The evaporation of housing inventory:Â What a continued drought in housing inventory will mean for the real estate market.

The housing market continues to operate in a very lean environment. Home builders are building but are focusing their efforts on multi-family units to cater to a growing renting population. Builders are also shy about placing big bets given the recent memory of the previous housing bubble. Places where they can build freely like Arizona, Nevada, and Florida are known to pop as quickly as they go up in value. And in areas like California, where NIMBYism rules the day, people are now convinced that prices will never go down so the ratio of bulls to bears is extremely high. The sentiment seems to be that there could be no wrong in purchasing real estate even if it means leveraging up into a crap shack. Yet what is very telling is that inventory is still very low after many years.

Bouncing at the bottom

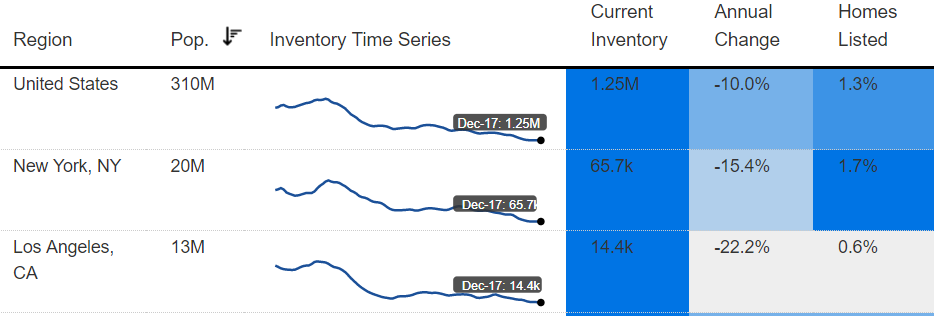

Inventory has been bouncing near the lows for almost six years now:

Nationwide inventory is down 10 percent year-over-year from an already low year.

In Los Angeles, inventory is down 22 percent year-over-year from an already low year.

What this means for house buyers is that you are going to encounter slim pickings, house lusting shoppers, and a market sentiment favoring sellers. If you are buying, you are not in the driver’s seat. If you are selling, you can command top dollar even for a shanty crap shack.

One thing that has changed since the late 1990s is that we now seem to live in a perpetual boom and bust cycle. Housing being a safe investment that tracks inflation is no longer the case. Real estate is now like a hot stock with big leverage behind it. When things are good, it can be very good. When things go bad, they can turn quickly. And for most people, the challenge in the last housing bust was simply making the mortgage payment. Recessions tend to expose those who are over leveraged in debt.

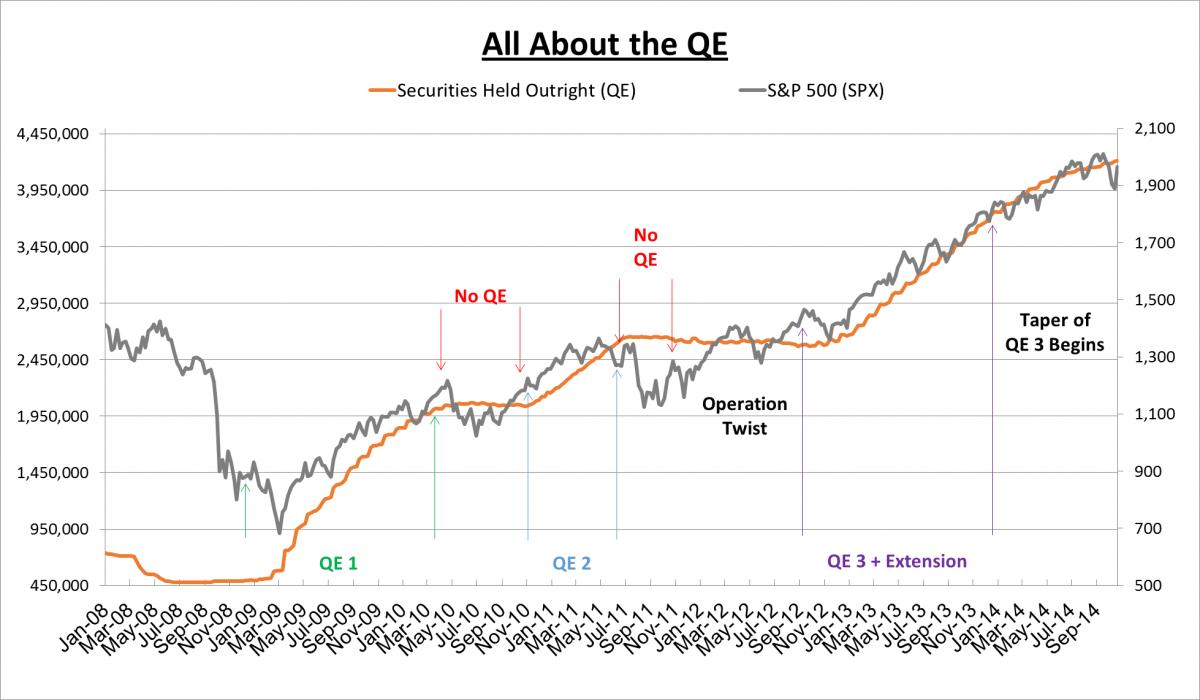

People seem to think this hot market is because of the current administration which is hard to believe. Timothy Geithner set the markets on fire in 2009 with QE:

Quantitative Easing essentially reversed the market and we have yet to look back since 2009. But this happened nearly a decade ago which is hard to believe. Yet to think all of this euphoria is happening because of current policy is incorrect. And clearly anyone in power is going to leverage positive factors to their side, regardless of party affiliation. But one things is clear and that is things are looking frothy across multiple asset classes.

The housing market is deep into a FOMO stage. There is a deep seated fear now that people will miss out: That $700,000 crap shack will be $1 million.  Bitcoin will be $30,000. The Dow will hit 30,000. Everything seems to be going up yet the homeownership rate is stagnant and housing inventory is in the dumps.

The continued drought in inventory means that people will be bidding up crap shacks. The typical home in the US costs $206,000. The typical L.A. home is $632,000. It’ll be interesting to see how much more this market can sustain because the bull fever is definitely out:

The VIX Index shows near record low volatility meaning people expect the party to go on forever. The index nearly looks as low as housing inventory.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

344 Responses to “The evaporation of housing inventory:Â What a continued drought in housing inventory will mean for the real estate market.”

The narrative is generally that 2009 QE ends up in the hands of banks that buy up the real estate inventory. Thus, asset bubbles in stocks and RE are also a reflection of inflation that has not penetrated other assets, yet. Those with stocks and RE holdings are happy. In addition, foodstuffs and everyday purchases have not witnessed much inflation, yet. But now at the end of the cycle, raising rates beyond 5%, according to many analysts, would trigger the bust or exacerbate it.

If this narrative is true, there are not many options for the central banks. Purchasing in California will not cashflow at this stage in the boom, although it may appreciate more to reflect the asset bubble inflation. But condos on Florida can still cashflow, even if there is little to no more expected appreciation. So, even though there is much uncertainty, 2018 can still be a positive year for the savvy and fortunate investor.

So are you predicting continued zirp and more real estate appreciation or it all hits a wall, rates rise and real estate crashes?

I neither have the background nor the tools to predict anything. However, if I am going to pick a narrative for its truth claims, by process of elimination I have to exclude ideologues in order to make sound investments, including MAGA cheerleaders and perma-bulls/bears.

The 10 year Treasury has crept up to 2.72% as I write this . This is the benchmark rate for mortgage rate settings. A 170bps spread between the benchmark and mortgage rates is about average, which puts the 30 year mortgage at 4.42% .

I agree with @eckspat and many analysts. The 5% mortgage is the Maginot Line for further price appreciation. That’s why the can-kicking Fed will go all out to keep the 10y Treasury under 3%. They will do anything to avoid a tsunami of underwater leveraged homes.

You should also add the anti-Trump doom and gloom narrative to your bag of avoidable ideology for investment purposes. So far that has been the biggest strategic loser, including cryptocurrency skeptics and housing bears.

“foodstuffs and everyday purchases have not witnessed much inflation”

I don’t understand why people keep saying this. It’s not my reality at all. There’s a local restaurant near my office that has a banner sign out front of 4 burger combo offer that was $10, ~10 years ago….it’s $22 today. AND packages have gotten much smaller as well.

