Mortgage Electronic Registration Systems (MERS): A System Designed to Create the Mortgage Back Security Bubble.

I’ve gotten many e-mails regarding the Mortgage Electronic Registration Systems (MERS) case out of the Kansas Supreme Court. This is an important case but first let us discuss what MERS is. MERS claims to be a privately-held company and their function is keeping track of a confidential electronic registry of mortgages and the modifications to servicing rights and ownership of the loans. However, if you dig deeper into MERS and their shareholders you will find the same crony bankers that have led our economy off the financial cliff. Some of the shareholders include AIG, Fannie Mae, Freddie Mac, WaMu, CitiMortgage, Countrywide, GMAC, Guaranty Bank, and Merrill Lynch. It is a stunner how these same players show up in every financial war we have been dealing with.

MERS was founded in 1995 under the pretext that it would lower the cost of recording an assignment of ownership in county land records. By the way, as someone that has bought property in multiple states the filing fee is the lowest cost in acquiring a home. If you cannot afford the tiny fee in recording the deed then you probably shouldn’t be buying a home. The reality of course is MERS allowed for the mortgage backed security business to explode since it allowed mortgages to be shipped off to Wall Street to be minced into tiny tranches and sold off by the big investment banks to pensions, foreign investors, retail investors, and everyone else that wanted a piece of the mortgage bubble.

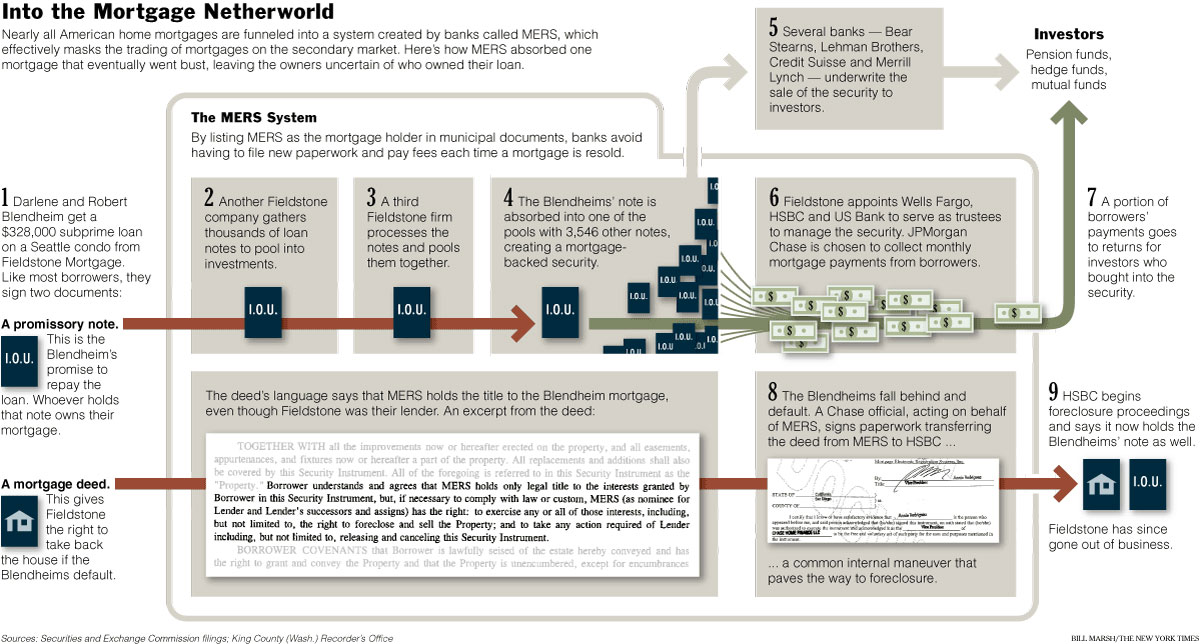

The New York Times had an excellent graphic of the MERS system dating back to April of 2009:

The reason that stories on MERS started showing up years ago is because many lawsuits have been flung at MERS. Who in the world actually owned the home or at least the note that secured it? If you have a mortgage and think you own your home, stop making a few payments and you will find out who the real owner is. That is, assuming banks even move on foreclosing and many are not given the growing shadow inventory. So let us walk through the graphic above. A promissory note is signed by the buyer of a home. The lender has the right to take back the home if the buyers fails to meet contractual agreements (meaning paying the monthly nut). Interestingly enough MERS shows up on title to the mortgage even though the mortgage was originated by someone else. These lenders then process and package the mortgages into a bundle and ship them off as a package. Banks like Lehman Brothers and Bear Stearns underwrite the actual security (or used to). At a certain point the lender will appoint a certain bank as a servicer to collect the monthly mortgage payment. Each monthly payment kicks down a portion to the investors in the MBS. However, if a foreclosure takes place this is when things get extremely dirty.

In the New York Times article, we are given an example where a lender that is now defunct, has Chase sign over the paperwork (acting on behalf of MERS) to HSBC so they can proceed on any actions with the deed. Now with a few foreclosures this can be covered up. But with millions of foreclosures this gets problematic. Here is how it breaks down:

MERS has been involved in thousands of lawsuits. Here is what the honorable Jon Gordon of Florida’s circuit court in Miami-Dade stated:

“It truly concerns me, however, that thousands and thousands—thousands and thousands of mortgage foreclosure actions have been filed with these allegations. I am not certain what remedy, if any, these people would have were it to be determined that MERS was not ever the proper party notwithstanding that these folks [might] have been in default what their recourse, if any, would be.â€

MERS assigns a unique 18-digit mortgage identification number to supposedly track the loan through its life. If you haven’t followed most of the MERS saga, it is because the purpose of this is to essentially make homes a commodity to be traded like oil futures on the stock market. No need for your local bank to vet you for a mortgage when you can sell MBS to some international schmuck in Norway. Does it now sound like a good idea to save a few dollars because people are too lazy to record a file at their local county clerk office? This of course was never the main intent. The main crux of MERS was to make it easy for fly by night shady mortgage brokers to give mortgages like Alt-A and option ARM loans to anybody and everybody without thinking twice about the long-term problems simply to juice the Wall Street MBS machine. What do they care? Think of all the subprime outfits that imploded during the bubble bursting. By the time they imploded the mortgage was being serviced by someone else, someone that wasn’t at the table to make the loan in the first place.

