Are renters of today worse off than their parents? Examining rental and household income growth going back to 1960.

The rental revolution continues unabated in this country. While everyone is now trying to be on the home buying train, sales figures don’t really reflect a major shift. Desires don’t always coincide with what the market is doing. Prices are largely being driven by tight inventory, investors, and low interest rates. Prices can be boosted by low rates but rents need to be paid out through real earned income. This is important to understand especially in Los Angeles County with 10 million people and the majority of households actually being renters. The reality is, today’s renters are worse off than their parents. Over the last decade we’ve added 10 million renter households while homeownership has been stagnant – largely by 7 million completed foreclosures. How bad has the rental situation gotten?

Renters are worse off today

Too poor to buy or even rent. At least that is the case for millions of Millennials living at home with parents. Unable to afford even rents, many are staying home. The data backs this up in a dramatic fashion. You have anecdotal stories of Taco Tuesday baby boomers sitting on big bucks giving out gifts to kids to buy homes. While this of course happens, this completely ignores the reality of 2.3 million young adults living at home in California. Many recent buyers are investors and high income households chasing the low amount of inventory on the market. For those looking to rent, the market is also intense.

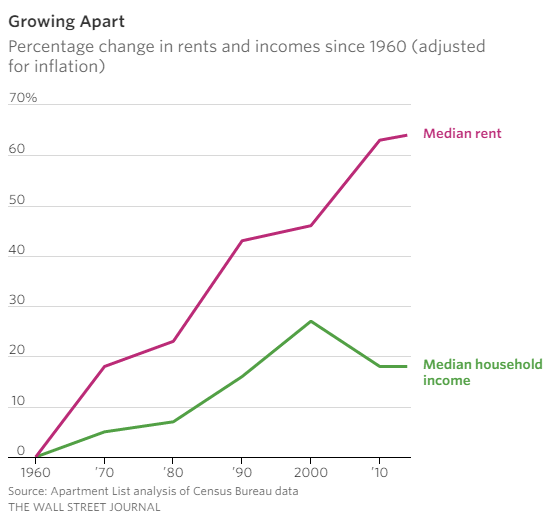

Take a look at rent growth and income growth since the 1960s:

Inflation adjusted rents have gone up by 64 percent since 1960. During this same period real household income is up 18 percent. What this means is that more net household income is locked up by rents. In places like Los Angeles it is not uncommon for households to spend 50 percent of their net income on rent. In San Francisco you have many high paid tech workers shacking up with roommates just to get by. On a nationwide scale this trend has been happening consistently.

So this bodes well for home buying right? Not at all. Home prices are up as well. In high priced areas, the barrier to entry is the down payment – so that $700,000 crap shack would likely require a 10 or 20 percent down payment for you to be competitive – $70,000 or $140,000. And this is absolutely common in competitive markets. Looking at sales data for the past couple of years on some crap shacks you find the buyers coming in with 10 or 20 percent down (at least). In other areas you have cash buying still being a big player.

So renters with stagnant incomes are basically treading water. Millennials, the next batch of potential buyers are stuck between living at home or renting. The home buying trend for this group is not actually showing some amazing pent up demand. The idea of 3.5 percent down payments in high priced areas is just not happening. But also, those buying are squeezing in. Take a look at this home we featured when it was for sale in Culver City:

3130 Reid Ave, Culver City, CA 90232

3 beds 2 baths 1,415 sqft

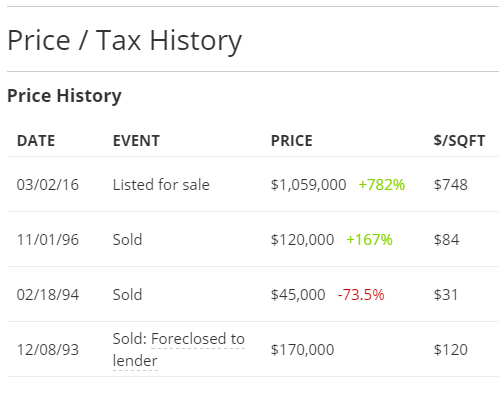

We initially covered this home back in March. Here is the list price and history:

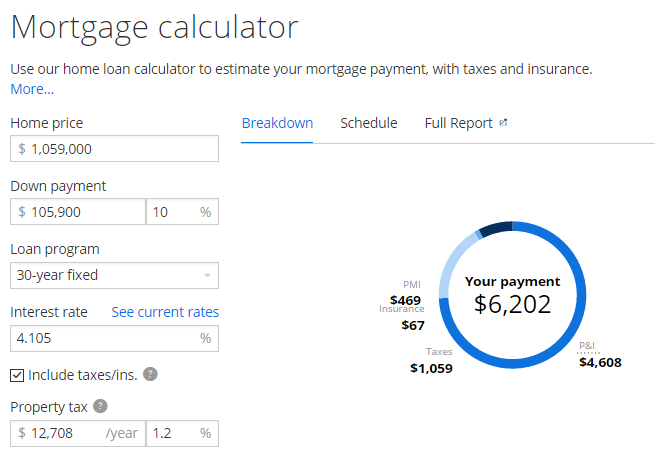

It sold in May of this year. And they sold it for the asking price of $1,059,000. All cash buyer? Massive down payment? No. The buyers put down $106,959. The place now has $950,569 in loans active. Nearly $1 million in loans on this place. And this is supposedly in a prime market where buckets of cash are being thrown around. People are still going into massive debt to buy. So instead of doing some hypothetical rent/buy math here – we have a real world buyer making this happen. This place would rent for $3,800 to $4,000 a month. The current monthly nut?

$4,000 a month in rent or $6,202 for the monthly nut – plus they now have nearly $1 million in mortgage debt? That is a pretty big difference even for a high income household.

So renters are worse off today. This argument has now been used as reason to leverage yourself into the grave on a crap shack. Pick your poison. Or move out like many people are doing in high priced areas. There are many choices on the table.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

177 Responses to “Are renters of today worse off than their parents? Examining rental and household income growth going back to 1960.”

Housing To Tank Hard Soon!

Keep on preachin’ Jim.

But I disagree.

Yep. Print” $ as fast as they can to keep the leveraged house of cards erect!

This isn’t about right and wrong. It’s simply a prediction of whether prices will collapse.

Devaluing our currency and borrowing our way to prosperity will surely work this time.

@Jim Taylor

Today is July 1, 2016, we are half way through the year. Not only has there been no tanking, but there is no tanking in sight.

I hope you are saving bucket loads of money while you are waiting for a downturn. Something tells me there will be plenty of competition to buy houses at lower prices…whenever that may be.

Jim, some of us are keeping the faith. Keep preaching brother!

Most mortgages sold by the government remain delinquent, FHFA says:

http://www.marketwatch.com/story/most-mortgages-sold-by-the-government-remain-delinquent-fhfa-says-2016-06-30

Pending Home sales skid 3.7% in May:

http://www.marketwatch.com/story/pending-home-sales-skid-in-may-2016-06-29

According to one Economist, China may be heading for a 1929 style depression:

http://www.marketwatch.com/story/this-economist-thinks-china-is-headed-for-a-1929-style-depression-2016-06-30

Brexit may cause more uncertainty in the Markets but on the hand, rates are predicted to fall – see 10 year T-bill recently. Rates are not going up anytime in the next year or two (or more!). The only things that will drop home prices will be on the demand side (a job loss recession, lack of interest from cash/foreign buyers, etc). Many commentators on this website have already mentioned this. Question then is, what are the odds of any of these happening?

Jim, your prediction is on total mercy of how FED interest rate trends in the future. For 2016 you most likely will be dead wrong. So go hide yourself until 2017.

Housing will not tank in Flyover land. You can buy nice houses in nice neighborhoods for 100 sq ft or less.

http://www.realtor.com/realestateandhomes-detail/220-NW-Hemlock-St_Lees-Summit_MO_64064_M82419-10315#photo0

I can’t stand when you say “too poor” to rent. The only people who are too poor to rent are the homeless. Given any city in the US one can find affordable rent in a different area and/or with roommates. Some people even rent out bunks in shared spaces.

