The internalization of toxic loans and the growing cracks in the shadow banking economy – Half of 7 million California home owners are baby boomers. Who will they sell to in the future?

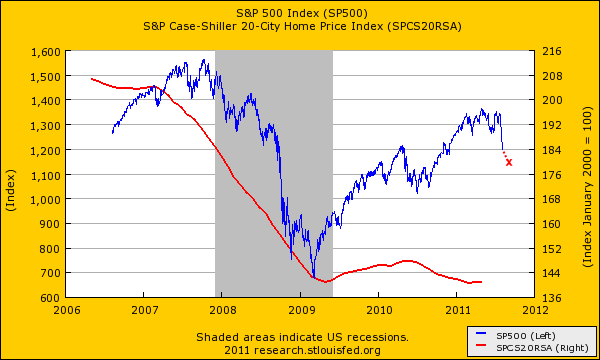

Well that wasn’t a good way to start the week. The S&P 500 fell a stunning 6.66% (no need to read anything further into that) and global markets seem to be back into panic mode. It seems like people are realizing that the Federal Reserve and their mortgage buying spree was simply a way to protect the too big to fail banks. What use is a record low interest rate if your paycheck is shrinking or no jobs are to be found? Certainly there are very few new career opportunities to justify home values in many bubble locations. What is happening today is merely a realization of the obvious; the large bailouts were simply a redistribution of wealth to protect the crony banks that were heavily invested in the real estate market. That game is largely over and many painful years later more and more people are gaining consciousness regarding this mess and how it was mishandled. The crushing losses in the stock market will hit heavily in states like California where a large portion of the tax base is directly connected to capital gains. Do you think the recent stock action is going to add to the tax base?

The demographic nightmare

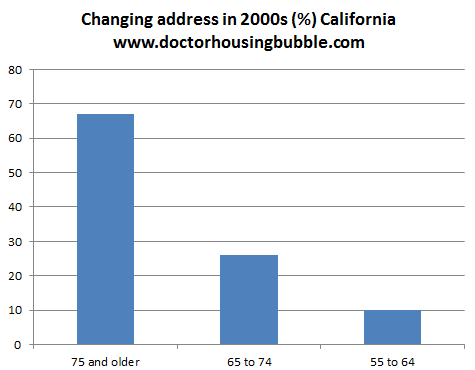

Half of the state home owners in California, roughly 7 million are aging baby boomers. The bulk of home sales in the last decade did come from this group or people that are older:

Source:Â Census

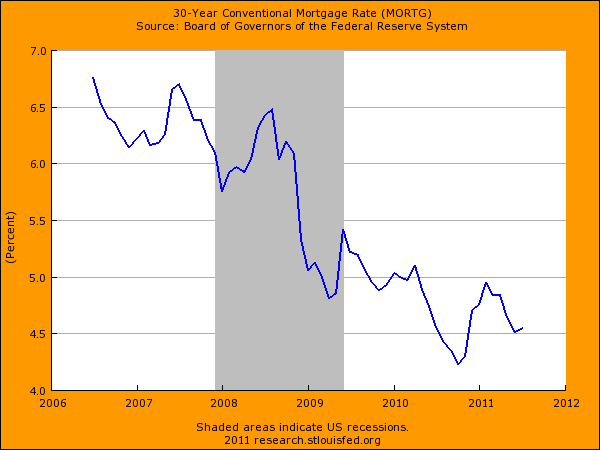

67 percent of those 75 and older changed addresses in the last decade, 26 percent of those 65 to 74 changed addresses, and finally 10 percent of those 55 to 64 changed addresses from 2000. This is important to note because in a state like California with a housing bubble still going, you have a wealthier older generation now selling to a generation that has a lower standard of living. Banks can play charades and hide inventory in balance sheet trickery but there is nothing that can reverse the aging of this nation. And many baby boomers are still expecting top dollar for their inflated real estate. Who will they sell to? One another? A younger and poorer generation? The math simply does not compute. The Fed would like to entice more suckers into the game by artificially slamming mortgage rates to record lows:

Ironically most of the activity has come from people refinancing their mortgages which are as a group financially doing better than most. Ultimately the only underlying force that will reverse the market is if the economy reverses and people begin earning higher household incomes. So far we have seen no evidence of this. With the stock market imploding like it did back in 2008 and early 2009, do you think incomes are slated to go up anytime soon? And the shadow inventory is still extremely large:

