The return of the prodigal interest only loan: The appearance of safety is bringing back our favorite mortgages.

What if I told you that you could have a $600,000 mortgage for a monthly payment of $1,700? Sounds like a great deal right? Of course the only way to get this kind of action is by going into the “exotic†mortgage options that everyone once thought were put to rest. I was going through some of my mail and noticed a surge in the last year of offers for creative mortgages and credit card offers. The volume is close to what it was in 2005 and 2006. I’m thinking that the difference this time is that the insane offers are now only going to those with decent credit as opposed to every person in the virtual phonebook. One flyer caught my attention regarding interest only mortgages. Interest only? I thought these were done. So I decided to run a scenario for an $800,000 home purchase with $200,000 down (25 percent). What I found was interesting and also highlights how some people are assuming a big down payment is somehow the immunity from risky moves.

The interest only loan is back!

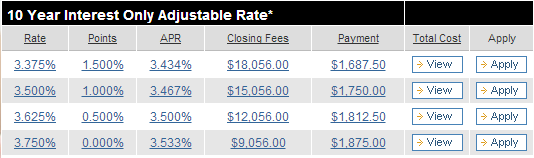

The interest only loan has slowly crept back into the market over the last few years. A few years ago, only a few players were offering this loan with large down payments (30 and 40 percent as a minimum). Today you can have it for 20 percent. Check out the numbers that I ran for a $600,000 mortgage on a home with a price tag of $800,000:

Not a bad deal! Sure, for the best rate you’ll need to pony up $18,056 in closing fees but check out that ridiculously low monthly payment. Astute readers have pointed out many times that when it comes to housing, the only thing that matters is the monthly payment. Let us set aside that we are paying $800,000 for a home. I’ve missed these loans because they really highlight the manic mentality of our current housing market. When someone goes into an interest only loan like this they are making a bet that housing prices will be rising in the future. For those that make the minimum payment, they are definitely making this bet because after 10 years, you still have a $600,000 mortgage to pay off. If you do this and home prices stall, you are basically renting. After 10 years you can sell and take out your down payment but you need to factor opportunity costs lost from that $200,000 not being put to work elsewhere.

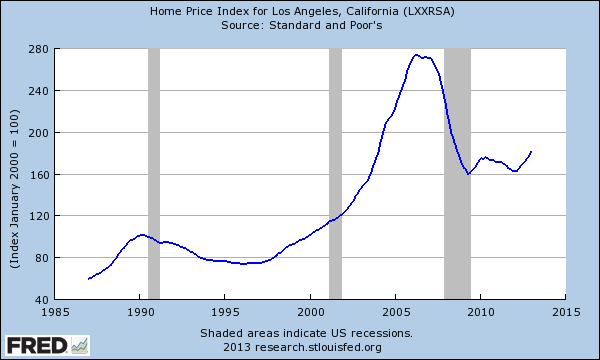

There is no guarantee on anything in life as we all know. Heck, 10 years ago housing bubble 1.0 was merely in its embryonic stage. What has happened since then? A roller coaster ride of ups and downs. We are now back in full manic mode especially in California, where these loans are likely being used:

Home prices are back to where they were in 2004 (nearly a lost decade). So taking on a 10 year interest only loan on an $800,000 home is a big deal. Keep in mind that going back for a half a century the average mortgage rate was around 7 to 8 percent. Let us assume that rates in 2023 go up to 6 percent and your only option is to refinance into a conventional 30 year fixed rate mortgage. What does the payment look like?

30 year fixed rate mortgage ($600,000) at 6%:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,597

That is a big difference from the $1,687 in the 10 year interest only option. Also, don’t forget that you have taxes, insurance, maintenance, and all the other typical costs of owning a home. For an $800,000 home we are looking at an additional $800 to $1500 a month depending on where the home is located. So even with the interest only loan, we are looking at a monthly payment of $2500 to $3200.

Yet this kind of loan helps to explain some of the irrationality occurring with some buyers.  Keep in mind that very few actually have this amount of a down payment. The all cash buyers of today are investors (buying up 34 percent of SoCal properties). Given the smaller and smaller number of American families that are able to keep up, don’t be surprised if that mortgage deduction isn’t curtailed at some point (especially with broke states hungry for money). I can certainly see it being capped at $500,000 or $750,000 – probably less given the median home price in the US is less than $200,000.

