The collapsing prices in Irvine condos – two zip codes see year over year price drops of 40 percent. Shadow inventory in Irvine is bigger than non-distressed MLS inventory.

The condo market in mid-tier locations is in the middle of a major correction. It is surprising to see the velocity of how quickly prices are falling in some of these condo markets. Today we will look at Irvine and their condo market since it provides an interesting look at a lower price entry level market within a mid-tier location. Two zip codes in Irvine have seen median condo values fall by 40 percent in the last year. I have alerts setup for threshold points in certain locations and was surprised in the last few months of the number of condos hitting the MLS at $200k but also in the $100k range in Irvine. The mid-tier markets are definitely in a correction mode. I doubt many that buy these condos with FHA insured loans realize the HOA and high taxes on homes in Orange County, especially with Irvine. Let us examine the market in detail and see what we can find.

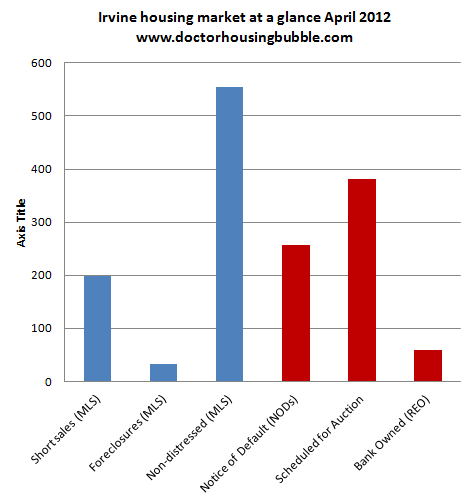

Irvine snapshot April 2012

For a mid-tier market like Irvine there sure are a lot of people unable to pay their mortgages. Roughly 200 of the current MLS inventory is listed as short sales (essentially one out of three in a solid mid-tier market). Foreclosures on the MLS continue to be low. If we dig deep into the foreclosure pipeline we realize that listed MLS data is on par with the actual shadow inventory. Here is the current market snapshot for Irvine:

Almost 400 properties are scheduled for auction and this is a deep stage of foreclosure. It is very unlikely these homes will cure. The notice of default pipeline is large as well at roughly 250. Information like this continues to suggest underlying weakness in the market and economy. After all, if things were doing so well don’t you think people would be current on their mortgages in an otherwise solid city like Irvine? Those notice of defaults are all rather recent and with FHA insured loans defaulting at higher rates, you are starting to see folks going into foreclosures even after home prices collapsed in round one of the housing market correction.

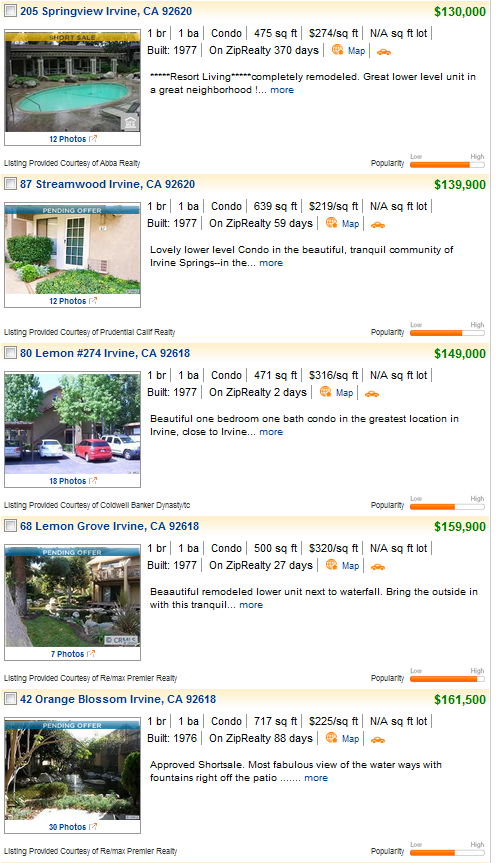

$100k properties in Irvine?

It seems like banks are getting aggressive on moving condos in Irvine. Take a look at some current listings:

$130,000 in Irvine? No wonder why my alert system went off. We are now into 1990s prices at least for some of these condos. You’ll notice a couple of these already have sales pending. I would really be curious if these were being bought as owner occupied properties or by investors to rent out? I have seen some new investors running the numbers stating that a $200,000 purchase would yield a $1,400 rental. Yet they didn’t factor in the $300 HOA and $200 taxes that would be on the property indefinitely. That might cut into those generous cap rates. Either way, we are seeing some major price cuts in Irvine especially in the condo segment of the market. The two condo markets with y-o-y price drops of more than 40 percent are 92604 and 92620.

