Millennials and living at home: For the first time on record the most common living arrangement for young adults is living with a parent.

The topic of young adults living at home is critical to the housing market since it will impact future home building, renting, buying, and purchasing behavior for the foreseeable future. It is interesting that Trump being the de facto candidate for one of our major parties is basically a real estate marketer/developer that pitches real estate that is “too great†for most Americans. On the other end, we have Sanders who is essentially the direct opposite of Trump (i.e., free college tuition, break up the banks, etc). The billionaire and the non-billionaire – interesting. At this point, you have 3 candidates left standing and in many households, this divide is playing out. You have Taco Tuesday baby boomers that essentially were fortunate to buy at a time when the housing playing field was easy. I even see this in neighborhoods I’m familiar with. These are people that bought and many don’t even have college degrees. In virtually every case, many would not be able to buy in their own hood today even if they took a time machine and came back with their similar educational training and inflation adjusted income to today’s hyper competitive arena. When a home goes for sale, it is bought by investors or by two working professionals (most common I have seen are tech couples made up of engineers and programmers). Parents may gripe but now many have their Millennial kids living at home. If it feels like a common trend it should be because this is now the most common living arraignment for young Americans.

Breaking Young

If it feels like many Millennial “kids†are living at home then it is merely reflecting reality. For the first time in record keeping history, the most common living arrangements for those 18 to 34 years of age is living at home with a parent. This is a dramatic reversal of the typical Leave it to Beaver family.

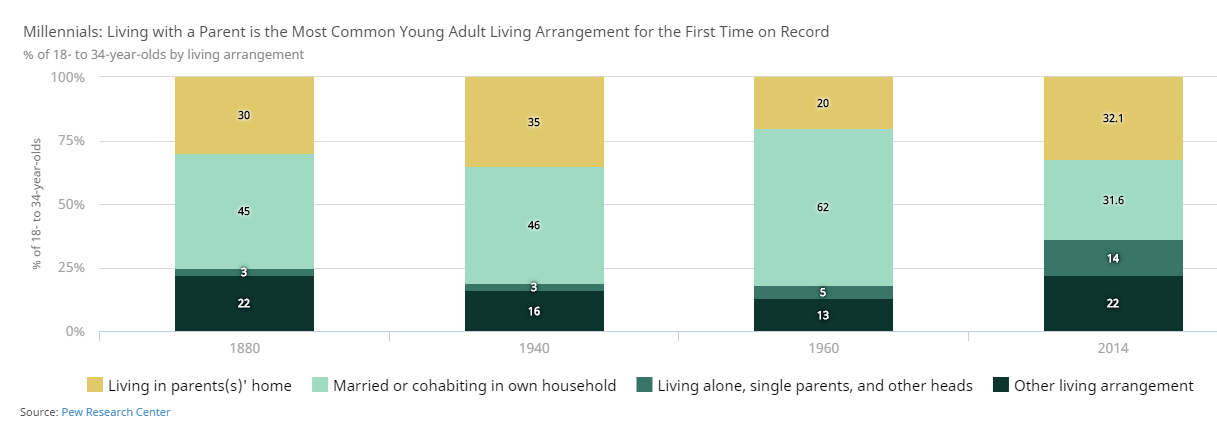

Let us look at the data:

It is worth analyzing the above. In 1960 most 18 to 34 year old households were living on their own in married or cohabiting households (over 60 percent). Today that number is only 31.6 percent. The biggest living arrangement today is living at home with a parent coming in at 32 percent. It is also worth noting that those living alone has shot up from 5 percent to 14 percent and alternative living arrangements are big as well. This jumps from 13 to 22 percent and in this group you have people living with roommates (think of the sardine like living in Los Angeles).

The implication for future housing is big here. When other surveys are analyzed the bulk of Millennials are living like this because they flat out can’t even keep up with rising rents let alone the rise in crap shack prices if they even get the idea of buying into their heads. The assumption that most are at home saving up major war chests of money is simply not true. Sure, you have examples of this in a society of 320 million people but when carefully analyzing the figures this is the exception rather than the rule.

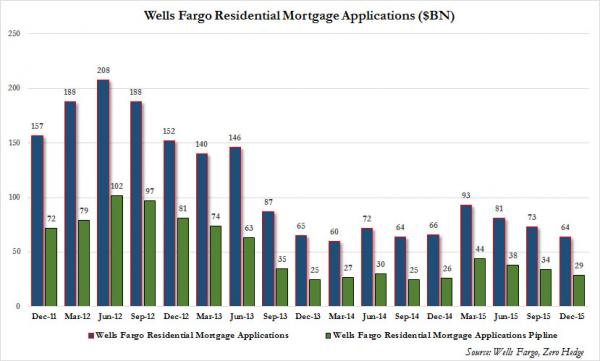

You can also see this lack of demand in mortgage applications. Even if someone was saving giant sums of money for a down payment, they would still need a mortgage. Wells Fargo is the biggest mortgage provider in the country. Let us look at their mortgage application volume:

I thought everyone was putting in applications to buy? That is clearly not the case. The volume of mortgage applications is weak. Millennials are in their prime buying years and it is simply not happening. For the last five years or so that gap in buying has been made up by investors including domestic and foreign buyers. With minimal supply and prices set at the margin, this was enough to push housing prices sky high once again even with weak income growth. People ask about the foreclosure hit. It happened. Over 7 million Americans lost their homes via foreclosures. Many investors bought these up. That hand off happened so quick that people missed the addition of 10 million new renter households in the last decade.

The fact that Millennials living at home with a parent is now the most common living arrangement for this group should tell you something. Keep in mind real estate construction was a big part of our economy for many decades thanks to the baby boomer bull market. But builders aren’t building today at anywhere close to that level. Why? Because if there is demand, it will come in the form of rentals for or multi-unit living locations. These are also less risky because you can turn a condo project into an apartment complex really easily.

If you are a Millennial living at home you are no longer a minority. Welcome to the majority.     Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

138 Responses to “Millennials and living at home: For the first time on record the most common living arrangement for young adults is living with a parent.”

You have to stop using “Taco Tuesday Boomers” and other stereotypes when describing homeowners who bought back in the day. These homeowners (myself included) bought homes years ago as a place to live. None of these people had anything to do with the current bubble mania.

This bubble is the result of several global events that are a once in human history phenomenon. The prime mover of this bubble is China and the expanding economies of Asia. Couple that with cheap money and crazy central bank monetary policies, dumb massive government debt debacles and sinking economies in other regions, then you get the present situation.

65 year old boomers had nothing to do with these prime movers of the housing bubble here (or elsewhere). The millenials and other young people who now face high housing costs in SOME markets are not facing ruin or death or any real suffering. It’s just an obstacle of life.

What young people should really worry about is what happens if WW III begins (it may have already started), or the economies of the industrial nations really fall apart and there is a global financial disaster that makes the last little financial crisis look like a non-event.

They’re no more wrong to use than the term millenial to describe a certain group of people in shorthand fashion. So long as its not done in a insulting fashion its no big deal. Which I think is how the author is using them.

I would take offense at your downplaying of the effect that high housing/rental cost is having on young people though. No they’re not dying here but it is quite awful to have to struggle financially for years on end. Which is why they’re living with mom n’ pop more and more: they have no other choice. Well unless you consider living in a box on the street a reasonable choice.

I think you’re also missing the long term knock on effects of having a entire generation too poor to move out or buy a new car will have on the economy. For all practical intents and purposes its near certain that this new young generation will stay poor. And that their children will be just as poor, if not poorer, as they were.

That might sound hard to believe but its already been largely true since the .com bubble busted.

http://www.nytimes.com/2006/05/25/business/25scene.html?_r=2

“,,,,,,,,,,,

The recent evidence shows quite clearly that in today’s economy starting at the bottom is a recipe for being underpaid for a long time to come. Graduates’ first jobs have an inordinate impact on their career path and their “future income stream,” as economists refer to a person’s earnings over a lifetime.