It is interesting to see the interest only option now making a strong comeback in the market. Just because you put a large down payment doesn’t mean you are safe. This reminds me of a beagle burying bones in an area prone to sinkholes. A large down payment only means you were able to save for a very long time. Once you plow it into a home of this price and going with an interest only loan, you are making a big bet on the future. I was off when I said most ordinary people were off limits from the maximum leverage being provided by the Fed. Apparently with a 20 percent down payment, you can get some of the action as well.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “The return of the prodigal interest only loan: The appearance of safety is bringing back our favorite mortgages.”

If buying options on your own real estate becomes widespread again, I can’t think of another sign of how frothy the market has become.

Insider money is buying in anticipation of govt making more money available for the retail buyer. Pump and dump in full swing.

http://usawatchdog.com/real-estate-pump-and-dump-scheme-fabian-calvo/

Southern California is great, at least if you can afford the nice bits. However, if you have $200,000 for a down payment you could buy anything from a decent house to an outright mansion in 80% of the country. That sounds real nice, no debt!

That’s not the point of SoCal. People in CA don’t want to live in miserable rainy Oregon. Zzzzz boring. Is oregon Silicon Valley a local Best Buy?

Fact CA > *

It’s not rainy here and $300K buys you a new 3,000 ft craftsman style home on 2 acres with shopping 5 minutes away and the airport 45 min away. Your choice isn’t S. California or misery.

I wasn’t even talking about Oregon – the vast majority of the country has extremely affordable housing with a good portion of the community that is not developers/flippers/investors creating an artificial market.

The problem is the majority of the country is nothing like Southern California. Not even remotely close. No one can match the weather, the diversity, the great food, healthy lifestyle, to me and millions of others this is the best place to live in USA. Maybe Hawaii is better but that’s a little disconnected.

Apparently the only person here who thinks it’s a “problem” is yourself.

My God My God…..Wall St. got off scott free and here we go again…..this truly is the twilight zone….

its sick! that’s what happens when the banksters get to put their former attorney’s that helped them pull off the scam as our US atty General and also place the head of our criminal division at the US Justice Dept. Both helped the banks create MERS and white favorable legislation that allows the banks to use the homeowners in their scam. If everyone woke up we would have economic collapse because people would be rioting in the streets. If people don’t wake up we will have economic collapse later.

Bank of America (BAC) offered me another interest only loan back in 2010 or 2011. I told the fella that I didn’t need to be doing that anymore (I had an interest only loan that started in 2005), and he then agreed it was a bad idea.

What I find extraordinary is that not one person that deals with BAC customers has access to an interest-only/adjustable rate calculator that shows an amortization table (where the rate can be manipulated, and such would then result in an updated table). Questions like, ‘If the interest rate is x next period, and I have z more months on my loan, what will be my monthly payment during that new period?’ are on par with tensor algebra or tensor calculus when it comes to customer relations there.

Talk about bureaucracy: someone there has to be operating the computer that calculates the adjusted monthly payments and publishes these to the bill you get in the mail (if you have an ARM). Yet this person or set of persons is not accessible to the public. This puts three thoughts in my mind: 1) Where/what is the quality assurance that oversees that the computer doing the calculation is doing it correctly; 2) Because no one at the customer service level of BAC is trained on the dynamics of an ARM, such is just more evidence that the ‘Masters of Mankind’ like to keep the wool over the eyes of their sheep as they’re robbing them – easier that way; 3) Because no one at the customer service level knows what the heck is happening inside an ARM, if the computer that does the calculations did ever have an error, then no one at the customer relations level would understand the discrepancy. The only way to resolve such an error would be through a legal claim against them in court using an accountant or a mathematician as an expert witness. Expensive.

I begrudgingly thought I was going to have to make my own excel spreadsheet amortization table for an adjustable rate loan since it seemed like such a mystery to the dozens of people I talked to at BAC, but I ended up finding one someone else made online.

Nominated for best comment ever on the housing bubble and our political/economic system in toto.

What’s funny is that BAC sent me a ‘How is our service?’ survey shortly after I talked with the entire team of in house, online, and phone customer service people, and I let ’em have it about the ARM calculation. Not that those surveys mean anything – just a technique for creating the perception that they actually care about their mortgage clients.

Shortly after that they sold my loan servicing to M&T, and then I refinanced to a 20 year fixed rate.

