Housing market will get much worse before it gets better. How far are we from a normal housing market? 4.3 million distressed properties away from normalcy.

It is amazing what fraudulent paperwork can do to market psychology. The market chatter is now buzzing with phony mortgages and people squatting in homes that haven’t made a mortgage payment in months (or years in some cases). Yet anyone that follows the housing market with an open mind already knew banks were fraud factories and people were staying put without paying their mortgage. The difference now is that there is open acknowledgement in the popular press. Someone in the gym told me, “things will get a lot worse in housing before they get better.â€Â We are still a long way away from the bulk of the public feeling openly this way about housing. A few months ago people were talking about how far home prices have fallen. Even a few investors have told me they have no idea how this paperwork mess will sort out and they are reluctant to purchase a foreclosed property because of this. Who knows, you might have a family of 11 suddenly moving back in claiming they owe nothing on the place. Foreclosures are a big chunk of the market for the last two years. We need to examine why housing will get worse before it gets better.

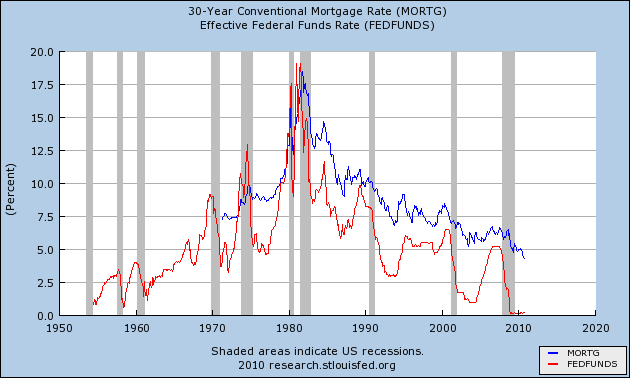

The Federal Reserve believes that low interest rates and buying up junk debt from banks is the solution to every crisis. Of course they pander to their banking overlords so this is no shocking revelation. But mortgage rates can’t go any lower:

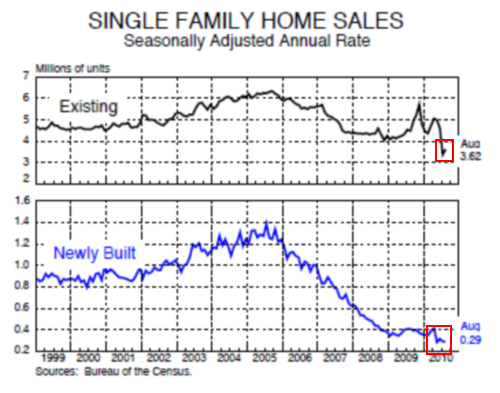

So what is the Fed doing since they can’t lower rates any further? They are gearing up for quantitative easing part two. Yet this will have little long-term impact on the housing market because the economy is still weak for working and middle class Americans. Without a healthy and steady paycheck even if interest rates fall to zero percent, how can anyone buy a home without adequate income? If low teaser rate mortgages were the solution Alt-A and option ARMs would still be flooding the market. Let us ask Japan how low interest rates and quantitative easing worked for their economy. All of the bailouts and trillions of dollars spent on banks and subsidizing housing has done this:

Home sales are still plunging because people have shifted to the lower levels of Maslow’s hierarchy of needs. That is, with 43 million Americans living in poverty and another 26 million unemployed or underemployed the last thing families are thinking about is purchasing a home. What is usually lost in the data is even of those who are employed, how many have now taken a full-time job that is much lower paying from their previous job? You have many mortgage brokers in California who once made six-figures a year now working in retail or another field that doesn’t come close to their former salary. The unemployment statistics show them as fully employed but the income data tells us another story. Housing can stage no recovery without an employment recovery first. It is amazing that over the past three years now, the massive bulk of the bailouts have been on bailing out banks and focusing with tunnel vision precision on housing. That is why today with so much money funneled into the banking sector, housing is still tanking and the taxpayer is that much poorer. You can thank the Fed, the banks, and you’re current and former government.

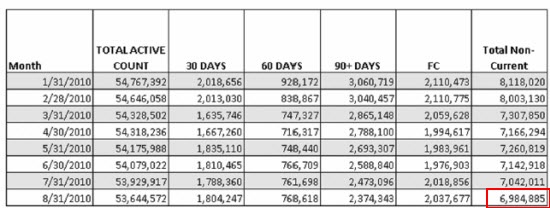

Current foreclosure and non-current data

Here is the current status of non-payment in the mortgage market:

Source: Â Lender Processing Services

Of course this is one of the players now having to defend their record in the robo-signing mess:

“(The Washington Post) Lender Processing Services, the Jacksonville, Fla., company whose subsidiary is the subject of a federal probe for issues related to the preparation of foreclosure documentation, fought back this week against what it said were “mischaracterizations” by the media.

