The Los Angeles and Orange County area becomes even more unaffordable when it comes to housing: In last two years home prices up 28 percent while wages are up 2 percent.

L.A. is the most unaffordable housing market in the entire country. Beyond the pretense that everyone is rich and has money stashed in their backyards being guarded by Chihuahuas with cubic zirconia necklaces, most in California are living deep in debt. Those buying homes today are either investors, wealthy foreigners, or locals leveraging to the max for that wonderful crap shack. What makes the LA/OC market the most unaffordable is that wages flat out do not justify current home prices. Since LA is a majority renter county, it is important to look at dynamics in this group. One study from UCLA found that LA renters devote nearly 50 percent of their income to rent. Taco Tuesday isn’t only a baby boomer mainstay, it is a necessity to pay the rent. The disconnect only got more profound over the last two years. Housing prices in the LA/OC area went up by 28 percent while wages went up by 2 percent. Thanks to maximum leverage loans, big investor demand, and low interest rates, people can buy a $700,000 crap shack and pretend they are truly rolling deep in cash. All the data coming out is showing that many are flat out pretending and living paycheck to paycheck, even with expensive budgets.

The big disconnect between wages and home prices Â

It is good to see more people seeing the disconnect for what it truly is. All we are seeing is more money being siphoned off into the housing industry. The amount of justification now coming out for crap shacks is at levels last seen in 2006 and 2007. Just take a look at the glorious deals you can have and be our guest and plunk down $700,000 for a box that needs major remodeling and lock yourself into 30 years of mortgage payments.

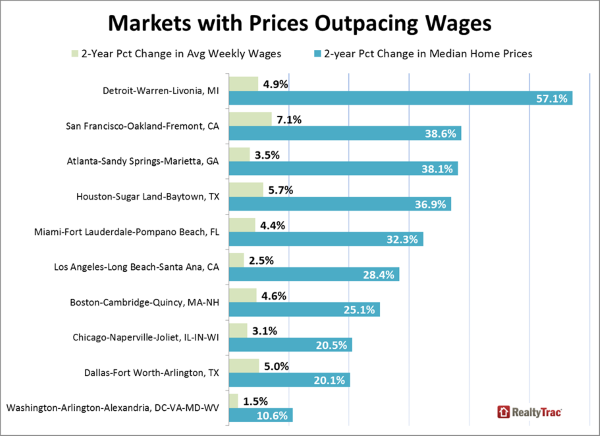

The LA/OC market isn’t the only one seeing this dramatic disconnect. The San Francisco market which is even more bananas than SoCal saw even a larger disconnect. Take a look at wage changes versus home price changes over the last two years:

This isn’t happening only in wealthy areas. In fact, Detroit where homes can be bought for $500 saw prices go up by 57 percent while wages went up 4 percent in the last 2 years. This is being heavily driven by investors (as many other areas in the chart above). San Francisco home prices went up a stunning 37 percent from already very high levels while wages went up by 7 percent. In always sunny LA/OC, prices went up 28 percent while wages went up a “whopping†2 percent. And then we are surprised that we are seeing rental Armageddon like scenarios.

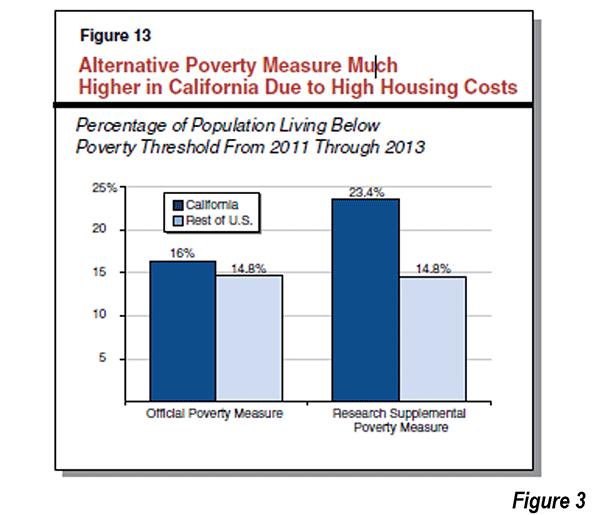

Because of the high cost of living and many Californians living in sardine like conditions, we have a very high level of poverty:

Bubbles occur when prices rise because of irrational behavior. Many people buying in the LA/OC area are buying with the underlying notion that prices will only continue to go up. They are buying their ugly crap shack in hopes they can build some equity and move into their semi-ugly crap shack and then finally into their dream property ladder property. This idea that people buy and stay put is nonsense, at least when looking at data. The fact that we have gained so many more renter households in California is merely a testament to people being unable to afford homes, even with low down payment loans hitting the market.