MERS is a front for the mortgage and banking industry. It is claimed as a system of convenience but in reality, it is nothing more than the grease to lube up the housing bubble. It made underwriting easier but it also made it harder for homeowners to go after the lender who originated the note. After all, if they no longer hold legal action on the deed, who do you really go after? So make no mistake that nothing that you are hearing about MERS today is some kind of shocker. This system has been under attack for years. But what is significant about the Kansas Supreme Court finding has to do with the actual legal ownership of the note and deed especially when it comes to foreclosure.

Landmark National Bank v. Kesler

What was found in this case is basically that MERS is a straw man. You know, like a shady phony buyer who buys a home and never really intends to take possession of the home? The way the mortgage is split up essentially muddles the entire process but also provides “an opaque veil that clouds not only the actual real ownership of the promissory note, but title to the property.â€Â In other words, MERS does the exact opposite of what it claims it set out to do. In regards to the straw man argument this is what the case found:

“The relationship that MERS has to (to holder of a loan) is more akin to that of a straw man than to a party possessing all the rights given a buyer. A mortgagee and a lender have intertwined rights that defy a clear separation of interests, especially when such a purported separation relies on ambiguous contractual language. The law generally understands that a mortgagee is not distinct from a lender: a mortgagee is “[o]ne to whom property is mortgaged: the mortgage creditor, or lender.â€

Interestingly enough the Missouri court found that MERS was not the original holder of the promissory note and since the record never contained evidence that the original note holder never explicitly authorized MERS to transfer the note, the overall language was in essence not effective. This is a big case because it goes to the heart of how MERS plays a crucial role in splitting a promissory note and basically creates immediate flaws in title. In other words, to grease the market and blow up the MBS market these people failed to even adhere to their own tracking of a mortgage! This system is like trying to track a laundered note through the economy after one year. Who really owns the actual note or holds title to foreclose?

In the case in Kansas, the court finds that MERS has very little claim on the note:

“”What stake in the outcome of an independent action for foreclosure could MERS have? It did not lend the money to Kesler or to anyone else involved in this case. Neither Kesler nor anyone else involved in the case was required by statute or contract to pay money to MERS on the mortgage. [citation omitted](â€MERS is not an economic ‘beneficiary’ under the Deed of Trust. It is owed and will collect no money from Debtors under the Note, nor will it realize the value of the Property through foreclosure of the Deed of Trust in the event the Note is not paid.â€). If MERS is only the mortgagee, without ownership of the mortgage instrument, it does not have an enforceable right.”

This wouldn’t be such a big problem aside from the fact that MERS has its dirty hands on some 60 million mortgages (assuming processed). Matt Taibbi talked about this case:

“This is a potentially gigantic story. It seems that a court has ruled that about half of the mortgage market has been run as a criminal enterprise for years, which would invalidate any potential forelosure proceedings for about, oh, 60 million mortgages. The court ruled that the electronic transfer system used by the private company MERS — a clearing system for mortgages, similar to a depository, that is used for about half the mortgage market — is fundamentally unreliable, and any mortgage sold and/or transferred through MERS can’t be foreclosed upon, at least not in Kansas.â€

So this is one big mess as you can imagine and Pandora’s Box may have been open. But let us look at what made this case happen:

Timeline:

March 19, 2004:Â Boyd Kesler secured a loan of $50,000 from Landmark National Bank in Ford County, Kansas

March 15, 2005:Â Mr. Kesler secured another loan for $93,100 from Millennia Mortgage Corporation

Both mortgages are secured by the same property but the second mortgage is at the core of the case.

That mortgage (2nd) stated that the mortgage was between Kesler and MERS which was “acting solely as nominee for Lender, as hereinafter defined, and Lender’s successors and assigns.

At some point in time, Sovereign may have taken possession of the note but it wasn’t recorded in Ford County (whoops! Trying to save those few dollars)

April 13, 2006: Kesler files for bankruptcy in US Bankruptcy court. He named Sovereign as creditor although he claimed the secured property as exempt.

November 16, 2006: Bankruptcy court discharges Mr. Kesler’s personal liability.

July 27, 3006: Landmark filed a petition to foreclose on the its mortgage. It named defendants as Kesler and Millennia. It did not serve MERS or Sovereign.

September 29, 2006:Â Trial court filed an order of sale.

October 4, 2006:Â Notice of sale (NTS) was published in Dodge City Daily Globe

October 26, 2006: Dennis Bristow and Tony Woydziak purchase the secured property at a sherriff’s sale for $87,000.

November 14, 2006: Landmark filed a motion to confirm sale of the secured property. On same day, Sovereign filed an interest in the property saying it was successor in the interest of Millennia’s second mortgage.

November 21, 2006: Sovereign files a motion to object confirmation of sale. The motion asserts MERS as a necessary party to the proceedings. It also states Landmark failed to name MERS as a defendant and Sovereign did not receive notice of the proceedings.

November 27 ,2006: Kesler files a motion seeking funds from sherriff’s sale on January 3, 200.

January 16, 2007: MERS filed a motion joining Sovereign’s motion to vacate the journal entry of default judgment and objects to confirmation of sheriff’s sale.

February 1, 2007: MERS and Sovereign file motions to reconsider. Trial court denies motion to reconsider.

At this point this is where the August 28th, 2009 Kansas Supreme Court case enters. So what exactly happened? Basically someone extracted equity from their home and went bankrupt.  The home was sold at a sheriff’s sale to two investors (did they even know what they were getting into?). As it turns out, that second note is pretty big but proper parties weren’t notified because as it turns out, these people don’t do a good job keeping track of what is happening. Apparently the Kansas Supreme Court being logic driven saw right through the utter crap that is MERS and issued a smack down.

