The housing market is now entering a visible slowdown – affordability challenges, low inventory, and higher interest rates are now coming home to roost.

Real estate cycles turn as slowly as a massive cruise ship. Unlike the stock market where a stock like Facebook can fall 20 percent overnight, real estate tends to boom and bust at a much slower rate. There is an odd logic to the current market. “We bought a few years ago and look how late to the game you are!â€Â Then when asked if some would buy today, “no, but it can only go up!â€Â Coming from an investor mindset, if housing values are priced in a good range you should buy, just like you would buy an undervalued stock. When you are spending $1 million on a crap shack, you need to do some serious due diligence. It is odd that house humpers always use the “but you can’t treat your home like an investment†line and then talk about how reasonable it is to pay for an absurd amount for a property in a subpar neighborhood with underperforming schools. Then they compare real estate to stocks! Of course it was a matter of time where the market would hit a bump and here we are. Even Robert Shiller hints at this being a turning point.

As the market turns

In the last year, the absurdity of the market came full circle. Home values in some areas were going up $50,000 to $100,000 a year. Why work when you can simply live off equity gains? But here in SoCal, where people live a Hollywood debt fueled lifestyle the homeownership rate hit a generational low and this is from recent data:

You want to own?  You need to pay an absurd price for a crap shack. And this is happening in many large metro areas but things are changing:

“(Bloomberg) They were fed up with Seattle’s home bidding wars. They were only in their late 20s but had already lost two battles and were ready to renew with their landlord. Then, in May, their agent called.

Suddenly, Redfin’s Shoshana Godwin told the couple, sellers were getting jumpy, even here in the hottest of markets. Homes that should have vanished in days were sitting on the market for weeks. There was a three-bedroom fixer-upper just north of the city going for $550,000, down from more than $600,000. They made the leap in early June and had closed by the end of the month, for list price.

The U.S. housing market — particularly in cutthroat areas like Seattle, Silicon Valley and Austin, Texas — appears to be headed for the broadest slowdown in years. Buyers are getting squeezed by rising mortgage rates and by prices climbing about twice as fast as incomes, and there’s only so far they can stretch.â€

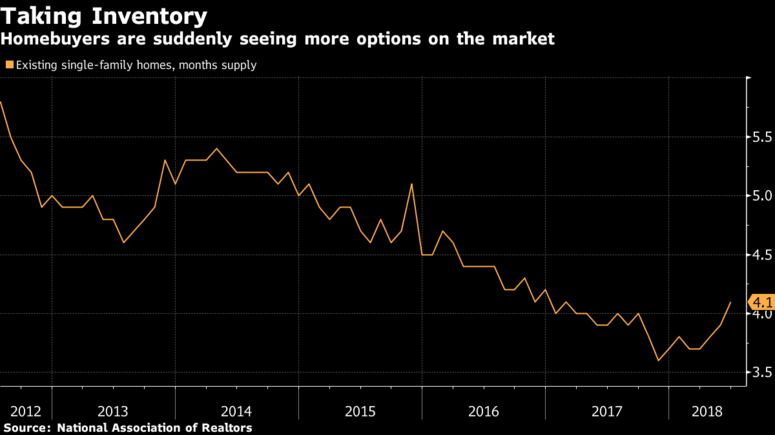

This story is playing out nationwide as a few things are hitting at the same time. Inventory is slowly rising, mortgage rates are having an impact, and people are seeing price gains slowing so why rush?

This is the first time in many years where there does seem to a broad base of inventory increasing. And there are deep generational differences in this cohort. I know of many people with very high incomes and no kids and with no plans of having kids. They largely travel and spend a large portion of their time at work or traveling. Why would they buy a crap shack? Others buy and totally miss the budget mark. They have kids, don’t realize that childcare in places like LA or OC will cost you somewhere between $1500 and $2000 per month and then as the kids get older, they think they have to compete with their debt saddled budgets simply to throw expensive parties with jump houses, catering, clowns, and all other sorts of things just to feel they are making up time because they are strapped to their cubicle for 40 to 60 hours per week to pay for the massive mortgage, multiple car loans, daycare, and other expenses. And college! Good luck with that race.

The housing market has been running on fumes and has been in the tailwind of an incredible stock market recovery. People would like to buy but simply do not have the budget to do so. You are also seeing foreign money soften up a bit as the current administration has been tough on China. Is this good or bad is yet to be seen but in places like San Francisco, Arcadia, and Irvine you have an entire cottage industry catering to Chinese money to buy real estate.

The market is slowing down. The question yet to be seen is whether this will be a minor correction or an actual bust. We’ve clearly been in a boom. What comes next?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

444 Responses to “The housing market is now entering a visible slowdown – affordability challenges, low inventory, and higher interest rates are now coming home to roost.”

Seems like the headlines have started to change and a slowdown (hopefully a crash!) is starting. Curious what you all think of the article below and how CA is going to get it’s self out of this mess? Is prop 13 a goner?

https://www.americanthinker.com/articles/2018/07/the_blue_state_housing_bubble.html

Yikes! My guess is a mix of defaults, bankruptcy, and debt forgiveness. Pensions will have to shrink, and the state would likely reduce the pensions heavily if the person lives out of state. Modification of prop 13 as well (too many greedy homeowners to kill it entirely).

Greedy? Why? Because they bought a house and have lived in it for years ?

Because anything someone else has that you don’t is “greedy” ?

Not like they didn’t risk future earnings on a 30 year commitment. Not like they didn’t work to pay off that mortgage.

There should be no property tax on any primary residence, period.

But homeowners become sitting ducks when having a bond obligation pinned on them by free riders in elections who don’t have to shell out to pay them off.

They’ve been paying property taxes for decades longer than those waiting on the sidelines for a crash.

Your values are really really screwed up.

“There should be no property tax on any primary residence, period.”

Dweezilaz, A++++ for that statement. I think that it should be repeated many times till people get that through their skull. They already paid a mountain of taxes on the money they used to purchase: federal income tax, state income tax, SS tax, medicare tax and you would expect they would get a break finally on their house. It looks that the greedy thieves (liberal politicians) are not happy just with state and sales taxes; they have to take it all for their cronies who put them in power.

If someone is GREEDY, it is the socialist politician buying votes with the wealth of the middle class.

I’ll give a 3rd + for the no tax on primary residence properties.

At most a state should tax income or property, not both. In Cali we get the trifecta, sales, income and property tax.

In any event I don’t like property tax because of the reason prop 13 exists. It forces and individual to realize rising costs on something they potentially own due to inflation and speculation which are both out of your control.

At least with income tax you get taxed more when you earn more and with sales tax you pay less if you buy less.

With property, you pay more because 20 years from now people think your home is worth twice as much.

Greedy? I sense your a self centered douche.

@dweezilaz

July 31, 2018 at 12:15 pm

“Greedy? Why? Because they bought a house and have lived in it for years ?”

No cuz’ of tax avoidance. A tax avoidance which BTW primarily benefits the rich but the old and long time residence people are used as a strawman whenever talk of killing Prop13 comes up.

“Not like they didn’t risk future earnings on a 30 year commitment. Not like they didn’t work to pay off that mortgage.”

Paying off the mortgage is its own reward. That is by paying it off you no long have to pay for the house itself to the bank and now only need to pay off tax, power, etc.

“There should be no property tax on any primary residence, period.”

LOL how the heck do you think things like roads, schools, water, etc get paid for? If there is no property tax where is the money supposed to come from? They’ll just have to tax something else more, like sales (which is regressive), to make up the difference. At least with property taxes (if properly done, Prop13 sabotages this) you have a way to tax the rich’s wealth more for the property they own.

“They’ve been paying property taxes for decades longer than those waiting on the sidelines for a crash.”

That is the risk you take with buying property. No market is risk free. If you don’t like it don’t enter that market.

@Flyover

July 31, 2018 at 2:59 pm

“They already paid a mountain of taxes on the money they used to purchase:”

And they’re getting something for their money: a functional govt, infrastructure, a military, schools, etc.

When you give someone money and they do what you want with it that isn’t greed. That is called doing their job. Now there might be aspects of that job that you don’t like or decisions that got made that you didn’t like but you don’t solve that by calling them greedy: that is what the vote is for.