The instability of the mid-tier market

It is obvious that a correction is taking place. You would have been laughed at if you suggested a $100k condo in Irvine just a few years ago. Now that we give examples of prices correcting, you’ll then hear a response that quality homes in these markets are still expensive. Sure. People are willing to pay the price. But is this a good investment or a good price point? Maybe yes and maybe no. These condo short sales were very bad decisions for people that bought them only a few years ago even in mid-tier Irvine.

The market is dynamic and much of the lower end energy has come from investors and FHA insured loans. Yet premiums have jumped up significantly this month especially with mortgage insurance. Why? Because massive defaults are hitting the FHA. Ironically to keep the FHA going insurance premiums are going to go up and make it even more expensive to take on a FHA insured loan. Instead of realizing that giving out 3.5 percent down payment loans is setting up many for failure, they are going to make the monthly nut more expensive for future buyers to make up for the defaults they are dealing with right now. In other words, program future defaults at the expense of getting money right now. Does this sound familiar?

The housing market at the moment is anything but a free market. It is a jumbled up mess of shadow inventory being hidden from the public, real estate industry cheerleading, and emotional buying. As we just showed, a solid mid-tier city like Irvine has more homes in the foreclosure pipeline compared to non-distressed MLS inventory. All those in the foreclosure pipeline are not paying their mortgage. Yet this is somehow construed as a healthy market? I’m not sure about that arithmetic.

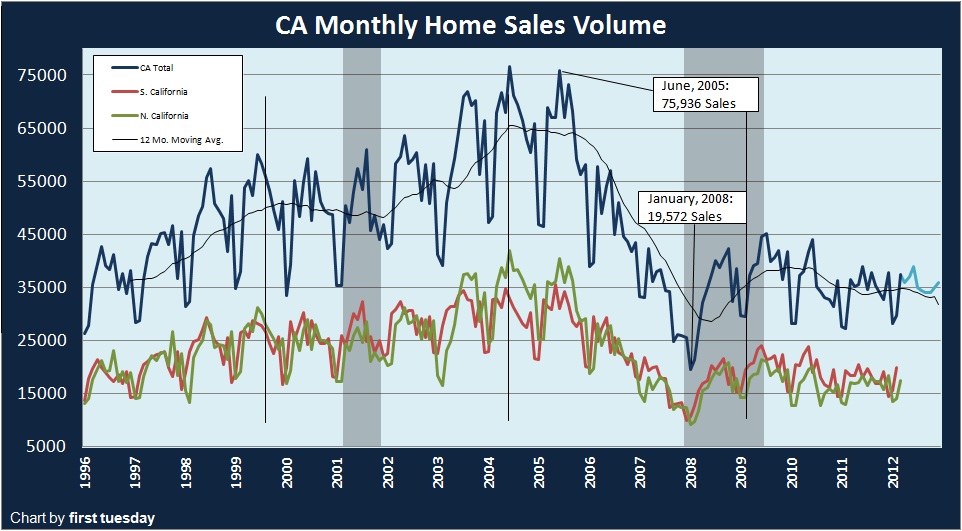

Recently California home sales came out and the spin was that we are now off to the races up. Of course, this is the start of the spring selling season and let us not forget the insanely low artificially priced mortgage rates as well. Yet when you put sales in perspective, you realize there isn’t anything spectacular about the number:

37,000 homes sold last month.  Not bad but in June of 2005 in the mania over 75,000 homes sold. From 1998 to 2008 the moving average was never lower than 37,000 so take that in for perspective. There are many leftover artifacts from the bubble and people are just itching to recreate the bubble environment. You even have some real estate cheerleaders coming back out of hibernation from 2007 echoing “buy now or be priced out forever!â€Â Buy if it makes sense. Run the numbers and don’t take on a mortgage that goes beyond your household income.  I get e-mails from people making $200,000 worrying about buying a $400,000 home. You are in good shape if you plan on staying put. Yet the reality is you have people making five figures leveraging still and buying $500,000 homes typically with FHA insured loans. That is purchasing with one foot on a financial banana peel.

The fact that we are seeing more shadow inventory coming online should actually be an argument for lower home prices and this is exactly what is happening in mid-tier markets. A healthy market is going to be one where the foreclosure pipeline is minimal and prices start tracking household incomes. We are still a long way from that but moving closer in that direction.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “The collapsing prices in Irvine condos – two zip codes see year over year price drops of 40 percent. Shadow inventory in Irvine is bigger than non-distressed MLS inventory.”

