Large investors make the full exit: Big rental investors like Blackstone are now selling properties to current renters.

Big Wall Street investors stopped buying real estate in large quantities back in late 2014. In many cases big investors had front row seats at banks and were able to buy in bulk and for incredibly low prices not offered to the public. This crowding out of course has caused two major things to unfold: inventory to dwindle and a push up in prices for regular families looking to buy. For the first time in history many things happened in the housing market including nationally falling prices but also a large interest from Wall Street in single family homes. Now with prices near previous peak levels many of these large investors are making the full exit by offering to sell the homes to current tenants, for of course a modest increase. Those bailouts that were geared to helping the public actually created a system that has slammed the homeownership rate lower and has now jacked home prices up once again. Large investors are now making their final play by cashing out.

Large investors cashing out

An interesting story from Bloomberg examines this new trend:

“(Bloomberg) Melissa Suniga and her mother had been renting a three-bedroom Phoenix house for less than a year when their landlord, Blackstone Group LP’s Invitation Homes, gave them the chance to buy it.

Suniga, a 40-year-old childcare worker, used her security deposit and $2,000 she’d saved from her income-tax refund, along with a county grant and a credit from Invitation Homes that together provided her with $10,600 more for her down payment and closing costs. She expects to complete her purchase of the $150,000 house this week.â€

The Arizona market is blistering hot yet again. The home in the example above was purchased for $83,000 in 2013 and now is being offered for sale at $150,000. All of this of course depends on the economy not having any minor hiccups ahead:

“Now, Suniga is buying the renovated place for $150,000 with a loan from the Blackstone-owned Finance of America Mortgage LLC. A bankruptcy from more than a decade ago, along with a past sale of a home for less than what was owed on it, had raised flags with other lenders Suniga talked to, even though she’s brought her credit score up to 660, she said.â€

Milking it from every angle. This is why over the last decade the U.S. has become a renter nation. If another hit comes about, we can expect investors to line up to pickup these foreclosures and repeat the cycle. Prices and rents have surged well beyond income levels:

There is still maximum leverage in the market. Even in the above example, you have someone that has a tough time getting standard financing and had a bankruptcy in the past. And is now buying a property that has jumped in price by 80 percent since 2013. Has the family’s income gone up by 80 percent? One argument for places like Nevada and Arizona in the past was that with prices being lower, there was just no way that foreclosures would happen in mass. The exact opposite happened with these states being the hardest hit because incomes tend to be lower as well. Incomes absolutely matter when you leverage yourself to the hilt. The homeownership rate is now going to be pushed up slightly with people being squeezed into inflated properties from an artificial market.

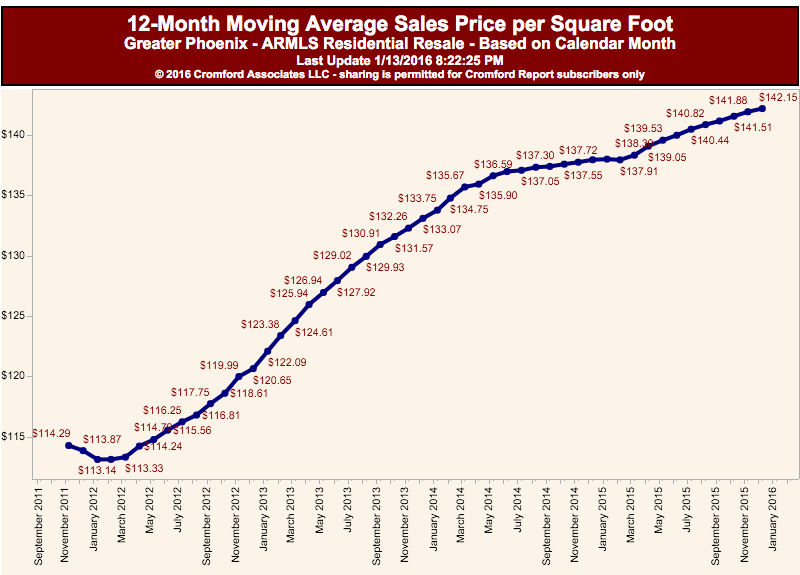

Real estate has been surging in Phoenix:

With this trend it is no surprise that big investors are unloading properties. It is a simple mantra: buy low and sell high. However someone else is buying at this level and it certainly isn’t Wall Street. Why would big investors sell if it is such a great deal to be a landlord in mass? Wouldn’t they just keep buying more rentals or going for more flips? Or do they realize prices are inflated and they don’t want to push their luck? In the end, people are stretching their budgets once again on rents and home prices. And you wonder why people are so angry in a year where the stock market is at a record level and home prices are back near peak levels in many places (higher in San Francisco). Blackstone stock is up 57 percent since 2011 and this will add a nice boost to their revenue.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

130 Responses to “Large investors make the full exit: Big rental investors like Blackstone are now selling properties to current renters.”

I have a twice-bankrupted relative in Phoenix who has just gone back to flipping houses. So I am 100% positive the top is in !

Ads for “my new flipping system” are all over the radio where I am so yeah, it’s Mr. Bubble time all over again – but wait, it’s different this time!

A twice-bankrupted person should realize they’re no good at financial investing. It’s not within their skills set.

Such a person should realize that, like last time, the Big Boys have taken all the good flips, and all that remains are the latecomer Flips Gone Bad.

Smart people learn from others’ mistakes. Stupid people learn from their own mistakes. Morons never learn.

Just now on the radio: Some kind of “mortgage loan” where “You don’t qualify for the loan, the house does!” – you buy the house and rent it out to make the mortgage. I guess the idea is, if you AirBNB it, you can make fantastic amounts of money a month, we’re talking $100 a night per room or more, and that pays the mortgage with ease.

I could almost see swinging it with a house that has enough parking room for several cars at a time, and having what’s essentially a full-time job washing linens and cooking breakfasts, and you’d better keep good track of the finances for tax purposes.

All would be well and good until your city declares your little operation illegal, or the economy crashes (again).

Clearly you all aren’t taking into account that buyers today are well qualified. Because surface quality leverage automatically infers efficient price discovery and central banks are better than ever before at spinning plates. It REALLY is different this time!

/sarc

You can check in anytime you like, but you can’t check out.

I’m still skeptical the large investors are leaving. It probably will turn into the stock market where they are all just trading with each other and will run prices up and down to make a profit.

We sure can hope they are exiting though, it doesn’t seem sustainable.

“…The home ownership rate is now going to be pushed up slightly with people being squeezed into inflated properties from an artificial market….”

Welcome to the new serfdom, Blackstone-owned Finance of America Mortgage LLC style!

The new normal.

You can now spend your entire life earning money to service debt.

Or you can spend your whole life paying ever-increasing rent, your choice.

