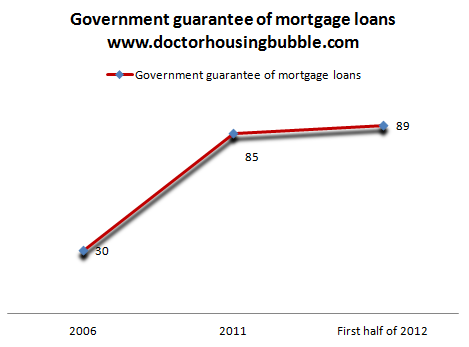

Financing the wealthy homeowner – Government loans helping some of the most affluent US communities. In 2006 Fannie Mae and Freddie Mac backed one out of three loans in top 20-income markets. Today it is 3 out of 4.

One of the biggest ironies of current housing policy is that its initial target was in helping middle class Americans when the actual results have helped upper middle class and wealthier American homeowners get sweeter deals on their home purchases. We have seen this in California for example. We will highlight some new data released on the housing market but the fact of the matter is current low rates and government guarantees of massive mortgages have aided wealthier Americans to purchase more expensive homes. So what you may say? Well, these loans are heavily subsidized on both ends. First, the interest rate is low courtesy of the Fed massively buying up MBS in the market. Next, you have many of these homeowners maxing out on the interest tax deduction on the back-end. Many homeowners that own the median priced home of say $150,000 in the US don’t even get a big bang for their buck once you factor in the typical standard deductions. Let us take a look at some of the data.

Government backing of housing market a boon for wealthier homeowners

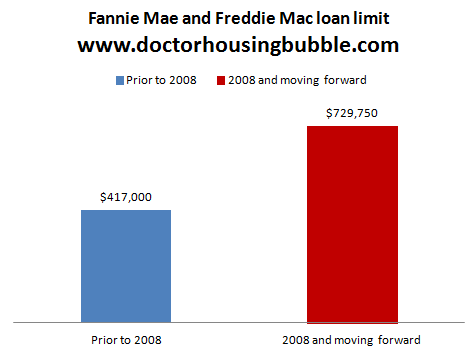

Back in 2008 when the housing market was imploding and Americans were strapped for cash (they still are), the government snuck in a policy to insure loans all the way up to ridiculous levels:

With home prices crashing and adjusting as needed, why the need to double up on the amount the government was willing to secure? This never made sense. After nearly five years of policy, take a look at some examples of where the benefit is going:

“(MSNBC) Julie Wyss earns $330,000 a year selling real estate in Silicon Valley. When the time came to look for a new home for herself, Wyss settled on a four-bedroom, three-bathroom house in Los Gatos, California, an enclave of young technology entrepreneurs. It has about 2,400 square feet of floor space, four sets of French doors and a price tag of $1.45 million. When she bought the house in June, her main financing was a $625,500 mortgage from Wells Fargo guaranteed by government-backed Fannie Mae.

The benefit to Wyss was an interest rate, of 4.125 percent, that was lower than she could have gotten on a loan that was not guaranteed by the government. “It’s a totally sweet deal,” Wyss said.â€

Why are we helping finance a $1.45 million purchase? More disturbing is that the higher the loan and with higher incomes, there is more of an opportunity to itemize deductions and max out on those interest payments. For example, let us run the interest payment on two examples:

Interest rate at 4.125 percent:

$150,000 mortgage (interest payment)Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,139 (year one)

$625,500 (interest payment)Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $25,599 (year one)

The standard deduction for a couple is currently at $11,900. This is where most of the public is duped into thinking the mortgage interest deduction is really for them. In reality, it is a big subsidy for people like Julie above that buy million dollar homes and finance a portion of it with government subsidized products. They can also deduct insurance and other items that are costlier on a higher priced place. Glad we’re helping out the middle class! This is where the mission of loans like the FHA have gone complete astray.

Why compete when the government owns the market?

What is now occurring is the government pretty much dominates the entire mortgage market:

Even in 2012 with the market reviving, the banks are keeping their hands off the public and would rather funnel these government backed mortgages out like pancakes. The refinancing fees have provided a nice steady stream of revenues. Think this is an isolated case?

“In 2006, the two entities guaranteed only about one-third of new mortgages in the 20 highest-income mortgage markets in the country. By 2010, that share had risen to about three in four, the data showed. In the 20 lowest-income markets, the shares also rose to about three in four in 2010 from about one-third in 2006, the analysis showed. The figures were from large markets, those in which 2,000 or more new mortgages were taken out in any year in the period.

