Cash investors altering psychology of real estate market: Can the regular home buyer compete with the big money from Wall Street?

Investor buying has pushed the real estate market into uncharted territory. Starting in 2008 after the crash in home values, investors at first stepped in slowly and now they represent a dramatic share of all home purchases. This may not matter to some in most states across the US but in places where investors are heavily focused, the power wielded by this group is still large. Sellers for the most part, this includes the banks off-loading distressed properties (aka repossessed homes), look for quick sales at the highest price. Sounds simple enough. Yet most in the public stand no chance with the large money crowd. For example, I know of people in targeted areas that scout for distressed properties and show up at auctions with checks ready to bid on properties. Some are individual investors and some work for a larger system of buyers. It is no new game with investors in the market but the volume of big institutional investors is definitely something new.

California purchases by big money

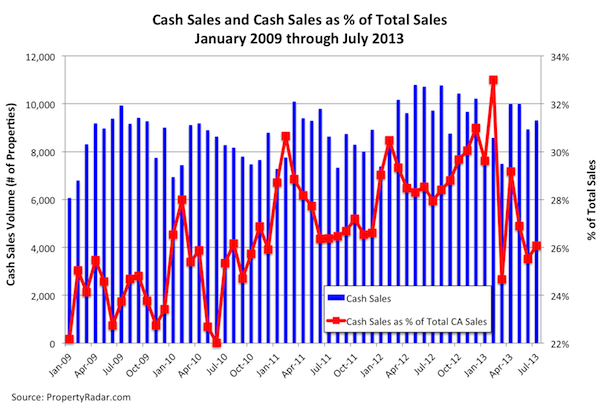

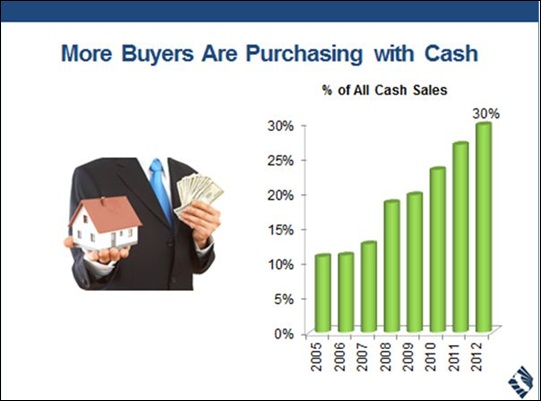

In 2007 very few investors were in the market at least relative to all home sales. A low interest rate eco-system drove large pools of money into chasing real assets including real estate. The large pool of money has had a dramatic impact on home prices. Inventory is still very low and this is also part of the new psychology behind cash buyers. Do the math. Since 2008 you have close to 30 percent of all real estate transactions going to investors. This figure could be more since some mom and pop investors are actually taking out mortgages. But let us go with the “all cash†crowd that is recording no mortgage on the purchase. Many of these buyers are aiming for rental securitization (meaning they have no plans to sell soon). Contrary to the staying put for 30 years myth, most people move for a variety of reasons (i.e., growing family, divorce, job changes, etc). Yet we now have a massive pool of real estate owners that have no plans of selling (at least for now):

At one point in early 2013 roughly 33 percent of all home sales in California were ending up in the hands of investors. Keep in mind this is occurring at a time when inventory is very low. Inventory is also low for the following reasons:

-1. Negative equity. Still close to 2 million of California homeowners are underwater or slightly above water (i.e., 5 percent equity)

-2. Investor buying – and holding. This massive group has been dominant since 2008 and shifts the normal ebb and flow of buying and sales

-3. Banks slowing down foreclose process. Banks systematically leaking properties out to stunt the market and drive prices up

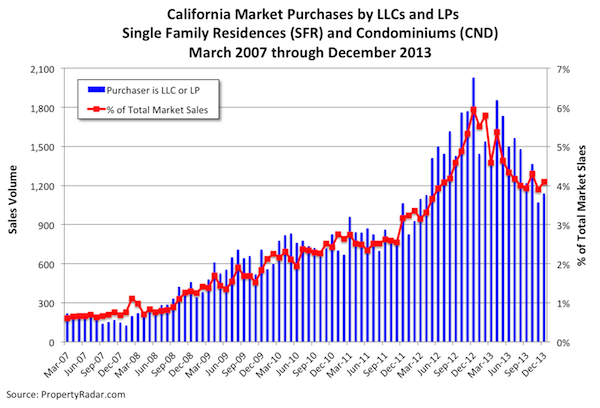

All these factors will make for an interesting 2014. There was a slight pullback in investor buying at the end of 2014 and this has hit sales. The big money crowd has certainly slowed down a bit:

The above is a telling chart since this reflects purchases going to big money, not individual buyers. In 2007, this figure barely registered under one percent of all sales. At the peak, this was up to six percent. It has recently fallen to four percent which is still high.

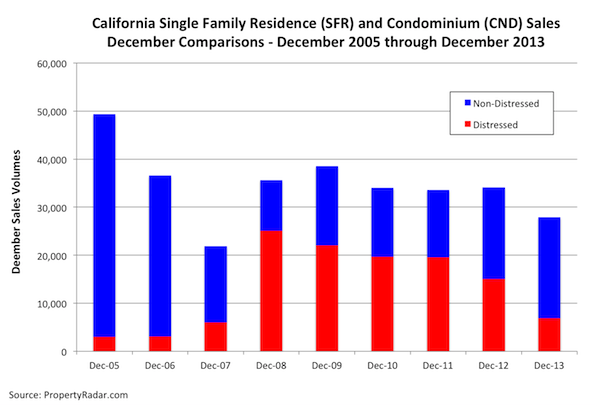

Even though prices in California saw one of the best years in 2013, December sales registered a weak showing, the slowest December going back to the meltdown days of 2007:

Investors are in it to make money and the Fed has created this low interest rate eco-system. Why else do you have Wall Street and hedge funds suddenly interested in being landlords? It is a hard grind business. Rents are also impacted since many investors are pushing prices up on this end.

The impact on real estate psychology

It is interesting to see the shift in psychology in the market where investors dominate. The view is now one of capitulation. “Well you can’t beat them!†seems to be the rallying cry. Beat them at what? Look, if you have the cash to buy a home and pay the monthly nut then there is little problem. But for California only 1 out of 3 families can actually afford to purchase a home. Affordability is derived from the price of a home and low rates add additional purchasing power (this is why ARMs and interest only loans are back in the game). In 2003 through 2007 you saw this unfold dramatically as anyone and everyone had access to easy money and this was used to make up for weak income growth. Why be prudent with money when you can buy a home anywhere, sit-back, and enjoy dramatic home price increases? This was the era of the Flip This type reality shows.

Today, we now see many buyers stretching to buy via Adjustable Rate Mortgages and even interest only loans. In other words, many are stretching every inch of their budget to buy. What is telling to me, in spite of the wicked increase in prices in 2013, 26 percent of California homeowners are either underwater or have barely enough equity to sell their place. Now I doubt these are investors that bought rock bottom deals since 2008 but this is a big chunk of the market that is essentially not ready to sell for profit. Throw in the mix of golden handcuffed baby boomers and you can see why inventory in California is constrained.

It is undeniable the demand from the cash crowd:

In California, around 10 to 12 percent of all sales going to cash buyers is normal. We are three times that today. Some tend to think that this volume of investor buying is the new norm. I doubt that. At some point these investors want returns either from rents or flips. Rent yields go hand and hand with prices. Keep in mind that rents have to reflect reality as tenants need to pay for that monthly outlay from wages. No Fed to inflate your rental payment. In California these yields are essentially non-existent and that is largely a reason why investor buying is slowing down. Investors follow herd like behavior as well. They just typically get out of the way before the train hits the regular mom and pop buyers.

For those buying in 2014, how are you penciling out the figures and in what areas are you looking at?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

132 Responses to “Cash investors altering psychology of real estate market: Can the regular home buyer compete with the big money from Wall Street?”

