Living at home generation: a modern day feudalism awaits young Americans as the prospect of homeownership falls out of grasp.

The prospect of homeownership for many young Americans seems so far out of reach that many are resigned to be renters for the rest of their lives. In places like San Francisco and New York even those with decent paying jobs will find it hard to own a piece of real estate. Obviously many investors with easy money from the Fed realized this end-game and dove into the landlord business with all the gusto in the world. Wages are weak for the children of baby boomers. Many in fact are back living at home. Homeownership seems like a massive pipedream when many don’t even have the income to support a rental. Of course in California, you have odd inter-family dynamics where some kids are just waiting until the parents keel over so they can inherit the Prop 13 protected World War II built property. What more do people expect from a narrow focus on the present while ignoring the challenges facing a new generation of Americans? This structural change has also created a big hit on new home sales. Unfortunately for many a modern day system of debt serfdom awaits. For those that have the chance to buy, it may require a massive leap into debt on top of the student debt many already carry.

Living at home is in fashion

The number of young Americans living at home has risen dramatically in the last decade. Many thought this was some short-term shift but it looks to be a significant trend with permanence. Short of real wages going up for this group, it is unlikely that many of the young Americans out in the market for housing have a fighting chance against the dark pools of money from Wall Street. With limited inventory, prices go up but so do rents since big investors are in the game as modern day mega landlords.

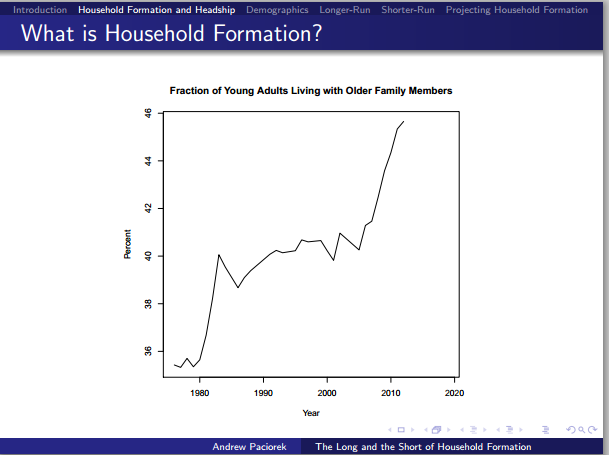

The number of young adults living at home has grown dramatically since the 1980s:

I find this chart very telling. From 1980 to 1990 we saw a sizable jump but this stabilized. For nearly 20 years the percentage stayed within a tight range. That is until the Great Recession hit in 2007. We are now deep into uncharted territory. It isn’t like a lifestyle shift hit where young Americans now want to suddenly live at home with mom and dad. What did occur is weak income growth and low wage jobs pushed many to move back home for financial reasons.

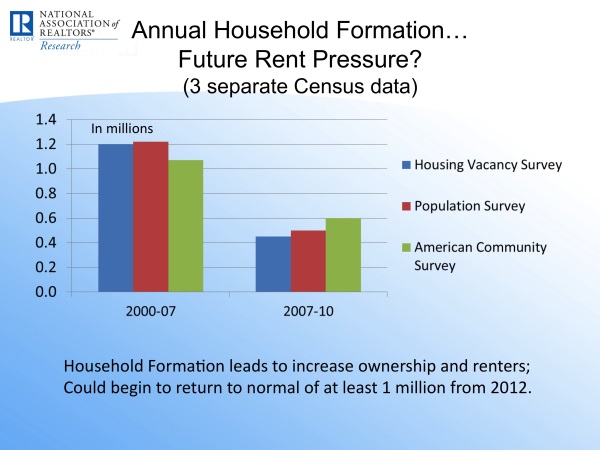

The Great Recession took a hammer to household formation:

From 2000 to 2007 household formation was running at around 1.2 million per year. From 2007 to 2010 it was roughly 500,000. The latest figures have it back around 1 million. Keep in mind that from 2000 to 2007 NINJA loans allowed anyone and everyone to buy a home. So low incomes didn’t matter. We essentially lived a late night real estate infomercial in real-time. Today, with government backed mortgages, people have to show legitimate income and this has hit sales. Of course investors using non-traditional financing are eating up a large share of inventory.

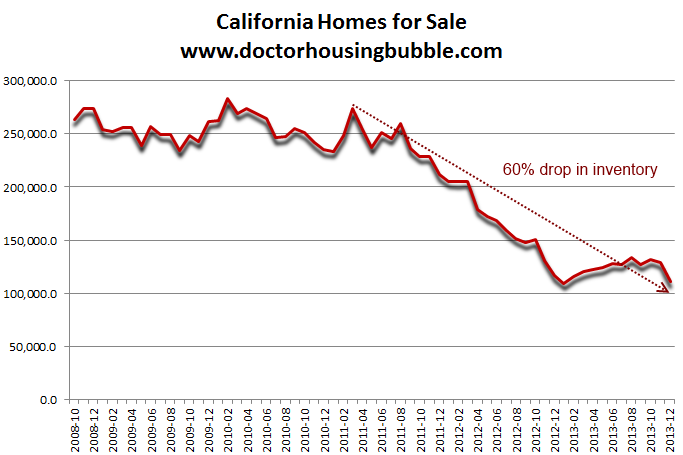

You would think that given these kinds of dynamics that the market would have a healthy amount of inventory. That is not the case. Banks have selectively captured the system and with the Fed pushing big pools of money out of cash, you see money rushing into real estate and the stock market. Take a look at the number of homes available for sale in California over the last few years:

Source:Â Zillow

Inventory has picked up slightly since the year started which is not reflected in the chart above ending in December of 2013. However, do you see young Americans out in the market trying to buy up real estate? In high priced markets this is even more unlikely. The new school of thought is “well you get two professionals and you take on a jumbo mortgage.â€Â Ironically, many of these people plan on having a family and guess what? This usually means someone is out of work for a few months and when they are back, a giant chunk of money is going to go to childcare. This is tough on an already stretched budget. And when you are squeezing into a home based on two incomes you better hope those two incomes continue to exist or be prepared to cover the mortgage on one income.

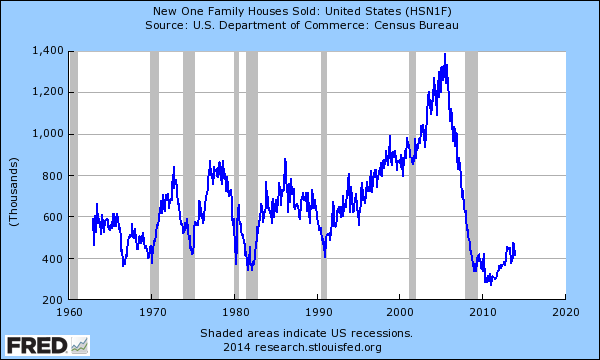

I doubt many young households are even running these numbers at least in expensive areas. In fact, new home sales missed their mark showing that the end of 2013 was not a good one for housing:

This chart doesn’t even do justice to the absolute collapse in new home sales:

Builders clearly understand the current trend. This is why there is no flood of new home building. Many of the new home building permits are going to multi-family dwellings (aka apartments for rent).  Large investors are aggressively going after this income stream. In places like Florida over 60 percent of recent purchases went to investors.

Many young Americans will be accustomed to paying their student debt and rents on a monthly basis while these income streams go into banks, many that own their property. Not a bad situation if the market wasn’t rigged by banks where preference is given to large money and low rates matter little when the Fed has set a fuse to Wall Street to buy out large portions of real estate in the market. Of course many will try to pretend that this is some sort of free market. The housing market is fully subsidized and juiced to the gills and while this is going on, a younger generation gets older and their dreams of homeownership move further and further away. At least they can bunk with mom and dad and enjoy stories of those beautiful golden real estate handcuffs.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

104 Responses to “Living at home generation: a modern day feudalism awaits young Americans as the prospect of homeownership falls out of grasp.”

