Squeezing out the working class through higher rents: 11.3 million Americans spend more than half their income on rent in 2011, a jump of 28 percent from 2007.

Welcome to landlord nation. People need a place to live and a recent Harvard analysis found that more Americans are spending a larger portion of their income on housing. More to the point, there are now 11.3 million Americans that spend half of their income on rent. This is a significant jump of 28 percent from 2007. Rents also went up throughout 2012 and the first half of 2013 so this figure has definitely increased. Is this a good thing for households? Probably not but that is simply the current trend. This is also a reason why only 1 out of 3 households can actually afford a home in California and is a direct consequence of the massive flood of investors into the real estate market. When properties go back into the market with artificially low supply, these owners have the ability to command higher prices. The end result? More money to landlords and less money in the pockets of renting households. And with America becoming more of a renter nation, this is putting a strain on the budgets of many households.

The massive gentrification in high cost areas

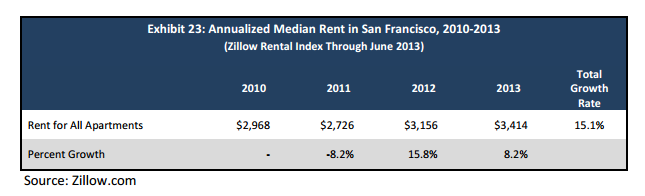

Only a handful of markets have higher prices than those seen in Southern California. San Francisco is one of those markets. The cost of housing in the Bay Area is astronomical and the recent tech and social media resurgence has caused a boom in home prices. The media has covered the home price angle extensively but really hasn’t looked into the large rise in rents. A recent report has some stunning figures on apartment rental figures:

The current median rent for an apartment in San Francisco is $3,414 per month. Even to afford the typical rental you’ll need a good income or a few roommates. So it should come as no surprise that evictions are also up during this timeframe:

“(NPR) A recent city report finds that Ellis Act evictions have increased 170 percent over the past three years. Low- and middle-income tenants are unlikely to find another affordable apartment in San Francisco, where the median monthly rent has risen to about $3,400.â€

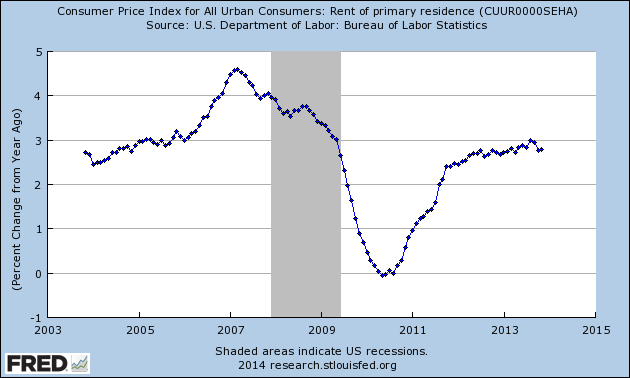

Keep in mind this is happening in one of the most progressive areas in the country. Many metro areas are seeing a similar gentrification of neighborhoods as working and middle class families are priced out. The aggressive buying of properties by Wall Street has created a new kind of housing market. One where the homeownership rate has declined dramatically but where home prices continue to go up. Rents across the country have moved up steadily:

Currently rents are going up around a 3 percent rate. This is problematic when incomes are having a tough time climbing up in conjunction. So what happens is that more money is consumed by rents and also, mortgage payments. The rapid rise is largely based on the booming real estate market and also, the banner year for the stock market. Will this continue into 2014?

I think many of these changes also highlight a dramatically large class of Americans who are simply hanging on by a financial string. Many don’t follow the financial media or pay close attention to macro trends. They live paycheck to paycheck and debt payment to debt payment. Data from last year shows that the typical reader of this blog has a household income around $100,000. Compare this to the median household income of $61,000 for the state. I’m fairly certain this is a trend across all finance and real estate related websites.

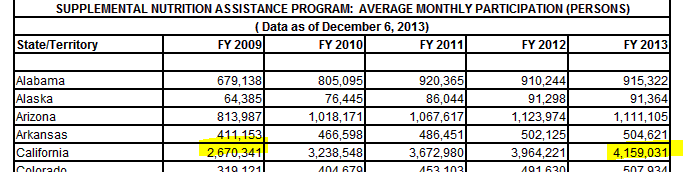

In California, the number of people on food stamps has jumped steadily throughout this recovery:

Source:Â SNAP

This is a 55 percent increase since 2009. Then you have younger potential buyers unable to purchase because many are saddled with large amounts of student debt and living at home. This is why the latest figures for home sales in Southern California highlight a very split market:

“Cash†buyers:                 27.7 percent

FHA insured loans:Â Â Â Â Â Â Â Â Â 19.6 percent (scraping everything to buy)

ARMs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 12.9 percent (stretching budgets to compete with Wall Street)

It really is an interesting market. The median price in SoCal is up 22.3 percent and sales fell 9.2 percent year-over-year. Sales volume is very low but so is the inventory. Given current prices it is much more difficult for investors to find a good potential flip or to find a good property to rent out. We’ve noticed some slowdown in the last few months but real estate is a big momentum trade. The current winds are still very strong and most headlines are positive when it comes to housing. The fact that rents are rising and more income is going to housing simply reflects a shift to a rentier class. This was the big play the Fed made to assist their banking friends. In that respect, the Fed managed to essentially re-inflate the economy and their balance sheet is up to $4 trillion. The big question will be, is this sustainable or is this similar to the Irrational Exuberance brought on by the master of bubbles, Alan Greenspan? Only time will tell but one thing is certain and that is many working and middle class Americans are being kicked out of high priced metro areas via high priced gentrification.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

125 Responses to “Squeezing out the working class through higher rents: 11.3 million Americans spend more than half their income on rent in 2011, a jump of 28 percent from 2007.”

We live in a country that doesn’t care for their own citizens.

You have today a party at the Wall Street and the depression on the Main Street.

All policies implemented since 2008 are just to benefit the rich, the big banks and the wall street crooks.

Rich have never got it better then today and they don’t want to go back to old America. This new Feudal America is very good for them.

Housing was a basic shelter and necessity but today Wall Street and NAR have turned housing into Las Vegas Casino game, trading vehicle or get rich quick scheme.

Unbelivable.

In some areas housing prices have gone up over 300% but wages have stayed flat for 30 years. Instead of paying workers decent and livable wages the Lords or Masters have given them the Credit. So majority of Americans today are plain and simple a modern day debt slaves.

Wall Street firms are Americas new Slumlords.

How long will American Sheeple bend over and take it in the ass before he wakes up and explodes????

Debt is hardly slavery… Until the government brings back debtors prison…

You have nearly as much freedom with a mortgage as with rent. Only you can squat in your home easier when crap hits the fan!

Hey Low, Debt is slavery….. and just how complete debt has on your life depends on the type of debt you have. Bankruptcy will wipe out some types of debt, but start to think about what types, and the growing number of different types of debt bankruptcy will not wipe out?

Student loans? I’m not even sure that debt goes away if you die. IRS and taxes…. not sure, but as long as you are alive, the IRS will make your life a living hell to the point where debtors jail would be a vacation. Changes in the bankruptcy laws back in the mid 2000’s ( about 2006) put a dent in what you could write off…. but I expect in years to come the Bankers and NAR will work to make mortgages impossible to discharge.

Even the Bible tells us we are slaves to debt, and warns us about it. But the folks back then had the humane way of wiping off the books every seven years…. we need that again. Lenders will be careful, and people can again live without the fear of being thrown into the street or your stuff taken back….. Read the Bible, it’s in there…. I’m not going to tell you where… reading the Bible will be good for you, and with Google, it’s painless to find.

We already have debtors prisons. Fathers unable to pay child support can be imprisoned in some states.

Thankfully, I’ve never suffered a divorce, so I’ve never had to deal with child custody payments. But I have talked with fathers who’ve been taken to the cleaners by their ex-wives.

They have brought back debtors prison in some instances and it is happening more and more. Google it.