Sales volume continues to be very low. You have many baby boomers seeing their adult kids moving back home since they can’t compete in the current housing market. At least they can pop down to the corner vegan market and enjoy a good salad together and then head back to their crap shack. Again, when you look at the detailed data on the Torrance housing block you find that most people bought at reasonable prices compared to incomes at the time. In fact, virtually the entire neighborhood would be priced out if they had to buy today. I’ve seen this in Pasadena, Huntington Beach, and Culver City where one older neighbor is walking into the house with 99 Cents Store only shopping bags and Wal-Mart bags while another is pulling into their new purchase with Whole Paychecks bags and a leased Tesla plus the gift of paying 10 times more in property taxes just because they were born at the wrong time. It is funny how the anti-legislation crowd is more than happy to keep Prop 13 legislation as long as it benefits them directly. It is also the irony of San Francisco that in the 60s and 70s the city saw a young and largely poor artist crowd move in giving the city its vibe. Now NIMBYism is in full effect and even the middle class is being pushed out. Good luck being a regular artist in San Francisco and paying $4,000 a month for a studio full of roaches. Even highly paid tech workers are renting.

The market right now is running on fumes and extremely low sales volume is a reflection of the chart above. That is, wages just can’t support current home prices without massive mortgage debt. The investor crowd pulling back is having a big impact. Then again having a taco truck and vegan store on the same corner is the LA/OC way. But paying $700,000 for a crap shack is different from buying a $5 fusion taco.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

101 Responses to “The Los Angeles and Orange County area becomes even more unaffordable when it comes to housing: In last two years home prices up 28 percent while wages are up 2 percent.”

Excellent article as usual. Looks like LA and OC aren’t the only ones in bubble territory. From the chart, Atlanta and Houston saw median home prices rise almost 40% in the last two years! That is a shocking number for areas that have affordable housing. It’s unfortunate for a whole generation that housing has been turned into a casino ala Wall St.

Problem with the comparison above is that there’s no basis taken into account for where prices stand relative to wages – it simply compares two velocity metrics – which gives a false impression that an Atlanta or Houston “bubble” is as relatively meaningful as an SF or LA bubble. Some markets like Atlanta overcorrected to a degree, LA undercorrected, and we’re looking at percent change so a smaller percent change of a larger number can be as significant as a larger percent change of a smaller number. So the point stands that SoCal is very overpriced relative to its worth and no, Houston or Atlanta don’t even come close to the “bubble” territory that SoCal is in. Detroit sure the hell isn’t and it’s number one on the list which you conveniently didn’t mention at a “shocking” 57%. 57% returning to fundamentals is way different than going from stupid to stupider at 28% and 38%.

Detroit’s number was not very shocking since houses could be bought for $1000, now they are $1600. You conveniently picked Atlanta which you claim overcorrected. Houston did NOT overcorrect since it never really went into housing bubble territory. However, the last two years has shown massive gains (almost 40%). For a city with slow and steady housing appreciation, you can’t tell me this number isn’t shocking! Big gains in short periods of time are a warning sign, buyer beware!

Actually, you picked Atlanta and I responded in kind. The last bubble was national in scope and included Houston. I stand by my claim that both markets overcorrected.

” The So. California Real Estate LITMUS TEST ”

=================================

In Southern California .. We know we’re in a REAL ESTATE BUBBLE …WHEN…

The average Selling Price for “single family homes” in the areas in the INLAND CITIES begin to approach or equal the Selling Price for “single family homes’ located near the Coast (i.e. Beach Cities).

Just look the historical prices in So.California during the last two “Bubble Events”,

we had homes in San Bernardino and Riverside .. almost the same prices as the

Beach Cities … That’s just impossible .. BUT IT HAPPENED.

No… there has been divergence…. San Bern / Riverside some correction vs doubling down in prime. It’s a new beast now, with prime in superbubble.

Denver was mentioned as well. I’m not surprised. We have decent job growth here but there’s no way wages are keeping up with home prices. I fear I’ll never own a home here.

We’re cooking up another recession, no doubt in my mind. This all reminds me of 1979-1980 when people had money in their pockets but didn’t seem to have any purchasing power.

Attention housing dumb asses: should have bought rental property 2009, 2010, 2011, 2012…you would be loving all these stats…viva renter! I love my rentals/renters…life is great!

And to think, you are a single mom. I have no idea how someone could leave a gracious person like you. Your children must be so proud.

Wow, funny how all the a-holes in the world seem to prosper off of other peoples misfortune. You are a true piece of sh@#

Unfortunately the IE, where I just bought, has an even higher ratio.

As much as I agree that homes are overpriced, I don’t think it is fair to compare home price appreciation with income appreciation. Let’s face it, it is about affordability, with interest rates being the biggest component of affordability.

Everything that makes payments more affordable will increase prices, especially on items that essentially must be financed. Imagine what would happen to home prices if interest rates went to zero or mortgages went out to 40 years. Heck, look what happened to college tuition as the government made it more ‘affordable’.

Also, the alternative rent must be considered. Sometimes buying is the ‘less bad’ situation. That doesn’t mean it’s great.

The housing market can do three things. It can go down, up or go sideways. If you are putting all your chips in scenario one, you better be darn sure you got it right. Because if it goes sideways or up you will probably lose by sitting on the sidelines, especially if lacking the tax write-off makes you pay more to Uncle Sam every year.

I sold in 2009 and have been sitting on the sidelines waiting for bubble 2.0 to pop. But my fear is that maybe it won’t. Interest rates can go lower. The government can do another incentive plan. Heck, interest rates don’t even have to stop at zero, as many other countries have already proven. Imagine what a negative-rate mortgage would do to home prices!