,,,,,,,,,,,,

Consider the evidence uncovered by Paul Oyer, a Stanford Business School economist, in his recent paper, “The Making of an Investment Banker: Macroeconomic Shocks, Career Choice and Lifetime Income” (National Bureau of Economic Research Working Paper 12059, February 2006. http://faculty-gsb.stanford.edu/oyer/wp/mba.pdf). Dr. Oyer tracked the careers of Stanford Business School graduates in the classes of 1960 to 1997.

He found that the performance of the stock market in the two years the students were in business school played a major role in whether they took an investment banking job upon graduating and, because such jobs pay extremely well, upon the average salary of the class. That is no surprise. The startling thing about the data was his finding that the relative income differences among classes remained, even as much as 20 years later.

The Stanford class of 1988, for example, entered the job market just after the market crash of 1987. Banks were not hiring, and so average wages for that class were lower than for the class of 1987 or for later classes that came out after the market recovered. Even a decade or more later, the class of 1988 was still earning significantly less. They missed the plum jobs right out of the gate and never recovered.”

The situation will only continue to get much worse until a concerted effort is undertaken by govt. to get businesses to try and raise wages and crack down on the money men who keep engineering these bubbles.

The situation will only continue to get much worse until a concerted effort is undertaken by govt. to get businesses to try and raise wages

All govt seems able to do is raise minimum wages — and that’s not going to help any Stanford Business School graduates.

Standford Business School grads generally aren’t the ones who need more money.

And if businesses won’t raise wages themselves then raising the min. wage is one of the few relatively easy ways the govt. has to force the issue.

The amounts of min. wage increases that are generally being put forward on a state by state basis still aren’t all that high either BTW once you account for inflation alone vs min. wages back in say, the 1960’s. More food for thought here, the tl&dr being that if fast food restaurants raise wages to $15 an hour prices would only go up by around 28%: http://www.fool.com/investing/general/2014/06/08/what-will-a-higher-minimum-wage-cost-you-at-mcdona.aspx

A $15 hour minimum wage won’t help anyone buy a home in SoCal. Prices of goods and services will increase to compensate for higher wage costs. As the minimum wage continues to go higher, jobs will continue to be lost and companies will hasten their investment in labor saving technology like robots.

https://www.washingtonpost.com/business/capitalbusiness/minimum-wage-offensive-could-speed-arrival-of-robot-powered-restaurants/2015/08/16/35f284ea-3f6f-11e5-8d45-d815146f81fa_story.html

http://money.cnn.com/2014/05/22/technology/innovation/fast-food-robot/

re: seismic

$15/hr min. wage would gradually push up all the other wages over time and that would have a significant effect on the standard of living. To make homes affordable anti-bubble/bust policies must be enacted which is a very complex and difficult task. Germany has pulled it off though:

http://www.forbes.com/sites/eamonnfingleton/2014/02/02/in-worlds-best-run-economy-home-prices-just-keep-falling-because-thats-what-home-prices-are-supposed-to-do/#7365a86dbb2d

http://www.bloomberg.com/news/articles/2016-05-19/germany-strives-to-avoid-housing-bubble-by-forming-new-policies

Its absolutely brain dead to try and keep wages low because it might increase the speed automation eliminates jobs too. Why? All suppressing wage growth will do is kill the economy as people buy less and less and essentially force us into a recession.

At that point you’re stuck with a economy in the gutter with 30%+ U6 unemployment rates permanently and at THAT point you have to implement a UBI or let the country devolve into a series of South American-esque favelas.

And then the robots come anyways because eventually they’ll be cheaper than any human labor, even at current wages. So you’ll have driven the country into ruin for nothing.

Emotions aside, the minimum wage increases do not help the workers and do not help the small businesses which are the engine of job creation in US. The only beneficiaries of minimum wage increases are the largest banks who own the FED. They are the main ones organizing rallies and pushing for it.

Higher minimum wages will ship lots of jobs overseas increasing the numbers of unemployed and users of food stamps.

Higher minimum wages will increase the overall level of inflation given the stagnant or very slow increase in productivity.

Higher minimum wages and higher inflation will increase the bank assets (numerically) value given them more coverage for the bad loans they did. The rich get richer and the poor get poorer.

Higher minimum wages increase the taxes the poor pay on SS and medicare (the only ones they pay without rebate). Whatever is left is not going to increase the purchasing power of the poor. The government and the bankers know this very well. They promote it because it benefit the bankers and sound good for the politicians – easy sell.

If you increase the minimum wages at the same time you promote globalism (both parties currently work hard for dismantling national borders for all practical purposes) all you get are less jobs in US.

Uh you’re like flat out wrong there on several points.

More money for low wage workers means the workers lives improve plus they’ll spend all the money they get which goes to improve the economy which will help small businesses. That is basic Econ 101 stuff.

I already posted the link showing what effect $15hr would have on prices (28% increase) and its well worth it.

The FED has been publicly against increasing wages several times that I know of. They refer to it as “wage inflation” if you want to google it. Older but still good and detailed read on the subject:

https://rortybomb.wordpress.com/2011/03/18/the-federal-reserve-unions-wage-stagnation-and-risk-shifted-jobs/

The banks/FED have done flat out nothing to push for higher wages too. Its flat out factually incorrect to say so. That is almost all workers self organizing though some unions have tried to help too.

Service jobs also aren’t going to get shipped overseas with higher min. wages. They’re service jobs, you CAN’T ship them overseas. Its also worth pointing out that several countries have a much higher min. wage than the US right now and don’t have any economic issues either. Australia for one pays $17 an hour as a min. wage. And in the past the US had a effective higher min. wage too if you adjust for inflation. So all the doom n’ gloom about $15hr is just plain wrong.

And productivity has been rising for decades with no wage increase so letting the min. wage go up shouldn’t cause any issues from that perspective too. I also have no idea why you think productivity is stagnating unless you’re doing something dumb like looking at 1yr intervals only since it goes up and down quite a bit on a 1yr interval. If you look at 2 or 5yr intervals you’ll see its gone up. And if you use a 30yr interval you’ll see its gone up massively.

http://www.tradingeconomics.com/united-states/productivity

Man you don’t know a thing how taxes are calculated at all. Like flat out just don’t. Yes its true that if you get paid more then you’ll pay more into SS and Medicare in nominal terms but the tax rate isn’t changing there. And its one that still leaves you with more take home money even after taxes. Your FICA out of pocket would go up by $1000 or so for the year but you would be taking home almost double the money so you’re clearly full of it here.

We do NOT need to raise minimum wages up to some level that is way above the current rate. A reasonable rate tied to inflation by law would be fine, removing it as a political football for people to argue over.

What we really need to do is reduce the insane costs of housing, health care, and education. They are intertwined so eliminating the fraud in one segment will have an effect on the others, but you have to eliminate the fraud. No more pensions for government employees, health care pricing up front, open competition, no insane drug manufacturing protections, transparency at all levels. Then that 30K/year salary is once again solidly middle class and this country is humming again.

RE: Minimum wage/UCI blather

For the lowest run of earners, any increase in wages only increases the volume of high-velocity money in the economy. It does not increase the standard of living for them. The velocity of their money is already maxed out…do ANY of these minimum wage earners save/invest? Will they be able to when their hourly wage goes from $12 to $15? The answer for 99% of them is NO. If you can’t accumulate capital you can’t bootstrap up the economic class ladder.

NOW…if someone were to write a wage law that said, “we’ll keep your take-home at $10/hr and we’ll put $5/hr into a locked 5-year (or 10-year?) instrument earning some percentage, tax-free” what would that do for those individuals? The economy?

re: tango_uniform

“For the lowest run of earners, any increase in wages only increases the volume of high-velocity money in the economy. It does not increase the standard of living for them.”

I already posted the link showing the effect $15hr would have on inflation which is what really matters here since wages haven’t been rising in line with inflation for over 30, going on 40, years now. You can’t talk about large scale marco econ. effects without also addressing major issues like that. And that wages haven’t been going up with productivity for a similar time span too. Remember wages went up just fine for decades post WWII until the late 70’s/early 80’s without causing any ill issues in the economy so don’t even bother posting as if its some sort of impossibility or would cause some sort of economic catastrophe to allow that to happen again.