“How long will American Sheeple bend over and take it in the ass before he wakes up and explodes????”

Sounds like gay porn meets the Die Hard series. There must be a role for Bruce Willis in there somewhere.

“How long will American Sheeple bend over and take it in the ass before he wakes up and explodes????”

Sadly, for most, never. As long as food is easily accessible, credit cards work and cable/internet/phone access continues, I would guess most will continue on as usual until the day it doesn’t.

This shouldn’t be happening under a democratic progressive administration. What occupies Obama’s time so much that he apparently doesn’t give a rat’s ass?

Why WOULDN’T this happen under a Democrat’s watch? Take a look at who contributes to whom and you’ll realize that Democrats are even more beholden to Wall Street than the shitty Republicans are. Don’t kid yourself, the Dems in high office are as much or more corrupt than the Republicraps, and one thing is for sure, they will never give a rats ass for you and me.

Obama is not distracted and he is not dumb…he knows full well what the deal is and he is onboard with the Wall Street scum that finance his campaigns, he does not care about us, it is painfully obvious to all but a child.

if debt is slavery, then pity the fool who sold himself into it.

Yeah, that’s what Mr. T said a lot too. I can picture him now, jumping out of the back of the van with your gold chains on. “”No debt, Sucker!”

If one wants to live in the U.S. today, they pay more by not having a credit profile, not only in real dollars but also via ways these profiles (credit ratings) are used.

People with no debt (or debt they haven’t paid for) , are more likely to see the inside of a jail and are are more likely to never enter the top tier of wealth holders. Those trends are increasingly more likely in other places as much of the rest of the world is moving toward a finance-centric world that rewards corps handsomely.

On the other hand, people who live without debt (which quite often means they acquired a nut without having to work for it, and now don’t want to lose it.) seem to think they are free of something even though their fortunes are bound up with everyone else. They pay a price too, but are sometimes too busy to notice it.

.

http://thisisindexed.com/wp-content/uploads/2014/01/card4037.jpg

http://thisisindexed.com/2014/01/please-tell-bootstraps/

The reason why the people in the USA are watching the Middle Class deteriorate is because of trade policies that allow the out sourcing of durable wealth producing supplies domestically that leave the citizenry in SERFDOM Dependent on others for their needs and this will only intensify with the passage of the latest trade policy trying to get fast tracked into law called the TPP or Trans Pacific Partnership , http://www.exposethetpp.org/ .

Excellent post! Everyone needs to spread the word on this POS legislation.

I can confirm that my middle class single family home community turned into a rental community in the last 4 years. Investors are snapping up houses at Auctions then turned them into a rental unit as quick as in 30 days.

Here is an example; REBOUND RESIDENTIAL LLC

There are more homes coming in the pipeline for investors ( shadow inventory) Average Joe has no option but to rent and hope for a housing crash in 2014.

I still think, it is time to buy a 2nd or 3rd house this year.

Fed and Banks has too much control over the supply & demand for housing therefore this leads me to believe that there will be no crash in 2014 but slow down on raising home prices.

Multi-family, and roommate homes, are not good for healthy marriages. Spending more on rent or mortgage and less in the stores is not good for the economy.

But your 401k went up $30,000 last year. Party on.

Yes. As long as the stock market soars and housing prices rise, the feeling of wealth continues and people can head out for another day of shopping and eating.

Many people have an odd relationship with California that reminds me of an abused spouse; they can’t/won’t leave California no matter how bad things get or what they must sacrifice to continue on; they were “born here”, can’t live far from family/childhood friends, weather, restaurants, culture, etc. Powers that be know they have a very large, captive audience; it doesn’t matter how bad the traffic gets, how miserable the quality of life becomes, how high taxes/fees are raised and how much the cost of living soars. Many people just can’t/won’t quit Cali.

Here’s a recent interesting report on the quality of California schools.

http://www.ocregister.com/articles/california-597193-education-school.html

“California gets D+ in school achievement” Excerpts from the article…

“California lags most of the U.S. for student performance in math and reading, sinking the state’s scores in a new national report ranking quality of education.”

“California scored a D-plus in both K-12 achievement and school finance, and a C-minus in chance for success.”

“One of the striking patterns that emerges for California is that the state fares poorly on measures related to current reading and math performance,†said Sterling Lloyd, senior research associate with the Education Week Research Center. “Those results are cause for concern given that reading and math skills are critical for students seeking to succeed in post-secondary education or the workforce.â€

“California ranks last in the nation for having the lowest number of parents who are fluent English speakers, Lloyd said.”

“California ranked 42nd in the nation for chance for success.”

On the flip side, I have two kids who play outside daily, not bundled from head to toe taking vitamin D supplements. California, in it’s infinite open mindedness has a robust plethora of “alternate” school options from Magnets, to Charters, homeschool charters and relaxed private homeschool rules. The community is robust. School, in it’s current form is the problem, even Palos Verdes schools are antiquated models of a bygone era. Also the weather is fantastic, if you haven’t noticed. People who live in cities use less energy per person then those who live in rural communities, FYI. Right now on this 80 degree day all my old friends in CO are jealous. I guarantee it. I moved here 7years ago and it was one of the best decisions I ever made. People who don’t see what I see should leave and follow their dreams but even though it’s been no cake walk I love it here, I ain’t moving. Oh also my mother lives in a MIL suite in my house and shares the mortgage expense with us, we get more childcare this way and it works out just fine.

I think this study is skewed because most Anglos, Asians, Indians, middle class Latinos, etc. put their kids in private schools at any cost. What you are left with are poor recent immigrants from Latin America.

In response to “What”, this is the most recent enrollment information I could find in a quick internet search of California students enrolled in private schools; it appears to be consistently less than 10%.

http://www.cde.ca.gov/sp/ps/rs/cefprivinstr.asp

Candace, I am glad you found contentment in California, a place you describe as having a “robust plethora of “alternate†school options”. Reading your response, with its unique grammar and sentence syntax, use of the word “ain’t”, use of a contraction, “it’s” (“California, in it’s infinite open mindedness”, “School, in it’s current form”) instead of the possessive, “its”, not spelling out a numeral less than ten, I wonder if you homeschool? Of course, it is none of my business.

Drinks – What is the makeup of these folks in the public schools?

http://www.kidsdata.org/topic/36/publicschoolenrollment-race/table#fmt=451&loc=2,127,347,1763,331,348,336,171,321,345,357,332,324,369,358,362,360,337,327,364,356,217,353,328,354,323,352,320,339,334,365,343,330,367,344,355,366,368,265,349,361,4,273,59,370,326,333,322,341,338,350,342,329,325,359,351,363,340,335&tf=67&ch=7,11,621,85,10,72,9,73

My mother was a teacher in LA Unified for over 45 years. Her classes were all Hispanic by the end of her career…

I am usually impressed with your observations/analysis but you really missed a very important factor. This is why volume is as important as price…

“What” – I’m a little confused by your response…

“Drinks – What is the makeup of these folks in the public schools?”

“My mother was a teacher in LA Unified for over 45 years. Her classes were all Hispanic by the end of her career…”

Perhaps I’m wrong, or wasn’t clear enough but I think this issue was addressed in one of the excerpts of the article I linked to earlier in the thread? I’ll post it again…

“California ranks last in the nation for having the lowest number of parents who are fluent English speakers, Lloyd said.â€

I guess I incorrectly assumed that the logical assumption would be that these parents are Hispanic, although I’m sure there are tiny slivers of other demographics that would fall into this group.

There often seems to be an assumption that large numbers of California parents simply send their kids to private schools to avoid some low performing public schools, but this doesn’t seem to be the case. Also, if people are “stretching” to buy a house or even afford life in California, I’m really not sure how many can/will fund tuition for private school…

Drinks – I am not sure if we are agreeing or disagreeing at this point.

I think the first point is that the majority of children in the California public school system are “Hispanic†with a large amount of these being children of low wage immigrant parents. The demographic skews performance for obvious reasons.

The second point is that I know of absolutely no one with children in the public school system. All the parents that I know send their children to private/alternative schools. I do know that there are some public schools in California that perform well but they are averaged out by the masses identified above.