So what now? We basically wait. This case does set a precedent so it will be interesting to see if any other state supreme courts uphold or try to go against this case. Looking over the material, it is pretty hard to challenge the logic. MERS will fight as much as it can because this case virtually makes them a non-entity in mortgage holdings and that is their entire purpose. They serve as a front for the crony bankers and thankfully, at least a few judges can see through this crap.

Continuing with Judge Gordon:

“I’m not certain with the satisfaction of mortgages that have been filed on behalf of MERS how good those are and I am not certain how good title to property is that people bought at these foreclosure sales if it turns or becomes established that MERS was indeed not only not the right party but misrepresented by way of their pleadings and affidavits that they held something they didn’t own, so I’m not certain of the consequences but it seems vast.”

Oh hell yeah it is vast.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

44 Responses to “Mortgage Electronic Registration Systems (MERS): A System Designed to Create the Mortgage Back Security Bubble.”

The Court’s published opinion in this case may be found by clicking the link by my username.

Matt Taibbi talked about this case:

“This is a potentially gigantic story. It seems that a court has ruled that about half of the mortgage market has been run as a criminal enterprise for years, which would invalidate any potential forelosure proceedings for about, oh, 60 million mortgages. The court ruled that the electronic transfer system used by the private company MERS — a clearing system for mortgages, similar to a depository, that is used for about half the mortgage market — is fundamentally unreliable, and any mortgage sold and/or transferred through MERS can’t be foreclosed upon, at least not in Kansas.â€

>>>>

And Taibbi is DEAD WRONG! The court did NOT rule that a mortgage sold and/or transferred through MERS “can’t be foreclosed upon, at least not in Kansas.â€

>>>

What the Court ruled was:

>>>

(a) MERS has no ownership interest in the debt that is independent of its principal for whom it is acting (the one owed the money and who owns the loan.)

>>>

(b) Therefore MERS is NOT a necessary party to the case since it has no interest in its own right.

>>>

(c) Millennia made the loan and recorded its interest. It then sold the loan to Sovereign who DID NOT RECORD its purchase of the loan. MERS acted as agent for both.

>>>

(d) Sovereign had notice that the 1st lienholder was going to go to foreclosure sale having learned this in the context of the bankruptcy case.

>>>

(e) Sovereign did nada to try to collect part of the sale money. It did NOT show up at the hearing where the Court confirmed the sale and put in a claim. Admittedly Sovereign did not get formal notice of the foreclosure sale or notice of the hearing, but that was Sovereigns’ own fault as it and MERS didn’t bother to properly record the transfer of the loan to Sovereign from Millennia.

>>>

(f) Millennia did get proper notice of the foreclosure sale. That would be correct as it was the only one who had recorded another mortgage on the property.

>>>

MERS and Sovereign were told to sod of by the Court when they came in after the judgment and tried to reopen the case. MERs was told to hit the road because it had no interest of its own in the mortgage and was merely the agent for another (here Sovereign.) Sovereign was told to fuggedabout because it was Sovereign’s own fault that it didn’t get notice of the foreclosure sale because it hadn’t bother to properly record its acquisition of the mortgage. When a party causes its own problems, courts do not let it ask for the court to fix the problem when it would affect others – particularly when it means reopening a judgement. That was all the case was about and nothing more.

>>

Taibbi is so far off-base in what he claims and can cause so much damage with such false statements that he needs to be slapped with a charge of ‘practicing law without a license.’ Taibbi is WRONG WRONG WRONG in his assertions – and I went to the link and read the over-blown WRONG conclusions he drew from the case.

>>

(Note: I DO have the degrees and have been retired from the practice for years.)

AnnS – I note that your post was almost a year and a half ago, and indeed lots has transpired since that time. A couple of things should be painfully obvious o you now: (a) your assertions were dead wrong, and (b) your ‘degrees’ are quite obviously worthless.

Hm, that paperwork most likely started a nice fire “literally” dick. Can the hatchet just be buried already. I cannot and will not do this anymore. Just want to try to live and be happy. Ya, and i cannot take being kicked in my nuts anymore. I fucking give up. P.S. eye contact is nice and respectful when communicating. Oh, you have a team, i don’t. Me, myself and I. And i fucking hate being alone.

I forgot to add that Taibbi asserts absolute total falsehoods like ” Since a sale isn’t legal unless there’s full transfer of the physical note, a lot of the sales of mortgage-backed securities were not entirely legal, since the actual notes were often not transferred.”

>>>

That is SIMPLY untrue. The sale is perfectly legal. B sells the note to C and C pays B money. C can leave the phsyical hard copy of the note with B and STILL be the owner. If B later tries to renege on the sale on the grounds that C gave him the money for the note but left the piece of paper with him, C sues B and WINS!

>>

In real property law, one MUST record any interest they have in the land if they want to be protected against 3rd parties. For example, B writes out a deed to Blackacre (which he owns) transferring Blackare to C for $10 and gives it to C who sticks it a drawer; and then tomorrow B writes out a deed to Blackacre transferring Blackare to D for $10 and D immediately takes it to the courthouse and records it. Who gets Blackacre? Answer: D because he recoreded his deed first and had no knowledge of the deed to C. C can sue B and get hie $10 beack but he won’t get Blackacre.

>>

Here is another example. B lends money to C and C signs a loan note and mortgage on C’s property Blackacre. B sticks the loan note and mortgage in a drawer. Later C borrows money from D and gives D a loan note and mortgage on Blackacre. D records his mortgage. C stops paying B. B goes to foreclose. D objects and says his interest in Blackare comes before Bs and if B does foreclose, then C gets paid first out of the proceeds of any sale. C wins. He recorded first. B’s note and mortgage are good even though they weren’t recorded. He just loses to the one who did record in terms of priority of interests, and goes to the end of the line behind all those creditors who recorded before him.

>>

Taibbii is CLUELESS!

AnnS – Considering that an instrument is given value, faith and credit by the signature of a living man or woman, is it lawful (don’t care about legal, and I’m sure you know the difference) for C to make a copy of the the genuine original instrument that was left with B, and C then use the copy, with no living soul’s wet-ink signature thereupon to give it value, and possibly even make multiple copies of the copy, and profit from each copy? What of C’s lawful contractual consideration and disclosure to B in such a case?