There is also the fact that people working min. wage jobs 30+ years ago were genuinely able to do more stuff with what they earned. Like buy cars and pay off most if not all of their college depending on their degrees. So its obviously completely wrong to say there would be no benefit to their standard of living.

“The velocity of their money is already maxed out”

WHAT?!

http://www.valuewalk.com/wp-content/uploads/2015/04/Velocity-Of-Money-1.jpg

Its at a 50yr low right now!! The EXACT opposite of what you’re saying. I don’t know where you’re getting your information from but they’re flat out lying to you about stuff.

“If you can’t accumulate capital you can’t bootstrap up the economic class ladder.”

Hahahahah omg do you realize how much capital you need to “bootstrap” your way up the economic ladder at all at anything other than a multi decade pace?! I’m not exactly sure myself now but I was told back in 2006 its about $250K. Minimum. And that was considered high risk. All talk of major investing for some one who even makes a min. wage of $15hr is clueless. The best you could hope for investing wise with that much money is to put away $50-100 a month in some managed index fund and let it grow for 30-40yr so you have something to retire on.

“NOW…if someone were to write a wage law that said”,

An enforced stock investment program like that would probably cause major market disruptions. And the stock market isn’t short of cash at all so there would probably be a lot of mal-investment going on too. Especially for a “short” 5-10yr term. $10hr is also not a whole lot to live on in many parts of the country right now. You’d see a much more minor economic improvement since most would still be at “subsistence” levels of income. They need decent surplus cash to spend in the economy on goods and services to make a big difference.

Also what exactly is wrong with helping people before things get to the “they’re dying” stage? I mean see people, such as yourself, all the time play down things with a comment similar to, “oh they’re not dying so no big deal”.

Even if you lack the compassion to get involved prior to them getting messed up big time, you may or may not I don’t know, isn’t it cheaper overall to intervene before things get really bad anyways?

Imagine if any of the recent bubbles had been prevented or popped early instead. Wouldn’t we all be much better off financially both as individuals and as a country?

In the end its “our kids” that make up the millenial generation that this is all effecting.

@tts

Excellent point! “Stop your crying” attitudes are intellectually lazy and show complicity. But this person’s response is a reminder that many in the US will not have compassion for the collateral damage and generational economic “losers” discussed in this post. Because the generational “winners” will not easily confess their unfair advantage. They will rationalize it away, even parents to their own children, in many cases ( not all).

And so imho only coordinated civic action can address the suffering and implement policy which protects resident workers’ housing interests over foreign capital interests. Singapore seems to be a good model for this.

@tts @Laura

Excellent points. The U.S. economy is becoming a top heavy pyramid that makes it more susceptible to shocks. Far too many resources have been devoted to preserve the wealth of the few at the expense of the vast majority. To this point, I think that the greatest threat to the housing interests of millennials and the younger generation is crony capitalism. The greater problem is the government and the Fed favoring vested interests, whether domestic or foreign, when doling out their assistance.

“Intervene”, “Prevented”, “Unfair advantage”????

In what universe do you guys live? Oz? I think it’s safe to say that you’re already “messed up.” My suggestion is that you vote for Bernie!

In case you missed my point, the current housing issue in parts of the State of California is not the result of anything that anyone in the United States can do anything about. As in some things are bigger than you and your little concerns. Like 1.2 BILLION Chinese, or the world economy.

Housing prices are quite reasonable in lots of places in California and America–they might not be reasonable where you want to live, but guess what? And this will come to a shock to you snowflakes, you aren’t the center of the world. As in you don’t always get what you want.

Besides, this EPIC bubble that is going on right now is going to pop one day and there’s going to be a lot of hurt. Lots of people are going to lose their shirts and jobs and homes and ….

Or put it this way, would it really be a good idea to spend $850,000 on a 1950’s crapshack in a crappy neighborhood? Has this website not taught you anything?

I live in the US FWIW and you’re not even addressing much of anything I’ve said in a rational manner at all.

Heck I even posted an example of a country that does successfully implement controls on their housing market to suppress bubbles and booms. If they can do the US can too. And no you can’t just blame it all on the Chinese or other foreigners. Very few of them have the money to immigrate or buy a $800K+ house and the vast overwhelming majority of them are still quite poor. Its their 1%’ers who are coming over here and buying.

And China has been cutting off the flow of their money overseas anyways. All the billionaires in the world could be over there now and it wouldn’t matter since they can hardly get any money out.

http://www.nytimes.com/2016/04/08/business/dealbook/china-foreign-exchange-reserves-rise.html?_r=0

I don’t want to CA. I moved OUT of CA several years ago due to prices still being insane even after the bubble popped. And my comments have not just been about CA but the US as a whole. Prices everywhere have gone up massively for no good reason. Where I live, which is not at all a well off state, my home value has nearly doubled with no increase in wages and not much of a increase in jobs. Pure insanity.

yes, it is the all American Hot Dog as we see in the add next to the article. Taco Tuesday is only for Mexicans in Oxnard.

“The millenials and other young people who now face high housing costs in SOME markets are not facing ruin or death or any real suffering. It’s just an obstacle of life.”

Here we go again! So, it is my fault that I was BORN (A.K.A. “obstacle of life”) and RAISED in So Cal? If you think those of us that love our home towns are going anywhere, think again! In fact, I have a better idea. Why don’t you zzy sell now and move to “SOME market” while the bubble is still at it’s peak so that when the prices come down you won’t have “an obstacle of life” in the form of lost equity.

You need to accept the reality of the housing market situation and the fact that you did have an advantage. It’s not your fault. It’s not my fault.

I was born and raised in West L.A. My parents were born and raised in L.A., too. I live in Lancaster, houses are still affordable here. I commute into L.A. everyday.

So what were you saying about “unfair advantage”? Life is about choices. Make bad choices, suffer the consequences. There are lots of places to live and work in California, So Cal included.

re: zzy

So how exactly do people get to chose where and when they get born?

They don’t of course. People can and do get born into unfair places or time periods, yes even in the US or even just CA.

People also can luck out too and be born into a good time or place.

Did you ever consider that maaaaybe you’re one of those zzy? I’d also point out that Lancaster is just one tiny piece of CA and an even smaller one compared to the rest of the US. So even if you’re right and home prices are affordable there it wouldn’t matter at all since that area would be a statistical outlier.

And moving is really expensive and risky since decent, or even low, paying jobs are really hard to find. And saving is damn expensive when you’re already living paycheck to paycheck as a large majority of Americans already do. So you can’t just say “oh just move somewhere the grass is greener” because for most that flat out isn’t possible at all.

You know I’m starting to wonder if you have any empathy at all. You sure post as if you don’t.

If you were born and raised in SoCal, you have every advantage in the world. You are a 1%er globally speaking, and yet you whine about being born in the wrong place and time. Let’s get real. You were born into one of the best places and times in human history, but you lack the awareness to see it. Your life is better than 99% of humans currently alive, and better than 99.9% of humans that have ever existed, but you are only able to complain because houses cost a lot in your desirable hometown. Life’s a real bitch, eh?

I’m not complaining or feel sorry for myself that I live where I do. I Love L.A. Go Dodgers!

You may not have read one of my previous posts but I bought in 10 and sold late 15. I made more than I could ever have saved up.

I’m just not buying again in this market and I am not going anywhere! A rational person will not say “Well I’m so sorry, the housing costs in L.A. are going to continue to go up and never down”. “You are priced out of your land.” “Go live in Palmdale.”

I’m a 31 year old millennial, born 1985, finished medical residency last year, joined a private practice group in a large west coast market, make an income that would put me in the top 1-2% of the country. Fiancée is also a professional making an income in the $120k range.

We have always rented and will continue to do so. Home prices are so out of touch with reality it is shocking. I find it hard to believe anyone would be so foolish to put $160k down on a crappy 1960s home value at $800k in an OK, not fantastic neighborhood – yet it seems many, including many of our friends continue to over-lever themselves to buy a home out here. These are people with a household income in the $200-400k range. If they feel they’re stretching to buy a home, save for retirement, and put their kid(s) in a good school, I have no idea how the median household making less than $100k is able to buy a home.