What’s different in bubble 2.0 is that lower interests rates are not part of NINJA loans or ARM’s…they are genuine loan-interest rate loans. So payments are not going to suddenly explode and make people default.

I am not planning on buying because I think prices are going to go up. I need a place to live, I need a write-off, and rent is sky-high in all decent areas of Socal. Buying is the lesser of two evils, IMHO.

Also, you talk about $700K crap-shacks a lot. $700K does not buy you a crap-shack in OC. I saw a crap-shack yesterday that was $575K and there are very nice places to live for $700K. Still overpriced, IMHO, but not crap-shacks.

LA County’s got the $700k crapshacks, OC the $500k crapshacks and IE the $300k crapshacks. In most of the rest of the country they go for $100k.

I’m not a real estate expert by any stretch of the imagination, but I do have half a brain. I can discern that So Cal prices are out of sync relative to the income of the populace and relative to historical norms, perhaps with the exception of a few past bubbles.

Which brings me to my next question- how can this not be a bubble? Maybe the reason for the bubble is not the same as the reason for the last one (ARMs, NINJA loans etc). But if it looks like a duck and quacks like a duck, well, maybe it’s a duck!

I’m burning though about $7,500 a year (give or take) in rent versus what I would be spending if I lived in a condo that I own and rent out (I don’t want to live there because the neighbors are awful and it would cost money to install A/C, new windows etc). For example, if prices decrease by 15% to 20% or more over the next five years for a $700k place, waiting for a dip will have been well worth it. Since it would be ridiculous for prices to further increase by any substantial amount in the near term, waiting it out seems like the best decision for me. Worst case scenario, I can just move back into the beater condo I own.

I guess what I’m saying is that, I think the best decision is to wait it out. Historical evidence seems to suggest this is the best decision. Unless this time is different (as realtors like to tell you).

Easy money policies directed at home debtors fueled growth based upon fantasy economics. That was Bubble 1.0

Easy money policies directed at specuvestors fueled growth based upon fantasy economics. That is Bubble 2.0

The two most important elements, the easy money and the fantasy, moved right from Bubble 1 to 2. I have yet to here a compelling reason why the outcome of 2 will be materially different than 1. It’s all playing with borrowed money looking for returns based on non-existent fundamentals. Appreciation, whether in your own home or the cap rate of your rental, based on Hopium isn’t an investment strategy.

I love you NihilistZerO. You continually put my doubts about the current market in the right words, and give me the reassurance I need to stay the course.

@Gary

The price of RE is at the heart of the bubble, not the quality of loans or purchases. In past crashes, exotic loans were not the main culprit. In addition, many of the RE purchases were made by financial institutions that are beholden to shareholders. If the ROI is not satisfactory, those shareholders will not idly stand by and ignore the opportunity cost.

Not really sure what the point is, Gary. You’re focused on the trees while we’re havig a discussion about the forest. As if finance and monetary inputs operate in a vacuum. Nominal factors of rate schemes and the like don’t change the underlying real organism, rather they only serve to mask or pervert something which is immediately seen.

My point is that prices and interest rates are not prohibited from going sideways for a very very long time jut because they are ridiculous where they currently are.

Heck, look at the stock market. Just because stocks are ridiculously high it doesn’t mean that a crash is imminent.

@Gary: “Heck, look at the stock market. Just because stocks are ridiculously high it doesn’t mean that a crash is imminent.”

Maybe not, but the last two peaks in 2000 and 2007 (each followed by what I would basically consider a crash) might serve as strong evidence against your supposition.

@Gary, short term interest rates are controlled by the Federal Reserve. Long term interest rates are a function of the market, specifically pension, retirement, mutual funds and 401k funds.

The Fed can manipulate the market and keep interest only and variable rate loans at obscenely low levels. The Fed cannot control the long term fixed interest rates.

So the really big questions are is when do baby boomers retirement en masse, how fast do baby boomers draw down their retirement funds, what are the health expenses of baby boomers, and what is the life expectancy of baby boomers.

This is what is really going to control long term fixed interest rates and housing prices.

When bubbles are the norm, does that mean there are no more bubbles?

That is very thought provoking. I think the dr. Should do a post on this topic.

No it’s not. A turd is always a turd, regardless of how long the smell lingers or how many are encountered.

NO — It means there are MORE “Naive Suckers” being VICTIMIZED by CROOKED REAL ESTATE Brokers/Agents and Mortgage Brokers.

With a new Wave of young First Time Buyers …

…. we are headed for another BIG CATASTROPHE.

*** Let’s all do some Good Deeds and WARN THE YOUNG NEW BUYERS.***

While there are still many ridiculous $700K – $900K crap shacks listed on the Westside, I’m beginning to see a lot of reductions from $2.2M to $2.1M, $1.6M to $1.5M, etc. Nonetheless, still overpriced, especially in “hip” Venice, but there seems to be a growing sentiment among sellers and agents of not wanting to be the last one heading for the exit.

Ding. There has most certainly been a change in the winds of asking prices. I’ve been noticing it for months. The few times I’ve brought it up, some respond as if asks are meaningless – as if the price negotiation 101 day one lesson of setting your price somehow is just for show. There’s a huge mispricing disconnect with reductions across the board in all price levels, flips, organic, and shorts, and neighborhood types across the region. It’s an indication of what’s yet to be seen by those not paying close attention.