These millenials who live at home are the ones saving up for something. Maybe they want a car, or to pay down student loans or nice furniture for their first place or maybe (as crazy as it sounds) a house. It is a choice, it is not because they are too poor. Even making minimum wage you can swing an apartment with roommates in majority of cities. Maybe you sacrifice cable, or going out, or even insurance but having a roof over the head is top priority for 95% of people.

I am a millennial, I have friends who are all millennial, I know how this story goes. They were all coddled and grew up afraid to leave the nest. My parents made it so I couldn’t wait to get out, other generations felt this same way. Parents today make everything too easy for the kids. This is extremely common in the Burbs (shocker shocker).

@Manbearpig4LFE

“I can’t stand when you say “too poor†to rent.”

He posted the chart, which is trivial to read. And there have been previous posts showing more people are living with their parents for even longer. Which is directly attributable to the high cost of housing and rents and the low wages. So you might hate that he says it but he is entirely correct and merely posting in a factual fashion.

Your claim that people can somehow find affordable rent just by moving out far enough is complete nonsense. Even if you want to ignore the cost of transportation and the effect 2hr+ drive times have on your quality of life more people wouldn’t be living at home well in to their late 20’s or even 30’s if that were the case.

And if more people now require room mates to make rent ‘affordable’, when in the past that wasn’t so (and it wasn’t), then guess what? You’ve got a big affordability problem, either due to high prices or low wages or some combo of both. And no you can’t point to bunk bed or sofa renting as a viable solution or as some sign that high prices and low wages aren’t having a seriously negative effect on people.

Previous generations didn’t have to live that way well into their late 20’s or early 30’s, why should today’s generation be forced to?

“millenials who live at home are the ones saving up for something”

HAHAHAHAHAHAHAHAHAHAHAHAHAHA

OMG man you don’t know anything. I know that is harsh to say but you seriously don’t know a thing if you really believe that. Articles on this subject aren’t hard to find either so there is no excuse for saying the stuff you’re saying. An example: http://www.usatoday.com/story/money/personalfinance/2014/11/19/millennial-money-habits-survey/19169671/

What you will find are the occasional article that says that millenials who are saving are saving for retirement however VERY few can afford to save anything at all because their wages are garbage while the cost of living is high and they’re loaded with debt. More information here: http://cdn.gobankingrates.com/wp-content/uploads/2016/03/age.jpg

“Even making minimum wage you can swing an apartment with roommates in majority of cities.”

You need 3-5 roomates to do it if you and your roomies only earn minimum wage. I’m not kidding. My brother still lives in CA and that is how he scrapes by. And scrapes by is the word. He can’t save or do much of anything other than pay his rent, pay for gas, pay for insurance, and pay down his car (which is 5yr+ old now, I think he has a 7yr note on it). He is in his mid 30’s BTW. And the roomie drama never ends. Never. He was sick of it years ago but he is trapped. He has no options. And neither does anyone else he knows either.

“I am a millennial, I have friends who are all millennial, I know how this story goes.”

Yeah I’m a millenial too and so is my brother, sister, and most of the people I know and they’d say your version of events is complete nonsense. Just because things have worked out for you doesn’t mean it can work out for everybody you know.

If you are trying to save money (for whatever reason), there is nothing wrong with living with your parents or roommates when you are in your 20s/early 30s. Unlike flyover country, 25 year olds simply can’t buy a house in socal due to cost. Unless you have parents willing to help out with the down payment, it is totally normal to save for a decade or more before buying in socal. With skyrocketing rent prices, many people simply can’t save money and will be perpetual renters if they choose to stay in socal. This is one of the brutal realities of choosing to live here!

Lol did you really just write this extremely salty novel of a post and end it with “Just because things have worked out for you doesn’t mean it can work out for everybody you know”?

Pathetic. Considering the excuses you’re coming up with, it’s clear that YOU won’t reach any measurable level of success. Anyone who sheds your awful mentality can though.

How can someone who lives paycheck to paycheck buy a new car? 5 year old cars are so much cheaper.

@ Lord Blankfein

“If you are trying to save money (for whatever reason), there is nothing wrong with living with your parents or roommates when you are in your 20s/early 30s. ”

Except they can’t save money. Their wages are too low even when living with mom n’ pop. I already posted the chart showing millenials savings and they’re in terrible shape.

“many people simply can’t save money and will be perpetual renters if they choose to stay in socal. This is one of the brutal realities of choosing to live here!”

That you’re willing to accept this, or believe that anyone else should, is obscene. Having a place to live is a necessity and if people can’t afford to live there anymore, when in the past their parents could, then something is wrong with the housing market there and it needs correcting.

@ LuckyOz

Car loans are easy to get into. They pretty much do the functional equivalent to NINJA loans today and back then too. To make it work though they stretch out the car loan over 6 or more years. More information here: https://www.cars.com/articles/2014/09/seven-year-car-loans-are-growing-but-beware/

Here too: http://www.autoblog.com/2013/07/25/more-car-buyers-favoring-longer-term-loans-up-to-10-years-w-po/

6yr + loans started getting real popular after the housing bubble and Great Recession kicked off. The 10yr loans are pretty common now actually. My brother counts himself as lucky since he’ll soon have his car paid off and it was only a 6yr loan. Many of his friends are in worse shape.

And buying a used car is joke these days. I’m kind’ve bewildered anyone would suggest it anymore since the prices are so high. Its been that way since Cash 4 Clunkers. You have to get a 10yr old, or older car, for prices to really drop down enough to make it worthwhile. Otherwise you’ll still stuck with getting a 6yr+ loan because the prices are too high. And around 10yr lots of things start to break on them.

@tts:

This is not something that only affects millenials. Things have gotten tougher for every generation for the last few decades. There was a time back in the 1960s/1970s where ONE very mediocre middle class income could support a family in socal and buy a 3/2 crap shack. Those days are long gone and will never return. But I will agree with you that things look pretty bad for most millenials.

But not every millennial has a bleak future. There still are people who choose to take the hard road and major in the STEM field. The engineers, computer science, pharmacists, accountants, etc are the ones who will be buying houses in socal in the near future. Many of these people marry similar types so it is not uncommon to see a 30 year old couple making 200K plus. These are your socal 750K crap shack home buyers.

tts you are way off on used cars. You can get into 4 yr old luxury cars for about 50% off new. You can go older, 7-8 yrs old, and get them for about 70% off.

@Lord Blankfein

“This is not something that only affects millenials.”

Its effecting them disproportionately. I’ve already posted the savings charts but if you want to ignore them I’d point out that millenials have come of age during the greatest period of economic malaise since the Great Depression. 2 major shocks to the economy (.com bubble + housing/GFC bubble) 1 of which was about as big as the Great Depression in terms of dollars lost and nearly equaled it in terms of unemployment during a period when jobs and wages still hadn’t really improved at all since the last bubble busted. And somehow its all millenial’s own fault they aren’t better off even though they had nothing to do with causing any of those bubbles:

http://www.dailydot.com/via/millennial-parents-poverty-internet-scapegoat/

Meanwhile there has been no equivalent of a New Deal or Great Society programs or the good economic times that boomers benefited from greatly to help them improve their lives. And what social welfare programs that do exist are under constant attack and frequently aren’t even sufficient to provide proper levels of support which is a big part of the reason why malnutrition is so common now in the US among children. Over and over you’ll comments from aid workers that come from overseas and are shocked that so much of the US is now like a 3rd World country.

“Those days are long gone and will never return.”

Nonsense. Oh those days are indeed gone but its not impossible for them to return. Not at all. Just raise wages to be back in line with inflation + productivity increases since when they stopped around the late 70’s or early 80’s, then roll back the Reagan era tax cuts, get rid of the SS Wage Cap so FICA is no longer regressive taxation, and link executive compensation to company profits/stocks for up to a decade after they leave the company to fix the ‘quarter long outlook’ and ‘IBGYBG’ diseases.

Doing all that would fix most of the US’s debt problems and improve the standard of living for millenials everyone within a decade. And please don’t bother with the tired conservative meme that doing stuff like that would wreck the economy. For instance: from the post WWII period to the late 70’s-early 80’s wages grew in line with inflation and productivity and the economy was by and large fantastic for most people.