Rent can go down… ask anyone who lived through a boom/bust. Heck, in Houston circa 1990, Rents fell through the floor and apts came with free utilities and cable. Anything to get SOME cash flow going… Rent is much quicker to respond to the laws of supply and demand.

@falconator

The advantage with renting is if you lose your job or have to move you’re not linked financially to the housing market and can move much more easily.

You really only likely to get any equity or sale profit in a home in a non-bubble market after owning it for 7yr+ of paying down the interest on the mortgage anyways. Few jobs offer enough stability to make paying down the whole mortgage practical over 20-30yr these days.

Ok guys you are right, renting is a better way to get wealthy than buying. You force me to admit that all the wealthy people I know are renters. Why lock in your monthly housing expense, build equity and get a tax break when you can rent? Stupid millionaires, they know nothing. RENT, PEOPLE, RENT!!

Simple equations from simple minds. Too bad it fails due to the wealthy people who rent.

You missed the point about buy low, sell high! It’s all risk vs reward, and I learned a long time ago you should sell when people are chasing high prices and buy when people are desperately trying to unload!

i see the trolls are out in force lately, another market top indicator.

based on my rent increases over the last 10 years it will take 30 years to get to 3/4 of the price of buying…..right now my rent is about 1/3 the cost or buying. And this year i just signed a new lease with a $50 a month increase…..my 3rd increase in 10 years.

@falconator

“Why lock in your monthly housing expense, build equity and get a tax break when you can rent? Stupid millionaires, they know nothing. ”

Locking in your monthly housing expenses doesn’t matter if you can’t afford it.

Building equity takes years and people can’t count on stable jobs that will last for decades like they used to.

The tax break from ownership is a joke.

http://www.cnbc.com/2016/04/15/homeownership-no-longer-a-tax-break.html

“yet another reason why younger Americans are choosing to rent: Buying a home is unlikely to offer them any tax break. That is thanks to near-record low mortgage rates and an increase in the standard deduction. Add them up, and the math doesn’t compute for savings.”

The tax break largely is there to help wealthy property buyers anyways so its pretty horrible to bring it up as a big advantage for your common house shopper too.

http://www.mymoneyblog.com/mortgage-interest-tax-deduction-doesnt-help-homeownership.html

I would also point out that just because previous generations have done well in housing doesn’t mean future generations will. Particularly as long as the bubble n bust cycle is allowed to continue. Housing was always only ever a financial gain the long term for your average person. But if housing goes through a boom n’ bust cycle every 7-10yr just like the stock market or economy at large then people can’t grow their wealth or equity through housing at all: they’ll just be perpetually trying to pay off the interest before they lose the house to the next pop.

Even if they can keep the house if they bought near the peak of a bubble they’ll never get out of it what they put into it unless they sell near the top of another bubble. But timing markets is hard and your average person is likely to fail even if they try to do that.

So… Blackstone bought the house, fixed it up a little, rented it out until the value went up and now they are providing the financing to a sub-prime buyer….

They are using the “Note Lot” model of Used Cars. Buy the asset cheaply at Auction, polish the turd, rent/sell it to sub-prime creditor and when the loan inevitably fails, they will gladly repossess the asset. >>> RINSE and REPEAT <<<

This is predatory capitalism and it will eventually result how it always does. Revolutionary France, Russia 1917, America 1929-1935… eventually the people will demand reform. There is no invisible hand of the marketplace. There never was and never will be. Its a theory that doesn't work.

“eventually the people will demand reform.”

That may be true some time down the road. Right now the masses have more important things to worry about. Which channel of the 500 should I watch, what yummy fried food can I stuff my face with, Pokémon Go playing, adding more baby mommas to the stable, what is my next tattoo, what new car can I get since there is 0% for 72 months deals, etc, etc, etc.

As the article states, you can STILL buy a crapshack in Phoenix for 150K today. If you somehow scrape together a 10K downpayment, that’s a mortgage payment of $621 per month at today’s insanely low 3.4% interest rates! Housing is still dirt cheap in the vast majority of the country. Don’t confuse sky high coastal CA prices with the rest of the country.

Blankfein – But can you pay for that $150k crap shack in Phoenix? Because all you’re going to make out there is minimum wage. Maybe $12 an hour if you have 3 degrees and management experience.

You are not denying the business model…. it’s just like a used car lot. Also, I doubt she got a single-digit interest rate. Her credit score was sub-prime.

However, I agree with you on everything else… the revolution won’t happen until the cable and internet are no longer being mainlined to the masses. Religion isn’t the opiate of the masses…. entertainment is. We are being entertained to death.

BTW, I recommend you visit kunstler.com (ClusterF*ck Nation) based on your mentioning the entertainment, tatts and baby mommas. You will find lots that we both agree with!

Our nation has become an endless loop of rackets…. financing… consumerism… healthcare… college

Sir Blankfein,

We get the gig, in fact some of us started the gig long ago in 1999….

but every gig ends….this is fact….

anyone rushing to buy today is truly a sucker….all the things you list to feed their energy will cease to keep them from being fleeced…..they will lose….

the water crisis and many other things will keep them from enjoying the hopium

Alex, why do you keep going on and on about jobs everywhere paying minimum wage. Google is your friend. https://www.google.com/search?q=phoenix+az+average+income&oq=phoenix+az+average+income&aqs=chrome..69i57j0.6029j0j4&sourceid=chrome&ie=UTF-8

Median family income in Phoenix for example is $46,467. That’s $3,872 per month. I think a $621/mo mortgage is doable for that salary.

Look, I get it. You’re making less than median. But that doesn’t mean that’s true of everybody everywhere.

I recommend that you don’t visit kunstler.com (ClusterF*ck Nation).

James Howard Kunstler is an old leftist Jewish snob from NYC who graduated from New York City’s High School of Music & Art, and attended the State University of New York at Brockport in the 1960’s, where he majored in theater.

He’s a expert on nothing and spews the typical leftist bile.

Jeff – I know *one* person making over $100k a year, the guy I work for. OK I know two, a guy who does “environmental test” too, but I live in the lap of Silicon Valley and 99% of the people I know make min. wage or less. We’re borderline 3rd-world here with a tiny wealthy elite. The surest way to a decent living here is to go to work for the Post Office or the water treatment plant or something, stay the hell away from college, think Government and Unionized.

Seismic – you’re dead on about Kunstler. He wrote *one* good book, The Geography Of Nowhere, and he’s been resting on his laurels ever since. He hates all things Goyische, and thinks, apparently, of all people not like him (educated, limousine-ish liberal) as 2-dimensional cartoons. He doesn’t seem to realize that a huge portion of non-Jewish people, intellectuals or just regular folks, also hate the suburbs. His rants are not causing Jewish people necessarily to move to small towns and raise chickens; he’s inspiring a lot of the very part of the population he deplores to do so. So in the end it’s all good, but I’d not want to meet him in person.

kunstler.com (ClusterF*ck Nation) that guy is a jack ass that screeches non stop about peak oil and how our economy is unsustainable. One would, after being so wrong for so long, alter his opinion, instead he just doubles down. I gave up reading him when he said that $100 oil was the indicator that the oil was almost gone…..guess what really happened?