Wow… I heard the “Your Money” segment on 1070am on the way to work this morning and the line was “The market under $500,000 in LA and Orange County is red hot!” They cited low inventory, and low interest rates. I felt like this was the kiss of death. My wife and I thought that this year might have been a decent time to buy and hold our home we would live the rest of our lives in, but it seems the tables were turned on us. Now we are going to get out bid by FHA knuckleheads. They only have to come up with $18,000 down on a 600K loan. In a normal market you would need $120,000 to afford that kind of home. You put $18,000 down and in 6 months realize you maxed out the credit cards trying to afford that home, and guess what? You can stop paying. In 5 months saving the 3600 a month PITI, you got your $18,000 back, and are now living free and clear. A few attempts at loan mods, HAMP, HARP, and lots of hemp, and you could freeload for a couple years. Not a bad deal.

Just remember folks when you hear “red hot!” you know we are in a bubble.

When the grocery checker is talking about flipping houses, you know your in a bubble.

When you hear “It’s the perfect time to buy” you know your in a bubble.

When you hear “it’s a perfect storm of low prices and interest rates” you know your in a bubble.

Buy now or get priced out when rates go up…you get the point…ad nauseum

I am so with you. I’ve been lurking on this sight for YEARS now, just want to buy a modest house in Sierra Madre. Low inventory here and prices have gone UP! Ugly unfinished shack up the street just went on the market for almost $600,000. I’m just so tired of this, thank goodness I have a wonderful rental house, but if my OLD landlady dies, hubby and I and the two dogs are on the street. We have over 20% to put down on a $500,000 house and both have sterling credit, so is a decent house for a little less than a half million in our favorite town too much to ask? apparently so . . .

We have a rental house too. But tired of landlords that don’t care to keep up property.

I have been waiting years, and heard all the promises of “tsunami of foreclosures” and, changes in the way people get loans. In both cases our dear government has in an attempt to “help” screwed us over. We can wait longer but who knows what they’ll come up with next. I’m in Three Card Monte, and I’m never gonna win!

And just wherever did you develop the expectation that you would ever “win”?

Nice post CC, way to throw in a negative spin on cannabis. Here’s a clue for the clueless, the industry would not be the #1 cash crop in California if the professional people didn’t partake of the herb.

I’m willing to bet, oh let’s say $10,000, that the people who are defaulting, have a much higher percentage drinking alcohol than smoking the herb, why not just say that. HAMP, HARP, and whole lot of alcohol, and you could live free and clear.

Hemp worked so much better than ETOH, so that’s why I used it, it was just a joke…

To each his own. I personally believe they should legalize it, but the fact that its so easy to grow worries the government that they won’t be able to have their greasy paws all over it. I don’t smoke or drink, not that anythings wrong with it.

Always such a rib-tickler to see the marijuana lobby come blazing out over the slightest (self-inflicted) provocation.

Dood, haven’t you figured out? This blog is about macroeconomic trends in the housing industry, particularly in SoCal. Here, diatribes about mind-altering substances are generally reserved for the topic of NAR propaganda.

CC, the powers that be are trying to engineer another false bottom in the housing market. It looks like they are pulling out all the stops this time:

1. Artifical low interest rates

2. Government backed low down/average FICO loans are back in play

3. Mark to fantasy for lenders = no hurry to foreclose and realize losses

4. Banks are allowed to leak out shadow inventory one drip at a time

5. Priciple reductions, loan mods, every program under the sun to keep your house

6. High conforming loan limits maintained

7. Buyers see fringe benefits to owning never imagined (squatting for years)

8. Investors are getting first dibs on many of the bargains out there

9. Landlords can get greedy knowing many are unable or unwilling to buy

I’m sure I missed a bunch, but you get the point. With the current status quo, owning a house with a low downpayment has few drawbacks since the government has signalled there will be endless mulligans allowed in this game. It’s a rigged game, be careful out there!

Good post and I hear you but I think the few sane people look at this and 1) realize it is an absolutely screwed market with no fundamentals i.e. just plane scary with prices creeping down in light of that huge list rigging being done 2) the ticket price has gotten so high that unless you live FAR below your means a financial misstep is a huge potential loss.

Consider the family making $250K. Most of the other $250K earners who bought years ago purchased $550-750K homes that are now “valued” around $1.5m – most still make $250K though. So you want to live with others who make your income or around there…big dangerous ticket price and you’ll be footing a huge share of the community tax bill (Prop 13). So what if the family buys at $500K or 2x income to be conservative, living with neighbors who make <1/2 their income most likely, but then are forced to sell? Figure minimum 10% loss on transaction costs and likely more to get it done fast so 15%. All in that's $75K in losses. $250K is a decent income but it takes time to amass $75K in cash after tax especially if you have kids, that's nearly a paid for college education at a non-top tier private.