‘But not every millennial has a bleak future.’

So because a handful of STEM types maybe manage to do OK all the problems effecting the vast majority of millenials get to be ignored, downplayed, or shrugged at as if nothing could ever be done to fix the situation?! The millenials are the future of the country, like it or not, since they are in effect this nation’s kids and if you write off their economic well being because change is hard or you don’t like the necessary changes because of ideology what do you think is going to happen to the country?

‘There still are people who choose to take the hard road and major in the STEM field.’

Very very few! STEM is HARD for most since most aren’t smart enough to be engineers, doctors, scientists, etc. And the jobs that are available for those who do finish a STEM degree are few and far between since outsourcing of such jobs hasn’t gone away or because funding has been cut on R&D both in govt. and private industry. STEM is no economic panacea or way forward for most!

‘Many of these people marry similar types so it is not uncommon to see a 30 year old couple making 200K plus. These are your socal 750K crap shack home buyers.’

A $200K household is in the top 5% income earners of the US! Do you actually believe that when only the top 5% or so of income earners can ‘afford’ current housing price levels on ‘crap shacks’ of all things that the housing market is sane and sustainable much less actually in good shape?! That is clearly a dysfunctional market! The only questions that remain are when and how exactly it all falls apart.

And your $200K household can only actually afford a $600K ‘crap shack’ BTW. And even that that is if they don’t have any debt. But you know they will have debt. Lots of it too since college is expensive. It wouldn’t be out of line at all to assume $100K+ of college debt alone in such a household. God forbid 1 of them became a doctor, then total school debt could easily be over $200K. Which would mean they have a DTI of 50-100% with no mortgage debt which of course means they can’t afford a home period out of college.

Oh and those school loans? The interest rate on them tends to be significantly higher than the rate of inflation. Which means even in a household with $200K pre tax income they’ll be paying off their debt for some time. Of course $200K is a probably significantly higher than even most dual STEM degree holder households will make for sometime out of college even with a master’s:

http://www.thecollegesolution.com/wp-content/uploads/2013/11/College-measures.jpg

Most will tend to make less than $100K.

@falconator

‘You can get into 4 yr old luxury cars for about 50% off new. You can go older, 7-8 yrs old, and get them for about 70% off.’

The KBB says the average price for luxury cars is $40K. Half of that is $20K. Do you really thing $20K for a 4y old car, especially one that is expensive to fix if it breaks, is affordable for someone who earns min. wage? Or anywhere near it for that matter?

Yearly income for a min. wage earner in CA right now is $19.2K. And that is pre-tax. So getting such a car would put them at over 100% DTI ratio. Even with a sweetheart low interest rate and a 6yr loan you would still be looking at a $300+ a month car payment.

And even at 70% off after 7-8yr it would be stupid thing to do. You’re virtually guaranteed to have something expensive break on it once they start getting that old. Even for dumb stuff like suspension you can end up paying more than $1000 a wheel to get things fixed, which is common BTW since many luxury vehicles have complex suspensions to improve ride quality. And $1000 isn’t the high end by any stretch. God forbid something electrical goes out.

Someone who makes min. wage in a expensive state like CA can’t really afford hardly any car which is why they live paycheck to paycheck with no savings.

Falconator,

Please let me know where you are seeing 50 and 70% off, since I buy ABS paper I can tell you your dream is great but like reality, you need to wake up.

Used car values are higher than they have ever been due to fed induced hopium financing..The feds saved GM and Ally to create conduit for subprime to restart. I mentioned this in calculated risk starting in 2010.. It was easy to see if your aware and a part of the game itself.

I look forward to the next down move, it will be epic….

tts & cd – it matters not what some book says, the market sets values. If you are looking at luxury sedans such as the Mercedes E350, BMW 528i, Lexus GS350, Audi A6 and the like, you are looking at low to mid $50K new. You can get into nice used ones in the $25-28K range about 4 yrs old. I’m no math whiz but even I can tell you that is about 50% off, just like I said. If you flipped cars every 3-4 years like I do in this market you would know this, it’s a fact. Look at auto trader and you can see what the older models are being priced at. And they sell for less than the asking price. And if you go older than about 4 yrs, and into a 7-8 yr old model, the discount is obviously more significant. Any more questions?

@falconator

“it matters not what some book says, the market sets values.”

1) I gave the average price of luxury cars (of $40K) sold when they are new according to KBB, not used.

2) KBB doesn’t determine new prices, they go by what the sale price is according to the dealers when new.

3) KBB is a fairly reliable source of information that serves both the public and dealerships alike. You on the other hand are a random internet poster. One that claims to know something about selling cars yet doesn’t seem to know much about the KBB. Why in the world would you think anyone could trust you here?

“I’m no math whiz but even I can tell you that is about 50% off, just like I said.”

It sure is but I didn’t bother to disagree with you there since I was talking about affordability. In particular affordability from a min. wage stand point. How in the world is a $25K car, according to the new numbers you’re giving, going to be considered affordable for someone on min. wage?

tts – Great posts, please stick around – you can be the newest member of the Jim fan club.

@tts:

If you are truly talking minimum wage, why the hell are we bringing up luxury cars. For people making minimum wage, their options are ride a bike, take the bus, walk, maybe ride a motorcycle or get a beater car. Back in my younger days, I had several beater cars and some of them were actually good solid transportation. Nothing flashy, no AC, looks like shit but gets you from point A to point B.

Falconator brings up a good point with some of these cars. Hondas and Toyotas tend to hold their values pretty well. The domestics will see a 50% decline in four years, that is a fact. Go shopping for a 4 year old Chevy Malibu and see how it compares to the original MSRP. If you really want massive depreciation, buy the high end German stuff (BMW 7 series, Mercedes S Class). Nobody wants theses cars when the warranty is up because maintenance can be absolutely mind blowing. Nobody buys these cars either, they are all leases. You can buy previous 100K cars after 6 or 7 years for 35K all day long.

Falconator,

You don’t know jack from what I can tell. When you deal with ABS loans on a daily basis with multiple regions across the US and no more about tiered loan programs by lenders from A-D paper come back and talk to me. You probably know about your job but it has nothing to do with paper or values on vehicles.

@Lord Blankfein

“why the hell are we bringing up luxury cars”

How the heck can you read my posts but not falconator’s? He is the one who brought up luxury cars as affordable for min. wage just because they have huge mark downs after several years.

“For people making minimum wage, their options are,,,,”

Frequently a job is too far for walking or riding a bike. Public transport is a joke in most cities. Motorcycles are actually pretty expensive, break down lots (particularly older cheaper ones), and have expensive insurance costs. Not to mention you have to deal with the weather and near-homicidal drivers constantly.

A used car is definitely my choice but the used car market has gotten to be incredibly expensive. You used to be able to get a beater that would run for a few years for around $1K, sometimes less, without any issue. Oh it’d be ugly, rusted, and maybe the interior would smell a bit. But so what? It just needs to work and be cheap. These days $1K tends to get you a ‘project car’ that will probably need several more thousand in repairs soon after you buy it. Getting something that is actually reliable enough and cheap is nearly impossible now.

“Chevy Malibu and see how it compares to the original MSRP”

Those are terrible cars which is why they’re relatively cheap used. And relative is the key word here, you’re still talking about a car that costs around $12K after 4 years. If you go back 5yr for a 2011 Malibu they tend to run around $11K. Used to be a domestic lost 30% of its value after you drove it off the lot in the ancient days of the early 2000’s when dinosaurs still roamed the earth. Must’ve been before your time.

“If you really want massive depreciation, buy the high end German stuff (BMW 7 series, Mercedes S Class). Nobody wants theses cars when the warranty is up because maintenance can be absolutely mind blowing. ,,,,,You can buy previous 100K cars after 6 or 7 years for 35K all day long.”

Yes. Exactly. So why in the world would you say they make sense to buy at all for someone who is cash strapped if even those who could afford them when new don’t want to try and pay and get them fixed? Didn’t you just try and (wrongly) admonish me for recommending expensive cars for people on min. wage in your same post? If they can’t afford $20K or $25K how will they afford $35K?