“Median family income in Phoenix for example is $46,467”

that’s “Family” …..meaning? two people working both making barely over min. wage…..welcome to America.

Cali Fan- the “Buy Here Pay Here Car Lot” model of real estate. And I agree, this is why I’m so pro-gun. I want to see all the guns possible in the hands of the proletariat, plus we have plenty of “War Is A Racket” veterans who will know about improvised weapons, tactics, etc. Plus and it’s no doubt not even thought about by the oligarchs, but the military, in the end, tends to sympathize with the common people more than with stateless international corporations.

Alex, keep electing liberals and you’ll be left with no guns in no time; same as in all socialists countries of Europe. The liberal leaders say so, not me. It is their declared agenda. You can not eliminate the first amendment as long as you have the second. The freedom to criticize can not be taken from a populace “armed to their teeth”. You see, the second amendment does not have anything to do with hunting. That was not the intent and worry of the founding fathers.

I don’t know how a gun loving guy like you supports the liberals.

Flyover- Bernie Sanders himself has said he doesn’t want to take guns from those who need them.

Guns are just one type of tool – lack of a gun hasn’t kept many people from fighting, or fighting back.

I’ll take having to have the NRA – several million strong – keep Hillary in check over the kind of right-wing dystopia der Drumpfenfuehrer would put in place.

Jeff, was in Phoenix 2 weeks ago, lets see a new Porsche dealer in Chandler just open, BMW dealership closed for major remodeling to many buyers not enough space, must have passed a Tesla and Aston Martins several times a day. nothing but high end apts everywhere, and yes we tried to get a reservation at the many great restaurants and none had seating to after 8:30 and this is summer here.

Freeways are beautiful very clean and well lighted, sure this is the 5th biggest city in America and it has it concerns, but for such a big town it is manageable and yes in some parts you can good a nice house for 300k to 500k (Gilbert) West Valley is very nice for the young. Other locations can get expensive somebody is making money to afford these 600k to 800k houses, no question the very high end luxury homes ( N Scottsdale Paradise Valley) are hurting, but overall this town considering a bad economy in this country still looks good and is keeping up its infrastructure nicely.

kunstler.com – what a bunch of retarded racists right wing clap trap. Angry white people for Trump have a meeting place at last.

The only way the vacuous masses will rise and revolt is if the Kardashians tell them to.

So True! This cell phone generation is a joke. 30 year olds living at home with

mama. They are non contributors and whiners.

1944: 18 year olds storm beaches at Normandy into the face of sheer death.

2016: 18 year old complains that someone spoke to him incorrectly. Goes home to tell

his parents.

I know, its exaggerated, but there is certainly a disconnect where the current Millinneals are concerned. I’ve decided this is fun to watch…

Curt – I was on my own at age 18 to sink or swim, and was out earning money so my siblings and I could eat dinner from about age 14 or 15 on.

I think it’s rough, and admittedly there were a lot more jobs then, and perceptible social mobility, but I wonder if I’d have ended up like some of the 30 and 40-somethings I see now, if I’d not been thrown out of the nest at 18? (In my case, it was actually that there wasn’t any nest, and I could hardly wait to get out.)

Right now the children of families who back them up and let them stay at home while they go to college are at an advantage, but the key is to instill a good work ethic in the child, otherwise you get a perpetually at home “communications” major.

But think of the money they’ll save not having to supply a GPS device and kill start switch on a house !

What is even more nauseating is this sort of ‘deal’ that strip mines wealth from working people to Wall St is facilitated by Federal Reserve Bank policy. Blackstone can borrow money for less than 1% and offer a 4% mortgage to this woman and pocket the interest rate differential.

Those same concessionary interest rates were what enabled Wall St. firms to buy up these homes in the first place. They scooped up property at wholesale prices with low interest financing and are now retailing them back to the public and its all profitable thanks to Yellen!

As a Las Vegas realtor, I’m seeing the smoke and mirrors, propaganda, just plain lying.

My managers lie in the name of keeping new agents stupid, and boy do they want new agents, young ones that have no knowledge of the past, or even basic history. As long as they have boob jobs, wear tight dresses, and the men have the buzz-cut hair with skinny pants and earrings, they are defined as a professional. Our office meetings are full of sales pitches from crooked home warranty companies and hungry attorneys that lie their asses off and Do Not like to be questioned.

What put the knife all the way in was yesterday, at a seminar by one of the world’s top RE coaches. His opening act was some asshole from BofA, 15 minutes of pure sales for BofA – the biggest abuser of realtors working harder than ever to sell Short Sales during the Bust. As agents, many of us put comments in our listings, “NO BANK OF AMERICA LOANS!” And yet, here they are, selling BofA LOANS to seminar attendees, “YOU ARE SURROUNDED BY LENDERS, YES, WE ARE DOING MORTGAGES!!!” ….”Here are our Loan Packages!”

And, here we go again…..ALL young men with buzzed hair, skinny pants with skinny jackets…no knowledge of anything considered reality….just babies doing what they’re told.

This coaching company is OFF my radar, and I’ve been a huge supporter but now I see them as medicine men, liars, cheaters.

My Arizona clients are stupidly buying expensive houses like crazy. The very same thing they did in ’05-’06, and lost everything. Now, here they go again.

The time has come. Here we go again. I will just sit and watch. I’ll order some more popcorn from the Amish, just as before, and keep an eye on my favorite blogs. They are all heating up, just like before. It’s different this time??? NO!!

Thank you for telling the truth. I’ve been beating myself up lately, renting here in Las Vegas. I could have bought my last rental, but just couldn’t bring myself to do it. The other shoe has not dropped.

I worry that they can keep this up much longer than anyone imagines. Some encouraging signs – even though my rental’s “zestimate” has gone up $20K in one month ($40K since April 1) those in the neighborhood looking to cash out are dropping their asking prices by $10 to 25K each time they reduce them.

Zestimates aren’t accurate, only more consumer smoke and mirrors. My fear for LV RE is that people will buy overpriced homes because of LOW interest rates, believing they’re getting a “home” vs a nightmare. LV is a gaming town and it’s brutally lacking integrity. Bankrate.com has good rates and they’re a San Diego online lender that will do loans here. Renting isn’t a bad idea. Best wishes!

Jaws, I’m reading a book called “Serpent On The Rock” about the Prudential-Bache scandal of the 80s.

Same thing then promoting tax shelter partnerships based on nonsense and sales promotions for the brokers: trips, dinners, quarterly bonuses etc. Just sell, even though we know due diligence just rubber stamped the offering. No questions allowed.