Hi Doc I wonder if this explains some of the gentrification I hear about in LA. I recall someone posted some time back that Boyle Heights was going to be the new Silverlake… cheap homes yet within a rock’s throw of Downtown LA where many young people are getting professional jobs…

http://www.kcet.org/arts/artbound/counties/los-angeles/the-potential-promise-and-pitfalls-of-the-boyle-heights-arts-district.html

http://laist.com/2013/08/18/ny_times_chipsters_are_gentefying_b.php

At 32 and 36, my wife and I aren’t exactly setting the world on fire income-wise, but we do rent from my father-in-law at the market rate in an area we can’t afford to buy in. Not always ideal, but having (both) been unemployed for a period of time we’re both a little skittish on rocking the boat right now and realize that we are lucky to have a buffer if SHTF.

Kids are behind a dog at this point, which we won’t get until we move out of the condo and into something with a yard. In other words, sometime in 2030.

You should buy the property from your father in law (if he’s willing too). Depending on how much equity he has you could do a refi adding you and your wife on the loan and removing him off the loan. He could get some cash from the refi and he wouldn’t have to pay capital gains selling the property and you wouldn’t have to come up with a down payment. Just a thought, I did this a few years ago with my family.

That’s called tax fraud.

I was being a little facetious.. we have options that are probably better than most, but they aren’t within commuting (sanity) range in LA.

More to the point, I can count on one hand the people in our age range who are out living the life my parents did at a similar time. The other hundred~ are, like us, just nudging it along. We are driving that car until the wheels fall off and upgrading nothing that still functions. Investments? Hah.

Try and get a RTO deal. Look at it as a forced savings plan. by 2030, you will have put a 6-figure amount into that plan versus having just given it all in rent to a LL.

Add the tax breaks you will get and this might work out for you, with you having to drive to some park to enjoy a lawn.

Another Baby Boomer syphoning off of a couple of Gen Xers who, in a sane world, should easily be able to afford a home of their own to live in.

Is this the way it goes? Baby Boomers spend their entire lives enjoying the fruits of inflation until they own absolutely everything, bleed Social Security dry, and rent everything back to the Gen Xers and Millenials at double profits until they die of old age in their McMansions?

Sounds legit.

Silly disgruntled manchild.

I speak as a member of neither of the “generations” (actually demographic conventions invented by the advertising industry to deliver profits to shareholders) you note.

There is nothing wrong with renting. I did it till I was nearly 50. I worked through three recessions, didn’t get my real career started till 30 while working multiple crappy jobs to stay in an Ivy League Ph.D. program, and worked my glutes off for 20 years, saving everything I could. Then I bought a house when I could afford to pay cash.

There were a lot of us who didn’t stand around in the early ’80s whining because the oil embargo and 15% inflation robbed us of earning capacity and the opportunities we felt we deserved/were entitled to. That is the ultimate difference between successful and unsuccessful people: the latter whine while the others work.

And unlike the person you are criticizing, I didn’t have the option of living with parents. I was responsible for mine and had to figure out how to keep a roof over everybody’s heads. At the time I felt overwhelmed by too many responsibilities starting at age 19…but it turned out that it came at just the right time of my life: I was young and strong and had many years to build toward something better.

Your generational resentment is simply another accoutrement of the Era of Undescended Testes. Put on your big boy pants, face up to how life is everywhere, for all people, and quit whipping yourself into frothing heaves of resentment about people who were luckier, or more provident, or whatever.

As for me, my hobby is making life miserable for people who move to WA state from California. I’ve sent Doc this in the past:

http://duhprogressive.com/index.php/311-fleeing-californians-ponder-which-state-to-ruin-next

I think you are mislead to focus your anger at the wrong target (your parents and their generation). The bankers and 1%, instead of investing in production, they gambled in high-frequency equity trading, cheating via insider trading and selling worthless investment papers (derivatives) to everyone. They called these financial services and innovations. Greed for them is good, they steal. They used free money from the Fed; they bough and hold needed resources (oil, corn, aluminum, iron ore, etc.) until prices were pushed higher than real values. Therefore, there are no jobs and money left for Gen Xers and Millenials! Wise up, organize and fight back until you and your generation become slave (via financial mean). Don’t wait for your government, which is bought and controlled by the 1% already!

Lord B is right So Cal Prime locations will always be desirable (LA #2 highest homeless population in the country): http://www.zerohedge.com/news/2014-01-27/where-homeless-are-and-are-not

Housing To Tank Hard in 2014!!

Jim Taylor, even the homeless aren’t that stupid. You can “live” in a place like LA or stay put in the Midwest/Northeast freezer. I was up in Palos Verdes over the weekend, I didn’t see any homeless up there. I did however see a homeless guy pushing a shopping cart up PCH in Hermosa.

No paradise is perfect. If you find one, could you let us all know so we can join you. 🙂

In the USA, we have been used to an economic cycle that was always raising most everyone up when it turned up. This is not the case now.

As with many countries around the world, there’s a large number of the population that live in continual poverty while the top 10% enjoy income and real estate value growth. This upper level want to live in the same areas and have the same std of living and they create their own world as the other 90% languish in their own lower world. This transition is difficult for most of us to grasp as we’ve not seen it before. But if you’ve spent time in Brazil or India or anywhere that has this type of demographic, you know that it functions this way and has for a long time.

Everybody wants to go do heaven but nobody wants to die…

CAE, the difference is that the middle class in India is growing by leaps and bounds in India. While it is small as a % of the population, the numbers are huge. Population: about 1.3B, Middle class about 330M people and growing fast. The middle class in Brazil is growing as well. I can’t recall the stats at the moment. In the meantime, the middle is shrinking in the U.S.

Whoops! Everyone wants to go TO heaven not DO heaven… To do same same…

The “middle class” in a developing country is glad to have floors that are not dirt. Actually, the term “middle class” is not meaningful. The measure should be the std of living….education, health care, etc….

You’re kidding, right? My middle class relatives in India live in Condos and own flat panel TVs, PS4s, SUVs, jacuzzis. That’s the NORM. If you haven’t travelled outside the U.S. in the last decade or so, you have no idea how far behind our middle class has fallen.

Janum

Maybe, but, from what I understand, there are more cell phones than working toilets in that country. It is not uncommon to see even the “middle class” just relieve themselves in the street.

Pave the roads and establish a modern public sanitary infrastructure, and then we can compare creature comforts.

I’ve been India and Brazil in the last 5 years. But my point is that a country can have a huge percentage of the population is basically disenfranchised from the general economy and yet there’s enough people with the financial capabilities to put upward pressure on things like real estate prices. This is something we really have not encountered in the USA until recently.

I’m not sure I can add much more to this blog without regurgitating/repackinging my previous posts. There is some truth that we all bring our own lives (and our own insecurities and/or accomplishments) into what we write here, so just be careful to recognize this and try to separate this when making an investment decision. Fck the joneses too. Life is not about buying a bunch of things you don’t need with money you dont have to try and impress people you dont really give a sht about it (quote butchered and stolen from somewhere). That being said, if you do purchase a home (or stocks or other assets), don’t be a turd and start patting yourself on the back if things go up in the short-term thinking you are now smarter than you are or bragging to others of your ‘success.’ Kenny Rogers should have taught you by now not to count your chips while you’re sitting at the table. A little theme music as I bounce:

http://m.youtube.com/watch?v=XuQzkt5a2EU&desktop_uri=%2Fwatch%3Fv%3DXuQzkt5a2EU

You’re not going to stop posting, are you?

FTB – Don’t stop. We really need to hear the facts over and over and over to have any chance of it setting in…

” Life is not about buying a bunch of things you don’t need with money you dont have to try and impress people you dont really give a sht about it (quote butchered and stolen from somewhere). ”

In other words, don’t live your life as a slave to the perceptions of others.

