Managing shadow inventory – California home prices up 12 percent year-over-year while household incomes remain stagnant.

At the core of QE3 and every other program aimed at saving the financial system is the ultimate mission of stunting the natural market process. It is hard to find any system that is purely market based especially when it comes to housing. The US since the Great Depression has heavily subsidized housing via Fannie Mae, Freddie Mac, and other programs but also through more subtle benefits like those offered via the mortgage interest deduction. Yet each step that has been taken to “fix†the housing market has become more dramatic in fashion and is like using a bazooka to remove one cockroach. At first if you recall it was a suspension of mark-to-market accounting. Then it was programs like TARP and Maiden Lanes designed to transfer toxic assets off bank balance sheets (a good amount still sit in the Fed balance sheet). Today the Fed is now on QE3 and will need to commit half-a-freaking-trillion dollars over the next year in MBS purchases just to make interest rates stay the same or tick lower by a tiny amount. To think that this kind of massive action will have no repercussions is simply ignoring what we are now seeing. In essence, to keep things going at the current pace the Fed needs to get more dramatic.

What about the shadow inventory?

At first shadow inventory did not exist. Then it was an issue of defining what constituted shadow inventory. Now, with half a decade of action items we realize that:

-a. Suspension of mark-to-market was largely the first step in creating a massive amount of shadow inventory

-b. Deny this pool of properties exists while working behind the scenes to off load properties initially. Now banks are selling into a largely controlled system (i.e., the Fed/GSEs are the only game in town)

-c. If the market was truly functioning, why in the world would the Fed need a market intervention program like QE3?

So what we now have today is this:

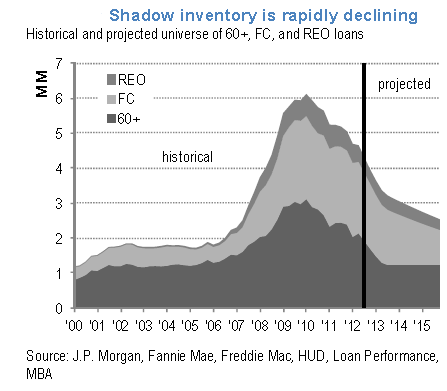

At the peak in 2009 and 2010 we had roughly 6 million homes in the shadow inventory pipeline. The good news is that this has been slowly winding down. From the chart above you can see it has been steadily moving lower. The “throw everything†at the wall approach has supported this move lower by:

-1. Dropping mortgage rates to historically low levels (at the cost of the Fed increasing their balance sheet to nearly $3 trillion)

-2. Constraining inventory. The slow leaking out of shadow inventory is possible courtesy of banks having the ability to re-write accounting rules and selectively leaking out properties.

-3. Drop in home prices. Home values across the nation are looking better in relation to absurdly low interest rates.

Keep in mind that the housing market on paper was already recovering yet the Fed decided to do an open ended MBS purchase program of $40 billion per month until “the market stabilizes.â€Â Yet monetary policy can only go so far and of course the biggest winners were the large financial institutions. Low interest rates are keeping prices inflated and in some markets, we are seeing bidding wars that bring back memories of the 2000s.

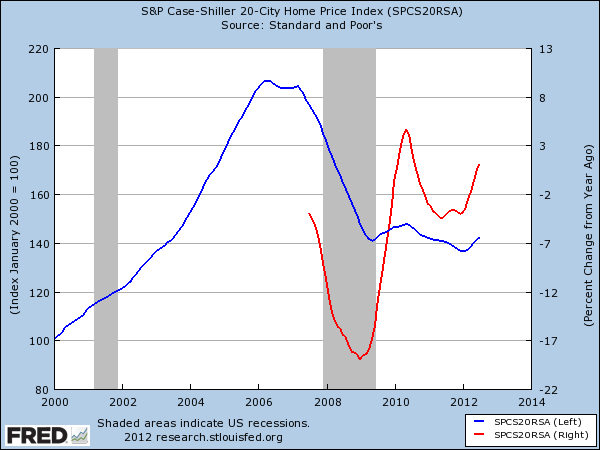

If we look at the Case Shiller, we are starting to see a trend develop:

