Shadow Inventory Revisited: Silent Alt-A Mortgages, Southern California REO, and the Great Public Swindle.

I think you saw this coming. In the most e-mailed story on Friday, many of you sent in a link from the L.A. Times showing a confirmation of shadow inventory. One home does not make a trend. But connect that home to Bernard Madoff and you got yourself a fantastic story of absolute cronyism and corruption that we have grown accustomed to from the banking industry. Now one home is merely an example but there have been a group of people that actually deny the existence of shadow inventory all together, an argument that makes you feel as if you are talking to someone who still believes the world is flat.

This story would be laughable if it weren’t for the fact that the banking industry is an absolute corrupt industry that will bring down the real U.S. economy merely to protect itself.  In a nutshell this is what happened:

“(L.A. Times) Bernard L. Madoff’s massive fraud stunned some of the wealthy denizens of Malibu Colony, especially when a couple devastated by the scheme surrendered their oceanfront home to Wells Fargo Bank.

But some neighbors say the real shocker came when they saw one of the bank’s top executives spending weekends in the $12-million beach house and hosting eye-catching parties there. What’s more, Wells Fargo spurned offers to show the property to prospective buyers, a real estate agent said.

“It’s outrageous to take over a property like that, not make it available and then put someone from the bank in it,” said Phillip Roman, an 18-year Colony resident who lives a few homes away from the property.

Residents identified the house’s occupant as Cheronda Guyton, a Wells Fargo senior vice president who is responsible for foreclosed commercial properties.

Guyton could not be reached at her downtown Los Angeles office. Wells Fargo declined to discuss Guyton, saying in a statement that representatives “don’t discuss specific team member situations/issues for privacy reasons.” But the bank said it would “conduct a thorough investigation of the allegations” by neighbors.

The bank also said its ethics code wouldn’t allow employees to make personal use of property that had been surrendered to satisfy debts.â€

Bwahahahahaha! This puts an exclamation mark on prime shadow inventory property. You have all the key players here. You have crony bailout recipient Wells Fargo having their senior VP who is responsible for foreclosed properties using the place for “eye-catching†parties. You cannot make this stuff up. Early in the day, Wells Fargo stated they would “conduct a thorough investigation†but apparently all it took was a few hours for them to come out with this statement to the L.A Times:

“(L.A. Times) Wells Fargo & Co., seeking to distance itself from a company executive’s alleged personal use of a $12-million beachfront Malibu home owned by the bank, said today that it would “take decisive action” against any employee “who may have violated Wells Fargo’s policies.”

The bank said in a statement that its rules of conduct prohibit employees from “personal use of properties held by Wells Fargo.” The company reiterated that it had launched a full investigation into the allegations.â€

Seriously folks, all it takes is a bit of investigative journalism and my hat goes off to the L.A. Times reporters here. But the real story is the thousands of homes sitting in the real shadow inventory in areas like Culver City, Pasadena, and other middle-class areas that will be slammed by the Alt-A and option ARM wave starting next year. I love it how some people were saying that shadow inventory was essentially a thing of “poor†areas. Well a $12 million beach front home in Malibu isn’t a poor property in my book. Maybe the VP at those parties was trying to figure out how to sell the foreclosure to the party guests? Let us keep an eye on this to see what kind of “decisive action†Wells Fargo is going to do. Seriously, Bernard Madoff is in jail while you have another crony partying in his home. This is the proud American banking system that we have back stopped with trillions of dollars.

I dug deep into the shadow inventory data again and it is simply growing. But in a variety of ways. First, many banks are simply not moving on homes. That is, you can stop making your payments and depending on which incompetent bank you may have, you probably have a fifty-fifty chance that you will have no notice of default for 6 to 9 months. The foreclosure process now takes 18 months to 2 years. And for those properties that are taken back, some banks are going with rent to own options. Or in other properties, banks are merely using them for Romanesque blowout parties. But the most common option is doing absolutely nothing. First, let us show you how absurd things are getting in Southern California:

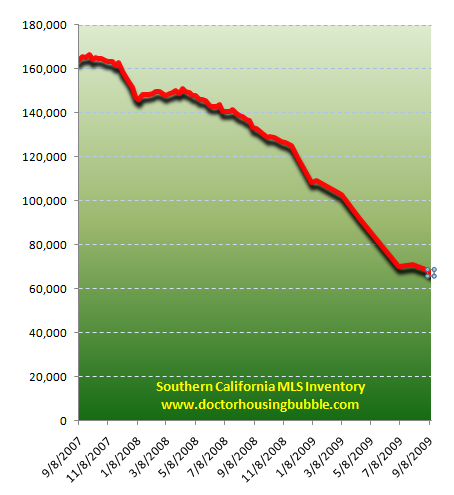

At first glance, you might interpret this as solid news. For Southern California, public MLS properties have been on a steady decline since September of 2007. In fact, since the start of the year the MLS inventory has fallen by 41,000. If we use last months sales of 24,000 we have less than 3 months worth of supply in Southern California. Run out and buy a home before all the homes are sold! Seriously folks, this is such a joke. Now let us run some quick numbers for distress properties this year:

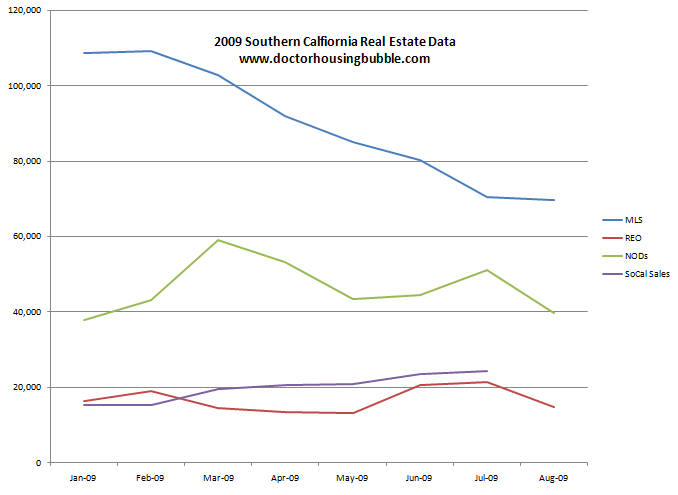

Distress property data is for the state. As we know nearly 50 percent of all statewide sales are foreclosure re-sales. Here in Southern California the number was 43.4 percent. We can drill down on the data a bit:

August Sales:

Statewide:Â Â Â Â Â Â Â 45,709

SoCal:Â Â Â Â Â Â Â Â Â Â Â Â Â 24,104

Southern California makes up 52 percent of all sales in the state. So let us apply this ratio to the data last month:

August Distress:

REOs:Â Â Â Â Â Â Â Â Â Â Â Â 14,590

NODs:Â Â Â Â Â Â Â Â Â Â Â Â 39,542

14,590 x .52 = 7,586 distress SoCal sales

Keep in mind that these are REOs going back to the bank, the foreclosure resales are happening with properties back in the pipeline from months ago. If 43.4 percent of the properties last month were foreclosure resales that would mean:

24,104 x .434 = 10,461 properties sold from the foreclosure pile. Let us apply this ratio for the entire REO inventory for the year:

2009 REOs statewide:

132,443 x .52 = 68,870 SoCal REOs

So by this approximate estimate, Southern California should have added 68,870 REOs as additional inventory throughout the year. Total sales for the region:

138,599 SoCal 2009 sales x .434 (foreclosure count) = 60,151

So it does look like once the bank has the property as an REO, it is moving on it. So all is well right? Not exactly. And keep in mind these are rough estimates since we are using data from various sources such as DataQuick, RealtyTrac, MLS, and foreclosure records and trying to arrive at a number. If anything, simply looking at this tells us that yes, REOs are being moved and that isn’t necessarily the big part of the entire shadow inventory. But what is occurring is this. Regular buyers are unable to see a vast amount of this inventory on the MLS. Here is one part of the shadow. We just saw that last month, by actual stats some 10,461 properties were foreclosure re-sales. As of that sales period, approximately 5,000 properties were listed on the public MLS as foreclosures. So where is the other property listed? Some of it is being sold in bulk to investors in depressed markets.

