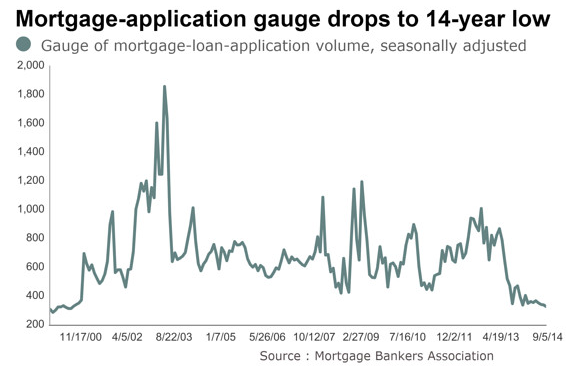

The destruction of traditional mortgage demand: Applications for mortgages hits a 14 year low and affordability for housing continues to decline.

There is a fine line between using debt wisely and being a slave to crippling loans. Unfortunately most Americans have used debt as a meal replacement for actually saving and are now entering their older years with very little saved. Liquid asset anorexia. It should be telling that purchasing a car, an item that depreciates the instant you set your rear in the leather seat, has some of the easiest financing the world has ever seen. Zero percent loans are common but when you look at the underlying price tag, the cost is actually very high. College loans are given to students with zero income on the future prospect they will generate enough income to carry their loans. Not a big deal when you take on $5,000 a year but what about $40,000 a year? As we are seeing, many young adults are having to move back home with mom and dad as grown adults merely to pay their bills, many times in car loans and student debt. A similar phenomenon has occurred in housing where base cost is very high thanks to cheap financing. Low rate mortgages still cannot force demand if people are unable to service the debt. That is the problem we now confront today. It isn’t a question of the raw number in population growth. If for every doctor or engineer we create 10 to 20 McJobs, then where will the housing growth be? Homes are unaffordable even in the face of record low mortgage rates.

Nationwide affordability in housing is not good

Nationwide data on household incomes is out and it is not a pretty picture. Rents and housing values completely outpaced any nominal gains in income. The end result? More money is going to housing instead of other sectors of the economy. The trend towards a feudal landlord nation continues and the number of renters continues to grow at a faster pace than those buying houses.

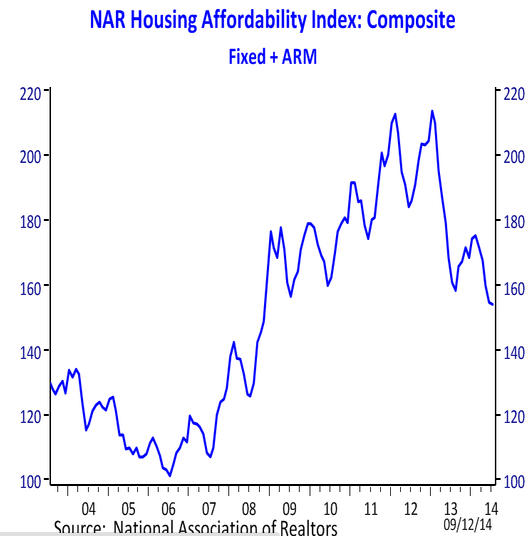

Take a look at affordability today:

As a nation, household incomes absolutely matter. Go to your local bank and apply for a mortgage and see how far you get with telling them that incomes don’t matter. Most regular families need a mortgage to purchase a home. Even if mom and dad assist with the 20 percent down payment, you still have a mortgage for 80 percent of the value of the home. In California, if you purchase a crap shack for $700,000 that means you will have a down payment of $140,000 plus a mortgage of $560,000 for 30 years. In other words, you are going to need monthly cash to cover the monthly nut (i.e., W-2 work, 1099 income, selling weed, etc).

The chart above shows that affordability is not good today. Where do we stand at the moment? Back to where things were in 2008 according to the NAR. 2008 wasn’t exactly a good year if you recall. Even though affordability was horrible in the 2000s, we had no income, no job, and no pulse loans floating around. Basically a student loan financing model. Incomes did not matter and desire to sign was the only requirement. Today, you still have to show you have adequate income to cover the monthly nut since the entire mortgage market is now flooded with government backed loans. In other words, you have to demonstrate income to carry the note.

Which leads us to the next chart. People continue to lust after housing and are itching just to put their lives into debt turmoil. The WSJ had a story about a women in Chicago with a $200,000 income and went deep into credit card debt of $300,000. The article then gives a comical look at a $400,000 annual income and how “quickly†it can go. Unfortunately this is the kind of debt religion we live under. The more you make, the more you should spend. The more income you have, the more sophisticated your debt should become. If you are making $400,000 a year you are in top 1 percent of the country and if you can’t manage your budget, you have deeper issues at hand. The budget is a complete joke and of course, housing eats up a massive portion of after tax income.

So clearly people are in love with debt and house horny. So you would expect mortgage applications to surge:

Mortgage applications hits a 14 year low. Why? First, investors have dominated the market going back to 2008. Only until late in 2013 have they started to pullback in earnest. Next, you have low inventory combined with stagnant incomes. Since virtually all originated mortgages have to meet minimum qualifications, many people are locked out. Not because rates are horrible (they are great) but because households simply do not have the income to cover the payment. This is more pronounced in areas like California where a one-year run basically locked out most families. Now, inventory is up, prices are being adjusted, and sentiment is clearly changing.

The destruction of traditional mortgage demand has come because of current policies that occurred over the last bust. It is no surprise that investors connected with big banks have been the big winners here. Mortgage rates are still in the 4 percent range and this is great considering inflation is running between 2 and 3 percent per year. Low mortgage demand tells us one thing that is very obvious and that is the middle class is being hollowed out and this was the primary source for new household demand. Welcome to feudal America were you now have the ability to become a leasing serf to a hedge fund or Wall Street.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

152 Responses to “The destruction of traditional mortgage demand: Applications for mortgages hits a 14 year low and affordability for housing continues to decline.”

What percentage of the Mortgage Applications Gauge are for purchase and how much for refis? It could be that the refi apps are dead, but new purchase apps are still coming in.

I’ve read somewhere some time ago that we are at 20 years low on mortgages. So, I wonder, is demand up?

A couple weeks ago I posted a comment about ridiculous prices in the Highland Park neighborhood of L.A. Here’s one of the examples I mentioned, an 891 square foot shack in original condition. They were asking $548,000, now after 35 days they cut the price to $495,000 and I’ll be surprised if they get any offers at that. This neighborhood has crappy schools, lousy air quality, lots of traffic and plenty of crime. Good luck.

http://www.zillow.com/homes/for_sale/20771999_zpid/days_sort/34.131504,-118.168967,34.103685,-118.197248_rect/14_zm/0_mmm/?view=map

Mortgage purchase applications are down 10% from last year, in spite of increased inventory.