I’ve noticed the same with street tacos. Not too many years ago you could pick those up for well under a buck or less outside of Tuesday. Now much higher and I’m referring to standard hole in the wall mexi places and trucks.

This notion that there is no inflation (outside of asset markets) is totally absurd, and it is absolutely scandalous that the American populace tolerates government lies. Exhibit 1, the raw data (from BLS); let’s examine common household groceries. From 2007-2017, the inflation rate for all-purpose flour is 44%; white rice +31%; sugar +21%; pasta +45%; wheat bread +16%; salted butter +10%; red delicious apples +15%; seedless grapes +28%; dried beans +45%; sliced bacon +58%; and the list goes on and on. The retail price of gas at the pump was $2.33 on 1/1/2007; it ended 2017 at $2.50 and has recently spiked to $2.63 (data from U.S. Energy Information Administration). Looking at the CPI series for Medical Care for all Urban Consumers (sourced from BLS), the cumulative inflation rate was 35.2%. Obviously, shelter costs have also increased dramatically. So the data themselves belie the government’s preposterous claim that there is little inflation. Secondly, hedonic quality adjustments are also a fraudulent mechanism for understating real inflation. Lastly, substitution of goods into the basket under consideration may also improperly skew the true inflation rate. The motive is obvious: tracking social security COLAs against actual inflation would bankrupt the government. The funny thing is that the Fed wanted to create inflation in order to enable debt pay down. The problem is that, if the Fed never creates wage inflation, but has engendered galloping inflation everywhere else, the Fed has done nothing but sew the seeds for the next recession on Main Street. These guys are serious idiots.

Calling BS, I agree with you on inflation. The CPI for a long time was a bogus number. However, the CP plays an important role in calculating the GDP. If the GDP adjusted for the true inflation, it was negative for a very long time – the economy was in contraction/depression for over a decade – so much for the bogus “recoveree” and green shoots”. No wander for most of America it was feeling like depression – the purchasing power decreased year by year while the government was printing money to mask the depression. Sooner or later the financial markets will prove that we were swimming naked.

Probably, true, there are lots of houses in LA and OC brought up by investors that jacked the price up, but with rising interest rates and a limit of the mortgage deduction it might not work as much in the future. They would be smart just to sale foreclosures in rentials,

Regardless of inventory, Los Angeles is un-affordable, I have a full time job plus a part-time business (it use to be full-time). Still, prices increase faster than what I can generate income. Lastly, the market is saturated for almost any kind of business. At this rate, I will never be able to buy a house.

What a $615,000 crap shack looks like in Portland: https://www.redfin.com/OR/Portland/7068-SW-Windemere-Loop-97225/home/26667368

Random thoughts:

-At first I thought that it was just a poorly staged RE offering, and then I saw the closet shot. They’ve – owners – been there for three years, and yet there’s hardly any furniture, and what’s there is so-so Ikea quality. Bare bones. Hardly anything on the walls, an “Art” here and there. To me that indicates that they’ve just been barely keeping their heads above water financially until they could unload this.

-They raised the price, and *then* somebody bought it. House-horny, anybody?

-The important part: Portland is part the Cascadia Subduction Zone. Last big blowout was 1700 – took out both the coastal regions from above SF to Vancouver as well as a 600 mile (!) chunk of Japan – so it’s past due to cut lose again. (Unlike 1700, now the Pacific Northwest is densely populated.)Does anybody who’s knowledgeable about these things *really* want to buy in the Pacific Northwest?

Here, have an informative read: http://strangesounds.org/2016/07/the-really-big-one-cascadia-worst-disaster-history-continent-video.html

Raining on the parade I guess.

Just a thought.

VicB3

Portland and Seattle are not on the coasts. Perhaps the earthquake’s damage won’t be that bad so far inland?

You think that is a crap shack? Looks good the me. No comment on price but looks pretty decent

I was being sarcastic. Of course it’s nice.

My point was that $615k, which is crap shack money in SoCal, can buy this in Portland.

You couldn’t touch a place like that Portland home anywhere here in Chicagoland for less than $850,000K, even in the outer suburbs.

Only libtard fools would buy a home in ShitCongo where property taxes are among the highest in the country thanks to corrupt Democrap thugs like Mayor Rham Emanuel.

http://www.chicagotribune.com/news/local/politics/ct-chicago-property-tax-bills-met-0614-20160613-story.html

Yes, 2400 sq feet, too big for me. My Burbank vintage Tudor, 1300 sq ft , Zillow, says $860k, the Portland house is too big for me. I don’t like rain and clouds, I get cabin fever.

Portland, Oregon. “Porkland” refers to the fact that many women in Portland are fugly, frumpish, and frequently overweight. Hence, “Porkland – the Other White Meat” as often heard on the Tom Leykis Show.

How can you compare Burbank girls to Portland when you are in a city where women have the biggest, hairiest bodies ever, bro? Seriously… And 1300 sq ft in a very hot and boring post war part of Los Angeles vs Portland? The smog has made you crazy.

Yeah, but you have to live in Portland.

Quite shocking. When I joined this site in 2011 all I read about was the ‘dead cat bounce’ that was coming soon and anyone who was buying a home in 2011 was a ‘knife catcher’ and would be stuck with an overpriced home on a 30 yr mortgage. Well after reading those doomsday posts for almost 2 years, I decided I would buy a home as I saw home prices slowly rising and the default mortgages clearing out. In Q4 of 2012 I started looking at homes near Culver City and witnessed most homes selling at multiple over-asking prices, many all-cash offers. After looking at 15 homes, I found one in Baldwin Hills for $470K. I made an over asking offer, got accepted by the sellers who were retiring to Thousand Oaks.

Anyway, my home today would sell for $850K easily. Glad I was a ‘knife catcher’.

https://la.curbed.com/2018/1/5/16852170/los-angeles-homes-how-to-buy-guide-2018

Great Sell and be happy. No need to rub it in to the rest of us.

The raise in price means absolutely zero if you do not sell to realize the profit. Otherwise it is just a number on the screen. You are not richer or poorer for it – you still have the same house you bought years ago. The unit of measurement for the value just got smaller.

That is the way I look at it. When you will want to sell or be forced to sell for one reason or another, the value could be the same as before or even lower. With the amount of leveraging on all assets, prices can go either way.

Price appreciation in your own home is more like downpayment donside protection, in an unfortunate event if you have to sell when prices are falling

I think he’s saying that if he waited he wouldn’t be able to afford to buy the same place today.

That is one of the reasons inventory is so low. The huge equity build up has paralysed would-be sellers. In behavioural finance investors invariably sell when losses occurs and not when gains have accrued. This is due to so-called “loss aversionâ€. It is the opposite of what they should be doing. My own theory is that a wealth trap has occured. Alternative investments and downsizing options are limited. Homes are not liquid and you can’t sell a portion of them …yet! I can see a situation where you will be able to buy shares in a home.

Good lordt this guy is still droning on about Baldwin hills? What good does this do anyone looking to buy or sell now?

Good for you! In 2012 I thought housing prices would continue their downward descent and that the bump or bounce up was only temporary. Looks like that was the bottom for the forseeable future and the trend has been up up up.

May be a pull back is in the cards for the near future, but, 50-70% crash I just dont see how. I suppose anything is possible, but, like many others have said on here you buy something you can afford and plan to stick it out in the long term. Think utility as opposed to “investment” taht is supposed to be flipped quickly.

I never had to live in Baldwin Hills. Who’s winning?

But according to Mille there is plenty of inventory. Oh, and rents haven’t gone up either. Lol

If you dressed up as Millie for Halloween all you’d have to do is fit your head up your own ass.

Not cal fella,

That’s a cute line. Why so hostile? Have I said anything you disagree with or did I upset you? If so, let’s hear it and we can discuss. Just keep it professional 😉

Dan, my rent has not gone up – at all. I am just stating the facts. Sure, if someone rents a professional managed apartment he might get ripped off. If rent is a problem I would suggest to live with parents or roommates and always rent from a private individual not a company. As far as inventory goes…..just go on realtor.com and click on for sale. Type in any zip code and you will see lots of houses for sale. The realtors I email with send me new listings on a daily basis. Since we are in a bubble and every house in California is heavily overpriced we have historic low sales numbers. Many people confuse that and think we have low inventory. Nothing could be further from the truth. The re cheerleaders just use the low inventory myth in a pathetic attempt to justify insane prices. That’s all. Hope that’s helps. Let me know if you need further clarification.