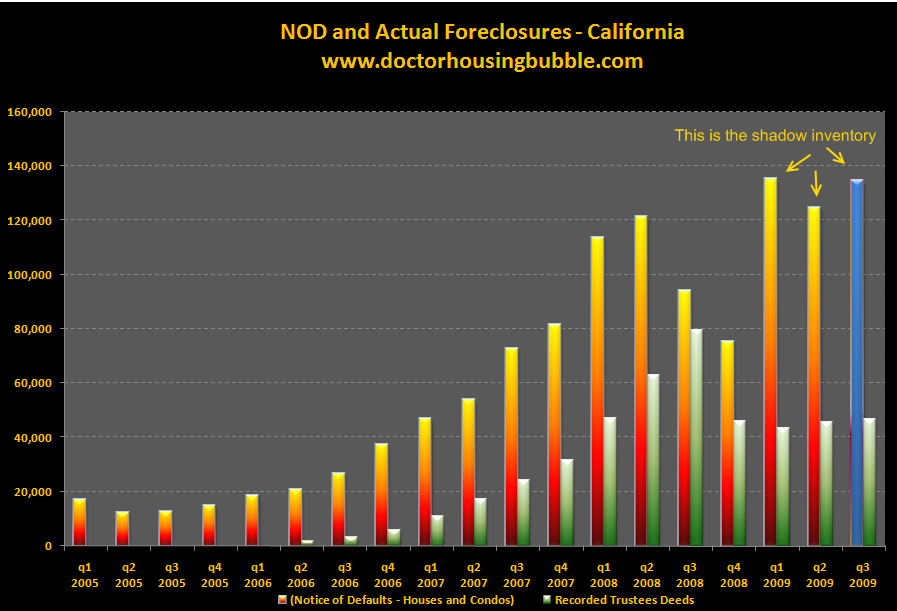

That part of the equation should be a lot clearer now. But the real shadow inventory is occurring with banks not moving on non-payers. In fact, if we look at notice of defaults we can see a major storm brewing. I have reconstructed the chart below with an average for Q3 of 2009 since we don’t have September data until October but the trend is unmistakable:

So far this year 370,000+ notice of defaults have been sent out. Most of these as we know will end up as foreclosures. A handful will be modified but those are crap modifications and will end up only buying a little bit more time for the borrower. The chart above is unmistakable. You notice that the only time that actual foreclosures increased steeply was in Q3 of 2008. That was because of the spike in NOD from Q1 and Q2 of 2008. But now, we have three elevated quarters of NODs running at peaks yet recorded foreclosures are still holding steady. What gives? Banks are not moving on the entire foreclosure process. That is the ultimate point here. That is why when I talked about the $1 trillion in toxic waste mortgages, much of it has been ignored. Where do you think this property is going? Banks are hoping for a bailout or some vehicle to dump this crap off on the taxpayer.

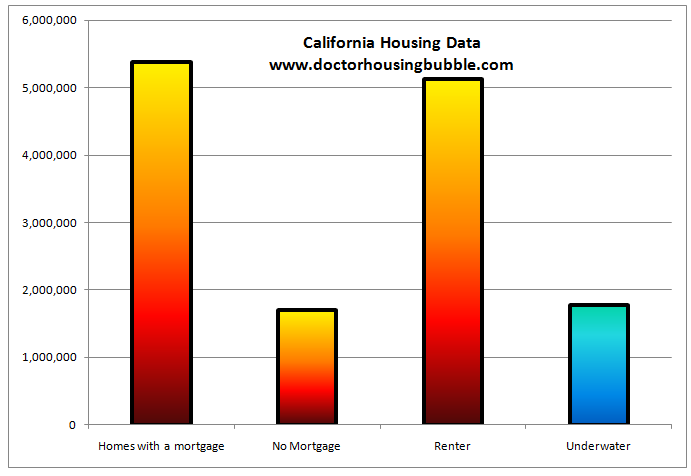

Looking at the chart above again, actual recorded foreclosure are going to be flat for four consecutive quarters! Really? This is such a convoluted mess. The problem is we have to estimate how many people have stopped paying their mortgages. The most recent data shows 1 out of every 10 homeowners now delinquent on their mortgage. For Southern California, it is expected to jump to a stunning 14 percent. So assuming that this ratio applies to California (it does and is most likely higher) that would mean of the 5.3 million homeowners with a mortgage 530,000 are now late on their payments. That seems about right given how many people are underwater in the state:

My overall point with shadow inventory would be this. It would be an enormous mistake to conclude that this is the bottom for the state. If you only look at MLS data and the movement with REO data on properties banks have selectively moved on, you would think the system is efficient. It is not. There are hundreds of thousands of mortgage holders betting on a jump up in 2010 and 2011 so they can exit left as quick as possible. Properties would have to appreciate like they did in the bubble for these people to exit. That is not going to happen. Already, hundreds of thousands have stopped paying on their mortgage and no where is this data being seen publicly but the bank knows full well that they are having cash flow problems.