Eventually sanity will prevail – when interest rates increase or the tech bubble pops as VC money dries up in the next market correction – prices will have to come down and we may buy in cash then. We’ve been good stewards of money all our lives, no rush to buy now at these prices. We’ll wait.

Good decision mark. Wait for the correction as I’m waiting too

Great thinking Mark! one of the most eloquent replies I have ever read in this blog. Smart! wish you the best to both of you!

“Home prices are so out of touch with reality it is shocking.”

I don’t know if I would agree with that statement. Home prices are a product of ultra low interest rates, inflation, supply & demand, etc. Just a few short years ago, the monthly payment relative to incomes for owning a home in socal was at its lowest prices in decades.

If you truly are in the top 1 or 2% of incomes, there is nothing to worry about. Rent, pay off student loans and then start filling the war chest for a down payment. You’ll likely be able to buy in almost any part of this city. Be patient, hard work and sacrifice pays off (I am sure you are already quite aware of this). I remember suggesting a few years back that it is totally normal in socal to save 10 years for a down payment and then sign up for a 30 year loan. I got plenty of laughs regarding this…that’s just the way it goes if you want to live in certain parts of socal.

The problem is that these statements contradict your statements when this blog first started before the last housing bubble popped. What’s different this time? A vested interest at stake.

“Home prices are a product of ultra low interest rates, inflation, supply & demand, etc.”

You’re effectively presuming bubbles/booms can’t happen in your post here. But if you look at home prices vs wages its obvious as all hell we’re definitely in one or the other.

I’d say bubble and not boom because so many are delusional again plus the stupid lending is coming back again too.

“I don’t know if I would agree with that statement”

then you are part of the problem and have no clue how little most Americans earn. for 100 years homes were 3-4 times local incomes, where i am it’s closer to 10 times. That simply can not last and it wont.

i ask the same question to to everyone “which one of your kids can afford to buy the home you live in” and i get the same answer every time “i couldn’t afford to buy the home i live in now on my current income”

and you don’t see a problem?

@Hotel California: Regarding my contradictory statements and what’s different this time. Let’s just say that I finally accepted reality that the Fed, government, PTB, TBTF, puppet masters, etc hold all the cards. The people who have bet against these entities got CRUSHED. I never dreamed that all the BS intervention and manipulation would have taken place, but it did. To think that this can’t keep up and we’ll have economic normalcy from here on out is utterly ridiculous.

@Mumbo Jumbo: Housing is still VERY CHEAP in the majority of the country. You will have no problem buying for 3 or 4x local income. As we all know, those rules don’t apply to desirable parts of CA especially when you have the lowest interest rates in history and massive supply/demand issues. As I have said umpteen times, housing prices relative to local incomes don’t mean squat in desirable parts of CA. The only thing that matters is incomes of today’s qualified buyers…and there is no shortage of these people.

re: Lord Blankfein

It doesn’t matter that there are a few places that haven’t been effected by the bubble too much and still have home prices in sane values vs local wages. Why not? Because those are the places where the local economy is doing REALLY poorly and is pretty much still at recession levels even after all these years of “recovery”.

If you try and move to them you’ll find it nearly impossible to find work, unless you have a job lined up before you even get there, and even then wages will tend to be much lower than your previous area.

They’re also usually fairly crappy areas too which doesn’t help at all either.

@LB

Price to income ratio doesn’t matter in desirable parts of CA — and apparently anywhere in the state. Articles throughout this blog have pointed out how prices in even the less desirable areas are exponentially higher. A true sign of real estate mania — just like prior to the previous downturn.

@tts: I am talking about the vast majority of the country (just don’t include coastal Ca, Portland, Seattle, Denver, Austin, Eastern seaboard from DC to Boston.) There are plenty of jobs and plenty of decent places to live elsewhere. Nobody is forcing anybody to live in expensive parts of Los Angeles. This is all self inflicted pain.

@mumbo_jumbo, there are lots of homes in California that are priced at 3x to 4x income. The problem is they are all in the rural (agricultural/non-cosmopolitian areas of California, i.e. not Los Angeles, Orange County, Ventura County, San Diego, Santa Barbara, the Bay Area)

Heck, Los Angeles County has sub $125K properties, but the drive to where the jobs are is horrendous.

re: Lord Blankfein

“There are plenty of jobs and plenty of decent places to live elsewhere….This is all self inflicted pain.”

No there isn’t and no this is not. I say that as someone who has moved multiple times to different states since the 1980’s. It really has been different this time and you can see that in the interstate migration stats.

http://cdn.static-economist.com/sites/default/files/imagecache/290-width/images/print-edition/20120707_FNC528_0.png

Job growth has been crap in nearly all 50 states throughout the “recovery” and most of the jobs that have been created have been min. wage jobs in the few states (like Texas) that had decent job growth. There are still less Blue collar jobs now than there were before the Great Recession hit!!

http://thinkprogress.org/economy/2014/04/28/3431351/recovery-jobs-low-wage/

And outside of the areas you mentioned there is virtually no work to be had at all. Plenty of struggling small towns that are dying though.

The grass is not greener on the other side and its a jaw droppingly bald faced lie to say otherwise at this point. And yea that is harsh to say but I would point out you’re being incredibly insulting by saying that the economic pain people are going through here is self inflicted. The unspoken insinuation being millenials are too stupid or lazy to move where all the jobs, affordable homes, and money are just magically waiting around to be picked up.

@tts: I still don’t think you get it. This has nothing to do with bashing millenials. I am targeting people who complain about the high cost of socal housing when there are so many options available elsewhere. There are specific reasons why sought after areas in socal are so expensive, we all know what they are. There are plenty of decent areas outside socal that have cheap housing and jobs. Newsflash, if nice houses can be had for 200K you don’t need a high paying socal 6 figure job!

Some people are so brainwashed by LA. You pay premiums for the weather, culture, million things to do, etc. That all comes with a price. Nobody is forcing anybody to live here. This is a free country, you can pack the U-Haul and move anywhere anytime you choose. If people don’t have the skills, earning potential, rich parents, etc to make it in socal…they need to look elsewhere. Complaining about high rent and unfair housing prices year after year is self inflicted pain.

re: Lord Blankfein

“This has nothing to do with bashing millenials. I am targeting people who complain about the high cost of socal housing”

The entire article is about millenials!! As are most of the posts!! And its millenials who are doing a lot of the complaining here too. So if you’re trying not to single out millenials you’ve chosen the wrong topic here to do it to say the least.

“There are plenty of decent areas outside socal that have cheap housing and jobs.”

Except there isn’t. I’ve already posted some information for you on that subject. I also happen to live in a area where homes tend to go for around $200-250K. And guess what? Nearly no locals can afford them. How so?! Because their wages are too low!! Then who is buying these homes you might ask? Why haven’t prices fallen in line with wages? Out of state buyers, most from CA, right now.

Its like that nearly everywhere right now. If you don’t want to listen to my anecdotes then read and address the articles I’ve already given you.

“You pay premiums for the weather, culture, million things to do, etc.”

The premium should be relatively small for that and historically it was. CA home prices tended to run closer to 4x avg. local salary rather than 3x as with other states. That the premium is now so high most of the people living there can’t afford it is a pretty bad sign to say the least of both wealth inequality and a housing bubble.

“Nobody is forcing anybody to live here.”

I’ve brought up before how risky and expensive it is to move. You’re not even going to try to address what I’ve said previously about this? Just ignore it like its not there??

I don’t see at this point a way for you to be honest in your statements and still fail to understand that a individual’s economic situation can limit what that person can do with their lives just as thoroughly as a gun held to their head. Yes, even in a free country bootstraps don’t work and this is not a Just World where those who work hard are automagically rewarded for doing so.

From your lips to God’s ears. I’ve told my daughter to wait for the next correction, as you describe, because it surely has to come. And when it does cash will be king. The market, as it currently exists, really cannot sustain itself because its huge overvaluation. Just let VC capital money dry up, high tech slow down, or a general economic malaise ensue and prices will drop. I believe that when investor speculation and foreign buyers back off, this market will correct to realistic levels.

