A mortuary of 7,000,000 foreclosures and counting: Nation still faces 9.1 million properties that are seriously underwater.

If a foreclosure happens in the wilderness, does it make a sound? It seems like people have conveniently forgotten that since the housing crisis hit we have witnessed more than 7,000,000+ foreclosures. Do you think these people believe the Fed is almighty and can stop a speeding train or turn water into wine? Apparently some people forget that the Fed failed to prevent the tech bust or the housing bust in the first place. Now, the Fed is somehow the cult leader and the leader will not let housing values fall. The nation still has 9.1 million seriously underwater homeowners on top of the more than 7 million that have gone through foreclosure. It is abundantly clear that the mindless drivel of “buying is always a good decision†is just that. Investors are starting to pull back in expensive states because value is harder to find. I see the lemmings at open houses and you can see the drool at the side of their mouths hoping for a morsel of real estate. The Fed, for better or worse, has turned us all into speculators. Simply putting your money in a bank is a losing battle because inflation is eroding your buying power. Yet wages are not keeping up. What you have is people competing with investors, foreign money, and a market with low inventory and trying to guess the next move from the Fed. Yet the tech bust and housing crash (keep in mind these happened only since 2000) were major events not prevented by the Fed.

Does buying today make sense?

The big question for many is whether buying today makes sense. Hopefully the 7 million foreclosures within the last decade highlights that housing isn’t always a simple buying decision. Investors have been dominant in the market since 2009. Big money is clearly pulling back from inflated markets like those in California. This trend is fairly new but even with this minor twist, inventory is picking up and sales are still very low.

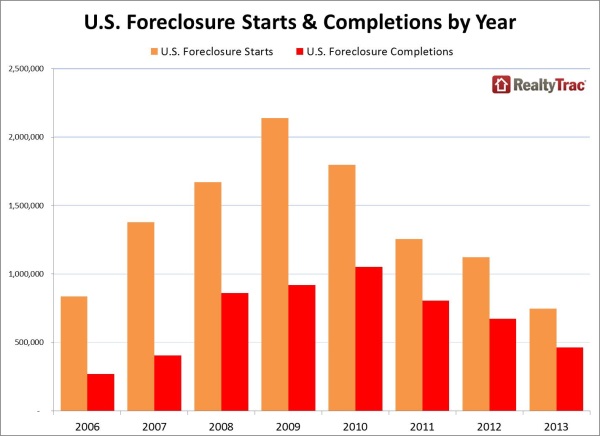

It helps to understand that many foreclosures are happening because people are spread thin. People are still maxed out. Unlike big banks with sophisticated deals and systems in place, most households are living paycheck to paycheck even those with higher incomes. First, take a look at some foreclosure history:

Print this chart out and just remember that housing is a big freaking purchase. Probably the biggest you will ever make. Just because someone is house horny doesn’t mean they should act on it. What fascinates me is that late in 2012, most of those in the housing industry failed to see the big run-up in prices for 2013. Most were predicting 2 to 5 percent price gains. Instead, we saw double-digit gains. At the end of 2013, the predictions were incredibly optimistic for 2014.

If the trend is so obvious and clear, why do we see low volume in housing sales?

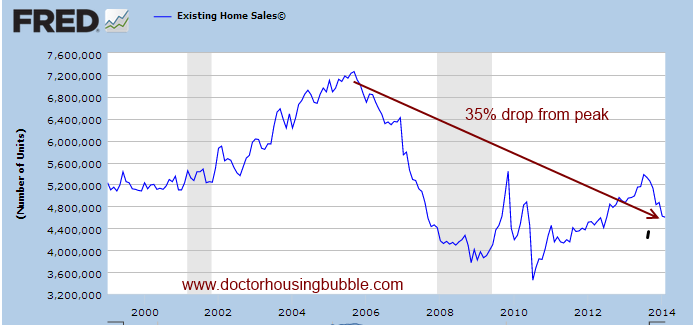

Existing home sales are down more than 35 percent from their peak reached in 2006. Our population is growing and prices are going up. Yet the push for higher prices has come from Wall Street, low rates, and normal buyers competing with the investor group. A big question that many are wondering is what will happen when big money starts to flow out of real estate. We are starting to find out slowly. Rates are also likely to go up – so for those that believe the almighty Fed can do anything they should listen to their leader that is utterly telling the market rates will go in one direction.

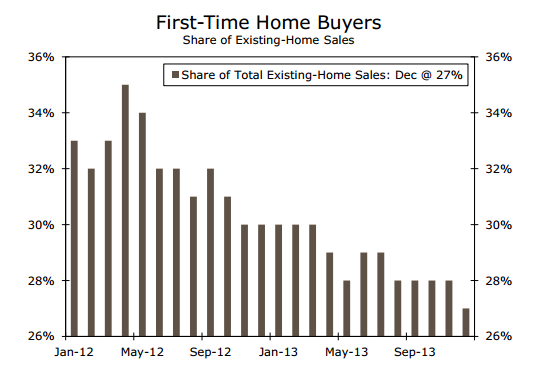

What we don’t have to guess on is that this recent trend has made it tougher for first time buyers:

First-time home buyers are a small portion of the market today because of investors crowding them out. We also have a large number of young ones living in the basement of their parent’s granite countertop sarcophagus.

Still underwater

Despite the recent rise in home prices we still have 9.1 million home owners seriously underwater. What this tells us is that many people pushed their budgets to the financial limits merely to squeeze in. If this were truly a solid housing uptrend we would be seeing home builders doing what they do, building homes. We would also see existing home sales kicking butt. Yet we have a juiced up system with countless forms of accounting shenanigans. Some try to make it out as if economics and finance are somehow a new science. Unlike Newtonian physics on Earth, the Fed can act like a deus ex machina and literally change the rules for a brief period of time. And people are emotional and the reptilian part of our brain goes haywire when you talk about the “nest†– you need only go to an open house to see the house horny folks battle it out.

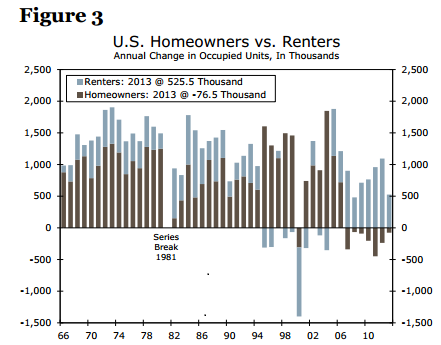

We’ve been adding many more rental households over the last few years, just in line with the big investor buying (those 7 million foreclosures have to move somewhere but foreclosures are also slowing down):

What is telling about this chart is that we have never had a sustained period of actually losing home owner households since, well this last crisis. Why? Take a look at the graveyard of 7,000,000 foreclosures. The Fed has turned the housing market into a speculative vehicle and with this volume of investor buying, you should proceed with the caution of buying a stock. This is another critical point here in regards to perceived risk. You have people staying miles away from stocks (which are up 170+ percent since 2009) yet are more than willing to stuff their entire $100,000 or $200,000 down payment into a highly priced piece of property that just went up by double-digits courtesy of investor fever. Yet they feel this is safer! California was a big chunk of the 7,000,000 foreclosures folks. You have people with pathetic 401ks and retirement funds yet 80 to 90 percent of their wealth tied up in one piece of real estate.