The figures do not include loans by the Federal Housing Administration, so the total share of government-backed mortgages was even higher than the data suggests.â€

Hah! So back in 2006 when home prices were peaking, Fannie Mae and Freddie Mac guaranteed roughly one out of three loans in the 20 highest income markets. By 2010? It was up to 75 percent! And as the caveat above shows throwing in FHA insured loans and the percent moves much higher. I’ve been very vocal that there was absolutely no reason to insure loans at such a high level. They could have capped any government backed loan to state median home prices for example. Any tiny market where prices are over inflated would need to get a piggy-back loan from a bank at a higher rate. Why should the taxpayer subsidize this nonsense? This policy would cover your middle class American but wouldn’t give massive kick-backs to people buying homes from say $700,000 and getting excellent tax breaks. This policy has helped keep certain markets inflated and the data above simply backs this up.

“Nevertheless, many academics and some lawmakers have said the government should lower the limits on the size of guaranteed mortgages gradually, a strategy that may avoid disrupting the housing market while at the same time testing the readiness of private capital to supply more of the market on its own.

It’s an idea that appeals to affordable-housing activists such as John Taylor of the National Community Reinvestment Coalition, who says Fannie and Freddie should only back mortgages for lower- and middle-income families. “Nobody I know buys a house for $600,000 or $700,000 who isn’t affluent,” Taylor said.â€

I wonder if people even fully realize how these tax deductions work? I doubt it. The markets have been hanging on the word of Ben Bernanke for months and not a 30 minute segment was dedicated on the tube to discuss Quantitative Easing III. This is a big deal. The Fed just stated that they will purchase up to $40 billion a month in MBS until they see fit! And earlier in the week we heard that household income fell yet again and adjusting for inflation, is now back to levels last seen in the mid-1990s. The solution? Cheaper debt for everyone! The policy of guaranteeing massive mortgages is nonsense and should be completed revamped. No need to get rid of it. Cap it off at the state median price or even better, at the nationwide median price. Then let banks fill the gap and see how responsive they are to helping out the public. They rather blow the bailouts on speculating in the stock market (up over 100 percent since March of 2009) instead of the housing market (even with price gains is still down 30 percent from the peak).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

37 Responses to “Financing the wealthy homeowner – Government loans helping some of the most affluent US communities. In 2006 Fannie Mae and Freddie Mac backed one out of three loans in top 20-income markets. Today it is 3 out of 4.”

And, have you noticed that both candidates haven’t even mentioned this near crime? Hell, one owns more homes than he could probably tell you without counting with his toes, and probably games the tax system for a nice little savings. We’ve learned that he’s real good at gaming taxes. Lord only knows what we’d learn if he released the data, finally.

Hey Mike: If you are trying to infer that Mitt Romney needs financing on any property he has bought then you need to apologize–a man of his success and wealth

doesn’t need the “Gamed” system so aptly described in the this great article and besides that he is a man of great integrity who has CREATED wealth for himself and tens of thousands of individuals honestly by building companies to employ people and not just

a few paper pushers on Wall Street.

http://www.alternet.org/election-2012/matt-taibbi-reveals-how-romney-made-his-fortune-it-aint-pretty-and-he-shouldnt-be

The Zuck is worth Romney X30 , yet he financed his modest $4 million home on an option arm.

Wow, Tom S, you should read up on the mechanics of private equity before you post on the matter again. Much of their money is made gaming taxes, It’s a very important component of that process. Also, ask yourself, why would a Great American like Romney have millions stashed (from what we know of) in accounts in the Cayman Islands?

thas right.

HEY, WILLARD N MINI MITTS, REVEAL YOUR TAX RETURNS……WE’RE WAITING

How long did it take Barry to show his birth certificate?

What do you expect? Money talks…nobody cares about or wants to finance the ghetto.

That is good and all but the politicians are flat out lying in collusion with the banks and the GSEs. The FHA under HUD has this overall mission statement:

“HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all. HUD is working to strengthen the housing market to bolster the economy and protect consumers; meet the need for quality affordable rental homes: utilize housing as a platform for improving quality of life; build inclusive and sustainable communities free from discrimination; and transform the way HUD does business.”

Rents are going up, larger metro areas are seeing bidding wars, and many middle class families are going broke. That is to say FHA under HUD is doing everything but their mission statement.