Nothing seems to change whether it be real estate or financial “products”. Always sell the sizzle. The bank or the insurance company keeps the steak.

The time has come. Here we go again. I will just sit and watch. I’ll order some more popcorn from the Amish, just as before, and keep an eye on my favorite blogs. They are all heating up, just like before. It’s different this time??? NO!!

Thank you. Renting gets old. One more year left on my lease, then, if sanity doesn’t return…I’ll wait one more year, and another :-p

sheesh

Jaws, have a good friend who is a top producer in RE and yes you are right on. These green peas know nothing, the mangers keep them in the dark, just go list a house and lie to the sellers it will sell in 90 days, tell them everything is good but never let them know for every house listed another one gets delisted, couldn’t sell it.

Those stats are never made public, wonder why? good post

I profit from buying at a low price but upload some of my properties if you have 100k equity why don’t you sell it the re market cool off a bit and stock market are heating up. They know that there will be a correction coming up.

Till this country limit the foreign ownership and limit the illegal immigrants American dreams for the Americans will still be a dream unlike Chinese people that really enjoy Socal re

One of the main pillars of the Nationalist, Protectionist, Isolationist plan would be to ban foreign ownership of property, of majority stock, etc in the US.

Regarding foreigners buying up US homes and renting them out to who would have been buyers of those homes, the locals don’t stand a chance against them. I’ve lost out on multiple bids to them. One bought the same house for the same amount as my bid, except in cash. Another one went tens of thousands above my bid…

In London, and I believe Australia, foreign buyers crowd out the locals. They imposed extra tax for foreign buyers just the cool off foreign demand. I would be happy to see the US do something similar. Otherwise, the US housing market will be collateral damage from bidding wars among foreigners.

In SoCal I’ve been to many open houses looking for my next home. On majority of them, there were foreign buyers.

I believe there should be some things that foreigners should not be allowed to easily buy. Homes are one of them, hence would love extra tax imposed. In some countries they don’t even allow foreign ownership of land. That should be the very last thing you sell. Otherwise the US would end up like the native Hawaiians… Where rich foreigners bought their land.

They can bid up the stock market all they want. There’s tons of liquidity there, and lots of choices.

Nhb this what I’m trying to say how can you beat foreign buyer if they buy a properties in cash. First time home buyer suffer a lot,Chinese are invading America now. In business, real estate, stock market check who are the biggest investor and business buyer here in America. Even students they are open to students loan to send those kids in this country. One day American will woke up and this country is owned by Chinese. Trump is correct in some ways because he’s a businessman. He knows what’s coming. So better wake up. Stand up for your beautiful country don’t wait for the correction as it might not happening soon. Greedy foreigner are making American middle class poorer with the help of dumb politicians In this country.

Wang Bu – Exactly. What we need is a healthy amount of xenophobia. Is it xenophobia if the human body rejects the tuberculosis mycobacterium? Is it xenophobia if the body tries to reject the syphilis spirochete, and the spirochete is eliminated by modern drugs, the body’s counterpart to self-preservationist laws, police, militia, and military?

You do know American expats buy homes in other countries and drive up prices in other countries? It can’t be ok for us to do it, but get mad when other people from around the globe to it to us.

No, I do not like that one bit. Part of being Nationalist, Protectionist, Isolationist is not running out on your country. You stay there and vote or fight, if need be, to improve it.

Do you know that many countries around the world have limitations on foreigners buying houses and property if they are not citizens?

Mexico’s Constitution prevents foreigners from purchasing property in the “restricted zone” which is defined as the land 100 kilometres (62 miles) from Mexico’s borders, and 50 kilometres (31 miles) inland from its coasts.

Hong Kong imposes a 15-per-cent surcharge on homes purchased by non-permanent residents and has areas with new dwellings that can only be sold to permanent residents of Hong Kong.

The Swiss government assigns quotas to the country’s 26 cantons, limiting the number of residential properties that can be sold to foreigners.

The U.K. imposes a 28 per cent at the point of sale on foreign-owned residential property.

In Australia, buyers from outside the country are limited to newly constructed houses and apartments. Australia also forces foreign investors to register purchases with the federal government.

Property ownership for foreigners in Thailand is carefully controlled. Without special permission from the Minister of the Interior, foreigners are not allowed to own the land on which any piece of property is found, or to own a condo in a building if 49% of the other condos are foreign-owned.

In communist China, Foreign investors are not allowed to buy land in China since land is owned by communist party collectives or by the government. A land user obtains only the land use right, not the land or any resources in or below the land. A land grant contract shall be entered into between the land user and the land administration department of the people’s government at municipal or county level.

http://www.cbc.ca/news/business/real-estate-housing-foreign-buyers-1.3479508

https://en.wikipedia.org/wiki/Chinese_property_law

Do US expats buy properties in foreign countries for the purpose of renting it out to the locals? How many US expats exist that buy homes in foreign countries? Vs How many foreigners (expat or not) buy US homes in an already tight market? In extremely high volumes? In Vancouver, word on the street is around 50% of sales are to foreigners, and their average home now bid up to $900k CDN. Are they all expats?

Have you heard of the AREAA? In one of their tweets, they’re bragging:

“#Chinese are expected to DOUBLE #realestate #invesments in #US over the next 5 years – to the tune of over $200B”

I’m not making this up. Look up @areaa in Twitter. They even have a convention in Vegas on how to buy up US real estate. You can sign up here: http://convention.areaa.org.

Look them up.

When $200 billion comes pouring in from China to buy up US real estate, let us know if that’s still fair. The US housing market is already super tight. Imagine how much havoc $200 BILLION will cause when it enters the US housing market.

Good post.

“Or you can spend your whole life paying ever-increasing rent, your choice.”

Yes because housing prices only go up….until they do not.

I was a Realtor in CT in the Eighties and early Nineties. Home prices peaked in 1988 and went down, over 50% in some towns. It took TEN YEARS to come back the 1988 highs.

House prices only go up. Riiiiiight.

Overall home sale prices are still slipping in Connecticut due to factors such as baby boomers looking to leave Connecticut’s high taxes by moving out of state, millennials putting off home purchases, and the lack of higher paying jobs.

Through the first 11 months of 2015, the median sale price of a single-family house in Connecticut slid 2.6 percent, to $247,000 from $253,625 for the same period in 2014.

http://www.courant.com/real-estate/property-line/hc-connecticut-home-prices-20160117-story.html

The brainwashing continues at the LA Times:

Q&A Why home prices in Southern California keep climbing:

http://www.latimes.com/business/la-fi-qa-home-prices-20160713-snap-story.html

I dont see how this is brainwashing, he is citing various reasons why home prices are climbing in the SoCal region. And he adds that no one can predict when the downturn will happen.

Maybe 2017 the downturn will begin and by 2018-2019 prices will go back to 2012 levels? Is that what everyone is waiting for? Dont forget that investors are perched for the next downturn also.