I feel one of the most under discussed aspects of the rental model is what pissed of tenants are going to do to the Wall Street fat cats properties. You have multi-generational and roommate based households becoming the norm. People making less wages and piling together in SFHs just to make ends meet. 3 or 4 to a bathroom. 6 or more adults sharing space. Most people do not have the psyche to live in such an environment. Besides the extra wear and tear on the property from more people landlords have to worry about the stability of these arrangements and much higher chance of eviction situations. There is NO STABILITY to the low cap rate SFH rental model. It’s the new bubble, same as the last bubble, and it will burst. A combination of tax payers, pension funds and F’d borrowers are going to foot the bill while the Wall Street criminals walk yet again.

Look at history. It’s astonishing how much the serfs will put up with and for how long. I see strapped homeowners renting out guest houses in prime areas, and in sub-prime areas rooms being rented out. Sometimes lease-holders will sub-let. I know of a situation where two people who pay $600 each for separate bedrooms in a crappy 3/1 stucco in Lakewood. It’s the only way the homeowner can make it work.

I know of someone who lives in their RV in the driveway and rents out the house

That would be a miserable way to live.

“People making less wages and piling together in SFHs just to make ends meet”

People have already been doing this for years in other countries. Take a quick look at rental prices in other international cities. Then take a look at how small those units are and how many people squeeze into them.

Globalization is going to impact the US lifestyle as well.

I’ll buy your argument for the Prime areas. Squeezing together to afford Pasadena, the West Side, etc. But people are living this way in the Inland Empire! I repeat, PEOPLE JUST TRYING TO GET BY IN THE 909 ARE FORCED TO COHABITATE! This (temporarily) controlled market cannot last. The bust ALWAYS follows the boom…

>> You have multi-generational and roommate based households becoming the norm. … 3 or 4 to a bathroom. 6 or more adults sharing space.<<

Illegal aliens (can I use that term?) have been living like that in SoCal for decades. A dozen or more crowded into one tiny house. One result is sewage backup, because so many people use one toilet, and the drainage wasn't built for it.

KFI-AM's John and Ken refer to such arrangements as Clown Houses (presumably because in old movies, dozens of clowns would apparently emerge from a single room or tiny house.)

How the urban dictionary defines Clown Houses: http://www.urbandictionary.com/define.php?term=clown+house

It was actually from the circus where a bunch of clowns would emerge from a tiny car. You must be younger than me because this was pretty typical in B&B’s circus.

Lol you’re too funny. I’m not sure what this has to do with illegal aliens and what you’re point is, but I can tell you personally that illegal immigrants that bank with me are cash rich and own their properties and vehicles outright.

The bigger drain on the system are the under educated CITIZENS that cannot pay and afford their procreations.

I probably know what’s in your bank account too.

You could never guess what’s in my bank accounts…

Banker…

Then you’re in touch with the criminal class.

Genuine illegals are routinely shaken down by the (Mexican) criminal class.

The stand out favorite: the protection racket — against mom, dad, and sister.

Racketers simply hold the safety of kin over the illegal’s heads.

Any failure to come through means sex crimes back home.

The typical grift (‘touch’) is $2,000 on up. To make this pay off, many an illegal immigrant is impressed into committing crimes in the drug trade, burglary, shop-lifting, etc.

This is the PRIMARY route to sending Mexicans into California prisons.

The actual causative agents live, safely protected, in Mexico and DC. (Without DC, the entire game would come to a halt. No other nation on Earth permits this ‘trade activity.’

%%%%

Clown houses were ten-a-penny in New York City 130 years ago. Back then they were termed tenements.

“The term “tenement” originally referred to tenancy and therefore to any rented accommodation. The New York State legislature defined it in the Tenement House Act of 1867 in terms of rental occupancy by multiple households, as

Any house, building, or portion thereof, which is rented, leased, let, or hired out to be occupied or is occupied, as the home or residence of more than three families living independently of one another and doing their own cooking upon the premises, or by more than two families upon a floor, so living and cooking and having a common right in the halls, stairways, yards, water-closets, or privies, or some of them”

Wiki

This type of ‘arrangement’ could, and did, go on for centuries.

After a fashion, it goes on in Hawaii — right now.

Folks, if you REALLY want to know where California is headed: just pick up a real estate history of Honolulu — circa 1960 through 1990. There are plenty of brokers still living who’d love to tell you tales.

Everything that is now shocking to Californians is OLD HAT back on Oahu.

So, speculation is not necessary.

Sadly, and without nihilism, you are spot on I am afraid.

look if we didn’t have leasing hardly anybody could afford a nice car. Is leasing or really renting a car the way to go, except for business deductions probably not, but Americans like to show off.

Same in housing, many people want the Arm Rate, they get more house, look at me I look rich.

If you want a country that has to think for you and explain being is debt is dumb then you want a Socialist or Communist nation. We all know going to a high steak house and paying $50 for a piece of meat and all sides are extra is crazy but these establishments are packed and valet parking is the norm.

Housing is not going back to 50% off, eventually a market of some normal will return, but in the end they will always be overpriced homes. folks in trouble for living the high life driving to much car etc. It is still about The Rich and Famous, many Americans want to play the part, credit and in debt, it is not the smart move but it is our freedom, if it makes you happy before you die, go for it.

Yes Robert, let’s celebrate the freedom of the banksters to offer counterfeit money to the serfs at high interest with zero risk (FED bailouts and all…) enabling the massive class divide. There’s nothing “free” about our FIRE economy. While serfs make bad decisions they suffer the consequences while the banksters do not. If the rentier class was forced to sleep in the bed they made they couldn’t enable Housing Bubble 2.0. The drop in asset prices is coming because free market dogma won’t allow the only thing that could keep them afloat, protectionist policies and a higher minimum wage. I agree it won’t be 50% but the suburbs of Prime areas where most of the wannabes you describe live are going to get hit hard. Everything since 09/10 has been an illusion.

Yup.

BTW – Robert is a real estate shrill. The first sign of cracks in the foundation is when shrills start commenting on housing bubble blogs…

I hate the idea of being a serf serving a rentier, but again you are correct. Maybe I can buy more cheap stuff from walmart to make me happy and forget about my servitude.

Robert, I can see that you haven’t worked up a lease deduction on a 1040… since 1987!

The income tax lease advantage was utterly destroyed by the tax reforms of 1986.

Regardless of the terms of the lease, the deductions are CAPPED — with special emphasis on snazzy cars used by executives — even salesmen in real estate brokerage.

The ONLY remaining advantage for lesees is leverage. The economic debt of the lease agreement is omitted from ones balance sheet. For some firms, that’s motivation enough.

True luxury cars are paid for with credit cards.

It’s been rumored that Harrison Ford paid for the very newest M-B roadster straight off the showroom floor — with a credit card. (This was pre-divorce, so he could afford it.)

This is certainly the style at

http://rolls-roycemotorcars-beverlyhills.com/

Their publicity machine made that evident a generation ago.

Leasing is so “try hard.”

Cracks in the foundation are starting to show. I haven’t seen Jan businesses “going out of business” in the mall since 08/09. I also see increased marketing gimmics, sales, and change of pricing structure similiar to Old Navy and Forever 21, in stores that never used to do that.

I think the food/fuel/housing prices are starting to take their toll. Their just isn’t enough to go around for everything, and consumerism will take the first hit. Maybe it’s a blip, who knows, 2014 data in the markets and spending will tell.

Papa, you might enjoy this article about consumers. I think the writer makes some excellent points to support his arguments.

http://www.zerohedge.com/news/2014-01-20/retail-death-rattle

Great article and some great comments. Highly suggested reading especially the comment about how the top 1% are making all their money and can’t possibly spend/consume as much as the 99%’ers.

Author tied retail sales malaise to brick and mortar, while internet sales accounted for 40% of Christmas shopping this year. Just sayin

“Author tied retail sales malaise to brick and mortar, while internet sales accounted for 40% of Christmas shopping this year. Just sayin”

Agreed. However, check out some recent retail earnings disappointments: Bed Bath Beyond, Best Buy, Coach, Victoria’s Secret, Costco, Family Dollar, Big Lots, etc. Is it perhaps company specific issues, or is the consumer running out of gas?