7 million foreclosures and currently 9.1 million seriously underwater home owners. It should be apparent that when it comes to buying a house, you really need to run the numbers. Investors have and they are pulling back from certain markets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

106 Responses to “A mortuary of 7,000,000 foreclosures and counting: Nation still faces 9.1 million properties that are seriously underwater.”

Housing To Tank Hard in 2014!!

How-zing to go up fo-eh-vah!!!

What, you accused me of having a crystal ball in the last thread. But one does not need a crystal ball to make rational, short-term predictions.

As I predicted, I think house prices will stabilize (maybe a bit up or down), and inventory remain low, for the remainder of the year.

I also agree with those who foresee hyper-inflation. I’ve been worrying about hyper-inflation on these boards for months. I just don’t see how you can print all that money and it not create hyper-inflation sooner or later. I don’t care where the money is currently sitting, it’ll be released eventually, and then comes trouble.

And I agree with those who think it’s better to own tangible assets — real estate, cars, food, fuel — rather than green toilet paper.

Sure, real estate has holding costs — property taxes, insurance, utilities, etc. Nothing is 100% secure and risk-free. But tangible stuff beats fiat currency during hyper-inflation.

How are cars, food, fuel “tangible assets? Aren’t they just consumables? Why even mention them next to real estate. Al three are just used up and spit out, right? Always fascinated me how a car is listed as an “asset” in one’s net worth. They always, always go to zero. Well, maybe not in Cuba.

SOL – I didn’t ask for your predictions because I disagree with your premises. When I read “I see” predictions in comments it makes me chuckle because predicting the future is so difficult at this point it has become nearly impossible. I have been wrong on every prediction to date because I did not understand all the moving parts. I just wish I still believed in crystal ball predictions…

Mike M, – “tangible” asset has an accounting definition and cars, food, fuel, pencils, toilet paper, are all tangible assets. Intangible assets are “assets’ that cannot be touched or have not been put into service like internally developed software. I believe Goodwill, Trade Marks, Patents (not sure on this one), trade secrets are considered intangible and therefore are not depreciated. Intangible assets can be amortized. Land is the only tangible asset that I know of that is not depreciated but the building is depreciated. I believe if the land has mineral rights that are in the process of being mined then you will depreciate the land minerals. So I think you are confusing depreciating asset with tangible asset. Two totally different things…

Food and fuel, properly stored, can last for years. And they retain their value, in that people will always need them. Unlike paper money.

Son of Landlord,

“Prices stabilizing” in one paragraph. “Hyper-Inflation” in the next? Please.

Hyper-inflation. More like hyper-defaults.

Bank seeks bag holder. Sign here.

“So I think you are confusing depreciating asset with tangible asset. Two totally different things…”

No, I’m not confused. I think that most citizens and their enabling accountants are confused when they list a 50,000 dollar car slowly rotting in the driveway as an asset. You can argue semantics all you want, professor, but, I know that’s a fools game that does not end well. There’s millions of Boomers finding that out right now as they enter the end game.

“No, I’m not confused”..

You may not be confused, but you’re being intentionally obtuse.

Unless we can figure out how to reverse entropy, you’re right, eventually everything “goes to zero” However in common terms, anything you can sell for a chunk of change is considered an asset, even a car or works of art.

@Son of a Landlord,

You are a little too late to the hyperinflation ballgame. Home prices going up well in excess of incomes is hyperinflation. Medical care going up well in excess of incomes is hyperinflation. Higher education going up well in excess of incomes is hyperinflation.

And since housing costs and medicare care are the two biggest ticket items for many families, we are witnessing hyperinflation as we speak. It is not Wiemar or Zimbabwe hyperinflation but inflation that is double the core inflation rate can be considered hyperinflation.

“we are witnessing hyperinflation as we speak.”

No, overpriced homes in California and expensive schooling is not a sign of hyperinflation, sir. A loaf of bread that costs twice as much as it did yesterday is. Please.

“No, I’m not confused.â€

“Tangible assets are those that have a physical substance, such as currencies, buildings, real estate, vehicles, inventories, equipment, and precious metals.â€

“Intangible assets lack of physical substance and usually are very hard to evaluate. They include patents, copyrights, franchises, goodwill, trademarks, trade names, etc. These assets are (according to US GAAP) amortized to expense over 5 to 40 years with the exception of goodwill.“

http://en.wikipedia.org/wiki/Asset

You are painfully confused or you choose to use the English language incorrectly to confuse others. The definitions I give are from the English language and if we cannot agree on the meaning of words and you are making them up as you go there is no reason to continue communication…

2015 Jim…..2014 is an election year!

http://www.redfin.com/CA/San-Gabriel/1427-S-Charlotte-Ave-91776/home/7038425

The selller of the house is SUPER GREEDY! A 2 bedroom/1 bathroom house asks for $600K. This is crazy. Please boycott him/her.

The seller can ask for $6 million not just 600,000. It is his house and in a free market he is allowed to ask as much as he wants. You have only 2 choices: buy it or not buy it. If a buyer wants to buy it and they agree on a price, that is the market price.

But, but, but … it’s on a “LARGE LOT”!

Not a “large lot”, but a “LARGE LOT”!

It even says so, in CAPS!

America’s collective attention-span is equal to that of a gnat. And you’re expecting people to remember clear back to 2000? The whole system DEPENDS upon our short attention-spans in order to conduct business.

The Fed is a criminal institution. Yellen likes the housing prices elevated, because she knows that banks will fail if housing goes lower, and she also knows that all the toxic debt the Fed bought so joyfully and energetically in 2009 will become worthless.

If the global economy is preparing to vanish again into the waters of recession, how will prices advance during another recession, with workers being laid off, salaries contracting, and prospects for the future getting less and less hopeful. Americans need cheaper housing, not inflated housing prices, backstopped by Fed money printing that destroys the US Dollar. Mortgage Bankers Association Purchase Applications do not show any recovery happening in US housing.

America has quite a few bubbles that still need to burst: bonds; stocks, higher education costs; medical costs. Many students are borrowing money to go to school because there are no jobs. But there will not be jobs when they finish school either probably.

We have to pop these bubbles. Yes, this will cause pain. It will also cause pain to our lending institutions, and the interest rates are going to go through the roof. If we would have begun raising rates in 2001, we would have avoided all these bubbles Greenspan/Bernanke have given us.

We see that the Fed ‘inflation mania’ and bond purchase program (QE) has propped up stocks first and now housing. But it is not propping up anything else. For people who don’t own stocks and real estate there has been no recovery, it’s actually much worse for them today.

Housing recovery is a illusion or mirage.

The fed will keep doing what will help the banks not the people. No way is this bubble even close to bursting. Unlike the run up in 2006 the loans today are well qualified and loads of cash buyers. Adjustable loans are a small fraction of what they were. No more using your house as a personal ATM. Things are different because we did not fully understand that the fed and the banks were purposely drawing us in for the kill…all for their profit. The bailout was for the banks who committed the crimes. The fed is in bed with the politicians and the banks. There is no relief for main street till every last dime is fleeced from their pockets.