Really? Investors with a boatload of cash are waiting around for the next downturn? They won’t be too busy unloading their current inventory to satisfy their shareholders or creditors?

More likely the next down turn will go to 2015, 2016, or 2017 levels….. or who knows maybe later than that.

@NoTankinSight

Bargaining – Before a loss, it seems like you will do anything if only the object of your interest (real estate) would be spared…seeking ways to avoid having the bad thing happen. Bargaining is thus a vain expression of hope that the bad news is reversible.

Barginaing?

What are you bargaining for: 2012, 2003, 1991, 1980 prices?

1970 prices

enquiring minds want to know more about this barganing

@NoTankinSight

You’re hoping that a price downturn will be shallow based on more extraordinary government and Fed interference rather than on economic fundamentals. Prices in 2015, your earliest date, were already in a bubble.

@Prince of Heck

I’m not hoping for anything…. I’m just dealing in reality….

you guys didn’t buy in 2010, 2011, or 2012…..

Hoping, Bragaining… it never ends

@NoTankinSight

The reality is that the principles behind our booms and bust economy has not been repealed by the government and Fed.

Brainwashing? More like common sense.

.

Supply and demand, no more buildable land, draconian anti-growth measures, etc. I thought this article was actually written well. There are some people who will deny the obvious no matter what

Just as before the previous downturn, easy and cheap credit is the principal factor behind demand and supply. They ain’t making any more land has always been a real estate talking point. In these respects, the article was shallow and devoid of substance.

“There are some people who will deny the obvious no matter what”

The irony is strong in that statement!!! Boomers will be selling to a smaller demographic that makes less money, and this applies to ALL western nations……lets see, lots of people selling to poorer people which there is less of.

I was picking up the girlfriend the other day and every single person i saw in her hood looked to be in their 60’s or 70’s…..

as I’ve stated many times, which one of your kids can afford to buy the house you currently live in…the answer is always the same “i couldn’t afford to buy the house i currently live in”

LOL, and this is with interest rates the lowest in history.

@POH,

Your easy credit argument will go nowhere. It is MUCH harder to get a loan in 2016 compared to 2006. That is a fact! Unlike 2006, the vast majority of buyers have “skin in the game”…this is especially true for the desirable areas. Based on this fact alone, you can’t compare today’s housing market to the one in 2006.

@mumbojumbo:

The old “your kids can’t buy your house argument is lame.” As witnessed by the multiple offers and bidding wars, somebody is buying the houses on the market today. If the kids don’t have what it takes to make it in LA, there is plenty of other opportunity in this country for them. Some areas get unaffordable to the masses over time, coastal CA is one of them.

somebody is buying the houses in coastal Cali on the market today…and it is often foreign buyers (think China) parking offshore hot money

http://www.zerohedge.com/news/2015-09-30/80-all-new-home-buyers-irvine-are-chinese

Things that make you go hmmm…

“Based on this fact alone, you can’t compare today’s housing market to the one in 2006.”

“With today’s much lower rates and 10 years of inflation, housing is much cheaper today than 2006.”

@LB

Once again, you’re wrongly assuming that organic owners comprise the same percentage of buyers during the current cycle as during the last. The cheap and easy financing has been going exclusively to financial institutions and large investors who have been the true market makers in the past 7+ years. Thus, organic buyers having skin in the game matters very little to them.

BTW, did you notice that the financial institution in this article is actually issuing loans to its subprime buyers? The skin in the game is all Blackstone’s.

Is it really, Orange County builds more tract houses than Maricopia County where Phoenix is and housing is a lot more expensive. Its not just land regulation but some other factor like foreign buyers able to afford a more expensive house and people getting con by low interest rates that make mortgages seem lower but the housing is jack up 50,000 more if the mortgage rates were lower Irvine grew 2 to 4 percent a year since 2,000 when the rest of Orange County grew more like .6 to .9 for every year since 2,000.

Yup, apparently this is the new normal according to almost every articles now on Yahoo…nothing to see here, no bubble and we’ll all be riding this gravy train, well the ones that are homeowners, for the rest of us can’t afford to buy, well good luck on your next life..

http://finance.yahoo.com/news/not-housing-bubble-just-expensive-130004091.html

Does anyone know any good sources to read/learn about SD real estate, moving down to that area is an option. It seems a lot cheaper and less crowded than LA, better schools. I’m trying to read about the different suburbs and pros/cons.

A good blog to start on SD real estate:

http://www.bubbleinfo.com/

Just like LA, the coastal SD is mostly near or over the 2005/06 peak prices.

With today’s much lower rates and 10 years of inflation, housing is much cheaper today than 2006.

And before the “wages haven’t gone up” crowd comes in. The article is for coastal SD. If you are able to afford desirable coastal CA RE, you’ve done just fine the last 10 years.

Reminds me how every everyone in prime coastal desirable everyone wants to live here this place is different was doing just fine leading up to 2006.

I rent out the house I lived in when I lived in SoCal and have recently started thinking that if my tenants wanted to buy my house, I’d be very tempted to sell it to them. The way prices have been going in that area, my net profit on the deal would be about 10 years’ worth of net profit from rent. You get a nice chunk of liquidity and no longer have to deal with any major repairs that may need to be done within that time (eg. new roof). An offer almost too good to pass up.

I’m going to assume that you realize that’s nowhere near enough information to use as the basis for an informed decision/opinion. If you/your family bought that house a long time ago, your prop 13 based taxes should be a very strong motivation for you to want to keep the home.

If you’re interested in being an owner/investor but not in the maintenance, then just hire a property management company. Have you mapped out cash flow/profits/taxes/asset valuations of your various scenarios over the next 10, 20, 30 years? It takes me a while to do this for my own situation, but being a landlord has been a much better investment than the stock market for me and that will continue to be the case unless the stock market strongly outperforms housing prices and rental prices. But I’m in MT now, not CA.

Yes, I realize it’s not enough information on which to base a decision, and I do hire a property management firm since I no longer live close enough to the property to be able to manage it myself.

I agree with you that so far being a landlord has given me a pretty good return on my money. It’s a nice house in a decent, lower-income neighborhood near a military base, so vacancy has never been an issue. And it does exceed the return on any other investment of comparably low risk (not hard to do given the current low yields on low-risk investments). That’s why I haven’t yet sold: because there’s not a good alternative place for me to put the profits from a sale.

On the other hand, it’s an older and higher maintenance house not well-suited as a rental. At some point the house is appreciates enough to become “an offer you can’t refuse” due to the projected maintenance costs for the property. For example, in 20 years the property will almost certainly need a new roof, probably need to be tented for termites a couple times, and a cracked retaining wall on the property may need repair. If I could, for example, get 20 years’ worth of rental income on the property now, I’d have cash in hand to buy a lower-maintenance property during the next downturn in the market for which I wouldn’t need to do those repairs.