Refinance activity is down 73%.

http://www.calculatedriskblog.com/2014/08/mba-mortgage-applications-increase-in_27.html

Thanks Dom. I had a hunch that was the case.

@TJ Mortgage apps are at 14 year lows, so . . .

Tools (Seattle and Fernandez) please read Doms link. The major hit to the mortgage gauge was refi activity (down 73% yoy), purchase apps are down only 10% yoy. Loss of refi activity is not going to crash the housing market.

If you don’t have your piece of the pie yet because of an inheritance or a successful business or a boomer with assets, chances are you will never get a piece of the American dream pie

Ben I hardly find holding a 30 yr debt obligation for a shoddy box the American Dream. Renting and going on Vacations, fine dining, and shows is more of a Dream to me.

You’re an intelligent independent free thinker like myself who has decided for yourself what makes you happy. My dream is early retirement and I can do that because I have no kids no wife

Felon yellen has suggested recently to get rich. Too poor… get the f…ing rich, problem solved!

If TPTB, and Yellen is their mouthpiece, are telling the proles to get into assets then that means it’s time to get out. Do you need any further evidence that we are at a market top?

Don’t worry if the bank is giving you a hard time on nonsense such as DTI and cash reserves, just tell them that the property is located in an international world-class city where the rich elite are clamoring over themselves to also have a home. I’m sure the bank will then respond that your income doesn’t matter.

Nice laugh, hater. The “rich elite” don’t use a “bank” to purchase real estate. You are truly exposing your ignorance.

# # #

Don’t worry if the bank is giving you a hard time on nonsense such as DTI and cash reserves, just tell them that the property is located in an international world-class city where the rich elite are clamoring over themselves to also have a home. I’m sure the bank will then respond that your income doesn’t matter.

Sorry it went over your head. Maybe next time you’ll get it. LA sucks!

I love it. Anything that doesn’t fit the narrative of Los Angelhole being the promised land brings out the defensive rhetoric. You are truly exposing your weakness. So easy and fun! Thanks for playing!

By the way, nice tears, douche.

“July House Price Inflation Highest Since Jul 07”

https://mninews.marketnews.com/content/uk-analysis-july-house-price-inflation-highest-jul-07

Okay, I knew that woman profiled in the article — Sylvia Flores. She was living in Portland. A really nice and smart person but I have doubts about whether she was pulling down 200K — at least at that time. She was always hustling for jobs no matter how small. For some reason I think all of this notoriety is part of a self generated mythology that leads to her personal brand enhancement and traffic to her sites. I checked out her LinkedIn profile and she loudly and proudly uses her financial troubles to promote herself. A hero’s j0ourney out of debt is always a good way to become a debt mgmt. expert.

Well, I don’t know her, but, that’s a ridiculous story to base an article like that on. How in the world does someone amass 300,000 in credit card debt in these times?? Maybe, just maybe, before ’08, but most banks reeled that in during the crisis, and only just a few years ago relaxed credit for consumers. And, to top it off, she declared bankruptcy in ’05! She’s got a personal chef?? WTF? She’s obviously a little crazy, especially since she seems to be almost proud of her situation by allowing the WSJ and whomever else to expose her issues to the world. Let’s get back to the real world, Spock.

Credit card approvals are loose right now. Revolving line tranches are still hurting from the past few years of household deleveraging so the banks have been desperate to get the numbers up.

tolucatom – good posting, and I like your cynicism.

However there are lots of high-earners who are mired in debt as well. A landlord I know of carrying $45,000 on credit cards, and running a fine line with his rental properties.. a few voids and banks may go for his portfolio, especially when markets turn.

Many leveraging themselves, doubling down in investments, but leverage can work both ways when markets turn. Also more recently, look at how that famous lady photographer had to readjust her position, despite all the $millions, also $millions debt. http://www.dailymail.co.uk/femail/article-2648895/Annie-Leibovitz-downsizes-11-25M-New-York-apartment-five-months-selling-28-5M-compound-debt.html

Perish the thought. I wasn’t one when I started working on the internet in 1999. Gosh, that’s a long time ago particularly in internet years.

@Brain Of England

I would hardly compare a personal debt of 300,000 to 45,000 of what very well be business debt/investment. Yes, it’s risky, but, that’s the game some play to make some money.

The more I think of it, that WSJ article has to be BS. How is it possible to have 300,000 in credit card debt if you aren’t insanely wealthy?

Your world will change drastically in a few hours, when Scotland at last will be free. It will shake the UK to its core, with a great impact upon real estate and everything else. I am proud to be a Scottish Lord.

@ Mike M. some ‘business people’ may use credit cards to juggle and arbitrage their financing for opportunities, whatever they might be in this yield chasing frenzied market. Although playing with credit cards in such a way scares cares me a bit and I usually pay my credit card off each month. I know for a fact the $45,000 credit card landlord I mentioned has been living the high life for years (shopping/luxury vacations each year). Wouldn’t take a lot with their grotty properties, a few void months, a missed payment to bank, bank reevaluting their position…. to perhaps put them in a life changing situation, hard landing from near the top of the layer cake.

Alba gu brà th – It’s looking like Scotland has voted to remain part of the UK. I’m neutral on the subject. Scotland is already own country, just one in the United Kingdom bloc. It does irritate though they complain about not getting enough from Westminster (London)… when Scotland university students get free tuition fees, and English students have to pay $10,000 to $16,000 a year in tuition fees… and other things like that. I think they’ve voted sensibly… they do get a lot from the UK as a whole, and these are troubling times geopolitically, where strength in being United.

housing in Southern California is 15 overvalued as we speak. Price reductions are popping up all over, in current prices are leveling out.the lack of affordability, and the impending rise in interest rates is going to kill housing. The path we are on is unsustainable and unhealthy for the economy.

Price reductions have been picking up steam for months. There have also been a lot of properties go on market only to be taken off market after reductions. It’s now finally coming to a head.

And be extra careful when taking out that loan for law school.

http://www.lawyersgunsmoneyblog.com/2014/09/thomas-jefferson-school-law-go

Prices are being cut across the board in SoCal, especially on condos. Unfortunately, this has also meant (at least in my experience) dwindling supply.

But some of the prices I’ve seen on condos lately are almost reasonable. It seems some sanity is coming back, at least in this specific market.

Don’t get caught catching a falling knife.

Ah, knife catching. Let me tell you how fun that can be. A couple of bubbles ago SoCal real estate peaked in 1989-90. Prices had dropped a good 10% by the time I went house hunting in ’91 and so I found a “deal”. Then housing continued to drop another 25% over the next 5 years. I was underwater until ’98 or so. That delightful experience is why I was (rightly) hesitant to jump in back in the early ’00s, and (probably wrongly) remained overcautious during the recent dip of 2009-12.