The company said its subsidiary, Docx, stopped executing affidavits in September 2008 and that the documentation was prepared by the lenders or servicers. “These affidavits were then executed by LPS consistent with industry practice,” the company said. As for assignments of mortgage, the company said Docx relied on the lenders to input information that was downloaded into a template and then signed. LPS said it only prepared such documents for two lenders/servicers between 2008 and 2009 (but the company failed to mention that these servicers themselves often signed for dozens of mortgage companies.)

The most revealing part of LPS’ statement is explaining why some signatures on documents seemed to differ so wildly that it looked like several people signed them. This issue was first reported in The Washington Post on Sept. 23 and referenced again in an article in The New York Times on Oct. 4.

Here’s LPS’ explanation/admission: “The varying signature styles resulted from a decision made by the manager of Docx to allow an employee to sign an authorized employee’s name with his or her express written consent. LPS was unaware of this practice … [U]pon learning of it, LPS immediately took remedial actions to correct all assignments of mortgage signed in this manner and provided these corrected assignments of mortgage to the two lender/servicer clients or their attorneys.”

The company’s stock was down nearly 10 percent midday Tuesday.â€

Let us set aside this paperwork mess for a few minutes because this story is only beginning. The chart above only goes out to the end of August and the latest data shows that 7,018,000 mortgages are either in foreclosure or non-current, an increase from August to September. It’ll be interesting to see how this paperwork mess will impact the actual number of foreclosures. My belief is that we will see foreclosures drop yet non-current payments remain high. The only reason the foreclosure figures will drop is because of the public and now government pressure on mortgage servicers to use an iota of due diligence. Yet the economy still feels like a recession for most of the American public. Even with FHA insured loans, the reason the housing market is still sputtering along is because of low down payment options. What this signifies is the inability for American households to even support an adequate down payment (i.e., 10 percent or higher).

With over 7,000,000 mortgages in foreclosure or non-current, the housing market has a long way to go before bottoming. Plus, we are now in the historically slow fall and winter selling seasons. Kids are in school. The weather doesn’t make for showing homes in many parts of the country. And the tax gimmicks are for the most part over. The paperwork mess is plastering the media so the public is now realizing in mass how shady banks and their tentacles have gotten if they haven’t realized this already. In other words, the housing crisis is anything but over.

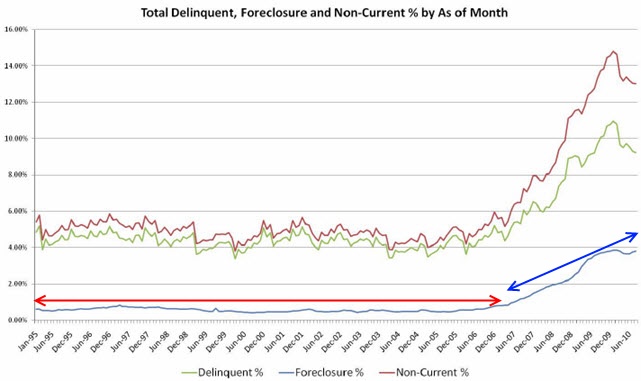

Historical foreclosure rates – how far from normal?

Many people have short memories and really have no idea what a normal real estate market looks like. Of course, if you made your living based on the housing bubble then you probably think that from 2000 to 2007 things were normal. Yet things are far from normal:

Chart Source:Â Minyanville

You will always have a certain amount of homes in foreclosure at any given time (i.e., divorce, job losses, etc). Right now that figure is up to 3.8 percent (2,037,000 mortgages). In more normal times as the chart above shows, this figure is around 1 percent (or 530,000 mortgages). We are a long way from that. Yet given the paperwork issues it is probably more accurate to look at the non-current loans.

Today over 13 percent of all mortgages are non-current (over 7,000,000 mortgages). In the past this figure hovered around 5 percent (2,682,000 mortgages). So if you want to do the math to figure out what a more normal market will look like:

7,000,000 – 2,682,000 = 4,317,800 mortgages away from a healthy market

As things stand today, we are over 4.3 million mortgages away from a healthy market. With more delays assured by the paperwork fiasco and many people entering into default, we are years away from the housing market resembling anything that is normal.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “Housing market will get much worse before it gets better. How far are we from a normal housing market? 4.3 million distressed properties away from normalcy.”

