The search for the smallest home in Los Angeles currently for sale: 3 properties in various parts of L.A. Washington Mutual sins still relevant in 2015.

Whenever the mainstream press talks about the housing market they rarely provide pictures of the crap that is selling. They speak in overall glossy trends with flowery language but fail to put a picture to what is actually selling in the market. The rent is already too damn high for most in SoCal but many continue to live paycheck to paycheck enjoying the glorious weather and sipping on frappuccinos even if it means sleeping with roommates in bunk beds to cover the rent deep into your 30s and 40s. Apparently the sun wasn’t shining in 2007 when the market went bust. The momentum from 2013 and 2014 has definitely hit a wall as hipsters move into gentrifying neighborhoods crossing their fingers a Whole Foods market will somehow turn their bet into a quick profit. Again, I probably don’t need to remind you but you actually need to sell your place before cashing in on that equity. Today we’ll take a look at three homes currently selling in the Los Angeles market. These are active listings and you can go on out and buy them right now. Do you want to be priced out forever? Make sure you lock in the sun, beaches, freeways, and avoid being priced out of your next hood.

Washington Mutual you naughty bank!

Some of you might remember Washington Mutual. They were a great no frills bank. I enjoyed having an account with them. Of course they decided to take this great reputation, place it on the back of the MetroLink and ride the housing market off the rails. At one point people were doing bank runs at good old WaMu. Then again, this is ancient history in the land of financial amnesia. Human nature has evolved away from greed and speculation since the Great Recession ended. We have learned every single lesson to be learned and will never speculate on housing again. Cross our fingers!

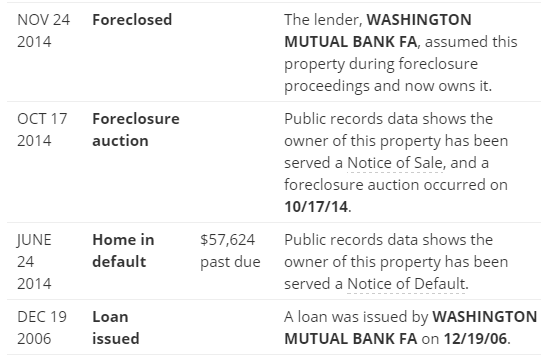

WaMu was doing some shady loans. Take a look at this property which looks like someone HELOC’d their way out of a home:

4124 Manor Ct, Los Angeles, CA 90065

1 bed, 1 bath 465 square feet

“Cute LA bungalow!! This home has been completely updated with love! Brand NEW flooring throughout home, new interior and exterior paint, NEW custom kitchen cabinets and lighting. Don’t miss out on this opportunity to own a property in this up and coming area! Mature drought resistant landscape and great backyard perfect for entertaining. Extra storage available in backyard shed and exterior cabinets.â€

So cute! 465 square feet is tiny. What in the hell was WaMu thinking leveraging this place up? This place is listed as a foreclosure but the history is telling:

Bwahaha! The place was past due to the tune of $57,624! That is a LONG time of not paying your bills. For a 465 square foot property in a not so stellar area, this is ludicrous. Of course WaMu was swallowed up into the belly of Chase. This place can be your home for the modest price of $339,000. $729 per square foot is insane for this area but hey, some people enjoy living in closets. Let us move on to the next property.

All cash players only!

Normally when you see places for all cash you are looking at some top notch prime level homes. In this case, you will need all cash because the place is beat up:

227 W 62nd St, Los Angeles, CA 90003

3 beds, 2 baths 625 square feet

“Perfect for Investor/Developer. This property is in need of major upgrades/repairs. and will not qualify for traditional financing. Buyer must be all cash. Front unit (227) has a bonus room. Bonus room is not included in the square footage. Permit status of the additional room(s) unknown. The property is being sold in “as is” condition, Buyers to verify the condition and all permits.â€

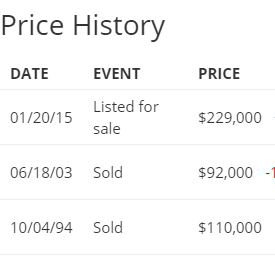

3 beds and 2 baths on 625 square feet? I love how the ad talks about a bonus room. Of course the permit status is “unknown†but a good way to Airbnb your way into millions. Look at the price history here:

Over a period of a decade this place lost money. This place sold for $110,000 in 1994 and then in 2003 for $92,000 (that price sounds about right for this place). It is now listed for $229,000. Of course you’ll need all cash and those all cash investors largely exited California in 2014. The ad mentions that it needs major repairs which means it needs MAJOR REPAIRS. If you believe some people every area is going to gentrify so no worries here!

Time to get high   Â

I love listings with all caps. The deal is so good they need to yell to get that point across:

522 Toledo St, Los Angeles, CA 90042

1 bed, 1 bath, 576 square feet

“ADORABLE, RENOVATED BUNGALOW IN REVITALIZED HIGHLAND PARK NEIGHBORHOOD. 15 MINUTES TO DOWNTOWN … 10 MINUTES TO PASADENA … DODGER STADIUM ONLY MINUTES AWAY! WONDERFUL ALTERNATIVE TO CONDO LIVING AND NO HOA! MOVE-IN CONDITION. ONE BEDROOM & ONE BATHROOM PLUS A BONUS ROOM WHICH COULD BE 2ND BEDROOM. TILE & HARDWOOD FLOORING THROUGHOUT. NEWER A/C & HVAC, NEWER ROOF, TOO! SHOPPING, METRO & MANY AMENITIES WITHIN SHORT DISTANCE.DON’T MISS THIS ONE!!!â€

I love this ad. So a selling point is that it is 10 minutes close to Pasadena. Sure, you’ll need bars on your window but go down at night knowing you live 10 minutes away (with no traffic) to Pasadena. Dodger Stadium close by? Have you gone to a Dodgers game? Coming out of a game is like exiting a Wal-Mart on Black Friday. You do realize baseball has 162 games in a season and half are played at home. I’m sure it’ll be nice and calm on those game days. Of course, the ad also rattles off every SoCal selling point.

