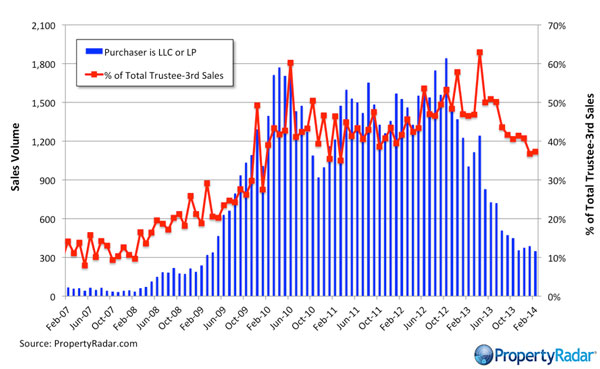

Big money investors pull out of California dramatically: Large purchases from LLCs and LPs for trustee sales are down by over 80 percent from peak reached in 2012.

Follow the big money has been an adage on Wall Street for many decades. If that philosophy holds true for real estate as well, big money investors are signaling something regarding California real estate. Big investors have entered the single family housing market in a way that is unparalleled in history. We truly are in uncharted waters here. It is clear that the investors pulled the market up from the graveyard and gave it a substantial boost. It is no surprise then, as investors exit the California housing market that sales have waned and inventory has slowly started to pick up. A good way of seeing big money demand is to look at purchases made under LLCs or LPs since these are your big money Wall Street and hedge fund players. They are interested in deploying large sums of money versus your crap shack aspiring flipper or buyer. What is clear is that large buyers have pulled back in a dramatic fashion.

Big money pulling away from California

Wall Street is obsessed with profitability and examines things like price-to-earnings ratios. For rentals, your earnings come from rents and your price is the market value of a home. Simple enough. The fact that housing values inflated very fast has put the question of valuation to the forefront of these big investors that scour the numbers carefully. The results? Purchases from LLCs and LPs are down by over 80 percent from their peak in 2012.

The drop in big money purchases is rather clear:

This is interesting data. Back in 2007, you will notice that hardly any purchases were made via LLCs and LPs given that Wall Street and hedge funds had little interest in being feudal landlords. That obviously changed starting in 2008. This trend has had a good six year run – from 2008 to 2014. Now, valuations simply do not make sense and you see this reflected in the number of purchases by big buyers.

What is also telling is that even though volume has plunged, big money is still a large part of all total trustee and third party sales. This makes sense. This is the only group with the pockets deep enough to make all cash offers in large numbers for distressed properties.

Most of the large investors are interested in deals via foreclosure resales. There is now limited distressed inventory and good deals are hard to find. Because of this, large investors still wanting to buy and compete are now being pushed to pay market rates for properties and with current prices, it just doesn’t make sense.

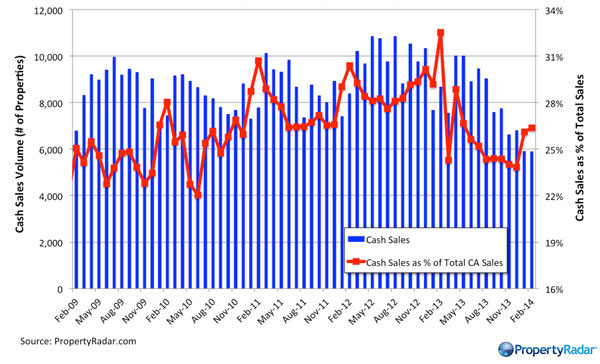

Take a look at cash sales volume:

While cash sales are down 40 percent from their peak a few years ago, cash sales still make up a sizable portion of all current sales. Regular buyers in California are largely priced out. We have 2.3 million adults living with parents because they simply don’t have the money to buy. Investors are largely exiting because of perceived values. With the stock market outperforming real estate by leaps and bounds, hedge funds and Wall Street would rather deploy more of their money in sectors that have a higher potential of returns.

For mom and pop investors looking to start now, the numbers flat out don’t make sense. This is why you see most individual investors today going for flips because of the potential of making a quick profit. The buy and hold buyers are out because the numbers absolutely make no sense in most of California.

Some seem to think that big money and the Fed are all powerful and can do whatever they like. Sure, for their gains but what about you? Keep in mind this is the Fed that was unable to stop the tech bubble from popping or even more recently, the simultaneous implosion of the stock market and real estate bubble. We are talking about the same Fed here and this was only a few years ago. Ultimately, trends can reverse quickly. People have an uncanny ability to forget financial history even if it happened only a few short years ago. So let us use the logic that big money is all powerful. Does the fact that most of the big money pulling out of California now signifies that people should do the same? Those that try to talk about 2009 and 2010 as perfect entry points conveniently forget that the economy was crashing and burning at that time. Many in the public were trying to hold onto their jobs let alone become savvy investors that somehow, had access to special treatment during this timeframe.

With that said, many big investors realize that prices may be a bit frothy right now. All you need to do is look at the tiny old homes that you can buy for inflated price tags to ground you a bit.  Or maybe, you are much savvier than those hedge funds now pulling away from the California housing market. Time to open that checkbook and make your offer on that dollhouse for $700,000.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

150 Responses to “Big money investors pull out of California dramatically: Large purchases from LLCs and LPs for trustee sales are down by over 80 percent from peak reached in 2012.”

“Some seem to think that big money and the Fed are all powerful and can do whatever they like. Sure, for their gains but what about you? Keep in mind this is the Fed that was unable to stop the tech bubble from popping or even more recently, the simultaneous implosion of the stock market and real estate bubble. We are talking about the same Fed here and this was only a few years ago.”

But, but, but this time is different. This is the new, new, new, new…new, new economy!!!

Dead ahead: the impact of 0-care on THAT segment of the market that constitutes the First Time Home-buyer.

For, every September-October from this point forward will feature re-ratings for the 0-care TAX. (The USSC has ruled it to be a tax. QED)

Unlike any other tax, it’s not rejiggered by Congress. Instead, it’s recalculated by bureaucrats — inside the Democrat party and inside the Insurance Cartel.

(Entire sectors of the Federal civil service are Republican-free: CIA, IRS, HHS, etc. The idea that the Federal bureaucracy is apolitical is absurd. It’s pretty easy to determine anyone’s politics during the first year of probation. The few (GOP) leakers that get through the selection process merely prove the rule.)

What is STILL not apprehended is that 0-care crushes those who constitute the First Time Home-buying segment of the American society.

1) By the arithmetic: a First Time Home-buyer HAS to have an income that is entirely above the subsidy zones of 0-care. So, they’re no help at all.

2) By the arithmetic: a First Time Home-buyer is NOT entering the market with roll-up proceeds; and must attempt to finance their play with INCOMES. The vast bulk of this segment will only be able to toss in a token down payment. Retail interest income has been flat-lined for years. The cost of living has ramped straight up — capped by the ultimate exponential: 0-care.

3) Consequently, the First Time Home-buyer cohort has to pull back — probably for a decade — so as to build a bidding stash — in an era of no retail interest income. Due to the tax simplifications now embedded in the tax code, such families will be filing 1040A or 1040EZ… with no tax deductions to speak of.

&&&

S L O W L Y Wall Street is comprehending that the ENTIRE structure of the housing market has been up-ended with 0-care.

For, obviously, the First Time Home-buyer is THE foundational buyer for the rest of the asset finance chain.

The trickle of players that can get around the above numbers merely prove the rule. Only a handful of professional athletes, entertainers, and super-star salesmen- promoters will be able to carry on in this new environment.

As for The Powers That Be: they don’t live in this market segment. Their kith and kin can still get (intra-familial) financing. So, they just don’t see it as a show-stopper. It’s not on their radar.

&&&

Pulling the foundation out from under the market should have savvy players running for the exits. Plainly, the domestic American buyer — taken as a whole — is fully priced out of the market. A smattering of exceptionally wealthy, liquid, and house horny souls should not blind anyone to this larger truth.

