

Now it would appear the media is highlighting much of what I have been saying regarding these loans. The Washington Post has an excellent article talking about the growing foreclosure crisis. What I like about the piece is that it shows that some people losing these homes were simply speculators and delusional about the expectations they had with real estate and not a sob story. I read the piece more as a study of the consumer psychology that permeated and infected bubble states like California and Florida. Let us take a look at the option ARM break down:

The article focuses on the Inland Empire:

“Of the 20 Zip codes with the highest share of underwater loans, seven are in California and four are in Riverside County, the vast exurb southeast of Los Angeles where the Bohnens live. Riverside’s unemployment rate has zoomed to 10 percent, well above the national average of 7.2 percent. About 94,200 people in the county are looking for work, many of them formerly employed in the real estate, banking and construction industries, according to the county’s economic development agency.”

The piece focuses on the Inland Empire, which has been ravaged like a hyena eating a carcass by the recent bubble bursting. Prices have cratered and unemployment has skyrocketed. These areas are the reason California will not see any housing bottom until 2011. These areas also had an incestuous relationship with housing. Big-ticket stores sold items to fill these big McMansions, paid realtors, lenders got their delicious cut, and all seemed glorious in housingland. Now that the golden calf of real estate is gone, these communities are realizing why it is simply wrong to rely on one industry for growth especially if that industry is in an epic bubble. The story does a good job highlighting the numbers by showing a couple of real world examples:

“The home to the left is listed for $699,900 and the other for $725,000. She and her husband owe $932,000 on their house, so they’re facing at least a $200,000 shortfall. That’s not what they expected when they bought their home two years ago. The economy looked good then, the housing market was still thriving and the house seemed like a steal. It was the cheapest available in the exclusive gated community that they had been eyeing for some time.”

So what do you really do here? Realistically, prices are going to come down even lower and lower in a limbo to the bottom. The problem arises when you anchor your belief in bubble world economics and now expect that prices will be rising in the future. They bought at the peak and as the article highlights, they both had jobs dependent on the housing market thriving. So now that the market has tanked, they are also facing the wrath of wage and salary deflation. The end game is here and Option Pac-Man has run out of real estate dots to eat. This is going on across the country but here in California, the concentration of Option ARMs has made the amount of money breathtaking. The story in the Inland Empire is playing out multiple times a day like a broken cuckoo clock:

“Now the Bohnens are tapped out. They missed their third mortgage payment yesterday and can barely keep up with their homeowner association dues. Their twins are in college and their 4-year-old in day care. They’re working with a housing counselor to try to modify their loan.”

Really, what can you do with a nearly $1 million loan? Their income is shrinking or stagnant while their mortgage payment is growing. Before you feel sorry, you will want to hear what is going on in the trenches:

“There’s this easy come, easy go mentality,” said Mike Novak-Smith, a real estate agent in Moreno Valley, a working-class part of the county. “Some people would rather hold onto their pickup truck or Mercedes than their homes.”

I’ve recently heard some Podcasts of the Dave Ramsey show. I have multiple shows I listen to but some of his stories revolve around people paying down their debt. And when I say pay down their debt, I mean everything. Typically, he’ll have a story about a family who paid off their $100,000 mortgage or someone who just wiped out $30,000 and do a radio celebration. He’ll ask how they did this and many times you’ll hear things like:

“I sold the boat.”

“We ate rice and beans for 5 years.”

“We ate out less.”

“I sold my luxury car and bought a used bucket.”

It is a simple lesson in frugality. Now, I usually smirk when I hear these stories because I compare them to the above case of someone moonwalking away from their home to spare the much needed Mercedes. The psychology of many here in California during the boom was that the avalanche of debt would never catch up to them. I still think that people don’t realize how big a $500,000 mortgage is (that was the peak median price of the state according to one data source). Now with prices half off, people think this is the bottom and will somehow come back up. They will not.

The troubling psychology behind this exposes what I have argued many times. Many are living in a silent depression and most Californians were all hat and no cattle. The fact that these people want to hold on to their luxury symbols is that most people probably believe that keeping the car would catch more eyeballs on the street. After all, how many people see your pad? A car will be seen when you go out, go to work, and visit friends. It is a perverted epidemic here in the state but the repo stats are showing that this too will pass. We are living in a financial 1984. Many that look rich are broke and drowning in payments. Debt is wealth.

Just to highlight how bad things are, here are more stats on the Inland Empire:

“In 2006, about 25 percent of Riverside County home buyers took out loans without making a down payment, according to SMR Research, which analyzes mortgage data. For those borrowers, Novak-Smith says, their loan payments are akin to rent: They essentially have no stake in their homes, which makes walking away easier.”

And this isn’t only to beat up on the Inland Empire. These loans found there way through the entire state of California. The fact that 25 percent of people made no down payment is simply stunning. That is, they have absolutely no skin in the game. Here is a new twist to the psychology of these borrowers; they view their loan payment as basically paying the rent. In fact, it is worse. At least when you sign a lease you can leave in a year if you like. With these underwater mortgages, the only way out is via foreclosure or forking over tens of thousands of dollars for someone to buy your home. Short-sales? Come on. From people I’ve talked to lenders did very little short-sales and the stats back this up. With little skin in the game including from lenders, many are choosing to take a hit on their credit score. Yet I would argue the majority actually have no money to make the new adjusted payment. They don’t have a choice. Oh, but the game isn’t over yet:

“I had one the other day and she’s telling me, ‘We’re going to buy this other house and let the one we’ve got go because it’s a money pit,” Clark said. “They have three homes, including a vacation home and rental property. . . . I keep telling people: ‘You signed a promissory note. You told the bank you’d pay it back. It’s like marriage. It’s for better or worse.”