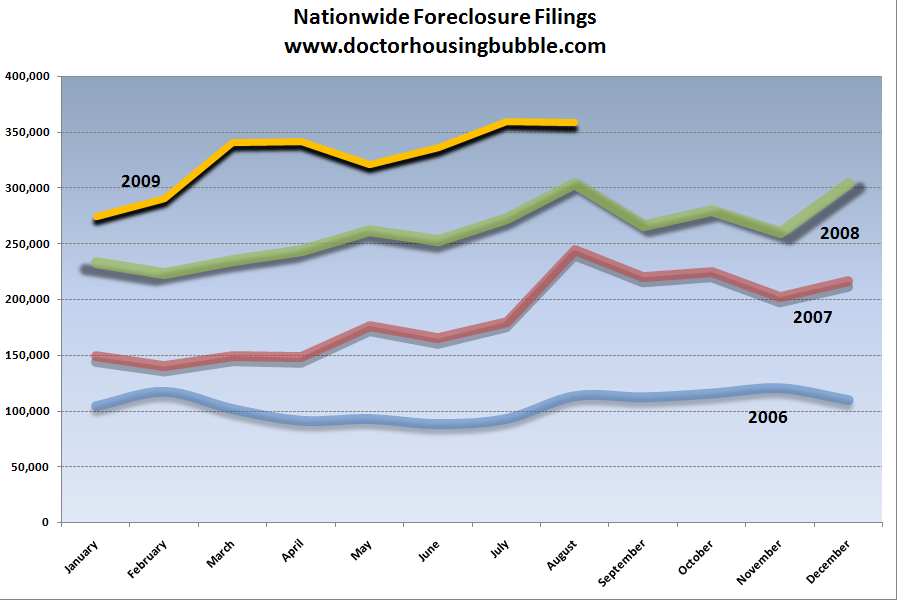

We made a mistake going down this road of backing the corrupt banking system. We are going to have a Japan like scenario. Banks will not admit the true issue of the problem. But every so often they will be hitting up the taxpayer for additional funds. If it isn’t obvious what path we should have taken it would have been to gut the entire financial system and flush out the inventory from the market at once. Those that didn’t favor temporary nationalization now realize this one fact. The banks are still running the show with the same cronies at the helm. And we are still paying! The PR on TARP repayments is such a colossal joke since they have repaid a few billion while we have back stopped the system with nearly $13 trillion. Have things really gotten better? Let us look at nationwide foreclosure filings:

I took some heat when I recommended temporary nationalization a year ago. This wasn’t something I welcomed but our options were as follows:

1. Nationalize and remove every banking head and claw back every damn penny once we opened up their books

2. Give the banks every penny they ask for and trust them to do the right thing

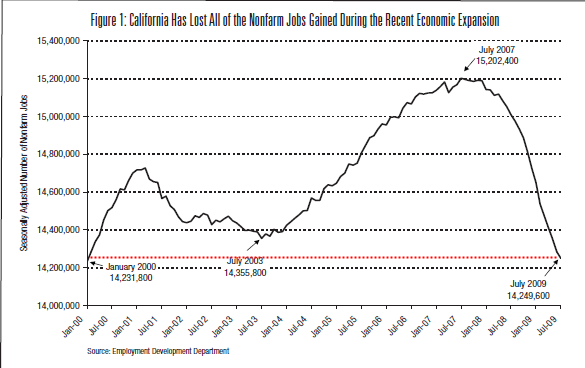

Option 2 is the path we took and look at what it has gotten us. And what is happening is no shock to any of us who studied what happened in Japan’s lost decade. We are now destined to a decade long malaise. California has already witnessed a lost decade in job growth:

Yet people are willing to believe this is the bottom? The only winners here are the banks and those in the real estate industry. The major losers are the American taxpayers. This is a story that is becoming all too familiar.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

36 Responses to “Shadow Inventory Revisited: Silent Alt-A Mortgages, Southern California REO, and the Great Public Swindle.”

It’s nice to see the LA Times actually publish a story like this. I am sure they know of many more. Let’s hope they publish more of them.

So I’m trying to buy our family’s first house here in Silicon Valley. I’ve bid higher than asking on 9 bids so far and have been beat on price for all of them except one short sale. There the bank declined my offer.

The worst case was a beater across the street from a sound wall. List was $460k. I bid $512k. The winner was an all-cash at $555k.

