$1.1 Trillion in Toxic Loans: $908 Billion in Interest Only and $198 Billion in Option ARMs. The Zombie Loans that Simply Don’t Die.

Two years of a deep and prolonged recession and we still can’t seem to get a hold of the toxic assets plaguing the books of banks. Much of this comes from the scamming and blood sucking from banks on the taxpayer. How can $13 trillion in backstops and commitments not resolve the problem? First, the banking system operates as a crony operation looking to serve its own interest even if it comes at the detriment of the entire economy. News coming out this week simply reaffirms what we have been saying for the entire year. The Alt-A and option ARM wave is imploding right on schedule.

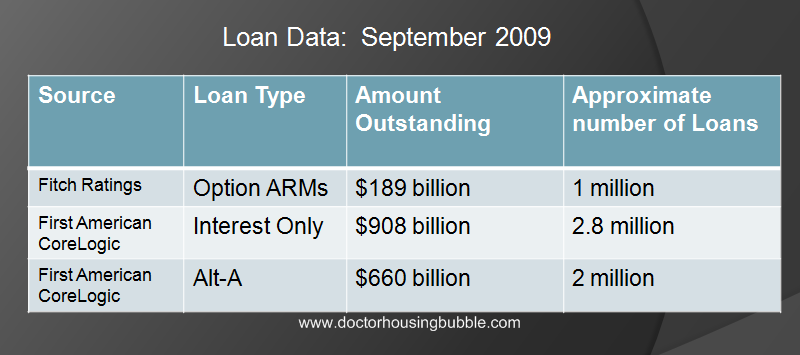

When I wrote about the Alt-A loans back in May of this year, we put a ballpark figure of $1 trillion for toxic mortgages. So after all the gimmicks and money being thrown at the system it turns out that we still have over $1 trillion in junk mortgages. A recent analysis by First American CoreLogic put the amount of Interest Only mortgages at $908 billion with 2.8 million loans active. Fitch Ratings came out this week showing that there are still $189 billion in option ARMs in the system. For all you folks who thought that all the option ARMs were modified, the data shows only 3.5 percent of the nearly 1 million loans have been modified. And those that have been modified still re-default at incredibly high rates.

So let us put this into perspective with current data:

Now a couple of things to mention. There is overlap between a few categories. For example, a large number of the option ARMs fall under the Alt-A category. Many Interest Only loans are also Alt-A loans. A better estimate is the specific category of Option ARMs and Interest Only and that is a combined total of $1.097 trillion. This is the number of loans out in the system currently. Plus, there are still many active subprime loans. These loans are part of the zombie bank balance sheet.

Yet the reason these loans will be so problematic is how borrowers are viewing the future:

“(NY Time) With many of these homes under water — worth less than the loans against them — many interest-only mortgages will soon become unaffordable, as the homeowners have to actually start paying principal. Monthly payments can jump by as much as 75 percent.

The Mollers owe so much more than their house is worth, and have so few options, that they are already anticipating doom.

“I’m praying for another boom,†said Mr. Moller, 34. “Otherwise, we’ll have to walk.â€

Keith Gumbinger, an analyst with HSH Associates, said: “This is going to be the source of tomorrow’s troubles. The borrowers might have thought these were safe loans, but it turns out they bet the house.â€

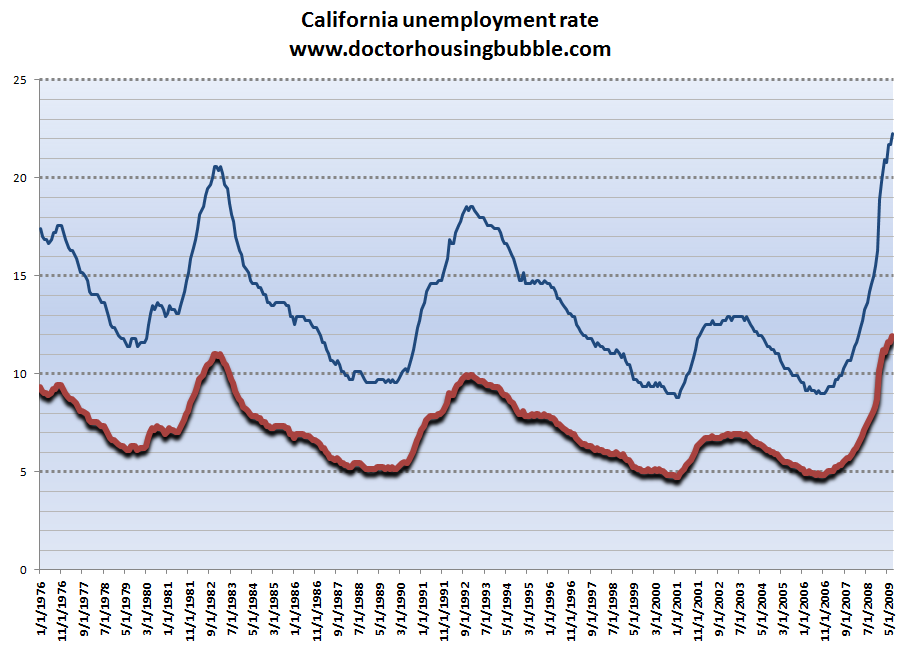

Praying for another epic housing bubble is highly unlikely. The Mollers by the way bought in over priced and over hyped San Diego. San Diego, just like Los Angeles and Orange counties has a legion of people that are praying for another boom to come along. Forget about jobs or income, they conveniently ignore the 11.9 percent unemployment rate and the reality that the state has had to budget some $60 billion in budget cuts. If we use a better measure of unemployment and underemployment, the state has a rate above 22 percent:

What does this data tells us? First, these loans are doomed to fail. It isn’t a question of whether they will fail but how bad will they fail. The issue of shadow inventory is important because many of these banks are simply not moving on homes and ignoring the foreclosure process completely. Not true? Well look at some examples across the country:

“(Cleveland) Renetta Atterberry thought she had lost her East 102nd Street house. So she was shocked to learn in January — five years after her mortgage company filed for foreclosure — that it was still in her name.