The game they are playing now is a new game. They have taken the ability to keep your money safe in a bank with pathetic interest rates. They have herded us into housing and the stock market. They want to support housing prices and when housing starts to slump, no worries they will be there with new programs to keep the buying going. When the stock market crashes, the government will be here again to take hold of your 401k/ retirement accounts with their “safe” government issued bonds, a forced bond buying program. If banks collapse there is not even close to enough FDIC money to refund depositors. The banks are highly leveraged in derivatives so once things start tumbling it will all come crashing down. The banks already rewrote the rules on money market accounts that they can legally acquire every cent for future bank holidays/haircuts.

Remember they want us in real estate and the stock market. We are not the only ones with this crazy housing bubble. This is a global housing bubble and when this one pops it will be like nothing ever seen before. I don’t see this ending well. There is absolutely no safe place to keep your money so housing is not a bad bet. I think we have quite a few years till this bubble pops but nothing is predictable because of so many shady players.

I would be interested in where other investors are concentrating their funds if not in real estate?

Los Angeles does not have a metonymic relationship to the US housing market more broadly or the global housing market even more broadly. In other words, a notable correction can certainly happen in the LA market without putting the banks in the kind of catastrophic danger you describe. Los Angeles is not the center of the world. And the Fed is not thinking about what happens in our little neck of the woods per se; they have bigger fish to fry.

Good post. It is a stupid scary financial culture (cronyism) that can navigate through a RE securities/derivative fueled financial disaster straight into another looming collapse without having done anything to limit systemic risk and having used up all of the monetarist get out of jail money supply cards.

Gold

So while this is a bit meta, this Dr. HB article explains why housing is isn’t a hyper inflation hedge.

http://www.doctorhousingbubble.com/housing-apocalypse-prediction-of-hyperinflation-real-estate-values-debunking-hyperinflation-argument-deflation/

Still want to leverage yourself 5x? Do it in equities, not housing.

“Bottom line: In marks, stocks had an amazing run”

http://www.businessinsider.com/heres-what-happened-to-stocks-during-the-german-hyperinflation-2011-11

The Feds just look at some spread sheets, checks if the medians are out of whack across the country as a whole and go on vacation. They don’t say “Uh oh, prices in SoCal and Manhattan are crazy. Gotta make some adjustments for these two area that includes all 50 states.”

Should have let the FIRE burn it to the ground in 07-08, instead you, me and the rest of the 99% taxpaying populace will take it where the sun don’t shine to keep the 1%’s cash flows insured.

We would have had a bottom and a future to build if GS and the other IBanks had gone insolvent. A crime against the people has occurred in the name of wealth. Would Alex Hamilton have approved?

The Fed’s insanity plan — and the global plan — to reflate the economy cannot work for the simple reason that there is a season of Inflation and a season of Deflation and these two seasons are in opposition, like Spring and Autumn are in opposition.

Pretending that Deflation doesn’t exist is a case for insanity. The economy grows for ?? years and then rests for ?? years. The Rest Cycle is just as important for the process as is the Growth or the Inflation Cycle. Deflation Cycles need to 1) destroy debt; 2) move the country away from the speculative frenzy of the Inflation Cycle which favors the rich and special interests; 3) close the gap between the rich and the poor, so the country can avoid civil war; 4) raise interest rates to do all of these things, destroy debt and reward savers especially.

I hope you understand now how necessary and important is deflation for us today.

We need deflation to do its job and save our country.

Raise the interest rates now and crank the default machine!!!!!

The longer we wait, more painful is going to be for everyone.

Good Luck

I’d love to see deflation. I’m not in debt. I’ve no mortgage and pay my credit card in full every month. Deflation would increase the value of my cash, and make housing more affordable.

But I worry that hyper-inflation is more likely.

How in the world would hyper inflation happen? Ask yourself that. Hyper inflation would need wages to follow. That isn’t and won’t happen with the third world taking all of our jobs. Deflation, on a macro level, is much more possible. Think Japan. They had a big head start on the rest of us.

We are not Weimar or Zimbabwe. The world isn’t either. I would relax and prepare for many years of stable to lower prices for years to come. Hopefully, your California real estate follows. I’m happy I don’t live there. I just had a bid accepted on a condo in a very upscale town in Fairfield county, CT., for thirty percent less than it sold in 2004. That, sir, is deflation.

Mike, just because wages aren’t rising NOW doesn’t mean there won’t be hyper-inflation in the near future.

When all that printed money is released into the economy, prices and wages will both rise (prices more so than wages, I think, but wages too.)

You have no debt.

That sounds like someone who is not expecting hyper-inflation.

Get as much as you can now. While its cheap!

“Mike, just because wages aren’t rising NOW doesn’t mean there won’t be hyper-inflation in the near future.

When all that printed money is released into the economy, prices and wages will both rise (prices more so than wages, I think, but wages too.)”

So, what will change in the “near future”? The only thing that will raise wages in the developed world is to somehow shut down the import of goods and services made in the third world. That’s protectionism, and, sorry, ain’t going to happen. At this moment, the White House is trying to push through a trade pact with the far eastern countries that would make NAFTA look like a tariff building exercise. Even China is concerned that they will lose manufacturing to even cheaper labor in Vietnam and Bangladesh, and, who knows, Africa. It’s a race to the bottom, and your politicians and elites controlling policy here in America could care a flying F what happens to the unskilled and even skilled and educated worker, as long as those enormous profits continue to roll in. Unless we close our borders to outside trade, you will never see hyper inflation. Hell, inflation is barely registering, unless, of course, you’re trying to buy a house in California. You guys gotta move. I know the weather is nice, mountains are cool, nice beaches, but, jeez, a million dollars for a piece of 50s junk? c’mon. Life is way too short.

And, for god’s sake, furcyingoutloud, once and for all, they ARE NOT PRINTING MONEY! The Fed has lowered the borrowing costs to banks to zero, and are buying an enormous amount of MBS, but, they ARE NOT PRINTING MONEY. Please. If I hear that one more time……

Anyway, imagine a world after 2008 if the FED didn’t intervene and try to inflate the housing market. You think it’s bad now? Hoo boy. Our economy, and, therefore, the world’s economy, would be a sorry mess. We’d be stuck in the mother of all depressions, with prices dropping like a stone. Hey, I’d do OK, and others with money, but, we’re rare. Everyone else is in hock to their ears, and have no “tangible assets”. I know, I know, price discovery and all that, but, you better have all of your ducks in a row before you wish that on the world. It won’t be pretty if suddenly the credit spigot was turned off after forty years of easy money. At least make sure you live in a town with a well paid police force protecting you.

Oh, and another thing. You Fox watching gold bugs have been deceived and lied too. The 800 pound gorilla isn’t the Fed. It’s China. Watch China. Some think that the Maoists of just a generation ago have capitalism all figured out, but, I highly doubt it. That’s where your deflation, which some think is happening already, will come from, when they can no longer build cities in nowhere connected by trains from no where to nowhere, and forcing anybody with money to buy the empty condos because there is nowhere else for them to invest. That’s why copper and all sorts of commodities are sinking in value, because they have to at least take a breather and wait for the empty cities to fill with dirt peasants before they embark on another spree. There’s nobody else left in the world to take up the slack. That’s the end game of the great credit cycle of the early 21st century. For a while.