Well, “if the government managed the Sahara desert, it would run out of sand…”

Amazing how perception becomes anchored. Subsidizing home buying through the interest deduction is wrong, all together. To only do it for “low income” people is still wrong.

If you want to help certain income groups (still wrong, btw), stop subsidizing housing all together and it will become more affordable.

Agreed, we do the same thing to lower end borrowers that we are arguing against with the more affluent borrower if we lower the limits to just the poor to middle income Americans. I think everyone is trying to use that as some sort of compromise. It makes more sense to just end the housing subsidies, we don’t solve everything with loans.

Obama, Romney, blah blah blah…sounds like a parrot making noise…hilarious. News flash…the only time politicians care about the middle class is election time. Otherwise, their primary concerns are banks, Wall Street, Unions and more rights and benefits for illegal immigrants (future voters with a growing population). Most legislation approved by the majority eventually is overturned by some judge, so resistance is futile. Just go to work (if you still have a job), pay your taxes and shut up. Nobody cares. That is all.

The FED has laid down the gauntlet. As Steve whatshisface said on CNBC, the FED has thrown the kitchen sink at the economy and has basically said, they will throw the stove and refrigerator too if they have to.

What that means is, sub 2% 30 year fixed is in the cards unless somehow the world economy ignites, which is highly unlikely.

The FED is all in and I think we will be in a mess like this for many years to come. One of three things will bring an end to this, an improving economy or a significant inflationary event that includes wages or lastly, a resumption of the debt collapse that the FED has up til now thwarted..

The FED is in unknown territory. If you all remember Long Term Capital Management, it was a hedge type fund created by a couple of Nobel Peace Prize winners in economics. The untested economic model they came up with could not fail. We all know the history on that one. Untested economic theory is now in play at the FED and it is full speed ahead. The outcome could work or the entire financial system could come tumbling down. The FED has nothing to lose by throwing the sink, stove, refrigerator or even burning down the house because the current economic model of the last 40 years in no longer sustainable without something big happening.

That something big is coming from the FED because they think that is preferable to the something big that would come from the free market.

Actually, I shouldn’t have included “an improving economy” as one of the things that will bring sanity back to the FED.

The only way the economy could improve is with artificial stimulus, so as soon as they stop the stimulus, the economy would turn down again. In other words, now that they started, it is unlikely it will ever stop.

> Back in 2008 when the housing market was imploding and Americans were strapped

> for cash (they still are), the government snuck in a policy to insure loans all the way

> up to ridiculous levels:

That is one interpretation of it. Another interpretation is that in some areas of the country (e.g. Santa Clara, CA, which is by no means anything nice) you couldn’t get a house for $417k. You couldn’t get a house for $600k. It is a government program for lower income families that simply didn’t function for those areas. Now, it works for areas around San Jose. Before, it didn’t.

>With home prices crashing and adjusting as needed, why the need to double up on

> the amount the government was willing to secure?

Because the banks stopped lending almost entirely for a while there. It was a program designed to prevent the economy from being in a power dive, rather than simple free fall. I think it was money well spent. I really don’t see why you think this is broken, DHB. I don’t like private banks. I don’t think they have our collective best interest at heart. They seem to be in large part responsible for the housing bubble, through reckless lending. I see no reason why they need to be the sole providers of housing capital. If the government wants to undercut them and drive them out of the housing market, then great! Printing money is something the government can do better than the banks.

> The solution? Cheaper debt for everyone!

Yeah, well there I agree with you. Debt is not good. I’d rather we spent $40B/mo. on something likely to have a real economic return, like infrastructure spending. Lets lay fiber to the home, fix the roads / bridges and increase the NIH / NSF / DoE budget for grants.

> Why should the taxpayer subsidize this nonsense? This policy would cover your

> middle class American but wouldn’t give massive kick-backs to people buying homes

> from say $700,000 and getting excellent tax breaks. This policy has helped keep

> certain markets inflated and the data above simply backs this up.

The intent here is to make banks extremely profitable for long enough to recover from systematic losses from bubble era debt, and resume their previous role. Inflated prices reduce bank losses they would otherwise take when unloading foreclosed homes. What percentage of homes are REO owned? What percentage should it be? There’s your problem, not the government. Letting prices sink to market equilibrium would make that problem worse. The subsidized higher prices we currently “enjoy” give people an out when they can’t pay for their house anymore due to unemployment. They can sell. There lies the purpose of the government. It isn’t here to make money on every loan. Unlike banks, it must take into account the best interest of the citizenry, and that is good.