Worse, the long-vacant rental home had been vandalized and she faced a raft of housing code violations. Since then, she has been saddled with debts of about $12,000 to pay for demolition and back taxes.

“I thought I had nothing else to do with that home,” said Atterberry. “I was so embarrassed and humiliated by this.”

Her mortgage company didn’t buy the house and never took it to sheriff’s sale to see if somebody else would, leaving Atterberry the legal owner, responsible for upkeep and taxes.

These so-called “bank walkaways” are another troubling development in the foreclosure crisis, particularly in cities like Cleveland with weaker housing markets, say housing advocates and government officials.â€

In many other areas, banks are simply walking away from homes. In fact, it is a cold and calculating move. If they take possession of a property, they are responsible for taxes and maintaining the property according to city ordinances. Instead, they do nothing. In their calculus, they figure legal fees and handling the foreclosure process correctly outweigh doing absolutely nothing. You would think with trillions in bailouts banks would have a structured system in place after two long years into the crisis but they are as incompetent as they ever were. That is why it is maddening to entrust the people that created this mess to get us out of it. We need a new group and a new way of thinking. A first easy step is to eliminate the CEOs of every single top bank in the country. Also, we should claw-back any bonuses and compensation from these scammers.

If you think it couldn’t get any more ridiculous, the U.S. Treasury on their FAQ actually tells you how you can contribute to help pay down the national debt! Bwahahahaha! You must have cajones the size of watermelons to ask for something like that.

But back to the toxic loans, the clock has now stopped ticking:

“The interest-only periods, which put off the principal payments for five, seven or 10 years, are now beginning to expire. In the next 12 months, $71 billion of interest-only loans will reset. The year after, another $100 billion will reset. After mid-2011, another $400 billion will reset.â€

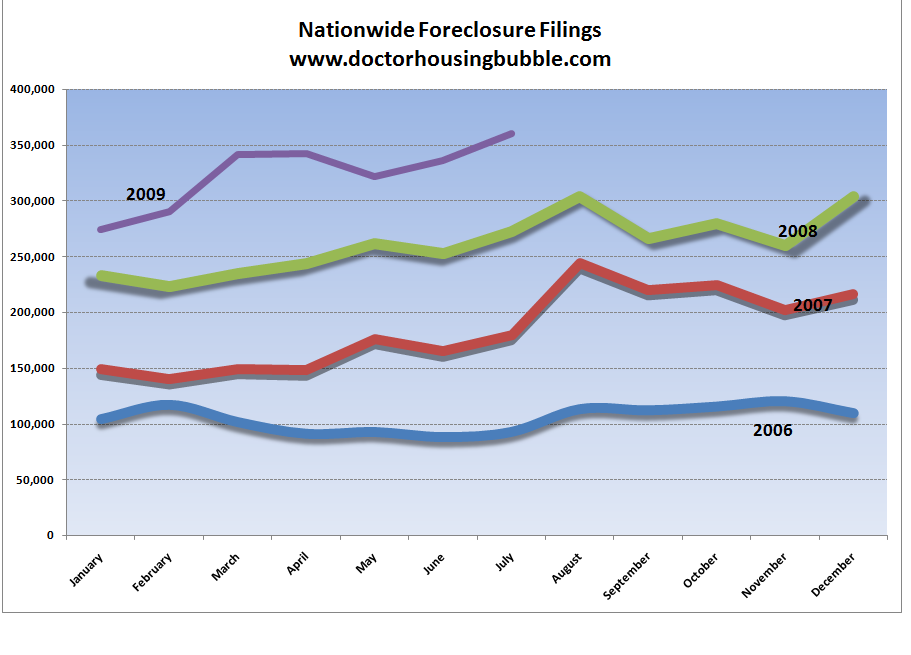

So much for these loans being resolved. You might be asking, what have banks been doing with all this money? Well first, they haven’t done much to stop nationwide foreclosures:

So not much is being done there. Maybe they’re lending more money. Nope:

“(MarketWatch)- U.S. consumers reduced their credit burden by a record amount in July, the Federal Reserve reported Tuesday. Total seasonally adjusted consumer debt fell $21.55 billion, or at a 10.4% annual rate, in July to $2.47 trillion. This is the sixth straight monthly drop in consumer credit. Consumers have retrenched since the financial crisis hit the economy in full force last September. Credit has fallen in every month since then except January.â€

This really leaves you scratching your head. If they aren’t helping on the foreclosure front and aren’t lending, then what are they doing? How about paying out massive profits to their cronies:

“(Bloomberg) — Goldman Sachs Group Inc. posted record earnings as revenue from trading and stock underwriting reached all-time highs less than a year after the firm took $10 billion in U.S. rescue funds.