Of course, I using a pre-approved FHA loan but my own down payment. Is this really going away soon or will it be extended? I’m thinking it might be just a political ruse or sop but I see half the sales in some markets are FHA loans.

If there is a REAL shadow inventory, I’m eager to see it hit the market.

Many homes being put on “Hold Do Not Show” status in the area we’re looking at. This has been happening for the last three weeks and is severely constricting the inventory. Anyone have any idea why this might suddenly be happening?

I still think the banks are doing four things,

1. Avoid taking losses for as long as possible in order to delay the hit to the balance sheet so they can survive a bit longer, if only in an accounting-gimmick alternate reality, and related to this:

2. Wait for the next bailout. Expose yourself to the minimum short-term loss so that you can offload the maximum amount of damage onto to taxpayer,

3. Salvage what little is salvageable – that is – refinance time-bomb loans into low-interest 30-year-fixed-rate mortgages for those that have any change whatsoever of being able to handle them, and finally,

4. Try to stabilize / slow down price-declines to avoid pulling underwater millions of other homeowners who still think they have some equity and thereby prevent a “If you’re in any trouble, just stop paying your mortgage, you get to live in your house free for two years!” mass-psychology movement.

The good Doctor tells it like it is, again but……

I say if you are a cash buyer and inventory does not jump this winter, take the plunge.

Yes, I think house appreciation is out for at least 10 years in San Diego (unless inflation is rampant) but if you are a cash buyer, how much will your cash earn for you while you pay rent? That is just another of the epic battles going on, cash is trash if interest rates are nearly zero. A half a million can buy a minimal shelter or it can earn you 5000 a year in taxable interest.

There use to be a huge opportunity cost with say 500K cash versus buying. Now the opportunity cost is ZIP!

I’ve been looking at Realtytrac and it seems that banks are actually going through with Foreclosure. On the 9th, I saw more foreclosure sales going through than the entire month of August. Now, I haven’t noticed the Citibanks and Wells Fargos of the World going through with them. But I have been seeing Deutsch Bank, US Bank, some smaller lenders.

I’ve also started seeing foreclosures begin to be listed after a summer lull. Not at great prices, but definitely competitive with existing comps, so prices are reasonable. Perhaps the banks were just waiting for reduced competition to list their inventory–although you also need to consider you have fewer buyers now too.

whitehall, good god are you insane? The SillyCon Valley is going to get hit hard over the next few years. Watch and wait. Things will really start to heat up. I know several people that are so far underwater it’s mind-boggling; and like most in the SillyCon Valley they refuse to give up the idea that they are special and on the path to riches.

Silicon Valley Burbed is a pretty good blog to see some highlights of insanity in the valley.

@ Whitehall: ?!?!?!? Aren’t you reading the good Doctor? Why on earth are you bidding on houses in Silicon Valley? I don’t know the NoCal market, but my daughter in W.LA says it’s still cheaper to rent than to buy. She’s got the cash, but refuses to buy until the market actually gets back to ‘normal’ levels. She’s ‘not lost’ a lot of money by doing that.

@Martin – if you are worried about taxable interest (by which I assume you mean that the interest you would earn on the 500K) get non-taxable govt paper. The income may be small, but the principal doesn’t shrink.

There are so many opportunities to make money in a down economy with cash. Housing in San Diego is not currently one of them. People have to stop thinking of real estate as a great investment or even a safe harbor. It’s an investment like any other, and you need to run the numbers and assess the risk/reward ratio. There’s a very significant chance that 500k house will be worth 300k by the time we finally bottom. Conversely, there’s very little chance of significant appreciation over he next 5-10 years.

If you want to actually play it safe, wait 2 years with the cash in tax free investments. I know so many people trying to arrange short sales or find exit strategies from properties. It’s hard to conceive that there are people who would willingly switch places with them simply because their minds are stuck in the bubble paradigm.

Why not change the law for foreclosures so that the bank will automatically get ownership of the house the same day the old owner gets evicted? Sounds like a huge waste to evict someone and then let them know later that they still own the house.

I live near Silicon Valley in No. Cal. . A friend of mine does contract computer work for many of the tech giants. She has been out of work, and all of these companies are telling her they expect further layoffs in Jan., at which point they will be hiring contract workers to replace full time employees. I was in Mt. View yesterday in a coffee shop, and 2 high tech workers at the next table were talking about layoffs in their respective companies.Both were joking that their fellow employees didn’t have a clue about what was about to hit them.