Dr. Housing Bubble, great article as usual. Those numbers are absolutely amazing how cheap the monthly payment is, this all points back to how absurdly low interest rates are. While I would never recommend doing this, it is very intriquing from a numbers standpoint. Anybody buying an 800K house should have a very healthy income. If the mortgage payment is only $1700/month (all interest, all written off)…this should free up LOTS of money every month (I’m thinking business owner or investor). If the person doesn’t completely squander this money away, they should have quite a nice stash after 10 years. Yes, you are essentially renting the place but with a twist. Your payments are fixed for the next ten years, you get appreciation if there is any, no moving and you are likely way below rental parity. I would think most 800K houses rent for 3K plus per month. Just more fuel onto the fire…

or you could end up like me, with I purchased a $850,000 home l owed 530k w 30 yr fixed rate. I had my home since 2002. It’s now worth 300k. So I lost all my cash I sunk into this house. After playing on it for 11 years. That’s what happens when price is dictated by Wall Street investor demand and not in sound economic principles. Now it’s simply gambling.

Everyone I know that bought back in 02~04 (a couple dozen people) all can still sell their homes at prices equal to or greater than the price they bought for. Some can actually sell for almost double given the current market conditions. Sounds like you just got a really really bad deal on your home…

NO, price was based upon what you were willing to pay.

Lynn, where on earth did you purchase a home in 2002 for 850K that is worth 300K today? I’d like to know because this doesn’t make sense at all.

How and why could you be so wrong about a house of that price. Again someone who didn’t know wtf they were doing.

Why not just invest or start a business with the 200K you already have on hand instead of putting it down on a home and using the extra cash saved from cheap, tax-deductible mortgage payments? Furthermore, if you want to use that 200K, you’ll have to take a loan against it as well.

I’m a bit lazy to calculate all the numbers, and the bottom line would ultimately determine whether I would really do it, but my initial inclination would be to just use the initial 200k capital and forget about accruing savings over time. After all, time is money too right 😛

Interest only makes a lot of sense. All the risk is now on the lender. In 10 years you can save up the 600k to pay it off or walk away based on the current value. With inflation it’s almost free money. It may make sense to buy 100 homes, interest only, rent them out to cover the interest. Then in 10 years if they went up 50% cash out, if they dropped, walk away.

Not a bad strategy. That’s why Wall Street is getting in in the game.

oh my god, i just said that right before i read your comment – great minds think alike! If you do interest only, you will even free cash flow the place (rent > mortgage and expenses). Not only will you get any appreciation in 10 years, you can even structure a nice income for yourself in the mean time. START TO LEVER UP!

I sure hope that you’re being sarcastic, because 200K down doesn’t strike me as risk free.

Nice ethics, fella.

@Lord Blankfein wrote: “…If the mortgage payment is only $1700/month (all interest, all written off)…this should free up LOTS of money every month…”

Sorry dude, but that’s not the way mortgage interest and property taxes work. Mortgage interest and property taxes go on Schedule A (itemized deductions). They are income reductions not tax credits. They are not “all written off”, as you think.

Example: $800K home, property taxes $8000 per year, $1,700 x 12 = $20,400 mortgage interest. Schedule A itemization: $28,400

Married couple taking the standard deductions: $19,500

The Dr. HB example would require a household income in the 28% tax bracket.

Hence: $28,400 – $19,500 = 8,900 * 28% = 2,492 per year in savings.

The actual monthly savings from this interest only mortgage is about $200 per month. So Lord Blankfein, do you consider $200 per month in savings to be LOTS of money?

If the couple has a 401k plan, they can contribute $16,000 per year per person. That negates the $200 per month. Contributing $5000 per year per person to a Simple IRA also negates this interest only loan advantage.

Standard deduction for married couple in 2012 is $11900

Standard deduction for single payers in 2012 is $5950

The calculation for a married couple in the 28% bracket should be:

28400 *.28 – 11900*.28 = 4620.

The calculation for a single individual in the 28% bracket should be:

28400 *.28 – 5950*.28 = 6286

This deduction is also applicable to your CA state income tax return.

People often have other potential deductions that were not able to take due to taking the standard deduction: vehicle license taxes, some medical expenses, and charitable contributions, etc.

Households in the 100k-200k range averaged a deduction of 9,269 in medical expenses and $3754 in charitable contributions in tax year 2008.

If you have medical expenses or tithe/donate regularly to charity you’ll probably find more value from the MID. If MID + Property Tax is the only deduction you take, you’ll find less value.

Ernst, I can see you didn’t do too well in math class. I am quite aware that filling out scedule A reduces taxable income. You forgot some key numbers in your calucation, are you aware that property tax and state income taxes can be claimed on scedule A. For a married couple buying an 800K house, you will need a healthy income (I would guess close to 200K per year). That is likely another ~12K in state income taxes that can be written off. So let’s do the math again for a married couple.