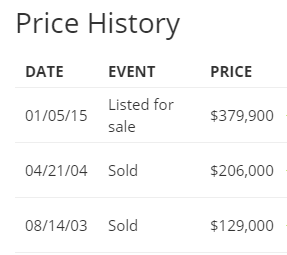

Let us look at the sales history here:

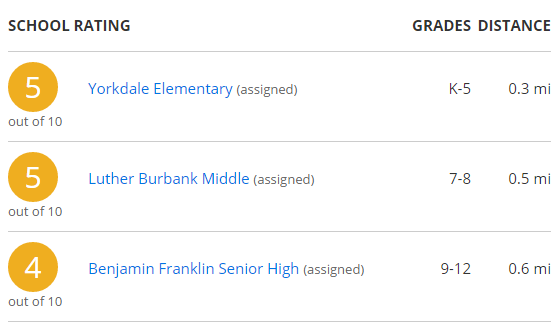

$379,900 for this place. All this nonsense that people stay put. The people that bought in 2003 hit the eject button in six months. Apparently the selling points weren’t all that great. The 2004 buyers have a bit of a buffer and with the HGTV upgrades, are strategizing their exit as well. And here is the rating of schools in the area:

Screw the kids and enjoy the hipster lifestyle!

When you hear about the “hot†SoCal market remember these places as well. People sometimes forget that they have the choice of not buying. Some would rather live in storage unit sized properties with bars on their windows just to claim that they own a home in SoCal. You don’t own jack until the mortgage is paid off (ask those WaMu folks who owns their place). In reality though, people are eager to buy and don’t want to miss the boat because they are greedy. Simple human nature. They don’t want to miss the next rocket ship of appreciation so they can flip it to the next lemming buyer in a few years. Boom and bust central and somehow every buyer is a Nostradamus when it comes to price. Pause for a second and look at these places. Use some common sense and try not following the herd. Just because someone is willing to pay the current price doesn’t mean it should be you.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “The search for the smallest home in Los Angeles currently for sale: 3 properties in various parts of L.A. Washington Mutual sins still relevant in 2015.”

These places are a STEAL! We’re in L.A., the BEST city in the world. Hip, COOL and trendy with the best weather and amenities!!!

Buy now or forever be vanquished from the market!

There. That just about sums up what Real Hoar is going to say.

This just proves that people have a brain that’s smaller than a rodent. Oops, that an insult to rodents.

Okay, what’s so hard to see about this Bubble? Prices are way to high just because every other person in the world seems to think that they can “invest” in real estate and become rich.

Did it ever occur to anyone that real estate really doesn’t have much intrinsic value? Except for land that can be farmed, has clean fresh water, oil or other useful minerals, the value of most land is arbitrary. Think about that.

Unlike the value of a Boeing 757 or Chevy or the services of a neurosurgeon.

That’s why real estate speculation exists since people can be suckered into believing just about anything!

So what are you waiting for?

zzy: “real estate really doesn’t have much intrinsic value? Except for land that can be farmed, has clean fresh water, oil or other useful minerals …”

You forgot PROXIMITY. That’s a real value to land, whether you want to call it intrinsic or not.

Proximity to jobs, entertainment, culture, good weather, a fiscally sound municipality, retail, and people.

The PEOPLE in your proximity, who your neighbors are, is a real value to land. Is the land situated among safe, affluent people, who can pay high taxes for extensive services? Or among poor, dangerous gang-bangers?

The proximity value of land might change over the years, but rarely overnight. And the other things you list — a land’s access to good soil, fresh water, and minerals — can likewise change over the years.

There’s a reason some people would rather buy a crapbox in Santa Monica, when they could instead buy a mansion for the same amount in Portland. (Although this Santa Monican is increasingly considering the Pacific Northwest.)

It’s like that movie Elysium with Jodie foster. Who are your neighbors

The fact that land value is influenced by anything “proximate” demonstrates that land values don’t have intrinsic value. Intrinsic values are not dependent on other factors, proximate or not.

A Boeing 757 is worth $60,000,000 (or whatever) because it takes lots of resources to design and build it. A 757 isn’t worth 6,000 one day and $60 Billion another. The value of a 757 doesn’t change if it’s sitting on a ramp in Sudan or at LAX.

Land on the other hand, can be worth just about anything, in fact it’s clear that land values are almost arbitrary. Why? Because land values are a product of speculation.

That’s how people get rich, from speculation schemes. It’s the aspect of our economy that’s going to kill us one day. Because it’s all based on GREED, and greed is as old as the Bible.

The value of ANYTHING changes greatly based upon it’s demand and usage. So yes, it can be worth differing amounts to different people. Just like housing in premium markets like SoCal

“enjoying the glorious weather and sipping on frappuccinos even if it means sleeping with roommates in bunk beds to cover the rent deep into your 30s and 40s.”

YES.

And who says it’s about investment? To me, it’s about being a part of the place the rest of the world envies. “Oh my gosh, you live in California?!”

Yes I do. I live in Los Angeles, California, the place everyone wants to be and dreams about.

So great you spend all your time commenting on a housing bubble site. Like a realtor without much to do.