What a mess. You couldn’t get me to buy a piece of property if you offered it to me for a dime.

Oh, land is -0- management & problems. Been to 68 countries researching laws on investments, taxes, politics, businesses, family law, immigration law, etc. Only 4 pages left in passport #5! USA is the best country in the world because we are a “yes we can do it” country. We don’t tolerate “liars and cheats” like other countries. So joke, smile, work & enjoy USA! It’s #1 and Citizens don’t appreciate USA like I do, because you have not seen or researched the others like I did legally! PS: 3rd Generation, Dad was an Army Sgrt with 28 years Army Reserve! I wish I served, but missed the opportunity!

What planet do you live on?

OR, you work for some Federal (Alphabet soup -i.e. FBI,DEA, NSA, on forever) agency looking to do a little “Cheer Leading” for the good ole’ USA (“no place better” line of BS).

Usual rubbish reference to the military (and your “wish you had served” sentiments) show you for the “Shill” you are for the “War Mongers” you back!

“Yes, so sorry I too, like my father, did not bomb people of color into oblivion – and kill in the millions – to “Keep you FREE”!

What a disgusting line of pure dribble!

GO AWAY AND DON’T COME BACK!

WTF was that about?

LOL!

Get a load of this guy.

Is he Tom Vu’s long lost cousin?

http://www.myspace.com/johnjasonchun/photos/

Hey, there are a few folks here serving our country or family members of those serving… Let’s remind each other why we are here gathering at this site, not to attack one another but to offer constructive insights in solving the housing issues that effect us all. Focus your anger at a more appropriate site and let’s stop ripping on each other.

Forgive my “Personal Comments”…

Semper Fi

It is easy to dismiss this post. But, one should not. Like the poster, my passport is running out of pages. No joke, we are in a mess. It will be a mess for a long time to come. But absent the scandinavian countries, Denmark, Belgium, Germany, you have to come to the conclusion that doing business is better in the US. The list of reasons is long. Read the book “This time is different”. You will see that most countries around the planet routinely defraud their people. The US has internally defaulted only once, and never externally. There has been some currency debasement since 1933, but not at the scale of nearly every other country on the planet. Look at Nicaragua, Argentina and Mexico for recent examples.

ok for banks to evict homeowners even if the banks break laws doing so. How is this different from a gangster rubbing someone out if they don’t pay their owed bill?

Oh come one Niel….I agree that banks probably used terrible, neglegent practices, but please remember, the lamo being kicked out of the their home probably bought more home than they could afford, or their circumstance has changed. I am not on the side of the banks, but the person shouldn’t be allowed to stay in a property if they do not pay for it. What happens if you buy a car and don’t pay on the loan. Some creepy repo guy comes and takes it so that the lender can try to recover their loss. Why shouln’t the banks kick out deadbeats, whether they are victims of circumstance, foolish over-borrowers, or willful defaulters. Yeah, the bank kicking you out of a home you didn’t pay for is almost like a mobster murdering you…. Right.

The market got falsly inflated in a lot of areas in this country. When Joe Plumber has to max out his mortgage just to have a some what decent place to live, and home prices rise fast, it is a recipe for dissaster. Wages have fallen when the cost of living has gone up in all catergories. This is a route to an even further financial disaster than this world has ever seen……

This is in response to Matt’s message, not Ruths.

A huge part of the problem is that a significant portion of potential buyers are public employees who get:

-higher pay than private sector counterparts

-pensions that require far less input than retirement accounts

-programs to cut loan rates for certain types of employees (fire, teachers, police, etc)

In the last 4-5 years, as unemployment has skyrocketed, what sector has been able to avoid layoffs? And if you look at wage data, around ’04-’05, the median wage in OC was around $60,000. I saw a figure for ’08 that showed it at $75,000.

We have seen in the last year government jobs outnumbering production jobs in the US. Falling back to the very concept of how wealth and value are generated, and considering that public sector job generally don’t make much, the fact that so much of our GDP is tied to them is completely outrageous. But you can’t scale back because if you think teachers are paid too much, you aren’t “thinking of the children” or if you want fewer cops, you’re “soft on crime” or if you think firefighters making six figures a year in OT alone is excessive, then you don’t support public safety.

The more I think about it, the more I think we just need a huge crash, collapse the state of California, and start over. But even then, we would have the same people voting for bond measure after bond measure, and sinking us with a complete lack of understanding of the principles of economics. Because I can guarantee you that neither Jerry Brown nor Meg Whitman stand any chance of correcting our course. No one person does. No 120 people do, for that matter. A symbolic measure like Prop 13 won’t do it, either (honestly, that wasn’t a tax revolt. That was a tax sucker punch. And without the follow through, whose ass got kicked in the long run? It sure wasn’t the legislature’s).