Standard deduction plus exemptions = 12200+(2*3800)=19800

Itemized calculation

Exemptions = 2*3800= 7600

Mortgage Interest = 12*1700 = 20400

Property Tax = 10000

State Income Tax = 12000

Total = 50000

Difference = 50000-19800 = 30200

Assume 28% tax bracket = 0.28*30200 = 8456 in tax savings or $705/month.

I would call $705/month tax savings significant…wouldn’t you? And this is for a married couple. Doing the calculation for single is even greater savings.

Ernst, don’t hate the player…hate the game!

Bear in mind that your rental on the property includes the security deposit (not guaranteed refundable) so to speak in the form of a down payment. Interestingly enough when you do the math to amortize 200,000 down over ten years it comes out to 1666.6666666666666 presumably into infinity. Hmmm Mark of the beast? In any event mathematically your payment is now using the 1700 payment you cite your monthly rent is 3366.66666…. You lose the deduction portion of the 1666.66 a month and you gamble that the value of the property will remain stable or increase. I have to agree with Dr H. here – you are taking a big risk on one of these properties particularly here in Cal. where the cost of housing is still way higher than income parity.

C’mon guys. Be patient. It’s an echo bubble. Not uncommon. ALL bubbles come to an end in one way or another. Don’t get discouraged.

Dr. HB, you really need to stress California property taxes. The minimum property tax is 1%. And if you live in an area with Mello-Roos, local assessments and levies, this could go as high as 2%.

So this $800,000 home could potentially have an annual property tax bill of $16,000, or about $1300 per month. Even with a Schedule A income reduction, (assuming Congress does not take this away in the future), it’s still $12,000 a year or about $1,000 per month in property taxes.

The mortgage interest deduction basically cancels out property taxes.

Depends on your tax situation.

Numbers never lie – I like that. I am in the process of buying a house – 600k, 183k down, finance 417k – max conventional mortgage in my area. @3.5% for 30 years equals ~14.5k yearly in interest, my property taxes are 5k annually. That is 19.5k itemized versus the 12.2k which is the standard deduction. Now lets say my effective tax rate is 25%, I only saved 25% on 7.3k or $1825 – no where near canceling my property taxes. An added bonus yes, but $150 a month is peanuts considering how much this saving is touted.

Property tax is cheap in CA at 1.25% of most areas. Other states are much higher and they don’t include sunshine. Instead you get a $800 heating bill in the winter months.

CA > *

I’d bet that I spend more money on AC here than I would on heat in Oregon. I’ve gotta get the hell outta L.A. and move to the Pacific Northwest, although they’ve got their own little bubble brewing.

Sunshine is overrated, and, despite living here 15 years, so is L.A.

No need to go to the Oregon Territory when you can come down here to Texas and get a spread for cheap(no school taxes on the property tax on the ranching land) and raise your own beef like me.(if you are a vegetarian, then go to Oregon). Plenty of free sun down here and throw in the humidity for free. We got along just fine before refrigerated air. Old windmill makes the juice now(electricity, not white lightning, that is my cousin in the eastern Tennessee hills).

If you think property taxes in California will stay low with all the hundreds of billions in future state obligations, you are either a fool or an idiot, or both. How about California income tax, where do you think that is going? California has a tremendous drag on the economy in the depths of places like East LA. LA County has around 100,000 gang members. Why not buy a house for cash, $150,000, in Compton? Instead of throwing it away on a downpayment. I think it is just as sunny there as Culver City.

Sean is a KOOK

I’m Koo Koo for California. Tax may go up here 1%. Big deal. It’s worth it. And now we are going done the lets be scared of gangs? Get real, there is trouble anywhere you live. I think irvine is safer than most large cities.

All the talk of California being broke, I don’t see it. Irvine has great schools.

I know history repeats itself but seriously? This fast?

Yep, this fast…. it’s what happens when we vote the inmates back to run the asylum again…

Vote? The wolves voted themselves in.

A banker I know was saying the same thing.

When the FEDs raise interest rates, all these high housing prices will need to come down unless by that point, everybody’s income has gone up to accomadate that interest increased. Lord Bernanke and the FEDs have hinted that they will not be raising interest rates anytime soon. So… I guess for now, all the people who purchased their home at inflated prices can enjoy their high prices a few more years until interest rates really does go up. The last housing bubble hurt a lot of low income people. This new housing bubble will hurt a lot of the middle income people with good credit scores and a good down payment. Scary.

I finally come to accept that the Fed CAN’T (or won’t) raise rates for a very very long time. Sadly, I think this bubble is going to continue to inflate for quite a while.