In the city I have my eye on, there have been many price reductions but I have also seen houses sell for more than their asking prices in a matter of days. I can only deduce that they have multiple offers in these cases.

The price-reductions ones are typically not in nice condition or just need upgrades badly (original windows, original tile countertops, etc.)

DHB,

Always insightful. Similar stories out east in Florida. High rents

People doubling up. Too much spent on housing and transportation making new home buyers hard to find.

What about the other elephant in the room? The drought.

If it continues, what impact will it have?

When Bert said that Obamacare will take money out of RE many bloggers laught at him and dismissed his remark. Although it was logical to make that assumption, here are the official numbers and graphs showing massive increase on Obamacare and decrease in RE. This happened in a background of lower gasoline prices.

http://www.zerohedge.com/news/2015-03-27/its-official-americans-spent-all-their-gas-savings-obamacare

As gasoline prices will increase over the Summer under pretty constant wages, Obamacare will impact budgets even more. Most of the GDP increase was due to Obamacare and how GDP is calculated. Given the globalization and flat wages, Obamacare will become the straw on the camel’s back. And wait! Not all Obamacare provisions were implemented yet. Some were postponed by Obama for the next president to make the economy even more miserable.

In conclusion, people didn’t save the money they did not spend on gas (as the offical narrative says), they spent them on Obamacare. Wholesale and retail plunged while people supposedly have more money from gas savings. Oh, I forgot!…it was too cold!

You mean Blurt? He has delusions of grandeur.

Oh Jed, until you can put together something as interesting as Blert does, I’d suggest you hold off on the criticism. I enjoy reading his material, it gives me a new perspective on things. Plus, I usually have to put on my thinking cap just to understand half of what he’s saying.

Where is Blert’s blog? I’d like to read it.

oh wait, was that the “Bert was right” link?

He said more than OCare would take money out of RE, he said that OCare (0-Care was his pejorative) would be THE reason for the next RE bubble burst.

He also claimed that the Fed and other central banks adopted his blog posts into their monetary policy.

Please.

The ACA will actually make the FED pull their hair out by way of Congress.

Say hello to the “1095” tax form, the “You Owe the IRS” for your subsidized insurance invoice.

The only method of revenue collection from ACA penalties and subsidy refunds is by way of the IRS refund. They have no other legal means of recourse. The IRS can’t sell your bad debt to a collection agency.

On or about April 15th a lot of people will realize that in order to avoid that issue they will need to claim Married with the Max number of dependents possible. So that they owe the IRS and not the other way around.

So tax receipts will plummet from the working poor payroll class. The next time Congress Klowns threaten to shut down government again the triple witching will force the Fed to commit to “Japan like” bid to cover action.

Do you think any of the States that tax income are prepared for that?

Next year these working poor will end up spending away what they used to give the IRS to hold on to in the past. Next April the IRS will be overwhelmed with “I owe this year and I have no cash, give me a payment plan and Boom goes tax receipts again down the drain.

Fun Fact, If you are a US citizen you don’t actually qualify for the ACA. You actually have to be a US debtor with an Experian credit score in order to apply and receive insurance. If you don’t have a credit history, you have to go make one first.

Long term O-care will be good for the RE market. A Harvard study found 62% of bankruptcies are related to large medical bills. O-care includes an annual maximum out of pocket ceiling, shielding homeowners from 6-figure bills for operations. This should reduce the number of people losing their homes because they had surgery.

As housing prices are set at the margin, the fact that 75 or 80% of the population cannot afford the median priced house is not that important as long as the market clears, i.e. the number of houses for sale stays in balance with those being bought. The story I hear is that not a lot of housing is for sale nor is there a lot of new housing being built as compared to historical levels. As to why more people are not taking advantage of high prices is curious. I recently read of people in the D.C area who wanted to do this found that downsizing was a wash, i.e. a new condo downtown cost as much as their house in Fairfax or Montgomery County and the same was true were they to want buy a highrise condo in Florida. Only if you are willing to move out of the more desirable urban enclaves can you take your equity with you.

“As to why more people are not taking advantage of high prices is curious.” I don’t think it’s curious at all (assuming you are referring to prospective sellers), and you even solved the mystery in your own post. Even if people sold, prices are too high for them to want to buy after they sell. So they stay put. If I owned anything worth a significant amount of money (say, $800k or more), I would sell now and rent a smaller place until prices (hopefully) adjust down the road. But I don’t, so that’s not really an issue.

Prop 13 prevents folks from moving down the street. Why downsize when your increased taxes will negate the sale/purchase price differential?

Good point, Jeff. Prop 13 didn’t solve the original problem it was purported to correct (limiting government spending) and instead created new problems such as the one you mentioned.

I’m a huge proponent of reining in government spending (fiscally conservative) but I’m not going to support something (the Prop 13 legacy) that doesn’t actually do anything about unchecked spending just so the entrenched status quo (long time existing homeowners) can keep getting a handout subsidized by all other tax payers.

And this continued majority renter thing doesn’t bode well for Prop 13’s future in the state legislature.