A lot of those earning dissapointments can make sense based on luxury (vic. sec.), or internet sales (best buy) but Costco is a stunner. Those places are always packed, and sell essentials. If they slow down I’d pay attention.

So I am curious to see what kind of responses the Dr. gets to the question he begins with, “For those buying in 2014…”

Most properties listed in San Diego are outrageously overpriced. I am just wondering what kind of sane investor is actually buying here. If you did, in fact, have the full $700K in cash to buy a ugly vintage c. 1968 tract home in cash, would you really do that? How could you possibly make money off of that? It might take you decades to recoup your investment if you rented it out. And you can’t exactly turn it around to flip at that price. After all, as the Dr. suggests, there are not that many homeowners out there ready, willing and able to move a large amount of equity or cash into a new home purchase. Especially an ugly vintage c. 1968 So Cal tract home. It doesn’t matter how much more beautiful San Diego is compared with, say, anywhere in the disgusting plastic OC or LA messes. Most of what’s out there is overpriced trash. All over SoCal.

And NO, wealthy overseas investors are not streaming in and won’t be streaming in to buy up all this junk.

Be careful about calling attention to the elephant in the room. SoCal is like people clamoring all over each other for the few great ocean view seats at an otherwise marginal restaurant. Then you have the patrons sitting in the majority mundane seats trying to convince everyone else that it’s the best restaurant in town.

Wow, what a great analogy.

it is a pretty good restaurant though.

For most in soCal the restaurant is a Tommy’s burger joint in Stanton or Rubidoux, not a mediocre ChartHouse in DanaPoint or Santa Monica.

San Diego has (had?) quite a few biotech startups. A little IPO money can go a long way to making 750k houses affordable. $300k down. $450k mortgage. This is realistic on a scientist / engineer salary + ISOs. It probably doesn’t take more than a few hundred or thousand such people released on the market with each new IPO to soak up supply and keep prices up.

They are selling such flop-houses to non-Californians, that’s who.

For those flying in from Canada… with their own rotten forty-year old homes… San Diego doesn’t look so bad.

There is a new wave of ‘Clampetts’ being re-born across the Bakken and the Tar Sands. Not all of them, however, have remotely that level of oil luck. Thawing out in San Diego would suit them just fine, however.

Zany prices set by professionals are a pretty good indication that it’s you who is in error. It’s the error of epicentric thinking: whereby the nearby experience is assumed to hold everywhere.

This bizarro tick was most evident during WWII. All of the critical enemy ‘executives’ held to epicentric notions of how the world worked… and who held the top cards. By the time they figure out where reality was, they were blowing their brains out.

At one point in conference, Stalin mused to Churchill, if we’re both making 3,000 a month… how can America make 10,000 planes per month? (Leaving off the fact that America was producing four-engined bombers and Russia was not; and that America was sending Stalin its ‘rejects.’ (A-20, P-39… etc.))

What you’re actually seeing is the end result of a generationally stagnating America — while the rest of the planet has leapt forward.

If prior trends had held, Americans, themselves, would’ve completely revamped the old homes — and prices would be even higher still. Of course, wages would be profoundly higher.

Real estate values are an index into the soul of the economy: per capita wage growth.

“Real estate values are an index into the soul of the economy: per capita wage growth.â€

WTF? You were the one touting Steve Keen’s GDP model of income PLUS CHANGE IN DEBT equals GDP not the standard money supply times velocity equals GDP. I have to believe you are joking…

Scarlett, I totally agree, very poor constructed homes, very small lots, throw in 4 bedrooms, a kitchen, great room 2 car garage and their you have it the San Diego $1.2miilion stucco box.

Here’s the problem, young couples whose husbands make very good money per month, don’t mind a mortgage of lets say 4k and up a month. Throw in private schools, a wife that most likely won’t work because her work out program is more important.

This scenario is played out all over the country but especially in the sun belt. It is as I explain in my post, I want the good life now, I don’t want to be preach to by the boomers and I don’t care about 1929. It is a all about me generation so let them spend and buy debt, I don’t care about these folks anymore, who has to worry are their children, and the way they spend and spend their kids are going to be hurt in the future, let them worry about it?

Oh, so now it is the “there is a lot of money out there†argument… These arguments are getting really tiring. Speaking of 1929, how would you like your stock market crash straight up or on the rocks?

Until you start to see BMW and MBZ dealers fold, then you are living in a world with blinders. Did you see Barrett Jackson Auction, tell us who were all those buyers and record crowds were, a Hollywood stunt?

Robert – First of all, you are embarrassing a great name by your comments. Second of all, how many people bought from the BJ auction? Was it more than a Million? Yes there is a very small minority that has money but these are not the folks buying small stucco cracker boxes in mediocre neighborhoods. These are the ones buying 10 million dollar and up homes in Bel Air. How many new Mercedes are sold in the US compared to the number of Ford F150s? Not even close. So are there some out there that can actually buy a Beemer, Benz, or Bentley? Yes, but the majority of these cars depreciate dramatically and then the wanabes buy the used B of their choice to pretend to be rich. I saw a homeless guy in an old 450 SL here in Silly Clown valley. That is the ultimate in broke ass fool pretending to be rich…

“Here’s the problem, young couples whose husbands make very good money per month, don’t mind a mortgage of lets say 4k and up a month. Throw in private schools, a wife that most likely won’t work because her work out program is more important”

Here’s where Robert goes full troll retard. The number of Californians who earn the 150K plus to support Robert’s thesis is somewhere around .5% nationally so let’s say hi CA it’s closer to 1-2% (and I think that is high) you’re only talking about 500,000 people. That number cannot set a market for the other 37 million. If ANYTHING Robert said were true regarding organic income and demand the FED would not be shiting the QE bricks they are. Thats why they are scaling back QE this year. The more they juice the market, the worse the crash will be, so they’re exiting this round (the next round will be a bailout of the health insurance industry over Obamacare). Robert admits that the market is rigged but can’t accept the reality that for bubble economies to continue you must have booms AND busts. His daddy class is about to be old news as the healthcare and pharmaceuticals are next in line for the coaster.

A household income of $150,000 only qualify you in the top 12% of in the Los Angeles/LB area

$150k would only put you in the top 18% in Orange County, and 17% in Ventura/Oxnard/Simi Valley

For you folks out there who have never been to Cal. don’t listen to this garbage. During the housing crisis many got hurt for sure but people over 96% of homeowners either made their payments or have their house paid for in this country.

In Cal, there still is many, many people with crazy money who can and do buy expensive cars and homes just go there and see how many German cars are driving around and gated areas are well maintained.

Remember folks Cal in ten times bigger then most places so if you have 1,000 people out of work in Topeka Kan. you 10,000 in LA sounds bad? You also have 1,000 people in Topeka doing great and 10,000 in LA ding great, sounds better now doesn’t it??

> The number of Californians who earn the 150K plus to support Robert’s

> thesis is somewhere around .5% nationally so let’s say hi CA it’s closer

> to 1-2% (and I think that is high) you’re only talking about 500,000

> people. That number cannot set a market for the other 37 million.

They can if that one percent gets a disproportionate amount of total income. I don’t suppose you have read any articles lately about the widening income disparity between rich and poor. Here’s one:

http://www.theatlantic.com/business/archive/2014/01/the-worlds-85-richest-people-are-as-wealthy-as-the-poorest-3-billion/283206/

The bottom 60% in this country can lay claim to a whopping 4.2% of the wealth:

http://en.wikipedia.org/wiki/Distribution_of_wealth

It turns out they aren’t just making that stuff up!

Consider that, and it is abundantly clear why the Republicans’ 1, 2 & 3 priorities are to control spending. Every dollar given to the poor for this or that is paid for exclusively by their constituency. (And some wealthy Democrats who probably are proud to do so!) The 4th priority is to keep illegal aliens from becoming citizens so they can keep doing 1,2 & 3.

According to the LA times (http://articles.latimes.com/2011/nov/23/opinion/la-oe-andersonross-99percent-20111123) the top 1% in California got 25% of total income.

Is this housing market starting to seem a bit lopsided? They have 33x more money than you do.

Consider also that (taxes notwithstanding) all of that excess is disposable income. If you are in the top 1%, then cost of living (luxuries aside) is a small fraction of your income, so you have proportionally more spending power available for investments.