Really we can debate the good and bad things about living in SoCal, but it still boils down to economics. I know Mark Hanson’s blog posts have been shared here before, but I’ll go ahead and share it again as he updated it late last year. If you like numerous great points with actual data and analysis to back it up, here it is again.

http://mhanson.com/archives/1674

I don’t know about you, but when my friends and relatives from other states and even other countries come to visit LA, all they say is “What a dump! Are you sure we are not in Mexico?”.

“I live in Los Angeles, California, the place everyone wants to be and dreams about.”

Realist, the word “everyone” includes me and it is not true. I don’t want to be there and I have nightmares (not dreams) about it. I used to live there and I am glad to be out.

There many places way nicer and with better weather than SoCal. Likes and dislikes are subjective. The tastes are as varied as there are people. Everyone (and I mean everyone) has diferent likes and dislikes.

To each its own….

Never wanted to live in LA, I wonder why… is it jealousy or envy? You tell me, the smart guy.

Hunan, your argument is self defeating. Everyone comes to visit, yet you say they dislike the place. It makes no sense, and coincidentally they are coming to one of the most visited and popular cities in theworld. So yeah, we’ll let you tell it.

Observer? What are you doing here??? Burn!

Flyover, name a place with better weather. And no its not subjective, its human vote count. And 40 million vote Cali, plus 1 MILLION tourists any given day.

Bam.

Realist, people do not dream about living in Los Angeles. They dream of living in the fictitious Los Angeles depicted on their TV screens.

When I was growing up in New York in the 1970s, I saw L.A. on TV, in such shows as The Rookies, SWAT, Marcus Welby M.D., Medical Center, Dragnet, The Brady Bunch, The Partridge Family.

It seemed the good life was in L.A. Beautiful people, attractive homes, pristine streets. Cars always moving on sparsely traveled freeways.

The reality is different. The L.A. of 2015 is not quite Blade Runner, but it’s not the 1970s TV L.A.

All those people worldwide who want to move to L.A. — what they really want is to move into their Hollywood-fueled fantasies of L.A.

Exactly. Son of a landlord said it perfectly. People love the idea of LA, the reality is much different. People see Hollywood, Malibu, Beverly Hills, etc. on TV and think all of LA is like that. But when they come here they are disappointed to learn that the vast majority of LA is more like Tiajuana then Beverly Hills 90210. I have experienced this 1st hand with many 1st time visitors to LA.

BTW, Realist there are much nicer places in Cali then LA. If you don’t know that then you are either delusional or grossly ignorant. I believe that the majority of people here are because of work.

I think, LA is overrated. I blame Hollywood for that 🙂 🙂 🙂

My neighbor from New York must’ve seen too many movies about L.A. with palm trees cause when he bought the house he planted many. He doesn’t realize they drop little beads that stain the driveway and are a mess to clean up, but they’ve been hypnotized by the “fictional” version of Socal.

What $749,000 buys …

In Santa Monica: https://www.redfin.com/CA/Santa-Monica/1319-Chelsea-Ave-90404/home/6768369

In Portland: https://www.redfin.com/OR/Portland/8616-NW-Mendenhall-St-97229/home/26625649

Great price comparators. I was really surprised by the ‘relatively’ inexpensive Portland property.

North Carolina

Part of the lower pricing is that Portland doesn’t have near the quantity of high paying jobs to support extensive development of million dollar homes.

Those homes are in an area with a lovely view, but they’re also not exactly in the ideal place either for getting downtown, to Nike, or Intel. People willing to deal with the commute have other competing high end options – for a commute downtown in that price range personally I’d rather commute from Laurelwood.

Yeah…but…then…you…have…to…live…in…Portland.

A nice place for the ‘2nd place’ crowd.

Realist. If you want some crowing about a 2nd place crowd, here it is.

I guarantee that in real life you are a loser, two bit sales person driving a leased luxury car and making it paycheck to paycheck trying to hustle other suckers so that you can eat and pay your child support. I bet that you have a mortgage and I bet that you think going to Cabo San Lucas for some jet skiing once a year is the highest form of human endeavor. Meanwhile, I’m sitting on a large pile of cash about to bail out of my rented luxury home and am going to spend the next year living in various rented villas in Europe while overseeing my actual investments. (yes, it’s actually cheaper than living in LA) I might come back to LA or I might live in New York, Barcelona or Rome – all of which make Los Angeles look like a squatter’s camp under the freeway. Even Portland, Savannah and San Francisco achieve that.

Point is that there are many great lives out there to be had. It just takes a little imagination and some independent thinking. Save the infomercial bullshit for the newsletter that you mail out to suckers on your prospects list.

But, but…. I thought it was all about SoCal blog, where you cannot talk about North West…

/sarc

BTW, I like WA wine much better than Californian. Always buy Columbia Valley wine, Woodinville Rye and Jin. Now you tel me what you have that we, the secondary people north west people, don’t. And don’t event start on that weather BS.

Our family has lived both in LA and in Portland. Traffic is bad in both cities. Housing in Portland is expensive in the prime areas with views. Portland has much cleaner air than LA because of all the rain. Portland is probably more livable for someone with a family than LA. We escaped from both cities and don’t really miss either.

Funny, I actually looked at this place in Portland.. even though I would normally not even consider that area..

But seriously, you can’t compare the location to Santa Monica. Not even close.

https://www.redfin.com/OR/Portland/1311-NE-Knott-St-97212/home/26490546 this is more like it..

I found out that even in Portland in prime areas I can’t get what I am looking for under $1mil.

UnRealist and sun of a Californian beach 🙂 are famous for comparing apples to oranges.