I’ll give you an example why I’m not selling. Bought a house in 2000 for 500k. Now worth about 1.5million, but have been renting it for the last 9 years. I’m single. I’d pay at least 300k in capital gains. A 1031 exchange is a risky proposition because I’d have to i.d. a suitable replacement within 45 days. I’d want to buy another rental, but can’t justify the whole thing because mutlifamily units I’ve been looking at in my price range, after the property taxes I’d be paying for them on the stepped up basis for the purchase, I probably wouldn’t be making significantly more on the income on them than I am now renting the single family house. And at least renting a SFR isn’t subject to rent control the way multi-family units are.

And the economy will continue to struggle partly because RE-related economic activity remains weak. Those who buy overpriced RE will drastically curtail other expenses just to handle housing expenses.

A vibrant RE market requires a healthy dose of entry-level buyers to soak the inventory from those wishing to move. Investors have already pulled back. With future generations already being shut out, who absorb the inevitable inventory from the older generation?

It’s not curious at all. They have to buy back into the same market they sell into for a replacement and they don’t trust the market. That and there are still a shit load of people upside down while banks continue to be allowed to not account for non performing “assets.” It’s all self-reinforcing. That’s what happens when a marketplace isn’t allowed to be. And some on here say throw in the towel and wade into that sewer water with your nose pinched shut.

People aren’t selling in SoCal because they believe their $700K crap shack will gentrify and soon be worth $15 MILLION DOLLARS!!!!!!

Did you not get the memo? Torrance/Culver City/Palms/Mar Vista/Burbank/Glendale are the new Newport Beach/Balboa Island/Holmby Hills/Malibu.

Re Detroit: It’s easy for a home price to go up 57.1% when the house is only $1,000 to start with …

It’s true you can buy 1000 dollar houses in Detroit. What they fail to mention is the property taxes on it are 8k per year.

Property taxes put downward pressure on prices, therefore providing counterbalance, so the point is moot. That’s what the prop 13 proponents don’t dare mention.

Siggy, care to explain that “downward pressure”? I’m pretty sure Prop 13 has the opposite result. There are fewer properties for sale d/t folks who don’t want to give up their low tax basis… then something-something about supply and demand. I’m interested to hear how Prop 13 would cause downward pressure.

Property taxes put downward pressure on prices, therefore providing counterbalance, so the point is moot. That’s what the prop 13 proponents don’t dare mention.

Siggy, care to explain that “downward pressure� I’m pretty sure Prop 13 has the opposite result. There are fewer properties for sale d/t folks who don’t want to give up their low tax basis… then something-something about supply and demand. I’m interested to hear how Prop 13 would cause downward pressure.

@Jeff: I think you misread/misinterpreted Siggy’s post. I believe he is effectively stating that, without Prop 13, higher property taxes would put downward pressure on prices. Which is hard to argue against.

I’m kind of undecided about Prop 13. On the one hand, I know I will benefit from it someday (and even now to a small extent on a condo rental I own). On the other hand, it would be nice to buy a reasonably-priced house, which might come to fruition if Prop 13 were repealed. And all home owners would pay their fair share (as Siggy likes to point out).

Speaking of casinos, whoever bought this place less than 4 years ago is going to hit an almost $500k profit jackpot if this pending sale closes at or near the asking price: http://www.redfin.com/CA/Los-Angeles/108-S-Wetherly-Dr-90048/unit-2/home/39642159

This particular zip code is on fire over the past year.

Tenancy in common sale……no jackpot of 500k

On fire is a good metaphor although it’s risky to run into a burning house.

Perhaps the biggest problem with the housing disconnect in Southern California is the impact on the future. People spending all their income today just to exist in these expensive areas, are sacrificing their futures! By some accounts almost 80% of American’s have less that $100k in savings or retirement! Living just for today whether by plight or intent, means a person’s future is getting bleaker with every passing day. As the author has pointed out a number of times, Southern California is full of elderly people living in million dollar homes, who have to eat dog and cat food, because they have no money other than that tied up in their homes!

Isn’t that what reverse mortgages are for?

Here’s a thought…

Bring back minimum down payments of 20% and …

mortgage rates of 8% and …

scrutinize the buyer’s ability to pay the debt using reasonable lending standards.

Then let’s see what happens to price.

It is not going to happen because the local govs depend on property taxes and therefore on property prices….they have a vested interest in having the prices to increase even further.

The only way out is to make the property taxes independent of property values….as it should be

I don’t know what to think about the current sky high values in housing, the stock market, etc that have been re-inflated by the FEDs easy money / low rate policies. Maybe the builders know something we don’t and are unwilling to go out and build a bunch of homes again as they will be left holding the bag again in meltdown 2.0. Or maybe they just were unprepared for the snap back in pricing and don’t have cheap dirt to build on. Who knows????

It is the same everywhere. Low volume on homes for sale as frankly, I don’t think most people have the incomes to move up anymore. So this is the new normal unless something makes the whole marketplace tank again.

“Maybe the builders know something we don’t and are unwilling to go out and build a bunch of homes again as they will be left holding the bag again in meltdown 2.0. ”

Yes, they do know something. They know that prices for materials, land and skill labor went up while the house prices stay flat (with the exception of few zip codes which are red hot). Without profit, nothing gets built. Without new building, the supply stay low.