Like houses.

Which you can own more than one of. Many, many more.

Some even call it an investment, or their retirement. You don’t have to live in them to own them. The last landlord I rented from owned seven 3/2 houses. I don’t rent anymore. Through no real attempt on our own, we seem to have two houses now, though one is in Vermont. The first house, like the first million is apparently the hardest.

RE:MB The problem with the stats you present is that you’re focusing on the Prime areas that cannot hold the market long term. There is no volume. When the sickness of the next crash rolls through those high earners and holders of Prime RE will get the sniffles while the valleys get a heavy cold and the IE gets bird flu. I haven’t seen one serious post claming prime areas will completely collapse but I definitely see Robert and others predicting only minor corrections in the valleys and inland areas. This is a fools bet. To think that when the FEDs or the market takes away the punch bowl (which is inevitable) there will be some slight but orderly downturn flies his the face of all recorded economic history. Some of that history is a mere 6 years old.

The stats I referenced are exactly as I wrote. I did not segregate by “prime areas”

A household income of $150,000 would only qualify you into the top 12% of in the Los Angeles/LB area

$150k would only put you in the top 18% in Orange County, and 17% in Ventura/Oxnard/Simi Valley

Here’s the best illustration of it I could find:

http://www.nytimes.com/interactive/2012/01/15/business/one-percent-map.html?_r=0

—

Perhaps there are a lot more households making $150k+ than you thought? Does that change your hypothesis at all?

Re:MB

You specified the Los Angeles/LB area, OC and, Ventura/Oxnard/Simi Valley. One could argue they are all prime, but either way I’ll bet you have Uber high earners in the TRULY prime areas skewing those stats. Also Robert made the argument for a swath of 150K individuals not households, so my guesstimates were based on his Army of Alpha Male Superman who disregard 4K mortgage.

Okay, if you consider LA/Long Beach in it’s entirety “prime” that’s fine.

How about these areas:

150k = Top 9% @ Riverside / San Berdoo

150k = Top 6% @ Bakersfield

150k = Top 11%@ SLO/Paso Robles

150k = Top 25% @ San Jose

150k = Top 24% @ SFO/Oakland/Vallejo

Whatever the case, it’s nowhere near the 1-2% you referenced earlier. Pretty much in order to be the top 1% in SFO, LA, San Jose, OC etc you’d need to have a household income of around $500k

150K income for prime areas really isn’t that much. That’s two working stiffs each making 75K per year or one 150K income supporting an entire family. These people aren’t living the high life. I guess if you were single, that would be a different story.

I think that number needs to go up to 250K per year to really even think about buying in socal “prime” areas.

“Here’s the problem, young couples whose husbands make very good money per month, don’t mind a mortgage of lets say 4k and up a month. Throw in private schools, a wife that most likely won’t work because her work out program is more important.”

“This scenario is played out all over the country but especially in the sun belt”

No offense, but this is 2014, not 2005. “This scenario” is hardly played “out all over the country” any longer. I’m guessing this is perhaps a wacky attempt at sarcasm, dry humor?

Nope. Robert is a real estate shrill. He is dead serious. But I do laugh when I read his posts…

I don’t see many major grocery stores closed, I don’t see many banks closed, I don’t see many fast food places closed, I don’t see many colleges campuses empty.

I do see downtown NY, Chicago, LA, bustling with no place to park?

“I don’t see many major grocery stores closed, I don’t see many banks closed, I don’t see many fast food places closed, I don’t see many colleges campuses empty.

I do see downtown NY, Chicago, LA, bustling with no place to park?”

What does this have to do with high paying jobs? Everyday people living paycheck to paycheck (even EBT folks) buy groceries, eat fast food, bank, park in major cities, and attend college. In fact colleges are more crowded as people have gone back to school because the market for decent paying jobs is that provide a living wage is pretty bleak, especially in California.

The scenario you describe exists; however it is a sliver of the population, far more an exception than a norm. True, some lived like this pre-2008, but when Dad lost his high wage job, he scrambled to pick up a gig that paid 1/3 less. Mom got a PT retail job; adult offspring with fine arts degree now back living in childhood bedroom working as a movie extra, minor children now enrolled in public school. Yes, the family is still living in the trophy house in a nice neighborhood and it looks great from the curb, but the reality of their finances is in many cases now a very different story.

I forgot to add that also Grandma or Uncle Joe now lives in a spare bedroom to provide free childcare and kicks in some of his/her SSI check to help cover the mortgage.

“a wife that most likely won’t work because her work out program is more important.â€

Where are these wives, and how do i sign up for one?

Or perhaps a wife who won’t work because her INFANT and young children are more important.

*****Standing ovation for that wife!*****

…and for stay at home Dads too! 🙂

Decreasing wages, maxed debt, increasing food, fuel and housing equals what?

Unsustainable = “not capable of continuing at same levelâ€.

Why are “cash buyers†(aka institutional fund managers) willing to pay what ever it takes to buy a crappy disintegrating pile of sticks, stucco and stone on a pile of sand? First of all, it is not their money. Second of all, they plan to sell it back to you in your 401K or pension fund and they don’t care how much the under lying asset costs they only care about the “deal†(AKA fees). Don’t worry, you will be the owner of these homes in the end and when they do not perform it simply comes out your hopes and dreams of a retirement you might have had…

Bingo! You hit the nail on the head. I like to think that I’m a well-read and financially-literate individual but its honestly shocking to see how convoluted our economy is – as much as I’ve struggled to “Unearth” the truth behind so many business models shoved down our throats (thanks to lobbyist) I don’t see how the average person will ever “get it”, which is why I fear we’re nowhere near the end/collapse of our greedy corporatocracy.

I don’t understand why any investor or fund manager would buy into the whole idiotic concept of securitized SFR rental offerings? It is so obviously a loser investment idea when you factor in property management, eviction costs, flatlined wages, clown houses, etc., etc., why wouldn’t professional fund managers, banks and regular mom & pop investors see that and just not buy these securities? Especially considering the locations of so many of the homes (IE, Palmdale, Lancaster). I just think anyone who buys-in sort of deserves to get hosed for being an idiot.

I’m buying this year, but am starting to look at different property types now. I was going for the ready-to-move-in $500K with 100-125 down (depending on what I can swing with pre-approval, probably 350-400K). Now I’m thinking it might be better to get a smaller/older house on a larger property and be open to some fixing, since the flippers have pushed everything into the $500-600 range, and 500 is my upper end. I’m looking in North San Diego CA county and maybe squeeze into smaller house with good room to expand on the 1/3-1/5 acre lot. I will start looking about April and hope the 90 day loan window works for me

I hope you’re right Doc about the investors leaving town/getting nervous. I’m seeing small reductions in No San Diego county and no bump-up yet for spring selling. A lot of down arrows and I’m glad of that

I know is probably feels like spring time, but its still only the middle of January.

“I feel one of the most under discussed aspects of the rental model is what pissed of tenants are going to do to the Wall Street fat cats properties.”

I’ve pondered this as well. Tenants are hard enough on property as it is, but if they know that their landlord is a hedge fund…sky’s the limit on what kind of damage could be done.

It’s less about the landlord and more about their life. I grew up in the lower classes and I’ve seen the family infighting and the blood rage that comes out when resources are low and frustration is high. One argument that leads to someone walking out of the arrangement means a vacant property unless you can get someone else to come in and share the burden. If you’re already burned out yourself maybe you decide to rent a room from someone else instead of managing the whole thing. So you already have high vacancies and add to that volatility with the tenants you do have. It’s going to be less about people being “hard on the property” as much as you can’t keep anyone in the property for any length. The housing bulls on this site cheering the rentiers have no idea how the real world of property management works.

Housing to Tank Hard in 2014!

Recessions and interest rates are the keys to this.

Housing bubble 1.0: early 1980s, housing tanked hard after the double recession of 1980/82

Housing bubble 2.0: 1990, housing tanked hard in the aftermath of the 1990/1991 recession.

Recession of 2000: housing was not in a bubble therefore no tanking.