Milly,

“Just go to realor dot com and see all the houses for sale in each zip.” Even in low inventory times, there are MANY (likely dozens) of homes for sale at a given time. What we have been seeing the past few years is low inventory relative to historic norms. Maybe you are trying to skirt around the issue, or you just don’t know any better.

We are currently in a period of low inventory relative to historic norms. The fact can’t be refuted!

Millie, inventory is at historic lows, just read the damn article from the doctor.

don’t be pathetic

“always rent from a private individual not a company”

Millie is 100% correct on this.

This is what MAGA looks like. Increase in pay, increase in sales and increase in profits. The Obama depression is finally over.

NEW YORK (AP) — Sales and profits picked up for companies at the end of last year, and more say they’re paying their workers higher wages and salaries in the latest signs that the U.S. economy continues to improve. The encouraging signals come from the latest survey the National Association for Business Economics did of more than 100 members at companies and industry groups. The survey by the NABE, a professional association for business economists, academics and others who use economics in the workplace, was released Monday.

Nearly half of the surveys’ respondents said that their wages and salaries rose over the past three months. None, meanwhile, said that they cut pay for workers. That difference of 48 percentage points is the strongest reading for the survey since January 2000 and is the third-highest since the survey began in 1982.”

At some point your individual landlord will end your paradise – either he will raise your rent or sell the place. It is great you got a good gig, but at some time youbwill have to face the reality

What are you guys taking about with your inventory is low myth? You don’t see for sale signs on your way to work? Your are not bombarded with listings from realtors and Zillow? You don’t see houses for sale sitting on the market for over 180 days? You don’t see how they build literally everywhere new sfh and especially multi family homes???

You guys confuse low inventory with highly inflated price levels. Nobody wants to buy at these levels. Therefore we have historic low sales numbers. When I ride my bike I see plenty of empty homes or newly build homes. I would argue we never had more inventory than nowadays. Don’t believe everything you read from RE cheerleaders. Just open your eyes. RE cheerleaders like to ride on the no-inventory-train-myth to justify insane prices. That’s all.

“What are you guys taking about with your inventory is low myth? You don’t see for sale signs on your way to work? ”

Millenial, just read the damn article, facts are facts.

Of course there are homes for sale.

The Tooth Fairy is a myth, Millie. This is called “data”. Actual current number of listings compared to actual previous number of listings. Public records. You can’t look at your own little neighborhood, extrapolate to the entire city or state, not comparing it to anything, and say “inventory is high”. That’s wildly inaccurate at best, and especially stupid considering we have THE ACTUAL NUMBER OF LISTINGS. What is it with you and your aversion to reality?

Millennial, in prime areas, homes under median price for that particular are scooped up in days (median price is 1.2mil).

Let’s do the following. If you are in the market to buy a home (which I would reconsider given every home in California is overpriced) but can’t find one provide me with the zip code and I will gladly find you the homes for sale. IMO There is no inventory issue here at all. They are building everywhere you look. Just wait a couple of month until all these new buildings are open for the public. Until then, keep preaching the inventory is low myth to justify insane price levels.

@Millenial

I stand with you about the low inventory myth. In fact, I posted numbers from the Fed that the doubters conveniently ignore. Funny that the same people who rail against about the biased politics of the mainstream media would buy up their RE narrative. I see more RE-based mis-information where high prices somehow represent good news or an indicator of a strong economy.

You’re looking for a conspiracy and an argument in the wrong place – believing the data is hoaxed because it doesn’t fit your definition of “low”. The problem with your definition is that you’re not comparing it to anything and you’re exaggerating the consequences of low inventory. If inventory is down 22% year-over-year, it’s low. That doesn’t mean you can’t find a house to buy, and no one (except maybe RE agents) is claiming it justifies bubble prices. It just means that there will be more competition among buyers.

Talked to a banker today. She is specialized in lending. Nice conversation, she is renting waiting for the biggie. She said, right now a ton of sellers want to cash in and not many people are looking to buy! Is the top reached? Maybe! That’s very different than what bankers told me a couple months/years ago. Similar to my realtors, yes they bombarding me with open listings but none of them is telling me it will continue to go up. They say they expect a correction but not as much as I forecast. Crazy how quickly the situation changed! Six month ago you were told housing is looking strong now we are discussing how dramatic the dip will be. Even banksters and realtards expect it. We are getting closer every day!

For the doubtful Dan’s of the world:

https://fred.stlouisfed.org/series/MSACSR

Inventory in December 2017 was 5.7 months — the same as it was in 2006 — and higher at anytime during the 2000’s prior to the downturn. Yet, the number of sales was higher ~11 years ago.

BTW, if demand is so high relative to inventory, why are lending standards falling?

It’s interesting you bring up lending standards. As I have alerted this board on a previous posting it seems there is a bit of disconnect possibly taking place between the GSE’s (fannie and freddie aka conventional financing) and PMI companies.

GSE’s late last year loosened up guidelines on above 45% DTI (debt to income ratio) files and initially PMI companies followed suit writing PMI on those. Now; the past 2 weeks 2 different PMI companies have adopted guidelines requiring 700 ficos on 45%+ DTI files. There are other PMI companies that still follow suit with the GSE’s, however, this is an interesting development as PMI companies are tightening up and have no appetite for that risk bucket.

I’ll report more once I find out.

It’s true that the latest housing boom started with QE, but it’s absolutely false to say that the current administration’s policies have nothing to do with rising asset prices across all asset classes to include housing since the election of the 45th president. Absurd statement. Tax cuts always effect assets prices, regulations are estimated to account for up to 35% of building new construction costs for homes in some locations and though federal deregulation may not impact local regulations as much it does have a multiplier effect on the economy just like a tax cut does and anticipation of an infrastructure plan the scale of this administration’s, though it hasn’t been passed, would also have an anticipatory effect on leading indicators like stocks and other commodities that raise costs, which we have already seen. Generally speaking, the combination of all this increases confidence and all of this we easily predictable based on any projection of what the combination of these policies impact would be if the current president were to win. Not shocking, not hard to understand.

Look, I’m agnostic on our President. However, he should have been a little more careful about owning the so-called successes of this this stock market. That’s working out real well now. Furthermore, the idea of introducing huge government spending programs is foolish. For one, the GDP bounce will be ephemeral; there’s just not a lot of multiplier on building bridges to nowhere. Second, we have serious deficit problems, and the Chinese are growing weary of financing us (thus their attempts to position the Yuan as the new reserve currency). Similarly, the Fed can only go so far in monetizing the deficits before it becomes completely obvious that we are a banana republic (we in fact already are, it’s just a slow motion train wreck playing out). I do, however, agree that de-regulation can create structural change that can alter the long-term GDP path.

Oh dear, our gracious host has the gall to suggest “People seem to think this hot market is because of the current administration which is hard to believe”. What rants will Trump’s fervent cheerleaders who lately populate this comment section come up with in response.

You are a riddle wrapped in an oxymoron.

Your name insinuates that you are not interested or involved in politics, but then you make a politically charged statement. You must be a flaming liberal, contradiction is a defining quality of the left.

Obama blamed Bush for 8 years. And his sycophants will assign Trump’s successes to Obama for the next 8 years.

LOL

Not sure you can blame the ‘current’ Administration for California’s $1.3 T debt, or homeless everywhere you go in the greater L.A. area! Not sure you can blame the ‘current’ Administration for the declining infrastructure in California. I mention these things, because in my humble opinion, these things will ultimately make California untenable as a place to live! Rapidly declining affordability, rising costs, rising local taxes, unbearable traffic, is already turning the State into a 2-class society, rich or poor! The middle-class of California are either becoming poor or leaving!

Quality always advances in value. Same with RE….location, location, location. Sure, catastrophes can upset mankind’s trend, that’s why it’s always wise to protect from them – insurance, liquidity, etc. But, quality RE, especially homes, has/have advanced long term.

RE dopes have been left behind with the current boom. Sure, timing can work better, but gamblers, on average, always lose.

What were “crap shacks†in Manhattan, over anytime since all of Manhattan sold for the equivalent of $24, were wrong in understanding RE.

Greta article.

Housing TO Tank Hard Soon!

Can you quantify “soon” please? I’ve been hearing “the next crash will happen soon” for years and years. Is it 6 weeks? 6 months? 6 years?

Jim,

Serious question here. Is there a time/year at which point you will throw in the towel? Do you have a Red line? 2019? 2021?….