So, again, I believe that the performance of the school system is skewed. I am not sure where you disagree with the statement that the results are skewed for the two reasons I identified. Are you saying that kids in California are dumber because of something in the water? Or are you saying that the public schools in California are worse because of some difference in the structure of schools versus other states. What is your understanding of the reason for the disparity?

@What is correct on this one.

In areas that are under jurisdiction of the Los Angeles Unified School District, parents in the top 40% of the income earnings distribution, usually send their children to private schools. That is why you see very few white kids (and to a certain extend Asian kids) in LAUSD schools.

“I think the first point is that the majority of children in the California public school system are “Hispanic†with a large amount of these being children of low wage immigrant parents. The demographic skews performance for obvious reasons”

Agreed.

“Are you saying that kids in California are dumber because of something in the water? Or are you saying that the public schools in California are worse because of some difference in the structure of schools versus other states.”

No. California children are not “dumber”, Hispanic students are not “dumber”, I believe it has nothing to do with the water, race, or school structure. I believe low test scores (and many other societal struggles, but that is another discussion for another blog) are due to socio-economic issues. Undocumented immigration of a primarily poor populace has forever changed California in many ways. However, that too is another discussion, for another blog.

“The second point is that I know of absolutely no one with children in the public school system. All the parents that I know send their children to private/alternative schools.”

Your personal experience doesn’t seem to reflect the norm; children who attend private/alternative schools in California seem to be a very small slice of the pie (a quick internet search appears to me the number is around around 10-15%, but maybe I’m wrong).

The majority of California parents send their children to public schools. For an average family “stretching” to buy or even rent a home in California, in the future will they be able to afford to do so in a high performing school district? Will they be able to afford private school tuition? I’d guess the answer is no.

Something has to give eventually. If no one can afford the rents, properties will go begging, and the prices will fall. In the meantime, who do they think they’re going to replace the evictees with? Seems to me that these greedy “investors” are killing the golden goose.

It’s giving now. The “cash buyer” myth (it’s all borrowed money) is about to be exposed as cap rates are shit, vacancies are up, and the recession hasn’t even started yet. Once the FED loses control of the bond market and interest rates rise OR they take spectacular measures to keep interest rates low and inflation rapidly accelerates (it has to be one or the other) good luck to those rentier class parasites remaining capitalized.

Yup.

The Fed is doing everything in its power to fight deflation, I think they will eventually lose the fight.

2014 will be the year of the “all-crash” buyer!

The 100% cash buyer funds may be borrowed somewhere but cash buyers were definitely not mythical when I was trying to buy in Norcal in 2011 and 2012, I had a big downpayment and a preapproved loan for much more than I needed and that did me no good at all, made bids on several houses and was ignored due to 100% cash flippers and specuvestors, finally gave up in disgust after a year of this….but definitely agree that Bubble 2.0 has to pop before long

Bluto- that is the myth that NZ is refering to, most of the “all-cash” buyers have borrowed cash prior to the sale, it only looks like and represents itself as 100% cash… It is either already financed cash, or cash on hand that is immediately re-financed within a few days of the all cash purchase…

Remember the “all-cash” really only means that a mortgage lien was not recorded for the sale, so if you have the means to obtain cash without having to actually put it into a mortgage situation you just bought a house with “all-cash” does not mean that you actually have that much cash, just the availabilty to leverage what you do have in a different way than most.

It’s very sad to see what direction America is heading into. The media never mention the increase of people on food stamp or how more and more people are having less money to spend because they are spending it all on the higher cost of housing with no increase in wages. What I hear everyday from the media is how great the stock market is doing and how many new (part-time) jobs is created each quarter when it’s really a full-time job being converted into a part-time job. There really is no real job creation. We are living in a very sad time in America. 🙁

The reality is that the entire concept of “middle class” is more or less a blink in the eye of history. It started in this country after WWII because Japan and Germany were bombed to bits, and we were the only industrialized country ready to produce anything. Now, it’s time for the emerging markets to enjoy this concept; our time has passed, and the policies of the progressives have accelerated the middle class’ demise by encouraging companies to become (and remain) as lean as possible moving forward.

As to So. Cal. housing, you see the writing on the wall.

As a small footnote to my previous post, here’s where the American middle class is most protected. My favorite quote from the article:

“To the average person, those salaries seem very high, but when they’re compared to other cities they are not,†Scotto said. “Comparing it to the private sector, it is enormous. Comparing it to other cities, it isn’t.â€

http://www.dailybreeze.com/government-and-politics/20140110/torrance-struggles-to-rein-in-high-city-employee-salaries

Had a convo with my brother in law last night when he was getting all upset about the mainstream media for basically lying to our faces at every turn, diverting our attention to bs (fcking oscars are lead story on cnn.com), etc. Had to remind him the media is not a public consumer watchdog agency here to serve the people. The media is a combination of approved messages by their advertising base (big corporations). Those that work in the media have families and don’t want to lose their job in this market and be blackballed. They do their job, just like lawyers who work for rapists, brokers that sell sht to retirees, used carsalesmen that sell lemons, etc. People justify things, rightfully or wrongfully. I mean the US was founded on caveat emptor (aka buyer beware), btw, not love thy neighbor regardless of what then bible may say.

Price discovery for assets (homes, stocks, art, collectibles, etc) thanks to the fed and truth discovery thanks to our bought and sold media and govt are fading fast in this world. Soon they will be completely gone. I used to think the internet would be the great equalizer. That’s how honest middle class folks could band together. Nah. TPTB using the NSA has that covered. Nightie night sheeple. There will be no revolution. Just long and protracted pain. More people slip down and a few go up. Marry rich is the best advice for the future to pass on to your kids. They should teach that class in high school and college. More relevant than 90% of the other crap they teach.

Mainstream Media no longer exists. There is only the corporate media which has very little vested interest in providing information to the Public. 90% of media is controlled by these 6 companies – Disney, Viacom, News Corp, GE, Time Warner, and CBS.

http://www.businessinsider.com/these-6-corporations-control-90-of-the-media-in-america-2012-6

It is truly hard to believe how morally degenerative the media and advertising has become.

Yes, it seems to me most news/media outlets in the past few years have gone to a formula with reporting stories on certain subject matter on a heavy rotation; current faves seem to be racial issues, LBGT issues, gun control, comprehensive immigration reform, lots of celebrity filler. Anchors emoting; sighing, rolling eyes, injecting personal viewpoints, etc.; reminds me of radio stations with an annoying chatty DJ that plays the same ten “hit” pop songs over and over again.

Sometimes it seems as if someone decided America is fixated on these issues/types of stories, little else is worth reporting.

Drinks – the media is the circus part of bread and circus…

Willy Loman: “90% of media is controlled by these 6 companies – Disney, Viacom, News Corp, GE, Time Warner, and CBS.”

I thought Viacom owned CBS.

Son of a…

They broke up in 2005…

Redstone still holds controlling positions, IIRC.

In that sense, he still holds a trust type structure with these firms. It’s amazing that he’s never been taken to task WRT the Sherman Anti-Trust Act.

The media certainly exhibits concentrated ownership — and immense political power. Blocking the latter was at the absolute heart of the Sherman Anti-Trust Act.

I just wanted to add that it’s the same “1 full-time job” being converted into “two part-time jobs”. Why? Because employers don’t want to pay for Obamacare. The cost of Obamacare is drive US down to our knees just like the high cost of our military spending. And the stock market? Yeah, it’s at an all time high so the economy must be doing great, right? That’s what the media keep saying but they don’t tell you that it’s being rigged and steroid-fed by the pumping of the Fed’s easy money. Rome was a country that was once larger than life. They, too, collapsed because they overextended their way of living. US may be heading in that same direction.