Thinking about this as I write, that’s probably what the Blackstone folks are doing. They buy properties cheap at the start of a maintenance cycle (they tend to buy newer homes) and sell them before they need a major repair. The new owner has to deal with the inevitable maintenance, and they get cash to repeat the cycle of buying a newer distressed (but low-maintenance) home to rent. Perhaps they do this in another market in a downturn, or perhaps in the same market during the next downturn.

leydan – just remember that “jingle mail” is a thing here in California.

Own it free and clear, so the only place I’d be mailing keys is to myself. It all comes down to whether I want the liquidity or the potential for revenue and future appreciation. And whether or not I think I can better get those things by selling and buying elsewhere at some later time.

that’s the thing about California, i had customer who’s wife was a realtor and at the last peak, he kept preaching to buy and if the price falls just walk away. That is the mentality here.

This is bubble 2.0 style! Childcare worker Melissa Suniga “buying” a house that has nearly doubled in “value” in 3-4 years? And she doesn’t even have the down payment – all she has to her name is her rental deposit and a $2,000 tax refund. Childcare workers in PHX make about $8.75an hour. Big mistake on her part. Subprime anyway you slice it.

Bet my left leg Blackstone has its own appraisal company lol.

I was in Phoenix last month and looked at SFHs. Prices have gone up over 80% since 2012 and for what reason? NONE. The new home builders are throwing in some generous incentives to “buy now” – closing costs, 3.5% fixed mortgages, $15k upgrades and some are throwing in a swimming pool. If they were selling like hotcakes they would have no reason to give incentives.

I looked at some resale homes also. A month later they are all still for sale, and all of them except one stubborn, deluded owner, have lowered their asking price by over 10%. Top of the bubble for sure.

Some of the resales I looked at were owned by Canadians as vacation homes. Realtard’s excuse for selling was “they don’t use it much”. Yeah right… we all know Canada’s RE market is in a super bubble and their economy is teetering…

There are some good jobs in PHX but they are the exception rather than the norm. I was looking because I was offered a transfer with my company, moving costs and $100k a year salary base. For me – buying a house in Phoenix is dirt cheap compared to NorCal where I live now. BUT… I am not prepared to buy at the top of another bubble, when, if I wait a few yrs I can buy the same property for a 40% discount and pay it off fast.

Except you didn’t buy in 2010, 2011, or 2012…… so there is that.

Direstraights – Canadians love Phoenix, Brits too. Miserable bunch of sods. I was given some shit by a Brit working the cold cuts counter at the market, because since I don’t speak Hick, he thought *I* was a Brit and upper class at that. That’s right, folks, if you speak intelligibly, you’re a Royal or some shit.

What your saying is … by the time anything financial/investment news makes headlines, the big money has already beaten everyone to the punch. I’m sure all these big investment companies had the math all figured out before they even started purchasing … we’ll buy in at this price, spend this amount on repairs and maintenance, charge this much rent, and when we’ll cash out at a certain profit margin. I’m glad I sold several properties when I did … certainly, I could have held out and made more, but when markets turn, they often do so quickly!

JNS – you got it and you can take it to the bank. The media are notorious for being *years* behind reality.

“ever increasing” rents falling in everyone wants to live here localities such as San Francisco with a low vacancy rate, during the prime moving months of summer, say it ain’t so!

National Apartment Report: July 2016

https://www.abodo.com/blog/july-2016-national-apartment-report/

Time to change the narrative to explain that a) RE prices shouldn’t be justified by rental rates or b) So Cal has surpassed SF (or London or Sydney) in RE appeal.

Alex: “Flyover- Bernie Sanders himself has said he doesn’t want to take guns from those who need them.”…..and you believed him:-)))…!!!!

The only data points that make me think there is a possibility of a ‘no tank’ scenario is that tons of people, including myself, are sitting with cash and lying in wait for bargain deals again. That and infinitely low rates means that alex in san jose may be living in his car for a while longer and flipping burgers with his Bernie 2016 underwear on.

I suspect that confidence that the future economic prospects will play a role as well. The Fed and government has saturated the economy with so much debt that more “extend and pretend” is unlikely to be effective the next time around.

lying in wait? what’s your cut off? when prices fall 10%? 20%? if the market was left alone the last crash should have gone further and lasted much longer. I feel into the trap in 1991 and bought after a 15% reduction only to see another 40% and then the “value” didn’t move much until 2000, that’s 9 years of being upside down on my mortgage.

in 2005 the X bought a house which i pleaded with her to not do but i’m just mumbo_dumbo and she believed the hype. She just sold that house for $30K less than she paid for it.

Mr Miyagi you’re so full of it … for starters I don’t have a car, and secondly, if Bernie undies are or were a thing, I’m sure they’re $14.99 plus shipping, too rich for my blood.

Funny you mention this too, because I’m taking the bus over to Target to get more undies tomorrow. Fruit Of The Loom 4-pack for $8 or so, take that, political swag mongers!

Prince of Heck, I agree with your sentiment but I don’t think the government will stop manipulating the markets. The questions is if their arsenal will be rendered useless or not. There is no question that they cannot stand idly by and allow for a much needed and authentic market correction. The question is only if it will be able to inflate things again as it has in the past. In other words, we all might be wrong in our prognostications because this is not a free market at all and we are acting like it is.

Mumbo Jumbo, for me I’d need a 50% price haircut minimum to start buying again. I don’t care about being ‘upside down’ as you said because I cannot be upside down. I never buy for equity positions… I’m a cash flow investor and I pay cash now instead of with loans which is how I started.

Haha, Well alex in san jose, you’re a good sport, so i like you more than previously after reading your communist spout. I’m sure you’re a good fella, please excuse my attacks.

Mr. Miyagi you never really pissed me off. I’m a normal person not one of these idiot Internet-bots who still live with Mom in their 40s and never learned what humor or perspective are.

Your comment just made me laugh – like the time some “crusty” begged me for money out in front of the local Safeway and said, pointedly, that my giving types like him money keep them from robbing my house… I told him that I lived in a warehouse with no running water and anyone who broke into my place would feel ripped off.

I am indeed Communist as I can get away with, but I like yer old-fashioned insular, xenophobic, Soviet style communism. Kick the foreigners out, look out for ourselves and the world can go take a fucking hike. Be armed to the teeth, each kid taught sniper skills and other fieldcraft from kindygarden on, I take my “Nationalist, Protectionist, Isolationist” principle seriously.

PR damage control by the real estate industry, or unbiased objective research?

http://www.realtor.com/news/trends/housing-bubble-2/

Note that the shills routinely only go as far back as the most recent previous bubble.

We’ve had many price manias throughout time. Real estate, et al.

There were plenty of “qualified” and cash buyers in 1988 and real estate bubbles prior. I’m willing to bet there were a lot of qualified cash buyers of Dutch tulips and South Sea stock certificates, too.