“I don’t like private banks. I don’t think they have our collective best interest at heart. They seem to be in large part responsible for the housing bubble, through reckless lending.”

Wow! You are obviously a collectivist/socialist/communist! That aside, are you saying that government had no part in this bubble? So, the Fed’s artificially lowering interest rates and keeping them artificially low had no impact? And, government mandating banks to sell a certain percentage of sub-prime loans to keep their charter had nothing to do with the bubble? I agree banks played a part but they aren’t the only ones that created this bubble.

Now, are you telling me government has “our collective best interest at heart”? What government doesn’t eventually govern for the powerful? Government is just as corrupt as private institutions. How many politicians are currently spending time in jail? There is plenty of corruption to go around…

The intent here is to make banks extremely profitable for long enough to recover from systematic losses from bubble era debt, and resume their previous role.

What role is that? In 1999, Clinton signed into law with bi-partisan support the repeal of the Glass-Steagall Act. The Act originally passed in 1933 and outlawed Banks from getting into the investment business. Guess what! Obama blamed the mortgage crisis on the repeal but 2 years ago did not approve its repeal with latest banking regulations. Therefore, gambling continues by Banks.

Inflated prices reduce bank losses they would otherwise take when unloading foreclosed homes. What percentage of homes are REO owned? What percentage should it be? There’s your problem, not the government. Letting prices sink to market equilibrium would make that problem worse.

Actually the lesser of the two evils would have been to let the bubble pop and not intervene. The government took the most evil route to only protect the banks by printing tens of trillions of dollars out of thin air and it is now causing widespread worlwide inflation in food and fuel prices. Have you been to the grocery store or gas stations lately? Have you seen the price of precious metals and commodities? Global food inflation is up 10% in one month!!

The subsidized higher prices we currently “enjoy†give people an out when they can’t pay for their house anymore due to unemployment. They can sell. There lies the purpose of the government. It isn’t here to make money on every loan. Unlike banks, it must take into account the best interest of the citizenry, and that is good.

No way. The government is doing what is in the best interest for the Banks and printing money out of thin air to buy their financial feces backed by us taxpayers.

> [The banks would] rather blow the bailouts on speculating in the stock market (up

> over 100 percent since March of 2009) instead of the housing market (even with

> price gains is still down 30 percent from the peak).

Yup, which is why the Fed is buying mortgage backed securities, specifically. It is better to buy off the toxic assets that are causing banks to be unhelpful, than just give them free money. After you give them free money, the banks go blow it on the lottery and still hold the toxic debt. Buy the toxic debt and it is no longer a problem for the bank. They will still go play the lottery, but there is not much you can do about that except restore Glass-Stegall. It is, at times unfortunately, a free country.

<>

Dr HB, you are correct in doubting they understand considering over 60% of all American adults cannot multiply 75×13 correctly. How in the world can they understand the finances of buying a house?

Most potential buyers walk into the house and say, “I like the wall paper…I’ll buy it!”

Here is a great take on QE3 and the mortgage buying the govt will undertake. I have been following Peter Schiff for about 7 years and he has been 100% right with all of his predictions.

http://www.youtube.com/watch?v=LS879r7xeLc&feature=youtu.be

I follow Peter too. He speaks the truth which is basically common sense which many do not have, even the most educated.

BUT….Peter has not been 100% correct.

Schiff was big on decoupling and that was totally wrong.

Then you haven’t been following him carefully enough. He strongly recommended his firm’s funds which invested heavily in foreign stocks, thinking the mortgage crisis would devalue the dollar. That fund got crushed in 2008 2009.

No one is 100% . You have not been following nearly as much as I have. I still remember his call that when silver went up to 49. last year he said worse case it would go to 40 then blast back through 49 in a few months. I thought that was too bullish and it was, silver went down to 27 and is just now back to 34.. Anyone who followed that advice lost big time. Although generally, his is correct, Silver is a good investment long term but not right after it just went up 400%.

The point is, his general view is absolutely correct, his calls, generally correct but not 100%.

Schiff is a gold peddler and an aspiring politician. Keep that in mind.

Um, no. Schiff has not been right. A decade ago he was saying hyper-inflation was imminent. Not regular 5%+ inflation, but hyper 25%+ inflation. Schiff can forecast the future no better than any other economist or financial mouthpiece.