We’d rather live in NW Portland. The Irvington neighborhood in NE Portland is fairly nice, but there are some sketchy areas in NE Portland. The worst area is SE Portland.

http://www.wweek.com/portland/article-18071-the_other_portland.html?current_page=3

Location, location, location 🙂

SOL,

That demonstrates exactly what I said above – every person is different and with the same amount of money they like diferent choices.

Only Realist lives in his own imagination that “everyone” likes exactly what he likes and live in the same place where he is, because he is his own God and measure for everything. He is the REFERENCE and if you don’t like the same think he likes and you don’t live in the same he likes that means you are a second rate citizen. What a buffon and self absorbed person!….He is simply ridiculous.

Whatever, I have the housing market figured out.

You don’t achieve top commenter on this board through audacity. Excuse me for being the host with the most.

>> Brand NEW flooring throughout home, <<

Considering the house only has 465 sq ft., how much could all that NEW flooring have cost?

No greedy is the folks who own are not listing their homes for sale.

My friend just unloaded his shack with that purpose, agent told him the most he would get is 600k, he said screw it, put it up for 825k, well he just got 800k.

Now that cat is smart and not afraid to take profits.

Here is always the endless supply of greater fools 🙂

Greedy? For not selling their houses for any number of reasons ? That makes no sense at all. Nothing greedy about it. Couldn’t be they’re happy where they are could it? It’s not your property to keep or sell. They’re not doing anything to you or anyone else.

Envy: pretty toxic way to view other people’s lives.

“ADORABLE, RENOVATED BUNGALOW IN REVITALIZED HIGHLAND PARK NEIGHBORHOOD.”

Yes.

Instead of commuting to Lake Elsinore, why not push the trash out to Hemet so we can live in the city? Makes sense to me.

I have nothing against Lake Elsinore, it’s nice, and many people like their piece of the dream out there. New suburbia has it’s benefits, and living in Los Angeles has it’s benefits. And those benefits beast Phoenix, Dallas, Atlanta, Chicago, NYC, and every other miserable weather town in this country.

I think that you are really “What” and this whole thing is internet performance art. Being ironic and sarcastic didn’t get you there. This character, The Realist, just might…

This article is all about the tiny house “movement”…for the banks that is!

I’ll guess someone will come along shortly and post about how one of these places might be a great income property.

Recently heard of two tragic fires in SoCal…I believe one residence housed 21 people, the other, 17? Not sure if these were rentals or the properties were owner occupied, but I’ll guess large numbers of people living in a single residence is hardly uncommon nowadays, especially in SoCal. The issues and liabilities that may arise from these type of situations are something a future landlord may want to think long and hard about before investing in some “no brainer cash cow”. Just my humble opinion.

Hosing to tank hard in 2015

Hey, Jim Abyss, housing will not tank in 2015. I wonder, Draghi just launched QE in EU which will pull T-notes down even moar!!! meaning the mortgage rate, most probably, are headed south for the rest of the year. The FED is to announce the rate hike delay any time now, and, probably, QE4 by the end of the year. 2015 is wishful thinking, looks like we have some chance in 2016, I even kind of start thinking of 2017 now. Anyways, I got my new lease a week ago, I am happy with the place and the price. I am fine staying put for the next 5-10 years…

It’s all about location and incomes.

Based on Case-Shiller (http://us.spindices.com/indices/real-estate/sp-case-shiller-ca-los-angeles-home-price-index), SoCal is in nosebleed territory with an index of 225.

Most of the U.S., while well above CS historical averages, is within acceptable ranges based on current economic activity.

SoCal, the SF Bay area and Washington DC are the regions that are suspect. These have Case-Shiller indexes above 200.

Even if the plunge in commodities (oil, copper, steel, lumber) signals a recession for 2015, real estate prices are sticky and it will take many years before a bottom is reached. So, no tanking real estate in sight.

Why would it take “many years”??? It only took 3 years to trough last cycle (2008-2011). I’ll never argue for rationality in so-called “prime” areas, but the working class areas, suburbs and the IE are teetering on the brink. Nothing is moving and sales pressures are rising. Failed flips and rentals, just like last time.

The last 2 years plus was an illusion. The stimulus and foreign investment was always unsustainable, thus so were the price increases. With no momentum to sell into the jig is up. You cannot have a soft landing or a flat prices when properties are being liquidated, which they will be. And there will always be those that need to sell no matter the price.

This year is going to see an acceleration in price declines. Not even NINJA loans can save this market as the proles have a better memory than TPTB give them credit for. As an aside, I also suspect some of those foreign oligarchs will take there losses now as a cost of laundering there money rather than deal with managing a rental property during a recession.

Nhilst, all the homes I drive by in the IE are gone within weeks. Nothing is “teetering”

Realist, your trolling is incredibly weaksauce. Tell me why RedFin shows IE and SGV listings months old with multiple price reductions sitting? Why are median closing prices down YOY? How much more would that median be down if you discounted luxury properties? Your embarrassing yourself. First you brag about rolling LA hipster prime and that the riff Raff should move to Hemet. Now you’re an expert on IE real estate. Your posts are far from top tier, but please stick around to explain to us why the second pathetic spring selling season in a row and housing starts at 1991 levels are just precursors to the next run up. Try and Google some data so you can look somewhat informed in your poor thesis. Please, thrill US with your acumen 🙂

@NihilistZerO,

The Federal Reserve did a study on regional housing bubbles. Not just U.S. bubbles but housing bubbles all over the world over the last 40 years. The study came to the conclusion that it takes 4 to 7 years, peak-to-trough, for housing prices to bottom out.

NYC prices peaked in 1987, the stock market crashed, NYC prices did not bottom out until 1992-94, 5 to 7 years.

SoCal prices peaked in 1980, then fell until 1986, 6 years.