KEn

January 16, 2014 at 10:20 am

I just wanted to add that it’s the same “1 full-time job†being converted into “two part-time jobsâ€. Why? Because employers don’t want to pay for Obamacare. The cost of Obamacare is drive US down to our knees just like the high cost of our military spending. And the stock market? Yeah, it’s at an all time high so the economy must be doing great, right? That’s what the media keep saying but they don’t tell you that it’s being rigged and steroid-fed by the pumping of the Fed’s easy money. Rome was a country that was once larger than life. They, too, collapsed because they overextended their way of living. US may be heading in that same direction.

^^^^ Just too juicy to pass up.

1) ALL direct expenses caused by an employee HAVE TO BE EARNED by that very same employee — or they get fired, however gracefully.

This means that EVERYONE earns their W-2 gross income wage PLUS all of those expenses that are tucked “above the line” and not deemed taxable income.

Put simply: they are income that is not taxed on the 1040.

Under NO CIRCUMSTANCES should you ever state, believe, or assume that these items are paid for by the employer. YOU paid for them.

Your employer is acting merely as the clerk for the government — and routing your income directly off to Big Government — hiding these exactions from your eyes.

Should the proles ever comprehend just how vast these takings are, one might fear for riots at the state capitol building. (cf Walker)

2) In this modern era, the US DoD is an ‘export good.’ It’s a two-step process, but ultimately America gets foreigners to pay for its military.

A) The US Dollar is the International Reserve Currency, thusly transmuted into gold. Every other power on Earth has to import said dollars to provide liquidity for international trade. As this tempo picks up, the need forever grows. These are dollars that are conjured up out of thin electrons and wired overseas. Netting off, they NEVER COME BACK. They have to be retained overseas.

The cumulative value of these dollar exports is a stunning match to post WWII DoD spending. It’s and astounding correlation. It makes perfects sense when you consider:

B) It’s the DoD — particularly the USN and USAF — that makes the US Dollar International Currency. They go hand in hand. Shrinkage in the DoD budget has EVERY other power figuring out how to ditch the dollar. It’s not a coincidence.

When post war Britain shrunk her Royal Navy, the overseas demand for Sterling simply collapsed. Since gilts automatically redeem upon maturity, the rest of the world cashed them in.

The Labor Government of the time found that they had to crash dive the Royal Navy’s budget faster and faster. With each round of retrenchment, the gilt market shrunk. They never made the connection. Ultimately, London became utterly dependent — financially — upon DC. This was finally revealed to itself during the Suez Crisis. Ike didn’t threaten Britain with force. He just told London that they’d have to pay for all imports (think Texas oil) with dollars on the barrel-head. And that was that.

C) Even if America really was paying for her military, its GDP % is a joke. It’s not even a meaningful drain on the economy. The DoD kick starts most of our high tech export sector. (Boeing, Intel, Raytheon, et. al.)

The DC bleeding is all in something never before seen in government folly: the Medical-Pharma-Insurance Cartel. This puppy out chows even the Banking-Wall Street Cartel. Its takings are so vast that it’s ruining the entire remainder of the economy. MPIC is the real, proximate, reason for “above the line” ‘budget cancer’ everywhere.

%%%

To re-cap: Employers NEVER pay for ANY employee benefits. Employees EARN them.

When Big Government mandates that everyone instantly earn more wealth, reality intrudes and causes ‘displacement.’

In the construction trades this is achieved by hiring new blood at sharply reduced W-2 nominal rates — and laying off the old hands as gracefully as possible. The new W-2 numbers mate up with the new “above the line” expenditures on behalf of the troops (mandated 0-care) so that the total cost per man hour is returned right back to where it started.

This process is only a more intense version of what had already been the practice for all other ‘freebies’ mandated by Congress.

On its face, it should be obvious that Congress can enact more income out of the blue. It’s sole contribution to our modern economy is to shrink it — and vector wealth to cronies and favored voting-dependency groups. You can visit any 3rd world hell-hole to see this cross-action in a much simpler, crass, setting. Starting at a low point, the despots dig their nations right through the floor.

(Venezuela sits on a bucket of money yet can’t put rice on the shelf!)

0-care is merely a fouled up attempt to reformat the MPIC.

In fact, there is no blanket large enough to cover that beast. It bears more than a passing resemblance to the lethal dreams found on the “Forbidden Planet.”

http://www.imdb.com/title/tt0049223/

The alien super-culture was destroyed by seeking an ultimate good.

The MPIC is just such an enterprise. That such is so is not perceived.

Again, we’re in the footsteps of the Krell.

Ugh… dang typos.

Some good info for you here. http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA140114.aspx

“January 14, 2014

La Jolla, CA—Southern California home sales fell to a six-year low for the month of December as investor activity eased again and buyers struggled with a tight inventory of homes for sale. The median price paid for a home jumped to the highest level in nearly six years, the result of demand outstripping supply, declining distress sales and a slight increase in the share of sales in mid- to high-end areas, a real estate information service reported.

A total of 18,415 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 6.5 percent from 17,283 sales in November, and down 9.2 percent from 20,274 sales in December 2012, according to San Diego-based DataQuick”.

“Food stamps up 55% in 3 years” If everyone is living at home with their parents riddled with student debt why do they need food stamps? If Mom and Dad are footing the bills for this entitled generation then maybe the kids who need the program should actually reap the benefits. Only until the liberals in Sacramento stop making rules that allow handing out food stamps to anyone with a pulse, deserving or not, will that system work for those who are in true need of assistance.

My god! You are pretty damned ignorant and simple minded.

My God, Bobi is a typical mindless liberal who attacks others and spews nothing but hatred. Bobi’s ignorant comments add nothing to this blog.

Dependency breeds votes, votes give power. The circle of life in CA.

Yes, people who become dependent on food stamps are more likely to empower Democratic politicians. But left-politicos aren’t the only ones benefiting.

Agri-business is a big supporter of food stamps (and school breakfast, lunch, and dinner programs). Essentially, the govt is creating currency that can only be spent on their products.

“Progressives” don’t realize that they’re often a tool of big corporations.

When I was a kid in the 1970s, we brought our lunches to school in paper bags or lunch boxes. Today, schools in California have free lunch AND breakfast AND after-school meals — AND they want to expand it into summer, when school is out.

Much of this food goes to waste. No matter. The state still pays agri-business for the food, whether the kids eat it or not.

CJ, wow, there is a whole lot of doublespeak in that comment. If a kid can’t afford to do anything but live at home, we’re going to call them “entitled”? Look, I’m sure that we’re both in the same camp regarding the fact that there are way too many kids taking on way too much debt in an effort to get a degree, and that their true “effort” may be lacking, but that debt needs to be paid regardless.

When a “kid” can’t find a job THAT PAYS REASONABLY WELL and has a mountain of debt, what alternative do they have at that point? I moved back in with my parents after school for 3 years because I had a hard time finding a job, but then also to save money for the down payment on my first home. I see no shame in doing that and certainly didn’t feel a sense of entitlement.

Your last statement makes me wonder: is there somebody that truly needs food stamps but doesn’t get them? This is a serious question as I don’t know anybody on food stamps nor do I know what the qualifications are to get the food stamps. Don’t food stamps max out at $200 a month? Nobody wants unqualified people getting into that program, but in the big picture that’s not a whole lot of money… (i.e. gov’t spending on food stamps can’t be remotely close to defense spending, debt payments, health care, etc.)

This is all going to get worse as I fail to see the innovation/invention or the like creating new good full-time jobs. As the older folks stay working longer, there just won’t be enough good jobs to go around. And as has been pointed out in other comments, people can’t take on much more debt.

So, welcome to our new lower standard of living!

ANYONE living in the home of kin is amalgamated, economically, for the purposes of California’s means-tested aid programs — specifically to include SNAP/ food stamps.

(Food stamps, per se, are now history. EBT cards are used — issued by JPMorgan under contract, BTW.)

So, it’s possible to get SNAP — and at the same time find out that the actual $$$ is a joke — like $20/ week — after the math is applied.

Additionally: most California means-tested programs have embedded claw-backs.

This never gets mentioned in the popular press.

What happens is that Sacramento wants its money back — the minute the young adult gets W-2 income. This claw-back is formulaic. The employer will receive a notice to bump up tax withholding.