I don’t think so. Many people in their 20’s don’t have incomes, credit or down payment for an overpriced house. They can’t even rent an apartment. The next cohort won’t be able to afford these prices. Incomes just aren’t there. I think within the next 5 years when boomers really begin trying to sell we’ll see huge inventory increase and declining price.

This will end badly again…..and it will be before 2023.

This time with people putting down 20 percent and 25 percent down payment when the bubble bursts they will lose all their cash! What a smart way to transfer the wealth now they will not only get to steal all the homes back, but they get all that cash too! Banksters gotta love em. They have stealing down to an art form.

I personally wouldn’t do it since I’d prefer to be conservative, but it doesn’t seem exceptionally risky. Certainly not in the same league as the no-money-down ARMs of 7 years ago.

If know you’re going to stay for less than 7 years, consider this..

$600k home / rents for $3k (similar to another article Dr. HB posted here a month ago)

You can probably get a 7/1 interest-only loan for ~3% probably less

480k @ 3% financed is $1200/mo

To simplify, we’ll say mortgage deduction cancel out prop taxes. Yes, there is a possibility this may change, but IF it does, it will probably be gradually edged out within this 7 year timeframe.

Throw in insurance + maintenance at $300/mo and we’re at $1500 give or take which conveniently is about half the cost of rent.

At the end of 7 years you’ve saved $125k vs renting and that’s assuming rents haven’t gone up in those 7 years. Closing costs and selling fees will be your biggest hit, and the biggest unknown is if your home will be worth more than $600k 7 years later, but you do have your rent-savings cushion to work with.

Absolute worst case scenario in 7 years if home prices have crashed: You walk away from your home and leave your $120k downpayment behind. That pretty much balances out the $125k you’ve saved in rent and you’re in credit jail for 4-5 years.

Best case scenario is you’ve saved at least $125k in rent + gained whatever amount your home has appreciated.

I wouldn’t do it since one can get a fixed 30 year for .5% more and not have to put on a timeline on your home, but I don’t think it’s financial suicide either.

Don’t forget the $18K in closing costs and potential interest to earn on that $200K that’s locked away.

Now your example doesn’t look so great.

You also didn’t mention the possible case scenario of income stream disruption for which renting gives a flexibility advantage in case a quick exit from monthly expenditure is needed. I’d rather break a lease anyday over a foreclosure.

Your worst case scenario is also lacking. Good luck discharging the debt on a BK if you don’t pass means testing. Recall that just before the last bubble popped, the banking industry lobbied for and got the means test put into law.

Your right that it’s not financial suicide, rather it’s financial roulette.

There is no free ride.

I was trying to keep it simple, but for your sake I’ll add the numbers up.

“Don’t forget the $18K in closing costs and potential interest to earn on that $200K that’s locked away”

– On my example the DP was $120k. With closing costs at 20k, it’s up to $140k. A 5+2 Year Jumbo CD would net you less than $20k. Interest income would be taxed at ordinary tax rates, so less ~30% of that. Of course your miles may vary if you choose a different investment vehicle.

“You also didn’t mention the possible case scenario of income stream disruption for which renting gives a flexibility advantage in case a quick exit from monthly expenditure is needed”

– In an emergency, renting out for $3k/mo while paying $1.5k/mo is doable, even for a novice landlord.

“Good luck discharging the debt on a BK if you don’t pass means testing.”

– Who said anything about bankruptcy? No means test on a foreclosure.

– No deficiency judgement on a non-judicial foreclosure

Things are rarely as simple as they are promoted to be.

“Of course your miles may vary if you choose a different investment vehicle”

Exactly

“No deficiency judgement on a non-judicial foreclosure”

Assumes a judicial foreclosure along with other assumptions.

It is sad to me that we now live in a world where “walking away from your home” can be part of a strategy.

Justify it all you want, but I call it stealing.

“It is sad to me that we now live in a world where “walking away from your home†can be part of a strategy.”

It’s a legal document you agree to with a bank, not a promise to a family member. The bank charges you interest for the right to borrow money and will confiscate your collateral should you fail to live up to the terms of the agreement.

It is no different than an ETF on a cell phone contract or putting down a deposit on a hotel room and forfeiting that deposit if you don’t show up. You “promised” a hotel that you’d pay $100/night or $50 deposit on a room. Is it morally wrong to not pay the $100/night and just forfeit the deposit instead?

Everybody has their own set of morals; if you don’t agree with strategic default then I supposed the worst case scenario would be much worse than what I outlined above. Bankruptcy if that’s within your moral compass or a $800k loss if it is not.

Jim m, it is nothing more than a business decision. That is an option for the homeowner, it is not illegal so I would keep the morality and ethics out of it.