Second-quarter net income was $3.44 billion, or $4.93 a share, the New York-based bank said today in a statement. That surpassed the $3.65 per-share average estimate of 22 analysts surveyed by Bloomberg and was 65 percent higher than last year’s second quarter.â€

So that’s where the money is going. The pretense that the money was to help the average American consumer was a gigantic stinking load so they could continue paying one another massive amounts of money. Incredibly for bringing the country near the brink of another Great Depression they are rewarded. We still haven’t seen a comparable Pecora Investigation. We have a committee looking into the causes as if we need to understand anymore! The banking system is corrupt to the core! It produced a minion of greedy short sighted thinkers that paper pushed this country into believing flipping homes to one another and sticking on granite countertops to every home was the ultimate sign of success. A massive and epic fraud. This is something we already know. Yet here we are allowing these same players to continue to game the system while 26.3 million Americans are unemployed or underemployed seeing the middle class evaporate like a drop of water in the Mojave Desert.

Leave it to California to have these same players proclaim that the bottom is here. Where do you think most of the $1.1 trillion in loans sit? California, Florida, Nevada, and Arizona own 75 percent of the option ARMs. Alt-As? California holds 42 percent of all loans categorized as Alt-As. Yet here people are thinking it won’t impact them in Pasadena, Culver City, or other semi-prime areas.

And guess what? There is this naïve notion that somehow these areas are populated by rich households able to withstand any economic hardship. Right on time to eliminate that wrong perspective:

“(Bloomberg) Wealthy Families Face Bankruptcy on Real Estate Crash

Wealthy individuals’ Chapter 11 bankruptcy filings jumped 73 percent in the second quarter from a year earlier, according to the National Bankruptcy Research Center, a research firm in Burlingame, California.

More individuals or families with at least $1,010,650 in secured debt and $336,900 unsecured are using Chapter 11 of the U.S. bankruptcy code typically associated with business reorganizations. Falling U.S. home prices leave them unable to refinance or sell properties when they drop below the value of the mortgage, said Joseph Baldi, a Chicago bankruptcy attorney.

Chapter 11 is more expensive and time-consuming for debtors and creditors than a Chapter 7 liquidation of assets. Wealthier people filing for bankruptcy typically have large homes, two car payments and children in private schools, said Leslie Linfield, executive director of the Institute for Financial Literacy in Portland, Maine, a credit-counseling and research group.

“You’re living on the edge, you’re juggling those financial balls,†Linfield said. “When one ball goes, they all fall down.â€

People forget that a vast majority of people live on the financial edge. If you live in keeping up with the Joneses areas like Orange County, if you make $150,000 many times you are spending $175,000. Make $300,000? Some spend up to $400,000. That is the issue. Americans from poor to rich spend more than they make. This is now fundamentally changing by force. People forget that a million dollar mortgage carries enormous costs. In some areas like Irvine you saw million dollar homes going to people that made $200,000! Maybe this is out of the realm of most people. Take a look at this sample option ARM case:

“(NY Times) Mr. Clavon, 63, was planning to sell the home in a few years and retire to Palm Springs. So he got a loan called an option adjustable rate mortgage, or option ARM, which allowed him to pay less than the interest for the first five years.

On his annual salary of $100,000 as a television camera operator, he could afford the $2,200 initial mortgage payments. And he planned to sell the home before the mortgage reset.

Because Mr. Clavon made only minimum payments on his mortgage, his balance has risen to $680,000 from $618,000, on a house worth closer to $400,000.â€

Mr. Clavon is in good company. As it turns out 94 percent of option ARM borrowers made the minimum payment.

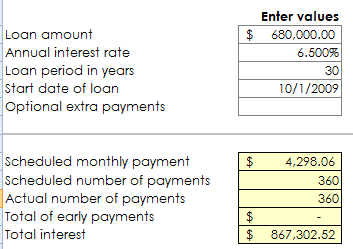

His payment is scheduled to go over $4,000 in two years. In fact, it might go much higher since he has paid zero to his principal. Let assume he refinances his mortgage to a 30 year fixed jumbo:

Given Mr. Clavon is 63, what bank is going to offer him a 30 year loan on a home that is underwater by $280,000? According to our numbers, he will pay off the home at 93 if he goes with a 30 year fixed mortgage. Why not go for the 40 year loan mods and be done at 103? The home is located in California (of course). Look at the above though, even with a refinance his principal and interest payment alone is $4,298. Add in insurance and taxes and his payment goes up to $5,000! That will virtually eat 100 percent of his net pay.

You might ask why banks have not dealt with these loans. Easy, that loan of Mr. Clavon is still on the bank balance sheet at face value. Do you think they want to lower it to $400,000 and eat the loss? They will go under. Shadow inventory is here and only those who are blind choose to ignore it.

This case isn’t unique. You can rummage through the multiple Real Homes of Genius examples and you will realize California is littered with these mortgages. People and banks praying for another boom so they can off load these homes to other suckers. Sounds like a fantastic strategy to me.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

45 Responses to “$1.1 Trillion in Toxic Loans: $908 Billion in Interest Only and $198 Billion in Option ARMs. The Zombie Loans that Simply Don’t Die.”

Why don’t we nominate William K. Black to carry out today’s equivalent of a Percora hearing. He nailed the crooks during the S&L scandal and put the bad banks into receivership. Time is running out. There’s a statute of limitations on fraud. We wait much longer and no one will do time.

Believe me Doc. I’ve had to go to realtytrac’s website to win some realestate arguments. There are so many people out there that believe housing will rebound in the next 2 years here in SoCal. That is the about the most ignorant mindset one can have at this moment with all the coming resets and current shadow inventory. The C.A.R.’s new motto is “There’s a sucker born everyday, let’s see if he qualifies”

Elizabeth Warren would be a good choice to lead such hearings too, and her selection would have the added benefit of naming it the “Warren Commission,” which would drive all the conspiracy types even crazier.