Similar schemes are used to claw-back welfare expenditures from ‘daddy’ whenever possible for dependent children. With any luck, they’ll actually be his own.

(Family courts routinely reject/ deny/ suppress paternity test results. Cuckolded men number in the millions — some of whom are required, by the state, to pay for another guys ‘project.’ Feminist-sluts are pressing to make paternity testing at birth illegal or irrelevant.)

%%%

All of which is to say that a slew of these SNAP dependants are not getting big bucks… and that the rules make EBT more as a loan program.

This loan aspect also extends to Medicaid/ Medi-Cal. The state places a lien on assets to claw-back expenditures for that means-tested program, too. Most citizens are totally unaware of this element of the program.

As you’d expect, most of these debts are hopeless losses. They do kick in for those entering employment or upon death. (The family home is ‘touched’ to pay off nursing home expenditures, while not deemed an asset for means-testing.)

LOL, if it wasn’t for liberals there would be rainbows, unicorns and pots of gold for everyone, there’s heads and tails on a quarter but in the end it is still just a quarter, same thing for U.S. political parties.

We live in an insane world. While I certainly don’t agree with many of the policies going on, I have accepted the fact that I am powerless to change them. Crack open a cold one and don’t worry about any of that crap. Forget about being idealistic, look out after your family and yourself. Period. End of story.

+1

*****Standing Ovation*****

What you say is heartbreaking, the beginning of the end. You have more power and influence than you know, use it wisely.

While you certainly don’t agree with many of the policies going on, you have chosen to be powerless to change them.

There, I fixed it for ya.

Anon, I’m a realist. Instead of spending my time and efforts trying to “right the system”, I choose to spend it with my family and friends. You only get so many years on this planet, use them wisely!

Yes, because we have to live our lives which will always include both comedy and tragedy. I am fully awake and aware of all the offing crap that is being perpetrated on us debt slaves. I see my husband woking LITERALLY 17 hours a day, weekends, holidays, and it is still never enough for his company ( a large publicly traded company and no he isn’t having an affair, he works out of the house and is on stupid conference calls back bad from 5am till 2pm before he can even get to his mountain of other tasks.) So he makes good$ if it was a 40 hour a week job, but it isn;t it is a 100+ hour a week job with calls and e-mails 24/7. Is it legal? No, Are they paying him the extra hours? No. He is “salaried”. That means he is their personal slave. He is not an “exempt” employee either according to the Federal Law, but what can he do? complain? sue? Not if he wants to keep his job he can’t. So this is what is happening if you do have a job. Oh, and after he pays taxes and FICA crap he takes home the median salary anyway so divide that by the number of hours he is working and he ends up not much better off than working about a 14.00 a hour job! So wtf? might as well work a $14.00 an hour job, put in your 8 hours and still have a few hours left to have a life. He is killing himself for this effing company!! working people are killing themselves and have no life and are just debt slaves. Even if you supposedly “own” your house outright, you will still need to pay your tax rent, insurance rent, sometimes HOA rent, for the life of the “ownership”. How EFFING bs is that? You have to keep paying tax on your purchase forever. wtf kind of logic is this? Would you keep paying tax on the tv you buy? idk anymore. I’m with George Carlin, “It’s all BS and it’s all bad for ya”. So we could go on and on and on about all the ways we lied to and conned, oh let me count the ways…but what’s the point? The whole financial and monetary system is fixed and rigged and there is nothing short of full out revolution that will change it. Who can squeeze that into their day? So pray for a kind master folks or get busy building underground railroads, stocking up on ammo, etc. and prepare to go after the International Banking cartel. 🙂

When 30% of the sales are going to investors, you have a very different market then we’ve seen in the past. Especially if the homes have no debt.

It will be very interesting to see how it plays out for people that think being a landlord is not too difficult or can be handled by a property manager without cost a lot of whatever profit there may be.

You’ve nailed it. The hedge fund management has promised the pension fund crowd that they will handle the drudge work — and in scale.

The pension fund crowd is now actually desperate to find a home for their assets that’s both somewhat safe and available in SIZE.

The Fedsury is driving them out of US Treasuries and traditional mortgage debt. In both cases the Fed is injecting billions per week.

$ 75,000,000,000 / month in US Treasuries is twice over the issuance of new debt.

$ 40,000,000,000/ month in mortgage support is almost all NEW money, too.

(Principal pay-downs by way of amortization and home sales trims the gross figure.)

Doing the adding and subtracting: about $ 75,000,000,000 is being injected into the pension universe each month/ assets being cashed out by the Fed.

These monies are looking for the next — only slightly more risky — asset they can land on.

The hedge funds have squared that circle. The pensions are going right back into the very same asset segment (real estate) that they just left. (mortgages)

The mandarins at the Fed never saw it coming. They’re spinning their wheels — and ruining the SFH market.

Instead of providing funding for a slew of private parties, the new normal consists of providing a monster bucket of liquidity for Wall Street lairds. As this progresses, Home Depot, Lowes, Ace, et. al. become long term shorts. Renters don’t DIY improve their abodes. Expect a severe long-term contraction in white goods, furniture, and all things domestic.

Nat Geo once did a photo-essay on domestic wealth across the planet. The typical American family needed, and justified, a double-wide photo spread. That was b a r e l y enough to squeeze in the truck, cars, McMansion, furniture, PCs, TVs, kids, pets,…

The next closest, Europeans, looked like they were on the dole in a southern state. Even a half-page was too much space! (Adjusted for currencies and cost of living, Swedes live poorer than the poorest American southern state. It’s not even close.)

This trend can be expected to transform America into ‘residential Germany.’ In that land, most average citizens rent. And for years on end rent in the exact same abode.

It’s hard to be a real estate broker there!

Blert, I could be wrong, but i believe the Fed is purchasing $40B per month of MBS and $35B per month of Treasuries, total of $75B per month…just sayin.

“(Adjusted for currencies and cost of living, Swedes live poorer than the poorest American southern state. It’s not even close.)”

If you leave all the benefits out and look only the cost, you get a very skewed view. On purpose, I think, in this case.

Swedes have free universities and health care: How much money do you pay for those?

Also they have unemployment insurance which pays about 70% of your former salary if you are fired and firing a worker in Sweden needs a real reason and still takes several months.

How much money you count on that? It’s abviously a benefit.

Of course free benefits will raise the taxes, a lot, but nothing is free, not even in the US.

Tell me Swedes have it bad when one broken leg (with couple of days in hospital) doesn’t cost anything: How long you do work to pay the bills from that?

Would you swap that to higher tax or not? That’s the real question and comparing apples to bananas doesn’t make any sense.

Doctor Housing Bubble – This is the real crux of the problem. When the majority of our economy is consumed by housing there is little else left for consumers to consume. The US private debt cannot increase much from here. I am not clear how declining income and maxed debt can continue to pay for ever increasing rent, food and fuel while continuing to consume plastic crap from China…

And a leftover from the prior post…

TJ – I have a long history of not timing the market. To many it would look like I “left money on the table†because I sold a lot of stock before the crash of 2001, 2008 etc. This is not because I am a genius rather it is because I never allow myself to have more than 30% of my net worth in the stock market. This approach forces me to sell into bull markets. As for the housing market, I have absolutely no idea when it will bust but I am very confident that it will bust. It is the same as earthquakes, we know that the pressure is building over time and the longer we wait the greater the event…

If you can’t fix the formula you mentioned of decreasing income and maxed debt paying for the increasing costs of necessities by increasing income then people get poorer or it would seem that wealth redistribution is the ‘easiest’ solution (basically youre not increasing necessity costs for those with decreased income and/or maxed debt). That’s always a fun one politically. I’m not making any opinions on it; I’m just saying things from an outside looking in/math type way.

We already have wealth redistribution. Why do you think the only folks who have profited in the last 5 years and have extracted 95% of all wealth created in the last 5 years are the very top .001%? Not even the top 10% has benefitted. The top .001% are now stealing from the rest of the top 10% since the bottom 90% is already tapped out. It’s rigged. It’s called stealing. It’s on such a massive scale most folks can’t get their brains around it.