“If someone is GREEDY, it is the socialist politician buying votes with the wealth of the middle class.”

LOL everyone but the rich keeps getting poorer + Repubs have been in control of Congress since 2010 + Repubs control all 3 parts of govt right now + Obama was self described policy wise as a 90’s Repubs despite the party he ran under but nooooo its them Socialists that are the problem!!

@RangerOne

August 1, 2018 at 5:33 pm

“I’ll give a 3rd + for the no tax on primary residence properties. At most a state should tax income or property, not both. ”

You have to tax property or else the rich just classify all their wealth as property via loopholes, tax havens, and straight up tax evasion.

Prop13 just legalizes some of the tax evasion for the rich. Some of the people who own homes will benefit but Prop13 was always a time bomb waiting to go off. Reagan passed it knowing it’d either blow up the housing market over time (because it puts ever upward pressure on housing prices) or it’d blow up the state economy. The goal was to cause a political crisis that the Repubs could exploit.

It never turned out the way those 80’s Repubs thought it would. The Repubs for instance are no longer able to mount real political power in CA anymore, so they can’t capitalize on the mess they’ve purposefully made. But the time bomb is still ticking and to prevent a major economic and humanitarian disaster Prop13 will have to go at some point.

“With property, you pay more because 20 years from now people think your home is worth twice as much.”

Same thing happens with any other asset or commodity. Look at the value of the stock market, gold, silver, steel, etc. over time. Value inflation is everywhere and unavoidable without inducing major economic recessions a la Volker’s FED actions in the 80’s.

Some of you either aren’t using critical thinking skills or are underestimating the danger in ignoring this issue.

If the value of our property increases due in part or whole to services and improvements of the commons, the price for that is a tax. We don’t expect to get something for nothing, do we?

The further said tax is removed from apportionment by way of market forces, the more those who don’t benefit from the gain are made to subsidize those who do. That’s what Prop 13 does because the state makes up for the difference by disproportionately increasing all of the other taxes and fees everyone is subject to. This imbalance has further consequences beyond the scope of this discussion.

Why don’t some of you just admit you’re fine with having other people subsidize your lifestyle? You know, fuck everyone else because I got mine. The charade is obvious and tiring.

I’m a property owner. I’m not okay with being subsidized because these things cause distortive knock-on effects that come around to bite in ways that are worse than just taking the medicine up-front. Greed is indeed at the root of the problem.

TTS,

Voting does not change anything at the federal level. I can not compete with the billionaires in buying politicians. Between 100% democrats and a large part of republicans (RINOs), the system is rigged against the average Joe. It is a system of plunder and bringing the middle class to extinction. Most of the taxes are for their cronies not for what you mentioned. What you mentioned is the excuse, like the one protecting the grandma for being kicked to the curb.

You said that sales tax are a regressive tax. However the biggest regressive tax devised is INFLATION. ALL the socialist policies are conducive to inflation and decimation of the middle class. Yes, the socialism for the Military Industrial Complex is conducive to the same outcome and it is supported by all democrats and ALL RINOs (democrats with R after their name). Conservatives like Ron Paul are against both – welfare and warfare.

I’ve been in conservative states with no income tax, super low property taxes, low sales taxes and the schools were excellent, the fire stations working fine, the roads were perfect and without running deficits. The difference is in the level of corruption which is always a feature of the liberal states (massive corruption). Look at Illinois, Detroit and Baltimore for an example of what I am saying.

It’s fairly comical to watch renters complain about prop 13 as if they’re somehow losing out. Nothing stopped you from buying a home and benefiting from it yourself.

It’s also comical to watch people like Lordt B conflate stocks and metals with a house and justify ever increasing tax. Newsflash for dopes like Lordt B, you don’t pay taxes every year on stock that sits in an account. You pay tax when you sell or get a dividend. Last time I checked, I’ve had/done neither with my house.

I love having prop 13, it’s the best gift ever and I’m never selling my home. I’ll pass it on to my kid at a super low tax rate.

It’s just comical to watch complainers because if they had any brains they would’ve bought a home instead of thinking there’s always going to be a 70% crash. Maybe you guys should spend more time trying to make money instead of complaining as there’s an inverse correlation to complaining and making money.

I’m up $120,000 (37%) since 2014 and my taxes are up 6% at most. Feels good.

Why would you hope for a crash? if there is a housing crash then that means the entire US economy is again in trouble. Will your job be secure if there is a crash? If and when prices to crash, good luck outsmarting the Blackstones who purchased thousands of foreclosed homes en bloc from the banks and good luck outsmarting flippers with deep pockets who will buy with all-cash and 10 days closing. That is what happened in 2008.

Why the obsession with Prop 13? of course it will change someday; perhaps a 5% increase in property taxes each year, but it will NEVER overnight be changed other than incremental increases.

Yes, I’m definitely hoping for a crash. My job is recession proof and so is my spouse’s. We can’t compete with all the tech people for a house in our area (east bay) even though we make a combined 250K/year. We’ve been saving diligently for many years and were not in a good position to buy during the last down turn, so this time we are ready. I have many friends who were in a position to buy in 2012 and they did not have trouble “outsmarting” Blackstone et al and flippers to get into a house. Tech is waaaaaay over-valued and is due for a correction which should help send housing prices in the bay area in the right direction.

There are real threats to modify prop 13 for commercial property and 2nd homes. And a “surtax” on luxury homes is being discussed.

“but it will NEVER overnight be changed other than incremental increases.”

….”incremental” like in the article – $10,000/year increase with no increase in market value – people will sell for half price just to run away. You can not mess with this mafia of “Democratic Socialists” like Rahm Emmanuel and Obama; …and if you don’t like those 2 you can elect Maxine Waters or Ocasio Cortez, the darling of the millennials.

“but it will NEVER overnight be changed other than incremental increases.”

….”incremental” like in the article – $10,000/year increase with no increase in market value – people will sell for half price just to run away. You can not mess with this mafia of “Democratic Socialists” like Rahm Emmanuel and Obama; …and if you don’t like those 2 you can elect Maxine Waters or Ocasio Cortez, the darling of the millennials.

New York and New Jersey have high property taxes, so does Washington. They also have areas that have housing just as high as LA-OC. People blame low property taxes too much. Some states like West Virginia have much lower property taxes than Texas and lower prices mainly because its a poor state.

New York and New Jersey and Washington state don’t have prop 13. They have high property taxes and high housing prices. Prop 13 is always to blame. Basically, its the progressives in Ca which opposed the inland counties have more building because of environmental rules. Also, the tech industry is so progressive politically it opposed moving some of the industry to cheaper locations like in Sacramento and so forth.

@QE Abyss

July 30, 2018 at 7:07 am

“Why would you hope for a crash?”

Because housing is a necessity and its getting unaffordable to live anywhere.

Also bubbles are all about false valuation, in this case homes, so why the heck would anyone reasonable want a necessity to be falsely valued? Much less falsely valued to the point of unaffordability??

“if there is a housing crash then that means the entire US economy is again in trouble.”

All bubbles pop though. The economy was in trouble no matter what.

“Why the obsession with Prop 13?”

Because it helps blow housing bubbles and disproportionately rewards the rich for being rich at the expense of everyone else.

@Flyover

July 30, 2018 at 4:43 pm

“You can not mess with this mafia of “Democratic Socialists†like Rahm Emmanuel and Obama; ”

None of those people are in power or have any sway over Congress. Check the date, its 2018, not 2016.

QE Abyss,

“Why would you hope for a crash? if there is a housing crash then that means the entire US economy is again in trouble. â€

That’s exactly what we want. If we have a big recession, housing prices and stocks crash. You can buy in cheaper. A wrecked economy is the best thing in the world if you have cash and want to invest in a house and more stocks. Luckily we get a real estate crash every ten years in California (roughly)

Wow!!!…Thank you for the good article. I kind of knew what was going on in that liberal democratic “paradise ” but the numbers spoke volumes. They gave a very vivid picture.