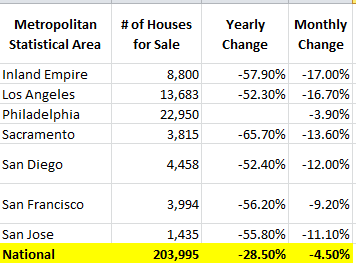

However much of this has come because of the previous items we have discussed. The Fed is trying to use housing as the catalyst for another economic recovery. Yet there is a cap as to how high home prices can go because now with 30 year fixed rate mortgages in the 3 percent range and FHA insured loans with a 3.5 percent down payment, you really can’t get any more leverage unless you bring no-doc loans back. Similar to bubble part 1, we would feel better if home price increases were occurring because of rising household incomes. Which plays into the overall trend that US households are facing more than a lost decade of household wage growth. At the same time, take a look at what has happened to inventory:

Source:Â Redfin

It should come as no surprise that combined with insanely low rates, California home prices are up 12.9 percent year-over-year all the while income growth is stagnant. This only makes sense when you mess around and manipulate the financing side of the equation.

Heck, even within the Fed people are seeing this:

“In a speech prepared for delivery in Philadelphia, Federal Reserve Bank of Philadelphia President Plosser said the central bank’s latest round of monetary easing was unlikely to help growth.

“We are unlikely to see much benefit to growth or to employment from further asset purchases,†Plosser said in a prepared speech.”

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “Managing shadow inventory – California home prices up 12 percent year-over-year while household incomes remain stagnant.”

Given the fragility and hollowness created by all the anti-DEflationary Fed measures you’ve outlined, plus the lack/decline of real income growth, the inverse relationship ‘tween interest rates and housing prices is/will be WAY MORE “sensitive” than it was in the 1970s, with a very real possibility of seeing prices drop to 1989 levels, or even… nah, just ate… too scary.

But, I gotta give Duh Fed magicians credit: they’ve kept the charade going at least 2 years longer than I ever thought they could. Still, the springs are just winding ever tighter–Maiden Lanes I, II,… XII can’t be wished away–and the bag o’ tricks for pulling a SLOW unwind seems to be shrinking.

Lawdy, I just hope no bankSters lose their Hamptons digs. That would be terrible.

QEinfinity changed everything, this is the new normal. Interest rates will never rise, as they can not or the US will not be able to service it’s debt.

Welcome to Japan-style stagflation for decades to come. For this reason, I think it’s wise to buy a home simply for the fact of (in theory) getting it paid off and retiring. Or eventually having equity after 10 to 20 years of knocking PITI down through payments.

One caveat I have is the “next boom”. Of course we do not know when it will happen, or what it will be, but I’m 32 and confident another one will happen before I pass in 40/50 years. Electricity, the assembly line, radio, internet, etc…all created legimate economic gain and I theorize the next boom will be energy related. Not false green Obama energy, but fusion or something along those lines. The cure for cancer is also valued at over a Trillon dollars…times are bad now but I’m hardly sticking my head in the sand…

Yes, I was thinking this the other day. Perhaps something like a leap in battery technology. A battery pack that could power a car for 200 miles and take an hour to recharge and cost less than $5K. This would not take a quantum leap in technology, but would cause a whole bunch of change in the system.

But I am thinking that something along the lines of large gains in energy efficiency would be a similar “break through” as well.

It’s very popular to rail against the actions of the Bernanke’s Fed. But in light of what is an historic, Western 1st Word asset bubble-burst that’s lead to an equally historic deleveraging phenomenon (institutional, consumer and sovereign), what other choice, and what other institution on earth, could possibly keep the global financial ship afloat with enough liquidity ballasts to stop a horrible deflationary Titanic recession plunge than Big Ben’s tactics?

Posters bring up Iceland’s bitter pill reversal, but that’s a country with the population of Anaheim, and rich in self-sustaining natural resources.

No answers, here. Just questions.

So are you saying prices from here on out will continue to rise, and to buy now? Sold in 2006 and have been waiting to re-enter market but because of such low inventory have not been able to find anything, was considering to buy in the spring but decided to wait and see if fall/winter would be calmer, as of now not any calmer. Do you think shadow inventory will bring prices down any time in the near future? Any thoughts?

The Feds changed the the REO timeline so that banks now have 48 months to dispose of foreclosures versus 12 months previously. That means that in mid-tier areas, inventory will be artificially low for the next few years. Supply and demand dictates that prices then go up. By 2015, unless the banking rules are changed again, inventory should be back to the normal levels, and selling prices will reflect this.