Actually, most of the country is not in this insane real estate situation. Southern Calif. and the Silicon Valley area are the primary geographic areas of real estate insanity. This will reverse sooner or later…… be ready.

Both Mark and zzy above make good points…

Mark is correct. Houses are way out of otuch with reality; namely, wages and rental incomes. Worse yet, property taxes in many areas are soaring as well as home insurance. Not to mention other costs such as health care (think, Obamacare), sales taxes, food, education, (think $20k and up even for elementary school these days), and so on and house prices will eventually correct/revert to the norm which will be significantly lower.

Central banks and the flood of foreign money — legit and illegit — will not continue forever either. Locking oneself into a 30 year overpriced house/mortgage is like leads weights around your ankles these days especially as mobile as young people are who may want to move across the country, or across the world for a better job or life style—why get stuck in that house?

My neighbor bought at the height of the bubble in ’06. Just sold the house for $90K more than he paid. Paid his principle down about $140K over the 10 years he lived there. His downpayment was about $160K. Just closed escrow and walked with about $350K after transaction costs. He did a few upgrades here and there over the years but nothing crazy, he could have not gone in for more than $20K tops. So he turned his $160K into $330K in 10 years and lived well below rental value for the last 5 years at least. This is a family that bought at the last peak. This a tract development in North San Diego.

Buy quality RE in a quality area in SoCal that you can afford and live your life. Over the long run you will make a lot of money. Mark are you also a stock market timer? I have come across many a timer in my life and they are smarter than everyone until they’re not. Put your money into quality SoCal RE and a total stock market index and live your life, you will get rich.

If your neighbor bought a like kind or better replacement property to live in (which is the case for the vast majority of sellers) then all he has gained is a higher relative tax bill.

i love ready this blog for the laughs. Some are still trying to justify price levels based on the most manipulated market in the history of real estate. From the getting a loan if you can fog a mirror from 10 years ago (yes the insanity has been going on that long) to the massive investor rush for yield, to the record low interest rates, to banks selling off multiple properties (for less than the homeowners could have afforded in a renegotiation) to the families living 48 moths mortgage free while taxes paid, to money laundering by the Chinese……..i could go on and on and on.

this is insane and i’m thinking in 20 years we’re all going to be talking about how nuts this all was.

@Hotel CA: If they bought a better replacement, they would have a better property. Since these people were peak buyers in 06, Prop 13 helped them very little if any.

@Mumbo Jumbo: In 20 years from now, this place will be almost paid off. Something tells me that home prices and rental prices will be much higher by then. As the Falconator said, buy quality socal RE and have a long term horizon and you will make money. Sounds logical to me.

“If they bought a better replacement, they would have a better property. Since these people were peak buyers in 06, Prop 13 helped them very little if any.”

The property tax subsidy helped them to the extent of the new price level which enabled them to sell for $90K more than original purchase price less factoring for the marginal cap. Judging by the numbers given, the selling price was a double digit gain on the original purchase price. Assuming similar increases in rate experienced at the price level of the original and what would be the level of a better property, the Prop 13 income subsidy loss increases and provides a diminishing effect on purchasing power to the degree that the replacement is better. The replacement buyer gets a better property and pays a higher real tax cost.

sorry falconator, times have changed, the stock market will stagnate for 10 years, housing will come down, it’s inevitable. I have been thru 3 bubbles in So Cal and 2 in Bay area

Buying now is foolish and anyone buying now will feel pain and will get to know max draw down. If they can wither the draw down they will make do…..

the great Cbanker ploy is almost played out. The main problem with Americans in general is patience. Only a few have it….

“If your neighbor bought a like kind or better replacement property to live in (which is the case for the vast majority of sellers) then all he has gained is a higher relative tax bill.”

Terribly incorrect. They “gained” an even more awesome custom property with some land about 2 miles away. In addition to the $350K check they received when escrow closed, they had been shoveling away dough into VTI index etf because their monthly post-tax deduction nut on the old house was so low that they had excess cash laying around. No way do they pull off the new house without the dough they made on the old house and the monthly savings provided by the tax writeoff. They are pumped up on the move and they should be, the new place is sweet.

And again these are people that bought at the “worst” possible time in ’06. What a disaster it has been for them!!!!

As the Falconator has proved, people with the ability to save money (no matter how they do it) have a tremendous advantage when it comes to socal housing. The days of zero or low down loans are over. If you want to buy in any decent place in socal, you better brings some serious cash to the table…because that’s what the competition is doing.

Buying quality RE in socal with a long term horizon that you can afford is the key. If you think housing will crash and rent prices will come tumbling down, then you clearly need to hold off and wait.

“Terribly incorrect. They “gained†an even more awesome custom property with some land about 2 miles away.”

You’re either misinterpreting or misleading the point. The price was higher for the replacement than what they sold the original for, yes?

“In addition to the $350K check they received when escrow closed, they had been shoveling away dough into VTI index etf because their monthly post-tax deduction nut on the old house was so low that they had excess cash laying around.”

According to the numbers you provided earlier, $320K of that was capital they put in which leaves a net gain of $30K. Like kind replacement cost is $90K more. Better replacement cost is even more. Taxes are higher due to loss of Prop 13 subsidy from 2006 basis. These people don’t seem to be very shrewd when it comes to trading housing.

“The days of zero or low down loans are over.”

Are they?

“Buying quality RE in socal with a long term horizon that you can afford is the key.”

Everybody instinctively already knows this. The problem is the increasingly unavoidable and presently unknown volatility that happens on the “long term horizon”.

“The days of zero or low down loans are over. If you want to buy in any decent place in socal, you better brings some serious cash to the table…because that’s what the competition is doing.”

Not only is this extremely false, but the quality of lending does not matter. The bubble has and always will be in the high prices:

1. The majority of failed loans were from prime borrowers in the last downturn. In earlier real estate busts, exotic loans were not an issue. In other words, you bought into media sensationalism, hook, line, and sinker.

2. Many of these “all cash” deals are non-mortgage loans. There is no guarantee that these won’t fail either.

3. Buying when prices are not supported by investor mania rather than economic fundamentals is not a good long term plan.

@Prince of Heck,

You are making some giant assumptions once again. Why don’t you try to buy a house in one of hotly contested desirable areas with your 0 or 3% down. First of all you won’t get a loan and chances are very high the property will go to somebody VERY qualified (cash or large downs). We are not talking about quantum physics here, this is common sense. Not sure why some of the bloggers here can’t accept certain things.

@LB

You failed to grasp my point and therefore are making a straw man argument. I never debated whether low down payment offers will get any traction. By “all cash offersâ€, investors borrow a large sum of money (non-mortgage loan) and use it to buy the property from the seller in its entirety. Nevertheless, it is — borrowed money — that the investor has to pay back to their creditors.

“According to the numbers you provided earlier, $320K of that was capital they put in which leaves a net gain of $30K. Like kind replacement cost is $90K more. Better replacement cost is even more. Taxes are higher due to loss of Prop 13 subsidy from 2006 basis. These people don’t seem to be very shrewd when it comes to trading housing.”

Your analysis makes no sense as usual. The $140K they paid in principle is money that that would have been spent on rent and vanished – “poof” – if they were lifer renters like some on this board. Because they owned, they got that money back. They are therefore plus $140K over renter-guy on this line item alone. But it doesn’t stop there.

Their $160K downpayment yielded far more than the $30K profit you assert. The downpayment in combination with historically low interest rates and tax writeoffs resulted in net monthly outflow far below rents in the area. These people could afford such rent and therefore benefitted greatly by investing the difference in VTI. Due to a very long and steep rise in rents in the area, the spread between their actual outflow and what their rent would have been grew to an approximate amount of $2K/mo. Going back in time, the spread was smaller as rents were lower. A fair estimate of the net outflow vs rent spread during their ownership is approx. $1K/mo. That’s $12K/yr times 10 yrs = $120K. That money was put into VTI throughout the years and would have grown to approx. $180K.