One last thing, thanks again to the poster and reposter of the below re: sir James goldmsmith’s predictions for the US back in 1994. For those that haven’t watched it yet, its really a must see. Not long and not political either.

http://m.youtube.com/watch?v=4PQrz8F0dBI&desktop_uri=%2Fwatch%3Fv%3D4PQrz8F0dBI

Yes, Goldsmith had a lot of things right. He was right about trading among developed and undeveloped nations, right about excessive immigration, right about the EU and the Euro currency zone. I was put off at the time by his anti-nuke stuff which I took for eco-nuttery, but he was right on the money in so many areas.

Wow, those videos are creepily prophetic. Twenty years ago!

Remarkable videos. Goldsmith paints the picture of the world we live in, yet he did it 20 years ago. A must see…

Prophetic indeed… OTOH, maybe it’s just the 1890s all over again?

His ‘money’ quote: “What good is an economy that grows 80% if unemployment goes up (by 1,200%)?”

“Builders clearly understand the current trend. This is why there is no flood of new home building.”

So true. I listen to financial media, and hang out at some websites, and have been amazed at the cheerleading for homebuilder stocks over the past few years, and, they’ve actually done pretty well. So many think that this is just a cyclical downturn, that soon homes will again be built in large numbers as all of the young people will certainly be in the market for a sweet little palace in suburbia, just like their parents and grandparents. My answer has been, and still is, then why aren’t these companies building homes in any kind of quantity? Sure, they’re buying land, and maybe even starting a process by applying for permits, but, they aren’t building. Maybe they know best?

look around in your demo graphs before moving forward. If new home sales are being discounted and the traffic on weekends is poor, then this gives you a idea your location may be slowly down for new and resale.

This isn’t everywhere, people still on waiting list in many Cal. communities, again if things are slow in Atlanta, it has nothing to do what is happening in San DIEGO COUNTY?

Folks like to generalize a lot, not good for making money, every plan you make should be on your terms and situation not someone’s else’s.

Many people Mike have the money to buy, these buyers are waiting for the shoe to drop on prices they have a long wait. Eventually buyers will realize they either pay the price or face 5% to 5.5 % mortgages coming sooner than you think.

Pent up demand it is coming, and builders and banks will play the supply and demand game and cause another frenzy, lots of panic buying low inventory, it works every time to drive home prices up.

“Many people Mike have the money to buy”

I disagree. Most people have no money. That’s why homes aren’t being built or selling to individual homeowners across the country. The pre bubble housing market was based on incredibly easy, almost criminal money. That’s not coming back. A very large portion of the housing market activity out there is institutional investors buying up junk, thinking they can be America’s landlord. (65% of the Florida churn is cash buyers) That’s not going to end well, but that’s a subject for another thread that’s been discussed here.

As I said, nobody has any money. The average savings account, either day to day or retirement, is abysmal. Young adults are carrying staggering amounts of student debt, and their parents are again racking up credit card debt as they get back on the consumer train that is America. Sure, you can point to certain towns and regions where life is rosy, but I’m guessing those are the places where the 1% live and play. Do the simple math. There aren’t too many of them, and the rest of America is falling behind rapidly.

Oh, and…

“builders and banks will play the supply and demand game and cause another frenzy”

No, that’s not going to happen for many years. Read the new Consumer Finance Protection Bureau mortgage rules that just came into affect as of January 1. The days of no doc, no money down loans are gone for probably a decade or two.

In the spirit of full disclosure little “r†robert is a real estate shrill. Any advice should be taken with a grain of salt…

Hey “What?”

It’s SHILL not SHRILL. I normally wouldn’t correct on a blog but you’ve called him that repeatedly and I’m pretty sure the term you’re trying to get across is shill…

CAB – thanks for the correction. I get some words wrong no matter how many times I try to correct like “you” and “your”… But he really is a shrill as well because he is really hard to listen to… 😉

“people still on waiting list in many Cal. communities”

Do you have proof of this statement? Define “many.”

robert said: >>> Eventually buyers will realize they either pay the price or face 5% to 5.5 % mortgages coming sooner than you think.

Pent up demand it is coming, and builders and banks will play the supply and demand game and cause another frenzy, lots of panic buying low inventory, it works every time to drive home prices up. <<<

My reply = It is far better to pay a low price with a high interest rate than a high price with a low interest rate, even if the mortgage payment is the same either way.

As interest rates fall, real estate prices generally rise…. which is a phenomenon we've seen. Let's see what happens when interest rates notch up a bit more from the lows you've been creaming your pants over (maybe). You've had the driving up of house prices. My bet is you're going to feel what a true house price crash is all about (I hope).

Good article Dr. Housing Bubble. It makes me sad, but it's the truth of things. Got to hope something comes along to give younger people opportunity, against all the Vested Interests against them.

The culture is changing to Mexican. We like three generations in the house. Anglos do not have this culture. The Anglos can move to Texas and etc. for their old fashion type of housing that they grew up in.

Ok… it is not only the Mexican or Hispanics, But also the Asian and Indian that do this. Living all in one house.

You can notice the Asian multi-generation housing, when you see like 5-6 BMWs, Benzos, Lexus’ all parked outside the house.

Why do you mention the expensive cars? We like practical pick up trucks and mini-vans for the kids. May be the expensive cars were brought with all the free government benefits?

“old world” people are use to multi-generational housing. It has only been recently, in America, that every generation has their own house. Anglos don’t have many kids, if any, because they do not have the older generation(parents and aunts) to take care of the kids while the parents are at work. The Anglos have to go to Texas now(leave the big homes for the multi generational families) if they want to have kids and a house without the older generation living with them.

It used to be American culture too, depending on your cultural heritage. So we could actually look at this situation as a cultural “correction” in that sense. A number of my neighbors live multi-generationally – Armenian, Japanese, Korean – sure. But some of my American neighbors have their young adult children living with them, as does my brother and my husband’s sister. Maybe this is the new normal.

I was also in PV this weekend looky-looing the sparse open houses there. Real estate agent told me buyers are looking for the four-plus bedroom home. I saw a 6-bed house, and as I was leaving, a multi-generational group of Chinese came to look. And in the development of mega-mansions in front of the Admiral Risty, there are two $8 million spec homes being built for sale at about 8,000 sq ft each.

@ Juanita… yeah the nice cars with the Asians and the mini-vans and pick-ups with Mexicans… << this is beside the point.

My point was that you can pretty much tell how many adult people live in one house by the daily cars parked on the driveway, front of the house. Multi-generation habitat

Thanks for this follow up to your prior post “Failure to Launch” that I cited as further reading in my post: Millennials Not Part of the Club Yet

http://smaulgld.com/millennials-not-part-of-the-club-yet/

Like you, I blame the Fed for the millennials’ plight in housing and in all other areas of economic stagnation. The only hope for millennials is a collapse in the economy and home prices that doesn’t get ‘cleaned up’ so that they can begin to participate in the economy on more equal footing.

Living with parents is not uncommon in some parts of Europe (ie. Switzerland).

What’s next? 100 year mortgages?

“What’s next? 100 year mortgages?”

The new Consumer Finance Protection Bureau regulations limit mortgages to 30 years.

I know several young people who have bought houses, started families, have promising careers, etc.

The catch? They move to areas where housing is more affordable with lower cost of living, less competition and better economic opportunity. They’re pioneers. They leave the comfort/security of living with Mom/Dad in the family home or renting a apartment in a cool familiar ‘hood; they move far away from family/childhood friends, leave familiar places they know/love, adapt to unfamiliar territory, meet new people, experience new cultures, etc. Spending a big chunk of disposable income on electronic gadgets, entertainment, new cars, etc. may no longer be an option as it might have been living in the childhood bedroom. There may be cold winters, snow, and/or hot summers. There may not be beaches or mountains and fewer entertainment/restaurant choices. It’s a decision an individual can only make for themselves.