Ernst,

Where did you find this information?

Renter, I sure hope so. We have been sitting on a lot of cash, was waiting for the tsunami that never arrived. We being retired are taking the brunt of the Fed’s action our interest rate is now 00.12% .

When i was building houses the fed pushed the loan rate up to about 18% and put me out of work and we lost our chance to buy, now that we have the money this is the way we are treated.

Prudent saver get screwed to help the big bankers and their high salaries.

Why are you still waiting Tim? Your rent is probably more expensive than a mortgage payment+insurance would be on a decent 2br.

Renter, nobody knows what the future holds regarding pricing, interest rates, rents, shadow inventory, etc…these are all things nobody has control over. People do have control over their monthly payment if they buy today, and that payment is likely less than comparable rent. This is why we are seeing such a frenzy.

Last week I gave an example of buying a 750K house with 20% down versus renting. The numbers showed that it was mathematically equivalent on a monthly basis buying said 750K house with 20% down versus renting a place for 2K/month and being forced to put 1K/month into a savings account. Many people on sidelines are paying this type of rent anyway and probably saving, so why not buy? The Fed has intervened with super low rates to make this possible. The fence sitters who have been waiting are making calculations like this. I’m sure I’ll get lots of flack for this, but this is the cold, hard reality!

Payment on that mortgage would be $2.8K, not 2k.

and that doesn’t include home-owner’s insurance, melaruse, HOA and property taxes.

NO, I’m saying that if interest rates rise even a little bit–which they must, to contain INflation–then housing prices, already dancing on Fed/MSM/NAR hot air, will DROP, rather sharply. This will put peeps back on the sidelines, causing further drops, etc… cascade effect. See graphs from the 1970s. Duh Fed/FHA *knows* this, hence the extreme QE games, MBS repurchases, etc.

I’m saying the second plunge of the double-dip hasn’t happened yet, and that due to the constellation of headwinds outlined on this blog, it will likely be DEEPER than the 2006-07 plunge.

As pointed out on this blog (and many others, e.g. patrick.net)–with numbers: it is better to buy a house at a low PRICE (the REAL “lock-in”) with a high-interest mortgage (which can always be re-fi’d later), than to buy an overpriced house with a low-interest mortgage. You’ll pay a LOT less over the life of loan with the former scenario.

Higher interes rates = lower prices? Uhhh – no. At least not in nominal terms. Even over on patrick.net this meme has been thoroughly discredited.

http://patrick.net/forum/?p=1211412

Notice how the doomish posters mock the guy for making the argument “higher interest rates = lower prices” and prove it is wrong with graphs from the 1970s. Just imagine the guy in 1977 watch in horror as rates rose to 16-17-18%, and yet, in nominal terms prices just got higher and higher and higher.

So if you want that to be you, be my guest…

Gary Shilling says “recovery” is fake, prices to drop ANOTHER 20%

http://www.businessinsider.com/gary-shilling-no-housing-bottom-in-sight-2012-9

“The main reasons Shilling is so pessimistic: There is a huge supply of excess inventory not being accounted for (SHADOW!), and prices still have not fallen to anywhere near long-term historical averages.”

Real life FUNDAMENTALS. Imagine that.

All I know is there is very little decrease in prices in the Sherman Oaks area. The inventory of affordardable housing here is non existant. If you happen to find something for 500 grand, it is a major fixer. Will this ever end? Also, it is my understanding that investors are buying up everything for cash. What type of neighborhoods is that going to create in the future? A crime ridden city full of nomads? Guess I will never own a home in my lifetime.

Also what does Fed/GSEs stand for?

1929 to 1934 = 5 years. 2008 bubble +5 years = 2013???

Avg. length of stay in home, 7-10 years? Found / observed: 2006 purchased home $1.3M. Now listed for $1.2M. Tax appraised value = $850k.

Are we starting to see the 7 year itch / rollover? People who thought they’d buy and sell to the bigger fool….??