Oh, and I’m seeing the shadow inventory grow around me in my L.A. neighborhood. One REO has been vacant and for sale for about 10 months. Another was pulled from the market after 8 months and rented to a rather sketchy-looking tenant who keeps bed sheets on the windows – which are still plastered with foreclosure notices. A third place has been vacant for 6 months without ever going on the market, and a fourth house just was repossessed, vacated, and papered with a shocking number of bank notices.

Of course, despite all this, the home owners with their houses listed are still asking about $1.1 million for little places that went for under $300k in 2002. Somehow, they are thinking that they can recoup the $950k they paid in 2005 and still turn a bit of a profit (these are all actual figures from Zillow sales data). What must they think when they pass all those empty houses down the block overrun with the dead weeds and eviction notices? Are they totally delusional, or are they ready to bail themselves?

The people who run this country are scum. The bankers are scum. The lobbyists are scum. The special interests are scum. Truly, if you executed all of them, the world would be a better place and we could start over. Otherwise, al we can do is watch as the thievery continues, while nobody in “government” lifts a finger to stop them.

I am past depression and anger, and I’ve gone into resignation. I just don’t care anymore. I’ve lost all faith. The masses are too stupid to figure any of this out. A few people know what’s going on, but the numbers are too small to create the critical mass that would force a change.

I still have hope that some lone sniper will pick just a few of these bastards off…

Here a “new way of thinking” proposal. Follow this flow-chart.

1. Homeowner in trouble? If Yes, then:

2. Homeowner has equity? If yes, sell. If no (underwater):

3. Homeowner could afford payments on a 30-year-fixed refinancing of note value? If yes, refinance, if no:

4. Homeowner could afford payments on a 30-year-fixed refinancing of less than existing note value, but greater than fair-market-value? If yes – encourage banks with incentives to write down principle. (Kind of like the existing program), but if no:

5. Then homeowner could not afford to pay normal payments on a non-teaser mortgage even at the new fair market value of the house they live in. If they are not already in default, it is only because they have some “teaser time” left on their time-bomb contract.

Now, what we want is for these people to depart these homes as quickly and painlessly as possible – and for the banks to repossess the properties and sell them also as quickly as possible. Until this process is complete we cannot expect to resolve the underlying problem in the market.

What I propose is that we offer banks a deal – the government will cover 25% (or whatever number is necessary to save some shred of the banking system) of the final losses on any particular property so long as the bank offers such a homeowner a “put option” of turning over the deed at any time and that the bank furthermore sells such an REO property within 6 months to 1 year.

So, for example:

Jon makes $60,000 a year. In 2006 he bought a $600,000 home with an Option-ARM with a minimum monthly payment of $1,700 for 3 years. Now the home is only worth $400,000 and the payment is about to recast.

Jon is underwater, couldn’t afford the payments if he refinanced the $600,000 note, and couldn’t afford them even if he was allowed to refinance at $400,000. It’s in everybody’s best interest that he leave the property and that the bank resell the property in a timely manner.

The bank will “lose” over $200,000 on this deal, but in exchange for a timely resolution to toxic-mortgages, expeditious equilibrium price-discovery, the unzombification of the financial system, and various other social benefits, the government will offer the bank maybe $50,000 to get this done if they can resolve it quickly.

Maybe you could make it a limited-time-only deal, like cash-for-clunkers, or the $8,000 new homeowners credit, and tell banks that they only get the subsidy if they act before June 2010. My guess is that most toxicity would cease to exist within 9 months.

Why don’t we nominate William K. Black to carry out today’s equivalent of a Percora hearing. He nailed the crooks during the S&L scandal and put the bad banks into receivership. Time is running out. There’s a statute of limitations on fraud. We wait much longer and no one will do time.

P.S. – Sorry, forgot to tell you great post!

Oh snap – the minute I come up with what I think is an original idea, Treasury announces they’re doing something close. Oh well, “great minds think alike”?

http://www.housingwire.com/2009/09/10/federal-incentives-coming-for-short-sales-deeds-in-lieu/

If no one does time Robis, notwithstanding widespread and obvious fraud, this is very much deliberate. The NAR and NAHB are both in the top 10 campaign contributing PACs – and Congress will not bite the hand that feeds.

Our system has become very fundamentally corrupt, and any illusion of democracy is just that. What we have now is an oppressive regime that imprisons people for such grave offenses as, e.g., putting plants in their own bodies, takes by force and consumes a third of all economic output (soon to be half – and a lot of the naive public thinks it should be more and more, and that this is for their benefit!), propped up by a very effective propaganda machine (and if you doubt this, consider the truthfulness and accuracy of the reporting on the bubble before it was too obvious to ignore) and by selected beneficiary groups who pay to retain their protected status and keep the con game running.

Srla, Elizabeth Warren is a terrific lady and brilliant lawyer, she would be an excellent choice to help with this process. Man, just hearing her name takes me back… {Sigh}

Great post.

One quick note. The $189 billion figure mentioned by Fitch is for Option-ARMs that have been securitized. There are many more that sit on bank’s balance sheets directly ($50B plus w/ Wells Fargo alone that are carried at face value… another $30B plus that have been written down, but probably not far enough).

From a Bloomberg article linked at drudgereport today:

“Nevada had the highest foreclosure rate in August, with one in every 62 households receiving a filing, even with an 8.4 percent decrease in foreclosures from July, RealtyTrac said. August filings were up 53 percent from a year earlier, with 17,902 Nevada properties receiving a foreclosure filing.

The second-highest foreclosure rate in August was recorded in Florida, with one in every 140 households receiving a filing, followed by California, where one in 144 households received a foreclosure filing.