We need to evict the whole mess in Sacramento and replace them with good, honest, educated people. Or rather, we need to make sure to limit the rot, spoilage, and corruption that we send to office. And I really don’t know how that can ever happen. Not with the lax attitude people have for politics, not with the mentality of any and all criticism being ‘negativity’ and unacceptable, and not with political districts that are so gerrymandered that every election is a landslide.

because their fraud has caused the debt to become UNCECURED.

Agree 100% with your article. We are nowhere close to a normal housing market. This mess will probably be around for another 5 or so years. If anything, the job prospects are getting WORSE here in California. There is little if any hiring going on in this climate. The state will probably be forced to layoff tens of thousands of workers. Defense spending is getting cut in a big way…all the big aerospace companies in CA and their suppliers will take it on the chin. Unless there is a new industry that sprouts up overnight or another bubble takes place and provides jobs and easy money, there willl be no recovery in this state. Many people don’t know if they will have a job in a year or two, buying a house today would probably be the dumbest thing to do. I’m waiting this mess and will rent and save my money. I’ll buy when the time is right or I’m moving out of state!

I love the “moving out of state” line. I haven’t been to every great state of our union but the ones I have been to (Hawaii, Louisiana, Nebraska, New York, Pennsylvania, Texas, Illinois, Massachusetts, Rhode Island, Nevada, Arizona, New Jersey, Mississippi, Alaska, Colorado, South Dakota, Virginia) always have the residents complain of bureaucracy, taxes, anti business policies and undesirable people. Every state has problems and benefits, as does every country. The key is embellish the positive…which is not easy in current permabear land. Gipper, we need ya!

Defense spending has yet to see any significant cuts. Obama’s first defense budget was $527 billion, up from Bush’s final-year budget of $513 billion. Up less than the rate of inflation for military hardware, but hardly a significant cut even when adjusted for inflation.

Maybe you’re anticipating future defense cuts? Those would seem more likely, but I doubt it under a Republican House.

A major reason for the hysteria over Foreclosure-gate is that there might not be a single person in this country that actually is an expert in all the legal issues concerning the many issues, from the birth of the mortgage to the foreclosure sale. The legalities will ensure us years of confusion and endless lawsuits, which will impact housing downward, even further. Would you want to buy a foreclosure at this point? The bankers, lenders, servicers have all engaged in fraud, just to make the system go faster so they could make more money.

It’s greed that brought down this house of cards. And then put on top of that the coming tsunami of student loans that won’t, or can’t be paid back, we’re about to topple as an economy. As has been asked by a few,..”On which day does the global financial system collapse?”

The foreclosure crisis is now hitting the white upper and middle class neighborhoods so the alarm bells are starting to ring in D.C. beyond the black & Latino caucus. The vast growth of urbanization over the past 40 years has allowed white flight to flourish as vast tracts of Ag property has been replaced with the 3bed/2bath 1/4 acre American Dream home which has accounted for the large numbers of endless strip malls and big shopping malls that dominate suburban landscapes. Today those malls are going BK at faster rates while the search for new tenants drive rents lowers and lower putting more commercial property at foreclosure risk and changing

the suburban areas into blighted poor looking neighborhoods.

While the media is suddenly interested in the foreclosure issue behind the curtains are the MBS/Monoline/Hedge Funds that do not had the political power of the banks but are activity using the foreclosed homeowner as a Trojan horse to weaken the banks political power and influence to better achieve their goal of full paybacks by the banks for shafting them in the first place.

wages have fallen while the cost of living has gone up. This financial system will fail completely if there is not change soon!

But I though we elected change. And hope. Where’s the change and hope?

(bah. I hope they keep their change.)

Your unlikely to ever get much change through the electoral process for someone that high up on the ballot (if your lucky you local house member might still be somewhat accountable to you).

Do not lose sleep for that . Tea party potentates will save the day! They have a secret weapon knows as”Tax cuts” and “budget/deficits cut”

jrs: I got gerrymandered out of Dana Rohrbacher’s district and into Ed Royce’s. As is inevitably the case, there are minor things with either of them that I’d disagree with, but for the most part, both of them are among the most sane and rational congressmen I’ve heard, luckily. It’s really too bad we don’t have more like them, especially considering just how bad some of our neighbors are (like Waters and Sanchez)

Just when you thought it couldn’t get worse, the banksters come back with another blow to the face. These guys are criminals, and should be treated as such. Fraud is fraud, and companies should be prosecuted to the full extent of the law, even more so than individuals. These guys are making a mockery of the United States Judicial System.