Here is some justification Jim.

Our government is outlawing everything. You don’t think so? Outhouses were outlawed long ago. Today it is against the law to go to the bathroom in the U.S.A. except in a Department of Environmental Conservation approved system. To make sure I’m not arrested for bandaging my finger I’ll have to read and understand how many pages of Affordable Health Care Act ?

Look up license in the dictionary : A license is permission to do what would otherwise be against the law. When did we outlaw taking a wife and starting a family ? When did we outlaw beating nails and sawing boards ? When did we outlaw cutting meat? When did we outlaw locomotion ? When did we outlaw riding a bicycle or driving a car ? When did we outlaw building a home for the family.

When our government starts treating us like criminals over everyday things then maybe it’s long past time to admit the fact and start acting like one !

I hate it as well .

In other words. I’m getting to the point where I don’t care what a mans got to do to provide for his family. Even if it means squating in a half a million dollar home.

Jim it’s called a put in the stock market investing. The bank is taking a risk and they have no problem collecting the interest or turning you over to collections if you miss a payment. So don’t be a chump and lose all of your money because you feel it’s steeling even though its not.

Why frown on the strategy? Why should folks like me who have saved up a large down payment put it on a house in this market that has irrationally increased?

I too thought it wasn’t the right thing to do, but I’m not going to bet my saved down payment money that this bullshit of a recovery is real. I’m putting down as little as possible and walking away if things don’t go well. Blame the banks they produced this Playbook over the last few years and the government backed them.

Jim, I applaud you for sticking by your principles. A fundamental reason why we find ourselves in this environment is due to many people abandoning the golden rule of doing unto others as you would to yourself. At some point, our national culture shifted from proudly creative to shrewdly making money from money. It’s a popular diversionary tactic to frame the debate in the context of just doing business or what’s legally possible as if those two categories automatically are exclusive of wrongdoing.

I don’t regard it as stealing but it certainly is void of regard for others. Why? Because we are all forced to participate in this monetary system. People that abuse the system in an attempt to get free rides leave a wake of disruption that affects everyone else whom are participants of the system. They are taking from the pot without giving a commensurate share back to it in return. This is because new money is created for the loan action and if they walk, the money doesn’t suddenly disappear. It’s still in the system whereby subsequent users rightfully expect use of the value it represents.

That’s why I like to say that there’s no free ride, because someone always pays.

Joe,

Applying golden rule to bankers? You must be kidding. They loan you money that they created from thin air and they could care less if they are paid back, because if not, the government will pay them back anyway. Walking from a loan is not moral because it hurts people playing by the rules? So they don’t mind being sheared by the banks, but they don’t like it when some people refuse to be good sheep and break the ranks. I say it’s their choice to be sheared instead of putting an end to this miserable system.

If I am a “chump” for purchasing a $150k condo that I can easily afford rather than leveraging myself into a home that I might have to “strategically default on”, than I choose to be a chump.

“…A mans got to do to provide for his family. Even if it means squating in a half a million dollar home.” Sorry, that argument doesn’t hold up for me. I live in a building where 1st & 2nd generation immigrants are raising a family of 4 in a one-bedroom apartment. And they are the best neighbors a person could ask for.

I really do not care if the banks lose money on people walking away when they failed to do due diligence in their lending processes.

However, the problem no one seems to mention here is that it has not been the banks who are footing the bill — many of the loans got passed onto the taxpayer. That is something I do have a problem with….

Jim, living within your means is prudent. I agree with that. But if someone ever get stuck I don’t have problems with them defaulting on the loan, that’s why you pay interest because the bank is taking a risk. A chump would be a guy who tries to pay the bank back instead of putting it on the bank. If the bank wants to make stupid loans then let them take the loss. The problem last time around was that banks were able to pass on those crappy loans

“But if someone ever get stuck I don’t have problems with them defaulting on the loan, that’s why you pay interest because the bank is taking a risk.”

Agreed. My original comment is in relation to “strategic default” being part of a strategy when buying. I consider that stealing.

If I lost my job and had no income for multiple years, would I be a “sucker” for continuing to pay my mortgage from savings even though I could walk away from the home and rent?

Gaius is almost there. The point is that the bankers won’t take it in the ass because the government has demonstrated that they will ensure that the misery is spread by use of the vary tricks that are being exposed on blogs like this and in the “alternative” media. Hello, remember Too Big To Fail? The banks didn’t take the haircuts that they signed up for because it would have brought significant pain and change to the system that feeds the status quo.