Is it lawful for C to change the terms of the contract, genuine original or copy, without agreement from or notice to B (e.g. loan modification)?

Is it lawful for B to purport itself as an organization that wants to loan its money to me, and then to enter the security instrument, that I created value upon by my wet-ink signature, as a deposit on the B’s? Where is the lawful risk and consideration in that scenario? It seems to me that in such a case it is lawfully *I* who created the value for everything with any respect to my property, and *I* who loaned B money. Where is my lawful consideration therein, and especially if B made millions upon millions on copies of the value I created without disclosure to me?

If I am misguided or need further education, I would be happy to pay you any price you demand, to come out of retirement and educate me and, I would pay you up front and in full with a copy of: a personal check, cashier’s check, money order traveler’s check or, promise to pay (you pick). If you have former associates who could assist you in furthering my education, I will would also be happy to pay them up front and in full with additional copies of the instrument with which I paid you.

Right on. Despite all the “befuddlement,” there are certain invoilates in Real Estate Law. Thank you for clarifying the waters.

AnnS, could you please address the question of who if anyone can foreclose on a mortgage when the note has been resold as a part of an MBS. Variation 2: What if another lender forecloses on the property? Variation 3: What if the house is sold in a normal sale? I would imagine that since it is impractical that an investor in an MBS could record its interest in the property, that the homeowner is not required to repay the loan when the house is sold. There are several questions here. Please address each separately. Thank you.

Someone or group have a lien against the property. If MERS is just a service corp then this case will make it so that the real lien holders have to be the one’s that file and pursue foreclosure proceedings.

What I take away from Dr. B’s post, the article he is discussing, and the comments of posters above, is any home buyer these days may be and most likely is, stepping into a toxic legal quagmire that may result in the loss of his or her down payment and any claim to ownership of the property because the intricities of mortgage securitization as well as the conflicts arising from multiple loans from different lenders have made it almost impossible to establish who owns a particular property, and you could spend years in court establishing your claim, especially if you’re purchasing a foreclosure.

Add this to the construction problems due to shoddy construction of new and rehabbed properties during the bubble years, and buying a property looks more and more like a very risky bet on any terms, unless you are a cash buyer buying directly from a seller who owns free and clear.

Making sure the title is clear on a property is now looks a lot more difficult.

In contract law there are four basic ways you can respond to an offer, claim or demand: (1) straight unconditional acceptance, (2) conditional acceptance, (3) rejection/decline/dispute and (4) silence/acquiescence, which is essentially agreement.

When someone comes to you and says, “You are in default and we’re taking your home,” you can conditionally accept upon proof of claim that the entity moving against you: (1) Is a real party of interest, (2) is either the only party of interest or has properly met its obligation to notify all other alleged parties of interest as they have the right to claim their stake in the foreclosure, (3) is the lawful holder in due course of the genuine original promissory note, because if your home is taken on a copy of the note the real holder in due course of the genuine original can still come after you later, which creates and imposes undue liability with no remedy (a no-no in law), (4) has not already been paid in full for your home through bailouts, mortgage default insurance and the like, (5) that a true and lawful loan of actual money was made to you, as opposed to the lender just taking the security instrument that is given value by your signature and entering it as a book deposit, therein taking no risk and giving no consideration (not to mention misrepresenting the agreement and committing fraud) and thus making the original contract and all contracts therefrom derived void ab initio.

In light of the infamous and notoriously known “bank bailouts” and “mortgage and securities fraud” that have caused a financial crisis of global proportion, and such putting millions upon millions of American families out of work and out on the streets as the blood-sucking banks profit from this fraud fostered upon us, I think the above is more than reasonable to ask. Proof of claim. Put up or shut up.

When you conditionally accept, you have lawfully put the ball back in their court. If you say you’ll be happy to pay them upon their proof of claim and standing and they resist, sue them and ask your questions again via interrogatories, subpoenas, demands for production and et cetera, and put them on the stand and make them swear on and for the record under penalty of perjury and against their full commercial liability, and you might just see that their fraud and deceit has been fostered upon you too.

He (or she) who does not object agrees. Most people just assume that when they get a notice of default then they must be in default and should just pack up & go. This has to stop. It’s fraud and it’s not right unless you make it right by going along with it and not objecting. If someone wants to commit such a serious action against you as to take your home, call them on it. Conditionally accept.

Let that which has been done in the darkness be brought into the light.

This is not legal advice and should be completely ignored. Nothing to see here. Move along.

Sorry, Laura, that reply was not meant to be to you.

I have been in the lending industry for 18 years. Back in the early to mid nineties, when a loan was sold you had to send off an “Assignment of Mortgage or Deed of Trust” to the local county recorders office any time a loan was sold. This cost anywhere from $18 to $78 dollars depending on what state/county it was being recorded in. There were some counties(mostly Northeast) that would take 6 months to a year to record the document. This was a nightmare for wholesale lenders to keep up with and was my understanding of why they came out with MERS. The charge for registering the loan with MERS is about $6, so it is cheaper for the customer and easier on the lender.

Matt Taibbi is a GOD. His expose on Goldman is one of the shining lights in a long slog toward some serious paybacks for the Wall St. scum. He might not have a law degree, but the man is generally correct in his assessment of the wrongdoings and the methods by which the criminality was accomplished.

AnnS, could you please address the question of who if anyone can foreclose on a mortgage when the note has been resold as a part of an MBS. Variation 2: What if another lender forecloses on the property? Variation 3: What if the house is sold in a normal sale? I would imagine that since it is impractical that an investor in an MBS could record its interest in the property, that the homeowner is not required to repay the loan when the house is sold. There are several questions here. Please address each separately. Thank you.

>>>

__

(1) Who can foreclose if the note has been sold to 1 or many (MBS) purchasers?

>>

The answer is quite simple. Anyone who OWNS the note and who has not been paid by the borrower. B borrows money from A to buy Blackacre and gives A a note and mortgage on Blackacre. A sells the note and its concomitant mortgage to C. (Keep in mind that the mortgage is nothing more than a lien against the property securing the note.) B doesn’t pay. C can foreclose. A can not foreclose as they no longer have any interest in the real property or the note.