SoCal prices peaked again in 1991, prices did not bottom out until 1996, 5 years.

I would not hold my breath looking for prices to tank like they did in 2008-2011.

@ernst blofeld

2008-2011 equals 4 years. FED study says 4-7, of course that is factoring in previous bubbles of smaller size that were not influenced by MASSIVE FED intervention. Seems I’m not that far off from your numbers…

Riddle me this Batman? What one of the previous regional bubbles was an echo bubble driven solely by an expansion of credit to specuvestors and foreign liquidity searching for a laundromat? The answer of course is none. The exit of those to elements has been as swift as there arrival. Why do you expect the results of their exit to be any less swift than their entry?

This market has been hyper-manipulated. That manipulation has run it’s course this cycle. Most SoCal RE is not Santa Monica or Laguna Beach. It is in swaths of suburbia where people pay their rent and mortgages with real wages. Buy vs Rent is beyond skewed even in the IE. That number is even worse when you figure that even a modest 15% drop in prices would move some people into ownership freeing up rental inventory and thereby putting downward pressure on rents.

In 2011 rental parity was there in many areas. I believe that’s where were headed back to once the echo bubble deflates. Whether in 2017 or a little later the monthly nut will reach parity with 2011. And I suspect mortgage rates will be higher so prices will be lower. After all we know about the manipulation of the market is a 25% drop in SoCal suburbs and the IE such a radical thesis???

No drop. Too many people.

S&P facing one year suspension:

http://www.bloomberg.com/news/2015-01-20/s-p-unit-said-nearing-suspension-was-at-heart-of-infight.html

CFPB goes after Wells Fargo and JPMorgan for kickback scheme

http://www.housingwire.com/articles/32690-cfpb-goes-after-wells-fargo-jpmorgan-for-mortgage-kickback-scheme

In some ways SOAL’s Portland house example is even more ridiculous. Too much house. It holds no appeal for me. We need decent new housing (at non-bubble prices), a lot needs knocking down and starting again (imo), but not extravagant large wasteful houses.

4124 Manor Ct… looks a lot different on the streetview. It’s also got a huge tractor-trailer rig to the side… not sure if that is land which comes with the house or not.

Dodger Stadium close by? Have you gone to a Dodgers game? Coming out of a game is like exiting a Wal-Mart on Black Friday.

Here’s my priced-out sister at a Dodger’s game a couple of years ago, as a tourist..although she won’t be going back as a tourist any time soon with the £€ exchange rate to dollars slipping (she rents and lives in Europe… where in prime areas the bubble is just as bad, and so many owners so complacent, their homes worth fortunes, little inventory on the sales market.)

http://oi61.tinypic.com/1z70gt5.jpg

Typed in haste; above should read *Dodgers game (not Dodger’s).

Listening to all the blondes on here drivel over prices and commutes and “surf days” is both hilarious and nauseating. I’ve been living in Iowa my whole life and my kids go the best schools in the nation, my house is worth $120,000 and that’s about what it was worth last year and may be worth $121,000 next year. It takes me 10 minutes to get to work, unemployment is low, and average wages pay all the bills including housing, quite comfortably. And yes, it’s cold out. In a few months, it will be hot and humid. Who cares! It’s always 72 in my house and at the bar and at the restaurant and any other place I go.

We have the same music as you. We have the same sports, same TV channels, same magazines, a lot of the same restaurants except you get better burritos and In N Out, and I get a much better steak. Yay!

My stress level is probably 1/10th of yours, and will always be that way. Iowa > California, many things are better than California

Um. Okay. Glad you’re happy.

“surf daysâ€, really, most people with beach and ocean fronts have never served in their lives. The reality, you get used to it quickly and it no longer matters. I used to enjoy going to the mountains for hiking and camping, we have lots of beautiful mountains in the North West. But most people don’t do that… I wonder why. I have a lake wa front office that overlooks seattle and lake WA. It was gorgeous…. for the first 3-4 months. Then I just used to it and stopped noticing it. Lake front? So What?. See, when you live to the ocean next door, it no longer matters because the most thing we enjoy are the ones we don’t have (the grass is always greener on the other side).

And it is not just SoCal. My mom lives in Italy and she has a house close to the sea shore and she is retired. You would assume she spends all her time hanging around the beaches, sun bathing, swimming (unlike the Pacific shore, you can actually swim there). And you know What?, most time she spends is not hanging out, but watching TV at home. This is What? the most Californians do too. I know a lot of people who, say, bought boats (we have lots of lake as well as the Puget Sound), but here is the saying. The two best days in your life are when you bought a new bout and … when you sold it.

I have to agree with you on this.

I live walking distance to the beach. I work 60+ hours a week. I am frequently too tired to do the SoCal “lifestyle” activities. I have not been to the beach in over a year.

I rented a couple of blocks from the beach for 15 years, then bought a house another block inland four years ago. I walk along the beach less than when I was younger, but still a bit more than once a week, and my standard weekend bicycle ride is Redondo Beach Pier to the UCLA rowing area by Playa Vista, occasionally going up to Santa Monica Pier and back. I’ve taken hundreds of walks along the beach in the last 18 years, and though I no longer exclaim and point at dolphins jumping out of the water just for kicks, I’m not bored when I see them. (I also have a particular need to hear the white noise of the waves to clear my head; perhaps that gives me the extra motivation to walk down there so often.)

Then there’s the moderate temperatures, about 5-10 degrees cooler than the rest of LA, and seeing the tourists along the beach and being happy, because they’re on vacation. Maybe it’s because of mindfulness and gratitude for some fortunate opportunities I’ve had, but I think it’s great. As I leave my house to walk down the beach, I sometimes think of the crappy projects I grew up in in Queens, NY, with a train platform 70 feet away, thinking about how the kid I was would be over the moon, imagining being able to go to the beach(!) by walking for ten minutes from my front door. Back then, a couple of times each summer I’d tag along with a family next door when they went to Jones Beach, which was like a crowded subway, but with sand and horseshoe crabs.