Housing bubble 3.0: 2007, housing tanked hard in the aftermath of the 2009 recession.

Housing bubble 4.0: 2013. ????

Recessions since WW2 happen every 57 months. It has been 52 months since the Great Recession of 2009 ended. The clock is ticking…

I like your analysis a lot and just have two quick notes:

– 1990 housing bust was magnified by the departure of aerospace and military contracts from the Southland. Kinda a long-playing story but I remember a lot of friends’ parents having to sell for that reason.

– 2009-present is arguably a non-existent recovery, so I wouldn’t be surprised if the next recession isn’t delayed due to that. That being said, I think we are stuck in first gear, economically, as long as govt keeps focusing on income disparity rather than growth.

5 houses sold in 12 days within a 6 mile radius for 849k to 1.1 million dollars. I guess all these buyers won the lotto, somebody has money out there?

I bet sales in the same area where really good in 2006. How did that work out? Do you know what an asset bubble looks like? Do you know what dynamics cause an asset bubble? Do you know what the outcome of every asset bubble has been since the beginning of time? Why don’t you get back to your open house?

Details please Robert. Where is this? L.A. westside is a very skewed market, and all of southern cali is high within 40 miles inland of the coast.

Well not exactly like 2006. In todays mortgage financing world, if you are in the jumbo range you need 10-20% down (unless you are getting a VA loan). In 2006, you couldve bought to 1mil+ w/ 0 down, going stated income.

That is a very very big difference.

Make enough of the population renters and they’ll start to vote for things that make a landlord less desirable. Like rent control and higher property taxes. If they feel disenfranchised, the tenants will also start to abuse the landlords in any way they can.

The only problem with that theory is if you believe the gov’t is bought and paid for by the rentier class. Then we’ll end up with things like more deregulation, nobody going to jail over banker fraud, more easy money for Wall St, more cheap labor for business owners, more taxes (hello obamacare)… So I’m skeptical that we’ll see new regulations negatively impacting banks or hedge funds.

Rent control is alive and well in San Francisco. If enough people feel as though they have no play on the future, they will move towards control.

“…more deregulation…”

Don’t be absurd.

Check out the Federal Register: it’s expanding faster than you can read!

The EPA is on a tear.

The purported de-regulations were taken under wing by Bill Clinton and BOB RUBIN — and everyone’s pals: Larry Summers and Jon Corzine. (Goldman Sachs(D), what would we do without you?

Regulation is going through the roof — it’s that Goldman Sachs and its alumni are EVERYWHERE at the controls.

The regulations, therefore, never seem to quite hit home.

While all of that was not going on: Paulson (GS again) managed to un-fund Lehman Brothers (arch rival to GS) — uniquely among all of distressed Wall Street.

It was subsequently revealed that GS was as bankrupt as LB. Perfect.

What you’re looking straight at is Crony Capitalism(D) and Wall Street(D) is at the heart of it.

Wall Street(D) is NOT Republican. I know, I worked there.

The LAST time Wall Street was dominated by Republican attitudes was — Hoover — a full eighty-years ago.

Wall Street rallies to the (Federal) Purse — which has been controlled since the Great Depression by the Democrat Party.

Republicans are SMALL businessmen and SMALL farmers.

Big businessmen and Big farmers are ALL Democrats.

K Street is a dual-party creature — but the upper hand is for bigger spending and MORE (anti-competitive) rules. And, of course, K Street wrote 0-care. It was faxed in.

That’s why it’s not internally consistent — and why the US Territories were entirely left out. K Street entirely forgot them. No Congressman would.

CAE – Yes, and rent control alive and well in NYC too. That’s it, nowhere else as far as I know. Those exceptions don’t do much to bolster an argument that we’ll see more laws passed in the future. Matter of fact – plenty of people in SF realize that the rent control seems to be making things worse as it’s limiting the amount of investment in new rental properties being developed. And that seems like a pretty logical result: over-regulating rental properties is a disincentive for investors to put $ into development. Thus, it’s a net negative for renters over the long term as the supply remains constrained.

I think you vastly overestimate the uppitiness and capacity for collective action of the average American. I can’t think of any significant rent-control movements outside of Manhattan and Santa Monica. Maybe Tom Hayden will come out of retirement to fight for rent control in downtown L.A. but I doubt it.

Don’t hope for rent control. I say that as a former renter.

Rent control guarantees a drastic and incurable shortage of rental properties, bad landlord maintenance, and bad landlord/tenant relationships. Every property worth anything will be sold to an owner/occupant and/or converted to condo or co-op if it is a multi-family property.

Rent control has wrecked the rental market in every community in which it is implemented.

Chris D. – There is now a movement in Culver City(the city the Doc writes about often) pushing for rent control. They have been handing out flyers all over town and at a local city council, one of the rent control proponents said renters are receiving multiple increases in one year and are unable to afford purchasing a home in light of absurd over pricing in Culver City See link http://culvercityrentcontrol.com/

Laura L. – You say rent control ruins the rental market. Not seeing a correlation to rent control ruining rental markets when Santa Monica and Manhattan are the only two major places it still thrives in. They are 2 of the most expensive places on the planet to own a home and rent. Landlords make up the lost rent opportunity by raising the rent when someone moves out. You will have your aberations of some who remain in buildings for many years but most do not and they are able to make up the lost rent on new renters.

Matt…

You’ve entirely missed it.

Labor mobility collapses. You’re rewarding the stay-behinds and punishing the up-and-coming.

You’re also rewarding the elderly (30+ in this case) as against the young.(18+) There’s too much of that already.

Further, history has shown that properties eventually devolve into classic tenement conditions under economic pressure. Tenements were NEVER built to be dumps. They ALWAYS evolved out of middle class neighborhoods.

I give you Harlem. It’s original (European American) middle class households wouldn’t recognize the place, forty-years onward.

Crony pay-offs explain why officialdom consistently permits astounding debasements. Each one seems as harmless as a paper-cut. A lot of the debasement occurs without an official paperwork/ approvals at all.

%%%%

“This Old House” has some episodes that ‘retro-renovate’ classic urban dwellings. You’ll even see some such on the DIY network with Nicole Curtis: “Rehab Addict.”

What you witness — on camera — is the many, many, (stinko) renovations that have been endured by nice homes in nice neighborhoods — as they were dumbed down to the rental market.

This would typically entail lowering the ceilings to hide failing plaster. (The original awesome work was plainly attacked by residents in some prior era.) Devising walls would be put in — however hacked. Additional kitchens would be shoe-horned into the upper levels — even if it was a plumber’s nightmare. This latter headache solved by sundering critical load-bearing timbers. (!)

All of these await modern repairs during gentrification.

%%%%

There is no proper cause to interrupt the free market in rentals. The nation is able to move right along — forever and ever — without it.

Once initiated, it is ALWAYS hijacked by the politically connected cronies.

This debases the power of money and inflates the power of campaign juice/ blood connections. Both are against the entire philosophy that has made America modern.

To do otherwise, is to clone all of Europe’s problems state-side; to repeal the Revolution, in so many ways.

Just as with Prop 13, rent control rewards the early entrants at the expense of the later entrants. It disincentivizes productive people who are born into the system later than others. The thinking goes “we’ve built it, so they’ll continue to come” but long term the majority of productive people choose other options.

This whole rent control argument is totally blown out of proportion. There are various loopholes to get around rent control and since the late 90’s many landlords have gotten around these laws. Rent control in some cases expires once certain criteria are hit. In NYC if the rent for a rent-controlled studio goes above $2000 or so a month, it becomes a market priced unit from then on.

Jeff, apparently supply is not that constrained in Manhattan.

http://www.bloomberg.com/news/2014-01-09/manhattan-apartment-rents-fall-as-landlords-offer-breaks.html

True. I remember Barney Frank saying that the government should do more for renters. He mentioned making rent tax deductible.

Rent is at least partially deductible under MA Income Tax (Frank’s home state). Cap is lesser of 50% or $3,000 I believe, but it’s something.

AFAIK that preceded his making the suggestion that it be also considered under FIT rules.

I think the one thing this analysis misses (though I agree with most of it) is that the speculators aren’t operating in the entire market, they’re targeting specific niches.