Are you drunk posting or what?

cd for 2 posts in a row you talk about paper and you provide no data that refutes that the auto class I reference is discounted 50% after 4 yrs. You asked for backup and I direct you to check out dealers’ new pricing and then auto trader for used pricing which backs up my position quite clearly. Your posts are worthless so far. You don’t bring data because you have none. Bring data or stop taking up space here.

@tts:

If you are moaning and groaning about paying 5-10K for a used Civic or Corolla, I have no idea how you plan on buying a home in socal. Things are expensive here. There are plenty other alternatives (likely better) if this place is too expensive.

You are missing the point of the Doctor’s commentary… yes, people can afford to rent if they get room mates or bunk up. That wasn’t the point of the article… the point is, this generation is doing SIGNIFICANTLY poorer than prior. They are spending a larger portion of their flat-lined income on housing than prior cohorts (even when they “bunk up”). In the bigger picture, the sociological implications are YUGE. BTW – Your user name? Sounds like a good date. You gotta be in SF.

High housing costs is one of the major reasons why the economy is in the sad shape that it is in now. Little or no discretionary income left to fuel sustainable consumer spending and, correspondingly, economic growth. Since income growth is stagnant, many leverage themselves to make up the difference in higher costs.

Why is this a surprise that this generation is significantly poorer?

Previous gens got a significant benefit of world war outcome. US was in great position to benefit and wealth (relative to other world) was immense.

It is not that this generation is poorer or richer. it is becoming on par with the other parts of the world, which are catching up. There standard of living is becoming higher everywhere, world is becoming more competitive, US is becoming denser. This is a natural and inevitable progression. In most parts of the world, real estate is super expensive (relative to income). It’s just US was so competitive that its economy could hire a lot more workers and give those workers enough means(including ability to do loans) to purchase real estate early on in their life (and leverage through the nose).

US workers – less competitive relatively globally (just because world is improving).

US market – a lot more people have access to it now

Finance industry – lots of leveraging, but this is common across the world and is not going away.

Actually the guy I work for has one 40-something son living at home and he’s not saving a thing. His money goes to bars and restaurants, and it’s a major crisis for him when the radiator in his Dodge Neon goes out; no just buying a new one and putting it in, nope, all kinds of anguish and trying Barr’s Stop-Leak and other shortcuts marketed to the poor.

It would be interesting to see hard data on how many of these stay-at-homes are actually saving up money. I’d like to see data showing that most are, but given the way people think about money in the US, I doubt it’s very many.

If you think that most people are not too poor to rent, put yourself in their shoes. Just try finding an affordable rental and see where you find yourself. You will likely be in Compton or in a rural area near farms. If you want a job that pays enough for rent, you will need to either commute hours, as many do in the Sacramento area, or live in little holes in high crime areas.

The poor (single mothers, young adults just getting out of college) are in a crazy situation, especially when you can see all the vacant bank-owned houses sitting on Zillow. It disgusts me. This level of greed has far surpassed the greed of the 90’s.

I’m tired of all the tears shed for single mothers. The vast majority are solely to blame for their poor predicament. They were not raped, they choose their outcome.

Single mothers either bed down an obviously bad boy, or they kicked out a good man (most divorces are initiated by women for no good reason), or they set out to become single mothers for some reason or another.

Lots of poor single mothers out there? So sad, too bad.

I live in the sacramento area and its a lot more affordable than the LA areas. Plus there are enough jobs to sustain oneself in a roommate type setting. Rents average from 900-1400 for 2 bedroom apartments (which is high compared to a few years ago). But compared to other cities like bay area and LA and its affordable for someone making 13-15 dollars an hour. Regarding purchasing a car, yes it is easy to obtain financing with little down payment for a new car, but you might as well give up the keys in a few years as if anything breaks down after the warranty, you will lose it. Better off saving up for a 1k to 2k beater that is easy to fix. Need help to fix, plenty of youtube videos. Millienials should know how to do that.

Hi Doc. I was a ‘renter’ in the Santa Monica / WestLA area from about 1985 (when I moved out from home) till 2012 when I purchased my first home in Baldwin Hills.

here is an article on where LA renters are wishing to move to.

http://la.curbed.com/2016/6/25/12031608/renters-moving-neighborhoods-rental-prices

I would suggest renters will be in a great position when housing bubble 2.0 mean reverts. They will not stand to lose their down payments and capital investments. Home prices and rents can and will not continue to out grow wages. At the collapse we will all be congratulating Jim Taylor on his tank call.

Depends on how the economy responds to another housing crash.

If we go into another major recession most renters won’t be able to capitalize on cheaper homes since they’ll probably be out of work or even more strapped for cash. Banks will also probably tighten standards too at the same time most likely.

Something they should’ve done a long time ago but those guys didn’t learn anything other than how to get bailed out again on the taxpayer’s dime by vote buying in congress.

He probably meant those who are qualified and were waiting for prices to regain their sanity. You know, the “cash on the sidelines” demographic.

Maybe he/she does and I misread.

But that demographic doesn’t really exist since even if home prices went down 30% or more almost no one has the necessary 10-20% down payment of $100K+ saved up. We need some massive combo of home prices declining and wages going up greatly for sane lending (ie. 20% down + 30-20yr mortgages) to make sense again.

A decline to where prices return to close to their historical trend line would correspondingly reduce the required down payment to less than 100K. A 20% down payment that is equivalent to 100K for an average SFR So Cal house is based on bubble pricing.

“A decline to where prices return to close to their historical trend line,,,,,,,A 20% down payment that is equivalent to 100K for an average SFR So Cal house is based on bubble pricing.”

Yes but I think you’re inadvertently making my point for me. I mean we really didn’t see home prices get all that affordable during the last bust did we in CA? They went down but not enough to get affordable. They were STILL pretty bubbly vs wages even at the ‘bottom’ back in 2010.

If we see the same sort of ‘bottom’ this time around while wages stay stagnant nothing with change. Savings won’t be enough no matter what since almost no one can save anything at all given the current cost of living vs current wages.

@tts

Record Fed and government intervention, which are still ongoing, to restore confidence is the primary reason why prices didn’t return to their historic growth trend. If and when prices fall the next time around, the next response from the Fed and the government will not be as effective. Financial institutions and investors are already leveraged with their own RE portfolios and will be looking to sell, not buy.

@Prince Of Heck

“If and when prices fall the next time around, the next response from the Fed and the government will not be as effective. Financial institutions and investors are already leveraged with their own RE portfolios and will be looking to sell, not buy.”

You know I never believed they’d try and do as much as they did last time to keep the bottom from really dropping out of the market. Or that it would be effective. But they did and it was.

And unfortunately I don’t see much reason to believe they won’t again pull some shenanigans to keep prices from getting reasonable vs current wages. I don’t just mean the actions of the FED either. I’m talking about the multiple mortgage moratoriums, the whole robo signing document fraud, the rocket dockets, the banks not taking delivery of homes in foreclosure to keep bubble values on their books, etc.

If they were willing to allow all of that, or look the other way on blatant widespread fraud, then really there isn’t anything they won’t do to keep housing from becoming affordable.

tts, The Fed can always pull ever more and different shenanigans, but the real question is what can they get away with politically and practically. It’s resulting in enormous imbalances that not even the best plate spinners are familiar with.

@Hotel California

I have no idea where the limits are to what they can do and I don’t think they really know either. As you said we’re in uncharted territory. The thing is I don’t believe they even know how to stop doing the same old shenanigans at this point. I see no reason to believe anybody at the FED or in govt, state or federal, who really learned anything from the last bust. They’ve ran out of ideas so they’ll probably just go and pull the same ‘levers’ they did last time to keep the market prices from falling too low and causing the banks to go bust.

@tts

The first bailouts benefited the too big too fail banks and were politically unpopular. Both presidential candidates are currently incorporating anti-Wall Street action into their platforms. Another public bailout, this time of private and foreign investors (the primary RE buyers during the cycle), would be political suicide when mainstreet is suffering.