I lived under communism and the thieves in power stole all the country property for themselves and their buddies – fast nationalization- like in few months. Then, they starved the rest like the collectivists/socialists in power do in Venezuela now.

It looks like the communists in power in Illinois do the same nationalization a little bit slower, like in 10 years. At that rate, people have to buy their properties every 10 years or Chicago becomes the next Detroit.

It is sickening what the liberal democrats do everywhere – mass poverty in the name of being equal with the third worlders imported by millions every year – fed and taken care of in sanctuary cities built by the old former middle class. Enrichment of the few at the expense of everyone else. No wonder Michigan, a former solid blue state voted for Trump. The roads look like after the war.

Detroit and Chicago used to be among the richest cities in US till the socialists/democrats grabbed the power by importing voters from third world countries – traitors (they run out of other people’s money)!!!!….Now the former inhabitants move to other states as economic refugees because they can’t pay what the communist/socialists overlords demand (over 80% of counties are losing population!!!!….). I feel for them because I’ve been in their shoes.

And these communists/collectivists/socialists from Illinois in 2016 wanted to expand their “successful” experiment to the whole country!!! Tyrants want that everywhere so taxpayers don’t have any place where to seek refuge. CA will follow in their footsteps very soon. Communists act the same everywhere. Wait till CA will get a governor like Maxine Waters or Ocasio Cortez (“”Democratic Socialists)!!!…..That 1 million crapshack will get $90,000 year in property taxes while all businesses head for the exit. That is the problem with these socialists/communists – in their mind they can do whatever they want with no consequences – everything stays static.

You’ve just identified the heart of the problem in California, and in America these days… failing/failed socialist policies.

You’ve just identified the heart of the problem in California, and in America these days… failing/failed socialist policies.

It is good to see so many new people posting.

What does this mean? Is this like a mob of people gathering to see a train wreck or a bunch of hopeful people who see the light at the end of the tunnel so they can buy a home?

From my past posts, I see 2 paths into the future.

1) Housing will crash hard per Jim and Our Millennial. The economy is doing well now so it is hard to predict if a Black Swan will come crashing through our windshields in the near future. If it does, whatever it is, Our Millennial and Jim will be correct and we will see a 50% crash in the stock market which will drive down all of that down payment money, jobs, and then the slow moving housing market will start to fall. I saw it happen in 2008 and I refuse to believe that it cannot happen again. Have 1-2 years of cash available if you own a house already so you don’t lose it.

Have a boatload of cash available and keep your job to buy a house. It doesn’t help if you are jobless and your 100K stock market gains that went up 400% since 2008 are now only worth 40K. If you are jobless without cash, you will wait on the sidelines.

2) The Fed has complete control of our economy now after that “Oops” in 2008.

Inflation will start to rise and stocks and housing will be flat or slightly rising with inflation as long as the Fed is in charge. Housing and stocks will on average start to rise with inflation. If wages don’t go up with inflation, we will have stagflation like we saw under Carter. It was a terrible malaise. If wages do go up with inflation, we may see a positive feedback effect like we saw under Reagan. Wages go up, inflation goes up, so housing goes up. Under Reagan and Carter, inflation was up to 15% yearly. The Dow has been slightly down since Jan 2018 and the Nasdaq has been tracking inflation. Housing might do the same for the next decade. Housing prices could stabilize and the FOMO effect will go away. Why buy now when the price will be the same in 2 years?

As far as Prop 13, the senior baby boomers on Social Security who bought their houses in 1975 for 50K and are currently paying their 2K per year Prop 13 taxes are probably the lowest priority target for state government. As long as people keep buying 1M houses and paying 12K per year, the tax money keeps flowing in.

It may or may not happen, but IMHO the law that Millennials can inherit the property taxes from their parents is the most unfair. Why should a Millennial be able to keep the 2K property taxes on their parent’s 1M house after they pass away into the great CA sunset? They already inherit the house tax-free, why is it even a law to inherit the taxes? Why not inherit the house slave or house dwarf? 🙂 It creates dynasties. So unfair! Millennials should not get this unfair tax break.

Very insightful Bob. I haven’t been as active on this forum as I’d like to be but I remember when posts would barely break 50 comments. I was thinking the same thing; “does this increase in interest in a housing bubble blog signal an incoming bubble???”

For me, the short answer is a big fat NO. The way I see it, the market is irrational and does not agree well with rational people. The threefold increase in commentary from a year ago tells me that there are a bunch of people salivating at the thought of a housing crash that they join a forum so that they can circle jerk each other into “waiting it out.” Unfortunately, waiting it out is a rational thing to do which doesn’t agree with an irrational market. At the moment, I believe that the factors involved are perfect for steady, sustainable growth. It took years of trial and error in the form of booms and busts but what we’re left with now are all the elements in place to keep the circus going for quite some time. Low interest, low inventory and a regulatory framework that makes it difficult to deviate from this norm until this low down payment scam comes into fruition (your income still has to qualify so the effects aren’t going to be as spectacular as 2008).

What we need for a bonafide bubble to occur is a change in the factors that are keeping the market together. Interest rates must rise which increases FOMO and locks out buyers (this is very likely to happen but I can’t see 10%+ anytime soon), developers must get greedy and build en masse which increases supply (this one is definitely coming, just you wait) and regulations must loosen (Trumps last hoorah possibly?) to allow those buyers back into the market but to a feeding frenzy of hyper inflated real estate. Lots of people buying over-priced property in a high inventory market…the perfect conditions for a bubble.

The fact of the matter is that 2008 is still fresh in people’s memories. Everyone wants to wait for a crash so no one’s going to get it. Once those memories fade and the factors I mentioned come into play, then we can talk bubble. So the real question is what’s the market outlook? Here’s my best guess. Stagnant prices for a few more years until wage catches up or growth that’s in line with inflation, if at all. If foreign investing dries up and/or boomers flood the market with supply, then you may have a 15% drop from relative peaks but I wouldn’t bet on it. Don’t be surprised if prices continue like this for the next 10+ years.

Mark. These. Words.

Why rent a box from the bank if you can rent the same box from a private landlord? The answer would be: in case renting from the bank makes sense. But it doesn’t – financially. What bob and new age don’t mention is rental rates. Rents have not kept up with the irrational market.notice how RE cheerleaders do not talk about rental parity? A market that is so out of whack cannot stabilize unless something gives: Price reductions.

Of course RE cheerleaders counter that with the low inventory lie. Have you noticed that they are building everywhere on your way to work? Have you noticed all these empty houses when you walk your dog through the neighborhood or ride your bike? Low inventory is the last big lie they have left in their arsenal to justify a highly overpriced market.

Going back to “stabilizationâ€. What a great, positive word! Reminds me of when realtards were running around a few years ago telling everyone about RECOVERY! Recovery can mean healing from a disease. In real estate terms it means re-inflating the bubble. Consequently “stabilization†translates into keeping the bubble going, somehow maintaining the sky high prices. Notice that only RE cheerleaders who bought a long time ago or people who profit from the bubble talk about the plateau/stagnant prices(stabilization) it’s their dream and last hope. They realize prices are sky high and demand for overpriced crap shacks has fallen off (avg hoe. I meant joe). What you have left is speculators/flippers.

For the longest time RE cheerleaders told you that somehow millennials will start buying at these ridiculous prices. “THIS is the year when millennials go out and buy in drovesâ€. We have heard that every year for the last 3-4 years. The reality is of course very different. Millennials are by far in worse shape than their parents were at that age (financially speaking). So it remains a sales pitch. But RE cheerleaders will read from the same script. Expect to keep hearing that THIS will be the year!

Basically, what bob and new age are telling us is: crash postponed. This time is different. Boom cycle ending? No way! It can only go up or at least stay stagnant! No recession for 20 years! 2008 – 2028!

Simple response: no crash no purchase. I am getting paid to wait (dirt cheap rent compared to buying at heavily overpriced levels.

“…and regulations must loosen (Trumps last hoorah possibly?) to allow those buyers back into the market but to a feeding frenzy of hyper inflated real estate. Lots of people buying over-priced property in a high inventory market…the perfect conditions for a bubble.”