In particular, at least in my metro, they seem to be focusing specifically on the properties you’d be wanting to buy if you were at 0.8x to 1.5x median income range. Whereas they’re not involved at all in the market for higher end properties – if you’re making 2-3x median, it probably doesn’t impact you at all.

If you could really break the data down by market segment, I suspect we’d see that they control 50% or more of some of them.

Yep, that was my experience when I was still looking in Norcal in 2011and 2012…wanted a 3/2 in a decent neighborhood and made offers on several but all were ignored in favor of 100% cash flippers and specuvestors who unfortunately were looking for the same sort of house. Had I been able to make a deal I would have put $50K down and had a mortgage of about $200K with a payment of about $1000/mo, much less than I pay in rent.

Recently have been wondering how the current serious California drought will affect Bubble 2.0…if it continues (God forbid) it could very well be a factor in popping it.

Dude, this drought is gonna be a killer! For some reason, SoCal never has water restrictions but the rest of CA does. This is going to increase tensions between North and South like crazy.

Until you see the dollar not the world’s currency, Super Bowls with no sponsors, half empty Meadow Lands, professional contracts at over 200 million dollar’s, soup kitchens in every town ( btw none of this happen when we had the second worse recession ever) then you needn’t worry.

America is still the world’s standard not China ever or any country, if we go down they all go down.

The world has a huge vested interest in us. Buy that car, home, or good steak dinner,enjoy life, it all ends to early for most.

Can someone muzzle this imibicile please? The fact that Robert never denied he was in real estate should say enough. If a rapist doesn’t deny he’s a rapist, I think we all know whats what. Ditto with Roberto. His examples cited and lack of understanding of pretty everything, including how the world works in general, the use of debt to compensate for lack or income, etc is scary. someone driving a german car equating to someone automatically being wealthy enough to buy a home in cali or the meadlowlands being full meaning people must be doing fine (ever hear of corp seats in a place like NY/NJ or read how many stadiums are not selling out anymore including the greenbay packers in a playoff game!?) shows you have an agenda or have the IQ of a turnip. Then the real sales line comes at the end. The ol life is too short so buy a steak dinner, a car or, oh yeah, a house. Actually life is not short for most people. Its pretty long and expensive with less of a safety net going forward. So save your money and live within your means. Btw, as a recent homeowner now (not in CA and note I bought bc I was very cash heavy and needed to diversify and I just hate stocks (I know I’m a fcking idiot)) and a former renter in NYC and LA forever, there is NOTHING wrong with renting. I made decent money and never lived in bigger than a 1000 sq foot one bedroom….and worked from home. Saved tons of money that way. when you buy a house, you spend and spend and spend. Ask anyone who is beig honest and its not just maintenace. its little improvements here n there n furniture you probabky never needed before and stuff for the yard, etc. Life is in your mind. Not your home.

I am guessing that you are younger than me (40) and have had the 1999-present stock market from your opinion about it. Short of another crash (it will happen again one day), you can fairly safely earn income just by writing deep-in-the-money weekly covered calls. Open the position on Monday and let it automatically expire on Friday. If the market goes up, stays flat, or dips mildly, you make money. Do it for SPY for a relatively well diversified position. I am not a stock broker but enjoyed very steady returns from this strategy in recent years.

What exactly do you expect to get from this blog? Are you so mentally challenged that you think you are going to convince the few holdouts that all is good? Are you a political troll? I really don’t understand your motivation…

BTW – don’t you have an open house to get to?

What? We live in AMERICA and that means yes “all is good”

Robert, yes everything is on the increase. The election boycott block has increased to 43% (only eight points away from a simple majority) and is growing in leaps and bounds.

http://www.boxthefox.com/

Tent cities are also on the upswing;

http://www.google.com/search?q=us+tent+cities&newwindow=1&hl=en&gl=us&authuser=0&source=lnms&tbm=isch&sa=X&ei=pM3eUuLTGLbKsQSSnYAo&ved=0CAkQ_AUoAQ&biw=1209&bih=1090

I would go on and on but you know all this.

Deception is the strongest political force on the planet.

The one thing I rarely see addressed is that when you make the majority population renters and throw in a crashing economy they’re going to vote for populist eviction moratoriums. How’s that any different from someone just taking your asset away from you? It isn’t. If the economy breaks as expected then expect confiscation of real property via eviction moratoriums. Stick that in your equation and smoke it.

The economy is not crashing now and hasn’t been for quite a while. It is growing. Even the lagging government sector is growing. Unemployment is half a point above where it was in 2003, and dropping. The fed is cutting back on QE because the economy is (expected to be) growing robustly.

It is probably true that we are due for the business cycle to go around again soon. Apart from that, claims of recession or doom or exceptionally hard times today are at best the result of your local micro economy, but in most cases probably just stuck-in-the-last-decade thinking. We should all probably be more worried about the drought than a glut in outside investment in our housing.

I say if the Chinese want to drive our housing prices up by investing over here, you can get them back by buying a house in China! (There, see? I fixed it! 🙂 I hear Beijing is lovely this time of year, with beautiful sunrises projected by very large outdoor television screens so you can see them. (http://www.techinasia.com/beijing-residents-watching-fake-sunrises-giant-tvs-pollution/) There is also no end of employment options, and all the melamine you can drink. Really, is it better to have plastic in your milk, or (Yay LA!) plastic in your personal milk-makers?

Life is far too wonderful for all this complaining.

…Except for the drought, of course, which threatens to ruin everything with Endless Summer (http://www.imdb.com/title/tt0060371/) in CA.

Another all cash (investment?) purchase in my neck? See 4015 Sinova 90031, just had its 1st open house and was listed for less than 6 days. Apparentlly needs some serious structure and termite work.

I would add two more reasons for low inventory to this list:

-1. Negative equity. Still close to 2 million of California homeowners are underwater or slightly above water (i.e., 5 percent equity)

-2. Investor buying – and holding. This massive group has been dominant since 2008 and shifts the normal ebb and flow of buying and sales

-3. Banks slowing down foreclose process. Banks systematically leaking properties out to stunt the market and drive prices up

——————-

4. homeowners not selling waiting for higher prices

5. lower than historic new home building ( 2011-2013 new homes built were nearly 3X less than homes built from 2003-2006 and 2X less than 1979-1980)

I’ve recently been following the HUD homes website because I saw a great house in the area I was looking, that had never been on the MLS but had sold at a reasonable price, about 100K under what would have been asked by a realtor or bank. I couldn’t believe my eyes at the price, so checked it out and it was HUD offering. I checked out HUD buying years ago but it was too complicated but it has been simplified and you can see houses as they come on in the area you want. The HUD houses in the area I’m looking are fewer but I’m keeping my eyes open. Some good buys still coming on the site.

I looked into HUD listings — years ago.

HUD won’t work with you at all.

They wanted All Cash offers in an auction setting.

Going into escrow with you was NOT even a possibility.

This was true no matter how dumpy the property was. Usually, the homes had been savaged by those departing. (Crack houses?)

So, when compared to commercial REO officers, HUD was as stiff as KGB HQ.

It’s absolutely no wonder that HUD attains terrible auction results.

HUD rejects negotiated deals out of hand. HUD never considers that the auction process, itself, is quite a burden to the buyer — any buyer. For the buying community, HUD auctions are terribly time wasteful, actually repellent.

%%%

The hot Phoenix recovery marketplace drew speculators from far and wide. So much so, that circus generated its own TV show. “Property Wars”

The bottom line: there are enough wasted bidding campaigns to repel most.

%%%

Unique to real estate, the selling logic is to keep the bidders almost totally in the blind, as if — in ignorance — they’re sure to bid even more.

Folks, these aren’t Picasso paintings at auction. NONE of the structures is to be a ‘keeper.’

Which is to say that ALL of the properties are auctioned into the market at BELOW wholesale. That’s axiomatic.

%%%

Which brings us to: you can’t buy from HUD liquidators at retail. They won’t tolerate it.