Assuming prices continue their upward trend, what is your breaking point? Or, will you be like Mille and ok renting forever and making millions on crypto and waiting for his parents to pass too be in RE ?

Hey Dan. No red line and yes I am happy to rent otherwise.

Hi Dan, I am impressed! You got it down. Just a small correction. “Renting forever†can be replaced by renting until a crash occurs or inheritance. So, it’s not really until forever. It may be another two years or 20. There simply is no reason to waste your money on overpriced RE if renting is so much cheaper. Even the biggest RE cheerleader agree with this-just look at the rental PARODY example by surge. Buyer pays 1500 more a month AFTER putting 200k down plus maintenance, fees and closing costs.

Jim Taylor said the same thing at the end of 2012 and into 2013, when home prices were 20% below rental parity.

The broken clock will be right at some point

And when he’s right, you’ll get a margin call and disappear. It’s coming; better buckle up. Hubris. Look it up.

2018 is going to be another rough year for home buyers with tight inventory and rising mortgage rates.

Rising mortgage rates are actually great for potential buyers. It mans prices will go down. It’s always better to buy a lower priced house with high interest rates than the other way around. Also, I would not describe it as a tough environment. I would rather say, it’s not an environment in which an investment in RE makes any sense. As soon as we have a RE crash it will make sense to invest in RE. Just a bit more patience!

True, but only in text book world such conditions occur

It’s more complicated than you let on and a higher rate of interest means paying more for leverage. For example on a 30 yr mortgage $100K at 4% costs $72K whereas 8% costs $164K.

Millennial,

Except that just hasn’t been the case historically speaking.

in fact more often house prices have risen with rising mortgage rates.

Why? Because higher interest rates signal inflation and a better economy.

I’m not saying this time it can’t be different… but reality is different than you are preaching.

Any way you look at it tighter inventory and higher mortgage rates does not help someone trying to buy this year.

If mortgage rates went up too fast that would be interesting. We would either be in hyperinflation mania or it would crush the housing market.

Mortgage rates will be low for quite some time. 4.5%-6% is very low. House prices have gone up with mortgage rates in the 15-18% range.

Unfortunately, as prices get even more unrealistic and people still have the mentality that they need to buy because that “$700k crap shack will be $1M”, means more and more people will get destroyed financially when the market does crack! The problem is, when it does pop, it will be sudden and severe!

However, unlike the run-up in the last bubble, you need to actually qualify for the loan this time. The people who get in trouble will be those who bought a few years ago and HELOC’d the crap out of it, while running up credit card balances, followed by job loss. The rest will be low-down buyers who don’t have skin in the game and just walk away. There will be foreclosures, but my guess is there won’t be nearly the tsunami we saw the last time.

Exactly my thoughts and exactly why I think the limit to downside is 20%-25% (in prime areas). People with a lot of equity will not just give it up and prefer not to sell. The only ones that will be ok to sell are the ones with very low equity (low downpayment) or lots of HELOC debt (effectively, very low equity). These will become bank properties and banks will find something to do with them other than selling at 50% discount (most likely)>

Exactly right. The loans made in the last decade aren’t nearly as reckless as pre-2008. I work in community lending and while credit has loosened a bit, you still need to prove you are qualified to get a loan (e.g. income verification, credit history, d/e ratio not over a certain %). NINJA loans don’t exist anymore, to my knowledge.

Prior to the passage of Dodd-Frank they ran Actuarial tables to determine the most common variable associated with the default rate and it was not skin in the game or low down payment requirements it was income verification and income underwriting AKA stated income.

That is why income verification became the Center Point for the Dodd-Frank legislation and qm lending. So the past 10 years almost all mortgages written have Been income Centric. The programs of today and what POH likes to call “exotic lending” are no where near the loans of the 2000s.

Even if you took out a HELOC you most likely would not have been able to get up to 100% of loan to value (LTV). 90-95% max AND you still must income qualify.

Not like the ole days where no income verification and could get up to 125% ltv.

@Dan

“That is why income verification became the Center Point for the Dodd-Frank legislation and qm lending. So the past 10 years almost all mortgages written have Been income Centric. The programs of today and what POH likes to call ‘exotic lending’ are no where near the loans of the 2000s.”

The current cycle is different from that of the last cycle in that a bigger component of the unorthodox lending involves investors (REIT’s and rentiers). That is why the rental market became so “hot” after the last downturn.

But make no mistake, low down payment loans, among other exotic mortgages, are back and helping to push prices up at a time when income growth has continued to lag far behind exponential price gains.

Real estate industry wants to continue to spin it as an inventory problem, but it’s more of a policy/price problem. Govt and Fed policy during the last decade has been successful in doing exactly what it was designed to do, to the detriment of the housing “market”.

Exactly. Glad there are still posters on this blog who get it.

You can spin it all you want, but once you are in the market of buying a home (And I mean really trying to buy a home, not just looking at the icon in redfin or zillo) then you will know that it is very very difficult to buy a quality property right now.

I agree, right now US-China the worst time to buy Real estate. Wait until the market crashes 50% and you can pick up quality houses left and right for half the price

Lol. Don’t know how US-China got in there.

Dumb, borrowed money pushing up the price of even undersirable properties has been well documented.

I see the deflationary trend from the 2008/2009 crash going away now. Apple is on pace to spend $55 billion this year here from overseas money, Broadcom is going to bring in $20 Billion, etc. There are trillions in overseas earnings that could potentially come in over the next few years. All of this money hitting the economy at once will cause wage inflation, and until the effects of the investment take hold in productivity increases, we will see inflation. The dollar index against other currencies is slowly sliding downward. The 10 year treasury bill is over 2.6% and climbing.

Spending on projects involving workers in the building trades, is already up. We started a renovation project last Summer, and we have seen an increase in what we are being asked to pay for the work. I see more increases in that area this next year. A lot of skilled building trades people left for greener pastures, so there is a shortage now.

I’m seeing high asking prices in my neighborhood that are startling. A neighbor sold out 4 months ago for an Arizona move and already others are asking $50K more than what they got for less desirable properties.

10yr is at 2.7% already today and climbing! Rates are definitely responding by going up up up. The past 2-3 weeks have been BRUTAL for rates; haven’t see a move like this since the “Taper Tantrum”.

Dan are you like Millie also a millenial? It kind of sounds like you are. Millenials think history started the day Obama was elected and have no frame of reference historically speaking, about anything.

Do you realize it was over 15% in the early 1980s? In the early 2000s it was over 6%. Even just a few years ago, it was bouncing along just under 4% in 2013/4.

And yet 2.7% is some sort of end of the world scenario? Perspective my man, perspective.

@mr L,

Not at all. Just noting that the market (rates) has been climbing quite a bit.

I still believe that conditions in California and throughout the country support continued upward pressure on prices for the most part. Again I feel a 50 to 70% downward crash like a few on here are hoping for will not materialize in the near future

Mr. Landlord: I think you are missing the perspective. The world is VASTLY more leveraged today than it was in the 1980s or even the early 2000s, so any rise in rates (duration) is going to wound risk assets rather quickly. The markets aren’t freaking out per se on a 2.7% UST rate; the hysteria is a prognostication of things to come if the financial tightening continues. The Everything Bubble, like all bubbles, will unwind — and it will be as ugly as all prior unwinds. And some folks will have the dry powder to buy cheap assets at that point.

Rates continue their surge now for the past 3 weeks.

Overall we’re seeing an increase of around 0.375-0.5% in some rate buckets from 3 weeks ago. Definitely a startling TREND.

NOTE: I did not say this will crash the market tomorrow; however, the TREND is continuing unabated.

Dow 30K is about 14% from where it is today. We will hit that before Labor Day.

Many of you here still don’t get it. We had an 8 year depression under Obama. Growth was non-existent. Tens of millions were added to welfare. There was virtually no capital investment made. That lost Obama decade will be made up and then some in the next 3-4 years. It was already happening and the tax cuts just added gas to the existing economic boom fire.

So Millie and Co, I have bad news for you. Your 70% off dreams will have to wait a few more years.

The MSM brainwashed people into thinking Obama’s depression was a new norm. It wasn’t.

Enjoy the party while the music still plays 🙂

Dow 30k! I would love that! Dow 15k /crash? Would love that even more – I would buy stocks cheaper!

We will need to wait a few more years for a RE crash? That’s fine! If we get another 2017 in terms of stocks and crypto gains – I am set!