@Anthony Fernandez, in the 310 area code, I see plateauing prices and highly erratic month to month median price changes due to razor inventory and the mix of what is for sale. No bargains here in the condo market.

Beg to differ, Ernst. I get listings every day. I have 4 condos in SM tracked. This one has been on the market for months. Started at 565K and is now 495K on friggin’ 4th St — so close to the ocean. Can you tell me what’s wrong with it? I have several others just like it to offer up as proof that the up to 600K market has stalled even in Santa Monica, http://www.zillow.com/homedetails/1044-4th-St-APT-115-Santa-Monica-CA-90403/2107234111_zpid/

@Tolucatom – that SM condo is still overpriced. It’s on the 1st floor facing West – from the map, that may be facing an indoor patio or an alley. That’s a safety and privacy issue; it’s in the People’s Republic of SM – home of the homeless!

Units on 1st floors always catch the brunt of plumbing issues in upper floor units.

Ridiculous price for a 1bd/1ba econobox.

@ernst blofeld

I’m looking more in the SGV. I have no idea what it’s like on that other side of LA.

@tolucatom, here is what’s wrong what that Santa Monica condo.

1.) It’s only 1 bedroom. the market is for 2 bedrooms and up. 1 bedrooms are only desireable for empty nesters, singles and maybe childless couples.

2.) $500 a month HOA dues. This is a real killer. HOA dues in most SoCal condos are in the low $200 a month range. $500 is very steep.

3.) It’s a condo. Which means although the square footage is nice, you need Board of Director approval, and some places the entire complex votes, on whether you may do alterations to your unit.

4.) Let’s pretend an FHA buyer comes in with a 3.5% down payment. Factoring in the $500 HOA dues and the $500 a month in property taxes, in order to qualify for the loan and keep the PITI (principal-interest-taxes-insurance) down to 30% of gross income, the prospective FHA buyer would need an annual income of $135K per year to qualify. In other words, a top 10%’er.

This 1 bedroom condo in Santa Monica is really for trust funders, empty nesters and singles who are top 10%’ers.

@tolucatom,

Let me also add, for less than $500K I would rather buy a 2 bedroom crap shack in Torrance/Gardena/Lawndale/Burbank/Pasadena/Glendale/Lawndale/Anaheim/Garden Grove/Lakewood/Downey/Norwalk. At least with these you get a front yard, back yard, and a garage.

Having already done the condo ownership/living thing, I prefer not living in the whole decision-by-committee arrangement that condos have.

@Ernst & @Bora Horza Gobochul — thanks for the input. Good stuff. Also, it looks like they painted everything with a cheap thin paint. I’m amazed because I went to look at a condo on 26th St. last year. Nice enough 2 bedroom — about 900 sq. ft. — patio. Priced at 525K. Multiple offers the day of the showing. And tat for a condo closer to Bundy than the Ocean.

@tolucatom, you are correct about the 2 bedroom in Santa Monica for $525K. Any 2 bedroom (or larger) condo in SM priced around $500k should get multiple offers the first day it is available. The lower the monthly HOA dues, the more offers the 2+ bedroom condos should get.

Housing IS Tanking Hard in 2014!!

It appears the tanking is just beginning, Jim.

@jim tank, Housing to tank hard in 2016, here, fixed it for you 🙂

Housing to TANK HARD in 2016…in Seattle.

BTW, are you still afraid of the ideas of march? Just wonder…

Once Subprime loans are back in vogue. Hopefully not but maybe that is what the banks want before the official crash happens.

@Jim Taylor, housing is starting to tank in Compton! There is no inventory shortage in Compton, and the prices are reasonable.

Not only that, you are minutes away from World Class Downtown Los Angeles California!!!!

blo –

Just about every “global cities” list has LA in Top 10 in the world. Go ahead and be histrionic if that makes you feel better.

You at LA_Sucks seem made for each other.

http://www.atkearney.com/research-studies/global-cities-index

And “Housing to tank hard” in 2015 and probably 2016

I see moar and moar people accept 2016 as “housing to tank hard” idea… Told you that, my crystal ball doesn’t lie.

Irvine is already tanking. That’s what happens when the Red Chinese government cracks down on hot money fraud in mainland China.

blo –

According to you and your bff anon/Tired BS, there never was a “hot money” issue coming out of Red China in the first place.

Remember, “I question the ‘scope.'”

WHEN WILL THE CORRECTION OCCUR? DEBASEMENT V. INFLATION

I DON”T KNOW!!!

Of course you don’t. Nobody does… except, perhaps, my crystal ball 🙂

Ohh Mr Seattle… what don’t you understand? You keep trying to create your own crystal ball when history has already laid it out for you. Seattle housing prices ALWAYS follow SoCal. Your friends here may try to explain away why “Seattle is different” cause “Seattle has Boeing” … or “Seattle is just so much more educated” & the people are just “a higher class of individuals”… Cause median income is so much higher than LA’s.. (Not).

Seattle is NOT different.

No one has bothered to dispute historical facts.

They just come up with the same tired anecdotal reasons that caused Seattle-ites to lose their shirts on housing

1) in the last downturn

2) the last round of Boeing layoffs

3) the recession before that, etc and etc.

There’s a reason Washington hates Californians. It’s because we know the signs …. when our market coughs it means yours is next.

We’re ready to pounce. Are you???

“Welcome to feudal America were you now have the ability to become a leasing serf to a hedge fund or Wall Street.’

You say that like it’s a bad thing.

Agreed. I would rather rent from the pigs and hold shares of GDX. In weimar Germany rents were frozen so renters enjoyed the benefits even more than landlords. More money left to buy inflated food and energy. Landlords could not yield a return whatsoever after the rents were locked in a negligible amounts after the hyperinflation.

I wouldn’t fall in love with GDX just yet, might be a short term bounce very soon, but medium and longer term more downside coming for gold and miners from the rise in interest rates.

Interesting perspective: http://www.zerohedge.com/news/2014-09-17/goldmans-former-head-housing-research-predicts-housing-crash-within-three-years

@Tick Tock, that is an amazing article, very well researched — a must-read:

http://www.zerohedge.com/news/2014-09-17/goldmans-former-head-housing-research-predicts-housing-crash-within-three-years

Thanks for posting.

It sounds spot on to me. The crash is due to 15% over value. However, that’s not what everyone here is thinking – armageddon. If it crashes to only 15% less than what home prices now, nobody here will still be able to buy so why is everyone here excited about the news? Sounds like nobody here will buy unless home prices drop by 50-80% and at that time what they haven’t considered is so many people out there have money and will scoop those properties up because of connections and all cash.