Time passes quickly; regret is a terrible thing. Life is full of trade offs. JMHO.

“The catch? They move to areas where housing is more affordable with lower cost of living, less competition and better economic opportunity.”

And, where might that be? From what I understand, and have experienced in life, one moves to where one’s job is, and accepts whatever conditions one can accept in that locality. These kids aren’t going to move just anywhere, especially a couple, as you imply, who are actually going to “start a family”. No, both will attempt to live in a place where both can get decent jobs, because most families need two incomes to afford a nice house.

And, from what I’ve seen, that means moving from cheaper rural areas and rust belt metro areas to hipper cities where new companies start up. Unfortunately, those places are more expensive, because, well, duh, that’s where the good paying jobs are.

Mike M,

I agree with your argument with a caveat: You can choose to live in a lower cost of living area with employment options. I once worked for a start up in Boulder, Co., but I lived 15 minutes away in Longmont. I now work for a high tech company HQ’ed in the Silicon Valley, but I can live anywhere I’d like and telecommute. I live in Texas.

Texas

Not trying to be sarcastic, but, lucky you. I’ve been stuck in NY metro all my life because that’s where the jobs are for me. Wait, no, I have another choice: San Francisco. Nice choice, huh?

Mike, most people nowadays have careers that there is opportunity in many geographic areas. All the jobs in the US aren’t just in NY and CA; it’s a big world with alternatives. Accounting, medical, banking, insurance, finance, hospitality, law enforcement, govt, retail…on and on…you can make a decent many places besides California and New York. You really can. You might make less but your cost of living is often less, so in many cases it all evens out.

I know people who relocated to TX, AZ, KS, ID and WA. I know a few who left the US. They’re all doing fine; some bought houses, some rent. Some voluntarily took transfers from jobs they had in CA, moved businesses, or secured a new job before relocating. The major factors why they left seemed to be either/or the desire to buy a house, lower cost of living, start a family, better quality of life, etc. For some owning a house and having kids was never going to happen in SoCal; hard choices had to made and sensible plans put in place. No, they didn’t just hit the open road as a couple with no jobs and start having kids, wheeee!!!

It often baffles me how people react when they hear a person has left CA…it’s as if that person has fallen into a fiery abyss of no return. People become agitated, incredulous…how can that person leave, there is no life anywhere else! They can never come back! They will be sorry! Mike, there is plenty of economic opportunity and jobs in many parts of the US. One might make less and/or might not be a Silicon Valley superstar, but in many cases one can own a house and have children, maybe a spouse can stay home with the kids if the cost of living is low enough. Some just want a lower cost of living/business friendly/different political climate. For some the trade off is more than worth it. JMHO.

Well, I don’t know what world you live in, WeDon’tDrinks, but I’m on Earth, western hemisphere, north of the equator and the tropics, where it’s really really hard for a plus 50 year old to find a job in many many fields. I’m doing fine, but, for the past drive years I have read horror story after horror story told by formerly comfortable white upper middle class people who thought they had it all going on, they were on the gravy train, and then, bam, end of the line. Of course they had no savings, that’s the American way! But, even if they did, that pool evaporates a lot quicker than you might think if you have no other income sources. And, haha, they thought they could cash in on the overpriced MacMansion. Ha.

I’m happy your friends are doing well, but, I wouldn’t get to comfortable, if I were them. Job outsourcing paired off with new uses of technology are destroying our job base like a buzz saw, and the recession inspired even more expense cutting by all companies, accelerating the trend. Nobody is indispensable in any company (I’m looking at you, Jamie Dimon), especially the 52 year old who negotiated a tele commute from his second home near outdoor recreation in Idaho or Colorado. They’ll be the first to go. What’s the difference between him/her or somebody on Skype from Mumbai, except the large difference in compensation. (Indians are doing law these days, you know. What’s next?)

I think you guys are bringing up a great point: you have to be ready for your career to go off the rails at 50. That’s part of the reason I moved out of California right before age 40–I had the 92130 house, pool, etc…, and I looked at my savings and realized that there was no way that I’d be ready for retirement at 50 unless I made some important changes. Now, I’m in Florida and find, in my circumstance with my family, that the cost of living is significantly lower and quality of life higher. I’ll be ready at 50, should I have to retire, as long as I stick with my current situation.

That’s what confounds me with so many of the Californians I know. Unless you’re coming from money, are you really prepared to retire? Don’t count on getting re-hired for anything substantial beyond age 50.

Texas Accountant, nice to meet a son of Texas, God’s country, the promised land. Of course, I live near Kerrville, the Hill Country. You probably live near Austin. Texas is a big country(according to our affiliation papers with the Union, we can leave and be our own country). Governor Perry says for you all to come on over, but I like it as it is here. Apparently, from reading this blog, the people on the coast of California would never leave and will put up with all types of hardships to stay there. Now that is true grit. Some people just love to suffer.

“Well, I don’t know what world you live in, WeDon’tDrinks, but I’m on Earth, western hemisphere, north of the equator and the tropics, where it’s really really hard for a plus 50 year old to find a job in many many fields.”

Mike, my original post was related to the topic of Doc’s posting “Living at home generation: a modern day feudalism awaits young Americans as the prospect of homeownership falls out of grasp” and addressed young Americans/young people starting out, how it might benefit them to relocate to more low cost areas if they want to buy a house, have children, etc. since that can be very difficult to do in SoCal. My post didn’t have anything to do with 50+ year olds finding jobs, Jamie Dimon, or outsourcing. Perhaps I To be fair, I do know some 50+ people that left SoCal to relocate to lower cost areas, but they were either retired/semiretired; most sold houses, paid cash for a house where they moved, and banked/invested the rest. They also left because they didn’t like the CA business and/or political climate, felt quality of life was deteriorating, wanted a slower paced lifestyle, etc.

Best of luck to you.

“Drinks”, I really couldn’t agree with you more. I’m a early 30’s professional who grew up in an affluent area of Northern California. I now rent in an affluent area of Southern California. I have a low six figure salary and no chance of living a life style California where saving and investing are realistic options. You are so right when talking about how those from CA believe this place is the be all end all. My company will be bought out in the coming years at which time I will cash out some small stock options and leave CA for more realistic pastures. It is all about making tough choices, and the bottom line is, most of us can’t afford to live here and also plan for the future.

I left home at 17 with nothing and no help because I had worked since I was 12 years old I managed to travel around the world build my own business save enough money to buy two beautiful homes unfortunately with bad timing I lost it all in the 2008 “collapse” (really it was out and out theft as it was ask planned for the banks to take over the real estate market) Everything I worked for since I was 12 years old that I invested into the safe boring real estate market. no one told me my equity was being stolen the day I closed escrow. No one told me that my signature was being sold to investors as collection rights with no interest in the property however the bank would steal the property anyway. No one told me that all the laws that I thought applied to property ownership were just lies. people talk about to collapse like it ” just happened,” this was planned, it is called stealing and it’s still going on to this day. Anyone that thinks securitizing the rent rolls is a good thing is a sucker or I mean investor. Just know that in physics an inflated” balloon must pop at some point.

Buyer beware. Next time maybe you should read before signing. A little market research would probably have helped as well.

Lynn Chase: >>No one told me that my signature was being sold to investors as collection rights with no interest in the property however the bank would steal the property anyway.<<

How did the bank "steal" your properties?

I assume you agreed to pay X amount of mortgage every month, knowing that if you stopped paying, you'd lose the properties.

You stop paying. So the bank — or "investor" — foreclosed.

What difference does it make to you whether it was the bank, or some investor, who foreclosed? Your mortgage obligations, and the penalty for failing to meet them, remained unchanged.