I’m not so sure that a post 2007 style “recovery” could easily be repeated. As someone already postulated, the world is awash in so much debt that governments would be hard pressed to figure whom to bail out. Would the public stand for more bail outs (i.e. the return of nationalism in the form of Britexit and Trump)? Can the Fed once again exert influence on the bond market? Right now, it appears to be playing catch up rather than lead it.

10,000 boomers retiring every day for the next decade plus.

10,000 boomers a day retiring but what has the result been… a flood of houses on the market, no.

What I think has happened is;

– Boomers – renting out rooms on AirBNB

– Boomers allowing kids to move back in

– Boomers renting out their entire home (which was paid off) and downsizing (either renting a small apt or moving to flyover coutry) and still pocketing money

– Boomers allowing kids and grandkids to move in….

– Boomers not retiring even though they are at retirement age…

ie: the onslaught of retiring boomers has been going on since approx 2011 yet low inventory today.

10,000 boomers a day retiring was going to lead to massive housing inventory in CA. Guess what, inventory all but dried up. I realize there are many other factors leading to this, but boomers are certainly not selling their CA houses in large numbers. Most CA boomers paid pocket change for their home, add in Prop 13 protection and why would anybody in their right mind sell their gold mine that is still yielding large nuggets.

Most people are living longer, staying in your home for 20 years after retirement isn’t uncommon. Like was said, many of these homes will be left to heirs or simply rented out for income. Expecting massive inventory (especially in desirable areas) will likely be an exercise in futility.

Calculated Risk estimates people stay in their properties on average until 75. They don’t generally move right on retirement. Plus, although the oldest Boomers are in their early 70’s, the youngest are in their mid 50’s and not about to retire. In California there’s the additional issue of losing Prop 13 tax limitations. It’s hard to see enormous amounts of inventory coming on the market from the Boomers soon.

I’ll roll in the mud with you. I’d argue it’s nit fair to judge Obama’s record for growth to standard periods not coming off a financial crisis. Economies in Europe and also japan in the 80’s took far longer to recover from financial catastrophes than we did in Obama’s years. He left the ball tee’d up for trumps goons. Now they are knocking it out of the park.

No, you don’t get it. (First of all, Dow 30000? That’s a good one genius.) More importantly, this has nothing to do with Bush/Obama/Trump/fill in the blank. The Executive Office surrendered control of the economy to the Fed in the mid 1990s (or perhaps even earlier); your unelected leaders go by the names of Greenspan, Bernanke, Yellen, and now Powell. (The last President who really did anything with a material impact was Nixon, when he closed the gold window, and ushered in the era of fiat money.) A simple and completely needless intervention in the LTCM crisis gave birth to a cycle of asset bubbles fueled by borrowing, followed by busts, followed by more bail outs and so on. It’s admittedly challenging to identify where the chaos catalyst will emanate from; one reasonable scenario is that the “shadow” banking system could implode and trigger a crisis redux. But you sir have ABSOLUTELY no idea where the leverage in the system is right now; how quickly it can and ultimately will unwind; and the collateral damage that will be inflicted on financial assets, including real property. This is a time for a guy like you to get past the hubris and hold on to as much of your capital as you can.

+1

Correct on that one!

LA housing will continue being expensive as long as illegal immigration continues un-abated. $650K isn’t that much when you have 3 families pooling their resources. Add to that the fact banks have to accept public assistance as “income”, and you have a never ending supply of buyers, even at outrageous prices. And since they are here illegally, there’s no risk to them if the market ever does turn. Buy with 0% down and then walk away. Since they are using forged documents, it’s not like they have a credit score to worry about or any fear of being sued by a lender. And banks don’t care either since they know Uncle Federal Govt will be there with bailout money just like the last time.

The same leftists whining about the cost of housing keep voting for Democrats who created the problem and continue making it worse. Conclusion: liberalism is a mental disease. But we already knew that.

Just to get it out of the way – I am not a liberal (and not a trump fan either). In regards to illegals in California I don’t understand how this would pan out if you deport them or stop future illegal immigration. By thinking of the field workers for instance – if you don’t have illegals do the work than who is willing to do it? US citizens. And you would pay them benefits and higher wages in order to recruit the talent. Right? your labor cost will triple if not more. The avocado will then cost 2 bucks instead of 50 cents? Just think about what will happen to millennials and their avocado toast costs! Kidding aside, do you really think we will see US citizens take over working the fields and cleaning toilets?

Hi millenial,

Labor is a small part of the price of produce:

https://www.sandiegoreader.com/weblogs/fulano_de_tal/2011/aug/18/the-myth-of-illegal-immigration-and-food-prices/

The cost of labor is a very small component of food. Consumers who pay $1 for a pound of apples, or $1 for a head of lettuce, are giving 16 to 19 cents to the farmer and 5 to 6 cents to the farm worker.

So even if wages doubled the cost of the lettuce would only go up 6 cents.

Millie,

I know this may come as a shock to you since you are young and live in CA. But, long ago, like 30 years ago, Americans did all sorts of jobs “Americans won’t do”. They washed dishes, cut lawns, picked lettuce, etc. In CA, all these jobs are now down by illegals. But in many parts of the country, Americans still do these jobs. Take a trip out to oh I dunno rural Wyoming or Montana or Idaho and you’ll see farms/ranches without a single illegal. Go the local McDondald’s and Americans work there. Who cleans the hotel rooms? You got it…Americanos.

Americans will do all the jobs “Americans won’t do” when an employer will hire them.

Oh and last I checked a tomato in Montana cost less than a tomato in California.

“Kidding aside, do you really think we will see US citizens take over working the fields and cleaning toilets?”

Yes, if the Section 8, welfare and EBT stop coming, and stoping will happen sooner than you think. The government can not borrow to infinity and the bankers will not want to see the dollar crashing completely. People do not work unless they have to. They never work to receive the same thing or less than when they just watch TV.

The Illegal Immigration Reform and Immigrant Responsibility Act of 1996, or “IIRIRA.†Congress legislated that not only would undocumented immigrants not receive welfare, but legal immigrants wouldn’t get benefits such as food stamps, Medicaid or money for child assistance until they’ve lived here at least five years and even seven years after their arrival.

You continue to spill your Virol bullsh!t on illegal immigration and maga is annoying and nauseating. How about stick to the topic at hand and leave out the politics of it all unless it directly affects housing. The only illegals that are causing housing costs to go up in California is from out of the country, china and russia. I am in full doubt that three mexican illegal families can come up with 650k in cash or they wouldn’t have illegally come here in the first place as homes in mexico would be hella cheaper with that kind of cash. Get over your stupid maga self.

“How about stick to the topic at hand and leave out the politics of it all unless it directly affects housing.”

Nothing affects housing more than the population density. The higher the population density, the higher the rents and higher the prices. That is very obvious for anyone with open eyes when they look at the largest cities in US like NY and LA.

Politics aside, nothing creates more demand for housing that open borders and immigration laws which are not enforced like in sanctuary cities and states. It is good for large corporations who donate campaign money to the politicians in Sacramento. It is bad for the average employee regardless if he is college educated or not. H1 Visa affects the educated people as well.

What you advocate is a windfall for the largest corporations and 0.0001% and race to the bottom for the average worker (the 99%). That is how you get an ever growing income inequality.

It is basic stuff if you have your eyes open, 2 functioning cells and not blinded by politics.

I don’t think you are aware of how illegal immigration plays a very real role in home prices. Especially in L.A. what often happens is that a multigen immediate and often extended families will pool their resources living together to support a mortgage payment. The person(s) on the loan is a citizen, many times using VA or FHA, but the other people in the house aren’t all legally authorized to be here. It’s part of the chain migration issue Trump keeps talking about. This demand decreases supply both for rentals and for sale inventory. Price goes up and traditional non multigen American renters or buyers are now competing with what’s basically a lowered standard of living at the same or higher price. So the politics of the matter is very appropriate and relevant to the housing debate. Not making a judgement here but the truth of the matter is important and too many people with a political agenda seem to want to deny this is really happening or the large scope of it. Source: I personally well know several families in L.A. in the scenario I described.

How long have you lived in California?

The only mental disease is the MAGA people who piss in the wind and call it rain.

I don’t doubt there are multi-generational illegals pooling resources to crowd a house/condo and thus hurting supply and pushing price up. It is much bigger than than demographic.