“Sounds like nobody here will buy unless home prices drop by 50-80%”

YoSig,

The people on this site frustrated with their income versus cost of living will not buy even after a 50% drop for 2 reasons:

1. Never catch a falling knife

2. Why buy now after 50% correction when it will probably continue to go even lower and get a better deal? Lets face it, emotions like fear and greed have no respect to people’s wealth – it’s part of human nature. Some people never buy, period. When prices increase they wait till they go back down. When they drop they wait till they drop even more – never try to catch a falling knife.

@YoSig, location…location…location. All real estate is local. 15% overvalued may be the entire region but not in all the local neighborhoods. Neighborhoods I have been watching are priced very close to where they should be relative to household incomes, i.e. SFRs in the mid $300K range.

It’s the trendy hipster areas that are completely out of whack by 50%, i.e. Echo Park, Silverlake, Palms, Culver City, Mar Vista, Westchester, West Hollywood, portions of Pasadena, specific segments of the San Gabriel Valley and certain areas of Orange County, etc.

This looks like the early 1990s when overall prices fell by 15% by 1997. However places like Palms-Mar Vista-Culver City and West Hollywood fell as much as 60%.

Nobody! Everyone here is exactly the same. Great scarecrow argument.

Typical Zero Hedge sky is falling stuff. Those people are constantly cheering for disaster to overtake us all. I’ll bet they love to stop and stare at car wrecks.

The young man who wrote that piece totally disregarded demographics. In other words, the state of the Boomers and the state of the Xers. Prices will stay sticky for much longer than his prediction because most Boomer homes will be sold in estate sales, trickling out over the next twenty plus years as they die off. The Xers will be stuck in overpriced mortgages for years and years, and just can’t afford to sell until they give up or have to, which will take time.

It’s not all about math and excel sheets. People live in houses.

Do you want to know my forecast for 2015? The momentum of 2014. How about 2016? You got it… the momentum of 2015… The whole economy is now momentums of the previous years. Now you know how my crystal ball works 🙂

$125 to $150/sq ft is a reasonable price. Excluding direct coastal property of course, but the rest of SoCal is not that wealthy.

@The Realist wrote: “Excluding direct coastal property…the rest of SoCal is not that wealthy.”

DING!!! DING!!! DING!!! We have the correct answer!

Median household income in the Glendale-Los Angeles-Long Beach region is $53K a year. Include Orange County in the SoCal numbers then median household income jumps to $58K per year. This pales in comparison to Seattle, the Bay Area, San Diego and NYC which have household incomes in the mid-$70K to upper-$70K range.

Basically, World Class Los Angeles is a giant slum/ghetto/barrio east of the super expensive coastal areas.

Whoa there, median hh income in San Diego county is a mere $62k and Seattle $67k – let’s get our facts straight here.

@Seattle$$$Investor wrote: “…let’s get our facts straight here…”

The fact: The Los Angeles area east of the 405 freeway and west of the 710 freeway is one massive low-end garbage dump. There are a number of areas between the 710 freeway and the 605 freeway that are very scummy as well.

A little off topic here. Anybody interested in the following properties doesn’t need a mortgage!

Property number 1 was profiled by me earlier this year and raised quite a few eyebrows. They had the gall to ask 8M for this POS and ended up getting 9.5M. Six months they want 13.9M…and they haven’t done anything to the property. Are people out of their mind? We will see how much money the rich can toss around.

https://www.redfin.com/CA/Manhattan-Beach/104-The-Strand-90266/home/6712526

Property number 2 is a 5 minute walk south on the strand. This baby is listed for 16.9M. The caveat is you need to bulldoze it first and then build your dream house. Are you kidding me? Should be interesting to see how much it goes for.

https://www.redfin.com/CA/Hermosa-Beach/1942-The-Strand-90254/home/6713656

I think the rich are doing pretty well in certain areas. These areas likely won’t get sacked like lesser areas during the next downturn.

Housing to tank HARD in 2017! 🙂

@Lord Blankfein wrote: “I think the rich…won’t get sacked like lesser areas during the next downturn.”

Since the really rich are not W-2/1099 wage earners, we’ll see what happens to the stock markets when the Federal Reserve (allegedly) pulls the plug on QE in October.

If you really believe that QE is ending in October, I’ve got some swampland in Florida that sounds perfect for you.

Ernst, stop with the QE ending in October. They can’t stop, they are in too deep. They may scale back a bit, but QE is here to stay. A good analogy would be a forcing a major heroin addict (the US of A) to go cold turkey (no more creating money out of thin air). The carnage that would ensue would be a disaster of epic proportions. The methadone clinic is the only way out of this mess. Everybody needs to weigh Fed actions when making ANY type of financial decision today.

Got Gold and Silver?

There you go :). 2017 will work too…

Housing to TANK HARD in 2017…. in Seattle.

Housing to tank hard in both SoCal and Seattle in 2017 🙂

They did do something. They created plans for a mega multi million dollar contemporary estate. That’s got to be worth a few mil, right? Imagine how awesome it would be to have daily hoards of the general public milling about right in front of your mega estate. Just steps from crying babies, barking dogs, and loud-mouthed uncouth Americans. Sign me up!

Lord B.

The problem with many complainers on this blog is that even if they receive those properties as a gift (the condition being not to sell) they can’t even pay the property tax, insurance and maintenance/dues, forget about the mortgage. I think they watch too much Hollywood movies and they develop “champagne taste on a beer budget” to quote the Doc.

Complaining about complaining. A teacher of mine always said that two wrongs don’t make a right.

Irony much?

HOUSING STARTS PLUNGE

http://www.businessinsider.com/housing-starts-aug-2014-2014-9

Toulcatom,

If the supply doesn’t increase with population growth I see massive shortage down the line with corresponding price increases (NOMINAL prices). Nobody is looking for grandma houses built during depression era. Everyone want new or newer homes. Older homes will be bulldozed creating even higher shortage.

Based on the news you posted I forsee higher prices due to lower supply. The fact that new construction dropped tells me that builders can not make a profit based on today cost and prices. The cost of construction usually does not go down (it is very sticky) or goes down very little. The only way to see more construction is too see higher housing prices. Without profit nothing gets built.

I believe housing prices are high when I see massive construction – profit margin gets high in order to see that. That absent, means prices are stable due to continue decrease in supply vs. population (some older houses gets demolished every year).

If people could afford new housing, it would be built.

Flyover – your assumption is deeply flawed. If a large amount of the potential buyers can’t afford to purchase the properties regardless of supply/housing starts or are unable to secure loans, then prices will drop. The pro investors are already shedding their inventories, which leaves the landlord investors and owner/occupants. If someone needs to sell and they property isn’t selling fast enough, they will drop price.