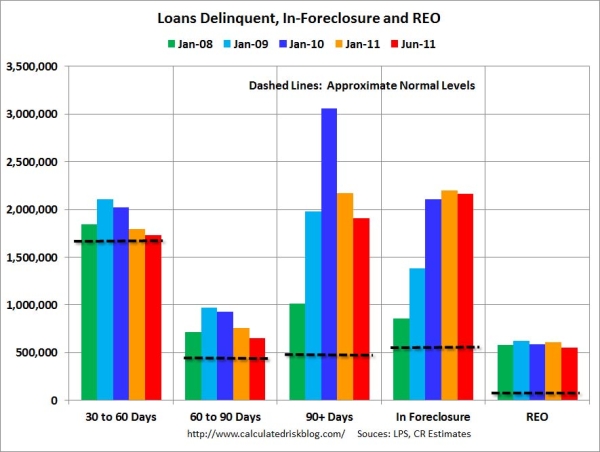

Source:Â Calculated Risk

This is one of the most telling charts. You have close to 500,000 homes that are bank owned in the shadow inventory. But you have another 5,500,000+ in the delinquency pipeline. Most of these will be a drag on prices and with demographics shifting, this is not going to be good for prices. Plus, all those boomers and their 401ks will be selling into a market with less money so who will buy all those portfolio liquidations? I have found no argument that convinces me of rising home prices at least for the next five years.

The pangs of unemployment

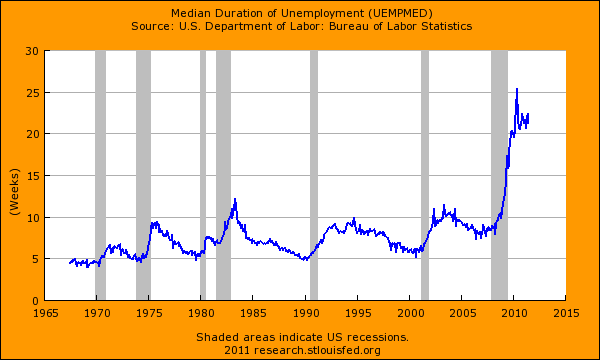

What is even more troubling is the length of unemployment:

This is by far the worst economic crisis since the Great Depression. The only reason GDP was up and we were technically out of recession is because of trillions of dollars flung at the banking sector. Yet the real economy is in shambles and contracting severely. Many Americans need only look at their balance sheet to see how things are going. I saw this headline today:

Shortly after this, the market resumed tanking. It reminded me of this SNL clip:

Source:Â Daily Motion

The market goes up, and the market goes down, but in the end the market goes up. You need to justify the price of a good and not have this belief of permanent growth economics. This problem is many decades in the making. You have a new generation that is very likely to be less well off than the large baby boomer generation that benefitted from the world destruction of World War II and the U.S. being the largest player on the block. The Great Depression saw radical shifts in how business was conducted. There was a public realization and action taken against the big banks. Today, we get the worst of both worlds. We have bigger banks stealing from the public and no actual reform. The crash is still here and if you have no job which millions don’t, then the stock market is merely a fantasy casino.

The stock market is now merely catching up to the trend in real estate:

Our current financial system is too obsessed with investment banking and real estate. That is the core of the issue here. In fact, our central bank with the Federal Reserve basically enacted a trillion dollar plus action to buy up mortgage backed securities that had little to no demand in the real world markets. This was going to be temporary until it wasn’t. Instead of allowing for a massive reformation of the banking sector, resurrecting Glass-Steagall, and clamping down on rampant speculative greed and graft we swallowed it up into our national economy. Is it a shock that our credit has been downgraded? We basically co-signed a loan with our gambling cousin Tommy and he is heading out on the next flight to Brazil. Who will pay the bill?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “The internalization of toxic loans and the growing cracks in the shadow banking economy – Half of 7 million California home owners are baby boomers. Who will they sell to in the future?”

Maybe I misunderstood something, but us Boomers were born between 1946-1964. Most of the groups on that bar graph are much older…

Agree with Rhiannon, but I reject the label Boomer, and was born in ’58. My life and expectations profile were shaped by my Depression-era parents and by the oil embargoes of the 1970s and vicious recessions of that decade and the ’80s.

Rhiannon, see the observations on the demographic called “Generation Jones”–people born between 1955 and 1964. Not Boomers, not Gen X. Squeezed in the middle of two major economic and political systems–FDR/JFK/Woodstock on the front and Ronnie Raygun/Corporations Uber Alles on the back.

I was born in ’64, my sister was born in ’47, my brother ’56! We are all supposedly Boomers, but I don’t feel like I’m part of either one’s cohort. Like you, the 1970s shaped my world view. Our parents were born in ’21 and ’22, and had the Depression Era mentality to a degree. My parents benefited greatly from the GI Bill and got to be part of the Greatest Generation. No way us kids could have that standard of living today!