I see this across many more people (citizens or not) of various cultures. Adult children living at home, helping pay the bills. People renting out rooms, putting six adults in a 3 bedroom. Others are renting out rooms on AirBnB.

People are getting creative in finding ways to pay the mortgage, and it does push prices up for a lower the quality of life.

As a side note, the 6 adults in a 3 bedroom situation is killing the parking in my community, these places were designed around the traditional family with two cars in the garage and a few guest spaces. Yet now we have all these people fighting for the few guest parking spots and street parking. The community was not designed to accommodate 6 car per household.

The last few days, I have seen new listings in beach cities hit the market with astronomical price increases compared to sales that closed just two months ago. This is big. We might be looking at a substantial inflation spike. If sales occur at these prices, expect the FED to step in and attempt to cool this off. I have never seen anything like this

The Fed does not care about California beach city prices. They won’t stop until it’s a national problem.

Why would the fed do something based on what’s happening in overcrowded SoCal beach pits? There’s plenty of this country left with affordable and reasonably priced properties. The fed chair serves at the pleasure of the president. Trump has made it crystal clear that what happens in California is no longer at the top of the priority list.

I agree with your statement but not with this sentence:

‘The fed chair serves at the pleasure of the president.’ – It is more like both of them serve the guys behind the scenes. The FED chair cares less about the president. The guys who put him there are those who control the private cabal called FED. The FED is as federal as Federal Express. Not everything with Federal is government. Trump’s influence on the FED is close to zero. Maybe a little bit in a round about way.

The president appoints the Fed chair. Not sure how much clearer it could be that the chair serves at the pleasure of the president. Case in point, Trump appointed Powell and that means Yellen is on the way out very soon.

It is not a nomination in the true sense of the word. The owners of the FED propose/nominate and the president just gives his blessing to add legitimacy to a private cartel which prints our money.

I know the technicalities but I don’t let the technicalities obfuscate what is really happening – to see the larger picture. If you talk only about the show, you are right; however, for all practical purposes I am right.

jt, just two more weekends to go and socal RE will be off to the races. The floodgates generally open the weekend after the Super Bowl. The effects of the recent stock market gains will definitely be seen in desirable socal regions. People with money made LOTS of money recently.

Superbowl? More like post-Chinese New Year for SoCal, isn’t it?

Superbowl? Doesn’t the SoCal market jump around that time due, actually, to the end of the Chinese New Year (Feb 16 this year) when cash pours in?

Post Super Bowl or Chinese New Year (that is new to me) will definitely see more inventory and sales. This happens like clockwork in CA. Spring is around the corner and families are looking to secure a property/move/settle in before school starts.

Every year on this blog we hear around the same time frame, “THIS is the year when millennials go out and buy in drovesâ€, “Spring is around the corner, RE prices will skyrocket†, etc. All this rhetoric is trying to accomplish is make believe that right now is a great time to buy. The funny part is that the posters who spread this stuff are actually not looking to add to their RE portfolio unless the market tanks (like lord blankfein). So listen up newbies/potential buyers, the great time to buy is now, prices can only go up from here on! Can you feel the fear of missing out on huge gains? Yes? Great, than buy, buy, buy!

Agreed. The party can’t go on forever. Booms and busts, thanks to the Fed.

If the stock market falls this year, what will that do to housing?!

The party can’t go on forever. Booms and busts, thanks to the FED.

If the stock market falls this year, what will that do to housing?!

This bubble is much less housing specific than the last, and involves not only houses, but stocks, bonds and financial conditions on the other side of the world. So the pin that pops this bubble probably isn’t even on anyone’s radar at the moment. But when the bubble pops, it will probably happen so fast that no one will have time to sell before prices plummet.

Yes, this is exactly right. And this is why this time likelyhood that next asset price decrease will cause by liquidity event that would require movement of capital out of US into somewhere else

@Surge

What country would be safe in this liquidity-based crisis? Most other central banks have followed the Fed’s leads for years. They should be scared of a recession hitting while their rates are still too low to support cuts.

I keep seeing people claim if rates go up, prices must come down. This is just not true. What really happens is if the inflation rate is higher than interest rates, then prices will go up. So, if the economy is strong and inflation is picking up, then a rise in interest rates will not cause prices to drop. This is just basic economics …

However, if rates go up while inflation is weak, then prices will fall. It is about the difference between inflation vs. rates that determines how home prices move. Rates by themselves does not tell the story.

I subscribe to the theory that with the higher rates, houses will appreciate but not as fast as inflation rate. So, in real terms they will actually depreciate, but small appreciation in nominal terms. And of course, the response to rate changes is lagged by several months.

So, typical rate change by itself will not cause prices to drop. In fact, rates are adjusted based on multiple market conditions (RE included) to ensure economy is moving to the right direction.

As I said multiple times, significant prices decreases are mainly due to liquidity crunch: Sudden reduction in lending (fewer people to buy homes), massive job losses (fewer means to service debt), over-leveraging (less inclination to service debt). Yes, this can occur, but in that case buying a home that is 50% discounted will be just as risky (cash or not) as buying a home at today’s prices.

Change of rates are just adjustment in money velocity.

Fundamentally, you are incorrect. When interest rates (cap rates in real estate parlance increase), asset values decrease. It’s just the nature of running a discounted cash flow on ANY asset to arrive at its value. (If you think about it in simple terms as an investor, increasing debt costs on an asset is decreasing its cash flows over its lifetime and thus its value.) Moreover, you have to mix the affordability factor in here. Lastly, with the stock market vomiting on the higher rate move, there is no possible way that prospective buyers are feeling too comfortable stretching into an asset that is looking pretty toppy (like all other assets). Anyway, my main point is that a fundamental investor would absolutely arrive at a lower value on account of using a higher discount (cap) rate in his valuation model. It’s just the math of it.

In the “Obama Depression” 1/20/09-1/20/17, unemployment decreased from 7.5% to 4.7%. The Dow Jones increased from 7949 to 19827, the S&P almost tripled, and the NASDAQ quadrupled.

It’s cute how you use 1/20/17 as the end period knowing full well any stock appreciation from 11.8 on was due to Trump.

And unemployment rate? LOL. The 1960s called and want their useful metrics back. How many people left the labor force? Tens of millions. Remove millions from the labor force and VOILA unemployment magically falls.

How many additional people were on SNAP pre and post Obama? Tens of millions. That is a depression.

How many people went on disability pre and post Obama? Tens of millions. That is a depression.

What was the growth rate during Obama’s years? Averaged less than 2%. What happened to the debt under Obama? Doubled. Not only doubled, but increased by more than every single president before him COMBINED.

Lemme ax you this….if the Obama years were so amazing, why did Bernie campaign in 2016 on restoring the middle class? You’d think if times were as great as Obama sycophants claim they were, Bernie would have been laughed off the stage.

The numbers you quote are ONLY those collecting unemployment benefits not the 100 million (working age) without work (who never got a job or had unemployment benefits expired).

The stocks increased because of the QE (done by the FED not Obama) and the fact that Obama borrowed more than all previous presidents combined (over 10 trillion dollars). Nothing to be proud of. He improved only the Wall Street while he threw the Main Street under the bus. Truth hurts!!!….It was the strongest depression in the last century. All the Main Street got was less purchasing power for everything while incomes were mainly stagnant – less purchasing power for rents, education, houses and health care; food also went up in price. Nothing good for the Main Street (99%). During Obama’s dictatorship the income inequality increased like never before – even the MSM (Obama supporters) confirms that.

Financial smoke and mirrors (cheap and easy credit for investors, speculators, corporations, and financials) that did little to benefit the masses. Close to $1 Trillion lost to savers to fuel this giant casino. No wonder Hilary couldn’t rest on Obama’s laurels.

Real Estate is clearly at a “Breaking Point.” Prices MUST go Down!

Why? Potential buyers can no longer afford to buy homes even with low interest rates, low inventory and fear of missing the boat (buyer panic). Average wages have simply not kept up with real estate inflation in California and other hot market areas.

The first sellers will be investors, then flippers and other groups will follow. Foreclosed homeowners will not cause the decline and will actually be the last group to sell.

As I mentioned about the 10,000 boomers at some point prices very well could be heading south and they and their heirs might start to realize that they better take money of the table ASAP thereby escalating the price drops.