>>

To expand the example, B borrows money from A to buy Blackacre and gives A a note and mortgage on Blackacre. A sells the note and its concomitant mortgage to C, D, E and F. B doesn’t pay. C or D or E or F or all of them together can foreclose. Now if C starts the foreclosure on his own without the other 3 , C has to give notice to the other 3 AND has to disburse the proceeds of the foreclosure to the other 3 as well in proportion to their interests in the note/mortgage under the agreement between C,D,E and F about ownership of the note/mortgage .

>>

(2) What if another lender forecloses on the property?

>>>

I assume you are asking what happens if the 1st lender forecloses and there is a 2nd lender. B borrows money ($80) for a 1st note/mortgage from C. B then borrows money ($20) from D and gives D a 2nd mortgage. D’s secured lien (mortgage) against the property is junior to C’s.

>>

State law uniformly requires that if a lienholder is going to foreclose, that they give notice of the foreclosure action to ALL other RECORDED lienholders. In the example, B doesn’t pay the 2 mortgages. Both C and D have separate rights to go to foreclosure. If C moves to foreclose on the property, C has to give notice to D so D can protect its interest. C forecloses and the property only sells for $80 at auction. D get’s nothing from the sale and its lien against the property is extinguished. D can still sue B personally on the now-unsecured debt. (Note: these are general rules and CA has some weird rules about purchase money mortgages that are not in effect nearly anywhere else.) If the property sells for $100, C gets $80 and D gets $20. If the property sells for $120, C gets $80, D gets $20 and B gets $20.

>>

Let’s say B pays C but not D. D has the right to go to foreclosure. If D forecloses and sells the property, the proceeds go first to pay C everything that is owed to C. Only if there is something left after C is paid does D get anything. (That is why 2nd mortgage lenders generally don’t bother foreclosing.)

>>

Foreclosure proceeds are disbursed to lienholders in the order that the liens were filed. (Or in the case of an 80/20 mortgage made on the same day, the one that is designated ‘primary’ gets paid first and then the one designated as ‘2nd.) There is only one exception that can jump the line ahead of earlier lien holders and that is a property tax lien – it is either paid or it remains on the property even if the property is sold at foreclosure. It is never extinguished as a lien.

>>

In the case discussed in Doc’s post, the current owner of the 2nd mortgage didn’t bother to record that it had purchased it and now owned the note. The agent of both the seller and buyer of the note/mortgage (MERs) screwed up and didn’t record the transfer of the mortgage/note. The first-mortgage holder properly gave notice of the foreclosure to the recorded owner of the 2nd mortgage – who no longer owned it as they had sold it. No recordation, no notice required.

>>

(3) What if the house is sold in a normal sale?

>>

Works the same way. If a lienholder has not recorded a claim against the property, the sale proceeds are disbursed without regard to their claim. B borrowed the money from C and then D. C records its liens on the property but D does not. B sells the property and the only recorded lien is C’s. The title company is correct in paying out the proceeds of sale only to C. D would have no claim against the title company for doing so or against the purchaser although it could go sue B.

>>

Lets use the case reported. B borrowed the money from C and then D. Both C and D recorded their liens on the property. D later sold its note/mortgage to E who did not record. B knows the name and address to where he sends his payments for the mortgage/noted originally owned by D. The title company (and purchaser) will not disburse money from the sale until they have a release in hand from whoever owns the loan originally made by D. That means B has to track down the current owner, get something showing that someone other than D owns the loan, get a final amount due and arrange for the release. (That is where an agent like MERs comes in. If they are designated as the agent in orginial loan or have later notified B to send his payment to them, it is a lot simpler to get the deal done.

>>

(4) I would imagine that since it is impractical that an investor in an MBS could record its interest in the property, that the homeowner is not required to repay the loan when the house is sold.

>>

No it is NOT impractical that the investor in an MBS record its interest. B borrows money from C with the note and mortgage. C sells the note/mortgage to D,E,F,G, and H who calls themselves “MBS Group 1 Buyers.†When D,E,F,G and H buy the note from C as a package (along with several other notes) there will be documents transferring the note to them as MBS Group 1 Buyers. All D,E,F, G and H have to do is record that transfer document in all counties where the properties are located whose notes they have purchased. Typically group purchasers like the hypothetical MBS Group 1 Buyers will designate an agent or trustee in their purchase agreement. Getting such things recorded is one of the 2 jobs of agents/trustees like MERs (the other being collecting the payments) or places like Deutsche Bank. It is not impracticable to make up a list of properties and then mail off a copy of the transfer/purchase agreement (along with the recording fees) to the county courthouses.

>>

It is very important to get that transfer agreement recorded. A court will not allow someone to come in and foreclose unless they can prove they own the loan/mortgage. Deutsche Bank is particularly sloppy – they don’t get things recorded and then they lose the transfer agreement so they end up unable to prove that MBS Group 1 Buyers actually own the loan because they bought it from C. And that means if it is not recorded and then MBS Group 1’s transfer agreement is lost, then MBS can not foreclose. Courts have been kicking out servicers (agent/trustee) and the alleged loan owners for just that reason.

>>

Hope I covered it all. Sorry it is so long Doc.

Dr. HB – thanks for all the great posts. I check this site every day!

AnnS — thank you for sharing your knowledge with us and illuminating a rather murky process.

This isn’t all of the problem with bad bookkeepers. There can (and will) be problems when the note is fully paid. The borrower may have a very difficult time getting a reconveyance if she doesn’t know who can validly give it to her. And, the trustee may not even know that it’s been paid.

“Blackacre” – funny. It’s been a long time since I had to deal with that particular piece of property. AnnS, you set out some good examples to support your case, but a key point you have missed is that the rules covering each of these situations can vary greatly from state-to-state (or even by county), so the end result won’t always play out as you have suggested.

Makes title insurance seem like a worthy purchase.

Are any title insurance companies at risk from this mess?

Dear Anns, Dr. HB

I am again and again stunned by the vast information provided at this blog. Thank you all and especially Dr. HB for your great work.