I agree with Rhiannon & compass rose. I was born in late ’57, and I don’t think that people my age had the same type of childhood or the same opportunities in early adulthood that those born in the 40s and even the early 50s had. People I have known who finished college by the early 70s seem to have had a much smoother path in life than those who graduated in the 80s. Lots of people who graduated in the late 60s or early 70s, especially men, worked their way through college and did not owe the government or their parents any money when they finished. College was pretty cheap at that time, and it was still possible to get part-time jobs in factories or businesses that paid well, even if you had no experience.

Someone born in 1946 probably went to segregated schools, etc., and I know for a fact that they diagrammed sentences in English class, etc., while by the time I was in school, it was one silly fad after another in public education. There were simply HUGE changes in society during the Boomer time period, and the early Boomers also had better job prospects. Women with college diplomas were still pretty unusual in the 60s, and they were right on time for all the executive jobs that opened up for women in the early 70s. By the 1980s, every female with a three-digit IQ was in college. The oldest boomers were married and buying houses by the mid-70s. By the early 80s, house prices in California were already ridiculous.

I don’t have to go any further than next door to validate your assertion. My neighbor has a beautiful house in southeast US with huge yard surrounded by woods on three sides. They are almost in their 70’s and just want a smaller place, but the house has languished on the market for the last six months (299k). The other neighbor is a couple of boomer dink’s with another awesome house and yard also with natural areas on three sides–they moved into the downstairs and the top floor is now vacant. Just don’t need all the extra space. My house is much more modest but I’m getting too old and wish I had something smaller and easier to care for. I see the Gen-X guys with the lawn gear running every weekend–it’s nice for a while, but I’m not a landscaper/handyman, but that’s what owning a large home is unless you are really wealthy. That’s not really how I want to spend all my spare time. A lot of folks have already figured this out. The American dream is being spoiled by Freddy Kruger…and now the world has called our bluff…

The demographics of the US tells the whole picture for the future. We’re a contracting society and economy. Families are smaller and few people are having children at all. 30% of all US citizens will be over the age of 60 in ten years time.

Yep. We aborted 20 million American workers since 1973. They were supposed to be paying into the utopian Social Security, Medicare and now Obamacare Ponzi schemes. Except they aren’t here. The schemes are failing.

That is the most specious ridiculous thing ever posted here. If you look at the facts both the economy and the population experienced strong growth since 1973. Birth is not the only way to increase population although I expect that the US had growth for at least the first two decades beyond 72 due to birth. Immigration also grows a population – and just imagine illegals pay in to SS but can’t legally take the money out so perhaps it more of a win situation. In an event I am appalled by your obvious ploy to foment a baseless religious agenda.

Great post as usual. I still think the S&P500 index is a great buy opportunity right now. Barry Knapp, the New York-based chief U.S. equity strategist at Barclays, told Bloomberg his year-end projection is 1,450. It’s trading at 1119 as of close today – about a 21% discount from where it traded at less than 3 weeks ago.

Yeah, Kirkus, I think today’s Fed announcement will drop some big hints about QE-3, and that will help the market. Probably get a dead cat bounce anyway, since it has fallen 1900 DOW points in a couple of weeks. I kind of doubt that the DOW and S&P 500 will retake their July highs, but they could make a good run in that direction, with an aggressive QE-3 program in place soon.

The Fed was looking for cover to roll out QE-3 and now have it in spades. First of all, Congress completely and utterly failed at their one big chance at deficit reform. And the stock market is down big.

Don’t see how any of this will help housing rebound, though. The whole country, collectively, cannot make mortgage payments from a stock market portfolio. If, collectively, we have to sell stocks to pay the mortgage, then there will be a net outflow from the market.

As Dr. HB says, over the long haul, mortgage payments must come from earned income, not savings or investments. When people lose their jobs, they try to hang on to their houses buy draining savings, then the 401-k. Unless the market rebounds smartly, the ‘hanging on’ period just got a lot shorter.

No argument here…great time to but a RHoG, as a colleague just told me Real Estate is the safest investment…Really? The world is still flat to so many people they cannot see things any other way:

“Few people are capable of expressing with equanimity opinions which differ from the prejudices of their social environment. Most people are even incapable of forming such opinions.”

Albert Einstein

It’s easy to be bullish when you’re TBTF. Barclays literally has NOTHING to lose.