Blert, I enjoy your posts (even the ramblings) often and typically agree with a lot of your views but you are wrong on this one. HUD homes are typically qualified for FHA (even 203k) and conventional financing. They are an excellent option for owner occupants because the majority are only open for bidding to owner occupants for the first couple weeks. After that investors can bid. Additionally any overbid from the listed price must be paid in cash by the buyer. No financing on overbids (for HUD, homepath the morons can bid up all they want because there is no appraisal required on a homepath loan) which prevents a low down payment FHA or conventional buyer from bidding the price way up.

In fact these types of homes (HUD, homesteps, homepath) are practically one of the only options for your average buyer competing with all these ridiculous cash investors. One must ask him/herself why is it that there are not more of these properties available if .gov really wants the “home ownership dream” available to more Americans (hint: fat chance). The answer lies in crony capitalism, where all the real deals are given to hedge funds and insiders to flip and REO to rent.

Downside to these properties is that the majority of HUD owned homes are not in desirable neighborhoods. But every once in a while, one does pop up in a desirable area.

Wondering what’s going to happen to California’s economy if the drought continues? Saw where it’s already up to 200,000 acres of farmland that won’t be farmed this year. That’s a big chunk of cash from producing something of actual value needed that’s going to be sapped out of the CA economy this year… Modern Day economic dust bowl currently in the making.

Agriculture is just a tiny fraction of the California economy. It and mining together are 2%. (http://en.wikipedia.org/wiki/Economy_of_California) We will miss the fresh fruits and veggies! However, the land and water use from agriculture is hugely disproportionate to the economic value we get from it.

The rice crop is a water PIG.

Changing rice over to … can save enough water to cover the shortage.

Whether that’s practical, equipment and facilities wise, I can’t say.

I wouldn’t be shocked if the insanely cold weather of the East shifts around…

And California gets some insane snow pack ninety-days from now.

%%%%%%

In all of this…

No-one wants to mention that Red China is altering the atmosphere of the high latitudes by injecting astounding amounts of SOOT.

Said soot melts the ice cap — to great alarm — each Summer.

Said soot causes astounding precipitations in the Fall and Winter. The Arctic ice pack is restored to greater levels than ever. (!)

Neither effect is in any way correlated to AGW.

Folks, this is plain vanilla air pollution, Beijing style. Naturally, the Greens will say nothing of it.

North America is down wind of Asia, pure and simple.

Until Red China puts a damper on its soot emissions, this crazy weather is going to get even crazier.

BTW, it’s entirely possible for Chinese soot to cause California bound moisture to rain and snow into the Pacific.

Fishermen in the Bering Sea report astounding ice build-ups there. This is significant because that sea is a nursery for many pelagic fish. (It’s highly oxygenated and shallow. Baby fish love, and need, both.)

Sure, Blert, “Greens” care not for the delights of air pollution, for their hard-on is truly only for CO2.

Why don’t they build little 3/2 homes Inland for $150k? I see them all over in the Midwest, so it can be easily done.

Because no one wants to live in inland CA. Unless you have family or a niche career to keep one there, what’s the attraction over the alternatives? Slightly more temperate weather year-long?

Inland in Cali is desert, bone dry, no businesses to support yourself with. Long commute if you buy there, and there are places you can buy for 150-200K already available. It’s just that it’ll take you two-to-fours hours a day to commute, and yes, people are doing it already. Terrible for family life, can’t grow a garden, no social/art/entertainment options etc

@Papa Hey paps. plenty of houses in Joshua Tree for under $150K…. 3 hour drive to LA with no traffic. Blythe California, plenty of homes for under $100K.

Anon that’s bullshit. 4 million people live in the IE, including myself and many aerospace employees. Thats more than a lot of metro areas, including all of St Louis, where im from. A lot of Pasadena commutes into Rancho and Fontana. A lot of OC and the south bay live in Corona and Riverside are filled with good families.

Itwasntme, nothing priced at $150k is in a safe place. My place in Southridge was $225k and a rip off. But I do not loathe my friends stressing about their $400k notes in L.A. County, screw that. The whole place is a rip off. But the commute is one hour in a vanpool.

I guess it depends on your definition of “social options”. To me, L.A. is full of pretentious metrosexuals that have stupid lives and stupid times. All I need is a good dive bar or restaurant, and a good metal show at San Manual Amphitheater. Only Hermosa pier is any fun in L.A.. Hipsters, valley girls, and the 1% can shove their lives of illusion up their arse.

Papa, where is Southridge? In Fontana? I agree with you about the “social” options, I was thinking more about museums and other amenities, looking forward to getting away from the crap you describe. And a good dive bar is hard to find. Glad you are in a good place, still searching for mine

Papa, my comment was a bit tongue in cheek, and not meant as an insult to folks such as yourself who have chosen to live in the IE. The pervasiveness of vanity in L.A. has not yet ceased to amaze me.

That said, I’ll wager that most people who immigrate to SoCal have coastal delusions in mind. Perhaps I’m wrong.

I’d take an affordable place in STL over the IE. What’s the relative advantage of the IE? Marginally temperate weather year-long? Niche job prospects?

From Bill Moyers

“Are high housing costs killing the American dream?”

http://billmoyers.com/2014/01/21/not-moving-up-are-high-housing-costs-killing-the-american-dream/

Historically, economic and geographic mobility have been intertwined. Studies have shown that the number one reason that people pick up and move to another community is for work: Americans move out to move up.

But something has happened. In the 1980s, we began to stay put. In the early 1950s, about 3.5 percent of all American households moved from one state to another in any given year. This proportion held up through the 1970s, and then started to fall around 1980. By 2006 interstate migration had dropped to 2 percent, and by 2010 to just 1.4 percent, or less than half the rate of the early 1950s. The latest available data, for 2011-12, shows interstate migration still stuck at a mere 1.7 percent. Though it may not square with our national self-image, America today is a nation of people who tend to stay put, with a population that is no more mobile than that of Denmark or Finland….

More recently, housing prices have been pushed up by Wall Street, which has bought up huge numbers of distressed properties for pennies on the dollar. So while average home prices increased by almost 13 percent last year – which is great for underwater homeowners but awful for people looking for a new place — that recovery, as David Dayen noted at Salon, is “not being driven by the typical American families who lost their homes in the economic crash. In fact, it’s being fueled by the banks and hedge funds whose speculation caused that crash in the first place.â€

That’s a great observation. I started my own business (a highly mobile one at that) in 2001 and didn’t figure out the benefits of moving to a lower-cost, business-friendlier locale until 2012. Now, I’m a very happy Floridian saving about 15% on gross income annually, just counting the low-hanging fruit.

Of course, all of my other native Californian friends think it’s crazy. But they’re also relatively ignorant about life outside the California bubble. All they know is that it snows in most places, the Mexican food is worse, and that makes moving a deal-breaker.

I’m a bit in wonderment of that attitude. I understand that my trustfund friends have no motive for moving, but pretty much anyone who works for a living should take a good, hard look at how other markets might help them reach their long-term financial goals…particularly with all of the pension baloney on the horizon. (I heard a great analogy talking about how public employees are akin to the residents on Matt Damon’s ‘Elysium’–all the private sector workers down below fighting it out to keep the pensioners happy and healthy deep into a long, cozy retirement.)

YOY So Cal proces up 22.5%. decemeber poped up.

What’s amazing is the inventory of for sale is back

at the lowest level since Jan 2012 which caused the whole boom.

Lots of room for more increases up in price.

401’ks and pensions of baby boomers placing

lots of lump sum payoffs in the market.

People I have known who make big money off of single family residential real estate are mostly folks in the business who bought distressed properties at bargain prices over a number of years and own a large number of properties that they rent. They buy low and sell high. If they can’t find a bargain in a particular market, they wait. One guy had dozens of crummy properties in the Antelope Valley that he milked over a number of years. His family lives in a mansion with a view in a desirable West Pasadena neighborhood. Another guy nearly wrecked the small town in Oregon where my Mother lived with his tactics of buying, renting and not paying for anything. (Google “Red Door Landlord Oregon”.) Another is a realtor who began buying houses when he joined his Dad’s brokerage firm at about 20, and hasn’t stopped. He went the more high end route, but buys at a discount, always.