And the average American is clueless.

Americans have fallen in love with real estate once again:

http://finance.fortune.cnn.com/2014/04/18/real-estate-investment/

From the article:

According to a Gallup poll released Thursday, a plurality of Americans now think of real estate as the “best” long-term investment, followed by gold, stocks and mutual funds, savings accounts/CDs, and bonds

Fannie, Freddie cut housing-market forecasts for 2014:

http://blogs.marketwatch.com/capitolreport/2014/04/21/fannie-freddie-cut-housing-market-forecasts-for-2014/

Don’t the years of losses of home owner households partially mean rising pent-up home owner demand? It certainly is supportive of rising rents, which supports the rent-parity equation.

No the losses do not indicate pent-up demand. If there was pent-up demand then sales wouldn’t be tanking. Although many people may want a house they can’t put up the money at this price level, and contribute nothing to demand. People being forced to rent also doesn’t necessarily force up rent prices. Rents are more tied to income than housing and the more they raise them the more you risk vacancy. People can vote with their feet and young middle class people are moving out of California.

Yes, there is pent-up demand to buy a house.

But this is balanced by a fear of being burned again. Nobody wants to risk over-paying and being underwater. Buyers are a lot less trusting of realtors, politicians, and the economy’s future than they were a decade ago.

Many Americans do have attention spans longer than a gnat.

Perhaps this adds nothing to the discussion but in my anecdotal observations with “young middle class” friends who have moved to PA, IL, AZ and CO all of them bitch about it and miss the So Cal life. You cannot replicate this lifestyle, and if you don’t get what I mean then you should leave for the flyover zone.

It is true you can not replicate the SoCal lifestyle: no more traffic bumper to bumper sitting for hours in the car, no more smog, no more astronomical taxes for everything and everything, no more mountains of debt and all the stress associated with that, it is true you can not replicate that. I lived in SoCal and moved out 24 years ago – the best move I ever made. You have to experience life outside the rat race do understand what you are missing.

To repeat what another blogger stated: “you have only a life to live!!!!….”

Having grown up in Pennsylvania and having now lived in socal for 15 years, there is NO way I’d go back. I’m happy spending more to live here. Why? Because Socal is better in every way.

Also, am just closing on a house. Am I paying a lot? Yep. Do I expect it to go up? I don’t know. Somewhat. But I plan to live in it for many years so that’s not my concern. I DO know that even if it goes down in value, it won’t go down the amount I’ve spent on rent for the past 15 years.

Anon, since you are anonymous, would you mind telling what what city or L.A. neighborhood you’re buying a house in?

La Crescenta

Also from PA, also would not go back. California is not a comfortable for people who earn an average wage. All those bad things go away when you are a big earner. Flexible working hours, no money issues. In that context California is a paradise.

Otherwise, I agree, for many people it is hell. If you want the American Dream you should really try to get your financial bearings straight elsewhere. This is not a place to get started, it will bleed you dry.

Supply and demand is not so simple. There is little demand for housing at the price points we are seeing in many areas of SoCal–thus the paucity of sales Leaf Crusher identifies.

@GenXer, you are correct about the price points in SoCal. I make 6 figures and I cannot justify buying at the current price levels. For the cost of a down payment in SoCal, I can purchase for 100% cash outright a house in the most of the rest of the U.S.

I also make six figures and bought a 1500sq ft place in an area with great schools in Orange county. It will be paid off in 4 years. Should I expect more for my money? I don’t think I should.

For people with vested interest in house appreciation the homeowner versus renter plot is the scariest. The homeowner decrease is national in scope and the figure is of the entire US. I would guess that a plot of only SoCal would be even more dramatic.

Where will increased housing demand come from?

1) Foreclosed peoples-Most of the foreclosure activity has hit in the last 6 years. The people that got hit buy this do not have large capital reserves. Some will try to jump in again, even if they are highly leveraged. Compared to 2006 fewer of this cohort will be owning or seeking to own a house even as banks loosen lending standards.

2) Wall-street- Large investors can’t find deals. Tapering.

3) Young people- This group is too broke paying off student loans and the like. They may want to buy but they just don’t have the capital at these price levels. Many will continue to live at home, rent without savings, or leave the state. In any case they will be making a historically smaller impact.

4) Chinese- Some foreign investors love real estate. China’s big bubble is brewing. Any pop there will have effects here. Currently this is probably your best set of buyers. Are there enough to drive a large market? We will see how much inventory they can suck up this year.

In my opinion, there is a huge demand problem. Supply constraints can keep up prices, but the industry can’t make enough money off the current volume. Mortgage originations are at all time lows partly because people aren’t seeking to refi, but also because sales suck.

Home ownership in S. California is quickly becoming a luxury item only affordable to the wealthy. With median home price of over 400k home ownership is simply unaffordable to those not making at least six figures. I’m seeing more and more competition in South LA and less desirable parts of LA, due to affordability.

Does buying today make sense ?

Does anything today make sense ?

Only if what the Bank of England had recently to say, is examined and in its proper context.

What the Bank of England had to say, in its historic announcement, and the proper context in which it should be taken, can be found part way down the source document linked, under the subtitled heading –

‘SEQUENCE OF DOING BUSINESS USING WRITTEN INSTRUMENTS AS CONTRACTS’

SOURCE DOCUMENT:

THE BUSINESS OF KNOWING YOUR PLACE

http://thereisnodebt.wordpress.com/2014/04/05/the-business-of-knowing-your-place/

So, all rants aside, if people here so hate the stock market and real estate as sucker’s games, what do you all recommend doing with your money? That stack of gold buried in the backyard bunker (or equivalently the savings account full of cash) hasn’t done all that well either.

Even given that markets are manipulated, we have to acknowledge the realities of inflation or watch it eat us alive. So what fraction of one’s assets should be in equities, R/E and cash? I personally think that something like 60/30/10 (or perhaps as cash heavy as 50/20/30 if one is ultraconservative and closer to retirement) are reasonable goals, but I’m kind of curious what the doomer consensus is.

By way of confession, I made my own personal capitulation to real estate last week – but not the sort folks here usually talk about. After several years of increasing my cash position to prepare for either a home purchase or an interest rate rise sufficient to increase my bond holdings I finally threw in the towel and just paid off my mortgage instead.

After years of advocating holding onto a mortgage and investing one’s excess cash instead I feel like something of a hypocrite, but I haven’t been able to find bond yields exceeding my effective mortgage rate for several years and watching the effective negative return on cash was finally too hard to bare. And now, of course, I regret not simply paying it off 2-3 years ago when rates really tanked.

Apolitical,

I own a tourist rental in France and will invest in another in a market with steady tourism and collapsing prices. Tourism is a very safe bet i think. I also have a diversified stock portfolio. However I will be a renter in California until something cash flows here.

I think that investing in tourism is very high risk. It is heavily dependent on discretionary income. What we see in the developed economies is very fast rising prices for food, health, education and energy while the incomes are stagnant. That means you invest in an industry with a very fast diminishing discretionary income. What would that do to the profitability of your rental? Vacation budget is the first to be sacrificed when people have to heat the home and buy food and pay for gas.