A 9.6 percent month-to-month decrease in filings helped lower Arizona’s foreclosure rate to fourth-highest in August from third-highest in July, RealtyTrac said. One in every 150 Arizona households received a foreclosure filing last month, still more than twice the national average, the company said. “

“….the government will offer the bank maybe $50,000 to get this done if they can resolve it quickly.”

That’s a joke, right? Right?? Offer the very THIEVES scamming us MORE money?? Yeah, I guess the $23.4 trillion they’ve gobbled up already, enough to pay off every mortgage in America AND still give the banksters trillions in “bonuses” wasn’t enough…..

You mean, the US taxpayers will fund it, don’t you? Exactly where will “the government”, toxic with a looming $9 trillion in additional debt EVEN while furiously printing dollars to fund Goldman-Sachs $100 million/day “profits” from rigged “automatic trading” schemes, find this money?? Borrow it from California? bwahahahaha.

And if your 9 month window closes, and the housing market drops another 10%? Will “the government” then step in to fund another refi?

And exactly WHO is going to be stupid enough to buy a house falling in value for anything close to the imagined value? Oh yeah, the growing unemployed hordes need a roof over their heads….let’s loan them the money…

I think that you’re on the wrong blog. You need to go to some right wing extremist Militia website. The people here do not condone political violence…. thank you very much! Surely we can have a discussion without invoking and hoping for more violence!!!

my previous comment was directed to the pseudonym “Robin Thomas”

@ LA-Architect –

I agree – it’s sad that people are hoping for violence, as we would like to believe that our society is “beyond that”.

BUT, it’s important to look at the root of the problem, rather than vilify someone and downplay their point of view by saying they need to go to a “right wing extremist militia website”. The anger out there is real. It has nothing to do with right or left wing. It has to do with the fact that real, hardworking, honest people are feeling powerless to prevent being sucked into a financial quagmire by being forced to shoulder the burdens created by rampant fraud and manipulation by “financial elite”. The reason why many people find their conversations steering towards open hostility and violence is because every authority figure in this country has done nothing but protect the wealthy and saddle the poor and middle-class with more taxes. Who can we turn to for protection? The system has proven that it does not work. Out legal system is of no help and the government is corrupt. Historically, when the citizens of any country can no longer rely on their government to protect the interest of the general public, the only avenue available to them is violence.

Which, ironically, is the reason why this country was originally founded in the first place.

I think the nation’s housing market is facing new downward pressure as holders of subprime-mortgage bonds inundate the market with foreclosed homes at prices that are much lower than where many banks are willing to sell.

“Experts say this is a bad omen for residential real-estate prices and homeowners trying to sell or refinance, because the fire sales, many to cover soured subprime loans, put downward pressure on the value of nearby homes. All of this undermines federal efforts to stabilize the housing market and revive the broader economy.

“While the banks are trying frantically to get loans off their books, they face the problem of large shadow inventories of housing being dumped on the market, which would depress prices further,” said Anthony Sanders, real-estate finance professor at George Mason University in Fairfax, Va.”

Read More: http://www.housingnewslive.com

a small change in the law would be interesting, -> if a bank issues a intent to foreclose notice give them 3 months to do so from the date of the notice then if they have not taken the house it reverts to the owner free and clear that would kill the shadow inventory fast

Steve said:

“I agree – it’s sad that people are hoping for violence, as we would like to believe that our society is “beyond that.”

Have to disagree with you that we are beyond violence. We like it as long as it’s carried out by our military against a foreign entity on their soil. The 19th and 20th century were bloody. We had our own civil ware in the 1860s. It was followed up by WWI and WWII in the first half of the 20th century. Let’s not forget all the other little skirmishes like The Mexican American War, Korea, Vietnam, etc.

We love aggression, bloodshed, and brutality. Just look at the selection of movies that are out there. Thing is, we like it at a distance. Maybe some civil unrest here on the homeland would do us good? Maybe we’ve forgotten the horror of it all? Reading about it or seeing it on TV isn’t enough to make us want to change. Perhaps we need to experience it first hand?

Except that in the Clavon example, the lender will offer his a 5 year interest only mod at 3% which will go to a 25 or 30 year fixed in 2014, when they hope things have recovered. Extend and pretend, baby! And shit, with FedFunds at zero, they’re even making money on the 3% loan, PLUS they keep carrying the principle amount ($680k) at face value on the books. Call that a hot, steamin pile o’ shareholder value! Yeaaahhh.

@ robis:

No we don’t need to experience it firsthand. WTF, you want your family caught up in that kind of misery? Because I do not.

Well said Steve! No matter if you call yourself a liberal or a conservative or independent or whatever. We must get past that nonsense to see that we have been lied to and handed an unbelievable tax bill. It’s time to see that both parties are ready to buy protection for the elite at the expense of the middle class. How will we ever pay this off and why -by God- did it get dumped on us in the first place?

I had several friends and neighbors calling about loan mod. One guy received a temporary modification with a ballon pymt due at the end of six months. Another was in the midst of a mod and the lender foreclosed on her this month. Another took 4 months and got the mod at a reasonable rate and payments. I have a Bank foreclosure listed and there was a Buyer for the property with a $140k cash offer, the banker countered with $2900 off the asking price. I say this because before I took the listing , it was listed with another Broker 2months before and on the market for almost a year now. Who do you suppose it going on?

Sad truth is that masters of the US are not Americans–New York is technically in the US but it is an international finance area. The people there couldn’t possibly care less about us. Like Hong Kong or London. They are here to loot the country and as from another ruse on an aircraft carrier in recent years: Mission Accomplished.