With a small number of properties, it’s hard to make money, even when you aren’t mortgaged. I know that from personal experience owning residential real estate in rural Oregon. (Unless you inherit it as I did, don’t even think of acquiring anything rural with the eye to making money off of it.)

Owning residential real estate in the area where you want to live isn’t a bad thing. In the long run the benefits of owning your own place will erase any mistake of entry point. It is particularly true for people moving from a starter home to a place that meets your current needs. In that case I feel that the difference in monthly cost between the old and new place is the important figure to work with. Of course, it never hurt to pick up a bargain in anything. And always get less than you can afford, and have a safety margin. Shorter commutes make for a better lifestyle, so getting a smaller house nearer where the jobs are beats a palace in the boonies. It is better to spend more on your house and less on your car.

My officemate came in today complaining about a 17% rent increase this year, and how he now needs to move from his west LA apartment. From what he has alluded to this is a 2k+/mo place.

I try to keep my ear to the ground and think this is an omen of the squeeze that is heading down the pike. Inflation is the only way out of this mess, but it’s going to hit a huge swath of the under 100k/yr crowd right between the eyes. I now think a lot of these hedge funds were operating with insider (.gov) info, and considering how we’ve been printing over the last five, I can’t say I blame them for jumping on the (housing) grenade.

Ahhh your “office mate” should be covered by LA rent control ordinances. I think 17% is way above the allowable rate for 2013 – 2014. He/she may be able to take these guys to the board and not have to move…

http://lahd.lacity.org/lahdinternet/LinkClick.aspx?fileticket=RHSagu8gnT8=

Not if it was new construction. Rent control in most cities only applies to rental stock in place at the time rent control ordinances were enacted.

“buying has pushed the real estate market into uncharted territory.”

A frothy and bubbly market is what I see, but I am not a RealTurd – just a RentaLurker. When will she pop with devastating consequences?

Matt, RE rent control, you made my point for me.

Rent control wrecks the rental market for the very people it is intended to help by creating severe shortages of rental properties, which of course means a landlord’s market.

From what I have seen over decades of rent control in NYC and San Fran, landlords whose properties are under rent control will do ANYTHING in their power to get an incumbent tenant to move out, from imposing ridiculous, oppressive rules to creating nightmarish living conditions. In a market with many available rentals, tenants are treated like customers, and stable, long-term tenants are gold because they live in a place for many years without requiring their places to be reconditioned and improved.

But in a rent controlled community, the difficulty of raising rents first causes many people to back away from rental property and/or convert it to condos or co-ops, or make sure that the units turn over as quickly as possible so they can hike the rent steeply.

>> Rent control wrecks the rental market for the very people it is intended to help <<

Yes and no.

CURRENT TENANTS benefit from rent control. They stay in their apartments, some not for years, but for generations.

It's the PROSPECTIVE TENANTS — the newcomers to New York seeking their first place — who are faced with rental shortages, and must pay above market rents, essentially subsidizing the old-timers.

As for landlords doing "anything" to get tenants to leave — New York has very strict "tenant harassment" laws. There's no level playing field between a tenant and landlord. The tenant has all the cards.

A tenant can phone a landlord, announce that they're recording the call — and then be as abusive in their language as they like, while the landlord must listen and respond with utmost politeness. A tenant can curse out a landlord, and it's legally a non-issue. But if a landlord curses back in defense, a court may still find it to be "tenant harassment."

The exact same things have happened in Santa Monica. Though it’s really tough to get a rent controlled holdout to move. The tricks that Laura mentioned – they are possible, but it’s very risky as tenants can sue the LL and win.

Rent control is similar to Prop 13 in that it rewards early entrants into the system at the expense of later arrivals. Both are protectionist and attempt to tweak or fine-tune the market. Both are treating symptoms and not addressing causes. Both are held up as just and successful by those who benefit the most.

Rent control in SM is a joke. I know some lucky early entrants who have since bought a house on the eastside but keep up their payments on their artificially low rent controlled SM apt. Perfect! A forever beach pad they use a couple nights a week, more during summer when they rent out the eastside house for some extra cash. Another unintended consequence of rent control.

Yes but in the late 90’s in SF, you had landlords paying $15K or more to tenants to move out. Many tenants took these deals thinking they could just find another place. Many could not and moved out of the city. I believe after a rent-controlled tenant moves out, the apartment can be listed at market rate, and then subsequent rent increases would be subject to rent price controls. These laws also don’t apply to new construction.

In major cities, except for seniors, you have a very dynamic population – people coming and going for jobs as the city booms or busts. This gives apartments a chance to “refresh” to market rates as people who lose jobs leave those cities. Just a few years ago, you could get a 1 bdrm for $1500/month in SF. My buddy had a Nob Hill studio for $1100 back in 2009. There are always ebbs and flows.

That also has happened in L.A. In cases I’m familiar with, the landlords lied to the tenants by telling them that the properties were going to be redeveloped and the cash was offered as an incentive for the tenants to break the lease early. Tenants take the cash, move out, and the properties are then re-rented at market rates. For a LL to part with such large lump sums tells you just how below market rate these places can be.

Don’t blame us Chinese. You send us your money to buy the goods we make(which costs 500,000 people to die from air pollution every year), so it is our right to buy up the best properties and send our kids to the best schools and colleges. We live in a world wide economy, so stop being so parochial. We have a real estate bubble in China, but our Leadership is working on a soft landing.

“so it is our right to buy up the best properties and send our kids to the best schools and colleges”

Wow Lee that’s quite a comment, especially the word “right”. As if it’s a right that China can violate intellectual property rights, endlessly hack into the computers of Fortune 500 companies to steal product designs, commit trade violations, and threaten their neighbors.

I don’t blame the writer for being parochial!

If we believe the free market dogma we’ve exported to the rest of the planet then (economic) might makes right. So yes, the rich (Chinese or otherwise) have the right to buy up anything they can.

Don’t believe that and you must be some kind of commie – like the Chinese… oh, wait…

JQ, the Leadership denies all your charges. You just don’t like us buying up the prime real estate for cash, the cash that you gave us. What did you think that we would do with our cash? Don’t blame me for the problems that your Leadership has caused you. If you have any complaints, take it up with your Leadership(they do like our political contributions that are mostly all funneled legally). Now is the time for the Chinese to buy the prime real estate along the west coast.

Lee, I never said I didn’t like Chinese buying prime real estate for cash. Anyone who purchases prime real estate at inflated prices is doing a favor to the community in terms of high property tax revenue.

I’m not blaming you for any problems that my Leadership has caused me. If I had a problem, (which I don’t) I would talk to them directly.

Here’s a question for you Lee: How are the Chinese legally getting their cash out of China? If you are in a position to buy prime West Coast property you would have the answer.

“According to WealthInsight, the Chinese wealthy now have about $658 billion stashed in offshore assets. Boston Consulting Group puts the number lower, at around $450 billion, but says offshore investments are expected to double in the next three years. Many experts say that the wealthy are moving to protect their wealth, their health and their families. With China increasingly cracking down on ill-gotten gains and corruption, many of the politically connected wealthy are looking for safer havens abroad.Still, much of China’s offshore wealth is moved illegally or in the shadow economy. China maintains a closed capital account and Chinese citizens are generally not permitted to move more than $50,000 out of the country. So reliable data on exactly how much money is moving out remains unclear. ” http://www.cnbc.com/id/101225781

You can buy it, but it doesn’t mean Patriot Americans and the rest of the geographical areas are going to like you. Have fun in your “west coast prison”.

Seems like a good deal for the 500,000 a year in China that as you said “die from air pollution”

The average Chinese citizen has been thrown under the bus in a political system that should protect against systematic corruption and capital flight. It will be interesting to see how this plays out in the next few years. Perhaps the average Chinese citizen will re-discover that they have rights too.

Don’t nobody want no Chi-nee in these parts.

Wow. .. You think this real estate market is f*cked?!? Boom and bust?.. Comments like this set our WORLD back 100 years. plain ignorance. I’m a born and raised Angeleno and comments like this make me ashamed to have neighbors like you. Yours truly – the Chinese with the triple dot sights and triple figure might NEIGHBOR!

Leave a Reply