Prices are falling because buyers can’t get loans, prices are highly unaffordable, there is little value to these home prices and homes aren’t selling fast enough. Not everyone wants to live in LA that badly.

Thanks flyover.

“The fact that new construction dropped tells me that builders can not make a profit based on today cost and prices.”

Ridiculous extrapolation. The average cost to build a home in 2013 was ~$150/SF. Plenty of areas in So Cal are selling @ >$400/SF.

Starts are dropping because sales volumes are plummeting. Prices have passed the limits of affordability for most folks, and the sales numbers bear that out.

Why build when no one is buying?

http://www.doctorhousingbubble.com/wp-content/uploads/2014/09/mortgage-applications.png

@DOM

Price per sq. ft. is the most meaningless number you can throw around. I would have to writhe few pages to completely refute this meaningless number.

You say that it cost $150/sf to built and houses sell for $400. Do you hear yourself?!!….

So the builders want to make $250/sf?….Is that what you mean? They don’t want to build more houses because they can’t get $250? That is the worst argument I heard.

Lets say the house is 2000-3000 sf. Based on your statement the builder profit is $500,000-750,000. So, if he can not get that he stops building. He would not be happy with 100,000-200,000 profit. He would prefer zero profit by not building.

Did you ever took an ECON 101 class to learn the basics of business? If builders would be that dumb they would be working at MacDonald for minimum wage because they can’t get the $750k profit they make based on your statement.

I think I’ll stop here. I can’t teach you Econ 101 online.

“Did you ever took an ECON 101 class to learn the basics of business? If builders would be that dumb they would be working at MacDonald for minimum wage because they can’t get the $750k profit they make based on your statement.

I think I’ll stop here. I can’t teach you Econ 101 online.”

Did you ever “took” an English class? Econ 101 (aka micro economics) teaches debunked single product supply and demand modeling that has been debunked for years. I believe most successful businessmen do not price according to flawed marginal cost theory. Otherwise they would be working at BK in competition with your MD friends…

Developers are not building in volume, because it’s a dysfunctional market, in my opinion.

General theory – (with a few exceptions here and there).

>> With a true free market, homes would be getting larger, better and cheaper in relative terms, in response to the demands of the consumer. This is not happening. New properties are about half the size they were in the 1930s and they have become so expensive that millions are now being delayed or excluded from homeownership.

The housing market is virtually the only sector where this is happening. Imagine if we were driving cars that were worse than they were in the 1930s. Relying on free market forces will not work so long as builders, lenders, speculators and private sector landlords can exploit the existing dysfunctional market. Things could even get worse. <<

Those housing start plunge figures are madeup of multiresidential and SFH. The starts for SFH is not as bad as multiresidentials.

The limiting factor for builders in SoCal is cost of land, not building cost. Sure permits are a pain, but if the cost of each lot cuts too much into profit, they won’t build. Now that’s Econ 101.

“Now that’s Econ 101.”

Not really…

It is obvious that cost of land is part of the cost of the house. That is why I told DOM that cost/sf is TOTALLY meaningless especially in SoCal where price of land is significant. Price of land is included in price per sq. ft. Cost of landscaping is also included; how much you want to spend on landscaping. Is the house with one garage or four? The additional 3 will raise the price per sf. Dou you have covered porch in front and back or not? That cost is included in price per sf. Do you have one level or 2 levels? Price per sf is significantly higher for one level.

Does the lot has view to the ocean or to the freeway? That is changing the price per sf. I can continue writing for ever on the same line. The point I am making is that price per sf is TOTALLY meaningless. The second point I am making is that in any given market, the builders are not going to build if the cost exceed or is equal with the price of the house (selling price). For any person with common sense I was stating the obvious.

When you hear that builders reduced the number of SFH being built or stop building you know that the price of the house is at or below the cost of construction (in its respective market segment).

It’s Builder’s Econ 101.

“When you hear that builders reduced the number of SFH being built or stop building you know that the price of the house is at or below the cost of construction (in its respective market segment).”

Not necessarily true. Of course builders won’t build if they think they can’t turn enough profit. But as others stated more eloquently above, they also consider potential demand for their homes, i.e. the builder sentiment index. Builders don’t make a profit if those houses don’t sell.

While I agree housing is due for a pullback in prices, I don’t think it will “tank”:

– In 2006, Case-Shiller housing index peaked at 206 and in 2012 bottomed at 137. Today the C-S index stands at 170.7. While the market may be overextended in the near term, the massive mortgage bubble of 2005-6 does not exist today. This is a market in search of equilibrium following a deep bottom.

– While some think interest rates have to soar, there is little evidence this will happen soon. Sustained inflation requires a wage-price spiral and that can only occur with full employment and a labor shortage. Given the global labor surplus (partly due to robotics), the outlook for sustained inflation is low. The Fed has signaled that rates will be zero forever as long as employment is weak.

– Credit-collapse recessions, like the one in 2008, are relatively rare. The next recession will most likely be an ordinary short-lived business contraction, such as 2001-02. During that time the Case-Shiller index stayed flat and did not pull back at all.

Signs point toward an orderly pullback of 10% or so. There will be some overheated zip codes that will “tank” (pockets of LA, SF, etc.) but it will not be a universal collapse like we saw in ’08-’12.

RSpringbok,

100% correct assessment.

Yea,

Ignoring the hundreds of years of data that housing prices directly track wages, you make a good case for “it really is different this time.” Let’s throw that Occam’s razor in the trash.

The S&P 500 is presently at 2,010, about 33% higher than the previous peaks of around 1,500 in 2000 and 2007, and 150% higher than the trough in 2009. Dow Jones is presently at 17,280, about 24% higher than the previous peak of 13,930 in 2007, and 144% higher than the trough in 2009.

Is the economy 24%-33% better than in 2000 and 2007, and 144%-150% better than in 2009 to merit the current valuations? Based on admittedly anecdotal evidence (myself, many friends/family and general observations), it certainly does not appear so. Just as you’ve probably heard a million times, the current stock prices might be more closely linked to QE, stock buy backs and general bull-oriented sentiment than real profits.

I doubt housing prices are sufficiently detached from stock prices such that when the stock market crashes again (it almost certainly will, and it might be major), that housing prices will not be impacted. In fact, my guess is that in over-valued markets such as LA and OC, housing prices could even be disproportionately impacted, since the net worth of many middle/upper middle class folks may be derived significantly from the stock market.

Just because a credit collapse appears an unlikely spark to ignite a housing market crash (say at least 20%) this time around, doesn’t mean that some other (perhaps unforeseen) cause won’t be the spark this time.

Assuming the economy doesn’t descend into total social unrest and my wife and I hang onto out jobs, we are thankfully well prepared to make an additional purchase or two when the next crash (hopefully) happens. I don’t think this charade will last indefinitely…

This nice soft orderly “pullback†of about 10% that RSpringbok surmises seems unlikely, unless it’s simply a precursor to the storm ahead.