Whom does the misery mostly spread to? Holders of the monetary units which back the system we all participate in. That means that you’re not sticking it to the bankers when you walk, you’re sticking it to everyone. When everyone starts to do that, there’s a profound cumulative impact.

So yeah, go ahead and tell yourself that stiffing someone on the bill doesn’t hurt anyone like yourself.

It’s kind of a slippery slope considering individual preservation versus systemic risk. Like one of those game theory exercises….

If morality should not be considered when trying to preserve one’s money during a strategic default, then applying this idea to other ‘levels’ of the system results in the rationale that bankers, politicians, realtors, Greek union workers, etc. should also be allowed to interact with the system for their own gains, with no regard of how it affects the entire system.

If it is perfectly fine to make a deal with a bank, knowing there is a significant probability you will apply the contingency part of that deal, then it is also perfectly fine for a corporate VP and CEO to make hundreds of thousands of millions of such deals for their own gain, knowing that in each individual case there is too a probability attached that the contingency will be executed.

And then it is perfectly fine for the government to interfere in the game, when it gets out of control, knowing there is a significant probability that it would be in a better position if it does so, than if it does not.

In other words, if everybody is doing what is right for themselves, with no regard for the entire system as a whole, then the game can be played perfectly by every individual and still result in comprehensive disaster that affects all the players.

What kind of system one would like to participate in then boils down to their (or the community’s) subjective values. I think most people apply a synergistic philosophy to community interaction (whether they’re conscious of such or not): the interaction of the players results in something greater than the sum of their individual efforts. Most people put a value on this synergy.

I read a few years ago that very few people that are underwater actually do a strategic default, even though it would probably be better for them if they did. Most defaults are from job losses, health bills, etc.. Imagine that if everyone that was underwater in 2008 or 2009 strategically defaulted. What are the good and bad things that would have happened in that case?

A secondary point is that the ‘moral’ argument is not wholly about ‘breaking your promise’ to a bank, or other points that revolve around a closed system of just two players (the mortgage lender and its holder). Because in reality, there is not a closed system like this. The contagion can spread beyond this subset to the entire system.

Like it or not, on some level we are dealing with a moral/value infused system.

Most folks purchasing (or that should have the income to purchase) a 600k home in CA, NY, NJ, CT, etc would pay alternative minimum tax-AMT-and therefore do not get the full mortgage interest deduction.

Also, someone (Sean?) was bragging about the low property taxes in Cali at 1.25%. They are low, but you would need to compare size of home and property or it doesn’t make much sense. The same size 1700 sq ft, 1 mil Cali home on a 6000 sq ft lot in studio city can cost much less elsewhere so you need to look at the home price youre multiplying the property tax percentage by. Also, Cali income taxes suck worse than anywhere in the country. If you got a mortgage, youre probably proving income and paying income tax here.

PS: Cali is enormous and has a ton of positives. I’ve heard people brag on these boards about Cali being a huge economy and that’s true….however, its also way over bloated with enormous pension and healthcare costs. Don’t forget they figured much higher rate of annual returns in their calculations years ago when calculating how much teachers (calpers says hello), police officers, etc had to contribute. Piper has to be paid eventually by someone. Either taxes or govt goes bankrupt and tries to discharge the debt. Add that to the fact that the monopoly Silicon Valley has had on tech/emerging companies is slowly being chipped away by other states offering better tax rates. Best hope you can bottle all this sun and sell it to the rest of the country…where it only rains, snows and has never seen the sun….

FTB..please don’t put teachers with CalPers…it’s STRS..different vehicle there. Police/firemen get a multiplying factor of 3% at 50 while teachers are at 2% at age 60. Big difference.

Sorry, JK. Regardless, public pensions are a noble concept and great and cool if you got em (my treat from my taxes as I have no pension nor does anyone else I know who works everyday)…..but completely unsustainable in a world where people can work 25-30 years and retire and then collect for life…plus health care, often. I get promises were made and people want ‘theirs,’ but its really gonna bankrupt this country due to people living longer, unfortunately.

MB, good post. You left out one thing:

“Absolute worst case scenario in 7 years if home prices have crashed: You walk away from your home and leave your $120k downpayment behind. That pretty much balances out the $125k you’ve saved in rent and you’re in credit jail for 4-5 years.”

People just don’t walk away anymore. It’s been a pretty lucrative business model to squat and drag things out. Living FREE for several years while saving every penny should be included in the equation. An acquaintance of mine just did this and lived in the house for 2.5 years while only paying utilities. In the end, he worked out a short sale deal with the lender…now it’s rental time for 2 or 3 years and then back into the housing market. I certainly don’t agree with the rules, but they aren’t changing anytime soon!