Also pay attention to how these same shills say incomes don’t matter out of one side of the mouth and then talk about quality of mortgages out of the other.

“Those sky-high prices and ultracompetitive bids we at realtor.com® report on daily are mostly the result of a housing shortage rather than ominous signs of another real estate meltdown.” – from the “article”

After pumping and hyping home prices to go up to unsustainable levels, they want it to moderate and go up a bit more. The thing is, if the real estate industry keeps giving sellers the expectation that home prices will keep breaking records, eventually seller expectations will far exceed what buyers want (and can afford) to buy. When that happens, bidders will keep bidding what’s affordable, and sellers will keep getting insulted with those bids. But that means inventory never moves, and listings expire, then the seller changes agents, demanding high prices, it expires, rinse and repeat… Eventually, a lockup in the real estate market. Then equilibrium price has to go down.

It’s crazy that condos now cost more than houses did years ago, and houses now even in neighborhoods where the locals will go “shopping” or draw “street art” go for astronomical amounts.

Regarding income… It’s insane how much banks require in reserve (in addition to large downpayment) for mortgages. How can so many people even enter this housing bubble market?

Big Wall street investors are just as clueless as we are. For all we know, they could be exiting the market too early because they feel that prices creeping up to levels that caused the last recession are near the peak. However, the last recession didn’t have low interest rates and a considerable amount of foreign buyers now did it?

And since we’re on the subject of foreign buyers, has anyone thought to stop and think the dynamics behind foreign ownership? Let’s break that down shall we?

1. Regulations. There are none.

2. Foreign buyers don’t compare properties in the US to other properties in the US. You and I as savvy real estate enthusiasts look at a property in Ghetto-ville, Los Angeles and say to ourselves “$750,000 for this piece of snot?!?!?! But that was not even $150,000 back in 2010! If I was desperate for a house I’ll go 30 more miles inland and pay half of that…”

The foreign investor says “$750,000 for a house bigger than mine back in China AND it’s in LA close to those famous celebrities I keep hearing about. What a steal when compared to the ridiculous prices in China! My friends are gonna be sooo jealous!”

3. Emerging middle class from the buy side, coupled with a dwindling middle class on the sell side means deals galore for these guys. You got a group with an increasing amount of potential buyers flocking to an area where no local is buying.

I’m sure I’m missing a few more points (feel free to add to the list!) but the general idea is there: the hysteria among Chinese buyers in US real estate hasn’t started yet. Maybe there’s a little delusion among certain out-of-touch US buyers but that won’t end until we pass the 2006 pre-recession peak before hysteria phase 2 among Chinese buyers begins. Couple that with possible economic turmoil (a la Japan circa 1989) and we could have a pretty big bust on our hands. Till then, the market is just getting warmed up.

For the record, I’m not advocating that this market is prime to enter; I’m only arguing that it isn’t quite time to exit. This is what I call a hot potato market where entering it could net you a profit if you dump the potato quick enough but playing the game could also get you burned without warning.

The foreign investor says “$750,000 for a house bigger than mine back in China AND it’s in LA close to those famous celebrities I keep hearing about. What a steal when compared to the ridiculous prices in China! My friends are gonna be sooo jealous!â€

C’mon, Chinese buyers aren’t that dumb. They clearly do enough research to know where the Chinese enclaves are — Pasadena, San Marino, Irvine, etc.

You could be the absolute worst market timer in the world, and purchased LA County beach cities at the 1991 or 2006 bubble peak, or at any other bubble peak, and you still would have made a substantial profit. That should give you confidence that even if we are seeing another bubble peak, which is possible, in the long run, you will still make a decent profit.

However, if you are looking at non-coastal locations with a crime issue, then you could be making a huge mistake by purchasing near a bubble peak. In this case, you had better think twice before buying.

Bottom line is coastal locations are a no brainer … buy when you can. In non-coastal locations, you need to be careful.

“in the long run”

Whatever that means.

That’s an Eagles song, Mr. Hotel California.

😉

What is different this time is the acceleration of flight of high paying middle class jobs enabled by technological jobs as well as abolition of these jobs because of advancement of technology.

The jobs I am talking about pays close to $150K and I am seeing first hand how these jobs are either outsourced or obliterated.

I work in the similar field and I can tell stories first hand

Not sure with these low minimum wage paying services job, how can people afford it.

The class gap is increasing in USA faster than before and this is not gonna make socal pleasant place to live for the riches.

Actually, the low paying jobs are exaggerated, they grew a lot since Joe Blow goes out to McDonald more because gas is cheaper if gas goes up, then many of the leisure jobs growth will slow down. Also, there are plenty of middle skilled jobs but in Orange County or LA a machinists is far from being middle class at 49,000. In fact people whine about factory work leaving but hey there is a small uptick of companies like Space X in the area that pays a lot better than Garment sewing jobs that go to Mexico or Vietnam.

jt you make a point I have made many times on prior threads but don’t hold your breath for any concession here.

as for the ‘long run’ I would say the 2/2 condo in S Mission Beach I bought in ’92 for $160K qualifies as ‘long run’, worth $650K now, paid off, big cash flow positive asset. Also the 3/2 PB townhouse I bought in ’96 for $225K also now paid off, worth $775K and a cash flowing beast. I suffered for many years with shaky employment, roommates and Ramen. I was stressed for awhile, but it was worth it.

now I am no market timer, I bought a 2/2 ocean view property in ’05 for $500K, comps bottomed around $325K after the crash but now I am even again. positive cash flow as a rental thanks to a ridiculous low-rate refi and soaring rents in the area. that property was the worst timing ever and over the ‘long run’ it’s going to be another big winner and cash flowing beauty.

jt the guys here don’t want to consider opposing views to their narrative, they don’t have a ‘long term’ view or perspective, you can’t tell them anything they are too smart.

Indeed, it is oft repeated the premise that anytime is a good time to buy. What is conveniently not mentioned is when it’s a good time to sell.

Most people simply want a house to live in and not get financially screwed. Their lives will evolve requiring moves and they don’t want to be landlords. They’ve also no interest in being that guy boasting about his equity gains today only to be the same guy who can’t sell without a loss tomorrow.

Of course, on a long enough run, anything anywhere can be paid down. It has nothing to do with calling out the deceitful promotion that some place is always a sure bet irrespective of situation often made by those here who are desperate to avoid loss to what they have riding on the legitimization of their ramen and roommate suffering past.

that’s all very nice, but jt’s great point stands, you could have bought in a lot of places in SoCal in ’06 at the peak of the bubble, worst timing ever, and today you would likely have a property worth more money than what you paid and you would have paid down 10 years of principal. there’s not much to argue, but people still seem to want to negatively spin that fact because acknowledging it makes them feel bad about themselves.