I’m afraid the real estate market in California has just been set back another 2-3 years. Best case scenario now, is for a bottom in 2015.

http://www.westsideremeltdown.blogspot.com

I’ve been reading DHB articles for a few months and was very happy to see the blog get started here. I think there are a a lot of intelligent and articulate readers and I appreciate the comments. I too feel like many of you; that the bankers have turned into our worst nightmare and are the most lawless bunch out there. I even had a major credit card company increase my apr from 8% to 27.99% just because they said my debt to income ratio “concerned them”. The first thing I asked them was if you think I might be a risk at 8%, can you imagine the kind of risk I’ll be at 28%?? The balance by the way at that time was 40,000.00- not a pretty picture. I am happy to say that I now carry 0 credit card debt. It took me 3 years, but I paid off those SOB’s. They also were basing my income data on my declared income from 5 years earlier. Well the bankers were able to raise my interest rate 20 points over night because Congress let them. They were allowed to by law. Congress will also pass a new law that says that the banks don’t have to have all the proper paperwork in order to foreclose. The banks dictate which financial laws will be passed. We are living in strange times. We have the power of the internet but it seems no ability to organize and band together and vote in a truly representative government. Let’s see what happens 11/2. There’s NOBODY worth voting for……..

I haven’t gone down this path but I believe that when they up your rates you have the option of shutting the line down for future use and freezing the existing balance for the old promised rate. Obviously this isn’t advertised but this is the option you have as you borrowed at the old rates. Maybe something better is out there now with the new protections but this existed long in the past. Of course, you need to be able to cut up that card/close the line but for $40K it would be totally worth it.

Hence I believe that classes in managing money, financial decision making, and utilization of credit should be covered in high school. This is all important no matter where you eventually work.

How sure can we be of that 7,000,000 number? Not only did the banks freeze foreclosures but in many cases they stopped issuing NODs. How many homeowners are squatting and haven’t yet received their first notice?

Another issue I think about with regards to the issue of “Who owns the loan?” is that not only would it apply to foreclosures but to ANY home with a mortgage that’s been sliced, diced and resold. Who’s to say that after you purchased a home that some long lost MBS holder isn’t gonna show up claiming that they were never paid?

What a f***ing mess.

RUTH, Sociopathic behavior by banks is OK because they are acting in the best possible ways for us americans? Sociopathic is no conscience at all.

There are local pockets in Denver where good rental properties make sense at the right price. The rental market has picked up quickly and it reminds me of the the turn-around in the early 90’s. The interest rates are very appealing for the first 4 properties but financing costs are quite costly, in my opinion so shopping is important. With nearly 40 years of experience, I am carefully purchasing properties but it isn’t any different than any other investment, you have to know what you are doing, work hard, be willings to do what others won’t, and stick with the investment for at least 5 yeats, perferably longer.

If you look at stats of people living paycheck to paycheck, the non-current issue looks bad. Reflecting on my mortgage paying days, I believe that if someone is behind one and especially after two payments it’s pretty much game over.

Why should a bank get a home that THEY didn’t pay for or put up one dime to loan money to the borrowers? The investors did! That’s why the bank are creating fabricated documents…they didn’t track who truly owns the loan or the note. Sometimes it’s thousands of investors, ie; your pension funds. Sometimes, they’d sell the loans more than once. The fabricated documents are simply fraud covering up fraud. If the banks did everything by law in issuing all the loans in the first place, we wouldn’t see the problems that are now occurring. So the banks get free houses that they didn’t put out a dime for in the first place? The reason banks gave out such bad loans is that they didn’t care…it wasn’t their money. The worse the loan, the more money they made. It wasn’t the homeowner’s fault that the appraisals were fraudulant…apppraisals created by the banks. They deceived investors AND borroers. I think EVER homeowner at the very least deserves due process. And let’s not forget, the banks TOLD most of these homeowners to make lower payments on forebearance agreements…lingered them on for months…sometimes over a year and then told them they would have to come up with as much as $30,000 to get a modification…it not, they’d have to foreclose. These people thought the banks were working with them on these fraudulant loans. In reality, they were setting them up for foreclosure. The banks much more money from the investors by doing this. Due process is definately in order as the very least.

Welcome to Mexico. During the devastating earthquake which rolled through Mexico City in the 80’s. Beyond the death and destruction of a major Earthquake a major flaw was brought to light – and it was the lack of control on the paperwork of “who owned what’. Today, the USA is facing a similar situation. Mexico got their act together – by implementing drastic changes to the system which the usa is not even acknowledging as a problem. Sometimes I wonder if the wall is more meant to keep you guys in inside of keeping us out.