It looks like we’re going backwards, but whether this will lead to another financial meltdown depends on how many of these loans will be made. This is just the beginning, and new restrictions may limit the candidate pool for these loans.

@KEn: rates will not rise in a few years. given our circumstances, they will tick upwards slowly over decades. we’ll only see significant rise if somehow our economy switches gears and usher in a new era of prosperity.

Two articles worth reading today – both of which contain elements that the good doctor has already pointed out:

Banks push risky deals AGAIN and CLOs and subprimes are baaack:

http://finance.fortune.cnn.com/2013/04/24/banks-risky-deals/

Upto 46.1% re-default rate of HAMP mortgages as of March 31:

http://blogs.marketwatch.com/thetell/2013/04/24/modified-mortgages-show-alarming-default-trend/

When are we going to learn? Only good thing that may come out of this is that home prices will come down as House Bubble 2.0 pops.

So every 5 years we repeat the cycle. Wash, Rinse and Repeat. It’s the Wall Street mantra. Especially when there is no such thing as moral hazard. Nothing has changed, it has only created bigger monster banks, which will create a bigger monster crisis. If people buy into this again, they have nobody to blame but themselves. Same old story. “don’t get left behind” We have no real economy any more, just manufactured bubbles. Bust and boom is the business cycle for the entire country now, not just California and Florida.

http://www.westsideremeltdown.blogspot.com

If there’s really a 5 year cycle then what’s the worry. Well-to-do homeowners weathered the last crisis just fine. When values dropped that just sat on their properties (and well paid behinds) for the duration with no need to sell – and are cashing out now if they like. Rinse and repeat and they’ll do the same damn thing next time. We’re dreaming if we think we can wait out the rich and high end properties will fall into our deserving laps when the next crash finally happens.

Where is anyone claiming the following?

“we think we can wait out the rich and high end properties will fall into our deserving laps”

Nice straw man attempt, but its not gonna work.

I’m starting to see reverse mortgage ads on TV as well. The game is back on! Now what have we learned from the last RE bubble??? Go out and buy the most expensive house you can get qualified for and then stop making the payments asap.

You know it’s coming.

Here is a good example of the full swing flipping that is still happening. This home was purchased in March 2012 for $330K then remodeled and on the market today for $599K.

This was likely a foreclosure that was out of reach of the average buyer like me, instead a backroom bank deal.

http://www.trulia.com/property/3100139223-3701-Hillcrest-Dr-Los-Angeles-CA-90016

Anyway, just an example of how the bankers and their friends are making money again, while the average Joe is seeking an interest only loan in order to buy a house in a mediocre neighborhood for $600k!

At least that is just an listing price. There is still chance for it to go down. But i think they are basing that listing price on this near-by comp:

http://www.redfin.com/CA/Los-Angeles/3730-S-Norton-Ave-90018/home/6880770

That Norton flip was picked up for a song at 286k. Nice finishes on both houses though.

The house that makes me mad is this one:

http://www.redfin.com/CA/Los-Angeles/1614-Ellsmere-Ave-90019/home/6904434

2×1, 1076 sqft on a small 2,831 sqft lot. This is essentially a starter home. 575k for a starter home! Granted it is in a “desirable” central LA location, but my god! There is a sad paved backyard big enough for a patio table, chairs and a bbq. And the ugliest bathroom I have ever seen. Must have been a DINK with no dogs. I would have maybe offered 450k on it. Now it raises the comps in the area I would like to live…ugh.

@ forever sidelined

Wow, that is amazing ridiculous price, and Ellsmere Ave near Venice Blvd is probably not a safe street to walk on at night either. I just purchased a home in Baldwin Vista, near LaCienega and Rodeo Road for $470K. 1,800 sqft on 7,000 sqft of land. My price per square foot in a nicer area is half that of Ellsmere. go figure.

I found this site with statistics for most countries, such as the housing index back to the 1950s.

http://www.tradingeconomics.com/united-states/housing-index

What do you make of it? What do you think compared to say, Japan?

Actually, I find this chart on the money supply more interesting (quite scary, really).

http://www.tradingeconomics.com/united-states/money-supply-m0

American banks have once again begun producing mortgage-based bonds in substantial numbers. Meanwhile, institutional investors have been buying up low-cost houses in order to rent them while speculating on the value. As a result, the housing market may be going into another bubble. Are we headed for another financial crisis? Moreover, is history destined to repeat itself, given human nature? If interested, see the following article: http://thewordenreport.blogspot.com/2013/04/return-of-mortgage-based-bonds-another.html

Leave a Reply to MB