I use to check this blog 4 times a day before I baught my house. I love this blog and check when I get a chance. It appears DHB gave up and start signaling that we might not see home prices goes down further in good areas like (Cerritos, Arcadia,Diamond Bar, Walnut etc….). I am so glad that I picked up a decent house in Cerritos in April 2012 and my payment is same as rent and we are very happy. I am less worried about the housing crisis I am more worried about the quality of products in USA. You go to any store for anything you will find cheap cotton, cheap leather even on branded names.

Doctor Housing Recovery,

“Keep in mind that the housing market on paper was already recovering yet the Fed decided to do an open ended MBS purchase program of $40 billion per month until ‘the market stabilizes.’ ”

This is the most important statement in this post. It is my understanding that this is the most dramatic action that the Fed has ever taken. Why exactly with all the rosy stats coming out about the recovery would the Fed take such dramatic steps? The actions of the Fed are exactly opposite of the news we are getting about the economy. My guess is that either the news is incorrect or the Fed is incorrect…

Do you trust the shadow inventory chart? Isn’t it brought to us by the very same sources behind mark-to-myth, extend and pretend accounting, and unemployment stats? It looks highly sus to see inventory back to near normal levels next year. And to see deliquencies back to flat normal within just a few months is not even remotely credible.

For those who trust the J.P. Morgan/HUD chart, be sure to write me for your free catalog of discount bridges . . . now available for rent at low, low rates, including one month free move-in (under) allowance!

Trust? I dont know, but before I automatically “distrust” the source, ask yourself, if they wanted to show the shadow inventory being “contained” why did they put out charts in 2009 showing it going to the moon???

There’s no employment or wage growth, but at least our assets (if we have any) are staying over-priced.

If reflation worked, deflation would never occur, but history shows the exact opposite outcome of all reflationary strategies going back to ancient Rome. You might as well have an economy based on rising baseball-card prices as housing prices because the whole game is based on, directing the income of working, productive people to the pockets of nonworking asset-owners. Debauching the currency delays the day of reckoning but not the ultimate outcome. In the case of the US, the housing sector employs low-skiled trades and sales people whose output is unwanted on world markets; that means the US has nothing to balance its trade deficts with productive countries like China and Korea who together dominate world trade in electronics. A Kondratiev wave analysis of US real estate prices for 300 years predicts a collapse in 2007, a dead-cat-bounce in 2012, and a bottom in 2033. This is the way empires end, not with a bang but a wimper.

The FED is merely following the Japanese playbook. Protect the banks at all cost. That is why it was first created and that is really their job. Banksters. They could care less about the public. What happens in 2015 when the FED has to raise interest rates to spur foreign investment and our balance sheet is bloated another 4 trillion or so to 20,000,000,000. Goodbye reserve currency and hello hyperinflation, or a depression the world has never known.

Even though prices appear to be rising, banks are releasing short sales on the Westside and we’re seeing 15 – 20 properties a week going at 2002 – 2004 prices.

http://Www.westsideremeltdown.blogspot.com

and all those people who purchased overpriced SoCal homes wil lbe running thier asses off to avoid the roits and looting. To live and die in LA.

What’s to keep the Fed from buying just about all the Treasury issuance? This would keep the 10 year note rates low and thus mortgage rates as well. The downside would probably be that every nation that traded with the US would want a lot more money for everything they sold here.

“The FED is merely following the Japanese playbook. Protect the banks at all cost. That is why it was first created and that is really their job. Banksters. They could care less about the public. What happens in 2015 when the FED has to raise interest rates to spur foreign investment and our balance sheet is bloated another 4 trillion or so to 20,000,000,000. Goodbye reserve currency and hello hyperinflation, or a depression the world has never known.”

Except Japan has been fighting deflation for that past 20 years, not sure how you get to hyperinflation via what is happening in Japan.

The Fed controls interest rates and can set them to whatever they want. That is simply how it works. If they want the rates to remain low for the next 10 years, they will remain low. We don’t need to raise rates to attract foreign investors. Are you saying that our government has to raise rates to obtain our own fiat currency from foreigners or they cannot spend it’s own fiat currency? Does that even make any sense to you when you thing about it?

Dr. HB, you have nailed it once again. In early 2010 we made a preauction offer for my daughters Northern California condo from a well known auction company. At that time their were 250+ houses on their website for the entire state of California. I have watched as the inventory they have, has slowly dropped. Guess how many houses were in their inventory a few weeks ago? Two. Yes, two. Where did all the houses go?