Lynn, buying RE near the peak of the last bubble was anything but a safe, boring investment. Keep repeating that sentence to yourself and you may finally come to the conclusion that you share some of the blame for your unfortunate situation.

I don’t know if I would call myself a pioneer drinks, but what you are describing is exactly what goes on around the dinner table at Thanksgiving/Christmas when we come back to SoCal. My parents, extended family all still live there while my two brothers and I left twenty years ago. My cousins, aunts/uncles still to this day ask when we’re coming back, and are stunned when we tell them we’re not. Every year it’s the same discussion all the while everyone bitches about taxes, traffic, gov’t, cost of living etc.

It used to be when I flew home, I always had that “I’m home” feeling after 22 yrs now I no longer have that. I’ve made my life elsewhere and for me it was the right move. Californians are like New Yorkers, they can’t believe there are other places to live. There’s over 7 billion people on this earth and a lot of ground to cover, I want to see and experience as much as I can before my life is over. You’re right, life is full of choices if you make them.

When housing prices fell in 2007,

1.) Banks refused to put the forecloses on the books, increasing the size of official foreclosures across America and lowering prices,

2.) Realtors and local city/county governments refused to drop the prices of the empty or foreclosed homes, keeping prices high, until the houses became “shotgun shacks” from ripping out all the copper piping and/or wiring, or “crack houses” in the neighborhood,

3.) Mega-investors are buying the decent houses as they hit the market, preventing prices from going low enough for newlyweds and young people to afford them.

This is not going to end well. There’s a chart out there showing the average price of a home across the USA as a proportion of annual income, and it nearly got to 1:1 in 1973. Today that ratio is 6 times an average annual income, and the realtors and governments and banks are unapologetic. “If you can’t afford it, maybe you should rent.” is what young people are being told. But if you rent, you don’t own the house, and the owner tells the renter what they can and cannot do with the house, including smoking, owning a gun, putting in a garden, etc. Which is what the socialist government wants, so there is no incentive to change the status quo.

President Bush (43) talked about a “homeowner society” in the US, but that was no-job-no-income fraud loans for $400,000 on a house now worth $100,000, but still on the books and tax forms as $400,000, if not $450,000. Six times normal annual income. It was all fake, and until good, non-destroyed homes are back down to only 2x annual income ($60,000?), young people will continue to be forced out of home ownership and into renting, which is not the same as owning.

Dear Dr.,

Cities will always need new parcels to collect property tax on. This is more lucrative on properties that are for ownership and not for rent. Ownership is not going to be dead. Remember last time property prices were getting out of hand?

Actually the strangest thing has happened in Silly Clown Valley. There is commercial real estate sprawl with many hundreds of square feet available with no takers along with residential real estate consolidation with very little inventory. This is because the state and local governments get more taxes on commercial real estate output than on residential. These are truly strange times…

that would be hundreds of thousands of square feet…

If we had the option to live with our parents, we probably would! We like them and enjoy their company, plus free babysitting. But geographically that’s not possible. It will take a while since many Americans are too spread out now, but in the coming decades I could definitely see a lasting shift to multi-generational housing. This assumes you can stand your parents’ company of course. 🙂

We’re propagandized to think that that is a bad thing, but there are a lot of benefits to it. Historically, humans lived in family groups within larger groups, not in these tiny individual households where no one is around to help each other.

Must be a generational thing. Folks in my cohort (tail-end Gen X’ers in our early 50s) recoil in horror at the thought of living with parents and high tailed as soon as possible. Similarly the lure of the automobile was sufficiently irresistible that virtually everyone I knew in high school got their driver’s license the first day they were available and then did whatever was necessary to get whatever rusty beater car they could immediately thereafter.

Kids I see now not only never seem to leave home, but have little use for driving. Living with their parents and getting Mom to drive them everywhere until they’re 30+ years old. The very thought of either of these would have been utterly abhorrent to anyone in my generation. It’s like we’re different species.

PS. While we may have had better job options coming out of college than kids do now, the kind of crap jobs we took in H.S. to afford cars are still plentiful. So it’s not just a matter of better luck and timing, but truly a shift in attitudes.

I work with educated professionals, and also some long tenured employees who have worked their way up the ladder (no college debt) and so many of them STILL LIVE AT HOME. Some are in their mid-30’s.

AND THEY HAVE NOT SAVED OR INVESTED A RED DIME.

They spend everything they make, they don’t cook, clean, think ahead financially – mom and dad do it all for them.

I agree with another poster in that living at home with my parents after age 18 was such an alien thought to me… I did everything I could to be independent.

Home prices show signs of topping out:

http://money.cnn.com/2014/01/28/real_estate/home-prices/index.html

Southland December Home Sales at Six-Year Low; Median Price Jumps:

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA140114.aspx

California Foreclosure Starts Dip to Eight-Year Low:

http://www.dqnews.com/Articles/2014/News/California/CA-Foreclosures/RRFor140121.aspx

Congratulations on being “Instalanched”, i.e. being linked out at the Instapundit site.

I’ve been following you since 2008 or so when my kid moved from fly-over land (where I own 20 rental properties) to SoCal. (Rivertucky, Pasadena, Culver City in that order).

As an arm-chair Medievalist, feudalism is perhaps overstated, but what else to call this (rather rapidly) occurring retrograde phenomenon?

Better hope there is not re-imposition of ius primae noctus or droit de seigneur.

After last night’s State of the Union, that may not be so far-fetched: If you like your wife-screwing overlord, you can keep your wife-screwing overlord …

December sales in CA cratering 19% YoY, full-year 2013 falling 6% — while month’s supply is up 27% — is inconsistent with both a “durable” housing market recovery and the “supply constraint” meme.

After starting 2013 roaring, CA real estate slumped in the back half of 2013 to such a degree it pulled full-year 2013 sales lower YoY, which nobody had forecasted.

In fact, December NorCal and SoCal sales literally “plunged” to their lowest levels since 2007; the last time prices were at a bubble peak. At the same time, supply increased sharply and so did the time it takes to sell a house. Yet, prices were up nearly 20%.

Bottom line: To those who think real estate prices are firmly rooted in the laws of supply and demand, these metrics probably look very confusing; demand plunging, supply surging, and prices surging?!? Say what??? But, to those who believe that the past two years has been rooted firmly in unorthodox monetary policy and investing this makes perfect sense. Data such as these are a leading indicator of price decreases on deck. In fact, Fitch put out a recent report noting that based on the historic relationship between home prices and a basket of econometric factors house prices are 17% over valued nationally, 30% in CA.

Strong evidence is now pouring out confirming what I think many have instinctively known for a long time; that the house price parabola — over 50% of the past 2-year Twist/QE induced gains came between Jan and June of 2013 — was not necessarily due to a ‘fundamental’ increase of demand or a ‘lack of supply’; rather largely tied to new-era “investor” activity. And that there really isn’t much difference between what occurred between 2003 and 2007, on the back of aggressive ‘leverage-in-finance” stimulus that turned every homeowner in America into speculators; and 2011 to 2013, on the back of the most aggressive interest rate and monetary policy known to mankind that turned a much smaller cohort of professional investors into speculators who drove prices twice as quickly as during the previous bubble.

December single-fam sales were down 18.6% YoY

Full-year 2013 single-fam sales were down 5.9%

December Mos Supply up 27% YoY

December time-to-sell increased by 6% YoY

December single-fam prices up 19.7% YoY

Some will say about the plunging housing demand, “oh, but this is due to a lack of supply”. But, that doesn’t hold water; sales were very strong in the first half of the year and supply for sale was much lower.

Since mid-year sales have been dumping, supply rising, and prices rising. Moreover, there is no shortage of supply “in which to live”. In the new-era housing market record multi-family building/rehabs, fully rehabbed single family houses for rent, and 7-million loan mods/workouts compete head to head with houses for sale.