All real estate and especially housing, is fairly local (although cheaper gasoline helps the lesser earning individuals spread out choices of residence in an area). The younger people and potential first time buyers of the homeowning upper class in an urban location (Orange County) have always been paid less than the generation above them (25 versus 45 years old median income). The National Association of Realtors points out that in their opinion, the discussion and actuality of semi-serious creditworthiness to buy threatens to further cut sales volume and prices of homes; and the possible 20% downpayment as desirable to sound banking practice is a threatened disaster to the class who should be (in their opinion) buying homes and thus supporting Realtors. They figure a 20% down payment for a median income family of $52,000 of all ages, will take 13 years to accumulate. That number doesn’t reflect local earnings medians or the current medians of those under 35 especially, though, and that’s a much more critical number and may be a lot less than we think. However wrong this number is for the homeowning class in major cities, it shows their focus is tight at NAR not to let Congress quit the bank-supporting and bubble creating low mortgage rate with no down payment or token; NAR just raised member dues by about half, strictly to use for buying lobbyists, they make clear (thirty million slush fund, approximately).

Keep in mind as DrHousingBubble points out, this whole mess supports the banks, and something like 60% of mortgages are written by just five banks, I believe is the number, from memory. So the NAR and the banksters are on the same page still, to do anything it takes even if a bubble and unsound banking or government results. You know, it should have worked, especially with ultra-inflation going on and getting worse (see proposed social security hike possibly 4% for inflation). Meanwhile, the market for homes has flopped.

The investor class (rehabbers, speculators, small landlords) is mostly out of the market compared to the bubble days. The only place for the public to go to make money is no longer bank cd’s and now it isn’t the stock market despite the FED’s shenanigans. With this recent days’ stock market mini-crash, the small investor especially ought to find that “last investment choice left” a flop too. As DrHousingBubble projects, failure to address jobs and pay is going to work to detiorate home prices, in all likelihood, as the pure economics and demographics and massive student debt hangover plague the marginal homeowner class and all-important first time buyers skitter away. Worse yet, the stock market drop and negative possible “WEALTH EFFECT” will, if experience holds true, slow down sales and resales of the existing, deemed vacant, twenty million second homes bought by the uppermost classes.

Good points. Also, I wonder how the psychology will change towards realtors when higher “real” downpayments of 10-20% are put in the context of commissions of 6%. Let me see, I worked and saved for years for this downpayment, and basically you skim off 30% for driving me around for a few days……

Home buyers don’t pay any commission or fees to a realtor. 50% of the listing agents commission goes to the buyers agent. If the buyer doesn’t use an agent the listing agent just takes the full commission without splitting it.

Krikus, really? Who’s the one with the checkbook in this transaction? The buyer pays 100% of the commission. It’s baked into the price. If there was no commission the price would just be lower.

It’s a free market. It’s not mandatory for anyone to use a realtor. If real estate agents are really not needed, then there won’t be a market for them. You can buy or sell your house on your own.

Yes , and you can do away with attorneys, legal description, title searches, deed restriction s, boundaries, home inspections and all the other little things that can rise from the swamp to ruin your life for years to come.

You fail to take into account immigration. About 1,500,000 people legally immigrate to the U.S. every year. Many of these are skilled workers- Silicon Valley types,etc. Combined with births, the U.S. is still growing at the rate of around 3,000,000 people every year.

The 30,000,000 million people that we will add in the next decade have to live

Somewhere!

Ron. Yes, many of these are skilled workers undercutting skilled native workers. Most of the total immigration are unskilled workers undercutting our bountiful crop of native unskilled workers. We need to stop that inflow. 9% of the labor force is illegal aliens. The unemployment rate is said to be 9%. Does this suggest anything to anyone?

I may be mistaken, but I believe the average household size today is less than two. I think we’ll see a lot more doubling up and larger household sizes. A lot of those 30 million people are going to be living with mom and dad, or their uncle, or with room mates and, sadly, on the street.

I stand corrected. The average household size is 2.6. It is not under two as I suggested.

Also, I’ve heard that illegal immigration is slowing, in in some cases even reversing, because of the job situation.

>Ron. Yes, many of these are skilled workers undercutting skilled native workers.

> Most of the total immigration are unskilled workers undercutting our bountiful

> crop of native unskilled workers. We need to stop that inflow. 9% of the labor

> force is illegal aliens. The unemployment rate is said to be 9%. Does this suggest

> anything to anyone?

It suggests to me a conspiracy theory. Really, the kind of jobs that illegal aliens around here take, most people don’t want. They certainly don’t pay enough to afford buying a house, at least not without taking advantage of a NINJA loan. I can understand bitterness towards importing skilled immigrant labor. However, they are hear legally, and I really think that the immigration process is enough of a headache that companies wouldn’t bother unless they just couldn’t find qualified applicants. Certainly in the group I’m in at my company, we kill ourselves to find someone, anyone who has a clue what they are talking about in the area of high performance computing and numerics. When people are that hard to find, I frankly don’t care if they come from Mars as long as they do good work and their communication skills are not a problem.