I agree with Enzo, I can’t believe that the Feds are, (and somewhat successfully), keep blowing air back into the bubble to reinflate it. Like Renter, I am asking the same questions….how long can they keep this up? How many more years do I have to wait before I am living in a house that meets my needs? It seems to me that money parade the Feds have created cannot continue. After the election, reality, the real reality, will settle over all of us. And I ask you, what will THAT look like?

” Like Renter, I am asking the same questions….how long can they keep this up? How many more years do I have to wait before I am living in a house that meets my needs? ”

Anywhere from 1 decade to multiple human lifetimes would be my guess. A smart man once said “the market can remain irrational longer than you can remain solvent”, a smarter man said “the govt can play kick the can longer than you can remain alive”.

There is concrete evidence that Obama, along with the Fed and others, is manipulating the markets to increase his odds of re-election. Job done, so far. However, after November 6th all bets are off. Why anyone would not wait to see how this plays out after the election is beyond me. We are in the most uncertain financial times in history and people want to stand in line to throw a half million at a house. If interest rates go up only two percentage, you will have automatically lost $100,000 on your house!!!

I completely agree. The strange thing is that the nature of QEinfinity is long term but the election is short term. Maybe it is a signal to the markets in hope of a housing/stock market bump in time for November 6th.

Inventory is quite low these days, but an even lower mortgage interest rate is increasing demand. The end result is rising prices in some markets. Not so much in other markets. I think all this has done is get some people off the fence….mostly those with a good enough employment situation that are paying rent that may be more than what their PITI would be on a house they’d like to live in.

The price rise has a ways to go, as it is fueled by people using the incredible low interest rates – which allows them to bid higher on bigger houses for a fixed monthly payment. The price rise will run until the majority of homes have been sold at these interest rates – which is about 5-10 years (the average buy-to-sell time is about 7 years). If the interest rate returns to normal, for any of a variety of reasons, we will see another housing price collapse, possibly to significantly lower values that seen previously.

I still have the same question I had back in 2005. How the heck can people afford these things?

I’m seeing prices for nice MODEST homes in Long Beach creeping up to $650K. So you either need a 130K down payment or you go the FHA route and your monthly payment is probably going to be $3500. Again, how many people can afford this? In Long Beach? There can’t be that may DINKs out there, right, but they are definitely selling.

Renter, I’m in the same boat as you, on the sidelines here in Phoenix. The inventory being leaked out is priced above comparables, not only that but the CONDITION of the properties are AWEFUL. By that I mean, origional 1980’s style kitchens, tile, AC, trashed out by renters or by not being maintained for years.

How do I justify paying top dollar for a beater that needs 50K, just to bring it current.

I beleive that those buying now, will learn a painful lesson. Never mind, some people never learn…….After all, the average household incomes in the Zip codes I am looking in are 48k combined–how does that support a 200k house?

If you have been paying attention is this market, you already know all of this but I must say its nice to see it written somewhere. The MSM will never say any of this. The real question is what is next? If Obama stays in office all of this will continue. If Romney gets in office it will probably continue as well. So WTF does somebody who has been trying to buy a home for years do? Just wait a couple more years until it gets much worse? And worse for who exactly?

“Just wait a couple more years until it gets much worse? And worse for who exactly?”

That’s my plan.

Worse for who? Hopefully, worse for the people who bought overpriced assets. Quite possibly, worse for me for for waiting.

Not in a position to buy right now anyway, hoping that once I am in a couple of years, this will all be sorted. I thought in 2006 it would be by now, sadly we’ve just been treading water with no resolution.

I have been looking in Thousand Oaks for a while and anything decent goes in a day or 2. I have been looking at upto 550K but the inventory is dry. Looks like I will have to take my savings into Gold and Silver and wait for what is to come. Inflation – Hyperinflation or Depression then Inflation. That is the question?

Great article on this from a historical perspective.

http://news.goldseek.com/GoldSeek/1348679133.php

That is the area we are looking in, just came back from looking at a house for 489 that just came out today and already has an offer on it, total fixer need at least 100 in upgrades, very discouraging.

“In a speech prepared for delivery in Philadelphia, Federal Reserve Bank of Philadelphia President Plosser said the central bank’s latest round of monetary easing was unlikely to help growth.