Anns I would like to have clarified something from your last paragraph:

The mortgage originator has sold the note and transferred all relevant docs to the MBS/CDO investors/ its trustee(s). In this case the investor/ trustee has every right to foreclose on the non performing notes/loans. As soon as there is one relevant piece of “paper” missing from the note/mortgage transfer the house buyer has nothing to fear (except gods angriness) and he can even stop paying without being foreclosed and live there forever?

If it is so, isn’t it very likely that at least 50%+ of the documentation of the securitization went missing/under in the heydays of the MBS/CDO bonanza?

Thank you all for the conversation!

It was just a matter of time before this decision came down from a Supreme Court. You’ll start seeing this happening in more states because more homeowners are filing lawsuits because of the fraud that has been perpetrated upon American homebuyers. I audit mortgage loans and I’m disgusted at the way banks have profited off the backs of Americans in this country.

From a legal standpoint, there is no way MERS can ever foreclosure — they lack standing. MERS entire business operation is premised on the wholesale and ever changing sale or transfer of “servicing rights.†MERS does not own the loans, rather they are acting as a “nominee†for whomever might or might not say that it owns the note at any given time. Further, since MERS never obtains possession of the Promissory Note which secures the Deed of Trust, it cannot ever have the right to enforce the terms of the Deed of Trust, since that right is reserved to the owner and holder of the secured instrument, the Promissory Note.

Gman

>>

I just recited the basic hornbook rules. If you remeber Blackacre, you will remember hornbooks and the “general and majority” rules that one had to memorize for the bar.

>>

CA for example has different rules about the collection of deficienies after foreclosure depening upon whether it was aprimary or second house, purchase money or refi…..etc etc.

>>

Recordation of claims against land is CRITICAL to protect one’s interest against 3rd parties.

I’m requesting advice on reasonable closing costs. I was high bidder on a bank owned home in Florida. The real estate agent is trying to get me to go with her mortgage broker. The good faith estimate is on a loan amount of $132,000. Are the following fees in the good faith estimate reasonable (its an FHA loan if that matters)?:

810 Processing fee $695.00

812 Broker fee $650.00

Admin fee $595.00

1101 Closing/Escrow Fee $250.00

Thanks

Yeah. That’s it. I don’t even want to buy a home anymore. WTF?! One would need a law degree to sort through the mess involved. So much for progress.

Christine, I agree with you except that homeowners were not such innocent victims. I would like to buy a $9,000,000 home in Malibu for no money, with no job, a bad credit, and without reading what I sign. I would like to withdraw $5,000,000 from this home I did not pay for because it is in Malibu and it will be worth much more, I am so sure. And if they kick me out in 5 years after living there for free and profiting from it, I will feel like a victim, because I bought this home to make money off of it. By the way, if I can pull this off, then everybody on this blog is invited for a house warming party.

Good stuff AnnS. Christine’s comments are valid except that it doesn’t mean the power of sale from those Trust Deeds can’t be enforced by the Trustee on behalf of beneficiary, whoever it may be, and it can be conducted in the name of MERS. Read the MERS Membership rule 8 regarding Foreclosure proceedings.

http://www.mersinc.org/files/filedownload.aspx?id=172&table=ProductFile

AnnS,

The real issue isn’t what your stating. Yes a debtor would still be on the hook. But your lenders b,c,d,e,f are greatly underestimating the issue. You have thousands of “owners”. Each with a tiny piece. Not a tiny piece that is a whole either. It is a tiny partial piece, a percentage of the whole.

To make it simple.

they took 1000 mortages.

Of these

25% were AAA rated or 250

25% were AA rated or 250

25% were A rated or 250

15% were BBB rated or 150

10% were bbb rated or 100

Then these were sold individual to investors. No they were Still sold in a block of 1000, but the payout expectation was as above. So the AAA got paid till 75% didn’t pay. So they won’t show up in court and aren’t due any money and couldn’t care if J6P gets the house.

The AA got paid till 50% didn’t pay. So they won’t show up in court and aren’t due any money and couldn’t care if J6P gets the house.

Same for A and the BBB rated folks. But it could be argued they also “own” a portion and need to be made whole. But they are in fact whole because they have been and continue to be paid in full.

Now what’s left? bbb well this is the junk bond or worse status. They knew they aren’t to be paid first. They are also the speculators, the fly by night industries, they had little in resources and were just gambling and knew it. Also their stake is likely very tiny in any particular mortgage, like 10%(keeping it simple). So even if they were to foreclose on their own, they would be standing alone in court because only they didn’t get paid. Only they would be due money. They can only claim the portion due them. Everyone else was paid.

Now in reality the mortgages were broken into 1000’s of pieces with the bulk of the “owners” getting paid. So most of them would have no standing to reclaim any monies. But due the few that aren’t getting paid actually “own” enough of any one house to foreclose on it? Say the guy not getting paid owns 1000th of your 100,000 dollar loan. He is made whole with 100 bucks. I think most would just give the payout to the claimant.

Title insurance may have been a worthy purchase before the last ten years but the standards used to produce the product no longer protect you as they once did. I repeatedly battled the loosening of standards with former bosses in a company that is now bankrupt. You stopped getting what you paid for in about 2000 or 2001. It became a mere formality with the notion that “We’ll take our chances with the claims down the road…” and it was across the industry, not just the company I worked for. According to a mortgage maker I spoke to recently, ‘Makes you wonder why bother with title insurance at all, they are hard to locate now, with so many out of business, and we have so many problems to locate them for.’

The NYT article must be read. From the graphic, the critical language from a typical deed held thru MERS is quoted:

“Borrower understands and agrees that MERS holds only legal title to the interests granted by Borrower in this Security Instrument, but, if necessary to comply with law or custom, MERS (as nominee for Lender and Lender’s successors and assigns) has the right: to exercise and or all of those interests, including, but not limited to, the right to foreclose and sell the Property; and to take any action required of Lender including, but not limited to, releasing an cancelling this Security Instrument.”

Depending on local law, I can see how judges would take one look at this and freak out. This clause seems like an awfully fancy way of saying “Borrower acknowledges that lender and a consortium of others has completely privatized the recording of deeds, and Borrower further acknowledges that the actual government records are a sham.”