As HC noted, the current economic imbalances are so severe that further action could prove futile or self-defeating. The Japanese authorities have been experimenting with various actions for 20+ years. Yet, their real estate market and economy remain mired in stagnation after the bubble popped.

I hope you are right. I have adult children who won’t leave until they do.

This article really give me an impression that life in this beautiful state are becoming difficult for the millenials. On other country millenial enjoying their condo, new car courtesy of American companies where they work.

But in this state millenials Need a room mates to scrap by and live frugally. Millenials in China, Korea are even buying houses here in cash. I think you guys need to wake up your incompetent politicians. One day California will be owned by Asians and on some area, becoming a ghetto because of the illegal immigrant. Shall we call California the sick man of America lol

Wang bu – the “Yellow Peril” was being discussed over 100 years ago and I personally think that if it weren’t for alarmism, the flat-out burning out of Chinatowns and Japantowns, restrictive laws, etc we’d be even further along than we are. Oh, it’s big-pad racism but it’s true, at least in the past people knew it was going to be either Group A or Group B that was going to own a particular patch of land, just ask the Native Americans about this.

I don’t see it ending well. The kind of US government it’s going to take to rectify the problem is not going to be a fun one to live under. But when it becomes a choice of living under the kind of government that can fix the problem or living under the Red Chinese, I don’t think any of us born here are going to choose to live under the Red Chinese. So, we can only wish for a relatively peaceful future in which these things are settled diplomatically without raw force, and in which cargo ships are retrofitted for passenger duty and leave, fully laden, for China with regularity from our shores.

STFU Alex. The Chinese who are here are either Americans, or they will be Americans in the not so distant future. As in, they’ll get Green Cards and then become citizens.

Don’t like yellow skinned Americans? Too bad. And the native Americans did NOT take ownership of the Americas when they got here way back when. Who gave them the deed to two continents? God?

Ownership comes when a flag is planted and defended with force. Like killing people who invade. That’s the way it’s always been.

In the future, those 1.3 BILLION Chinese and 1.2 BILLION Indians, and the other BILLION living in Asia (not counting the stupid Russians or M.E.) will simply make America into an irrelevant once great nation. We’ll be like the U.K., or Spain or France.

So take your self-pity to a KKK meeting where all the other loser white guys hang out and drink cheap beer.

Soon the Chinese and other Asians are going to discover that life here in America ain’t so great. Have you been to downtown L.A. lately? It looks worse than horror movie. The future markets and billions are going to be made in Asia since Americans are becoming so poor and destitute, that half of Americans haven’t saved a dime for retirement.

We’ve become fat, lazy and bigoted. The white boy peril has struck again just like it’s doing now in Europe. Europe is toast because of dumb white people. White people who can’t learn from the past and keep making the same mistakes over and over again.

You cannot move to China. They have no program or desire to make outsiders citizens. With very few exceptions, you can only be a temporary visitor, as a tourist, worker, student, etc. My wife and I retired to China 3 years ago. She is from here. We have to leave the country 3X a year and return to keep our visas legal. This fits in well with our traveling, so it’s OK for us. Life is pretty good for Average Joe in China. The middle class is growing and is now 54% of the population. The poor have come the farthest-nobody is hungry and most people have Western style consumer goods. It is easier to start a company and get rich in China than in America.

82% of the people here pay no rent or mortgage because they own their own home. There is no property tax. All they have to do is pay very cheap utilities and buy food. They can get by on very little income and be comfortable. A household income of $9600 USD a year gives a family a decent middle class life that includes savings.

In America you can make 6 or 7 times that and still be struggling. Debt is probably the reason. Mortgages, credit cards, car loans, student loans and taxes, taxes, taxes.

I don’t know what the solution if for America. It is a very expensive place to live.

Perhaps having military bases in 130 countries and waging war in 7 right now should be reconsidered.

ZZY – you are making my point for me. Land belongs to those with the population numbers and ruthlessness to take it and keep it, simple as that.

Today’s Klan is pathetic, a joke. That might change when you really do have Joe Lunch Box, the out-of-work white collar guy next door, the family with 3 sons who can’t even get jobs mowing lawns, etc joining up.

Like as not they’ll join something like http://www.tradworker.org though. Those white sheets are so darned hard to keep clean!

I’d not be very happy to see the Klan or a group of like mind take over, but then I’m not too happy with the ongoing take-over of my country so it’s a toss. I’m just reporting the sentiment of many here.

Asians tend to emphasize education and their success reflects that, but they don’t seem to wield political power in CA and I’m not sure why. Maybe they don’t have the “star power” needed in the sycophantic state to succeed in politics. But I credit my success in school to having lots of good competition from them – it made me elevate my game. There just isn’t that much of an emphasis on STEM amongst whites as their families instead adopted the hippy mindset.

As far as owning CA, that may be more of a curse. Other than the value of overinflated real estate, what is its intrinsic value? Lots of natural resources, but too many liabilities and takers and lets not kid ourselves, its on its way to becoming Venezuela given its corrupt, venal politicians.

Junior Bastiat – then why is tech so dominated by whites? Sure there are nonwhites in it too, but they’re generally contributing money; it’s up to whites to come up with the ideas, make them happen, etc. Nonwhites have had decades now to take over tech and tech has become whiter than I’d ever imagine it had a chance to, thinking about it back in the 1980s.

That is a good question that I have asked myself many times over my 2 decade+ career in tech. I believe whites on average are more creative – maybe its genetics, maybe its their culture/family upbringing or some combination but thats the difference. Whites also are more willing to lead, whereas asians tend to not push for leadership roles for whatever reason. I’ve found myself in leadership positions just because no one else was willing to do it. I’ve found middle easterners to be similar, and haven’t dealt with enough indians to form an opinion. But they are all pretty damn smart and hard working and those two qualities alone blow the doors off 50-75%+ of the whites IMO, but then again I’ve dealt with some of the best of the best who have made it to our shores.

I have traveled a fair amount, including asia last fall and I’ve always wondered why I don’t listen to music from asia – I like a lot of different genres, but much of what comes out of there is derivative and not my thing, although I like the artwork/craftmanship of old Japan. Even the asians I grew up with or work with, if they play a musical instrument its because their parents made them and while good, they didn’t do it out of inspiration or love of music (maybe that came over time to them, haven’t asked), whereas I picked up a guitar 30+ years ago because I loved music and wanted to “feel” that awesomeness first hand and as a result I’ve been writing my own songs the whole time.

A heavy part of my disposition is a “Fk your rules” mentality from growing up in skateboarding and punk rock though – so I’m an outlier but I think there’s something to my observations. Big reason I wouldn’t want to be a kid today – don’t want to go to the man’s schools, don’t want their vaccinations, don’t want to color inside their lines.

Junior – Whites created the greatest music the world has ever known, hands down. Chinese, Indian, African music have had far longer to become popular all over the world and it’s not happened, with the exception of the hybrid of black rhythm and white creativity that has contributed much to popular music. Indian music is arguably more complex, and older, but it stays in its own area because to most people it sounds like a session at the dentist. White music simply is one of the greatest things created by humankind and it’s no wonder the rest of the world wants their kids growing up to Mozart, Bach, etc and playing white-created instruments.

White leadership and creativity goes back to before skateboarding and punk rock, although it’s a typically white thing to do, to popularize the Hawaiian sport of surfing and change it from something done by the elite, on massively heavy wooden boards that went pretty much in a straight line, to lightweight boards (even before fiberglass and foam, whites were inventing boards made of balsa wood, hollow boards, etc) and where individual creativity rules, and socially accepted to do not by an elite but by anyone who cares to.

It gets into politically dangerous territory to ascribe the unique contributions and talents of whites to the world to genetics, but as we (and by “we” of course it’s always meant whites) learn more about genetics, maybe that will be scientifically proven.

The Chinese, the Africans, the Indians, have all have much more time to invent science, the industrial revolution, widespread literacy, etc. Generally under more hospitable conditions too. Yet somehow a group of people living in lands that were generally cold, damp, inhospitable, and often hungry, came up with all this stuff. Go figure. And meanwhile, hire a white guy if you need to actually get something done.