Agreed – this would put what is currently merely an inflated metro market (with outlying areas being pulled along for the ride, but with many other areas not inflated at all) into a true bubble. It wouldn’t surprise me if it happens via a desperation move, or simply as part of an effort by Trump to deregulate anything and everything. If/when we see liar loans again, then I will be the one calling for a 30-60% crash (and possibly jump in the market for a quick flip or two). Until then, more and more I’m thinking a sudden steep drop is unlikely without something really big to trigger it.

@JohnD

I’m reading your comments and beginning to think we are identical in our philosophy about real estate prices and the outlook. It’s kinda scary actually!

Disclaimer: I’m not a RE Cheerleader. I’m just a realist.

Back to the main subject, Riverside, my lovely hometown, is sort of a microchosm of the real estate industry’s booms and busts. An average sized city nestled between some of the biggest cities in the nation and smallest towns. It ideally should be average priced but at the moment, it’s valued above average because of its proximity the hot markets of SD, OC and LA. Back in 2006, my parents house was valued 725,000 (about $900K today) at the peak. The same house is barely selling for $650K in today’s market. I don’t think we’ll get quite up the previous high inflation adjusted but we still have a few more years before we get close to that. When it does, then we’ll be in bubble territory but for now we’re only begining to heat up. Not the best time to buy but definitely not the worst. Whether you rent or buy it really doesn’t matter if immobility isn’t an issue to you and that’s reflected in the parity between the two, pretty much the same. So to wrap it up, if I can describe the market in one word it’d be “meh”

Poor representation. Shoddy research numbers don’t add up. https://mediabiasfactcheck.com/american-thinker/

I got very excited when I saw a group of Chinese nationals roaming through our 80% built out new housing development.

Inventory is nearly non existent in Monterey County so there really is only one direction the market can go.

Could it retreat? Anything is possible but professionals like doctors and dentists need to live somewhere and they don’t want to live in Salinas.

LOL…..yeah, there’s literally millions and millions of doctors and dentists waiting for houses

Not millions, but again, enough of them to price you out of nice area

Haha … you need to get off your iphone or stop gaming Mikey. Chinese buyers are gone gone gone. They are essentially out of the US housing market which means there’s no buyers and prices are heading for a hard landing.

The Chinese are having a tough time getting their money out. It was capped at $50k a year per individual, they just reduced it to $20k. Banks there are doing some serious capital control.

Yuan just devalued. Chinese economy isnt in the best of shape. Most people are not wealthy and inflation is ridiculous (everything cost the same as in the US). With some manufacturing already moving away from China and the tariff war starting, they are really worried over there.

Everyone with money and can get it out already got out in the last 5 years.

That’s fascinating, I hadn’t heard of this before. Can you link me to some sources about this?

yeah, I’d like to see some info about this too,_<sR

yeah, I’d like to see some info about this too.sR

Maybe Trump’s tax plan is finally sinking in. There’s almost no tax incentive anymore to own a home, if you are in the middle class.

Plus, the sting of 2007-8-9 still resonates with people. Nobody wants to buy near the top of the market, and be left holding the bag when it corrects.

TeeJay erroneously thinks: There’s almost no tax incentive anymore to own a home if you are in the middle class.

This is simply not true. The tax deductibility for mortgage interest still remains fully intact for the vast majority of America’s homeowners.

Theoretically, yes; practically, not. For the vast majority of americans, the new standard deduction is higher than the interest/itemized deduction.

Other Side of the Tracks, it is true that “the tax deductibility for mortgage interest still remains fully intact for the vast majority of America’s homeowners.†However, the standard deduction just doubled to 24k for married couples, which gives almost no tax incentive for middle class to buy a home. I’m talking about middle class. The upper 20% will still benefit from buying a home and claiming a mortgage deduction. Of course, I’m speaking in generalities, each person should decide for themselves.

Maybe Trump’s tax plan is finally sinking in. There’s almost no tax incentive anymore to own a home, if you are in the middle class.

Plus, the sting of 2007-8-9 still resonates with people. Nobody wants to buy near the top of the market, and be left holding the bag when it corrects.

Teejay~

I was just thinking yesterday that another reason not to buy a house in California is because at least some part of the state is on fire almost every day. Right now, we again have multiple fires. We don’t have a specific fire season anymore. Also, fires are starting to burn into the cities themselves, and not just the surrounding wilderness areas. It’s nuts here lately. Personally, I think something’s afoot so that the lefties can claim ‘climate change’, and restrict our use of natural resources like water accordingly. I think the weather is being manipulated (sudden high winds out of nowhere prior to the fires starting), and I think DEW’s (direct energy weapons) are involved. Nonetheless, we’re under attack, and frankly, I’m starting to think it’s not safe to live here anymore. It’s just too much lately, and it’s non-stop.

You dont need anything as exotic as DEW – you have 37 million+++ mostly 3rd worlders and they take up a lot of water. Less water in the rivers, lakes, streams and reservoirs means a dryer environment, then those same 3rd worlders driving their unregistered unmaintained junkers catch fire and burn down half the state (or crash into you and your loved ones after a night of drinking and kill your family). I actually saw a fire started in north san diego county years ago on the I-5 by my house during the dry season – a junker dragging its tailpipe sent sparks into the median that started a fire. All the lagoons had encampments of illegals and their prostitutes – protected by the state. I got ticketed taking pictures on my kayak and threatened with confiscation and they demanded to know who I worked for. Cali has been a corrupt third world country for decades now, no different than mexico, just higher – much much higher – prices.

You mean Trump is controlling the weather and directing satellite weapons at the US to start fires?

We really should impeach him.

True engineers do not fall for conspiracy theories.

Speaking of conspiracy theories, the Flat Earth movement apparently began as a joke, which has since been co-opted by the tens of thousands of idiots who actually believe it. Well, a new group was recently formed on Reddit based on the theory that the ocean is bottomless. It’s a joke, yet anyone who calls it that is banned from the group. They’re trying to repeat the flat earth fiasco, and I think they’ll succeed.

In the next few years, you’ll see hundreds of youtube videos posted and watched by people who actually believe the ocean has no bottom.

Bob, let me tell you about what you call ‘conspiracy theories’. This was a term used by the CIA after the JFK assassination to discredit information so that people don’t even look at it. A conspiracy is, at minimum, nothing more than a handful of people working together in the shadows, to accomplish a goal that benefits themselves and hurts everyone else. By that definition, there are countless conspiracies in the world. The endless fires in California contribute to the ‘global warming’ hoax so that government can cut off our resources and tax or fine us to death for using them over artificial limits set for us, such as Jerry Brown’s 55 gallon/day restriction on water use per person as of 2022. Conspiracy theories are anything that differs from the official version of events. The term “conspiracy theory” is used dishonestly to prevent investigation of the claims of critics. “It’s a conspiracy theory. There’s nothing going on.†That’s just a lazy way to shut down dialogue. It shuts people’s brains down and doesn’t make them think.

We don’t need to be a society that sees intrigue and scheming at every turn, but we do need to be aware of the deceit that exists around us. The mainstream media is knowingly broadcasting almost pure fiction 24/7, and hoping to convince you it’s fact. Anything they don’t want you to believe is branded a “conspiracy theory” — a phrase used as a pejorative, almost as a kind of hate speech against the intellectually curious. So what to believe, then? Hopefully by now you’ve figured out that anything which is officially denied by the federal government is probably true. Anything broadcast by the mainstream media (or published in science journals) that supports the commercial interests of powerful corporations is probably false. You are living in a realm of extreme deception, and sorting out truth from fiction is a full-time job. Most people utterly fail at the task and end up surrendering to the engineered influence of corporations, governments and corrupt institutions. It’s easier, after all, to just go along with the narrative you’re spoon fed rather than try to think critically about the world around you. And that’s exactly what the institutions of control are counting on.

J Edgar Hoover (1895-1972) the United States lawyer who was director of the FBI for 48 years and a man who understood such things, wrote that: “The individual is handicapped by coming face to face with a conspiracy so monstrous he cannot believe it exists.”