I agree that there are MANY places in the world and the US that are beautiful. For the short time I lived in Chicago in my teens, we’d walk through the forest preserves or take the mostly tree-shaded bike path 40 or 50 miles out of Chicago through the boundaries of various farms, and in the fall, the Morton(?) Arboretum was a thing of beauty. There’s a lot of beauty throughout the country and the world. But you can’t seriously say that the good things in LA aren’t as good as the good things in other places. It’s just that people have different tastes. I love the sound of the ocean, going on long hikes and (for me) year-round motorcycling weather. And I hate mosquitos.

Umm… Did you just justify living in Iowa by saying there are all kinds of great things to inside since the weather is so constantly heinous outside?

I, actually, have quite hard time finding any new contraction that is smaller than 2500 sq.ft., unless it is a nownhome or condo… It seems like they no longer build those “tiny” 1800-2200 sq. ft SFH in our area…

Just wait for the next bust….most likely a dollar crisis and you will wish you bought a crap shack when your dollars hyper inflate away…sometimes you can’t win. There is a push to buy assets now because we could all wake up one day and the dollars value gets cut in half over night…or the new bill that passed that if banks get in trouble again depositors money will be first in line to be taken by the banks. Pretty futile if you ask me.

the FED is worried about deflation not hyperinflation like they do in japan and europe

They are not worried about hyperinflation, and the only way to deflate is to pull credit and that will never happen. The dollar is really credit anyway, so Ctrl + P away and watch things keep going up in price.

It’s never going to stop.

~~these days they call me Realist but I gave in to what I don’t believe in so now I troll this board to cope with the decision and the desperation~~

Knew it was sarcasm. That is some fine trolling – they all think you’re sincere. Carry on. 🙂

Realist .. “It’s (Price rise) never going to stop”

Spoken like a true “shill”

All this time I thought you were ‘What?”

If ya can’t beat ’em join ’em. Housing will continue to skyrocket, Dow at 25K and gas at $2.00 a gallon. Happy days are here again. How do I know? Obama told me in his State of the Union.

Check this one out LOL. It has to be a joke.

https://www.redfin.com/CA/Santa-Monica/704-15th-St-90402/home/6771176

I’d think it was a joke if it were not for the history further down the page…the owner has been trying to sell it for $2M give or take a bit for the last 7 years.

So, it doesn’t sell for $ $1,975,000 in Oct, 2012, they increase the price in Nov, 2012 to $2,100,000, then it doesn’t sell at the increased price, they increase it again in few month, then it doesn’t sell, you increase the price again… everything is backwards in SoCal…

If it doesn’t sell, keep increasing price, until… well, it doesn’t sell… Nothing seems to be wrong here, this is exactly What? I would do!

/sarc

I have a buddy in the same boat. It’s all about the rezoning and tearing down to build apartments, the house isn’t worth anything. Location, location, location. If someone wants to buy it, they will build apartments and make a lot of money. Santa Monica is a very, very desirable place to live.

No, Realist. That’s North of Montana, East of Lincoln. It’s zoned for single family homes only.

There are some townhouses and condos North of Montana, West of Lincoln, but not East of Lincoln.

That house can only be torn down and replaced with another house.

Tear down houses North of Montana Ave and East of Lincoln typically sell for a land value $2.2M – $2.5M so their price asking price of $2.8M is not too far off. Perhaps they have offers over-asking in the past and cranked up the price to hope for a higher sale price. In any case, there is nothing unusual with that piece of land with tear-down selling for +/-$2.5M. Let’s see.

“Use some common sense and try not following the herd. ”

Kind of scary when you think of it… Almost cult like.

There’s nothing wrong with small houses.

I live in a 110 ft2 house, that I helped build myself. It has no utility bills, because it’s walls are three feet thick and is located at 700 feet altitude, so it’s always cool at night, even in the summers. Oh, it has solar and wind power.

I’m currently on vacation for three to six months, living in a country for $1000 a month—like a king.

How can I afford to take three to six month holidays?

Because I live in a small house, not a crapshack McMansion in California.

Go ahead and tell me how stupid I am, because I live in a “tiny” house…

BOOM!!!

World’s most affordable housing is where???

USA!

http://globaleconomicanalysis.blogspot.com/2015/01/housing-affordability-how-bad-is-us.html

♪ And the beat goes on ♪

The USA has some of the most affordable major markets in the world.

But SoCal is most definitely not one of them. LA is the 10th least affordable market in the world. Riverside-SB is pretty pretty bad too relative to the rest of the country, rating as the 9th worst in the country.

“The USA has some of the most affordable major markets in the world.”

Depends on the definition of ‘major’, of course.

Here in North we have about 2/3 of whole country as ‘countryside’ and most land is valued by trees on it. The problem is that no-one wants to live there either as there’s nothing there. Very affordable as the houses (old farms) are sold practically for peanuts: A house and some land at $20k, does that sound bad?

Very affordable while not at all desirable.

Price drop momentum on L.A. county flips is really beginning to pick up some speed. Especially so in marginal areas like South Central, Compton, and Long Beach. Still seeing failed escrows at a higher rate than normal. Super risky bets are not paying off for the latest phase flippers, if things don’t pick up soon enough, that trade is finished for this cycle.

Not sure if Fannie/Freddie 97% LTV and FHA lowered annual MIP/97% LTV is going to be enough to buoy this thing in priced out markets like SoCal.