I’ve heard this argument a lot and I don’t completely disagree. The real issue though is not that they are going to live somewhere but rather the type of housing that will be affordable to them on their incomes. We have plenty of people living somewhere or doubled up that wouldn’t mind owning a home today – what keeps them out is pricing and uncertainty. This is all about pricing being too high and not wanted to catch a leveraged knife that vastly exceeds your income.

You’ll note the trend toward multi-family housing and much smaller homes (just like we had in the “wealthy” 50s/60s/70s before everyone needed 4500 squ feet to be middle class). Take a look at Europe and see how long the kids stay at home. I don’t really see any way that the larger single family residences of today don’t take a major hit as the incomes don’t justify the pricing. Hell, CA has whole neighborhoods of very well off people from an income perspective who could never afford to buy their home at “today’s value”…big problem. Now potentially multiple families/incomes could double up to keep pricing but that kind of living (nothing inherently wrong but for whatever reason it comes with lots of cars/kids/crime) has destroyed neighborhoods and home values in some areas.

When people voice the ‘have to live somewhere’ argument, I get it but more often than not it’s with the idea that this will support housing as we know it today and there are a ton of implied assumptions that don’t stand up (income, student loan debt, psychology having watched the past blow up etc….).

Anecdotal story – I volunteer to work with MBA students on occasion as they do a business simulation. Each of the last few teams (2-3 years) has tried to pay off their entire company’s debt burden and hold huge cash. All because of “uncertainty”. BTW – these kids have heard all the optimal capital structure stuff and these companies are long-term sustainable and very predictable so no reason to crush ROE. This is a paradigm shift and reminds me about the debt aversion people had in the 1940s-1960s (depression era remembered). These people will graduate with a big loan burden as most MBA tuitions have doubled in the past 10 years. Given their experience and what I just said, even if they land good jobs/careers, how many of these kids are going to be doing houses for 4-5x gross? NONE. Most will probably try to come in around 2-3x at most (a lot happier with 2x) and that will be the limit of their tolerance.

What are MBA programs offering today that they did not 10 years ago? The only “lab” classes an MBA program would need are computer simulation and the price of that has dropped through the floor?

Classes can be taught in a strip shopping center store front, add blackboard, screen, projector and a bunch of tables and chairs.

Same applies for almost all college classes. Plus better parking.

Pedrito: honestly, it makes zero sense to me. From what I can tell top tier universities raised their rates, because they could, and everyone else followed to benchmark so as not to seem inferior. Foreign students or wealthy pay full boat but the majority of US kids have mega loans thanks to the government and this is what enabled this kind of tuition spiral along with a total lack of thinking and insensitivity to price on the part of students/families.

It doesn’t help that over the last decade Universities embarked on major spending/building plans with Hyatt-like dorms and the best recreational gyms in the country. None of this contributes at all to core competency which is passing on knowledge. This effectively squandered their endowments during big contribution years that they are unlikely to see again for some time.

One of the top things that angers me but my other post was long enough without adding in another topic.

Has anybody notice how the PMI insurance companies are facing harder times? If you get rid of FHA and PMI, then you’ll must have 20% down for a house. Let’s see that’s:

*Lower Conforming loan limits

*Harder underwriting standards

*Reduction in the Mortgage Interest Tax Deduction

*Privatization of Fannie and Freddie, which will lead to higher rates

*PMI issues

*Unemployment Issues

Anybody see a trend here.

Ron, 2.6 million people in the US DIE each year, and maybe 300-400K leave the US. Those people aren’t living in their residences any more.

The Good Doctor dispenses his fairy dust of commonsense and awakens the blind.

The leading edge of the baby boomers caught the World War II “King of the World” wave and rode the crest into easy American Dream single income Jim Anderson, Henry Mitchell, Darren Stevens, Tony Nelson, I dream of Jeanie utopia.

Those of us at the end of the Boomer wave got the froth and as I tell my 20 something kids, you got the riptide. Remember to swim parallel to the shoreline so as not to get dragged into ruin, i.e. live without baggage. Jack be nimble and such.

Ron, that’s not true. In 2009 (the last year of data), 1,130,818 people obtained legal resident status in the U.S. The average number of legal residents admitted over the last 10 years of data is 1,029,943, or about 47% less than your 1.5 million figure. In fact, the only years in which 1.5 million or more people legally immigrated into the U.S. were 1990 and 1991. (Source: 2009 Yearbook of Immigration Statistics). Even invading two countries and creating two huge populations of refugees over the past decade couldn’t pump up that number.