“We are unlikely to see much benefit to growth or to employment from further asset purchases,†Plosser said in a prepared speech.â€

Then why are we dumping $32 billion per month into the economy with QE3 if it isn’t going to do anything? These Fed people have lost their minds.

“In a speech prepared for delivery in Philadelphia, Federal Reserve Bank of Philadelphia President Plosser said the central bank’s latest round of monetary easing was unlikely to help growth.

“We are unlikely to see much benefit to growth or to employment from further asset purchases,†Plosser said in a prepared speech.â€

Then why are we dumping $32 billion per month into the economy with QE3 if it isn’t going to do anything? These Fed people have lost their minds.

He is right, QE doesn’t really help.

QE does not add money to the private sector. It does not increase net financial assets. There is no evidence that it reduces the value of the dollar or causes sustained inflation. The trade weighted dollar index is flat since QE1 started. Treasury yields are down 1.5% since QE1. The annual inflation rate is flat since QE1.

QE is an asset swap. The Fed buys assets from the private sector in exchange for bank reserves. This results in no change in private sector net financial assets. Before QE, the banks held a bond. After the sale they hold bank reserves. This does not change their net financial asset position as both reserves and bonds are an asset for the bank. Therefore, the money supply remains exactly the same. Banks do not lend out reserves so unless QE results in more lending due to some other reason then there is no reason to expect the money supply to increase from this.

Why are they doing this then? Because they have set interest rates to near zero and they simply have no other monetary tools left to spur the economy. They hope people become more confident and start borrowing money again?

When Fed buys assets from bank, either bond or MbS, Fed pays cash, which is money, which is used to settle transaction. If Fed buys bond or MBS from bank, which may have lost value, bank gets cash that increases reserve. Bank can lend to borrower against the reserve. This way, the old asset, either bond or MBS, is no longer on the balance sheet of the bank. Bank asset is shrinking but cash reserve is increasing, so it is healthier and free to lend. Bank is in trouble because it has too much bad asset such as loans and defaulted loans, but not enough cash reserve to settle obligations.

QE3 buys 40b MBS monthly with no end in sight which is very significant. If it lasts 2 years, it will be close to a trillion for MBS. That’s a lot mortgages. MBS could be new mortgages, could be refi, or old loans bank still holds on its balance sheet.

Why do they do this? Maybe just what they told you, to increase housing construction job and increase inflation which is very low at present? Whether inflation is really low at present is another story. But the goal of the QE3 is stated clearly, to increase construction job and inflation.

Assets are not cash. MBS are garbage assets marked-to-face value, not market. Fed buys MBS for cash. Thus turning crap assets into cash. Bank buys treasuries. Win-win. Banks unload garbage at face value, govt gets cheap loans as does the mortgage market. Twist buys down the long bonds as well. $85B/month of this for a couple of years. Maybe more.

End result: Govt keeps borrowing at low rates, mortgage interest rates stay low, banks clean-up balance sheets by getting cash for garbage assets. By buying all these garbage assets, the Fed becomes the infamous “bad bank”.i.e…toxic dump.

Rumble,

I think QE-3 is a lot more dangerous than you are giving it credit.

The Fed. is buying 40 billion dollars worth of over priced mortgage backed securities from banks. The banks get a sweet hart deal getting rid of toxic loans and in return get’s dollars which then get invested mostly on wall st. Bank stocks and and stocks in general go up in value because of the 40 billion monthly that is getting reinvested.

QE-1 failed, QE-2 failed, now what makes you think QE-3 is going to be any different.

It hasn’t gone unnoticed to me that the Fed is also doing this a couple of months just before a presidential election. Stocks go up in price, people feel better about the incumbent, home values artificially rising because of dropping interest rates, helps the incumbent.

Rumble, it’s like steroids, Botox or collagen injections, taken before the beauty pagent. They wear off soon, and if done too often the side effects can be deadly.

Greg in La

“Rumble,

I think QE-3 is a lot more dangerous than you are giving it credit.

The Fed. is buying 40 billion dollars worth of over priced mortgage backed securities from banks. The banks get a sweet hart deal getting rid of toxic loans and in return get’s dollars which then get invested mostly on wall st. Bank stocks and and stocks in general go up in value because of the 40 billion monthly that is getting reinvested.