As for ‘true engineers’ such as myself, we just want an explanation. That’s why people like you call us ‘conspiracy theorists’. We’re not conspiracy theorists – we’re just not gullible. We won’t take anything that you put out there simply because you’re authority figures. We’re going to look at it, and say, ‘Does this add up? No, no, 2+2 is not equal to 5’. So then people like you call us conspiracy theorists.

A final quote:

“Only small secrets need to be protected. The large ones are kept secret by the public’s incredulity.†~ Marshall McLuhan

Karin, A+++

Excellent explanation!!

Thank you for the effort to explain in detail what most people with critical thinking already know. The primary function of the intelligence community is disinformation not collection of information (that comes in second).

Karin–Finally someone who gets it. Great posts.

Karin- Finally, someone who gets it. Great posts.

Flyover and pau~

Thank you very much for your appreciation. I rather liked that one as well, and it seems to have shut Bob and John D down on this topic. If they want another round, I have plenty more ammo to fire.

Actually, the way I differ from other engineers is that I can write and spell, which most engineers are not at all proficient at. But engineering paid more, so I let my writing career fall by the wayside. It comes in handy sometimes, though.

“…and it seems to have shut Bob and John D down on this topic”

Shut me down? A) I was on vacation, and B) I don’t disagree with much of what you write. I actually have a very open mind – I evaluate the evidence and decide for myself if something is likely true. I also use as many sources as possible, which is why it took me all of 5 minutes to doubt the Rothschild conspiracy. The best conspiracies have hints of truth, and different people take the conspiracy farther than others. For example, the rumor that the Rothschilds control 80% of the world’s wealth. It’s absurd on the face of it and easily disproven. Other aspects of the conspiracy were very obviously penned by raving anti-semites, and when I looked at the actual economic claims, they turned out to be impossible. If there were really compelling evidence, I’d be happy to do more reading, but you can bet that I would check every “fact” presented to me.

I like conspiracy theories – they’re entertaining, and sometimes proven correct, but too many people glom onto too many of them just because they need someone else to blame for their unhappiness.

John D~

I would re-post what I wrote about Rothschild and how he made a fortune after Napoleon’s defeat at Waterloo, but the site monitors here deleted my post, and will probably do so again. We can’t let the people know how the world is actually run, now can we? Also, the research cited previously by others than myself, that this was all a conspiracy theory, came a) from research sponsored by the Rothschilds, and b) from a book written by Niall Ferguson, ‘The House of Rothschild’, which was approved by the Rothschilds before publication. From one of the reviews:

“This long-winded and dull history is nothing more than an apologist’s love letter to the rich and powerful. I should have stopped with the introduction which claims that the author had the full blessing of the Rothschild family and that they even approved the manuscript. Well, we won’t be getting anything negative then will we? No, we won’t.”

Actually, this reviewer does mention the aftermath of Waterloo with respect to the manipulation of the markets by Rothschild:

“According to articles I have read about Nathan Rothschild, he had a significant role in the Napoleonic Wars and most especially in the Battle of Waterloo. Rothschild’s couriers were famously faster at delivering news than even the King of England’s and he therefore learned of Napoleon’s defeat a day before the Crown. He then used this knowledge to cause a panicked sell off in the English market, buying the bonds up later at a huge discount.”

There was actually more to this, but I’m not going to get into it again.

As for the Rothschilds controlling 80% of the world’s wealth, I sincerely doubt that. They once controlled most of the wealth of Europe, but today they are not even at the top of the totem pole. And with the bust of the pedo rings that have been occurring since Trump took office, they are losing a lot of what they have left. New laws have been passed against people caught child trafficking and the like, that are similar to asset forfeiture laws here in the States. This has not been a good time for wealth preservation in the Rothschild circles.

“He then used this knowledge to cause a panicked sell off in the English market…â€

I agree that the book is hardly objective. However, you got this from a purchaser’s review posted on a book store site. In making this claim, this person doesn’t cite the articles read, or the sources those articles used. For all we know, he thinks the Rothschilds control the weather.

I prefer to start with someone who did some actual research, even if they’re skeptics:

https://skeptoid.com/episodes/4311

…and then check those claims myself, in order to get both sides of the story. Granted, one of his sources is the Ferguson book (but frankly, looking into Ferguson’s background, he is extremely well-qualified, if not a wonderful human being), but he has five other sources as well. The wiki page on the subject has more than a hundred sources. The idea is to get to the very bottom of it, and knowing who is potentially biased is helpful in itself.

John D~

I opened your link, ‘Deconstructing the Rothschild Conspiracy’, ‘Filed under Conspiracy Theories’, and right off the bat this tells me that this is a conspiracy debunking site rather than a site that deals with actual historical research. Next, I opened the ‘conspiracy theory’ link to ‘Skeptoid Episode Guide – Conspiracy Theories’, and find alleged debunking of conspiracies that have long been proven to be factual, such as ‘The Big Pharma Conspiracy’, ‘Autopsy: The Clinton Body Count’, ‘Firestorm in Waco (Skeptoid #511) – The FBI did not deliberately murder the Branch Davidians in Waco, Texas’ (yeah, right), ‘Agenda 21 (Skeptoid #465) – A look at the conspiratorial hysteria and sensationalism surrounding the United Nations’ Agenda 21′, ‘Satanic Ritual Abuse (Skeptoid #462) – The history of claims that secret Satanic cults are abusing children’, and on and on and on. I feel like I’m reading the highly discredited site, Snopes. This is not intelligent and unbiased research, John. I’m not saying all of it is false. I’m skimming ‘The Death of Mad King Ludwig’, and I agree that King Ludwig was eccentric, but not mad (his family, the House of Wittelsbach, was fairly inbred, though, and his brother Otto was the one that was crazy enough to be locked up and kept out of sight. But not Ludwig.). I’m from that part of Bavaria, and actually spent a year of high school living across from the spot where Ludwig was drowned in the Starnberger See (Lake Starnberg).

Next, I looked up the guy running this site, Brian Dunning. Here’s what I found:

“This Man Cheated eBay Out Of $5 Million And Now Faces 20 Years In Federal Prison

“If you know Brian Dunning at all, it’s probably as the host of “Skeptoid,” a podcast that debunks pseudoscience. Recent episodes have discussed UFOs, aliens, and free energy machines.

“But for the last few years he’s been fighting eBay and the FBI in court over allegations that he cheated the auction site out of $5.2 million in an ingenious “cookie stuffing” affiliate marketing scam.

“Yesterday, he gave up that fight, and pleaded guilty to wire fraud in a California federal court. He faces 20 years in prison.”

So he’s not very trustworthy, for starters.

But getting back to the Rothschilds, let’s see if this site’s monitors delete my post on this again:

“The Rothschild family has played a crucial role in international finance for two centuries, as Frederick Morton, in The Rothschilds, writes:

“For the last one hundred and fifty years the history of the House of Rothschild has been to an amazing extent the backstage history of Western Europe.”10 (Preface)… Because of their success in making loans not to individuals, but to nations, they reaped huge profits, although as Morton writes, p. 36, “Someone once said that the wealth of Rothschild consists of the bankruptcy of nations.”

“E.C. Knuth writes, in The Empire of the City, “The fact that the House of Rothschild made its money in the great crashes of history and the great wars of history, the very periods when others lost their money, is beyond question.”

“The sire of the family, Mayer Amschel Rothschild (“The original name of Rothschild was Bauer.” p. 397, Henry Clews, Twenty-eight years in Wall Street), established a small business as a coin dealer in Frankfurt in 1743. Although previously known as Bauer, he advertised his profession by putting up a sign depicting an eagle on a red shield, an adaptation of the coat of arms of the City of Frankfurt, to which he added five golden arrows extending from the talons, signifying his five sons. Because of this sign, he took the name ‘Rothschild” or “Red Shield”. When the Elector of Hesse earned a fortune by renting Hessian mercenaries to the British to put down the rebellion in the American colonies, Rothschild was entrusted with this money to invest. He made an excellent profit both for himself and the Elector, and attracted other accounts. In 1785 he moved to a larger house, 148 Judengasse, a five story house known as “The Green Shield” which he shared with the Schiff family.