The Medical-Pharma-Insurance-Attorney Cartel/ Guild Complex can only be sustained in its exponential by a major feeding.

The Democrat party has fed them the housing sector.

(Not a single GOP vote in the entire project; which makes 0-care TOTALLY unlike all major (social) legislation heretofore. To repeat: EVERY single expansion of the social spending budget HAD been entirely bi-partisan. Indeed, many votes were virtually unanimous!

This is capped off by endless provisions within 0-care that are aimed at the permanent destruction of the Republican Party; provisions that are to be implemented by Democrats wearing civil service cloaks.

Hence, EVERY significant 0-care mail-out has a voter re-registration form tucked in to it.

Consequently, DC is locked into a death struggle, across the partisan divide.

Consequently, DC can hardly pass (substantive) legislation — and the can gets kicked down the road.)

&&&

Death-struggle politics is often lethal for investment returns.

In such a conflict, the rules can get flipped on a dime. Somehow, the changes always cause even more assets and income to tip into the hands of the politicians.

One could even term this devolution as political-economic addiction. Like cocaine or heroin, too much is never enough. The abuser just keeps amping up the dosage until a higher power intervenes — and a systemic collapse ensues.

After a fashion, that’s what happened to Weimar Germany. Berlin had to throw the keys to London and Paris. It had gotten so bad that the French Army was sent into the Ruhr!

In all of this ^^^^ keep in mind that individual players discover that they can’t change the course of events — even if they fully understand what’s going on.

A macro dynamic has taken hold, and all of the players soon discover that they are mere puppets to history.

This is the dynamic of revolutions: French, Russian, Chinese, Egyptian, etc.

It’s also the dynamic of a financial super-panic: 1929, 2008, etc.

%%%

TPTB have set up the numbers such that one is punished for holding large amounts of cash.

This has skewed the entire spectrum of investments.

The liquidity thirst that can erupt — with no notice — figures to be epic.

If you’re curious as to how societies handle such debacles: study up on Argentina. It’s an entire society organized around chronic, systemic, crisis. Their experiences are highly illuminating. They put the kibosh on many assumptions dear to American investors.

And here I thought that most first time home buyers had jobs and that most employers still provided healthcare benefits even in the age of Obamacare. I’m sure, though, that Blert will provide the catastrophist wisdom to show that the taxes created by the evil Democrat cartel are screwing us all.

PS. Plenty of GOP in the CIA and all the other mil/intel portions of the gov. These are largely long term civil servants whose working lifetime far exceeds the typical blue/red political cycle.

Employers don’t provide healthcare. They deduct in from your paycheck — either before you even realize that they’ve done so (it’s an above the line deduction that does not appear on your W-2)…

Or, the deduction — or merely a portion of it — is deducted below the line — and shows up on your W-2 and wage stub.

At no time does any employer pay for your health insurance.

YOU pay for it as part of your total compensation package.

Only a child, or a socialist, or a college graduate is stupid enough to actually think that the EMPLOYER actually paid for employee benefits — above the line or below the line — out of the goodness of its heart — instead of because competitive pressure made such compensation the normal way of conducting economic affairs.

&&&

Folks, this is what we’re dealing with: naive economics. The financial understandings of a child — or college graduate.

By staying in school, graduates stay insulated from the real world. They’re the LAST to start a business.

The ONLY reason to hang around for a college degree is to work for someone else.

Bill Gates

Steve Jobs

Larry Ellison

All left college to get down to business. (And that’s just the short list.)

If you’re REALLY smart, you drop out of college.

For anyone who has founded and run a business my commentary above ^^^^ is like saying the sky is blue and the Sun comes up in the east.

For college graduates, it’s heresy.

Such drones actually believe that Congress can mandate higher wages and benefits.

LOL!

&&&

Which is to say ‘apolitical’ is fulsomely political and can’t comprehend that wages diverted to 0-care will evaporate from below the line W-2 incomes.

There is no such thing as a free lunch — or free mandated benefits.

Fortunately, ‘apolitical’ is about to be schooled by the Scru University. The mass exaction required to sustain the hyper cartel will still draw blood.

%%%%

My life is too short for gag Web links. I had to give them up: time management.

I don’t click on them even if they figure to endorse my emotions.

I pray yours was funny.

All my life I’ve received complaints that my missives are above comprehension.

For reasons of economy, I have to be concise. Otherwise no-one could afford me.

And who would sit through college economics detoxification, anyway?

One must take the 12 steps pretty much alone.

After you’ve sobered up, my postings will still remain here at the Doctor’s ‘office’ for your edification.

Cheers.

“At no time does any employer pay for your health insurance.”

You mean we don’t get “French” benefits???

Blert is wrong on this. Most employers do provide health care coverage. About 85% of the population had health insurance coverage before Obamacare.

My employer provides a “gold” plan and they pay 100% of the premium for employees (no payroll check deductions).

Now if you want family members insured then my employer requires employees to pay 100% of their costs for their family’s coverage. But since it is part of a group policy the cost for family coverage is a fraction of what market rates would be for individual coverage.

So my employer doesn’t pay my health care? If I accept that as fact then it must also be true my employer does not pay my wages either!

Your logic is real weak.

bleat’s posts always remind me of this:

http://fontsinuse.com/static/reviews/0/4ffafa30/full/2012-05-DrBronners-peppermint-bottle.jpg

lol – true

Can you imagine going out for a drink with Blert? I wonder if he has social skills?

Why I am feeding the Trolls I don’t know….

Blert, Employers do provide healthcare, employees typically pay only a portion of it. My employers covers a majority of the cost, I pay $475 monthly for my health coverage, If I tried to buy the exact coverage on my own it would be $1400 monthly for my family.

I k

Mr. Smith in KTown…I’m a wart on my organization’s backside: I’m a middle manager. In my yearly departmental budget process I have to allocate for my employees’ benefits: medical, LTD, etc. I only get so much dough to deal will and year-over-year I’m seeing the “employer provided benefits” line eat more and more of it. I have a real need to add staff but it’s hard to do when my budget gets depleted by increasing overhead. In that sense, the employee I could hire is paying his salary toward (soon to be mandated) health coverage and other mandates of my existing departmental employees. I think the term is “opportunity cost”.

Mr Smith…

You are fundamentally incorrect.

Speaking as someone who has founded a company, and hired and fired many…

Regardless of your opinions — the ones that count are those of the employers. And as an employer one totes up EVERYTHING that it takes to put a man/woman on the payroll:

The W-2 ‘nominal wages’ — this is the figure that the average prole thinks of as his wages — and as his cost to his employer… as IF!

FICA — The so-called employer’s matching contribution… as IF. BOTH the below the line and above the line amounts are toted up. The below the line figure is built into the W-2 figure. Then the above the line figure is added…

Federal Unemployment Insurance — most proles don’t even know that this tax exists.

State Unemployment Insurance — widely known. Your cost to the employer includes this, too.

Workmen’s Compensation Insurance — treated, accounting wise, as if it were just another tax. Yes, it’s toted up, too.

Every manner of fringe benefits — too many types to list… {company car/ truck…}

Health Plan expenses — in private industry this is usually split into below the line — which the union screams about — and the above the line figure. The above the line value is toted up here. This figure is ramping away to such a degree that it’s impacting the raw W-2 wages.

In my area, this is solved by laying off/ terminating/ firing all of the old blue collar hands — and replacing them with new hires at a reduced rate. This way the 0-care expense is ENTIRELY shifted back down to the troops. For competitive reasons, there is no firm in existence that could’ve eaten such a ferocious expense.

This ‘slippage’ amounts to about $5-6 per hour — across the board. Naturally it absolutely HAMMERS the guys at the low end of the wage scale. It HAS to. The 0-care tab is at a flat per capita rate. In smaller plans no calculations are made for age distribution.

IF any employee fails to earn enough for the firm to cover absolutely ALL of the above charges — they move onto the bubble and get cut at the earliest opportunity. For me that always meant the very next Friday.

****

Obviously, by your comment, you’ve never seen any employer’s payroll software package. Every last one of them totes up all of these charges. No exceptions. None.