Question for the Doctor.

Given the state of the US governments finances, at some point won’t the mortgage deduction be revised or eliminated? For instance, Paul Ryan has discussed visiting the mortgage interest deduction elimination as part of a grand bargin to address the entitlements issue… Doesn’t that put some of these people with high interest costs and their home values at risk?

With 3% mortgages, the interest deduction is becoming less and less important to the average Joe.

Hopefully the MID can be curtailed as time goes on. Allowing interest on a 1M mortgage to be deducted is ridiculous. If the conforming loan limit is 417K, then the line should be drawn there. I really doubt anything will come of this, kind of like reforming social security…political suicide.

Got something all you people in California and the border might one to think about. You have a very large timebomb sitting on your doorstep.

No inflation here. Cost of food.

Just purchased a one pound bag of pinto beans in a chain Mexican grocery (San Francisco de Asisi) in Merida, Mexico.

Cost: 24 pesos, roughly two dollars at today’s peso of 12.6

Minimum wage Mexico: 55 pesos a day, if you are lucky enough to have a job.

Same product in Walmart USA

One dollar a pound

Minimum wage around $60 a day

Beans cost .016 percent of daily wages

Beans cost in Mexico .50 percent of daily wages

What do you think will be the result of this?

SAME THING IS HAPPENING ALL OVER THE WORLD

TRY THE MIDDLE EAST

Jeff asked, “What do you think will be the result of this?” [beans costing more in Mexico]

Most likely, the result is that the USA dollar will eventually lose its world reserve currency status. Then, beans will cost a lot more here, and a little less there, until there is no difference, except to factor in the efficiency of the retail chain.

Actually, you can see the destruction of the USA dollar right before your eyes. Ten years ago, gasoline was around a $1.25 to $1.50/gal, I think, and silver was $4.50/oz, so with one ounce of silver you could buy 3+ gallons of unleaded.

Now gas is $4 to $4.50,depending your city/state, and silver $34, so you can buy 7 or 8 gallons of unleaded gas with the same ounce of silver.

The reason why housing isn’t going up in dollar price is that wages are flat (or even dropping a tad), so everyone is getting squeezed and can’t save up a down payment or repair damaged credit scores, and therefore can’t buy houses.

Doctor Housing Recovery,

You missed the real joke! “Julie Wyss earns $330,000 a year selling real estate in Silicon Valley.” How does a real estate agent anywhere add $300,000 value to an economy? Two week training course and multiple choice test and off you go? Wow! We are in for some real hurt!

Riddle me this,

Why do we need QE4(we need to remember that operation twist counts) if we are in recovery? Ben is speaking out of both sides of his mouth! Why is he committing to endless monetary stimulus if we are on the road to recovery? He knows the danger of increasing the Fed’s balance sheet. He must see something on the horizon that is not discussed on the evening news. I think we should be very afraid that we are being told everything is fine while the Fed continues to take extreme actions. I have a bad feeling that this is not just election time actions to make things look good for the next two months…

They should take away the mortgage tax credit for anything over a conforming loan. The 1% don’t need a tax credit, incentive for home purchases. Give me a break the 1%-Jumbo loan people don’t need this credit but they benefit the most from it considering their incomes/tax credit dollars they receive. Joe lunch box barely gets a bump tax credit wise and the rich make out hand over fist. In many cases the 1% can buy with cash but choose not to. Why pay cash when you can get the government subsidy to buy an even bigger and better house? If you are the 1% or have a jumbo loan you don’t need this hand out.

Is there any other nation in the world where the government controls and finances the mortgage market?

This is what will happen to health care: endless tinkering, unforeseen consequences, unfairness, waste, rent seeking.

But the goverment did cut back in 2011!

The new limits, which will vary by locale, apply to loans backed by government-controlled Fannie Mae and Freddie Mac, the two largest mortgage-finance companies in the country, and the Federal Housing Administration. Together, they currently buy or guarantee about 90 percent of all mortgages. Starting in October, 2011, the maximum eligible loan will fall to $625,500 from $729,750. http://www.bloomberg.com/news/2011-06-28/banks-appetite-for-jumbos-may-soften-blow-of-new-loan-limits.html

I agree with prior post here that The Bernank is up to something big with QE3 and beyond. I wonder if it has something to do with the PETRODOLLAR (see video).

http://www.youtube.com/watch?v=P02vjiEZyUs

Leave a Reply