What, do people really think that house prices going up 55% in Sacramento in the past 18 months was due to fundamental employment and wage increases? Of course not…it’s largely because somebody bought a dump for a dollar, put lipstick on it, and sold it for $1.5.

Here boys…..take a closer look at the following super interesting and frightening housing data from Folsom, CA

Folsom, CA is a higher-end suburb of Sacramento that you may recognize from the famous Johnny Cash song, “Folsom Prison Blues”. It’s a very nice community with a wide range of old and new houses.

First, we know that problems fester/manifest in the outskirts first then move into the more suburban and urban regions.

Second, we know that new-era investors ran to the outskirts last year when distressed inventory in the more suburban and urban regions dried up first.

The end result; a market imploding in real-time much more violently than it imploded in 2008. In the world of QE, Real Estate trends come much faster and are far more powerful than in the 2003 to 2007 bubble when boring ol’ exotic loans / leverage in finance controlled the market.

Bottom line: In Folsom, CA demand is literally “plunging” and supply “surging”.

This trend change is so powerful since May it makes the 2008 trend change look mild by comparison. And obviously, the demand / supply divergence means the plunge in demand is not due to a “lack of supply”. Rather, a lack of organic. fundamentally-based demand once new-era “investors” took their balls and bats and went home.

Take a look @ Folsom sales, supply, pendings

Inventory up 102% YoY

Sales down 26% YoY

Pendings down 24% YoY

Sales down 65% from pre rate-surge May, an historical collapse

Supply up 40% from pre rate-surge May, an historical surge into the shoulder months when inventory generally plunges

This is not how durable housing recovery looks like!!!!!!

Folsom is near that Cow Town, known as Sacramento, it is not the desirable areas along the coast. Completely different market dynamics. But you are right in that the market has turned. A Broker told me that it is taking a rest, as if the market is an animated creature.

Who is on watch duty tonight captain?

I sure hope you’re right about Folsom. I live there and have been watching the market and will buy if the prices correct to an “affordable” level.

I think prices are still sky high. I can barely afford a condo with shared walls. The cheapest 3 bd condo I can find in Folsom is over $300,000 with huge HOA fees to go along with it. I earn double the average US salary, have zero debt and still everything is out of reach.

Mr. Jones… Stop boring me with all your facts figures. I want to talk about feelings and positive thinking… How about you are forgetting that God isn’t making new land (well actually if you have been to Hawaii God is creating new land)? Or you are forgetting that you got to live somewhere (like in your car or a public park or on the street or friends couch etc.). And one of my favorites “there is a lot of money out there†(no there is a lot of debt out there). Did you see the Barrett Jackson auction? Blah, Blah, Blah. I am tired of fighting all the stupid comments so I thought I would try being a real estate shrill/shill…

Actually on the “law of supply and demandâ€, blert’s friend Steve Keen makes a good case why you can see exactly what we are seeing and that the law is not really a law but and misinterpretation of market dynamics. He states that the problem with neo-classical models is that they don’t include the impact of banks, debt and money. Interesting stuff that can explain why supply goes up demand goes down and price rises…

Folsom is an outlier.

1) It has a significant greenfield development right to the county line. (the east) These are McMansions plopped down on seriously expensive land. Their target market is the Intel engineer community. Intel has a major research and proto-typing plant just to the west, north and adjacent to I-50. It’s the engine for Folsom’s economy. Its claim to fame is flash memory — the chip technology was pioneered at this site.

2) Just south of I-50 and a few miles further west another massive greenfield residential construction campaign is under way. (5,000+ homes) It’s way behind original hopes. Bad timing.

3) Just south of I-50, and to the east, across the county line, a massive 5,000+ residential construction campaign is under way. It’s also way behind original hopes. Bady timing.

Absolutely NONE of the above properties has any appeal to the rentier crowd. They are not a factor in Folsom at all.

Instead, the mega-landlords are dialed in to Sacramento’s old suburbia: Citrus Heights, Orangevale, Antelope, and South Sacramento. Anyone with a brain shuns Sacramento city proper: the building inspectors there are out to get any real estate investors or developers. It’s so bad that they’ve been taken to court — upon which they LOST. (Dang that video evidence!)

All of which is a long way of saying that you can’t use Folsom as any kind of indicator of the California real estate scene. It’s actually a ‘company town’ instead.

BTW, the old core of the city is dinky. It’s so tiny that you can just forget it, market wise. Most of Folsom is as new as Elk Grove — a company town built by Apple Computer that straddles the I-5 south of Sacramento. These days it’s an echo of its past: Apple exported all of the manufacturing jobs to Red China. It lingers on (the facility) as a warehousing hub.

The other major real estate market in greater Sacramento is Roseville. It’s Hewlett-Packard’s company town. Its super-boom never recovered from Carly Fiorina. One of her first acts was to shut down all Roseville expansion — and ship the jobs to Asia. (Compaq in Texas got the same treatment, too.)

Like Elk Grove and Folsom, Roseville is completely shunned by the bread-and-butter crowd. Other than a trickle of older homes near the railroad tracks, everything is too new and pricy. (Roseville has been the main service hub for Southern Pacific for a century, essentially replacing Sacramento as the western terminus of the Transcontinental Railroad of lore.

%%%

In the out years, Sacramento is destined to become the next Los Angeles. It has all of the critical infrastructure. (Hence, HP, Intel and Apple.) This evolution will take fifty-years. LA and the Bay are entirely built out – – major facilities wise. Just ask Google.

I’m a early 30s renter with roommates, I live with 3 guys and rent a house in the north bay area. Two of us have college degrees, I’m assume we all make between 45-65K. We each pay $750 a month which covers the HOA. It is sort of lame on some fronts, but it really isn’t such a big deal. The girlfriends don’t mind, and they have roommates also.

However, In my opinion…Wall Street is going to HATE HATE HATE being a landlord. Our landlord has 5 rentals in Novato, Petaluma and Santa Rosa. She is selling one, just had this one refi’d late last year….plus we have to get a new refrigerator, plus we had a fire in the living room from a fish tank pump that malfunctioned or maybe the wall socket..no one could prove either way so we cleaned the place and she agreed replace the dry wall if we painted the room…$$$$$$$$$…Wall Street is going to HATE IT.

I can see all the 25 year old air conditioners and refrigs going out in Redlands already and eating up 3-6 months profit.

Another observation about myself and my friends in the bay area between 28-35…no one is in a rush to have kids. Yet, everyone I hangout with on a weekend is looking to move to the I-80/580/880 corridor and live in a nice apartment within walking distance of a BART station.

Getting a 3/2.5 house in Walnut Creek or Milpitas isn’t really on the radar for anyone I know…and..”yes” people will say that’s not true, but it’s what I’m seeing.

That’s the problem in California if you live in: a) Bay Area b) West of the I5 in Southern Cali C) San Diego…

You can’t move forward… unless you you have mom and dad gift you 100K down-payment for a “Starter home”

65K is penauts in Bay Area, LA and San diego. having a College Degree means nothing here. I know a few people without college degrees making a good living.

guy A: Mexican Immigrant working for a CITY here in Cali as a “Landscaper” making like 70K with a whole MONTH of vacation paid, Health Insurance, and a PENSION… gulp…(junior high – Degree from Mexico is all he has as education)

Girl B: She was the dumbest girl in high school regarding academics… never put any effort, got knocked up in high school by some gangbanger… now she works for the county with some social program making 65K…and many benefits…

Do you still want to go to college and have students loans and not get a job that pays a decent wage???

It’s nice to see that the tide seems to be turning in some parts of CA, ex Folsom, but here in L.A. between mid-city and the beach, I’m still seeing plenty of pending and sold properties at or near peak prices. If something is priced right, it gets multiple offers right away. Overpriced properties usually take a few price drops but eventually seem to sell. The only properties I see sitting for a long time are way overpriced, but I don’t think those sellers really want to sell unless someone is dumb enough to meet their price.