Saludos desde Baja.

LUIS, you are right. With so much denial on this side of the fence, corruption, postponing, bending out of shape the very core principles of capitalism, suppressing of reality and clinging to dreams when the piper start singing for USA the wall will have function to isolate a violent ghetto…

no, no, buddy…don’t be fooled…it’s to keep you out. And I’ll have to assume you’re living in Mexico…based on your “us vs. them” comment, right? or were you just saying it in a racist kind of way?

Gosh. I love this information on DHB. Thank you.

nice work, liked the charts expecially.

The “recovery” looks to be weakening again. And now the word is getting out that mortgages have immense problems behind the scenes. I wonder how many people will stop paying their mortgage going into the Fall/winter season? As many people that stop paying dont even get an NOD notice these days, the problem may be much bigger than the data suggests….

The entire housing market has been manipulated beyond belief. The banks and the government have turned housing into a Las Vegas style casino in order to enrich themselves and to bleed the homeowners (think “debt slaves”) dry. The pharase ‘the house always wins’ comes to mind.

The biggest tragedy that has resulted from this is the lack of affordable housing. Housing is still overpriced and still highly manipulated.

We need to get the government out of the houusing business and to prosecute the massive fraud that has taken place in regards to housing, morgage loans and morgage backed securities. Only in this way will American become a free market once again.

How do you get the goverment out of the housing business? The banks will never let that happen.

Looking back from 1990 to now, we had massive inflation but thought we had equidity in out homes, so to compensate for low wages and high costs we borrowed away thinking it would all balance out later if we invested wisely. We still have massive inflation now we have lost half of all savings both stock market crash and housing, a life’s work cut in half by the goverment and the elites.Whats going to happen to the oldler masses that have no time or strength to work for it all again? Talk about displacment.

We downsized and bought cash and have a small nest egg, but we have no way to make that nest egg grow. Can’t trust the stock market and the banks happily use our money interest free.

What’s could happen is that these newly partially-dispossed masses, the bottom half of the boomers and some generation x, are going to form a political base that will demand social welfare for people in old age. They will fight for Social Security (to prevent privatization) and will fight for improvements in healthcare reform.

Some are in the Tea Party now, fighting to undermine these institutions, but as the taste the bitter fruits of their labor, they will take the organizing lessons learned, and turn against the Tea Party.

The US is being pauperized, and work continues to be shipped offshore. The gap between our workers and foreign workers is shrinking. At the same time, the gap between the global rich and global working class is widening, creating the conditions for class conflict.

Hopefully, American people will find common cause with workers in the EU, India, China, Japan, Mexico, and around the world. This might not happen, but I can hope.

Sure, prima facie, it looks like just another legal maneuver by defense (homeowners’) attorneys to stall the process. After all, (except for a few freak, well-publicized cases) these homeowners ARE in default, and, AFAICT, we don’t have any cases where more than one plaintiff (lending party) is making claims on the house or the first lien. (Now that would be priceless… Hedge Fund v. Bank, “It’s ours… No, it’s OURS… lol.)

OTOH, if we sit back and allow the bank$ters to subvert or destroy the formal legal LAND-TITLE system in this country–in the name of “expediency”– then hello Dark Ages! It seems we can expect NOTHING from the banksters in terms of social conscience–or even basic ethics–so it seems only wise to insist they provide ALL of the due diligence required by the State and County in which the property is sited.

My bubble-zone (Broward County, FL), despite the well-documented shenanigans of decades past (think Roaring 20s, swamp-deals)–or maybe BECAUSE of them–requires ORIGINAL WET INK SIGNATURES and PERSONALLY EMBOSSED (“puffy”) NOTARY SEALS on Deeds of Title, Mortgage Originations, and related RE docs. The Banksters can no longer hide behind MERS, and now all their MBS underwriting fraud is in danger of being brought into the sunshine! ;’)

I’m sure that most of you have seen this by now but just in case:

http://abcnews.go.com/Business/wireStory?id=11910150

“Bank of America plans to resume foreclosures on more than 100,000 homes in 23 states next week, saying Monday it has a legal right to seize them.”

“The company on Monday said it plans to resubmit documents with new signatures in states that require a judge’s approval to restart the foreclosure process.”

Here’s my letter to BOA: I am hoping thousands upon thousands of homeowners refuse the evictions en masse and demand proof of BOA owning the promissory note, and then organizing a planned “march” to the media, if the sheriffs try the eviction. Civil disobedience of a non-violent sort is what’s needed. Show the world that the USSA has become a facist-police state controlled by the rich and well-connected—after all these people are behind on their payments to the criminally but entitled banks.