Buyers fever is controlling the market here,to snap up expiring tax credits. Keep renting. When the tax credits expire this year, sales will tank in Jan,Feb,and March. If you must buy, wait 4-5 months, at least.

I know its been said before, but on top of not moving on the NODs they have filed the banks are waiting possibly a year to even file an NOD. I haven’t paid for 9 full months and still haven’t got an NOD. The bank was calling me at least once a week for a long time, but I haven’t received a call from them now in a month. I wonder what they have for the value of my loan on their books as I am 220k underwater.

I would disagree that there are/were just 2 options. We could have done a number of things and we still can. We need to force the banks to let go of the REOs and place to true value of all their assets and liabilities on their balance sheets.

We need to STOP giveaways of taxpayer’s money. We need to reduce taxes on the producers and citizens. The FAIR Tax would be one option. We could reduce property taxes on owner occupied homes and eliminate the tax write-offs on non-owner occupied homes (start slow and escalate until there is no tax write-off). There should be no tax write-off for any kind of interest. This could be eliminated gradually. Start by dropping the mortgage interest write-off for all loans that are more than 95% LTV then the next year for those less than 90% and keep dropping it 5% a year until you get to 80% LTV then drop it 2.5% a year (e.g. 77.5% LTV). This encourages savings and debt reduction. It also equalizes the fairness of taxation since the renters are effectively forced to subsidize mortgage interest. The entity with the largest equity in a home should be liable for property taxes or at least a percentage equal to their value in the home. A bank that had a mortgage for 1,000,000 on a home purchased for 1,500,000 would have property tax liability of 67%. They could also be made to have 67% of the responsibility for code compliance…. Furthermore, non-owner occupied homes could be made to pay taxes monthly and fines that include the cost of collection +20% could be levied on those seeking to escape their responsibilities. Some cities are going after CEOs with misdemeanor or criminal charges to force them to clean up their properties. There could also be demolition fees to disincentivise the destruction of homes (environmental costs). THings could be done… we have representatives who do not want them done.

Robert Cramer, I am also in No-Cal. I handed out 6 WARNs over the past week. Next round is supposedly in December for February layoffs. I’ll count my blessings if I have work for the next year, and I’ll saving massive amounts of cash (including gold & silver) in the meantime.

I wonder if the story in the times and the order for 10,000 WFC October puts @ 26$ were related, sombody was taking advantage of the bad press.

Linguistics Improperly Framing Banking Discussion: As Geithner has repeatedly stated, his primary obljective is keeping the banking system private in contrast to say to say keeping it functional or solvent at the lowest cost to the taxpayer.

Amongst older generations in the US the word “nationalization” is a prejorative word which has strong “knee jerk” reactions whereas the FDIC has been in the business or “reorganizing” banks since the 1930’s. The financial community is exploiting this linguistic bias to its advantage.

Would strongly suggest you and others delete “nationalization” and substitue “reorganization”, which is what truly happens.

But Who Is Watching Regulators?

The financial arena still operates the same and is supervised the same regulator one year after the crisis.

NOTHING succeeds like failure, as the saying goes. And nowhere is this dismal truth more evident than in our financial regulatory system, one year after the bankruptcy filing of Lehman Brothers.

Even though calamitous lending practices laid waste to the nation’s economy, surprisingly little has changed about how the financial arena operates and is supervised. Sure, a couple of venerable brokerage firms have vanished, but many of the same players remain on the scene, in the same positions of power.

Senior regulators who stood idly by for years as financial firms built their houses of cards have been rewarded with even bigger jobs or are jockeying for increased responsibilities. The Federal Reserve Board, for example, wants to become the financial system’s uber-regulator, even though its officials did nothing as banks made deadly decisions to lend recklessly and leverage themselves to the max.

Awarding increased power to those who failed in their oversight duties flies in the face of all notions of accountability. Imagine hiring Angelo R. Mozilo, the former chief of Countrywide Financial, to run a global financial institution, or installing E. Stanley O’Neal, who presided over a disastrous period at Merrill Lynch, at the helm of a major investment firm.

Yet those in the public sector ask us to believe that regulators who snoozed during the credit bubble will be alert to emerging problems on their beats when the next mania begins.

That’s asking a lot, isn’t it?

Here’s a novel thought.

Instead of creating more regulations to try to prevent this kind of mess from recurring, why not figure out how to hold regulators accountable when they perform as poorly as they did in recent years?