Blacks were instrumental (pun, lol!) in the genesis of many genres of music – blues, jazz, funk, rock, etc. What I have noticed though is that most humans wants a structure to their music and whites seem to excel at taking a genre and imposing a structure (verse-chorus-verse-chorus-solo-chorus) similar to a 5 act play and when that is done the music becomes much more popular. You can see it in genres that are on the fringe and then someone comes along and is able to create music with that structure and it becomes a “crossover” hit. A good example is dubstep – some of the stuff sounds like a thousand alarm clocks going off – you have to be on something to enjoy it – but people start to impose structure on it and its popularity mushrooms. Same goes for rap.

Wet, cold, inhospitable – misery makes good art, always has. I am not all that familiar with England and english people, but the amount of music to come out of that tiny place has always blown my mind. Why them and not the french? Is it weather, is it the language (and any inherent limitations), is it the culture? I always like to ask that because I can’t be accused of being racist by the uptight sjw d-bags when I compare two groups of whites.

The day Obama allowed foreign “investors” to buy our properties was the day he showed his true colors. He was not working for America. He was working for the banks.

although Obama is a corporatist, the acquisition of U.S. assets by foreign buyers began well before he held any sort of public office.

Allowing foreign investment and working for the money interests rather than for the people goes back 100 years or more. You need to only look at that idiot Reagan for a more recent example of something that’s been going for on a long time.

As some commenters have

As some have noted, rent prices cannot and will not out pace wages. It’s the law of economic physics. Are we seeing a bit of a strain at the moment? Yes, but min. wage in CA is going up to $15 an hour over the next few years so I’d imagine that it will pan out smoothly between now and then.

Will the market “tank hard soon?” Yes, but not anytime soon. As a matter of fact, these things are hard to predict because each bubble is unique and the factors that drive it are different every time. Back in ’06, prices were ridiculously inflated across most (if not all regions) driven by anyone with an income (most if not all domestic buyers) over a short period of time which resulted in the crash. This time, prices are rising more gradually than before at a more moderate (but still unsustainable) pace in certain regions (LA, OC, IE, SD aka “metro regions”) driven by investors with mostly cash/solid down payments with the international element involved (seeing how much of a role Chinese buyers are playing in the market, you just can’t ignore it).

The main indicator to me is when prices becoming unreasonable in areas that have no business dealing with prices that high. For example, Barstow, CA is a small town (pop. 25K) located halfway between LA and Las Vegas and is a major transit hub for people traveling to/from Vegas to/from just about anywhere in CA. It’s about 90 to 120 miles away from LA, IE, Vegas which seems far but traffic is generally not an issue so a few hours driving to get away for the day isn’t asking for much. Houses there are still selling for 70K to 130K for a 3/2 1300 sq ft in an OK neighborhood. That’s something a newly married young couple with min wage jobs can easily get into. Back in ’06, that was far from the case. The real estate frenzy inflated prices to levels that are still not seen in the region. Victorville (the closest major city pop. >250K) is BARELY seeing inflated prices approaching unreasonable levels and that could keep up for some time.

Point is, the cancer hasn’t spread yet outside of major metro regions to pull the plug on housing. There’s still quite a bit of life left in this boom.

New Age – All it takes is a little bit of legislation; foreign-owned assets are seized, foreign ownership of houses (or anything else) becomes illegal, higher taxation on homes besides ones’ primary home, etc. Send foreign workers packing, end the H1B program and make worker training a thing again instead of hiring 6 droolers from India to try to make one real (American) engineer, etc.

Logical, rational reforms like this will make rents align with incomes again and like planting a walnut seedling now for the tree it will be in 20 years, be a huge boon to national security.

Take it a step further and send out all the transplants from other states.

Or at least stop new ones from coming in. Connecticut, New York, Ohio, Tennessee take back your children. Apply for temporary work visas if you want to come here. Now that would really empty this place out.

California loves the chinese and indian money flowing in….. and there is no way in hell outsides are being pushed out of CA.

California loves the tax money…

People are happy to pony up for the sunshine tax

Being born in CA does not entitle you to being able to afford CA

NoTank – Hell, in the eyes of Neoliberalism, being born in the USA does not entitle you to afford to live in the USA.

Being native-born Californian I can get all smug and say that’s a great idea (because it is) but until we change from a neoliberal state (a new concept that’s not tried and true, has been stabbing itself in the throat since the mid-late 1970s or so when Reagan’s advisors came up with it, and an idea that has no lasting center of stability other then money which can be fleeting, just ask one of its heroes, Bernie Madoff) back to an ethno-state, it’s not going to happen.

And yet not a single politician addresses this issue, even in our own state. It is like they are deaf.

The credit worthiness angle is a distraction from the big picture. The majority of mortgage failures 10 years ago originated from prime borrowers. Now, as back then, the the level of debt needed to sustain the speculative market is unsustainable. Today, the level of debt (hard loans masquerading as cash sales) taken on by the RE market makers, financial institutions and investors, is much worse Don’t count on financial institutions and investors being the last to sell in case of a downturn. They have shareholders and creditors to answer to.

Housing, for a variety of reasons, costs too much to build. We just don’t see gains in construction productivity like we see in manufactured goods. I remember the first Sony Trinitron color TVs. Cost about $300 in 1970, no remote control and the screen was about 15 inches. I got an ad in the mail yesterday telling me I can buy a 42″ 4K HD TV for $328. Looking at it another way, a new Cadillac ( with big fins) cost about $6000 in 1960 or about 1/5 the price of a new home in a decent California suburb. Today a new Cadillac wouldn’t even be a down payment!

The thing is no city today would let a builder put up low cost housing like Levitown or the famed ‘Ticky Tacky Little Boxes” in Daly City Malvina Reynolds once sang about and given land and development costs it probably couldn’t be done either.

Given this reality employers are just going to have to put their jobs in areas their workers can afford. Larry Ellison and Mark Zuckerberg can live in Atherton but unless Larry and Mark want to pay their employees a whole lot more they are going to have to put their company operations in the Central Valley or Inland Empire.

Sangell- I’m continually surprised at new structures being built using OSB (oriented strand board) these days. The US produces a lot of lumber, why aren’t we using it? It’s time for the government to put its foot down and make building with OSB illegal, put heavy protections in place for US lumber so it’s not getting sent overseas and can be used here.

People have got to realize that some large reasons we had a thriving middle class in the 1950s and 60s and so on was that we had some heavy protectionism going on, high tariffs, nativist Unions, etc. A great deal of work was put into dismantling this, and it has to be built up again.

Sounds like you’ll be voting for Trump – lol! I know, you’d never vote for an evil white (non jewish) man – must be tough walking around with a noseless face though.

Junior – there’s no way in hell I’d vote for Trump.

I am forecasting what I see likely to happen, but this doesn’t mean I’ll stop voting for who I think is the best among a group of overall poor choices.

I’d like to see Hillary and Sanders get together, and frankly unless the US is a lot more fucked than even I think it is, I don’t think Trump has a chance.

Shacking up with roommates, or living alone in apartments in “transitional” neighborhoods, driving used cars, doing without shiny objects all seemed pretty normal to this native Californian when I was in college and well beyond. I realize the game has changed but my parents are depression era and being “resourceful” was normal. I think a real game changer today is how needing a cel phone, internet and cable provider (or alternate streaming products) are now basic life necessities. I went without even having TV (and all you needed was an antenna!) for many many years, shared a landline with many (many) roomies, used a typewriter to get through college, went to matinees, and smoked a lot of good weed. Life was good, I was poor and the living was good. This lasted well into my thirties and when the housing market crashed a few years ago I got in.

Can we also talk about condos? yeah yeah yeah, cue up the hating. But they are cheaper, lower maintenance, maybe even safer to live behind locked gates. Sure I share walls, but with people who know that I’m here and my dog is here if “something were to happen” and we water each others plants when needed. Yep it’s a forced community, and can go both ways.

I hate living in a condo, but you’re right about the increased security. My building has 24/7 doormen. Burglars ignore this building, as they prefer easier opportunities — empty houses with windows ajar, ground-floor apts with open windows, etc.