Yes, it is good to lock in gains and diversify. And it’s probably better to sell a little too early, rather than a little too late. But, being way too early is just as wrong as being way too late, imo. As I said…timing is everything.

No, inside trading is everything. Clowns who think they are brilliant because they get lucky once in a while are the ones that get taken in the end. The house always wins in the end…

I work in Silly Clown Valley and almost everyone I know was a paper multi millionaire before the 2001 crash. Now these folks are looking for Happy House coupons for lunch. I made out like a bandit “selling too early†whatever that means…

What? I’m talking RE, and you’re talking stock options…clearly a disconnect here.

TJ – I am talking RSU’s not stock options. They are both very different animals. These folks actually had the stock vested in their brokerage accounts. They did not sell and many had 100% of their net wealth wrapped up in the stock of the company that they worked for. They did not want to sell because the stock kept going up and when they would sell a few shares for something like a down payment on a house they felt like they lost out when the market continued to rise. So they learned to never sell because taking money off the table was the same as a loss even if they made millions on the stock they held at the time. I see no difference between having all your net worth in a single disintegrating grouping of sticks, stucco and stone on a pile of sand or having all you net worth in the stock in a single company. When greed and fear drive financial decisions there is a very high likelihood that big mistakes will be made (i.e. buy high and sell low)…

“This is the real crux of the problem. When the majority of our economy is consumed by housing there is little else left for consumers to consume.”

1) Gradually eliminate mortgage interest tax deduction

2) Further lower FHA limits on loans

3) Eliminate Prop 13 benefits for all but SFR

4) Invest in public transportation to allow faster and cheaper access to good-paying jobs

5) Stop the flood of poor, illiterate, low-skilled immigrants that dumb down our local schools (which forces flight to the areas where there are a limited number of good public schools)

6) To curtail flippers, mandate that “owners” must keep a property for 36 months before re-selling unless financial circumstances of the owner-occupant can be provided (divorce, loss of job, relocation of job, etc.)

7) Eliminate real estate investment as one of the $500k tickets that allow immigrants a pass to the front of the green card line

But, the fact of the matter is that our government cares not about how squeezed is its citizenry, but only how many tax dollars can be squeezed out of property values and how to keep their well-heeled constituents (i.e., donors) happy by providing every existing wealth redistribution scheme alive and well.

DFresh – is that you? I think somebody stole your handle because this does not sound like you…

Glad to throw you off! A true ideologue wouldn’t cause such confusion.

DFresh – How do you reconcile the following statement together with your support of O-Care/R-Care? Isn’t O-Care/R-Care taking tax dollars from the healthy young (it is a tax according to the Supreme Court) and redistributing it to sick boomers to keep insurance companies (i.e. donors) happy?

“But, the fact of the matter is that our government cares not about how squeezed is its citizenry, but only how many tax dollars can be squeezed out of property values and how to keep their well-heeled constituents (i.e., donors) happy by providing every existing wealth redistribution scheme alive and well.â€

Yes, OCare is a tax. As such, it is a form of wealth redistribution, as are all taxes. Like social security, it relies on a broad base of tax-payers to support a common good (if you can agree that all members of a citizenry having access to affordable health coverage as a common good). It’s hard to argue that SS hasn’t worked extremely well in keeping a large percentage of old people out of poverty, especially if you look at poverty rates of the elderly before and after SS.

So, yes, young people pay in, even when they probably won’t get value out…today (just like with SS). But, their parents also don’t have to worry about losing their life savings should their uninsured adult child succumb to an illness.

The old system seemed worse. People being denied coverage due to pre-existing conditions. Rates being tied to your health condition (bad on me for getting cancer). People going BK due to serious illnesses. People using emergency rooms as their primary care physician.

I think O-Care actually adheres to the Preamble…promote the general welfare. General (everyone). Welfare (health).

Some ?’s for What?:

Should DINK’s pay lower state taxes because they don’t have children that use public schools?

Should I not have to pay unemployment taxes if my parents are wealthy and can prove that they’ll take care of me should I lose my job?

Should I get to pay lower federal income taxes should I sign a waiver indicating that I agree to forgo any benefit that our armed services might provide me?

Should I deduct my share of Federal taxes that go to FAA taxes if I declare I never take a plane?

Lastly, would you rather see uninsured adults lie outside emergency rooms and die on the sidewalk so their care not be a financial drain on the rest of us?

Health is a common good. Like social security is for the poor elderly. Like an educated populace. Like a well-armed military. Like efficient interstate travel.

DFresh – So wealth redistribution is a good thing and the state elevating the value of homes in order to get around the shackles of prop 13 taxation limits is ok if it is for the common good? I guess I misunderstood your statement about wealth redistribution at the cost of the citizenry. This is why I thought someone stole your handle. My bad…

In answer to your question:

No, but parents should have the ability to choose any school they want to send their child to and the funding should follow the child not the local public school.

Yes I believe that you should have the right to be your own insurer. There is no common good at AIG just corporate greed…

Absolutely not! There is no way to separate the protection by the arm military from your everyday life. BTW this is the primary roll of the federal government.

Nope. The FAA actually conducts a service that can not be separated from your everyday life. Safety in air traffic affects all aspects of life including mid air collisions that fall on your eight by ten shed in the wild country of Montana.

Last but not least your question makes a lot of assumptions that I do not agree with. Your assumption is that a really bad republican idea is going to save the lives of people dying on the sidewalk. I lived in MA during the implementation of the precursor to O-Care (aka R-Care). I got a secret for you. It actually made it harder to find a doctor and harder to get care. Go figure. I had friends and family in the healthcare industry and they said that R-Care made it much tougher to collect $ from insurance companies. Not sure how you save lives if everyone has a piece of paper stating that they have insurance but there are no available healthcare providers to provide healthcare… So I am not convinced that O-Care/R-Care is anything other than an insurance company give-away to appease big lobbies and campaign donors…

DFresh: “I think O-Care actually adheres to the Preamble…promote the general welfare. General (everyone). Welfare (health). ”

Hey, DFresh, here’s some news that may shock you. The Preamble to the Constitution is NOT the Constitution.

This is NOT a controversial or “right-wing” statement — it is settled Constitutional Law.

I went to law school, long ago. I passed two bar exams, long ago — California and New York. During my bar exam preparation courses, we were told that in multiple choice questions, when asked about the Constitutional basis for a law, the Preamble was NEVER the correct answer, so we could cross it right off.

The Preamble merely explains why the FOLLOWING Constitution was written. It’s not the Constitution itself, in the sense of conferring any powers.

It’s like this:

Your Dad says, “I want to you to drive a safe car. (That’s the Preamble.) So I authorize you to take $20,000 from my bank account toward the purchase of a car.”

Does this authorize you to take $30,000 from his bank account, because you can’t find a safe car for under that amount? He did say he wants you to drive a safe car. NO, it does not!

His desire that you should drive a safe car is merely a Preamble to why he’s authorizing you to take $20,000. But it does not authorize any amount over $20,000.

!! What we have here are some people bent on contorting arguments into intellectual pretzels to make pleasing ideological treats for their own consumption.

My Wiki understanding of the Constitution is the Preamble was the “Constitutions’ fundamental purposes and guiding principles.” Yep, sounds like some bull crap we can toss on the dung-heap of historical irrelevance. Perhaps something only a Drunk Historian would spend time on.

The Preamble to me is a version of the modern Mission Statement. Sure, most crap firms use empty boilerplate platitudes, but we’re not talking about any country or any document, we’re talking about the greatest sociological and economic experiment in the history of mankind, which created the most enduring Mission Statement of any ever created.

What about the other tenets of the Preamble? I bet dollars to doughnuts that SOL has no issues there. I call cherry-picking, straw-man, red herring to name but a few.

DFresh, you Just Don’t Get It.

The Preamble has does NOT issue any powers to the government to do anything. None of it. The General Welfare Clause, as it’s called, has NO force and effect. It is ALWAYS the WRONG ANSWER on the Multi-State Bar Exam (the multiple choice section).