Of course, they’re not done. They’re chumming up the water for another kill. Only question is when do they pull up the net.

According to this article, only 85,000 loans have been modified under the Obama plan, far short of the 7-9M projected. http://www.bigbuilderonline.com/industry-news.asp?sectionID=363&articleID=1064161 This is actually a blessing in disguise.

Those of you seeking housing revenge through the courts might be interested in this development: class action law suites have been filed against 8 big builders in California blaming them for the housing bust. http://www.bigbuilderonline.com/industry-news.asp?sectionID=363&articleID=1064107

Federal investigators or not, class-action law firms are willing to take a stab at justice American-style. Unfortunately, the builders (and their mortgage companies and appraisers) were the “pushers”, not the “kingpins” in the crack housing cartel. It’s always harder to get to the real bosses.

Be brave Comrades!

Foreclosure Headlines Misleading

Zelman estimates that the foreclosure timeline has doubled “due to moratoriums, modification efforts, lenders’ self-serving motivations, postponements at trustee sales and logistical delays, which are all leading to a mounting pipeline. In total, foreclosures in-process are 88% higher than the year ago, led by prime non-jumbo (up 159%) and prime jumbo (up 152%) mortgages.”

Treasury Secretary Timothy Geithner said it himself today, “the foreclosure problem is going to last a long time.” According to Treasury’s own report, banks participating in the administration’s loan modification program have only made offers to 12% of eligible borrowers.

The treasury report listed, bank by bank, who was doing what, and Geithner claims, “I am quite confident that will produce much much faster modifications more quickly because institutions do not want to live with the consequences of being so far behind the curve.” I’m not so sure about that, especially when no one big bank is doing any better than another.

yparson, that illustrates the present reality.

No matter what, the banks are going to demand high dollar for properties that aren’t going to sell because they don’t have an interest in selling because we are propping them up with tax dollars.

Its a win-win for them right now, but beware, because down the road this snowball is going to choke them. You can’t inflate things like this and not have a repercussion.

The loan mod thing is a joke. A political ploy to make it seem like we are doing something on the Congressional level about the issue.

Everyone’s best bet is to pay off that home loan despite the total cost out of pocket, and sit tight. Its what my grandparents did during the Great Depression and its what helped them survive.

Listen up, you limp wristed dipshit pussies…if you can look on while this once great country gets raped by scum then you can go to hell. LOOK AT WHAT THEY HAVE DONE!!!!!!!!!!!

They RAPED the United States Treasury! There has never been anything like this ripoff in the entire known history of mankind. We don’t even HAVE a government in the truest sense of the word; Wall St. IS our government. If your blood isn’t boiling then you are too dumb or uninformed to understand what has taken place.

Pick up a copy of The Web Of Debt, then speak to me about showing restraint.

Let me clarify that I would not personally go out and shoot anybody. However…I sincerely believe that some of these people richly deserve to be shot. And the longer that nothing is done, the madder I get. I work HARD for small money in a helping profession, and I have to watch as this country is raped and pillaged. If you’re not furious then you’re not paying attention.

LA-A,

I don’t condone violence either, but I understand Robin Thomas’ anger and frustration, and I’m somewhat of a social liberal.

I feel helpless that more isn’t being done to hall these crooks in the banking and financial industry before a judge for due process.. But the system isn’t working. Bush and Co. was a jerk, Obama and his team of goofballs is turning out to be a big disappointment, the FDIC and the Treasury are crawling with GoldySachs’ and other investment bank’s cronies. And we can just forget about the pieces of garbage that make up the Senate and CONgress.

We as a country can never criticize Russia and it’s petroleum oligarchy or Japan and it’s construction/banking/real estate oligarchy as we have our very own banking oligarchy.

Don’t worry, the government will take care of all these problems. The government can!!!!!

http://www.youtube.com/watch?v=LO2eh6f5Go0

I’m furious too, but I, like other informed Americans, have little recourse right now to do anything about it. Voting isn’t until November, and mid-term elections are next year. What do you propose we all do other than cover our asses as best we can?

I’d like to have SOMEONE propose to me a SOLUTION for the common man other than hunkering down at the moment!!! The fear of our own government is growing on all levels of society. (I won’t insert a political discussion point here as this is about real estate and the mortgage debacle.)

The truth is that we do NOT have a say in what is going to happen OTHER than minding our own store. Our representatives have not listened to us, WON’T and in the future I seriously doubt wether the voice of reason will overcome this tendency to run off the cliff first and ask questions later for the sake of profit.

We have collectively sold ourselves to China via the bailout and this is just the beginning of a long and painful process of bondage to entities even bigger than Wall Street.

Robin THomas….

Where was your outrage when this country’s economy was booming. All this fraud was happening and few people complained loudly enough. The same people who profited then are profiting now. I am a social liberal (like you couldn’t tell right) however I too am outraged by everything going on. All I want is for house prices to be allowed to fall back to a level that can be supported by economic fundamentals. Comments like yours, despite assurances that you wouldn’t personally shoot somebody, are not helpful. Your comments serve to stoke the fire in unbalanced and irrational people who might not be able to show so much restraint. It disgusts me to hear so many ultra Conservative extremists incite violence against Obama and people in power. Please don’t chase me from this forum. I used to frequent Ben Jones’ “Thehousingbubble.com” until it was too heavily frequented by angry conservatives. I like this forum because the people who comment tend to be quite educated about what really is going on.

Anyway…. please don’t use terms that incite or can be seen to incite violence.