33.3/33.3/33.3

This is a very old model but I believe it applies today as it did in its day.

Take this with a grain of salt. THere will be inflation in everyday need items and deflation in the bigger items like housing, commercial RE, stock market, bonds, etc. Gold/Silver have to be part of any portfolio nowadays with govts around the world printing like crazy. But one thing i can pretty much guarantee is that there will be an inflation in Fed/State taxes in the future. When GOVT will need more cash(FRN are not money) they will increase taxes on everything and try to find new things to tax.

I think this is a good move apolitical. Bonds are nowhere, gold is for the anxious, stocks are for a portion of your cash and RE is what’s left. Home grown veggies are the best…

The Dr stated, “Simply putting your money in a bank is a losing battle because inflation is eroding your buying power”. In my 55 years on this planet, everything has got more expensive, as time marched on. That said, people need to take a long view in how they allocate their money.

In the long run, I feel prices will march higher and be much higher in 15 years than they are today for most everything except electronics. I encourage younger people to own RE and to invest in the stock markets, as that is the only way to keep up with and hopefully exceed inflation.

Could deflation happen and turn my beliefs on their head? Maybe, but the FED will throw everything they have at deflation to keep it from occurring. If the FED fails in that mandate, then all our lives will be really different anyways, so these conversations really will not matter.

Housing prices can’t march higher if incomes are not there to support it and incomes aren’t rising, they are going in reverse. People will have to seek out affordable places to live and go where the jobs are since we all can’t deliver pizzas to each other.

The average person investing in stocks will get crushed. The pros have too much leverage, make trades much quicker and stocks are too volatile lately. Can’t trade shares of a stock that go to zero.

Heh. Love the phrase “house horny”.

Seriously, a lot of people blame the big bad banks and the sweating screaming type A males that run the financial business for our housing industry morass, but, I always point to the American woman as a primary cause, and her “house horniness”. I got divorced at the right time (2001), because, if I didn’t, I’m pretty sure the ex would have saddled me with an enormous housing debt that I would carry to the grave, much like those burning tires they put over the heads of people on the wrong side of the argument in S. Africa.

Wow, the monolithic “American Woman” is to blame for the housing crisis. How does one even address such an oversimplification?

“Wow, the monolithic “American Woman†is to blame for the housing crisis. How does one even address such an oversimplification?”

Reading comprehension. I didn’t say it was the only reason. But I never hear it addressed as a cause. Trust me, if men had their way, they’d be living in little man caves with nice garages. Name me one male acquaintance of yours who really wanted that 5000 sq. ft monstrosity with the pool and all that damn landscaping.

No, but you did say “primary.”

To Mike M

If men had their way, they’d be living in nice man-caves with 4 car garages with 4 cars costing about $65000 each, and a massive boat on a trailer out back…. and the man cave would be stuffed with an array of Big Boys’ Toys costing thousands of dollars each. There’d be a Ford F-150, and a high-series Benz or 700 series Beamer, and a ‘Vette or some other over-powered cop-attractant, and at least one 50 year old “classic” car sitting on blocks out back while the guy rang up $20,000 in parts for the thing.

And

Whew! Wow Laura, you are going to get a large alimony payment aren’t you?

Yes, many women look at the “house” and call it their “home”. My mom was that way and destroyed our family because she needed a giant “house”. I remember when I went over to my Dad’s crappy little apartment after the divorce and having him tell me “he has never been happier?” When I sold at the peak of the market in 2005 and rented my wife rode me for years about selling, finally coming around to now “we” sold in 2005….If your not “man” enough to make hard decisions don’t get married. And if your “spouse” is just to damn stubborn and will make your life hell if you don’t buy a “house” then get the H out. “Houses” are not homes……………..

This is the same message for the last 5 years. Unfortunately if you did not buy, you missed some awesome deals. I know I bought a bunch. Now the story is that it is too late. All real estate is local and there are still deals in markets. The advice in this column has been to not buy for the last 5 years as the market could not support itself. A lot of money has been made in that time frame. Just like the reference to the stock market the last 5 years, not sustainable, no earnings growth etc and it is up 170%.

A lot of money has been made? You mean a lot of money has been STOLEN in the greatest transfer of wealth aka outright theft in recorded history. Stolen from the actual, tangible, real hard work blood sweat and tears of main street, the common man, the taxpaying citizen as well as future generations of similar people. Now relegated to being debt and wage slaves to shit sippers such as yourself.

Looks like 5 years ago the DJIA was at 8000, now it’s at 16000 so 100% higher…where do you get 170%?

Broader market is more typically represented by the S&P 500, which bottomed at 666 in early 2009 and most recently closed at around 1872 – closer to a 180% increase in 5 years.

Agree with Dr. HB, “You really need to run the numbers.” For my family in SF Bay Area it was about moving out of our home on a busy, steep street so that we could raise our toddler grandson in a quieter, flatter neighborhood where he could ride his bike safely some day soon. This was in Spring 2008 when it was very much a buyer’s market. It seemed like the right time to make the move. We probably should have negotiated more, but purely based on our income, available down payment, and finding what appeared (and still seems to be) the perfect home for our family, we took the plunge. We didn’t know then, that in less than a year we would lose $100K in value, nevertheless based on our solid reasoning for purchasing we have never regretted our decision. Going into the transaction, we knew that we likely would retire in this home, therefore we did not consider it to be an investment but a HOME. Our grandson is now almost eight and has many good friends in our neighborhood. In many ways, we continue to appreciate the decision that we made six years ago even though we have no idea if our home is now back to its 2008 value, much less whether it has increased in value.

Meanwhile, we kept the first home and continue renting it to family. The new home is no larger than the first, a modest 3 bedroom 1.5 bath home that will be just the right size once the grandson has moved on.

Having read about Warren Buffet’s advice (paraphrased), “Be fearful when others are greedy, and be greedy when others are fearful,” I often ask myself where we were back in 2008; were we fearful, or were we greedy? And I can’t answer entirely in one way or the other, because we really did not consider our purchase of a home to be as much something we should do to make money (as with an investment), as it was something we needed to do to make a better environment for our grandson.

Then I remember what we had discussed about our impending purchase…That we were fearful of losing out to better offers on the one home, out of all the homes we looked at, that seemed “perfect” for us; that the market was “probably” at the best it had been in a long time, that if it went lower it likely would not go very much lower, so going ahead with the purchase seemed like a sound decision. And now that home values have increased from the 2009 lows, we feel more and more content with our decision to purchase.

But that was US, and that was THEN. I don’t think it is reasonable for anyone to make pronouncements that this is a good time to buy (or a good time to sell, for that matter) or not a good time. It all depends on the specific family and their needs, and their reasons for making a purchase at this time. If a family is able to find a house that they can call home for the rest of their lives if they have to, then it might be worth taking the plunge if there are no more than one or two other bidders, if the appraisal is aligned with the asking price, and if their lender will provide a fixed rate mortgage. Beyond that set of circumstances it seems to me is very risky.