This is NOT ME saying this. This is SETTLED LAW, and is taught in EVERY law school, by Constitutional teachers across the political spectrum.

It does NOT matter that “to you” the Preamble is a sort of Mission Statement. It does NOT matter what it means “to me.” The law is what it is.

DFresh, I’m NOT “cherry-picking” — YOU brought up the General Welfare Clause in the Preamble, so I’m merely responding to YOUR cherry-pick.

As for your “Wiki understanding” of the Constitution, here’s what Wikipedia says of the General Welfare Clause:

“The United States Constitution contains two references to “the General Welfare”, one occurring in the Preamble and the other in the Taxing and Spending Clause. The U.S. Supreme Court has held the mention of the clause in the Preamble to the U.S. Constitution “has never been regarded as the source of any substantive power conferred on the Government of the United States or on any of its Departments.”[2][3]

Moreover, the Supreme Court held the understanding of the General Welfare Clause contained in the Taxing and Spending Clause adheres to the construction given it by Associate Justice Joseph Story in his 1833 Commentaries on the Constitution of the United States.[4][5] Justice Story concluded that the General Welfare Clause is not a grant of general legislative power,[4][6] but a qualification on the taxing power[4][7][8] which includes within it a federal power to spend federal revenues on matters of general interest to the federal government.[4][9][10] The Court described Justice Story’s view as the “Hamiltonian position”,[4] as Alexander Hamilton had elaborated his view of the taxing and spending powers in his 1791 Report on Manufactures. Story, however, attributes the position’s initial appearance to Thomas Jefferson, in his Opinion on the Bank of the United States.[11]

As such, these clauses in the U.S. Constitution are an atypical use of a general welfare clause, and are not considered grants of a general legislative power to the federal government.[12]”

http://en.wikipedia.org/wiki/General_Welfare_clause

As you said in the beginning of this column the average reader of Dr. Housing Bubble is thought to have an income of over $100,000 and that amount must damage their brains. These readers are so isolated from the real world they think everyone has the same as they do and that we all have rich parents. Older Americans were hit very hard by the Wall Street caused crash. Many, like me lost everything, a life time of savings gone – just like that because of Wall Street criminals. Just because a family is living in one house does not mean Mom and Dad are footing the bill or are even able to do so. Get a hold of yourselves. These are very hard times. WE have a poverty rate of 47% in this country. This is shameful but just fine with the rich and aiming for riches. What fools. Do you have any idea that upward mobility is about dead in this country and particularly in CA.

A poverty rate in America of 47%….that is beyond laughable. Also it sounds like you defacated yourself when the 2008 stock market crash hit and sold low after years of buying high. Who’s fault is that really? If you bought and held and dollar cost averaged, you’d be far more affluenty today than in 2007.

“like me lost everything, a life time of savings gone”…

How is this possible? How do you lose everything?

You really don’t know? Well contrary to the mdm story about what caused the hosing market collapse. Many people put down huge down payments that they saved for years, and fell for the bankers story about what their properties were worth, hence when the market collapsed people lost their entire life savings that was wrapped up in their houses. Most folks are not in the stock market hence they did not make their money back that way. It all was transferred to the banks pockets the day they closed escrow on what they thought was an asset since they had so much equity in their homes. Money doesn’t disappear, it only transfers, and the redistribution of wealth that has occurred since 2008 is staggering. Most has gone not to the top10% but to the top .001%. If you follow the money t’s easy to see who the gangsters are.

Bobi’s needs to look in the mirror and blame Bobi for “a life time of savings gone.” Instead of investing wisely, spreading risk and developing a diversified portfolio, it sounds like Bobi was foolishly greedy, did the opposite, and ended up losing it all. Now Bobi lashes out like a typical mindless leftist liberal at others who invested wisely. No doubt Bobi wants big government leftist communists to come to Bobi’s rescue, steal from others, and provide more “free” entitlements.

Uh, what part of Bobi’s comment are you offended by? She’s not blaming others that “invested wisely”. She’s blaming Wallstreet and the rich getting richer. She’s not asking for a handout. She’s just saying that not all people getting food stamps are gaming the system. That there are real people suffering across the entire country. I know this blog is for soCal and it has it’s particular set of circumstances, but it doesn’t mean you should be narrow-minded. Are you going to lash out at me too and call me a “typical mindless leftist liberal”? The commenters on this blog have jumped the shark. With Sylviasays ugly attacks and Blert’s crazy and misogynistic rants, best just close this chapter. It’s been a great few years, but nothing new is being said.

Forever-Sidelined – I actually remember the Happy Days episode where Fonzie jumped the shark tank. I was glued to the TV. Hey Evil Knievel failed at Caesar’s Palace in the 1960’s and I was ready for the crash…

I had to look up “misogynistic†because I have never heard that word before and was disappointed to hear that it is defined as a hatred of women. I admit blert is out there but I have not seen any focus on hatred of woman. I haven’t been able to discern any focus from him at all…

Do you prefer we just comment on if it is a good time to buy or not? That would be pathetic. I believe there is quite a bit of good dialog compared to many other sites…

Uh, Forever-Sidelined, what part of Bobi’s silly comments and hateful attacks do you identify with? Bobi is blaming others when she makes foolish generalizations like “the average reader of Dr. Housing Bubble is thought to have an income of over $100,000 and that amount must damage their brains.” Bobi said nothing about people getting food stamps and gaming the system. Instead, Bobi lashed out with the comment that CJ Johnson was “pretty damned ignorant and simple minded.”

Why is Bobi just blaming Wallstreet for the rich getting richer? Why doesn’t Bobi also blame rich big government Democrats like Obama and rich Democrats in Congress like Nancy Pelosi who all went along with bailing out Wall Street and the big banks? These rich big government Democrats spout endlessly about income equality while they live like royalty at taxpayer’s expense and party with their rich Hollywood friends.

How do you know that Bobi isn’t asking for a handout? With a name like Forever-Sidelined, you sound like a typical mindless leftist liberal victim who probably wants big government to save you too? No doubt big government Democrats will steal ever more from taxpayers and then will throw you a few crumbs just to keep you voting Democrat?

Hey Bobi, how exactly did Wall St. wipe you out? I am constantly amazed when I speak with people nearing retirement and they have almost all their eggs in the stock market basket. Are you effing kidding me? As we have witnessed, you can lose half or more of your “life savings” in a blink of an eye. There is a time when people NEED to start transitioning out of the market into much safer, boring capital preservation assets. This isn’t exactly rocket science here.

This runs a bit outside of our usual purview, but many of the same arguments between doom and gloom apocalyptists and self-satisfied optimists that we endlessly hash out apply equally well to general investments as to the specifics of real estate.

The market is manipulated!

The Bubble is ready to pop!

The dollar is being destroyed by (QE, Obamacare, etc. choose your pet demon)!

All of these may be true, but in finance as well as housing there is a large potential cost to being *either* too optimistic or too pessimistic. For every Bobi who was killed by the crash of ’08 I can think of many gun shy investors who have stayed on the sidelines rather than participate in a nearly 200% run up in stock prices since ’09. Similarly for everyone who lost their home to foreclosure there are any number of us now grumbling about missing our opportunities to purchase during the post-bubble low of 2011 (however limited the actual available inventory was).

My point is that no rant here – positive or negative – is worth betting your future on. The truth is almost always a shade of grey somewhere between, and the wisest investment strategy is almost always diversifying one’s eggs among many baskets – including some real estate even in today’s market.

I was speaking to a broker in my neighborhood yesterday (LaCienega and Rodeo / Jefferson area) and I asked him how many of the properties he has sold in the last 3 years were to occupiers versus flippers. [Keep in mind he was not making inside deals with the banks, rather mom and pop with short sales and standard listings]. He said that over 90% of the homes sold East of Crenshaw were to flippers but that the homes sold West of Crenshaw into Culver City were nearly all occupiers (North/South bounded by 10fwy on the North and Kenneth Hahn, Blair Hills on the South). He also added that in the early days of flipping, most flippers were doing “hit and run” (cheap) remodels but over the years, the flippers become more sophisticated and began doing more high end remodels rather than home-depot style remodels. He further told me that he predicts home prices will flatten this year, perhaps falling 5% but to major re-setting due to loan qualifications process. For what its worth.