The resulting figure is hooked to your name and updated as time goes by.

Here are some typical figures — from ten years ago:

Nominal wage paid (W-2 figure) = $ 25.00 per hour

ACTUAL WAGE EXPENSE — same employee => $ 43.50

It was the second figure that determined whether he stayed on the payroll or not — and how much his time was billed out as.

($ 75.00 was his billing rate) That difference, $75.00 — $43.50 = $31.50 reflected the fact that the company could not bill for his transit times — but had to pay for them — and for office overheads, marketing expenses and a slice of profit.

###

It has been the purpose of the politicians to confuse the proles as to the economic realities.

In your case, they have done their job well.

To repeat: Not one of your employers ever paid for any of your fringe benefits. YOU earned them. They were part of your overall compensation package. No doubt they were brought to your attention during the hiring process/ negotiation. They always are. Sometimes this takes no more than mentioning that “they’re a union shop” and that’s that.

You should take a clue that all employers in a given sector/ industry have pay packages that are structured virtually identically. Hint, hint, hint.

There is no slop for your employer to kick out because he’s a nice guy. Wages move in lockstep almost as tight as pricing. That’s how the world is.

Every time Congress mandates a benefit, it still has to be earned by you. It merely means that this or that industry/ sector now has a captive base of customers.

Congress PRE-SPENT your paycheck. Nothing more, nothing less.

In Europe, this has reached such extremes that their W-2 figure is the minor portion of the payroll expense! Even so, THAT diminished figure faces brutal income taxation. This is how France and Sweden have national governments that spend 55% to 60% the GDP!!!! They’ve practically removed money from their economy.

All of this occurred — the death of a thousand cuts — by convincing you that Congress was actually getting your employer to pay you a benefit out of thin air. And, yes, most college graduates believe that is actually possible.

You’ll see some of them posting — even here.

Mr. Smith, no, in a very real sense YOU are paying your health care costs, not your employer.

This is because when an employer decides WHAT wages to pay an employee, or even WHETHER to hire an employee, the employer looks at the TOTAL COST per employee. That includes all monies paid to the employee, union, government, insurance companies, etc.

The employer doesn’t care WHERE the money goes. $10 an hour to the employee, or $5 to the employee and $5 to the government, is all the same to the employer.

Nor does the employer care about the ROUTE the money takes. Whether he pays the money directly to the government, or whether it’s first paid to “you” and then deducted from your paycheck, it’s all paid to “you.” You just never saw it, not even as a deduction.

But because you never saw that money, you don’t realize that it’s actually your money, which the employer paid to the government.

The more money the employer pays to the government per employee, the less he’s willing to pay directly to the employee. If the government raises the “benefits package costs” per employee high enough, the employer will even start firing employees.

Ah, I see that Blert has explained it better. Mine is the Dummies version.

Maybe Blert’s been having us on all this time: http://dictionary.reference.com/browse/blert

I hate to have to agree with Blert on this one – normally his ramblings are nonsensical. But on this ONE topic he is right – most economists would see it his way – the total cost to the employer includes everything the employer pays directly (salary) or indirectly (benefits/insurance/taxes) etc.

BUT

Blert then has to agree that a low-wage worker, rather than paying no taxes, may pay a fair amount, if you look at both halves of the Social Security and Medicare taxes! Sure, they may pay no federal income tax, but that’s not the same as not paying taxes.

Wow, time to turn off FAUX news. No one buys their made up crap anymore, except for the far right always angry wackjobs. Even the moderate Repubs are distancing themselves from FAUX.

If you have statistics and a point to make, you should make it. Name-calling and insults just make you look bad.

Take the numbers and make your argument. That is unless you are unwilling to accept different points of view

It’s an even money bet that nobody on Fox has proffered the connections spelled out here.

However, since I simply don’t watch Fox — or subscribe to any conservative publications — I’m only making a guess.

No media outlet ever lets a talking head go beyond sound bites. So, regardless of content or platform — really big ideas don’t suit the medium — which is entirely oriented towards proles — the ultimate LIV.

Social reinforcement is their game; eyeballs are their metric.

Networks serve the same function as the string section on the Titanic.

A patina of normalcy is an adjunct to (social) control.

In the meantime, blather pays well; it’s a living.

Wow, why do some far-left, always angry, wackjobs want to completely silence the only news outlet that occasionally offers news that other liberal news media outlets refuse to cover? Many of us don’t want to be living in a country where a Marxist dictator censors the news and decides what we can watch or listen to.

Now getting back to real estate in SoCal, I’m bullish in the long run and cautious in the short term.

Student loan debt will have the effect you describe, not O-care, which should help out a large number of people (like it did for me), personal savings of $8k year really helped me out when my son was allowed to stay on my insurance – and has pre-existing conditions. Get yr head out of one-way thinking to see the reality of the situation nobody listens to hysterical single-minded dupes, whether left or right.

0-care — or ANY socialization of medicine — shifts resources from young adults to the elderly.

That you, or any particular young soul, benefited from this or that feature of expanded socialization must stand as the exceptions that prove the rule.

As ANY actuary could tell you: over half of ones life expenditures on health care are expended during the last twelve months of life.

Simply no-one wants to check out. By such a late date, no-one has any borrowing capacity. One must either liquidate assets or — depend upon the socialization of medicine.

Regardless, true life extension is a product much desired — but generally unavailable.

Who can overlook the fact that modern medicine can’t really lengthen lifespans. It’s great claim to fame is drastically reducing infant mortality.

As the ebola epidemic is going to show, modern medicine can’t really master a true killer disease. Ebola is ALREADY entirely out of control in (west) Africa. It’s so bad that no-one dares visit to get first hand video footage.

&&&&

BTW, did you know that until socialized medicine came along, doctors’ wages were merely above average?

Did you know that the delivery of a new born cost less than a few days wages?

Did you know that the typical health plan (under Kaiser) was budgeted out at less than $6 per month, per employee. (At the time, the typical employee needed a doctor to set bones, deliver babies, and whip out a common prescription. The number of drugs available was a trivial fraction of today’s. Test procedures involved fogging a mirror, coughing, blood pressure, weight, heart beat, etc. – the stuff a nurse does today. As interesting as the new test technology is, on the whole it has not changed much. Funding them, and all the rest, has warped the national economy. In effect, open ended medical spending has achieved the same social effect as building pyramids, erecting pylons,… or Stonehenge. The latter, BTW, is now considered to be a medical-religious facility, healing stones and all the rest. Things do repeat.)

Agree about Obamacare — it’s been a huge savings for me and most of my friends. Student debt on the other hand is burying the mellennials — $29,500 of debt per college graduate on average. With the lousy job market, how long do you think it’s going to take for them to pay it off and then save for a down payment for a house?

Duh!

ANYONE poor enough (ie in college) to ‘benefit’ from 0-care is by definition too poor to be a First Time Home-buyer.

The very second ones income improves to the point that home ownership seems to make sense — the 0-care TAX makes the financing fall apart.

Please re-read from the top. Get out the schedules and do a work up on your own situation. Calculate some what-ifs.

BTW, the Academic Cartel is no boon to First Time Home-buyers, either. It’s just a lesser evil… one can duck it by not spending large on a useless degree.

No such ‘out’ is available for anyone attempting to duck the 0-care tax.

&&&

Heavily socialized medicine has been around for generations… and in the First World. The results are uniform. Innovation collapses. No bureaucrat can pencil in monies for new treatments.

This has reached such an extreme that America is almost solely responsible for ALL of the medical advances in the last fifty-years. (The Great Society)

This goes double for medicines. Americans lack perspective. Every socialized medical scheme awaits American introductions of new treatments — above all new drugs.

In most nations, new drugs are only permitted AFTER they’ve fallen out of US patent protection. Sometimes, nations don’t wait. (India — it’s a chronic cheater) US lawsuits get no traction inside India.

This collapse in new medicine exactly coincided with the socialization of medicine in those nations. There was a time when Germany produced seriously important new medical technology, new drugs, new treatments. Today such events are freakishly rare.