Here in SF it’s hard to find a fixer-upper anymore. People pay hundreds of thousands over asking and then gut the place and rebuild. A $1 million house becomes a $2.5 million house within the year.

And people pay over asking for it . . .

Forget housing, recession in 3 2 1….

Do you mean a “real” recession or a “fake” recession?

We have bee n in the real one for the last 6 years. The fake one can start any time now…

Yup.

Strange times indeed. When rates rise the mortgage application nadir will just find a deeper bottom. The winds of change are blowing but incomes remain stagnant. How do they manage to exclude food and gas from the inflation equation. I imagine if the rains don’t return something more sinister may be afoot. It’s a true testament to how smart devices have improved our lives when so many families can be underwater in one of the worst droughts ever. The dust and kipple is growing thick.

How can they exclude food, energy and housing (they use a BS rental equivalent) you ask? Because they have to. That is part of the fake economic recovery narrative…

All the loans that have been made since 2007 have required a down payment and proof the people actually qualify for the loan. So the market blowing up due to liar loans isn’t happening again. The only way prices are taking hard in any geographical area is if there is a huge exodus of jobs. That happened in San Diego when Clinton was elected and gutted the defense industry budget. Thousands of jobs left San Diego, as the big defense contractors closed down. At it’s worst, my value was down 30%-40%, but 5 years later it was back. It always has come back, just as it pretty much has today from the 2005 highs. I am just curious what event is going to make the prices tank in 2016 or 2017? Wishful thinking? A 20% correction in the stock market? What?

@ JIm

From what I read on Calif Ass. of Realturds, more than 50% of all home purchases were at least 20% down. This sounds like a substantial amount of purchases with major ‘skin in the game’. Not sure if that was for 2013 or 2014 or perhaps since the bottom in 2011.

Skin in the game has nothing to do with investors “outlasting” any downturn when an item is priced marginally. There are a natural number of buyers and sellers in the market at any one time. How they transact can temporarily affect the price of the whole asset class. What the next set of natural buyers and sellers do can totally reset everything.

I wonder how many down payments and cash payments have been in the form of security backed loans and then called cash sales in the graphs. Since all the stock portfolios are through the roof, I believe the specuvestors have borrowed heavily against them and that is your hot money in real estate. If the market falls, the brokerages will require additional collateral or request the loans be paid immediately.

…and borrowing against your portfolio rather than actually cashing out avoids a tax hit.

No, What? alone cannot cause a major market correction…however, if you happen to catch Bert’s penultimate missive preceding impending doom on some “influencer” blog (His final message surely to be cloaked in preternatural indecipherable g-gook to throw off the State Department, DOJ and World Banks), then consider yourself blessed and copy and paste said instructions to all your very best friends and loved ones before Cuban, Branson, Buffett and the rest of His disciples make all the hay.

What?

Nice!

Doc: “Since virtually all originated mortgages have to meet minimum qualifications, many people are locked out. Not because rates are horrible (they are great) but because households simply do not have the income to cover the payment.”

_____

Mortgage credit credit everywhere, (on really low rates) and not a dollar to borrow.

Millennials are staying put at mom and dad’s place:

http://money.cnn.com/2014/09/17/real_estate/millennials-still-home/index.html

From the article: “They also don’t seem to be in a hurry to get married, have kids — or buy a home. And that has pushed the homeownership rate among young adults ages 18 to 34 to a new low of 13.2%, according to an analysis of Census Bureau data by Trulia.”

I am running out of time, I will soon be 55, no where near ready to retire, and still living in Illinois. What I need is a crystal ball so I can know the best time to move my family to our dream shack in Southern California. Then I can get away from the long gloomy winters and the suffocating summer humidity. “Get busy livin or get busy dying” is where my heart is but my brain says no to $700k crap shack :p

Same amount of green in the grass here, just a different shade.

What is all the ruckus about? Affordability has never been better! Ask me about finally moving out of that stale old apartment and in to the home of your dreams! Yes, you may have to sacrifice a little to own a piece of the American dream! Sellers, ask me about getting full list price on your home! But you better hurry, because these low, low rates won’t last long!

“Affordability has never been better!” Really?

@GetRetard, the affordability will remain the same with the rates higher because the housing prices will have to adjust. Most people buy on monthly payments. So, the higher rates = lower home prices which will result in the same monthly payments.

GetShilltard!!!

As I drove location to location the sentiment is the same as 5 months ago, buyers have little appetite to look at houses any price, any loan rates.

It seems the memory of the boon and bust continues to haunt the market.

I KNOW WHEN THE CRASH WILL OCCUR BUT IM NOT TELLING WHEN.

I need to be able to cash in. Murica.

I DON’T CARE!!!

The Realist….I suggest you sell your formula of when the crash will hit, you will make more money that way?

Seems all of a sudden housing sales have come to a screeching halt in my zip code. Even lower end of the market is not moving. A comp to the house I rent up the street has been on the market for 3 months now. Started at $399,000, then dropped to $379,000. 2 weeks ago they dropped it to $349,000 and still nada.

I’m guessing my landlords won’t be able to sell my rental for anywhere near what they need to liquidate it. The comp up the street is much nicer than mine, upgraded and full back yard landscaping. I’m not expecting to move anytime soon. They owe $402,000 on it.

Calgirl….expect for very small pockets sales are dismal thru out the country. My findings as I go location to locations is a apathy among buyers.

1 Don’t know if they are overpaying

2 Hoping for a 2008 collapse

3 Scared of applying for loans even though many programs exist

4 Friends and relatives got burned in the bubble

5 Tired of poorly trained and misinformed agents

6 Bad homes and overpriced property

7 Scared of job loss

8 Just plain sick of buying anything in this country, smoke and mirrors syndrome

Watch California Dry Up Right Before Your Eyes In 6 Jaw-Dropping GIFs

http://www.huffingtonpost.com/2014/09/18/california-drought-gifs_n_5843534.html

Yeah, I saw those photos several weeks ago (though they weren’t GIFs when I saw them).

Yet there are still some idiots saying the drought is all fake, a government lie. John (on KFI’s John and Ken Show), says, “I don’t believe it!”

John keep bragging about how he waters his lawn, and hoses his driveway, and uses all the water he wants, and no “government weenie” is gonna tell him to conserve water.

Here in the 805, specifically TO, Amgen is about to layoff about 2000 employees. That should definitely affect the prices i am thinking from Oct till Apr 15, thats when the layoffs will be finished. BTW, amgen is the biggest employer in TO, or at least they were.

RE: Amgen: Does anyone have any specific insights regarding the layoffs in TO/Conejo Valley area? What type of income demographics do these employees have, what types of homes do they live in, etc? thanks in advance for anyone’s help as I am currently looking in the area.