And, not all the immigrants are single. So you can’t assume 1 million immigrants are going to buy houses. The average family size in the U.S. is 3.19, so you’d better likely divide the pool of homeowners by about 3. So now you’re down to about 350,000 potential homebuyers. Also, over time, only about 1/2 of legal immigrant heads of households are college educated, so divide again: or 175,000. Considering that the average homeownership rate in the US is say, 65%, make it about 113,750 homebuying households. That group would be able to absorb the 6,000,000 vacant homes in about 52 years.

Oh, and your statement that “that 30,000,000 people that we will add in the next decade have to live somewhere” is substantially true, but they could just be living on the streets or in a van by the river.

…a mini van filled with Al cans down by the Santa Ana, San Gabriel or LA rivers.

I’v been talking about this for 20 years. The same “pig in the python” that caused the housing market to soar in the mid-Eighties is going to have the opposite effect for the next 10 years or so. This would cause a drop in prices even if we did not have the economic hard times.

A home is a rapidly-depreciating consumer good like a used car or big-screen TV. If you really want one and you can afford to lose the money, then buy one.

And, let’s not forget the property tax problem for the Boomers with too much house and property. Some tax bills here in Westchester county in NY are near the average annual American income. I have read of Boomers having to sell their farm properties in upstate NY they bought in early retirement because of the massive and ever rising tax bills. The property and homes on them are very affordable, but, hoo boy, forget about the taxman.

Look at the jobs numbers. Who’s immigrating to the US for good jobs these days? No one!

I just received my new 2012 IKEA Catalog. It’s clearly obvious that IKEA understands their American market very well. The theme of this year’s catalog is: “A home doesn’t need to be big, just smart”. On pages 4-5 IKEA imagined: “What would happen if six friends decided to live together in just 430 square feet”. Yes that sounds like dorm living, but maybe our recent graduates strapped with student loans, are already accustomed to living in cramped quarters. IKEA has stylishly and effectively problem-solved “small spaces” throughout their entire catalog.

Also, many new illegal & legal immigrants to CA already live in small cramped-apartments. Twenty-somethings would rather live with room-mates than live with their parents. And empty-nesters would rather have much smaller & low-maintenance homes. So, IKEA created “flex rooms” to accommodate these growing cultural trends.

It’s quite amazing to see how many “activity zones” one can get in such a tiny amount of space. Clearly, IKEA wants to enlighten Americans to the European way of smart design. For example, one vignette showcases an energy-efficient washer/dryer combo unit in the “wet room” or bathroom. That’s pure GENIUS! You must take off your clothes before showering, so you may as well do a quick load of laundry right there! Makes you wonder why you have that extra-large “laundry room”? IKEA’s multi-tasking rooms = less cleaning & maintenance! NICE!!!

For more info, please check out: http://www.ikea-usa.com/smallspaces

On the trend to “smaller”, Japan knows a thing or two. The inside doors of many apartments are the sliding-type and the rooms are smaller, as expected.

The IKEA laundry-bathroom concept is often seen in Tokyo and other large, dense cities. The toilet is often on a small, separate room, with hand washing sink. Another, larger room serves as laundry and shower. One showers on an empty corner, the water running down to the middle of the slightly inclined floor. On another spot you have the washing machine. Also, a bathtub (more like a small tank), deep, with a step in which you seat and soak a bath. The tank has a sliding cover, like a swimming pool, for keeping the water hot longer or for multiple use — I assume. (Amazing how they stand such high temperatures!)

One does not go into this room barefoot. There are wood shoes, with rubbery soles, that one uses, which stay at the door, once finished.

From the description, one could think that the whole thing is messy, cumbersome, unhealthy. But when one considers their hygiene standards, it makes lots of sense for their often cramped circumstances. As they say, necessity begets creativity.

Thanks for the link, to visit next, and for sending me back down memory lane.

Japan used to have a lot of toddler drownings in their home soaking tubs — I’ll bet the sliding covers on the tubs were probably mandated by the government sometime in the past 10 or 20 years. Older homes may have soaking tubs that lack this feature.

Love it. We did a short sale after and are very happy with our rental but would like to buy again someday. We will stay to 2x or less our income and a 15 year loan or wont due it at all. We also think a thousand square feet will be more than enough for us and our one mid life disabled child (who may always live with us), and this catalog nailed it. Hmm maybe stock in IKEA is still a good bet

The Dr. makes a great point about boomers having nobody to sell to but each other. In many areas of SoCal, banks are already asking for huge down payments, big verifiable income (no self-employed need apply) and months of reserve savings. I have friends who have excellent credit and strong “middle class” verifiable incomes. In LA they were recently pre-approved to finance $300k to buy a house. Unless they move way outside LA or to an awful neighborhood, there’s no way they’ll find something in that price range. So I ask, WHO is buying owner-occupied homes in LA right now? With insanely high asking prices and no credit available, WHO other than wealthy investors can afford to buy homes? And what wealthy investor would ever want to buy an over-priced SFH? It just doesn’t add up.