No bucks — no Buck Rogers.

No funding, no spending on research, no discoveries reach the population.

The few medical discoveries that do happen outside the US — end up in the fulness of time — being related to financial assistance from the Americans. Big Pharma is using American profits/ cash flow to fund European projects (otherwise unfundable by the national governmnts) doing so strictly because the European research team is CHEAPER than their American peers. The Big Pharma crowd then shunts the drug to market — straight through the US FDA — and recovers all of its outlays in the American market.

All of the above is just TOO COMPLICATED for the MSM and sound bites. You won’t see it in print, either — unless you’re reading specialist, technical literature. Since the matter turns on money and economics — that literature is floating around Wall Street, not the JAMA.

Needless to say, the American socialist that dominate the FDA and all the rest — keep their mouths shut about the above wealth transference. For if the LIV actually comprehended what’s going on, the hue and cry would trim the HHS budget.

If you want to know why the Federal budget is blowing up: it’s because the cartel has cost-plus pricing on every manner of new drug, new device, new treatment. While this is wonderful for medical advances, it’s actually breaking the national economy.

This latter point will only become evident AFTER the credit card gets ripped up.

Remember, Bourbon France went broke for decades — then blew up overnight when the macro-embezzlement was discovered. The absolute panic only got started when the damage was complete.

The Soviet Union imploded using the very same dynamic. First lies, then reality, then ka-boom.

Race to the bottom neo serfdom here we come. Poverty wages to the service economy that don’t need a brain to do their job and living wages to the service economy that services the ruling class, I.e. Lawyers, FIRE employees, and the STEM employees.

Prior to the ACA I paid $387 for a neck brace I saw on sale for $27 at RiteAid. I paid 35K for a minor operation because I didn’t have insurance due to a preexisting condition. While in the hospital I saw I saw the homeless and destitute given the same quality of care I received. It was then I understood that people like me were overpaying and being raped by the medical industrial complex as it was. I paid more for services so the hospital could serve the down and out, bill their Medical, and overcharge people with money like me. I pay a big premium now but theoretically I should have more confidence in spending since I don’t have to worry about 30K bills no more. But I don’t. It has nothing to do with ACA. What should be worried about is this, These 9 Charts Show America’s Coming Student Loan Apocalypse, http://www.huffingtonpost.com/2014/08/20/student-debt-distress_n_5682736.html

Welcome to http://www.doctorblertbubble.com.

Public hospitals are required to treat all patients. Private hospitals can turn away non-emergency patients without health insurance.

i always learn something from blert. assuming what he writes is factual

What did they used to say about the Devil mixing facts with his lies to confuse us…?

Anyway there’s no doubt that Obamacare and other taxes take money away from business owners. Let’s carry out a thought experiment and suppose this and other taxes were rescinded. Who here really believes any decent fraction of the money returned to the business would be distributed to employees as salary or other benefits vs. simply swelling profits? While the extra money filling up corporate coffers could create some additional competitive pressure to raise wages there’s a whole lot of slack in the system and I would bet that the vast majority of such money would end up nowhere but the bottom line and in dividend checks to stockholders.

All politics is about allocation of resources and distribution of funds. In a simplistic makers vs. takers worldview I would expect business owners to support whatever interpretation of the facts best suits their agenda of tilting that distribution in their direction. I would hope, however, that even business owners recognize that our economy isn’t just a zero sum game and that resources they are forced to provide their workers might just make a better society for all of us.

Blert and Others

Sure the insurance I pay for and the company provides is part of my compensation, I can opt out of recieving it, I can also pay next to nothing as an individual, or a few hundred for my family (the comapny pay more or less as well). The idea of course is that the employer can get a better rate through a group buy that the employer negotiates.

I know that most people do not have a lot of negotiating power when they apply for jobs, and the benefit is a fixed part of their compensation. I am fortunate that I do have that kind of negotiating power and at times consult, so I am very aware of what the “benefits” cost me and how much I have to ask for in compensation in order to cover the costs of insuring my family, paying for retirement etc…

On paper I negotiated a salary thats looks like it is 20% higher than my last project, but in reality it is only 4% higher due to the increase in out of pocket I had to pay for my benefits and retirement.

Anyway, I will be insuring my family some way, either through an employer or through the market, and I have checked the california exchange site, and it is very competitive with my current employer provided plan at almost the exact same cost. I like the piece of mind that I can easily find coverage for my family regardless if what project I am on provides benefits or not.

I would prefer a universal system, but I make do with what is available.

Blert is absolutely 100% correct.

Although the political diatribe is unpleasant, it must be spoken.

Obamacare is a massive (possibly the largest) and regressive tax levied upon the American people. As the gov’t controlling senate finally realized that it can neither suck any more revenue from the small business nor touch with a ten foot pole the billions in corporate profits sitting in the Caribbean banks nor nosh off the backs the investment income of financiers, they went after what the Constitution has protected for over 200 years….the American.

Simply put, Obamacare is a (personal) PROPERTY tax where the property in question is YOU, namely, your body. Much like real property tax, you begin paying when you purchase the property -at birth- and you may stop paying when you sell the property -at death.

In economic terms your purchasing power, especially for fthb’s, drops dramatically, so simply put you’re poorer. But on the flip side your govt representatives who hold the power of the purse get to decide how to spend their new found riches….oh the places they will go!!

Call it what you want…healthcare for all, insurance for the uninsured….reparations…? But in essence your freedom, your liberty, its gone…you are no longer a people but instead subjects and all loyal subjects must now pay his yearly dues to the Kingdom of America.

ACA empowers people to leave jobs they only took so they could have benefits. We are free to start a business or to take a job based on what it pays rather than the fact that I need benefits. I can negotiate one company against another for the best salary because again ACA frees me from having to take something, anything so I can have medical benefits.

I feel no sympathy for companies using tax inversions and other sophisticated means to move tax revenue off shore. The tax burden they dodge falls on me and you! And that degrades the whole economy.

Pure nuttinomics! I love America. The GOP has made me billions.

Yep. I’m sure that’s true. You and the other billionaires who post on a bubble forum add so much value with your insightful, rational, and pithy posts.

blert

We get it O-care ruined the economy, not anything else we did…like saddle students with high student debt, low wages and poor job prospects, money printing which in turn accelerated home prices…that effectively priced the young out of the housing market all together.

Christie, that’s some might poor reasoning on your part. Where did Blert ever say that Obozo care is the one and only reason things are going downhill? I would suggest that you spend more time reading and thinking and less time typing.

I still haven’t figured out how Obamacare travelled backwards in time from 2013 to 2008 to ruin the economy. The economy which is busy recovering, albeit too slowly.

Blert – any answer?

etherist…

You’ve wandered off and fallen into dogma.

Everything I’m posting turns on FUTURE events. The BITE hasn’t yet hit.

Barry’s been delaying it. Always innumerate — he admits he could never master long division — our president was stunned when the new rate schedules tumbled out of the system. It’s his intention that this fiasco blow up on the next president — whomever.

The 2008 debacle was predicted by me — in July, 2003. Yes it was THAT obvious.

“Total train wreck” — “complete collapse” — “end of the road” quotable quotes from that time.

In the Spring of 2009 I posted some correctives that the powers that be ought to jump on. (Belmont Club) Overnight, that blog thread jumped to #1 out of 350,000 references to Syn-CDO.

The ONLY way that Google pops you that high, overnight, is because the most important Internet nodes on Earth are copy-pasting its content.

The most important Internet nodes = Wall Street, central bankers, the City of London, government officialdom, major media. ALL had to be passing that post around for it to vault straight to the top of Google. It’s the ONLY way. Go to Google for an in depth explanation on their ranking engine.

Within my wordy post I laid out a stream of policies. AMAZINGLY most were adopted during the next 24 hours. My post ran just one market day before the current bull market began. Some co-incidence.

The kernel of my post was how the authorities could shrink the problem down to a manageable size — and running a government mortgage bank was essential.