Hard data of major housing and mortgage “demand destruction” is everywhere but nobody is looking, or rather wants to see it.

Has anyone been paying attention to multi-family demand and supply????

Lets take a look at the classic bubble market Phoenix,AZ.

Less than a year ago this was one of the most supply constrained markets in the nation with a month of supply at best in the first half of 2013. It’s avg price is up double digits with a respectable number in front over the past two years.

Now, it’s in peril with months supply up 700% in 6 months. Yes….700%.

The supply/demand divergence is mind boggling. This certainly isn’t consistent with a “durable housing market recovery.

Just like the stampede to get in, now there is a stamped to get out. But there are no more greater fools, especially with 10s or hundreds of thousands of single-family rentals pouring on-line.

This “is” 2008 all over again, just different puppets.

Lets go to another classic bubble market. Las Vegas housing demand has crashed.

Dec 2013 sales were down 20% YoY, while full-year 2013 was down 10.4% YoY and and the weakest since 2008.

“Demand destruction” is the only appropriate term to use. This is not hyperbole. In fact, “crashed” is absolutely the appropriate word to use here given sales are suddenly the weakest levels since Armageddon 2008. I mean come on…sales at the same pace as when the stock market was in the midst of one of the greatest plunges in history and people feared their ATM cards wouldn’t work speaks loudly to me. For a little while, as all-cash “investors” deploy their remaining capital based on flawed models and assumptions, house prices can fight the fundamentals drag and pretend to be stable.

But volume always precedes prices……just remember that.

Dec Existing Sales/Supply Stats

Demand plunging

Sales…

down 20% YoY

down 25 % from peak summer

down 31% from post-Bubble 1.0 crash peak of Dec 2011 down 27% from Dec 2010 and down 31% from Dec 2009

Look at this headline from a week ago;

“Southland December Home Sales at 6-year Low; Median Price Jumps”

Prices up vertically in the past 18 months — more as a percentage than during any other 18 month period on record — in the context of persistently weak demand, weak employment, chronic underemployment, stagnant wages, and increasing tax burdens makes sense to me only in periods of high-froth, or a bubble.

This makes perfect sense, as we are presently in “Bubble 2.0”.

Nearly 40 to 52 percent of grown men in Italy still live at home with their mothers. It’s so common in Italian culture, there’s a word for it, “mammino. Nobody takes care of them like their mother. The young Italian women are frustrated.

Gently mocked as “bamboccioni” – literally, “big babies†– or “mammone” – mama’s boys – for their reluctance to fly the nest, Italian adults are living with their parents in huge numbers.

But it’s not simply the warm embrace of the Italian “mamma” that is keeping them at home. The phenomenon has grown in large part due to the current economic crisis in Europe, experts say. Nearly a third of Italians now live with their parents, according to new research by Coldiretti, a national farmers association, and Censis, a market research firm. Among the 18-to-29-year-old age bracket, the proportion rises to a staggering 61 percent. Of those who do not live at home, 42 percent reside within a 30-minute walk of their parents. But the cultural trend has been accentuated by the current economic crisis – the number of young Italians living at home is up from 48 percent in 1990.”

The EXACT same phenomena was written up in Honolulu — thirty-years ago — about Japanese American boys who were still single and yet 35 years old — and at home.

For them, the situation was driven by the absolutely extreme expense of establishing a new home.

Unless facilitated by mom and dad, no-one on Oahu could ever establish a conventional mortgage on a SFH. Even by 1977, prices vs wages were so extreme that all off the dynamics now under way in California were fulsomely in bloom.

This also made it impossible for Whites to flood in from the Mainland. Instead, they lived, as single young adults, in ‘clown houses,’ a term of art not then used.

There was a time when “Agreement of Sale” transactions utterly dominated the Hawaiian real estate scene. (late 70’s early 80’s) After Volker’s crush, AoS declined like mad.

These deals — in economic structure — greatly mimicked ARMs — in that they permitted hyper-leverage — really almost no-money-down deal makings.

The buyer would put up pledge money, a shockingly low percentage of the contract price, with the seller taking back (de facto) a purchase money mortgage / balloon note that ran out 36-months. (typ.)

During that three-years, the lender would (often enough) be kept in the blind — and held to the original terms of the first mortgage. ( ALWAYS at drastically below current market rates — this was during the Carter inflation ramp.)

Then, the buyer would pay off the balloon by taking out conventional financing, with the appreciation of the last 36-months used as his equity in the calculations. This worked well — until it didn’t. Then there was a panic as AoS were defaulted upon en masse. These deals defaulted to, essentially, three year rentals — at above market rates — sort of an Option-to-Buy that was discarded.

This bubble mechanism kept SFH entirely out of reach of those forming families — even up scale earners just couldn’t build up any savings.

The entire economy had become addicted to the real estate appreciation ladder.

For those wondering where California is headed: Hawaii is it … especially Oahu — Honolulu in particular.

Guessing is not necessary. Everything that is to come is already forty-years history in the Islands.

Obama, personally, grew up in exactly this environment. Naturally, he does not thing anything is untoward.

As for banker’s sympathies: he was RAISED by a bank vice-president. Imagine what he absorbed at the diner table. During his teenage years this ^^^ is the very real estate boom he lived through.

It’s also the same time frame that the State of Hawaii absorbed the impact of state mandated ’employer provided’ health insurance.

This is his frame of reference.

EVERYTHING we see on the national scene is an echo of what Barry lived through, in his TEENS. We’re seeing it in both his domestic policies and international ambit. Both would be deemed completely orthodox among the ‘smart’, Punahou set at that time. He doesn’t see himself as radical AT ALL, merely slightly ahead of the pack.

This last aspect is lost on most, as many believe that he’s trying to take America down.

His internal view is that he’s Moses — and it’s high time for America to wander through the desert for forty-years to expunge its arrogance and sinful ways.

So, for him, he’s on crusade.

Thus we have:

Forward!

Push-back-twice-as-hard!

I-have-a-pen-and-a-phone!

And, of course, his internalized emotions that his opponents are inherently evil.

(The Moses-wonder-child story arc must have been started by his own mother. Tip-offs that she did so are all over his bio.)

Which is a long way of saying: he’s not for turning, not for moderation, and can barely suffer the Senate Democrats, let alone the GOP. He’s on a mission!

More taper = higher interest rates — even with a jaw boning.

The stock market is not going to like the credit contraction coming out of Red China.

At the end of the day, Red China sets the price of all internationally traded commodities: iron, met coal, food stuffs, you name it. There are short sales to be put on.

You forgot to mention that Barry has been surrounded by hardened communists all of his life: his grandfather, his mother, his mentor Frank Marshall Davis, Bill Ayers, etc. Forward comrade!

So how high are interest rates going up? Are you saying that Yellen is Volker?

Naples…

Yellen may well be chit-chatting with Volker…

In any event, she is establishing her own policy twist away from Bernanke’s dead end.

If she shuts off Barry’s ‘Wealth-Tax-Machine’ by terminating QE/ the hyper-inflation press…

The body-politic may be able to go cold turkey and shake off the ZIRP narcotic.

As posted before: ZIRP kills off Angel Investing. No elderly holder of assets can dare liquidate assets to fund any start-ups when the sole source of income is capital gains in a frothy market.

The incentive is to stay hyper-engaged in equities speculation.

The prospect that ones asset pile can evaporate paralyses any impulse to risk illiquidity.

This Angel starvation cripples new business formation. It’s so bad that money is denied to even kin. Even co-signing a note becomes too risky.

Without new business formations, jobs just don’t grow.

The Fortune 1000 crowd makes its bones by replacing labor with capital. Their employees are terminated, day in and day out, year after year, China or no China.

Yellen may be crossing her fingers and hoping that the system can hold together long enough for a true recovery to start up — for real.