Median incomes to home prices is a terrible way to measure relativity and is huge flaw in these stories.

Say 100 people live in L.A., and 45 rent and 55 own. The median income of those owners is probably quite higher than the lower 45 renters, and especially the median overall. So the top 55 owners can afford it, the lower 45 can’t, and the median does not tell that tale.

Perhaps a story on that, DHB, would be compelling.

True. If 5 unemployed guys are drinking in a bar, their median income is pretty low. But if Bill Gates comes in and joins them, the median income of the 6 guys in the bar is now is in the billions!

Change “median” to “mean” and you would be correct.

The median of 5 guys making nothing per year with Bill gates *is* nothing. I think you meant “mean” or average.

No, their median income would still be low. Their average income would be in the billions.

You’re confusing median with mean. Bill would have to bring 4 NFL team owners to raise the median that much.

Somebody is confusing median with average. If there are 5 unemployed guys in a bar and the median (the middle of the total population) income is zero, and then Billy waltzes in; the median income will still be zero. The average will change but not the median…

Median incomes don’t matter because:

* Prop 13 is allowing retiring boomers to hunker down in their overpriced crap shacks (the only ones disputing this don’t live in SoCal…those who do know these neighbors by name)

* Immigrants coming with large cash down-payments and bringing with them non-income declaring housemates and business practices that don’t involve stating income to the IRS

* The Great Re-set at 3% rates has inflated homeowner purchasing power

* Again, if you’re living in SoCal you know plenty of neighbors renting out bedrooms, garages or guest homes, thus providing unaccounted-for income to afford their stucco crap shack

* The simple fact that people ARE using more of their meager income to purchase in SoCal. This is empirical and indisputable.

@Derrick

No one disputes the high percentage of income going to RE. What is disputed is to what extent this can keep the current bubble inflated. For every group of adults who squeeze in to a SFH rental there is a decrease in the pool of renters. This eventually leads to vacancies and price reductions. More importantly to the “buy” side of RE rental parity for SoCal as a whole went out the window around 2012. There aren’t enough money laundering oligarchs to keep the ponzi going. You can’t have a functional RE market without first time buyers and along with lack of income lack of rental parity kills the first timer market. As the Doc has covered previously, NINJA Neg Am loans made mortgage payments BELOW rental parity last cycle. That isn’t happening again. So the moment specuvestors lost momentum to sell into the bubble was pricked. We’re now watching the deflation unfold. Those that have to sell are growing right as those that can buy are shrinking. We had a 30% plus run up in 2 years on non-existent volume. We can have just as sharp a drop. If 5 houses must be sold and there are 4 buyers that can afford -10% of peak and the forth can only afford -40% peak the 5th seller is boned. Do the math on what the median price would be then. Expect this micro economic phenomenon to play out very quickly…

Never mind the figure of average income for a zip, look at the average expenditures. You are right about the underground economy here, it is as bad as Greece and we will end up the same way. The good times will continue to roll. It is the middle class wage slave that will leave town. http://www.mcclatchydc.com/static/features/Contract-to-cheat/Labor-law-dodge-hurts-taxpayers-and-workers.html?brand=slo

We don’t have a rational real estate market anymore especially in Southern California. We don’t have a rational economy anymore either. The new normal is just bubbles. RE, Stock Market, Bond Market etc. etc. Bubbles eventually pop. Always. Just look at history and show me one time when they have not. It is only a matter of when. Easy for people to justify themselves with groupthink as long as they are winning. And easier to blame someone else when you lose. This real estate bubble began in 1995 and about half of the air was let out in Late Summer of 2009. It began to re-inflate as investment groups swooped in and began to blow even harder in 2013. And with TBTF and govt help, there is no risk to big $$. What a surprise. We now have the mother of all bubbles waiting to pop. All the signs are there. Arms, Interest Only, FHA, 3% down, record low interest rates, Mortgage Backed Securities, Rental Backed Securities, Flip the House TV, Remodeling TV Shows, Stagnant Wages, Foreign Investment etc.. etc.. Just waiting for NINJA loans to appear and one big fish jumping ship to a different asset, class while shorting the RE market on the downside.

“But I thought it would be different this time!”, said the littler fishes.

Caveat Emptor.

http://www.westsideremeltdown.blogspot.com

Tyrone, here’s a better thought….

Putting huge restrictions on vulture capital/Hedge funds on purchasing blocks of housing.Though kinda late now. The rich and connected get richer… They were the 1st to be able to borrow larges sums and then go on a buying frenzy paying 100% in cash. This not only drove prices higher but, anyone looking for a place to buy and live in couldn’t compete (like me). Of course the real villian is the Federal Reserve who lowered interest rates forcing eveyone to look for a better returns on their money else where; which was in the housing market. Since, a small group now owns so much property they also have more control over the rent$. Really our only hope is for interest rates to go up and forcing their cap rates to look bad…..UNLESS they continue to raise rents. I think we are so screwed for a long time. The only pleasure I see is IF interest rates surprisingly increase dramtically and quickly and then see a selling frenzy. Good luck for them to sell their condo’s that have a high owner/occupant ratio, not a problem when u have a buyer paying all cash… just a thought.