Volker and Geithner ran with it. Volker met with Barry — in the White House. The Fed immediately began massive purchases of mortgage debt on an epic scale — right along with the hyper-expansion of the Federal home loan bank.

My post explained why — due to the emergency — this HAD to be done before the crack-up compounded away.

This levitation saved the solvency of Europe. Kept from general public knowledge, the Europeans had been buying American mortgage debt — and in size — for years on end. That’s where the housing boom money was coming from: Europe.

When the first defaults occurred — they all landed overseas! One default famously ‘took out’ a Norwegian whaling village — and everyone in it. Oslo was pissed. Most Americans never heard a word about any of this — even to this day.

Bernanke lifted the values of all mortgages at a stroke. On the whole, he was buying back mortgages that had been sold to Europeans. The American banking system NEVER loaded up on American mortgages during the mania. They were writing the crap — and sure as Hell didn’t want it anywhere near their balance sheets.

The levitation was so pronounced that every European bank cashed out and used their profits to staunch their horrific losses in the Euro zone.

Yes, yes, yes, — EVERYBODY copies and pastes — including the boys at the top of the system.

How do you think they got there in the first place?

The cribbing by the Bank of England — from this very blog — has been discussed here before. The duller minds refuse to believe the connection. This is an indication of bad mathematical understanding.

The odds of any writer (or group) TOTALLY mimicking a substantive stream of posts — nothing more and nothing less — is, simply, ZERO… unless it’s cribbed.

Any high school teacher or college professor would testify that this is so.

In the case at hand, the BoE even used identical phrasings!

STILL, that’s not convincing.

That you left the path to wander off into a false trail — should stand as a terrible self-indictment. You should worry.

blert oh blert… O-care killed the housing market, like that’s a bad thing? Do you really want housing to keep going up? The market needs a correction my friend or you will never have young people buying again.

Housing crashed and gave new found opportunity for first time homebuyers to buy in 2009 and 2010. A lot of young buyers bought after the crash! If O-care crashes the housing market, more first time home buyers will be able to buy again! Yay!

Obama the hero! Blert you’re so smart always looking out for the little guy…or will it hurt YOU if housing crashes? You need those young people buying to keep up this Ponzi scheme. Who will buy blert’s crap shack?

blert don’t be sad, all good Ponzi schemes must come to an end. Obama care to the rescue!

That was awesome! Stimulating and really on target. ….but…the last part about penalizing large cash holders being punished might betray your own bias. Part of the cycle we see in the economy crushing wealth inequality and wealth hoarding that occurred in 1928 America and that same wealth inequality corrupts the political system and policy choices just as in Germany before both WWs.

Keynesian economics could provide corrective action to reverse the wealth inequality but, of course, those with wealth control the economic system and politics. Janet Yellen and her predecessors are myopically obsessed with helping bankers and speculators via monetary policy. Congress has no will to enact Keynesian fiscal stimulus to create jobs, raise taxes on those who can pay, place tariffs, and thus raise wages. (Yes, I know it is fashionable amongst the liberter-atti to say the policy today is Keynesian but that’s just braindead stupidity).

Just as in monopoly, wealth inequality is a game ender. Policy makers have only these choices to correct things: Taxation/Confiscation/Inflation or, as you said, revolution.

Hi Blert, exceptions do not ever prove a rule. In science, as soon as you can find an exception to a rule, that disproves the rule. End of story. Many a great scientific theory has been disproved by only one exception. If E does not equal M C squared in even one case, that means that the theory while apparently right in 99% of cases is still incorrect. Exceptions always disprove the rule.

Politics isn’t math or physics.

In politics, there are ALWAYS exceptions to the average outcome.

In political argument, these are always trotted out to argue away from unfriendly facts.

This tick is so pronounced that seasoned voters look for it.

Typically, the spinners will not only find an counter-factual case — it will be insanely extreme.

Then, with enough repetition, the proles buy it.

But the seasoned observer realizes that the reason that the example IS being trotted out is precisely because it’s counter-factual.

In the case of high profile blogs, they are attended to by paid staffers — to inject total nonsense and counter-factual claims.

Such antics can reach risible extremes. The Belmont Club was absolutely bombed by SVR/ KGB apparats during the Georgian War. But, more than that, every high profile politically involved blog was getting the ‘treatment.’

Barry has a HUGE side-staff — OfA that he keeps raising monies for.

You’d better believe that his staffers are monitoring every blog with a Web presence for chatter that is harsh. He really is that paranoid.

The Atlantic had a serious write-up — just ahead of the 2012 election — about how Barry had an entire crew of heavy-weight Google programmers working the Internet — with (essentially) unlimited financing.

Keep in mind that NSA backdoors let Barry’s boys inside every MSFT server. By 2012, most polling was tabulated on just such servers!

In the fullness of time, it will probably be revealed that his crew hacked Florida into Barry’s column… and other states, too. In Florida — which spans two time zones — the eastern voting just kept getting stretched — over and over — to over top the late arriving Republican votes up in the panhandle. Yet, in an era of electronic tabulation, there’s no physical explanation for ‘late arriving’ votes. They all blew in electronically — at the speed of light!

Similarly, North Caroline was not even considered ‘in play’ — yet Barry’s crew kept pulling in (electronic) votes, on and on. Romney carried the state by a razor thin margin. Barry’s crew ‘let it go’ only after it was evident that Barry had enough electoral votes to prevail. Magically, no more additional Democrat votes showed up.

With a totally rotten economy, the macro statistics indicated that Barry should’ve been blown out of office in one of the worst defeats in American history. Google saved him. And, as Snowden reveals, Google is, de facto, now part of NSA and the administration. All is denied, of course.

Barry learned his skills and paranoia in Chicago. It’s an anything-goes town. He then took the Chicago boys to Washington. So, we really have Chicago on the Potomac. Back in Chicago, the machine has never let itself be deposed by the proles. I must assume that this ethos now dominates Washington.

A totally corrupt city can be tolerated. One can move out.

It’s scary when it reaches national scope. The historical record is extremely bleak.

No Republicans in the CIA? I think you just shot your credibility right there, along with your equating of “Republican” with some kind of moral/ethical superiority.

The issue is PARTISANSHIP.

There are parts of the nation that are absolute locks for the Republican party:

Idaho, Wyoming, — and until recently Alaska.

There are parts of the nation that are absolute locks for the Democrat party:

California, …

In EVERY case, such polities become ever more corrupt.

Detroit is an exemplar for wholesale and retail corruption.

%%%

Most voters have never crossed over to the other party.

They don’t even much associate with those with opposing views.

Whereas modern political issues are anchored more by ‘team ownership’ than anything.

A case in point: six weeks ago the administration (Susan Rice) was pleading with Congress to repeal the President’s authority to operate militarily in Iraq. — That’s right, just six-weeks ago.

Less than four weeks later, the President decided that he DID want to operate militarily in Iraq. No doubt Congress was encouraged to drop the prior missive.

This is a classic example of an issue not having any basis other than what the team leader wants at a given moment.

Which makes any larger debate by voters pretty silly.

My best friend was a Clintonite fanatic. He was ‘on-the-team’ no matter how many times Bill flip flopped — in a SINGLE DAY. When he was informed that Bill had ENTIRELY reversed himself, my friend was totally on board with the decision. When Bill reversed himself, yet again, yet on the same day, he was STILL on board the Clinton express.

(This tick of his was universally known inside the Beltway. The MSM never emphasized his ‘style’ to the larger pool of proles. For eight-years, no-one would know from an evenings broadcast that Clinton had flip-flopped four times on a key issue — since noon!)

There is a larger issue with team worship in politics. To do so one must abandon any points of fixed reference.

This is how horrific despots drift off into crazed hate-fests.

This can be only avoided if voters STOP worshiping their political team.

You HAVE to separate yourself from any emotional bonding with — or against — any political party.

Most find this impossible to do. This is why despotism keeps coming back.

I make no accusation against the Democrat party as a whole — but Barry has serious despotic impulses and is largely politically paranoid.