QE-1 failed, QE-2 failed, now what makes you think QE-3 is going to be any different.

It hasn’t gone unnoticed to me that the Fed is also doing this a couple of months just before a presidential election. Stocks go up in price, people feel better about the incumbent, home values artificially rising because of dropping interest rates, helps the incumbent.

Rumble, it’s like steroids, Botox or collagen injections, taken before the beauty pagent. They wear off soon, and if done too often the side effects can be deadly.”

qe1 failed, qe2 failed qe3 4 5 or whatever will fail also. There is no mechanism for the qes to affect the real economy.

Qe is moving stock prices higher? hmmmm

The dow closed at an all time high of 14,164.53 on Tuesday, October 9, 2007.

Since then we have had the endless string of qe programs.

Right now I see the dow at 13,421. Wow, that worked.

I disagree, botox, steroids and collegen at least do something before they wear off.

Pete

“When Fed buys assets from bank, either bond or MbS, Fed pays cash, which is money, which is used to settle transaction. If Fed buys bond or MBS from bank, which may have lost value, bank gets cash that increases reserve. Bank can lend to borrower against the reserve. This way, the old asset, either bond or MBS, is no longer on the balance sheet of the bank. Bank asset is shrinking but cash reserve is increasing, so it is healthier and free to lend. Bank is in trouble because it has too much bad asset such as loans and defaulted loans, but not enough cash reserve to settle obligations.”

Banks don’t lend reserves. The creation of a loan creates reserves in the banking system. All a bank needs to create loans is credit worthy customers that want to borrow. In our current economic environment, there simply aren’t enough these people to expand the economy.

People without jobs don’t usually borrow money to buy a car or real estate. Businesses that can easily provide the output to meet the current demand don’t hire additional people or expand.

Rumble, I read Cullen Roche MR regularly, and I don’t believe they are entirely true. Bank reserve is cash, loans and bonds are assets. They are not identical. You said that QE is asset swap. that is not accurate. Cash is asset, but asset is not necessarily cash. Band becomes insolvent because it has too much bad asset but not enough cash reserve. Any business dealing is a transaction, and cash is the only way to settle the payment. If you buy anything, you either pay by cash or credit card. If you pay by credit card, the credit card company pays the seller cash at the time of transaction. You will have to pay the credit card company with cash plus interest.

Rumble,

The Dow Jones, was around 7000 in 2008 when the Fed started the QE-1, now four years later it is almost at 14,000, that’s almost double. You can see what Qe-2-3 has done to the stock market. Not much for main street. but it works wonders for gold and Wall St.

10000 baby boomers a day turn 65 and face retirement. I think it’s a modest assumption that 1% of this group have life savings of $500k in a CD somewhere.

That’s still a large number of 100 a day of baby boomers faced with a decision of where to put their $500k of life savings to generate cash flow. If you had $500k in a 0% CD, you’d take it out too. And many will take this money and invest in real estate especially early this year where prices hit all time lows in many areas. They’ll either rent it out, rent to their kids at a discount.

I would be interested to see Bank of America’s total CD depository size and how much that has decreased over the past year as I believe a significant outflow of that have gone towards housing.

Because 0% CD is no longer an option for the low risk savers that needs cash flow, Ben essentially forced a large group of baby boomers to raise their risk level and compete in the real estate market.

So all the savers and fence sitters that frequent this blog, you now have one more group to compete with in real estate, which is the baby boomers’ life savings.

The bottom line is the savers that need and deserve housing the most are the ones being screwed over by Ben.

That’s an excellent angle to highlight, touche’! I wonder if our savvy and resourceful host, Dr. HB, has any avenues for obtaining good hard stats on these retirement nest eggs “forced” off the sidelines?

I don’t know, Jason. A lot of boomers own their homes, free and clear, with no mortgage, or only modest amounts outstanding. Probably a lot more are looking to unload property than buy it.

Most folks want to see some housing price strength to sell into, but many just want to move on, once in retirement. The easiest way to reduce your monthly expenses is to get a smaller house, or better yet, go from house to apartment.

I believe I remember something about four men in the mid 70’s were buying cattle and trucking them to pasture in the Rocky Mountains of Idaho. The activity was an effort to control prices. Cows were crossing state borders . The Department Of Justice served indictments. Two of the men committed suicide, the other two were rumored to of fled to Argentina.