Long way of illustrating that the price to play has simply gotten out of hand due to many years of "pretend equity" that is no longer realizable as people are (should be now and will eventually be guaranteed) purchasing based on raw income or accessible liquid savings – both of which are in short supply in major housing markets. I think this is a reason why you don't see inventory in the CA market, out of FHA range and forced sales, sellers are far underwater or they know damn well that getting "their price" is a pipe dream for the time being.

A shame the responsible are kept frozen out and paying for the whole deal while those who failed are being catered to. Actually it's tragic and a sad reflection on this country. If govt wouldn't have catered to the risk fools for so long they could have never blown it big enough to force this kind of concession. The viscous cycle of government driven market distortion goes on. Looking forward to the day we get off this merry-go-round.

slim, do forgive me for invoking very ancient history–i.e., about six years ago now. But if I recall correctly it wasn’t “the govt catering to fools” that spurred all this. It was Alan Greenspan’s effort to use new housing and mortgage debt mechanisms to pump up the inflatable Ayn Rand doll that had sprung such a “viscous” leak.

Compass. You’d have to be either ignorant or nuts to think that anything that Alan Greenspan was doing had anything to do with the ideology supported by Ayn Rand. The existence of the job itself, head of the Fed, runs 180 degrees counter to what she supported. Criticizing his brutal manipulation of markets as the work of Ayn Rand is like criticizing Jerry Rubin’s later work on Wall Street and saying that it somehow reflects on the protest movements of the late 60’s.

Ayn Rand was Alan Greenspans mentor and he executed this philosophy by not prosecuting fraud, not protecting the public against fraud and turning over the whole henhouse to the foxes like Rubin, Summers Geitner etc who were fiercely fighting transparency in financial markets, especially derivitives.The collapse of ‘Banker’s Trust’ should have sounded the warning bells loud and clear as to what lay ahead

http://www.pbs.org/wgbh/pages/frontline/warning/view/

This Frontline program documents the influence of Aynn Rand on Alan Greenspan’s decision’s not protect the public trust and monies against fraud, setting the stage for the looting that followed….

“They only have to come up with $18,000 down on a 600K loan. .. You put $18,000 down and in 6 months realize you maxed out the credit cards trying to afford that home, and guess what? You can stop paying. In 5 months saving the 3600 a month PITI, you got your $18,000 back, and are now living free and clear. A few attempts at loan mods…, and you could freeload for a couple years. Not a bad deal. ”

Jeez, that really does sound like a great deal!! I wish I lived in Cali…

Seriously though, maybe thats what a lot of people are doing ? The whole rule of law and the integrity of the financial system has beome so de-valued the world over in the last half decade, it makes sense to grab a piece of the free money flying around when you can. The same sort of people who might have been property flippers or in finance in years gone by, making easy money and thinking they were geniuses, wouldn’t they make these exact calculations?

one of the better summations I’ve read – I sure hope normalcy (whatever that is) will return for responsible buyers like you.

See this new Case-Shiller index release. LA area declines again at 5+% year to year.

http://www.housingviews.com/2012/04/24/nine-cities-and-both-composites-hit-new-lows-in-february-2012-according-to-the-spcase-shiller-home-price-indices/spcase-shiller-home-price-indices-april-2012-release-2/

Interesting article about California…

http://online.wsj.com/article/SB10001424052702304444604577340531861056966.html?mod=WSJ_hp_mostpop_read

Just read that article yesterday. I moved to Texas from California 22 years ago. I guess I was ahead of the curve. I’ve always dreamed of moving back but it looks like the California dream is dead.

Turtle–just a hint: it never existed except in the minds of its boosters, babbitts, and bubble-blowers.

Dr. you forgot the $5,000 assessment to replace the roof, plumbing, etc. I am not sure these “investors” realize the risk of condo ownership…

The high end in Irvine actually isn’t doing much better – especially when compared to high end markets on the coast:

Shady Canyon homes that sold below 2004 price:

http://www.redfin.com/CA/Irvine/21-Jewel-Flower-92603/home/5929625

http://www.redfin.com/CA/Irvine/26-Vernal-Spg-92603/home/5899654

Dave, I was wondering if you could explain something I saw in both those listings. They both refered to “HOA dues”. Homeowners Association dues? What’s going on? Does this mean those homes are on a private street or something? Gated community?

Wake me up when the prices hit 1985 prices, which I expect to happen within 18 months. You’ll see……

I’m with you!