It’s the price, stupid.

Then we wait for more Government intervention like grants, $0 down, etc.

Small?! for a 5 foot Chinese that’s a 3 thousand square foot mansion!

Do you want to be priced out forever?

Some bear-food below.

Occasionally this Financial Website below (link below) have some good articles, and sometimes secure video interviews with some very clever people / business leaders etc. It is UK focussed, but you can not look at UK without looking at financial outlooks of US/China RoTW (rest of the world).

Their guest the other day, called the oil price plunge, and profited from it, at exactly the right time last year. He is of the older generation, but to me he comes across as honest, clear and intelligent, and a man who will always act with integrity. He may not be correct about everything going forwards (I think the US main banks are clever, and rest of the world will help rebalance US position via all the debt owed to the US, and US investors will snap up cheap investment assets in strong dollars around the world) but I hope some of it allows for correction in prime property values, to allow opportunity to younger people/savers/workers to take a position, at a much more realistic price level.

___

…House prices could fall 50% in global ‘Great Unwinding’

22/01/2015

.. China’s lending from 2009 to last year went up from $1 Trillion to $10 Trillion – but the new leadership seemingly wanting to go back to a new normal = less growth.

Oil prices? The actions of Central Banks was one of trying to create demand by printing money; the futures markets took the money because pension funds wanted to look for a store of value against declining currency, which was oil. Everyone uses it, very large market, and it’s priced in dollars. Oil price rose from $30 at 2008, upto $120, to because of QE,.. 6 times as many speculators/investors (pension funds etc) looking home for money.

The oil price rose from $30 at 2008, to around $120, to because of QE; not just normal demand but 6 times as many speculators/investors (pension funds etc) looking home for money. Price discovery mechanism destroyed because of the central banks.

Trigger for the change? China has realized if they continued with this stimulus plan their economy could implode. So they stopped, and not only did they stop, but they began to go backwards. From $1 Trillion dollars to $10 Trillion dollars and back again. Now once you start deflating the bubble, it doesn’t go slowly. It bursts. And this is what you saw happening in July and August (oil); that is why we made the call in the middle of August the oil price is now going to collapse, and the obvious logical corollary of that is the dollar is going to go very high indeed.

And we’ve seen that, the oil price down 50%, the dollar up over 10%. Now the dollar going up 10%, absolutely critical because you’ve got $6 or $7 Trillion dollars of debt in the emerging economies all tied to the dollar, all thinking, “Well we’ve borrowed at 1%, aren’t we clever.” Well it was 1% then, but now it’s 1% + 12% increase in the dollar.

You’re going to see bankruptcies all over the emerging economies. And of course you’re going to see bankruptcies all over the United States because people spent a $1 Trillion dollars. The US economy is now riding for a fall. We don’t know how big it is, but if you look at jobs growth since 2009 it’s all been, and I mean ALL in capital letters, been tied into the oil and gas exploration bubble. All the rest has not moved at all. If you look at the housing recovery, such as its been, 600,000 to a million (new build housing starts per year) – which sounds good but when you’re coming down from 2 million it’s not so good – that 400,000.. much of that new house building has been in Texas. I was in Houston in the Summer last year, 10,000 people a month were coming into Houston, so you’re building a lot of houses.

The real action is over in China. The property market in China, property taxes paid in China last year fell 30% in one year. Now that’s a pretty big downturn in one year. If you look at the car market; all the growth in the world car market from 2009 to now has been in China.

The rest of the world, overall, we’ve been flat. China is moving forward on what they call the New Silk Road, targeted now to real income levels. As long as China doesn’t change policy which is unlikely, what I think will happen, we will see what we call this great unwinding continue, and the Fed will find its US recovery has disappeared, but that’s not very surprising for the Fed was very surprised when the financial crisis happened in 2008.

We’ve got an unwinding in China, and Russia and other Opec countries are in crisis.

Depressing? I am actually quite happy – it may not appear it – because I believe we are now going to have to confront the issues that we should have confronted 10 or 15 years ago. .. We now seeing the Minsky moment, which is not a bad thing. The collapse of the oil price. .. We will have deflation in a couple of months. Deflation in itself is fine, but not if you have vast debt that cannot be repaid.

I think UK house prices are already falling. I just wish they had never got to these levels. I think you’re going to see, the top end prices have begun to fall 15-20%. We’ve seen price falls in the early 1990s fall 50%; I think we’re at the start if that kind of decline. I’m not depressed about this; it’s something we have to go through to get to reality. Cash is actually going to be a very good investment, because under deflation, the value of cash goes up every day. It’s already happening, we’re going through deflation shock. The cost of a house is relative to earnings. The thing that Minsky highlighted was that you have to be able to repay the capital. My sons have been priced out of the market. It’s all well and good to say they could afford the interest, they could, but they can’t afford the capital repayment.

So for their good, for the good of younger generations, I’m afraid us old generation have to say, “We did pretty well out of this, we have to hand something back.”

Link/video: http://moneyweek.com/paul-hodges-interview-the-great-unwinding/

“Flyover, name a place with better weather. And no its not subjective, its human vote count. And 40 million vote Cali”

California has many different types of climate from north to south and east to west. Let’s see how many contradictions you have in one sentence. You were talking about LA and to change the reality you switched to the whole state of CA population. LA population is a quarter of that and that make it aprox. 3% of the US population. Remember, the subject in discussion was “everyone”, in other words the whole US population. Now, to apply your logic, 97% of the US population (close to “everyone”) is AGAINST you “paradise” because they don’t live there. They voted with their feet that for one reason or another they prefer to live in other places, not LA. They are free to go any time there, but for a reason or another they refuse – they vote against it.