Most heirs I know really don’t have very well paying jobs……well compared to the RE prices now anyway…..and some are just chomping at the bit to get that house to sell, cash out and move. Thing is there’s a lot of reverse mortgages out there too (1 friend got that little wake up call). I have a buddy that works the IT department at one, in the last 10 years they have gone from 60 employees to almost 1,000. Boomers are slowly selling their houses back to the banks to survive.

I think a lot of heirs are going to be surprised by this. I think we are going to see more of this as boomers age and health care cost rise, pushing them into last resort reverse mortgages to pay the bills.

The reverse market has slowed down considerably the past 12-24 mos due to FHA adopting QM guidelines aka income verification.

The boomers must qualify based on a residual income calculation; must have income to get a reverse now.

Is the new tax law constitutional?

There are many constitutional concerns with the elimination of SALT deductions that have nothing to do with the invidious motives of Red state legislators. My understanding is that, since the inception of the federal income tax, there have always been SALT deductions. I always assumed this was to help the federal income tax comply with federalism principles. Indeed, here are three glaring federalism issues that the new fed tax plan raises: (1) elimination of SALT deductions will lead directly to decreased state purse revenue in high tax states because residents with high income are now further incentivized to leave high tax states, and, additionally, legislators in high tax states must now think twice before voting to increase state taxes, since such increases will now have a magnified effect on local taxpayers–thus, the fed tax plan sticks its hand directly into the state pursue and state legislative policy; (2) by magnifying the effect of state and local taxes, the new fed tax plan is helping to dictate where people live (ie, incentivizing a move to low tax states), which the federal govt shouldn’t get to do (at least not thru a tax policy)–rather, the states should be able to continue their taxing experiments in this democracy without undue interference from the feds; (3) the new fed tax plan creates potential havoc and fundamental fairness problems for certain individuals–for example, suppose the Federal income tax at the highest bracket is 51% (in fact its been even higher in the past), and suppose New York also wanted to tax the highest income bracket at 51% (to pay for, say, increased anti-terrorism security)–under the new fed tax plan, a high income earner living in New York could actually be *negative* 2% on the year, because there’d be no available SALT deductions–if that sounds unfair to you, next ask which government should yield, the Fed or the state?

What article in the Constitution are you basing that statement on? Or is unconstitutional in your vocabulary just a synonym for “I don’t like it”? When the income tax first came in it was very low and had a high standard deduction. $3000 then is like $60000+ now. Here is a link to the 1913 tax form.

https://www.bradfordtaxinstitute.com/Endnotes/IRS_Form_1040_1913.pdf

The 16th amendment doesn’t cover the specifics as thaw to levy the income tax. All it says is this:

Amendment XVI

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.

“thaw” ..damn spell checker at it again… “as to how” is what it should say…

I can say this with 90+%! If you think Trump is restricting immigration now then you have no idea what to expect IN A FUTURE RECESSION THE BORDERS WILL BE CLOSED, WORK VISA’s WILL BE A DRIBBLE AND VISA OVER STAYS PROSECUTED. Trump wants people off social welfare programs since cuts to those programs hurt votes and so Trumps preferred method is creating a labor shortage that keeps wages from dropping, unemployment low, makes it worthwhile for companies to train and sucks people off social assistance programs.

There are also 2 parts to Trumps strategy on trade. 1) Trump wants a fairer more level playing field in global trade. If that means imports are taxed then you can look for that to happen in the next recession. 2) Trump wants less imports. Stimulate more domestic business that satisfy domestic / local demand. There might even be a tax deduction for a businesses that don’t export.

It is feasible by starting a recession with a labor shortage, stimulating nonexport small businesses that satisfy local demand (ie prevent the need for imports) and import taxes to have a recession that effects investment and debt more than jobs. More people would be able to keep their jobs even as the PE drops, bitcoin drops, hedges and credit default instruments drop, real estate drops…BASICALLY YOU PROP UP MAIN STREET AND WORKING CLASS WHILE WALL STREET AND REAL ESTATE DEFLATE BACK TO THE MEAN. IN THE PAST…NO ONE GAVE A SH*T ABOUT MAIN STREET…IF WALL STREET FELL THEN IT TOOK THE WHOLE COUNTRY WITH IT. I cannot say for sure it this will work of if this is Trumps strategy but the actions of the last year point to this as a strategy.

Hi Luis, I appreciate you at least putting a %probability to the even you are describing. At least some sort of probability assessment. Most people here are 100% sure that something particular will happen

The Dow was 18332 on 11/08/16; more than double when he took office.

Unemployment is measured the same as 2008. The “Obama Depression” began September 2008.

We were losing 700,000 jobs per month, and the growth rate was below 2%.

The debt is a problem, so the Republicans reduced taxes with no reduction in spending.

The middle class has been declining for decades due to offshoring of jobs, robots, and immigration providing a large labor force.

If this is a depression, I don’t think it was created by Obama.

It was not a depression. It was a financial panic engineered by the media and the Democrats with the sole purpose of getting Obama elected. This panic created runs on banks. Someone should go to jail.

I have been on this blog for 11 years (the end of the last bubble) while mortgagees were still granting “no doc” loans. It popped when mortgagors defaulted on their loans, Credit default swaps with no reserves, issued in large part by AIG caused the financial industry collapse. Dr.Housing Bubble covered the pop without mentioning any engineering by the media or the Democratic Party. Do you have a source to back up your engineered claim? Every thing I’ve read shows Lenders and insurance companies were the main cause because they were reckless and stupid.

Fannie & Freddie certainly had tight ties to the Democrats who were primarily responsible for their creation. The heads of both were big backers of the Democrats in the 2008 election. Here is data on their campaign donations up to the bubble pop:

Top Recipients of Fannie Mae and Freddie Mac

Campaign Contributions, 1989-2008 (as of June 30, 2008)

Name Office Party/State Total

1. Dodd, Christopher J S D-CT $133,900

2. Kerry, John S D-MA $111,000

3. Obama, Barack S D-IL $105,849

4. Clinton, Hillary S D-NY $75,550

5. Kanjorski, Paul E H D-PA $65,500

6. Bennett, Robert F S R-UT $61,499

7. Johnson, Tim S D-SD $61,000

8. Conrad, Kent S D-ND $58,991

9. Davis, Tom H R-VA $55,499

10. Bond, Christopher S S R-MO $55,400

But of course, Republicans friendly to the Real Estate industry got some money also.

Investment in speculative ventures with essentially “free” money and no serious underwriting checks on creditworthiness always leads to this. The VA had a better credit check system and had a much lower default rate despite not requiring big down payments.

As I predicted last summer rates go to 5% and blue states like Ca. will tank hard, this will not be everything coming up roses this spring or any spring in the next few years?

The Dow went from 8000 up to 18000 under Obama and houses went up over 100%. Mr Landlord says this was all fake and driven by fake money while Obama was President.

My questions are:

When will these Dow gains evaporate and the Dow plunge 10,000 point when they realize Mr Landlord was correct?

When will the housing gains plunge 50% when people finally listen to something Mr Landlord is stating as fact?

It seems both Millenial and Mr Landlord agree that the all of the gains under Obama were fake and a 50% plunge in housing is imminent.

It was all fake. The Democrats and the media got Obama elected by engineering a financial panic. Together, they created and fed the public with a narrative that triggered a financial panic that caused people to dump stocks and homes at fire sale prices. They did this because they knew a collapse in stock and home prices would result in Obama getting elected since they could blame the Republicans for the collapse. After the election, money printing bounced prices back to were they were before the fake financial panic set in. This was a bigger scandal than what occurred with Hillary.

So the bankruptcies of Bear Stearns and Lehman Brothers were engineered by the media and Democrats by convincing 12,000,000 mortgagors to become delinquint. We learn something every day.

And the Republicans had Bush as President and complete control of both the House and Senate from 2003-2007.

It is pretty easy to assign blame in this case.

Those bankruptcies were the result of the financial panic. After the media saturated homeowners with house crash hysteria, many started defaulting on their mortgages, mortgage security values collapsed, and that triggered bankruptcies. Case closed.

It wasn’t fake. It just wasn’t anything Obumbling did. The Fed printed a gazillion dollars made it practically illegal to put money in the bank. So the only option left was stocks.