You realize that 1985 prices would mean game over for the folks that are running the show. A housing market at that price would mean that entitlements have gone poof, civil services have gone poof, no one can be retired, no one can find a job, basically all is lost for the have it alls’ so do you really think they will let that come to pass?

The have it alls need to face reality and go to jail for the biggest crime this country has ever seen. Too bad the schmucks that are supposedly watching our backs, namely the US atty general Erik Holder and his side kick Lanny Breuer the chief of the criminal division of the US Justice dept. , are same schmucks that were the attorneys for the 5 too crooked to fail banks that pulled off this crime spree! No worries, I am sure they signed a conflict of interest waiver so it’s ok. When are people going to get it? We were robbed and hence the victims are responding as any victim would. They are trying to hang on to what they have left (nothing) so they are staying in there homes to which their equity was robbed and not paying on the fraudulently obtained so called mortgage (it wasn’t). When are people going to figure this out? Learn people!! These banksters are doing the same trick with sovereign debt in every country in the western world! Wake UP!!!!

Lynn, I agree with you that the answer is to follow the money. We were defrauded and I’ve been saying that since 2008. What started out as pure unadulterated hate and ridicule to my point of view, is slowly coming into acceptance, especially by those whom are getting shafted from the fraudulant transfer of wealth.

I expect this to continue until we have a further division between the have’s and the have not’s. It’s a race to the bottom where we are not our brother’s keeper, we only care about those whom can contribute to TANGIBLE assets. Our humanity is being robbed in order to meet productivity goals for the the ones who DO NOT WORK…aka the wealthy.

In some forms, I support IRan and other countries that REFUSE to have the bankster cartels enslave their people through USURY. Christians are not supposed to charge usury either…..what happen to America the “christian” country?

Yah, but not-POTUS…we’d have, like, a great huge house with a big foyer with 30-inch marble tiles, and cathedral ceilings, and a designer kitchen with molybdenum countertops, and a spa room, and a jetted bathtub in the bonus room…

…who cares if anything else is functioning, the NAR-flogged zombie of home ownership uber alles staggers on!

N.b., I bought a house in late 2000. It was just shelter. I couldn’t have bought it within our fundamentals even 16 weeks later. So would have kept renting as I had the previous twentysomething years. One strategy makes some things possible, another strategy makes other things possible…but try explaining that to people who have been programmed to believe It’s Not Your Car It’s Your Freedom (to be owned by global petro interests).

Only in your dreams farang… (and mine as well)

Condos are risky now and falling dramatically. One reason is some banks won’t lend on them if 15% or more of the owners are behind on the HOA dues. They are essentially buying into a glorified apartment building that gives you the “thrill” of ownership. Be very careful on who else has bought into the building and even the type of work they do. Special assessments and unkept dues can raise the HOA in a hurry. Then good luck trying to resell it. Large HOA is a definite red flag.

http://www.westsideremeltdown.blogspot.com

Absolutely, I would avoid condos like the plague right now. In a normal market, condos are a good entry point for first time buyers to build equity and climb the next wrung of the housing ladder. I don’t need to tell anybody that we are NOT in a normal market and the entire housing ladder is broken. No appreciation for years to come, large HOAs, special assessments and don’t being able to sell your place because lenders won’t lend are all big, giant warning flags against a condo. Renting an apartment makes much more sense than “owning” an apartment in this environment.

The 15% HOA delinquency rate is a point I’ve posted on a number of times and one that Dr. HB has completely missed. While Dr. HB harps on 3.5% FHA’s, once the HOA delinquency rate hits 15% that means no FHA, no VA, no Freddie Mac, no Fanny Mae loans. In other words, about 80% to 90% of the loan market drops out. That means potential debtors will need to pony up a 20% cash down payment. And since condos are historically entry level in the real estate market, what percentage of these entry level buyers have $30K cash for a $150K condo? Correct answer: very few.

Sell the same orifice over and over to foolish people who pay for their fantasies with other peoples money. And then the costs and consequences are passed on to those who act responsibly. Pimps, thieves and whores are running the show.

Actually, honest sex work has more integrity than much of what goes on in financialization.

Some of the HOAs are so high, you can rent a smaller condo for the same.

Who takes out a mortgage to live in 500 square feet?

The Japanese.

DHB – “I have seen some new investors running the numbers stating that a $200,000 purchase would yield a $1,400 rental. Yet they didn’t factor in the $300 HOA and $200 taxes that would be on the property indefinitely. That might cut into those generous cap rates.”