Speaking as someone who lost big in the market downturn, I think putting $100,000 into a house is a very different thing: at least you have someplace to lay your head at night, even if you’ve lost most of your down payment to a falling market. You can’t say that losing $100,000 in stocks, which happened very quickly, and me with a dying spouse. Of course I did the stupid, frightened person thing and took what was left out of the market. I did put some back in and made good money recently. It certainly wasn’t all I could have put back in but I’m not regretting the gains I *didn’t* make. Rents becoming outrageous and I see more young people in their late 30s slowly pushed into downsizing here in L.A. Watching the stock market sites, they are waisting their time boosting each others’ morale about how a downturn *isn’t* at the door, so you know something is afoot IMHO

I feel for you having a personal tragedy to deal with during the crash. It seemed traumatic enough to me even without that. In my late 40s I had begun to diversify, but was still a solid 75% in equities in ’08 when the poop hit the prop – and like many here watched my net worth drop 30-40% over the course of 8 months.

I wasn’t obliged by family necessity to pull money out during the crash, but even so I was scared enough by the crash to rebalance out of equities more aggressively during the recovery than perhaps I should have. Starting when the S&P got back to around 1200 and ending last year at 1700 I incrementally pulled money out of the market until my equity stake was down to 50% of my NW. While “prudent” this abundance of caution (and perhaps over-reaction to the crash) has cost me a pretty substantial chunk of change compared to what I’d have if I’d simply let it ride – but then I’m near retirement now and sleeping at night is important too.

You did the right thing.

I hear you apolitical…thanks for the sane response to my post. Sometimes the crazy gets a bit thick around here, but still I’m hoping “housing to tank hard in 2014” happens before I buy this summer! Probably not, but I’m still going to buy now. If I lose some or most of my down payment to a correcting market, just got to shrug my shoulders and go forward. I’m not big into waiting around for the world to fit into my plans – even if that means a much smaller place than I’d like right now because prices are high. Gotta remain nimble and flexible in this world and count your blessings. A lot of the world is living in tin sheds with dirty water – USofA isn’t there yet…

I’d say that’s the conservative (and correct) approach. If you’d left all of your money in stocks and the market collapses tomorrow, where would you be?

I’m at the opposite end of the spectrum, less than 10% of what I have is in stocks. Just seems like there is too much risk in the market nowadays.

DHB,

I think we need to answer two critical question before we speculate…

1. How long the Inflation will keep going up ?

2. Not if but when the inevitable deflation will happen?

Blert, the observer, son of a landlord, Robert, what, Jt,Tj or somebody enlighten us

I’ve seen inflation for the past several years at the supermarket. Some price increases are obvious. Some price increases are hidden — e.g., cans of salmon selling at the same price, but downsizing of the cans from 6 oz to 5 oz. I’ve caught several products downsizing in like manner.

I know some will say that inflation is not the same as price increases. I understand how that’s technically true — but inflation often leads to price increases. For all this talk of wages remaining stagnant, or money not being released into the economy, I see prices increasing. That’s real inflation to me, in practical if not technical terms.

And I foresee more, and more rapid, price increases, thus hyper-inflation. I don’t know when, but likely sometime in the next few years. Maybe even by 2015. I wish it weren’t so, but the govt is borrowing (and, I believe, printing money) and spending like crazy.

In another thread What asked me for my crystal ball. No crystal ball, just my analysis of what I see in real life, and read about here and elsewhere.

SOL, I think you are right in your analysis, that inflation for everything which can be exported is very visible. On top of that health care cost and education cost went up even if it can not be exported – these last 2 have to do with politics. Even with the wages stagnant the prices went up and will continue to go up because prices are not dictated ONLY by US consumers. The level of liquidity went up across the globe. It does not matter where the money are, the fact remain that more dollars are chasing the US goods.

“What?” is also correct that we witness and will continue to witness deflation for everything dependent on debt – i.e. housing. It is obvious why: if wages are stagnant and everything goes up in price there is nothing left to save for downpayment (in general, because there are exceptions). However, I don’t believe that long term we are going to witness deflation or that the deflation will be very deep at least in major cities with employment. The reason for that is this: the same inflation you witness at the store and gas station is experienced by builders for all the materials (remember that materials can also be exported with a low dollar and all imported materials go up in price). Therefore, unless the house prices increase a lot, at least to keep up with the increase in materials and labor, the builders don’t build. Also in very crowded cities, the price of land also goes up in price. Low building volume eventually, over the years, leads to shortage of housing. Even with stagnant demand, the prices will increase because of decreased supply. We already see that – not too much building taking place where people want to live, low sale volume and stagnant or increased prices.

This is why I think that both you and What? are correct from you point of view.

As for deflation, I don’t foresee any “inevitable” deflation in the near future. Maybe not for many years.

Deflation begins when ZIRP ends. Maybe sooner.

This time the crash will be brutal – real estate investors will not think twice about sending in thousands of keys if it makes financial sense to do so.

Furthermore, real estate investors/holding companies watch each other and usually follow the same strategy. If one ditches a bunch of homes, the other may very well do the same.

The US Government backing many of these loans will do nothing to stop the drop in real estate prices and the US taxpayer is going to get hosed – again!

Let me explain America as a capitalist nation. Most people don’t have enough savings, most don’t have health insurance, many are on the brink of poverty.

Folks it has been that way since we got our Independence. The scare of real estate values and people purchasing more house then they can afford has been around for ever.

My Grandfather’s home in Chicago back 1950’s also went thru housing uncertainty it was called racism, everyone left or got foreclosure on because minorities were moving in.

In those days if we had internet you people would be saying the same nonsense, you can’t trust real estate investment why buy a home a minority is going to ruin your value.

Today that area is luxury Hi Rises that sell from the 500’s?

So many people are under water so what, many people file bankruptcy in America this morning, GM should be put out of business for the deaths and cover up, it goes on and on, look out for yourself and if you come across a house you can offer on or a neighborhood you like buy it!

Thank goodness that there are housing prophets such as yourself with a brave enough soul to spread the good word on these scary blogs and save the innocents from being tempted by Satan’s words of caution.

Anon… It is not about caution, that is when you are told to proceed but be cautious, it doesn’t mean turnaround and never take this route again.

On this site people are professing to rent for the rest of their lives and that housing will never be a good investment again.

I profess, to look at a house, check the zip code and be cautious but buy the darn property if you can do it.

Most want my head , they call be a real estate agent and crooked car salesman, I don’t read anything about being cautious and buy a home on this site.

It is all about they can’t afford a home so bash housing market, I’m just keeping the natives honest on this board, with my take?

Either you’re not very bright or you’re intentionally distorting the truth. Doc and the vast majority of the regular commenters here are not advocating a position of “forever” nor “never.” That’s more your speciality.

Again, why are you proselytizing on here? Oh right, to keep ’em honest. Yeah, okay pal, whatever you have to tell yourself…

Just don’t see this in the Bay Area. Or, rather, foreclosures are, as far as I can tell, bought by flippers, investors, people with money to burn/risk since it isn’t possible to inspect (except visually) a foreclosed property. These flippers can put money into fixing up the foreclosed homes (bought at bargain basement prices) and then sell at current market rates.

Case in point: 4/2.5 house bought in Oct. 2013 for about 500K. (I assume this was a foreclosure since I never saw it listed.) It’s on a major traffic through street and is practically on top of a BART station.