“The five sons established branches in the principal cities of Europe, the most successful being James in Paris and Nathan Mayer in London. Ignatius Balla in The Romance of the Rothschilds (12) tells us how the London Rothschild established his fortune. He went to Waterloo, where the fate of Europe hung in the balance, saw that Napoleon was losing the battle, and rushed back to Brussels. At Ostend, he tried to hire a boat to England, but because of a raging storm, no one was willing to go out. Rothschild offered 500 francs, then 700, and finally 1,000 francs for a boat. One sailor said, “I will take you for 2000 francs; then at least my widow will have something if we are drowned.” Despite the storm, they crossed the Channel.

“The next morning, Rothschild was at his usual post in the London Exchange. Everyone noticed how pale and exhausted he looked. Suddenly, he started selling, dumping large quantities of securities. Panic immediately swept the Exchange. Rothschild is selling; he knows we have lost the Battle of Waterloo. Rothschild and all of his known agents continued to throw securities onto the market. Balla says, “Nothing could arrest the disaster. At the same time he was quietly buying up all securities by means of secret agents whom no one knew. In a single day, he had gained nearly a million sterling, giving rise to the saying, ‘The Allies won the Battle of Waterloo, but it was really Rothschild who won.'”***

“After the success of his Waterloo exploit, Nathan Mayer Rothschild gained control of the Bank of England through his near monopoly of “Consols” and other shares.”

*** The New York Times, April 1, 1915 reported that in 1914, Baron Nathan Mayer de Rothschild went to court to suppress Ignatius Balla’s book on the grounds that the Waterloo story about his grandfather was untrue and libelous. The court ruled that the story was true, dismissed Rothschild’s suit, and ordered him to pay all costs. The New York Times noted in this story that “The total Rothschild wealth has been estimated at $2 billion.”

From ‘Secrets of the Federal Reserve’ by Eustace Mullins

I’m just back from vacation also to the Santa Barbara area

The mountains and hills are now ash-gray instead of the green/brown when I grew up

It is true that the fires in CA will stop when everything burns and the lack of rain keeps the vegetation from ever growing back.

Look up Occam’s Razor.

Is it more likely CA has major wildfires because:

1) Prolonged drought caused by global warming has dried out vegetation to the point where major wildfires can exist. The enormous CA population makes it more likely that someone will be careless and start the fires.

or

2) Trump is shooting high energy particle weapons from satellites in space at the request of the Rothchild’s to start fires in normal CA weather conditions.

Occam’s Razor determines that the simpler explanation is the most likely.

Bob: Is it more likely CA has major wildfires because:

1) Prolonged drought caused by global warming has dried out vegetation to the point where major wildfires can exist. The enormous CA population makes it more likely that someone will be careless and start the fires.

or …Occam’s Razor determines that the simpler explanation is the most likely.

Occam’s Razor says simplest explanation is:

1) Prolonged drought

caused by global warminghas dried out vegetation to the point where major wildfires can exist. The enormous CA population makes it more likely that someone will be careless and start the fires.“So he’s not very trustworthy, for starters.”

Which is why I prefer to use many sources.

From wiki:

Eustace Clarence Mullins Jr. (March 9, 1923 – February 2, 2010)[1] was an antisemitic American writer, propagandist,[2] Holocaust denier, and disciple of the poet Ezra Pound.[3] His best-known book is The Secrets of The Federal Reserve, in which he alleged that several high-profile bankers had conspired to write the Federal Reserve Act for their own nefarious purposes, and then induced Congress to enact it into law. David Randall called Mullins “one of the world’s leading conspiracy theorists.”[4] The Southern Poverty Law Center described him as “a one-man organization of hate”.

Even after reading that, I still don’t doubt the book has a pinch of truth in it, but I certainly wouldn’t blindly trust it.

Again, John D, your source is unreliable. “A wiki is a website on which users collaboratively modify content and structure.” This is from Wikipedia itself. You don’t know who wrote what you posted, and what their agenda is. It’s common knowledge that Wikipedia can be notoriously unreliable, to the point that many universities will not allow papers to be sourced from the site. It’s also common knowledge that “several high-profile bankers had conspired to write the Federal Reserve Act for their own nefarious purposes, and then induced Congress to enact it into law.” There are many books on this topic. As for David Randall, anyone that maligns someone by calling them a ‘conspiracy theorist’ immediately exposes themselves as someone that has no better argument against the theories promulgated by said ‘conspiracy theorist’ than to label the person as such, and hope that no one catches on and calls them on it. It’s an intellectually lazy way to present an opposing argument, which is to say that they have no argument at all.

And speaking of lazy, who is David Randall? You just throw out the name. I clicked on the name under Wikipedia’s site on Eustace Mullins, and see that he’s a journalist. That doesn’t carry much weight these days, for starters. And what are his credentials? He works for ‘The Independent on Sunday’, which was sold to Russian oligarch Alexander Lebedev in 2010. Per Wikipedia:

“Nicknamed the Indy, it began as a broadsheet, but changed to tabloid (compact) format in 2003.[3] Until September 2011, the paper described itself on the banner at the top of every newspaper as “free from party political bias, free from proprietorial influence”.[4] – me: I’m sure.

More:

“In July 2011, The Independent’s columnist Johann Hari was stripped of the Orwell Prize he had won in 2008 after claims, to which Hari later admitted,[15] of plagiarism and inaccuracy.[16] In January 2012, Chris Blackhurst, editor of The Independent, told the Leveson inquiry that the scandal had “severely damaged” the newspaper’s reputation. He nevertheless told the inquiry that Hari would return as a columnist in “four to five weeks”.[17] Hari later announced that he would not return to The Independent.[18] Jonathan Foreman contrasted The Independent’s reaction to the scandal unfavourably with the reaction of American newspapers to similar incidents such as the Jayson Blair case, which led to resignations of editors, “deep soul-searching”, and “new standards of exactitude being imposed”.[19] The historian Guy Walters suggested that Hari’s fabrications had been an open secret amongst the newspaper’s staff and that their internal inquiry was a “facesaving exercise”.[20]

“In 2007, Alan Rusbridger, editor of The Guardian, said of The Independent: “The emphasis on views, not news, means that the reporting is rather thin, and it loses impact on the front page the more you do that”.[43] In a 12 June 2007 speech, British Prime Minister Tony Blair called The Independent a “viewspaper”, saying it “was started as an antidote to the idea of journalism as views not news. That was why it was called the Independent. Today it is avowedly a viewspaper not merely a newspaper”.[44] The Independent criticised Blair’s comments the following day[45][46] but later changed format to include a “Viewspaper” insert in the centre of the regular newspaper, designed to feature most of the opinion columns and arts reviews.”

John D, you say you look at all points of view, but what you post seems to indicate otherwise. We all do to an extent, but you definitely exhibit distinct bias in what you choose to believe.

Oh, and don’t even get me started on the Southern Poverty Law Center. I feel my blood pressure rising just thinking about that lying criminal organization. Just for starters, look up Oklahoma City.

As for ‘Secrets of the Federal Reserve’, you can download it online. The information packed into it is astounding, and is a very enjoyable read if you’re into these things (which I am). For instance, I have never encountered anyone that knew that Katherine Graham of the Washington Post, who presided over the Watergate story, was the daughter of Eugene Meyer, one of the founders of the Federal Reserve:

“The shareholders of these banks which own the stock of the Federal Reserve Bank of New York are the people who have controlled our political and economic destinies since 1914. They are the Rothschilds, of Europe, Lazard Freres (Eugene Meyer), Kuhn Loeb Company, Warburg Company, Lehman Brothers, Goldman Sachs, the Rockefeller family, and the J.P. Morgan interests.”

Your wall of text misses my entire point, which is to dig all the way down. You can try to discredit journalists all you like, but if I can trace their sources back to multiple history/text books, and their sources come from records contemporary with the subject, then what they reported on (even if it doesn’t fit your narrative) is probably correct. If a potentially biased article has sources, I follow them. For example, the suggestion that Eustace Mullins is an anti-semite. Just because a Wiki article mentions it doesn’t mean I take it at face value. So I did a little digging, and yup – he’s a raving, paranoid anti-semite. I don’t like bigotry. It pisses me off and shows a glaring bias. But again, I don’t doubt there is some truth in his books.