I live in Walnut Creek in the Bay Area, which may be comparable to Irvine – nice mid tier area. I was shopping for a rental a few months back and came across a 2br/2ba condo in Walnut Creek for rent around $1.8k/month. Looked up the address on redfin and found it had recently been sold for $224k. I was shocked. Just over $200k to buy in Walnut Creek? Unthinkable! Redfin also showed that at that purchase price, with FHA 3.5% down loan, the monthly mortgage payment was just under $1k. These people must be making a killing on this place when they find a tenant, right? I ran the numbers to include HOA, taxes and insurance and they were just about break even at the rental asking price. However, this place sat for a few weeks and the owner ended up dropping the rental price to get a tenant.

But here’s the kicker – on redfin there was another unit in that exact same complex, exact same floorplan, sold a month later for $177k. A $47k LOSS to the owner of the unit I had looked at in only 1 MONTH. Guaranteed, even if the owner is breaking even or cash flowing, which they are not, they feel like crap because they could’ve had one a month later for $47k LESS. This is the kind of risk you assume if you jump into this market.

I can’t believe anyone is paying over 100.00 a sq ft for condo! Especially knowing there are at least 12 million ( I think the real figures are at least double that) of foreclosures or pre foreclosures hidden on the banksters phony balance sheets. Don’t people understand that the banks are operating zombie banks? If the truth were told the banks are bankrupt along with every the country in the western world. The top .01% own 99% of all the real wealth and assets on the planet. Not the top 1%, the top.001% Think about it. If you could create money out of thin air and charge interest to the suckers, er people for every fiat Note you printed, you too could own the world.

Great post. Another great example of rents coming down! They’re down about 15% from last year in Ventura County yet the press keeps saying that they’re rising. No way is this going to happen with the massive supply in rentals coming on the market.

Having left California for Texas 22 years ago, I have to laugh at the Irvine condo prices mentioned. 500 sq ft for $160k? And that’s 40% off? No wonder Californians are fleeing in droves to the Lone Star state.

I live in a very nice 2200 sq ft brick house in a beautiful neighborhood of Fort Worth. 3 car garage, diving pool and spa with waterfalls, 4 bedrooms, 2 living, 2 dining. It’s worth about $195k. No state income tax, no economic meltdown, and the nicest people you’ll ever meet. I visit my friends in Cali (and everywhere else) several times a year. When the cost of living reasonable it’s amazing how much money is left over for travel.

My California friends tell me to forget about ever moving back. The California I left 22 years ago no longer exists.

All very nice apart from the 110 degree heat, Tornados, expensive property tax and insurance, clay soil that is contracting badly due to the drought destroying your foundations.

You much more likely to sustain earthquake damage in greater LA than a tornado in Ft. Worth. The tornados have a small footprint, try an earthquake. The worst thing about Cali is you are sitting a dumpy $500,000 house surrounded by literally millions of gang members and low income earners. How do you think the majority of people feel when they see the incredible disparity in wealth in Cali? What kind of vibs do you get?

Oh, well, I guess the earthquakes and rampant wildfires in California are OK? Texas is far from perfect, but my point is that California is beyond insane. Did you actually take time to read this article that another commenter posted a link to?:

http://online.wsj.com/article/SB10001424052702304444604577340531861056966.html?mod=WSJ_hp_mostpop_read

If Texas is that awful why are Californians heading here in droves along with their companies (from the aforementioned article: Apple just announced that it’s building a $304 million campus and adding 3,600 jobs in Austin. Facebook established operations there last year, and eBay plans to add 1,000 new jobs there too).

Yeah, property taxes are high as a percentage of a home’s market value, but Texas has one of the lowest tax burdens overall because the market values are 1/4 of California’s.

So turn your nose up at Texas all you want, but as they say here, you’re “all hat, no cattle”.

Turtle Wins – “If Texas is that awful why are Californians heading here in droves along with their companies (from the aforementioned article: Apple just announced that it’s building a $304 million campus and adding 3,600 jobs in Austin. Facebook established operations there last year, and eBay plans to add 1,000 new jobs there too).”

This is true and not just in high tech. I interviewed with Petco corporate office in San Diego. They told me the position was moving to Austin, TX in 2 years and they didn’t care if the person who took the job relocated to keep it (ie. you pay to move yourself if you want to keep the job, or hit the unemployment line and they’ll find someone in TX to fill it).

I’d love to live in california one day. Dancing horses wouldn’t get me to texas.

I’m with you, Paul. TX has another big problem – it’s full of Texans. And Rick Perry and a bunch of mean bigots and threats to leave the union. Actually if they did I would support letting Texas go. Austin if not bad, a bit like Boulder – little oases in a desert.