This one recently sold right up the street from my apt. These houses only stay on the market for a couple weeks here before they are grabbed. Haven’t seen the new residents yet though.

http://www.estately.com/listings/info/1717-fletcher-avenue

Ok so a restored 4br craftsman sold for $1.3 mil, $100k under asking in S. Pas. There will always be a market for those, even though I think those buyers still overpaid. But look at any run of the mill LA neighborhood and you’ll still see asking prices around $800k for crappy 3/2 stucco boxes. I still wanna know – in today’s market, WHO is buying these things if they intend to live in them?

This is for Pwnd. If LA is anything like the Bay Area then I can sort of guesstimate who’s spending 800k for ho-hum houses. In the Bay Area there are the following common buyers:

A: Other Boomers who can use their equity. They basically swap one house for another or pay a bit more for a better one. That sort of defines the content in this post.

B: Dual income families, typically in their 40’s buying a first home. Around here you’ve got married couples working in tech making 200k-400k combined incomes. That’s still risky for buying an 800k home. But they do so anyway.

C: The same couple above with a large amount of cash given to them by parents. Id say a huge swath of buyers here fit that definition. Mom-n-Dad give em’ say… $100k or so or more. Ive even run into people where their parents bought a house for them.

Also- you mention 800k for a typical home in LA? That seems high. Around here 500k for ho-hum houses seems the norm unless we’re talking about “Fortress” areas.

up the street from your apt.?

“I don’t really see any way that the larger single family residences of today don’t take a major hit as the incomes don’t justify the pricing. Hell, CA has whole neighborhoods of very well off people from an income perspective who could never afford to buy their home at “today’s valueâ€â€¦

+1 Sample and hold

Its da banks man…Da Banks! with their shadow inventory and bailout balance sheets.

I get RE shlubs calling me every week or two who have ended up with my number after my house hunting folly over a year ago. I tell them that I am waiting for the bubble to deflate. Must be a bummer shilling the residential properties this summer in the OC. I will probably be wrong and we will get an OC Register report showing a year over year 3rd quarter increase in sales and/or RE home prices. It is like groundhog day over and over.

Repeat – incomes do not support pricing – Repeat.

The above story is what happens when a number of unintentional events happen.

1: Prop 13 passed and prices subsequently start their bubble and pop cycles, but at the end of each bubble prices ratchet up more and push out one more economic demographic. Basically those prior to Prop 13 ” Got in” when prices still made some sense.

2: As this occurs younger people can’t afford to buy their homes. Or if they do buy, they buy shacks and when they do, they’re either well-off or older. Most I know who have more recently bought are in their early 40’s, and bought either a teardown house that needs a TON of work, or they’re buying a tiny loft or some other small piece of real estate that in the past would’ve been prime real estate for the working class. The scale of what people can afford gets pushed down.

I can attest that the Bay Area in particular is growing older. Since a lot of people my age ( 30’s) can’t afford it we move away to states like TX and NC, which incidentally have some of the youngest average ages in the country. I think Austin has an average age of under 30 and so too does Atlanta. Meanwhile California ages away. Practically everyone in my east bay neighborhood who owns is in their 60’s-80’s with the exception of a lawyer couple.

The irony of this is that I’ve been to numerous estate sales at huge, beautiful old Victorian homes. In many cases the carpets are thread-bare, the walls haven’t been painted in decades, the appliances and furniture are old and ratty, and its basically clear that the owner had no money and worked at some working class or lower middle class job- a job that in no way shape or form would ever enable them to buy the house they could now never afford.

At some point this pattern will have to change because either all young people will move away and there won’t be anyone left to buy, or prices will have to come down more.

Another enemy of prop-13 ? Please explain. Jarvis is one of my heros, why do you detest the poor so much?

Prop 13 wasn’t passed to save lil’ old ladies from losing their homes. At least that’s what it was touted as, but the truth is that it was more for corporate real estate and the windfall benefit they would get from passing such a law.

The reason I dislike the law is because it was passed in an unintelligent way. It was passed universally- meaning EVERYONE was placed under its umbrella. Why was this wrong? As mentioned before, this law has been repeatedly touted as the law that saved old people from losing their homes. In almost all other states residents of a certain age get their taxes lowered or frozen on their properties- the idea of course being that retired people have limited incomes. This works in the approximately 48 other states that do so. But in California the law was passed for ALL residents. Instead it should have been passed only for those that it was touted as being for- elderly residents.