I once left my condo for an extended 6 month trip. Never worried about burglars. I phoned periodically to check on packages, which the doormen signed for. If my mail piled up, the doormen were opened my unit (you have to leave your key with them) and deposited my mail and packages on the kitchen counter.

I hired one doorman to check my P.O. Box once a week. And one of the maintenance men, I hired to paint my unit. Building employees are permitted to accept jobs from residents in their off hours. (Not true of all condos.)

As a condo owner, I can state that the positives of living in a condo outweigh the negatives, and the positives points are worth the trade-offs. As an older woman living alone, security is my major concern, and I’m much safer on the 3rd floor behind heavy solid-core doors and deadbolt locks, and with neighbors close at hand who will know i I need assistance.

Another factor is the cost- there is a huge spread in cost between condos, and sf houses with similar architecture and amenity here in Chicago. There is no way I could easily afford a vintage bungalow with the same lovely architecture and amenity. But what do I need a quarter-acre or third-acre lot to take care of for anyway?

One downside is the lack of private outdoor space, which is major if you have young kids, and you don’t have a basement of your own to accumulate unused junk in.

The major potential downside, though, is the quality of the association you’re buying into. I strongly recommend that you do a lot of due diligence into the association, as well as have the unit and building inspected. If you have a good association, you will enjoy condo living, but a poorly run association makes life hell and degrades the value of your unit. Associations vary widely in their financial stability or lack thereof, and in their governance and day-to-day administration. You’d do well to avoid small associations, which is any complex with fewer than 24 units, and by all means avoid any complex with more than 10% investor ownership. The fewer rental units, the better. Ideally, there should be NO rentals. And it’s not the tenants who are the problem. The problem with investor owners is that they view their places as rent mines, and are stingy with both their time and money, being extremely unwilling to spend the money necessary to maintain the appearance of the complex, while expecting “the Board” or “the association” to do all the work and assure their profits. Getting them together for an owner’s meeting is like herding cats. And once they have become the majority of the owners, units cannot be financed easily, and the place starts to become run down because they do not want to spend money for major improvements.

I have owned numerous condos and town-homes over the years. And I will say that I have never met a HOA I liked. Mismanaged, underfunded communities run by power mad people who can’t even balance their own checkbooks and get off by dictating silly rules and trying to micro-manage others.

Maybe there is a good HOA out there. I haven’t seen it yet.

Laura, any noise problems in your building? Is it easy to hear the neighbors on other floors, or behind your walls?

Noise, the constant water-shut-offs (two floors must have all water shut off whenever a unit has problems), the constant intrusions for inspections (fire alarm, smoke detector, AC/heat ventilation, etc.) are some of the problems of living in a large condo building.

When the market turns, condos are the first to tank and last to appreciate. As someone else mentioned, due to FHA & lender restrictions it can sometimes be difficult to sell a condo if there is a majority of renters or the HOA is not healthy. I once had a difficult time unloading a condo because of the HOA financials.

When I got out of college ( 1974 ) I rented a studio on Post St two blocks up from Union Square for $160/month. I worked for Bank America at their data processing center at Market and Van Ness for $1200 per month ( gross) which wasn’t big money but given what rent and taxes were then I certainly didn’t struggle. True, I had no cell or ISP bills nor did I get cable as you had quite a few broadcast channels ( VHF and UHF ) that showed plenty of movies, Giants and A’s games etc. and as my TV was a 10 year old Philco Predicta ( that cool looking set with a swiveling picture tube atop the receiver) I scrounged from my parents it was adequate It wasn’t a perfect world but it was an affordable one especially since I had no student loans or other debt as tuition at UC was modest and banks did not issue credit cards to students.

I believe that people who live in communities will be better off than loners. A society of loners will not last, because society and loner are mutually exclusive terms.

It used to be extemely common place for families to board people with extra rooms. Those people who could not afford to rent their own apartment rented a room from a family.

This is rare these days.

NoTank – you can think the real estate racket for that – having regulations changed, etc. Thou shalt live like a yuppie or thou shalt live under a bridge, no inbetween.

20 years ago there were 8 million people in L.A. County. Now it’s 10,000,000. The State of California has had a similar increase in population. A large proportion of these new residents are illegal aliens mainly from Mexico.

The people in California have voted solidly Democratic for the last several decades. The state finances are in horrible shape with massively underfunded pensions and declining tax revenues. Businesses are leaving the state and the Democrats keep making more and more restrictive laws that choke off freedoms and commerce.

In short, the present housing mess has been ordered by and delivered to the citizens of California. So quit complaining. You got what you voted for and desired. Liberal politics in action, that’s what we’re seeing. Don’t like it? Then leave or shut up.

You are right, leave or shut up. What you described is the exact reasons why I fled California after living there for 31 years. Good riiddens to this joke of a democratic hole.

If you think voting for a different party or even voting is going to change things, then you are involved in the Bread And Circuses that serve to distract the masses.

The house in this example could have been purchased by someone who currently owns and lives in their house but bought the Reid house with available cash. Once they sell their old house they’ll pay down the loan. Pretty typical if that’s the case, laddering from one property to the next.

In any case, I agree the property laddering process is difficult if you’re a renter. Either you’re saving up or reluctant to part with your savings for a home that seems too expensive.

Friends of mine, a couple, moved up from San Diego to Culver City. He owned a house in LA 15 years ago, sold it, moved to SD and now is shocked at the rents in LA. They’re willing to pay the $4K price tag for all new, loft style, walking distance to bars/restaurants/shops. Mentioned the Harlow in CC and they jumped on it. There is a market for that type of rental. If both people make decent money, over time they will save up together and will aspire to buy that $1.1M bungalow. And if they are lucky maybe they’ll get it even cheaper than that after the bubble deflates a bit.

one interesting idea is that there will need to be a 6 month (or more) housing inventory before we see a drop in prices

https://loganmohtashami.com/2016/05/28/housing-bubble-2016/

Agree, it will need to be at least 6 months…

At some point those people who bought in 2010-2013 and beyond will decide to cash out and leave…. it’s already started but inventory is so low…. at some point prices will be high enough it will push inventory up….at that point though prices will be extremely high.

Logan might be right about the inventory angle for the wrong reasons. On one hand, he cites how the South Sea bubble collapsed due to aggressive speculation. On the other hand, he doesn’t believe that there currently is a RE bubble primarily because the “recovery” is comprised of an extraordinarily high amount of “cash” purchases. Unfortunately, he doesn’t acknowledge that these “cash” buyers are financial institutions and hedge funds that dwell heavily in speculation.

Supply has to increase in order for housing prices to go down. It’s Economics 101. As long as there are buyers, the market will continue rising. Is there a point where people stop buying? When is it just too expensive? The price of a average starter home in many nice parts of S. Cali with decent schools is already out of reach for families making a median income of 60K. Most can’t come up with the down payment let alone afford the monthly nut, especially when you factor in taxes, fire insurance, PMI, upkeep, etc. Even if they could afford it, starter homes seem to be harder and harder to come by as the current owners are staying put as they can’t afford to move up the property ladder.

http://la.curbed.com/2016/3/22/11284584/los-angeles-starter-homes

According to this article, one must make at least 96K to qualify for a mortgage on a starter home in LA.

http://la.curbed.com/2016/2/16/11028498/los-angeles-housing-affordability-2015

@ Danny Ready

“Considering the excuses you’re coming up with, it’s clear that YOU won’t reach any measurable level of success.”

I’m actually the most successful out of all my siblings and own my house and have a paid off car. Even a little savings. Did it without a college degree too. But that is very unusual these days and it had more to do with luck than hard work. Not because I didn’t work hard but because hard work isn’t worth much since wages haven’t been scaling with inflation or productivity for decades.

Also I did give actual information and charts in my post. Which you seemed to have ignored. But then you also seemed to have ignored the articles information too in your rush to make personal judgements over the internet.

“did you really just write this extremely salty novel of a post and end it with”

He was literally making a value judgement to that effect while also dropping in a snide comment how all millenials are of course lazy and need a push out the door. That Just World Fallacy crap is just straight up insulting in this day and age.

tts: your long post earlier is exactly reality.