You must be in an expensive part of Fort Worth. One of my sisters lives in Fort Worth near Benbrook Lake. Her house is 4,875sf, 5br, 3.5ba. She bought it for $199k.

People have been very nice there when I’ve visited. As a Californian it’s very unsettling. It feels like you’re being molested.

What are the property taxes? I knew people that moved to Texas a few years ago. They found out the state gets most of its money from property taxes. Is it something like 4%?

These condos are still overpriced by about 100k if the prices were based on reality instead of the manipulations by the banksters that have robbed our country in the biggest equity striping ponzi scheme this country has ever known.

Bingo. $278 sq ft for an apt? Are you kidding me? Beyond the plus of thumbing your nose at yard work in owning there are only negatives to owning one to these tiny pill boxes at anything over Vegas prices for the same.

Condo’s can be hell in a slack economy. Don’t forget that “owning” a condo means that you are also in common ownership of everything outside your unit. HOA’s and assessments can add up to an alarming amount even when every unit is carrying its share of the cost load. But have some dead beats and empty units…..it gets very ugly, very fast. No thanks.

Same thing out here in Northern NV…

Especially in Reno where multiple casinos were converted to condos which are not being converted back to casinos…it’s a weird world.

But still, Irvine property for $100,000. I don’t know…could be a good buy for cashflow investment.

-Joe

Interest rates have nowhere to go but up. Property prices must go up as Sacramento struggles to balance the ledgers. Insurance rates must rise in tandem with the coming wave of FHA foreclosures. Even a rental property priced at $100,000, renting at $1,000 a month, is a bad deal, because rising costs are baked in. Some markets will need a return to five-figure price tags before they become investment-worthy.

Interest rates are NOT going to go up in the next few YEARS. Property prices are going to continue to slide. Rents are going to slide also as investors buy property and rent it out. We’re seeing this starting to happen now. I’m glad that I’m a renter. We’ll wait it out a few more years before we purchase a house at a more reasonable price.

I think you’re right about interest rates. Look at Japan. Interest rates can go sideways a long time. The Fed can keep buying the bond market, if needed.

Think what would happen to our entire system if rates were in the 6% to 8% range??!! It would completely implode at all levels. We, as a nation, are just far too leveraged to sustain the debt payments at those levels. The govt will destroy the currencies value long before they would allow interest rates to rise at any meaningful level.

I was in GA for a while and a friend bought a 3br/2ba townhouse with two car garage for under 60k-in a rather decent area to boot. With career options shifting offshore, other states seem to be a nice option too. It is not like before, where you can get a nice paying job easily.

Meanwhile, I hear in countries like China and India, wages are going up 10-20% a year. Though they are still legions behind us. I look at this and wonder if we can ever come back?

The current worries about China and India overtaking the US are not based on long – term projections regarding their economies. China’s looming demographic crisis is going to make them change from one of the youngest countries to one of the oldest, in less than two generations. The worry about China should be focused on what happens if their society implodes from within, and how much debt they’ll still own from our barren coffers. India has made great strides in their economic conditions, but they still suffer from a very strong caste system, along with the usual problems that many other 3rd world countries suffer under – pollution, overpopulation, language differences, etc.

Wow, finally some downward pressure on Irvine. Great city but prices are insane. LA is no different.

Are there two California housing markets?

http://www.cbsnews.com/video/watch/?id=7406478n&tag=contentMain;contentBody

You may notice that they did not name the prices those houses sold for before and after but the guy who bought the first featured house said the prices have gone up so much since he bought it in May (has to be last year) have gone up so he could not afford to buy it now. My take given what we read here and see on Trulia, Zillow, et al is that these are still in 04 05 bubble prices, especially the flipped house. I don’t see this as sustainable. That line at the end about the rising prices not being seen in years is ominous of impending downturn in the medium term. Highland Park by the way is home to one of the most notorious gangs that LAPD had to deal with. This is the gang that started a shootout with LAPD using an AK47. I lived for years across the freeway in South Pas. Highland Park is far from a middle class neighborhood. Graffiti and grime abound.

California is totally screwed. The WSJ had a piece the other day about the exodus out of California. I agree with the above post that said 500K gets you a crappy little box with gangbanger neighbors and tagging all around and nightly drive bys. The elites socially engineered this entire disaster. Schiller says that housing might not go up in out lifetime. How can the economy improve when the jobs have been outsourced? How can people buy houses when working for low wages in the service sector?