…should be easy, especially considering many of the people getting foreclosed never had jobs in the first place to pay for their lifestyles. They have plenty of time to complain into the cameras and march down the street. A brilliant plan, Gandhi.

You wrote in your article: “You can thank the Fed, the banks, and you’re current and former government.”

How about thanking the United Nations and the international central bankers that use the facade of the UN as their method of implementing world-wide legislation? How about thanking the IMF and World Bank — the two financial arms of the UN?

Just because the media these entities have purchased does not educate you on what the UN is up to does not mean you have to follow lock-step with the paradign that’s been created to distract you.

No! The Fed, the banks and the government are partly to blame. The United Nations takes most of the blame.

“In order to save the planet we need to bring about the collapse of the industrialized civilizations. It is our responsibility to bring this about†— Maurice Strong, visionary of the United Nations

And that’s just scratching the surface, folks…

Hello to DHB and DHB loyal readers: This is whats happening:

From the moment the Titanic hit the iceberg, that ship was doomed to sink, but more than 99% of the passengers didn’t realize it at the time and continued their activities as is everything was normal.

I submit to you today that just like the events on the Titanic, the U.S. banking system has ALREADY HIT the iceberg, but more than 99% of the public don’t currently realize it, and continue their activities as is everything is normal.

Everything isn’t normal.

The banking system is doomed to collapse.

The giant financial firms have destroyed

the banking system in the U.S.

The crisis is centered around MERS, the Mortgage Electronic Registration System created by Wall Street to record ownership of mortgages electronically in order to avoid having to physically record mortgage documents in counties all over the United States.

The problem is that the law REQUIRES the recording of original documents in local registry of deeds (this is called different names in different counties.)

Wall Street packaged up literally trillions of dollars in mortgage loans and sold them to pension funds, insurance companies, mutual funds, and foreign governments and did not record who purchased what mortgage.

The problem is that those securities packaged by Wall Street were supposed to be “mortgage-backed” securities.

Because Wall Street did not follow the requirements of the law, those securities are actually “nothing-backed” securities, and the owners of those securities have no legal right to foreclose on a home when the homeowner fails to pay the mortgage payments.

This is a multiple trillion dollar problem,

with no easy solution.

And to make matters worse, the Wall Street firms have hired former Burger King and Wall Mart workers to pretend to be lawyers and sign phony legal documents, complete with phony notarized signatures and stamps, to try to convince the courts that they have a legal right to foreclose even though they have no legal right to do so.

What would happen to you or I if we forged documents, affixed a false notorization to it, and submitted it to the court as “evidence?”

We’d be in jail.

This entire “robo-signing” scam is just a

fraud to hide an even bigger fraud!

Yeah, the fraud of allowing UNELECTED individuals to determine the fate of humanity, via their exploitation of the United Nations. These UNELECTED individuals have no concern other than to control the batteries (you and me) that ensure they maintain their power and profits. Socialism at the end of a surveillance camera is what they want, and people seem ready to hand it to them.

When I pull public records, I have yet to find a Realtor that didn’t HELOC/ATM their house to the hilt.

and is now a “short sale specialist,” lmfao

Unlike our parents’ generation who married younger and bought their homes at an earlier age, many of us here will be entering the game a lot later. This means that some of us who do a buy a house later in life, on a fixed rate thirty year mortgage, may be working into our mid-seventies just to be able to pay off that mortgage. Of course, we have to hope for a thirty year run of incredibly good luck, never getting laid off, never getting sick, having a body that defies the effect of age and decay, etc. If we enjoy such a long streak of good luck we can continue to live in our modest concrete box in South Gate or Paramount.

But what if, say, we lose our job or are no longer physically able to work at age 65 or 70? How do we continue to pay the mortgage while we pay for our health insurance, groceries, and utilities? Unlike our parents, most of us will not have our homes paid off when we stop working or even have a guaranteed pension to draw on when we retire. The fortunate among us might have an unreliable and wildly fluctuating 401K account that we will probably burn through in a couple of years, but there will be no security like our parents had.

How this next generation will manage this reality is a bit scary to think about. Even the one government program designed to ensure that those too old or too sick to work have at least enough money to die in a warm bed, Social Security, is under attack by members of both parties. How an unemployed 70 year old manages to continue paying a mortgage in this environment is beyond me. But this is the scenario for those of us who didn’t buy at the age our parents did and, hence, will never be close to having a house paid for when we can no longer work.