Crapshack alert! In SF, $400k buys a microscopic 796 sq ft 1 BR 1 BA built in 1910. Lot size a mere 1873 sq ft. The gas meter in the front, along with the low-hanging overhead electrical cables, truly give it that “shack” ambiance.

http://zephyrsf.com/ingleside/272-granada

shabfu …that is very bad news for sure, TO is showing the effects now of the low volume of sales. Simi-Moorpark having a devil of a time in the high end homes, all in all the news continues on the bleak side.

At least we have Aliabada stock to buy? (not)

Once 0-care REALLY bites in, one should expect mortgage applications for first time home-buyers to evaporate.

What happened in Hawaii was that such buyers had to receive a hidden stash from mom and dad to make the numbers work. This may have required the parents to take out a fresh mortgage/ second mortgage on their abode.

The net result was that the only first time buyers were native born, typically Sensei Japanese.

The transfers required were typically below the threshold for IRS gift taxes.

The other common dynamic was ‘late departure.’ It was common as dust for Sensei Japanese boys to stay with mom and dad into their late 30’s. This social trend was worthy of more than a few local magazine articles. It was largely restricted to Japanese American households.

All other young adults were compelled to rent. During that period, rents were rising like crazy. So it was a huge economic advantage for Sensei Japanese to lock in their cost of housing.

&&&

LA prices are so crazy at this time, that the above dynamic can’t pencil out.

Instead, it would appear that LA is following the Beijing dynamic: even the grand-parents have to chip in!

Hard as it is to accept, I believe that the LA market can’t cool down until Beijing does.

The Red Chinese are going to have to stop spinning out quite so much liquidity.

They are also going to HAVE to let blue collar wage rates rise.

They are going to have to stop importing manufacturing as their overarching societal goal.

Americans are going to have to get used to the fact that the American economy does not determine the marginal pricing of most commodities.

This latter fact has STILL not sunk into the brains of econometricians. Their (quasi-linear) models still harken back to the prior era.

Even so, the Fed runs its ‘book’ based upon said models.

Hence, the Fed is off the road and into the cloud blue yonder.

Paging Wile E. Coyote.

blert – if you ever have a craving for a good lau lau plate or spaghetti with a japanese twist i know a couple places in gardena. the best and only good thing about living in LA is the diversity of food and the weather

” Econ 101 (aka micro economics) teaches debunked single product supply and demand modeling that has been debunked for years. I believe most successful businessmen do not price according to flawed marginal cost theory. Otherwise they would be working at BK in competition with your MD friends…”

What?,

I agree that every businessman charges based on what the market bears and I understand that supply and demand works ONLY in some circumstances.

What you and DOM refuse to accept, at least on this blog, that the ONLY reason the builders stop building is because they can NOT generate profit based on today cost of construction and house prices. WHY is that happening we can argue forever – that is a different issue. What is a FACT – based on the current cost of construction and house prices the builders can not generate profit and they stop building.

I did NOT argue why the cost of construction it is what it is and why the house prices are where they are. I was stating a FACT you can not dispute. With what you Bert stated so many times in regard to the relationship between the supply and demand I am in total agreement. In regard to my English, I did not know a thing before I was 23. To reach the current performance it is an accomplishment. I wish you would be able to master a second language to my level.

Dysfunctional market is why, Flyover. Yes, all you state now is a fact – but it does not mean it will continue that way permanently. Market locked up, and yield chasers and speculators, and so much stimulus has, in my opinion, created this situation. However global monetary tightening, and smart money selling off for lower prices, might undo it.

General theory, with some regional exceptions.

>>With a true free market, homes would be getting larger, better and cheaper in relative terms, in response to the demands of the consumer. This is not happening. New properties are about half the size they were in the 1930s and they have become so expensive that millions are now being delayed or excluded from homeownership.

The housing market is virtually the only sector where this is happening. Imagine if we, in the UK, were driving cars that were worse than they were in the 1930s. Relying on free market forces will not work so long as builders, lenders and private sector landlords can exploit the existing dysfunctional market. <<

“…that the ONLY reason the builders stop building is because they can NOT generate profit based on today cost of construction and house prices.”

You are right that I refuse to agree that this is the “ONLY” reason. It may appear on the surface to be the only reason from the perspective of a home builder but it is by no means the only reason.

What is the impact of market speculation, credit/debt and monetary policy (aka money) on the price of land or raw materials or energy? I would argue that the current housing/land, equities, bond (credit/debt) and commodities markets are heavily influenced by market speculation, debt and money along with market collusion, manipulation, fraud, etc. The ever growing number of hands in the pot (aka skimmers) has now become bigger than the end output. Many are missing the real story because they are so busy bending economic models designed in 18th century in an attempt to explain the current world.

As far as the ESL thing goes, I would think that anyone that lives in a glass house (who knows absolutely nothing about econ 101) would not cast stones…

BTW, I almost never agree with blert; although I am sometimes entertained buy his rambling rants…

“BTW, I almost never agree with blert; although I am sometimes entertained buy his rambling rants…”

What?,

I know you ALMOST never agree with Blert, but you do agree with him on the issue of supply and demand that in real life doesn’t work always as taught in Econ 101. You stated so on this blog before. The rest of your reply addresses they “WHY” we have the fact I stated. I didn’t make an attempt to address the “why” – that is another long subject.

I am glad that you and Brain are in agreement on the fact I stated.

Brain,

I agree that the market never stays the same. It is dynamic, it is always changing. Looking into the future your guess is as good as mine – it will go up and down depending on your time horizon.

” What is a FACT – based on the current cost of construction and house prices the builders can not generate profit and they stop building.”

So much energy wasted defending a provably incorrect viewpoint.

Were homebuilders building and profiting in the 90s? Yes. Is the profit margin for new homes even higher today? Yes it is.

http://www.nahb.org/assets/images/11HEO/SS010214Table2A.jpg

“So much energy wasted defending a provably incorrect viewpoint.”

DOM,

It is true that the link you provided is an incorrect view point. It is using averages and when you apply national averages to SoCal you get totally meaningless numbers. In RE everything has to do with location. You can’t compare the cost of land in Malibu or Manhatan Beach to a lot in Ohio or upstate NY. Also, in higher cost of living area everything cost more: permits, land, materials and labor. It really does not matter WHY. They cost more and that is a FACT you can not deny. That is a reason you pay less for a house in NV vs. a house in San Francisco. You can do the averages between the 2 places and all you get are meaningless numbers and you very well know that.