The Rentier class is going to make an epic run for the exits soon. When their cash flow runs negative (after debt servicing) what else can they do but flood the market with properties??? The cash buyer is a myth. All these wannabe rentiers are playing with house money and they will exit the market as soon as they are at risk of losing their gains. This is the same it’s different this time bullshit we heard from 2005-2006. Then 2007 brought the market to a standstill before the 08 crash. This market is Wile E Coyote hovering over the canyon. The drop is imminent…

Great article Doc! But the problem is the same all over the USA. Rents and house prices rising while real income is stagnant. http://confoundedinterest.wordpress.com/2014/01/16/u-s-housing-ownership-and-renting-grows-more-unaffordable-rising-home-prices-rent-stagnant-income/

Would you rather pay a higher rent, but be able to live where you work or enjoy where you’re living…

OR

Would you rather pay an inflated mortgage, pay high downpayment, and risk losing “value” in your “investment” when the bubble pops. Ohhhh, and if you’re planning on holding the property for the long haul, good luck keeping that job in that location for the next 30 years!

Prices will stay up because there is so much money that needs to be invested. After the Cyprus crises caused those banks to take depositors money for their bail out and the European Central Bank affirmed that using depositors money will be ok for future bailouts, money has fled to more stable areas of investment

“Prices will stay up because there is so much money that needs to be invested.”

So I’ve got some neat toy collectibles. They’ve only gone up in value since I’ve bought them and are much more liquid then a house. You don’t even need the next buyer to go into debt when you resell. Why aren’t investors beating down my door with offers that would equate to the miniscule cap rates they’re getting on SFHs.

Maybe because they know toys aren’t in a fucking bubble and their is no greater fool to sell to. If you’re investing in something purely chasing momentum its a bubble and ALL BUBBLES POP! So me thinks your thesis is bullshit.

This was the exact same logic I heard during the dot com bubble. There is so much retirement money chasing investments and it will go forever… Yea… how did that work out? Oh??? You say it is different this time because you can live in your bubble investment… Human nature… you can’t fight stupidity…

Under rent control, San Francisco landlords get an annual rent increase which can be imposed on tenants without the landlord having to petition the Rent Board. The landlord must give 30 days notice (or 60 days if this increase as well as any other increases in the past 12 months result in a rent increase of more than 10%). Landlords can “bank” these increases, that is, not impose an increase in one year but then impose that “banked” rent increase in a later year..

Effective March 1, 2012 through February 28, 2013, the annual allowable increase amount is 1.9%

PAST ALLOWABLE INCREASES

Effective Period—Amount of Increase

March 1, 2012 – February 28, 2013 1.9&

March 1, 2011 – February 28, 2012 0.5%

March 1, 2010 – February 28, 2011 0.1%

March 1, 2009 – February 28, 2010 2.2%

March 1, 2008 – February 28, 2009 2%

March 1, 2007 – February 28, 2008 1.5%

March 1, 2006 – February 28, 2007 1.7%

It’s true that most rentals in San Francisco are rent controlled. There’s an interesting article from the SF Examiner that describes how a combination of rent control, anti-growth limits on new housing, a city initiative that allowed landlords to sell their rental apartments as single ownership units, and increased demand from tech workers for rental housing has created a toxic situation where San Francisco rental prices are among the highest in the country:

http://www.sfexaminer.com/sanfrancisco/is-rent-control-hurting-san-franciscos-middle-class/Content?oid=2665463

Housing to Tank hard in 2014

Thanks for checking in Jim.

Doc, do you have any statistics as it relates to your website traffic. I’m wondering if there might be a correlation between increased traffic on your site, and when housing prices have reached another apex. (assuming your traffic goes up in a bubble, and down in a bust)

If you do have any such info, please provide details in one of your upcoming rants. It would be fun to examine, and it also may give us all another clue as to when this bubble is about to pop. Thanks.

TJ – that’s funny, I was thinking the same exact thing. We may all have “jumped the shark”.

“The big question will be, is this sustainable or is this similar to the Irrational Exuberance brought on by the master of bubbles, Alan Greenspan?”

Ironic that it was mater of bubbles AG himself who coined the phrase “irrational exuberance” when warning about the rise of the stock market back in ’96 or so. Turns out the NASDAQ wasn’t irrational at the time after all.

Why is everyone blaming greedy investors? It is because of Fed policy and all this money printing that investors are getting rid of their cash. US dollar is losing its value and hard assets are the only way to store wealth.

It’s not just a California problem either. Even in areas where the economy is poorer the rental prices are ridiculous. The gov is well aware of this, they have given it lip service several times, just no action on it.

I say rent should be no more than 33 percent of a persons income. The owners would say, so what I”ll just rent to high income earners but would find out fast they would have alot of empty house.

Housing is a necessity not a luxury and be treated as such.

The problem is CREDIT.

Most people have absolutely NO FINANCIAL EDUCATION. They think if someone offers them half a million dollar mortgage, they should take it, even if they have no chance in a snowball to repay it.

This trickles down to renting. All of my renters have lost their house to a foreclosure or short sale. They are good people, but even those making six figures are CLUELESS about financial planning.

They all feel they should have the best even if they can’t afford it. While certainly aspirational, it carries the risk of killing you! I had to reject a large number of applications where people lost their home because they couldn’t afford to pay $3000 a month in mortgage, but now they want to rent a $3000 house! Literally makes you wonder what the heck are they thinking.

Higher housing prices create higher rents. There is no proportion, however. House price can go up twice, but rent only 10%. The reason is that mortgage is funny money. First, it’s prorated to 30 years, and secondly even if you can’t pay mortgage, government will let you live there rent free for years. What’s not to like!

On the other hand, rent is real money. If you can’t pay, the sheriff is only weeks away from kicking you out to the street.

But the root cause of all these issues is that the rest of the world is working hard on making real value, while we sit on our laurels and twiddle our thumbs. Americans have become lazy and unproductive. We have traded being the best for being the below average. Real wages are falling. However, real estate costs remain, well, you guessed it, REAL.

So in the end, whatever we may think, it’s us who’s to blame. Our own politicians sold our business to China. We lost our marbles and our inheritance in exchange for a privileged few having billions. We shouldn’t blame China, or India, or Russia. It is squarely OUR OWN FAULT.

Trickle down, and anything real will cost an arm and leg. And the first in line is the rent. Welcome to the real world, America.

Our real estate market is dysfunctional because we allow private persons and corporations to appropriate publicly-created land values. This encourages speculation which generates real estate booms and busts that precede every major economic recession and depression.

One approach that has been used successfully to remedy this situation is to convert the property tax into a public service access fee. This is accomplished by reducing the tax rate on building values while increasing the tax rate on land values.

The lower rate on building values makes them cheaper to construct, improve and maintain. This is good for residents and businesses alike.

Surprisingly, the higher rate on land values makes land more affordable as well. Because the higher rate on land values reduces the profits from land speculation, it reduces the speculative demand for land.

Several jurisdictions have used this technique successfully to enhance housing affordability and job creation. If properly implemented, this technique also encourages more compact development which helps reduce energy consumption and pollution while preserving rural lands for agriculture, recreation and conservation.

For more info, see “Using Value Capture to Finance Infrastructure and Encourage Compact Development” at https://www.mwcog.org/uploads/committee-documents/k15fVl1f20080424150651.pdf

Kinda interesting CNBC article: about 2/3 of wealthy Chinese have already emigrated. Wonder what that means for future real estate demand.

http://www.cnbc.com/id/101345275

Don’t worry! There are way more wealthy “I” in “PIGS” Italians to pick up where the rich Chinese left off. You know there are more Italian millionaires than Chinese millionaires and the “I” in “PIGS” Italy is producing more millionaires a year than China. So don’t worry the housing market is safe!