Part of my calculation is a high probablity of inflation – the die has been cast. The value of the dollar will continue to fall but rents will track.

Yes, the tech industry has some downsizing to do yet but it remains a viable economic center with global markets. Personally, my industry is countercyclical infrastructure so we’re doing great and growing rapidly.

Waiting a few months means perhaps losing the FHA loan and the $8k tax credit. Neither are essential but the wifey has been crying for a house for 20 years. Renting is cheaper, true, but I could be out the door at my landlord’s whim. With the interest and property tax deductions, buying wouldn’t be much more than rent, cash-flow-wise.

So, going underwater for a few years is not too much of a downsides for me. Missing a locked-in housing cost is a bigger worry and my family would love the permanence.

Thanks Tyrone for the link.

Sadly the banks can do whatever they want, right?

They can hold shadow inventory for 5-10 years, rent them out (and maybe not show the true value of the asset, not sure how that works…) and then sell them when the market picks up?

Banking System Problems ‘Now Bigger Than Pre-Lehman Era’…

Sept. 13 (Bloomberg) — Joseph Stiglitz, the Nobel Prize- winning economist, said the U.S. has failed to fix the underlying problems of its banking system after the credit crunch and the collapse of Lehman Brothers Holdings Inc.

“In the U.S. and many other countries, the too-big-to-fail banks have become even bigger,†Stiglitz said in an interview today in Paris. “The problems are worse than they were in 2007 before the crisis.â€

Stiglitz’s views echo those of former Federal Reserve Chairman Paul Volcker, who has advised President Barack Obama’s administration to curtail the size of banks, and Bank of Israel Governor Stanley Fischer, who suggested last month that governments may want to discourage financial institutions from growing “excessively.â€

Risk-taking is back for banks 1 year after crisis –

Data from the April-June quarter show that the banks are leaning heavily again on their trading desks for revenue.

• During the fourth quarter of 2008, when the financial crisis made even the shrewdest bankers risk-averse, Goldman’s trading of risky assets nearly stopped. But in the second quarter of 2009, trading revenue had climbed to nearly 50 percent of total revenue, closer to where it was two years ago before the recession began. JP Morgan’s reliance on trading revenue has exhibited a similar pattern.

• Also in the second quarter, the five biggest banks’ average potential losses from a single day of trading topped $1 billion, up 76 percent from two years ago, according to regulatory filings.

The government hasn’t just watched banks resume their freewheeling ways and prosper. It has been an enabler in the process…

—

One investment gaining popularity is a direct descendant of the mortgage-backed securities that devastated many banks last year. To get some lesser performing assets off their books, banks are taking slices of bonds made up of high-risk mortgage securities and pooling them with slices of bonds comprised of low-risk mortgage securities. With the blessing of debt ratings agencies, banks are then selling this class of bonds as a low-risk investment. The market for these products has hit $30 billion, according to Morgan Stanley.

Another reason banks are holding back is to create the illusion of recovery. They are borrowing billions free of charge from the Fed and using it to jack up the stock market. Almost all of their trading has been profitable so far and they. You can see from other financial blogs like zerohedge that the market is totally manipulated by the banks big block trades in a low volume market. But they can only keep up the illusion for so long and by my estimates they are running out of time fast now. Bottom line – don’t be fooled. They will dump these shares on all the fools now entering the market who believe in this “new bull market’ BS. Ironically I just heard today on Marketplace special about the finiancial collapse last year and everyone is talking like it’s in the past and recovery is here! Fools never learn. The coming fall in the makets will make what has happened to date look like a walk in the park and I think America will be FOREVER changed. If the government and Fed fight it anymore, then you can add a currency crisis to the mix.

i’m lookimg for my mantion in the sky no tresures laid up down here . huh! housing is a lose lose situation until youens fixes the systems comptrolers . I smell sheep droppings , If you have 500,000 dolarinies , wow ! get your head out of the gutter . Work most likely will wait till the crisis is over . Go waterworld ! Get some floatin realstate. Where the ocean , like the ozzies say , is your back yard . ohi ! But what does me knows any who ? I’m no body

Spot on Doug N. Shadow housing inventory is only the symptom of the problem. The shadow banking culture is the disease. The financial foundation of our so-called capitalistic system is nothing more than a swindle wrapped in an illusion. It’s not like we weren’t warned. Anyone remember Enron or Worldcom? We absolutely need some daylight on what is happening on the books of the financial titans (including the Treasury and Federal Reserve). William K. Black, Sheila Bair, Ron Paul and others have workable plans to pull us from the brink of implosion. Unfortunately, they are up against the Bernanke, Geithner, Dodd, Frank, Pelosi, etc. and their Wall Street cronies.