This last aspect is quashed by the MSM — who are entirely aligned with Big Government and the themes of the Democrat party.

Yet, leakers leak: White house insiders have revealed that Barry has a ‘tracking crew’ that vets everything that Bibi says for linkage to the GOP and Sheldon Adelson!

And we now know that Axelrod performed a total hatch job on Herman Cain in 2012. Cain sued the women who had defamed him. EVERY LAST ONE folded in court — admitting that they’d made up their stories out of whole cloth. The breadcrumbs led straight to Axelrod — and Barry. Axe doesn’t turn left without Barry’s okay.

But, Barry has done such dirty deeds all his political life. He directs most of his ammo against Black politicians. He never wants to face them at the polls!

With time, you’ll perhaps come to realize that sleaze is all over politics. And, if anything, urban politics is even sleazier. Again: Detroit.

Since there are simply no end of Democrat party scandals that would erupt if anyone lifted the rug, the MSM stays out.

I once witnessed a high ranking Democrat cue the local TV stations to STOP RUNNING THEIR CAMERAS. She did so with a trick gesture. She was protecting the largest single property owner in the State of Hawaii.

She was noticed. One eye witness dedicated his existence to her defeat at the polls that Fall. She was the only Democrat not re-elected. His testimony about the cameras absolutely killed her. He also was able to tease out her $$$ connection to Mr. Big — something that was never comprehended until then.

The other big Hawaii scandal was how the developers were kicking back graft to the relatives of major politicians. Since Hawaii is a Democrat bastion, no-one gave a penny to Republicans. That’s how it works. The minority party is not even presented with the opportunity to be tempted. The chronically powerful get boatloads of bucks.

Again, Detroit.

Hey, RE noodnicks, the bargain now are 3% 15 year mortgages. Just buy any home to live in, in a prime location, at any price you can afford, and own a great home, free and clear in 15 years.

That sounds like great advise! I just need to get this whole income thingy nailed first. Prime area 15 year mortgage 3.5% down… Sooooo all I need is like $500k per year and all is good!!! There are tons of yobs where I could bring down a cool half! I think it is time for me to dust off that old Arby’s Roast Beef uniform…

Chilling realities:

http://theeconomiccollapseblog.com/archives/30-stats-to-show-to-anyone-that-does-not-believe-the-middle-class-is-being-destroyed

john williams says the true unemployment rate is more than 22%

“Yes, the stock market has soared to unprecedented heights this year […] overall, the long-term trends that are eviscerating the middle class just continue to accelerate. ”

____

I’ll be playing it short on the markets, at some point. “Everyone is rich on paper, but no one has any money.” (Ok not ‘no one’ but probably surprisingly few. Too many people asset-value rich.) It could be like a new golden age of opportunity for those with just a bit of savings, little/no debt, in the future, to buy for cents in the dollar (imo).

___

>> Banks’ balance sheets allocated to marketmaking are 25% of pre-2008 levels. Since the financial crisis, the US corporate bond universe has doubled in size, but dealer inventory is four times smaller. The problem is that less capacity for liquidity makes volatility spikes much more likely, especially if investors all rush for the – smaller – exit at the same time.<<

Source: Lombard Odier Investment Managers

THE CALM BEFORE THE STORM?

Jan Straatman – Chief Investment Officer

11 June 2014

[PDF] https://www.loim.com/files/live/sites/lo1/files/documents/news/2014/20140612/thewealthnet.pdf

I realize this may not be indicative of a larger trend, but this last week has seen an enormous uptick of new listings in my area, a bit odd given the time of year.

Anyone else noticing the same?

Yes, very true in Eastern Ventura County. Also, price reductions of $10-$15K every few weeks as sellers realize that they are still priced too high.

yes … and a lot of ” price reduced ” add-ons to the front yard ‘for sale’ signs

The number of listings in July was up to 2.37M, the most since mid 2012.

The percentage of listings with a price cut in July was 32%, which is the highest percentage since Oct 2011.

Inventory is at it’s highest level in 2 years, and price cuts are accelerating.

http://www.zillow.com/ca/home-values/

https://ycharts.com/indicators/us_existing_home_inventory

Good to know, I figured that was the case. I think I just saw about 10 more pop up in my latest Redfin email alert, too. 2015 will be interesting, to say the least.

Look at this: https://www.redfin.com/CA/Los-Angeles/11772-Idaho-Ave-90025/home/6758011

Junk box of a “house” sold in February 2014 for $484K—reduced down from the original asking price of $499K. Now these jerks are trying to flip it without putting any actual work into building a new structure. What are they charging to hand over their draws for this unrealized house? $729K, a nearly 50% markup.

I really hopes this market crashes and burns so these phony investors can leave and make things somewhat affordable for the average buyer again.

Amen to the crash and burn..I hope if there’s a next bubble it will take no prisoner. It’s sickening to see housing is worse than Vegas gambling, you can see the greed coming out of some of these suckers eyeballs..

There has been Middle Class destruction for several decades now. It isn’t a GOP or Dem thing. It’s a “I’ll help my friends and collect donations ” – called crony capitalism. It’s also a “let’s help the poor and minorities” – War on Poverty, Obamacare, etc.

Who do you think is paying for this? The most recent detail I saw was a map of Chicago from 30 years ago and recently. The city and suburbs went from well over half Middle Class to almost none.

There are handouts and programs for the rich and the poor – and us? We pay for all this hooey…..

Please, no one in govt wants to help the poor or minorities, unless fatcats can get rich off of it. Obamacare was just a way to funnel $$ to health care companies. They had to accept certain tradeoffs for a dramatic decrease in risk. People are still stuck with having to pay out the nose for healthcare.

Chris-

Yea, I’m actually in Reno, NV but we had our share of institutional buyers and cash only folks. We have fitnessed a decent bubble in this area, skinny inventory…and now inventory is really increasing. I think less is selling AND I think the folks that were hemming&hawing about “should we sell or see if it goes higher?” missed the boat, things are on the down-slide…so they jump in and increase inventory.

DOC HB- Thanks for the fantastic blog, witty writing and insight.

Pulling out of the market to me is if they are selling. Just because they are not buying doesn’t mean they are out they are just not finding the future potential growth.

So now we will sit at high prices for years. Looking for a tank? Me too. But I doubt it.

Permanently high plateau!!!

O-care sucks for middle class people. That is i would say 90% of the people on this blog. Those that are rich, get help from the gov’t via 0% interest rates, while the poor get EBT, O-care etc. But someone has to pay for those things. By and large its the middle class. Its good that your older son has insurance now, but the problem is that its not free. It taken from others(via higher premiums) to pay for it. So its benefits some at the expense of others.

Side note, someone said that this is like the great depression, but no bread lines. Why aren’t there bread lines? Because now we have EBT cards, which get credit every month or whatever. If there was no EBT cards we would have bread lines now.

Not just in premium hikes: http://obamacarefacts.com/obamacare-taxes.php

Oh oh who coulda known? But Iam sure many of the “real – estate” experts here will have a perfect explanation for that! Cause this time it is different!

Observation from the 90004 which runs through North K Town/Wilshire Center, Windsor Square, Handcock Park, and Very South Hollywood.

I run a 3-6 mile loop through the zip code a few times a week for fitness. The explosion of for sale signs in the past few months is stagering. Most of these, if not all, are $1.5 Million plus.

See the flip being done on this property, bought for 900K 1 year ago, and being sold for $1.6 million today.

https://www.redfin.com/city/11203/CA/Los-Angeles/real-estate#!v=8&sst=&lat=37.073183232365395&long=-126.60271222940548&zoomLevel=7&disp_mode=M&market=socal

What the picture doesn’t show is that it is right on Beverly which is basically a freeway, and windsor has a stopkight so it is heavy traffic as well..

It is a modest looking one level.

I always imagined that spending $1.6 Million on a house would get you something a little sexier, a view at least.

There can’t be that many people who make enough money to pay the nut prices like this. It seems like like the owners in this Zip are sensing the peak of the bubble and are cashing in fast.