In the meantime, we have big issues with crony-capitalism: see “Of Two Minds.”

FOMC has committed to a scheduled taper for QE3?

http://uk.reuters.com/article/2014/01/30/uk-usa-fed-poll-idUKBREA0T1JQ20140130

What do they know that we don’t know? Who really believes that the economy is recovering/recovered? Could it be that they are concerned that they do not have a lot of tools left when the next crisis happens? Or are they concerned about the negative consequences of endless QE?

Bernanke does not look like the cover of Time magazine with Rubin, Greenspan and Summers with big smiles claiming how the three Marketeers have prevented a global market meltdown…

http://content.time.com/time/covers/0,16641,19990215,00.html

Yellen is responding, correctly, to the kick back she’s getting from all of the other central bankers.

She realizes that QE is either terminated by volition — or by the market.

The latter consequence would occur under stresses too terrible to discuss in open forum.

The FIRST domino to fall ought to be Junk Bonds. They almost always lead the way to the abyss.

The dire status of both Sears and JC Penny has vast implications for CRE.

These twins are the anchors of that world. (Bad news for the Debartolo empire.)

Follow on repercussions must slam municipal budgets across the nation. The afflicted shopping malls are monster tax revenue generators, especially via property taxes.

Unlike residential property taxation, city hall normally goes hog wild when taxing Sears and its kin. Both assessments and rates are pushed to the limit.

This high fixed nut becomes a brutal store killer when turnover drops. City Hall keeps spending like nothing’s wrong. It’s like taking on Pauli as a business partner. (!)

For many satellite burgs, the shopping mall IS the big game in town. Not just a few will be looking straight at a Chapter Nine filing as the retail contraction unfolds.

%%%

At some point, Yellen will have to show her true colors. Can she save the dollar, or will she pimp it to Wall Street and the Mega Banks. (Now fused at the hip.)

For the pressure to juice the markets will become insane.

The Federal Reserve is made up of private member banks who like profits and dislike losses. This QE bond holdings are getting too large on the balance sheet and the bankers are getting nervous. Hence the taper. They are getting out while the getting is good. It is a survival instinct, as the good captain Edward Smith did, or was that the captain of the Costa Concordia? No matter, it is human nature to be the first in the lifeboat before the ship sinks, at least that is what these cruise ship crews think.

This. I found not much else more naive than those comments over the past couple of years claiming that the Fed wouldn’t put away the punch bowl so that the newly mortgaged would be saved.

Hey, is everybody forgetting that we CAN CHANGE this shit? We just have to pay attention to what worked in the past and get that done again. Sorry, but UNIONS were necessary for getting fair wages, paid time off when you’re sick and guaranteeing a clean process when you were let go/fired. UNEMPLOYMENT INSURANCE needs to be in place for when you’re out of work, AFFORDABLE EDUCATION should be available as you get moved out of your current work situation and need to move into another field, something that will be happening a lot in the future. These things used to exist and can again work for the population if you pay attention and vote in people who believe these things are worthwhile as well. It doesn’t have to stay this way. I don’t know where people got the idea that all unionism is bad (always some shit in the pile, true) and that the government shouldn’t be the entity that can provide it. Sure as hell private enterprise isn’t going to without being made to treat workers fairly. This goes against the grain for some of you, but it’s the truth. Tax rate in the 60s when this country boomed? Some as high as 75%. I’m not recommending that, but the wealthy are getting away with not supporting this country and I for one am on track to see that they do by voting for folks who recognize we need to get tuff with some of these “American” corporate abusers.

You dream nice, but in the real world it doesn’t work for many reasons:

1. you can not replicate the 60s because America is no longer producing 50% of the world GDP (all other countries were barely rebuilding after the war). The global landscape is no longer the same.

2. Companies are no longer afraid of communism and can produce anything anywhere

Keep dreaming nice. If what you dream would work, the politicians would take advantage in a heart beat like they did at SEATAC with the minimum wage at $15. That city has a monopoly on one of the biggest international airports in the world, something like in the 60s.

US no longer has a monopoly on the world economy. You may unionize just to see the company leaving. The company also is trying to survive and make a profit in a world of fierce competition. Same with the high taxes – companies leave, unemployment goes through the roof, and who pays for the unemployed?

So how are union workers in this country going to compete with workers in poor third world communist countries where workers will work for next to nothing? When this country boomed in the 1950’s and 1960’s, we still had high paying manufacturing jobs and it was not a global economy like it is now. Japan and Europe were still emerging from the devastating effects of World War II, Communist Maoist China mostly was cut off from the rest of the world, and Russia was mainly focused on the nuclear arms race. While tax rates in this country were higher during the 1950’s and 1960’s, there were many more itemized deductions and credits available to offset those high tax rates so most people did not pay those high tax rates.

The U.S. was once a major exporter with trade surpluses with most countries. Now the U.S. has trade deficits with most countries, has trillions of dollars in budget deficits, and borrows from Communist China. Where’s the money going to come from to pay for entitlements like Obamacare and affordable education for all?

@nanosecond

You asked some questions. The answer is “I don’t know”. Do you have real answers to your questions which create more good than harm? I have plenty of answers which implemented will create more harm than good to the economy as a whole and to the vast majority of the US citizens. There will always be crooks, cronies and leaches deriving some benefit – I agree with that. But overall, how do you stop it? Maybe the only alternative is to scrap completely the NWO and any politician who supports it, regardless of the political color.

These progressives supporting NWO are: Clintons, Bush, Obama, McCain, Romney, Christie, etc. There is a long list. Maybe this is the reason they demonize so much the Tea Party, because it stays in the way of their agenda? What do you think?

people are camping out in front of sales office right now for saturday sales release..what do you guys say about this?

Dr. Housing Bubble states that some kids are just waiting until the parents keel over so they can inherit the Prop 13 protected World War II built property? Really? How many homes can be in SoCal that have still have parents living in Prop 13 protected World War II built properties? It can be that many considering how often people move and the fact that so many people living in LA coastal communities are renters?

My wife and I bought our 1950’s era tract home in Rolling Hills Estates in 2001 for $950K. We watched the value of our home drop during the recession. Now similar are selling between $1 million and $1.2 million. We plan to cash out and move to Washington state when I retire next year. Many of the homes in our neighborhood are being bought by Chinese nationals. Hopefully they will still be in the market for over priced 1950 era tract homes when we are ready to sell!

Do not wait… if you think you can get $1M to $1.2M, sell that place this spring, and list it NOW. The spring selling season is already setting up.

I strongly sense that this is going to be a very disruptive time for all assets. If your place gained 30% in value after dropping precipitously before, then you know that you could easily see a 30-40% loss in value just as quickly and easily.

Since you know you don’t want to stay, why not unload it right now? Sure, you may be a little early and leave a few thousand dollars on the table, but that smallish amount of money is a pittance compared to what you will lose out on if you wait to long and try to “time” this market.

Don’t play market-timer. Remember, it’s better to sell a year too early than a day too late.

As a South bay resident I agree.. 1-1.5m seems to be the sweet spot for foreign money in that area, and I’ve already seen some price reductions to get them to move (meaning they were too high, not that demand was waning). Take the money and rent until you retire.

Sell it to a Chinese national now and lease back for a year. They may just want the investment for now and you get to stay in the home until you retire. The markets getting shaky!

If Yellen really does turn off the spigot, then a price retreat in California real estate is a pretty solid bet.

The Fed would then no longer be cashing out the mortgage holding crowd.

Cash-for-Clunkers dried up the market in viable used cars.

QE3 has dried up the market for viable starter homes. It’s priced them out of reach. With a stroke, the Fed has unwound decades of government policy, returning the middle class to tenancy. This goes double for those starting a family — unless they are illegal immigrants — in which case big momma is there with the milk and honey.

Leave a Reply to Enzo MiMo