Don’t you feel sorry for someone with 3 homes including a vacation home and rental property? One quick thing our government can do to stop this moral hazard from getting worse is revamping the title check system. Let us be honest. Most loans are now government backed and sponsored. As such, anyone looking to buy a home needs to have a deep title check and anyone with multiple homes or loans should be exempt from buying a new place with a government loan. Period. This is a perfect example. I would suspect the above scenario is with someone with still good credit. Keep in mind to make the teaser rate payment is easy. It is when the recast hits that the problems begin for these uber speculators. What they want to do is while their credit is pristine, buy another home at a rock bottom price and let their current home go back to the bank as a parting gift. Is this really what we had in mind when we think of the poor family struggling to make a loan payment?

I despise this scenario because it really keeps us from going forward with more sane policies. I think of a family in Ohio or Michigan, states that have been struggling for years and a family with a $70,000 or $80,000 mortgage on a modest home. The home may be worth $50,000 or $60,000 now. In these cases, the government can step in to help and it would only cost maybe $10,000 or $20,000. The above California scenario would cost $200,000 to $250,000 assuming we use the $1 million home. Is a family in California deserving of 20 or 25 times the help of someone in other states? I’d actually argue the family above should have their vacation home yanked to pay for their current home.

And government help especially in option ARM and Alt-A orgy states like California are a waste of time:

“Federal regulators recently held a one-day seminar in Riverside for troubled IndyMac customers interested in a loan modification. About 4,200 were invited. Only 250 showed up, half of whom probably will not qualify for a more affordable loan.”Â

Bwahaha! This is exactly what I have been talking about in my article moonwalking away from your home mortgage. The government is assuming these people actually want to stay in their home. They want to stay in their home as long as they make a profit. They are speculators. They are no better than the banks that made these insane loans. They married each other and now want others to suffer the ills of their mortgage divorce. That is why I am so disgusted by the $700 billion TARP and this notion of a bad bank that is now making the rounds. What I am for is cram-downs. These people with no skin in the game need to be held accountable just like banks. If a bad bank is set up, you can bet your skin that the vast amount of loans in terms of nominal value will come from California and Florida.

Many lenders are holding on to these toxic assets just anxiously waiting for that bad bank to get started so they can dump them off to you. That is right. You will own these loans. How does that make you feel?

Before you answer, we already can see that what we’ve been predicting is coming to light:

“Already, 24 percent of option ARMs were at least two months late in September, up from 5 percent a year ago, said Mahesh Swaminathan, a Credit Suisse mortgage strategist.”  Â

So much for blaming this entire mess on poor inner city subprime borrowers. That mess is largely over. We are now dealing with the mania and speculation of greed from borrowers and lenders on supposedly prime candidates. But you’ll love how people are rationalizing this entire thing:

“Did you know that the housing market was going to collapse?” she says to her husband. “Did you know I was going to lose my store? Did you know you were going to lose your job? Come on. There was no reason to believe any of this would happen. It’s not like we did anything impulsive. You’ve been doing this job for 10 years and making good money.”

“Twelve years,” he said. “It’s been 12 years.”

Just because you haven’t seen a black swan does not mean the world lacks this species. They did do something impulsive like running off to Vegas to get hitched by an Elvis impersonator. They bought and over leveraged themselves. No one told them to sign for a home that almost takes them into a 7-figure debt. They didn’t live prudently. You think having a million dollar home is a constitutional right? There were many legitimate and rational reasons to believe this was going to happen. Yet how can you argue with those blinded by the rose-colored glasses of greed and delusion manifested by their own pipe dreams of being mini Trumps? If they think things will be better soon, they can look at Japan who has seen virtually no growth in real estate prices for 20 years after their stock market and real estate crash. 12 years may actually be the time it takes for us to see California prices ramp up again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

36 Responses to “Option ARM Borrower Psychology: The Dirty Truth behind the Worst Mortgage Product and Those that Abuse Them. My Name is Bob and I use Option ARMs.”

Anyone with a high income that leveraged up because they really needed a 4k+ sq ft McMansion deserves what they get.

I do pretty well and bought a nice house. That said, I can afford my mortgage and taxes on less than half what I currently make. Financial stretching is for people who do not have a lot of money to start with. The number of wealthy people who stretch to buy a huge house so that most of it will be unused blows my mind.

The biggest deleveraging is going to be people’s attitudes about consumption.

DHB, good story. However, I have yet to see much movement in Newport Beach where I rent a house. I have been waiting foir the prices to come down, but they really haven’t. Not many sales but a few people continue to enter the market and are overpaying – -or at least that’s the expectation of many, including it seems, you. But when are the Newports going to come down, or are they relatively immune? I am not talking about the multi-million dollar Newport Coast properties. I’m in 92660. Is there any expectation on your part that we will see significant drops in the next year, down to even approaching semi-fundamental levels? Or are we many years away?

Your last sentence about Japan was what I was going to post until you mention it.

Plus, they had saving in the bank to help them out.

The United States saving was in their house and 401k. We are in big trouble in the next few years unless huge inflation comes back in 2011 to help pay for the government debt.

Another great one, DHB! In particular, I think your example of the Ohio/Michigan single-home family vs the California three-home family was spot-on.

Well done, as always!