The unreliability of Wiki is a myth, by the way. Studies have shown that it is extremely accurate. You can test this yourself by becoming an editor, inserting some inaccurate bits in any random article, and watch how fast it’s removed. Unlike most conspiracy web sites, you can also find the sources of an entry’s information on the same pages.

Do you believe the Earth is flat? Or that the moon landing was hoaxed? Or that chemtrails are being used to control our minds?

But John, your sources are quite biased in one direction. And no, I don’t think you are doing the research. You cite this quasi-journalist, and then write that “if I can trace their sources back to multiple history/text books, and their sources come from records contemporary with the subject, then what they reported on (even if it doesn’t fit your narrative) is probably correct.” Did you trace his sources? Then what WERE those sources, specifically? No, you assumed his sources were correct because they were aligned with your belief system.

As for Wikipedia, I have found many errors on this site. Particularly on the subjects of allopathic vs. holistic medicine, GMOs, and the like. Look up this article: ’10 shocking facts you never knew about Wikipedia and Jimmy Wales’ (Jimmy Wales is the founder of Wikipedia). From the article:

“Jimmy Wales likes to fraudulently claim Wikipedia is run by “thousands of volunteers.” What he leaves out is the fact that many of those “volunteers” are actually paid by drug companies, food giants and the biotech industry to exploit editing privileges in order to censor information they don’t want the public to see. The fact that Wales continues to allow anonymous editing across Wikipedia means any corporate troll can alter information in Wikipedia pages to benefit the financial interests of that corporation (or government, or industry group, etc.).

Oh, and before he launched Wikipedia, Jimmy Wales ran a porn site network called “Bomis” that featured “Bomis Babes.” Great qualifications.

There’s more – read the article. Also, and this is key, Wikipedia itself admits that there is ‘Conflict-of-interest editing on Wikipedia’:

https://en.wikipedia.org/wiki/Conflict-of-interest_editing_on_Wikipedia#Jimmy_Wales

It’s a long article, but details ‘pay to play’ editing by corporate interests: “Conflict-of-interest (COI) editing on Wikipedia occurs when editors use Wikipedia to advance the interests of their external roles or relationships. The type of COI editing of most concern on Wikipedia is paid editing for public relations (PR) purposes.”

As for research, I do have an extensive library, the largest section being history. After my last reply to you, I picked out a book called ‘How the World Really Works’, by Alan B. Jones. I bought this years ago based on several high recommendations. I started reading it yesterday, and could not put it down. It’s a synopsis of 12 books of historical/political/economic significance, including ‘Tragedy and Hope’, by Carroll Quigley, a book written by a globalist insider that was granted access to private archives regarding the goals of the international elite, and the history behind them. He sides with the elite, and agrees with their goals (so this is definitely not a side I’m aligned with), but felt that the information he provided should be public information. The book itself is over 1300 pages long (I have it on pdf.), so I’ll stick with the synopsis for now.

(to be continued)

(cont’d):

The first chapter I read in Jones’ book was a synopsis of ‘A Century of War’, by William Engdahl, who writes for Global Research. The chapter starts out with the origins of World War I, which came about because of Great Britain’s secret strategy to control gold, the seas, and the world’s raw materials, particularly oil. The furtherance of this was in the hands of the group ‘The Round Table’, consisting of Cecil Rhodes and others, who were anti-German and pro-Empire. Round Table members viewed the economic strengthening of Germany with alarm, and considered the German effort to build a Baghdad-to-Berlin railway as a direct military threat, since it would provide German access to the Middle East’s oil fields, bypassing the sea routes controlled by the British. So before the route could be finished (the last link being in Serbia), the Austrian heir-apparent was assassinated by a Serb (what a coincidence, aka a ‘false flag’ – look the term up), to which Austria responded, starting WWI by bringing in Germany, France, and Russia by treaty with either Serbia or Austria, and also Britain, with a secret treaty signed with France only 3 months before the assassination. The war produced between 16-20 million deaths, mostly civilians. Germany was successfully cut off from Russian and Middle Eastern oil, and the war was won with Rockefeller (!!!) oil from America. After the war, Britain and France carved up the Middle East by a prior secret wartime agreement. Britain obtained protectorate status over Palestine (the future Israel), which set the stage for their planned creation of a Jewish homeland, which intent was proclaimed to British Zionists in a letter from Britain’s Foreign Secretary Arthur Balfour to WALTER LORD ROTHSCHILD (there’s that name again), representing the English Federation of Zionists. Gee, and who could possibly have been behind the war all along?

And what happened to Germany after the war? Well, under the Versailles Treaty, the Germans were saddled with unpayable war debt, and were then denied any reasonable possibility of paying it off. The German reparation debt amounted to 132 billion gold marks, with the unpaid balance to accumulate at 6%. Germany signed the agreement under the threat of military occupation of the Ruhr, then engine of their economy, if they refused. But in 1922, Germany’s foreign minister Walter Rathenau signed the Rapallo Treaty with the Soviet Union to forgive reparation agreements due Russia in exchange for German industrial technology, which the British vigorously protested. Two months later, Rathenau was mysteriously assassinated, and any hope for German economic stability was lost. The German Mark then began its famous fall. In December 1922, the Mark had fallen to 7,592 DM to the dollar. Germany was declared in default of her reparations payment on January 9, 1923, and two days later French military forces occupied the Ruhr. By November, the DM was trading at 750 billion Marks to the dollar, and the savings of the entire German population were destroyed, substantially wiping out their entire middle class.

And that was just World War I, which was a walk in the park compared to WWII. My family is from East Germany. My mother, born in 1928, grew up under Adolph Hitler (who was part Jewish, btw, which freaked out his remaining command at the end of the war when they found out; they burned down the entire town he was born in to hide the evidence). Hitler was funded by the global banking families, particularly by the British banks that initiated WWI, in case you didn’t know. Hitler came to power in 1933, and as soon as his control was consolidated, credits immediately began to flow from Montagu Norman, the Governor of the Bank of England, to Hitler’s government – in support of his regime. Support came from America as well. Prescott Bush, for one, funded the Nazi party through the Union Banking Corporation (he was a founding member and one of the directors of the bank). Of course, look this up in Wikipedia, and it says, “Historian Herbert Parmet agrees with the assessment that Bush was not a Nazi sympathizer.†Yeah, right. I love Wikipedia – such chutzpah, as the Jews would say.

After the war, the part of Germany where my family home stood was given to Poland, and my grandmother lost everything she had left (she’d already lost her husband during the war itself). My aunts were brutally raped after the war by the Russians, and other things happened to them that were not even discussed because they were too painful. There were death marches of the Germans, particularly in East Germany:

https://www.henrymakow.com/2015/11/what-illuminati-did-to-germans.html

Everything was taken from them, and this was AFTER the war. My mother is an alcoholic wreck to this day because of what happened to her and to her family.

There’s so much more. I’ll stop here. Studying history, though, gives me an understanding of why many of the older Germans are, as you might say, ‘raving anti-Semitics’.

>”The housing market is now entering a visible slowdown ”

Lol so what? Prices are still at record highs, good properties are still going over asking, and inventory is still at near-record lows in most major metro areas.

Considering Democrats are now pushing for amnesty for millions of illegals and completely open borders while NeoCon Republicans are fast-tracking nearly 500,000 H1B visas for Indian tech workers and expanding asylum claims to allow a further 38 MILLION central and South Americans to claim asylum in the U.S., housing prices are NOT going to go down significantly; after all America’s future is brown and these third-worlders will need places to live!

The housing market is now entering a visible slowdown â€

“Lol so what? Prices are still at record highs, good properties are still going over asking, and inventory is still at near-record lows in most major metro areas.â€

Exactly what I was thinking. Prices are high and sales volume is slowing. Seems normal to me.

This is exactly what you want to see. I think the goal is to let a little air out of the balloon not pop it. It’s still going to rise just not as quick. The Fed is raising rates and unloading their balance sheets while the economy is growing.

So you saying Illegal immigrants, brown people and Asylum seekers are the one pushing the prices high? Blaming other people for your problem not gonna solve it for you. May be you are so broke because you so racist? There are still alot of affordable areas in the US. Go buy a home there before any illegal or third-worlder go there.