So let’s summarize for those who do not own real estate or know how to build net worth:

This homeowner vs. a renter in the same neighborhood, same/similar floor plan:

Owner plus $140K in return of mortgage principle paid. (Renter gets ZERO)

Owner plus $180K due to monthly outflow below rental level plus ROI. (Renter gets ZERO – had to pay ever rising rents)

Owner plus another $30K beyond return of principle and return of downpayment.

So Owner comes out ahead $350K over Lifer Renter. Owner also gets his $160K downpayment back, don’t forget, so Owner sells and goes away with $510K. And that’s how it works.

Plus $180K in

“Your analysis makes no sense as usual.”

Whether deliberately or not, you’re all over the map and haven’t provided some of the necessary numbers needed to verify your claims.

$160K down

$140K principal paid

$20K upgrades

———————–

$120K difference from comparable rent

$60K gain from VTI

———————–

??? purchase price

??? sale price

??? transaction cost

??? mortgage terms

The “analysis” makes perfect sense to anyone able to comprehend that the renter could also invest the $160K and that the “savings” from a lower comparable monthly living expense is offset by the marginal liquidity of the DP. What also makes perfect sense is that a like-kind or better replacement at a cost equal to or greater than the sale of the original requires either the reuse of the principal from the sale or making up for the difference with leverage at a new cost.

What doesn’t make sense is that you’ve yet to provide the actual starting figures for purchases, sales, equivalent rent, and so on but there’s the implied suggestion that we should take your conclusions at face value.

“Whether deliberately or not, you’re all over the map and haven’t provided some of the necessary numbers needed to verify your claims.

$160K down

$140K principal paid

$20K upgrades

———————–

$120K difference from comparable rent

$60K gain from VTI

———————–

??? purchase price

??? sale price

??? transaction cost

??? mortgage terms”

___________

Already set out the transaction cost. Already said sales price > purchase price by $90K. Calcs already include principle pay-down figure and tax benefits. The fact is you are someone who will argue in the face of any evidence that purchasing real estate now is a poor investment. You just want to fight it. I think you are bitter because RE is out of reach for you. I have been buying RE here for 25 years regardless of “market timing”. I am plus $1.65 mil due to RE alone. Socal RE is an awesome investment. Stop fighting it, get smart and start buying. If you can’t hang out here, go somewhere else that you can afford. Otherwise you are just a perm-renter. Go ahead and hazard a guess as to how many wealthy people are perma-renters. Wake up and get smart or send me a rental app and pay me, your choice.

“Already set out the transaction cost. Already said sales price > purchase price by $90K. Calcs already include principle pay-down figure and tax benefits.”

You still refuse to give the actual numbers. For some reason.

“The fact is you are someone who will argue in the face of any evidence that purchasing real estate now is a poor investment.”

False. There are a lot of scenarios today that I believe buying makes sense over renting.

“You just want to fight it. I think you are bitter because RE is out of reach for you.”

I’ve been a property owner for nearly two decades.

“I have been buying RE here for 25 years regardless of “market timingâ€. I am plus $1.65 mil due to RE alone.”

Congratulations.

“Socal RE is an awesome investment.”

That’s an opinion.

“Stop fighting it, get smart and start buying. If you can’t hang out here, go somewhere else that you can afford.”

No. I afford where I live just fine.

“Otherwise you are just a perm-renter. Go ahead and hazard a guess as to how many wealthy people are perma-renters. Wake up and get smart or send me a rental app and pay me, your choice.”

I’m a landlord, too. Fortunately for my tenants, I don’t resort to personal attacks, erroneous labeling, and name calling if questioned. Still waiting for the numbers to validate your claims.

In the mean time rents in the nice areas just keep going up.

At some point you either buy at rental parity like your friends are doing …or leave.

not a fucking chance where i live unless you put $200K+ down and even then it only works with the tax deduction with the interest. That gets you to parity.

my rent is 1/3 the price of buying, old house and hood,

exactly 20% down and interest deductions get you to rental parity

that’s why your friends are buying

you also get over $1000 a month in principal reduction

A rental doesn’t require the equivalent of a 20% DP for a comparable property. The false equivalence can easily get ridiculous because why stop at 20% when we can put down anywhere up to 100%.

The comparison has to come down to return on capital and because an owner occupied home is consumption, the return can only be known after disposition of the asset. It’s a matter of timing and therefore OP’s point is basically buy now or be priced out forever.

Not sure about everyone’s math here. I just bought another house in ’15 in coastal North San Diego, put exactly $250K down, my net outflow after tax benefit is approx. $3K/mo. and comp rentals are running in the $4500-$5K/mo. range. Huge rental premium, low inventory.

No clear indication when that will be. Back in 2002, I was a young “clueless” kid and I could’ve told you that a market correction will happen around ’08 because the market was driven by over-enthusiastic home builders and greedy bankers that played off of each other to sell over-priced homes to under-qualified people causing exactly what played out.

Now we have a much different market. The first wave of investors that came in post-recession (’09 to ’12) was largely domestic and bought up massively under-valued homes. I’m talking homes built in 2005 for $30,000 in an area about 90 miles outside of LA; not the most desirable part of CA but for $30K, anyone with a brain (and the cold, hard cash) would jump on that. Then prices finally began to stabilize to what I consider fair market value for what seemed like one night because 2013 rolled around the second wave of investors came in and this time it was a foreign invasion. Around this time, I was working on in the OC real estate industry hacking away at virgin mountain-sides to eventually build entire neighborhoods. You’ve heard it before and you’ll hear it again: 80% of these properties were being bought up by Chinese investors, almost all in cash and over half would by the house to the left and to the right of them IN CASH AS WELL.

Let’s take a step back an analyze this. Bubbles form when the value of something is so high that it must be bought on credit at unsustainable levels, eventually causing them to pop. Now, when assets are being bought up mainly in cash and very little credit used to acquire them is there really a bubble? Maybe for the domestic homeowners that take out a mortgage to buy these over-priced homes but how many of those are in the market? Not many if the rental market is indicative of anything.

Until the foreign investments stop coming in, this market will continue to rise; maybe slowing down here and there but never falling. Real estate prices in the most expensive parts of the country are still a bargain when compared to cities like Shanghai, Hong Kong and Taipai. When prices reach those levels or near them, maybe we’ll see some long term stagnation but prices coming down isn’t likely from what I see.

As for the tech bubble, I predict that as the software sector fizzles out, the hardware starts picking up as automation and self-driving cars start gaining more steam; a passing of the baton if you will. Please feel free to reply and give me some feedback! You can’t grow as a speculator without challenging your speculations!

the Chinese market is still not done deleveraging….they will sell their properties just like the Japanese in the 80’s ….please don’t tell me it’s different…

margin calls happen in all investments….

It seems a lot of people don’t fully comprehend how prices change on the margins in a marketplace of mostly equal parts buyers to sellers. Leverage is only one potential known input variable.

If a large portion of these foreign buyers are buying but not LIVING in the property that can cause issues. If they are holding it simply as a “safe space” for money while china figures things out there will inevitably be a market correction and these foreign “buyers” will panic and say “my money is safer in china than the crazy USA” and they will sell causing further drop in average housing prices. Your thesis makes sense if everyone was able to think clearly and not panic. But this is human psychology not a math equation. Humans are very very odd.

“As for the tech bubble, I predict that as the software sector fizzles out, the hardware starts picking up as automation and self-driving cars start gaining more steam; a passing of the baton if you will.”

Pardon me, but I think you may be a bit misinformed. I don’t know about you, but I’ve never seen a piece of hardware get up and do ANYTHING without a piece of software controlling it. How will the self-driving car work if there is no software running it?

Automation literally IS software. No Software, no automation. Hardware does not work without software, my friend. They are like husband/wife – a pair.

Software cannot exist without hardware, and hardware cannot exist without software. Well, technically, the hardware can “exist” without software, but it won’t do sh*t. You’ll just have a piece of plastic and metal sitting there, doing nothing.