One of the men was a friends father. Never thought to call them “Shadow Cows ” or how about this one ” These cattlemen are too big to fail ” .

I can not see how that activity is any different than this shadow inventory game being played out today. And in broad daylight. In full view of the DOJ and God and everybody !

We have all been desensitized.

Good analysis.

It isn’t just the retirees though. Many folks with money to invest are still spooked by the stock market and frustrated by zero percent yields.

There are a lot of people with a lot of money to invest that are using RE as an alternative to traditional investments.

I agree with your premise but am not sure how this will play out.

First, I know from personal experience that real estate investments are not all that liquid. I had a REIT fund that I made a good amount of money in and wanted to cash out in 2009. The fund had been frozen\locked by the fund managers and I was not able to sell. I had no idea this was possible. I yelled at the advisor and he told me that I had to get on a waiting list to sell my shares. It took over 2 years to sell all my shares. This was at a major name fund institution.

I agree that the Bernanke is forcing savers into higher risk and less liquid assets in search for return. The problem is that risk is not properly priced into the current returns of these riskier assets. The main reason I still work is that I can’t get a reasonable return (6% – 8%) on a safe investment. I believe this is the only reason you see the stock market at near all-time highs during the worst economic times of my lifetime.

I wonder what will happen when we get our next dip in housing because so many “investors†are already real estate heavy. Will there be enough investors to absorb the next down turn? I am not sure they will be able to unload bad investments fast enough to take advantage and support a new bottom…

I was talking to my mom, she is 81, who was a child during the Great Depression. She stated that everyone on her block rented, including her parents. One guy who lived on the street owned most of the houses on that street. That is our future. Everyone will be renters.

My grandmother lived through the Great Depression, and she was reluctant to own rental real estate because she said during that time people had to move in with family or double up and that rental prices went down.

I keep seeing people say that families who have been foreclosed on are going to become house renters and keep rents up. I’m not sure that’s how it’s going to play out.

One thing I noticed on RealtyTrac is that when the house gets to the auction level it is postponed again and again and again. And the preforeclosures are getting less and less. Although some want to wait out those 48 months for the REO to get off the banks books, what I see is most of these are never going to even get to the REO status. The banks are just going to ignore these nonpaying mortgages and drag this out even longer. This can go on forever.

I was looking at some data in markets I watch, http://www.deptofnumbers.com/asking-prices/california/san-jose/ and http://www.deptofnumbers.com/asking-prices/nevada/reno/ . You can see on the 5 year inventory charts, normally inventory will “bounce” at the beginning of the year on seasonal cycle. In 2012 it didn’t happen – the market inventory stayed flat even during summer. Since demand is higher in the summer something had to move – the price.

In any case houses within driving distance of my work still are not at rental parity yet. I hope for a massive decline in price in the next few years because I’m sticking to cash. I looked and looked and all those things that I would hedge with like gold or stocks, have already had a rush of money to them. It’s still hard to tell if we will end up with inflation or deflation in the next 5-10 years, although I recognize that certain things are inflating right now. I’d much rather have an asset, but not when the prices are based on FHA leverage and fierce competition on little inventory.

Twist is trading short term Tbills for long term ones. This effects the 10 year and that effects the mortgage rate down. QE3 is buying crap MBS’s from banks. The banks then take this new found cash and buy TBills. There, problem solved…for a while. Paying face value for a clearly devalued asset helps prop up the price of these assets. $1T per year is a pretty good shot in the arm of the MBS market as well as the treasury market.

Every time the Fed pays face value for a market devalued asset, it is counterfeiting. No rational entity would do this unless they could create money for nothing.

Hey Conejo Valley readers! Look in Trulia. Many new Bank Owned houses listed 450,000 to 720,000 What’s up with that?

The Fed has done what it can to keep interest rates low. Good. Not the income (private production increase side of the economic equation MUST be addressed. Now ideas must be fed into that process which in former decades was always self correcting via individuals and individual businesses maneuvering for additional profit. That is to say, individuals and business must see their way to greater incomes WITHOUT any government assistance. This child must learn to walk alone. If it cannot, then there will be no future. Not one for the child, nor one for the government who is in fact dependent on the child, not the other way around.

seems like a lot of hot air around. i smell another bubble

Leave a Reply to Renter