Jim

I was just offered a loan modification by my lender IndyMac. Everyone i’ve showed it to says it is the most aggressive one they have seen to date. They have offered me 2.375 fixed for 5 years then in 2014, the rate goes to 4.375% and stays there for the remainder of the loan. it is also a 40 yr. loan. No money upfront, back pmts get put on the end of the loan and i don’t start making pmts again until 3/1/09. I haven’t made a pmt. since 8/1/09. Currently filing for BK and was undecided on keeping the house since i’m about 150k underwater with a ARM and HELOC. Did my loan full doc when i puchased it but then was laid off 3 years later and now found employment that is 1/3 less what i used to make. I live in California, work in the mortgage industry and am going to totally take this deal. I purchased my home in 2003 for 355,700 with 15% down, a year later added a HELOC of 77k which came in handy when i was laid off. So I owe now 278k on 1st with Indy and 77k on heloc.

http://www.guardian.co.uk/commentisfree/cifamerica/2009/jan/14/henry-paulson-portland-sports

My own private bail-out

After pushing for a $700bn bail-out for Wall Street

Henry Paulson wants Oregon residents to buy him a soccer stadium

Did you know that Henry Paulson would like the residents of Oregon to buy him and his son Merritt a soccer stadium and a baseball stadium in Portland, to the tune of 85 millions.

You see, Hank and Son own the Triple A baseball team and a soccer team, the Portland Timbers. Breathtaking arrogance.

Dr.HB is this why prices are still too high in the inland empire?

“Many lenders are holding on to these toxic assets just anxiously waiting for that bad bank to get started so they can dump them off to you. That is right. You will own these loans. How does that make you feel?”

Probably also explains why RealtyTrac shows thousands and thousands of foreclosures and only a few are on the MLS?

It made me mad when yahoos gambled up the prices to unsustainable levels. Now it makes me mad that prices are so sticky on the way down. It makes me tripple mad that tax payers will foot the bill for the couple buying a cheaper house and planning to walk on the bubble priced house. Lots of anger here, for sure.

Careergirl you are to be commended for deciding to keep paying and not just walk away.

@Careergirl:

You’ve not been making payments on your house since August and they’re cutting you a deal?

Careergirl,

How long did you haggle with them about this modification, if at all? Four months from the 1st missed payment to a mod offer seems fairly quick. Were there other offers or counter offers? Was this offer based on your current DTI ratio or just something they came up that would be more than they would make trying to resell the house for it’s current value in this current market if it went to foreclosure.

Also, did this change your loan in any other significant way, ie; make it recourse, or change it to include a pre-payment penalty?

We are all wondering…

J

In certain areas, there will always be premiums. In the likely case, it will be better to rent for 30 years and save your money than buy there. Newport is likely one of those places.

JMHO,

Chuck

I come to your site daily seeking insight into the current mess. Unfortunately I did not know about you and the others (Mish, Calculated Risk) or my life would be very different right now! You have been right about the unraveling, and I appreciate the perspective.

The post today is harsh. It does not take into account those of us who were just seeking a home of our own – and who bought into the idea that if we don’t get in now, we’ll be priced out forever. In addition the “experts” were telling us there was no bubble, and the real estate folks were convinced the market would hold. My mortgage broker “pushed” the 100% financing on an 5 year interest only ARM. (she would move me to a fixed loan in 2-3 years – and since I am in sales I saw this as a way for her to build a pipeline for future sales) I paid $812,000 in December of 2005. My Santa Ana, CA 92706 home built in 1951 @ 2200 feet is now worth $610,000 (per the Orange Co. Tax acessor).

I am NOT behind in my payments. However, my commission only income (I sell direct mail advertising) has decreased 50% over the last two years – after rising steadily over the years. I qualified for this mortage on my credit (score was at 789 range) and by showing substantial income over 5 years of 1099 statements.

My loan resets in 2010. I am scared to death. This situation is rapidly destroying my life. I made a terrible mistake and it consumes me daily.

I drive a 1999 Jeep that has 118,000 miles and is paid off. I have no vacation home or rental property. In fact, I haven’t taken a vacation in 3 years (since I purchased the home). I do have credit card debt (at fixed rates of 2.99 to 4.99%). I pay more than the minimums when I can and I am on-time with everyone.

I know the CA market is never coming back. Not in my lifetime. It will NEVER come back to prices even close to what I owe. I am a female 53 years old and in good health. I will do my best to keep above water as long as I can. I fear that I may not be able to hold it together once the reset hits. Despair has not fully enveloped me, yet.

My zip code made #10 on the list of the worst 20. 71% of of homeowners in my area are underwater. I am so proud. I wonder how my first home that I bought in 2006 for $380,000 which has already lost $200,000 will fare over the next year. Guess I won’t stick around to find out. I guess I bought into the craze that housing was the best investment you could ever make, but I certainly didn’t do it to flip. I bought with intention of staying a minimum of 7 years(potentially forever). At this point I think it would be 20 before I could even break even. I can’t swallow paying $3000 a month for a house that will soon be worth under $150,000. Huge respect though for anyone that does.

Susanna,

You are not alone. This entire situation has been a ponzi scheme on a massive scale. You, I and others are victims of fraud. Those who disagree are not in our situation, uninformed, and find it easy to throw stones as a result.

I also bought a home during the bubble TO LIVE IN, which is now down by 50%. While I might have considered staying, even though my income is connected to the construction industry…which is teetering on the edge, the homes in my neighborhood that have already gone into foreclosure are no longer sitting empty. The lenders, unable to sell them, are ( within the last 2 months ) now renting them out to ANYBODY, as evidenced by the non-running cars, trash, and unchained pit bull dogs in their front yards. Speaking with a new “renter” down the street, they informed me that they were actually going to be running a halfway home out of the house. WTF?

So, look for lenders everywhere to start doing this, as that way they at least can get some monthly $ for a property they can’t sell, while they wait for the government to buy up their bad loans.

Even if I thought I might be able to continue to afford my payment and remain in my neighborhood, my neighborhood is becoming a sea of rental homes.