Wait so you’re saying bringing in millions of people every year who need a place to live doesn’t increase prices? LOL

I love libs, I really do. One day you say you want unlimited immigration. Then the next it’s all “why aren’t wages increasing and why is housing so expensive, somebody needs to do something”. Uhm yeah that something is stop the millions of new people coming here. Less supply of labor will increase wages and less demand for housing will decrease housing prices. It’s Econ 101, first day of class stuff. But you don’t get it.

I’m never quite sure if you’re just really dumb and can’t put 2+2 together or if you just like playing dumb.

I never understood the “logic” of some of the immigrants from Mexico or other impoverished nations. They come here because they like it better than the previous place, for one reason or another. Then they want to turn the new place to look like the previous place by employing the same policies and electing the same type of politicians acting like the ones in the country they left behind. It is a classic example of idiocy when you do the same thing expecting different result.

You see that even among the liberals/socialists in US leaving the blue states behind and voting in the new red states the same type of communist politicians they left behind who ruined their previous state economically.

I am an immigrant myself (an economic refugee) from a previous socialist/collectivist country. I came here legally with a visa and I am glad for it. Family members can always come legally. Then, why would I want open borders for people to bring in the “ideals” of collectivism with them? It does not have anything to do with racism – it is just plain common sense which is not so common anymore. Why would those embracing “democratic socialism” (collectivists) destroy another country like they did in so many before? Just to satisfy the new feudal society envisioned by the 0.001% globalists (for them to own everything and all the rest equally poor)?

I travelled extensively in South America and is full of socialists/collectivists – not all, but a very large percentage, especially among the poor. They are poor because many are uneducated. Even if they come here, they get the same public school indoctrination they received in the previous country; to keep them poor.

These days the word “racist” is used as a code word for people who stopped learning and to stop any uncomfortable conversation where they can learn something. It is also used by the 0.001% at the top for obvious reasons – to keep power and get more power by manipulating the “useful idiots”.

Quote of the day:

“No one loves socialism quite like a moron who has never experienced it firsthand. No one hates it like someone who has seen it up close. ” It does not have anything to do with racism.

I did not see it up close; I lived in it. Don’t see it “up close” with dollars in your pocket. Work and live in it. You will be cured of collectivism/socialism for life.

You’re right. We should be as “non-racist” as the Indians, Chinese, Israelis, Mexicans, Saudis, and other foreign nations.

I visited China last year. I was shocked. The TV shows were so Chinese. No diversity. No white government officials. All the signs were in Chinese. And everyone spoke Chinese, like it was normal. Then I learned I didn’t qualify for immediate full citizenship and freebies upon request. So racist!

I continued traveling the world, and was shocked to discover that India is so Indian. I couldn’t find a single sign in Icelandic. And Israel is full of Jews. They even have laws preventing non-Jews from immigrating to Israel. And Africa is so African. They’re even trying to squeeze the few remaining whites out of South Africa. And Saudi Arabia is so Muslim. Islamic law is the law of the land, rather than sharing authority with Catholic Canon law. Insane!

When you think about it, the “white” nations of the world are the least racist, the most welcoming of diversity, yet it’s we who get called racist.

Imagine the outcry if we instituted reciprocity, treating each foreign nationality as their nation treats foreigners. Think Indians or Chinese would want to be treated as their nations treat foreigners?

@Megi that is a remarkably low IQ response. Sad!

You cannot actually be dumb enough to think that the mass immigration of tens of millions of foreigners doesn’t affect housing prices (or for that matter, wages and housing affordability)… no one is THAT dumb… right?

Flyover~

You summed it up in a nutshell. I’m an immigrant as well; my parents came over here from Europe when I was 3, and it took them 15 years to get their citizenship. While they were proud of their German (my mother) and Greek (my father) heritage, they loved this country, and were happy to live under the freedom and prosperity the U.S. afforded them. My mother was born in a communist country (Saxony in East Germany) in 1928, and the hell wrought onto her country by Hitler, who had Jewish blood btw, is a story that many do not know. And I’m not just talking about the bombing of Germany, but of what the Allies did to the Germans after the war. My father was raised in poverty in Greece, and kissed the ground of America when he arrived here. None of us wanted to re-create our ‘homeland’ here in the U.S. We made a good living for ourselves not with handouts, but with hard work. My family and I know that socialism does not work. I so appreciate that you understand this from personal experience.

Please pass the bong, Trump should shut down the government to get the Mexican govt. to bend very fast. Nothing comes or goes across the border, all commerce stopped. We would have a wall built by them in 6 months. Not a good wall either…

Illegal immigrants belong in Mexico, not America, stand in line like everyone else, I bet you love it when a group of folks step in front of you at the matterhorn….

hypocrisy is the biggest threat to the American Sheeple…..they are just minions ready to be crushed, debt serfs like you are clueless on what is going to happen in the market, housing etc.

Go take your liberal self to PV, live in Mexico, fine women in Puerto Vallarta too, maybe you will get lucky, no illegal will ever be able to buy a house here, its over…..

I just got back from Seattle. I visited Snoqualmie Falls state park, roughly 30 miles east of Seattle.

There were SO MANY Indian families hiking the trails. At first, I thought it was maybe a convention of some sort, and they were staying at a nearby hotel. Then I remembered all those H1B1 tech workers I keep hearing so much about.

It really hit home. There are a LOT of Indians in the Seattle area. And I suppose most of them are taking jobs that American tech workers would do. Perhaps a higher wages, but perhaps not.

I heard long ago that Trump was gonna clamp down on the H1B1 program. I wish he would. More higher wage jobs for Americans. It’s one of the reasons I voted for him.

Trump hasn’t done anything on H1Bs. He teased that he’d start cracking down on the fraud, but it went nowhere. It’s the one area of immigration where he’s shifted. It’s weird that the group of people that has done the most to harm him – Big Tech CEOs – are getting rewarded by him with a never end supply of slave labor from India. I really don’t understand what is in it for Trump. Maybe’s he’s bought into the BS about tech labor shortages in the US, which is a 100% complete and utter lie.

And Seattle is actually pretty low on the H1B list per capita. I think they just like to hike a lot, lol. The highest H1B concentration on a per capita basis is NYC and Dallas. Seattle isn’t even in the top 10.

SOL,

If Trump would ACT like a dictator, the way the left media portraits him, he would have stopped all that a year ago. But he is only one guy in a Congress full democrats and RINOs and courts packed with activist judges ruling from the bench. Add to that a bunch of not so “intelligent” agencies and a sleeping AG and nothing gets done.

If he tries to nudge a little bit those sleeping in government positions, everyone screams bloody murder that he is Hitler incarnate, dictator and a fascist. I think that by now everyone saw that day after day.

I’ve been waiting for you to update! I only follow (for years) and never comment. I’ve gotten the sense that the market is slowing. This is anecdote; however, what I’ve noticed are MANY more homes on the market in my area and all of them sitting longer.

I live in an outstanding community in Northern California with top-notch schools, which, BTW, is why we moved here! We currently rent a small townhome and fortunately, our landlord has NOT raised our rent once since we moved here in 2015.

Here is what I’m noticing. Last year, a condo in my area would RARELY hit the market, and if it did, a sale pending sign would be up within a week or so. Same complex as of yesterday, 6 for sale signs, all have been sitting for a few weeks and counting, and none of them pending. Again, this is an EXTREMELY small sample; however, I think it may be reflective of what is going on, but what in the hell do I know :). Time will tell!

The good news is, we could have bought into the very decent community just adjacent to us, BUT with the SHITTY school district and overpriced homes but we REFUSED. We’ve held steady, saved some money, kept or kids in a TOP high school and have essentially been riding this market out. It’s been tough over the years watching prices climb, thinking we may never get in the game.

We will see what’s to come. I’m just happy our children are nearly graduated and I also just graduated from nursing school. Things are looking up.

Northern Cal is a big place, please be specific – what city are you in?

What makes the adjacent school district so bad? Be honest – its the mudskins with their shoe sized IQs isnt it?