@Robin,

What are we going to do? You can’t change the world. Humans have been programmed with a few bugs. We do not live in a world of synergy and cooperation. You have to understand the world as it is and protect yourself and loved ones from the storm that is coming. Wall Street has so much power they don’t even pretend answer to anyone. The battle was lost decades ago. And as a race and a nation we are becoming dumbed-down, entertainment-lusting, cities filled with the foolish, faithless walmart-zombies. If you killed 50 cronies, there are 50,000 more just like them. Being pissed off at the Tsunami won’t help you–get to higher ground…or throw a tea party. Bet that’ll scare ’em.

What the government should have done was to let the banks fail, at least the ones which had all the toxic mortgages. Some of them wouldn’t have failed. Some of them would have foreclosed on all their properties, and sold them for prices that the market would bear. They would have lost a lot of money, but they might have survived. The deadbeats and the flippers would have lost their homes, which would have been only right, since they couldn’t afford them. Those people who had saved and waited for the bubble to end would have been able to buy houses at pre-bubble prices, and these people would have made far better and more responsible homeowners. All the trillions that the government spent to bail out the banks could have gone to the FDIC, to make sure that the depositors were safe, when many banks failed.

In short, there would have been some economic call to judgment; the crooked and the wicked would have been punished, and the more honest and frugal people would have gotten some financial reward. More importantly, there would have been a strong message sent, that it is important to save, to pay one’s debts, to be responsible; and that this goes not only for average people, but for large corporations. But instead, the government has sent the message that banks are too big to fail, no matter what they do; and that a consumer needs only to rely on credit, buy as much as he can, and then, even if things get bad, he will be bailed out, allowed to modify, allowed to keep what he couldn’t pay for in the first place, at the expense of others.

To me, this is the worst of it all. The moral swamp that we have fallen into, cannot be detoxified. How many of the people now buying houses actually intend to pay the morgtages for 30 years; or are they quite ready to walk away from the house at the first sign of depreciation? Years ago, that was pretty much unheard of, as people saw it as virtually criminal. But now, it is becoming acceptable, and where will that leave us in five years? And all those people left sitting in underwater houses–do you think that they are going to be keeping up their lawns and roofs? Will the banks’ property management companies do it for them? Or will entire neighborhoods be blighted by the aftermath of this drunken orgy that no one wants to pay or take responsibility for?

William,

This is exactly how I feel too. It is all so wrong and stupid and unfair.

I just left Peter Schiff’s site and gave some money for his exploratory committee. I would love to see Dodd out on his ass.

Sooo, since we can’t turn back the clock, and some are already tossing out silly ideas (violence, really???), here’s mine:

Once a “homeowner” has been in default for 8 months, the STATE takes possession of the property, auctions it off (banks are disqualified from bidding)and 98% of proceeds go into the budgets of first-responders, education and infrastructure building/maintenance (2% to cover auction/processing). The bank(s) loses everything, since they couldn’t be bothered to do their job in a timely manner, and the former “homeowner” has 8 months of mortgage cash to put down a deposit and pay rent for a few months while he/she gets it together… If they didn’t blow it all.

Okay, I know I’m CrAzY… flame on…

Ever,

Violence is silly? Violence sounds brilliant compared to your idea. Do you really think that any government entity is going to cross the banking industry, the industry that gives so generously to the scumbag politicians? The banking industry IS our defacto government, dude. I mean, I totally agree with you on principal, but what you suggested will never happen.

Robin,

Of course it won’t ever happen! That’s why it’s a silly idea from a CrAzY person.

Sorry, writing about violence in an already volatile environment is irresponsible, not silly. I was punchdrunk after my usual >12 hr. day, and used an inappropriate word.

I am one of the “sheeple”. I work long hours every day for well under the “median” yearly earnings, trying to always do the “right” thing. I don’t own a home, and I may never be able to own a home, but I’m saving for one anyway, which was no easy feat before, and is decidedly more difficult now. My business is being squeezed out of existence by the Feds, the State and the Insurance Companies. Manual labor has kept my “waves of rage” under control for >40 years.

In this era of economic turmoil, it wouldn’t take much to incite me and a lot of people like me to do something that you might think “brilliant”, but would hurt a lot of innocent bystanders. I would prefer to keep my dark thoughts inside my head for as long as possible, in hopes that they need never see the light of day.

I come here to read about real estate, in an effort to gauge my potential success in my efforts to purchase a (small) property I can spend the rest of my life on. While I do this, I work to remain debt-free, giving financial institutions as little of my $$$ as possible and helping as many of my friends and neighbors as I can, in any way possible, whenever possible. Oh yeah, and I vote at every opportunity.

Right now, given my work hours, those are the options I choose to exercise; if I wanted to see the other, darker options on a public forum, I would hang out on the survivalist blogs.

Believe me, I am NOT expecting anyone to give me a skittle-cr****ing pony. Ever.

Oh, and I’m not a dude, by the way.

Happy Saturday!

As far as I’m concerned, this IS a survivalist blog. I’m not inciting anybody to do anything. You’re exaggerating just a wee bit. What REALLY ticked me off was the idiot who said something about “right wing extremist,” which essentially indicated to me that that same fool is no doubt a left wing extremist. I HATE partisans. Partisans rah rah their “team” while paying no attention to the guys looting the treasury. It’s idiotic.

I hate both sides with equal fervor. If you’re partisan your brain is not operating properly. Look into the bubble, the crash, and the bailouts, and no way can you tell me that one “side” was any worse than the other. They both suck. They both take money from special interests and then allow the very same lobbyists to come in and write legislation that screws the citizenry. We have no leadership to speak of. Sure, there’s anger in the air but it’s not MY fault; the anger is richly deserved because our leadership has failed us at every juncture. I’m sorry if I offend. Believe me, I’m not spouting anything that isn’t felt by many people in this country.