So, I suggest that you get out of your home while you still can. You are 100% correct. The values will NEVER come back, and the surrounding neighborhoods will “change” as a result of incredibly lower values.

All the money you waste making a bloated payment would be better saved while you rent and rebuild your credit.

Meanwhile the lenders are waiting it out for the government to buy up their “bad loans”. It’s funny how they created this mess, profited from it, destroyed the housing industry, triggered a global economic collapse, and they get a bailout, while little people like us are crushed and guilt-ridden.

If the government wants to save the suburbs, they better get off their asses and send some of that bailout money to the people who keep this country going every day and not the scum slurping wall street fat cats.

Stress will kill you Susanna. Is the stupid house worth your health or your life? The bank who holds the note on your house would like you to think so. They’d like you to work until your dying day just to pay a bloated mortgage on a fraudulently priced home, while they get bailouts, bonuses, and spa vacations.

Does that seem right to you? It sure doesn’t to me.

J

Greed, Greed & more Greed. Living in your means makes you wealthy. Living like a rockstart makes you broke. I love to see greed fail. I’ve waited to buy til now, cause I knew I could only afford a house three times my annual income. I earn $110,000 a year as a police officer. I bought a house for $234,000.

That is what I call living within my means. For those of you who failed to live by the 3X rule, you will die by the 7X rule….

Sorry, I have NO sympathy for you people that overpaid for your house. You are constantly whining, “oh real estate only goes up”, “my realtor/broker mislead me”, etc., etc, etc. What part of your brain made you think that you could afford a $500,000 house (and that’s in the hood) on a $30,000 salary. Simple math and common sense is all it takes. Quit your f*cking whining, because we don’t care!!!!!

To say that a no down payment Alt-A home buyer has no skin in the game is an understatement. Even when you sign a lease the landlord requires a down payment (deposit)!! Dr. HB FOR PRESIDENT 2012

As much as I love this blog, I love the comments even more.

Very real situations happening here. good luck to all.

When I was in my 1st year of college I had a “crazy” philosophy professor who had some unusual rules. One of his rules was that if everyone in the row you were assigned to sit in did not do their reading before class then everyone in that row would have their grade reduced by 5 points. I was the only student out of about 50 students to argue that this was unfair in a college setting (I argued my point during one of his office hours). For the remainder of the semester I was left out of his silly “millitary” tactics, but everyone else just followed without question…

My husband and I have been waiting to buy for 8 long years while raising are family in a 2 bedroom apartment in LA. We have been looking to buy in the nicer areas of santa ana (92706) and Orange in order to live closer to family. It seems prices are just beginning to get realistic in these areas. We have both been in our professions for over 12 years and our combined income is about 200k/year. We have one car, no vacations in the last five years, no debt, $$ enough for a sizeable down payment in savings, and both of our credit scores are around 820. Many of our friends and family could not understand why we were waiting for a “fair price”.

I must say it is hard for me to be sympathetic toward those who did not wait…

But don’t worry I am only 1 in 50.

Another good post Doctor, thanks.

Carol made $350K a year, didn’t save, and apparently thought it would last forever? Amazing!

>

Are Americans that much out of touch with the incomes of the rest of the world (especially the third one) that we are now competing with?

Of all of the useless forms of advertising, which I feel is an industry of societal leeches as they add no value to the end user, there is nothing I hate more than junk mail.

Many people probably feel the same way.

And to hear that such a profession “afforded” a person an $800,000 house makes me despise the advertising industry even more.

Susanna…meet Karma.

I’m also writing from Southern California. I thought I was living within my means when I bought a reasonably priced, modest condo. It was late 2005, and it was my first home purchase. I put 20% down, and spent another 10k on interior renovations. The 30yr payment was 1/5 my monthly income. I have excellent credit but went with an Option Arm, because yes, it was pushed by my mortgage broker, who told me “never live in your home longer than 3 years” because that is how it’s done today. Since this was my first purchase I believed they hype. I quickly learned about the dangers of neg-am (after getting a belated education from my great-uncle, who it turns out, was right) and made the 30 year payments and interest only during the 3 months I was unemployed, so the “option” came in handy.

So what do I do? I put substantial “skin” in the game, made timely payments and invested in my property. The 20% down payment – what was supposed to be the buffer – has evaporated. There are now 5 foreclosures in my complex. None of them have sold. All are now about 40% less than what I paid.

The only benefit so far is that the adjustable interest rate is 2%, so should I keep this place for the remainder of the 20yr period, that might save something in terms of overall interest cost.

There seems to be little point to walking away, as comparable rent is roughly the same as my mortgage. I worked hard for good credit and would like to keep it.

I suppose in some way buying a home in California is like buying a car – you need one, and one day you can sell it but it will not be worth what you bought it for.

But otherwise, really, those who did not live here cannot understand the hype. They didn’t experience the pressure to buy, or feel the tinge of possibility from the stories from neighbors, family members or friends who cashed out on a home that appreciated 5x and then moved to Oregon. Prices were crazy but everyone in California was in on this.

J~

Be careful, all those things you listed a typical signs of a drug house. The “halfway house” might be a cover for lots of people coming and going too. And pitbulls are the meth dealer’s choice pet. I should know, I lived this first hand, ironically DURING the bubble years when No Doc’s were allowing drug dealers to buy into older established neighborhoods like mine (eastern WA). Lots of guys “tinkering” on the cars in the yard all the time? Short stop traffic? Different drape colors on heavy traffic days? During the bubble years many younger couples abandoned the typical “starter house” in an older neighborhood in favor of a “made to flip” McMansions instead. In my case we worked to drive the woman out, but she left a RAVAGED house behind, just trashed with garbage everywhere, 2 junkers in the back yard sinking into the ground, etc.. Luckily, a retired gentleman restored the place to sell right before the bust happened (when it was still profitable). I would be interested if anyone else experienced this. Take care and thank you for your stories everyone!