AnnS:

Are you sure “C” wins here? I’m no attorney, and sorting through your example makes my head spin, but it seems to me that “D” wins, not “C.”

Your example:

“Here is another example. B lends money to C and C signs a loan note and mortgage on C’s property Blackacre. B sticks the loan note and mortgage in a drawer. Later C borrows money from D and gives D a loan note and mortgage on Blackacre. D records his mortgage. C stops paying B. B goes to foreclose. D objects and says his interest in Blackare comes before Bs and if B does foreclose, then C gets paid first out of the proceeds of any sale. C wins. He recorded first. B’s note and mortgage are good even though they weren’t recorded. He just loses to the one who did record in terms of priority of interests, and goes to the end of the line behind all those creditors who recorded before him.”

>>

Secondly, if Tabbibi is “CLUELESS” then explain why the court found MERS without standing?

“Taibbii is CLUELESS!”

Thank you

Foreclosed on July 27, 3006?

I can see why my lender hasn’t initiated foreclosure on my home, they are going to give me a loan modification for 1,000 years!

Let me see if I understand AnnS aright:

Those who end up holding securities which are, in fact, mortgages on real property, are required by law to have their names & addresses on file in the county courthouse – which in the case of Ford County, KS, is Dodge City, with its Boot Hill & Front Street. (Yep. That’s the place.)

If their names are there, then they may appoint some third party, such as MERS, to represent them, as need arises. If their names are not there, then they have no standing in court.

If the deed is registered to parties who have, unknown to the court, surrendered or (informally) transferred the title to others, then the deed on file at the courthouse is worthless. When said mortgage is eventually paid in full, what party, precisely, has legal standing to give title to the mortgage payer? Meanwhile, how can said property be legally sold & the title transfered?

Anyone may go to their courthouse (or, increasingly, inspect the records on-line), determine who holds their mortgage, and then determine if said parties actually do so. If the listed owners do not, then after a court-ordered search, can the mortgage-payer petition the court to grant them title by default? (I.e., abandoned property?) If not, why not?

In what way does AnnS’s clarification differ from Taibbi’s conclusion? So long as foreclosures are in county court, the name(s) of the actual mortgage holder(s) must be on file in that county before said parties, or their designated representatives, can file for foreclosure.

farang, in the example from AnnS D will be paid first out of any trustee sale proceeds, then C (owner) will get any leftovers. B essentially looses out because they didn’t record.

I am thinking that it boils down to a due-process argument in that you have a right to know who can take over your property. This was lost in the MBS schemes. MERS didn’t take the risk, so it has no standing.

Of course, some high priced legal talent will figure out a way around this, but in the meantime lenders should become a little more careful…

A few of the assertions both in the article and in the comments are just completely wrong. A bondholder in an MBS security does not have to be on the deed – the MBS Trust owns the mortgages, and the Trust issues debt in the form of bonds that are supported by the cash flows from the mortgages. A Trustee (i.e. LaSalle) makes sure that the investors get their monthly coupon payments and represents their interest. A servicer (Chase) is in charge of servicing the actual mortgages, and simply sends out bills, and collects payments – they have no ownership interest in the mortgage, they are just a third party paid by the Trust.

Stanb99’s assertions are completely wrong and do not reflect reality at all. First the ratings he lists are not all real ratings – no agency that I am aware of has a ‘bbb’ rating that represents non-investment grade status. In general, AAA/Aaa through BBB/Baa2 represents investment grade, and BB/Ba2 down through D represent non-investment grade. The percentages representing the various size of the ratings are not accurate – AAA represents substantially more than 20% of the deal structure, and all of the other ratings are substantially less than 20% (using his number, not mine). Further, none of these bond holders are going to be in court for some individual debtors foreclosure! Where do you get this stuff?

That is not how these are structured. If you have 3,000 loans in a pool, and let’s say you have 15 bonds/tranches off the MBS, any losses from that pool flow up and are deducted from the lowest rated bonds first, so the lower rated bond is completely wiped out before the next highest rated bond takes it’s first dollar of loss. That is not actually 100% true, but for the purposes of this discussion, that is more or less how it works generally.

Stanb99, you are so far off base, you should really be embarrassed for putting this up there as a truth – please make use of wikipedia and get a better grasp of the subject before espousing to know the truth. The article has a lot of errors in it as well, but the overall gist is at least interesting on some level, although I’m not sure the conclusion is on target due to my own lack of knowledge surrounding the MERS part of the subject matter.

If the speed limit is 65 and everyone goes at least 80, you’re going to drive at least 80. That’s just the way it is. If everyone is selling buffalo stools and you don’t you’ll be looking for a new job. Worse, since organized crime is involved, there might be a lot more risk than just losing your job. Tell me Mozilla’s not a mobster. Maybe they’ll have Real Estate Wars on Fazebook next…

Just sold a house, refi mortgage was serviced by countrywide for 7 years.

MERS just recorded with the county that the new Trustee is ReconTrust Company Chandler AZ in place of “some random name aka a local attorney” whose signature of course is not on this recording.

For laughs, BAC asked for an additional 5.37 for the payoff.

“Where’s The Note, Who’s The Holder: Enforcement Of Promissory Note Secured By Real Estate” – by Hon. Samuel L. Bufford & Hon. R. Glen Ayers

http://www.langleybanack.com/admin/newsfiles/Ayers%20ABI%20-20090212-113015.DOC

What everyone seems to be side stepping here is the “simple” concept of STANDING. The above piece is the simplest, most basic and well written explanation of Article 3 of UCC and how it applies to legal standing with regard to notes that I have found to date. Maybe it’ll be useful to someone.