@Kenny

I think crony capitalism/socialism is at the heart of the problem. If those TBTF institutions had been allowed to fail, more people would have paid heed to the causes and consequences of an overheated RE market. And then real reforms, not parlor tricks to protect elite wealth, would have been undertaken.

It’s even worse than you thought, it was the Federal Reserve that put the program in place for the the hedge funds to be able to purchase all the cheap homes with cash in the first place! It was a program they had posted right on their website! Forget regulating it, they invented it.

@Tyrone

Doing loans for a living, the move up buyers have the 20% down the majority of the time. Lower down payments are to help people get into their fist home (not a bad thing).

I doubt we see rates much over 5% moving forward as every industrialized Western country is maxed out on deficit spending. Merika simply can not afford to make the interest payments on our deficit if rates are 8%.

If we see high rates, it is because we have defaulted on our debt (never will happen as the FED will just monetarized it/print money)

Move up buyers have almost no alternative to put the money anyplace else. It is a permanent feature of this voodoo fiat economy. A rational actor would put as little skin in the game as possible, but nothing else offers any thing close to the same store of value.

Savings are already being taxed in other economies, 0.75% isn’t much better here. Stock market, are you kidding me? The equity market can only go in 1 direction “up” a sustained turn to negative will freeze liquidity in a bidless market. Something truly is not really yours if you can’t sell it. So leave it in the down payment.

These are some of the best posts I’ve read in a while but I’m seeing a different ebb and flow.

I compare Southern California and Bay Area prices to other high priced places on the planet and I see a bargain here. The fact that most of us have do do a serious stretch to buy a $700K crapshack makes no difference whatsoever. You either stretch, rent or move. California, the government and the sellers don’t care. We need to see ourselves as a planet wide market now with monied people sneaking in or getting H1-B visas and outbidding you. It doesn’t help that there’s no supply, but home builders are nothing if not rational. Why would they run through government gauntlets to build new houses on nearly non-existent land and a dubious supply of buyers?

People have seen wages stagnate because there is an incredible supply of workers for us to compete with. If you think the Hispanics coming here are working as gardeners and field hands let me be the first to disabuse you of that. If you find a home construction sight with carpenters, electricians and plumbers I’m going to bet the first language there will not be English. I was downtown at the Produce Mart last week seeing customers and only the smallest handful were not Spanish speaking. Meanwhile the high tech industry, here and the Bay Area are importing people with H1-B visas as fast as they can to save on wages. I’ve seen several studies that have shown all of the job growth of the last 8 years or so have been mopped up by the immigrant increase. Supply and demand at work. If you want to see the future of coastal California you need to look no further than Santa Barbara. There is nothing affordable – period. People would kill to find a $700K crapshack and they aren’t there. The schools are shrinking away beacause there are no young families with kids. You can see all those employed in Santa Barbara on the 101 in the morning headed up from Ventura and Oxnard. It’s a wealthy and ossified enclave. I think coastal California will be like this in 20 years.

Prices won’t be migrating down as much as the Fed will try and push wages up and stimulate inflation. Of course this won’t happen until our leaders figure out that open borders and higher wages can never happen at the same time.

If you have the Jones for real estate you need to make your plans now. I remember 1983 when we were all shocked that nice houses were up to nearly $200,000. Perspective is a funny thing.

Fensterlips, you are 100% correct.

Here in the Bay Area, (Fremont) it’s all about offshore Chinese cash

and young HB-1 tech workers.

Their families will front the cash for the purchase.

They want the American dream more than you and will outbid you every time.

Ah, yes, the good ol’ everyone wants to live here narrative. Now with international! You know what happens when you hitch your raft to a boat in international waters? It gets pulled into the storm when those international waters get choppy. No free rides, even for global international world class prime coastal and boastful passengers.

Someone else’s Jones is going to bruise your chin into the coming Prime House Price Crash.

The reason all this is put up with is California is still one of the best places in the world to live.

No, the reason it is put up with by many is due to larger masses having stronger gravity. A lot of dumb dumbs follow each other to SoCal in exponentially increasing numbers.

What this country needs is a good war.

“War is a racket…It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.” — General Smedley D. Butler

The U.S. has become– “a country of the rich, by the rich and for the rich”

we already have a financial war with russia just like we had with japan right before they attacked pearl harbor.

and we have chaos and confusion in the mideast when we are fighting isis with our left hand and helping iran fight isis with our right hand

Errr I think we’re in one already… a full-scale real-estate QE 0.5% decade ponzi VI Rentier/Asset Wealth pump and value protection war…. blitzing younger professionals from bettering themselves, global in scale in low-mid-high prime real estate markets.

Doc: Sales volume continues to be very low.

A friend *cough* has begun to use Twitter more. He’s noticed quite a few links on there to your entries.

https://twitter.com/WilliamsSog/status/582160910896218112

No, it needs a good solid cleansing recession and adults running the show, not caving in to every rabble rousing academic or community organizer who comes along trying to start trouble. Federal reciprocity for concealed carry! Rioters? Shoot ’em. BANG, they’re dead. If they send more, we’ll keep shooting until they’re all gone.