If you want to make the case that prices on costal cities in SoCal are high you can use 1001 approaches to prove that. However, the breakdown of construction cost you have provided is meaningless. Even in the same neighborhood/development the price per sf. is meaningless. For the sake of time, click below to find out why:

http://www.sonomahomesllc.com/blog.html

Some people on this board seem to think Asians, Europeans and South Americans buying up properties in major US cities means housing will never drop, that these cities are now “world-class” cities that have insane demand, that it doesn’t matter if locals can’t buy because foreigners will.

They should really be scared shitless. If thousands of South Americans, Europeans and Asians are paying stupid prices to stash cash, how can anyone really feel good about the global economy? Remember, the rich foreigners doing all the buying are the elite of their countries – they know the politicians by name, have relatives who own the banks, are the people that control the economy. They have the inside track, and if they’re feeling panicked, shouldn’t we also be feeling panicked, that the economy isn’t as good as we think it is?

I play the drums. Back in 2005 or so, I bought a couple of vintage drum sets. The prices were high, but cheaper than new professional drum kits but with great old-school construction and tone. Thing is, prior to 2003 or so, you could buy these types of vintage drums for about half what I paid or less. They were marketed toward the Baby Boomers (listings would call these kits a “Bonham” or a “Ringo” set). As the housing bubble got further along, prices for these went up even further. I had to sell my drums due to financial problems and lost money on them – the market for them got killed as Boomers didn’t have the $ anymore and younger generations prefer using drum machines. However, from 2008 until last month, list prices on these drums were higher than ever on eBay and other sites – it was said that the Japanese had infinite demand for vintage music gear and would buy at any price. They did buy a lot, but many kits sat on sale and were removed from auction. Recently, these kits are at fire sale prices – people need the money. It’s the first crack I’ve seen in the Boomer wealth hoarding fortress.

The above can act as a metaphor for housing – the runup in pricing, the holding of inventory and finally capitulation. It’s really the story of politicians and bankers helping their own demo – Boomers – without understanding the position of the next generation. Cracks will form in the housing fortress. The vintage drum market is the canary in the coal mine, at least it is for me.

One more thing, interest rates not only determine mortgage rates, but these low rates we’ve been having financing marginal economic activity. The 4 main ones are Wall St. speculation, Tech Bubble 2.0, shale drilling, and housing. If IR rise just a bit, 1% or so, shale and Wall St. go bust. A little bit more, say 2% more, and tech and housing get murdered. That would still put us below 3.5% Fed funds. If the biggest financial success stories of the recession can’t survive at 3.5%, we’re in for another recession at some point. Since we’ve focused on giving rich people and corporations more wealth during this “recovery” it’s very likely that the next recession will be even harder to pull out of.

Check this article out from FT

China takes anti-corruption drive overseas

http://www.ft.com/intl/cms/s/0/6ec199d0-3cc5-11e4-871d-00144feabdc0.html#axzz3Dy9YntL6

You might have to google the headline to get past the FT paywall.

Basically Xi Jinping and the CCCP ain’t messing around. The writing is on the wall for this ridiculous idea that foreign hot money inflows somehow makes an area exceptional beyond a transitory state. Of course we’re going to get comments that somehow it’s different in socal from those who have the most at stake in promoting the idea. For some it will be mostly a financial position while for others it’s most an emotional drive to see their hometown succeed because they decided to stay or for some transplants a justification of the decision to adopt socal as their new home.

I think they are scared shitless as you said because why would anyone confident in this idea try to market it on this site? If it’s so assured then it would take care of itself and not need promotion to people like us who are questioning the current order of things.

Many seniors trying to retire with a mortgage

http://www.latimes.com/business/realestate/la-fi-boomer-mortgages-20140921-story.html

What a stupid, foolish man. Check out the $100k backyard. Sad part is, he’s not alone.

I have lost count of the over 65s at my company who can’t afford to retire. These are very well paid professionals, mind you. Most of them still buy new cars every few years. Wear expensive clothes. Go to Hawaii or some exotic place for vacations and are living it LARGE in their McMansions. They refuse to stop spending, downsize or reduce their “god given right to live the American Dream”. They look tired and on their last legs. Their attitude is no longer wanting to do their job but dragging their ass in every day because they have no choice, after 45 years of work.

All of them tell me that its SMART to have a mortgage when you retire so you get the tax breaks. They’ve bought into the mortgage deduction myth, perpetrated by financial institutions to induce you to borrow. The tax break doesn’t come near the small fortune in interest you are paying the bank every month. IMO its one of the biggest scams ever swindled onto the American people.

Since I come from a family of CPA’s and have been taught my entire life to be extremely frugal with money, these people’s spending habits are a shock to me. My grandma was a newlywed of the depression. Her and my grandpa saved every penny and throughout the years owned (yes owned outright) commercial real estate. They had a huge income every month and by anyone’s standard were very well off. Yet lessons learned from the great depression were still there: she bought fabric remnants for 20 cents and sewed their own clothes and underwear. She used up everything until it literally fell apart before buying a replacement. They didn’t waste a damn thing. They even had one car for most of their married lives, and they kept each vehicle until it was about 15 yo.

If these boomers had ever had a taste of being absolutely piss poor, with NO GOVERNMENT HANDOUTS OR MEDICARE, I would bet a lot of them would have very different spending habits.

Student loan debt curbs housing market by $83 billion this year, study says

http://www.latimes.com/business/realestate/la-fi-student-loan-debt-housing-market-20140922-story.html

‘…I have lost count of the over 65s…”

Ditto. CalGirl, you must work where I work <;}

What's shocking is that all [at my company] are highly educated (many with Phd degree).

"…All of them tell me that its SMART…"

And SMART to lease a car and SMART to borrow as much as possible 'cause interest rates are so low..

Quite sad, actually.

People will tell themselves and others anything they can come up with to justify their decisions. Just like those who try their hardest to convince us that LA is an exceptional world class international city with the inference that somehow imprudent spending behavior on homes in LA is thereby excused. It’s just a different flavor of the x always goes up delusion.

The housing spin machine is out and operating in full force. Housing bulls are publishing/posting daily and any negative data will be explained away. See http://www.bloomberg.com/video/what-is-holding-back-the-u-s-housing-market-NNXTQOwDSuuY_Ro6F4YBYQ.html for instance to learn that the I-15 corridor east of LA is “hot” and builders cannot buy enough lots out there.

I’ve been watching my local market and a few other target markets for 10 years now and can say it’s not hot. It’s stalled and nearly dead. Aside from the flippers and a very few families, demand is just not there at these bubble prices. The economic “recovery” involves an unemployment statistic low enough to justify raising rates at the fed while incomes have not reached levels of 1999 is most areas, myself included. I would say we are in for a lost decade in housing and would like for it to be over with already. When can we get some legislation to flush the flippers and speculators OUT of the market so housing can find the price that families can afford?

Leave a Reply to Flyover