One possible solution to the problem of excessively risky housing markets is to delete “market” aspects from the market. Make housing a less attractive, or even an unattractive investment vehicle. Then, the price will more closely track wages or the costs of maintaining a house and providing regular service.

A very gentle and interesting way to deal with this would be to focus our resources on reducing or ending homelessness. If you seriously address this issue, then the issues related to foreclosure and evictions and rent prices may start to look more manageable.

In short, treat housing as a human right.

I think that the current “paperwork mess” is just a government supported cover to allow the money center banks to continue their “amend-pretend-extend” strategy so that it doesn’t get out that they are insolvent. Regardless of whether or not a “robo-signer” was used or each and every document wasn’t sighted does NOT change the fact that the people trying to “take back their house” are scammers and deadbeats that overextended themselves, didn’t pay their bills and now the banks are executing on their contractual right to take possession of their collateral, pure and simple.

For all of the people worried about buying a foreclosed home, nonesense! The whole point of the foreclosure process is to deliver the title free of encumberances. Once title is recorded, their is no legal recourse unless there was a procedural error (and this means something like not delivering a NOD or other legal notice at the proper time, NOT someone not viewing an original document). In that case, your title insurance will pay you for the mistake as that is why you bought title insurance in the first place!

Peter, your scenario may be right, but this does not imply societal catastrophe or even crash of the RE market. It may just mean we have new normal. This normal will be much higher prices, so people are getting into bigger debt loads, which takes longer to pay off. This will result of elevated (from yesterday’s normal) level of foreclosures for foreseeable future. Life is full of surprises (and in society which is biased totally toward turbo optimism, those surprises are generally bad). You may hope “to get thru the raindrops†when you in your 40’s and 50’s may be , but if you are not debt free at 60 and 70 you are practically doomed… People will be foreclosed , but new fool swill be buying their shacks and they will be foreclosed also and so the new normal has come… BUT this does not imply lowering the real RE prices at any point in the future. I am staring to realize this painfully (been a prudent renter). The government support for the RE market created monster for generations to come. And again in society where the personal decisions are taken by the turbo optimism mood dictate, one may expect economy moving in the right direction, but spectacular failures in personal lives. In the case of USA I don’t believe in the right direction of the economy either, since it seems we have exosted all the possibility to cascade this balloon driven economy any further

I think the key here is to correct the mistake Congress made in it’s haste to stop a potential economic meltdown: Demand an actual inventory and re-assessment of ALL the assets the banks hold. That means going through the books painstakingly and demanding a complete clear accounting of all the properties the banks hold, demanding clear paperwork on all of them, and then requiring the banks to PUT THEM ON THE MARKET at a controlled rate of X amount per quarter. (If there was false paperwork, and past evicted owners were NOT behind on payments, make a deal that the past owner be compensated by being given a comparable house to move in and start making payments on at the same equity/rate as before. If they WERE behind on payments, they would have defaulted anyway, and the house is the banks. Period. )

FORCE the banks to stop this false market inflation and let the markets correct.

Mind you, I know I’m not smart enough to offer a “better” solution to the earlier market solutions/problems (except to know that it was being too smart for our britches and letting people think that “smart and short term” was better than “honest and prudent” that got us in this mess in the first place). I actually see a lot of parallels between our national obesity problem and our economy. Just like we have many people come into our ER’s suffering from acute problems like heart attacks and diabetic complications that were REALLY caused by daily choices of junk food and passive television watching instead of healthy food and action…we have a bloated and inefficient economy that was made so by millions of daily choices of greed and short-term wealth over honesty and prudent investment- fueled further by people basing their own choices on popular hysteria and fads instead of serious financial research. When Lehman brothers tanked, we could not insist on instant “boot strap” measures right away, any more than an ER doc can look at a 500lb guy having a heart attack and insist that he drop 250 before she would treat him.

But now that the “patient” is stabilized, we CAN insist on long-term healthier, more honest measures. (Warning- the banks are acting JUST like a junk-food addicted patient- sneaky, greedy and uncooperative. They are the WORST patients to treat!!).

I’ve got news. You can’t spend more than you make. Unless your parents had the foresight to get you numerous Social Security cards when you were a child.

I have always saved 20% of my income, while the rest of my friends bought the latest bling. I was always laughed at, but I always had money.

How can people get a teaser mortgage rate and not realize that their mortgage payment is going to go from $600 to $2400 in a year or two. Then cry to the news media that they can’t make the payments.

How do you run your credit card up to $25000? You think your mother is going to pay it off?

Live below your means!

Leave a Reply to Tyler D.