Your words:

–

“Truly, if you executed all of them, the world would be a better place and we could start over.”

“I still have hope that some lone sniper will pick just a few of these bastards off…”

–

Really? You don’t think your words incite violence?

———————————————————————————-

Then, further down the thread:

–

“Let me clarify that I would not personally go out and shoot anybody. However…I sincerely believe that some of these people richly deserve to be shot.”

–

If you air your desire for violence in a room full of anger, but are not willing to take on the responsibility of pulling the trigger, you had better be ready to stand with those you incite and accept the consequences right along with them. Otherwise, you are just as bad as the Defrauding Marauders and their Pocket Politicians.

–

I do hope that you are not so consumed by hatred and anger that you are unable to enjoy at least a few moments of your weekend.

Dr. Housing, I just realized tonight, after reading your blog for many months now, the most obvious thing.

The incentive is TO not pay your mortgage. As a working class family man, trying to do and teach his kids the right thing, MY government is rewarding deadbeats, crooks, liers, and cheats.

The only way you can get modified is to NOT pay your mortgage. By NOT paying your mortgage you are rewarded with the ability to not pay your mortgage for several, to more months, stash the cash, then get a cram down on your payments.

Same thing for short sales. Those who dug themselves in too deep are rewarded with the ability to write off huge sums of the debt they took on. Poof, that “cash” spent just goes into thin air. Or does it?

The reinforcement for people who pay thier bills on time and take their responsibilities seriously, NOTHING. People are sheep and they are going to increase the behavior that is reinforced, and stop the behavior that is not.

There is more than a simply shell game going on here. We are being fucked with as a population, as a people. I dont think of myself as one for conspericies, but something feels very strange about the lies being told to the American people during my lifetime as an adult (1st Bush to now).

@Robin

I think you’re right. If won’t at least voice our anger, nothing will happen. Ben Franklin told us not to let the Khazars in, but we did. Just a matter of time before they took control of everything, while we think we have freedom. Freedom to work like a slave to survive. Freedom to worry about who’s going to take everything we have and throw us out on the street. …Freedom’s just another word for nothing left to lose…we’re almost there…

Ever,

I won’t take back a word I said. The bad guys are not paying for their crimes. If some dude who has been laid off and foreclosed on selectively picks off a few of the bad guys I’d cheer him on. Absolutely. Better that than shooting your entire family, which I don’t understand at all. The bastards in power have people focused on trivialities while they plunder our tax dollars and debase our currency.

Furthermore….there was less at stake in the 60’s and people were crazy in the streets. Now, the very survival of our country is in doubt, and people sit home and watch Idol.

It’s ridiculous to claim that I’m “inciting” anybody when anybody with BRAIN is already furious.

Robin Thomas….

in suggesting that you would be more at home at some “right wing extremist” blog, I was merely responding to your comments, one of which, “Truly, if you executed all of them, the world would be a better place and we could start over” followed up with “I still have hope that some lone sniper will pick just a few of these bastards off…”

Our words and actions are described by others with certain adjectives that fit the tone and intent. I don’t see anything that I’ve written placing me in some “Left wing Extremist” camp. If you don’t wish to be described as some lunatic fringe, pay attention to what you’re writing!!! Keep the violence out of your blogs!

Oh Robin,

I never asked you to take back anything you said. This is a public forum; only the Site Owner can set the rules, not me.

Do you honestly think the denizens of the Ivory Towers give a da*n if we devolve into violence? Do you really think any of them can easily be picked off? Violence just gives them “die-off” of the “rabble”. And the First-Responders, with their newly-slashed budgets are the ones that end up as undeserving targets/collateral damage. The dastards will just watch us on their big screens and giggle.

Times have changed; the hearts of the Defrauding Marauders and their Pocket Politicians live in their wallets. Find the ways to attack the fat wallets and you punish them. And if you can do it without sinking into the mire of moral hazard, you win.

Madguru, just because “everyone else is doing it” doesn’t make it RIGHT. I used to hear this a lot as a youngster, from my mother who lived through the GD in the 30’s. Those that in the end succeed, are those who have integrity and some grasp of caring about their obligations. I’ve seen it a hundred-fold.

I’m not saying there aren’t people out there who don’t care, there are, a LOT of them. I work with one who is whining about having to pay off his wife’s CC bills, and he’s negotiation a Chapter 11 right now. Shameful. All that had to be done was to cut off her credit lines and separate himself from the credit lines legally, since her name was not on the deed of the house he owns. So he is instead going to “screw them all” (In his words) which makes me furious because he’s screwing ME.

He lives in a bigger house than I do, has more cash, better cars, etc.

But I know that in the end, I’m going to do better because I’m unencumbered financially to any institution. I can simply walk away from them and their money changing slight of hand practices. I can say “NO”

I think this is going to have a big backlash – it has to. The movement will be to limit credit a lot more for those who do go bankrupt. Already CC’s are carrying warnings on the applications of “If you have declared bankruptcy, don’t bother to apply”. This easy re-credit will dry up due to the sheer magnitude of the problem,and those who did this will find it a lot harder to repeat it in the future. As for now, there’s nothing we can do but stand by and let the house of cards collapse and pray it doesn’t take yours down with it.

Violence is NEVER the answer. What it the answer is peaceful demonstrations and voting with your cash. Pick wisely who you do business with!

Leave a Reply