This in turn basically created a single generation of homeowners whom enjoyed windfall appreciation and had to pay no more in taxes as a result. This in turn meant hardly any pressure for them to sell or downsize. But this also mean out-of-control appreciation and less and less ability for later generations to purchase.

But let’s look at another state for comparison. TX has some fairly high property taxes. But that said, prices are still within reason. Why? Because there is a penalty for appreciation and this in turn tends to put a tamper on rampant, out of control appreciation. This means prices stay more inline with real incomes because the tax bill will always be due and the more those prices go up, the more the owner has to pay. This works out nicely as a sort of check and balance system. This sort of situation doesn’t exist in California. Instead there are zero consequences to the owner if their values go up. But buyers on the other hand have to stomach that additional cost in the form of ridiculous home prices.

A few weeks ago I went to a handful of open houses in Forest Hills, Queens. they were townhomes located in “The Gardens,” a pre-war WW II subdivision just south of Austin Street. One of the properties I saw was a 4-bed, 3-bath home that was $1,399,900 at the time. On a more recent visit the price dropped to $1,299,900 & when I checked yesterday it was $1,150,000, a $250,000 drop in 7-weeks.

The house was great, but the bacement as well as the upstairs bathrooms needed serious work & even the agent I spoke to said as much. Despite that nessessary remoddling, the property had great bones .

Interestingly the home backs to the LIRR tracks & even with speeding trains, the house doesn’t rattle at all do to it’s concrete block & brick construction.

I wonder who will be able to pay that kind of price even though taxes & maint come to about $5500 a year, wich for this area isn’t bad at all.

Has anyone been warning Brazil the banksters are leaving the US?

“It’s quite amazing to see how many “activity zones†one can get in such a tiny amount of space. Clearly, IKEA wants to enlighten Americans to the European way of smart design.”

More or less a necessity rather than just smartness, I’d say. 😉 IKEA is a Swedish company and that shows.

Here in Scandinavia apartments are very small and expensive, thus you have to conserve space and that more or less is a reflection of the climate: -20F at winter means you have to have good insulation and real heating systems and those tend to cost a lot.

Heating bill is more or less related to the amount of cubic feet you have so a big house is for really rich people. Also property tax punishes by the value.

I’ve an apartment of ~600 sq ft in a decent area (car is not broken into at parking lot) and this is more or less luxury size for one person, I think this is designed for a couple or a couple with a baby, way too small for bigger kids.

The games are not over, they are only beginning with AIG suing BorA. There are many lawsuits in the works that will make the CPA’s and JD’s rich. BofA is going down, along with a number of others. You know the names, the usual suspects.

I know a newly-graduated Actuary who can’t find the traditional insurance co. job that most with that degree go into. I told him these are far-from-typical times, and he should instead look to get on with the LAW FIRMS who are suing the insurance cos. and banks! I told him that DC law firm that did the 2,000 (or was it 20,000) page post-mortem on Lehman Brothers is a great example.

It’s sad that the civil courts will be the only dispensers of justice in the reckoning of this Crime Against Humanity. 😡

“I have found no argument that convinces me of rising home prices at least for the next five years.” I agree, it could be longer. But if we get hyperinflation from foreigners not buying our T bills, all bets are off. Europe could have their bank failures soon that can affect the currency.

When will SoCal real estate stabilize? Like business, I don’t like uncertainty. I can handle low prices with a lateral move(no mortgage). When the market stabilizes, then I can get out of town.

It will be interesting to see how the Verizon Strike plays out. We’ll see if this is the final nail in the union movement coffin. If so it does not bode well for a strong middle class. It is hard to build a society with such a violent wealth disparity.

I also wonder if the European Riots will be exported or contained.

Aimlow Joe was here

http://www.aimlow.com

We are in a period of massive uncertainty and housing prices are out of alignment with income and employment is not stable these days… who in their right mind would buy right now?

@nobody- yes, up the street from my apartment. I don’t own a house. Lots of apartments in South Pasadena.

I hope prices decline but I try not to get my hopes up. I understand many 30-somethings are willing to leave So Cal but I simply won’t live in a different climate. My husband, who is employed, makes 60k/year. We are a family of 4 living on that. We can only afford 1000 a month for housing so my mom lives with us to help pay. This may sound like a typical situation but the irony is that we inherited and own a home free and clear in CO, but do simply do not want to live there. Not sure what will happen but I know plenty of people live in So Cal cause it’s not like everywhere else. FYI, we will only buy here when 100K down gets us a house in the South Bay, will that ever really happen? Not holding my breath that’s for sure.

No agenda here… but What about rising rents? My 30 year fixed mortgage never goes up but my neighbors rent does!!

Rents are said to be rising across the country. The rentals I see are tiny, pricey or crap, mostly crap.

Leave a Reply to CAE