Houses all over the Toluca for sale 1MM +. Here’s the way I see it — Venice, SM, Malibu, Brentwood, Westwood, etc. are safe places to overpay. There are super desirable and there will always be newly minted movie and tech money to willing to pay. But people in NH, Burbank, even Hancock Park act as if they too can expect prices to only go up ignorant of the fact that movie/tech money doesn’t want to pay a premium to live there.

In the early 2000’s these places would struggle to fetch $300K. LA is a fun place to live but it’s also filled with stupid people, fakers, and scammers. There are definitely not enough people to buy these houses. You might have actors making good money, maybe athletes too, but the vast majority of LA folks are sub-$100K/year folks.

I look at it like this. If this house were in the Bay Area, would people have a hard time affording it, keeping in mind wages tend to be much higher there? Most people there would, so how could that be affordable to anyone in LA is mind-boggling.

China may become worlds largest economy,

Sinclair Lewis said:

“The yellow race will bury the West not military but economally.

Gen Douglas McArthur was fired by Pres. Truman:

he wanted to advance on the Chinese in the Koran war.

President Nixon:

He gave them the farm (trade) in exchange, China would back off in relations with the then Soviet Union.

President Obama:

He of course has no foreign policy whatsoever, also in regards to China, be believes it is no big deal we have fallen behind them in world trade?

There you have it kids, America told you Vietnam was the communist domino effect, no it wasn’t, it was our own country

Truman

Nixon

Obama

That was the domino effect.

you’re seriously letting G.W. off the hook? Who was it that took the lid off Pandora’s box in the mideast?

Polo…I was posting about Chin, but of course GW gets no pass from me, the Middle East, what a disaster and black eye for us.

If that’s your standard: Bill Clinton.

Mr. Black Hawk Down, Mr. Rwanda, Mr. Serbia, Mr. Operation Desert Fox (1998, missile slap, Saddam), …

Mr. INACTIVITY.

Clinton and Clarke even passed over multiple opportunities to bag OBL; they just flatly turned the other way. No explanation has ever been proffered.

He even appointed Mr. Richard A. Clarke as THE counter-terrorism advisor — who was held over into the Bush administration — as Democrats blocked countless Purple Book appointments (filibustered) in anger over Gore’s close defeat.

Clarke promptly scooted the bin Laden extended clan out of America — even when regular air travel was grounded! He admitted it. It’s now coming out that OBL’s relatives were financing him — all along. Critical officials (Clarke) knew of such links — even in 2000. {SWIFT is the electronic money transfer scheme used for international trade. The NSA is able to ride along and take peeks.}

And it was during Clinton’s era that Saddam made a farce out of Food-for-Oil. It should’ve been exposed by him. All of the evidence was to hand by 1997. Each day that went by countless Iraqi children died from malnutrition.

Like Rwanda, Bill Clinton just didn’t want to know.

He famously pretended to not be in the room when calls came in from his own State Department from Rwanda! This happened more than a few times. Each day tens of thousands were being murdered. Bill kept it off the front page. A little bit of teleprompter time would’ve had a tremendous impact, the perps admitted exactly that.

The zit that popped in 2001 had been festering for the entire Clinton administration. Remember the first Muslim attempt to destroy it?

We also have Muslim moles riven through our national government — both parties — and the civil service — and the FBI.

NORAD had scheduled a scenario for 9-11-2001 which featured Muslim hyjackers. This tidbit of information was only admitted to when the NORAD commanding general was deposed by the 9-11 Commission.

THIS ^^^ is why Logan Airport’s traffic controllers ‘lost’ twenty minutes of tape — which covered the critical time frame. These guys naturally assumed that they were witnessing the NORAD scenario — of which they were previously informed — by a highly classified memo. Such scenarios have been conducted all through the Cold War by NORAD… and kept secret.

The ONLY way that 9-11 could’ve transpired was because some moles received the NORAD notice and rescheduled the atrocity. It’s now known that the original OBL target date was more than a week earlier. The Labor Day holiday was the original scheme. The rescheduling — in late August — was perfectly in synch with the NORAD notice to the FBI, the FAA, and others. It would only take a single mole to leak the news.

While all the above is buried in the 9-11 Commission report — and the open media — it must be obvious that the MSM has ‘faded’ this information. They have ‘moved on.’

Dunking Clinton with guilt does NOT serve the partisan impulses of the WaPo or NYT. Likewise, the Benghazigate matter has been faded. The ISIS connection to Barry and Hillary has been faded.

Say, what ever happened to the anti-Assad fighters that the administration was training (by the CIA) in the northern Jordanian desert? They were all over the news two-years ago. They went rogue and joined ISIS, that’s what. EVERY Middle East broadsheet is babbling about it. Our MSM: crickets.

I withdraw my previous support for blert – he’s clearly off his meds.

Don’t know enough about the 9/11-NORAD angle, but he’s absolutely correct about ISIS–a CIA created and funded Frankenstein monster. How convenient to whip the country into another “terror” frenzy as the economy collapses.

If the market is tanking and tanking more, what is to stop investors from jumping back in and scooping up properties like before and propping prices up again. Assuming they got out earlier.

I am not looking to invest, just want to get more room for my expanding family and know prices are a bit high. How to compete with the cattle drive again, since I will need a mortgage? Thoughts anyone….

The Fed is ending quantitative easing next month. If the end of QE tanks the stock market then that could potentially take down the housing market and keep investors out of the housing market.

A big chunk of the hedge funds, investment firms, etc, may have been using leverage in the stock market to play the housing market. So if stocks go down, so does housing.

Nice, well said-thanks eb

Such a gambit goes entirely against all human psychology — and market history.

Instead, markets crash clean through the floor.

You must be young.

B- how does that answer my question? I can appreciate your hypothesis on age, but it would be more helpful if you shared your thoughts on my original post.

I got that, “Markets crash clean to the floor” – if you were in my shoes what would your plan be? thanks

like health care was so great before obama care, stfu.

Exactly

0-care does not address health care.

No additional talent in enabled by 0-care. No new medical colleges, nurses colleges, etc.

While not a part of 0-care, Barry’s policy is to open our southern border — and the first movers are typically sick, REALLY sick. That’s why their parents are willing to break up the family and send a teenager half a thousand miles from home.

These poor souls bring with them many highly contagious diseases that have long been eradicated within the US. These rural kids then pass on their infections — and quickly too — check out the kind of emergency quarters the Feds are bunking them in.

So, on the one hand, Barry is increasing medical demands. On the other hand Barry is not increasing the supply of talent. No provision is being made for additional talent even in the out years. That’s really scary, since America is aging.

What 0-care DID do was address the Insurance Cartel — by making it even stronger.

For 0-care is ALL ABOUT FINANCES, not medical care.

To control expenses 0-care falls back on the universal solution of socialized medicine: bureaucratic rationing.

Death Panels are the real deal. They exist in EVERY single system of socialized medicine. Naturally, socialists hate the pejorative term. But it fits. The true result of the deciders is who is going to live or die, who is going to be cut off.

Such a mechanism is compulsory in every socialized scheme because financial resources are no longer any kind of factor at the granular level. (They ARE huge at the national, budgetary level. That’s why the Death Panels keep popping up in every socialized scheme.)

Canada has gone so far as to PROHIBIT anyone from spending their own monies on their own medical care. Australia at least operates a split system, so if you’ve got the bucks, you can through them at your problems.

0-care largely converts private parties (the insurance cartel) into quasi-government servants. No-one is much surprised, that industry largely WROTE 0-care, not Pelosi, Reid or 0bama. Big contributions flowed in from Big Pharma and Big Medicine. The financially interested parties wrote the law to suit themselves. What else?

0-care even has get-out-of-trouble clauses for the Insurance Cartel. They just can’t lose. Coupled to this, they’re compelled to stay quiet about any boners coming out of the White House, or the Federal government, generally. Hence, you haven’t heard a peep from them. It’s a bargain that Faust could best explain.