The flippers did a great job. I’ve never seen a house in such great move-in condition. inside and outside: no visible defects at all. Not a flaw in the paint work, closets, cabinets, nothing. A house to die for, excepting the location.

It was put on the market in March for $700K. Sold yesterday for $1,050,000. If one assumes the flippers spent $100K, even $200K, fixing up the house, that’s a darn good 6-months’ profit.

Another house, 3/2, “50 years in same family” on another major traffic thoroughfare, was put on the market for $950K last week. I don’t think the owners bothered to do any renovations/repairs. It is, shall we say, ugly inside (paint choices, cabinet finishes, ancient bathrooms). Unless the owners had 2nd and 3rd mortgages, they took a look at the market and realized that could finance a nice retirement in a less expensive place. I’ll be watching to see if the $950K price is a realistic assessment of what the market will bear (as opposed to the bait-and-switch asking prices for the past 10 months which have ranged from $200K – $500K under the sale price) or if the owners are still expecting a bid of $200-300K over the asking price.

But, to get to my point. The last housing bubble set a new “floor” for housing prices. The foreclosures have/are being sold to investors (as you point out) and these investors can wait and sell at current market prices. Even people who are still underwater, as long as they can continue to pay their mortgages and are still living in their homes, have no impetus to sell until/unless market prices will allow them to see at a profit (a price greater than they paid for the house at the top of the last bubble).

In short, the last bubble set a new “floor” for housing prices, just as the current bubble is setting another new floor. And that floor makes housing affordable only for the wealthy. Sure, there may be another housing crash but as long as owners can hold onto their property (and everybody needs some place to live), they can wait as many years as it takes for the market to recover. The result is that the inventory available for sale remains low – which contributes to high sale prices and a new floor for future housing prices.

The Bay Area wealth effect extends beyond Silicon Valley and San Francisco. The rich can buy million-dollar homes, can afford to pay cash or carry an $800K mortgage. The non-wealthy have only two choices: to move from rental to rental in, probably, increasingly less desirable neighborhoods as rental prices and housing prices increase or leave the Bay Area and move inland (where housing prices remain affordable) or leave the state.

During our entire life in the Bay Area, housing prices have always been beyond our reach, given that we did not want to lose our cash safety net. Our income has never increased at the same rate as the cost of housing. The one time we could have afforded the home we want, during the crash, was another time when we didn’t want to risk our savings (not wanting to bet that we would not lose our jobs during the recession). In retrospect, we should have taken the plunge. We didn’t. We remain stuck in rental land, increasingly fearful that we will be forced out when the owners sell.

Do we lust after a house? Yes. We want a place to live in for the rest of our lives, a place that isn’t subject to the whims of a landlord, a place from which we can’t be evicted, a place which we can modify to the extent we can afford to.

We see no way this will happen in the Bay Area.

I don’t think previous bubbles set the “floor.”

I think incomes set the floor, while low interest rates, QE, financial instruments and the likes set new, ever higher ceilings.

I feel for you folks in SF though. A lot of salaries directly tied to the stock market.

Weeee!

Yeah there are a lot of rich people in the Bay, but most are middle class. They got that way due to military, union jobs and small business mostly. Thing is military is gone, union jobs disappearing and small business is being eaten alive by high costs of business. You also have a lot of older folks all over who own properties. I don’t know many people outside of very special cases who own in the Bay who are under 40. Huge inventory exists that is going to be coming onto the marketplace within the next 5-10 years. Remember, Bay Area is huge, it goes from Sonoma all the way to Gilroy and east to Livingston. Can every city between these places realistically be high-priced forever? I understand SF and Palo Alto, but who wants to buy a $1 million home in West Oakland? Even in NYC (the king of crazy housing prices) you don’t see properties this crazy. Are there 7 million rich people to replace all those current residents? Nope.

It’s a bubble, and when this happens, housing gets crazy. The last few bubbles landlords made out so now they’re accustomed to greed. Happens every few years.

I can already hear the housing cheerleader responses.

“This place is different.”

“Everyone wants to live here.”

Until it isn’t… and they don’t.

I can see the problem you have with the Bay Area. Maybe you have a good job keeping you there; in that case you may want to find work elsewhere. It is not only important how much you make but what can you buy with your pay. The dollar is like a unit of measurement, it is not wealth in itself.

I see that you are risk adverse like most people on this blog. I am the same way. However, you can not eliminate risk in life. From the time you are born, to the time you die, you face risk. Everything in life is about managing risk – i.e. you have to measure the probability of each outcome. That being said, I agree that Bay Area is well known for very low purchasing power and very high risk in terms of real estate (if you buy something you might not be able to keep those astronomical payment, taxes, insurance and maintenance).

Interesting interactive graph from LA Times today, showing how much home prices have bounced back since the bottom of the crash a half decade ago. The part of this that is interesting is that the steepest price increases have not only been in places like Santa Monica, Bevery Hills but deep in SouthCentral LA (Willowbrook) also.

Here is the header to the graph and the link to the graph itself.

The Southern California housing recovery has been robust in 2013, with heavy demand from investors and families driving large price gains. Many ZIP codes that have seen the sharpest rebound were the ones hit hardest after the crash. Investors — including Wall Street firms — have bought up perceived bargains in those neighborhoods to flip or rent out. Use this interactive map to look up the difference in your neighborhood between the bottom and the median sales price for previously owned houses in the third quarter of 2013.

http://graphics.latimes.com/responsivemap-la-fi-median-home-prices/

I think the take-away is that the super wealthy who can afford Santa Monica, Beverly Hills will buy there as they please without much concern, whereas in WillowBrook area, the prices had plummeted more than Santa Monica but also as prices rise, more people are choosing to ‘own’ a home in super low cost SouthCentral rather than continue renting. Of course, I am not saying yuppies are moving to SouthCentral to be a homeowner but perhaps the rentier class from places like Pico Union or other parts of SouthCentral would rather own in Willowbrook than continue renting.

(from a prior LA Times article we know that rental rates in LA have risen strongly as well – no sign of rental rates flattening).

The rental across from my place dropped $600 from its original asking price before it was filled.

The buildings I see going up have “pre-leasing” signs during construction and then leasing signs well after completion. Many of those signs seem permanent. Balloons and leasing signs everywhere in LA.

Apartment construction up at an astonishing rate since Garcetti came into office.

I’d love to be in the crane rental business right now. Beyond that, not so much.

How long will the rental market at this price level last?

Productive people are leaving.

This is a strange phenomenon – massively increased inventory in LA but higher prices while UE remains high and wages go lower. Interesting to see what actually triggers the housing collapse in LA when it happens.

That we’re in a ‘bubbly’ time is of no question. However, one of the differences, I believe, is that this is not a ‘sub-prime’ tinderbox that will inevitably explode. People buying houses now ain’t dummies; they are people with either loads of cash, or great credit, solid-verifiable income and enough money for a down payment… in other words, not your typical ‘fools’. these are people who have essentially been responsible.

Cash investors do not make for a stable market. If/when there is a downturn, there will be a rush to the doors.