So, in short: Software sector will NEVER fizzle out, and it is one of the fastest growing, highest paid industries across the world, and it’s only getting better as more and more technologies depend on more and more complex software.

How do I know this?

I’m a 29 year old web software developer (JavaScript, HTML, CSS) and I’m getting around $140,000 a year over here in Tempe, AZ (which includes the cash value of all company benefits, my actual salary is $115,000).

Also, I am a 100% self-taught coder, I learned AT HOME, FOR FREE, using only my computer and Google. I never went to college for coding (I did go to college, just not for coding), any I never went to any special coding bootcamps (but those are a great idea to learn coding fast and for cheap, if you prefer hands on learning). I just went online, started reading, and started writing code.

Now, even though I’m not looking for a job, I still get literally 5-10 emails a day from recruiters trying to get me into a new software position that just came available… positions all over the country… and my resume is NOT even online anymore! When I put my resume online, I get about 20 phone calls and 20-30 emails a day from recruiters.

Point is that software is an amazing industry that will keep growing. So please don’t spread false information. Everything you do everyday of your life depends on software.

The computer you’re on. The smartphone. The car you drive. The automated traffic light control system we depend on daily. The microwave you nuke your food in. The TV. The washing machine. The dryer. Starting to get it? Everything piece of electronic hardware needs some form of software giving it instructions in order to operate properly.

Now, to all you lazy complainers, bitching and moaning about how there are no jobs, everything is too expensive, wah wah wah. F-YOU. Go learn some useful skills. Sitting on your ass complaining is a waste of oxygen. Every business hires workers that are skilled at something the business needs.

Obviously, all these unemployed people simply:

a) have no useful skills to businesses

b) don’t know how to effectively market themselves and their skills to businesses

c) are lazy and don’t give a shit, hoping for government handouts and welfare money.

I’m not saying all the millennials and baby boomers should go learn how to write code, but then again, why not? It’s easy to write code Just point and click. All you need is a keyboard, mouse, and computer, something most people do own/have access to these days. (Note: It’s only easy once you understand how it works, however, it’s actually very complicated and extremely difficult to learn unless you’re good at math. In other words, it’s only easy for me and other developers who understand this way of thinking).

Now, let’s say you don’t want to write code, then you better find something else useful to offer a company. Or you won’t get a good job. Or any job at all.

The day is over when unskilled labor will afford a decent life. Now, in modern society, it is required of all people to have SKILLED labor in order to earn a good living wage, and be solidly in the middle class.

Here’s another idea: If you don’t want to write code, do some manual labor — CONSTRUCTION. It’s still a very high paying position, considering it is easy to learn and only requires medium physical strength and hand dexterity. There’s a HUGE shortage of skilled (oh look at that, SKILLED came up again) construction workers, and that is causing new home builders to slow down construction AND raise prices.

Point is, you can easily earn a living income anywhere in the world, and even a GREAT income, as long as you have the SKILLS needed to offer the local economy you find yourself in.

Bottom line: Go online and learn some new SKILLS.

This is what I’m trying to say there’s not a lot of millenial and or American buyer out there. Loan application at its lowest because most foreigner, local investor are buying the properties in cash. What’s bring me to my attention is that most of RE agent and or housing cheer leader favor foreigner buyer than their countryman. Are they living their life just to earn extra money, Than give a deserving family a happy home to live in than sell their homes to greedy flipper and foreign investor, I have a couple of friends that’s been looking for almost three years and they are always outbid by cash buyers. They are really upset in the current system and what is happening to this country. What’s grubby though is that most of the house that they submit an offer they can find them listed after tree months at 50 to 60k above the previous asking price, who regulate the house prices here in California and why the National housing authority Don’t do nothing about it

I’m not a registered voter yet but millennial American wake up and talk to your congressman/senator about the current state of RE in California. Most of housing cheer leader are lobbying in congress so that they will not change the current rules in regards to housing. Act. Now because one day when you wake up most of the houses here are owned by Asians/foreigner and your future children are priced out even they are still unborn. This housing boom are just artificial till 80% of American have theirs own homes.

And one more thing illegal immigrant drive the rent and home prices.

This article gives us a perspective of what is really happening.

Although I think SOAL is correct in suspecting that these are troll posts, I’ll bite anyway.

A family doesn’t need to “buy” a house to have a happy home. There is no national housing authority. The real estate lobby has had significant political influence for decades, through both down and up markets. “This time is different” (a la Asia-based foreign interests are going to buy up all of the land so everyone else is doomed) are famous last words.

Homeownership in the U.S. didn’t exceed 50 percent until after WW2. Housing production peaked in 1972 and, despite adding 100 million more people we haven’t reached those levels since. It was truly a golden era in which U.S. technological and industrial supremacy allowed for rising real incomes and new highways made suburbia possible.

We are not going to see those circumstances return. If anything the U.S. will become more like Latin America both demographically and economically. Homeownership for the average worker was but a brief moment in history.

Homeownership went up because wages were allowed to rise in line with productivity and inflation. That stopped being true in the late 70’s-early 80’s and wages have stagnated since then.

When policies are pursued by govt. which once again allow wages to rise in line with productivity and inflation you’ll see this situation be reversed. Until then the consumer economy will continue its downward spiral which will put the breaks on the rest of the economy with it.

If you want to see this put simply in economic terms then here you go: https://www.youtube.com/watch?v=DoznQVAmJJY

BTW Asher Edelman is the guy Gordon Gecko was based in part on, he is anything but a friend of the poor or even all that caring about anything than his own bottom line. When you have people like that saying you need to raise wages or watch the economy fall apart you know its getting pretty bad.

Appreciate the link with Edelman, but I like this version better since it’s not truncated for political purposes.

https://www.youtube.com/watch?v=a9xSVzdUNqo

Eh they both get the point across about velocity of money and mine is a bit shorter which is why I chose it.

There is a half hour interview with the guy on youtube if any of you care to watch it. He is a interesting guy to listen to even if you don’t like him.

Sure, although the expanded context is more helpful than not.

There has been a broad decline in better-paying jobs and a shift toward job growth in low-wage industries in the U.S.

Good paying middle class jobs have been outsourced to countries like Mexico and China because of unfair trade policies like NAFTA and now

Obamatrade (aka TPP). Meanwhile, both legal and illegal workers are flooding into the U.S. because of open borders and companies are hiring more and more foreign workers by using H1-B and other work visas. The increased supply of workers is depressing wages.

http://www.breitbart.com/big-government/2015/06/17/experts-obamatrade-likely-to-devastate-american-workers-employment-prospects-if-congress-passes-it/

Hillary Clinton was one of the pioneers of outsourcing American jobs and she used her connections as senator and secretary of state to ship jobs overseas. Indian companies like Accenture, Tata, and Infosys made major contributions to the Clinton Foundation and her campaigns to continue outsourcing laws and expanding access to worker visas.

http://articles.latimes.com/2007/jul/30/nation/na-buffalo30

Obamacare is another burden on middle class taxpayers who have seen their insurance premiums and deductibles skyrocket. Most middle income taxpayers aren’t eligible for Obamacare subsidies provided to lower wage workers so those skyrocketing insurance premiums and deductibles are coming out of their pockets. Meanwhile, both Bernie Sanders and Hillary Clinton want to extend the Obamacare subsidies to all low wage workers regardless of their immigration or citizenship status–and the costs will be passed on to middle class taxpayers.

http://www.forbes.com/sites/theapothecary/2016/04/15/why-bernie-sanders-health-care-plan-is-just-as-practical-as-hillary-clintons/#349d17f045c8

Too many foreigners and immigrants keeping prices artificially high.

Housing To Tank Hard Soon@!

I saw a “decently” priced house for sale. South of the Blvd in Woodland Hills. Was listed for $549k. Contacted agents to see it, they said I could see it the next day. Then it was pushed to the next day. And then again. Then I was told I can’t see it because they already had 11 offers and they were not showing it anymore. One month later, it is now listed for rent, using the exact same photos and staging for $3400. Yet another sign of a rigged market to me. Too many investors. Too many comps and algorithms. Too many agents. Too low of interest rates. Too much hot money.