Thanks

Alex in San Jose, I know you are likely a flaming commie but I had to point something out brosef Stalin. I’ve heard you mention ‘what happened to native americans’ a few times. Newsflash though, the vikings were here before the native americans. Additionally the native americans came across Ye Ol Ice Bridge from somewhere other than Merica. People take over lands, always have, always will…moving on.

Even a broken clock is right once a day, keep peaching Jimboni. However there should be some ceiling attached to your prognostication not just years of ‘Housing to Tank Hard Soon.’

Mr. Miyagi – The Vikings were here well after the Native Americans were here. They arrived in very small numbers, not nearly enough to establish an ethno-state.

There are arguments that some sort of possibly Caucasoid people arrived on the Western shore of N. America but again, apparently in small numbers and almost certainly not from Europe.

Finally, there are theories that the Chinese arrived at and explored the Western United States just a few years before Columbus, but again, not in sufficient numbers to establish themselves here – apparently events back home caused exploration of such far-away places to cease.

I have been in SoCal 20 years, and when I return back to visit Texas I am always reminded how poor Californians are. Very middle income people in TX can get a decent home in a good area with decent commutes. I’m talking 2k sq ft and a back yard, and the head of household can be a fast food manager to buy the place for $150K

I then return here and see the tiny $500k plus crap shacks with tons of beat up cars lined up and down the street, with transients walking too and fro. It’s jarring, but most Californians I decided just don’t know how poor they are.

Yeah, let me pack my bags, I’m gonna to Texas and live in a hole in the ground because there are no jobs there. I’m gonna compete with half-starved TX homeless people for discarded cans and bottles and get into fistfights over prime freeway onramps to beg with a sign … NO THANKS.

Let’s keep just worrying about ourselves, I’m doing great! I feel at one with all my fellow posters on this site that just don’t get what any generation has to go through except mine! Ha! I had it rough and I made it! We did not have any lazy, freeloaders in my generation. We are all smart, we made a life for ourselves without college degrees, one wage earner households and bought homes in our twenties! Do as I did and you will be successful too you new generational whiners!

There is nothing new under the sun, only cycles. The problem each generation has is the cycles tend to be just long enough that people don’t see them so they think the world is linear but it isn’t. Unfortunately in our system there is a monopolization process that occurs. It is not just happening in CA but CA is a great example of late state issues. Unregulated immigration along with limited residential growth after the land is already monopolized is a no win situation for the person just joining the game of monopoly.

The Game of Monopoly was actually created many generations ago to help you see this. Most people don’t realize that they already know how the game ends. Lesson number one in Monopoly is that the majority of players will lose everything. Lesson two is that even the winner eventually loses when there is no longer anyone left with money to rent his houses or ride his railroads.

You are playing a real life Game of Monopoly where most of the players have already been around the board many times before you even had your first turn. Your best bet is to move to a state where the game is just beginning, that is the only way you will have a fair chance. The choice is yours. Realize though that Detroit and the rust belt is what comes after the game has ended, it just takes a long time to play out. The future belongs to the south and flyover.

Whoever decided to pay 1,000,000 dollars for that crap shack could have had a palatial estate in many states. We are talking malinvestment on a scale that should be really alarming to people but the bubble is just too seductive. Everybody lusts for a crap shack ATM.

Great post- every word is true.

All the newcomer can do is wait for the inevitable collapse and reset of the whole cycle, when the last fools in bust out, and everything resets to a lower level.. and a new game starts.

prices are unreal here in the outter bay area.. people are doing it though. As long as people will pay the price im sure these prices will stick. i wonder how long it will take for the prices to come back down.

Two things I’ve seen argued over I think are somewhat silly.

1) Millenials who live at home to save or out of poverty both exist and I know some of both. The more education and skills they have, the more likely it is for Mom’s cooking, saving for the future and luxuries. Every individual has his or her own set of reasons. Statistics does have its uses for understanding population trends but isn’t necessarily right for every case (outliers). Like in the ee cummings poem:

“preponderatingly because

unless statistics lie he was

more brave than me:more blond than you.”

2) Whether a Chinese resident is a good citizen or a yellow peril I cannot say without knowing him. I have met people who considered themselves American who were fifth generation of Chinese ancestry, Mexican ancestry, Italian ancestry etc. I’ve also known multi-generation Anglo Americans who disliked the country they were born in and left it.

As Calvin Coolidge said:

“Whether one traces his Americanism back three centuries to the Mayflower, or three years to the steerage, is not half so important as whether his Americanism of today is real and genuine. No matter by what various crafts we came here, we are all now in the same boat.”

Joe R. – And your 5th generation American of Chinese descent is joining the Asian students’ council, the Asian chamber of commerce, is donating toward pro-Asian (to the exclusion of others) causes, etc.

No white people need apply … do we need to have our country stolen from us before we wake up? I’ve seen, and lived, what it’s like living under Asian rule in Hawaii. Do we really want the Mainland US to get this bad? Is that what it will take?

This is why I will always be an Israelophile; because they’re honest about such matters. I will always be a Kahanist.

Alex: This is why I will always be an Israelophile; because they’re honest about such matters. I will always be a Kahanist.

Not entirely honest.

Many Jews support a Jewish-only Israel, yet also support ever more diverse immigration for the West. But when you observe the hypocrisy, rather than honestly admit it, they scream “anti-Semite” and invent excuses as to why it’s completely different.

son – I’m well aware of this – that most Jews support a Jewish-only state and I personally think it’s the only way they can survive, yet many Jews support more diversity of immigration for the US.

For a long time, Jews were considered “the other” in the US, not as strongly as in Europe, but there it was. The US however has always been good to the Jews even in pre-Revolutionary times, and now that we’ve become the tech and science powerhouse we are, and since Judaism is the very wellspring of science, tech, etc that it is, well, it’s just not the same country it was even 100 years ago.

One thing I will say is that at least in theory, “all Jews” in Israel means just that, all Jews, whether black, white, tan, etc. It’s really not a race-state but an ethno-state. The same thing is ideally espoused for the US, that whether you’re black, white, whatever, you’re an American first.

However, now that we have race-based affirmative action, quotas, different groups being OK or not-OK according to the race of their members, and whitest being taught that they’re inherently racist (by groups who are much more racist and allowed to be so) from birth, well, you can expect a backlash.

I should mention here that good old 23andme has come through and I have had the most amazing results: That I am as boring and European as a person can possibly be, with absolutely no Native American, Jewish, or any other than European ancestry. So I don’t get to say “I’m X” or “I’m Y” and get any brownie points.

This market continues to run. I’m not seeing a slowdown at all. Houses in the greater BallSacramento area are going pending instantly again after being listed. I thought there would be a slowdown by now but the bubble fest is still inflating at godspeed.

I went looking at properties last week and there were actual lines. Agents and clients waited outside for their turn to tour the property. And most of these places were dumps. Decent and even non-decent properties going pending for asking or above with multiple offers within days of listing. It’s definitely a seller’s market at the moment. I’m hoping the market cools down after the summer feeding frenzy is over.

I think your going to have to wait a while longer Jim.

Hey, someone stole my name…oh well…

the whole plan by the fed, treasury and govt. has been to create Pottersvilles. Hell is coming and it will downright ugly for society as a whole. Either president will reside over the worst economic conditions in the history of the US. Just because 40 Million americans drop off the looking for work, no job list doesn’t make flowers bloom. Just in the media.

The fed needs to be shut down, evil only wins when good people look the other way.

The fed is pure evil. Sleep with that devil of low rates because when the great default happens, selling will overwhelm the little guys.

Mr. Miyagi,

There are small signs here in the SF Bay area that we are reaching the market boiling point, Houses are sitting on the market a little longer and there is less competitiveness in over bidding. I also am noting there are many new homes coming on line as well as builders race to take advantage of the market. These are signs of a top not a bottom. We are not likely to see a break in the market until after the election when the market will naturally be slowing into the holiday season. Therefore those that think Jim Taylor will need to keep the chant up until 2017 are probably right.