Cash investors ‘are’ certainly a strange variable… but rather than losing money, I could see them just sitting on the property. A loss isn’t such until you cash out and if rent is being generated, likely still beats stocks, bonds, etc. (which would also be hurting, most likely)

This time is different. Couldn’t come up with your own comment forum handle?

I don’t know that there’s gonna be a ‘crash’, per se. A major taper, stagnation, probably. But a LOT of what happened in ’08-’12 was people who had no business buying in the first place, defaulting within 18-24 months. I think the current crop of buyers could, and would ride out a bumpy ride — at least their credit-worthiness along with financial reserves would seem to indicate so. I don’t see people with 780-800 credit scores suddenly becoming deadbeats. Underwriters are pretty hardcore these days.

If we’re to ignore larger structural issues in the economy and solely focus on who mortgaged up, there’s still a disconnect in that analysis because it only mentions the latest cohort of “buyers.” It doesn’t address the larger layers of bubble 1.0 distressed properties that are still waiting for their day of reckoning, or do you think that has all been solved by accounting gimmickry and the Fed’s monetization of junk mortgages?

It’s easy and simple to focus on one input, but that doesn’t paint a complete picture.

By the way, nice dodge on the comment handle question. Try getting your own instead of being lame and using someone else’s, robert.

Yes, foreclosures are up – as pointed out in news just a couple hours ago, but with increased pricing and low inventory, it seems that many people facing foreclosure could sell into the market rather than let the bank do it for them. Sure, there are still underwater houses, less so.

Hey, I’m not Nostradamus, but I am buying a house right now, to live in… and it’s something I did NOT do in ’04, because I felt the market was insane (though in hindsight, I probably should have bought then; I’d be ten years into the mortgage instead of the 270,000 dollars in rent that is out the window.

“I am buying a house”

Explains a lot. Let me guess, you originally came to this blog with an inkling that something about the market was off, but you’re so house horny that you’ll tell us everything you want yourself to hear in order to justify levering up. If you’re so confident in your position to buy, you wouldn’t be here trying to convince the rest of us (yourself) that red flags are white. Cognitive dissonance and confirmation bias can make for a particularly nasty hangover prone cocktail.

“something I did NOT do in ’04, because I felt the market was insane (though in hindsight, I probably should have bought then; I’d be ten years into the mortgage instead of the 270,000 dollars in rent that is out the window.”

Let’s do a quick back of the napkin.

’04-’14: Ten years / $270K rent = aggregated monthly rent of $2,250

$2,250 monthly P&I on a purchase (throwing you a bone by not factoring T&I or other possible outlays such as hoa, mello roos, maintenance, PMI, etc…) amortized over 30 years @ 4% (average rate assuming higher in ’04 and refinancing down toward 3% more recently) = purchase price of $471,288, after 10 years you would have paid $170,011.48 in interest to the bank (out the window) and have paid down $99,988.63 in principal. +/- a few negligible cents on the above

Now what? You have to sell into a higher market price level to lock-in a profit. Let’s assume in the best case scenario that the house you bought in ’04 sells for a higher price in ’14. If so, then what? Are you going to buy another home in the same market you just sold into? That mitigates any price level gain and presumably keeps your original $100K principal pay-down. We didn’t even get into selling costs or new loan costs.

All else being equal, the way to have come out ahead against only renting would have been to sell at the top in ’06 in order to lock a profit and preserve principal pay-down (less selling costs), rent until ’09, and then purchase again.

The question is – is now the time to sell again? You didn’t get it right the first time, so dag nammit, you’re gonna get it right this time, by golly!

Two disclaimers. This exercise doesn’t give a shit about “intangibles” of owning or renting. We’re strictly looking at the monetary since the original statement being challenged was all about the money. Also, one could very well borrow against assessed equity in the home and arb the difference if that money is used to invest in something with a higher rate of return. My bet is on most people moving before the opportunity of that ten years rolls around and they likely used any preserved principal pay-down to put into another home purchase, thereby extending the original cycle.

This isn’t meant to come across as a personal attack but when folks just casually toss around this whole “throwing money out the window by renting” meme, it begs to be exposed as the overly simplistic and lazy justification that it is.

There is no free ride or lunch. You’ll pay one way or another.

All good math. The variables though are — the place I would have bought in ’04, can’t be touched for the same price now. It’s well over that price now. (Silverlake) and who said I would move? I’d still be there.

But… even if I were one of the ‘average people who move 7-10 years’, if I sold, even at the same price I bought — or even took a bit of a loss, I’d still be ahead because I’ve lived in a place for ten years basically rent-free (or at least at a much lesser rate than $2250.00 per month.

Or am I missing something?

“It’s well over that price now.”

Emphasis on “now.” That means a sale now would result in a gain, who knows what the future holds. At some point when you would sell, only then can we determine gain or loss. Had you originally commented that you did buy in ’04 and would have thrown $270K in “out the window” if you had still been renting, my response would have been to let us know how it all works out after you sell.

The exception to this is by levering assessed equity into another investment and making out on the rate of return differential I mentioned above. Another possibility I forgot to mention earlier was if you have positive cash flow from renting the property instead of selling which is another blithely underestimated scenario people sometimes use to justify risk in purchasing. The whole “we’ll just rent it out if we can’t sell” thing.

“even if I were one of the ‘average people who move 7-10 years’, if I sold, even at the same price I bought — or even took a bit of a loss, I’d still be ahead because I’ve lived in a place for ten years basically rent-free”

I think something is missing here unless you would not have mortgaged. We assumed a monthly outlay of $2250 in both cases of renting and mortgaging. On the renting side, it’s easy, you spent $270K {$2250 * 120 months} and it forms our basis of comparison. On the mortgage side, after you subtract carrying costs (i.e. interest, taxes, insurance, maintenance, whatever else) from the $270K (which includes principal) that you spent {$2250 * 120 months}, you end up a lot less ahead vs renting than $270K should you sell to realize any potential gain. So, it’s not $270K in rent “out the window”, it’s less than that unless you gained the difference from selling into a huge up market (caveat on buying a replacement in the same market) or from levering the equity for a real return or from net positive cash flow from renting the place out. “Out the window” can also be said for interest, taxes, insurance, maintenance, selling costs, etc…

I didn’t even touch the potential tax implications as evaluating the potential scenarios involve way more time than I want to spend on this.

“anon” is the lack of a handle, idiot.

No, this is a lack of a handle. Comprehension.

“idiot”

Name calling… are you an elementary school student or an adult?

No… you had to type the entire word “Anonymous” in — Just like I typed in aNON Numbskull. That makes IT a handle.

‘anon’ is the default tag in the name field. So whoever that is commenting, didn’t bother to actually put a name in there.

Welcome to Jr. high, Sparky. I mean “A”non. Now go do your homework.

Rates for a conventional 30-year fixed mortgage are averaging 4.48 percent, according to Bankrate. For “jumbo” mortgages — those above $417,000 in much of the country — the average is 4.47 percent.

Just read that banks are now lending lower interest rates on JUMBO loans than conventional… The logic makes sense. They feel the JUMBO loan owners are buying in better neighborhoods and are more affluent.. so they are more likely to withstand another housing pullback.

Leave a Reply to Wisdom of Oz