That 0-care is actually still called a Health Care statute is risible. Such terminology is wholly inappropriate.

“National Compulsory Medical Plan Purchase Edict” is much closer to the mark. Even so, some mention of the massive cross-subsidy scheme needs mention. I still can’t wrap my mind around how it’s actually intended to work. As it stands, it would appear that the IRS and the Medical Insurance Cartel have been merged. The Cartel is going to be collecting taxes and the IRS is going to be collecting medical information. At least that much is clear.

It’s also apparent from the regulations — not the statute — that 0-care is actually going to be structured like Medicaid on steroids — that it’s (financially) granular down to the county level. Here and there it spans county lines, but 0-care expects Americans to basically not move around.

The plans — and regulations — are not set up for second homes/ summer homes. Once you leave your primary residence everything shifts into alternate (much more expensive) pricing. For the most part, you’re actually no longer covered.

While this might be fine for the immobile poor and retireds — it’s going to be a shock to the system for the Americans paying the freight.

&&&

The Democrats should’ve sliced this monster down to size so that it didn’t blow up. As it stands, 0-care is so politically toxic that Barry has to keep delaying the real program. Even now no-one knows what we’re in for. Even the experts are overwhelmed by the complexity.

0-care STILL needs all of the software to work. That event is still many, many, months into the future. Too late the experts discovered that it’s currently impossible for the various databases to link up in a timely manner. For computer logic ‘timely manner’ means micro-seconds. It turned out that even the fiber-optic links require upgrades. The mainframes require upgrades. Etc.

These huge outlays have to come out of somewhere. Right now that figures to be the housing sector. It’s the ONE economic sector that can be permitted to go slack during economic stress, most typically war.

That 0-care would hit the housing market like a major war was totally unforeseen.

As the posters here demonstrate, most still don’t make the connection. It’s just too big and scary.

Denial will devolve into horror. At some point the 0-care delays will stop. It’s at that point that the LIV and college graduates will get a fulsome education.

I keep bringing up the college crowd because college professors have been in a financial bubble of epic scope. This mania has validated their collective self-opinions. No professor has ever had to deal with business death. They are never tapped to turn a business around. And they certainly never have to deal with getting real results out of seriously dull sub-90 IQ minds. But real businesses have to do exactly that. It’s quite a trial, quite a revelation.

College kids, by their nature, have been shielded from such harsh realities. This causes them to be far too optimistic about grand schemes — and perfecting humanity in one life-time.

The more I look at the 0-care numbers, the greater my concern for real estate values. An epic crash is now looking to be likely. This may not occur in nominal dollar terms. I think the Fed will print madly. But still, the values will crater. They will follow the general economic pain of the American nation.

Don’t forget that the better doctors are opting out.

I had an annual medical checkup last year with a highly-recommended doctor, who refuses to accept insurance. He requires full cash payment, upfront. Credit cards and checks are fine, but no insurance accepted. He won’t file any claims. If you want to file on your own and try and get reimbursed, that’s up to you.

Luckily, I can afford his high fees. But those relying on O-Care must look for lesser doctors (i.e., those who can’t afford to forgo insurance money).

Blert, interesting post. Just one question for you. I know that you’re convinced that the additional obozo care costs are going to have a strong negative effect on housing prices. Isn’t it possible that people will just cut their discretionary spending as health care rises as opposed to the money they put towards housing? We’ve been seeing a trend in the more expensive cities that the percentage of income put towards rent keeps increasing.

Show me the proof! Where’s the data? What is the resource material?

The Latest From California: Obamacare is Working – Rate increases of less than 10% projected. Some Doctors opt-out because they can’t bill 30K for a hang nail anymore. I can go to Cedar-Sinai on ACA and don’t even try to say they don’t have the best Doctors.

California’s biggest health insurer says there won’t be any Obamacare rate shock next year:

In the strongest indication yet where Obamacare rates are headed, industry giant Anthem Blue Cross said its California premiums for individual coverage will increase less than 10% on average next year….[Anthem Blue Cross President Mark Morgan] said the age and projected medical costs of new enrollees are in line with the company’s expectations thus far.

California is a big state that had a successful Obamacare rollout, and there’s no telling if we’ll see the same kinds of rate hikes in other states. But it’s telling that Morgan said the demographic profile of its new Obamacare enrollees was about what they were expecting. Presumably, they’re also seeing new enrollees pay their first premiums at about the rate they expected.

Note that these are no longer just vague predictions. Anthem and other insurers filed their rate increase applications with the state last week, and final rates will be set a few weeks from now.

Obamacare got off to a rough start. But despite endless hysterics from an endless stream of conservative talking heads—enrollment numbers are low, there aren’t enough young people, nobody is paying their premiums, blah blah blah—Obamacare is working. It’s not perfect, and it could be better if Republicans were willing to allow improvements. But it’s working.

http://www.motherjones.com/kevin-drum/2014/06/latest-california-obamacare-working

Jeff…

0-care is weirdly focused on First Time Home-buyers because it ruins their cash flow — which is what sustains their financing a mortgage.

It’s such a huge nut, and the ‘system’ is so set on its norms (historical solvency modeling based on yesterday’s American economy) that even a pledge of extreme parsimony will not secure financing.

The single most likely consequence is a tremendous fall off in First Time Home-buying as couples are compelled to save up a seriously large down payment.

Prior to the FDR era, the typical down payment was 50% — and the mortgage was a balloon that was due in 60 months. As you can imagine, that America was pretty much a debt-free America.

Real estate mortgage debt is the number one source of our debt-backed money.

So the FDR era triggered a systemic increase in the money supply that has spiraled away, ever since.

Barry, the Democrat party, and Big Government spendists (both parties) have hollowed out the American economy.

The employed fraction of adult Americans is tailing off for a real reason.

Right around the corner, robots are going to take away/ destroy countless jobs that are now deemed essential.

America may have to shift over to a drastically different economy — that features truly massive levels of welfare proles — beyond anything imagined this side of science fiction.

Such a shift would have profound implications for real estate values. Habitation may well become a “right” that’s distributed/ allocated by the central government.

See Soylent Green — or the USSR.

Any trend in that direction would have every sane man cashing out and running for the hills. Such levels of socialization prohibit private gain. The two travel together like peanut butter and jam.

toluca…

I’d be ashamed to quote Kevin Drum, really ashamed.

And, Mother Jones… good grief.

They’re “on the team” — NOTHING could break that spell.

Drum is a die hard Leftist. He’s as predictable as Der Sturmer, and just as useless.

Re-read from the top. I’m coming from the point of the employer.

Your quoting Insurance Cartel spokesmen.

Good luck with that!

Blert, you’re right about there being a shortage of physicians, to the point that we import medical graduates from other countries and cause a brain drain. But expanding med school classes would be the easy part. Paying for their residency training is the expensive part – upwards of $100,000 per resident per year is what the federal government pays. But how exactly was Obama supposed to address that? If O’care was going to ruin the economy, wouldn’t spending billions more per year on residency training ruin it more?

Wrong about death panels. If you want to take a cancer drug that costs $300,000 and extends your life by an average of 6 months, go ahead and pay for it yourself. But that $300,000 could have benefited a lot of other patients. There are a limited number of resources, and tough choices have to be made. There will finally be payments made to primary care docs to pa for talking with patients nearing the end of their lives about what they do and don’t want done for them, and what the tradeoffs are. That’s not a death panel.

Wrong about private medicine in Canada: http://www.cmaj.ca/content/183/8/E437.full “Private clinics continue explosive growth”

Sort of right about “National Compulsory Medical Plan Purchase Edictâ€

Overall, C minus.

And seriously, do you have to write ten inches of commentary every flipping comment? All that does is rally your co-believers. That’s fine, if that’s your only goal. If you are trying to change someone’s mind who doesn’t agree with you, I don’t think your tactics work nearly as well as you imagine. You’re even worse than the serial commenting crackpots in the New York Times who insist on making FIVE comments on EVERY opinion piece. You’re smarter than us sheeple – we get it, already!