No value.

http://www.zillow.com/homedetails/5177-Don-Pio-Dr-Woodland-Hills-CA-91364/19943123_zpid/

The WH listing sounds like the listing broker had several of his own buyers and so was working both ends of the deal so he could double his commission. Then, after the sale, the investor, usually will give the listing (whether its for rent or sale) to the agent who he purchased from to begin with.

I had a friend who made tons of money in industrial real estate in Camarillo 20 years ago. He found a couple old farmers who wanted to sell their farms and he got the listings, then sold the land to developers, who parceled out the land into smaller lots, then build warehouses on all the small lots and gave the listing for every one of those warehouses to the broker who sold him the land.

Not a bad deal for someone. Judging by the comps $477 per sq foot ain’t bad for that area. With a $3400 per month rent, they should net about 5.5% after taxes. Not bad, but not great either.

All of the SFH rentals in that neighborhood have come up in the last 6 months have fetched about $3000. Many comparable in size and quality, some better. $3400 is a stretch.

Woodland Hills is probably one of the more “reasonably” priced nice areas in L.A., probably because the commute to other parts of L.A. is so long, and also because of the torrid summers.

However, burglaries are up in Woodland Hills, as I’ve noted before: http://patch.com/california/woodlandhills/home-burglaries-on-the-rise-in-the-woodland-hills-area

It makes me leery of buying in WH.

That article was from July 26, 2013. And it’s only reported in several neighborhoods, near the freeways, for getaways.

Jed, yes the article is three years old. But check out Trulia’s current crime map of Woodland Hills. More burglaries than I would have guessed.

Some speculate that Prop 47 is the reason for the rise in crime throughout California: http://www.realclearpolitics.com/articles/2015/08/16/in_the_wake_of_proposition_47_california_sees_a_crime_wave_127780.html#!

We have been in escrow with two houses in Woodland Hills. One in Jan. 2015 and one last week. Pulled out of both following the inspection. Both around $700k. They had so many issues due to the fact they were built in the 50’s and 60’s and on hillsides. Foundation issues with the last one really scared us, not to mention water damage throughout the home that the seller said he knew about only after we pulled out. Says that’s why he fixed the roof. He should have fixed the damage it caused before he tried to sell his money pit instead of painting over it poorly. The worst part is when we went in for the inspection they were already packing up the entire home. They put it back on the market the next day. I agree WH is more affordable than most areas around here, but being on a hillside proposes many issues we are realizing.

Looking in the Valley, yeah, those hillside houses have foundation issues — even the ones not on a hill, but near it.

At an Open House, I spoke with a realtor who was honest enough to tell me that the land the house was built on was shifting sideways. Since there was a hill behind the house, some people might have thought there might be a problem with the house shifting forward.

The realtor added that the owner had done much to firm up the foundation, and that this was the most stable house on the street.

I’ve also look under several houses in Woodland Hills — always look under the house, if you can — and I saw stilts partly holding up the houses. I passed. I prefer a house planted firmly in the ground, to a house that’s only partly on the ground, and partly on stilts.

I am ground zero in bubble land, Sacramento, CA. I was at an open house today in nearly Placer County and once the agent realized I knew my way around the real estate market admitted to me that inventory had DOUBLED IN THE PAST 30 DAYS. I am sitting on cash and waiting for the implosion, in the words of Jimmy Taylor, ‘housing to tank hard soon.’

Isn’t the doubling of inventory due to the high demand season? Sellers are selling now that many schools are out and buyers are going to try to buy before the next school year starts in late August. I believe inventory is always higher around this time of the year.

What $935,000 buys in Culver City: https://www.redfin.com/CA/Culver-City/3566-Schaefer-St-90232/home/6721366

That is one UGLY house. Old, decrepit interior. The seller isn’t trying to pretty this up.

I guess this is what’s called a “flipper’s opportunity.” You’re supposed to buy it for $935k. Remodel it. Then relist it for $1.5 million.

Only 2 bedrooms, 1 bathroom. Only 1,010 sq feet. Backyard faces what looks to be an industrial sound stage.

That Culver City listing is the epitome of a “million dollar crapshack”. $926 per a sq. ft to own a small 2/1 home on a small lot that looks like it hasn’t been updated since it was built in 1940. On top of all that it’s in the less-desirable part of Culver City. It’s hard to believe.

So ugly its awesome, c’mon people, bid that sucker up! Throw your money into the tornado of stupidity!

Wanted to give a real life scenario of the housing bubble here in SoCal. I was talking to a “friend” that happens to be on Indian decent (of the 7 Eleven variety). I was complaining about being a young succesful type making a good salary but unable to afford a home for my family. This “friend” said, “I probably shouldn’t tell you this but I have 5 homes, one here, 1 in LA and 3 in Vegas. One was bought 50% with cash, equity the rest are 100% leveraged with the mortgaged being paid by current tenants.” My conclusion from this is nothing has changed since ’08. Only difference is this cycle when things go down, it’ll be the foreigners that loose their shirts.

The takeaway there is that Americans should be helping their children buy franchises – maybe not 7-11s but all kinds of franchises are available that only immigrants buy because they are willing to work long hours – fast food, gas stations, plumbing and electrical and HVAC contractors. Instead, we continue to push the young into college and they end up in debt and with a job in the white collar ghetto.

“In 1960 most 18 to 34 year old households were living on their own”

Because the population aged 25 to 34 (prime first time buyers) had been stable, and comparatively low for 40 years, and the last lot in town was still vacant.

There are no vacant lots left, because we are so over populated, mainly because of immigration.

Eric Fischer observed that “What happened in 1954 to stop prices from dropping? The most obvious explanation is that that was when San Francisco ran out of large tracts of vacant land. ”

https://experimental-geography.blogspot.com/2016/0…

Your link is busted.

And the “we’re running out of land” argument is straight up BS nearly everywhere. There are a few places like SF that could maybe legitimately use it but they’re the exception that proves the rule.

The future belongs to the Latinos! They are living off the broken system getting free health care paying hardly any taxes, collecting almost 30k a year in SNAP and other government benefits. Young singles and families will live cramped up together sometime 30 millenial’s in a four bedroom house. They drive new cars and are the only shoppers I see at the mallsame thsee days.

The white folk is dying out like the Dinosaurs! The bank I’ve been going to for twenty one years is all latino but the manager and supervisor. Los Angeles is 80% latino California is 51%! 50 more years and it’s over. Good thing I won’t be around. Rip USA.

You should choose a different news source to go by. The one you’re currently using is feeding you Right Wing nonsense tinged with a lil’ too much racism it seems like.

For instance, your comment seems presume that Americans are supposed to be White only. You also seem to be hinting that when Whites are gone, as if they’re going to disappear or something, then the US will cease to exist too.

Its also worth pointing out 90% of all social support spending goes to the elderly, disabled, or working households: http://www.cbpp.org/research/contrary-to-entitlement-society-rhetoric-over-nine-tenths-of-entitlement-benefits-go-to

i thought for sure you were going to pull out the Nazi insult.

but i’m wondering, when you see an anti trump rally and all those Latinos are flying Mexican flags, what that means to you? One of my favorite signs was “no more colonizing indigenous lands”. I also so a video of some Latina in some guys face that “looked” white telling him “you ancestors stole my land” the best part was when he said “my parents immigrated from cuba and they did uit the legal way”

narraticve destriction at its finest right there, that pooe little Latina looked like she wanted to cry when her world videw of the evil white man was destroyed.

tts needs to choose a different news source since the one tts used is from Left Wing hacks with an agenda. King LG’s comments weren’t racist–he merely stated reality. Anyone who has lived in California for any length of time has seen drastic changes in the racial composition of the state due to illegal immigration and wide open borders. No one can deny that large swaths of LA and California look like Mexico.

More than half of households headed by immigrants in the county illegally, or 62 percent, received welfare benefits in 2012, according to a report released by the Center for Immigration Studies. Illegal immigrant households have higher use rates of government benefits than native-born households.

http://freebeacon.com/issues/report-majority-of-illegal-immigrant-households-on-welfare/