Be brave Comrades!

The public is being manipulated by the Govt, Wall Street, and the

Banks. Don’t beleive the hype. By March 2010 the real economic

storm will be bearing down on the country. Little Timmy Giethner, Obama,

and the rest of the gang will not know what to do.

The decision to nationalize the banks required faith that it was “temporary”. So we either had to trust bankers to take our money and do the right thing or give the banks to the gov’t and have faith that “we’ll give them back to you” in a year or two.

Hobson’s Choice.

GM has security at least until the end of Obama’s first term and his second if re-elected. He has personally taken ownership of that company and no other business has such security as they do. They will not be allowed to fail under his ownership, no matter how much money they require.

The assumption that a nationalized banking system would be de-nationalized later is belied by things like rent control which was a temporary measure for WW2. It still plauges many cities and damages housing markets to this day. There are many examples of temporary measures becoming permanent.

So it is a tough one. Corrupt bankers vs. corrupt politicians who otherwise are working together (Friends of Angelo anyone?) to further their respective goals: unearned commissions for the former and eternal re-election for the later.

Yeesh.

http://www.ownwercarryit.com

For seller financed properties. Because banks suck.

THE QUICKEST WAY TO FORCE BANKS TO LIQUIDATE THEIR SHAOW INVENTORY IS TO HAVE A RUN ON THEIR DEPOSITS! iN SUCH SECENARIO, BANKS WILL HAVE TO LIQUIDATE WHATEVER ASSETS ON THEIR BALANCE SHEETS & PAY THE DEPOSITORS!!!

& I SUSPECT THE ENTIRE BANKING SYSTEM CAN’T EVEN MEET 50% OF THE DEPOSIT WITHDRAWAL OBLIGATION COZ THOSE TOXIC ASSETS & INVENTORIES ARE WORTHLESS!!!

NOW WHO SAY MTM IS NOT IMPT???

CURSE TO THE BANKSTERS!

The big question with our political class (Obama Administration, Congressional Leadership) is:

Stupidity or Criminality?

Whitehall, a dose of both. And we all better pray there is NOT a run on the banks. And yes, we are in the ‘trough’ between 2 great waves. Wave #1 has nearly swamped the ship. Wave #2 is undoubtably going to do so.

Anyone thinking inflation is around the corner is fooling themselves. Invest accordingly.

It’s a small point, but I still want to make it. Referencing the beach house in Malibu that the Wells Fargo VP was partying in, you wrote: “Seriously, Bernard Madoff is in jail while you have another crony partying in his home.”

I read the LA Times article when it came out and to the best of my recollection it indicated that the home was owned by a couple who invested heavily with Madoff and of course lost it all. They surrendered the home to the bank as an offset to some pretty hefty loans they had taken out from Wells Fargo. I believe the Madoff investments were pledged as security on those loans.

The Madoffs never had a house in Malibu as far as I’m aware.

According to Business Week, ( http://www.businessweek.com/the_thread/hotproperty/archives/2009/09/wells_fires_exe.html ), the executive who partied int he house mentioned in the LA Times just got fired. It is nice that the LA Times gets such quick response. It would be even nicer if this blog would get a similar kind of response for all the shenanigans it exposes.

Wells Fargo FIRED their VP today: http://www.latimes.com/business/la-fi-malibu-wells15-2009sep15,0,3886240.story

rock on

Run on the banks will be a bit more difficult now that we (the taxpayers, voters, etc) have given the banks trillions of dollars through the bailouts. It’s hard for me to judge how much shadow inventory a trillion of dollars can provide, and how much longer the bubble prices in LA westside, for example, can persist. I was advocating to audit the FED for that very reason: http://echoesofwisdom.blogspot.com/2009/09/shadow-inventory-of-houses-another.html

However, as Tom says above, the government and the FED are in bed together when it comes to money, so Auditing and ending the FED is not enough!

In my unprofessional opinion, I think with the consolidation of WAMU and Countrywide the U.S. Government at arms link (and with tax $$$) will have the main 2 or 3 banks (Wells, Chase, BofA etc) control how this inventory is brought to market. They know if these millions or whatever the number of homes are floods the market, this country is finished for period of time.

Leave a Reply