If I wouldn’t care about what makes financial sense (let’s assume I am a billionaire) I would buy in La Jola (close to San Diego) but not in LA. Even considering that, I would buy it ONLY if I am forced to live in one house. But I don’t have to. I live in NW half of the year and Hawaii the rest. I like it better that way. Personally, I don’t like anything about LA and contrary to your opinion there are hundreds of millions like me.

I will let you live in your bubble (which is your own imagination) that “everyone” wants to live in LA. Personally I like Hawaii climate better because it has warmer water. In CA water I freeze even in August. Not for me. I don’t miss the smog, the traffic, the mass poverty and living with tens of millions around me. For me that is not quality of life. I like to have breathing room. In LA I feel suffocated. And no, I am not the only one feeling that way. Like I said there are hundreds of millions.

After just getting back from the Big Island, I can safely say that if I were going to become house poor and use the ‘best weather’ as my excuse, I’d pick the Kona coast over any part of Southern California!

Agreed. I’d rather be broke and homeless in Hawaii.

For those keeping a tally of $700k So Cal crapshacks, here’s another that just went pending. This one comes with the 10 Freeway in its back yard. http://www.redfin.com/CA/Los-Angeles/2814-S-Bedford-St-90034/home/6785930

But it has a hipster fence. That adds a lot of value. You could probably wave at the drivers on the 10 as they speed by and toss garbage into your backyard. Let’s not even discuss the noise and black soot that you & your family will inhale and will eventually settle on your new home. Another American Dream realized.

In addition to the hipster fence, if you use Google Street View to go down Beverlywood Street to Robertson Blvd, on the corner you’ll see a tattoo parlor.

Tattoo parlors indicate that hipsters have planted their flag, and are about to move in en masse, gentrifying the entire neighborhood.

A hipster fence AND a tattoo parlor? Those houses should triple in value by 2017. Flippers take note!

I forgot to mention the average public school rating for that district is a big 3. Awesome. Over $500 per a sq. foot so your kids can grow up illiterate.

I personally love LA and have no intention of leaving willingly. But it’s not for everyone. And real estate here is absurd. I’m not expecting a correction to gain steam until next year. Best beaches I’ve ever been on were on the coast of West Africa. Makes Hawaii seem cold. And St. Maarten. But LA has so much more AND the beach. Our family actually does a lot of outside activities so it’s worth it. Or at least it seems like it is. 🙂

I live in the Bay Area and each month I receive a monthly “inventory snapshot” from a variety of realtors (it’s the same report; I must’ve got on their distribution list at some point). I plot their data each month, and December marked the first time in the last 2 years (which was when I started tracking), I saw that BOTH the Median AND the Average prices for Single Family <$1m homes DROPPED! I can't say I was surprised but I wondered what the papers would print and/or say about this (the average barely dropped ~2 basis pts, but the median declined 300 basis pts).

I don't know why it shocked me when weeks later all the papers came out with the exact same headline for the last several years: "Sales decline but prices increase YoY" (sic). The only thing I can think of is that they must be looking at the market as a whole, and not the <$1m market which is (in my opinion) most buyer's territory even up here in the Bay Area. Most people can't afford $1m+ homes, while there are many that can, there are MANY more that cannot. I'm not saying that one month of data makes a trend, for all I know, the heavy rain (or fill in the blank for a reason) we had in December will prove that this was a one month phenomenon. Whatever the case may be, I was disappointed and surprised because I was truly expecting someone to raise the point that prices had actually declined for houses that most buyers can afford.

I don't know why I still am surprised (almost shocked) that someone/ANYONE didn't mention this decline in prices. I can expect mainstream media not to mention it, but there has to be a media company out there (or blogger) that can gain some traffic by highlighting this understated point.

It’s unfortunate that the fed/Wall St and politicians decided to hand the gains from this correction right back into the hands of the folks that caused it to begin with (not relieving borrowers from their responsibilities but reality is that "smart money" knew what they were doing and how it would end and thus I place the burden of this on them). Part of me thinks, well – interest rates can't possibly go any lower, so what can really stimulate real estate now? I don't believe there will be a change in emphasis on real estate any time soon (i.e., the gov't will continue its policies of championing home ownership as a way to build wealth – by offering tax breaks and artificially low interest rates, etc.). The only answer I keep coming back to is when all this inflation makes its way into wages so that people will be able to afford the $1m homes that are unaffordable today.

Going back to an earlier point about using blanket averages. I also keep reading headlines about how home prices are NOT inversely correlated to interest rates. (i.e., history shows that houses do NOT decrease when interest rates increase). I don't question the data, I believe it. However, I don't believe there isn't more to this statement. Our economy, wages, housing (size/location, etc.), financing (i.e., savings habits) have changed DRAMATICALLY in the last 50 years, so if you're going to tell me that one sentence can summarize the data I will call BS. I believe if we were to peel back this data another layer and divide housing between Wealthy/Middle-Class/Poor, we would see a COMPLETELY different picture. Obviously this is just conjecture on my part but this is yet another one of those areas where I'm disappointed that no one seems to be able to point to this data to support a point. (if I knew how to get it I would certainly crunch the numbers).

Anyhow, more of a long winded statement than a question. As always, I welcome the dialogue/feedback.

Richard, that’s one of the most well thought out comments I’ve seen on this site. I don’t have anything useful to add to it, but agree with it.

My relative used to be a managing editor in the newspaper business; it’s common knowledge in that field that newspapers will not print a story that offends their BIGGEST advertisor group: the local real estate agencies. Instead, the paper will reword the data to make the story appear to be bullish on the real estate market.

Leave a Reply to flyover to Realist