Careergirl, in light of the fact that you are going through the BK process, it might not be wise to keep your house with negative equity. I haven’t run the numbers but I’m pretty sure your principal portion on a 40 yr loan will be practically zilch for the first decade. As the market prices continue to slide, your net worth will continue to get wiped out by your mortgage balance (in the “red”). On the other hand, you may be able to purchase a new house in the near future (lease to own, etc.), on a house that is “priced right” with workable terms. In ten years your net worth could be in the “black”. (My 2 cents)

On further thought, can you give the house back to the bank and not file BK? That may be the quickest way to get turned around in the right direction. Good Luck.

Dear E,

You have played the Karma card…compelling me to respond. On paper (balance sheet, bank account, resume, junk mail solitations) our situations may look very different. However, in the realm of Karma/Dharma we are the same – both suffering. I from guilt, saddness, despair. You from anger, judgement, and fear. The only hope for us is compassion.

Can I be compassionate towards myself, in forgiveness for my earthly foolishness? Can you be compassionate towards another, who may not be quite as smart as you? In your compassion for another and in mine for myself, we free the bonds of Karma and create a destiny – Dharma – that looks much different.

Here we are….together…suffering. You pointing a finger at me and I flipping myself off. How’s that for fun?

This era of suffering must end. Those seeking someone outside of themselves to blame, to fault are suffering. And for those who blame themselves, more suffering. Guess what? While we’re busy doing dueling Karma the real problem is not being solved.

How do we get out of this mess? We’re all in it together? Right.

Longtime lurker, first time commenter: I love this site. DHB, you da man.

I’m an appraiser for the SLO County Assessor and I always advise all the real estate/finance industry professionals I know to check in with DHB to see what the hell is really going on.

I bought my condo in downtown SLO about 8 years ago. I’ve got a 30-year fixed rate mortgage and I was prebubble (or early bubble at least) so my equity is good. I refi’d a couple of times, but each time they were rate/term refis in which I stayed with a 30-year fixed and just lowered my payment. Stayed conservative and never took any cash out.

In any event, a couple of years ago this loan guy I know started touting the Option ARM. “How does it work again?” I asked him. After he explained it to me I said, “Why in the heck would I want one of those?”

A short time later I read on DHB about the utter toxicity of said mortgages.

I don’t know if you’ve got a crystal ball or what, but you are consistently ahead of the game. Keep up the good work.

I am so sick and tired of all the whining! I’m sick and tired of the Gov. thinking that I’m OK with them using MY money to bail people out – Wall Street to Main Street and EVERYONE in between, I had nothing to do with this and I’m sick and tired of paying for everyone’s “gambling†losses. You had a great run but snake eyes came up people and you have 2 options: walk away or pay to stay in the game but whatever YOU decide, remember that it’s YOUR decision, in fact it was YOUR decision to get in the game in the first place.

I’m sick & tired of people not taking responsibility for their actions. You helped cause this mess but it’s people like ME that are paying the price and have been for years. I was born and raised in the SFV. I rented a great 2 bdr tri-plex with garage and storage in Toluca Lake for 12 years from 1995 to 2007. During that time I was saving and rebuilding my credit so that I could afford a house – MY DREAM. Even when housing got out of control, I knew the fundamentals: Economics 101 Folks, “What goes up must come downâ€. Not sure how so many people missed that year of elementary school. In 2004 one of the owners of the property died and after probate the building was sold to a greedy speculator that was going to tare it down and build condos. Long story short – the credit markets seized up and his financing fell through. Bitter, he kicked me and the other 2 tenants out (even though we were under L.A. rent control) so that he could charge higher rent. Now my girlfriend and I are forced to live in a 1 bdr shack for $1100 plus $500 for a storage facility. We could have afforded a bigger place but didn’t want a year long lease b/c we still have the dream, it’s just taking longer than expected b/c of all the whiners. And don’t even get me started about my 401K. Last year alone I lost over 35% before I stuck it in a safety net. I take responsibility though for my loss, I should have been quicker on the draw to protect myself from the insanity that all of the greed and stupidity had brought on.

JOSH: You’re whining b/c – “I have excellent credit but went with an Option Arm, because yes, it was pushed by my mortgage broker, who told me ‘never live in your home longer than 3 years’ because that is how it’s done today.†– Hey Josh, from here on out you must only write with your toes because that’s how it’s done today. I guess the lesson here is to THINK FOR YOURSELF. And in case nobody told you, only living in a house for 3 years and then selling is still a version of flipping/speculating so – you get what you get. ALSO, and this one really frosts me, – “those who did not live here cannot understand the hype. They didn’t experience the pressure to buy, {I can see that you also missed the year of Elementary school when they taught you how to avoid peer pressure.}… or feel the tinge of possibility from the stories from neighbors, family members or friends who cashed out on a home that appreciated 5x and then moved to Oregon. Prices were crazy but everyone in California was in on thisâ€. Again – stop whining you speculator – YOU helped cause this mess!!