This is a simple one. I remember sitting in a conference room at DLJ (later absorbed by Credit Suisse) in the late 90s trying to identify the opportunities — and RISKS — associated with the CLINTON-led repeal of the Glass-Steagall Act. More than a few very, very smart people, who stood to gain much from the repeal, thought it was very foolish to bring commercial and investment banks back together. It took all of about 10 years for what were formerly boring, deposit-driven banks to become taxpayer-backed hedge funds. I don’t give a rat’s ass about politics frankly. However, if you’re going to pin the crash on someone, look no further than William Jefferson Clinton, who sold his soul to a bunch of greedy banksters.

Seen it all before bob, you mentioned me in your post…I am not interested in political discussions. Politicians in both parties are corrupt, if crookedHillarry and the trumpClown are your best candidates to run for president it shows you how f’d up ‘this is. Politicians can’t be trusted.

Every generation gets buying opportunities (next RE crash) and bubbles (e.g. cryptos) they can profit from. I rather put my time in researching stuff that makes money than wasting my time on political posts. I have friends and family that are DEms and Reps. I like to make fun of politicians and feel entertained by reading the heated discussions. That’s about it.

You’ve got that right. That is a sign of maturity.

There is no right and left, there is just right and wrong.

It looks that the bond market is revolting against the FED. As I said lately the inflation is way higher than the bogus publish number CPI, at least for everything that matters: food, health care, education, rent, housing, etc., things that the average person has to buy everyday. The bond market, which is 3 times bigger than the stock market, is saying “ENOUGH” (they know that the CPI is bogus).

The FED just realized that even with the modest increases, they are behind the curve. They will be force to raise the interest more; if not, the bond market will do it for them. As seen, that is crashing the stocks. If the stock market continues the slide, the margin calls can create a liquidity crisis.

What is the impact of that on RE prices????!!!!!…..It is kind of early to say to what extent the correction will go and because of that kind of early to assess the impact on RE prices. Pretty soon we’ll see who was “swimming naked”. It looks that my strategy of deleveraging by all means works, even if I occasionally left some profits on the table. It is kind of crowded at the exists these days. About a month ago I sold the last stocks I had. I don’t have any cryptos, but I have peace of mind. It is hard to put a value on that.

Yeah, i am with you. Especially the taking profit off the table. Often it’s fighting yourself not to get greedy. You have the right mind set. You would do well in crypto. If you have some play money available you might want to give it a shot. I constantly get crap from my investor friends in crypto chats for taking profits too early. I am not in the get rich camp. When a coin moons and pulls in a 3-4x I am getting the f out. When it goes further up it sucks. Shitty feeling. But the odds that it will continue are much lower than it correcting. Crypto is similar to other markets in terms of support levels and resistance levels (basic TA). It’s just way more extrem. AFter a while you re-train your brain and learn how to fight against the fomo and FUD. You need to become ice cold. When there is blood on the street and everything is flashing red every fiber of your body is fighting you to buy in. That’s when you want to invest.

Millenials are leading the charge as new homeownership rate reaches three year high.

https://www.marketwatch.com/story/homeownership-rate-reaches-three-year-high-as-rebound-from-crisis-gathers-pace-2018-01-30

“Homeownership among those under 35 jumped to 36% in the fourth quarter from 34.7% a year before. For those aged 35-44, the rate increased, though at a slightly slower rate — to 58.9% from 58.7%. Among those 45-54, it dipped to 69.5 from 69.8%.”

The entire west coast sees big jump in housing prices year over year

https://www.marketwatch.com/story/home-prices-accelerated-in-november-case-shiller-shows-2018-01-30

It is not millennials. These are just a generation that is just starting to get affluent, start families, which in turn lead to desire for home-ownership. They are labeled as millennials and most of them like this label since it makes them think they are different than previous gen. They are just younger at this point in time and naturally think slightly different, but now they are entering the next stage of their life (on average, not everyone of course)

The MSM, populated by cretins, believed that every 24 year old millenial from 10 years ago, would stay 24 forever. So since at 24, he didn’t want to get married, have kids or buy a house, it was assumed that he’d have the same outlook on life at 34 and 44 and 54. So we had this decade long narrative in the media about how millenials are totes different than every other generation. And what do you know? Turns out they’re just like every other generation before them. As they aged, they got married, had kids and realized living in a cramped 1 bedroom rental downtown (close to 17 Thai-Somali-Brazilian fusion restaurants) isn’t as awesome at 34 as it was 24.

The MSM, populated by cretins, believed that every 24 year old millenial from 10 years ago, would stay 24 forever. So since at 24, he didn’t want to get married, have kids or buy a house, it was assumed that he’d have the same outlook on life at 34 and 44 and 54. So we had this decade long narrative in the media about how millenials are totes different than every other generation. And what do you know? Turns out they’re just like every other generation before them. As they aged, they got married, had kids and realized living in a cramped 1 bedroom rental downtown (close to 17 Thai-Somali-Brazilian fusion restaurants) isn’t as awesome at 34 as it was 24.

My Millennial daughter and husband just bought a 3 BD 2 bath 2K sq foot house.

However, it was in North Carolina and under 200K.

Rental parity definitely leaned toward buying there.

Nice beaches in NC. No tar. However a little more humid and buggy than S. CA.

Why does everyone always talk about Millenials. What about Gen X’ers? We are starting to feel left out. What gives?

Gen Xers are boring. We go to work, pay taxes, raise families. Not as exiting as Millenials, whining 24/7 on Twitter and Instagram about how awful the world is.

Totally agree Mr landlord!

Millennials are way more fun. We smoke pot twice a day, don’t have (need) full time jobs, live in mom’s basement, play Xbox 12 hours a day, love-love-love avacado toasts for breakfast, lunch and dinner and enjoy Starbucks coffe every day. We don’t buy houses or stocks (of course) but love “investing†in Cryptocurrency making out big (some day) with our monthly 100 bucks allowance we get. Did I forget something? Oh and we protest on the streets any time we get a chance! At the dinner table (mommy is the worlds best cook) we struggle having a conversation with our parents because that’s the best time to be on our newest iPhone (leasing is your friend) to post on social media about the unfair life conditions we face. Also nobody can say we did not try the start a career thing but it turned out we don’t get a trophy for participation in real life!

Millenial, you nailed it! Congrats on becoming self-aware. You are now one step closer to enlightenment. Now treat yourself by busting out the Avocado toast and a trendy overpriced IPA and celebrate. You deserve it.

Wheelin! Thanks bud, that means so much coming from you!

House values should generally track wages and salaries. The roof over your head should not take more than 1/3 of your income. These are decades’ old principles. Do California RE prices reflect this? Of course not.

So, there will be a crash, to a value that represents historical norms. The current crowers will be eating crow, as they always do.

This is true for over-leveraged home-owners in liquidity crisis. Inventory is hard. If pool of buyers dries up because of high prices/low incomes, it does not mean prices will come down, it could mean pool of sellers will shrink even further (no motivation to sell).

This has to be a Home of Genius: https://www.redfin.com/CA/Inglewood/312-E-98th-St-90301/home/6460182

* $500,000

* 728 sq ft

* Bars on the windows.

* Next door to an auto repair center.

* Inglewood

It’s not the house that is of value; but, the land b/c this is probably near the new stadium that is being built in Inglewood.

There will be a huge influx of capital to that area and RE prices will (or are?) skyrocket.

People are mistaken to think that sport stadiums bring value to a locality. Fans arrive and leave, without spending much money at local businesses.

Sport stadiums do, however, being in traffic, noise, and rowdy crowds of drunken low-lifes and gang-bangers.

dan hit the nail on the head. This POS is a few blocks from the new stadium. It sold for 185K back in 2013…redfin has the value tabbed at 499K!!! I would love to see where this one ends up.

Buying RE in the ghetto just 5 short years ago turned out to be a smart move!

“…There will be a huge influx of capital to that area and RE prices will (or are?) skyrocket….”

Really?

Why should that be?

Explain what the *economic* difference of building a large concrete monolith like a stadium and a large concrete monolith like a sewage treatment plant.

Lending UPDATE:

As I have noted a couple times now, the past few weeks have shown that there was a growing disconnect between GSE’s (conventional) and PMI companies. 2 well known PMI companies have tightened up guidelines on DTI’s (debt to income ratios) above 45%. Today a 3rd PMI company followed suit AND word of an update in the GSE’s underwriting system to tighten up 45%+ DTI files has come through.

So; many on here have discussed the loosening of conventional guidelines as an indicator that there was weak buyer demand and said loosening was designed to make credit accessible; well, that brief experiment by the GSE’s is ending and they are tightening up guidelines.