LA Weekly ‘ 10 best neighborhoods to rent a house’

you will see that this list hits on many of the districts where gentrification is happening (West Adams, HIghland Park, El Sereno).

Keep in mind this is a hipster publication, promoting these neighborhoods. And dont forget there are 75 million Millenials in the US today with a median income of $61K.

If you think that home prices are going to crash soon, I think you are underestimating the Millenial demographics.

http://www.laweekly.com/news/here-are-the-10-best-la-neighborhoods-for-renting-an-affordable-house-5220450

and is gentrification ruining or improving LA?

http://www.laweekly.com/news/is-gentrification-ruining-los-angeles-or-saving-it-pick-a-side-5342416

Are you kidding me? I wonder what the writers at LA Weekly are smoking? 8 out of the 10 best places to rent are literal ghettos. I wonder if they have ever been to West Adams, let alone spent the night there. I have, and saw more then one person high as a kite running through traffic on Adams in only PJ bottoms and a cape in the middle of the day. Majority of the homes should be torn down due to decades of deferred maintenance and neglect. I’d rather rent a place in Syria or Iraq then West Adams.

The LA Weekly has suffered in editorial content, same as any newspaper. Back in the 1990s, they had a vast classified ad section. Craigslist killed it, taking a big bite out of it’s income.

It’s a much smaller-sized paper than 20 years ago. Used to be an over-sized tabloid. Now it’s a small magazine on newsprint.

Fewer employees.

Fewer original articles. It shares some editorial content with its sister publications (e.g., New York’s Village Voice).

Mostly it’s just a ton of display advertising and event listings, with a few articles and columns slipped in.

Um, yeah. Yet another top x click bait list. Bottom barrel scraping type of stuff that reminds one of Buzzfeed.

The stuff is starting to hit the fan in China as well.

China’s big banks double their write-offs:

http://www.marketwatch.com/story/chinas-big-banks-double-their-write-offs-2015-03-29

This mess is going to be a global event with massive political consequences. It will topple small regimes and governments.

In the meantime, another crapshack :

http://www.marketwatch.com/story/ramshackle-san-francisco-home-sells-for-12-million-2015-03-27

After reading the whole Realty Trac study, Denver was mentioned alongside LA, San Fran, and Boston as a city where the wage/ home price gap continues to widen. The truth is that there are some affordable places to live in Denver, but they’re not safe. Plus, right now there’s so few homes to choose from that buyers are skipping contingencies…we were advised to skip inspections and that’s partly why we gave up. I can’t put 70k down on something and not know what I’m really getting. Scary.

I think the bottom line, real deal fact is that a helluva lot of people want to live here. There is not quite a helluva lot of places to live. This equal high prices.

It will be a large job loss recession or major environmental event that changes that norm. And no, it’s not water. Water use by residents is 15% of the problem, and rations are not that hard to deal with. Brown lawns, oh darn. I’m sorry but funny money loans are not out there, and demand is. This is here to stay folks.

I don’t rule out stagflation. Caveat emptor – It is entirely feasible to assume home prices can hover around this current level for years, until incomes do rise.

Based on what I see, this spring/summer is going to be a seller’s market. Increased demand and lower inventory equals higher prices and bidding wars. I see many properties in my neighborhood getting ready for market. I think many sellers see this as the last chance to cash out before the feds increase rates and effectively decrease buying power of potential buyers.

That’s what I see in my neighborhood. There are many homes being touched up and shortly after being listed and selling within a week or two. I mean FAST, it’s listed and then someone is moving in right away. The magic price point seems to be $850-$950K for a 3 or 4 bedroom. Just like last time, prices are going to keep going up so we should buy now before we are priced out forever. After all home prices are increasing much faster than our income and savings rate.

If you take a cruise around the south bay, there’s a TON of construction activity, especially along the beach in Manhattan and Hermosa. Mostly teardowns with large brand new homes being constructed. This smells just like 2008. And I don’t know how to interpret it. I’m just going to ride this out for a year or two and see what happens. LA is nice and fun, but I’m not convinced I want to stay here.

The problem though is that I think the FED is going to be slow on its increases. So you won’t likely have a quarter increase each time they meet. Might be more like every 6 months or year or even longer depending on the economy. -all IMO.

The only other problem here is that saying that the the “tOp” is coming I am sure many banks will likely want to cash out of foreclosures while they still can.

Bad thing here is that the states are going to probably be hurting for tax revenue if prices are going to decline again and likely stay low. I can see home owners will be disputing with tax assessors for trying to asses their house higher if prices go down again.

For all the renters keep renting until their is blood in the streets.

-all IMO

Interesting article about foreign Chinese RE buyers snapping up houses in the Bay area.

http://www.sfgate.com/business/networth/article/How-and-why-buyers-from-China-are-snatching-up-5924991.php

Unfortunately, the system is rigged to force people to buy homes or invest otherwise lose it all to the IRS. I am in a situation where I am considering buying a home just for the tax breaks. I have tried to stay out of the game and rent but since renters get nothing except screwed by the IRS I now need to considering buying. And after following this blob since 2008 and we are still talking about the poor state we are in, they have one and this will never change. Play their game or get screwed.

Leave a Reply to Prince Of Heck