CAREERGIRL: Shame on you, – “I haven’t made a pmt. since 8/1/09. Currently filing for BK and was undecided on keeping the house since i’m about 150k underwater with a ARM and HELOC.†You haven’t paid mortgage/rent since Aug and you have the nerve to whine? That’s 5 fricken months of living free. And you’re filing BK – I applaud you for being such a stand up citizen. Insult to injury, – “They have offered me 2.375 fixed for 5 years then in 2014, the rate goes to 4.375% and stays there for the remainder of the loan. it is also a 40 yr. loan. No money upfront, back pmts get put on the end of the loan and i don’t start making pmts again until 3/1/09.†What’s wrong with becoming a renter again until your situation improves? Oh wait, I know why, – “I live in California, work in the mortgage industry.†nuff said…

SUSANNA: “The post today is harsh. {stop whining} …It does not take into account those of us who were just seeking a home of our own – and who bought into the idea that if we don’t get in now, we’ll be priced out forever.†Hey Susanna, damn realtor bullies putting so much pressure on you. Didn’t they know that you missed the Economics 101 series in school? I felt the exact same pressure as everyone else. My girlfriend and I would go to open houses in the area, just to see what was happening. {some call that being prudent when you opt to research such a huge financial responsibility} We got so many rich-bitch noses snubbed in our faces, now we look back and laugh. We would walk into 1200sq ft SFV homes and be shocked at the $700k asking price. When we would tell the {soon to be unemployed} BMW driving, snot-nosed princesses, that $700k was wayyyy out of our price range they would immediately tell us about their “friend†the mortgage broker that could “make it work for usâ€. We would grit our teeth and politely take their glossy spec sheet home to file under, “I wonder how stupid someone has to be to consider this houseâ€. So when you continue to whine about how, – “the ‘experts’ were telling us there was no bubble, and the real estate folks were convinced the market would hold. My mortgage broker “pushed†the 100% financing on an 5 year interest only ARM. (she would move me to a fixed loan in 2-3 years†– I guess you were playing hooky with Josh in Elementary school when they were teaching about peer pressure. But this line explains it all, – “and since I am in sales {not the most scrupulous characters or business savvy people, only out for the all mighty buck}… I saw this as a way for her to build a pipeline for future sales)â€

J: “This entire situation has been a ponzi scheme on a massive scale. You, I and others are victims of fraud.†J – maybe you and Susanna could pull together and hire a body guard to protect you from future bullies – or {and this is a long shot} start thinking for yourselves, taking responsibility, and remember that there is no short line at the DMV. Everything that seems to come easy, comes at a price. You played the game and you lost, period the end. But by your next statement, I can tell that you’re a bad sport when it comes to not winning, “Those who disagree are not in our situation, uninformed, and find it easy to throw stones as a result.†– Here’s a stone for you, J – YOU are the one that wasn’t informed because you CHOSE to be uninformed. You CHOSE to ignore logic, fundamentals, and History and side up with speculation: – “I also bought a home during the bubble†– this was YOU speculating that prices would never go down. Game over. – “It’s funny how they created this mess, profited from it, destroyed the housing industry, triggered a global economic collapse, and they get a bailout, while little people like us are crushed and guilt-ridden.†J – You helped this every step of the way. You were as much a part of it as the big guys but it’s people like ME that are paying the price. I don’t see anywhere in your post that says you put any $ down or what kind of loan you got and frankly – don’t really care at this point because you only see yourself as a victim and not a person that should take responsibility for a situation gone south.

I am sorry if I hurt anyone’s feelings here but I’m sick and tired of everyone that bought an artificially inflated home during the bubble, complaining about how it’s not THEIR fault because it most certainly is. You “unsuspecting, innocent victims†did not pay attention to the basics. You did not pay attention to history. You did not pay attention to anything except for the huge $ signs that had covered your eyeballs.

BTW – Little Johnny just jumped off the Golden Gate Bridge. Are you going to follow his lead again?

The Option ARM Equation keeps getting uglier and uglier here in California. This Spring and Summer, the !#&$*&?@#%! hits the fan on The Westside. Denial will no longer be an option, and acceptance of overpriced RE will be reality.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Karma also says, you pay what you owe, muthafucka. It isn’t an endless get-out-of-jail-free card in touchy-feely velvet for the Left Coast deliver-us-from-reality set.

~

We’re not “all in it together,” sorry. That’s the Brady Bunch/Partridge Family. By contrast this is a national and global economic system. We’re seeing the unwinding of a mass delusion of historic proportions where some people threw a tarp over a sewage lagoon and called it a prime investment.

~

Not everyone bit at that bait, many did. That’s about psychology, out of the culture of class privilege, and about values and choices.

~

Few listened to fiscal conservatives when housing was skyrocketing and we said danger, Will Robinson. Everyone I knew laughed at me and my partner–what fools, not selling out, not trading up, not wanting bigger better faster more. This isn’t Schadenfreude speaking. It’s the other tack of karma’s sailboat, and as far as I can tell, presently racing close-hauled into an arctic gale. Our house’s value may retreat to its 2001 value (when we bought it). We were prepared for that when we bought it. Our fundamentals will remain untouched. Hope y’all had fun thinking you were privileged millionaires in 2005-06! Bub-bye!

~

Yes, many people will have their assets, wealth and savings eroded because of the gullibility and greed of the greediest gullible. But those who stuck to fundamentals in economics and finance stand to be harmed less grievously than those who rejected basic arithmetic. Yes, I’m not happy to be paying so much because some people didn’t know how to think for themselves housing-wise. It’s probably a small price to pay, all things considered, for long overdue icewater than this nation desperately needed to wake it from the dementia of Reaganomics.

~

Fundamental comes from the Latin /fundus/, meaning BOTTOM. There is no period of vast and inflated wealth that will not ultimately drill back to the fundus, the foundation, the bottom it was connected to all along. Some people never lose a sense of that rooting. Some people lose a little wealth and jump in front of trains.

~

Many forgot that the oldest game in the PR/advertising/marketing book is to scare people into buying something. It was pioneered by Edward Bernays, who was both the nephew of Freud and the father of the American PR industry. “Your pits/breath/feet/hair/life stink! Buy this thing! Guess what, you still stink!”