And AnnS and GMan, assignments of mortgage can easily be fabricated, back dated, etc. – especially when they’re held “en blanc” until such time as they are deemed to be needed. Many times, they’re filed with blatant mistakes on them – but unless someone that knows what they’re looking at actually looks at them, they all appear to be perfectly legal. That’s why no one questions when Scott Anderson, Ocwen Servicing employee, shows up on assignments as a VP for MERS. Or Bill Koch, employee of Select Portfolio Servicing f/k/a Fairbanks Capital Corp., shows up on assignments as a VP of MERS, or Laura Hescott, employee of Fidelity National Information Systems or one of it’s subsidiaries depending on the week, shows up as Asst. Secretary or VP of several different entities. Also why MERS and various RMBS trusts shows up on some with a business address of 3815 SW Temple, Salt Lake City, UT. Or Ocwen’s W Palm Beach, Fl address. Or Fidelity’s 1270 Northland Rd, Suite 200, Mendota Heights, MN address. Fidelity’s is actually rather impressive actually. Upwards of a dozen entities and at least one CSFB trust purport to work out of Suite 200. Now THAT is some office space…

No one seemed to be questioning it until NY Supreme Court Judge Arthur Schack started to. He also began questioning why an RMBS would want to inset a non-performing loan INTO a trust. I’m rather curious about that answer myself. I’m thinking that it’s got something to do with the insurance policies covering RMBS trusts….

It is time for the the US Government to take mortgage servicers out of the picture as to loan modifications and foreclosure. Loan Servicers are, for the most part, concealing the role of distressed debt mortgage buyers. And loan servicers are members of MERS. US Government made a big mistake when it allowed “toxic assets” (whole mortgages and loans and MBS) to be purchased by default debt buyers – including deregulated hedge funds and debt collection firms. Does anyone know that Sallie Mae – student loan collector- is also a debt collector for default mortgages??? If you mortgage loan is in default, or was immediately categorized as a “scratch and dent” mortgage loan at origination, then a default debt buyer owns your mortgage. Same process is ongoing with credit card defaults, auto loans, and student loans.

You have a right to know who is attempting to collect debt (mortgage loan or otherwise), even if you are in default. Time for US Government to stop partying with default distressed debt (private equity) buyers – and hold “servicers” and MERS accountable.

How did you figure out where these people worked?

Ann S./Dr. Housing Bubble,

I’m very impressed with your knowledge here and have a “hypothetical” question if I may?

Since March ’09 homeowners have been in the process of re-financing their home with numerous delays brought on by the lender (orig. purchase date was 8/06 Conventional 30yr fixed, credit of said homeowners is Excellent). Through out the waiting process the homeowner found out the original lender has sold the mortgage loan and remains the collectors (thus, why lender didn’t notify homeowner of sale). Researching this information and coming across this article has brought about a pressing question: Excluding foreclosure (not the case), is the original lender required to tell homeowner what institution now, holds the original note if requested? If so, and the original note cannot be located, what is the recourse of the homeowner?

September 29th, 2009 at 11:00 pm

Ann S./Dr. Housing Bubble,

I’m very impressed with your knowledge here and have a “hypothetical†question if I may?

Since March ‘09 homeowners have been in the process of re-financing their home with numerous delays brought on by the lender (orig. purchase date was 8/06 Conventional 30yr fixed, credit of said homeowners is Excellent). Through out the waiting process the homeowner found out the original lender has sold the mortgage loan and remains the collectors (thus, why lender didn’t notify homeowner of sale). Researching this information and coming across this article has brought about a pressing question: Excluding foreclosure (not the case), is the original lender required to tell homeowner what institution now, holds the original note if requested? If so, and the original note cannot be located, what is the recourse of the homeowner?

It is time for the the US Government to take mortgage servicers out of the picture as to loan modifications and foreclosure. Loan Servicers are, for the most part, concealing the role of distressed debt mortgage buyers. And loan servicers are members of MERS. US Government made a big mistake when it allowed “toxic assets” (whole mortgages and loans and MBS) to be purchased by default debt buyers – including deregulated hedge funds and debt collection firms. Does anyone know that Sallie Mae – student loan collector- is also a debt collector for default mortgages??? If you mortgage loan is in default, or was immediately categorized as a “scratch and dent” mortgage loan at origination, then a default debt buyer owns your mortgage. Same process is ongoing with credit card defaults, auto loans, and student loans.

You have a right to know who is attempting to collect debt (mortgage loan or otherwise), even if you are in default. Time for US Government to stop partying with default distressed debt (private equity) buyers – and hold “servicers” and MERS accountable.

*ANNS – I beg to differ, as a title examiner for Lawyers Title I can assure you that MERS is a total SHAM! Even a cursory look at the snaked path of the securitized transaction shows that if the deal was truly a purchase money mortgage, it looks like no other PMM transaction out there.

Tell me why people have paid their loan servicer (in full) and had the note holder (in due course) come after them for payment subsequent to paying off the servicer?

Truth be told – the middlemen do NOT EVER EVER EVER want the borrower and the investor to meet – cause if they did, they’d join hands and go after the fraudster/bankster that peddled this crap and left more than 60 MILLION PEOPLE WITH TOXIC TITLE’S.

Go spin somewhere where people may tend to believe you.

My assignment of mortgage from MERS to _______ (large banking & financial institution that recently announced hefty quarterly profits… hmmmm aren’t they supposed to be losing money with all these foreclosures on their books) was executed by two individuals claiming to be Vice Presidents of MERS – when in fact, they are Vice Presidents of the very same large banking & financial institution that received the assignment – WTF???

Not to mention the fact that __________ (other large financial institution that will remain nameless) never appears on record as having held an interest in my loan when in fact they have. They were skipped over in the chain of custody in public land records. Was this an accident… I think not!

MERS is an outright sham, they are not licensed to do business as a mortgage company in any state.

This in addition to the fact that MERS is listed as both nominee AND mortgagee on my mortgage & insured as mortgagee on my title insurance policy. Yet by their own admission MERS does not and never has owned any beneficial interest in any mortgage or deed of trust. They are merely a tracking service (per the company website).

What they don’t mention is the the $1Billion they (MERS) saved their clients was taken from the local Clerk of Courts office – as a way to ditch the transfer and recordation taxes. Not to mention that recording mortgage liens in public land records is a requirement in order to perfect the lienhold interest.

So while I agree that you can fool some of the people some of the time, and some of the people all of the time, you definitely cannot fool all of the people all of the time and the judicial branch is now starting to GET IT!

Leave a Reply to CAE