I cite my own experience as a older guy who never paid much attention to timing anything, and not exactly a rocket scientist, but bought into the stock market and real estate over the decades and it’s amazing how the market and real estate in great areas goes up in value.

jt doesn’t really have much of a point, other than if one is able to continuously make debt payments on anything long enough anywhere, it can get paid off. It’s nothing new nor groundbreaking.

There’s plenty to argue given that important details are often conveniently left out.

For example, 10 years into a 30 year term, interest is the majority cohort paid down by a large margin. The only party who feels bad in that scenario is the one who got mislead into thinking only about principal and not its relationship to interest paid.

It certainly is interesting that someone who cares not about market timing would bother spending any time at all on a housing bubble blog, considering that bubbles are premised on timing.

It’s great though that the older generations can lend their experiences of past outcomes in a QE post Lehman world.

Excuse me, I got caught by your diversion from jt’s never lose strategy to principal payments on leverage. Still hearing crickets regarding selling to book actual profit.

You two should sell house price depreciation insurance to all of the LA county beach city home owners and hold lien. Imagine all of the zero risk easy money premiums. It’s hard to believe none of the established insurance companies aren’t already doing it.

Seems to be an obsession here with ‘coastal’ real estate as infallible. There are more desirable areas in CA that are not ‘coastal.’ The key is just that there are demand drivers…mountains, lake, coast/ocean, metro core, next to a university etc., not that it is exclusively ‘coastal.’

NewAge, these mythical Chinese buyers you speak of are not buying in numbers like that.

Mr miyagi I agree

You must be new here. There are several commenters who’ve put most if not all of their chips onto the coastal CA real estate table. You’d think that they’d be confidently enjoying the game enough to have no use for a housing skeptic blog, much less actively comment, but instead they continually promote a narrative that everyone wants to live in their casino, so therefore the house always pays out 100%.

They tend to point to organic features of the coast as justifications for why this time is different, even though the same features existed when the times weren’t different. The best is when they claim you can’t compare this time to last time but then they compare last time to this time.

No such thing as coastal properties immune from downturn.

With this trend it is no surprise that big investors are unloading properties. It is a simple mantra: buy low and sell high. However someone else is buying at this level and it certainly isn’t Wall Street. Why would big investors sell if it is such a great deal to be a landlord in mass?

I like the way you come at things Doc, asking questions.

I’m still here by the way, on the renting and saving side of things.

I don’t care either what happens to prices after I buy, the only thing that matters is the price I buy at. That’s a commonality we often see among posters here vs the rest of them who can only envisage buying in a forever rising market.

———-

Howard Marks of Oaktree Capital, re oil price decline.

MARKS: I’d say we should start getting interested in the asset class. Declines are not a reason to get worried. Declines are a reason to get excited. The investing public like things better at high prices than at low prices. The professionals like things better at low prices than at high prices.

RUHLE: Hold on, one more time. Say that one more time because it’s such a good point.

MARKS: Well the public, people who and who don’t understand how investing works like things, feel better at things when they’re at high prices, and lose confidence as the price falls.

“Seems to be an obsession here with ‘coastal’ real estate as infallible”

and it’s amazing to me that those same people can’t just bring themselves to address the record low interest rates, Chinese money laundering, bailouts of big banks, not mark to market accounting, bulk sales of home to insiders and a myriad of other false market manipulation as to be the REAL cause of the insanity that is the current housing situation.

and the worse part (or the best part if you are in the club) is that when the the next downturn comes and come it will (as an aside i even heard mention here already that it’ll only going to soften or plateau even though it never has in history, this will be the 4th crash I’ve witnessed) and that big earthquake hits it’ll be those very same people running to government hat in hand demanding free money to fix their “investment”.

without government control the RE market would look nothing like what it is, and i wish those bulls could at least acknowledge that simple fact.

They know full well what the current inputs are, but their rub is to spin those means as the ends.

Ya, I am new to this prom dance but not real estate. T

The bubble has not slowed down in the greater Sacramento area. Crappy deals are going pending immediately. In fact I’ve seen yet another surge this week alone as compared to before. I though perhaps we had hit a plateau but there I guess the market needs to gobble up some more stupid money before it implodes. This will be another fun one to watch.

The big investors are doing a public service to now sell the homes to their tenants. G-d bless them all.

Mr. Miyagi – the people running this site won’t let me respond to you directly, but no you have not made me angry.

I am a normal person, not one of these internet people who live at home in their 40s, have no detectable sense of humor etc.

I am indeed as Communist as I can be, but I like the old Soviet form of it, it’s Nationalist, Protectionist, Isolationist. The US would do well to emulate the Soviet example, take care of your own people, invent your own technology, and lead the world in space technology and well, pretty much every other kind.

Even now, post-Soviet, the US has to ask the Russians “pretty please” if they want to send anyone into space because only the Russians have working rockets.

Alex, I agree wholeheartedly with your ideals of nationalism, protectionism, isolationism and they are much needed in our country now which was once great but now a crumbling brick of civilization. However those are only three slivers of communism.

Anyhow, go Trump! A flawed man who often says things the wrong way, is unpolished, and far too direct. But the medicine we need. Enough politics though, this real estate market where I am is showing no sign at all of correction although it is badly needed. We have no middle class anymore, it is very sad to see.

Trump is literally Hitler.

Hitler left Germany after 12 years a smoking heap of rubble.

He was Nationist, OK, Protectionist, not really (got plenty of help from US industrialists and borrowed his race theories largely from the US esp. California) and not Isolationist at all – he wanted to declare war on the world, something Trump will do in a heartbeat if he thinks he can make a thin dime on it.

No, Donald Trump is Not Adolf Hitler ,Jonathan A. Greenblatt, CEO of the Anti-Defamation League.

American conservative radio and television host Glenn Beck is often criticized for his frequent use of reductio ad Hitlerum, including a controversial statement comparing the victims of the 2011 Norway attacks to members of the Hitler Youth.[15] Beck has also compared the National Endowment for the Arts to Joseph Goebbels[16] and ACORN to Hitler’s “Brown Shirts”.[

Alex: Trump is literally Hitler.

No. Only Hitler is literally Hitler.

Others might be like Hitler, or worse than Hitler, or better than Hitler. But only Hitler can be literally Hitler.

Just as only Alex in San Jose can be literally Alex in San Jose.

Please don’t misuse the word “literally” to mean its opposite, as so many ignorant people do.

What do they care the house loan will be bundled and securitized, then sold off to investors with an absurdly high credit rating.

I would say we are in the same boat as we were before the 2008 financial crisis but things are actually worse. The total outstanding volume for mortgage backed securities and asset backed securities is more than 10 trillion dollars in just the USA.

http://www.sifma.org/research/item.aspx?id=8589959616

It wasn’t hard to see what the big players were doing once the door to all of the foreclosures was opened up.

Leave a Reply to Direstraights