~

By the way, “karma” has a precise technical meaning, from the Sanskrit /karman/, to do or to act. Anyone who acted without regard to the broadest possible consequences of their actions (such as getting theirs while the getting was good because they were afraid to be locked out of the getting) doesn’t need to be dragging anyone else into the karmic picture. Karma parses and carves quite precisely. It’s as personal as custom orthotics.

~

The rules are simple. Houses are objects. Gotama taught that objects have no reality. They are seen by the mind. They have maya-nature. They are the play of mind on the external. Fear and greed are forms of suffering that one inflicts on oneself. Warning: never operate heavy financial machinery under the influence of the mind altering substances greed and fear.

~

compass rose

resident punk monk

Susanna, I feel compelled to say something here. Asking for compassion doesn’t really apply, and for one main reason. Every tax-paying American citizen is going to be paying the price for you and all those like you. All of us. People like myself and my husband, who didn’t buy into the BS. Who looked at prices vs income, and said “screw that. We’ll rent forever and save money toward retirement much faster, which is a far better return anyhow.” And we did. We rented well below our means, didn’t get caught up in the Credit idiocy and were able to sock away a pretty impressive nest egg.

Guess what? Part of our nest egg was in 401k. We switched our investments and got completely out of stocks, but not before catching a small loss when the world economy tanked last year. I find it difficult to feel much compassion for those who have and will continue to cost me money, personally, through zero fault or action of my own. Mess with my money, and you’re messing with my emotions. 😉 In fact, because I didn’t get caught up in the credit/housing frenzy and instead did the “right” thing, I am personally being penalized. So is everyone else like me.

Do you think that’s fair?

To Careergirl: a 40 year loan? Are you serious? Did they give you the ACTUAL figure of what the end cost is going to be with that 40 years of interest tacked on (assuming you stayed there)? Somehow I sincerely doubt your home will ever recoup that figure. Yes, maybe you will be able to sell it in 10 or 15 years, after we begin to recover. But who knows what will happen in the meantime.

This is such a fubar mess all the way around, and the “solutions” vis-a-vis reworked mortgages, at least from what I have read sound like just a new guarantee to keep as many persons as possible wage-slaves forever. Banks not loaning money isn’t the problem right now. They will loan money…but only if you are a reasonable risk. Funny how few of those we seem to have left. In my area of Granada Hills west of Knollwood, it is a never-ending cycle of escrow opening, falling out of escrow, relisting. Every time I see “contingent” on a property, the husband and I place bets with each other on how many weeks before it goes back on the market. I usually choose two, and am often correct. Only one property we’ve been watching since March of last year, has actually closed escrow…and I know the buyers are kicking themselves in the arse, since they bought in June, for FAR more than the property was worth. I’ll be utterly unsurprised if it ends up a short-sale within 6 months.

To make a long story shorter (I could go on for days about this stuff), compassion? Not so much, I’m afraid. Plenty of irritation. Some apprehension. A whole lot of head shaking. I’m no guru, and I’m not smarter than anyone. What I do have, is a strong dose of serious skepticism in what other people tell me, especially if they want me to join some sort of bandwagon. I’ve never been a person who feels the need to belong to anything; I detest faux company ‘teamwork building” crapoo, and if you tell me something, the very instant I get a spare block of time, I will be thoroughly researching it for myself. Why? I believe nothing I am told until I confirm or debunk it on my own.

So, while I cannot judge you and I will simply assume you are being honest – benefit of the doubt – I cannot find empathy. Not in this.

Hi everyone, another lurker posting for the first time because the post and the comments are so good today. esp. Compass Rose’s last paragraph, awesome.

I live in New Zealand which along with Australia is the last remnant of the property bubble (house prices 5.7 and 6.3 times income, respectively – US 3.2x). GE Money recently closed up their mortgage outfit here and are now being investigated for fraud (overstating values and incomes). We are a year or two behind you guys, prices have fallen about 8% from their peak a year ago, but we have not yet turned the corner in our mentality that property is a sound investment at any price. Once the declines start sinking in all the sellers who have been holding out (we have a year’s supply of houses on the market, demand has evaporated) will begin to fall over each other in a race to cut their prices. Their are heaps of greedy cashed-up investors swilling around who would like to buy now at a 20% discount, but if the experience in the US and UK is any guide, they will get burned along with everyone else.

I am in a position whereby I still have substantial positive equity in my house (although my equity has been reduced nearly 50% in the last 2 years) and still paying on time every month, top fico scores… and have recently come into a lump sum of cash (thanks, dear old dad.. we’ll miss ya pal) to pay off the balance completely. But here’s the thing — why should I just pay off the bank in full, and I take the full hit to the equity?? Shouldn’t they share my pain??! Where’s my share of the tarp?!! Am I wrong? I’m thinking I’d like either a discount for prepaying (maybe 5%?), or I’d definitely take something like 2.5% fixed for 40 years, then sink the balance of the cash into AAA rated tax-free munis paying 4%… CAN ANYONE HELP??

This article comes from The White Plains Citizens Net Reporter in New York.

Foreclosures Rate Slowed by August Legislation in County Posted on Thursday, January 22 @ 10:30:13 EST by jfbailey

WPCNR COUNTY CLARION-LEDGER. From The County Clerk. (EDITED) January 22, 2009: The rate of initiated foreclosure actions slowed over the last 12 months. Westchester County statistics released by the County Clerk’s Office today show the number of initiated foreclosure actions have been steady the last two years and have kept pace in 2008 numbering 2,166 in 2007 and rising 2% to 2,206 more foreclosure actions in 2008. The rate of foreclosures continued steady, but is down sharply from 2005, and 2006. Foreclosure proceedings in the county grew 50% from 2005 to 2006 and 40% from 2006 to 2007.