I have to laugh at the folks here dumping on Texas. I went to visit my sister in Katy a while back, and she lives in a mansion, a new 4 bedroom, three car garage, pool, just gorgeous, and it was 220K!!!!!! That same house here in California would have to be over a million dollars. I can’t see how California will ever dig out of this mess, especially with legislators that allow for such nonsense as the Dream Act. How can they expect the folks who pay taxes to continue to subsidize those who don’t? I read that CA. has 12% of the population and 34% of all welfare cases. Also, and this floored me, 12 MILLION people have swarmed into CA. in the last few years, but only 150,000 of them pay taxes!!!!!! HAHA! Tell me this is sustainable! So, naturally the Pew Center came out yesterday with a bogus report that Mexicans are no longer running over the border….well duh….they’re ALREADY HERE.

Until the Fed is audited and somehow overthrown, until the financial terrorists on Wall St. are thrown in jail, until we get back to the rule of law, there will NEVER be any improvement in our situation.

Here’s some food for thought. The ‘price’ of homes is entirely dependent on 30year money being lent forward. That is: a bank (or power-that-be) loaning an individual thirty (30) years of income FORWARD from today with the assumption of even interest rates for 30 years.

Did you know that in latin america, the most common “home loan” is one with 70% down and a term of not usually more than 3 or 4 years?

What makes you think that home prices in the USA won’t go down dramatically down when 30-year money goes away? You understand that the ENTIRE complex in value is based on this small factoid?

We’re in a 26 year decline for real estate that peaked on 2007.15. Values will go down to the late 1950’s for some areas. What makes this possible is the reality of some previously comfortable professions earning the (adjusted) equivalent of $10 USD day. In some parts of the world, this is what teachers and nurses earn. At this point, the financial center of the world will move from NYC to Asia as it did before from London to NY. An inflationary depression will overtake the US with hyperinflation (in foods & fuels) later on. The death kneel for housing will be a the culmination of the battle between treasuries, reserve currency, the defacto reserve currency (renminbi), and precious metals.

With this in mind, for all you renters who are savers: take a 5-10% asset hedge in precious metals. At a minimum, 100oz in physical silver per individual.

This is not an investment, it’s insurance.

http://1.bp.blogspot.com/_pCDyiFUv9XU/SwXuc9g2ZBI/AAAAAAAAHRA/Bcks4jLjcmI/s1600/Real+Estate.jpg

Amen. All the folks above talking about how much money they’re saving toward a down payment should be very fearful of having that money in any paper form whether it be in an account at a bank or a brokerage.

Look at what the MF Global robbery says about the security of your account at any brokerage firm. Look at what Bank of America did a few months back, moving their trillions, yes trillions of dollars of derivatives bets to a part of the bank where everything is backed up by federal insurance only supposed to be used for depositors (and Holder and Obama did nothing about it!). When screwup Bank of America’s derivatives go bad, who do you think will be paid off first, the average american’s deposit insurance or Bank of America’s derivatives contracts? That’s right, BofA’s contracts. Your money won’t be safe anywhere. But if you’ve got 200 or 300 or 500 ounces of silver kept securely at your home, you have real value that can’t be denied to you.

While there seems to be some kind of rational expectation of how things will go, there is no point in overreacting. Back in the early 70’s when US was forced to default on Bretton Woods agreement, there were many brilliant economists that feared financial collapse and global unrest were imminent; however, here we are 40 years later and things are much the same. A valid case for collapse can be made today, but we live in a virtual world where money isn’t real (unless it’s yours). Most of the world’s money is really numerical entries in computer memory. That stuff is unlimited. Perhaps history rhymes, but using allegories from 60 years ago is risky.

Today, it is obvious that the banking syndicate will do everything and anything to prop up the virtual world economy, and in the US that means housing and energy. Doc has assimilated years of data and can still only demonstrate general trends. The game is rigged and we are never going to ‘win’. The house always wins, so we just live our lives and make the least worst choices we can.

The U.S.’s debt was much smaller in the 1970’s. The U.S.’s demographics were excellent in the 1970’s with the baby boomers just about to hit their most productive work years. There was no chinese economy in the 1970’s. We were nowhere near peak oil in the 1970’s. We didn’t have, literally, tens of trillions of dollars of unfunded liabilities looming on the immediate horizon (medicare, social security) in the 1970’s.

A person could write page after page about why our situation is worse than it was in the 1970’s. To reassure yourself about our situation now by noting that we got through the 1970’s is to make *exactly* the mistake of assuming that history will repeat itself that you warn others about making.

The irony.

Well, Texas is also 37 percent hispanic and also has high poverty among hispanics. Both Houston and Dallas have higher poverty rates among hispanics than Anaheim. And in both Houston and Dallas its easier to get a job so why do Hispanics do better in Anaheim than either Houston and Dallas in terms of poverty rates.

Leave a Reply to What?