Contributing to Westchester foreclosures slowing were the foreclosure reform measures signed into law last August. One part of the new state legislation requires lenders to send pre-foreclosure notices to borrowers at least ninety days before an action is started. That notice encourages the homeowner to seek help and provides contact information for local government-approved housing counselors.

“The measure not only mandates lending reforms for the future,†began Idoni, “but also provides immediate help to residents in danger of losing their homes.†And while 2008 statistics show an overall increase in foreclosure filings, they also reveal a significant drop in foreclosure actions filed in the last four months of 2008:

Filings Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total

2005 83 64 97 98 82 93 83 104 98 85 110 86 1083

2006 100 119 159 120 140 128 112 136 117 162 130 123 1546

2007 146 132 252 181 145 156 176 226 179 201 181 191 2166

2008 243 231 285 224 202 225 238 242 73 96 71 76 2206

“The slowing of foreclosure filings is good news, but Westchester residents are still losing their homes and need help,†warned Idoni. “Without proper counseling, this respite will only be temporary.†Idoni urged local residents at risk of foreclosure to contact Westchester Residential Opportunities (WRO), a non-profit housing agency with offices in White Plains and Mount Vernon.

A trained counselor can be reached at (914)428-4507 or visit http://www.wroinc.org for more information.

The Westchester County Clerk is the Clerk for the Supreme Court where foreclosure actions are heard. Please note that the commencement of a foreclosure action does not mean that a Westchester home will be lost to foreclosure. Filing a foreclosure action in the Westchester County Clerk’s office is the first step of a process which could result in the loss of a home or building.

If a foreclosure is granted, the home or building is sold at a foreclosure auction and the proceeds of the sale are used to pay off the loan. However, some homeowners enter into a repayment plan, secure a modified loan, refinance with another lender or sell their home on their own to avoid foreclosure. The office of the Westchester County Clerk is located at 110 Dr. Martin Luther King, Jr. Blvd. in White Plains and is open Monday through Friday (excluding holidays) from 8 a.m. until 5:45 p.m. For more information, please call 995-3070 or visit http://www.WestchesterClerk.com.

@ Susanna,

The last person I will blame are the consumers. Why, because I read and the writers I read had the good sense to tell me this.

This is not a new species, just a different animal. I know you did nothing wrong, other than believe what they told you. We don’t have a decent set up in place to put blame where it belongs. It happens when your part of a large group of ppl. You get lumped. Keep doing whatever you can and stay strong.

“Career Girl” is a textbook example of everything that has gone wrong with this country morally and intellectually in the past 40 years, and she is a Poster Girl for the worst financial excesses and abuses of the past 10 years. She and people like her are the problem this country is having, and I fully expect that her demographic cohort, the tens of millions of soon-to-be-ex-upper-middle-and-middle-class folk to cause civil unrest and social upheaval that will make the insurrections Los Angeles experienced in the past few decades look like so many after-school brawls on Ashland Ave compared

For it will not be the ghetto poor or the dispossessed working and lower-middle classes who will be our most dangerous social problems in the coming rough years of economic deterioration in tandem with the decline of fossil fuel supplies. The poorer among us know how to cope with viccisitude and have never developed the outsized sense of entitlement that the people who took part in this boom have. Instead, it will be the folks who HELOCed their $750K houses to buy Benzes and boob jobs and vacations and boats, but who are now, like Career Girl, $150K under water, bankrupt, and unemployed or nearly so, and who are now confronted with the extreme gap between their inflated expectations and the bitter reality that we are now a broke, unproductive country with 3 generations of government debt, no productive capacity, and a population used to having their lives handed to them on gilt platters but who have no real productive or survival skills, for a huge percentage of our better earners ($100K plus income) have been people whose “skills” are now worthless in the post-Ponzi economy, and who probably will never be able to approach middle-class incomes or status again.

Look out below as the tens of millions of the former suburban middle class begin to act out their rage and disappointment, and attempt to hold on to their entitlements in an economy in which their “skills” are worthless, amidst growing resources shortages, and be prepared for unprecedented violence, crime, and disorder as their children fall in, or up against, those of the ghetto poor.

The next decade is NOT going to be pretty.

I’m claiming only gullibility, not greed. I stick to my specialized area of knowledge and listen to the experts in their area. I’ve made an incredibly stupid decision but out of ignorance.

My mortgage was a gamble on both parts. But the only reason I was still willing to sign the papers after they were changed at the last minute, was the only thing I was gambling was my credit rating. Since it wasn’t very good to begin with, this wasn’t much of a gamble.

Don’t bail me out. I don’t need it. But don’t bail out the banks either. The banks gambled and lost, let them lose what they gambled with.

@Marcy-think maybe your 401K was as artificially inflated as the real estate market? You bought into the same thing, just a different facet of the same beast. Sounds like you managed to profit a little bit even.

Hornet,

i am in the process of short sale on a townhouse in Grover Beach (SLO county). I remember over a year ago talking to a SLO assessor on the phone about lowering my taxes. After chatting a bit, I said I thought the market would be down (having read blogs like this one, patrick.net, etc). He said “they aren’t buildn’t any more land”. I did get my tax bill lowered from $4k to about $3.3k, which reminds me to submit yet another application to have taxes lowered. I did not make the Dec installment though, and hope the current offer under review by Countrywide will be accepted by the next installment date of April.

fyi, I am walking away from 20% down. 5% i had and 15% i borrowed from my parents. Any money I have I am paying my parents. I am hoping for some parental debt forgiveness because I owe them ~$60K on the house plus $22k in other debt.

Leave a Reply to susanna